Crop Protection Chemicals Market

Crop Protection Chemicals Market by Type (Herbicides, Insecticides, Fungicides & Bactericides), Origin (Synthetic & Biopesticides), Form, Mode of Application (Foliar, Seed Treatment, Soil Treatment), Crop Type and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

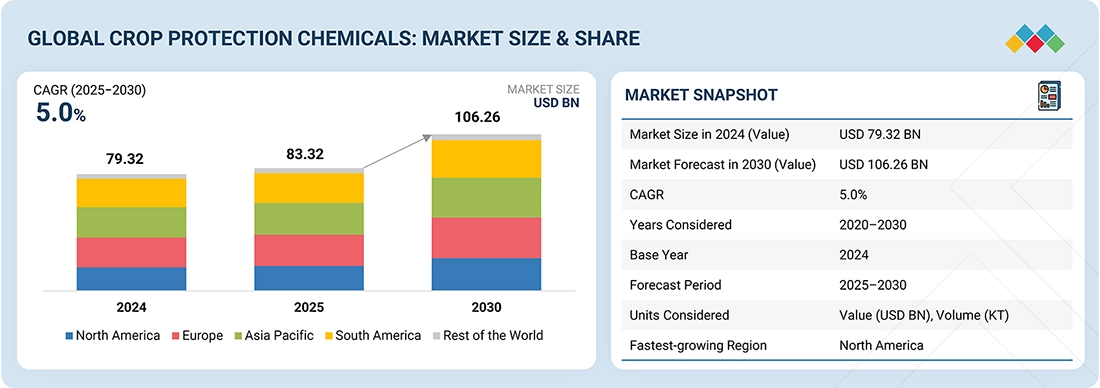

The crop protection chemicals market is estimated at USD 83.32 billion in 2025 and is projected to reach USD 106.26 billion by 2030, at a CAGR of 5.0% from 2025 to 2030. Rising demand for food across the globe, the limited availability of arable land, and increased agricultural productivity are some of the significant drivers for this market. Recent occurrences of pest attacks, as well as the continuous evolution of resistance among weeds and pathogens, have been the major contributors to yield loss, thus increasing the reliance on chemical crop protection to safeguard farm output.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific dominated the global crop protection chemicals market, with a share of 26.0% in 2024.

-

BY TYPEBy type, the Insecticides segment is expected to register the highest CAGR of 5.1%.

-

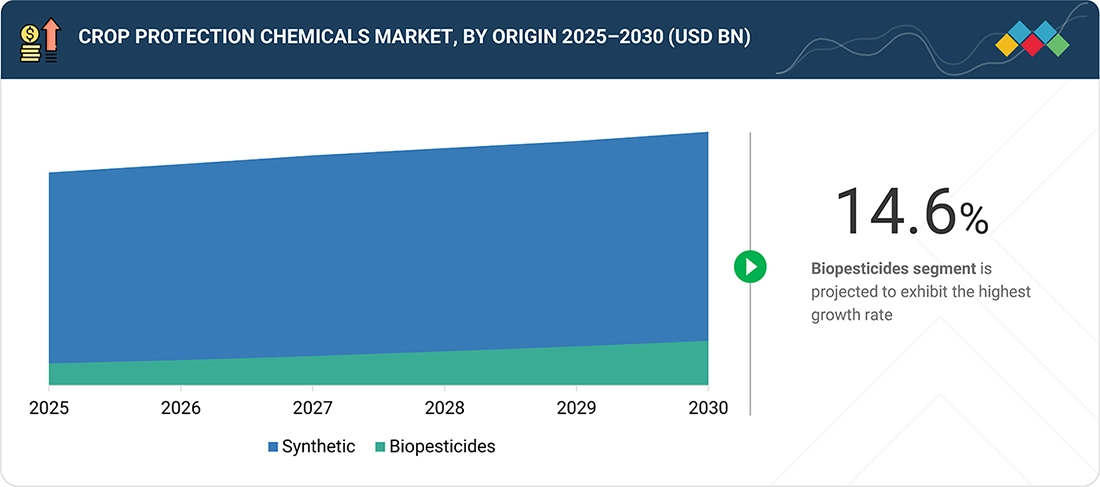

BY ORIGINBy origin, the biopesticides segment is projected to grow at the fastest rate at the CAGR of 14.6% from 2025 to 2030.

-

BY FORMULATIONBy formulation, the liquid segment will grow the fastest rate during the forecast period.

-

BY MODE OF APPLICATIONBy mode of application, the foliar spray segment is expected to dominate the market.

-

BY CROP TYPEBy Crop type, the fruits & vegetables segment to grow at highest rate.

-

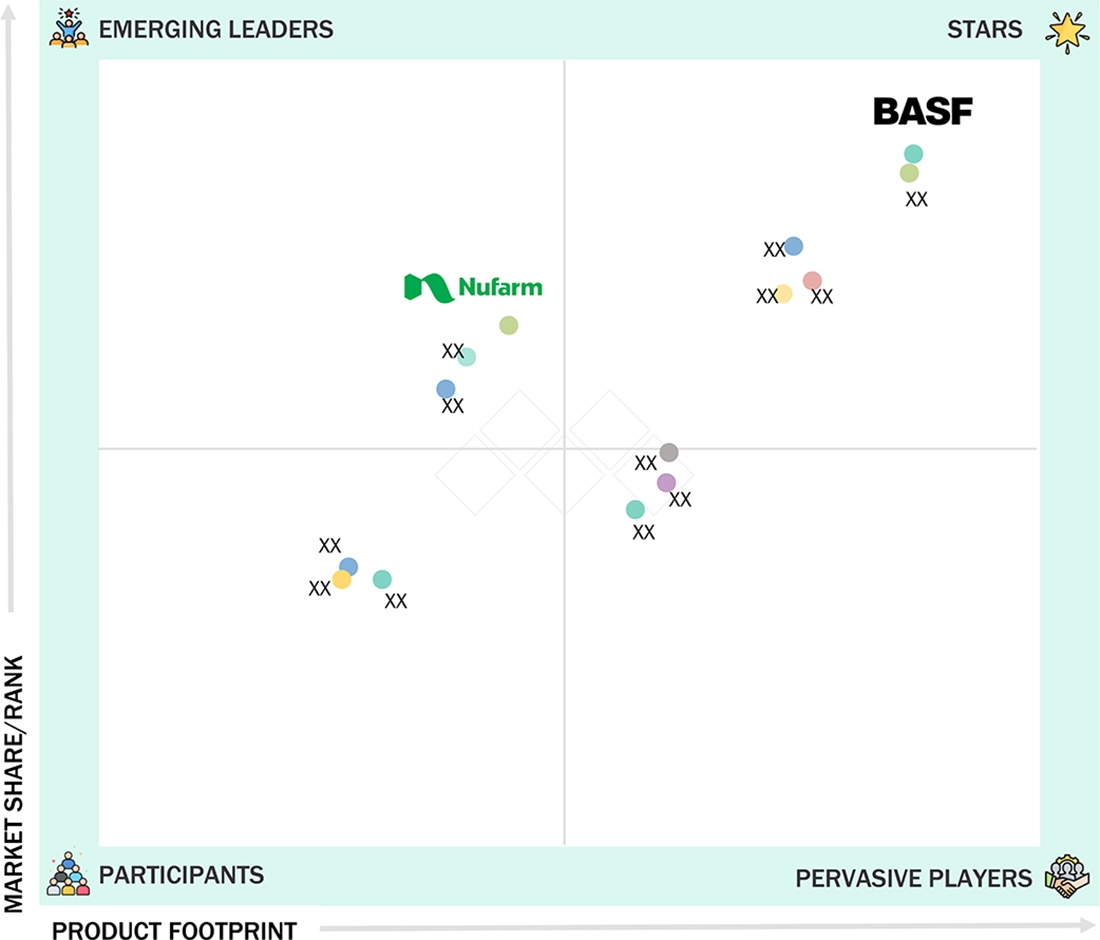

COMPETITIVE LANDSCAPEBASF SE, Syngenta, Bayer AG, UPL,and Corteva were identified as Star players in the crop protection chemicals market, as they have focused on innovation and have broad industry coverage and strong operational & financial strength.

The global crop protection chemicals market is driven by the increasingly growing global food demand, the limited arable land availability prompted farmers to look for productivity enhancement in previously established farmland. In addition to increased climate variability, changing weather patterns escalate the distribution and intensity of insects, pathogens, and invasive weeds, increasing dependence on chemical crop protection in major crop systems.

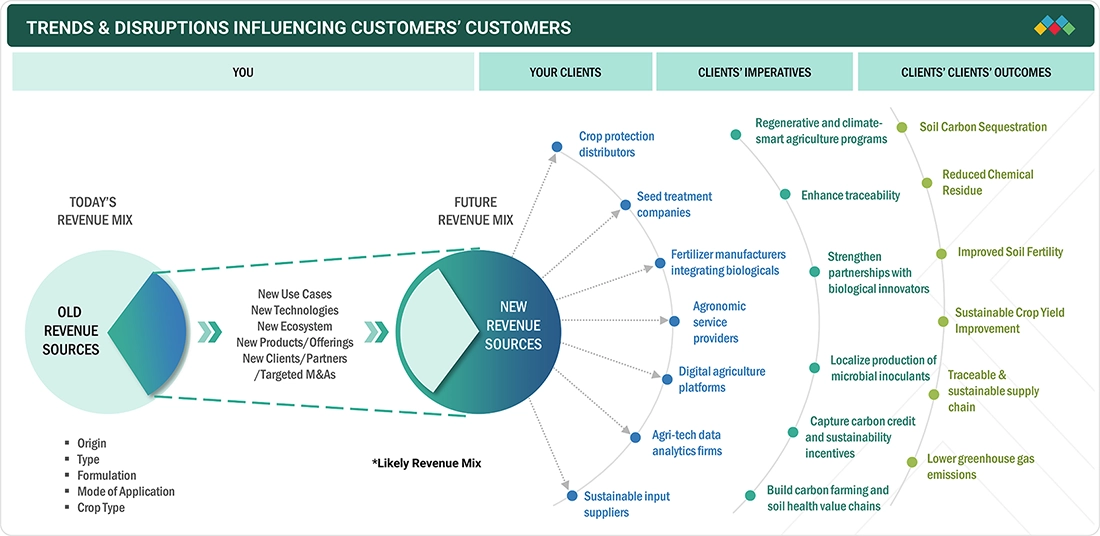

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Major trends concerning disruptions are influencing the global crop protection chemicals market; product innovations and redefining market dynamics. Fastened regulatory reviews and periodic re-evaluation of active ingredients are resulting in the withdrawal of older chemistries and replacement demands for new, safer and selective products. At the same time, weed, insect and pathogen resistance is underscoring the need to shift to newer modes of actions or combination products and better resistance management strategies. Similarly, sustainability aspirations from governments, food companies, and consumers are changing the dynamics for traditional portfolios, leading the way for manufacturers to mitigate environmental burdens by using low-dose actives and advanced formulations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising incidence of pest and disease outbreaks

-

Growing pressure to maximize crop yields on limited arable land

Level

-

Stringent regulatory frameworks

-

Environmental and health concerns

Level

-

Integration with precision agriculture technologies

-

Shift toward safer chemistries

Level

-

Increasing resistance to existing active ingredients

-

High R&D cost and long development timelines

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising incidence of pest and disease outbreaks

Climatic shifts, including increased temperature and erratic rainfall, are extending life cycles and geographical ranges of insects, weeds, and plant pathogens. Intensified agriculture and repeated cropping are generating a conducive environment for pests to build-up and disease transmission. The result is that farmers are thus increasingly dependent upon chemical means of crop protection to not only gain effective control over infestation, therefore preventing mass scale crop losses, but also ensure sustainable agricultural production.

Restraint: Stringent regulatory frameworks

With stringent regulation, the whole structure restrains the crop protection chemicals market, as any active ingredient with an evaluation of toxicity, environmental impact, or residue limits is unlikely to be approved, restricted, or phase-out. Long approval processes and frequent re-registration requirements add to compliance costs and delay product launches, thereby restricting the availability of new chemistries. Added to that, lack of uniformity in regulations across countries further complicates access for global manufacturers, thereby making it considerably challenging for standardized products to be marketed across regions with differing safety and environmental standards.

Opportunity: Integration with precision agriculture technologies

Integration with precision agriculture technologies presents a significant opportunity in the crop protection chemicals market by enabling more targeted, efficient, and data-driven applications. Sprayers guided by GPS, variable-rate applicators, and field sensors are capable of enabling farmers during the application of herbicides, insecticides, and fungicides specifically when and where needed, thereby freeing receipts of meeting all necessary costs while minimizing such chemical use, harming the environment, benefiting healthy crop growth. These aims will additionally improve product effectiveness and cost efficiency and ensure compliance with sustainability and regulatory requirements. Integration increases the adoption of the technologies for digital farming, which can then be seized by the manufacturer of chemicals in developing site-specific solutions, optimizing formulations, and offering value-added services to enhance growth in new markets.

Challenge:Increasing resistance to existing active ingredients

The growing resistance of weeds, insects, and pathogens toward existing active ingredients is one challenge the crop protection industry faces today. The repeated application of the same modes of action and abuse of these molecules lead to the fast development of resistance and reduced efficacy of the so-called traditional chemistries; this shortens the life cycle of the products. So, the trend inspires huge investments by the manufacturers in the research and development of new active ingredients, combination products, and resistance management solutions, and at the same time requires farmers to adopt much more complicated and diversified crop protection programs to ensure high-quality yield.

CROP PROTECTION CHEMICALS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Integrated use of chemical insecticides and biological solutions in corn and soybean systems | Enhances targeted pest control, supports resistance management, and sustains row-crop yields |

|

Advanced fungicides and seed-applied chemical treatments in cereals and grains | Improves early-stage protection, enhances plant vigor, and ensures consistent field performance |

|

Selective insecticides and herbicides applied in row and specialty crops | Controls resistant pests effectively while supporting integrated pest management programs |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

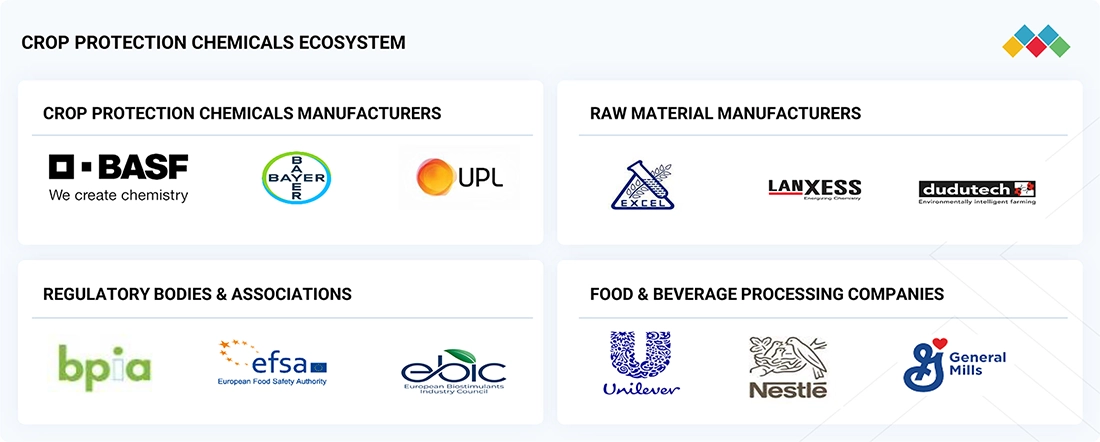

MARKET ECOSYSTEM

Some of the prominent companies in this market include well-established and financially sound manufacturers of crop protection chemicals. These companies have been operational in the market for more than a decade and have diversified portfolios, the latest technologies, and excellent global sales and marketing networks. Some of the prominent companies in this market include BASF SE (Germany), Syngenta (Switzerland), Bayer AG (Germany), Corteva (US), and UPL (India).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Crop Protection Chemicals Market, By Type

The type segment comprises herbicides, insecticides, fungicides & bactericides, and others. Herbicides account for the largest share of the crop protection chemicals market by type, primarily due to their widespread and recurring use across major field crops such as cereals, oilseeds, and pulses. Weed infestation is one of the most persistent constraints facing crop productivity, since weeds compete with crops for nutrients, water, and sunlight, and can severely reduce yields when unable to be effectively controlled. Thus, herbicides are an extremely efficient and practical answer to the farmer in the comprehensive control of weed problems, applicable in both preemergence and postemergence. The use of herbicides is further aided by the advent of large-scale commercial farming and conservation tillage systems, where chemical weed control lessens labor input and allows timely field operations.

Crop Protection Chemicals Market, By Origin

The origin segment comprises of synthetic and biopesticides. Synthetic products hold the highest share in the origin segment of the crop protection chemicals market, primarily due to their proven efficacy, broad-spectrum activity, and consistent performance across diverse crops and agro-climatic conditions. In particular, they are able to deliver both quick and reliable control levels of weeds, pests, and diseases. Thus, synthetic herbicides, fungicides, and insecticides are considered the best options in agro-commercial and large-scale farming systems. The highly standardized manufacturing processes, extended shelf life, and compatibility with modern applications provide features that favored developed countries and commercial farms for their usage.

Crop Protection Chemicals Market, By Formulation

The form segment comprises of liquid and solid. Liquid formulations account for the largest share within the form segment, driven by their ease of handling, application efficiency, and formulation versatility. Liquid products, namely, emulsifiable concentrates, suspension concentrates, and soluble liquids, are sufficient to ensure that active ingredients are evenly distributed and well covered over crop canopies during application; this leads to successful control of pests and diseases. Modern spraying equipment and precision application systems easily adapt these formulations to large-scale commercial farming. Liquid forms also encouraged flexible tank mixing and easy integration with adjuvants, fertilizers, and other crop inputs, thus enhancing the overall convenience for growers. From manufacturing aspects, liquid formulations can accommodate a variety of active ingredients and of highly innovative formulation technologies for differentiating products.

Crop Protection Chemicals Market, By Mode of Application

The mode of application segment includes foliar spray, soil treatment, seed treatment, and other modes of application. Foliar spray holds the highest share within the mode of application segment, driven by its simplicity, cost-effectiveness, and rapid action against pests and diseases on the plant surface, making it the preferred method for high-value crops such as fruits, vegetables, grapes, and greenhouse produce.

Crop Protection Chemicals Market, By Crop Type

The crop type segment includes cereals & grains, fruits & vegetables, oilseeds & pulses, and other crop types. Cereals and grains account for the largest share of the crop type segment in the crop protection chemicals market, primarily due to their extensive global cultivation and critical role in food security. Wheat, rice, maize, barley, corn, etc., require a huge area of land to be seeded yet are among the most affected by weeds and insects, as well as by fungal diseases, throughout their growth cycle. Because of this, all these crops require application of herbicides, fungicides, and insecticides at all stages of growth to protect the yield and also ensure grain quality. Furthermore, cereals and grains are usually subjected to intensive farming systems, which give high priority to maximizing yields and uniform performance of crops, thus increasing chemical use. These factors of high economic returns around such crops encourage farmers to invest heavily in very excellent crop protection programs for minimal losses.

REGION

North America to be fastest-growing country in crop protection chemicals market during forecast period

North America is projected to grow at fastest rate in the crop protection chemicals market, fueled by the adoption of advanced agricultural technologies, increasing use of sustainable pest management practices, and rising demand for effective herbicides, insecticides, and biopesticides that safeguard crop yields. The market is expected to achieve a strong compound annual growth rate through the latter part of the decade, driven by investments in precision agriculture and favorable regulatory support for innovative crop protection solutions.

CROP PROTECTION CHEMICALS MARKET: COMPANY EVALUATION MATRIX

In the crop protection chemicals market matrix, BASF SE (Star) leads the market leveraging its innovative chemical, microbial, and biochemical solutions to capture significant market share across key agricultural regions. Nufarm (Emerging Leader), meanwhile, is emerging as a strong player fueled by its strategic acquisitions that position it to challenge established players with high-performance crop protection solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- BASF SE (Germany)

- Bayer AG (Germany)

- Syngenta (Switzerland)

- FMC Corporation (US)

- Novonesis Group (Denmark)

- Koppert (Netherlands)

- BioFirst Group (Belgium)

- UPL (India)

- Nufarm (Australia)

- Corteva (US)

- American Vanguard Corporation (US)

- Kumiai Chemical Industry Co., Ltd (Japan)

- PI Industries (India)

- Gowan Company (US)

- Albaugh LLC (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 83.32 Billion |

| Market Forecast in 2030 (Value) | USD 106.26 Billion |

| Growth Rate | CAGR of 5.0% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (KT) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Region Covered | North America, Europe, Asia Pacific, South America, Rest of the World |

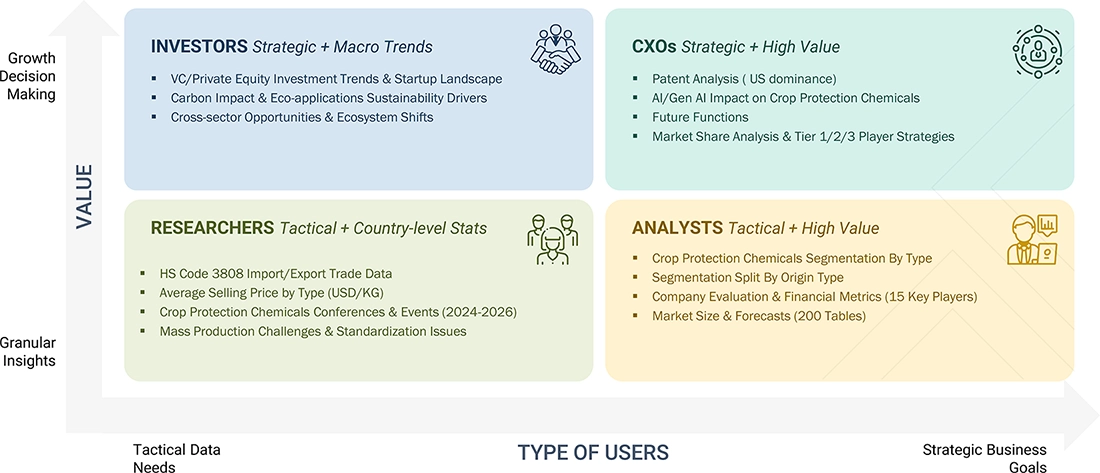

WHAT IS IN IT FOR YOU: CROP PROTECTION CHEMICALS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-based crop protection chemicals Manufacturers |

|

|

| Asia-Pacific crop protection chemicals Innovators |

|

|

| Global crop protection chemicals Distributor |

|

|

RECENT DEVELOPMENTS

- April 2024 : ADAMA announced the launch of Avastel, Maganic, Maxentis, and Forapro fungicides

- December 2023 : Albaugh introduced Maxtron 4SC Herbicide to the US Crop Protection Market

- March 2023 : Corteva acquired Symborg, to expand its position in biologicals market

- August 2022 : Koppert introduced Veraneio, a biological nematicide based on Bacillus amyloliquefaciens in Paraguay

Table of Contents

Methodology

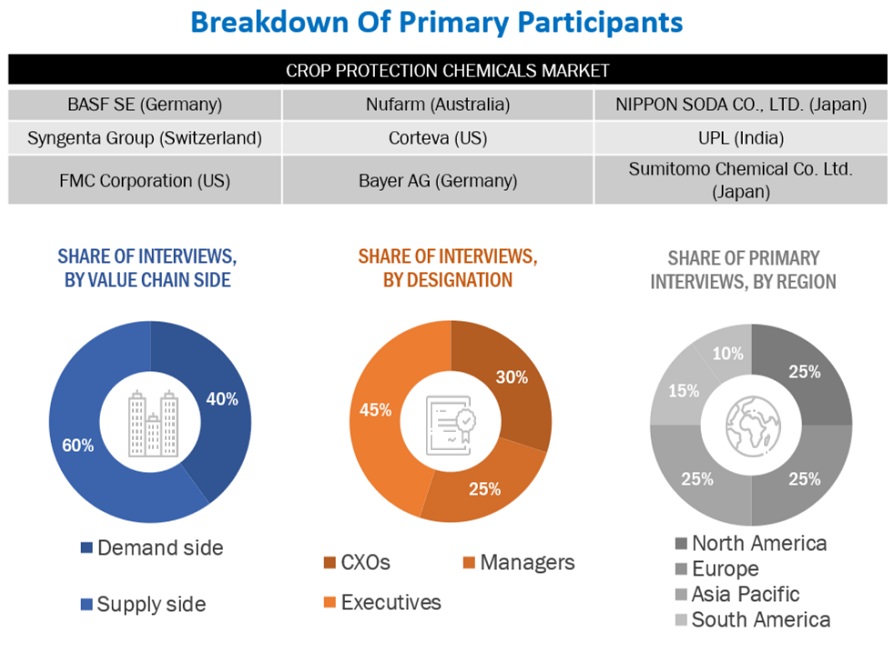

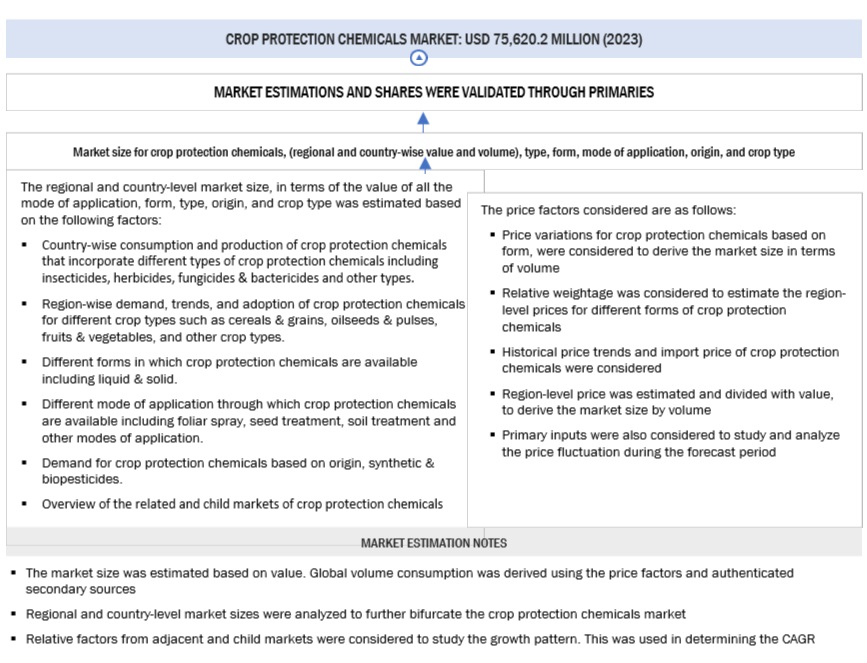

The study involved four major activities in estimating the current size of the crop protection chemicals market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the crop protection chemicals market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases were referred to identify and collect information. This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the crop protection chemicals market.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the crop protection chemicals market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to mode of application, crop type, type, form, origin, and region.

To know about the assumptions considered for the study, download the pdf brochure

Crop Protection Chemicals Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the crop protection chemicals Market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- Key players were identified through extensive secondary research.

- Primary and secondary research determined the industry’s value chain and market size.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The following figure provides an illustrative representation of the complete market size estimation process implemented in this research study for an overall estimation of the crop protection chemicals market in a consolidated format.

The following sections (bottom-up & top-down) depict the overall market size estimation process employed for the purpose of this study.

Global Crop Protection Chemicals Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Crop Protection Chemicals Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall crop protection chemicals market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

According to FAO, a crop protection chemical means a pesticide product intended to prevent, destroy, or control any pest causing harm during or otherwise interfering with the production, processing, storage, transport /or marketing of food, agricultural commodities, and wood and wood products.

Crop protection chemicals are used to protect crops from diseases, pests, and unwanted weeds & grasses, ultimately resulting in better yield. These chemicals include fungicides, herbicides, insecticides, nematicides, and other such chemicals that can either be synthetically or naturally produced. Crop protection chemicals are preferred over seed treatment chemicals and genetically modified (GM) crops because of their high effectiveness and easy application. Crop protection chemicals can be used in liquid or solid form and are widely applied to cereals & oilseeds and fruits & vegetables. They are mainly applied through seed treatment, soil treatment, and foliar spray.

Key Stakeholders

- Crop protection chemical manufacturers

- Crop protection chemical importers and exporters

- Crop protection chemical traders, distributors and suppliers

- Pesticides manufacturers

- Research institutes and organizations

- Government bodies, venture capitalists, and private equity firms

-

Regulatory Bodies

- World Health Organization (WHO)

- European Crop Protection Agency (ECPA)

- Pesticides Manufacturers and Formulators Association (PMFAI)

- China Crop Protection Industry Association (CCPIA)

- Food and Agriculture Organization (FAO)

- US Department of Agriculture (USDA)

- Institute of Food and Agricultural Sciences (IFAS)

- US Environmental Protection Agency (US EPA)

- Organization for Economic Co-operation and Development (OECD)

- Federal Office of Consumer Protection and Food Safety

- European Food Safety Authority

- Ministry of Agriculture & Farmers Welfare

- Department Of Agriculture, Cooperation & Farmers Welfare

- Directorate Of Plant Protection, Quarantine & Storage

- Commercial Research & Development (R&D) Institutions and Financial Institutions

Report Objectives

Market Intelligence

- To determine and project the size of the crop protection chemicals market with respect to the mode of application, type, form, origin, crop type, and region, over five years, ranging from 2024 to 2029.

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

-

To analyze the demand-side factors based on the following:

- Impact of macro-and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions.

Competitive Intelligence

- Identifying and profiling the key players in the crop protection chemicals market

-

Providing a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies players across the country adopt.

- Providing insights on key product innovations and investments in the crop protection chemicals market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe into Belgium, Luxemburg, the Czech Republic, Denmark, Greece, Ireland, Hungary, the Netherlands, Austria, Portugal, Slovenia, Finland, and Sweden.

- Further breakdown of the Rest of Asia Pacific into New Zealand, Vietnam, Thailand, Oceania (tropical Pacific islands), and South Korea.

- Further breakdown of the Rest of South America into Paraguay, Ecuador, Peru, and Chile.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Crop Protection Chemicals Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Crop Protection Chemicals Market