Wireless Chipsets (Wi-Fi/WLAN, Wireless Display/Video (HD & WHDI), Mobile WiMAX & LTE (4G), ZigBee, 802.11, 802.15.4 & 802.16) Market in Consumer Electronics & Automation Applications, Global Forecast & Analysis (2012 – 2017)

This report, based on the extensive research study of the wireless chipsets market and the related wireless semiconductor industries, is aimed at identifying the entire market of specifically the Wi-Fi/WLAN chipsets, Wireless Display/Video chipsets, Mobile WiMAX & LTE chipsets and ZigBee chipsets in Consumer and Automation applications. The report covers the overall market and sub-segment markets through extensively detailed classifications, in terms of both - revenue and shipments.

This report is focused on giving a bird’s eye-view of the complete wireless semiconductor industry with regards to the wireless chipsets market with detailed market segmentations; combined with qualitative analysis at each and every aspect of the classifications done by special technologies, IEEE standard, form factor, design architecture, products, devices, applications, and geography. All the numbers, both - revenue & volume, at every level of detail, are forecasted till 2017 to give a glimpse of the potential revenue base in each of the wireless chipset markets.

In the aspect of the Wi-Fi/WLAN chipsets and ZigBee chipsets in all crucial digital consumer electronics and high-growth segments of automation such as home automation, building automation and industrial automation; in the aspect of relatively new & emerging Wireless Display/Video chipsets and Mobile WiMAX and LTE chipsets, the report majorly focuses on their markets in major digital consumer electronics such as smartphones, tablet PCs, laptops, and set-top boxes.

The report also focuses on a technological front, with detailed classification of each of the wireless chipset markets by IEEE standards & protocols (except LTE), special technologies in chipsets such as Low-power WLAN, HD Display & Video, Multi-mode LTE, and Dual-protocol ZigBee. The report also includes detailed market & technology roadmaps, timelines & evolution of each of the wireless chipsets & related technologies, along with a detailed Porter’s analysis of the current wireless chipset markets.

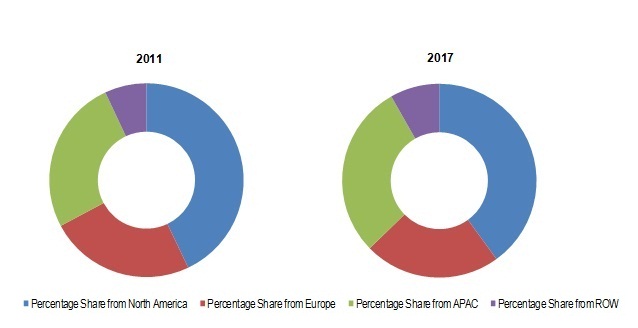

The report also focuses on various geographical markets for each of the wireless chipset markets, on the major geographical revenue bases and gives the market forecasts & estimates by major geographical regions – North America, Europe, Asia–Pacific, and Rest of the World. Each of the major geographical markets is sub-segmented for the wireless chipsets market by major countries & economies – U.S., Canada, and Mexico for North America, U.K., Germany, and France for Europe, China, India, South Korea, and Japan for Asia–Pacific, and Latin-South America and Middle East for Rest of the World.

A competitive landscape of the current market is analyzed by the market share analysis for each of the wireless chipset markets, with revenue, market shares, and market share rankings of the current key players. All the other details of the key players in the entire value chain such as key wireless products, launches, technologies, industry partners, financials, and growth strategies are discussed in the extensive company profiles section covering key chipset manufacturers, other key players in the value chain, and those of complementary technologies.

The competitive information in this report’s competitive landscape and company profiles sections include market shares of market leaders for each of the wireless chipsets, key developments, and core strategies deployed to win, mergers & acquisitions, new product developments, collaborations, ratification of standards, agreements, certifications and JVs for key players.

The report also analyzes the market by discussing the market dynamics such as its growth influencing factors, drivers, restraints, opportunities, burning issues, winning imperatives, Porter’s five forces, and other market trends. The wireless chipset prices and the price dynamics of each type of wireless chipset, in several major application segments have been discussed and analyzed in brief, with an emphasis on dynamics of price changing factors.

The entire market’s gigantic value chain is also included and all the industry segments have been entailed, with analysis of the strengths, weaknesses & dynamics of various industry segments such as EDA & Design Tool, IP & Technology Platforms, chipset component manufacturers, chipset manufacturers, direct and final product OEMs, and Assembly, Testing & Packaging along with the current trends.

In total, combining the revenue of the five major types of wireless chipsets in the research study’s scope (Wi-Fi, Wireless Display/Video, Mobile WiMAX, Mobile LTE and ZigBee) the overall wireless chipsets market revenue in consumer electronics & automation applications is expected to reach $20.4 billion, growing at a CAGR more than of 20% from 2012 to 2017. On the shipments front, the overall shipments are expected to reach 4.86 billion units by 2017, at a CAGR more than 29% from 2012 to 2017 (a higher CAGR than that of revenues, due to expected reduction in prices of chipsets).

Scope & Markets CoveredThe complete market viewed and analyzed in this report is only for ‘wireless chipsets’ in all the aspects and chapters. Under the term ‘wireless chipsets’, only four major wireless chipset groups are considered under the market scope. They are Wi-Fi/WLAN chipsets, Wireless Display/Video chipsets (all the various types in the market), Mobile WiMAX & LTE chipsets, and ZigBee chipsets. Besides, these wireless chipsets are considered in only two major application sectors – consumer electronics & automation, in the market scope.

The market scope does not include any other chipsets - wired communication & connectivity, processors (application & graphics) and any other ”standalone” wireless connectivity chipsets (GPS, NFC, GNSS, RF, NFC, GPS, GNSS, WiGig, UWB (Ultra-Wide Band), Bluetooth, etc.).

However, for combination chipsets integrated with any of the 4 major wireless technologies considered along with any other wireless technology, the overall chipsets’ price is considered for market statistics & calculations. For example, a combination chipset with GPS and Wi-Fi functionalities is considered under the market statistics of Wi-Fi chipsets, and a complex combination chipset NFC and Wireless Display/Video functionalities integrated is considered under the market for Wireless Display/Video functionalities.

In this report, the global wireless chipsets market and industry is fully segmented into the following categories and covered by the following aspects:

- Value chain & industry segments: wireless chipset industry value chain, EDA & design tool vendors, IP and technology platform vendors, chipset component manufacturers, integrated Device Manufacturers (IDMs) and Fabless players, Original Device Manufacturers (ODMs) or Chipset Manufacturers, Original Equipment Manufacturers (OEMs) or Final product manufacturers, and Assembly, Testing & Packaging (ATP) players

- Overall/Parent markets: Global Wireless Chipsets market, Global Wi-Fi/WLAN chipsets market, Global Wireless Display/Video chipsets market, Global Mobile WiMAX chipsets market, Global LTE chipsets market and Global ZigBee chipsets market

- Market by Technology: Market by IEEE standards & frequencies, Market by Form-Factor and Market by Special Chipsets

- Market by IEEE standards & frequencies: 802.11a/b/g/h, 802.11n, 802.11ac and 802.11ad for Wi-Fi/WLAN chipsets, 802.11n, 802.11ad and 802.15.3c for Wireless Display/Video chipsets, 802.16e and 802.16m for Mobile WiMAX chipsets, 802.15.4 for ZigBee chipsets

- Market by Form-Factor: System-on-Chip based Chipsets – Mobile & Tablet SoC chipsets, Other (TV, Set-top Box) SoC chipsets; IC based Chipsets – consumer & automation

- Market by Special Chipsets: Low-power and Traditional for Wi-Fi/WLAN chipsets, HD and Traditional for Wireless Display/Video chipsets, Stand-alone and Combination for Mobile WiMAX & LTE chipsets, Single-protocol and Dual/Multi-protocol for ZigBee chipsets and Single-mode and Multi-mode for LTE chipsets

- Market by Application: Market in Consumer Applications, Market in Automation Applications

- Market in Consumer Applications: Each type of wireless chipset in Desktop PCs (includes All-in-One PCs), Laptops (includes Notebooks, Notebooks and Ultra-books), Tablets (includes ‘Notes’), Smartphones (includes feature phones & PDAs), e-Book readers (includes e-paper displays), Media players (includes portable & non-portable media players), TVs (includes all television & home theatre display systems), Set-top Boxes, Cameras and Others (includes all other consumer applications)

- Market in Automation Applications: Wi-Fi/WLAN chipsets and ZigBee chipsets only, in Home Automaton, Building Automation and Industrial Automation

- Market by Geography: North America (sub-segmentation by U.S., Canada, Mexico), Europe (sub-segmentation by U.K., Germany, France and others), Asia-Pacific (sub-segmentation by China, Japan, South Korea, India and others), and Rest of the Word (sub-segmentation by Latin-South America, Middle East and others)

- Market – Competitive Landscape: Market share analysis separately for Wi-Fi/WLAN, Wireless Display/Video, Mobile WiMAX, Mobile LTE and ZigBee chipset markets

- Global wireless chipsets (Wi-Fi/WLAN, Wireless Display/Video, Mobile WiMAX & LTE and ZigBee chipsets) market statistics with detailed classifications and splits by revenue and volume

- Analysis of the global wireless chipsets market with a special focus on high growth technologies in each type of wireless chipset and fast growing market segments

- Impact analysis of the market dynamics with factors currently driving and restraining the growth of the market, along with their impact in the short, medium, and long term landscapes

- Detailed Porter’s analysis, market life cycle analysis along with technology & market roadmaps, evolution & time-lines of each type of chipset and their respective markets

- Illustrative and detailed segmentation of the global wireless chipset market by end-user verticals and applications

- Detailed segmentation of global wireless chipsets market by technology with a focus on markets of chipsets by IEEE standards, form-factor & design architecture along with evolution of chipsets by different IEEE 802 protocols

- Market forecasts of special types of chipsets such as Low-power Wi-Fi, High Definition Wireless Display/Video, Single & Multi-mode LTE chipsets, and Dual-protocol ZigBee chipsets

- Illustrative segmentation, analysis, and forecast of the major geographical markets to give an overall view of the wireless chipsets market

- The future of each type of wireless chipset market & industry from both - technical and market-oriented perspectives with techno-market oriented roadmaps till 2017

- The global consumption of each type of wireless chipset in consumer electronics and automation applications - in several application segments & products and expected consumptions & potential revenue for the next five years

- Detailed pricing & cost analysis of each type of wireless chipset, in various applications, along with future scenarios in prices and dynamics of changes in prices

- Detailed competitive landscape with identification of the key players in each type of wireless chipsets market, in-depth market share analysis with individual revenue, market shares, and market share rankings

- Competitive intelligence from the company profiles, key player strategies, game-changing developments such as product launches and acquisitions

- Complete value chain, allied industry segments & value chain analysis of the global wireless chipsets industry and their impacts on the market

Only 5 major chipsets – namely, Wi-Fi/WLAN chipsets, Wireless Display/Video, Mobile WiMAX, Mobile LTE and ZigBee chipsets are considered in this research study, to analyze markets of each of these chipsets in only two major application sectors – Consumer Electronics and Automation Applications. These five wireless chipsets which function on their respective wireless technologies are together referred to as Wireless chipsets in this research study (for convenience in this report), and the combined market is referred to as wireless chipsets market throughout the report wherever overall data/statistics are mentioned.

The overall size of the traditional and already established Wi-Fi chipsets market for all applications (including military, medical and all others along with consumer and automation) stood at roughly $2.6 billion in 2010, but with increasing penetration of Wi-Fi in all new consumer electronics, mainly into the gigantic smartphones market and exploding tablet PCs market, the overall revenue size increased by a phenomenal growth rate, to more than $4.5 billion in 2011 and is expected to cross $6 billion, by end of 2012. The overall ‘Wireless Display/Video’ chipsets market also competes in terms of growth rate with Wi-Fi chipsets market, and the market which roughly $200 million in 2008, grew to $800 million by 2011 and is expected to reach cross the one billion mark by the end of 2012.

But for Wireless Display/Video, with the technology just beginning to enter into the growth phase from its birth, it still has a long-way to go in all the above mentioned rapidly growing consumer electronic gadgets. Till 2012, they have just penetrated a established a solid base in high-end smartphones, tablets, ultra-books (covered under laptops in this report) and they are still in infant size in high-end versions of TVs (such as Smart & Intelligent TVs), set-top boxes and Cameras. By 2017, considering a commercial success of Wireless Display/Video with the features offered, and the fastest possible penetration of these chipsets in smartphones, tablets, ultra-books, TVs, set-top boxes (only for data transfer) and cameras, the percentage of Wireless Display/Video enabled devices in the categories mentioned above will still be much lesser than the percentage of traditional Wi-Fi/WLAN enabled devices in the respective device categories.

Coming to Wireless Broadband chipsets – namely ‘Mobile WiMAX’ and ‘Mobile LTE’ chipsets markets covered in this research study, Mobile WiMAX and Mobile LTE derive their roots from their parents – WiMAX and LTE wireless technologies which fall under ‘4G’ or 4th generation in cellular broadband technologies. Though the concept of 4G took birth theoretically in the world as early as 2004 when 3G technologies (such as HSPA, HSPA+ and W-CDMA) based chipsets were rapidly penetrating into several consumer electronics all across the world, the actual birth of ‘Mobile WiMAX’ and ‘Mobile LTE’ commercially, took place in 2007 and 2010 respectively.

An interesting scenario to observe is the competition between Mobile WiMAX and Mobile LTE, in turn affecting the deployment of related chipsets in consumer electronics. The overall mobile WiMAX chipsets market for all application sectors (including military, industrial and others along with consumer electronics) stood at $150 million in revenue globally in 2010, with roughly 40 million chipsets deployed across the globe. The market rose phenomenally with spread in popularity of 4G and reached a size of roughly $220 million in 2011, with roughly 250 million chipsets deployed globally; major shares into a selected few countries of North America, Latin-South America, Asia and Europe. However, before the Mobile WiMAX chipsets market could take-off for growth, the introduction of Mobile LTE in 2010, gave stiff competition mainly in the U.S. market, throughout the year 2011.

Considering the market for Mobile LTE chipsets across all applications, the overall market stood at $40 million approximately in 2010, which grew phenomenally to $100 million by 2011. With several telecom operators switching to Mobile LTE, and several smartphone & tablet manufacturers (the major OEMs in the value chain) switching to Mobile LTE chipsets from chipset manufacturers, the overall revenue of the Mobile LTE chipset market is expected to explode by the end of 2012, reaching $888 million for consumer electronics, with roughly 90 million Mobile LTE chipsets being deployed, predominantly for smartphones & tablets in 2012Q4 across the world. A major consumer in this scenario would be Apple, Inc. the world’s number one high-end smartphone manufacturer. Apple, Inc. launched in new iPhone 5 incorporating 4G LTE functionality in 2012Q4, and the sales of its iPhone 5 crossed 5 million units across the globe (mainly due to pre-sales) in the first week of its launch.

Among WPAN technologies, the fastest growing standardized WPAN technology all across the world is ‘ZigBee’. Though the concept of ZigBee technology took birth commercially in the middle of the previous decade, the technology itself evolved from the original ‘ZigBee’, to ‘ZigBee RF4CE’ in 2009 (with the merger of RF4CE technology into ZigBee in the IEEE802.15.4 standards, and later came out with two new variations, ZigBee PRO and ZigBee IP in 2010 and 2011. Originally RF4CE (Radio Frequency for Consumer Electronics) and the initial ‘ZigBee’ technology dominated the consumer electronic space, predominantly in TV and electronic remote controls. With advancements in the technological features of ZigBee in the fields of mesh networking, wireless security, data speeds and ranges, the complete ZigBee chipsets market took an upward turn in three crucial points over the time-line.

With the commercial launch of ZigBee IP, a more advanced variation, birth of huge demand for ZigBee chipsets & modules in several smart meters, alarm systems, remote control systems, lighting & heating control systems in home & building automation, and slow entry of ZigBee chipsets into industrial automation, the overall market revenue for all application sectors is expected to reach $300 million by end of 2012. GreenPeak Technologies Ltd. (The Netherlands), one of the market leaders in this market, launched the world’s first dual-protocol ZigBee chip that operates for both ZigBee PRO and ZigBee IP networks. With increasing demand in the field of home automation, wireless digital connected living rooms and smart homes, rapid deployment of ZigBee modules into several consumer electronic devices, automation products is expected over the next five years. Major revenue sources would be several economies in Asia and Europe, boosting the overall revenue across all application sectors to cross $1.5 billion by 2017, making the CAGR for this market for the period of 2012 to 2017 equal to 41.38%.

For Mobile WiMAX and LTE chipsets in the wireless broadband industry, since the scope of the application market is strictly restricted to consumer applications, chipsets in only consumer electronics are included in the market statistics and WiMAX and LTE chipsets in electronic hardware of networks, base-stations, mobile back-haul, servers, and other similar wireless infrastructure equipment (mainly Information & Communication Technology – ICT applications) are not included in the market scope. Chipsets for Fixed WiMAX, Base-station WiMAX, Fixed LTE, Military WiMAX, and other application-oriented broadband chipsets are not included in the market scope.

Further, for wireless broadband chipsets considered – Mobile WiMAX and Mobile LTE (4G), the market scope does not include any chipsets that offer wireless broadband connectivity with previous-generation wireless technologies such as stand-alone HSPA, HSPA+, UMTS, W-CDMA (3G), and GPRS/EDGE (2G) chipsets. The market scope includes wireless broadband chipsets for 4G and above generations only – thus including the wireless broadband chipsets of WiMAX-advanced and LTE-advanced technologies. However, 4G chipsets which include functionalities of WiMAX or LTE or a combination of both, along with integration of previous generation (3G or 2G) functionalities (as typically found in commercial digital electronic gadgets) are considered in the market scope.

In total, combining all the revenue mentioned above, the overall wireless chipsets market in consumer electronics & automation applications (considered for this research study) stands at the total revenue size of $5.65 billion in 2011, and is expected to grow at a healthy CAGR of 20.01% from 2012 to 2017 primarily due to steady revenue streams for all the four fast growing wireless chipset groups in consumer applications creating huge demand such as smartphones, laptops, netbooks, notebooks, ultra-book, tablets, All-in-One PCs, TVs and related display systems and set-top boxes.

Given below is an illustrative representation of the percentage split-up of the major geographies in the global wireless chipsets market in 2011 and the expected scenario in 2017.

Global Wireless Chipsets Market Revenue Shares By Geography, 2011 & 2017

Source: MarketsandMarkets Analysis

TABLE OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 ANALYST INSIGHTS

1.3 REPORT DESCRIPTION

1.4 REPORT SCOPE & MARKETS COVERED

1.5 STAKEHOLDERS

1.6 REPORT ASSUMPTIONS

1.7 RESEARCH METHODOLOGY

1.7.1 MARKET SIZE ESTIMATION

1.7.2 MARKET CRACKDOWN & DATA TRIANGULATION

1.7.3 MARKET FORECASTING MODEL

1.7.4 KEY DATA POINTS TAKEN FROM SECONDARY SOURCES

1.7.5 KEY DATA POINTS TAKEN FROM PRIMARY SOURCES

1.7.6 KEY COMPANIES OF PRIMARY RESEARCH

2 EXECUTIVE SUMMARY

3 MARKET OVERVIEW

3.1 INTRODUCTION

3.1.1 INDUSTRY SCOPE

3.1.2 OVERVIEW, HISTORY & EVOLUTION

3.2 HISTORICAL STATISTICS

3.3 DESIGN ARCHITECTURE

3.3.1 Wi-Fi/WLAN

3.3.2 MOBILE WiMAX

3.3.3 MOBILE LTE

3.3.4 ZigBee

3.4 INDUSTRY SEGMENTS AND VALUE CHAIN

3.4.1 INTELLECTUAL PROPERTY (IP) & TECHNOLOGY PLATFORM VENDORS

3.4.2 CHIPSET COMPONENT & IC MANUFACTURERS

3.4.3 CHIPSET MANUFACTURERS (ODMs)

3.4.4 OEM (DIRECT OEM & FINAL PRODUCT OEM) VENDORS

4 MARKET ANALYSIS

4.1 INTRODUCTION

4.2 MARKET STATISTICS

4.2.1 GLOBAL WIRELESS CHIPSETS MARKET

4.2.2 GLOBAL WIRELESS CONNECTIVITY CHIPSETS MARKET AND CHIPSETS INDUSTRY SEGMENTATION

4.2.3 GLOBAL Wi-Fi/WLAN CHIPSETS MARKET

4.2.4 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS MARKET

4.2.5 GLOBAL MOBILE WiMAX & LTE CHIPSETS MARKET

4.2.5.1 Global Mobile WiMAX Chipsets Market

4.2.5.2 Global Mobile LTE Chipsets Market

4.2.6 GLOBAL ZigBee CHIPSETS MARKET

4.3 MARKET DYNAMICS

4.3.1 MARKET DRIVERS

4.3.1.1 System-on-Chip & Embedded technology advancements

4.3.1.2 Launch of New Spectrums (Frequency Bands), Increasing Penetration into Emerging Economies

4.3.1.3 Explosive growth in Handheld & Portable Consumer Electronic Gadgets

4.3.1.4 Technological Advancements & Developments in IEEE protocols, Special Types of Chipsets

4.3.1.5 New Entrants in the market from related industries

4.3.2 MARKET RESTRAINTS

4.3.2.1 Unmet Needs & Issues in Technology Platforms, Intellectual Property, Licensing of Trademarked technologies

4.3.2.2 Increasing manufacturing costs with development of complex embedded chipsets

4.3.3 MARKET OPPORTUNITIES

4.3.3.1 Huge addressable markets for Combination chipsets integrating several wireless technologies

4.3.3.2 Emerging trend of Smart-Homes, Intelligent & Connected Living Rooms

4.4 BURNING ISSUES

4.4.1 HIGH FREQUENCY OF INTERNAL SUBSTITUTION FROM A TECHNOLOGICAL PERSPECTIVE

4.5 WINNING IMPERATIVES

4.5.1 FOCUS ON STRATEGIC ACQUISITIONS FOR INDUSTRY GIANTS & TIER 1 PLAYERS

4.6 PRICING AND COST ANALYSIS

4.6.1 CHIPSETS IN CONSUMER ELECTRONICS

4.6.2 CHIPSETS IN AUTOMATION APPLICATIONS

4.6.3 Wi-Fi/WLAN CHIPSETS BY APPLICATION

4.6.4 WIRELESS DISPLAY/VIDEO CHIPSETS BY APPLICATION

4.6.5 MOBILE WiMAX & LTE CHIPSETS BY APPLICATION

4.6.6 ZigBee CHIPSETS BY APPLICATION

5 INDUSTRY ANALYSIS

5.1 INTRODUCTION

5.2 PORTER’S ANALYSIS

5.2.1 Wi-Fi/WLAN CHIPSETS MARKET

5.2.1.1 Threat from New Entrants

5.2.1.2 Threat from Substitutes

5.2.1.3 Bargaining Power of Suppliers

5.2.1.4 Bargaining Power of Buyers/Customers

5.2.1.5 Degree of Competition

5.2.2 WIRELESS DISPLAY/VIDEO CHIPSETS MARKET

5.2.2.1 Threat from New Entrants

5.2.2.2 Threat from Substitutes

5.2.2.3 Bargaining Power of Suppliers

5.2.2.4 Bargaining Power of Buyers/Customers

5.2.2.5 Degree of Competition

5.2.3 MOBILE WiMAX & LTE CHIPSETS MARKET

5.2.3.1 Threat from New Entrants

5.2.3.2 Threat from Substitutes

5.2.3.3 Bargaining Power of Suppliers

5.2.3.4 Bargaining Power of Buyers/Customers

5.2.3.5 Degree of Competition

5.2.4 ZigBee CHIPSETS MARKET

5.2.4.1 Threat from New Entrants

5.2.4.2 Threat from Substitutes

5.2.4.3 Bargaining Power of Suppliers

5.2.4.4 Bargaining Power of Buyers/Customers

5.2.4.5 Degree of Competition

5.3 MARKET EVOLUTIONS & TECHNOLOGY ROADMAPS

5.3.1 Wi-Fi/WLAN CHIPSETS

5.3.1.1 Wi-Fi/WLAN Chipsets Market Life Cycle

5.3.1.2 Wi-Fi/WLAN Chipsets Technology Roadmap

5.3.2 WIRELESS DISPLAY/VIDEO CHIPSETS

5.3.2.1 Wireless Display/Video Chipsets Market Life Cycle

5.3.2.2 Wireless Display/Video Chipsets Technology Roadmap

5.3.3 WIRELESS BROADBAND CHIPSETS

5.3.3.1 WiMAX Chipsets Market Life Cycle

5.3.3.2 LTE Chipsets Market Life Cycle

5.3.3.3 Wireless Broadband Chipsets Technology Roadmap

5.3.4 ZigBee CHIPSETS

5.3.4.1 ZigBee Chipsets Market Life Cycle

5.3.4.2 ZigBee Chipsets Technology Roadmap

5.3.5 IEEE 802 PROTOCOLS EVOLUTION/TIMELINE IN CHIPSETS

6 MARKET BY TECHNOLOGY

6.1 INTRODUCTION

6.2 MARKET BY IEEE STANDARDS

6.2.1 Wi-Fi & WLAN CHIPSETS

6.2.1.1 802.11a/b/g/h

6.2.1.2 802.11n

6.2.1.3 802.11ac

6.2.1.4 802.11ad

6.2.2 WIRELESS DISPLAY/VIDEO CHIPSETS

6.2.2.1 802.11n

6.2.2.2 802.11ad

6.2.2.3 802.15.3c

6.2.3 MOBILE WiMAX CHIPSETS

6.2.3.1 802.16e

6.2.3.2 802.16m

6.2.4 ZigBee CHIPSETS

6.2.4.1 Overall 802.15.4 Chipsets

6.3 MARKET BY FORM-FACTOR

6.3.1 SYSTEM-on-CHIP (SoC)-BASED PRODUCTS

6.3.1.1 Mobile & Tablet SoC Chipsets

6.3.1.2 Other (TV, Set-top Box) SoC Chipsets

6.3.2 IC-BASED PRODUCTS

6.3.2.1 Consumer Products

6.3.2.2 Automation Products

6.4 MARKET BY SPECIAL CHIPSETS

6.4.1 Wi-Fi/WLAN

6.4.1.1 Low-Power Wi-Fi/WLAN Chipsets Market

6.4.1.2 Traditional Wi-Fi/WLAN Chipsets Market

6.4.2 WIRELESS DISPLAY/VIDEO

6.4.2.1 High-Definition Wireless Display/Video Chipsets Market

6.4.2.2 Traditional Wireless Display/Video Chipsets Market

6.4.3 WiMAX & LTE

6.4.3.1 Stand-alone Mobile WiMAX & LTE Chipsets Market

6.4.3.2 Combination Mobile WiMAX & LTE Chipsets Market

6.4.4 MOBILE LTE CHIPSETS MARKET

6.4.4.1 Single-Mode Mobile LTE Chipsets Market

6.4.4.2 Multi-Mode Mobile LTE Chipsets Market

6.4.5 ZigBee

6.4.5.1 Single-Protocol ZigBee Chipsets Market

6.4.5.2 Dual/Multi-Protocol ZigBee Chipsets Market

7 MARKET BY APPLICATION

7.1 INTRODUCTION

7.2 CONSUMER APPLICATIONS

7.2.1 DESKTOP PCs

7.2.1.1 Overall Market

7.2.1.2 By Chipset Type

7.2.2 LAPTOPS, NETBOOKS AND NOTEBOOKS

7.2.2.1 Overall Market

7.2.2.2 By Chipset Type

7.2.3 TABLET PCs

7.2.3.1 Overall Market

7.2.3.2 By Chipset Type

7.2.4 e-BOOK READERS

7.2.4.1 Overall Market

7.2.4.2 By Chipset Type

7.2.5 SMARTPHONES

7.2.5.1 Overall Market

7.2.5.2 By Chipset Type

7.2.6 MEDIA PLAYERS

7.2.6.1 Overall Market

7.2.6.2 By Chipset Type

7.2.7 TVs (& DISPLAY SYSTEMS)

7.2.7.1 Overall Market

7.2.7.2 By Chipset Type

7.2.8 SET-TOP BOXES

7.2.8.1 Overall Market

7.2.8.2 By Chipset Type

7.2.9 CAMERAS

7.2.9.1 Overall Market

7.2.9.2 By Chipset Type

7.2.10 OTHER CONSUMER ELECTRONICS

7.3 AUTOMATION APPLICATIONS

7.3.1 HOME AUTOMATION APPLICATIONS

7.3.1.1 Overall Market

7.3.1.2 By Chipset Type

7.3.2 BUILDING AUTOMATION APPLICATIONS

7.3.2.1 Overall Market

7.3.2.2 By Chipset Type

7.3.3 INDUSTRIAL AUTOMATION APPLICATIONS

7.3.3.1 Overall Market

7.3.3.2 By Chipset Type

8 GEOGRAPHIC ANALYSIS

8.1 INTRODUCTION

8.2 NORTH AMERICA

8.2.1 U.S.

8.2.2 CANADA

8.2.3 MEXICO

8.3 EUROPE

8.3.1 U.K.

8.3.2 GERMANY

8.3.3 FRANCE

8.4 APAC

8.4.1 CHINA

8.4.2 JAPAN

8.4.3 SOUTH KOREA

8.4.4 INDIA

8.5 REST OF THE WORLD

8.5.1 LATIN-SOUTH AMERICA

8.5.2 MIDDLE EAST

9 COMPETITIVE LANDSCAPE

9.1 OVERVIEW

9.2 MARKET KEY PLAYERS

9.3 MARKET SHARE ANALYSIS

9.3.1 Wi-Fi & WLAN CHIPSETS MARKET

9.3.2 WIRELESS DISPLAY/VIDEO CHIPSETS MARKET

9.3.3 MOBILE WiMAX CHIPSETS MARKET

9.3.4 MOBILE LTE CHIPSETS MARKET

9.3.5 ZigBee CHIPSETS MARKET

9.4 COMPETITIVE SITUATION & TRENDS

9.4.1 NEW PRODUCT DEVELOPMENTS & LAUNCHES

9.4.2 AGREEMENTS, PARTNERSHIPS, JOINT VENTURES & COLLABORATIONS

9.4.3 MERGERS & ACQUISITIONS

9.4.4 AWARDS, RATIFICATION OF STANDARDS, EXPANSIONS & OTHERS

10 COMPANY PROFILES (Overview, Financials, Products & Services, Strategy, and Developments)*

10.1 CHIPSET MANUFACTURERS

10.1.1 ALTAIR SEMICONDUCTOR, INC.

10.1.2 AMIMON LTD.

10.1.3 ATMEL CORPORATION

10.1.4 BROADCOM CORPORATION

10.1.5 FREESCALE SEMICONDUCTOR, INC.

10.1.6 GAINSPAN CORPORATION

10.1.7 GCT SEMICONDUTOR, INC.

10.1.8 GREENPEAK TECHNOLOGIES LTD.

10.1.9 INTEL CORPORATION

10.1.10 MARVELL TECHNOLOGY GROUP

10.1.11 QUALCOMM, INC.

10.1.12 SEQUANS COMMUNICATIONS SA

10.1.13 SILICON IMAGE, INC.

10.1.14 SILICON LABORATORIES, INC.

10.1.15 TEXAS INSTRUMENTS, INC.

10.1.16 WILOCITY LTD.

10.2 OTHER PLAYERS OF THE VALUE CHAIN

10.2.1 ENTROPIC COMMUNICATIONS, INC.

10.2.2 IMAGINATION TECHNOLOGIES GROUP PLC

10.2.3 MAVEN SYSTEMS PVT. LTD.

10.2.4 MINDSPEED TECHNOLOGIES, INC.

10.2.5 NOVATEL WIRELESS, INC.

10.2.6 PROXIM WIRELESS CORPORATION

10.2.7 VIXS SYSTEMS, INC.

10.2.8 WIRELESS MAINGATE AB

10.2.9 WISPRY, INC.

10.2.10 XILINX, INC.

10.2.11 ZIGBEE ALLIANCE

*Details on financials, product & services, strategy, and developments might not be captured in case of unlisted companies.

APPENDIX

ADDITIONAL TABLES

ADDITIONAL FIGURES

KEY SECONDARY SOURCES

RECOMMENDED READINGS

LIST OF TABLES

TABLE 1 GENERAL ASSUMPTIONS, TERMINOLOGY & APPLICATION KEY NOTES

TABLE 2 YEAR-WISE ASSUMPTIONS

TABLE 3 FORECAST ASSUMPTIONS

TABLE 4 WIRELESS CHIPSETS MARKET REVENUE, BY GEOGRAPHY, 2011 – 2017 ($MILLION) 73

TABLE 5 GLOBAL WIRELESS CHIPSETS MARKET IN CONSUMER ELECTRONICS & AUTOMATION APPLICATIONS - REVENUE SEGMENTATION (PERCENTAGE SHARES), 2011-2017

TABLE 6 GLOBAL WIRELESS CHIPSETS MARKET REVENUE IN CONSUMER AND AUTOMATION APPLICATIONS, 2008 – 2012 ($MILLION)

TABLE 7 GLOBAL WIRELESS CHIPSETS MARKET VOLUMES IN CONSUMER AND AUTOMATION APPLICATIONS, 2008 – 2012 (MILLION UNITS)

TABLE 8 GLOBAL WIRELESS CHIPSETS’ VS. GLOBAL WIRELESS CONNECTIVITY CHIPSETS’ MARKET REVENUE, 2011 – 2017 ($BILLION)

TABLE 9 GLOBAL WIRELESS CHIPSETS VS. GLOBAL WIRELESS CONNECTIVITY CHIPSETS MARKET VOLUMES, 2011 – 2017 (BILLION UNITS)

TABLE 10 MAJOR ACQUISITIONS BY LEADERS IN WIRELESS CHIPSETS INDUSTRY SINCE 2005

TABLE 11 WIRELESS CHIPSETS MARKET IN CONSUMER ELECTRONICS - COST & PRICING ANALYSIS OF VARIOUS CHIPSETS ($USD), 2011 - 2017

TABLE 12 WIRELESS CHIPSETS MARKET IN AUTOMATION APPLICATIONS - COST & PRICING ANALYSIS OF VARIOUS CHIPSETS ($USD), 2011 - 2017

TABLE 13 COST & PRICING ANALYSIS OF WI-FI/WLAN CHIPSETS IN CONSUMER ELECTRONIC PRODUCTS ($USD), 2011 - 2017

TABLE 14 COST & PRICING ANALYSIS OF WIRELESS DISPLAY/VIDEO CHIPSETS IN CONSUMER ELECTRONIC PRODUCTS ($USD), 2011 - 2017

TABLE 15 COST & PRICING ANALYSIS OF MOBILE WIMAX & LTE CHIPSETS IN CONSUMER ELECTRONIC PRODUCTS ($USD), 2011 - 2017

TABLE 16 COST & PRICING ANALYSIS OF ZIGBEE CHIPSETS IN CONSUMER ELECTRONIC PRODUCTS ($USD), 2011 - 2017

TABLE 17 GLOBAL WI-FI/WLAN CHIPSETS MARKET REVENUE SEGMENTATION BY IEEE STANDARDS (PERCENTAGE SHARES), 2011 - 2017

TABLE 18 GLOBAL WI-FI/WLAN CHIPSETS MARKET VOLUME SEGMENTATION BY IEEE STANDARDS (PERCENTAGE SHARES), 2011 - 2017

TABLE 19 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS MARKET REVENUE SEGMENTATION BY IEEE STANDARDS (PERCENTAGE SHARES), 2011 - 2017

TABLE 20 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS MARKET VOLUME SEGMENTATION, BY IEEE STANDARDS (PERCENTAGE SHARES), 2011 - 2017

TABLE 21 GLOBAL MOBILE WIMAX CHIPSETS MARKET REVENUE SEGMENTATION BY IEEE STANDARDS (PERCENTAGE SHARES), 2011 - 2017

TABLE 22 GLOBAL MOBILE WIMAX CHIPSETS MARKET VOLUME SEGMENTATION BY IEEE STANDARDS (PERCENTAGE SHARES), 2011 - 2017

TABLE 23 GLOBAL ZIGBEE CHIPSETS AND 802.15.4 CHIPSETS MARKET REVENUE (PERCENTAGE SHARES), 2011 - 2017

TABLE 24 GLOBAL ZIGBEE CHIPSETS AND 802.15.4 CHIPSETS MARKET VOLUME (PERCENTAGE SHARES), 2011 - 2017

TABLE 25 GLOBAL WIRELESS CHIPSETS MARKET REVENUE, BY PRODUCT TYPES (PERCENTAGE SHARES), 2011 - 2017

TABLE 26 GLOBAL WIRELESS CHIPSETS MARKET VOLUME, BY PRODUCT TYPES (PERCENTAGE SHARES), 2011 - 2017

TABLE 27 GLOBAL WIRELESS CHIPSETS IN SOC BASED PRODUCTS MARKET REVENUE, BY SOC TYPES (PERCENTAGE SHARES), 2011 - 2017

TABLE 28 GLOBAL WIRELESS CHIPSETS IN SOC BASED PRODUCTS MARKET VOLUME, BY SOC TYPES (PERCENTAGE SHARES), 2011 - 2017

TABLE 29 GLOBAL WIRELESS CHIPSETS IN IC BASED PRODUCTS MARKET REVENUE BY APPLICATION SECTOR (PERCENTAGE SHARES), 2011 - 2017

TABLE 30 GLOBAL WIRELESS CHIPSETS IN IC BASED PRODUCTS MARKET VOLUME BY APPLICATION SECTOR (PERCENTAGE SHARES), 2011 - 2017

TABLE 31 GLOBAL WI-FI/WLAN CHIPSETS MARKET REVENUE, BY SPECIAL CHIPSET TYPE (PERCENTAGE SHARES), 2011-2017

TABLE 32 GLOBAL WI-FI/WLAN CHIPSETS MARKET VOLUME, BY SPECIAL CHIPSET TYPE (PERCENTAGE SHARES), 2011 - 2017

TABLE 33 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS MARKET REVENUE BY SEPCIAL CHIPSET TYPE (PERCENTAGE SHARES), 2011 - 2017

TABLE 34 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS MARKET VOLUME BY SPECIAL CHIPSET TYPE (PERCENTAGE SHARES), 2011 - 2017

TABLE 35 GLOBAL MOBILE WIMAX & LTE CHIPSETS MARKET REVENUE BY SPECIAL CHIPSET TYPE (PERCENTAGE SHARES), 2011 - 2017

TABLE 36 GLOBAL MOBILE WIMAX & LTE CHIPSETS MARKET VOLUME BY SPECIAL CHIPSET TYPE (PERCENTAGE SHARES), 2011 - 2017

TABLE 37 GLOBAL MOBILE LTE CHIPSETS MARKET REVENUE SEGMENTATION BY TECHNOLOGY (PERCENTAGE SHARES), 2011 - 2017

TABLE 38 GLOBAL MOBILE LTE CHIPSETS MARKET VOLUME SEGMENTATION BY TECHNOLOGY (PERCENTAGE SHARES), 2011 - 2017

TABLE 39 GLOBAL ZIGBEE CHIPSETS MARKET REVENUE BY SPECIAL CHIPSET TYPE (PERCENTAGE SHARES), 2011-2017

TABLE 40 GLOBAL ZIGBEE CHIPSETS MARKET VOLUME BY SPECIAL CHIPSET TYPE (PERCENTAGE SHARES), 2011-2017

TABLE 41 GLOBAL WIRELESS CHIPSETS MARKET REVENUE, BY APPLICATIONS (PERCENTAGE SHARES), 2011 - 2017

TABLE 42 GLOBAL WIRELESS CHIPSETS MARKET VOLUME BY APPLICATION SECTOR (PERCENTAGE SHARES), 2011 - 2017

TABLE 43 GLOBAL WIRELESS CHIPSETS MARKET REVENUE IN CONSUMER ELECTRONICS BY APPLICATION (PERCENTAGE SHARES), 2011 - 2017

TABLE 44 GLOBAL WIRELESS CHIPSETS MARKET VOLUME IN CONSUMER ELECTRONICS BY APPLICATION (PERCENTAGE SHARES), 2011 - 2017

TABLE 45 GLOBAL WI-FI/WLAN CHIPSETS MARKET REVENUE IN CONSUMER ELECTRONICS BY APPLICATION (PERCENTAGE SHARES), 2011 - 2017

TABLE 46 GLOBAL WI-FI/WLAN CHIPSETS MARKET VOLUME IN CONSUMER ELECTRONICS BY APPLICATION (PERCENTAGE SHARES), 2011 - 2017

TABLE 47 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS MARKET REVENUE, BY APPLICATION (PERCENTAGE SHARES), 2011 - 2017

TABLE 48 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS MARKET VOLUME, BY APPLICATION (PERCENTAGE SHARES), 2011 - 2017

TABLE 49 GLOBAL MOBILE WIMAX & LTE CHIPSETS MARKET REVENUE, BY APPLICATION (PERCENTAGE SHARES),2011 - 2017

TABLE 50 GLOBAL MOBILE WIMAX & LTE CHIPSETS MARKET VOLUME, BY APPLICATION (PERCENTAGE SHARES), 2011 - 2017

TABLE 51 GLOBAL ZIGBEE CHIPSETS MARKET REVENUE IN CONSUMER ELECTRONICS, BY APPLICATION (PERCENTAGE SHARES), 2011 - 2017

TABLE 52 GLOBAL ZIGBEE CHIPSETS MARKET VOLUME IN CONSUMER ELECTRONICS BY APPLICATION (PERCENTAGE SHARES), 2011 - 2017

TABLE 53 COUNTRY-WISE MARKET SHARE IN SMARTPHONE PRODUCT SHIPMENTS TABLE 54 GLOBAL WIRELESS CHIPSETS MARKET REVENUE IN AUTOMATION BY APPLICATION (PERCENTAGE SHARES), 2011 - 2017

TABLE 55 GLOBAL WIRELESS CHIPSETS MARKET VOLUME IN AUTOMATION BY APPLICATION (PERCENTAGE SHARES), 2011 - 2017

TABLE 56 GLOBAL WI-FI/WLAN CHIPSETS MARKET REVENUE IN AUTOMATION BY APPLICATION (PERCENTAGE SHARES), 2011 - 2017

TABLE 57 GLOBAL WI-FI/WLAN CHIPSETS MARKET VOLUME IN AUTOMATION BY APPLICATION (PERCENTAGE SHARES), 2011 - 2017

TABLE 58 GLOBAL ZIGBEE CHIPSETS MARKET REVENUE IN AUTOMATION BY APPLICATION (PERCENTAGE SHARES), 2011 - 2017

TABLE 59 GLOBAL ZIGBEE CHIPSETS MARKET VOLUME IN AUTOMATION BY APPLICATION (PERCENTAGE SHARES), 2011 - 2017

TABLE 60 GLOBAL WIRELESS CHIPSETS MARKET REVENUE BY GEOGRAPHY (PERCENTAGE SHARES), 2011 - 2017

TABLE 61 GLOBAL WIRELESS CHIPSETS MARKET VOLUME BY GEOGRAPHY (PERCENTAGE SHARES), 2011 - 2017

TABLE 62 GLOBAL WI-FI/WLAN CHIPSETS MARKET REVENUE BY GEOGRAPHY (PERCENTAGE SHARES), 2011 - 2017

TABLE 63 GLOBAL WI-FI/WLAN CHIPSETS MARKET VOLUME BY GEOGRAPHY (PERCENTAGE SHARES), 2011 - 2017

TABLE 64 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS MARKET REVENUE, BY GEOGRAPHY (PERCENTAGE SHARES), 2011 - 2017

TABLE 65 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS MARKET VOLUME BY GEOGRAPHY (PERCENTAGE SHARES), 2011 - 2017

TABLE 66 GLOBAL MOBILE WIMAX & LTE CHIPSETS MARKET REVENUE BY GEOGRAPHY (PERCENTAGE SHARES), 2011 - 2017

TABLE 67 GLOBAL MOBILE WIMAX & LTE CHIPSETS MARKET VOLUME BY GEOGRAPHY (PERCENTAGE SHARES), 2011 - 2017

TABLE 68 GLOBAL ZIGBEE CHIPSETS MARKET REVENUE BY GEOGRAPHY (PERCENTAGE SHARES), 2011 - 2017

TABLE 69 GLOBAL ZIGBEE CHIPSETS MARKET VOLUME BY GEOGRAPHY (PERCENTAGE SHARES), 2011 - 2017

TABLE 70 WIRELESS CHIPSETS MARKET REVENUE IN NORTH AMERICA BY COUNTRY (PERCENTAGE SHARES), 2011 - 2017

TABLE 71 WIRELESS CHIPSETS MARKET VOLUME IN NORTH AMERICA BY COUNTRY (PERCENTAGE SHARES), 2011 - 2017

TABLE 72 WIRELESS CHIPSETS MARKET VOLUME IN EUROPE BY COUNTRY (PERCENTAGE SHARES),2011 – 2017

TABLE 73 WIRELESS CHIPSETS MARKET VOLUME IN APAC BY COUNTRY (PERCENTAGE SHARES),2011 - 2017

TABLE 74 WIRELESS CHIPSETS MARKET VOLUME IN ROW BY REGION (PERCENTAGE SHARES), 2011 - 2017

TABLE 75 GLOBAL WIRELESS CHIPSET MANUFACTURERS - KEY PLAYERS’ OVERALL REVENUE, 2010 – 2011 ($MILLION)

TABLE 76 GLOBAL WI-FI/WLAN CHIPSETS MARKET FOR CONSUMER ELECTRONICS & AUTOMATION APPLICATIONS - MARKET SHARE ANALYSIS, 2010 – 2011 ($MILLION)

TABLE 77 GLOBAL WI-FI/WLAN CHIPSET MANUFACTURERS MARKET IN CONSUMER ELECTRONICS AND AUTOMATION APPLICATIONS - MARKET SHARE RANKINGS, 2010 – 2011

TABLE 78 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS MARKET IN CONSUMER ELECTRONICS - MARKET SHARE ANALYSIS, 2010 – 2011 ($MILLION)

TABLE 79 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSET MANUFACTURERS MARKET IN CONSUMER ELECTRONICS - MARKET SHARE RANKINGS, 2010 - 2011

TABLE 80 GLOBAL MOBILE WIMAX CHIPSET MARKET IN CONSUMER ELECTRONICS - MARKET SHARE ANALYSIS, 2010 – 2011 ($MILLION)

TABLE 81 GLOBAL MOBILE WIMAX CHIPSET MANUFACTURERS IN CONSUMER ELECTRONICS - MARKET SHARE RANKINGS, 2010 – 2011

TABLE 82 GLOBAL MOBILE LTE CHIPSET MARKET IN CONSUMER ELECTRONICS - MARKET SHARE ANALYSIS, 2010 – 2011 ($MILLION)

TABLE 83 GLOBAL MOBILE LTE CHIPSET MANUFACTURERS IN CONSUMER ELECTRONICS - MARKET SHARE RANKINGS, 2010 - 2011

TABLE 84 GLOBAL ZIGBEE CHIPSETS MARKET IN CONSUMER ELECTRONICS & AUTOMATION APPLICATIONS - MARKET SHARE ANALYSIS, 2010 – 2011 ($MILLION)

TABLE 85 GLOBAL ZIGBEE CHIPSET MANUFACTURERS MARKET IN CONSUMER ELECTRONICS - MARKET SHARE RANKINGS, 2010 - 2011

TABLE 86 NEW PRODUCT DEVELOPMENTS & LAUNCHES

TABLE 87 AGREEMENTS, PARTNERSHIPS, JOINT VENTURES & COLLABORATIONS, 2009 – 2012

TABLE 88 MERGERS & ACQUISITIONS, 2010 – 2012

TABLE 89 AWARDS, RATIFICATION OF STANDARDS, EXPANSIONS & OTHERS, 2009 – 2012

TABLE 90 ATMEL CORPORATION: OVERALL REVENUE AND REVENUE FROM WIRELESS SOLUTIONS, 2009 – 2011 ($MILLION)

TABLE 91 ATMEL CORPORATION: REVENUE BY PRODUCT/BUSINESS SEGMENTS, 2009 – 2011 ($MILLION)

TABLE 92 ATMEL CORPORATION: REVENUE BY GEOGRAPHY, 2009 – 2011 ($MILLION)

TABLE 93 BROADCOM CORPORATION: OVERALL REVENUE AND REVENUE FROM WIRELESS SOLUTIONS, 2009 - 2011 ($BILLION)

TABLE 94 BROADCOM CORPORATION: REVENUE BY PRODUCT/BUSINESS SEGMENTS, 2009 – 2011 ($BILLION)

TABLE 95 BROADCOM CORPORATION: REVENUES BY GEOGRAPHY, 2009 – 2011 ($BILLION)

TABLE 96 FREESCALE SEMICONDUCTOR: OVERALL REVENUE AND REVENUE FROM WIRELESS SOLUTIONS, 2009 – 2011 ($MILLION)

TABLE 97 FREESCALE SEMICONDUCTOR: REVENUE BY PRODUCT SEGMENTS, 2009 – 2011 ($MILLION)

TABLE 98 FREESCALE SEMICONDUCTOR: REVENUES BY GEOGRAPHY, 2009 – 2011 ($MILLION)

TABLE 99 GCT SEMICONDUCTOR, INC.: OVERALL REVENUES AND REVENUE FROM WIRELESS SOLUTIONS, 2009 – 2011 ($MILLION)

TABLE 100 INTEL CORPORATION: OVERALL REVENUE AND REVENUE FROM WIRELESS SOLUTIONS, 2009 – 2011 ($BILLION)

TABLE 101 INTEL CORPORATION: REVENUE, BY OPERATING SEGMENTS, 2009 – 2011 ($MILLION)

TABLE 102 INTEL CORPORATION: REVENUE, BY GEOGRAPHY, 2009 – 2011 ($MILLION)

TABLE 103 MARVELL TECHNOLOGY GROUP: OVERALL REVENUE AND REVENUE FROM WIRELESS SOLUTIONS, 2009 – 2011 ($BILLION)

TABLE 104 MARVELL TECHNOLOGY GROUP: REVENUES BY PRODUCT/BUSINESS SEGMENTS, 2009 – 2011 ($BILLION)

TABLE 105 MARVELL TECHNOLOGY GROUP: REVENUE, BY GEOGRAPHY, 2009 – 2011 ($BILLION)

TABLE 106 QUALCOMM, INC: OVERALL REVENUE AND REVENUES FROM WIRELESS SOLUTIONS, 2009 – 2011 ($BILLION)

TABLE 107 QUALCOMM, INC: REVENUE BY PRODUCT/BUSINESS SEGMENTS, 2009 – 2011 ($BILLION)

TABLE 108 QUALCOMM, INC: REVENUE BY GEOGRAPHY, 2009 – 2011 ($BILLION)

TABLE 109 SEQUANS COMMUNICATIONS SA: OVERALL REVENUE AND REVENUE FROM WIRELESS SOLUTIONS, 2009 – 2011 ($MILLION)

TABLE 110 SEQUANS COMMUNICATIONS SA: REVENUE BY GEOGRAPHY, 2009 – 2011 ($MILLION)

TABLE 111 SILICON IMAGE, INC: OVERALL REVENUE AND REVENUE FROM WIRELESS SOLUTIONS, 2009 – 2011 ($MILLION)

TABLE 112 SILICON IMAGE, INC: REVENUE BY PRODUCT/BUSINESS SEGMENTS, 2009 – 2011 ($MILLION)

TABLE 113 SILICON IMAGE, INC: REVENUE BY GEOGRAPHY, 2009 – 2011 ($MILLION)

TABLE 114 SILICON LABORATORIES, INC: OVERALL REVENUE AND REVENUE FROM WIRELESS SOLUTIONS, 2009 – 2011 ($MILLION)

TABLE 115 SILICON LABORATORIES, INC: REVENUE BY GEOGRAPHY, 2009 – 2011 ($MILLION)

TABLE 116 TEXAS INSTRUMENTS, INC: OVERALL REVENUE & REVENUE FROM WIRELESS SOLUTIONS, 2009 – 2011 ($BILLION)

TABLE 117 TEXAS INSTRUMENTS, INC: REVENUES BY PRODUCT/BUSINESS SEGMENTS, 2009 – 2011 ($BILLION)

TABLE 118 TEXAS INSTRUMENTS, INC: REVENUE BY GEOGRAPHY, 2009 – 2011 ($BILLION)

TABLE 119 ENTROPIC COMMUNICATIONS: OVERALL REVENUES AND REVENUES FROM WIRELESS SOLUTIONS, 2009 – 2011 ($MILLION)

TABLE 120 ENTROPIC COMMUNICATIONS: REVENUE BY GEOGRAPHY, 2009 – 2011 ($MILLION)

TABLE 121 IMAGINATION TECHNOLOGIES GROUP: OVERALL REVENUE & REVENUE FROM WIRELESS SOLUTIONS, 2009 – 2011 ($MILLION)

TABLE 122 IMAGINATION TECHNOLOGIES GROUP: REVENUES,BY PRODUCT/BUSINESS DIVISIONS, 2009 – 2011 ($MILLION)

TABLE 123 IMAGINATION TECHNOLOGIES GROUP: REVENUE, BY GEOGRAPHY, 2009 – 2011 ($MILLION)

TABLE 124 MAVEN SYSTEMS: OVERALL REVENUE & REVENUE FROM WIRELESS SOLUTIONS, 2009 – 2011 ($MILLION)

TABLE 125 MAVEN SYSTEMS: REVENUE BY PRODUCT/BUSINESS SEGMENTS, 2009 – 2011 ($MILLION)

TABLE 126 MAVEN SYSTEMS: REVENUE, BY GEOGRAPHY, 2009 – 2011 ($MILLION)

TABLE 127 MINDSPEED TECHNOLOGIES: OVERALL REVENUE & REVENUE FROM WIRELESS SOLUTIONS, 2009 – 2011 ($MILLION)

TABLE 128 MINDSPEED TECHNOLOGIES: REVENUES, BY PRODUCT/BUSINESS SEGMENTS, 2009 – 2011 ($MILLION)

TABLE 129 MINDSPEED TECHNOLOGIES: REVENUE, BY GEOGRAPHY, 2009 – 2011 ($MILLION)

TABLE 130 NOVATEL WIRELESS: OVERALL REVENUE & REVENUES FROM WIRELESS SOLUTIONS, 2009 – 2011 ($MILLION)

TABLE 131 NOVATEL WIRELESS: REVENUES BY PRODUCT/BUSINESS SEGMENTS, 2009 – 2011 ($MILLION)

TABLE 132 NOVATEL WIRELESS: REVENUE BY GEOGRAPHY, 2009 – 2011 ($MILLION)

TABLE 133 PROXIM WIRELESS: OVERALL REVENUE & REVENUE FROM WIRELESS SOLUTIONS, 2009 – 2011 ($MILLION)

TABLE 134 XILINX: OVERALL REVENUE & REVENUE FROM WIRELESS SOLUTIONS, 2009 – 2011 ($BILLION)

TABLE 135 XILINX: REVENUE BY PRODUCT/BUSINESS SEGMENTS, 2009 – 2011 ($BILLION)

TABLE 136 XILINX: REVENUE BY GEOGRAPHY, 2009 – 2011 ($BILLION)

TABLE 137 GLOBAL WIRELESS CHIPSETS MARKET REVENUE SEGMENTATION, BY APPLICATION SECTOR, 2011 – 2017 ($MILLION)

TABLE 138 GLOBAL WIRELESS CHIPSETS MARKET VOLUME SEGMENTATION BY APPLICATION SECTOR, 2011 – 2017 (MILLION UNITS)

TABLE 139 GLOBAL WI-FI/WLAN CHIPSETS MARKET REVENUE SEGMENTATION, BY APPLICATION SECTOR, 2011 – 2017 ($MILLION)

TABLE 140 GLOBAL WI-FI/WLAN CHIPSETS MARKET VOLUME SEGMENTATION BY APPLICATION SECTOR, 2011 – 2017 (MILLION UNITS)

TABLE 141 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS MARKET REVENUE SEGMENTATION, BY APPLICATION SECTORS 2011 – 2017 ($MILLION)

TABLE 142 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS MARKET VOLUME SEGMENTATION, BY APPLICATION SECTOR, 2011 – 2017 (MILLION UNITS)

TABLE 143 GLOBAL MOBILE WIMAX & LTE CHIPSETS MARKET REVENUE SEGMENTATION, BY APPLICATION SECTOR, 2011 – 2017 ($MILLION)

TABLE 144 GLOBAL MOBILE WIMAX & LTE CHIPSETS MARKET VOLUME SEGMENTATION, BY APPLICATION SECTOR, 2011 – 2017 (MILLION UNITS)

TABLE 145 GLOBAL ZIGBEE CHIPSETS MARKET REVENUE SEGMENTATION, BY APPLICATION SECTOR ($MILLION), 2011-2017

TABLE 146 GLOBAL ZIGBEE CHIPSETS MARKET VOLUME SEGMENTATION, BY APPLICATION SECTOR, 2011 – 2017 (MILLION UNITS)

TABLE 147 GLOBAL WIMAX ECOSYSTEM CHIPSETS MARKET REVENUE SEGMENTATION (PERCENTAGE SHARES), BY TYPE OF CHIPSET, 2011 – 2017

TABLE 148 GLOBAL LTE ECOSYSTEM MARKET REVENUE SEGMENTATION (PERCENTAGE SHARES), BY TYPE OF CHIPSET, 2011 – 2017

LIST OF FIGURES

FIGURE 1 APPLICATION MARKET SCOPE

FIGURE 2 MARKET ASPECTS COVERED

FIGURE 3 MARKET CLASSIFICATION

FIGURE 4 MARKET RESEARCH METHODOLOGY

FIGURE 5 MARKET SIZE ESTIMATION

FIGURE 6 MARKET CRACKDOWN & DATA TRIANGULATION

FIGURE 7 MARKET FORECASTING MODEL

FIGURE 8 MARKET OVERVIEW - TREE STRUCTURE

FIGURE 9 INDUSTRY MONETARY CHAIN

FIGURE 10 TEXAS INSTRUMENTS CC3000 Wi-Fi CHIPSET BLOCK DIAGRAM

FIGURE 11 REDPINE SIGNALS WLAN 802.11ac SOLUTION ARCHITECTURE

FIGURE 12 SAMPLE BLOCK DIAGRAM OF 802.11a/b/g WLAN CHIPSET

FIGURE 13 SAMPLE WiMAX CHIPSET SOLUTION ARCHITECTURE

FIGURE 14 SAMPLE ARCHITECTURE BLOCK DIAGRAM OF A MOBILE LTE TERMINAL SYSTEM

FIGURE 15 ZigBee RF4CE CHIPSET DESIGN ARCHITECTURE

FIGURE 16 ZigBee CHIPSET SAMPLE BLOCK DIAGRAM

FIGURE 17 COMPLETE VALUE CHAIN (WITH BUSINESS MODELS)

FIGURE 18 MARKET DYNAMICS - TREE STRUCTURE

FIGURE 19 GLOBAL WIRELESS CHIPSETS MARKET REVENUE ($BILLION) AND VOLUME (BILLION UNITS) IN CONSUMER ELECTRONICS AND AUTOMATION APPLICATIONS, 2011 - 2017

FIGURE 20 GLOBAL WIRELESS CONNECTIVITY CHIPSETS MARKET REVENUE ($BILLION) AND VOLUME (BILLION UNITS), 2011 - 2017

FIGURE 21 CHIPSETS INDUSTRY BREAKDOWN (WITH FORECASTS)

FIGURE 22 GLOBAL Wi-Fi/WLAN CHIPSETS MARKET REVENUE ($BILLION) AND VOLUME (BILLION UNITS) IN CONSUMER ELECTRONICS AND AUTOMATION APPLICATIONS, 2011 - 2017

FIGURE 23 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS MARKET REVENUE ($BILLION) AND VOLUME (BILLION UNITS) IN CONSUMER ELECTRONICS, 2011 - 2017

FIGURE 24 GLOBAL MOBILE WiMAX CHIPSETS MARKET REVENUE ($BILLION) AND VOLUME (BILLION UNITS) CONSUMER ELECTRONICS, 2011 - 2017

FIGURE 25 GLOBAL MOBILE LTE CHIPSETS MARKET REVENUE ($BILLION) & VOLUME (BILLION UNITS) IN CONSUMER ELECTRONICS, 2011 - 2017

FIGURE 26 GLOBAL ZigBee CHIPSETS MARKET REVENUE ($BILLION) AND VOLUME (BILLION UNITS) IN CONSUMER ELECTRONICS AND AUTOMATION APPLICATIONS, 2011 - 2017

FIGURE 27 IMPACT ANALYSIS OF MARKET DRIVERS

FIGURE 28 IMPACT ANALYSIS OF MARKET RESTRAINTS

FIGURE 29 IMPACT ANALYSIS OF MARKET OPPORTUNITIES

FIGURE 30 MARKET ANALYSIS - TREE STRUCTURE

FIGURE 31 Wi-Fi/WLAN CHIPSETS MARKET - PORTER'S FIVE FORCE ANALYSIS

FIGURE 32 WIRELESS DISPLAY/VIDEO CHIPSETS MARKET - PORTER'S FIVE FORCE ANALYSIS

FIGURE 33 MOBILE WiMAX & LTE CHIPSETS MARKET - PORTER'S FIVE FORCE ANALYSIS

FIGURE 34 ZigBee CHIPSETS MARKET - PORTER'S FIVE FORCES ANALYSIS

FIGURE 35 Wi-Fi/WLAN CHIPSETS MARKET LIFE CYCLE

FIGURE 36 Wi-Fi/WLAN CHIPSETS TECHNOLOGY ROADMAP

FIGURE 37 WIRELESS DISPLAY/VIDEO CHIPSETS MARKET LIFE CYCLE

FIGURE 38 WIRELESS DISPLAY/VIDEO CHIPSETS TECHNOLOGY ROADMAP

FIGURE 39 WiMAX CHIPSETS MARKET LIFE CYCLE

FIGURE 40 LTE CHIPSETS MARKET LIFE CYCLE

FIGURE 41 WIRELESS BROADBAND CHIPSETS TECHNOLOGY ROADMAP

FIGURE 42 ZigBee CHIPSETS MARKET LIFE CYCLE

FIGURE 43 ZigBee CHIPSETS TECHNOLOGY ROADMAP

FIGURE 44 IEEE 802 PROTOCOLS IN CHIPSETS - WIRELESS TECHNOLOGIES – TIMELINE & EVOLUTION

FIGURE 45 MARKET BY TECHNOLOGY - TREE STRUCTURE

FIGURE 46 MARKET BY IEEE STANDARD – TREE STRUCTURE

FIGURE 47 GLOBAL 802.11g Wi-Fi/WLAN CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 48 GLOBAL 802.11n Wi-Fi/WLAN CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 49 GLOBAL 802.11ac Wi-Fi/WLAN CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 50 GLOBAL 802.11ad Wi-Fi/WLAN CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 51 GLOBAL 802.11n WIRELESS DISPLAY/VIDEO CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 52 GLOBAL 802.11ad WIRELESS DISPLAY/VIDEO CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 53 GLOBAL 802.15.3c WIRELESS DISPLAY/VIDEO CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 54 WiMAX – IEEE 802 PROTOCOL TIMELINE

FIGURE 55 GLOBAL 802.16e MOBILE WiMAX CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 56 GLOBAL 802.16m MOBILE WiMAX CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 57 GLOBAL 802.15.4 CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 58 MARKET BY FORM-FACTOR – TREE STRUCTURE

FIGURE 59 GLOBAL WIRELESS CHIPSETS IN SoC BASED PRODUCTS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 – 2017

FIGURE 60 GLOBAL WIRELESS CHIPSETS IN MOBILE & TABLET SoC BASED PRODUCTS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 61 GLOBAL WIRELESS CHIPSETS IN OTHER SoC BASED PRODUCTS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 62 GLOBAL WIRELESS CHIPSETS IN IC BASED PRODUCTS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 63 GLOBAL WIRELESS CHIPSETS IN IC BASED CONSUMER PRODUCTS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 64 GLOBAL WIRELESS CHIPSETS IN IC BASED AUTOMATION PRODUCTS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 65 MARKET BY SPECIAL CHIPSETS – TREE STRUCTURE

FIGURE 66 GLOBAL LOW-POWER Wi-Fi/WLAN CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011-2017

FIGURE 67 GLOBAL TRADITIONAL Wi-Fi/WLAN CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 – 2017

FIGURE 68 GLOBAL HIGH-DEFINITION WIRELESS DISPLAY/VIDEO CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 69 GLOBAL TRADITIONAL DISPLAY/VIDEO CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011-2017

FIGURE 70 GLOBAL STAND-ALONE MOBILE WiMAX & LTE CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 71 GLOBAL COMBINATION MOBILE WiMAX & LTE CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011-2017

FIGURE 72 GLOBAL SINGLE-MODE MOBILE LTE CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 73 GLOBAL MULTI-MODE MOBILE LTE CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 74 GLOBAL SINGLE-PROTOCOL ZigBee CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 75 GLOBAL DUAL/MULTI-PROTOCOL ZigBee CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 76 MARKET BY APPLICATION – TREE STRUCTURE

FIGURE 77 WIRELESS CHIPSETS DISTRIBUTION AMONG APPLICATIONS (MARKET PENETRATION)

FIGURE 78 GLOBAL WIRELESS CHIPSETS IN CONSUMER ELECTRONICS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 79 GLOBAL Wi-Fi/WLAN CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS) IN CONSUMER ELECTRONICS, 2011 - 2017

FIGURE 80 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS) IN CONSUMER ELECTRONICS, 2011 - 2017

FIGURE 81 GLOBAL MOBILE WiMAX & LTE CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS) IN CONSUMER ELECTRONICS, 2011 - 2017

FIGURE 82 GLOBAL ZigBee CHIPSETS MARKET REVENUE ($MILLION) & VOLUME (MILLION UNITS) IN CONSUMER ELECTRONICS, 2011 - 2017

FIGURE 83 GLOBAL WIRELESS CHIPSETS IN DESKTOP PCs MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 84 GLOBAL Wi-Fi/WLAN CHIPSETS IN DESKTOP PCs MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 85 GLOBAL MOBILE WiMAX & LTE CHIPSETS IN DESKTOP PCs MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 86 GLOBAL WIRELESS CHIPSETS IN LAPTOPS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 87 GLOBAL Wi-Fi/WLAN CHIPSETS IN LAPTOPS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 88 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS IN LAPTOPS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 89 GLOBAL MOBILE WiMAX & LTE CHIPSETS IN LAPTOPS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 90 GLOBAL WIRELESS CHIPSETS IN TABLET PCs MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 91 GLOBAL Wi-Fi/WLAN CHIPSETS IN TABLETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 92 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS IN TABLETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 93 GLOBAL MOBILE WiMAX & LTE CHIPSETS IN TABLETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 94 GLOBAL ZigBee CHIPSETS IN TABLETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 95 GLOBAL WIRELESS CHIPSETS IN e-BOOK READERS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 96 GLOBAL Wi-Fi/WLAN CHIPSETS IN e-BOOK READERS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 97 GLOBAL WIRELESS CHIPSETS IN SMARTPHONES MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 98 GLOBAL Wi-Fi/WLAN CHIPSETS IN SMARTPHONES MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 – 2017

FIGURE 99 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS IN SMARTPHONES MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 100 GLOBAL MOBILE WiMAX & LTE CHIPSETS IN SMARTPHONES MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 101 GLOBAL ZigBee CHIPSETS IN SMARTPHONES MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 102 GLOBAL WIRELESS CHIPSETS IN MEDIA PLAYERS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 103 GLOBAL Wi-Fi/WLAN CHIPSETS IN MEDIA PLAYERS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 104 GLOBAL WIRELESS CHIPSETS IN TVs & DISPLAY SYSTEMS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 105 GLOBAL Wi-Fi/WLAN CHIPSETS IN TV SYSTEMS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 106 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS IN TV SYSTEMS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 107 GLOBAL ZigBee CHIPSETS IN TV SYSTEMS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 108 GLOBAL WIRELESS CHIPSETS IN SET-TOP BOXES MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 109 GLOBAL Wi-Fi/WLAN CHIPSETS IN SET-TOP BOXES MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 110 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS IN SET-TOP BOXES MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 111 GLOBAL ZigBee CHIPSETS IN SET-TOP BOXES MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 112 GLOBAL WIRELESS CHIPSETS IN CAMERAS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 113 GLOBAL Wi-Fi/WLAN CHIPSETS IN CAMERAS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 – 2017

FIGURE 114 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS IN CAMERAS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 115 GLOBAL ZigBee CHIPSETS IN CAMERAS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 116 GLOBAL WIRELESS CHIPSETS IN OTHER CONSUMER APPLICATIONS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 117 GLOBAL WIRELESS CHIPSETS IN AUTOMATION APPLICATIONS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 118 GLOBAL Wi-Fi/WLAN CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS) IN AUTOMATION APPLICATIONS, 2011 - 2017

FIGURE 119 GLOBAL ZigBee CHIPSETS MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS) IN AUTOMATION APPLICATIONS, 2011 - 2017

FIGURE 120 GLOBAL WIRELESS CHIPSETS IN HOME AUTOMATION MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 121 GLOBAL Wi-Fi/WLAN CHIPSETS IN HOME AUTOMATION MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 122 GLOBAL ZigBee CHIPSETS IN HOME AUTOMATION & SMART ENERGY MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 123 GLOBAL WIRELESS CHIPSETS IN BUILDING AUTOMATION MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 124 GLOBAL Wi-Fi/WLAN CHIPSETS IN BUILDING AUTOMATION MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 125 GLOBAL ZigBee CHIPSETS IN BUILDING AUTOMATION MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 – 2017

FIGURE 126 GLOBAL WIRELESS CHIPSETS IN INDUSTRIAL AUTOMATION MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 127 GLOBAL Wi-Fi/WLAN CHIPSETS IN INDUSTRIAL AUTOMATION MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 128 GLOBAL ZigBee CHIPSETS IN INDUSTRIAL AUTOMATION MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 129 MARKET BY GEOGRAPHY – TREE STRUCTURE

FIGURE 130 WIRELESS CHIPSETS IN NORTH AMERICA MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 131 Wi-Fi/WLAN CHIPSETS IN NORTH AMERICA MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 132 WIRELESS DISPLAY/VIDEO CHIPSETS IN NORTH AMERICA MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 133 MOBILE WiMAX & LTE CHIPSETS IN NORTH AMERICA MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 134 ZigBee CHIPSETS IN NORTH AMERICA MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 135 WIRELESS CHIPSETS IN NORTH AMERICA MARKET REVENUE ($MILLION) SEGMENTATION BY COUNTRY, 2011 - 2017

FIGURE 136 WIRELESS CHIPSETS IN U.S. MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 137 WIRELESS CHIPSETS IN CANADA MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 138 WIRELESS CHIPSETS IN MEXICO MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 139 WIRELESS CHIPSETS IN EUROPE MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 140 Wi-Fi/WLAN CHIPSETS IN EUROPE MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 141 WIRELESS DISPLAY/VIDEO CHIPSETS IN EUROPE MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 142 MOBILE WiMAX & LTE CHIPSETS IN EUROPE MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 143 ZigBee CHIPSETS IN EUROPE MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 144 WIRELESS CHIPSETS IN EUROPE MARKET REVENUE ($MILLION) SEGMENTATION BY COUNTRY, 2011 - 2017

FIGURE 145 WIRELESS CHIPSETS IN U.K. MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 146 WIRELESS CHIPSETS IN GERMANY MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 147 WIRELESS CHIPSETS IN FRANCE MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 – 2017

FIGURE 148 WIRELESS CHIPSETS IN ASIA-PACIFIC MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 149 Wi-Fi/WLAN CHIPSETS IN ASIA-PACIFIC MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 150 WIRELESS DISPLAY/VIDEO CHIPSETS IN ASIA-PACIFIC MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 151 MOBILE WiMAX & LTE CHIPSETS IN ASIA-PACIFIC MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 152 ZigBee CHIPSETS IN ASIA-PACIFIC MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 153 WIRELESS CHIPSETS IN APAC MARKET REVENUE ($MILLION) SEGMENTATION BY COUNTRY, 2011 - 2017

FIGURE 154 WIRELESS CHIPSETS IN CHINA MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 155 WIRELESS CHIPSETS IN JAPAN MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 156 WIRELESS CHIPSETS IN SOUTH KOREA MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 157 WIRELESS CHIPSETS IN INDIA MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 158 WIRELESS CHIPSETS IN REST OF THE WORLD MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 159 Wi-Fi/WLAN CHIPSETS IN REST OF THE WORLD MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 160 WIRELESS DISPLAY/VIDEO CHIPSETS IN REST OF THE WORLD MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 161 MOBILE WiMAX & LTE CHIPSETS IN REST OF THE WORLD MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 162 ZigBee CHIPSETS IN REST OF THE WORLD MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 163 WIRELESS CHIPSETS IN ROW MARKET REVENUE ($MILLION) SEGMENTATION BY COUNTRY, 2011 - 2017

FIGURE 164 WIRELESS CHIPSETS IN LATIN-SOUTH AMERICA MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 165 WIRELESS CHIPSETS IN MIDDLE EAST MARKET REVENUE ($MILLION) AND VOLUME (MILLION UNITS), 2011 - 2017

FIGURE 166 MARKET’S COMPETITIVE LANDSCAPE – TREE STRUCTURE

FIGURE 167 GLOBAL Wi-Fi/WLAN CHIPSET KEY PLAYER MARKET SHARES, 2010 – 2011

FIGURE 168 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSET KEY PLAYER MARKET SHARES, 2010 - 2011

FIGURE 169 GLOBAL MOBILE WiMAX CHIPSET KEY PLAYER MARKET SHARES, 2010 – 2011

FIGURE 170 GLOBAL MOBILE LTE CHIPSET KEY PLAYER MARKET SHARES, 2010-2011

FIGURE 171 GLOBAL ZigBee CHIPSET KEY PLAYER MARKET SHARES, 2010 – 2011

FIGURE 172 AMIMON LTD: PRODUCT SEGMENTS

FIGURE 173 ATMEL CORPORATION: PRODUCT SEGMENTS

FIGURE 174 GCT SEMICONDUCTOR, INC: PRODUCT SEGMENTS

FIGURE 175 SEQUANS COMMUNICATIONS SA: WIRELESS CHIPSET CATEGORIES

FIGURE 176 SILICON IMAGE, INC. PRODUCT SEGMENTS

FIGURE 177 SILICON LABORATORIES, INC: PRODUCT DIVISIONS

FIGURE 178 ENTROPIC COMMUNICATIONS: PRODUCT SEGMENTS

FIGURE 179 MAVEN SYSTEMS PVT. LTD: PRODUCT SEGMENTS

FIGURE 180 MAVEN SYSTEMS PVT. LTD: SERVICES

FIGURE 181 NOVATEL WIRELESS: PRODUCT SEGMENTS

FIGURE 182 ALTERNATIVES TO ZigBee

FIGURE 183 COMPARISION AMONG ZigBee, BLUETOOTH, Wi-Fi & GPRS/GSM TECHNOLOGIES

FIGURE 184 WIRELESS TECHNOLOGY LANDSCAPE

FIGURE 185 GLOBAL FREQUENCIES FOR WIRELESS TECHNOLOGIES

FIGURE 186 GLOBAL WIRELESS CHIPSETS MARKET REVENUE ($BILLION) AND VOLUME (BILLION UNITS) IN ALL APPLICATIONS, 2011 – 2017

FIGURE 187 GLOBAL Wi-Fi/WLAN CHIPSETS MARKET REVENUE ($BILLION) AND VOLUME (BILLION UNITS) IN ALL APPLICATIONS, 2011 – 2017

FIGURE 188 GLOBAL WIRELESS DISPLAY/VIDEO CHIPSETS MARKET REVENUE ($BILLION) AND VOLUME (BILLION UNITS) IN ALL APPLICATIONS, 2011 – 2017

FIGURE 189 GLOBAL MOBILE WiMAX & LTE CHIPSETS MARKET REVENUE ($BILLION) AND VOLUME (BILLION UNITS) IN ALL APPLICATIONS, 2011 – 2017

FIGURE 190 GLOBAL MOBILE WiMAX & LTE CHIPSETS MARKET REVENUE ($BILLION) AND VOLUME (BILLION UNITS) IN CONSUMER ELECTRONICS, 2011 – 2017

FIGURE 191 GLOBAL ZigBee CHIPSETS MARKET REVENUE ($BILLION) AND VOLUME (BILLION UNITS) IN ALL APPLICATIONS, 2011 – 2017

Growth opportunities and latent adjacency in Wireless Chipsets (Wi-Fi/WLAN, Wireless Display/Video (HD & WHDI), Mobile WiMAX & LTE (4G), ZigBee, 802.11, 802.15.4 & 802.16) Market