Tissue Diagnostics Market by Product (Consumables (Antibodies, Reagents, Tissue, Probes), Instrument (Processing System, Scanner)), Technology (ISH, IHC, Slide Staining), Disease Type (Breast Cancer, Lymphoma, Prostate Cancer) & Region - Global Forecast to 2028

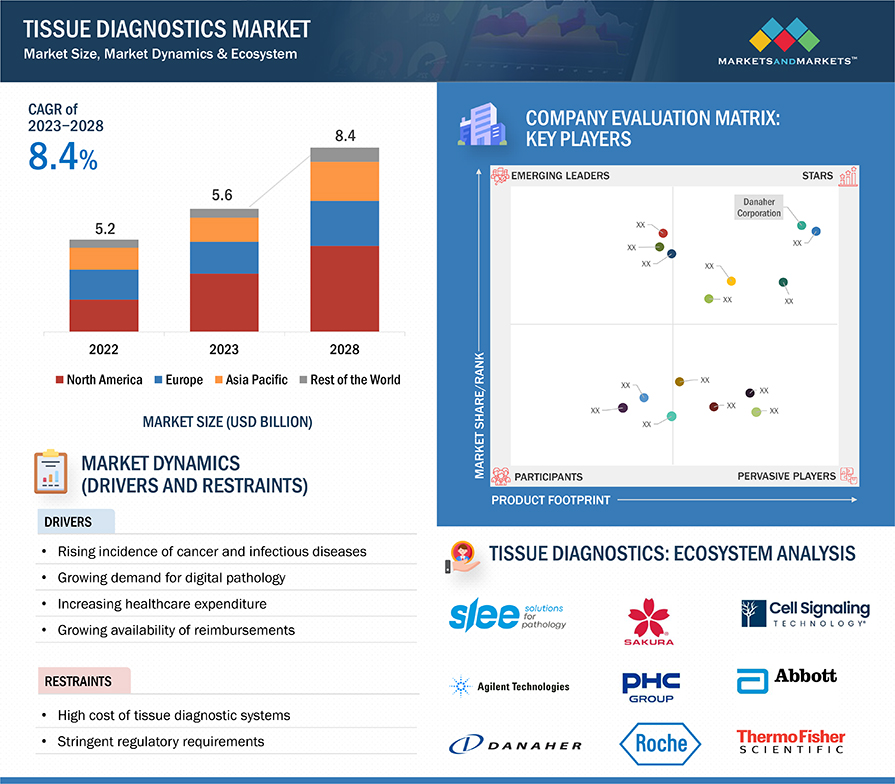

The global tissue diagnostics market, valued at US$5.2 billion in 2022, stood at US$5.6 billion in 2023 and is projected to advance at a resilient CAGR of 8.4% from 2023 to 2028, culminating in a forecasted valuation of US$8.4 billion by the end of the period. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Market growth is driven by the growing private diagnostic centers globally, and rising geriatric population with subsequent growth in chronic and infectious diseases. On the other hand, high degree of consolidation and high cost of diagnostic imaging system are expected to restrain the growth of this market to a certain extent.

Tissue Diagnostics Market Size, Dynamics & Ecosystem

To know about the assumptions considered for the study, Request for Free Sample Report

Tissue Diagnostics Market Dynamics

DRIVER: Growing demand for digital pathology

Digital pathology systems are increasingly being utilized by healthcare professionals across the globe due to the ongoing trend of automation of diagnostic laboratory processes across major healthcare markets. Moreover, improved laboratory efficiency is critical for healthcare providers and patients for accurate and timely disease diagnosis to devise effective disease management strategies. With the greater utilization of digital and automated processes, laboratory technicians can offer accurate and affordable disease diagnoses in a time-bound manner. As a result, major healthcare service providers are adopting digital pathology systems and related software to offer efficient and affordable services to their customers.

Globally, governments and industry entities are directing their attention toward diverse strategies within the realm of digital pathology, aiming to offer highly advanced, swift, and precise diagnostic solutions. Highlighted are key advancements which mentioned in below:

- In January 2023, Agilent Technologies, Inc. has entered into a partnership with Akoya Biosciences, Inc. to develop multiplex-immunohistochemistry diagnostic solutions. This collaboration intends to commercialize workflow solutions for multiplex assays dedicated to tissue analysis, ultimately providing a comprehensive multiplex IHC solution for biomarker clinical research, facilitated by digital pathology.

- In June 2022, Roche introduced the VENTANA DP 600 slide scanner, a digital pathology system designed for generating digital representations of stained tissue samples.

These advancements, coupled with the emergence of high-tech and diagnostic firms, are anticipated to drive market growth.

RESTRAINT: Stringent Regulatory requirement

The FDA's current approval process for tissue diagnostic tools and consumables poses a significant hurdle for companies aiming to introduce innovative products. Many of these fall under Class III, requiring exhaustive Premarket Approval (PMA) that scrutinizes safety and effectiveness, marking the most rigorous application route.

The recent release of FDA guidance documents further adds to the complexity. Any alterations to devices demand a 510(k) submission, whether for software updates, installations, or other modifications. Meanwhile, in the EU, In Vitro Diagnostic (IVD) products adhere to a distinct regulation, with the forthcoming Medical Device Regulation (MDR) and In Vitro Diagnostic Device Regulation (IVDR) adding more stringent criteria for CE Marking, crucial for market legality.

Aligning with these stringent regulations presents a challenge for market players. Adapting processes to comply with these norms may affect the launch timelines for new products, especially in the US and Europe, potentially creating temporary market entry delays.

OPPORTUNITY: Significant opportunities in BRICS Countries

Growing markets like India, China, and Brazil are poised to become pivotal growth arenas for industry stakeholders in the foreseeable future. As per SRB's analysis, the BRICS nations are projected to collectively contribute 50% to the global GDP by 2030, with a combined annual GDP of USD 24,142,139 million in 2021. Notably, each of these nations has seen consistent annual GDP increases; for instance, China's GDP has surged nearly sixfold since 2003. This economic upswing is anticipated to fuel expansion in the healthcare sector, presenting lucrative prospects for participants in the market.

Furthermore, the sizable population base, especially in India and China, forms a sustainable diagnostic market. Lifestyle shifts and suboptimal diets in these regions have elevated the prevalence of chronic ailments such as cancer, cardiovascular diseases (CVDs), and autoimmune disorders. The rising incidence of chronic conditions, coupled with a substantial patient pool in these regions and augmented healthcare spending, is set to create substantial growth avenues for market players. For instance, the NIH estimates India had 1,461,427 cancer patients in 2022. Similarly, China accounted for 24% of newly diagnosed cases and 30% of global cancer-related deaths in 2020, according to PubMed. The higher mortality rates are linked to undiagnosed cases, a shortage of diagnostic labs, and insufficient histopathologists in these regions.

CHALLENGE: Lack of Infrastructure and low awareness in middle and low income countries

The burden of cancer and other non-communicable diseases is very high in developing and underdeveloped countries. However, there is a glaring disparity in the access to care and health indicators in these countries as compared to their developed counterparts. This can be attributed to the lack of access to care, the limited availability of resources in terms of infrastructure and manpower, a lack of awareness, and the social stigma associated with cancer. According to the WHO, 44% of the WHO member states report having less than 1 physician per 1000 population. Similarly, according to the 2022 OECD data, China and India, respectively recorded doctor densities of 2.5 and 0.9 doctors per 1,000 people. There is a disproportionate distribution of health workers worldwide. Countries having the lowest relative need to have the highest numbers of health workers, while those with the highest disease burden have a smaller health workforce. The African region has more than 24% of the total global burden of disease but has access to only 3% of health workers and less than 1% of the world’s financial resources.

Tissue Diagnostics Market Segmentation & Geographical Spread

To know about the assumptions considered for the study, download the pdf brochure

In 2022, Consumables accounted for the largest share in the tissue diagnostics industry, by product.

Based on product, the tissue diagnostics market is segmented into consumables and instruments. Consumables accounted for the largest share of the market in 2022 by product segment. The rise in government and private funding in life sciences and cancer research and growing R&D expenditure by leading pharma companies, are factors expected to drive the growth of this products segment.

In 2022, Immunohistochemistry accounted for the largest share in the tissue diagnostics industry, by technology.

Based on technology, the tissue diagnostics market is segmented into four technology segments, namely, Immunohistochemistry (IHC), In Situ Hybridization (ISH), Digital Pathology & Workflow, and Special Staining. Immunohistochemistry (IHC), accounted for the largest share of the market in 2022 by technology. In IHC technique the antibodies are used to test certain antigens in tissue by combining immunological, anatomical, and biochemical techniques. The detection of antigens is achieved by using antibodies that bind to antigens with high specificity. This technology is widely used in the diagnosis of abnormal cells.

In 2022, Breast Cancer segment accounted for the largest share in the tissue diagnostics industry, by disease type.

Based on disease type, the tissue diagnostics market is segmented into six disease segments, namely, breast cancer, gastric cancer, lymphoma, prostate cancer, non-small cell lung cancer, and other disease types. In 2022, breast cancer accounted for the largest share of the market, by disease type. A number of factors led to the formation of breast cancer such as age, change in lifestyle and the use of hormone replacement therapy. Moreover, with a rise in breast cancer screening activities, the segment is expected to witness considerable growth during the forecast period.

In 2022, hospitals accounted for the largest share in the tissue diagnostics industry, by end user.”

Based on end user, the tissue diagnostics market is segmented into Hospitals, Pharmaceutical Companies, Research Laboratories, Contract Research Organizations, and Other End Users. Hospitals accounted for the largest share of the market by end user. The share of the end user segment is owing to the rise in prevalence of cancer and infectious diseases, which require Multi-specialty hospitals, cancer specialty hospitals, or cancer treatment centers. Hospitals generally have in-house laboratories that perform various types of diagnostics & monitoring tests that enable faster and reliable results.

In 2022, North America accounted for the largest share of the tissue diagnostics industry.

Based on Region, The global tissue diagnostics market is segmented into four regions: North America, Europe, Asia Pacific, and Rest of the world. North America accounted for the largest share of the market in 2022. The increasing healthcare expenditure, and high-quality infrastructure for hospitals and clinical laboratories in the region are the major factors driving the growth of market in North America.

The major players in tissue diagnostics market are F. Hoffmann-La Roche Ltd (Switzerland), Danaher Corporation (US), PHC Holdings Corporation (Japan), Agilent Technologies Inc. (US), Thermo Fisher Scientific, Inc. (US), These players’ market leadership is due to their broad product portfolios and vast global footprint. These dominant market players have advantages, including strong research and development budgets, better marketing and distribution networks, and established brand recognition.

Scope of the Tissue Diagnostics Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$5.6 billion |

|

Projected Revenue by 2028 |

$8.4 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 8.4% |

|

Market Driver |

Growing demand for digital pathology |

|

Market Opportunity |

Significant opportunities in BRICS Countries |

This report categorizes the tissue diagnostics market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Consumables

- Antibodies

- Kits

- Reagents

- Probes

-

Instruments

- Slide-staining Systems

- Scanners

- Tissue-processing Systems

- Other Instruments (automated cover slippers, microtomes, embedding systems, paraffin dispensers, and slide labelers)

By Technology

- Immunohistochemistry

- In Situ Hybridization

- Digital Pathology & Workflow Management

- Special Staining

By Disease Type

- Breast Cancer

- Gastric Cancer

- Lymphoma

- Prostate Cancer

- Non-small Cell Lung Cancer

- Other Disease Types (neurological disease, cardiovascular disease, immunological diseases, infectious diseases, cancers of the bone, colon, thyroid, cervix, and skin; gallbladder carcinoma; HBV; Epstein-Barr virus; hepatitis; muscular dystrophy; renal cell carcinoma; and pleomorphic sarcomas.)

By End User

- Hospitals

- Research Laboratories

- Pharmaceutical Companies

- Contract Research Organizations (CROs)

- Other End Users (reference laboratories and academic research laboratories)

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

-

Rest of The World (RoW)

- Latin America

- Middle East & Africa

Recent Developments of Tissue Diagnostics Industry

- In April 2023, Leica Biosystems received FDA clearance for BOND MMR Antibody Panel, for detection of colorectal cancer.

- In April 2023, Leica Biosystems launched its BOND-PRIME an advanced staining solution for increasing diagnostic productivity in the lab

- In February 2023, F. Hoffman-La Roche Ltd launched its IDH1 R132H (MRQ-67) Rabbit Monoclonal Antibody and the ATRX Rabbit Polyclonal Antibody for use in the BenchMark series of instruments for the detection of brain cancer.

- In October 2022, F. Hoffman-La Roche Ltd received FDA approval for its PATHWAY anti-HER2/neu (4B5) Rabbit Monoclonal Primary Antibody use as a companion diagnostic test to identify metastatic breast cancer patients with low HER2 expression.

- In August 2022, F. Hoffman-La Roche Ltd (Switzerland) received FDA approval its for label expansion for the VENTANA MMR RxDx Panel.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global tissue diagnostics market?

The global tissue diagnostics market boasts a total revenue value of $8.4 billion by 2028.

What is the estimated growth rate (CAGR) of the global tissue diagnostics market?

The global tissue diagnostics market has an estimated compound annual growth rate (CAGR) of 8.4% and a revenue size in the region of $5.6 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising incidence of cancer and infectious diseases- Growing demand for digital pathology- Increasing healthcare expenditure- Growing availability of reimbursements- Rising establishment of private diagnostics centersRESTRAINTS- High cost of tissue diagnostic systems- Stringent regulatory requirementsOPPORTUNITIES- High growth potential of emerging economies- Growing preference for personalized medicines- Increasing number of clinical trials for cancer therapeuticsCHALLENGES- Shortage of skilled professionals- Availability of refurbished products- Inadequate standardization for TDxINDUSTRY TRENDS- Increasing number of reagent rental agreements- Growing usage of AI in histopathology

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 TECHNOLOGY ANALYSIS

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.7 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.8 REGULATORY LANDSCAPE

-

5.9 PATENT ANALYSIS

- 5.10 KEY CONFERENCES AND EVENTS

- 5.11 PRICING ANALYSIS

- 5.12 TRADE ANALYSIS

-

5.13 ECOSYSTEM MARKET/MAP

-

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 6.1 INTRODUCTION

-

6.2 CONSUMABLESANTIBODIES- Rising prevalence of infectious diseases to drive marketKITS- Optimized sensitivity and versatility to boost demandREAGENTS- Rising uptake in IHC and FISH procedures to support market growthPROBES- Utilization in fluorescence microscopy applications to boost demand

-

6.3 INSTRUMENTSSLIDE-STAINING SYSTEMS- Development of high-throughput staining systems to drive marketSCANNERS- Rising use of multiplexed IHC scanners to drive marketTISSUE-PROCESSING SYSTEMS- Rising need for automation to support market growthOTHER INSTRUMENTS

- 7.1 INTRODUCTION

-

7.2 IMMUNOHISTOCHEMISTRYRISING UPTAKE OF IHC KITS FOR DIAGNOSTIC APPLICATIONS TO FUEL MARKET

-

7.3 IN SITU HYBRIDIZATIONABILITY TO DETECT SPECIFIC RNA AND DNA SEQUENCES TO BOOST DEMAND

-

7.4 DIGITAL PATHOLOGY & WORKFLOW MANAGEMENTRISING NEED FOR ANALYSIS AND SEAMLESS MANAGEMENT TO SUPPORT MARKET GROWTH

-

7.5 SPECIAL STAININGUTILIZATION IN CANCER DIAGNOSTICS TO BOOST DEMAND

- 8.1 INTRODUCTION

-

8.2 BREAST CANCERRISING UPTAKE OF HER2 TESTS FOR CANCER DIAGNOSIS TO DRIVE MARKET

-

8.3 GASTRIC CANCERRISING INCIDENCE OF GASTROINTESTINAL CANCER TO BOOST DEMAND

-

8.4 LYMPHOMARISING INCIDENCE OF NON-HODGKIN’S LYMPHOMA IN ADULTS TO SUPPORT MARKET GROWTH

-

8.5 PROSTATE CANCERRISING UPTAKE OF ISH TESTS FOR DIAGNOSIS TO FUEL MARKET

-

8.6 NON-SMALL CELL LUNG CANCERGROWING FOCUS ON DEVELOPING COMPANION DIAGNOSTIC TESTS TO DRIVE MARKET

- 8.7 OTHER DISEASE TYPES

- 9.1 INTRODUCTION

-

9.2 HOSPITALSABILITY TO OFFER ADVANCED EQUIPMENT & INFRASTRUCTURE TO DRIVE MARKET

-

9.3 RESEARCH LABORATORIESRISING DEMAND OF SPECIALTY TESTS TO DRIVE MARKET

-

9.4 PHARMACEUTICAL COMPANIESINCREASING R&D ACTIVITIES FOR DISEASE DIAGNOSTICS TO DRIVE MARKET

-

9.5 CONTRACT RESEARCH ORGANIZATIONSOUTSOURCING OF R&D ACTIVITIES TO SUPPORT MARKET GROWTH

- 9.6 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- High healthcare expenditure to drive marketCANADA- High prevalence of cancer to support market growthNORTH AMERICA: RECESSION IMPACT

-

10.3 EUROPEGERMANY- Availability of reimbursements for colorectal cancer screening procedures to support market growthUK- Rising investments in cancer research to propel marketFRANCE- Growing focus on early disease diagnosis to boost demandITALY- High incidence of cancer and geriatric population to support market growthSPAIN- High incidence of chronic diseases to drive marketREST OF EUROPEEUROPE: RECESSION IMPACT

-

10.4 ASIA PACIFICCHINA- Rising incidence of chronic & infectious diseases to propel marketJAPAN- Development of advanced diagnostic products to fuel marketINDIA- Rising establishment of diagnostic centers to drive marketREST OF ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

-

10.5 REST OF THE WORLDLATIN AMERICA- Rising number of cancer screening programs to drive marketMIDDLE EAST & AFRICA- Improvements in healthcare infrastructure to support market growthREST OF THE WORLD: RECESSION IMPACT

- 11.1 OVERVIEW

-

11.2 KEY PLAYER STRATEGIESOVERVIEW OF STRATEGIES ADOPTED BY MARKET PLAYERS

- 11.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPETITIVE BENCHMARKING OF KEY PLAYERSPRODUCT FOOTPRINTREGIONAL FOOTPRINT

-

11.6 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 COMPETITIVE BENCHMARKING OF STARTUP/SME PLAYERS

-

11.8 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHES & APPROVALSDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSF. HOFFMANN-LA ROCHE LTD.- Business overview- Products offered- Recent developments- MnM ViewDANAHER CORPORATION- Business overview- Products offered- Recent developments- MnM ViewPHC HOLDINGS CORPORATION- Business overview- Products offered- Recent developments- MnM viewTHERMO FISHER SCIENTIFIC INC.- Business overview- Products offered- Recent developments- MnM ViewABBOTT- Business overview- Products offeredAGILENT TECHNOLOGIES, INC.- Business overview- Products offered- Recent developmentsMERCK KGAA- Business overview- Products offered- Recent developmentsSAKURA FINETEK JAPAN CO., LTD.- Business overview- Products offered- Recent developmentsABCAM PLC- Business overview- Products offeredBECTON, DICKINSON AND COMPANY (BD)- Business overview- Products offeredBIO SB- Business overview- Products offeredBIOGENEX- Business overview- Products offered- Recent developmentsCELL SIGNALING TECHNOLOGY, INC.- Business overview- Products offered- Recent developmentsHISTO-LINE LABORATORIES- Business overview- Products offeredSLEE MEDICAL GMBH- Business overview- Products offeredCELLPATH LTD.- Business overview- Products offered

-

12.2 OTHER PLAYERSAMOS SCIENTIFIC PTY LTD.JINHUA YIDI MEDICAL APPLIANCE CO., LTD.MEDITE MEDICAL GMBHDIAPATH S.P.A.KFBIO KONFOONG BIOINFORMATION TECH CO., LTDDIAGNOSTIC BIOSYSTEMS INC.3DHISTECH LTD.RWD LIFE SCIENCE CO., LTD.DAKEWESYSMEX CORPORATIONENZO LIFE SCIENCES, INC.BIOCARE MEDICAL, LLC.MILESTONE MEDICALBIO-OPTICA MILANO SPA

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 RISK ASSESSMENT ANALYSIS

- TABLE 2 INCREASING INCIDENCE OF CANCER, BY REGION, 2020 VS. 2030 VS. 2040 (MILLION)

- TABLE 3 PROJECTED INCREASE IN GLOBAL NUMBER OF CANCER PATIENTS, 2018 VS. 2020 VS. 2040

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

- TABLE 5 KEY BUYING CRITERIA FOR END USERS

- TABLE 6 INDICATIVE LIST OF REGULATORY AUTHORITIES IN TISSUE DIAGNOSTICS MARKET

- TABLE 7 LIST OF CONFERENCES & EVENTS (2023−2024)

- TABLE 8 PRICE RANGE FOR TISSUE DIAGNOSTICS

- TABLE 9 IMPORT DATA FOR MICROTOMES, PARTS, AND ACCESSORIES OF INSTRUMENTS AND APPARATUS FOR PHYSICAL/CHEMICAL ANALYSIS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 10 EXPORT DATA FOR MICROTOMES, PARTS, AND ACCESSORIES OF INSTRUMENTS AND APPARATUS FOR PHYSICAL/CHEMICAL ANALYSIS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 11 TISSUE DIAGNOSTICS MARKET: ROLE IN ECOSYSTEM

- TABLE 12 TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 13 TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 14 TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 15 TISSUE DIAGNOSTICS MARKET FOR ANTIBODIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 16 TISSUE DIAGNOSTICS MARKET FOR KITS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 TISSUE DIAGNOSTICS MARKET FOR REAGENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 TISSUE DIAGNOSTICS MARKET FOR PROBES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 20 TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 KEY MANUFACTURERS OF AUTOMATED SLIDE STAINERS

- TABLE 22 TISSUE DIAGNOSTICS MARKET FOR SLIDE-STAINING SYSTEMS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 TISSUE DIAGNOSTICS MARKET FOR SCANNERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 TISSUE DIAGNOSTICS MARKET FOR TISSUE-PROCESSING SYSTEMS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 TISSUE DIAGNOSTICS MARKET FOR OTHER INSTRUMENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 27 TISSUE DIAGNOSTICS MARKET FOR IMMUNOHISTOCHEMISTRY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 TISSUE DIAGNOSTICS MARKET FOR IN SITU HYBRIDIZATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 TISSUE DIAGNOSTICS MARKET FOR DIGITAL PATHOLOGY & WORKFLOW MANAGEMENT, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 TISSUE DIAGNOSTICS MARKET FOR SPECIAL STAINING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 GLOBAL CANCER INCIDENCE, 2020 VS. 2040

- TABLE 32 TISSUE DIAGNOSTICS MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 33 BREAST CANCER INCIDENCE, BY REGION, 2020 VS. 2040

- TABLE 34 TISSUE DIAGNOSTICS MARKET FOR BREAST CANCER, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 COLON CANCER INCIDENCE, BY REGION, 2020 VS. 2040

- TABLE 36 TISSUE DIAGNOSTICS MARKET FOR GASTRIC CANCER, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 HODGKIN LYMPHOMA INCIDENCE, BY REGION, 2020 VS. 2040

- TABLE 38 NON-HODGKIN LYMPHOMA INCIDENCE, BY REGION, 2020 VS. 2040

- TABLE 39 TISSUE DIAGNOSTICS MARKET FOR LYMPHOMA, BY REGION, 2021–2028 (USD MILLION)

- TABLE 40 PROSTATE CANCER INCIDENCE, BY REGION, 2020 VS. 2040

- TABLE 41 TISSUE DIAGNOSTICS MARKET FOR PROSTATE CANCER, BY REGION, 2021–2028 (USD MILLION)

- TABLE 42 TISSUE DIAGNOSTICS MARKET FOR NON-SMALL CELL LUNG CANCER, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 TISSUE DIAGNOSTICS MARKET FOR OTHER DISEASE TYPES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 44 TISSUE DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 45 TISSUE DIAGNOSTICS MARKET FOR HOSPITALS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 46 TISSUE DIAGNOSTICS MARKET FOR RESEARCH LABORATORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 47 TISSUE DIAGNOSTICS MARKET FOR PHARMACEUTICAL COMPANIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 48 CONTRACT RESEARCH ORGANIZATIONS FOR ONCOLOGY DIAGNOSTICS

- TABLE 49 TISSUE DIAGNOSTICS MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 50 TISSUE DIAGNOSTICS MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 51 TISSUE DIAGNOSTICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: TISSUE DIAGNOSTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: TISSUE DIAGNOSTICS MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 59 US CANCER INCIDENCE, BY CANCER TYPE, 2020 VS. 2040

- TABLE 60 US: KEY MACROINDICATORS

- TABLE 61 LIST OF US FDA-APPROVED PRODUCTS FOR TISSUE DIAGNOSTICS

- TABLE 62 US: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 63 US: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 64 US: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 65 US: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 66 US: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 67 CANCER INCIDENCE, BY CANCER TYPE, 2020 VS. 2040

- TABLE 68 CANADA: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 69 CANADA: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 70 CANADA: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 71 CANADA: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 72 CANADA: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 73 EUROPE: TISSUE DIAGNOSTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 EUROPE: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 75 EUROPE: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 76 EUROPE: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 77 EUROPE: TISSUE DIAGNOSTICS MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 78 EUROPE: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 79 EUROPE: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 80 GERMANY: CANCER INCIDENCE, BY TYPE, 2020 VS. 2040

- TABLE 81 GERMANY: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 82 GERMANY: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 83 GERMANY: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 84 GERMANY: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 85 GERMANY: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION

- TABLE 86 UK: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 87 UK: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 88 UK: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 89 UK: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 90 UK: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 91 FRANCE: CANCER INCIDENCE, BY TYPE, 2020 VS. 2040

- TABLE 92 FRANCE: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 93 FRANCE: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 94 FRANCE: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 95 FRANCE: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 96 FRANCE: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 97 ITALY: CANCER INCIDENCE, BY TYPE, 2020 VS. 2040

- TABLE 98 ITALY: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 99 ITALY: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 100 ITALY: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 101 ITALY: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 102 ITALY: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 103 SPAIN: CANCER INCIDENCE, BY TYPE, 2020 VS. 2025

- TABLE 104 SPAIN: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 105 SPAIN: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 106 SPAIN: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 107 SPAIN: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 108 SPAIN: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 109 REST OF EUROPE: CANCER INCIDENCE, 2020 VS. 2025

- TABLE 110 REST OF EUROPE: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 111 REST OF EUROPE: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 112 REST OF EUROPE: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 113 REST OF EUROPE: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 114 REST OF EUROPE: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET, BY DISEASE, 2021–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 122 CANCER INCIDENCE, BY CANCER TYPE (CHINA), 2020 VS. 2025

- TABLE 123 CHINA: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 124 CHINA: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 CHINA: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 126 CHINA: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 127 CHINA: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 128 CANCER INCIDENCE, BY CANCER TYPE (JAPAN), 2020 VS. 2040

- TABLE 129 JAPAN: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 130 JAPAN: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 131 JAPAN: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 132 JAPAN: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 133 JAPAN: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 134 INDIA: CANCER INCIDENCE, BY TYPE, 2020 VS. 2025

- TABLE 135 INDIA: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 136 INDIA: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 137 INDIA: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 138 INDIA: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 139 INDIA: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: CANCER INCIDENCE, 2020 VS. 2040

- TABLE 141 REST OF ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 146 REST OF THE WORLD: TISSUE DIAGNOSTICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 147 REST OF THE WORLD: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 148 REST OF THE WORLD: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 149 REST OF THE WORLD: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 150 REST OF THE WORLD: TISSUE DIAGNOSTICS MARKET, BY DISEASE TYPE, 2021–2028 (USD MILLION)

- TABLE 151 REST OF THE WORLD: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 152 REST OF THE WORLD: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 153 LATIN AMERICA: CANCER INCIDENCE, 2020 VS. 2025

- TABLE 154 LATIN AMERICA: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 155 LATIN AMERICA: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 156 LATIN AMERICA: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 157 LATIN AMERICA: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 158 LATIN AMERICA: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 159 CANCER INCIDENCE, BY CANCER TYPE, 2020 VS. 2025

- TABLE 160 MIDDLE EAST & AFRICA: TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: TISSUE DIAGNOSTICS MARKET FOR CONSUMABLES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: TISSUE DIAGNOSTICS MARKET FOR INSTRUMENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: TISSUE DIAGNOSTICS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 165 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN TISSUE DIAGNOSTICS MARKET

- TABLE 166 TISSUE DIAGNOSTICS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 167 COMPANY FOOTPRINT

- TABLE 168 TISSUE DIAGNOSTICS MARKET: KEY STARTUPS/SMES

- TABLE 169 TISSUE DIAGNOSTICS MARKET: PRODUCT LAUNCHES & APPROVALS (JANUARY 2020−OCTOBER 2023)

- TABLE 170 TISSUE DIAGNOSTICS MARKET: DEALS (JANUARY 2020−OCTOBER 2023)

- TABLE 171 TISSUE DIAGNOSTIC MARKET: OTHER DEVELOPMENTS (JANUARY 2020−OCTOBER 2023)

- TABLE 172 F. HOFFMANN-LA ROCHE LTD.: BUSINESS OVERVIEW

- TABLE 173 DANAHER CORPORATION: BUSINESS OVERVIEW

- TABLE 174 PHC HOLDINGS CORPORATION: BUSINESS OVERVIEW

- TABLE 175 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

- TABLE 176 ABBOTT: BUSINESS OVERVIEW

- TABLE 177 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 178 MERCK KGAA: BUSINESS OVERVIEW

- TABLE 179 SAKURA FINETEK JAPAN CO., LTD.: BUSINESS OVERVIEW

- TABLE 180 ABCAM PLC.: BUSINESS OVERVIEW

- TABLE 181 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

- TABLE 182 BIO SB: BUSINESS OVERVIEW

- TABLE 183 BIOGENEX: BUSINESS OVERVIEW

- TABLE 184 CELL SIGNALING TECHNOLOGY, INC.: BUSINESS OVERVIEW

- TABLE 185 HISTO-LINE LABORATORIES: BUSINESS OVERVIEW

- TABLE 186 SLEE MEDICAL GMBH: BUSINESS OVERVIEW

- TABLE 187 CELLPATH LTD.: BUSINESS OVERVIEW

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 REVENUE SHARE ANALYSIS

- FIGURE 6 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

- FIGURE 7 TISSUE DIAGNOSTICS MARKET: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 TISSUE DIAGNOSTICS MARKET, BY PRODUCT, 2023 VS. 2028 (USD BILLION)

- FIGURE 10 TISSUE DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD BILLION)

- FIGURE 11 TISSUE DIAGNOSTICS MARKET, BY DISEASE TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 12 TISSUE DIAGNOSTICS MARKET, BY END USER, 2023 VS. 2028 (USD BILLION)

- FIGURE 13 GEOGRAPHICAL SNAPSHOT OF TISSUE DIAGNOSTICS MARKET

- FIGURE 14 RISING INCIDENCE OF CANCER AND INFECTIOUS DISEASES TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 15 CONSUMABLES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 16 CHINA & INDIA TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC REGION IS PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 19 TISSUE DIAGNOSTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 CURRENT HEALTH EXPENDITURE PER CAPITA

- FIGURE 21 CURRENT HEALTH EXPENDITURE (% OF GDP)

- FIGURE 22 GROWTH IN CURRENT HEALTHCARE EXPENDITURE IN BRICS COUNTRIES, 2012–2020

- FIGURE 23 PERSONALIZED MEDICINES APPROVED BY FDA (%), 2015–2022

- FIGURE 24 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASE

- FIGURE 25 DIRECT DISTRIBUTION—PREFERRED STRATEGY FOR PROMINENT COMPANIES

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USERS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 28 KEY PLAYERS OPERATING IN TISSUE DIAGNOSTICS MARKET

- FIGURE 29 ARTICLES PUBLISHED ON BREAST CANCER TISSUE DIAGNOSTICS, 2011–2021

- FIGURE 30 TISSUE DIAGNOSTICS MARKET: NORTH AMERICA SNAPSHOT

- FIGURE 31 TISSUE DIAGNOSTICS MARKET: ASIA PACIFIC SNAPSHOT

- FIGURE 32 REVENUE ANALYSIS OF KEY PLAYERS IN TISSUE DIAGNOSTICS MARKET

- FIGURE 33 TISSUE DIAGNOSTICS MARKET SHARE, BY KEY PLAYER (2022)

- FIGURE 34 TISSUE DIAGNOSTICS MARKET: COMPANY EVALUATION MATRIX

- FIGURE 35 TISSUE DIAGNOSTICS MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES

- FIGURE 36 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2022)

- FIGURE 37 DANAHER CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 38 PHC HOLDINGS CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 39 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

- FIGURE 40 ABBOTT: COMPANY SNAPSHOT (2022)

- FIGURE 41 AGILENT TECHNOLOGIES INC.: COMPANY SNAPSHOT (2022)

- FIGURE 42 MERCK KGAA: COMPANY SNAPSHOT (2022)

- FIGURE 43 ABCAM PLC. COMPANY SNAPSHOT (2022)

- FIGURE 44 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

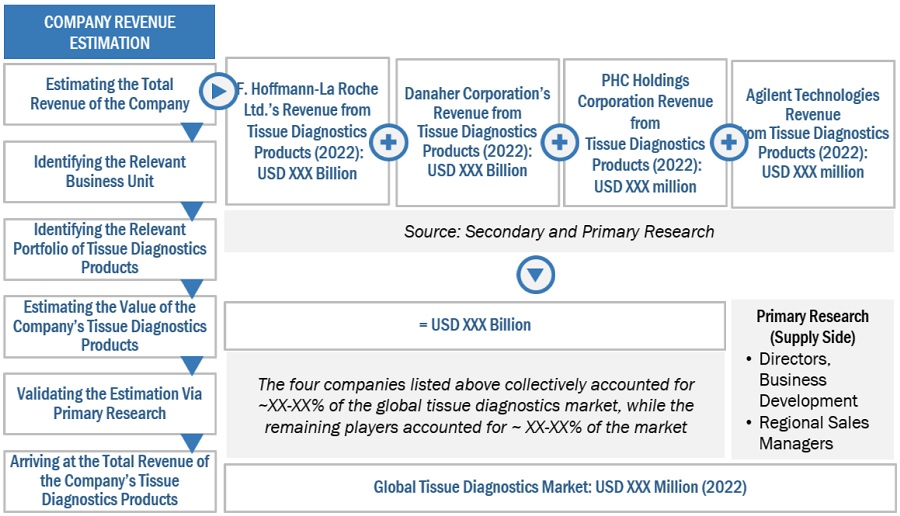

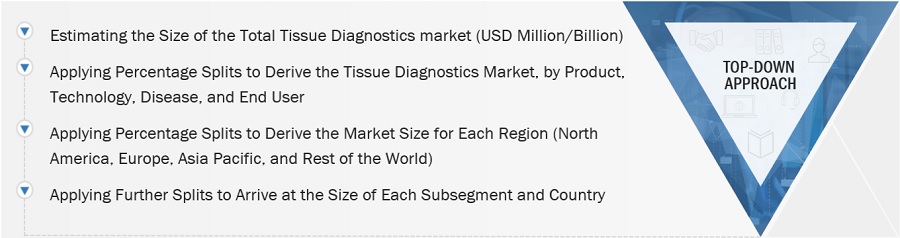

The objective of the study is to analyze the key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies. To track companies’ developments such as product launches and approvals, expansions, and partnerships of the leading players, the competitive landscape of the tissue diagnostics market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments, the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), annual reports, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the tissue diagnostics market. A database of the key industry leaders was also prepared using secondary research.

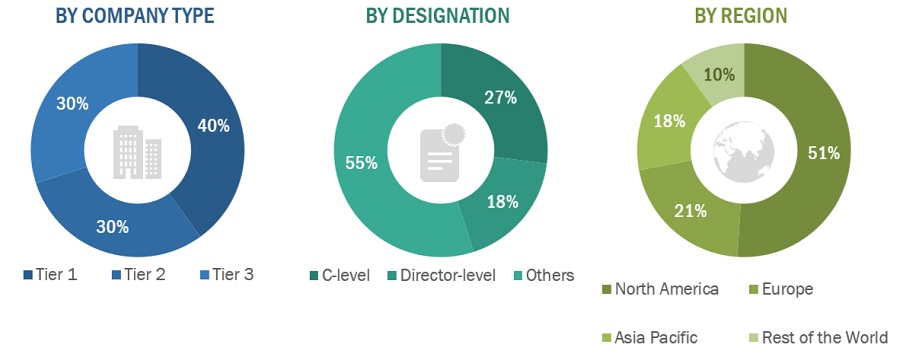

Collecting Primary Data

The primary research data was conducted after acquiring knowledge about the tissue diagnostics market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such as doctors, nurses, and hospital purchase managers) and supply side (such as included various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers, wholesalers, channel partners, and distributors) across major countries of North America, Europe, Asia Pacific, and Rest of the World. Approximately 40% of the primary interviews were conducted with stakeholders from the demand side while those from the supply side accounted for the remaining 60%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

Breakdown of Primary Participants:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue. As of 2022: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

F. Hoffmann-La Roche Ltd (Switzerland) |

Product Manager |

|

Danaher Corporation (US) |

VP Sales |

|

Thermo Fisher Scientific Inc. (US) |

Regional Sales Head |

|

Abbott Laboratories (US) |

Sales Director |

Market Size Estimation

All major manufacturers offering various tissue diagnostics product were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The value of tissue diagnostics market was also split into various segments and subsegments at the region and country level based on:

- Product mapping of various manufacturers for each type of tissue diagnostics products at the regional and country level

- Relative adoption pattern of each product type among key disease segments at the regional and/or country-level

- Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country level.

- Detailed secondary research to gauge the prevailing market trends at the regional and/or country-level

Global Tissue Diagnostics Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global tissue diagnostics Market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the tissue diagnostics industry.

Market Definition

Tissue-based diagnostics tests are performed for screening, diagnosing, and monitoring the response of cancer patients to therapy. Tissue diagnosis refers to the examination of intact tissues obtained during a medical procedure such as biopsies and surgeries. Tissue-based diagnostic tests are used in the treatment of breast cancer, gastric cancer, lymphoma, prostate cancer, non-small cell lung cancer, and other diseases (bone cancer, cervical cancer, colon cancer, cervix cancer, gallbladder carcinoma, skin cancer, HBV, Epstein-Barr virus, hepatitis, and muscular dystrophies). These diagnostics tests are carried out to identify a medical condition in its early stage so as to establish the correct course of treatment. Tissue diagnostic tests are also carried out to determine the course of recovery and response to the treatment.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To define, describe, segment, and forecast the tissue diagnostics market by product, technology, disease type, and end user, and region

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall tissue diagnostics market

- To forecast the size of the tissue diagnostics market in four main regions along with their respective key countries, namely, North America, Europe, Asia Pacific, and Rest of the World.

- To profile key players in the tissue diagnostics market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as product launches and approvals; expansions; and partnerships; of the leading players in the tissue diagnostics market

- To benchmark players within the tissue diagnostics market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of the tissue diagnostics market into specific countries/regions in the Rest of Europe, Rest of Asia Pacific, and Rest of the World.

Company Information

- Detailed analysis and profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Tissue Diagnostics Market