Snack Pellets Market by Type (Potato, Corn, Rice, Tapioca, Multigrain), Form (Laminated, Tridimensional, Die-face, Gelatinized), Technique (Twin-screw extruder, Single-screw extruder), Flavor (Plain, Flavored, Nutritional), and Region – Global Forecast to 2023

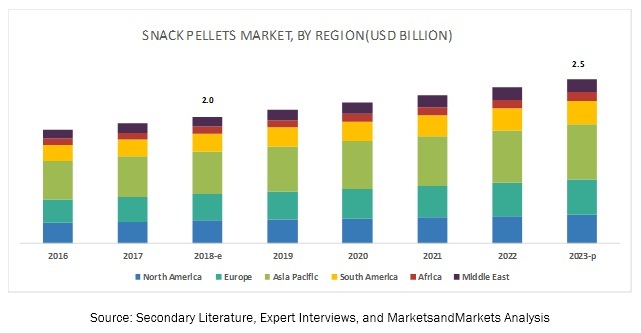

[149 Pages Report] The snack pellets market was valued to be at USD 2.0 billion in 2018 and is projected to reach a value of about USD 2.5 billion by 2023, at a CAGR of 5.3%. The growth of the snack pellets market is driven by the rising demand for prepared and convenience food products. In addition to this, the growing focus on facility expansion, marketing schemes, and information exchange programs for creating awareness to enhance the consumption of snack pellets has contributed to the growth of the market.

The multigrain type segment is projected to be the fastest growing in the snack pellets market during the forecast period.

The multigrain type segment is projected to be the fastest-growing segment in the snack pellets market during the forecast period. Multigrain snack pellets are made of various grains that have high nutritional value. Earlier, a single grain type was used to produce snack pellets, due to which the nutritional value of products was limited. Currently, the consumer demand for multigrain snack pellets remains high due to its high-fiber content. With low-fat content, multigrain snack pellets offer various health and taste benefits, as compared to potato- and corn-based snack pellets. Grains such as wheat is mostly used with other types for snack pellets.

The gelatinized segment is projected to account for the largest market size during the forecast period.

On the basis of form, the snack pellets market is segmented into laminated, die-face, tridimensional, and gelatinized. Gelatinized pellets are uniform in thickness; and are generally flat, with holes on the surface. The thickness is essential for the maintenance of shape definition upon frying or toasting. Gelatinized pellets can be produced by using a specially designed high-speed rotary cutting machine, which sequentially and synchronously punches the holes and cuts the sheet into the desired shape. Hence, the gelatinized form of snack pellets in the food industry is witnessing growth.

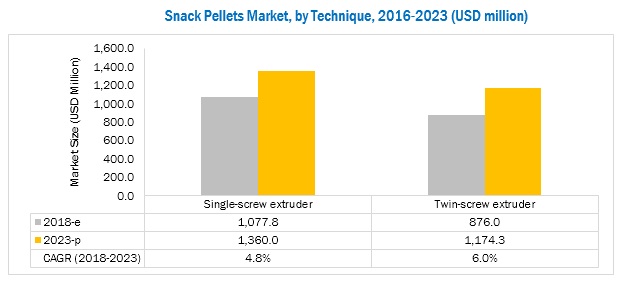

The single screw extruder segment is expected to account for the largest share in the snack pellets market in 2018”.

On the basis of technique, the snack pellets market is dominated by the single-screw extruder segment. Single-screw extruders are comparatively easy to operate and maintain. Moreover, there are various types of single extruders offered by leading players in the market; these extruders are effective and capable of producing complex extruded snack food products. A single-screw extruder uses one screw in the barrel of the extruder to transport and shape multiple ingredients by forcing the ingredient mix through a shaped die to produce a uniform shape.

North America is projected to account for the largest market size during the forecast period.

North America is projected to dominate the snack pellets market throughout the forecast period. Due to the abundant availability of raw materials and the presence of a strong food processing industry, North America holds the largest share of the snack pellets market, in terms of both volume and value. Additionally, snacks made from potato are highly preferred by consumers. These factors are responsible for the largest share of potato-based snack pellets in the region.

Market Dynamics

Rise in demand for prepared and convenient foods is driving market growth.

The snack pellets market is primarily driven by the growth of the processed food industry. The changes in lifestyles and high disposable incomes of the population have led to an increased demand for ready-to-eat food products, as they help save time and efforts. In addition to this, the demand for processed food and an increase in the trend of snacking between meals are also fueling the demand for extruded food products. Children and young adults require fillers in between their meals. Snacks act as alternatives to such fillers and are hence widely preferred. Being easy to consume and buy, consumers are increasing their purchase of snacks. Hence, snack manufacturers are demanding more and varied snack pellets to increase their production and meet the rising demand of snack pellets. The rise in per capita income and the trend of snacking between meals are fueling the demand for snack pellets. Consumer preferences in emerging economies such as China, India, Brazil, and the Middle East have gradually transitioned from traditional home-made breakfasts and snacking meals to ready-to-eat products over the last couple of decades.

High acrylamide content in snack foods is restraining growth of the market.

Snack pellets are further processed for consumption by frying or through the hot air expansion process. A critical issue faced by the snack pellets industry is the formation of acrylamide during frying. The asparagine and glucose present in the food form acrylamide when reacted in temperatures above 248°F. Acrylamide, when consumed in excess, can be carcinogenic and also affects the taste of the snack pellets. The presence of acrylamide has negatively impacted the growth of potato-based snack pellets. Thus, to decrease the acrylamide levels in potato-based snack pellets, frying at a controlled thermal input, vacuum condition, and flash frying ought to be implemented by the manufacturers. In recent years, companies such as Novozymes A/S (Denmark) have introduced enzymes that help in reducing the content of acrylamide and mask the insipid flavor. Another food player, J.R. Simplot Company (US), developed genetically modified (GM) potato varieties classified as Innate Generation 1 and Innate Generation 2, in 2014. The potato variety, Innate Generation 1, received safety approval in 2015, while the Innate Generation 2 received approval in 2017 from the US Food and Drug Administration (FDA). These potato varieties offer various benefits to the potato industry for key issues such as acrylamide formation in snack pellets, along with late blight disease, black spot bruising, sprouting, and shrinkage or loss of weight during storage. Hence, these potato varieties developed by the company contain less asparagine, which helps in the reduction of acrylamide formation at high temperatures. However, consumer perception of snack pellets having carcinogenic components restrains the market growth.

Government initiatives and investments to expand the processed and extruded food sectors will provide growth opportunity.

The demand for extruded snacks is expected to rise in emerging markets such as China, India, Brazil, and Russia, due to increasing consumer preference toward ready-to-eat food products. To tap these markets, snack manufacturers are increasing their production, due to which the requirement for food extruders is increasing in the region. Globally, the demand for extruded snacks is increasing. This is encouraging snack pellet manufacturers to expand and improve their production facilities. In Europe, high demand is witnessed for processed snack products. The European Snacks Association (ESA) has supported the markets for snacks and snack pellets by bringing together various stakeholders associated with the snacks industry. The association arranges various trade shows, conferences, and publishes technical insights for promoting trade by sharing knowledge. The ESA takes the responsibility to inform the members of the current and emerging trends of the association. Also, the North American Association of Food Equipment Manufacturers provides all the support in terms of technical expertise and other guidance to set up, expand, or upgrade businesses. Such initiatives by governments are helping snack pellet manufacturers to expand their business, hence creating an opportunity for the growth of the snack pellet market.

Operational complexity during food processing is a major challenge for the snack pellets market.

The viscosity, screw speed, temperature, and pressure, along with the complexity of the mathematical descriptions of the process, are closely inter-related. These dynamics present a challenge for accurate dynamic modeling of the extrusion process. Also, there are several load variables for viscosity regulations, depending on the choice of the manipulation variable, which may present disturbances. Extra caution needs to be taken while processing functional products, as there may be a loss of nutrients of the ingredients during processing. Such factors are the major challenges in snack pellets processing, and hence, can hinder the growth of the overall snack pellets market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Value (USD Million) and Volume (KT) |

|

Segments covered |

Type, Form, Flavor, Technique, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Africa, Middle East, and South America |

|

Companies covered |

Limagrain Céréales Ingrédients (France), Liven S.A. (Spain), Grupo Michel (Mexico), Leng d'Or S.A. (Spain), Pellsnack-Products GmbH (Germany), J. R. Short Milling (US), Pasta Foods Ltd (UK), Noble Agro Food Products Ltd (India), Bach Snacks s.a.l. (Lebanon), Mafin Spa (Italy), Le Caselle S.p.A. (Italy), and Van Marcke Foods (the Netherlands) |

On the basis of type, the snack pellets market has been segmented as follows:

- Potato

- Corn

- Rice

- Tapioca

- Multigrain

- Others

On the basis of form, the snack pellets market has been segmented as follows:

- Laminated

- Tridimensional

- Die-Face

- Gelatinized

On the basis of flavor, the snack pellets market has been segmented as follows:

- Plain

- Flavored

- Nutritional

On the basis of technique, the snack pellets market has been segmented as follows:

- Single-Screw Extruder

- Twin-Screw Extruder

On the basis of region, the snack pellets market has been segmented as follows:

- North America

- South America

- Europe

- Africa

- Middle East

- South America

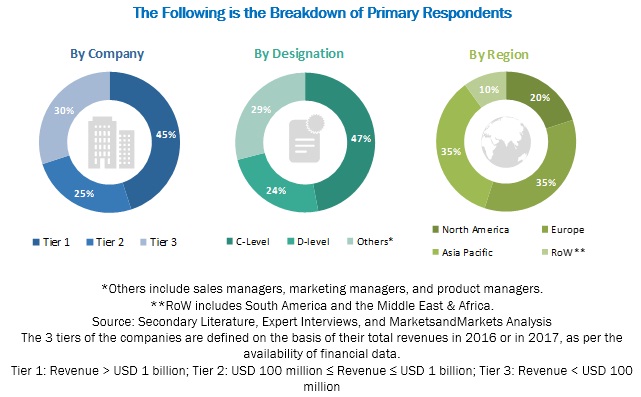

Break-up of Primaries:

- By Company Type: Tier 1 - 45 %, Tier 2 - 25%, and Tier 3 - 30%

- By Designation: C-level - 47%, D-level - 24%, and Others* - 29%

- By Region: North America - 20%, Europe - 35%, Asia Pacific - 35%, ROW**- 10%

*Others include sales managers, marketing managers, and product managers.

**ROW includes South America and the Middle East & Africa

3 tiers of the company are defined on the basis of their revenue, as of 2014; Tier1: Revenue>USD 1 billion, Tier 2: USD 100 million < REVENUE < 1100 billion, and Tier 3: Revenue < USD million

Key Questions addressed by the report:

- What are new trending flavors which the snack pellet companies are exploring?

- Which are the key players in the market and how intense is the competition?

- What are the upcoming growth trends which the snack pellets manufacturers are focusing on in the future?

- What are the high growth opportunities in the snack pellets market in each segment?

- What are the key growth strategies adopted by major market players in the snack pellets market?

Recent developments:

- Limagrain Céréales Ingrédients entered into an agreement to acquire 100% shares of Unicorn Grain Specialties (the Netherlands). This agreement would strengthen Limagrain’s strong presence in Northern Europe, in the pulses and cereals market. It would also provide specialized ingredients to industries such as breakfast cereals, bakery, snacking, animal nutrition, and nutrition markets.

Reasons to buy this report:

- To get a comprehensive overview of the snack pellets market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights about the major countries/regions in which the snack pellets market is flourishing

Frequently Asked Questions (FAQ):

I am interested in European market. Is the customization available for the same? What all information would be included in the same?

Yes, customization for the European market can be provided on various aspects including market size (all segments), forecast, market dynamics, company profiles & competitive landscape. Exclusive insights on below European countries will be provided:

- Germany

- France

- UK

- Italy

- Poland

- Spain

- Rest of Europe (Russia, Belgium, and other EU and non-EU countries)

Also, you can let us know if there are any other countries of your interest

Can you explain the research methodology on how you arrived at the market?

Yes, detailed explanation of research methodology can be provided over a scheduled call, it will also enable us to explain all your queries in detail. For a brief overview and knowledge: Multiple approaches have been adopted to understand the holistic view of this market including:

- Top down approach

- Bottom-up approach from regional level

- Primary interviews with industry experts

- Revenue mapping of key players and analyzing their market share

- Data triangulation

Which techniques and form are covered in the study?

The report provides granular information on the following techniques:

- Single screw

- Double screw The report also provides granular information on the following form:

- Laminated

- Tridimensional

- Die-Face

- Gelatinized

Can you explain the Competitive Leadership Mapping covered in the report?

The Competitive Leadership Mapping is positioning of market players in the micro quadrant based on strength of product offering and strength of business portfolio. It includes:

- Visionary Leaders

- Innovators

- Dynamic Differentiators

- Emerging Companies

Which companies have been included in this study?

The study comprises of top 20 companies operating in the snack pellet market. Following are some of the key players profiled in our study:

- Limagrain Céréales Ingrédients

- Liven S.A.

- Grupo Michel

- Pellsnack Products

- Leng-D’or

- J. R. Short Milling

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Currency Considered

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Growth Opportunities in the Snack Pellets Market

4.2 North America: Snack Pellets Market, By Type & Country

4.3 Snack Pellets Market, By Technique, 2018 vs. 2023

4.4 Snack Pellets Market, By Flavor

4.5 Snack Pellets Market, By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rise in Demand for Prepared and Convenience Foods

5.2.1.2 Increasing Innovations in Food Extrusion Processes

5.2.1.3 Expansion of Retail Landscape in Developing Countries

5.2.2 Restraints

5.2.2.1 High Acrylamide Content in Snack Foods

5.2.2.2 Health Problems Associated With the Higher Consumption of Processed Potato Snacks

5.2.3 Opportunities

5.2.3.1 Emerging Opportunities in the Extruded Snack Industry

5.2.3.2 Government Initiatives and Investments to Expand the Processed and Extruded Food Sectors

5.2.4 Challenges

5.2.4.1 Lack of Transport Infrastructure Support in Emerging Markets

5.2.4.2 Operational Complexity During Food Processing

6 Snack Pellets Market, By Type (Page No. - 39)

6.1 Introduction

6.2 Potato

6.2.1 Increasing Health Awareness Among Consumers is Creating A Demand for Low-Fat Potato-Based Snack Products as the Potato Starch Helps in Obtaining the Desired Texture and Properties for the End Product

6.3 Corn

6.3.1 With the Increasing Consciousness Toward Eating Healthy Snacks Supported With A Variety in Flavors, Consumers are Widely Adopting Corn-Based Products, Which, in Turn, is Expected to Boost the Demand for Corn-Based Snack Pellets in the Future

6.4 Rice

6.4.1 Advancements in Technologies Have Resulted in the Development of Improved Rice Varieties and Reduced Time for Production of Rice-Based Snack Pellets in the Developing Countries

6.5 Tapioca

6.5.1 Benefits Such as Low Gelatinization Temperatures and Well-Expanded Density Intact Will Boost the Demand for Tapioca-Based Snack Pellets

6.6 Multigrain

6.6.1 Growing Demand for Multigrain Snack Pellets has Increased Among the Young Population as they Consist of High Fiber & Low-Fat Content While at the Same Time, Not Compromising on Taste

6.7 Others

7 Snack Pellets Market, By Form (Page No. - 44)

7.1 Introduction

7.2 Laminated

7.2.1 Laminated Form is Widely Consumed as It has Precise Control Over Sheet Thickness During the Processing of Cylindrical and Traditional Form of Snack Pellets

7.3 Tridimensional

7.3.1 Demand for the Tridimensional Form of Snack Pellets is Expected to Be High During the Forecast Period as It is More Popular Among the Young Generation Due to the Availability of New Technologies to Produce Optimum Product Shapes

7.4 Die-Face

7.4.1 Die-Face Snack Pellets are Subsequently Dried to Moisture Levels That Permit Optimum Expansion During Frying Or Toasting, Which Produces Shapes Such as Stars and Wheels

7.5 Gelatinized

7.5.1 Gelatinized Form Dominated the Snack Pellets Market During the Forecast Period

8 Snack Pellets Market, By Flavor (Page No. - 48)

8.1 Introduction

8.2 Plain

8.2.1 Plain Snack Pellets are Widely Preferred as Popular Flavored Snacks as they Satisfy Cravings for Savory Snack Products

8.3 Flavored

8.3.1 Innovative and Unexpected New Textured and Flavored Variety in Snack Pellets are Responsible for the Larger Young Consumer Base

8.4 Nutritional

8.4.1 Convenient and Healthy Snacking Option is One of the Key Drivers for the Rising Demand for Nutritional Snack Pellets During the Forecast Period

9 Snack Pellets Market, By Technique (Page No. - 52)

9.1 Introduction

9.2 Single-Screw Extruder

9.2.1 Europe is the Largest Market for Single-Screw Extruders as they are Easy to Operate and Maintain

9.3 Twin-Screw Extruder

9.3.1 Demand for Twin-Screw Extruders is Increasing as they Provide Higher Flexibility Along With the Capability to Process A Wide Range of Raw Materials

10 Snack Pellets Market, By Region (Page No. - 56)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 High Awareness Related to the Efficient Use of Single-Screw Extrusion Technique Drives the Market in the US

10.2.2 Canada

10.2.2.1 High Demand for Nutritional Snack Foods Such as Corn-Based and Multigrain-Based Snack Pellets is the Major Growth Factor for the Market in Canada

10.2.3 Mexico

10.2.3.1 Increasing Commercialization of the Food Processing Industry is the Main Driver for the Snack Pellets Market in Mexico

10.3 Europe

10.3.1 Germany

10.3.1.1 High Availability of Raw Materials Such as Grains and Cereal is Driving the Market in Germany

10.3.2 UK

10.3.2.1 Presence of Major Players in the Region is A Key Driver for Snack Pellets in the UK

10.3.3 Italy

10.3.3.1 Snack Pellets Market in Italy is A High-Growth-Potential One as Foodservice Represents A Great Channel for Companies to Promote their Brands in the Country

10.3.4 France

10.3.4.1 Developments in Food Processing Technology, Marketing Innovations, and Export of Finished Snack Foods Have Contributed to the Country’s Increasing Demand for Snack Pellets

10.3.5 Poland

10.3.5.1 Increase in Disposable Income and the Rising Demand for Rte Products Fuel the Snack Pellets Market in Poland

10.3.6 Spain

10.3.6.1 Healthy Snacking has Influenced Manufacturers to Produce Snack Pellets Based on Vegetable Flour

10.3.7 Rest of Europe

10.4 Asia Pacific

10.4.1 India

10.4.1.1 Development of Cold Chain Infrastructure has Helped in the Growth of India’s Food Processing and Agribusiness Industries, Which, in Turn, has Helped the Country to Be A Potential Market for Nutritional Snack Pellets

10.4.2 Indonesia

10.4.2.1 Indonesia’s Strong Demand in Packaged Food Provide Significant Opportunities to Snack Pellet Manufacturers

10.4.3 China

10.4.3.1 Changing Consumer Preferences, as A Result of Growth in the Economy, are Driving the Market for Snack Pellets in China

10.4.4 Japan

10.4.4.1 Multinational Companies, in Alliance With Local Players, Have Developed New Varieties of Snack Pellets, Enriched With Flavors and Organic Ingredients That Suit the Taste of Japanese Consumers

10.4.5 Rest of Asia Pacific

10.5 Africa

10.5.1 South Africa

10.5.1.1 Growing Trend of Working Women and Busy Work Schedules Have Further Driven the Demand for Convenience Products Such as Snacks, Indicating Substantial Growth for Healthy Snack Pellets in the Country

10.5.2 Rest of Africa

10.6 Middle East

10.6.1 Demand for Snack Pellets is Estimated to Grow With the Development of the Market and Penetration of Large Manufacturers in the Country

10.7 South America

10.7.1 Brazil

10.7.2 Rest of South America

11 Competitive Landscape (Page No. - 114)

11.1 Overview

11.2 Competitive Scenario

11.2.1 Agreements

11.3 Market Ranking

12 Company Profiles (Page No. - 116)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

12.1 Limagrain Céréales Ingrédients

12.2 Liven S.A.

12.3 Grupo Michel

12.4 Leng-D’or

12.5 Pellsnack Products

12.6 J. R. Short Milling

12.7 Pasta Foods

12.8 Noble Agro Food

12.9 Bach Snacks

12.1 Mafin

12.11 LE Caselle

12.12 Van Marcke Foods

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 141)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (109 Tables)

Table 1 Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 2 Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 3 Snack Pellets Market Size, By Form, 2016–2023 (USD Million)

Table 4 Snack Pellets Market Size, By Form, 2016–2023 (Kt)

Table 5 Snack Pellets Market Size, By Flavor, 2016–2023 (USD Million)

Table 6 Snack Pellets Market Size, By Flavor, 2016–2023 (Kt)

Table 7 Snack Pellets Market Size, By Technique, 2016–2023 (USD Million)

Table 8 Snack Pellets Market Size, By Technique, 2016–2023 (Kt)

Table 9 Snack Pellets Market Size, By Region, 2016–2023 (USD Million)

Table 10 Snack Pellets Market Size, By Region, 2016–2023 (Kt)

Table 11 North America: Snack Pellets Market Size, By Country, 2016–2023 (USD Million)

Table 12 North America: Snack Pellets Market Size, By Country, 2016–2023 (Kt)

Table 13 North America: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 14 North America: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 15 North America: Snack Pellets Market Size, By Form, 2016–2023 (USD Million)

Table 16 North America: Snack Pellets Market Size, By Form, 2016–2023 (Kt)

Table 17 North America: Snack Pellets Market Size, By Technique, 2016–2023 (USD Million)

Table 18 North America: Snack Pellets Market Size, By Technique, 2016–2023 (Kt)

Table 19 North America: Snack Pellets Market Size, By Flavor, 2016–2023 (USD Million)

Table 20 North America: Snack Pellets Market Size, By Flavor, 2016–2023 (Kt)

Table 21 US: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 22 US: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 23 Canada: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 24 Canada: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 25 Mexico: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 26 Mexico: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 27 Europe: Snack Pellets Market Size, By Country, 2016–2023 (USD Million)

Table 28 Europe: Snack Pellets Market Size, By Country, 2016–2023 (Kt)

Table 29 Europe: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 30 Europe: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 31 Europe: Snack Pellets Market Size, By Form, 2016–2023 (USD Million)

Table 32 Europe: Snack Pellets Market Size, By Form, 2016–2023 (Kt)

Table 33 Europe: Snack Pellets Market Size, By Technique, 2016–2023 (USD Million)

Table 34 Europe: Snack Pellets Market Size, By Technique, 2016–2023 (Kt)

Table 35 Europe: Snack Pellets Market Size, By Flavor, 2016–2023 (USD Million)

Table 36 Europe: Snack Pellets Market Size, By Flavor, 2016–2023 (Kt)

Table 37 Germany: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 38 Germany: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 39 UK: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 40 UK: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 41 Italy: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 42 Italy: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 43 France: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 44 France: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 45 Poland: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 46 Poland: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 47 Spain: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 48 Spain: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 49 Rest of Europe: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 50 Rest of Europe: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 51 Asia Pacific: Snack Pellets Market Size, By Country, 2016–2023 (USD Million)

Table 52 Asia Pacific: Snack Pellets Market Size, By Country, 2016–2023 (Kt)

Table 53 Asia Pacific: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 54 Asia Pacific: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 55 Asia Pacific: Snack Pellets Market Size, By Form, 2016–2023 (USD Million)

Table 56 Asia Pacific: Snack Pellets Market Size, By Form, 2016–2023 (Kt)

Table 57 Asia Pacific: Snack Pellets Market Size, By Technique, 2016–2023 (USD Million)

Table 58 Asia Pacific: Snack Pellets Market Size, By Technique, 2016–2023 (Kt)

Table 59 Asia Pacific: Snack Pellets Market Size, By Flavor, 2016–2023 (USD Million)

Table 60 Asia Pacific: Snack Pellets Market Size, By Flavor, 2016–2023 (Kt)

Table 61 India: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 62 India: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 63 Indonesia: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 64 Indonesia: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 65 China: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 66 China: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 67 Japan: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 68 Japan: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 69 Rest of Asia Pacific: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 70 Rest of Asia Pacific: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 71 Africa: Snack Pellets Market Size, By Country, 2016–2023 (USD Million)

Table 72 Africa: Snack Pellets Market Size, By Country, 2016–2023 (Kt)

Table 73 Africa: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 74 Africa: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 75 Africa: Snack Pellets Market Size, By Form, 2016–2023 (USD Million)

Table 76 Africa: Snack Pellets Market Size, By Form, 2016–2023 (Kt)

Table 77 Africa: Snack Pellets Market Size, By Technique, 2016–2023 (USD Million)

Table 78 Africa: Snack Pellets Market Size, By Technique, 2016–2023 (Kt)

Table 79 Africa: Snack Pellets Market Size, By Flavor, 2016–2023 (USD Million)

Table 80 Africa: Snack Pellets Market Size, By Flavor, 2016–2023 (Kt)

Table 81 South Africa: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 82 South Africa: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 83 Rest of Africa: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 84 Rest of Africa: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 85 Middle East: Snack Pellets Market Size, By Region, 2016–2023 (USD Million)

Table 86 Middle East: Snack Pellets Market Size, By Region, 2016–2023 (Kt)

Table 87 Middle East: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 88 Middle East: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 89 Middle East: Snack Pellets Market Size, By Form, 2016–2023 (USD Million)

Table 90 Middle East: Snack Pellets Market Size, By Form, 2016–2023 (Kt)

Table 91 Middle East: Snack Pellets Market Size, By Technique, 2016–2023 (USD Million)

Table 92 Middle East: Snack Pellets Market Size, By Technique, 2016–2023 (Kt)

Table 93 Middle East: Snack Pellets Market Size, By Flavor, 2016–2023 (USD Million)

Table 94 Middle East: Snack Pellets Market Size, By Flavor, 2016–2023 (Kt)

Table 95 South America: Snack Pellets Market Size, By Country, 2016–2023 (USD Million)

Table 96 South America: Snack Pellets Market Size, By Country, 2016–2023 (Kt)

Table 97 South America: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 98 South America: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 99 South America: Snack Pellets Market Size, By Form, 2016–2023 (USD Million)

Table 100 South America: Snack Pellets Market Size, By Form, 2016–2023 (Kt)

Table 101 South America: Snack Pellets Market Size, By Technique, 2016–2023 (USD Million)

Table 102 South America: Snack Pellets Market Size, By Technique, 2016–2023 (Kt)

Table 103 South America: Snack Pellets Market Size, By Flavor, 2016–2023 (USD Million)

Table 104 South America: Snack Pellets Market Size, By Flavor, 2016–2023 (Kt)

Table 105 Brazil: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 106 Brazil: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 107 Rest of South America: Snack Pellets Market Size, By Type, 2016–2023 (USD Million)

Table 108 Rest of South America: Snack Pellets Market Size, By Type, 2016–2023 (Kt)

Table 109 Agreements, 2018

List of Figures (38 Figures)

Figure 1 Snack Pellets Market Segmentation

Figure 2 Snack Pellets Market: Regional Scope

Figure 3 Periodization Considered

Figure 4 Snack Pellets Market: Research Design

Figure 5 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 6 Market Size Estimation: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation

Figure 9 Snack Pellets Market Share, By Type, 2018 vs. 2023

Figure 10 Snack Pellets Market Size, By Technique, 2018 vs. 2023 (USD Million)

Figure 11 Snack Pellets Market Size, By Form, 2018 vs. 2023 (USD Million)

Figure 12 North America Dominated the Snack Pellets Market in 2017

Figure 13 Emerging Economies Offer Attractive Opportunities in the Snack Pellets Market, Globally

Figure 14 Potato Segment Was Dominant, in Terms of Type, in the North American Snack Pellets Market

Figure 15 Single-Screw Extruder Segment to Dominate the Market During the Forecast Period

Figure 16 Plain Segment to Dominate the Market Across All Regions From 2018 to 2023

Figure 17 US Accounted for the Largest Share of the Global Snack Pellets Market in 2017

Figure 18 Market Dynamics: Snack Pellets Market

Figure 19 Rise in Disposable Income to Drive the Demand for Processed Food Products

Figure 20 Snack Pellets Market Size, By Type, 2018 vs. 2023 (USD Million)

Figure 21 Snack Pellets Market Size, By Type, 2018 vs. 2023 (Kt)

Figure 22 Snack Pellets Market Size, By Form, 2018 vs. 2023 (USD Million)

Figure 23 Snack Pellets Market Size, By Form, 2018 vs. 2023 (Kt)

Figure 24 Plain Flavor is Projected to Be the Leading Segment During the Forecast Period

Figure 25 Plain Flavor is Projected to Be the Fastest-Growing Segment, in Terms of Volume, During the Forecast Period

Figure 26 Single-Screw Extruder is Projected to Be A Leading Segment During the Forecast Period

Figure 27 Single Screw Extruder is Projected to Be A Dominating Segment During the Forecast Period

Figure 28 North America to Lead the Snack Pellets Market Through 2023 (USD Million)

Figure 29 North America: Market Snapshot

Figure 30 Europe: Market Snapshot

Figure 31 Asia Pacific Snack Pellets Market Snapshot: India is Projected to Be the Fastest-Growing Market By 2023

Figure 32 Top 5 Companies in the Snack Pellets Market

Figure 33 Product Offering Analysis of the Top 5 Companies, By Type

Figure 34 Limagrain Céréales Ingrédients: SWOT Analysis

Figure 35 Liven S.A.: SWOT Analysis

Figure 36 Grupo Michel: SWOT Analysis

Figure 37 Leng-D’or: SWOT Analysis

Figure 38 Pellsnack Products: SWOT Analysis

The study involves four major activities to estimate the current market size for snack pellets. Exhaustive secondary research was done to collect information on the market as well as its peer and parent markets. The findings, assumptions, and market size was validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The snack pellets market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand-side of this market is characterized by the rising demand for ready-to-eat food products and extended shelf-life of these products. The supply-side is characterized by advancements in production technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the snack pellets market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology was used to estimate the market size, which includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for each market segment and subsegment, data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the food & beverage industry.

Report Objectives

- To define, segment, and project the global market size for snack pellets products

- To understand the structure of the snack pellets market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets; with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the four regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by players across key regions

- To analyze competitive developments such as expansions & investments, new product launches, mergers & acquisitions, joint ventures, and agreements

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Value (USD) & Volume (KT) |

|

Segments covered |

Type, Form, Technique, Flavor, and Region |

|

Geographies covered |

North America, APAC, Europe, South America, the Middle East, and Africa |

|

Companies covered |

Limagrain Céréales Ingrédients (France), Liven S.A. (Spain), Grupo Michel (Mexico), Leng d'Or S.A. (Spain), Pellsnack-Products GmbH (Germany), J. R. Short Milling (US), Pasta Foods Ltd (UK), Noble Agro Food Products Ltd (India), Bach Snacks s.a.l. (Lebanon), Mafin Spa (Italy), Le Caselle S.p.A. (Italy), and Van Marcke Foods (the Netherlands). |

This research report categorizes the snack pellets market based on type, form, technique, flavor, and region.

On the basis of type, the snack pellets market has been segmented as follows:

- Potato

- Corn

- Rice

- Tapioca

- Multigrain

- Others (cereal grain {other than rice and corn}, legume, and vegetable {other than potato} ingredients)

On the basis of form, the snack pellets market has been segmented as follows:

- Laminated

- Tridimensional

- Die-face

- Gelatinized

On the basis of technique, the snack pellets market has been segmented as follows:

- Single-screw extruder

- Twin-screw extruder

On the basis of flavor, the snack pellets market has been segmented as follows:

- Plain

- Nutritional

- Flavored (dry/wet)

On the basis of region, the snack pellets market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East

- South America

- Africa

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per client-specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe snack pellets market

- Further breakdown of the Rest of Asia Pacific snack pellets market

- Further breakdown of the Rest of Africa snack pellets market.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Snack Pellets Market

There is a requirement for market of potato snack pellet in Vietnam and Thailand. Is it possible to get specific information focusing on these countries ?