Train Control and Management System Market by Solution (PTC, CBTC, & Integrated Train Control), Component (Vehicle Control Unit, Communication Gateway, & HMI), Connectivity (GSM-R, Wi-Fi, TETRA), Train Type (EMU, DMU, Metro & High Speed) & Region - Forecast to 2022

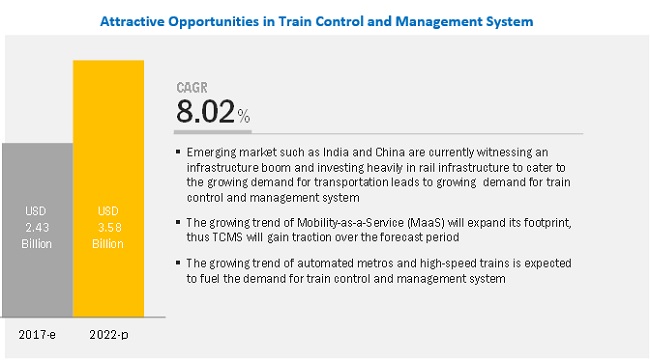

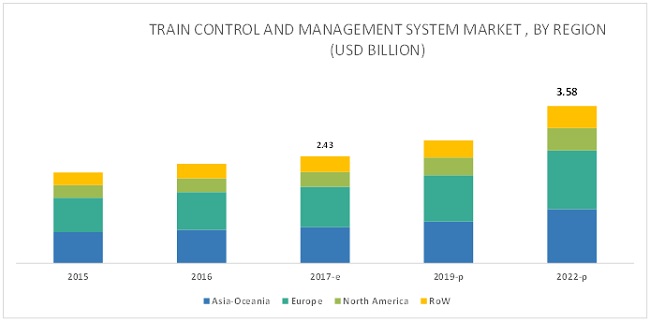

The Train Control and Management System (TCMS) market is estimated to be USD 2.26 billion in 2016 and is projected to reach USD 3.58 billion by 2022, at a CAGR of 8.02%. Public transportation offers a range of benefits over private conveyance such as fluctuating fuel prices, traffic congestion, and greenhouse gas emissions. This leads to the increasing demand for high-speed rail transit network which is estimated to boost the market for TCMS. The TCMS market is driven by the factors such as growing urbanization and population in developing countries such as India and China and increasing availability of high-speed communication systems. Furthermore, TCMS increases the efficiency and reliability of trains and shortens their response time by automating the operations of the train & its subsystem and passenger safety. These factors are estimated to drive the global TCMS market.

“Metros & high-speed trains to witness the fastest growth during the forecast period”

The market for metros & high-speed trains is projected to grow at the highest CAGR, in terms of value, during the forecast period. The increasing government initiatives to enhance high-speed rail network and fulfill the transportation gap in countries such as the UK, France, India, China, and South Korea are expected to drive the metros & high-speed trains segment in the TCMS market.

“Vehicle control unit is expected to be the largest market segment in the Train Control and Management System (TCMS) market”

The vehicle control unit is the most expensive component of TCMS. Thus, the vehicle control unit is estimated to be the largest segment in the TCMS market, by component. The growth of this segment can be attributed to the high installation rate of TCMS in developed regions and the increasing penetration in developing regions.

“Communication-Based Train Control (CBTC) is expected to be the largest market segment in the train control solution market.”

The Communication-Based Train Control (CBTC) segment is estimated to account for the largest share of the global train control solution market during the forecast period, owing to the growing demand in European countries such as the UK, France, Germany, and Spain. CBTC eliminates additional maintenance costs as physical vehicle detection systems such as track circuits are not required. CBTC also increases the turnaround time of vehicles.

Market Dynamics

Drivers

Population growth & urbanization

According to a study by the United Nations Population Fund, nearly 66% of the global population will reside in urban areas by 2050. Increasing urbanization triggers traffic congestion and increased demand for public transport. The trend of urbanization is strong in China, India, and the developing countries of Africa and Latin America. Rail transport is a viable alternative to road or air transportation. Rail transportation is an efficient mobility solution for urban and interurban transportation systems, given the increasing demand for passenger comfort and environmental concerns. The increasing urbanization has created the need to connect large cities to smaller cities by extending transportation networks.

Stringent emission norms

Some of the key environmental concerns around the globe include greenhouse gas emissions, the impact of air pollution on public health, and climate change. Rail transportation offers higher performance levels in terms of emission than other methods of transportation. Environmental norms and regulations are being made increasingly stringent in mature markets such as Europe, and emerging countries are gradually implementing rigid emission norms. The global railway sector has set ambitious targets for energy consumption and CO2 emissions for 2030 and 2050

Restraints

High infrastructural and maintenance costs

Major costs incurred for rail infrastructure include capital and maintenance costs for track, engineering structures such as bridges and tunnels, train signaling, communication systems, power supply in electrified sections, and terminal infrastructure. These infrastructural costs, coupled with the costs associated with equipment, land acquisition, and financing, act as a restraint for the rolling stock market.

Lack of interoperability

The interoperability of the train control and management system facilitates communication between different trains from different regions. Each national rail network has established different technical specifications for rail infrastructure. Gauge widths, electrification standards, and safety and signaling systems differ according to the country. The varying technical specifications increase the cost of running trains from one country to another.

Opportunities

Increasing demand for train control & management systems in emerging markets

Emerging markets such as India and China are currently witnessing an infrastructure boom. Governments and private sector players are investing heavily in rail infrastructure to cater to the growing demand for transportation. The demand for high-speed trains and rapid transit is on the rise in Asia and the Middle East. Train control and management systems and train control solutions play a crucial role in high-speed trains as well as interurban and rapid transit. The growing demand for rapid transit vehicles is therefore expected to propel the growth of the train control and management system market.

Challenges

Integration of new train control systems

Integrating new train control systems in existing infrastructure is difficult, and installing new systems is expensive. The Association of American Railroads has estimated that the total cost of the development and deployment of positive train control in freight railroads is well over USD 10 billion. An additional million dollars is needed each year to maintain the positive train control system. The adoption and implementation of CBTC is hampered by incompatibility and lack of interoperability with the existing rail infrastructure.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2022 |

|

Base Year Considered |

2016 |

|

Forecast Period |

2018–2022 |

|

Forecast Units |

Value (USD billion) |

|

Segments Covered |

By Train Type, Component, Connectivity, Train Control Solutions Market, By Region |

|

Geographies Covered |

Asia Oceania, Europe, North America, and RoW |

|

Companies Covered |

The key players in the Train Control and Management System Market, Bombardier Inc. (Canada), Siemens AG (Germany), Toshiba Corporation (Japan), Mitsubishi Electric Corporation (Japan), Hitachi Ltd. (Japan), Knorr-Bremse AG (Germany), ALSTOM SA (France), CAF GROUP (Spain), ABB (Switzerland), Thales Group (France), ASELSAN A.ª (Turkey) the report covered 20 major players. |

This research report categorizes the Train Control and Management System Market based on train type, component, connectivity, Train Control Solutions Market and region.

By Train Type

- Metros & High-Speed Trains

- Electric Multiple Units

- Diesel Multiple Units

By Component

- Vehicle Control Unit

- Mobile Communication Gateway

- Human Machine Interface

- Others

By Connectivity

- GSM-R

- Wi-Fi

- TETRA

- Others

Train Control Solutions Market

- Positive Train Control

- Communication-Based Train Control

- Integrated Train Control

By Region

- Asia-Oceania

- Europe

- North America

- Rest of the World

Key Market Players

These include Bombardier Inc. (Canada), Siemens AG (Germany), Toshiba Corporation (Japan), Mitsubishi Electric Corporation (Japan), Hitachi Ltd. (Japan), Knorr-Bremse AG (Germany), ALSTOM SA (France), CAF GROUP (Spain), ABB (Switzerland), Thales Group (France), ASELSAN A.ª (Turkey), DEUTA-WERKE GmbH (Germany), Rockwell Collins (USA), and MEN Mikro Elektronik GmbH (Germany), Eke Group (Finland), Strukton Rail (Netherland), CRSC (China), HUBER+SUHNER (Denmark), Wabtec Corporation (USA), Quester Tangent (Canada), Medha Servo Drives Private Limited (India), UniControls a.s. (US), Leroy Automation (France), Amaronia Rail Ltd. (Finland), and Tech Mahindra (India).

Recent Developments

- In 2015, Hitachi Ltd. acquired AnsaldoBreda S.p.A. (Italy). This strategic acquisition enabled Hitachi to strengthen its position in the signaling and traffic management system markets.

- In 2017, Thales Group received a contract from Gülermark-Kolin- a joint venture formed for Baºkentray project, to modernize the high-speed line between Ankara and Istanbul with advanced systems such as ETCS, electronic interlocking systems, and centralized traffic control system.

- In July 2017, Alstom SA announced to develop and design operational traffic management tool with SNCF Réseau- France based Railway Company for connecting railway network of countries such Lyon, Paris, and Marseille

- In January 2016, Alstom SA signed a supply agreement with India's Kochi Metro Rail (KMRL) to supply 25 Made in India coaches. Alstom is supplying an initial fleet of 25 three-car metropolis trainsets to KMRL under an USD 90 million contract awarded in October 2014, which also includes options for up to 25 additional trainsets

Key Questions addressed by the report

- What are the upcoming technologies, and new product launches in the global TCMS market?

- How will government regulations impact the Train Control and Management System market globally?

- What would be the share of different type of train in global market?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per company-specific needs. The following customization options are available for this report:

By Services (Installation Services And Maintenance Services), By Region

- Asia Oceania

- Europe

- North America

- Row

Train Control Systems Components Connectivity Market, By Country

- China

- Japan

- South Korea

- US

- Canada

- UK

- Germany

- France

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.3 Data From Secondary Sources

2.4 Primary Data

2.4.1 Sampling Techniques & Data Collection Methods

2.4.2 Primary Participants

2.5 Factor Analysis

2.5.1 Demand-Side Analysis

2.5.1.1 Infrastructure: Rail Network

2.5.1.2 High-Speed Rail Network Between Major Countries

2.5.2 Supply-Side Analysis

2.5.2.1 Technological Advancements

2.6 Market Size Estimation

2.6.1 Bottom-Up Approach

2.6.2 Top-Down Approach

2.7 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities in Train Control and Management System Market

4.2 Market, By Train Type

4.3 Market, By Component

4.4 Market, By Connectivity

4.5 Market, By Region & Train Control Solution

4.6 Market Growth Trends, By Country

5 Recommendation (Page No. - 41)

6 Market Overview (Page No. - 41)

6.1 Introduction

6.2 Market Segmentation

6.2.1 Market Segmentation: Train Control & Management System

6.3 Market Dynamics

6.3.1 Drivers

6.3.1.1 Population Growth & Urbanization to Fuel the Advancements in the Rail Industry

6.3.1.2 Availability of High-Speed Communication Systems

6.3.1.3 Development of Light Rail Transit

6.3.2 Restraints

6.3.2.1 High Infrastructural & Maintenance Costs

6.3.2.2 Lack of Interoperability

6.3.3 Opportunities

6.3.3.1 Increasing Demand for TCMS-Equipped Rolling Stocks in Emerging Markets

6.3.3.2 Mobility-As-A-Service

6.3.4 Challenges

6.3.4.1 Integration of New Train Control Systems

6.4 Revenue Shift for Train Control System Manufacturers

6.5 Train Control System Market, Scenario (2015-2022)

6.5.1 Train Control System Market, Most Likely Scenario

6.5.1 Train Control System Market, Optimistic Scenario

6.5.1 Train Control System Market, Pessimistic Scenario

6.5 Avergae Selling Price (ASP) Analysis

7 TCMS Market, By Train Type & Region (Page No. - 49)

7.1 Introduction

7.1.1 Research Methodology

7.1.2 Assumptions

7.1.3 Primary Insights

7.1.4 Operational Data

7.2 Asia Oceania

7.2.1 Upcoming Rapid Transit Projects in Asia-Oceania

7.2.2 Asia Oceania TCMS Market, By Country

7.2.3 Asia Oceania TCMS Market, By Train Type

7.2.3.1 Asia Oceania: Metros & High Speed Train TCMS Market, By Country

7.2.3.2 Asia Oceania: EMU TCMS Market, By Country

7.2.3.3 Asia Oceania:DMU TCMS Market, By Country

7.3 Europe

7.3.1 Upcoming Rapid Transit Projects in Europe

7.3.2 Europe TCMS Market, By Country

7.3.3 Europe TCMS Market, By Train Type

7.3.3.1 Europe Metros & High Speed Trains TCMS Market, By Country

7.3.3.2 Europe: EMU TCMS Market, By Country

7.3.3.3 Europe:DMU TCMS Market, By Country

7.4 North America

7.4.1 Upcoming Rapid Transit Projects in North America

7.4.2 North America TCMS Market, By Country

7.4.3 North America TCMS Market, By Train Type

7.4.3.1 North America: Metro & High Speed Trains TCMS Market By Country

7.4.3.2 North America: EMC TCMS Market, By Country

7.4.3.3 North America: DMU TCMS Market, By Country

7.5 RoW

7.5.1 Upcoming Rapid Transit Projects in Rest of the World

7.5.2 RoW TCMS Market, By Country

7.5.3 RoW TCMS Market, By Train Type

7.5.3.1 RoW: Metros & High Speed Trains TCMS Market, By Country

7.5.3.2 RoW: EMU TCMS Market, By Country

7.5.3.3 RoW: DMU TCMS Market, By Country

8 TCMS Market, By Component & Region (Page No. - 82)

8.1 Introduction

8.1.1 Research Methodology

8.1.2 Assumptions

8.1.3 Primary Insights

8.1.4 Operational Data

8.2 TCMS Component Market, By Region

8.3 TCMS Market, By Component

8.3.1 Vehicle Control Unit Market, By Region

8.3.2 Mobile Communication Gateway Market, By Region

8.3.3 Human Machine Interface Market, By Region

8.3.4 Others Market, By Region

9 TCMS Market, By Connectivity & Region (Page No. - 89)

9.1 Introduction

9.1.1 Research Methodology

9.1.2 Assumptions

9.1.3 Primary Insights

8.1.4 Operational Data

9.2 TCMS Connectivity Market, By Region

9.3 TCMS Market, By Connectivity

9.3.1 GSM-R Market, By Region

9.3.2 Trans-European Trunked Radio (TETRA), By Region

9.3.3 Wi-Fi Market, By Region

9.3.4 Others Market, By Region

10 Train Control Solution Market, By Type & Region (Page No. - 95)

10.1 Introduction

10.1.1 Research Methodology

10.1.2 Assumptions

10.1.3 Primary Insights

10.1.4 Operational Data

10.2 TCMS Solution Market, By Region

10.3 TCMS Market, By Solution Type

10.3.1 Communication-Based Train Control (CBTC) Market, By Region

10.3.1.1 Market for Asia Oceania, By Country

10.3.1.2 Market for Europe, By Country

10.3.1.3 Market for North America, By Country

103.1.4 Market for the Rest of the World (RoW), By Country

10.3.2 Positive Train Control (PTC) Market, By Region

10.3.2.1 Market for Asia Oceania, By Country

10.3.2.2 Market for Europe, By Country

10.3.2.3 Market for North America, By Country

10.3.2.4 Market for the Rest of the World (RoW), By Country

10.3.3 Integrated Train Control (ITC) Market, By Region

10.3.3.1 Market for Asia Oceania, By Country

10.3.3.2 Market for Europe, By Country

10.3.3.3 Market for North America, By Country

10.3.3.4 Market for the Rest of the World (RoW), By Country

11 Competitive Landscape (Page No. - 106)

11.1 Introduction

11.1.1 Visionary Leaders

11.1.2 Innovators

11.1.3 Dynamic Differentiators

11.1.4 Emerging Companies

11.2 TCMS Market: Strength of Product Portfolio

11.3 TCMS Market: Business Strategy Excellence

*Top 25 Companies Analyzed for This Study are – Alstom, Knorr Bremse AG, Bombardier, Siemens AG, Toshiba Corporation, CAF, Mitsubishi Electric Corporation, Strukton, EKE Finance LTD., Quester Tangent, Aselsan A. S., China Railway Signal & Communication Corporation Limited (CRSC), Hitachi LTD., ABB, Thales Group, Medha Servo Drives Private LTD., Leroy Automation, Unicontrols, Huber + Suhner, Deuta-Werke GmbH, Tech Mahindra, Men Mikro Elektronik Sas, Wabtec Corporation, Amaronia Rail LTD., Rockwell Collins, Inc.

11.4 Market Share Analysis

12 Company Profiles (Page No. - 111)

(Business Overview, Strength of Product Portfolio, Products Offered, Business Strategy Excellence & Recent Developments)*

12.1 Bombardier

12.1.1 Business Overview

12.1.2 Product Portfolio

12.1.3 Recent Developments

12.1.3 SWOT Analysis

12.2 Siemens AG

12.2.1 Business Overview

12.2.2 Product Portfolio

12.2.3 Recent Developments

12.2.3 SWOT Analysis

12.3 Toshiba Corporation

12.3.1 Business Overview

12.3.2 Product Portfolio

12.3.3 Recent Developments

12.3.3 SWOT Analysis

12.4 Mitsubishi Electric Corporation

12.4.1 Business Overview

12.4.2 Product Portfolio

12.4.3 Recent Developments

12.4.3 SWOT Analysis

12.5 Hitachi Limited

12.5.1 Business Overview

12.5.2 Product Portfolio

12.5.3 Recent Developments

12.5.3 SWOT Analysis

12.6 Knorr-Bremse AG

12.6.1 Business Overview

12.6.2 Product Portfolio

12.6.3 Recent Developments

12.7 EKE Finance LTD.

12.7.1 Business Overview

12.7.2 Product Portfolio

12.7.3 Recent Developments

12.8 Alstom

12.8.1 Business Overview

12.8.2 Product Portfolio

12.8.3 Recent Developments

12.9 CAF

12.9.1 Business Overview

12.9.2 Product Portfolio

12.9.3 Recent Developments

12.10 Strukton

12.10.1 Business Overview

12.10.2 Product Portfolio

12.10.3 Recent Developments

12.11 Additional Companies

12.11.1 Aselsan A.S

12.11.2 Oranjewoud NV

12.11.3 EKE-Electronics

12.11.4 Strukton Rail

12.12 Additional Companies

12.12.1 Asia Oceania

12.12.1.1 China Railway Signal & Communication Corporation Limited (CRSC)

12.12.2 Europe

12.12.2.1 ABB.

12.12.2.2 Thales Group.

12.12.3 North America

12.12.3.1 Quester Tangent.

*Details on Business Overview, Strength of Product Portfolio, Products Offered, Business Strategy Excellence & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 162)

13.1 Insights of Industry Experts

13.2 Other Developments, 2013–2017

13.3 Discussion Guide

13.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.5 Introducing RT: Real Time Market Intelligence

13.6 Available Customization

13.6.1 TCMS Market By Services (Installation Services and Maintenance Services), By Region

13.6.1.1 Asia Oceania

13.6.1.2 Europe

13.6.1.3 North America

13.6.1.4 RoW

13.6.2 TCMS Components Connectivity Market, By Country

13.6.2.1 China

13.6.2.2 Japan

13.6.2.3 South Korea

13.6.2.4 US

13.6.2.5 Canada

13.6.2.6 UK

13.6.2.7 Germany

13.6.2.8 France

13.7 Related Reports

13.8 Author Details

List of Tables (104 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 Train Control System Market (Most Likely), By Region,2015–2022 (USD Million)

Table 3 Train Control System Market (Optimistic), By Region,2015–2022 (USD Million)

Table 4 Train Control System Market (Pessimistic), By Region,2015–2022 (USD Million)

Table 5 Avergae Selling Price (ASP), 2015–2022

Table 6 Opertaional Data

Table 7 Train Control & Management System Market, By Region, 2015–2022 (Units)

Table 8 Train Control & Management System Market, By Region, 2015–2022 (USD Million)

Table 9 Proposed Rapid Transit Projects in Asia-Oceania

Table 10 Asia Oceania TCMS Market, By Country, 2015–2022 (Units)

Table 11 Market, By Country, 2015–2022 (USD Million)

Table 12 Market, By Train Type, 2015–2022 (Units)

Table 13 Market, By Train Type, 2015–2022 (USD Million)

Table 14 Asia Oceania: Metros & High Speed Train TCMS Market, By Country, 2015-2022 (Units)

Table 15 Asia Oceania:Metros & High Speed Trains TCMS Market, By Country, 2015–2022 (USD Million)

Table 16 Asia Oceania EMU TCMS Market, By Country, 2015–2022 (Units)

Table 17 Market, By Country, 2015–2022 (USD Million)

Table 18 Market, By Country, 2015–2022 (Units)

Table 19 Asia Oceania DMU TCMS Market, By Country, 2015–2022 (USD Million)

Table 20 Proposed Rapid Transit Projects in Europe

Table 21 Europe TCMS Market, By Country, 2015–2022 (Units)

Table 22 Market, By Country, 2015–2022 (USD Million)

Table 23 Market, By Train Type, 2015–2022 (Units)

Table 24 Europe TCMS Market, By Train Type, 2015–2022 (USD Million)

Table 25 Europe Metros & High Speed Trains TCMS Market, By Country, 2015–2022 (Units)

Table 26 Europe Metros & High Speed Trains TCMS Market, By Country, 2015–2022 (USD Million)

Table 27 Europe EMU TCMS Market, By Country, 2015–2022 (Units)

Table 28 Europe EMU TCMS Market, By Country, 2015–2022 (USD Million)

Table 29 Europe DMU TCMS Market, By Country, 2015–2022 (Units)

Table 30 Europe DMU TCMS Market, By Country, 2015–2022 (USD Million)

Table 31 Proposed Rapid Transit Projects in North America

Table 32 North America TCMS Market, By Country, 2015–2022 (Units)

Table 33 North America TCMS Market, By Country, 2015–2022 (USD Million)

Table 34 North America TCMS Market, By Train Type, 2015–2022 (Units)

Table 35 North America TCMS Market, By Train Type, 2015–2022 (USD Million)

Table 36 North America Metros & High Speed Trains TCMS Market, By Country,2015–2022 (Units)

Table 37 North America Metros & High Speed Trains TCMS Market, By Country, 2015–2022 (USD Million)

Table 38 North America EMU TCMS Market, By Country, 2015–2022 (Units)

Table 39 North America EMU TCMS Market, By Country, 2015–2022 (USD Million)

Table 40 North America DMU TCMS Market, By Country, 2015–2022 (Units)

Table 41 North America DMU TCMS Market, By Country, 2015–2022 (USD Million)

Table 42 Proposed Rapid Transit Projects in Rest of the World

Table 43 RoW TCMS Market, By Country, 2015–2022 (Units)

Table 44 RoW TCMS Market, By Country, 2015–2022 (USD Million)

Table 45 RoW TCMS Market, By Train Type, 2015–2022 (Units)

Table 46 RoW TCMS Market, By Train Type, 2015–2022 (USD Million)

Table 47 RoW Metros & High Speed Trains Market, By Country, 2015–2022 (Units)

Table 48 RoW Metros & High Speed Trains TCMS Market, By Country, 2015–2022 (USD Million)

Table 49 RoW EMU TCMS Market, By Country, 2015–2022 (Units)

Table 50 RoW EMU TCMS Market, By Country, 2015–2022 (USD Million)

Table 51 RoW DMU TCMS Market, By Country, 2015–2022 (Units)

Table 52 RoW DMU TCMS Market, By Country, 2015–2022 (USD Million)

Table 53 Opertaional Data

Table 54 TCMS Component Market Size, By Region, 2015–2022 (USD Million)

Table 55 TCMS Market Size, By Component, 2015–2022 (USD Million)

Table 56 Vehicle Control Unit Market Size, By Region, 2015–2022 (USD Million)

Table 57 Mobile Communication Gateway Market Size, By Region, 2015–2022 (USD Million)

Table 58 Human Machine Interface Market Size, By Region, 2015–2022 (USD Million)

Table 59 Others Market Size, By Region, 2015–2022 (USD Million)

Table 60 Opertaional Data

Table 61 TCMS Connectivity Market Size, By Region, 2015–2022 (USD Million)

Table 62 TCMS Market Size, By Connectivity, 2015-2022 (USD Million)

Table 63 GSM-R: Market Size, By Region, 2015–2022 (USD Million)

Table 64 TETRA: Market Size, By Region, 2015–2022 (USD Million)

Table 65 Wi-Fi: Market Size, By Region, 2015–2022 (USD Million)

Table 66 Others: Market Size, By Region, 2015–2022 (USD Million)

Table 67 Opertaional Data

Table 68 TCMS Solution Market Sze, By Region, 2015–2022 (USD Million)

Table 69 TCMS Market Size, By Solution Type, 2015–2022 (USD Million)

Table 70 Communication-Based Train Control (CBTC) Market Size, By Region, 2015–2022 (USD Million)

Table 71 Asia-Oceania: Communication-Based Train Control (CBTC) Market Size, By Country, 2015–2022 (USD Million)

Table 72 Europe: Communication-Based Train Control (CBTC) Market Size, By Country, 2015–2022 (USD Million)

Table 73 North America: Communication-Based Train Control (CBTC) Market Size, By Country, 2015–2022 (USD Million)

Table 74 Rest of the World (RoW): Communication-Based Train Control (CBTC) Market Size, By Country, 2015–2022 (USD Million)

Table 75 Positive Train Control (PTC) Market Size, By Region, 2015–2022 (USD Million)

Table 76 Asia-Oceania: Positive Train Control (PTC) Market Size, By Country, 2015–2022 (USD Million)

Table 77 Europe: Positive Train Control (PTC) Market Size, By Country, 2015–2022 (USD Million)

Table 78 North America: Positive Train Control (PTC) Market Size, By Country, 2015–2022 (USD Million)

Table 79 Rest of the World (RoW): Positive Train Control (PTC) Market Size, By Country, 2015–2022 (USD Million)

Table 80 Integrated Train Control (ITC) Market Size, By Region, 2015–2022 (USD Million)

Table 81 Asia-Oceania: Integrated Train Control (ITC) Market Size, By Country, 2015–2022 (USD Million)

Table 82 Europe: Integrated Train Control (ITC) Market Size, By Country, 2015–2022 (USD Million)

Table 83 North America: Integrated Train Control (ITC) Market Size, By Country, 2015–2022 (USD Million)

Table 84 Rest of the World (RoW): Integrated Train Control (ITC) Market Size, By Country, 2015–2022 (USD Million)

Table 84 Organic Developments

Table 86 Inorganic Developments

Table 87 Organic Developments

Table 88 Inorganic Developments

Table 89 Organic Developments

Table 90 Inorganic Developments

Table 91 Organic Developments

Table 92 Inorganic Developments

Table 93 Organic Developments

Table 94 Inorganic Developments

Table 95 Organic Developments

Table 96 Inorganic Developments

Table 97 Organic Developments

Table 98 Inorganic Developments

Table 99 Organic Developments

Table 100 Inorganic Developments

Table 101 Organic Developments

Table 102 Inorganic Developments

Table 103 Organic Developments

Table 104 Inorganic Developments

List of Figures (45 Figures)

Figure 1 Train Control & Management System (TCMS) Market Segmentation

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Global Rail Network, By Key Countries (Km), 2015

Figure 6 Global High-Speed Rail Network, By Key Countries (Km), 2015

Figure 7 Data Triangulation

Figure 8 Market Size Estimation: Bottom-Up Approach

Figure 9 Market Size Estimation: Top-Down Approach

Figure 10 Train Control & Management System Market, By Region, 2017 vs 2022 (USD Million)

Figure 11 Market, By Component, 2017 vs 2022 (USD Million)

Figure 12 Train Control Solution Market, By Type, 2017 vs 2022 (USD Billion)

Figure 13 Mobile Communication Gateway Market, By Connectivity, 2017 vs 2022 (USD Million)

Figure 14 Market, By Train Type, 2017 vs 2022 (USD Billion)

Figure 15 Market, By Region, 2017–2022

Figure 16 Market, 2017 vs 2022 (USD Billion)

Figure 17 Metro & High-Speed Trains to Be the Largest & Fastest Markets for TCMS, By Train Type, 2017 vs 2022 (USD Million)

Figure 18 Vehicle Control Unit to Be the Largest Segment in TCMS Market, By Component, 2017

Figure 19 Upcoming Technologies Such as Satellite & Lte-R to Be the Fastest Market Segments, By Connectivity, in the TCMS Market, 2017–2022

Figure 20 Europe to Be the Largest Market for Train Control Solutions & Communication-Based Train Control (CBTC) to Be the Largest Solution Type, 2017

Figure 21 China, UAE, & France to Be the Fastest Growing Markets for TCMS, 2017–2022

Figure 22 Market: Market Dynamics

Figure 23 Urban & Rural Population of the World, 2000-2050

Figure 24 Rolling Stock Infrastructure Investments, By Key Countries, 2013–2015 (USD Billion)

Figure 25 LRT and Metro Construction of the World, 1981–2016

Figure 26 Asia Oceania: Train Control & Management System Market Snapshot

Figure 27 Europe: Train Control & Management System Market Snapshot

Figure 28 Market, By Component, 2017 vs 2022

Figure 29 Market, By Connectivity, 2017 vs 2022 (USD Million)

Figure 30 Market, By Solution Type, 2017 vs 2022 (USD Million)

Figure 31 Train Control and Management System Market: Competitive Leadership Mapping

Figure 32 Train Control and Management System Market Share Analysis, 2016

Figure 33 Bombardier: Company Snapshot

Figure 34 Siemens AG: Company Snapshot

Figure 35 Toshiba Corporation: Company Snapshot

Figure 36 Mitsubishi Electric Corporation: Company Snapshot

Figure 37 Hitachi Limited: Company Snapshot

Figure 38 Knorr-Bremse AG: Company Snapshot

Figure 39 Alstom: Company Snapshot

Figure 40 CAF: Company Snapshot

Figure 41 Strukton: Company Snapshot

Figure 42 ABB: Company Snapshot

Figure 43 Thales Group: Company Snapshot

Figure 44 CRSC: Company Snapshot

Figure 45 Aselsan A.S: Company Snapshot

Growth opportunities and latent adjacency in Train Control and Management System Market

Dear all, in which of your fields of train control system does the ETCS fit it – Train Control Solutions Market or Positive Train Control or Communication-Based Train Control or Integrated Train Control? Query180047242460889000637_1573815378507

I am Interested in the report. Please share the sample of the report. It seems a good report. i would like to see the level of information you covered in the report. Thanks.