Smart Offices Market by Product (Smart Lighting/Lighting Controls, Security Systems, Energy Management Systems, HVAC Control Systems, Audio–Video Conferencing Systems), Software & Service, Office Type, and Geography - Global Forecast to 2023

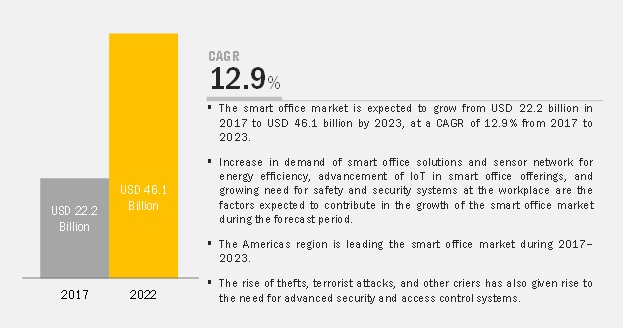

The smart office market to grow from USD 18.8 billion in 2016 to USD 46.1 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 12.9% during the forecast period. The growth of the smart office market is driven by the increase in demand for smart office solutions and sensor networks for energy efficiency, advancement of IoT in smart office offerings, growing need for safety and security systems at the workplace, and favorable government regulations in several countries. The objective of the report is to define, describe, and forecast the smart office market size based on product (smart light, security systems, energy management system, HVAC control system, and audio-video conferencing systems), software & service (software and service), type (retrofit buildings, and new construction office) and region.

Attractive Opportunities in the Smart Office Market

Source: Investor Presentation, Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

See how this study impacted revenues for other players in Smart Offices Market

Client’s Problem Statement

A prominent player in the home and building automation market wanted information about the current market trends of smart offices and wanted to expand his business for leading applications.

MnM Approach

The client engaged MnM to conduct a study with the following objectives.

• Market sizing and forecast for various products such as smart lighting, security systems, and energy management systems so as to target the fastest-growing products

• Information and analysis of the advanced technologies used for smart lighting systems was provided

• Profiles and competitive benchmarking of key vendors offering smart office products were provided

Revenue Impact (RI)

Our analysis helped impact a revenue of ~USD 800 million.

The energy management systems to grow with the highest CAGR in smart office market during forecast period

The market for energy management systems product captured to grow at the highest CAGR during the forecast period. Energy management systems provide a framework for commercial facilities to manage on-going energy use as well as identify opportunities to adopt energy-saving technologies, including those that do not necessarily require capital investment.

Market for new construction office to grow with the highest CAGR during forecast period in smart office market during forecast period

The new construction office type expected to grow with the highest CAGR between 2017 and 2023. The new construction offices provide the benefit of designing and implementation of smart office solution at the early stage of construction, resulting in minimizing the operational cost and economical use of the available resources.

To know about the assumptions considered for the study, Download PDF Brochure

Market for software held the lergest market share of the smart office market in 2016

In terms of value, smart office software captured the largest share of smart offices market, in 2016. Smart office architecture required software’s such as video monitoring software, video analytics software, fire mapping and analysis software, fire modeling and simulation software, and building energy management software .These software pertaining to smart office enables users to control smart appliances and devices installed in their workplace. Lighting control, security and access control, HVAC control, among others, can all be accessed using smartphones, tablets, computers, laptops, and hubs. The compatible software solutions and algorithms designed by smart office providers have enabled devices, such as smartphones, tablets, computers, laptops, and hubs, to easily control the smart office products from any remote location. The main purpose of any software-integrated smart office system is to control, track, monitor, and transmit the data of electric devices within a workplace. A modern smart office comprises hardware devices integrated with software solutions and algorithms that help in reducing energy costs.

Source: Investor Presentation, Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

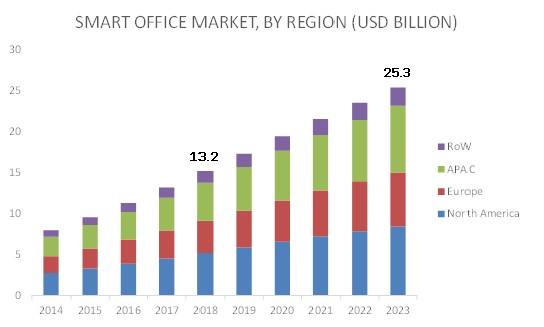

Asia Pacific (APAC) region to grow with the highest CAGR in smart office market during forecast period

The market for APAC region expected to grow with the highest CAGR during forecast period. The growth of this market is attributed to the adoption of energy management solution to reduce the associated cost and the implementation of security and lighting management solution in workplaces, ultimately leading to the growth of the smart office market in APAC.

Market Dynamics in Smart Offices Market

Driver: Increase in demand for smart office solutions and sensor networks for energy efficiency

The demand for smart offices is increasing with rising global concerns regarding energy-efficient systems to reduce the utility bills as well as the overhead costs. Smart office solutions play an important role in optimizing the energy usage and ultimately reducing energy cost. The lighting and HVAC systems are among the largest energy consumers in office buildings. Workspace automation can help automate the HVAC and lighting systems, saving around 5–30% of the overall energy consumption of the offices. Moreover, smart office solutions help in the early diagnosis of the operational problems associated with different equipment. This leads to the reduction in maintenance cost and also helps prevent losses due to unexpected breakdowns.

In this digital world, almost everything can be monitored with sensors. The plunging cost of semiconductor sensors along with an increasing trend of process optimization, building automation, and lifestyle improvement is giving rise to the proliferation of these wireless sensor networks. Advancement in wireless sensor network technologies such as ZigBee, Wi-Fi, Bluetooth, Z-Wave, and EnOcean is enabling its rapid deployment in office automation. In addition, precision sensors are finding applications throughout the value chain of smart offices.

Owing to the increasing concerns of energy efficiency and the rising cost of energy and maintenance at workplace, there is a growing demand for improving the operational efficiency while reducing costs. The smart office concept supports the requirement-based usage of energy through systems and controllers. The implementation of intelligent systems and automated workplace energy management platform for lighting, HVAC, water management, plumbing systems, and other workplace systems contribute significantly to reduce the power consumption. Thus, increase in demand for smart office solutions and sensor networks for energy efficiency are driving the growth of smart offices market.

To request to know about sample pages on the above findings, click Request Sample

Restraint: Complexity in replacing or upgrading the existing system

Smart office solution is an integration of different technology elements such as hardware (proximity sensors, smart meters, smart thermostats, relays, network switches and gateways, and actuators), software, and network elements that may become complex to configure over legacy system infrastructure. Therefore, legacy systems are unable to integrate efficiently with the new generation smart devices due to protocol issues. The integration complexities are expected to hinder the market growth in the coming years. In addition, IT and network security restrictions to reduce privacy intrusion and data breaches are projected as one of the major restraint for the development of smart office projects

Opportunity: Evolving cloud-based environment of IoT platforms

IoT as a technology involves storing, managing, and analyzing data in real time. Cloud platforms present a cost-effective and easily deployable alternative to eliminate the need for building on-premises data centers. While IoT is all about connected devices that produce a large number of data, cloud platform enables the analytics to derive value from the data. Cloud computing technologies are providing smart office solution vendors a way to connect workplace management systems installed at the control center to IoT-enabled devices. This capability will allow end users to build an IoT-based sense and respond system quickly and economically. The cloud platform is a secure platform for the storage as well as for computation of a large number of data. Besides, the cloud can also provide a unified platform that manages service life cycle and organizes deployment. Owing to the emergence of IoT Platform as a Service (PaaS), the deployment opportunities of IoT solutions have increased across the workplace infrastructure. The cloud platform can help in deploying various applications that provide workplace management authorities with new ways of connecting traditional information systems to IoT-enabled devices.

Challenge: Integration of real-time streaming analytics capabilities into smart solution

Data analytics is transforming the smart offices market. Smart office facilities generate huge volumes of data from many proximity sensors, smart meters, smart thermostats, relays, network switches and gateways, and actuators. Generating and gathering useful data insights from such vast data to provide real-time streaming analytics solution is the major challenge faced by the smart office solution providers. To gain a competitive edge, the solution providers need to come up with superior data analytical techniques and accurate predictive analysis models.

Scope of the report

|

Report Metric |

Details |

|

Market Size Available for Years |

2014-2023 |

|

Base Year Considered |

2016 |

|

Forecast Period |

2017-2023 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Communication Technology, Product (smart light, security systems, energy management system, HVAC control system, and audio-video conferencing systems), Software & Service (software and service), Type (retrofit buildings, and new construction office) and Region. |

|

Geographies Covered |

Americas, Europe, APAC, and RoW |

|

Companies Covered |

Siemens AG (Germany), Schneider Electric SA (France), Johnson Controls International plc (Ireland), Honeywell International Inc. (US), ABB Ltd. (Switzerland), Cisco Systems, Inc. (US), United Technologies Corporation (US), Lutron Electronics Co. Inc. (US), Crestron Electronics Inc. (US), Philips Lighting Holding B.V. (the Netherlands), Enlighted, Inc. (US), SensorSuite Inc. (Canada), FogHorn Systems (US). |

The research report categorizes the smart office market to forecast the revenues and analyze the trends in each of the following sub-segments:

Communication Technology for Smart Office

- Wireless Technologies

- Wi-Fi

- EnOcean

- ZigBee

- Bluetooth/BLE

- Others

- Wireed Technologies

- Digital Addressable Lighting Interface (DALI)

- Power Line Communication (PLC)

- Power Over Ethernet (PoE)

- KNX

- LonWorks

- Building Automatoin & Control Network (BACNET)

Smart offices market, by Product

- Smart Lighting/Lighting Controls

- Smart Bulbs

- Fixtures

- Lighting Controls

- LED Drivers and Ballasts

- Sensors

- Switches & Dimmers

- Relay Units

- Gateways

- Security Systems

- Access Controls

- Biometric Systems/Biometric Readers

- Card-Based Systems/Card-Based Readers

- Electronic Locks

- Surveillance Cameras/Video Surveillance

- Fire and Safety Controls

- Access Controls

- Energy Management Systems

- In-House Displays

- Smart Thermostats

- Load Control Switches

- Smart Plugs

- HVAC Control Systems

- Sensors

- Temperature Sensors

- Humidity Sensors

- Occupancy Sensors

- Pressure Sensors

- Flow Sensors

- Other Sensors

- Control Valves

- Heating and Cooling Coils

- Dampers

- Actuators

- Pumps & Fans

- Smart Vents

- VAV and FCU Controllers

- Sensors

- Audio–Video Conferencing Systems

- Audio, Volume, and Multimedia Rooms Controls

- Video Conferencing Systems

- Touch Screens & Keypads

Smart Offices Market, by Software & Service

- Software

- Service

- Advisory and Consulting Services

- Installation and Support Services

- Managed Services

Smart Offices Market, by Office Type

- Retrofit Offices

- New Construction Offices

Smart Offices Market, by Geography

- Americas

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- RoW

- Middle East & Africa

- South America

Key Market Players

Siemens AG (Germany), Schneider Electric SA (France), Johnson Controls International plc (Ireland), Honeywell International Inc. (US), ABB Ltd. (Switzerland), Cisco Systems, Inc. (US), United Technologies Corporation (US), Lutron Electronics Co. Inc. (US), Crestron Electronics Inc. (US), Philips Lighting Holding B.V. (the Netherlands), Enlighted, Inc. (US), SensorSuite Inc. (Canada), FogHorn Systems (US).

Siemens AG is one of the major engineering companies in Europe with branch offices located worldwide. The company is primarily engaged in the electrical engineering and electronics business. It offers products, services, and solutions for the effective use of resources and energy. The company operates in the following segments—Power and Gas, Healthineers, Energy Management, Digital Factory, Process Industries and Drives, Mobility, Building Technologies, Wind Power and Renewables, and Financial Services (SFS).

Some of the company’s key subsidiaries are Siemens Industry Software GmbH (Germany), Siemens Industry Software GmbH (Austria), Siemens Technologies S. A. E. (Egypt), Siemens Oil & Gas Equipment Limited (West Africa), and Siemens Limited (Ireland).

Recent Developments

- In September 2019, Lutron Electronics Co. Inc. (US) expanded it business by opening new commercial experience center in Manhattan, New York.

- In May 2019, Johnson Controls Inc. (US) partnered with Evoteq (UAE) to introduce an end-to-end integrated AI platform for smart building and districts by combining their capabilities.

- In May 2018, Siemens AG (Germany) strengthened its position in smart office market by acquiring J2 Innovations (US), a leading software provider for building automation and IOT.

- In September 2017, United Technologies acquired Rockwell Collins to complement its existing capabilities. This acquisition is likely to strengthen innovative systems capabilities and integrated digital product offerings, including avionics, flight controls, and data services.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the smart office market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of The Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for The Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.1.3.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research as sumption

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Growth Opportunities in The Smart Offices Market

4.2 Smart Offices Market, By Product

4.3 Market, By Software & Service

4.4 Smart Offices Market, By Office Type

4.5 Market in Apac, By Country & Product

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in Demand for Smart Office Solutions and Sensor Networks for Energy Efficiency

5.2.1.2 Advancement of IoT in Smart Office Offerings

5.2.1.3 Growing Need for Safety and Security Systems at Workplace

5.2.1.4 Favorable Government Regulations in Several Countries

5.2.2 Restraints

5.2.2.1 Complexity in Replacing Or Upgrading The Existing System

5.2.3 Opportunities

5.2.3.1 Evolving Cloud-Based Environment of IoT Platforms

5.2.4 Challenges

5.2.4.1 Integration of Real-Time Streaming Analytics Capabilities Into Smart Solution

5.3 Value Chain Analysis

6 Communication Technology for Smart Office (Page No. - 39)

6.1 Introduction

6.2 Wireless Technology

6.2.1 Wi-Fi

6.2.2 Enocean

6.2.3 Zigbee

6.2.4 Bluetooth/Ble

6.2.5 Others

6.3 Wired Technologies

6.3.1 Digital Addressable Lighting Interface (Dali)

6.3.2 Power Line Communication (Plc)

6.3.3 Power Over Ethernet (Poe)

6.3.4 Knx

6.3.5 Lonworks

6.3.6 Building Automation & Control Network (Bacnet)

7 Smart Offices Market, By Product (Page No. - 44)

7.1 Introduction

7.2 Smart Lighting

7.2.1 Smart Bulbs

7.2.2 Fixtures

7.2.3 Lighting Controls

7.2.3.1 Led Drivers and Ballasts

7.2.3.2 Sensors

7.2.3.3 Switches

7.2.3.4 Relay Units

7.2.3.5 Gateways

7.3 Security Systems

7.3.1 Access Controls

7.3.1.1 Biometric Systems/Biometric Readers

7.3.1.2 Card-Based Systems/Card-Based Readers

7.3.1.3 Electronic Locks

7.3.2 Surveillance Cameras/Video Surveillance

7.3.3 Fire and Safety Controls

7.4 Energy Management System

7.4.1 In-House Displays

7.4.2 Smart Thermostats

7.4.3 Load Control Switches

7.4.4 Smart Plugs

7.5 Heating, Ventilation, and Air Conditioning (Hvac) Control System

7.5.1 Sensors

7.5.1.1 Temperature Sensors

7.5.1.2 Humidity Sensors

7.5.1.3 Occupancy Sensors

7.5.1.4 Pressure Sensors

7.5.1.5 Flow Sensors

7.5.1.6 Other Sensors

7.5.2 Control Valves

7.5.3 Heating & Cooling Coils

7.5.4 Dampers

7.5.5 Actuators

7.5.6 Pumps & Fans

7.5.7 Smart Vents

7.5.8 Vav & Fcu Controllers

7.6 Audio–Video Conferencing Systems

7.6.1 Audio, Volume, & Multi-Media Room Controls

7.6.2 Video Conferencing Systems

7.6.3 to uch Screens & Keypads

8 Smart Offices Market, By Software & Service (Page No. - 74)

8.1 Introduction

8.2 Software

8.3 Services

8.3.1 Advisory & Consulting Services

8.3.2 Installation & Support Services

8.3.3 Managed Services

9 Smart Offices Market, By Office Type (Page No. - 78)

9.1 Introduction

9.2 Retrofit Offices

9.3 New Construction Offices

10 Geographical Analysis (Page No. - 82)

10.1 Introduction

10.2 Americas

10.2.1 Us

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 Uk

10.3.3 France

10.3.4 Rest of Europe

10.4 Apac

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Rest of Apac

10.5 Row

10.5.1 Middle East & Africa

10.5.2 South America

11 Competitive Landscape (Page No. - 102)

11.1 Introduction

11.2 Market Ranking Analysis

11.3 Competitive Situations and Trends

12 Company Profile (Page No. - 106)

12.1 Introduction

12.2 Siemens Ag

12.2.1 Business Overview

12.2.2 Strength of Product Portfolio

12.2.3 Business Strategy Excellence

12.2.4 Recent Developments

12.2.5 Key Relationships

12.3 Schneider Electric Sa

12.3.1 Business Overview

12.3.2 Strength of Product Portfolio

12.3.3 Business Strategy Excellence

12.3.4 Recent Developments

12.3.5 Key Relationship

12.4 Johnson Controls International Plc

12.4.1 Business Overview

12.4.2 Strength of Product Portfolio

12.4.3 Business Strategy Excellence

12.4.4 Recent Developments

12.4.5 Key Relationships

12.5 Honeywell International Inc.

12.5.1 Business Overview

12.5.2 Strength of Product Portfolio

12.5.3 Business Strategy Excellence

12.5.4 Recent Developments

12.5.5 Key Relationships

12.6 Abb Ltd.

12.6.1 Business Overview

12.6.2 Strength of Product Portfolio

12.6.3 Business Strategy Excellence

12.6.4 Recent Developments

12.6.5 Key Relationship

12.7 Cisco Systems, Inc.

12.7.1 Business Overview

12.7.2 Strength of Product Portfolio

12.7.3 Business Strategy Excellence

12.7.4 Recent Developments

12.7.5 Key Relationships

12.8 United Technologies Corporation

12.8.1 Business Overview

12.8.2 Strength of Product Portfolio

12.8.3 Business Strategy Excellence

12.8.4 Recent Developments

12.8.5 Key Relationship

12.9 Lutron Electronics Co. Inc.

12.9.1 Business Overview

12.9.2 Strength of Product Portfolio

12.9.3 Business Strategy Excellence

12.9.4 Recent Developments

12.1 Crestron Electronics, Inc.

12.10.1 Business Overview

12.10.2 Strength of Product Portfolio

12.10.3 Business Strategy Excellence

12.10.4 Recent Developments

12.10.5 Key Relationships

12.11 Philips Lighting Holding B.V.

12.11.1 Business Overview

12.11.2 Strength of Product Portfolio

12.11.3 Business Strategy Excellence

12.11.4 Recent Developments

12.11.5 Key Relationships

12.12 Ingersoll-Rand Plc

12.13 Leviton Manufacturing Company, Inc.

12.14 Robert Bosch

12.15 Buildingiq

12.16 Hitachi, Ltd.

12.17 Delta Controls

12.18 Emerging Company

12.18.1 Enlighted, Inc.

12.18.1.1 Strategies Adopted By The Company in The Smart Offices Market

12.18.2 Sensorsuite Inc.

12.18.2.1 Strategies Adopted By The Company in The Smart Offices Market

12.18.3 Foghorn Systems

12.18.3.1 Strategies Adopted By The Company in The Smart Offices Market

13 Appendix (Page No. - 149)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing Rt: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (70 Tables)

Table 1 Smart Offices Market2014–2023 (Usd Billion)

Table 2 Smart Offices MarketBy Product2014–2023 (Usd Million)

Table 3 MarketBy Smart Lighting2014–2023 (Usd Million)

Table 4 Smart Offices Market for Smart LightingBy Lighting Controls2014–2023 (Usd Million)

Table 5 Market for Smart LightingBy Office Type2014–2023 (Usd Million)

Table 6 Market for Smart LightingBy Region2014–2023 (Usd Million)

Table 7 Smart Offices Market for Smart Lighting in The AmericasBy Country2014–2023 (Usd Million)

Table 8 Market for Smart Lighting in EuropeBy Country2014–2023 (Usd Million)

Table 9 Smart Offices Market for Smart Lighting in ApacBy Country2014–2023 (Usd Million)

Table 10 Market for Smart Lighting in RowBy Region2014–2023 (Usd Million)

Table 11 MarketBy Security System2014–2023 (Usd Million)

Table 12 Smart Offices Market for Security SystemBy Access Controls2014–2023 (Usd Million)

Table 13 Market for Security SystemsBy Office Type2014–2023 (Usd Million)

Table 14 Market for Security SystemsBy Region2014–2023 (Usd Million)

Table 15 Smart Offices Market for Security Systems in The AmericasBy Country2014–2023 (Usd Million)

Table 16 Market for Security Systems in EuropeBy Country2014–2023 (Usd Million)

Table 17 Market for Security Systems in ApacBy Country2014–2023 (Usd Million)

Table 18 Market for Security Systems in RowBy Region2014–2023 (Usd Million)

Table 19 Market for Access ControlsBy Region2014–2023 (Usd Million)

Table 20 Market for Surveillance Camera/Video SurveillanceBy Region2014–2023 (Usd Million)

Table 21 Smart Offices Market for Fire and Safety ControlsBy Region2014–2023 (Usd Million)

Table 22 Market By Ems2014–2023 (Usd Million)

Table 23 Smart Office Market for EmsBy Office Type2014–2023 (Usd Million)

Table 24 Market for EmsBy Region2014–2023 (Usd Million)

Table 25 Market for Ems in The AmericasBy Country2014–2023 (Usd Million)

Table 26 Market for Ems in EuropeBy Country2014–2023 (Usd Million)

Table 27 Market for Ems in ApacBy Country2014–2023 (Usd Million)

Table 28 Market for Ems in RowBy Region2014–2023 (Usd Million)

Table 29 MarketBy Hvac Control System2014–2023 (Usd Million)

Table 30 Market for Hvac Control SystemsBy Office Type2014–2023 (Usd Million)

Table 31 Market for Hvac Control SystemsBy Region2014–2023 (Usd Million)

Table 32 Market for Hvac Control Systems in The AmericasBy Country2014–2023 (Usd Million)

Table 33 Market for Hvac Control Systems in EuropeBy Country2014–2023 (Usd Million)

Table 34 Market for Hvac Control Systems in ApacBy Country2014–2023 (Usd Million)

Table 35 Smart Office Market for Hvac Control Systems in RowBy Region2014–2023 (Usd Million)

Table 36 MarketBy Audio–Video Conferencing System2014–2023 (Usd Million)

Table 37 Smart Office Market for Audio–Video Conferencing SystemsBy Office Type2014–2023 (Usd Million)

Table 38 Market for Audio–Video Conferencing SystemsBy Region2014–2023 (Usd Million)

Table 39 Market for Audio–Video Conferencing Systems in The AmericasBy Country2014–2023 (Usd Million)

Table 40 Smart Office Market for Audio–Video Conferencing Systems in EuropeBy Country2014–2023 (Usd Million)

Table 41 Market for Audio–Video Conferencing Systems in ApacBy Country2014–2023 (Usd Million)

Table 42 Market for Audio–Video Conferencing Systems in RowBy Region2014–2023 (Usd Million)

Table 43 MarketBy Software & Service2014–2023 (Usd Million)

Table 44 MarketBy Service2014–2023 (Usd Million)

Table 45 MarketBy Office Type2014–2023 (Usd Million)

Table 46 Market for Retrofit OfficesBy Product2014–2023 (Usd Million)

Table 47 Smart Office Market for New Construction OfficesBy Product2014–2023 (Usd Million)

Table 48 Smart Office MarketBy Region2014–2023 (Usd Million)

Table 49 Market in AmericasBy Product2014–2023 (Usd Million)

Table 50 Market in AmericasBy Country2014–2023 (Usd Million)

Table 51 Smart Office Market in UsBy Product2014–2023 (Usd Million)

Table 52 Market in CanadaBy Product2014–2023 (Usd Million)

Table 53 Market in MexicoBy Product2014–2023 (Usd Million)

Table 54 Market in EuropeBy Product2014–2023 (Usd Million)

Table 55 Market in EuropeBy Country2014–2023 (Usd Million)

Table 56 Smart Office Market in GermanyBy Product2014–2023 (Usd Million)

Table 57 Market in UkBy Product2014–2023 (Usd Million)

Table 58 Market in FranceBy Product2014–2023 (Usd Million)

Table 59 Smart Office Market in Rest of EuropeBy Product2014–2023 (Usd Million)

Table 60 Market in ApacBy Product2014–2023 (Usd Million)

Table 61 Market in ApacBy Country2014–2023 (Usd Million)

Table 62 Smart Office Market in ChinaBy Product2014–2023 (Usd Million)

Table 63 Market in JapanBy Product2014–2023 (Usd Million)

Table 64 Smart Office Market in IndiaBy Product2014–2023 (Usd Million)

Table 65 Market in Rest of ApacBy Product2014–2023 (Usd Million)

Table 66 Smart Office Market in RowBy Product2014–2023 (Usd Million)

Table 67 Market in RowBy Region2014–2023 (Usd Million)

Table 68 Market in Middle East & AfricaBy Product2014–2023 (Usd Million)

Table 69 Market in South AmericaBy Product2014–2023 (Usd Million)

Table 70 Ranking of to p 5 Market Players2016

List of Figures (44 Figures)

Figure 1 Smart Office Market Segmentation

Figure 2 Smart Office Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: to p-Down Approach

Figure 5 Data Triangulation

Figure 6 Smart Office Market: Market Size Analysis (2014–2023)

Figure 7 Smart Office Market for Energy Management System Expected to Grow at The Highest Cagr During The Forecast Period

Figure 8 Smart Office Market for New Construction Office Expected to Grow at The Highest Cagr During The Forecast Period

Figure 9 Americas Held The Largest Share of The Global Smart Office Market in 2016

Figure 10 Smart Office Market Expected to Rise at A Moderate Rate During The Forecast Period

Figure 11 Security Systems Expected to Hold The Largest Size of The Market During The Forecast Period

Figure 12 Software Expected to Hold The Largest Size of The Market During The Forecast Period

Figure 13 New Construction Offices Expected to Witness The Largest Market Share By 2023

Figure 14 Security Systems and China Expected to Hold The Largest Share of The Market in Apac in 2017

Figure 15 Smart Office Market: DriversRestraintsOpportunitiesAnd Challenges

Figure 16 Number of Data Breach Incidents Over TimeBy Industry

Figure 17 Value Chain Analysis: Smart Office Market

Figure 18 Enocean Frequency Bands

Figure 19 Smart Office MarketBy Product

Figure 20 Market for Ems Expected to Grow at The Highest Cagr During The Forecast Period

Figure 21 Surveillance Cameras/Video Surveillance Expected to Dominate The Market for Security Systems During The Forecast Period

Figure 22 Apac Expected to Dominate The Market for Access Controls During The Forecast Period

Figure 23 Market for Smart Vents Expected to Grow at The Highest Cagr During The Forecast Period

Figure 24 AudioVolume& Multi-Media Room Controls Expected to Dominate The Market for Audio-Video Conferencing System During The Forecast Period

Figure 25 Market for Managed Services Expected to Grow at The Highest Cagr During The Forecast Period

Figure 26 Market for New Construction Offices Expected to Grow at The Highest Cagr During The Forecast Period

Figure 27 Geographic Snapshot (Cagr 2014–2023)

Figure 28 Smart Offices Market Snapshot: Americas

Figure 29 Market in Us Expected to Lead During The Forecast Period

Figure 30 Smart Office Market Snapshot: Europe

Figure 31 Security System Expected to Dominate The Market in Europe During The Forecast Period

Figure 32 Smart Office Market Snapshot : Apac

Figure 33 Market for Ems in Apac Expected to Grow at The Highest Cagr During The Forecast Period

Figure 34 Security System Expected to Dominated The Market in Row During The Forecast Period

Figure 35 Key Growth Strategy Adopted By The Companies Between 2014 and 2017

Figure 36 Battle for Market Share: Product Launches and Developments Were The Key Strategies

Figure 37 Siemens Ag: Company Snapshot

Figure 38 Schneider Electric Sa: Company Snapshot

Figure 39 Johnson Controls International Plc: Company Snapshot

Figure 40 Honeywell International Inc.: Company Snapshot

Figure 41 Abb Ltd: Company Snapshot

Figure 42 Cisco SystemsInc.: Company Snapshot

Figure 43 United Technologies Corporation: Company Snapshot

Figure 44 Philips Lighting Holding B.V.: Company Snapshot

Growth opportunities and latent adjacency in Smart Offices Market

We are a conferencing solution provider company and would like to know more about the Smart Office Market to see if there exists any opportunity to integrate our solutions with any specific technology provider.

There are a few areas of interest - 4.4 Smart Office Market, By Office Type - Table 43 Smart Office Market, By Office Type, 2014–2023 - Table 2 Smart Office Market, By Product, 2014–2023

Hi, We are a startup in the ideation stage and are looking for insights to develop a perfect product to establish a brand in the smart electronics segment. Can you help us by highlighting key applications to invest in? Is this concern addressed in the report? If not, how should we proceed?

I am working for a startup which develops smart air Quality meters for smart Offices and smart cities. As our financial resources are limited it would be great if you could send us a free copy of the study.

We are a network service management firm and would like to know about the key challenges faced by wireless technology providers for smart offices. Further, we would like to know about the most suitable technology providers with whom we can partner and enter the smart offices market

I just want to get some information for the seminar paper about the topic IoT in offices that I have to write. Hence, would like to interact with the author of the report. Further, can I get a report brochure and few other insights for my reference?

Which type of offices (retrofit or newly constructed) dominate the smart offices market? Which product (smart lighting, security system, energy management system, HVAC control system, or audio-video conferencing system) is expected to create more traction in the coming years?

Want to understand what all options are available for converting retrofit offices into smart offices as we are planning to renovate ours. Can you help us with the report brochure and identify players who could help us with this?

Hi, we are a HVAC system provider active in APAC region and would like to know the market size of HVAC control system in Singapore and Thailand. Is this covered in the report? If not, can there be any customization considered for lesser price than the original report?