Flexible Electronics & Circuit Market Size, Share, Statistics and Industry Growth Analysis Report by Structure Type (Single Sided Flex Circuit, Multilayer Flex Circuit), Application (Displays, Printed Sensors), Vertical (Consumer Electronics), and Geography (2021-2026)

Updated on : Oct 23, 2024

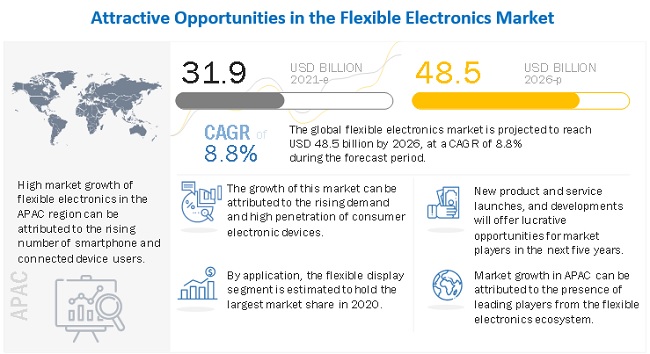

The Flexible Electronics Market Size is projected to reach USD 48.5 billion by 2026 from USD 31.9 billion in 2021, at a CAGR of 8.8% from 2021 to 2026. Rising demand for consumer electronic devices driving the growth.

Rising demand for consumer electronic devices and low cost of production as compared to rigid substrates are among the factors driving the growth of the flexible electronics & circuit industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Flexible Electronics Market Dynamics:

Driver: Rising demand for consumer electronic devices

Flexible electronics are cost effective, durable, and reliable, and widely used in smartphones, PCs, TVs, tablets, wearables, and other consumer electronic devices. Flexible displays are integrated in such devices to save on space, and reduce thickness and weight. The two major types of displays used are flexible organic light-emitting diode (OLED), and flexible organic liquid crystal display (OLCD). The demand for flexible electronics is growing with the increasing demand for consumer electronic devices. Although there has been a dip in the shipment of smartphones due to the COVID-19 pandemic, the smartphone market is expected to revive soon.

The growing penetration of consumer electronic devices across sectors also fuels growth in the flexible electronics & circuit market.

Restraint: High investment cost

When it comes to new technologies cost reduction is often a strong driver of R&D efforts. However, the cost of new materials and equipment for flexible electronics research is very high. Manufacturers thus need a huge focus on R&D to create value beyond cost reduction, such as thinner and more lightweight, robust and flexible products. Decisions regarding investments in certain technologies will be ruled by their material properties. The development of new technologies also needs precision machinery and trained personnel, adding to the overall costs. The high investment involved is thus a restraint for the flexible electronics & circuit market.

Opportunity: Continuous technological development to create lucrative opportunities

Major companies in the industry are investing heavily in R&D to continuously develop their products. For instance, Samsung achieved 305Gbps on its 5G SA core, in collaboration with Intel. The company expects to launch 5G services more swiftly and cost-effectively through its highly flexible and scalable design. In 2020, Apple Inc. was granted a patent for a foldable device with a hinge mechanism that utilizes movable flaps to help prevent the display from being creased or damaged when folded.

Through these developments major companies are encouraging and challenging each other to exploit the benefits of flexible technology. The continuous technological development in the flexible electronics industry is expected to create lucrative opportunities for players in the flexible electronics & circuit market.

Challenge: Difficult repair and rework

Repairing and reworking flexible electronics is a very challenging process. The types of damage to flexible electronics can include ripped or cut flex material, heat damaged/lifted pads and damaged conductors. Highly skilled persons are required to repair such damage. In some instances, the whole circuit can be damaged in the repair process. Rework on the same flex circuit is a challenging job as the circuits are very thin and complex and require high precision machinery. A flexible circuit first needs to be cleaned of all the components present and all the conductor material to prevent any short-circuiting situations.

The multilayer flex circuit held the largest share of the flexible circuit market in 2020, and will continue to hold a dominant position in the market during the forecast period.

The multilayer flex circuit held the largest share of the flexible circuit market in 2020, and will continue to hold a dominant position in the market during the forecast period. Multilayer flex circuits offer reduction in assembly costs, time, package size, and weight. They also offer better signal integrity than other structure types and are increasingly being used in the military, defense & aerospace; communications; automotive; and consumer electronics verticals. Multilayer flex circuit boards have very fine lines, allowing enough space for other components. Hence, multilayer flex circuit boards have high board density that is suitable for high density applications.

The displays segment held the major share of the flexible electronics market in 2020 and is expected to continue to do so during the forecast period.

The displays segment held the major share of the market in 2020 and is expected to continue to do so during the forecast period. The market for flexible displays is led by industry leaders such as Samsung and LG who produce flexible OLED display panels for the smartphone application. The demand for these flexible display panels, especially OLED display panels, is expected to increase in future. Smartphone manufacturers such as Samsung and Apple have started deploying flexible OLED displays into their flagship smartphones, such as Samsung Galaxy S series and Note series as well as iPhone X and XS series. Various other smartphone vendors are expected to adopt flexible displays during the forecast period. Flexible displays are also being adopted for large-screen devices, such as televisions and digital signage solutions.

The consumer electronics vertical is expected to capture the largest share of the flexible electronics market

The consumer electronics vertical is expected to capture the largest share of the market based on vertical. The growth of this market can be attributed to the large-scale adoption of flexible displays in consumer electronic devices such as smartphones, wearables, televisions, etc. Flexible OLED displays are widely used in leading smartphones by industry leaders such as Apple Inc. and Samsung Group. Apple has plans to introduce the iPhone Flip with a flexible display. Such developments have significantly contributed to the growth of the overall market for the consumer electronics vertical.

To know about the assumptions considered for the study, download the pdf brochure

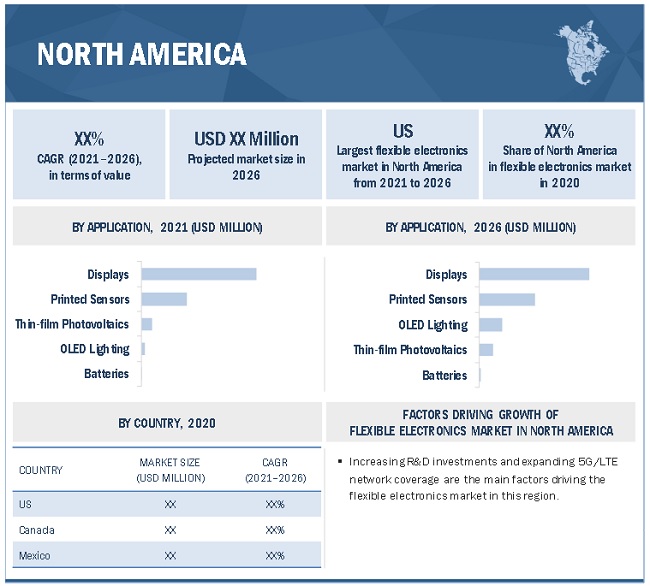

North America is projected to record the highest CAGR from 2021 to 2026 of the flexible electronics market by 2026

The flexible electronics market in North America is projected to record the highest CAGR from 2021 to 2026 largely due to the increasing establishment of high-technology industries of flexible electronics for military use. A number of US states that are at the forefront of innovation have established research centers for flexible and printed electronics.

Key Market Players

Samsung Group (South Korea), LG Corp. (South Korea), Panasonic Corporation (Japan), The 3M Company (US), Konica Minolta Inc. (Japan), First Solar, Inc. (US), E Ink Holdings (Taiwan), PragmatIC Printing Ltd. (UK), Blue Spark Technologies, Inc. (US), and BrightVolt Technologies (US), are some of the key players in the flexible electronics & circuit companies.

Flexible Electronics Market Report Scope

|

Report Metric |

Details |

|

Market Size Availability for Years |

2017–2026 |

|

Base Year |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By structure type, application, and vertical |

|

Geographies Covered |

North America, Europe, APAC, and RoW |

|

Companies Covered |

Samsung Group (South Korea), LG Corp. (South Korea), Panasonic Corporation (Japan), The 3M Company (US), Konica Minolta Inc. (Japan), First Solar, Inc. (US), E Ink Holdings (Taiwan), PragmatIC Printing Ltd. (UK), Blue Spark Technologies, Inc. (US), and BrightVolt Technologies (US), are among others. |

This research report categorizes the flexible electronics & circuit market based on structure type, application, vertical, and region

Flexible circuit market:

Based on structure type:

- Single Sided Flex Circuit

- Double Sided Flex Circuit

- Multilayer Flex Circuit

- Rigid Flex Circuit

- Others

Based on vertical:

- Military, Defense & Aerospace

- Automotive

- Consumer Electronics

- Industrial

- Others

Based on geography:

- North America

- Europe

- APAC

- RoW

Flexible electronics market:

Based on application:

- Displays

- Thin-Film Photovoltaics

- Printed Sensors

- Batteries

- OLED Lighting

- Others

Based on vertical:

- Consumer Electronics

- Energy & Power

- Healthcare

- Automotive

- Military, Defense & Aerospace

- Industrial

- Others

Based on region:

- North America

- Europe

- Asia Pacific

- Rest of the world

Recent Developments

- In January 2021, Samsung Group launched the Samsung Bespoke 4-Door Flex refrigerator in the US market to cater to a wide variety of household refrigeration needs.

- In January 2021, PragmatIC Printing Ltd. and Schreiner MediPharm, a pharmaceutical packaging company, have teamed up to provide a low-cost NFC-enabled label for medications. PragmatIC's ultra-thin FlexIC 13.56 MHz chip, compliant with a subset of the ISO 14443 standard, has been incorporated into Schreiner MediPharm's labels for use on cartons, vials and syringes. The slim and flexible new label can be easily applied, encoded and read, even on a small glass vial, syringe or pill bottle.

- In January 2021, LG acquired the controlling stake in TV data and measurement firm, ALPHONSO. This will allow the company to provide even more customized services and content to consumers.

- In January 2021, First Solar, Inc. entered into an agreement with Leeward Renewable Energy Development, LLC to sell its US development platform. This acquisition comprises 1.8 GWDC of First Solar modules. The acquisition will help the company to scale, develop, and sell its products.

- In October 2020, Samsung Electronics and Kyocera Communication Systems (KCCS) signed a Memorandum of Understanding (MoU) to jointly expand the private 5G network business in Japan. This will help the company to expand its 5G capabilities in Japan and provide a flexible, reliable private network.

Frequently Asked Questions (FAQ):

Which are the major companies in the flexible electronics & circuit market? What are their major strategies to strengthen their market presence?

The major companies in the flexible electronics & circuit market are – Samsung Group (South Korea), LG Corp. (South Korea), Panasonic Corporation (Japan), The 3M Company (US), Konica Minolta Inc. (Japan). The major strategies adopted by these players are product launches and developments, agreements, acquisitions, expansions, and partnerships.

Which is the potential market for the flexible electronics & circuit in terms of region?

The APAC region is expected to dominate the flexible electronics & circuit market due to the presence of leading players from the flexible electronics ecosystem, such as Samsung Group, LG Corp., Panasonic Corporation, and Konica Minolta Inc.

What are the opportunities for new market entrants?

There are significant opportunities in the flexible electronics & circuit market for start-up companies. These companies are providing new products which are widely used in the consumer electronics, automotive, healthcare, and energy & power.

What are the drivers and opportunities for the flexible electronics & circuit market?

Factors such as rising demand for consumer electronic devices and low cost of production as compared to rigid substrates are among the factors driving the growth of the flexible electronics & circuit market are the major factors driving the growth of the flexible electronics & circuit market. Moreover, continuous technological development to create lucrative opportunities in the flexible electronics & circuit market.

Who are the major consumers of the flexible electronics and circuits that are expected to drive the growth of the market in the next 5 years?

The major consumers for the flexible electronics and circuits are consumer electronics, automotive, healthcare, and energy & power are expected to have a significant share in this market. . .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 SCOPE

FIGURE 1 FLEXIBLE ELECTRONICS & CRICUIT MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.4 CURRENCY

1.5 MARKET STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 FLEXIBLE ELECTRONICS & CIRCUIT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primaries

2.2 FACTOR ANALYSIS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY SIDE): REVENUE GENERATED BY COMPANIES FROM SALES OF FLEXIBLE ELECTRONICS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY SIDE): ILLUSTRATIVE EXAMPLE OF COMPANY OPERATING IN FLEXIBLE ELECTRONICS MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2—BOTTOM-UP (DEMAND SIDE) – DEMAND FOR FLEXIBLE ELECTRONICS FOR CONSUMER ELECTRONICS VERTICAL

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach for capturing market share using bottom-up analysis (demand side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Approach for capturing market share using top-down analysis supply side)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 RESEARCH ASSUMPTIONS

2.5.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 47)

TABLE 1 RECOVERY SCENARIOS OF GLOBAL ECONOMY

3.1 REALISTIC SCENARIO

3.2 OPTIMISTIC SCENARIO

3.3 PESSIMISTIC SCENARIO

FIGURE 9 GROWTH PROJECTIONS OF MARKET IN REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

3.4 IMPACT OF COVID-19 ON FLEXIBLE ELECTRONICS & CIRCUIT MARKET

FIGURE 10 GLOBAL PROPAGATION OF COVID-19

FIGURE 11 OLED LIGHTING SEGMENT TO WITNESS HIGHEST GROWTH RATE FROM 2021 TO 2026

FIGURE 12 AUTOMOTIVE TO EXHIBIT HIGHEST CAGR IN MARKET FROM 2021 TO 2026

FIGURE 13 APAC LIKELY TO ACCOUNT FOR LARGEST SHARE OF FLEXIBLE ELECTRONICS MARKET BY 2026

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN FLEXIBLE ELECTRONICS MARKET

FIGURE 14 RISING DEMAND FOR CONSUMER ELECTRONICS TO FUEL DEMAND FOR FLEXIBLE ELECTRONICS IN COMING YEARS

4.2 FLEXIBLE CIRCUIT MARKET, BY STRUCTURE TYPE

FIGURE 15 MULTILAYER FLEX CIRCUIT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY REGION

FIGURE 16 NORTH AMERICA TO CAPTURE LARGEST MARKET SHARE BY 2026

4.4 MARKET, BY VERTICAL & REGION

FIGURE 17 CONSUMER ELECTRONICS TO ACCOUNT FOR LARGEST SHARE OF MARKET BY 2026

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 FLEXIBLE ELECTRONICS & CIRCUIT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising demand for consumer electronic devices

5.2.1.2 Low cost of production as compared to rigid substrates

5.2.1.3 Growing demand in healthcare sector

FIGURE 19 FLEXIBLE ELECTRONICS & CIRCUIT MARKET: DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 High investment cost

5.2.2.2 Complex assembly process

FIGURE 20 FLEXIBLE ELECTRONICS & CIRCUIT MARKET: RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Continuous technological development

5.2.3.2 Increasing adoption of displays, thin film photovoltaics, and printed sensors

FIGURE 21 FLEXIBLE ELECTRONICS & CIRCUIT MARKET: OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Difficult repair and rework

FIGURE 22 FLEXIBLE ELECTRONICS & CIRCUIT MARKET: CHALLENGES AND THEIR IMPACT

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 23 FLEXIBLE ELECTRONICS & CIRCUIT SUPPLY CHAIN

TABLE 2 FLEXIBLE ELECTRONICS & CIRCUIT MARKET: ROLE IN SUPPLY CHAIN

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR FLEXIBLE ELECTRONICS & CIRCUIT MARKET

FIGURE 24 REVENUE SHIFT IN FLEXIBLE ELECTRONICS & CIRCUIT MARKET

5.5 FLEXIBLE ELECTRONICS AND CIRCUIT ECOSYSTEM

FIGURE 25 FLEXIBLE ELECTRONICS AND CIRCUIT ECOSYSTEM

5.6 PORTER’S FIVE FORCES MODEL

TABLE 3 FLEXIBLE ELECTRONICS & CIRCUIT MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 CASE STUDY

5.7.1 NOVARES COLLABORATED WITH FLEXENABLE TO INTEGRATE CURVED DISPLAYS IN ITS DEMO CAR

5.7.2 HYUNDAI AND LG COLLABORATED TO INTRODUCE CEILING DISPLAYS IN ITS ELECTRIC VEHICLES

5.8 TECHNOLOGY ANALYSIS

5.8.1 COMPLEMENTARY TECHNOLOGIES

5.8.1.1 Active matrix organic light emitting diodes (AMOLED)

5.8.1.2 Organic thin-film transistor technology

5.9 AVERAGE SELLING PRICE FOR FLEXIBLE ELECTRONICS

TABLE 4 AVERAGE SELLING PRICE FOR FLEXIBLE ELECTRONICS APPLICATIONS

TABLE 5 AVERAGE SELLING PRICE FOR FLEXIBLE ELECTRONICS DISPLAYS, BY VERTICAL

5.10 TRADE ANALYSIS

TABLE 6 IMPORT DATA, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 7 EXPORT DATA, BY COUNTRY, 2015–2019 (USD MILLION)

5.11 PATENT ANALYSIS, 2018–2020

TABLE 8 TOP 20 PATENT OWNERS (US) IN LAST 10 YEARS

FIGURE 27 TOP 10 COMPANIES WITH HIGHEST NO. OF PATENT APPLICATIONS IN LAST 10 YEARS

FIGURE 28 ANNUAL NO. OF PATENTS GRANTED OVER THE LAST 10 YEARS

5.12 TARIFFS AND REGULATIONS RELATED TO PRINTED CIRCUITS

5.12.1 TARIFFS

5.12.2 REGULATORY COMPLIANCE

5.12.3 STANDARDS

6 TYPES OF FLEXIBLE SUBSTRATES (Page No. - 80)

6.1 INTRODUCTION

FIGURE 29 TYPES OF FLEXIBLE SUBSTRATES

6.2 PLASTIC SUBSTRATES

6.2.1 USED FOR FLEXIBLE DISPLAYS

6.3 THIN GLASS SUBSTRATES

6.3.1 USED IN OLED LIGHTING

6.4 METAL SUBSTRATES

6.4.1 USED TO FABRICATE SOLAR CELLS

7 FLEXIBLE CIRCUIT MARKET, BY STRUCTURE TYPE, VERTICAL, AND GEOGRAPHY (Page No. - 82)

7.1 INTRODUCTION

FIGURE 30 FLEXIBLE CIRCUIT MARKET, BY STRUCTURE TYPE, VERTICAL, AND GEOGRAPHY

7.2 FLEXIBLE CIRCUIT MARKET, BY STRUCTURE TYPE

FIGURE 31 MULTILAYER FLEX CIRCUIT SEGMENT HELD LARGEST SHARE OF FLEXIBLE CIRCUIT MARKET IN 2020 (USD MILLION)

TABLE 9 FLEXIBLE CIRCUIT MARKET, BY STRUCTURE TYPE, 2017–2020 (USD MILLION)

TABLE 10 FLEXIBLE CIRCUIT MARKET, BY STRUCTURE TYPE, 2021–2026 (USD MILLION)

7.2.1 SINGLE SIDED FLEX CIRCUIT

7.2.2 DOUBLE SIDED FLEX CIRCUIT

7.2.3 MULTILAYER FLEX CIRCUIT

7.2.4 RIGID FLEX CIRCUIT

7.2.5 OTHERS

7.2.5.1 Back bared or double-access flexible circuit

7.2.5.2 Sculptured flex circuit

7.2.5.3 Polymer thick film flex circuit

7.3 FLEXIBLE CIRCUIT MARKET, BY VERTICAL

FIGURE 32 CONSUMER ELECTRONICS SEGMENT EXPECTED TO RECORD HIGHEST CAGR DURING 2021-2026 (USD MILLION)

TABLE 11 FLEXIBLE CIRCUIT MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 12 FLEXIBLE CIRCUIT MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

7.4 FLEXIBLE CIRCUIT MARKET, BY GEOGRAPHY

FIGURE 33 APAC HELD LARGEST SHARE OF FLEXIBLE CIRCUIT MARKET IN 2020 (USD MILLION)

TABLE 13 FLEXIBLE CIRCUIT MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 14 FLEXIBLE CIRCUIT MARKET, BY REGION, 2021–2026 (USD MILLION)

7.4.1 NORTH AMERICA

TABLE 15 FLEXIBLE CIRCUIT MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 16 FLEXIBLE CIRCUIT MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

7.4.2 EUROPE

TABLE 17 FLEXIBLE CIRCUIT MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 18 FLEXIBLE CIRCUIT MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

7.4.3 APAC

TABLE 19 FLEXIBLE CIRCUIT MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 20 FLEXIBLE CIRCUIT MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

7.4.4 ROW

TABLE 21 FLEXIBLE CIRCUIT MARKET IN ROW, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 22 FLEXIBLE CIRCUIT MARKET IN ROW, BY COUNTRY, 2021–2026 (USD MILLION)

8 FLEXIBLE ELECTRONICS MARKET, BY APPLICATION (Page No. - 94)

8.1 INTRODUCTION

FIGURE 34 DISPLAYS APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 23 MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 24 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.2 DISPLAYS

TABLE 25 MARKET FOR DISPLAYS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 26 MARKET FOR DISPLAYS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 27 MARKET FOR DISPLAYS, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 MARKET FOR DISPLAYS, BY REGION, 2021–2026 (USD MILLION)

8.2.1 OLED DISPLAYS

8.2.1.1 Mass production for use in smartphones and wearables

FIGURE 35 OLED DISPLAYS FOR TV APPLICATION TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 29 FLEXIBLE ELECTRONICS MARKET FOR OLED DISPLAYS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 30 MARKET FOR OLED DISPLAYS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 31 MARKET FOR OLED DISPLAYS, BY APPLICATION, 2017–2020 (MILLION UNITS)

TABLE 32 MARKET FOR OLED DISPLAYS, BY APPLICATION, 2021–2026 (MILLION UNITS)

TABLE 33 FLEXIBLE OLED DISPLAY PANEL PRODUCTION, BY APPLICATION, 2017–2020 (THOUSAND SQUARE METERS)

TABLE 34 FLEXIBLE OLED DISPLAY PANEL PRODUCTION, BY APPLICATION, 2021–2026 (THOUSAND SQUARE METERS)

TABLE 35 MARKET FOR OLED DISPLAYS, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 MARKET FOR OLED DISPLAYS, BY REGION, 2021–2026 (USD MILLION)

TABLE 37 MARKET FOR OLED DISPLAYS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 38 MARKET FOR OLED DISPLAYS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 39 MARKET FOR OLED DISPLAYS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 40 MARKET FOR OLED DISPLAYS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

FIGURE 36 SOUTH KOREA HELD THE MAJOR SHARE OF MARKET FOR OLED DISPLAYS DURING FORECAST PERIOD

TABLE 41 MARKET FOR OLED DISPLAYS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 42 FLEXIBLE ELECTRONICS MARKET FOR OLED DISPLAYS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 43 MARKET FOR OLED DISPLAYS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 MARKET FOR OLED DISPLAYS IN ROW, BY REGION, 2021–2026 (USD MILLION)

8.2.2 LCD DISPLAYS

8.2.2.1 Highly suited to television and automotive applications

TABLE 45 MARKET FOR LCD DISPLAYS, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 46 MARKET FOR LCD DISPLAYS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 47 MARKET FOR LCD DISPLAYS, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 MARKET FOR LCD DISPLAYS, BY REGION, 2021–2026 (USD MILLION)

FIGURE 37 US HELD MAJOR SHARE OF MARKET FOR LCD DISPLAYS DURING FORECAST PERIOD

TABLE 49 MARKET FOR LCD DISPLAYS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 50 MARKET FOR LCD DISPLAYS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 51 MARKET FOR LCD DISPLAYS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 52 MARKET FOR LCD DISPLAYS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 53 MARKET FOR LCD DISPLAYS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 54 MARKET FOR LCD DISPLAYS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 55 MARKET FOR LCD DISPLAYS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 56 FLEXIBLE ELECTRONICS MARKET FOR LCD DISPLAYS IN ROW, BY REGION, 2021–2026 (USD MILLION)

8.3 THIN-FILM PHOTOVOLTAICS

TABLE 57 FLEXIBLE ELECTRONICS MARKET FOR THIN-FILM PV, BY TECHNOLOGY, 2017–2020 (USD BILLION)

TABLE 58 MARKET FOR THIN-FILM PV, BY TECHNOLOGY, 2021–2026 (USD BILLION)

TABLE 59 MARKET FOR THIN-FILM PV, BY TECHNOLOGY, 2017–2020 (GWP)

TABLE 60 MARKET FOR THIN-FILM PV, BY TECHNOLOGY, 2021–2026 (GWP)

TABLE 61 MARKET FOR THIN-FILM PV, BY REGION, 2017–2020 (USD MILLION)

TABLE 62 MARKET FOR THIN-FILM PV, BY REGION, 2021–2026 (USD MILLION)

TABLE 63 MARKET FOR THIN-FILM PV IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 64 MARKET FOR THIN-FILM PV IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 65 MARKET FOR THIN-FILM PV IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 66 MARKET FOR THIN-FILM PV IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

FIGURE 38 CHINA HELD MAJOR SHARE OF MARKET FOR THIN-FILM PV IN APAC DURING FORECAST PERIOD

TABLE 67 MARKET FOR THIN-FILM PV IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 68 MARKET FOR THIN-FILM PV IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 69 MARKET FOR THIN-FILM PV IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 70 MARKET FOR THIN-FILM PV IN ROW, BY REGION, 2021–2026 (USD MILLION)

8.3.1 CDTE

8.3.1.1 CdTe technology to lead thin-film PV market

8.3.2 CIGS

8.3.2.1 CIGS technology to record highest CAGR during forecast period

8.3.3 A-SI

8.3.3.1 Offers higher absorption coefficient and better weak light performance

8.4 PRINTED SENSORS

TABLE 71 MARKET FOR PRINTED SENSORS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 72 MARKET FOR PRINTED SENSORS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 73 MARKET FOR PRINTED SENSORS, BY REGION, 2017–2020 (USD MILLION)

TABLE 74 MARKET FOR PRINTED SENSORS, BY REGION, 2021–2026 (USD MILLION)

TABLE 75 MARKET FOR PRINTED SENSORS IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 76 MARKET FOR PRINTED SENSORS IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 77 MARKET FOR PRINTED SENSORS IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 78 MARKET FOR PRINTED SENSORS IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 79 MARKET FOR PRINTED SENSORS IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 80 MARKET FOR PRINTED SENSORS IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 81 MARKET FOR PRINTED SENSORS IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 82 FLEXIBLE ELECTRONICS MARKET FOR PRINTED SENSORS IN ROW, BY REGION, 2021–2026 (USD MILLION)

8.4.1 BIOSENSORS

8.4.1.1 Essential for point-of-care applications

8.4.2 IMAGE SENSORS

8.4.2.1 Easily scalable into larger areas and high-pixel densities

8.4.3 TOUCH SENSORS

8.4.3.1 Rising demand for smartphones to support market growth

8.4.4 PRESSURE SENSORS

8.4.4.1 Suitable for controlling and monitoring applications

8.4.5 TEMPERATURE SENSORS

8.4.5.1 Offer miniaturization and low power consumption

8.4.6 GAS SENSORS

8.4.6.1 Growing concern for indoor and outdoor air quality to fuel market growth

8.4.7 HUMIDITY SENSORS

8.4.7.1 Help to control environmental conditions

8.5 BATTERIES

FIGURE 39 CURVED BATTERIES SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 83 FLEXIBLE ELECTRONICS MARKET FOR BATTERIES, BY TYPE, 2017–2020 (USD MILLION)

TABLE 84 MARKET FOR BATTERIES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 85 MARKET FOR BATTERIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 86 MARKET FOR BATTERIES, BY REGION, 2021–2026 (USD MILLION)

TABLE 87 MARKET FOR BATTERIES IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 88 MARKET FOR BATTERIES IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 89 MARKET FOR BATTERIES IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 90 MARKET FOR BATTERIES IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 91 MARKET FOR BATTERIES IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 92 MARKET FOR BATTERIES IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 93 MARKET FOR BATTERIES IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 94 FLEXIBLE ELECTRONICS MARKET FOR BATTERIES IN ROW, BY REGION, 2021–2026 (USD MILLION)

8.5.1 THIN-FILM BATTERIES

8.5.1.1 Held major share of market in 2020

8.5.2 CURVED BATTERIES

8.5.2.1 Projected to record highest CAGR

8.5.3 PRINTED BATTERIES

8.5.3.1 Eco-friendly and bio-friendly

8.5.4 OTHERS

8.5.5 IMPACT OF COVID-19 ON BATTERIES

FIGURE 40 IMPACT OF COVID-19 ON FLEXIBLE ELECTRONICS MARKET FOR BATTERIES

8.6 OLED LIGHTING

8.6.1 ENERGY-EFFICIENT ALTERNATIVE TO OTHER LIGHTING DEVICES

TABLE 95 MARKET FOR OLED LIGHTING, BY REGION, 2017–2020 (USD MILLION)

TABLE 96 MARKET FOR OLED LIGHTING, BY REGION, 2021–2026 (USD MILLION)

TABLE 97 MARKET FOR OLED LIGHTING IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 98 MARKET FOR OLED LIGHTING IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 99 MARKET FOR OLED LIGHTING IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 100 MARKET FOR OLED LIGHTING IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 101 MARKET FOR OLED LIGHTING IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 102 MARKET FOR OLED LIGHTING IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 103 MARKET FOR OLED LIGHTING IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 104 MARKET FOR OLED LIGHTING IN ROW, BY REGION, 2021–2026 (USD MILLION)

8.7 OTHERS

9 FLEXIBLE ELECTRONICS MARKET, BY VERTICAL (Page No. - 134)

9.1 INTRODUCTION

FIGURE 41 CONSUMER ELECTRONICS VERTICAL LEADS FLEXIBLE ELECTRONICS MARKET IN TERMS OF SIZE IN 2020

TABLE 105 FLEXIBLE CIRCUIT MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 106 FLEXIBLE CIRCUIT MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

9.2 CONSUMER ELECTRONICS

9.2.1 GROWTH OF FLEXIBLE DISPLAYS WILL FUEL THE DEMAND OF FLEXIBLE ELECTRONICS MARKET

9.3 ENERGY & POWER

9.3.1 INCREASING DEMAND FOR RENEWABLE SOURCES OF ENERGY IS FUELING MARKET GROWTH

9.4 HEALTHCARE

9.4.1 FLEXIBLE SENSORS ARE OPTIMAL SOLUTIONS FOR MEDICAL ELECTRONIC DEVICES

9.5 AUTOMOTIVE

9.5.1 FLEXIBLE DISPLAYS OFFER ENHANCED INTERATIVE DASHBOARS IN THE VEHICLES

9.5.2 IMPACT OF COVID-19 ON AUTOMOTIVE SEGMENT

FIGURE 42 IMPACT OF COVID-19 ON FLEXIBLE ELECTRONICS MARKET FOR AUTOMOTIVE

9.6 MILITARY, DEFENSE & AEROSPACE

9.6.1 MILITARY, DEFENSE & AEROSPACE EMPLOY FLEXIBLE ELECTRONICS IN REMOTE SYSTEMS, INTEGRATED SENSORS AND WEARABLE TECHNOLOGY

9.7 INDUSTRIAL

9.7.1 FLEXIBLE ELECTRONICS OFFERS HIGH PERFORMANCE, LIGHT WEIGHT, SCALABILITY, SOFTNESS AND FLEXIBILITY TO THE INDUSTRIAL SYSTEMS

9.8 OTHERS

10 FLEXIBLE ELECTRONICS MARKET, BY REGION (Page No. - 140)

10.1 INTRODUCTION

FIGURE 43 MARKET, BY REGION

FIGURE 44 FLEXIBLE ELECTRONICS MARKET IN NORTH AMERICA EXPECTED TO REGISTER HIGH GROWTH FROM 2021 TO 2026

TABLE 107 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 108 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 CONSUMER ELECTRONICS VERTICAL DRIVING MARKET GROWTH

FIGURE 45 NORTH AMERICA: FLEXIBLE ELECTRONICS MARKET SNAPSHOT

TABLE 109 MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 110 MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 111 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 112 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

10.3 EUROPE

10.3.1 DEMAND FROM AEROSPACE AND AUTOMOTIVE VERTICALS PROPELS MARKET GROWTH

FIGURE 46 EUROPE: FLEXIBLE ELECTRONICS MARKET SNAPSHOT

TABLE 113 MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 114 MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 115 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 116 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.2 IMPACT OF COVID-19 IN EUROPE

FIGURE 47 IMPACT OF COVID-19 ON FLEXIBLE ELECTRONICS MARKET IN EUROPE

10.4 APAC

10.4.1 LARGEST DEMAND FOR FLEXIBLE ELECTRONICS

FIGURE 48 APAC: FLEXIBLE ELECTRONICS MARKET SNAPSHOT

TABLE 117 MARKET IN APAC, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 118 MARKET IN APAC, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 119 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 120 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

10.5 ROW

TABLE 121 MARKET IN ROW, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 122 MARKET IN ROW, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 123 MARKET IN ROW, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 124 MARKET IN ROW, BY COUNTRY, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 154)

11.1 INTRODUCTION

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 125 OVERVIEW OF STRATEGIES DEPLOYED BY KEY FLEXIBLE ELECTRONICS & CIRCUIT COMPANIES

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 MANUFACTURING FOOTPRINT

11.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

11.3 FIVE-YEAR COMPANY REVENUE ANALYSIS

FIGURE 49 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN FLEXIBLE ELECTRONICS MARKET

11.4 MARKET SHARE ANALYSIS: FLEXIBLE ELECTRONICS MARKET, 2020

TABLE 126 FLEXIBLE ELECTRONICS MARKET: MARKET SHARE ANALYSIS (2020)

11.5 MARKET EVALUATION QUADRANT

11.5.1 STARS

11.5.2 PERVASIVE COMPANIES

11.5.3 EMERGING LEADERS

11.5.4 PARTICIPANTS

FIGURE 50 FLEXIBLE ELECTRONICS & CIRCUIT MARKET EVALUATION QUADRANT, 2020

11.5.5 COMPANY FOOTPRINT

FIGURE 51 COMPANY PRODUCT FOOTPRINT

TABLE 127 COMPANY END USER FOOTPRINT

TABLE 128 COMPANY REGION FOOTPRINT

TABLE 129 COMPANY FOOTPRINT

11.6 START-UP/ SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

TABLE 130 LIST OF START-UP/ SMALL AND MEDIUM-SIZED ENTERPRISES (SME) IN THE FLEXIBLE ELECTRONICS & CIRCUIT MARKET

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 DYNAMIC COMPANIES

11.6.4 STARTING BLOCKS

FIGURE 52 FLEXIBLE ELECTRONICS & CIRCUIT MARKET, START-UP/SME EVALUATION MATRIX, 2020

11.7 COMPETITIVE SITUATIONS AND TRENDS

FIGURE 53 FLEXIBLE ELECTRONICS & CIRCUIT MARKET WITNESSED SIGNIFICANT GROWTH BETWEEN JANUARY 2017 AND JANUARY 2021

11.7.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 131 PRODUCT LAUNCHES AND DEVELOPMENTS (JANUARY 2017–JANUARY 2021)

11.7.2 DEALS

TABLE 132 DEALS (JANUARY 2017 TO JANUARY 2021)

11.7.3 OTHERS

TABLE 133 OTHERS (JANUARY 2017 TO JANUARY 2021)

12 COMPANY PROFILES (Page No. - 172)

12.1 KEY COMPANIES

(Business overview, Products and services, Recent Developments, MNM view)*

12.1.1 SAMSUNG GROUP

FIGURE 54 SAMSUNG GROUP: COMPANY SNAPSHOT

12.1.2 LG CORP.

FIGURE 55 LG CORP.: COMPANY SNAPSHOT

12.1.3 PANASONIC CORPORATION

FIGURE 56 PANASONIC CORPORATION: COMPANY SNAPSHOT

12.1.4 THE 3M COMPANY

FIGURE 57 THE 3M COMPANY: COMPANY SNAPSHOT

12.1.5 KONICA MINOLTA INC.

FIGURE 58 KONICA MINOLTA INC.: COMPANY SNAPSHOT

12.1.6 FIRST SOLAR, INC.

FIGURE 59 FIRST SOLAR, INC.: COMPANY SNAPSHOT

12.1.7 E INK HOLDINGS

FIGURE 60 E INK HOLDINGS: COMPANY SNAPSHOT

12.1.8 PRAGMATIC PRINTING LTD.

12.1.9 BLUE SPARK TECHNOLOGIES, INC.

12.1.10 BRIGHTVOLT TECHNOLOGIES

12.2 STARTUP/SME PLAYERS

12.2.1 HELIATEK GMBH

12.2.2 CYMBET CORPORATION

12.2.3 PALO ALTO RESEARCH CENTER (PARC), A XEROX COMPANY

12.2.4 OLEDWORKS

12.2.5 THIN FILM ELECTRONICS ASA

12.2.6 ROYOLE CORPORATION

12.2.7 FLEXENABLE LTD

12.2.8 ENFUCELL OY

12.2.9 AU OPTRONICS CORP.

12.2.10 IMPRINT ENERGY, INC.

*Details on Business overview, Products and services, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 207)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

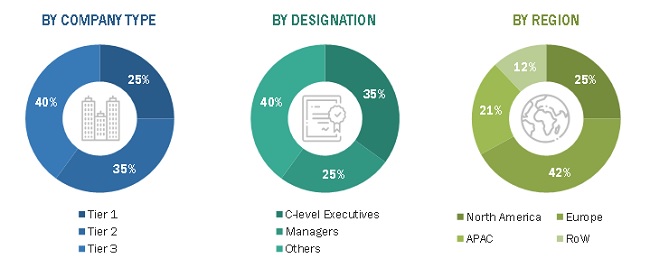

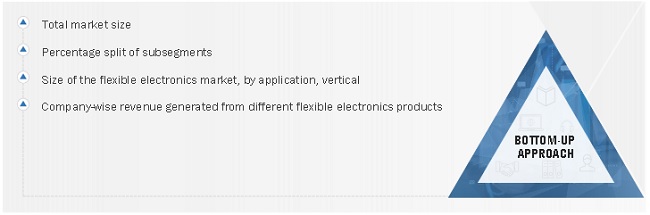

The study involved four major activities in estimating the size of the flexible electronics & circuit market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; IoT technologies journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases. Data has also been collected from secondary sources such as UK Competitive Telecommunications Association (UK), ASTM International (US), European Research Council (Belgium), World Trade Organization (Switzerland), The International Trade Centre (ITC) (Switzerland), and United States Telecom Association (US).

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the flexible electronics & circuit market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand and supply sides across four major regions: North America, Europe, APAC, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. This primary data has been collected mainly through telephonic interviews, which account for 80% of the total primary interviews. Questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employe to arrive at the overall size of the flexible electronics market.

- Identifying various flexible electronics products

- Analyzing the penetration of each product through secondary and primary research

- Analyzing the penetration of flexible electronics based on different end users through secondary and primary research

- Conducting multiple discussion sessions with key opinion leaders to understand the detailed working of flexible electronics and their implementation by multiple end users; this helped analyze the break-up of the scope of work carried out by each major company

- Verifying and cross-checking the estimates at every level with key opinion leaders, including CEOs, directors, operation managers, and finally with MarketsandMarkets’ domain experts

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down approach has been used to estimate and validate the total size of the flexible electronics market.

- Focusing initially on the top-line investments and expenditures being made in the ecosystem of the flexible electronics market; further splitting the key market areas on the basis of application, vertical, and region, and listing the key developments

- Identifying all leading players in the flexible electronics market based on application, and vertical through secondary research, and fully verifying them through brief discussions with industry experts

- Analyzing revenues, product mix, geographic presence, and key applications served by all identified players to estimate and arrive at percentage splits for all key segments

- Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the flexible electronics market.

Report Objectives

- To describe and forecast the global flexible electronics market, by application, vertical, and geography, in terms of value and volume

- To describe and forecast the global flexible circuit market, by structure type, vertical, and region, in terms of value

- To describe and forecast the market for four key regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)--in terms of value

- To provide qualitative information about flexible substrates in the flexible electronics & circuit market

- To provide detailed information regarding the drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the flexible electronics & circuit market

- To provide a detailed overview of the supply chain pertaining to flexible electronics & circuit ecosystems, along with the average selling price for flexible electronics

- To strategically analyze the ecosystem, tariff and regulations, patent landscape, trade landscape, and various case studies pertaining to the flexible electronics & circuit market

- To describe, in detail, the COVID-19 impact on the global flexible electronics & circuit market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically profile key players and comprehensively analyze their position in the flexible electronics & circuit market in terms of their ranking and core competencies2, and detail the competitive landscape for market leaders

- To analyze competitive developments in the flexible electronics & circuit market, such as product launches and developments, agreements, acquisitions, expansions, and partnerships

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the flexible electronics and circuit supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Flexible Electronics & Circuit Market

We want to understand the scope and coverage of Flexible Electronics Market. Can we setup a quick call.

We need to understand the flexible electronics market specific to each industry such as healthcare, automotive, energy and power etc. Does you report covers these industries.

I am interested in buying this report. Could you please help me with the scope and forecast year for Flexible Electronics Market

Flexible electronics and circuits have diverse applications in consumer electronics, healthcare, and automotive industries among others. We need to understand the flexible electronics market specific to each industry. Does you report cover these industries?

What are the growth opportunities for the flexible electronics market? What are the market dynamics? Who are the key players in this market? We are looking for market share analysis and the top players, along with their product offerings and business growth opportunities in the flexible electronics market.

Different types of flexible circuit structures are used for different applications to meet the requisite specifications. Flexible circuits have different kinds of structures, e.g. single-sided flex circuits. What is the market for these types and circuits? What are their applications?

Currently, flexible electronic devices have diverse application areas and sometimes there may not be any correlation in the manufacturing processes and environments in which they are deployed. What are the different growing applications for flexible cuircuits?

Flexible display panels are increasingly being used in devices such as smartphones, smart wearables, televisions, and signage solutions. I am trying to understand the adoption rate of flexible electronics for display.

I need to understand the flexible electronics market in terms of software. Does your report cover software as well