Tissue Diagnostics Market Size, Growth, Share & Trends Analysis

Tissue Diagnostics Market by Product (Consumables [Antibodies, Kits, Reagents, Probes], Instruments [Systems, Scanner], Software, Services), Technology (ISH, IHC, Slide Staining), Disease Type (Breast Cancer, Lymphoma, Prostate Cancer) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global Tissue Diagnostics market, valued at USD 6.19 billion in 2024, stood at USD 6.74 billion in 2025 and is projected to advance at a resilient CAGR of 10.0% from 2025 to 2030, culminating in a forecasted valuation of USD 10.86 billion by the end of the period. The market growth is driven by the rising incidence of cancer and the growing demand for digital pathology, which are fueling the need for more accurate and high-throughput tissue-based diagnostics. Additionally, increasing healthcare expenditure and wider availability of reimbursements are enabling broader access to advanced diagnostic technologies, while the expansion of private diagnostic centers is supporting the adoption of standardized and automated laboratory workflows. Collectively, these factors are driving higher demand for tissue diagnostics, enhancing early disease detection, and improving overall patient management across healthcare systems.

KEY TAKEAWAYS

-

BY REGIONThe tissue diagnostics market is segmented by region into North America, Europe, Asia Pacific, South America, the Middle East, and Africa. North America leads the market, driven by advanced healthcare infrastructure, high adoption of diagnostic technologies, and the presence of key industry players. The Asia Pacific region is expected to register the fastest growth, fueled by expanding healthcare access, increasing cancer prevalence, rising awareness of early detection, and growing investments in diagnostic laboratories and hospitals.

-

BY PRODUCT & SERVICEThe tissue diagnostics market is segmented into consumables, instruments, software, and services, with consumables accounting for the largest share. Consumables include antibodies, IHC and ISH kits, reagents, probes, and other essential materials that are used repeatedly across diagnostic workflows. Their recurring use, combined with the rising incidence of cancer, the growing demand for precise biomarker testing, and the increasing number of private diagnostic centers, is driving strong market growth. Instruments, software, and services support laboratory operations and workflow efficiency, but the consistent demand for high-quality consumables continues to make this segment the primary revenue driver in the tissue diagnostics market.

-

BY TECHNOLOGYBased on technology, the tissue diagnostics market is segmented into immunohistochemistry (IHC), in situ hybridization (ISH), digital pathology, special staining, and other technologies, with IHC leading the market. IHC remains dominant due to its high specificity, sensitivity, and versatility in detecting protein biomarkers across different tissue types. Automated staining systems, multiplex IHC platforms, and high-throughput workflows have increased efficiency and reproducibility, enabling laboratories to handle larger sample volumes with consistent results. The integration of digital imaging and advanced data management further enhances accuracy and reduces human variability, reinforcing IHC’s position as the most widely adopted and fastest-growing technology in tissue diagnostics.

-

BY DISEASE TYPEThe tissue diagnostics market is segmented by disease type into breast cancer, gastric cancer, lymphoma, prostate cancer, non-small cell lung cancer (NSCLC), and other disease types. Among these, breast cancer holds the largest share of the market. This is attributed to the rising global incidence of breast cancer, increased focus on early detection, and the growing utilization of biomarker-based tissue diagnostic assays. Technological advancements in tissue profiling and targeted diagnostics are further driving the adoption of tissue-based tests for breast cancer, making it the leading contributor to market growth.

-

BY END USERThe tissue diagnostics market caters to a wide array of end users, including hospitals, research laboratories, pharmaceutical companies, contract research organizations (CROs), and other end users. Hospitals remain a key end user in the tissue diagnostics market, as they handle high patient volumes and require accurate tissue-based diagnostics for effective clinical decision-making and treatment planning. The increasing prevalence of cancer has heightened the need for timely and precise tissue analysis, driving the adoption of advanced reagents and automated instruments. Moreover, hospitals are increasingly integrating standardized workflows and high-throughput diagnostic platforms to improve efficiency, ensure consistency in results, and support personalized medicine initiatives, reinforcing their central role in the market.

-

COMPETITIVE LANDSCAPEMajor players in the tissue diagnostics market are pursuing a combination of organic and inorganic growth strategies, including partnerships, collaborations, and strategic investments to broaden their product portfolios and expand their global footprint. Key companies in this market include F. Hoffmann-La Roche Ltd., Danaher Corporation, and PHC Holdings Corporation. These firms focus on developing advanced tissue diagnostic solutions, enhancing manufacturing and automation capabilities, and strengthening distribution networks to meet the increasing global demand for accurate and efficient tissue-based testing across hospitals, research laboratories, and diagnostic centers.

The tissue diagnostics market is poised for robust growth in the coming years, driven by the rising incidence of cancer and increasing demand for accurate and timely disease diagnosis. Advanced technologies such as immunohistochemistry (IHC), in situ hybridization (ISH), digital pathology, and multiplex staining systems are being increasingly adopted to improve biomarker detection, support personalized treatment decisions, and enhance patient outcomes. The growing number of private diagnostic centers, coupled with increasing healthcare expenditure and greater access to reimbursements, is further accelerating market adoption. In addition, ongoing technological advancements and the expansion of laboratory infrastructure are improving workflow efficiency, reproducibility, and the overall reliability of tissue diagnostic solutions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The tissue diagnostics market is experiencing notable shifts due to the increasing prevalence of cancer, rising focus on early and accurate disease detection, and continuous advancements in diagnostic technologies. Hospitals, research laboratories, and pharmaceutical companies form the primary customer base for tissue diagnostics solutions. Key trends, such as the adoption of automated immunohistochemistry (IHC) and in situ hybridization (ISH) platforms, integration of digital pathology, and demand for high-throughput and standardized workflows, are reshaping laboratory operations. These technological developments and workflow optimizations influence the procurement of consumables, instruments, software, and diagnostic services, driving market growth and redefining competitive dynamics in the tissue diagnostics sector.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising incidence of cancer

-

Growing demand for digital pathology

Level

-

High cost of tissue diagnostic systems

-

Stringent regulatory requirements

Level

-

High growth potential of emerging economies

-

Growing preference for personalized medicines

Level

-

Shortage of skilled professionals

-

Availability of refurbished products

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising incidence of cancer

The rising incidence of cancer is a key factor fueling growth in the tissue diagnostics market. As cancer prevalence increases globally, the demand for accurate and timely diagnosis of various tumor types has grown substantially. Early detection through tissue-based testing is critical for effective treatment planning, personalized therapies, and improved patient outcomes. This trend is driving hospitals, research laboratories, and diagnostic centers to adopt advanced tissue diagnostic solutions, including immunohistochemistry, in situ hybridization, and digital pathology systems. Consequently, the expanding patient population and growing focus on cancer management are directly supporting the adoption of innovative tissue diagnostics, positioning it as a high-priority area in healthcare.

Restraint: High cost of tissue diagnostic systems

The high cost of tissue diagnostic systems remains a significant restraint for market growth. Advanced instruments, such as automated IHC stainers, digital pathology scanners, and tissue-processing systems, often involve substantial upfront investments, making them less accessible to smaller laboratories and clinics, particularly in developing regions. In addition to equipment costs, maintenance, calibration, and consumable requirements further increase the overall expenditure. These financial barriers can slow adoption rates, limit the deployment of cutting-edge technologies, and pose challenges for healthcare providers aiming to balance diagnostic accuracy with cost efficiency.

Opportunity: High growth potential of emerging economies

Emerging economies present substantial growth opportunities for the tissue diagnostics market. Increasing healthcare investments, expanding hospital infrastructure, and rising awareness of cancer screening and early diagnosis are driving demand for advanced diagnostic solutions in these regions. As governments and private players focus on improving access to quality healthcare, there is a growing need for modern tissue diagnostic systems, consumables, and related services. Additionally, the adoption of newer technologies, such as digital pathology and automated IHC platforms, is gradually increasing, creating opportunities for market expansion and strategic partnerships in high-growth markets across Asia Pacific, Latin America, and the Middle East & Africa.

Challenge: Shortage of skilled professionals

A key challenge for the tissue diagnostics market is the shortage of skilled professionals, including trained pathologists and laboratory technicians. This scarcity can lead to delays in sample analysis, inconsistencies in diagnostic results, and increased workload on existing staff. The complexity of advanced diagnostic technologies, such as automated IHC systems and digital pathology platforms, further exacerbates the need for specialized training. Addressing this challenge requires investment in workforce development, training programs, and collaboration with academic and professional institutions to ensure a steady supply of qualified personnel capable of operating sophisticated tissue diagnostic workflows efficiently.

TISSUE DIAGNOSTICS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers integrated tissue diagnostics and digital pathology solutions using VENTANA series scanners for whole-slide imaging and quantitative IHC biomarker analysis (e.g., PD-L1 scoring in NSCLC) | High-quality digitized images, faster and reproducible biomarker scoring, optimized workflow efficiency, supports telepathology, reduces manual errors |

|

Provides complete pathology workflow solutions including sample preparation, automated staining (BOND RX/RXm), and imaging for IHC, ISH, and immunofluorescence applications | Standardized staining, high-throughput processing, reduced manual errors, flexible protocols, supports research and diagnostic workflows |

|

Supplies automated instruments for tissue processing: microtomes, tissue processors, embedding systems, and staining platforms to standardize histology workflows | Consistent tissue preparation, reduced labor and turnaround time, improved assay reliability, supports large-scale laboratory workflows |

|

Offers automated IHC/ISH staining instruments (Dako Omnis), reagents, and multiplex workflows for spatial biomarker analysis and companion diagnostics | Multiplex testing on single instrument, consistent results with ready-to-use reagents, high-throughput biomarker analysis, supports companion diagnostics |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The tissue diagnostics market serves a diverse range of end users, including hospitals, research laboratories, pharmaceutical companies, and contract research organizations. Testing primarily focuses on cancer and other disease diagnostics, with emerging applications in personalized medicine and biomarker identification. The uptake of tissue diagnostics is being driven by advancements in automated tissue processing, digital pathology platforms, and high-throughput immunohistochemistry workflows, which improve accuracy, consistency, and laboratory efficiency. Increasing regulatory approvals, hospital accreditation standards, and preventive healthcare initiatives are fostering innovation and expanding clinical applications across different end-user segments.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Tissue Diagnostics Market, By Product & Service

The tissue diagnostics market is segmented into consumables, instruments, software, and services, with consumables accounting for the largest share. Consumables include antibodies, IHC and ISH kits, reagents, probes, and other essential materials that are used repeatedly across diagnostic workflows. Their recurring use, combined with the rising incidence of cancer, the growing demand for precise biomarker testing, and the increasing number of private diagnostic centers, is driving strong market growth. Instruments, software, and services support laboratory operations and workflow efficiency, but the consistent demand for high-quality consumables continues to make this segment the primary revenue driver in the tissue diagnostics market.

Tissue Diagnostics Market, By Technology

Based on technology, the tissue diagnostics market is segmented into immunohistochemistry (IHC), in situ hybridization (ISH), digital pathology, special staining, and other technologies, with IHC leading the market. IHC remains dominant due to its high specificity, sensitivity, and versatility in detecting protein biomarkers across different tissue types. Automated staining systems, multiplex IHC platforms, and high-throughput workflows have increased efficiency and reproducibility, enabling laboratories to handle larger sample volumes with consistent results. The integration of digital imaging and advanced data management further enhances accuracy and reduces human variability, reinforcing IHC’s position as the most widely adopted and fastest-growing technology in tissue diagnostics.

Tissue Diagnostics Market, By Disease Type

The tissue diagnostics market is segmented by disease type into breast cancer, gastric cancer, lymphoma, prostate cancer, non-small cell lung cancer (NSCLC), and other disease types. Among these, breast cancer holds the largest share of the market. This is attributed to the rising global incidence of breast cancer, increased focus on early detection, and the growing utilization of biomarker-based tissue diagnostic assays. Technological advancements in tissue profiling and targeted diagnostics are further driving the adoption of tissue-based tests for breast cancer, making it the leading contributor to market growth.

Tissue Diagnostics Market, By End User

The tissue diagnostics market caters to a wide array of end users, including hospitals, research laboratories, pharmaceutical companies, contract research organizations (CROs), and other end users. Hospitals remain a key end user in the tissue diagnostics market, as they handle high patient volumes and require accurate tissue-based diagnostics for effective clinical decision-making and treatment planning. The increasing prevalence of cancer has heightened the need for timely and precise tissue analysis, driving the adoption of advanced reagents and automated instruments. Moreover, hospitals are increasingly integrating standardized workflows and high-throughput diagnostic platforms to improve efficiency, ensure consistency in results, and support personalized medicine initiatives, reinforcing their central role in the market.

REGION

North America accounted for the largest share of the global tissue diagnostics market during the forecast period.

The tissue diagnostics market in North America is expanding, driven by increasing awareness of cancer detection, rising adoption of preventive healthcare programs, and growing implementation of advanced technologies such as automated tissue processors, digital pathology scanners, and high-throughput immunohistochemistry platforms. Furthermore, the region benefits from a well-established healthcare infrastructure, substantial healthcare expenditure, and supportive initiatives from both government and private sectors to enhance diagnostic capabilities, collectively fueling the growth of the tissue diagnostics market.

TISSUE DIAGNOSTICS MARKET: COMPANY EVALUATION MATRIX

F. Hoffmann-La Roche Ltd. (Switzerland) holds a leading position in the tissue diagnostics market, known for its comprehensive portfolio of instruments, reagents, and software solutions that enable accurate and standardized tissue-based testing. The company’s VENTANA and BenchMark systems are widely adopted across pathology laboratories for immunohistochemistry (IHC) and in situ hybridization (ISH) applications, ensuring reproducibility and workflow efficiency. Roche’s focus on automation, quality, and integration has positioned it as a key enabler of advanced diagnostic practices, supporting faster turnaround times and improved clinical decision-making.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 6.2 Billion |

| Revenue Forecast in 2030 | USD 10.86 Billion |

| Growth Rate | CAGR of 10.0% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Million) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: TISSUE DIAGNOSTICS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Product matrix, which provides a detailed comparison of the product portfolio of each company in the tissue diagnostics market | Enables easy comparison of competitors’ offerings, helping identify gaps, overlaps, and differentiation opportunities. |

| Company Information | Additional five company profiles of players operating in the tissue diagnostics market | Provides insights into competitors’ strategies, innovation focus, and partnerships, supporting strategic planning. |

| Geographic Analysis | Additional country-level analysis of the tissue diagnostics market | Guides market entry, localization, and targeted launch strategies by highlighting regional demand and opportunities. |

RECENT DEVELOPMENTS

- September 2025 : Leica Biosystems (subsidiary of Danaher Corporation) (US) and Moffitt Cancer Center, one of the nation’s top cancer hospitals and a leader in cancer research, expanded their partnership to accelerate the adoption of digital pathology across the state. This strategic partnership marked Florida’s first large-scale implementation of digital pathology technology, aimed at improving speed, precision, and access to pathology services.

- June 2025 : Sakura Finetek USA (US) launched two new ready-to-use antibodies for the Tissue-Tek Genie Advanced Staining System.

- March 2025 : Epredia (subsidiary of PHC Holdings Corporation (Japan) received US FDA 510(k) clearance for its E1000 Dx Digital Pathology Solution, developed to enhance laboratory workflows in cancer diagnostics.

- January 2025 : F. Hoffmann-La Roche Ltd. (Switzerland) received US FDA approval for a label expansion of its PATHWAY anti-HER2/neu (4B5) Rabbit Monoclonal Primary Antibody to identify HR-positive, HER2-ultralow metastatic breast cancer patients who may be eligible for treatment with ENHERTU.

Table of Contents

Methodology

The study involved major activities in estimating the current market size for the global tissue diagnostics market.

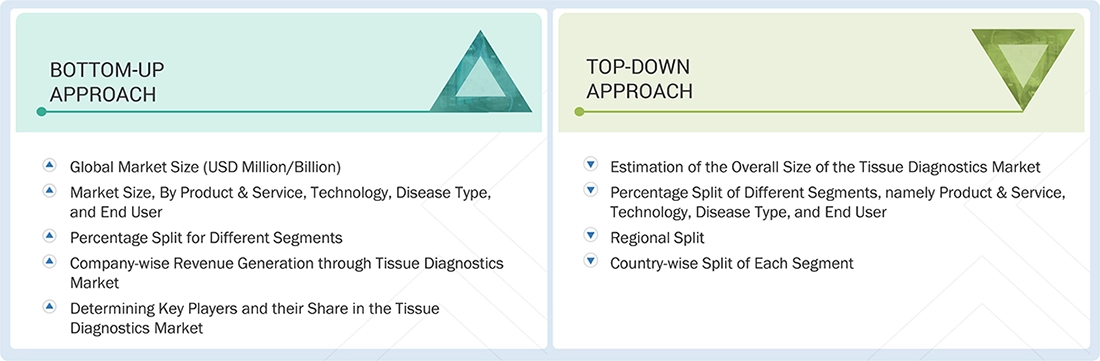

Exhaustive secondary research was done to collect information on the global tissue diagnostics market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the global tissue diagnostics market.

Four steps involved in estimating the market size are as follows:/p>

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

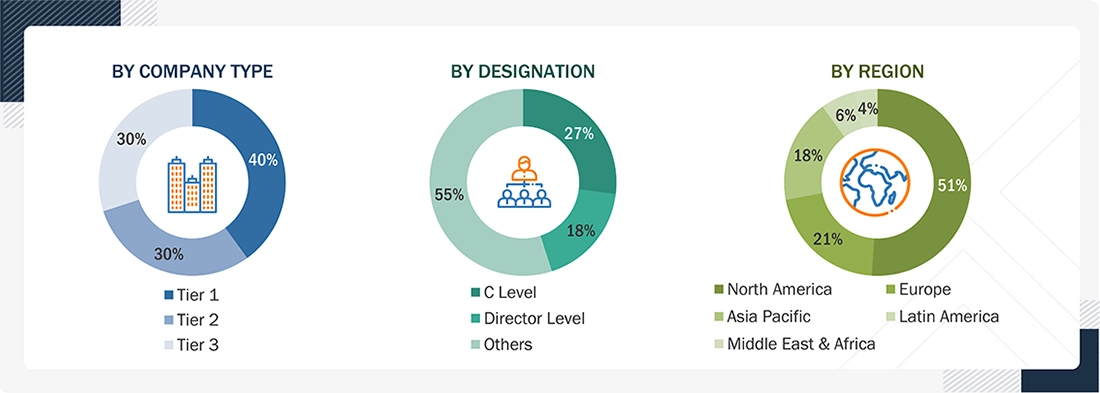

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry's value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as assess prospects.

Note 1: Others include Sales Managers, Marketing Managers, and Product Managers.

Note 2: Companies are classified into tiers based on their total revenue. Here's the breakdown of tiers:

Tier 1 = > USD 100 million, tier 2 = USD 10 million to USD 100 million, and tier 3 = < USD 10 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global tissue diagnostics market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry have been identified through extensive secondary research.

- The revenues generated by leading players operating in the tissue diagnostics market have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

The research methodology used to estimate the market size included the following:

Tissue Diagnostics Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Tissue-based diagnostic tests are performed for screening, diagnosing, and monitoring the response of cancer patients to therapy. Tissue diagnosis refers to the examination of intact tissues obtained during a medical procedure, such as biopsies and surgeries. Tissue-based diagnostic tests are used in the treatment of breast cancer, gastric cancer, lymphoma, prostate cancer, non-small cell lung cancer, and other diseases (bone cancer, cervical cancer, colon cancer, cervix cancer, gallbladder carcinoma, skin cancer, HBV, Epstein-Barr virus, hepatitis, and muscular dystrophies). These diagnostic tests are carried out to identify a medical condition in its early stage so as to establish the correct course of treatment. Tissue diagnostic tests are also carried out to determine the course of recovery and response to the treatment.

Key Stakeholders

- Senior Management

- End Users

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the global tissue diagnostics market by product & service, technology, disease type, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the global tissue diagnostics market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches & approvals, partnerships, acquisitions, agreements, and other developments

- To benchmark players within the global tissue diagnostics market using the Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings

- To study the impact of AI/Gen AI on the market, along with the macroeconomic outlook for each region

Customization Options:

MarketsandMarkets offers the following customizations for this market report.

Country Information

- Additional country-level analysis of the global tissue diagnostics market Company profiles

Company profiles

- Additional five company profiles of players operating in the global tissue diagnostics market

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the global tissue diagnostics market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Tissue Diagnostics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Tissue Diagnostics Market