Animal Antibiotics and Antimicrobials Market by Product (Tetracycline, Penicillin, Sulfonamide, Macrolide, Cephalosporin, Lincosamide), Mode of Delivery (Premixes, Oral Solution, Injection), Animal (Food producing & Companion) & Region - Global Forecast to 2026

Market Growth Outlook Summary

The global animal antibiotics market growth forecasted to transform from $4.7 billion in 2021 to $5.6 billion by 2026, driven by a CAGR of 3.6%. Market growth can largely be attributed to the rising demand for animal-derived food products, increasing incidence of zoonotic diseases, and the implementation of regulations to prevent the spread of animal diseases. Rising animal healthcare spending and the growing demand for pet insurance are further expected to drive the growth of this market. The untapped emerging markets such as China, India, and Brazil and growth in the overall companion animal population are also expected to offer significant growth opportunities to market players in the coming years However, the limited number of new antibiotics, growing resistance to antimicrobials and antibiotics, and increasing good husbandry and hygiene practices are expected to hinder the growth of this market to a certain extent.

In this report, animal antibiotics market, by the type of product, mode of delivery, animal type, and region

To know about the assumptions considered for the study, download the pdf brochure

Animal Antibiotics Market Dynamics

Driver: Rising demand for animal-derived food products

Animal-derived food products include beef, veal, buffalo meat, lamb and goat meat, pork, poultry meat, milk and dairy products, and eggs. The livestock sector is highly dynamic and was valued at USD 6.8 trillion in 2018. Livestock products contribute 33% to protein consumption globally; however, this figure varies across developed and developing countries. The overall livestock sector is expected to witness significant growth due to the high consumption of animal-derived food products. An FAO (Food and Agriculture Organization of the United Nations) survey in 2018 on mapping the supply and demand for animal-sourced food estimates that Asian countries will register the highest growth in the demand for livestock products such as beef, milk, mutton, pork, and poultry products (chicken and eggs). According to the Guardian and Bureau of Investigative Journalism, the number of industrial-sized pig and poultry units in the UK has risen by 7% from 1,669 in 2017 to 1,786 in 2020, owing to the growth of this market.

According to the FAO, South Asia is one of the major regions for dairy production and accounted for 20–25% of the global milk production in 2019. In this region, India was the largest producer and consumer of milk, followed by China and Pakistan. In 2020, the consumption of meat in India was over 3.9 million metric tons; by 2030, this is expected to increase to 145.7 million metric tons.

China accounted for the largest share of the total pork, beef, and poultry meat consumption in the Asia Pacific in 2019. The overall consumption of animal-derived food products is projected to increase by 2030. To maintain the quality of animal-derived food products and reduce the risk of zoonotic disease transmittance, livestock producers and the meat & milk industries are increasingly utilizing animal health products. In addition, in sub-Saharan Africa and South Asia, the consumption of livestock products is expected to increase from 200 kcal per person per day in 2000 to around 400 kcal per person per day by 2050. According to the North American Meat Institute, the meat and poultry industry is the largest segment in the US agriculture sector. US meat production totaled 52 billion pounds in 2017, and US poultry production totaled 48 billion pounds in 2017. With the growing consumption of animal-derived food products, the use of antimicrobials and antibiotics is expected to increase to maintain animal health.

Restrain: Growing resistance to antimicrobials and antibiotics

Intensive usage of antimicrobials in the management of animal diseases leads to resistance among microorganisms. According to the latest report published by nature.com, it is now estimated that antimicrobial resistance (AMR) among bacteria and viruses leads to 700,000 human deaths annually, posing a significant public health challenge worldwide. The resistant clones of bacteria are found globally. with over 90% being resistant to commonly used antibiotics such as co-trimoxazole, penicillin, ampicillin, and gentamicin, among others. Most human diseases originate from animals, with 61% being zoonotic. Animal diseases caused by microorganisms can be controlled by vaccination, good hygiene, and the use of antibiotics and antimicrobials.

Antibiotic and antimicrobial resistance is a burning issue in the animal health market. To tackle this issue, most farmers and pet owners tend to increase the dosage of antibiotics and antimicrobials or change the antibiotics and antimicrobials used. However, these practices may prove detrimental in the long run and result in multi-drug-resistant microorganism species. According to a European Consumer Organization report, in six EU countries, more than 70% of all meat products tested were contaminated with antibiotic-resistant bacteria. In 2017, the WHO suggested reducing antibiotic use in animals used in the food industry. Due to the increased risk of antibiotic-resistant bacteria, the WHO strongly suggested restrictions on antibiotics being used for growth promotion and antibiotics used on healthy animals. Animals that require antibiotics should be treated with antibiotics that pose the smallest risk to human health.

Antibiotic-resistant bacteria in livestock are a major concern. Food-producing animals serve as a reservoir of resistant pathogens that can be transmitted from animals to humans via direct contact between animals and humans or through the food chain and the environment. Antimicrobial-resistant infections in humans can cause longer illnesses, increased frequency of hospitalizations, and treatment failures resulting in death. According to the WHO, over 400,000 people die each year from foodborne diseases, with over one-third of these deaths occurring in children under five years of age. The vast majority of foodborne illnesses are caused by microbes, including bacteria. Some bacteria have become resistant to more than one type of antibiotic, making it more difficult to treat the infections they cause. Veterinarians, therefore, recommend the use of less-concentrated antibiotics to treat animals. Such practices have the potential to significantly affect the consumption of antibiotics across the globe.

Opportunity: Growth in the companion animal population

The adoption of companion animals has been associated with positive health benefits, such as reduced cardiac arrhythmias, normalization of blood pressure, decreased anxiety, greater psychological stability, and improved wellbeing. These benefits have driven the number of pet owners globally over the years. According to the APPA National Pet Owners Survey 2018–19, the dog population in the US increased from 77.8 million in 2014 to 89.4 million in 2017, while the cat population increased from 85.8 million in 2014 to 95.6 million in 2017. A similar trend is observed in many European countries. According to the European Pet Food Industry Federation (FEDIAF), the dog population in Germany increased from 6.84 million in 2014 to 10.1 million in 2019, whereas the cat population in the country increased from 11.80 million in 2014 to 14.7 million in 2019. Emerging markets such as Brazil, China, India, and Mexico are also witnessing higher animal ownership rates than five years ago. According to the India International Pet Trade Fair (IIPTF), the number of pets in the country increased from 11 million in 2014 to 19.5 million in 2018. Similarly, according to the Royal Society for the Prevention of Cruelty to Animals (RSPCA), Australia has one of the highest pet ownership rates in the world. There are over 29 million pets on the island continent. Approximately 61% of households in Australia own pets, with dogs being the most common (40%), followed by cats (27%). In India, around 600,000 pets are adopted every year, according to the India International Pet Trade Fair. The growth in companion animal ownership and willingness to spend on the health and welfare of companion animals are expected to support the growth of the animal health industry, which, in turn, will drive growth in dependent industries, such as animal antimicrobials and antibiotics.

Challenge: Stringent approval process for antimicrobials and antibiotics

Antibiotics and antimicrobials are intended to improve the health of livestock and companion animals and increase the productivity of food-producing animals. To ensure that these products do not exhibit negative effects on animal health and ensure their quality and efficacy, various authorities have set stringent regulations to approve animal pharmaceutical products.

The US FDA; Canadian Food Agency; European Medical Agency; Ministry of Agriculture, Forestry, and Fisheries (MAFF); and Australian Pesticides and Veterinary Medicines Authority (APVMA) are some of the major regulatory bodies that approve medicines used for veterinary purposes. The Veterinary International Committee for Harmonization (VICH) also plays a significant role in bringing together regulatory authorities in the US, Europe, and Japan; it also harmonizes guidelines and technical requirements to register veterinary products.

These regulatory bodies have set stringent regulations to approve veterinary pharmaceutical products. Regulatory standards for the approval of new veterinary pharmaceutical products, including antimicrobials, antibiotics, vaccines, parasiticides, and other pharmaceutical products, are also very stringent in countries such as Australia, Japan, and China.

Typically, the approval of veterinary pharmaceuticals in the US and European markets may take up to 5 to 11 years and incur expenditures of USD 75–100 million (from product development to commercialization). Considering the time-consuming and expensive nature of the development and approval process of new veterinary pharmaceutical products, many market players are reluctant to invest in developing antimicrobials and antibiotics for emerging microorganisms and parasites.

The Tetracyclines segment accounted for the largest share of the animal antibiotics industry.

Based on products, the global animal antibiotics market is segmented into tetracyclines, penicillins, sulfonamides, macrolides, aminoglycosides, lincosamides, fluoroquinolones, cephalosporins, and other antimicrobial and antibiotic products. In 2020, the tetracyclines segment accounted for 48.9% of the global market. Tetracyclines exhibit advantages such as the highest potency against pathogenic microorganisms, are well-absorbed, show low toxicity, and are relatively inexpensive compared to other animal antimicrobial and antibiotic products. These advantages contribute to the large share of this product segment. The fluoroquinolones segment is expected to grow at the highest CAGR of 8.0% during the forecast period. Advantages such as higher efficacy at low concentrations, quick penetration through tissues, and the availability of variations in the route of administration result in the higher adoption of fluoroquinolones among end users.

The Premixes segment accounted for the largest share of the animal antibiotics industry.

Based on the mode of delivery, the global animal antibiotics market is segmented into premixes, oral powders, oral solutions, injections, and other modes of delivery. In 2020, the premixes segment accounted for the largest share of 46.3% of the global market. The large share of this segment can be attributed to the advantages of premixes, such as simplified mode of administration and lower instability and hygroscopicity of formulations. The injections segment is expected to witness the highest CAGR of 4.9% during the forecast period. Advantages such as immediate delivery of drugs and rapid onset of drug effects are expected to drive growth in this market.

The food producing animal segment accounted for the largest share of the animal antibiotics industry.

Based on animal type, the global animal antibiotics market is categorized into food-producing animals and companion animals. In 2020, the food-producing animals segment accounted for the largest share of around 73.4%. This segment is also expected to register the highest CAGR of 3.9% during the forecast period. The large share of this segment is mainly due to the rising demand for animal-derived food products, increase in animal healthcare expenditure, and greater concerns about zoonotic diseases.

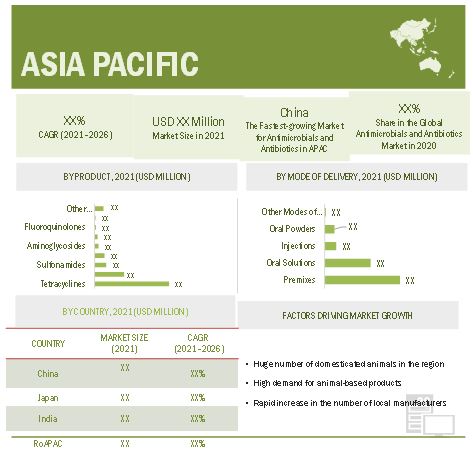

Asia Pacific recorded the highest CAGR for animal antibiotics industry

The animal antibiotics market is segmented into five major regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2020, North America accounted for the largest share of 30.3% of the global animal antimicrobials and antibiotics market. The large share of this region is mainly due to the increase in the region’s animal population, rising demand for animal-derived food products, growth in pet insurance, and rising animal health expenditure compared to other regions.

The Asia Pacific region is projected to grow at the highest CAGR of 5.4% during the forecast period. Factors such as the rapidly increasing animal population and rising demand for animal-derived food products are driving the growth of this market in the APAC.

Some of the prominent players in the animal antibiotics market are Boehringer Ingelheim (Germany), Zoetis Inc. (US), Elanco Animal Health (US), Merck & Co. Inc (US), Phibro Animal Health (US), Virbac (France), Vetoquinol S.A. (France), Ceva Santé Animale (France), Dechra Pharmaceuticals Plc (UK), Kyoritsu Seiyaku (Japan), Tianjin Ringpu (China), HIPRA (Spain), Zydus Animal Health (US), China Animal Husbandry (China), and Inovet (Belgium).

Scope of the Animal Antibiotics Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$4.7 billion |

|

Projected Revenue Size by 2026 |

$5.6 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 3.6% |

|

Market Driver |

Rising demand for animal-derived food products |

|

Market Opportunity |

Growth in the companion animal population |

The study categorizes the animal antibiotics market to forecast revenue and analyze trends in each of the following submarkets:

By Type of Product

- Tetracyclines

- Penicillins

- Sulfonamides

- Macrolides

- Aminoglycosides

- Lincosamides

- Fluoroquinolones

- Cephalosporins

- Other Antimicrobials and Antibiotics

By Mode of Delivery

- Premixes

- Oral Powder

- Oral Solution

- Injection

- Others

By Animal Type

-

Food-Producing Animals

- Cattle

- Pigs

- Poultry

- Sheep and Goats

- Other Food-producing Animals

-

Companion Animals

- Dogs

- Cats

- Horses

- Other Companion Animals

Recent Developments of Animal Antibiotics Industry:

- In 2020, Zoetis (US) acquired entered into an agreement with Trianni Inc. (US) to develop transgenic monoclonal antibody platforms for the discovery of new veterinary treatmentsThe acquisition of

- In 2020, Zoetis (US) received FDA approval for Marboquin

- In 2019, Elanco (US) collaborated with AgBiome to develop nutritional health products for porcine animals.

- In 2019, Elanco Animal Health (US) Announced the acquisition of Bayer’s Animal Health Business, thereby expanding its own companion animal business and portfolio mix by creating a balance between its food animal and companion animal segments

- In 2019, Boehringer Ingelheim (Germany) acquired Sanofi’s Animal Health business (Merial), and Sanofi took over Boehringer Ingelheim’s Consumer Healthcare (CHC) business. The acquisition of Merial made BI the world’s second-largest animal health company

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global animal antibiotics market?

The global animal antibiotics market boasts a total revenue value of USD 5.6 billion by 2026.

What is the estimated growth rate (CAGR) of the global animal antibiotics market?

The global animal antibiotics market has an estimated compound annual growth rate (CAGR) of 3.6% and a revenue size in the region of USD 4.7 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF THE STUDY

1.2 ANIMAL ANTIBIOTICS INDUSTRY DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 MARKETS COVERED

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

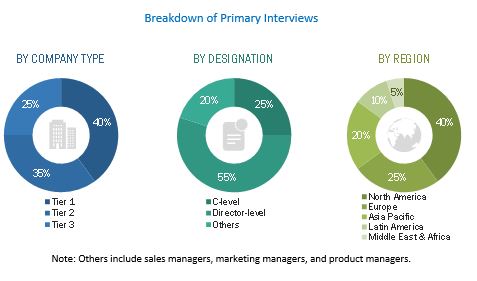

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 5 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 6 COUNTRY-LEVEL ANALYSIS OF THE ANIMAL ANTIBIOTICS MARKET

FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 8 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 9 MARKET DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 10 ANIMAL ANTIBIOTICS MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 11 ANIMAL ANTIBIOTICS MARKET, BY MODE OF DELIVERY, 2021 VS. 2026 (USD MILLION)

FIGURE 12 ANIMAL ANTIBIOTICS MARKET, BY ANIMAL TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 13 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL ANIMAL ANTIBIOTICS MARKET

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ANIMAL ANTIBIOTICS MARKET OVERVIEW

FIGURE 14 RISING DEMAND FOR ANIMAL-DERIVED FOOD PRODUCTS AND GROWING INCIDENCE OF ZOONOTIC DISEASES TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: ANIMAL ANTIBIOTICS INDUSTRY, BY MODE OF DELIVERY AND COUNTRY (2020)

FIGURE 15 CHINA ACCOUNTED FOR THE LARGEST SHARE OF THE APAC ANIMAL ANTIBIOTICS INDUSTRY IN 2020

4.3 ANIMAL ANTIBIOTICS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 16 CHINA TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

4.4 REGIONAL MIX: ANIMAL ANTIBIOTICS INDUSTRY (2021−2026)

FIGURE 17 NORTH AMERICA WILL CONTINUE TO DOMINATE THE ANIMAL ANTIBIOTICS INDUSTRY IN 2026

4.5 ANIMAL ANTIBIOTICS MARKET: DEVELOPED VS. DEVELOPING MARKETS

FIGURE 18 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 ANIMAL ANTIBIOTICS INDUSTRY DYNAMICS

TABLE 2 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IMPACT ANALYSIS

5.2.1 DRIVERS

5.2.1.1 Rising demand for animal-derived food products

TABLE 3 PAST AND PROJECTED TRENDS IN THE CONSUMPTION OF MEAT AND MILK IN DEVELOPED AND DEVELOPING REGIONS

FIGURE 19 ASIA: COUNTRY-LEVEL CONSUMPTION OF ANIMAL-DERIVED FOOD PRODUCTS, 2020 VS. 2030 (THOUSAND METRIC TONS)

FIGURE 20 ASIA: COUNTRY-LEVEL PRODUCTION OF ANIMAL-DERIVED FOOD PRODUCTS, 2020 VS. 2030 (THOUSAND METRIC TONS)

FIGURE 21 ASIA WAS THE HIGHEST CONSUMER OF MEAT AND MILK IN THE WORLD IN 2018

5.2.1.2 Increasing incidence of zoonotic diseases

TABLE 4 ANIMAL DISEASE OUTBREAKS IN ASIA PACIFIC COUNTRIES (2009–2019)

5.2.1.3 Increasing investments from private players

5.2.1.4 Rising demand for pet insurance and growing animal health expenditure

FIGURE 22 NORTH AMERICA: PET HEALTH INSURANCE MARKET, 2014 VS. 2019 (USD MILLION)

5.2.2 RESTRAINTS

5.2.2.1 Limited number of new antibiotics

5.2.2.2 Growing resistance to antimicrobials and antibiotics

5.2.2.3 Routine prophylactic use of antibiotics being replaced by good husbandry, probiotics, and hygiene practices

5.2.3 OPPORTUNITIES

5.2.3.1 Untapped emerging markets

5.2.3.2 Growth in the companion animal population

TABLE 5 US: COMPANION ANIMAL POPULATION (2010–2025)

TABLE 6 UK : COMPANION ANIMAL POPULATION (2010–2025)

TABLE 7 INDIA : COMPANION ANIMAL POPULATION IN (2010–2025)

TABLE 8 SAUDI ARABIA: COMPANION ANIMAL POPULATION (2010–2025)

5.2.4 CHALLENGES

5.2.4.1 Stringent approval process for antimicrobials and antibiotics

6 INDUSTRY INSIGHTS (Page No. - 66)

6.1 INTRODUCTION

6.2 COVID-19 IMPACT ANALYSIS

6.2.1 IMPACT OF COVID-19 ON THE ANIMAL ANTIBIOTICS MARKET

6.3 INDUSTRY TRENDS

FIGURE 23 GROWING CONSOLIDATION IN THE ANIMAL HEALTH INDUSTRY IS A MAJOR TREND IN THE ANIMAL ANTIMICROBIALS & ANTIBIOTICS MARKET

6.3.1 GROWING CONSOLIDATION IN THE ANIMAL HEALTH INDUSTRY

TABLE 9 SOME MAJOR ACQUISITIONS IN THE ANIMAL HEALTH INDUSTRY (2017–2019)

6.3.2 GROWING FOCUS ON LIMITING THE USE OF ANTIBIOTICS IN LIVESTOCK ANIMALS

6.3.3 HIGH GROWTH IN EMERGING MARKETS

6.4 REGULATORY ANALYSIS

FIGURE 24 DEVELOPMENT AND APPROVAL PROCESS FOR ANIMAL PHARMACEUTICAL PRODUCTS

6.5 VALUE CHAIN ANALYSIS

FIGURE 25 ANIMAL ANTIMICROBIALS AND ANTIBODY MARKET: VALUE CHAIN ANALYSIS

6.6 ECOSYSTEM MARKET MAP

TABLE 10 ANIMAL ANTIBIOTICS MARKET: ECOSYSTEM MAPPING

FIGURE 26 ANIMAL ANTIBIOTICS MARKET: ECOSYSTEM MARKET MAP

6.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 11 ANIMAL ANTIBIOTICS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.7.1 THREAT FROM NEW ENTRANTS

6.7.2 THREAT FROM SUBSTITUTES

6.7.3 BARGAINING POWER OF SUPPLIERS

6.7.4 BARGAINING POWER OF BUYERS

6.7.5 INTENSITY OF COMPETITIVE RIVALRY

6.8 SUPPLY CHAIN ANALYSIS

FIGURE 27 ANIMAL ANTIBIOTICS MARKET: SUPPLY CHAIN ANALYSIS

6.9 PATENT ANALYSIS

TABLE 12 LIST OF ANTIBIOTICS AND THEIR PATENT YEARS

6.10 PRICING ANALYSIS

7 ANIMAL ANTIBIOTICS MARKET, BY PRODUCT (Page No. - 82)

7.1 INTRODUCTION

FIGURE 28 SALES OF ANTIMICROBIAL AGENTS, BY ANTIMICROBIAL CLASS, AS A PERCENTAGE OF THE TOTAL SALES FOR FOOD-PRODUCING SPECIES (IN MG/PCU): AGGREGATED BY 31 EUROPEAN COUNTRIES, 2018

TABLE 13 ANIMAL ANTIBIOTICS INDUSTRY, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 14 ANIMAL ANTIBIOTICS INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

7.2 TETRACYCLINES

7.2.1 REDUCED COST OF TETRACYCLINES IS A KEY FACTOR DRIVING MARKET GROWTH ACROSS THE GLOBE

TABLE 15 TETRACYCLINES OFFERED BY KEY MARKET PLAYERS

FIGURE 29 SALES OF TETRACYCLINES FOR FOOD-PRODUCING ANIMALS IN EUROPEAN COUNTRIES, 2017 VS. 2018 (MG/PCU)

TABLE 16 TETRACYCLINES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 PENICILLINS

7.3.1 RISING INCIDENCE OF ZOONOTIC DISEASES IN LIVESTOCK ANIMALS TO DRIVE THE DEMAND FOR PENICILLINS

TABLE 17 PENICILLINS OFFERED BY KEY MARKET PLAYERS

FIGURE 30 SALES OF PENICILLINS FOR FOOD-PRODUCING ANIMALS IN EUROPEAN COUNTRIES, 2017 VS. 2018 (MG/PCU)

TABLE 18 PENICILLINS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4 SULFONAMIDES

7.4.1 REDUCED COST AND MULTIPLE APPLICATIONS IN LIVESTOCK INFECTIONS TO DRIVE THE DEMAND FOR SULFONAMIDES IN RURAL REGIONS

TABLE 19 SULFONAMIDES OFFERED BY KEY MARKET PLAYERS

FIGURE 31 SALES OF SULFONAMIDES FOR FOOD-PRODUCING ANIMALS IN EUROPEAN COUNTRIES, 2017 VS. 2018 (MG/PCU)

TABLE 20 SULFONAMIDES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.5 MACROLIDES

7.5.1 INCREASING PRODUCTION OF CATTLE-DERIVED FOOD PRODUCTS TO BOOST THE DEMAND FOR MACROLIDES

TABLE 21 MACROLIDES OFFERED BY KEY MARKET PLAYERS

FIGURE 32 SALES OF MACROLIDES FOR FOOD-PRODUCING ANIMALS IN EUROPEAN COUNTRIES, 2017 VS. 2018 (MG/PCU)

TABLE 22 MACROLIDES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.6 AMINOGLYCOSIDES

7.6.1 AMINOGLYCOSIDES ARE COMMONLY USED TO CONTROL LOCAL AND SYSTEMIC INFECTIONS CAUSED BY SUSCEPTIBLE AEROBIC BACTERIA (GENERALLY GRAM-NEGATIVE)

TABLE 23 AMINOGLYCOSIDES OFFERED BY KEY MARKET PLAYERS

FIGURE 33 SALES OF AMINOGLYCOSIDES FOR FOOD-PRODUCING ANIMALS IN EUROPEAN COUNTRIES, 2017 VS. 2018 (MG/PCU)

TABLE 24 AMINOGLYCOSIDES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.7 LINCOSAMIDES

7.7.1 LINCOSAMIDES EXHIBIT SERIOUS SIDE EFFECTS—A KEY FACTOR LIMITING MARKET GROWTH

TABLE 25 LINCOSAMIDES OFFERED BY KEY MARKET PLAYERS

FIGURE 34 SALES OF LINCOSAMIDES FOR FOOD-PRODUCING ANIMALS IN EUROPEAN COUNTRIES, 2017 VS. 2018 (MG/PCU)

TABLE 26 LINCOSAMIDES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.8 FLUOROQUINOLONES

7.8.1 AVAILABILITY OF VARIATIONS IN THE ROUTE OF ADMINISTRATION RESULTS IN THE HIGHER ADOPTION OF FLUOROQUINOLONES AMONG END USERS

TABLE 27 FLUOROQUINOLONES OFFERED BY KEY MARKET PLAYERS

FIGURE 35 SALES OF FLUOROQUINOLONES FOR FOOD-PRODUCING ANIMALS IN EUROPEAN COUNTRIES, 2017 VS. 2018 (MG/PCU)

TABLE 28 FLUOROQUINOLONES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.9 CEPHALOSPORINS

7.9.1 CEPHALOSPORINS ARE ACTIVE AGAINST A WIDE RANGE OF BACTERIA—A KEY FACTOR DRIVING MARKET GROWTH

TABLE 29 PROPERTIES OF SEVERAL GENERATIONS OF CEPHALOSPORINS

TABLE 30 CEPHALOSPORINS OFFERED BY KEY MARKET PLAYERS

FIGURE 36 SALES OF FIRST- AND SECOND-GENERATION CEPHALOSPORINS FOR FOOD-PRODUCING ANIMALS IN EUROPEAN COUNTRIES, 2017 VS. 2018 (MG/PCU)

FIGURE 37 SALES OF THIRD- AND FOURTH-GENERATION CEPHALOSPORINS FOR FOOD-PRODUCING ANIMALS IN EUROPEAN COUNTRIES, 2017 VS. 2018 (MG/PCU)

TABLE 31 CEPHALOSPORINS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.10 OTHER ANTIMICROBIALS AND ANTIBIOTICS

FIGURE 38 SALES OF POLYMYXINS FOR FOOD-PRODUCING ANIMALS IN EUROPEAN COUNTRIES, 2017 VS. 2018 (MG/PCU)

TABLE 32 OTHER ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8 ANIMAL ANTIBIOTICS MARKET, BY MODE OF DELIVERY (Page No. - 104)

8.1 INTRODUCTION

TABLE 33 ANIMAL ANTIBIOTICS MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

8.2 PREMIXES

8.2.1 ADVANTAGES OF PREMIXES, SUCH AS SIMPLIFIED MODE OF ADMINISTRATION AND LOWER INSTABILITY AND HYGROSCOPICITY, TO DRIVE MARKET GROWTH

TABLE 34 ANIMAL ANTIBIOTICS MARKET FOR PREMIXES, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 ORAL SOLUTIONS

8.3.1 ORAL SOLUTIONS PRODUCE SYSTEMIC EFFECTS BUT SHOW A RELATIVELY SLOW ONSET OF ACTION

TABLE 35 ANIMAL ANTIBIOTICS INDUSTRY FOR ORAL SOLUTIONS, BY COUNTRY, 2019–2026 (USD MILLION)

8.4 ORAL POWDERS

TABLE 36 ANIMAL ANTIBIOTICS MARKET FOR ORAL POWDERS, BY COUNTRY, 2019–2026 (USD MILLION)

8.5 INJECTIONS

8.5.1 INJECTABLE DRUGS PROVIDE SYSTEMIC EFFECTS AND POSSESS GREATER BIOAVAILABILITY, OFFERING A FASTER ONSET OF ACTION

TABLE 37 ANIMAL ANTIBIOTICS MARKET FOR INJECTIONS, BY COUNTRY, 2019–2026 (USD MILLION)

8.6 OTHER MODES OF DELIVERY

TABLE 38 ANIMAL ANTIBIOTICS MARKET FOR OTHER MODES OF DELIVERY, BY COUNTRY, 2019–2026 (USD MILLION)

9 ANIMAL ANTIBIOTICS MARKET, BY TYPE OF ANIMAL (Page No. - 112)

9.1 INTRODUCTION

TABLE 39 ANIMAL ANTIBIOTICS INDUSTRY, BY TYPE OF ANIMAL, 2019–2026 (USD MILLION)

9.2 FOOD-PRODUCING ANIMALS

TABLE 40 GLOBAL POPULATION OF FOOD-PRODUCING ANIMALS, 1970–2030 (MILLION)

TABLE 41 PER CAPITA CONSUMPTION OF MEAT IN MAJOR APAC COUNTRIES, 2019 (IN KG)

TABLE 42 ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 43 ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR FOOD-PRODUCING ANIMALS, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.1 CATTLE

9.2.1.1 Increasing beef consumption and milk production to drive growth in this market segment

TABLE 44 ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR CATTLE, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.2 PIGS

9.2.2.1 Growing incidence of zoonotic diseases will require better health maintenance of pigs—a key factor driving market growth

TABLE 45 ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR PIGS, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.3 POULTRY

9.2.3.1 Growing egg consumption in emerging countries to drive market growth

FIGURE 39 LEADING EGG PRODUCING COUNTRIES, 2018 (NUMBER OF EGGS, IN BILLION)

TABLE 46 ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR POULTRY, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.4 SHEEP AND GOATS

9.2.4.1 Increasing population of sheep and goats to drive growth in this segment

TABLE 47 ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR SHEEP AND GOATS, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.5 OTHER FOOD-PRODUCING ANIMALS

FIGURE 40 PER CAPITA FISH CONSUMPTION, 2019 VS. 2029

TABLE 48 ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR OTHER FOOD-PRODUCING ANIMALS, BY COUNTRY, 2019–2026 (USD MILLION)

9.3 COMPANION ANIMALS

TABLE 49 ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 50 ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR COMPANION ANIMALS, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.1 DOGS

9.3.1.1 Growing adoption of dogs to drive growth in this market segment

FIGURE 41 GROWING POPULATION OF PET DOGS IN INDIA (MILLION)

FIGURE 42 POPULATION OF PET DOGS GLOBALLY (MILLION)

TABLE 51 ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR DOGS, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.2 CATS

9.3.2.1 Growing research on feline health and wellbeing to support the market growth

TABLE 52 ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR CATS, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.3 HORSES

9.3.3.1 Declining horse population necessitates the adoption of health products—a key factor driving market growth

TABLE 53 ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR HORSES, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.4 OTHER COMPANION ANIMALS

TABLE 54 ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR OTHER COMPANION ANIMALS, BY COUNTRY, 2019–2026 (USD MILLION)

10 ANIMAL ANTIBIOTICS MARKET, BY REGION (Page No. - 130)

10.1 INTRODUCTION

TABLE 55 COMPANION ANIMAL AND FOOD-PRODUCING ANIMAL POPULATION, BY COUNTRY, 2020 (IN THOUSAND)

TABLE 56 ANIMAL ANTIBIOTICS INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 43 EXPECTED GROWTH IN THE NUMBER OF VETERINARIANS IN NORTH AMERICA

FIGURE 44 NORTH AMERICA: ANIMAL ANTIBIOTICS MARKET SNAPSHOT

TABLE 57 NORTH AMERICA: ANIMAL ANTIBIOTICS INDUSTRY, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 59 NORTH AMERICA: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY TYPE OF ANIMAL, 2019–2026 (USD MILLION)

TABLE 61 NORTH AMERICA: ANIMAL ANTIBIOTICS INDUSTRY FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: ANIMAL ANTIBIOTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

10.2.1 US

10.2.1.1 Rising pet expenditure and increasing meat consumption are driving the animal antibiotics industry in the US

FIGURE 45 US: GROWTH IN BEEF CONSUMPTION, 2014–2019 (BILLION POUNDS)

FIGURE 46 US: INCREASE IN PET EXPENDITURE, 2010–2019 (USD BILLION)

FIGURE 47 DOMESTIC SALES AND DISTRIBUTION OF MEDICALLY IMPORTANT ANTIMICROBIAL DRUGS FOR PRODUCTION AND THERAPEUTIC INDICATIONS IN THE US (THOUSAND KG)

TABLE 63 US: PRIVATE CLINICAL PRACTICES, BY ANIMAL TYPE, 2016 VS. 2018

TABLE 64 US: ANIMAL ANTIBIOTICS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 65 US: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 66 US: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY TYPE OF ANIMAL, 2019–2026 (USD MILLION)

TABLE 67 US: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 68 US: ANIMAL ANTIBIOTICS INDUSTRY FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Growing pet adoption rate to drive the animal antibiotics industry in Canada

TABLE 69 CANADA: ANIMAL ANTIBIOTICS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 70 CANADA: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 71 CANADA: ANIMAL ANTIMICROBIALS MARKET, BY TYPE OF ANIMAL, 2019–2026 (USD MILLION)

TABLE 72 CANADA: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 73 CANADA: ANIMAL ANTIBIOTICS INDUSTRY FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

10.3 EUROPE

TABLE 74 EUROPE: LIVESTOCK POPULATION, BY ANIMAL, 2011–2018 (MILLION HEAD)

TABLE 75 EUROPE: ANIMAL ANTIBIOTICS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 76 EUROPE: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 77 EUROPE: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 78 EUROPE: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY TYPE OF ANIMAL, 2019–2026 (USD MILLION)

TABLE 79 EUROPE: ANIMAL ANTIBIOTICS INDUSTRY FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 80 EUROPE: ANIMAL ANTIBIOTICS INDUSTRY FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

10.3.1 SPAIN

10.3.1.1 Large volume of sales of important antibiotics in this country to drive animal antibiotics industry growth

TABLE 81 SPAIN: LARGE ANIMAL POPULATION, 2001–2019 (MILLION)

TABLE 82 SPAIN: ANIMAL ANTIBIOTICS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 83 SPAIN: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 84 SPAIN: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY TYPE OF ANIMAL, 2019–2026 (USD MILLION)

TABLE 85 SPAIN: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 86 SPAIN: ANIMAL ANTIBIOTICS INDUSTRY FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

10.3.2 ITALY

10.3.2.1 Need to curb zoonotic diseases in livestock will contribute to the demand for animal antibiotics industry in Italy

TABLE 87 ITALY: ANIMAL ANTIBIOTICS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 88 ITALY: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 89 ITALY: ANIMAL ANTIMICROBIALS MARKET, BY TYPE OF ANIMAL, 2019–2026 (USD MILLION)

TABLE 90 ITALY: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 91 ITALY: ANIMAL ANTIBIOTICS INDUSTRY FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

10.3.3 GERMANY

10.3.3.1 Increasing number of pets, increasing veterinary visits, and growing healthcare expenditure to boost the growth of the animal antimicrobials and antibiotics market in Germany

TABLE 92 GERMANY: COMPANION ANIMAL POPULATION, 2012–2018 (MILLION)

FIGURE 48 SALES SURVEILLANCE OF ANTIMICROBIALS FOR VETERINARY USE IN GERMANY (2011 TO 2018)

TABLE 93 GERMANY: ANIMAL ANTIBIOTICS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 94 GERMANY: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 95 GERMANY: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY TYPE OF ANIMAL, 2019–2026 (USD MILLION)

TABLE 96 GERMANY: ANIMAL ANTIBIOTICS INDUSTRY FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 GERMANY: ANIMAL ANTIBIOTICS INDUSTRY FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

10.3.4 FRANCE

10.3.4.1 Presence of major players has ensured the strong share of France in the overall market

TABLE 98 FRANCE: ANIMAL ANTIBIOTICS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 99 FRANCE: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 100 FRANCE: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY TYPE OF ANIMAL, 2019–2026 (USD MILLION)

TABLE 101 FRANCE: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 102 FRANCE: ANIMAL ANTIBIOTICS INDUSTRY FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

10.3.5 UK

10.3.5.1 Increasing pet ownership is expected to drive market growth

FIGURE 49 SALES OF ANTIBIOTICS FOR FOOD-PRODUCING ANIMALS IN THE UK FROM 2015 TO 2019 (MG/KG)

TABLE 103 UK: ANIMAL ANTIBIOTICS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 104 UK: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 105 UK: ANIMAL ANTIMICROBIALS MARKET, BY TYPE OF ANIMAL, 2019–2026 (USD MILLION)

TABLE 106 UK: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 107 UK: ANIMAL ANTIBIOTICS INDUSTRY FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 108 ROE: ANIMAL ANTIBIOTICS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 109 ROE: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 110 ROE: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY TYPE OF ANIMAL, 2019–2026 (USD MILLION)

TABLE 111 ROE: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 112 ROE: ANIMAL ANTIBIOTICS INDUSTRY FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

10.4 ASIA PACIFIC (APAC)

TABLE 113 ASIA PACIFIC: FOOD-PRODUCING ANIMAL POPULATION, 2010–2017 (MILLION)

FIGURE 50 ASIA PACIFIC: ANIMAL ANTIBIOTICS MARKET SNAPSHOT

TABLE 114 ASIA PACIFIC: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 115 ASIA PACIFIC: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 116 ASIA PACIFIC: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 117 ASIA PACIFIC: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY TYPE OF ANIMAL, 2019–2026 (USD MILLION)

TABLE 118 ASIA PACIFIC: ANIMAL ANTIBIOTICS INDUSTRY FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 119 ASIA PACIFIC: ANIMAL ANTIBIOTICS INDUSTRY FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China dominates the APAC animal antibiotics market

TABLE 120 CHINA: FOOD-PRODUCING ANIMAL POPULATION, 2012–2019 (MILLION)

TABLE 121 CHINA: ANIMAL ANTIBIOTICS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 122 CHINA: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 123 CHINA: ANIMAL ANTIMICROBIALS MARKET, BY TYPE OF ANIMAL, 2019–2026 (USD MILLION)

TABLE 124 CHINA: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 125 CHINA: ANIMAL ANTIBIOTICS INDUSTRY FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Rising demand for imported breeds is driving pet adoption in the country

TABLE 126 PRODUCTION AND CONSUMPTION OF ANIMAL-DERIVED FOOD PRODUCTS IN JAPAN (2000 VS. 2030) (THOUSAND METRIC TONS)

FIGURE 51 VOLUMES OF VETERINARY ANTIMICROBIALS SOLD BY PHARMACEUTICAL COMPANIES IN JAPAN, 2001–2017 (IN TONS OF ACTIVE INGREDIENT)

FIGURE 52 AMOUNT OF ANTIMICROBIAL FEED ADDITIVES MANUFACTURED IN JAPAN, 2003–2017 (IN TONS OF ACTIVE INGREDIENT)

TABLE 127 JAPAN: ANIMAL ANTIBIOTICS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 128 JAPAN: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 129 JAPAN: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY TYPE OF ANIMAL, 2019–2026 (USD MILLION)

TABLE 130 JAPAN: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 131 JAPAN: ANIMAL ANTIBIOTICS INDUSTRY FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Rising food-producing animal population and growing awareness about animal health will contribute to market growth during the forecast period

TABLE 132 PRODUCTION AND CONSUMPTION OF ANIMAL-DERIVED FOOD PRODUCTS IN INDIA (2000 VS. 2030) (THOUSAND METRIC TONS)

TABLE 133 INDIA: ANIMAL ANTIBIOTICS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 134 INDIA: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 135 INDIA: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY TYPE OF ANIMAL, 2019–2026 (USD MILLION)

TABLE 136 INDIA: ANIMAL ANTIBIOTICS INDUSTRY FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 137 INDIA: ANIMAL ANTIBIOTICS INDUSTRY FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC (REST OF APAC)

TABLE 138 REGULATORY SCENARIO FOR ANTIBIOTICS IN THE ROAPAC, BY COUNTRY

TABLE 139 REST OF APAC: ANIMAL ANTIBIOTICS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 140 REST OF APAC: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 141 REST OF APAC: ANIMAL ANTIMICROBIALS MARKET, BY TYPE OF ANIMAL, 2019–2026 (USD MILLION)

TABLE 142 REST OF APAC: ANIMAL ANTIBIOTICS INDUSTRY FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 143 REST OF APAC: ANIMAL ANTIBIOTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

10.5 LATIN AMERICA

TABLE 144 LATIN AMERICA: FOOD-PRODUCING ANIMALS POPULATION, BY COUNTRY (2010–2014) (MILLION)

TABLE 145 LATIN AMERICA: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 146 LATIN AMERICA: ANIMAL ANTIMICROBIALS MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 147 LATIN AMERICA: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY TYPE OF ANIMAL, 2019–2026 (USD MILLION)

TABLE 148 LATIN AMERICA: ANIMAL ANTIBIOTICS INDUSTRY FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 149 LATIN AMERICA: ANIMAL ANTIBIOTICS MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

TABLE 150 AFRICA: NUMBER OF VETERINARIANS, 2010 VS. 2014 VS. 2016

TABLE 151 MIDDLE EAST & AFRICA: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 152 MIDDLE EAST & AFRICA: ANIMAL ANTIMICROBIALS MARKET, BY MODE OF DELIVERY, 2019–2026 (USD MILLION)

TABLE 153 MIDDLE EAST & AFRICA: ANIMAL ANTIMICROBIALS AND ANTIBIOTICS MARKET, BY TYPE OF ANIMAL, 2019–2026 (USD MILLION)

TABLE 154 MIDDLE EAST & AFRICA: ANIMAL ANTIBIOTICS MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 155 MIDDLE EAST & AFRICA: ANIMAL ANTIBIOTICS INDUSTRY FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 187)

11.1 INTRODUCTION

FIGURE 53 KEY DEVELOPMENTS OF MAJOR PLAYERS BETWEEN 2017 AND JAN 2021

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 54 ANIMAL ANTIBIOTICS INDUSTRY: MARKET EVALUATION FRAMEWORK: ACQUISITIONS—THE MOST WIDELY ADOPTED STRATEGY

11.3 PRODUCT PORTFOLIO MATRIX

TABLE 156 PLAYERS IN THE ANIMAL ANTIBIOTICS MARKET: PRODUCT PORTFOLIO ANALYSIS

11.4 ANIMAL ANTIBIOTICS INDUSTRY: GEOGRAPHICAL ASSESSMENT

FIGURE 55 GEOGRAPHIC ASSESSMENT OF KEY PLAYERS IN THE ANIMAL ANTIBIOTICS MARKET (2019)

11.5 ANIMAL ANTIBIOTICS INDUSTRY: R&D EXPENDITURE

FIGURE 56 R&D EXPENDITURE OF KEY PLAYERS IN THE ANIMAL ANTIBIOTICS INDUSTRY (2019)

11.6 REVENUE ANALYSIS: TOP 5 PLAYERS

FIGURE 57 ANIMAL ANTIBIOTICS MARKET: REVENUE ANALYSIS (2019)

11.7 VENDOR DIVE

11.7.1 STARS

11.7.2 EMERGING LEADERS

11.7.3 PERVASIVE PLAYERS

11.7.4 EMERGING COMPANIES

FIGURE 58 COMPETITIVE LEADERSHIP MAPPING: ANIMAL ANTIBIOTICS INDUSTRY, 2020

11.8 MARKET SHARE ANALYSIS

TABLE 157 ANIMAL ANTIBIOTICS MARKET: DEGREE OF COMPETITION

FIGURE 59 ANIMAL ANTIBIOTICS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2020

11.9 COMPETITIVE SITUATION AND TRENDS

11.9.1 PRODUCT LAUNCHES & APPROVALS

TABLE 158 PRODUCT LAUNCHES & APPROVALS

11.9.2 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS

TABLE 159 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS

11.9.3 MERGERS, ACQUISITIONS, AND DIVESTITURES

TABLE 160 MERGERS, ACQUISITIONS, AND DIVESTITURES

11.9.4 EXPANSIONS

TABLE 161 EXPANSIONS

11.10 SME MATRIX

11.10.1 COMPETITIVE LEADERSHIP MAPPING (SMES)

11.10.1.1 Progressive companies

11.10.1.2 Starting blocks

11.10.1.3 Responsive companies

11.10.1.4 Dynamic companies

FIGURE 60 ANIMAL ANTIBIOTICS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR SME, 2020

12 COMPETITIVE EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 201)

12.1 KEY PLAYERS

(Business overview, Products offered, Recent developments, MNM view)*

12.1.1 ZOETIS, INC.

TABLE 162 ZOETIS, INC.: BUSINESS OVERVIEW

FIGURE 61 ZOETIS: COMPANY SNAPSHOT (2019)

12.1.2 MERCK & CO., INC.

TABLE 163 MERCK AND CO., INC: BUSINESS OVERVIEW

FIGURE 62 MERCK & CO., INC.: COMPANY SNAPSHOT (2019)

12.1.3 BOEHRINGER INGELHEIM GMBH

TABLE 164 BOEHRINGER INGELHEIM GMBH: BUSINESS OVERVIEW

FIGURE 63 BOEHRINGER INGELHEIM GMBH: COMPANY SNAPSHOT (2019)

12.1.4 ELANCO ANIMAL HEALTH

TABLE 165 ELANCO ANIMAL HEALTH: BUSINESS OVERVIEW

FIGURE 64 ELANCO ANIMAL HEALTH: COMPANY SNAPSHOT (2019)

12.1.5 CEVA SANTÉ ANIMALE

TABLE 166 CEVA SANTÉ ANIMALE: BUSINESS OVERVIEW

12.1.6 VIRBAC

TABLE 167 VIRBAC: BUSINESS OVERVIEW

FIGURE 65 VIRBAC: COMPANY SNAPSHOT (2019)

12.1.7 VETOQUINOL SA.

TABLE 168 VETOQUINOL S.A.: BUSINESS OVERVIEW

FIGURE 66 VETOQUINOL SA: COMPANY SNAPSHOT (2019)

12.1.8 DECHRA PHARMACEUTICALS PLC

TABLE 169 DECHRA PHARMACEUTICALS PLC: BUSINESS OVERVIEW

FIGURE 67 DECHRA PHARMACEUTICALS PLC: COMPANY SNAPSHOT (2019)

12.1.9 PHIBRO ANIMAL HEALTH

TABLE 170 PHIBRO ANIMAL HEALTH: BUSINESS OVERVIEW

FIGURE 68 PHIBRO ANIMAL HEALTH: COMPANY SNAPSHOT (2019)

12.1.10 KYORITSU SEIYAKU

TABLE 171 KYORITSU SEIYAKU: BUSINESS OVERVIEW

12.1.11 ZYDUS ANIMAL HEALTH

TABLE 172 ZYDUS ANIMAL HEALTH: BUSINESS OVERVIEW

FIGURE 69 ZYDUS: COMPANY SNAPSHOT (2019)

12.1.12 TIANJIN RINGPU

TABLE 173 TIANJIN RINGPU: BUSINESS OVERVIEW

12.1.13 HIPRA

TABLE 174 HIPRA: BUSINESS OVERVIEW

12.1.14 CHINA ANIMAL HUSBANDRY

TABLE 175 CHINA ANIMAL HUSBANDRY: BUSINESS OVERVIEW

12.1.15 INOVET

TABLE 176 INOVET: BUSINESS OVERVIEW

*Business overview, Products offered, Recent developments, MNM view might not be captured in case of unlisted companies.

12.2 OTHER EMERGING COMPANIES

12.2.1 ENDOVAC ANIMAL HEALTH

12.2.2 ECO ANIMAL HEALTH GROUP PLC

12.2.3 INDIAN IMMUNOLOGICALS LTD.

12.2.4 ASHISH LIFE SCIENCE (ALS)

12.2.5 LUTIM PHARMA

13 APPENDIX (Page No. - 247)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This study involved four major activities for estimating the current size of the animal antibiotics market. Exhaustive secondary research was conducted to collect information on the market as well as its peer and parent markets. The next step focused on validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. Revenue Share Analysis, Parent Market and top-down approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg Business, and Factiva have been referred to identify and collect information for this study. These secondary sources include annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, and databases.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies operating in the animal antimicrobials and antibiotics market. Primary sources from the demand side include experts from hospitals and veterinary clinics and research centers. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on the key industry trends and key market dynamics, such as market drivers, restraints, challenges, and opportunities.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the animal antibiotics market was arrived at after data triangulation from two different approaches, as mentioned below.

Approach to calculate the revenue of different players in the animal antimicrobials and antibiotics market

The size of the animal antimicrobials and antibiotics market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global animal antimicrobials and antibiotics market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the global animal antibiotics market on the basis of product, mode of delivery, animal type, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa, along with the major countries in these regions

- To profile the key players and comprehensively analyze their market shares and core competencies2 in the animal antimicrobials and antibiotics market

- To track and analyze competitive developments such as partnerships, collaborations, acquisitions, divestures, product development activities, and R&D activities in the animal antimicrobials and antibiotics market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top companies

Geographic Analysis

- Further breakdown of the RoAPAC market into South Korea, New Zealand, Australia, Singapore, and other countries

- Further breakdown of the RoE market into Russia, the Netherlands, Switzerland, and other countries

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Animal Antibiotics and Antimicrobials Market