Air Traffic Control (ATC) Market by Offering (Hardware, Software & Solutions), Investment Type (Brownfield, and Greenfield), Airspace (ARTCC, TRACON, ATCT and Remote Tower), Service, Application, Airport Size and Region- Global Forecast to 2027

Update:: 13.11.24

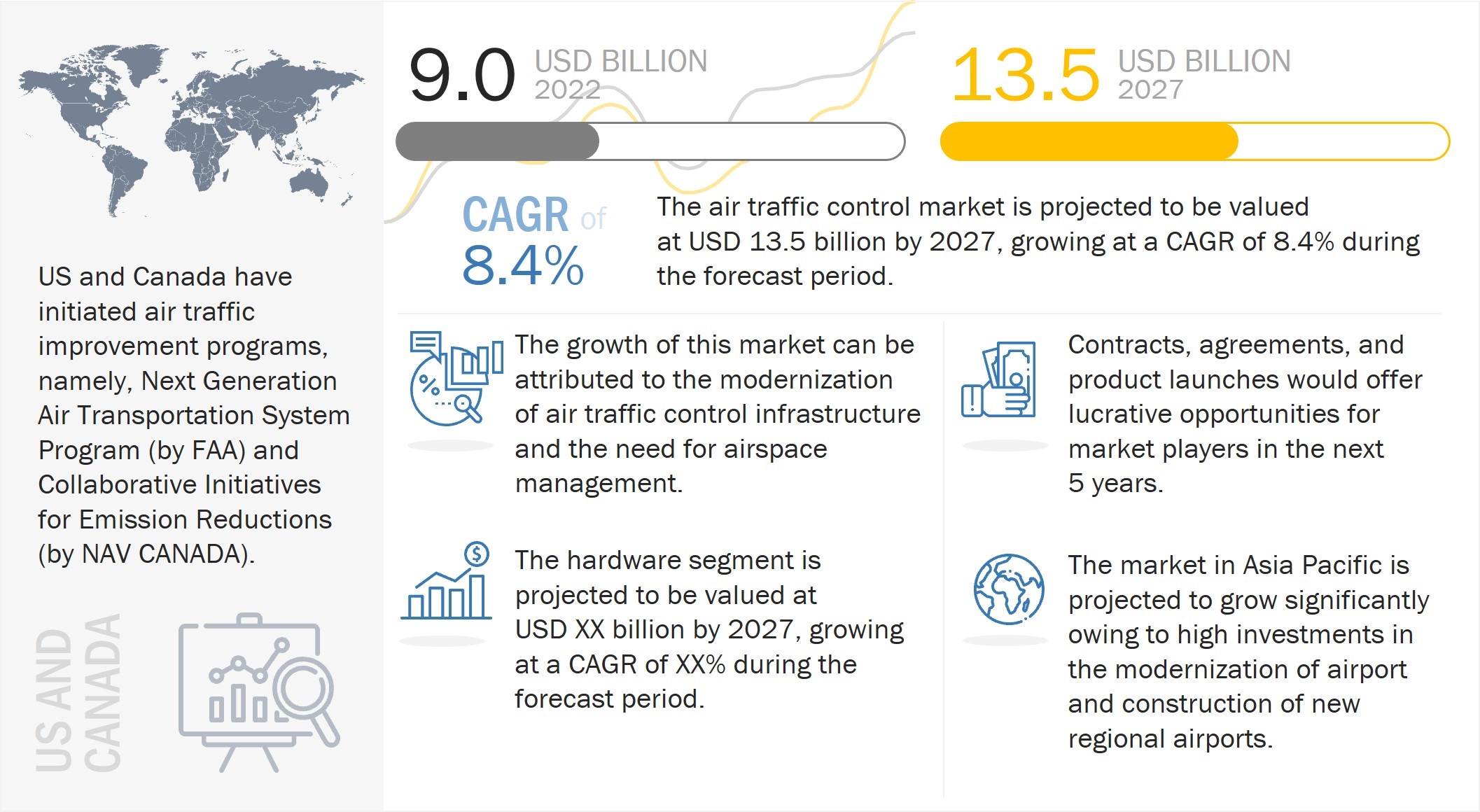

The Air traffic control (ATC) Market is estimated to be USD 9.0 billion in 2022 and is projected to reach USD 13.5 billion by 2027, at a CAGR of 8.4% from 2022 to 2027.

The ATC market is driven by factors such as NextGen air traffic management program leading to modernization of existing systems and high passenger traffic leading to high demand of Air Traffic Control Industry globally.

Air Traffic Control (ATC) Market to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 has disturbed supply chains of several products and services in several industries. According to the ICAO safety report published in 2021, the COVID-19 pandemic has posed unprecedented challenges to international air transport. ICAO reports that passenger totals plunged by 60%, with only 1.8 billion passengers taking to the air during 2020, the first year of the pandemic, compared to 4.5 billion in 2019. Countries took this opportunity to install new surveillance radars and navigational equipment and upgrade the existing air traffic control solutions to automate them. This can be seen in the global accident rate of 2.14 accidents per million departures in 2020, a decrease of 27% from the 2019 rate of 2.94 accidents per million departures.

Air traffic control (ATC) market Dynamics

Driver: Global focus on improving air safety

The air transport industry plays a major role in global economic activity and development. One of the key elements to maintaining the vitality of civil aviation is to ensure safe, secure, efficient, and environmentally sustainable operations at the global, regional, and national levels. International Civil Aviation Organization (ICAO) promulgates Standards and Recommended Practices (SARPs) to facilitate harmonized regulations in aviation safety, security, efficiency, and environmental protection globally. According to the ICAO safety report published in 2021, the COVID-19 pandemic has posed unprecedented challenges to international air transport. ICAO reports that passenger totals plunged by 60%, with only 1.8 billion passengers taking to the air during 2020, the first year of the pandemic, compared to 4.5 billion in 2019. Countries are installing new surveillance radars and navigational equipment and upgrading the existing air traffic control solutions to automate them. This can be seen in the global accident rate of 2.14 accidents per million departures in 2020, a decrease of 27% from the 2019 rate of 2.94 accidents per million departures.

Opportunity: Adoption of satellite-based air traffic control systems

Ground-based ATC systems are operated by human controllers manually, thereby resulting in excessive delays. This may lead to passenger discomfort, fuel waste, and disruption in the schedule of airlines. The ATC market is likely to witness the transformation to next-generation satellite-based systems from ground-based systems. The primary purpose of the shift is to reduce flight delays, implement more direct flight routes, and make flying a safer and eco-friendly experience. Satellite based ATC system reduces the time of flight due to timed planning, resulting in reduced carbon foot-print. Additionally better planned flight route can save huge costs to aviation industry and its stakeholders. A satellite-based ATC system is expected to be one of the key emerging technologies in airspace management systems. During implementation, a few non-technical issues such as funding, budget reductions, and environmental impact are expected to be observed. However, there is significant scope for satellite-based navigation systems in the ATC market for navigation and surveillance applications. Due to advantages provided by satellite based ATC system, it is one of the technologies driving towards the vision of SESAR and NextGen initiatives.

Challenges: Upgrading existing aircraft with advanced air traffic control systems

Upgrading existing aircraft fleets to serve advancements in ATC poses a major challenge for the growth of the market. In emerging regions, such as Latin America, Africa, and the Asia Pacific, countries majorly have low-cost carriers that tend to lease aircraft from other larger airlines with significant fleet strengths. This trend helps low-cost airlines reduce investments and operational costs. Most aircraft leased are old and hence not implemented with technically advanced systems. Upgrading air traffic equipment with new advancements, such as satellite-based systems, would challenge many airlines in emerging countries.

The ATCT segment is estimated to account for the largest share of the Air Traffic Control (ATC) market in 2022

The ATCT is an aeronautical facility located at every airport that has regularly scheduled flights. The direction of incoming and outbound flights, on the ground and in the airfield, is vital as orientation and siting of controllers are decided based on this; this is done for maximum visibility. The main function of ATCT is to handle aircraft takeoff and landing, as well as ground traffic. Additionally, due to the configuration of terminals and airfield, the ATCT has a commanding view of all ground operations, thereby improving safety, efficiency, and security of aircraft.

Greenfield segment accounts for the highest CAGR of air traffic control (ATC) market by investment type from 2022 to 2027

Upcoming new airports in developing countries has contributed to the growth of Greenfield market. Greenfield towers are constructed on an undeveloped site, whereas brownfield towers are usually built-in developed sites and can be modified or upgraded. In greenfield investments, different types of air traffic control equipment are to be installed; however, in brownfield investments, a few or all air traffic control equipment are upgraded or modernized. Increasing airspace congestion and growing need to modernize airport infrastructure are the key factors driving the growth of the air traffic control market. A few greenfield airports are also constructed near the existing airports to effectively manage the growing air passenger traffic, as well as to address the growing requirement for increased capacity and efficiency.

For instance, in February 2018, the Prime Minister of India announced the construction of an airport at Navi Mumbai, which requires an investment of USD 2.58 billion. Also, the government plans to develop greenfield airports in 6 cities-Nizamabad, Nellore, Kurnool, Ramagundam, Tadepalligudem, and Kothagudem, which, in turn, would drive the deployment of new ATC systems at these airports

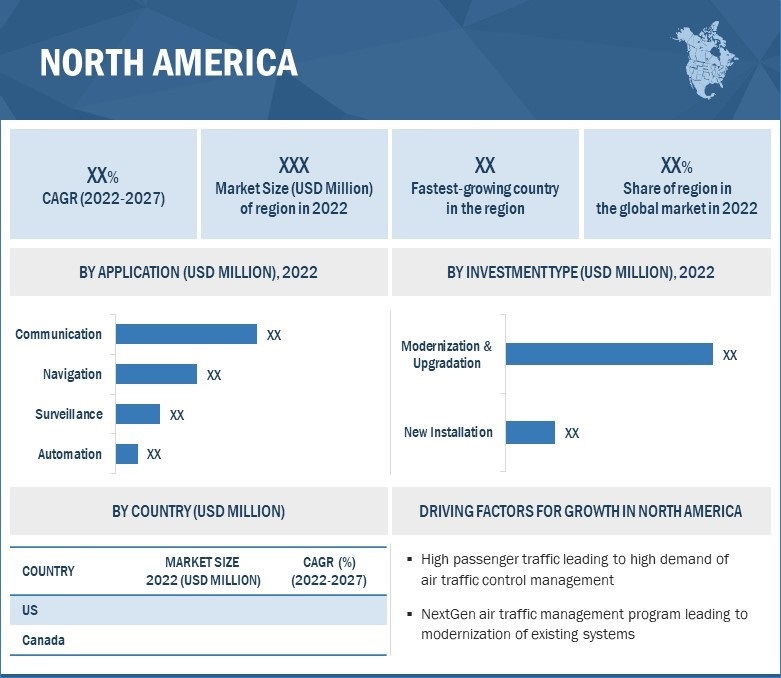

The North American market is projected to contribute the largest share in the year 2022

Air Traffic Control (ATC) Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Emerging Industry Trends

Remote Tower Systems

The remote tower system is a remote Air Traffic Control (ATC) room with video-sensor-based surveillance instead of the conventional out-of-the-window view from a real tower. Remote tower systems are gaining popularity as these contribute toward cost effectiveness and help airports stay competitive. Remote tower systems provide an integrated solution of subsystems that facilitate a wide range of services over conventional Air Traffic Services (ATS). High-definition real-time images are transferred via the data network to an integrated controller working position at the Remote Tower Center (RTC) as per the required airport model. It provides additional features, such as object tracking & alerting, night vision & image enhancement, and enhanced situational awareness in low visibility conditions, etc.

Key Players

The Air Traffic Control Companies are dominated by globally established players such as

Thales Group: Thales Group secured the first rank in the air traffic control market. It focuses on securing contracts to strengthen its position in the market. The company has enhanced its revenue through contracts and strategic partnerships. In March 2020, the US Federal Aviation Administration (FAA) awarded Leidos Holdings, Inc. (US) and Thales Group a contract to supply up to 142 secondary surveillance radars for the Mode S Beacon Replacement System (MSBRS). The company is working globally on leveraging the space-based Automatic Dependent Surveillance-Broadcast (ADS-B) service.

Raytheon Technologies Corporation: Raytheon Technologies Corporation is ranked second in the air traffic control market. It provides air traffic control solutions to more than 60& of the global airspace. The company has developed strong customer relationships by partnering with potential customers and including them on Raytheon Six Sigma teams to improve its programs and overall business processes. In order to cut down costs, it has implemented lean processes, undertaken strategic supply chain initiatives, and adopted Integrated Product Development System (IPDS) and other programs to enhance production capacities.

L3harris Technologies, Inc.: L3Harris Technologies, Inc is ranked third in the air traffic control market. It provides air traffic control solutions to enable customers to integrate and manage complex programs, including US Federal Aviation Administration (FAA), other civil and military air navigation service providers (ANSPs), airports, airlines, and system integrators. The company is a prime contractor and system architect for the FAA Telecommunication Infrastructure (FTI) program, which is responsible for integrating, modernizing, and maintaining the communication infrastructure for the US air traffic control system.

Indra Sistemas, S.A.: Indra Sistemas, S.A. has been ranked fourth in the air traffic control market. It is a leading provider of ATC solutions with a strong distribution and service network. One of the key strategies adopted by the company is the in-house development of technologies and solutions instead of outsourcing these to third parties. It caters to varied industries, such as transport & traffic, public administration, energy & industry, security & defense, financial services, healthcare, and telecom & media.

Saab AB: Saab AB has been ranked fifth in the air traffic control market. It is active in the defense market, commercial aeronautics, infrastructure security, and traffic control. The company delivers solutions, services, and products both as a main supplier directly to end customers and as a subcontractor of subsystems and components. Its products are used in over 100 countries, and the company has operations in every continent. Its international operations and expansion are concentrated in Europe, US, Australia, and Brazil. Its operations are divided into 6 business areas: aeronautics, dynamics, surveillance, support and services, industrial products and services, and Kockums.

Scope of the Report

|

Report Metric |

Details |

|

Growth Rate (CAGR)

|

8.4% |

| Estimated Market Size in 2023 |

USD 9.0 Billion |

| Projected Market Size in 2027 |

USD 13.5 Billion |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By airpspace, application, offering, sector, investment type, and airport size |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. |

|

Companies covered |

Thales Group, Indra Sistemas, S. A., Raytheon Technologies Corporation, L3Harris Technologies, Inc., Lockheed Martin Corporation (36 Companies) |

Air Traffic Control (ATC): Market Highlights

The study categorizes the Air traffic control (ATC) market based on airpspace, application, offering, sector, investment type, airport size, and region.

|

Aspect |

Details |

|

Air Traffic Control Market, By Airspace |

|

|

Air Traffic Control Market, By Application |

|

|

Air Traffic Control Market, By Offering |

|

|

Air Traffic Control Market, By Sector |

|

|

Air Traffic Control Market, By Investment Type |

|

|

Air Traffic Control Market, By Airport Size |

|

|

Air Traffic Control Market, By Region |

|

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Air traffic control (ATC) market?

Response: The Air traffic control (ATC) market is expected to grow substantially owing to the increase in air passenger traffic, as more aircraft use the same available airspace.

What are the key sustainability strategies adopted by leading players operating in the Air traffic control (ATC) market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the Air traffic control (ATC) market. Major players including Thales Group (France), Raytheon Technologies Corporation (US), L3Harris Technologies, Inc. (US), Indra Sistemas, S.A. (Spain), and Saab AB (Sweden) have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the Air traffic control (ATC) market?

Response: Some of the major emerging technologies and use cases disrupting the market include automation in air traffic control (ATC) services.

Who are the key players and innovators in the ecosystem of the Air traffic control (ATC) market?

Response: Major players in the Air traffic control (ATC) market Thales Group (France), Raytheon Technologies Corporation (US), L3Harris Technologies, Inc. (US), Indra Sistemas, S.A. (Spain), and Saab AB (Sweden).

Which region is expected to hold the highest market share in the Air traffic control (ATC) market?

Response: Air traffic control (ATC) market in The North America region is estimated to account for the largest share of XX% of the market in 2022. Air traffic control (ATC) market in Asia Pacific is expected to grow at the highest CAGR of XX% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

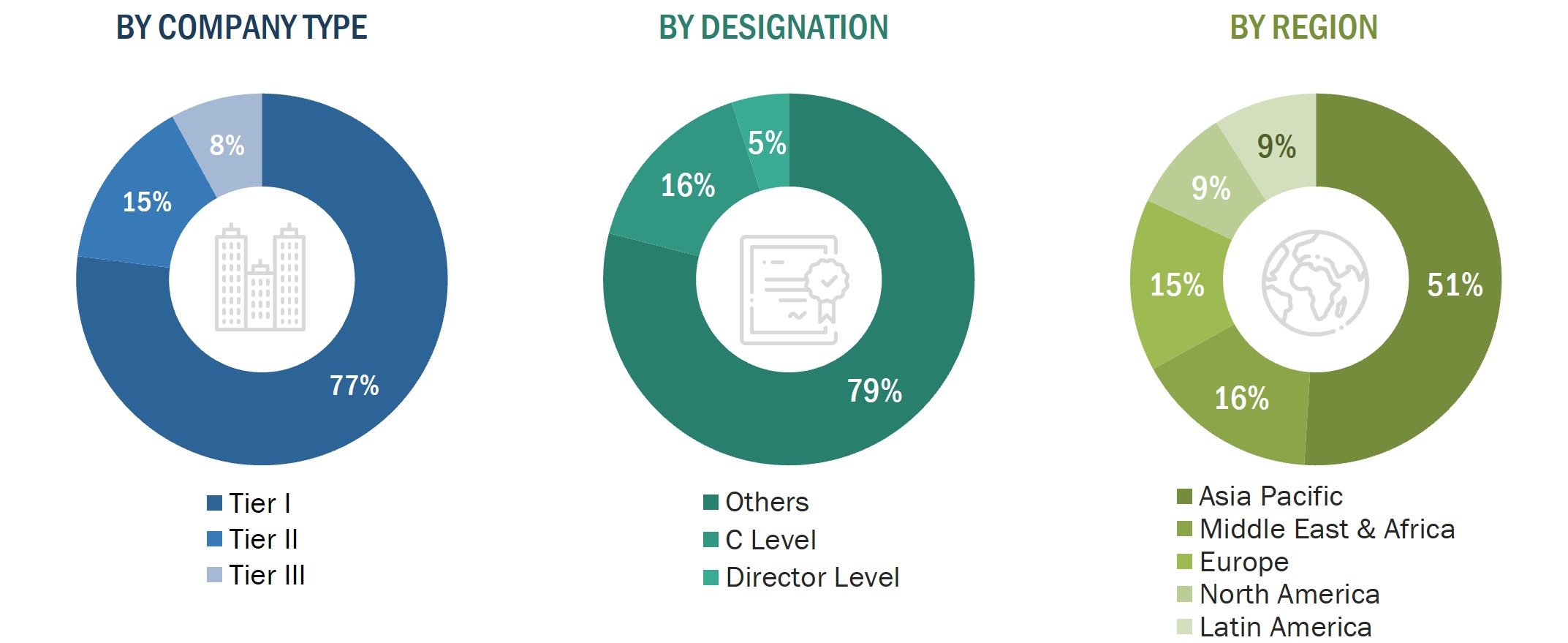

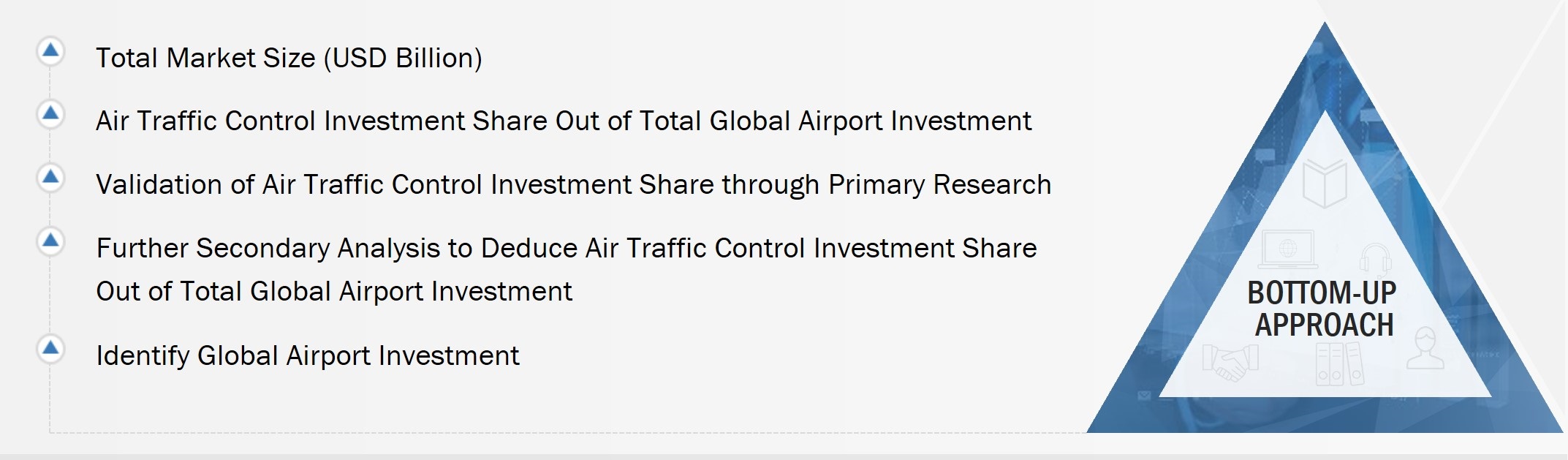

The study involved four major activities in estimating the current size of the air traffic control (ATC) market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The market share of companies offering air traffic control (ATC) was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies and rating them based on their performance and quality.

In the secondary research process, sources such as government sources; SIPRI; corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles by recognized authors, directories, and databases were used to identify and collect information for this study.

Secondary research was mainly used to obtain key information about the industry’s value and supply chain and to identify the key players by various products, market classifications, and segmentation according to their offerings and industry trends related to air traffic control (ATC) towers, components, platforms, services, and regions, and key developments from both, market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included industry experts such as vice presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from marine vessel manufacturers; aircraft manufacturers; C2 manufacturers; integrators; and key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the air traffic control (ATC) market. These methods were also used extensively to estimate the size of various segments and subsegment of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Air traffic control (ATC) Market Size: Bottom-Up Approach

Air traffic control (ATC) Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for air traffic control (ATC) segments and subsegments. The data was triangulated by studying various factors and trends from both, the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process used to develop this report.

Report Objectives

To define, describe, segment, and forecast the size of the air traffic control (ATC) market based on By airpspace, application, offering, sector, investment type, airport size, and region for the forecast period from 2022 to 2027

- To forecast the size of various segments of the air traffic control (ATC) market with respect to 6 major regions namely, North America, Europe, Asia Pacific, Rest of the World which consists of the Middle East and Latin America & Africa

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the air traffic control (ATC) market

- To identify the opportunities for stakeholders in the market by identifying key market and technology trends

- To analyze competitive developments such as contracts, agreements, acquisitions & partnerships, new product launches & developments, and Research & Development (R&D) activities in the air traffic control (ATC) market.

- To anticipate the status of the air traffic control (ATC) market procurements by different countries, technological advancements in ATC; and joint developments undertaken by leading players to analyze the degree of competition in the market

- To provide a comprehensive competitive landscape of the air traffic control (ATC) market, along with an overview of the different strategies adopted by the key market players to strengthen their position in the market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Market sizing and forecast for additional countries

- By segment, by sud-segment type breakdown at country level

- Additional five companies profiling

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the air traffic control (ATC) market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Air Traffic Control (ATC) Market