Traction Transformer Market by Rolling Stock (Electric Locomotives, High-speed Trains, Metros), Mounting Position (Underframe, Machine Room, Roof), Overhead Line Voltage, and Geography - Global Forecast to 2022

The traction transformer market was valued at USD 528.0 Million in 2015 and is expected to grow at a CAGR of 4.6% between 2016 and 2022. The base year considered for study is 2015 and the forecast period is considered for the period between 2016 and 2022.

The liberalization in the rail transport market, increasing government funding, and the growing environmental concerns are the driving factors for the growth of the market. The objective of the report is to provide a detailed analysis of the market based on rolling stock, mounting position, overhead line voltage, and geography. The report provides detailed information regarding the major factors influencing the growth of the market. The report also gives a detailed overview of the value chain of the market and analyzes the market trends on the basis of the Porter's five forces analysis.

The traction transformer market is expected to be valued at USD 724.2 Million by 2022, growing at a CAGR of 4.6% between 2016 and 2022. The growth of this market is propelled by the increased government spending for the rail infrastructure development, shift toward low carbon rail transport, and liberalization of the rail transport network.

The market for electric locomotives is expected to hold a large share of the overall market and is also expected to grow at the highest rate between 2016 and 2022. The growth of the market is driven by the rising population, growing demand for rail transportation, and increasing preference for moving goods by rail over road transportation.

The traction transformer market for underframe mounting is expected to lead the overall market in 2016 because of the increased space for passenger capacity and improved comfort level of passengers. The market for machine room mounting is expected to grow at a high rate between 2016 and 2022. Machine room mounting plays an integral role for providing maximum flexibility and reliability in single and multiphase rail systems.

Traction transformer market for AC overhead line is expected to hold the largest share of the overall market and expected to grow at the highest rate between 2016 and 2022. The majority of electric traction systems are equipped with AC overhead lines because of the advantage of low power losses over longer distance travel.

APAC is expected to hold the largest share of the traction transformer market during the forecast period. Countries such as China, Japan, India, South Korea, Taiwan, and Australia are majorly driving the growth of the market in Asia-Pacific. These countries are increasing the number of trains for reliable transportation. Further, the increasing investment in high-speed rail network, development of new lines, and expansion of existing rail networks are driving the demand for traction transformers in APAC.

North America is expected to be the fastest-growing market for traction transformers between 2016 and 2022. The major driving factors for the growth of the market in North America include rapid industrialization and modernization, government funding and support in the U.S. for the development and implementation of high-speed trains and metros in the country, and improvement in rail infrastructure.

The key restraining factors for the growth of the traction transformer market include the high cost incurred for the electrification of rail network and the dominance of diesel-powered rail engines in certain countries such as the U.K., Taiwan, Mexico, and Brazil, among others.

The key market players such as ABB Ltd. (Switzerland) and Alstom SA (France) are focusing on strategies such as contracts and new product launches to provide the best possible services to their customers and expand their business globally.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Traction Transformer Market Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Traction Transformer Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 29)

4.1 Traction Transformer Market, 2016–2022

4.2 Traction Transformer Market, By Rolling Stock (2016–2022)

4.3 Traction Transformer Market, By Mounting Position, 2016

4.4 Traction Transformer Market, By Overhead Line Voltage, 2016

4.5 Market, By Rolling Stock and Region, 2016

4.6 Market, By Geography (2016)

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Market, By Rolling Stock

5.2.2 Market, By Mounting Position

5.2.3 Market, By Overhead Line Voltage

5.2.4 Market, By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Significant Government Funding for Rail Infrastructure Development

5.3.1.2 Shift Toward Low Carbon Rail Transport

5.3.1.3 Liberalization of Rail Transport Network

5.3.2 Restraints

5.3.2.1 High Cost of Electrification

5.3.2.2 Dominance of Diesel-Powered Rail Engines in Certain Countries

5.3.3 Opportunities

5.3.3.1 Electrification of Rail Networks

5.3.4 Challenges

5.3.4.1 Complexity in Designing Traction Transformers

6 Industry Trends (Page No. - 38)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Model

6.3.1 Bargaining Power of Suppliers

6.3.2 Bargaining Power of Buyers

6.3.3 Threat of New Entrants

6.3.4 Threat of Substitutes

6.3.5 Intensity of Competitive Rivalry

7 Market Analysis, By Rolling Stock (Page No. - 46)

7.1 Introduction

7.2 Electric Locomotives

7.2.1 Freight Locomotives

7.2.1.1 Expansion of Railway Networks Expected to Drive the Traction Transformer Market for Freight Locomotives

7.2.2 Passenger Locomotives

7.2.2.1 Increasing Number of Contracts for Passenger Locomotives Driving the Market

7.3 High-Speed Trains

7.3.1 Increasing Concern for Carbon Footprint to Increase the Demand for High-Speed Trains

7.4 Metros

7.4.1 Government Funds for Metros to Increase the Adoption of Traction Transformers

8 Market Analysis, By Mounting Position (Page No. - 59)

8.1 Introduction

8.2 Underframe

8.3 Machine Room

8.4 Roof

9 Market Analysis, By Overhead Line Voltage (Page No. - 63)

9.1 Introduction

9.2 AC

9.2.1 12kv

9.2.2 15kv

9.2.3 20kv

9.2.4 25kv

9.3 DC

9.3.1 0.75kv

9.3.2 1.5kv

9.3.3 3kv

10 Geographic Analysis (Page No. - 70)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.3 Europe

10.3.1 Russia

10.3.2 Italy

10.3.3 Switzerland

10.3.4 France

10.3.5 Austria

10.3.6 Germany

10.3.7 Spain

10.3.8 U.K.

10.3.9 Rest of Europe

10.4 Asia-Pacific (APAC)

10.4.1 China

10.4.2 India

10.4.3 Australia

10.4.4 Japan

10.4.5 South Korea

10.4.6 Taiwan

10.4.7 Rest of APAC

10.5 Rest of the World (RoW)

10.5.1 Middle East

10.5.1.1 UAE

10.5.1.2 Kingdom of Saudi Arabia (KSA)

10.5.2 Africa

10.5.3 South America

10.5.3.1 Brazil

10.5.3.2 Argentina

11 Competitive Landscape (Page No. - 102)

11.1 Overview

11.2 Market Ranking Analysis for Traction Transformer Manufacturers

11.3 Competitive Situations and Trends

11.3.1 Contracts

11.3.2 Agreements, Acquisitions, and Certifications

11.3.3 New Product Launches

12 Company Profiles (Page No. - 107)

12.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

12.2 ABB Ltd.

12.3 Alstom SA

12.4 JST Transformateurs

12.5 Mitsubishi Electric Corporation

12.6 Siemens AG

12.7 EMCO Limited

12.8 Hind Rectifiers Limited

12.9 International Electric Co., Ltd.

12.10 Setrans Holding as

12.11 Wilson Transformer Company

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 129)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (51 Tables)

Table 1 Market, 2013–2022 (USD Million & Units)

Table 2 Market, By Rolling Stock, 2013–2022 (USD Million)

Table 3 Market, By Rolling Stock, 2013–2022 (Units)

Table 4 Market for Electric Locomotives, By Type, 2013–2022 (USD Million)

Table 5 Market for Electric Locomotives, By Type, 2013–2022 (Units)

Table 6 Market for Freight Locomotives, By Region, 2013–2022 (USD Million)

Table 7 Market for Freight Locomotives, By Region, 2013–2022 (Units)

Table 8 Market for Passenger Locomotives, By Region, 2013–2022 (USD Million)

Table 9 Market for Passenger Locomotives, By Region, 2013–2022 (Units)

Table 10 Market for High-Speed Trains, By Region, 2013–2022 (USD Million)

Table 11 Market for High-Speed Trains, By Region, 2013–2022 (Units)

Table 12 Market for Metros, By Region, 2013–2022 (USD Million)

Table 13 Market for Metros, By Region, 2013–2022 (Units)

Table 14 Market, By Mounting Position, 2013–2022 (USD Million)

Table 15 Market, By Overhead Line Voltage, 2013–2022 (USD Million)

Table 16 Market, By AC Overhead Line Voltage, 2013–2022 (USD Million)

Table 17 Market, By DC Overhead Line Voltage, 2013–2022 (USD Million)

Table 18 Market, By Region, 2013–2022 (USD Million)

Table 19 Market, By Region, 2013–2022 (Units)

Table 20 North America: Government Funding for Rail Infrastructure

Table 21 Market in North America, By Country, 2013–2022 (USD Million)

Table 22 Market in North America, By Country, 2013–2022 (Units)

Table 23 Market for Freight Locomotives in North America, By Country, 2013–2022 (USD Million)

Table 24 Market for Passenger Locomotives in North America, By Country, 2013–2022 (USD Million)

Table 25 Market for High-Speed Trains in North America, By Country, 2013–2022 (USD Million)

Table 26 Market for Metros in North America, By Country, 2013–2022 (USD Million)

Table 27 Europe: Government Funding for Rail Infrastructure

Table 28 Market in Europe, By Country, 2013–2022 (USD Million)

Table 29 Market in Europe, By Country, 2013–2022 (Units)

Table 30 Market for Freight Locomotives in Europe, By Country, 2013–2022 (USD Million)

Table 31 Market for Passenger Locomotives in Europe, By Country, 2013–2022 (USD Million)

Table 32 Market for High-Speed Trains in Europe, By Country, 2013–2022 (USD Million)

Table 33 Market for Metros in Europe, By Country, 2013–2022 (USD Million)

Table 34 APAC: Government Funding for Rail Infrastructure

Table 35 Market in APAC, By Country, 2013–2022 (USD Million)

Table 36 Market in APAC, By Country, 2013–2022 (Units)

Table 37 Market for Freight Locomotives in APAC, By Country, 2013–2022 (USD Million)

Table 38 Market for Passenger Locomotives in APAC, By Country, 2013–2022 (USD Million)

Table 39 Market for High-Speed Trains in APAC, By Country, 2013–2022 (USD Million)

Table 40 Market for Metros in APAC, By Country, 2013–2022 (USD Million)

Table 41 RoW: Government Funding for Rail Infrastructure

Table 42 Market in RoW, By Region, 2013–2022 (USD Million)

Table 43 Market in RoW, By Region, 2013–2022 (Units)

Table 44 Market for Passenger Locomotives in RoW, By Region, 2013–2022 (USD Million)

Table 45 Market for Freight Locomotives in RoW, By Region, 2013–2022 (USD Million)

Table 46 Market for High-Speed Trains in RoW, By Region, 2013–2022 (USD Million)

Table 47 Market for Metros in RoW, By Region, 2013–2022 (USD Million)

Table 48 Ranking of the Top 5 Players: Market, 2015

Table 49 Contracts, 2014–2016

Table 50 Agreements, Acquisitions, and Certifications, 2014–2016

Table 51 New Product Launches, 2014–2016

List of Figures (63 Figures)

Figure 1 Traction Transformer Market Segmentation

Figure 2 Market: Research Design

Figure 3 Bottom-Up Approach to Arrive at the Market Size

Figure 4 Top-Down Approach to Arrive at the Market Size

Figure 5 Data Triangulation

Figure 6 Assumptions of the Research Study

Figure 7 Market Segmentation

Figure 8 Market Snapshot (2016 vs 2022): Electric Locomotives Held the Largest Size of the Market in 2016

Figure 9 Market for Traction Transformers Mounted in Machine Rooms I Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 10 Market for 25kv AC Overhead Line Voltage Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 11 APAC Captured the Largest Market Share in 2016

Figure 12 Attractive Growth Opportunities in the Market Between 2016 and 2022

Figure 13 Market for Electric Locomotives Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 14 Underframe Traction Transformers Accounted for A Major Market Share in 2016

Figure 15 AC Overhead Line Voltage Segment Held the Largest Share of the Market in 2016

Figure 16 Freight Locomotives Captured the Largest Share of the Market in 2016

Figure 17 China Held the Largest Share of the Market in 2016

Figure 18 Market, By Geography

Figure 19 DROC: Traction Transformer Market, 2016

Figure 20 Value Chain Analysis: Major Value is Added During the Manufacturing and Assembly Phase

Figure 21 Market: Porter’s Five Forces Analysis

Figure 22 Bargaining Power of Suppliers Expected to Have A High Impact on the Market

Figure 23 High Quality of Raw Materials to Have A Significant Impact on Bargaining Power of Suppliers

Figure 24 Moderate Switching Cost of Buyers’ to Have A Medium Impact on Bargaining Power of Buyers

Figure 25 Low Growth Rate of the Market to Have A Low Impact on Threat of New Entrants

Figure 26 No Direct Substitute Leading to Low Impact of Threat of Substitutes on the Market

Figure 27 Moderate Technology Differentiation Leading to Medium Impact of Competition

Figure 28 Market Segmentation, By Rolling Stock

Figure 29 Freight Locomotives to H0ld the Largest Share of the Market for Electric Locomotives During the Forecast Period

Figure 30 APAC Expected to Witness the Highest Growth in the Market for Freight Locomotives Between 2016 and 2022

Figure 31 APAC to Hold the Largest Share of the Market for High-Speed Trains Between 2016 and 2022

Figure 32 North America to Witness the Highest Growth Rate in the Market for Metros Between 2016 and 2022

Figure 33 Market Segmentation, By Mounting Position

Figure 34 Underframe Mounting Position Expected to Hold the Largest Size of the Market Between 2016 and 2022

Figure 35 Market Segmentation, By Overhead Line Voltage

Figure 36 Market for AC Overhead Line to Be the Largest and Fastest-Growing Between 2016 and 2022

Figure 37 Market Segmentation, By AC Overhead Line Voltage

Figure 38 Market Segmentation, By DC Overhead Line Voltage

Figure 39 Market in the U.K. to Grow at the Highest Rate During the Forecast Period

Figure 40 North America: Market Snapshot

Figure 41 U.S. to Witness Higher Growth Rate in the North American Traction Transformer Market for Passenger Locomotives During the Forecast Period

Figure 42 Europe: Traction Transformer Market Snapshot

Figure 43 Russia Expected to Hold the Largest Share of the Market in Europe Between 2016 and 2022

Figure 44 Spain to Witness the Highest Growth Rate in the Market for Passenger Locomotives in Europe Between 2016 and 2022

Figure 45 APAC: Market Snapshot

Figure 46 China to Hold the Largest Share of the Market in APAC During the Forecast Period

Figure 47 India to Grow at the Highest CAGR in the Market for Passenger Locomotives in APAC Between 2016 and 2022

Figure 48 Middle East & Africa to Hold the Largest Share of the Market in RoW Between 2016 and 2022

Figure 49 RoW: Market Snapshot

Figure 50 Companies Adopted Contracts as the Key Growth Strategy Between 2014 and 2016

Figure 51 Battle for Market Share: Contracts Was the Key Strategy Adopted Between 2014 and 2016

Figure 52 Geographic Revenue Mix of Top Players

Figure 53 ABB Ltd.: Company Snapshot

Figure 54 ABB Ltd.: SWOT Analysis

Figure 55 Alstom SA: Company Snapshot

Figure 56 Alstom SA: SWOT Analysis

Figure 57 JST Transformateurs: SWOT Analysis

Figure 58 Mitsubishi Electric Corporation: Company Snapshot

Figure 59 Mitsubishi Electric Corporation: SWOT Analysis

Figure 60 Siemens AG: Company Snapshot

Figure 61 Siemens AG: SWOT Analysis

Figure 62 EMCO Limited: Company Snapshot

Figure 63 Hind Rectifiers Limited: Company Snapshot

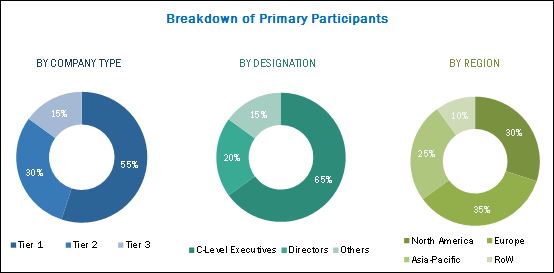

The research methodology used to estimate and forecast the traction transformer market begins with obtaining data on key vendor revenues through secondary research such as Association of the European Railway Industry (UNIFE), International Union of Public Transport (UITP), International Union of Railways (UIC), Railway Industry Association (FIF), Community of European Railway & Infrastructure Companies (CER), Railway Industry Association (RIA), National Association of Railway Transport (ANTF) (U.S.), and leading players’ annual reports and whitepapers. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the global traction transformer market from the revenue of key players. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have then been verified through primary research by conducting extensive interviews of people holding key positions in the industry such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primaries has been depicted in the figure given below.

To know about the assumptions considered for the study, download the pdf brochure

The traction transformer ecosystem comprises component providers, OEMs, system integrators, train manufacturers, and rail network operators. The players involved in the development of traction transformer include ABB Ltd. (Switzerland), Alstom SA (France), Siemens AG (Germany), Mitsubishi Electric Corporation (Japan), and JST Transformateurs (France), among others. The BS EN 50163: 2004, IEC 60850:2014, IEC 60310, and International Railway Industry Standard (IRIS) are among the major regulatory standards for the traction transformers.

Target Audience of the Report:

- Government bodies, venture capitalists, and private equity firms

- Manufacturers of components such as traction motors, drives, rectifiers, and other instruments

- Rolling stock manufacturers

- Rolling stock maintenance companies

- Rail network operators

- Research institutes, associations, and organizations

- Traction transformer manufacturers

This study answers several questions for the stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.

Scope of the Report:

In this research report, the global traction transformer market has been segmented on the basis of rolling stock, mounting position, overhead line voltage, and geography.

Traction Transformer Market, by Rolling Stock:

-

Electric Locomotives

- Freight Locomotives

- Passenger Locomotives

- High-speed Trains

- Metros

Traction Transformer Market, by Mounting Position:

- Underframe

- Machine Room

- Roof

Traction Transformer Market, by Overhead Line Voltage:

-

AC

- 1.2 KV

- 15 KV

- 20 KV

- 25KV

-

DC

- 0.75 KV

- 1.5KV

- 3 KV

Traction Transformer Market, by Geography:

- North America

- Europe

- Asia-Pacific (APAC)

- Rest of the World (RoW)

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companies’ specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

- Detailed analysis of electric multiple units (EMUs)

Growth opportunities and latent adjacency in Traction Transformer Market