Tile Adhesives & Stone Adhesives Market by Chemistry (Cementitious and Epoxy), Construction Type (New Construction and Repairs & Renovation), End Use (Residential, Commercial, and Institutional) and Region - Global Forecast to 2027

Updated on : June 17, 2024

Tile Adhesives Market & Stone Adhesives Market

The global tile adhesives market and stone adhesives market was valued at USD 4.7 billion in 2022 and is projected to reach USD 7.0 billion by 2027, growing at 8.0% cagr from 2022 to 2027. Market growth is attributed to the rising demand for tile & stone adhesives in the growing construction industry in residential, commercial, and institutional end uses across the world. The growth of the market is also triggered by the rising demand for ceramic tiles for decorative applications, the thin tile concept innovation, and advancements in technology related to low VOC emitting products.

To know about the assumptions considered for the study, Request for Free Sample Report

Tile Adhesives & Stone Adhesives Market Dynamics

Driver: Growth in global construction industry

According to ICIS, the volume of the global construction industry is likely to grow by 35% to USD 5.8 trillion by 2030 and will be mainly driven by the US, China, and India. This growth would drive the demand for tile & stone adhesives in various construction applications. Asia Pacific is leading the construction market due to the burgeoning growth of residential, commercial, and institutional engineering projects in countries such as China and India. The construction industry in ASEAN countries is expected to project phenomenal growth as compared to the rest of the world. This growth is expected to fuel the demand for tile & stone adhesives across the world.

Restraint: Low awareness regarding tile & stone adhesives in developing economies

Although countries such as India, Indonesia, Malaysia, Brazil, and Argentina are top consumers of ceramic tiles for flooring and wall applications, among others, only 25%-30% of all the projects use tile & stone adhesives. The primary reason for this is the low awareness about the benefits of tile adhesives, the less-known procedure of installing tiles using adhesives, and the lack of awareness regarding their affordability. In regions such as Europe and North America, where the awareness regarding tile adhesives is high, the demand is not that significant as a majority of flooring space in these regions is dominated by carpets and rugs & wooden flooring. The demand for tile & stone adhesives has now started to grow in the Asia Pacific region because of the use of exotic stones such as marble, granite, and vitrified ceramic tiles in high-end residential projects. In the Middle East, the usage rate of tile & stone adhesives is expected to increase from the current level to between 70% and 100% over the forecast period due to the use of premium ceramic tiles and exotic stones, along with limited availability of basic raw materials such as cement and sand. Also, due to extreme weather conditions in the region, the exterior stones and tile fittings become loose and damage the grouting due to a lack of appropriate adhesives.

India offers a huge potential for the tile & stone adhesives market. The current 20-25% usage rate of adhesives in the country is expected to reach almost 50% in the forecast period due to the increase in the use of these adhesives in high-end residential projects, commercial projects such as shopping malls, airports & metros, and the constantly upgrading hospitality industry.

Opportunity: Development in different innovative substrates

In recent years, developments in new production technologies for ceramic and porcelain tiles have led to thinner and larger tiles. These tiles are being used to create almost continuous surfaces, which increase their architectural value. Also, the increase in the demand for soundproofing and thermal insulation in buildings has led to a trend shift from the use of normal concrete substrates to different innovative substrate materials such as gypsum boards, chipboards, plaster boards, cement fiber panels, metal surfaces, and heated floors. Emerging new substrates for swimming pools, such as fiberglass and cementitious screed, have led to the development of new adhesives from Mapei S.p.A and Saint-Gobain Weber, among other companies.

Challenge: Established infrastructure in developed countries

Developed countries such as the US, Germany, the UK, Japan, and the other Western European countries have established infrastructure for the public, commercial, and transport sectors. The developed infrastructure in these countries provides low scope for new construction activities. Moreover, infrastructure is built to sustain for a longer period, thus providing low opportunities for growth of the tile & stone adhesives market. It is projected that in the next five years, the demand for tile & stone adhesives will witness moderate growth, mainly because of the increased activity in the construction sector.

The cementitious segment is expected to register the highest CAGR, by chemistry, during the forecast period.

The cementitious chemistry segment is expected to register the fastest growth during the forecast period. The demand for cementitious adhesives is fueled by modifications that require blending high-quality polymers, which enable them to bond huge ceramic tiles on walls. The advantages of using cementitious adhesives are their low cost, excellent adhesion properties, polymer-modified mix, slip resistance, self-curing properties, and the ability to mix large quantities of material in a single batch. Owing to the reduction in thickness of ceramic tiles over time, along with an increase in their size and improved construction techniques, which require continuous surfaces with extremely high architectural value, the demand for these adhesives is expected to remain significant.

The repairs & renovation segment is expected to grow at the same growth rate of new construction in the tile & stone adhesives market during the forecast period.

Although currently a smaller market compared to new construction, repairs and renovation is expected to grow at the same rate during the forecast period. Big economies such as Germany, the US, Italy, and France have started to recover from the economic slowdown in recent years and have shifted their focus to upgrading their infrastructure related to housing, airports, and metros, among other projects. Also, premium hotels, which regularly upgrade their flooring once in five-eight years, are emerging end users of tile & stone adhesives. Owing to an increase in the demand for granite and exotic stones for renovations in high-end residential applications, the tile & stone adhesives market is expected to witness significant growth during the forecast period. European and North American countries, where carpets and rugs are used the most in flooring, have started preferring tiles instead of traditional flooring methods, which will boost the repairs and renovation segment, thereby creating demand for tile & stone adhesives gradually.

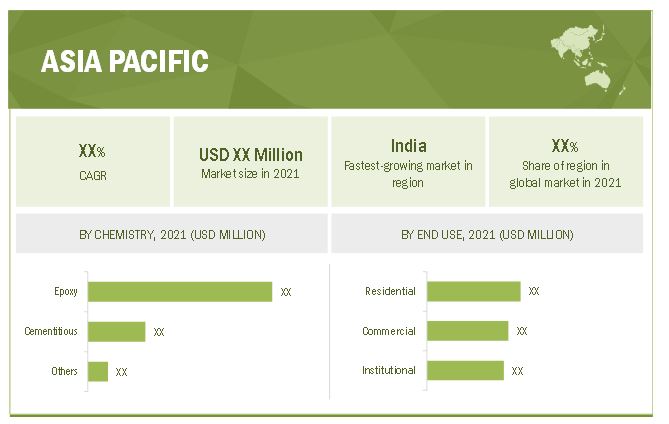

The tile & stone adhesives market in Asia Pacific is expected to register the highest CAGR during the forecast period.

Asia Pacific is the largest consumer of tile & stone adhesives, as almost 60-70% of the total Asia Pacific flooring market is dominated by ceramic tiles and natural stones such as marble and granite. The increasing awareness about the benefits of tile adhesives, improved tile strength & slip resistance, low VOC emitting products, and a large number of residential construction activities in Vietnam, Singapore, Malaysia, India, and China are fueling the growth of the tile & stone adhesives market.

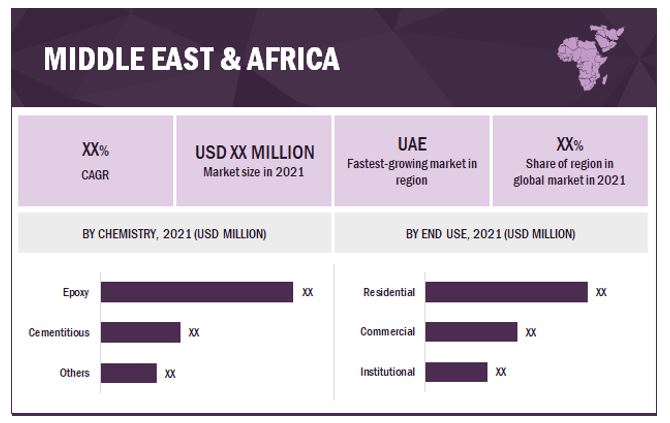

Middle East & Africa to account for the second largest share of the global tile & stone adhesives market during the forecast period.

Middle East & Africa is among the largest markets for tile & stone adhesives. Turkey, UAE, South Africa, and Rest of Middle East & Africa are the countries considered for the study of the market in Middle East & Africa. The construction industry in the Middle East is growing rapidly. The construction rate in the Middle East & Africa is high as the countries here are competing to develop the best foundation to encourage tourism and trade. The Middle Eastern region, especially GCC countries, are of utmost importance for the tile & stone adhesives market, as almost 75-80% of floor coverings are dominated by ceramic tiles. Many leading global players have set up manufacturing plants to cater to the growing markets in this region. In addition, an increase in affordable housing projects, growth in the retail sector, increasing tourism, and the rising population are some of the factors driving the market for these adhesives.

A number of projects are in the planning stage, and many are ongoing in Saudi Arabia and Qatar in the residential, commercial, and institutional segments. These factors result in the growth of the tile & stone adhesives market in the region.

To know about the assumptions considered for the study, download the pdf brochure

Tile Adhesives & Stone Adhesives Market Players

ARDEX Group (Germany), Terraco Group (UAE), Sika AG (Switzerland), Saint-Gobain Weber (France), H.B. Fuller (US), Mapei S.p.A (Italy), Fosroc International Limited (UK), Pidilite Industries Limited (India), Laticrete International, Inc. (US), and Arkema (Bostik) (France) are the key players operating in the global market.

Tile Adhesives & Stone Adhesives Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2017-2027 |

|

Base year |

2021 |

|

Forecast period |

2022-2027 |

|

Units considered |

Value (USD Billion) and Volume (kiloton) |

|

Segments |

Chemistry, Construction Type and End Use |

|

Regions |

Asia Pacific, North America, Europe, the Middle East & Africa, and South America |

|

Companies |

ARDEX Group (Germany), Terraco Group (UAE), Sika |

This research report categorizes the tile & stone adhesives market based on chemistry, construction type, end use, and region.

Based on chemistry, the tile & stone adhesives market has been segmented as follows:

- Cementitious

- Epoxy

- Others (acrylic and polyurethane)

Based on construction type, the tile & stone adhesives market has been segmented as follows:

- New Construction

- Repairs & Renovation

Based on end use, the tile & stone adhesives market has been segmented as follows:

- Residential

- Commercial

- Institutional

Based on the region, the tile & stone adhesives market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments in Tile Adhesives & Stone Adhesives Market

- In March 2022, Berger Fosroc Ltd, a joint venture between Berger Paints Bangladesh and Fosroc International Ltd, has set up a construction chemicals factory in Bangladesh to meet the growing domestic demand for construction chemical materials and solutions.

- In February 2022, Sika expanded in Tanzania to supply locally produced mortars and tile adhesives in addition to concrete admixtures by eliminating the need for long transport routes and ensuring rapid and reliable delivery to customers. Its site extension in Ivory Coast allows the company to double production capacities in tile adhesives and repair mortars while simultaneously increasing warehousing capacities.

- In August 2021, Sika acquired Bexel International S.A. de C.V., a leading manufacturer of tile adhesives and stuccos in Mexico. The acquisition strengthened Sika’s position in the large, fast-growing Mexican construction market and significantly extended its manufacturing footprint.

- In February 2021, Laticrete launched a premium adhesive mortar for glass tiles and mosaic tiles. Enhanced with superior adhesion for all types of glass tile applications, indoor and outdoor, including pools, spas, showers, and more. Glass Tile Adhesive Lite meets the highest standard for polymer-modified adhesives.

- In January 2021, Mapei South Africa extended its range of C2 tile adhesives with a new addition to the Kerabond family. Kerabond Plus is a C2E class cementitious (C), improved adhesion (2), extended open time (E) adhesive for ceramic and porcelain tiles. It is suitable for bonding all types of tiles (ceramic, porcelain, single-fired, terracotta, double-fired, klinker, etc.) and mosaic on internal and external substrates.

Frequently Asked Questions (FAQs):

Does this report covers the new applications of tile & stone adhesives?

Yes the report covers the new applications of tile & stone adhesives.

Does this report cover the volume tables in addition to value tables?

Yes the report covers the market both in terms of volume as well as value

What is the current competitive landscape in the tile & stone adhesives market in terms of new applications, production, and sales

The market has various large, medium, and small scale players operating across the globe. Many players are constantly innovating and developing new products and expanding to developing countries where the demand is constantly growing; thereby boosting sales.

Which all countries are considered in the report?

US, China, Japan, Germany, UK and France are major countries considered in the report.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 TILE & STONE ADHESIVES MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

FIGURE 2 REGIONAL SCOPE

1.3.3 MARKET INCLUSIONS AND EXCLUSIONS

1.3.3.1 Market inclusions

TABLE 1 TILE & STONE ADHESIVES MARKET, BY CHEMISTRY

TABLE 2 TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE

TABLE 3 TILE & STONE ADHESIVES MARKET, BY END USE

1.3.3.2 Market exclusions

1.3.4 YEARS CONSIDERED

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 3 TILE & STONE ADHESIVES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary data sources

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 5 TILE & STONE ADHESIVES MARKET SIZE ESTIMATION, BY VALUE

FIGURE 6 TILE & STONE ADHESIVES MARKET SIZE ESTIMATION, BY REGION

FIGURE 7 TILE & STONE ADHESIVES MARKET, BY CHEMISTRY

FIGURE 8 TILE & STONE ADHESIVES MARKET SIZE ESTIMATION, BY CONSTRUCTION TYPE

FIGURE 9 TILE & STONE ADHESIVES MARKET SIZE ESTIMATION, BY END USE

FIGURE 10 TILE & STONE ADHESIVES MARKET SIZE ESTIMATION, BOTTOM-UP APPROACH: BY END USE

2.3 MARKET FORECAST APPROACH

2.3.1 SUPPLY-SIDE FORECAST

FIGURE 11 METHODOLOGY FOR SUPPLY-SIDE SIZING OF TILE & STONE ADHESIVES MARKET

2.3.2 DEMAND-SIDE FORECAST

FIGURE 12 TILE & STONE ADHESIVES MARKET: DEMAND-SIDE FORECAST

2.4 FACTOR ANALYSIS

FIGURE 13 FACTOR ANALYSIS OF TILE & STONE ADHESIVES MARKET

2.5 DATA TRIANGULATION

FIGURE 14 TILE & STONE ADHESIVES MARKET: DATA TRIANGULATION

2.6 ASSUMPTIONS

2.7 LIMITATIONS

2.8 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

3 EXECUTIVE SUMMARY (Page No. - 43)

TABLE 4 TILE & STONE ADHESIVES MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 15 CEMENTITIOUS SEGMENT IS EXPECTED TO BE THE LARGEST SEGMENT (USD MILLION)

FIGURE 16 NEW CONSTRUCTION ACTIVITY TO LEAD TILE & STONE ADHESIVES MARKET (USD MILLION)

FIGURE 17 RESIDENTIAL SEGMENT TO DOMINATE DURING FORECAST PERIOD

FIGURE 18 ASIA PACIFIC COMMANDED LARGEST MARKET SHARE IN 2021 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES IN TILE & STONE ADHESIVES MARKET

FIGURE 19 SIGNIFICANT GROWTH EXPECTED IN TILE & STONE ADHESIVES MARKET BETWEEN 2022 AND 2027

4.2 TILE & STONE ADHESIVES MARKET, BY CHEMISTRY

FIGURE 20 CEMENTITIOUS SEGMENT DOMINATES TILE & STONE ADHESIVES MARKET (KILOTON)

4.3 TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE

FIGURE 21 REPAIRS & RENOVATION SEGMENT TO REGISTER HIGHEST CAGR (KILOTON)

4.4 TILE & STONE ADHESIVES MARKET, BY END USE

FIGURE 22 RESIDENTIAL SEGMENT TO LEAD TILE & STONE ADHESIVES MARKET (KILOTON)

4.5 ASIA PACIFIC TILE & STONE ADHESIVES MARKET, BY CHEMISTRY AND END USE, 2021

FIGURE 23 CEMENTITIOUS CHEMISTRY AND RESIDENTIAL END USE HELD LARGEST MARKET SHARE IN 2021

4.6 TILE & STONE ADHESIVES MARKET, DEVELOPED VS. EMERGING ECONOMIES

FIGURE 24 EMERGING ECONOMIES TO GROW FASTER THAN DEVELOPED COUNTRIES

4.7 TILE & STONE ADHESIVES MARKET, BY COUNTRY

FIGURE 25 INDIA TO REGISTER HIGHEST CAGR IN TILE & STONE ADHESIVES MARKET (KILOTON)

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 VALUE CHAIN OVERVIEW

5.2.1 VALUE CHAIN ANALYSIS

FIGURE 26 VALUE CHAIN ANALYSIS OF TILE & STONE ADHESIVES

TABLE 5 TILE & STONE ADHESIVES MARKET: SUPPLY CHAIN ECOSYSTEM

5.3 MARKET DYNAMICS

FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN TILE & STONE ADHESIVES MARKET

5.3.1 DRIVERS

5.3.1.1 Growth in global construction industry

TABLE 6 CONTRIBUTION TO GROWTH IN GLOBAL CONSTRUCTION OUTPUT, BY COUNTRY (2019–2030)

5.3.1.2 Increased demand from residential housing and infrastructure

5.3.1.3 Increase in use of decorative ceramic and thin porcelain tiles

5.3.1.4 Significant demand from Middle Eastern countries

5.3.1.5 Stimulus packages by US government to recover from COVID-19

5.3.2 RESTRAINTS

5.3.2.1 Low awareness regarding tile & stone adhesives in developing economies

5.3.3 OPPORTUNITIES

5.3.3.1 Development of different innovative substrates

5.3.3.2 Innovative low-VOC adhesives

5.3.4 CHALLENGES

5.3.4.1 Established infrastructure in developed countries

5.3.4.2 Changing regulations and industry standards

5.4 PORTER'S FIVE FORCES ANALYSIS

FIGURE 28 PORTER'S FIVE FORCES ANALYSIS

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 7 TILE & STONE ADHESIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

5.5 MACROECONOMIC INDICATORS

5.5.1 INTRODUCTION

5.5.2 GDP TRENDS AND FORECAST

TABLE 8 GDP TRENDS AND FORECAST: PERCENTAGE CHANGE

5.5.3 GLOBAL CONSTRUCTION INDUSTRY: TRENDS AND FORECAST

FIGURE 29 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2014–2035

5.6 ECOSYSTEM MAP

FIGURE 30 ADHESIVES & SEALANTS ECOSYSTEM

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

FIGURE 31 TRENDS IMPACTING STRATEGIES OF TILE & STONE ADHESIVE MANUFACTURERS

5.8 TECHNOLOGY OVERVIEW

5.8.1 WATER-BASED ADHESIVES

5.8.2 SOLVENT-BASED ADHESIVES

5.8.3 HOT-MELT ADHESIVES

5.8.4 REACTIVE ADHESIVES & OTHERS

5.9 AVERAGE PRICE ANALYSIS

FIGURE 32 PRICING ANALYSIS OF TILE & STONE ADHESIVES, BY REGION, 2021

5.10 KEY EXPORTING AND IMPORTING COUNTRIES

5.10.1 EXPORTS

TABLE 9 COUNTRY-WISE VALUE OF EXPORTED ADHESIVES (USD THOUSAND)

5.10.2 IMPORTS

TABLE 10 COUNTRY-WISE VALUE OF IMPORTED ADHESIVES (USD THOUSAND)

5.11 REGULATIONS

5.11.1 LEED STANDARDS

TABLE 11 ARCHITECTURAL APPLICATIONS

5.12 PATENT ANALYSIS

5.12.1 METHODOLOGY

5.12.2 PUBLICATION TRENDS

FIGURE 33 PATENT PUBLICATION TRENDS, 2018–2022

5.12.3 INSIGHTS

5.12.4 JURISDICTION ANALYSIS

FIGURE 34 JURISDICTION ANALYSIS OF REGISTERED PATENTS, 2018–2022

5.12.5 TOP APPLICANTS

FIGURE 35 NUMBER OF PATENTS, BY COMPANY, 2018–2022

6 TILE & STONE ADHESIVES MARKET, BY CHEMISTRY (Page No. - 71)

6.1 INTRODUCTION

FIGURE 36 CEMENTITIOUS SEGMENT TO LEAD THE MARKET DURING FORECAST PERIOD

TABLE 12 TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2017–2021 (USD MILLION)

TABLE 13 TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2022–2027 (USD MILLION)

TABLE 14 TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2017–2021 (KILOTON)

TABLE 15 TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2022–2027 (KILOTON)

6.2 CEMENTITIOUS

6.2.1 OFFERS EASY WORKABILITY, HIGH EFFICIENCY, AND DURABILITY

TABLE 16 CEMENTITIOUS: TILE & STONE ADHESIVES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 17 CEMENTITIOUS: TILE & STONE ADHESIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 18 CEMENTITIOUS: TILE & STONE ADHESIVES MARKET, BY REGION, 2017–2021 (KILOTON)

TABLE 19 CEMENTITIOUS: TILE & STONE ADHESIVES MARKET, BY REGION, 2022–2027 (KILOTON)

6.3 EPOXY

6.3.1 MOST VERSATILE RESIN USED ACROSS INDUSTRIES

TABLE 20 EPOXY: TILE & STONE ADHESIVES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 21 EPOXY: TILE & STONE ADHESIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 22 EPOXY: TILE & STONE ADHESIVES MARKET, BY REGION, 2017–2021 (KILOTON)

TABLE 23 EPOXY: TILE & STONE ADHESIVES MARKET, BY REGION, 2022–2027 (KILOTON)

6.4 OTHERS

TABLE 24 OTHERS: TILE & STONE ADHESIVES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 25 OTHERS: TILE & STONE ADHESIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 26 OTHERS: TILE & STONE ADHESIVES MARKET, BY REGION, 2017–2021 (KILOTON)

TABLE 27 OTHERS: TILE & STONE ADHESIVES MARKET, BY REGION, 2022–2027 (KILOTON)

7 TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE (Page No. - 80)

7.1 INTRODUCTION

FIGURE 37 NEW CONSTRUCTION TO DOMINATE TILE & STONE ADHESIVES MARKET DURING FORECAST PERIOD

TABLE 28 TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2017–2021 (USD MILLION)

TABLE 29 TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2022–2027 (USD MILLION)

TABLE 30 TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2017–2021 (KILOTON)

TABLE 31 TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2022–2027 (KILOTON)

7.2 NEW CONSTRUCTION

TABLE 32 NEW CONSTRUCTION: TILE & STONE ADHESIVES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 33 NEW CONSTRUCTION: TILE & STONE ADHESIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 34 NEW CONSTRUCTION: TILE & STONE ADHESIVES MARKET, BY REGION, 2017–2021 (KILOTON)

TABLE 35 NEW CONSTRUCTION: TILE & STONE ADHESIVES MARKET, BY REGION, 2022–2027 (KILOTON)

7.3 REPAIRS & RENOVATION

TABLE 36 REPAIRS & RENOVATION: TILE & STONE ADHESIVES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 37 REPAIRS & RENOVATION: TILE & STONE ADHESIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 38 REPAIRS & RENOVATION: TILE & STONE ADHESIVES MARKET, BY REGION, 2017–2021 (KILOTON)

TABLE 39 REPAIRS & RENOVATION: TILE & STONE ADHESIVES MARKET, BY REGION, 2022–2027 (KILOTON)

8 TILE & STONE ADHESIVES MARKET, BY END USE (Page No. - 86)

8.1 INTRODUCTION

FIGURE 38 RESIDENTIAL SEGMENT TO DOMINATE TILE & STONE ADHESIVES MARKET DURING FORECAST PERIOD

TABLE 40 TILE & STONE ADHESIVES MARKET, BY END USE, 2017–2021 (USD MILLION)

TABLE 41 TILE & STONE ADHESIVES MARKET, BY END USE, 2022–2027 (USD MILLION)

TABLE 42 TILE & STONE ADHESIVES MARKET, BY END USE, 2017–2021 (KILOTON)

TABLE 43 TILE & STONE ADHESIVES MARKET, BY END USE, 2022–2027 (KILOTON)

8.2 RESIDENTIAL

8.2.1 HIGH STRENGTH AND SUPERIOR FINISH DRIVE SEGMENT

TABLE 44 RESIDENTIAL: TILE & STONE ADHESIVES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 45 RESIDENTIAL: TILE & STONE ADHESIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 46 RESIDENTIAL: TILE & STONE ADHESIVES MARKET, BY REGION, 2017–2021 (KILOTON)

TABLE 47 RESIDENTIAL: TILE & STONE ADHESIVES MARKET, BY REGION, 2022–2027 (KILOTON)

8.3 COMMERCIAL

8.3.1 HIGHER COMPLEXITY LEADS TO FEWER COMPETITORS IN SECTOR

TABLE 48 COMMERCIAL: TILE & STONE ADHESIVES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 49 COMMERCIAL: TILE & STONE ADHESIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 50 COMMERCIAL: TILE & STONE ADHESIVES MARKET, BY REGION, 2017–2021 (KILOTON)

TABLE 51 COMMERCIAL: TILE & STONE ADHESIVES MARKET, BY REGION, 2022–2027 (KILOTON)

8.4 INSTITUTIONAL

8.4.1 REQUIRES SPECIALIZED KNOWLEDGE FOR DESIGN AND CONSTRUCTION

TABLE 52 INSTITUTIONAL: TILE & STONE ADHESIVES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 53 INSTITUTIONAL: TILE & STONE ADHESIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 54 INSTITUTIONAL: TILE & STONE ADHESIVES MARKET, BY REGION, 2017–2021 (KILOTON)

TABLE 55 INSTITUTIONAL: TILE & STONE ADHESIVES MARKET, BY REGION, 2022–2027 (KILOTON)

9 TILE & STONE ADHESIVES MARKET, BY REGION (Page No. - 95)

9.1 INTRODUCTION

FIGURE 39 ASIA PACIFIC EMERGING AS STRATEGIC LOCATION FOR TILE & STONE ADHESIVES MARKET

TABLE 56 TILE & STONE ADHESIVES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 57 TILE & STONE ADHESIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 58 TILE & STONE ADHESIVES MARKET, BY REGION, 2017–2021 (KILOTON)

TABLE 59 TILE & STONE ADHESIVES MARKET, BY REGION, 2022–2027 (KILOTON)

9.2 ASIA PACIFIC

FIGURE 40 ASIA PACIFIC: TILE & STONE ADHESIVES MARKET SNAPSHOT

TABLE 60 ASIA PACIFIC: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 61 ASIA PACIFIC: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 62 ASIA PACIFIC: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2017–2021 (KILOTON)

TABLE 63 ASIA PACIFIC: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 64 ASIA PACIFIC: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2017–2021 (USD MILLION)

TABLE 65 ASIA PACIFIC: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2022–2027 (USD MILLION)

TABLE 66 ASIA PACIFIC: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2017–2021 (KILOTON)

TABLE 67 ASIA PACIFIC: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2022–2027 (KILOTON)

TABLE 68 ASIA PACIFIC: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2017–2021 (USD MILLION)

TABLE 69 ASIA PACIFIC: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2022–2027 (USD MILLION)

TABLE 70 ASIA PACIFIC: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2017–2021 (KILOTON)

TABLE 71 ASIA PACIFIC: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2022–2027 (KILOTON)

TABLE 72 ASIA PACIFIC: TILE & STONE ADHESIVES MARKET, BY END USE, 2017–2021 (USD MILLION)

TABLE 73 ASIA PACIFIC: TILE & STONE ADHESIVES MARKET, BY END USE, 2022–2027 (USD MILLION)

TABLE 74 ASIA PACIFIC: TILE & STONE ADHESIVES MARKET, BY END USE, 2017–2021 (KILOTON)

TABLE 75 ASIA PACIFIC: TILE & STONE ADHESIVES MARKET, BY END USE, 2022–2027 (KILOTON)

9.2.1 CHINA

9.2.1.1 Largest producer, consumer, and exporter of tile & stone adhesives

9.2.2 INDIA

9.2.2.1 Developing economy and increasing urban population promote market growth

9.2.3 INDONESIA

9.2.3.1 Growth of construction industry propels market

9.2.4 VIETNAM

9.2.4.1 New production technologies increase imports and exports

9.2.5 JAPAN

9.2.5.1 Maintenance, repair, and renovation of structures drive market

9.2.6 SOUTH KOREA

9.2.6.1 Government support key to market growth

9.2.7 MALAYSIA

9.2.7.1 Attractive opportunities for investors

9.2.8 REST OF ASIA PACIFIC

9.3 MIDDLE EAST & AFRICA

FIGURE 41 MIDDLE EAST & AFRICA: TILE & STONE ADHESIVES MARKET SNAPSHOT

TABLE 76 MIDDLE EAST & AFRICA: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 77 MIDDLE EAST & AFRICA: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 78 MIDDLE EAST & AFRICA: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2017–2021 (KILOTON)

TABLE 79 MIDDLE EAST & AFRICA: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 80 MIDDLE EAST & AFRICA: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2017–2021 (USD MILLION)

TABLE 81 MIDDLE EAST & AFRICA: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2022–2027 (USD MILLION)

TABLE 82 MIDDLE EAST & AFRICA: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2017–2021 (KILOTON)

TABLE 83 MIDDLE EAST & AFRICA: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2022–2027 (KILOTON)

TABLE 84 MIDDLE EAST & AFRICA: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2017–2021 (USD MILLION)

TABLE 85 MIDDLE EAST & AFRICA: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2022–2027 (USD MILLION)

TABLE 86 MIDDLE EAST & AFRICA: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2017–2021 (KILOTON)

TABLE 87 MIDDLE EAST & AFRICA: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2022–2027 (KILOTON)

TABLE 88 MIDDLE EAST & AFRICA: TILE & STONE ADHESIVES MARKET, BY END USE, 2017–2021 (USD MILLION)

TABLE 89 MIDDLE EAST & AFRICA: TILE & STONE ADHESIVES MARKET, BY END USE, 2022–2027 (USD MILLION)

TABLE 90 MIDDLE EAST & AFRICA: TILE & STONE ADHESIVES MARKET, BY END USE, 2017–2021 (KILOTON)

TABLE 91 MIDDLE EAST & AFRICA: TILE & STONE ADHESIVES MARKET, BY END USE, 2022–2027 (KILOTON)

9.3.1 TURKEY

9.3.1.1 Rapid expansion witnessed in construction activity

9.3.2 UAE

9.3.2.1 Government policy supports growth of development projects

9.3.3 SOUTH AFRICA

9.3.3.1 Construction sector - driver of socio-economic development

9.3.4 REST OF MIDDLE EAST & AFRICA

9.4 EUROPE

FIGURE 42 EUROPE: TILE & STONE ADHESIVES MARKET SNAPSHOT

TABLE 92 EUROPE: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 93 EUROPE: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 94 EUROPE: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2017–2021 (KILOTON)

TABLE 95 EUROPE: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 96 EUROPE: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2017–2021 (USD MILLION)

TABLE 97 EUROPE: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2022–2027 (USD MILLION)

TABLE 98 EUROPE: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2017–2021 (KILOTON)

TABLE 99 EUROPE: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2022–2027 (KILOTON)

TABLE 100 EUROPE: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2017–2021 (USD MILLION)

TABLE 101 EUROPE: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2022–2027 (USD MILLION)

TABLE 102 EUROPE: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2017–2021 (KILOTON)

TABLE 103 EUROPE: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2022–2027 (KILOTON)

TABLE 104 EUROPE: TILE & STONE ADHESIVES MARKET, BY END USE, 2017–2021 (USD MILLION)

TABLE 105 EUROPE: TILE & STONE ADHESIVES MARKET, BY END USE, 2022–2027 (USD MILLION)

TABLE 106 EUROPE: TILE & STONE ADHESIVES MARKET, BY END USE, 2017–2021 (KILOTON)

TABLE 107 EUROPE: TILE & STONE ADHESIVES MARKET, BY END USE, 2022–2027 (KILOTON)

9.4.1 RUSSIA

9.4.1.1 Largest market for tile & stone adhesives in Europe

9.4.2 SPAIN

9.4.2.1 Construction - major industrial sector in country

9.4.3 ITALY

9.4.3.1 Repairs & renovation to grow significantly

9.4.4 FRANCE

9.4.4.1 Market affected by slump in construction industry

9.4.5 GERMANY

9.4.5.1 Market supported by growth in residential sector

9.4.6 POLAND

9.4.6.1 Rapid growth expected in hospitality sector

9.4.7 UK

9.4.7.1 New construction projects drive market

9.4.8 REST OF EUROPE

9.5 SOUTH AMERICA

FIGURE 43 BRAZIL TO BE LARGEST TILE & STONE ADHESIVES MARKET IN SOUTH AMERICA

TABLE 108 SOUTH AMERICA: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 109 SOUTH AMERICA: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 110 SOUTH AMERICA: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2017–2021 (KILOTON)

TABLE 111 SOUTH AMERICA: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 112 SOUTH AMERICA: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2017–2021 (USD MILLION)

TABLE 113 SOUTH AMERICA: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2022–2027 (USD MILLION)

TABLE 114 SOUTH AMERICA: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2017–2021 (KILOTON)

TABLE 115 SOUTH AMERICA: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2022–2027 (KILOTON)

TABLE 116 SOUTH AMERICA: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2017–2021 (USD MILLION)

TABLE 117 SOUTH AMERICA: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2022–2027 (USD MILLION)

TABLE 118 SOUTH AMERICA: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2017–2021 (KILOTON)

TABLE 119 SOUTH AMERICA: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2022–2027 (KILOTON)

TABLE 120 SOUTH AMERICA: TILE & STONE ADHESIVES MARKET, BY END USE, 2017–2021 (USD MILLION)

TABLE 121 SOUTH AMERICA: TILE & STONE ADHESIVES MARKET, BY END USE, 2022–2027 (USD MILLION)

TABLE 122 SOUTH AMERICA: TILE & STONE ADHESIVES MARKET, BY END USE, 2017–2021 (KILOTON)

TABLE 123 SOUTH AMERICA: TILE & STONE ADHESIVES MARKET, BY END USE, 2022–2027 (KILOTON)

9.5.1 BRAZIL

9.5.1.1 Government investments in development projects

9.5.2 ARGENTINA

9.5.2.1 Partnering with international agencies boosts construction industry

9.5.3 REST OF SOUTH AMERICA

9.6 NORTH AMERICA

FIGURE 44 US TO DOMINATE NORTH AMERICAN TILE & STONE ADHESIVES MARKET

TABLE 124 NORTH AMERICA: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 125 NORTH AMERICA: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 126 NORTH AMERICA: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2017–2021 (KILOTON)

TABLE 127 NORTH AMERICA: TILE & STONE ADHESIVES MARKET, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 128 NORTH AMERICA: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2017–2021 (USD MILLION)

TABLE 129 NORTH AMERICA: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2022–2027 (USD MILLION)

TABLE 130 NORTH AMERICA: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2017–2021 (KILOTON)

TABLE 131 NORTH AMERICA: TILE & STONE ADHESIVES MARKET, BY CHEMISTRY, 2022–2027 (KILOTON)

TABLE 132 NORTH AMERICA: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2017–2021 (USD MILLION)

TABLE 133 NORTH AMERICA: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2022–2027 (USD MILLION)

TABLE 134 NORTH AMERICA: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2017–2021 (KILOTON)

TABLE 135 NORTH AMERICA: TILE & STONE ADHESIVES MARKET, BY CONSTRUCTION TYPE, 2022–2027 (KILOTON)

TABLE 136 NORTH AMERICA: TILE & STONE ADHESIVES MARKET, BY END USE, 2017–2021 (USD MILLION)

TABLE 137 NORTH AMERICA: TILE & STONE ADHESIVES MARKET, BY END USE, 2022–2027 (USD MILLION)

TABLE 138 NORTH AMERICA: TILE & STONE ADHESIVES MARKET, BY END USE, 2017–2021 (KILOTON)

TABLE 139 NORTH AMERICA: TILE & STONE ADHESIVES MARKET, BY END USE, 2022–2027 (KILOTON)

9.6.1 US

9.6.1.1 Largest market in North America

9.6.2 CANADA

9.6.2.1 Construction – among key industries in country

9.6.3 MEXICO

9.6.3.1 Government investments in construction industry boost market

10 COMPETITIVE LANDSCAPE (Page No. - 137)

10.1 OVERVIEW

TABLE 140 STRATEGIES ADOPTED BY KEY MANUFACTURERS OF TILE & STONE ADHESIVES

10.2 MARKET RANKING ANALYSIS

FIGURE 45 RANKING OF KEY PLAYERS

10.3 COMPANY REVENUE ANALYSIS

FIGURE 46 REVENUE ANALYSIS OF KEY COMPANIES IN LAST FIVE YEARS

10.4 COMPETITIVE LEADERSHIP MAPPING, 2021

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE PLAYERS

10.4.4 PARTICIPANTS

FIGURE 47 TILE & STONE ADHESIVES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

10.5 SME MATRIX, 2021

10.5.1 PROGRESSIVE COMPANIES

10.5.2 DYNAMIC COMPANIES

10.5.3 STARTING BLOCKS

10.5.4 RESPONSIVE COMPANIES

FIGURE 48 TILE & STONE ADHESIVES MARKET: SME COMPETITIVE LEADERSHIP MAPPING, 2021

10.6 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 49 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN TILE & STONE ADHESIVES MARKET

10.7 BUSINESS STRATEGY EXCELLENCE

FIGURE 50 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN TILE & STONE ADHESIVES MARKET

10.8 COMPETITIVE SCENARIO

10.8.1 MARKET EVALUATION FRAMEWORK

TABLE 141 STRATEGIC DEVELOPMENTS, BY COMPANY

TABLE 142 MOST ADOPTED STRATEGIES

TABLE 143 NUMBER OF GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

10.8.2 MARKET EVALUATION MATRIX

TABLE 144 COMPANY INDUSTRY FOOTPRINT

TABLE 145 COMPANY REGION FOOTPRINT

TABLE 146 COMPANY FOOTPRINT

10.9 STRATEGIC DEVELOPMENTS

10.9.1 NEW PRODUCT LAUNCHES

TABLE 147 NEW PRODUCT LAUNCHES, 2017-2022

10.9.2 DEALS

TABLE 148 DEALS, 2017-2022

10.9.3 OTHER DEVELOPMENTS

TABLE 149 OTHERS, 2017–2022

11 COMPANY PROFILES (Page No. - 152)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY PLAYERS

11.1.1 ARDEX GROUP

TABLE 150 ARDEX GROUP: BUSINESS OVERVIEW

TABLE 151 ARDEX GROUP: DEALS

11.1.2 TERRACO GROUP

TABLE 152 TERRACO GROUP: BUSINESS OVERVIEW

11.1.3 SIKA AG

TABLE 153 SIKA AG: BUSINESS OVERVIEW

FIGURE 51 SIKA AG: COMPANY SNAPSHOT

TABLE 154 SIKA AG: NEW PRODUCT LAUNCHES

TABLE 155 SIKA AG: DEALS

TABLE 156 SIKA AG: OTHERS

11.1.4 SAINT-GOBAIN WEBER

TABLE 157 SAINT-GOBAIN WEBER: BUSINESS OVERVIEW

FIGURE 52 SAINT-GOBAIN GROUP: COMPANY SNAPSHOT

11.1.5 H.B. FULLER

TABLE 158 H.B. FULLER: BUSINESS OVERVIEW

FIGURE 53 H.B. FULLER: COMPANY SNAPSHOT

TABLE 159 H.B. FULLER: OTHERS

11.1.6 KALEKIM KIMYEVI MADDELER SANAYI VE TICARET A.ª.

TABLE 160 KALEKIM KIMYEVI MADDELER SANAYI VE TICARET A.ª.: BUSINESS OVERVIEW

FIGURE 54 KALEKIM KIMYEVI MADDELER SANAYI VE TICARET A.ª.: COMPANY SNAPSHOT

11.1.7 MAPEI S.P.A.

TABLE 161 MAPEI S.P.A: BUSINESS OVERVIEW

FIGURE 55 MAPEI S.P.A.: COMPANY SNAPSHOT

TABLE 162 MAPEI S.P.A: NEW PRODUCT LAUNCHES

11.1.8 FOSROC INTERNATIONAL LIMITED

TABLE 163 FOSROC INTERNATIONAL LIMITED: BUSINESS OVERVIEW

TABLE 164 FOSROC INTERNATIONAL LIMITED: DEALS

TABLE 165 FOSROC INTERNATIONAL LIMITED: OTHERS

11.1.9 PIDILITE INDUSTRIES LIMITED

TABLE 166 PIDILITE INDUSTRIES LIMITED: BUSINESS OVERVIEW

FIGURE 56 PIDILITE INDUSTRIES LIMITED: COMPANY SNAPSHOT

11.1.10 LATICRETE INTERNATIONAL, INC.

TABLE 167 LATICRETE INTERNATIONAL, INC.: BUSINESS OVERVIEW

TABLE 168 LATICRETE INTERNATIONAL, INC.: NEW PRODUCT LAUNCHES

TABLE 169 LATICRETE INTERNATIONAL, INC.: DEALS

11.1.11 ARKEMA (BOSTIK)

TABLE 170 ARKEMA (BOSTIK): BUSINESS OVERVIEW

FIGURE 57 ARKEMA (BOSTIK): COMPANY SNAPSHOT

TABLE 171 ARKEMA (BOSTIK): DEALS

TABLE 172 ARKEMA (BOSTIK): OTHERS

11.2 OTHER PLAYERS

11.2.1 BASF SE

TABLE 173 BASF SE: COMPANY OVERVIEW

11.2.2 3M COMPANY

TABLE 174 3M COMPANY: COMPANY OVERVIEW

11.2.3 HENKEL AG

TABLE 175 HENKEL AG: COMPANY OVERVIEW

11.2.4 THE DOW CHEMICAL COMPANY

TABLE 176 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

11.2.5 CUSTOM BUILDING PRODUCTS

TABLE 177 CUSTOM BUILDING PRODUCTS: COMPANY OVERVIEW

11.2.6 CONSTRUCTION CHEMICALS PTY

TABLE 178 CONSTRUCTION CHEMICALS PTY: COMPANY OVERVIEW

11.2.7 FLEXTILE LTD.

TABLE 179 FLEXTILE LTD.: COMPANY OVERVIEW

11.2.8 NORCROS ADHESIVES

TABLE 180 NORCROS ADHESIVES: COMPANY OVERVIEW

11.2.9 MAGICRETE BUILDING SOLUTIONS

TABLE 181 MAGICRETE BUILDING SOLUTIONS: COMPANY OVERVIEW

11.2.10 PERMA CONSTRUCTION AIDS PRIVATE LIMITED

TABLE 182 PERMA CONSTRUCTION AIDS PRIVATE LIMITED: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 187)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

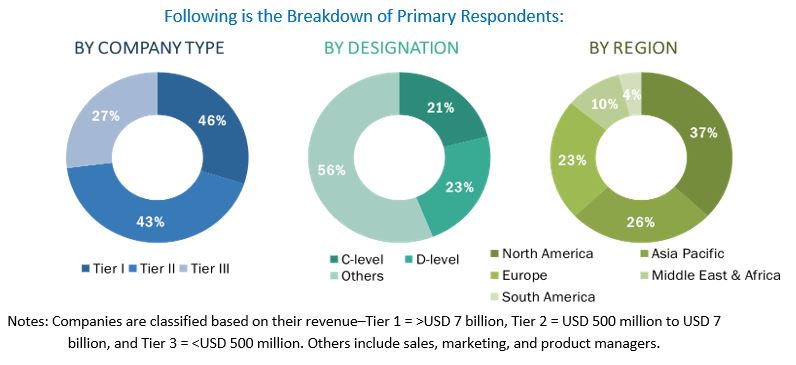

The study involved four major activities in estimating the current market size of tile & stone adhesives. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both supply-side and demand-side approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Tile Adhesives & Stone Adhesives Market Secondary Research

This research report involves the use of extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the tile & stone adhesives market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Tile Adhesives & Stone Adhesives Market Primary Research

The tile & stone adhesives market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development of the construction industry and its end uses such as residential, commercial and institutional. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Tile Adhesives & Stone Adhesives Market Size Estimation

Supply-side and Demand-side approaches have been used to estimate and validate the total size of the tile & stone adhesives market. These approaches have also been used extensively to estimate the size of various dependent sub-segments of the market. The research methodology used to estimate the market size includes the following steps:

- The key players have been identified through extensive secondary research.

- The tile & stone adhesives industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Global Tile & Stone Adhesives Market: Top-Down Approach

Tile Adhesives & Stone Adhesives Market Data Triangulation

After arriving at the overall size of the tile & stone adhesives market from the estimation process explained above, the total market has been split into several segments and sub-segments. The data triangulation and market breakdown procedures have been employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Apart from this, the market size has been validated using both supply-side and demand-side approaches.

Tile Adhesives & Stone Adhesives Market Report Objectives

- To analyze and forecast the size of the tile & stone adhesives market in terms of value and volume

- To provide detailed information regarding the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market and its submarkets

- To define, describe, and forecast the size of the market by chemistry, construction type, end use, and region

- To forecast the size of the market and its submarkets with respect to five regions (along with their major countries), namely, Asia Pacific, Europe, North America, Middle East & Africa, and South America

- To strategically analyze each micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments and provide a competitive landscape of market leaders

- To track and analyze competitive developments such as new product launches, mergers & acquisitions, investment & expansions, and joint ventures in the market

- To strategically profile the key market players and comprehensively analyze their core competencies

Tile Adhesives & Stone Adhesives Market Report Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Tile Adhesives & Stone Adhesives Market Regional Analysis

- Further breakdown of a region with respect to a particular country

Tile Adhesives & Stone Adhesives Market Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Tile Adhesives & Stone Adhesives Market