Inductor Market Size, Share and Industry Growth Analysis Report by Inductance (Fixed, Variable), Type (Wire wound, Multilayered, Molded, Film), Core Type (Air, Ferrite, Iron), Shield Type (Shielded, Unshielded), Mounting Technique, Vertical, Application, Geography - Global Growth Driver and Industry Forecast to 2027

Updated on : October 22, 2024

Inductor Market is experiencing significant growth, driven by increasing demand across various applications, particularly in the electronics and automotive sectors. As industries embrace advanced technologies such as electric vehicles, renewable energy systems, and smart devices, the need for efficient power management solutions becomes paramount. Key trends influencing this market include the miniaturization of components and the integration of inductors into multifunctional circuits, enhancing performance while conserving space. Additionally, the shift towards more sustainable energy solutions is propelling the development of high-efficiency inductors that meet stringent regulatory requirements. Looking ahead, the future of the Inductor Market appears promising, with anticipated advancements in material science and manufacturing processes that will further optimize inductor performance, catering to the evolving needs of modern electronic systems.

Inductor Market Size & Growth

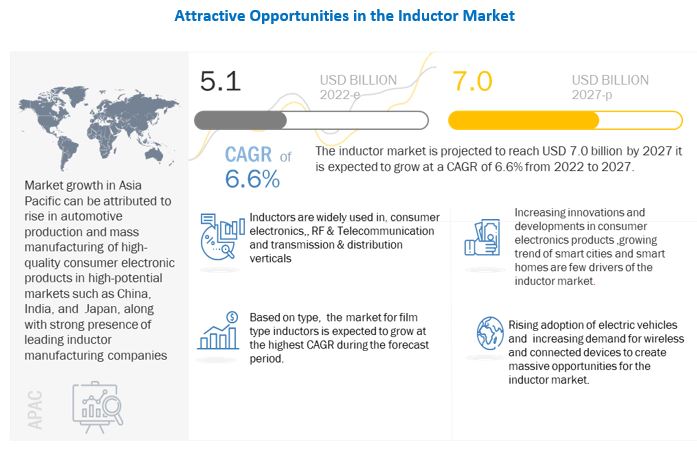

Global Inductor market size is projected to reach USD 7.0 billion by 2027 from an estimated USD 5.1 billion in 2022, growing at a compound annual growth rate (CAGR) of 6.6 % from 2022 to 2027. The market is driven by the increasing demand for inductors in various applications such as automotive, telecommunications, consumer electronics, and industrial automation. Inductors are passive electronic components that store energy in a magnetic field and are used in a variety of circuits to filter, store, and regulate electrical energy. The growing adoption of electric vehicles and the increasing demand for connected devices are some of the key drivers of the inductor market report. The need for compact, efficient, and cost-effective inductors is also expected to drive the inductor market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Inductor Market Dynamics

Driver: Increasing innovations and developments in consumer electronic products

Consumer electronics is a rapidly changing and dynamic industry, wherein the competition among the market players and game-changing technological developments are increasing significantly. These innovations and technological developments are assisting the manufacturers of consumer electronic devices in enhancing the features and the quality of their products. Moreover, they are expected to boost the total number of inductors that are being used in the consumer electronics vertical. The use of power inductors is more in consumer electronics as they provide large currents and low DCR characteristics and are small in size. Other types of inductors such as RF inductors, air-core inductors, and multilayered inductors are also widely used in the consumer electronics vertical. The increasing focus of manufacturers on new technologies and the rising adoption of a few of the major emerging technologies such as the Internet of Things (IoT) and artificial intelligence (AI) have propelled the adoption of inductors. Also, the integration of network technologies such as GSM, 3G, 4G, LTE, and 5G in various electronic products has driven the inductor industry growth.

Restraint: Fluctuating prices of raw materials, especially copper

Inductors are typically made up of copper, iron, and ferrite due to their features such as high electrical connectivity and low power losses. The reason for using copper coils is that copper has relatively good thermal and mechanical properties. Thus, it is widely used as a raw material in manufacturing inductors. While manufacturing inductors, the copper line width is limited, and the metal pattern density must be as uniform as possible. Any disruptions in mining in a specific region can affect global copper prices significantly. Natural disasters such as landslides in mining locales are quite common as well as frequent strikes of the mine workers. Variations in the weather, the time of the year, political instability, or transportation issues can reduce regional supplies and elevate copper pricing.

Opportunity: Rising adoption of electric vehicles

There is a sharp growth in the production of electric vehicles in recent years and is expected to grow further in the coming years and the pace of development of electric vehicles has been tremendous. The use of electric vehicles has spread, and this will lead to the adoption of connected cars and advanced driving assistance systems (ADAS), which will expand the role of electronic components. With an increase in the tightening of environmental regulations many major manufacturers and newly emerging car makers have increased the production volume of electric vehicles, which is expected to increase the demand for passive components. These electric vehicles are equipped with new technologies and are powered by AI and IoT. With the increase in the adoption of electric vehicles, the demand for inductors is expected to increase in the coming years.

Challenge: Increasing complexity due to miniaturization of inductors

The size of the products is becoming increasingly smaller as well as the functionalities associated with the products are being enhanced. There is a continuos shrink in the size of mobile devices that offer advanced complex functions. The market for such devices which include smartwatches, wristband-type wearable devices, and IoT devices such as sensor network devices need reduced size as well as thickness. These devices also need highly efficient power supply circuits for longer operating time. Due to reduction in the size and thickness of wearables such as smartwatches, there is an increased use of higher-speed processors for higher performance and multi-core processors for higher efficiency. This paves way for the the miniaturization of all components used, including inductors. In particular, multilayered chip inductors, therefore, also need to be made even smaller in size while providing high Q ratings. However, as feature sizes shrink, maintenance of dimensional tolerances and long-term reliability becomes more tedious. There is a continuos shrink in size of wireless handsets, PDAs, and other portable electronic devices along with increase in the complexity of its operations. Therefore, they face design challenges; as with the reduction in the size of an inductor, the original rated current (ODC) and DC resistance are required to be unaffected.

But as feature sizes shrink, maintaining dimensional tolerances and long-term reliability becomes more difficult.

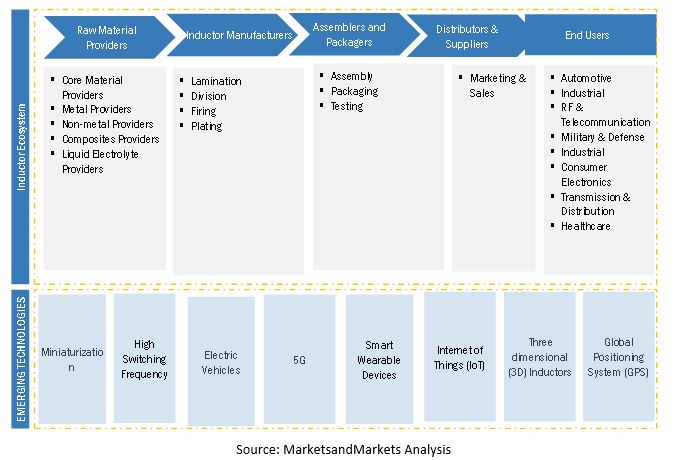

Inductor Ecosystem

Inductor market share for power applications is expected to grow at the highest CAGR during the forecast period.

Power applications segment is expected to exhibit the highest growth during the forecast period. Inductors are widely used as energy storage devices in many switched-mode power supplies to produce DC currents. Most of the power inductors are used as filters to reduce the amount of ripple in electronic circuits. Thus, the market for power applications is expected to grow at the highest CAGR during the forecast period.

Ferrite Core inductors is expected to dominate the market during forecast period

The inductor market for ferrite core inductor is expected to dominate the market from 2022 to 2027. A ferrite core inductor has low coercivity, which results in lower hysteresis loss. When compared to other inductor core types, ferrite core inductors offer higher resistance. These inductors are leveraged in surface acoustic wave (SAW) filters and voltage-controlled oscillator (VCO) circuits for telecommunication, hard disks, notebook computers, and other electronic equipment. Various applications involving ferrite core inductors are broadband transformers, noise filters, power transformers, converter and inverter transformers, and others.

Inductor market for surface-mount inductors is expected to grow at a higher CAGR during forecast period

Surface-mount power inductors are mainly used for power supplies to power converters. These types of inductors are available only in smaller sizes and in a variety of shapes such as pot cores (round), RM (square pot cores), and a few others including custom shapes. Their applications include fluctuating power circuits to filter EMI currents at low inductance loss, DC-to-DC and AC-DC converters, storing energy, and switching regulated power supplies.

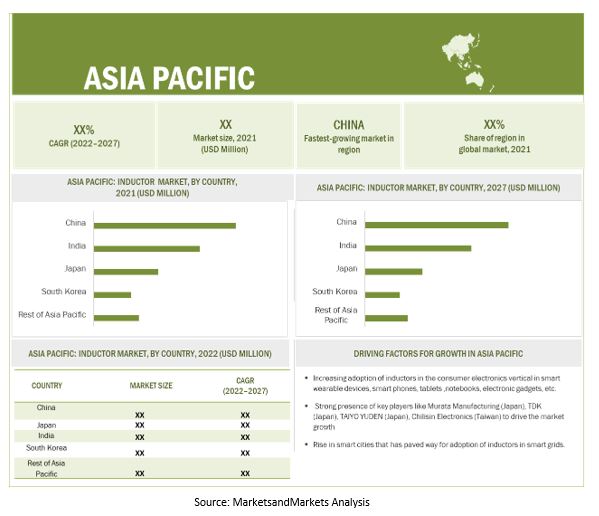

Inductor market analysis in Asia Pacific estimated to grow at the fastest rate during the forecast period

Asia Pacific plays a pivotal role in the development of the electrical and electronics industry. A few of the leading inductor manufacturing companies such as TDK (Japan), Murata Manufacturing (Japan), Taiyo Yuden (Japan), Chilisin Electronics (Taiwan), Delta Electronics (Taiwan), Panasonic (Japan), ABC Taiwan Electronics (Taiwan), Shenzhen Sunlord Electronics (China), and Sumida (Japan) are based in Asia Pacific. Several electronic manufacturing companies in other regions outsource their production to low-cost countries in Asia. This is more distinct in segments with higher demand for labor-intensive tasks such as passive electronic components and semiconductor assembly and testing operations. As Asia Pacific has low labor cost most of the inductors are manufactured in Asia Pacific and are exported to various regions. There is an extensive rise in the demand for power, which is increasing the need for power management and thereby accelerating the demand for inductors. The significant growth toward manufacturing and the potential of China, Japan, and India largely contribute to this growth trend.

To know about the assumptions considered for the study, download the pdf brochure

Top Inductor Companies - Key Market Players

Major inductor companies in the market include Murata Manufacturing (Japan), TDK (Japan), Vishay Intertechnology (US), TAIYO YUDEN (Japan), Chilisin Electronics (Taiwan), Delta Electronics (Taiwan), Panasonic (Japan), ABC Taiwan Electronics (Taiwan), Pulse Electronics (US), Coilcraft (US), Shenzhen Sunlord Electronics (China), Bourns (US). Apart from these, Sumida (Japan), ICE Components (US), Bel Fuse (France), Falco Electronics (Mexico), GCi Technologies (US), Würth Elektronik (Germany), Kyocera AVX (US), Samsung Electro-Mechanics (South Korea), Inductor Supply Inc. (US), Gowanda Electronics (US), Token Electronics (Taiwan), TT Electronics (UK), Laird Technologies (US), Johanson Technology (US), Zhenhua Electronics (China) are among a few emerging companies in the inductor market.

Scope of the report

|

Report Attributes |

Details |

|

Market Size Value in 2022 |

USD 5.1 Billion |

| Revenue Forecast in 2027 | USD 7.0 Billion |

| Growth Rate | 6.6% |

| Base Year Considered | 2021 |

| Historical Data Available for Years | 2018–2027 |

|

Forecast Period |

2022–2027 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Inductor Companies in North America |

|

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Consumer Electronics Segment |

| Highest CAGR Segment | Surface-mount Inductors Segment |

| Largest Application Market Share | Power Applications |

This research report categorizes the inductor market size based on inductance, type, core type, shield type, mounting technique, application, vertical and region

Inductor Market Size, by Inductance:

- Fixed Inductors

- Variable Inductors

Inductor Market Size, by Type:

-

Film Type

- Thin Film

- Thick Film

- Multilayered

-

Wire Wound

- Bobbin

- Toroidal

- Molded

Inductor Market, by Core Type:

-

Air Core

- Ceramic Core

- Phenolic Core

-

Ferromagnetic/Ferrite Core

- Soft Ferrites

- Hard Ferrites

- Iron Core

Inductor Market, by Shield Type:

- Shielded

- Unshielded

Inductor Market Analysis, by Mounting Technique

- Surface Mount

- Through Hole

Inductor Market, by Application

- Power Applications

- High-frequency Applications

- General Circuits

Inductor Market, by Vertical

- Automotive

- Industrial

- RF & Telecommunication

- Military & Defense

- Consumer Electronics

- Transmission & Distribution

- Healthcare

Inductor Market Statistics, by Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of APAC

-

RoW

- South America

- Middle East & Africa

Recent Developments

- In March 2022, TDK introduced the new PCM120T series of shielded SMT power inductors, optimized for high saturation currents and low DC resistance.

- In March 2022, Vishay Intertechnology expanded its IHLE series of low profile, high current inductors featuring integrated E-field shields for the reduction of EMI with new commercial and Automotive Grade devices in the 5 mm by 5 mm by 3.4 mm 2020 case size.

- In December 2021, Murata Manufacturing announced the availability of the DFE21CCN_EL series of power inductors for 5G smartphones. These inductors exhibit a 20% increase in saturation current (Isat) and a 50% reduction in DC resistance (RDC) over their predecessors. These parameters help to raise operational efficiency levels and enable downsizing of system designs.

Frequently Asked Questions (FAQ):

What will be the dynamics for the adoption of inductor market based on application?

Various types of inductors are used for general circuits. General circuits include filters and oscillators. Other types of general circuits include car navigations, car audios, and body control equipment including wipers and power windows. Inductors combined with capacitors and resistors are widely used to create filters for analog circuits, as well as in signal processing. Various types of inductors are used for general circuits. General circuits include filters and oscillators. Other types of general circuits include car navigations, car audios, and body control equipment including wipers and power windows. Inductors combined with capacitors and resistors are widely used to create filters for analog circuits, as well as in signal processing.

Which inductor type will contribute more to the overall market share by 2027?

The wire-wound inductors will contribute more to the overall market share in 2027. Wire-wound inductors have a core made of magnetic metals such as iron or ferrite with a wire wound around it. Unwanted radio frequencies can interfere with the audio sound quality and disrupt electrical circuits. As a result, wire-wound inductors are used as they can block or filter radio frequencies. They are typically found in car audio systems and electronic control units (ECUs) and also in electronic equipment used in communication infrastructures and mobile base stations. They are mainly used in the high-frequency circuits of mobile communication equipment, such as wireless LAN, mobile phones, broadband components, RFID tags, RF transceivers, Bluetooth, Wireless PDA, and security systems. The manufacturing cost involved is less compared with other types of inductors and they provide a high inductance value.

How will technological developments such as miniaturization change the inductor landscape in the future?

It is a new technology that is revolutionizing the manufacturing of inductors. The demand for today’s portable electronic devices that feature multiple functions in a small package is high; for instance, industry and market trends show a great convergence of the advanced packaging solutions in handheld products such as smartphones, tablets, and portable media players. The consumer electronics market for smartwatches, wristband-type wearable devices, and IoT devices such as sensor network devices require compact size and highly efficient power supply circuits for longer operating time. With reduction in the size and thickness of wearables such as smartphones, there is an increasing adoption of higher-speed processors for optimal performance and multi-core processors for higher efficiency. This has culminated in the requirements for the miniaturization of all components used, including inductors.

Which region is expected to adopt inductors at a fast rate?

Asia Pacific region is expected to adopt inductors at the fastest rate. Developing countries such as India and China are expected to have a high potential for the future growth of the market.

What are the key market dynamics influencing market growth? How will they turn into strengths or weaknesses of companies operating in the market space?

Consumer electronics is a rapidly changing and dynamic industry, wherein the competition among the market players and game-changing technological developments are increasing significantly. These innovations and technological developments are assisting the manufacturers of consumer electronic devices in enhancing the features and the quality of their products. Moreover, they are expected to boost the total number of inductors that are being used in the consumer electronics vertical.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 INDUCTOR MARKET SEGMENTATION

1.4 INCLUSIONS AND EXCLUSIONS

1.4.1 GEOGRAPHIC SCOPE

1.4.2 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 STAKEHOLDERS

1.7 UNITS CONSIDERED

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 INDUCTOR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE ANALYSIS)—REVENUE GENERATED BY COMPANIES FROM SALES OF INDUCTORS

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market share using bottom-up analysis (demand side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share using top-down analysis (supply side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 7 ASSUMPTIONS FOR RESEARCH STUDY

2.5 RISK ASSESSMENT

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 46)

3.1 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

FIGURE 8 FILM INDUCTORS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 9 MARKET FOR AIR CORE INDUCTORS TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

FIGURE 10 AUTOMOTIVE TO BE FASTEST-GROWING VERTICAL IN INDUCTOR MARKET DURING FORECAST PERIOD

FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF INDUCTOR MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN INDUCTOR MARKET

FIGURE 12 INCREASING DEMAND FOR CONSUMER ELECTRONICS DRIVING INDUCTOR MARKET GROWTH GLOBALLY

4.2 INDUCTOR MARKET, BY SHIELD TYPE

FIGURE 13 SHIELDED SEGMENT TO GROW AT HIGHER CAGR FROM 2022 TO 2027

4.3 ASIA PACIFIC: INDUCTOR MARKET, BY VERTICAL AND COUNTRY

FIGURE 14 CHINA AND CONSUMER ELECTRONICS TO BE LARGEST SHAREHOLDERS OF INDUCTOR MARKET IN ASIA PACIFIC IN 2022

4.4 INDUCTOR MARKET, BY MOUNTING TECHNIQUE

FIGURE 15 SURFACE-MOUNT INDUCTORS TO GROW AT HIGHER CAGR FROM 2022 TO 2027

4.5 INDUCTOR MARKET, BY APPLICATION

FIGURE 16 POWER APPLICATIONS TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

4.6 INDUCTOR MARKET, BY VERTICAL

FIGURE 17 AUTOMOTIVE VERTICAL TO REGISTER HIGHEST GROWTH IN INDUCTOR MARKET FROM 2022 TO 2027

4.7 INDUCTOR MARKET, BY REGION

FIGURE 18 US TO ACCOUNT FOR LARGEST SHARE OF INDUCTOR MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 54)

5.1 MARKET DYNAMICS

FIGURE 19 INDUCTOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS AND THEIR IMPACT ON INDUCTOR MARKET

5.1.1.1 Increasing innovations and developments in consumer electronic products

5.1.1.2 Growing trend of smart cities and smart homes that require energy-efficient electronic and electrical systems

FIGURE 20 GLOBAL SMART CITIES MARKET, 2017–2026

5.1.2 RESTRAINTS AND THEIR IMPACT ON INDUCTOR MARKET

5.1.2.1 Fluctuating prices of raw materials, especially copper

FIGURE 21 PRICE TREND ANALYSIS OF COPPER, 2019–2022

5.1.2.2 Longer lead time of inductors

5.1.3 OPPORTUNITIES AND THEIR IMPACT ON INDUCTOR MARKET

5.1.3.1 Increasing demand for wireless and connected devices

FIGURE 22 CELLULAR IOT CONNECTIONS, 2022 VS 2027

5.1.3.2 Rising adoption of electric vehicles

FIGURE 23 WORLDWIDE ELECTRIC CAR DEPLOYMENTS, 2018–2030 (THOUSAND UNITS)

5.1.3.3 Rapid development of 5G technology

5.1.4 CHALLENGES AND THEIR IMPACT ON INDUCTOR MARKET

5.1.4.1 Complexities associated with miniaturization of inductors

5.2 SUPPLY CHAIN ANALYSIS

FIGURE 24 SUPPLY CHAIN ANALYSIS OF INDUCTOR MARKET ECOSYSTEM

5.2.1 EXPERTS RESPONSIBLE FOR PLANNING AND REVISING FUNDS

5.2.2 RESEARCH & DEVELOPMENT ENGINEERS

5.2.3 RAW MATERIAL SUPPLIERS

5.2.4 ORIGINAL EQUIPMENT MANUFACTURERS (OEMS)

5.2.5 SUPPLIERS & DISTRIBUTORS

5.2.6 END-USERS

5.3 ECOSYSTEM/MARKET MAP

TABLE 1 PLAYERS AND THEIR ROLE IN ECOSYSTEM

5.4 PORTER’S FIVE FORCE ANALYSIS

TABLE 2 IMPACT OF PORTER’S FIVE FORCES ON INDUCTOR MARKET

FIGURE 25 INDUCTOR MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4.1 INTENSITY OF COMPETITIVE RIVALRY

5.4.2 BARGAINING POWER OF SUPPLIERS

5.4.3 BARGAINING POWER OF BUYERS

5.4.4 THREAT OF SUBSTITUTES

5.4.5 THREAT OF NEW ENTRANTS

5.5 TRENDS IMPACTING BUSINESSES OF CUSTOMERS

FIGURE 26 REVENUE SHIFT AND NEW REVENUE POCKETS FOR INDUCTOR MANUFACTURERS

5.6 CASE STUDIES

5.6.1 RF INDUCTORS OFFERED BY MURATA MANUFACTURING HELPED ACHIEVE REDUCTION IN INSERTION LOSS IN RF CIRCUITS

5.6.2 CHIP INDUCTOR FROM MURATA MANUFACTURING HELPED ACHIEVE NOISE SUPPRESSION IN POWER AMPLIFIERS (PA) AND POWER LINES

5.6.3 TDK’S POWER INDUCTORS HELPED ENHANCE SIGNAL TRANSMISSION QUALITY FOR POWER OVER COAX (POC) FILTER USED IN LVDS TRANSMISSIONS

5.6.4 CM CHIP CHOKES FROM PULSE ELECTRONICS HELP IMPROVE NOISE IMMUNITY FOR AUTOMOTIVE DATA TRANSMISSION

5.6.5 CLF-D SERIES POWER INDUCTORS BY PULSE ELECTRONICS CAN BE USED IN EXTREME TEMPERATURES WHEN DEPLOYED IN POWER SUPPLIES OF ENGINE CONTROL MODULES (ECM)

5.7 TECHNOLOGY ANALYSIS

5.7.1 ADOPTION OF MINIATURIZATION TECHNOLOGY IN INDUCTOR MANUFACTURING

5.7.2 INTEGRATION OF 3D PRINTING TECHNOLOGY INTO INDUCTOR MANUFACTURING

5.8 TRADE ANALYSIS

5.8.1 IMPORT SCENARIO

5.8.1.1 Import scenario for inductors

TABLE 3 IMPORT DATA, BY COUNTRY, 2017–2010 (USD MILLION)

5.8.2 EXPORT SCENARIO

5.8.2.1 Export scenario for inductors

TABLE 4 EXPORT DATA, BY COUNTRY, 2017–2020 (USD MILLION)

5.9 PATENT ANALYSIS

TABLE 5 NUMBER OF PATENTS REGISTERED IN INDUCTOR MARKET FROM 2011 TO 2021

FIGURE 27 TOP 10 COMPANIES WITH HIGHEST NO. OF PATENT APPLICATIONS FROM 2011 TO 2021

FIGURE 28 NUMBER OF INDUCTOR PATENTS PUBLISHED FROM 2011 TO 2021

TABLE 6 PATENT REGISTRATIONS RELATED TO INDUCTOR MARKET

5.10 TARIFFS

TABLE 7 MFN TARIFFS FOR INDUCTORS EXPORTED BY US

TABLE 8 MFN TARIFFS FOR INDUCTORS EXPORTED BY CHINA

5.11 REGULATORY LANDSCAPE

TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12 KEY CONFERENCES & EVENTS, 2022–2023

TABLE 13 INDUCTOR MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.13 PRICING ANALYSIS

TABLE 14 SELLING PRICES OF INDUCTORS

5.13.1 AVERAGE SELLING PRICES OF MARKET PLAYERS, BY OFFERING

FIGURE 29 AVERAGE SELLING PRICES OF KEY PLAYERS, BY TYPE

TABLE 15 AVERAGE SELLING PRICES OF KEY PLAYERS, BY TYPE (USD)

6 INDUCTOR MARKET, BY INDUCTANCE (Page No. - 91)

6.1 INTRODUCTION

FIGURE 30 MARKET FOR FIXED INDUCTORS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 16 INDUCTOR MARKET, BY INDUCTANCE, 2018–2021 (USD MILLION)

TABLE 17 INDUCTOR MARKET, BY INDUCTANCE, 2022–2027 (USD MILLION)

6.2 FIXED INDUCTORS

6.2.1 REMAIN IN FIXED POSITIONS

6.3 VARIABLE INDUCTORS

6.3.1 USED IN RADIO AND HIGH-FREQUENCY APPLICATIONS

7 INDUCTOR MARKET, BY TYPE (Page No. - 94)

7.1 INTRODUCTION

FIGURE 31 WIRE-WOUND INDUCTORS TO HOLD LARGEST MARKET SIZE IN 2027

TABLE 18 INDUCTOR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 19 INDUCTOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 20 INDUCTOR MARKET, BY TYPE, 2018–2021 (MILLION UNITS)

TABLE 21 INDUCTOR MARKET, BY TYPE, IN TERMS OF VOLUME, 2022–2027 (MILLION UNITS)

7.2 FILM TYPE

TABLE 22 FILM TYPE: MARKET, BY CORE TYPE, 2018–2021 (USD MILLION)

TABLE 23 FILM TYPE: MARKET, BY CORE TYPE, 2022–2027 (USD MILLION)

TABLE 24 FILM TYPE: MARKET, BY SHIELD TYPE, 2018–2021 (USD MILLION)

TABLE 25 FILM TYPE: MARKET, BY SHIELD TYPE, 2022–2027 (USD MILLION)

TABLE 26 FILM TYPE: MARKET, BY MOUNTING TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 27 FILM TYPE: MARKET, BY MOUNTING TECHNIQUE, 2022–2027 (USD MILLION)

TABLE 28 FILM TYPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 29 FILM TYPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

7.2.1 THIN FILM

7.2.1.1 Increased demand due to proliferation of RF technology

7.2.2 THICK FILM

7.2.2.1 More precise process compared with multilayered type

7.3 MULTILAYERED

7.3.1 PROVIDE HIGH-QUALITY FACTOR AND HELP IN FURTHER MINIATURIZATION OF ELECTRONIC CIRCUITS

TABLE 30 MULTILAYERED: MARKET, BY CORE TYPE, 2018–2021 (USD MILLION)

TABLE 31 MULTILAYERED: MARKET, BY CORE TYPE, 2022–2027 (USD MILLION)

TABLE 32 MULTILAYERED: MARKET, BY SHIELD TYPE, 2018–2021 (USD MILLION)

TABLE 33 MULTILAYERED: MARKET, BY SHIELD TYPE, 2022–2027 (USD MILLION)

TABLE 34 MULTILAYERED: MARKET, BY MOUNTING TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 35 MULTILAYERED: MARKET, BY MOUNTING TECHNIQUE, 2022–2027 (USD MILLION)

TABLE 36 MULTILAYERED: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 37 MULTILAYERED: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

7.4 WIRE-WOUND

TABLE 38 WIRE-WOUND: MARKET, BY CORE TYPE, 2018–2021 (USD MILLION)

TABLE 39 WIRE-WOUND: MARKET, BY CORE TYPE, 2022–2027 (USD MILLION)

TABLE 40 WIRE-WOUND: MARKET, BY SHIELD TYPE, 2018–2021 (USD MILLION)

TABLE 41 WIRE-WOUND: MARKET, BY SHIELD TYPE, 2022–2027 (USD MILLION)

TABLE 42 WIRE-WOUND: MARKET, BY MOUNTING TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 43 WIRE-WOUND: MARKET, BY MOUNTING TECHNIQUE, 2022–2027 (USD MILLION)

TABLE 44 WIRE-WOUND: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 45 WIRE-WOUND: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

7.4.1 BOBBIN TYPE

7.4.1.1 Varying design in terms of power rating and current levels

7.4.2 TOROIDAL TYPE

7.4.2.1 Low magnetic flux leakage due to circular shape of toroid

7.5 MOLDED TYPE

7.5.1 OFFER HIGH DC BIAS AND RELIABILITY

TABLE 46 MOLDED: MARKET, BY CORE TYPE, 2018–2021 (USD MILLION)

TABLE 47 MOLDED: MARKET, BY CORE TYPE, 2022–2027 (USD MILLION)

TABLE 48 MOLDED: MARKET, BY SHIELD TYPE, 2018–2021 (USD MILLION)

TABLE 49 MOLDED: MARKET, BY SHIELD TYPE, 2022–2027 (USD MILLION)

TABLE 50 MOLDED: MARKET, BY MOUNTING TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 51 MOLDED: MARKET, BY MOUNTING TECHNIQUE, 2022–2027 (USD MILLION)

TABLE 52 MOLDED: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 53 MOLDED: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

8 INDUCTOR MARKET, BY CORE TYPE (Page No. - 110)

8.1 INTRODUCTION

FIGURE 32 FERROMAGNETIC/FERRITE CORE INDUCTORS TO HOLD LARGEST MARKET SIZE IN 2027

TABLE 54 INDUCTOR MARKET, BY CORE TYPE, 2018–2021 (USD MILLION)

TABLE 55 INDUCTOR MARKET, BY CORE TYPE, 2022–2027 (USD MILLION)

8.2 AIR CORE

TABLE 56 AIR CORE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 57 AIR CORE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.2.1 CERAMIC CORE

8.2.1.1 Usually adopted in high-frequency and high-current applications

8.2.2 PHENOLIC CORE

8.2.2.1 Commonly used in high-frequency applications

8.3 FERROMAGNETIC/FERRITE CORE

TABLE 58 FERROMAGNETIC CORE: INDUCTOR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 59 FERROMAGNETIC CORE: INDUCTOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.3.1 SOFT FERRITES

8.3.1.1 Current losses are very low

8.3.2 HARD FERRITES

8.3.2.1 Inductance level is very high

8.4 IRON CORE

8.4.1 HELP IN APPLICATIONS REQUIRING HIGH INDUCTANCE

TABLE 60 IRON CORE: MARKET, BY TYPE 2018–2021 (USD MILLION)

TABLE 61 IRON CORE: MARKET, BY TYPE 2022–2027 (USD MILLION)

9 INDUCTOR MARKET, BY SHIELD TYPE (Page No. - 116)

9.1 INTRODUCTION

FIGURE 33 SHIELDED INDUCTORS TO HOLD LARGER SIZE OF INDUCTOR MARKET DURING FORECAST PERIOD

TABLE 62 MARKET, BY SHIELD TYPE, 2018–2021 (USD MILLION)

TABLE 63 MARKET, BY SHIELD TYPE, 2022–2027 (USD MILLION)

9.2 SHIELDED

9.2.1 PRODUCE LESSER EMISSIONS THAN UNSHIELDED INDUCTORS

TABLE 64 SHIELDED: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 65 SHIELDED: MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.3 UNSHIELDED

9.3.1 EASIER TO USE IN HIGHER CURRENTS

TABLE 66 UNSHIELDED: INDUCTOR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 67 UNSHIELDED: INDUCTOR MARKET, BY TYPE, 2022–2027 (USD MILLION)

10 INDUCTOR MARKET, BY MOUNTING TECHNIQUE (Page No. - 121)

10.1 INTRODUCTION

FIGURE 34 SURFACE-MOUNT INDUCTORS TO HOLD LARGER SIZE OF INDUCTOR MARKET IN 2027

TABLE 68 MARKET, BY MOUNTING TECHNIQUE, 2018–2021 (USD MILLION)

TABLE 69 MARKET, BY MOUNTING TECHNIQUE, 2022–2027 (USD MILLION)

10.2 SURFACE-MOUNT

10.2.1 PERMITS ATTACHMENT OF SURFACE-MOUNT INDUCTORS TO PRINTED CIRCUIT BOARDS

TABLE 70 SURFACE-MOUNT: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 71 SURFACE-MOUNT: MARKET, BY TYPE, 2022–2027 (USD MILLION)

10.3 THROUGH-HOLE

10.3.1 EXTREMELY RELIABLE AND PROVIDES STRONG MECHANICAL BONDS

TABLE 72 THROUGH-HOLE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 73 THROUGH-HOLE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

11 INDUCTOR MARKET, BY APPLICATION (Page No. - 126)

11.1 INTRODUCTION

FIGURE 35 GENERAL CIRCUITS SEGMENT EXPECTED TO CAPTURE LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 74 INDUCTOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 75 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.2 GENERAL CIRCUITS

11.2.1 INDUCTORS COMBINED WITH CAPACITORS AND RESISTORS TO CREATE FILTERS FOR ANALOG CIRCUITS

11.3 POWER APPLICATIONS

11.3.1 INDUCTORS ACT AS ENERGY STORAGE DEVICES AND PRODUCE DC CURRENTS

11.4 HIGH-FREQUENCY APPLICATIONS

11.4.1 RADIO COMMUNICATION SYSTEMS LARGEST APPLICATION AREA FOR HIGH-FREQUENCY CIRCUITS

12 INDUCTOR MARKET, BY VERTICAL (Page No. - 130)

12.1 INTRODUCTION

FIGURE 36 CONSUMER ELECTRONICS TO HOLD LARGEST SIZE OF INDUCTOR MARKET IN 2027

TABLE 76 INDUCTOR MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 77 INDUCTOR MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

12.2 AUTOMOTIVE

12.2.1 ELECTRIC VEHICLES DRIVE DEMAND FOR INDUCTORS

TABLE 78 AUTOMOTIVE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 79 AUTOMOTIVE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 80 AUTOMOTIVE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 81 AUTOMOTIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 82 AUTOMOTIVE: MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 83 AUTOMOTIVE: MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 84 AUTOMOTIVE: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 85 AUTOMOTIVE: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 86 AUTOMOTIVE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 87 AUTOMOTIVE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 88 AUTOMOTIVE: MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 89 AUTOMOTIVE: MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

12.3 INDUSTRIAL

12.3.1 INDUCTORS WITH HIGH-CURRENT STORING CAPACITY USED FOR POWER SUPPLY

TABLE 90 INDUSTRIAL: INDUCTOR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 91 INDUSTRIAL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 92 INDUSTRIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 93 INDUSTRIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 94 INDUSTRIAL: MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 95 INDUSTRIAL: MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 96 INDUSTRIAL: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 97 INDUSTRIAL: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 98 INDUSTRIAL: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 99 INDUSTRIAL: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 100 INDUSTRIAL: MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 101 INDUSTRIAL: MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

12.4 RF & TELECOMMUNICATION

12.4.1 WIRE-WOUND INDUCTORS PREFERRED DUE TO HIGH-CURRENT HANDLING CAPABILITIES

TABLE 102 RF & TELECOMMUNICATION: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 103 RF & TELECOMMUNICATION: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 104 RF & TELECOMMUNICATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 105 RF & TELECOMMUNICATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 106 RF & TELECOMMUNICATION: MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 107 RF & TELECOMMUNICATION: MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 108 RF & TELECOMMUNICATION: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 109 RF & TELECOMMUNICATION: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 110 RF & TELECOMMUNICATION: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 111 RF & TELECOMMUNICATION: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 112 RF & TELECOMMUNICATION: MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 113 RF & TELECOMMUNICATION: MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

12.5 MILITARY & DEFENSE

12.5.1 HIGH-ACCURACY AND LIGHT-WEIGHT INDUCTORS PREFERRED

TABLE 114 MILITARY & DEFENSE: INDUCTOR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 115 MILITARY & DEFENSE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 116 MILITARY & DEFENSE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 117 MILITARY & DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 118 MILITARY & DEFENSE: MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 119 MILITARY & DEFENSE: MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 120 MILITARY & DEFENSE: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 121 MILITARY & DEFENSE: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 122 MILITARY & DEFENSE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 123 MILITARY & DEFENSE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 124 MILITARY & DEFENSE: MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 125 MILITARY & DEFENSE: MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

12.6 CONSUMER ELECTRONICS

12.6.1 LARGEST END MARKET FOR INDUCTORS

TABLE 126 CONSUMER ELECTRONICS: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 127 CONSUMER ELECTRONICS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 128 CONSUMER ELECTRONICS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 129 CONSUMER ELECTRONICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 130 CONSUMER ELECTRONICS: MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 131 CONSUMER ELECTRONICS: MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 132 CONSUMER ELECTRONICS: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 133 CONSUMER ELECTRONICS: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 134 CONSUMER ELECTRONICS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 135 CONSUMER ELECTRONICS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 136 CONSUMER ELECTRONICS: MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 137 CONSUMER ELECTRONICS: MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

12.7 TRANSMISSION & DISTRIBUTION

12.7.1 HIGH CURRENT HANDLING CAPACITY INDUCTORS PREFERRED FOR POWER SUPPLY

TABLE 138 TRANSMISSION & DISTRIBUTION: INDUCTOR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 139 TRANSMISSION & DISTRIBUTION: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 140 TRANSMISSION & DISTRIBUTION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 141 TRANSMISSION & DISTRIBUTION: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 142 TRANSMISSION & DISTRIBUTION: MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 143 TRANSMISSION & DISTRIBUTION: MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 144 TRANSMISSION & DISTRIBUTION: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 145 TRANSMISSION & DISTRIBUTION: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 146 TRANSMISSION & DISTRIBUTION: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 147 TRANSMISSION & DISTRIBUTION: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 148 TRANSMISSION & DISTRIBUTION: MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 149 TRANSMISSION & DISTRIBUTION: MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

12.8 HEALTHCARE

12.8.1 DEMANDS HIGH RELIABILITY AND COMPACT INDUCTORS

TABLE 150 HEALTHCARE: INDUCTOR MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 151 HEALTHCARE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 152 HEALTHCARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 153 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 154 HEALTHCARE: MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 155 HEALTHCARE: MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 156 HEALTHCARE: MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 157 HEALTHCARE: MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 158 HEALTHCARE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 159 HEALTHCARE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 160 HEALTHCARE: MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 161 HEALTHCARE: MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

13 INDUCTOR MARKET, BY REGION (Page No. - 164)

13.1 INTRODUCTION

FIGURE 37 GEOGRAPHIC SNAPSHOT OF INDUCTOR MARKET, 2022–2027

TABLE 162 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 163 MARKET, BY REGION, 2022–2027 (USD MILLION)

13.2 NORTH AMERICA

FIGURE 38 NORTH AMERICA: INDUCTOR MARKET SNAPSHOT

TABLE 164 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 165 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 166 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 167 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.2.1 US

13.2.1.1 Rapid adoption of wireless charging technology

TABLE 168 US: INDUCTOR MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 169 US: INDUCTOR MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.2.2 CANADA

13.2.2.1 Robust demand for consumer electronics

TABLE 170 CANADA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 171 CANADA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.2.3 MEXICO

13.2.3.1 Continued growth of electronics industry

TABLE 172 MEXICO: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 173 MEXICO: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.3 EUROPE

FIGURE 39 EUROPE: INDUCTOR MARKET SNAPSHOT

TABLE 174 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 175 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 176 EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 177 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.3.1 GERMANY

13.3.1.1 Adoption of Industry 4.0 and robotics

TABLE 178 GERMANY: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 179 GERMANY: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.3.2 UK

13.3.2.1 Increased demand for inductors in RF & telecommunication sector

TABLE 180 UK: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 181 UK: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.3.3 FRANCE

13.3.3.1 Increasing adoption of mobile devices

TABLE 182 FRANCE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 183 FRANCE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.3.4 ITALY

13.3.4.1 Rapid industrial automation

TABLE 184 ITALY: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 185 ITALY: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.3.5 REST OF EUROPE

TABLE 186 REST OF EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 187 REST OF EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.4 ASIA PACIFIC

FIGURE 40 ASIA PACIFIC: INDUCTOR MARKET SNAPSHOT

TABLE 188 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 189 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 190 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 191 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.4.1 CHINA

13.4.1.1 Growing market for automobiles and consumer electronics

TABLE 192 CHINA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 193 CHINA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.4.2 INDIA

13.4.2.1 Increasing government initiatives to boost manufacturing sector

TABLE 194 INDIA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 195 INDIA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.4.3 JAPAN

13.4.3.1 Rising demand for inductors due to presence of electronics manufacturing industry

TABLE 196 JAPAN: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 197 JAPAN: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.4.4 SOUTH KOREA

13.4.4.1 Rapid development of smart homes and smart cities

TABLE 198 SOUTH KOREA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 199 SOUTH KOREA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.4.5 REST OF ASIA PACIFIC

TABLE 200 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 201 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.5 REST OF THE WORLD (ROW)

FIGURE 41 REST OF THE WORLD: INDUCTOR MARKET SNAPSHOT

TABLE 202 ROW: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 203 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 204 ROW: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 205 ROW: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.5.1 SOUTH AMERICA

13.5.1.1 High market growth owing to presence of leading electronics manufacturing plants in Brazil

TABLE 206 SOUTH AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 207 SOUTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.5.2 MIDDLE EAST & AFRICA

13.5.2.1 Increased demand for power inductors from oil & gas fields in Middle East

TABLE 208 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 209 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 196)

14.1 OVERVIEW

TABLE 210 INDUCTOR MARKET: KEY GROWTH STRATEGIES ADOPTED BY COMPANIES FROM 2019 TO 2022

14.2 TOP FIVE COMPANY REVENUE ANALYSIS

FIGURE 42 THREE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN INDUCTOR MARKET

14.3 MARKET SHARE ANALYSIS (2021)

TABLE 211 INDUCTOR MARKET: DEGREE OF COMPETITION

14.4 COMPANY EVALUATION QUADRANT

14.4.1 STARS

14.4.2 EMERGING LEADERS

14.4.3 PERVASIVE PLAYERS

14.4.4 PARTICIPANTS

FIGURE 43 INDUCTOR MARKET, COMPANY EVALUATION MATRIX, 2021

14.5 STARTUP/SME EVALUATION QUADRANT

TABLE 212 STARTUPS/SMES IN INDUCTOR MARKET

14.5.1 PROGRESSIVE COMPANIES

14.5.2 RESPONSIVE COMPANIES

14.5.3 DYNAMIC COMPANIES

14.5.4 STARTING BLOCKS

FIGURE 44 INDUCTOR MARKET, STARTUP/SME EVALUATION QUADRANT, 2021

14.6 INDUCTOR MARKET: COMPANY FOOTPRINT

TABLE 213 COMPANY FOOTPRINT

TABLE 214 COMPANY TYPE FOOTPRINT

TABLE 215 COMPANY VERTICAL FOOTPRINT

TABLE 216 COMPANY REGION FOOTPRINT

14.7 COMPETITIVE SITUATIONS AND TRENDS

14.7.1 PRODUCT LAUNCHES

TABLE 217 PRODUCT LAUNCHES, 2019–2022

14.7.2 DEALS

TABLE 218 DEALS, 2019–2021

15 COMPANY PROFILES (Page No. - 211)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

15.1 KEY PLAYERS

15.1.1 MURATA MANUFACTURING

TABLE 219 MURATA MANUFACTURING: BUSINESS OVERVIEW

FIGURE 45 MURATA MANUFACTURING: COMPANY SNAPSHOT

15.1.2 TDK

TABLE 220 TDK: BUSINESS OVERVIEW

FIGURE 46 TDK: COMPANY SNAPSHOT

15.1.3 VISHAY INTERTECHNOLOGY

TABLE 221 VISHAY INTERTECHNOLOGY: BUSINESS OVERVIEW

FIGURE 47 VISHAY INTERTECHNOLOGY: COMPANY SNAPSHOT

15.1.4 TAIYO YUDEN

TABLE 222 TAIYO YUDEN: BUSINESS OVERVIEW

FIGURE 48 TAIYO YUDEN: COMPANY SNAPSHOT

15.1.5 CHILISIN ELECTRONICS

TABLE 223 CHILISIN ELECTRONICS: BUSINESS OVERVIEW

FIGURE 49 CHILISIN ELECTRONICS: COMPANY SNAPSHOT

15.1.6 DELTA ELECTRONICS

TABLE 224 DELTA ELECTRONICS: BUSINESS OVERVIEW

FIGURE 50 DELTA ELECTRONICS: COMPANY SNAPSHOT

15.1.7 PANASONIC

TABLE 225 PANASONIC: BUSINESS OVERVIEW

FIGURE 51 PANASONIC: COMPANY SNAPSHOT

15.1.8 ABC TAIWAN ELECTRONICS

TABLE 226 ABC TAIWAN ELECTRONICS: BUSINESS OVERVIEW

15.1.9 PULSE ELECTRONICS

TABLE 227 PULSE ELECTRONICS: BUSINESS OVERVIEW

15.1.10 COILCRAFT

TABLE 228 COILCRAFT: BUSINESS OVERVIEW

15.2 OTHER KEY PLAYERS

15.2.1 SHENZHEN SUNLORD ELECTRONICS

15.2.2 BOURNS

15.2.3 SUMIDA

15.2.4 ICE COMPONENTS

15.2.5 KYOCERA AVX

15.2.6 BEL FUSE

15.2.7 FALCO ELECTRONICS

15.2.8 GCI TECHNOLOGIES

15.2.9 WÜRTH ELEKTRONIK

15.2.10 SAMSUNG-ELECTRO MECHANICS (SEMCO)

15.2.11 INDUCTOR SUPPLY, INC.

15.2.12 GOWANDA ELECTRONICS

15.2.13 LITTELFUSE

15.2.14 TOKEN ELECTRONICS

15.2.15 TT ELECTRONICS

15.2.16 LAIRD TECHNOLOGIES

15.2.17 JOHANSON TECHNOLOGY

15.2.18 ZHENHUA ELECTRONICS

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 274)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

The study involved four major activities in estimating the size for inductor market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These include annual reports, press releases & investor presentations of companies, white papers, technology journals, and certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the supply chain of the industry, the total pool of market players, classification of the market according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the inductor market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Primary Research

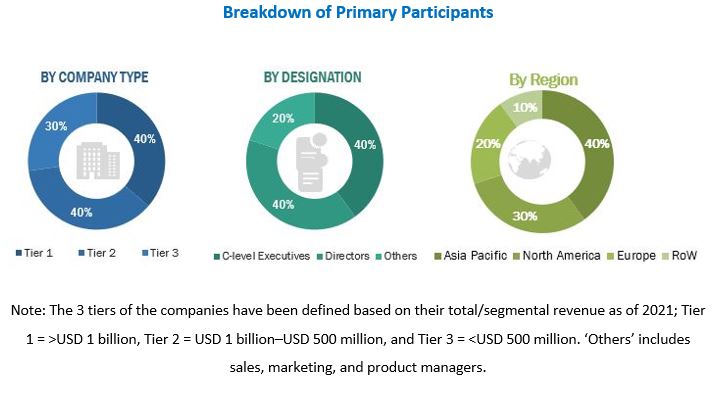

Extensive primary research was conducted after obtaining information about the inductor market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across 4 major regions, namely, the North America, Europe, Asia Pacific and RoW. Approximately 80% and 20% of the primary interviews have been conducted with parties from the demand and supply sides, respectively. This primary data was collected through questionnaires, e-mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both the top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the network monitoring market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Inductor Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained earlier, the overall inductor market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the size of the inductor market was validated using top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the inductor market, in terms of value, based on inductance, type, core type, shield type, mounting technique, application, vertical, and region

- To forecast the size of the market, by region—North America, Europe, Asia Pacific, and the Rest of the World (RoW)—in terms of value

- To forecast the inductor market size, in terms of volume, by type

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the inductor market

- To strategically analyze the micromarkets1 with respect to the individual growth trends, prospects, and their contribution to the inductor market

- To map the competitive landscape based on company profiles, key player strategies, and key developments

- To provide a detailed overview of the inductor market value chain and ecosystem

- To provide information about the key technology trends and patents related to the inductor market

- To provide information regarding trade data related to the inductor market

- To identify the key players operating in the inductor market and comprehensively analyze their market shares and core competencies2

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the inductor ecosystem

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes them on various parameters within the broad categories of market ranking/share and product portfolio

- To analyze competitive developments such as contracts, acquisitions, product launches, collaborations, partnerships, and research and development (R&D) in the inductor market

- To analyze the impact of COVID-19 on the growth of the inductor market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Inductor Market