Companion Animal Diagnostic Market Size, Growth, Share & Trends Analysis

Companion Animal Diagnostic Market by Product (Consumable, Instrument), Technology (Immunodiagnostic, ELISA, PCR Test, Urinalysis, Hematology), Animal Type (Dog, Cat), Application (Clinical Pathology, Virology), End User - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global Companion Animal Diagnostic market, valued at USD 3.29 billion in 2025, stood at USD 3.56 billion in 2026 and is projected to advance at a resilient CAGR of 8.7% from 2026 to 2031, culminating in a forecasted valuation of USD 5.40 billion by the end of the period. Factors driving the companion animal diagnostics market include the rising demand for rapid and accurate diagnostic testing, the rising use of advanced technologies such as molecular diagnostic tests and AI-based analyzers, and also the growing focus on preventive and early diagnostic testing for companion animals. Moreover, the rising cases of chronic and contagious diseases have forced veterinary diagnostic centers to adopt accurate high-performing diagnostic solutions.

KEY TAKEAWAYS

-

By RegionThe North American companion animal diagnostics market accounted for a share of 41.6% in 2025.

-

By ProductBy product, the instruments segment is expected to register the highest CAGR of 9.2% from 2026 to 2031.

-

By TechnologyBy technology, the clinical biochemistry segment is expected to dominate the market by accounting for a 36.1% share in 2025.

-

By ApplicationBy application, the clinical pathology segment is expected to register the highest CAGR of 10.0% during the forecast period.

-

By Animal TypeBy animal type, the dogs segment is projected to grow at the fastest rate from 2026 to 2031.

-

By End UserBy end user, the diagnostic laboratories segment dominated the market, accounting for 59.4% in 2025.

-

Competitive Landscape - Key PlayersIDEXX Laboratories, Inc.; Zoetis Services LLC; and Mars Incorporated were identified as some of the star players in the companion animal diagnostics market, given their extensive global reach and comprehensive product portfolios.

-

Competitive Landscape - StartupsMEGACOR Diagnostik GmbH, Biopanda Reagents Ltd, and Fassisi GmbH, among others, have distinguished themselves among startups and SMEs through specialized veterinary expertise and focused product capabilities.

The market for companion animal diagnostics is growing robustly, in large part due to rising expenditures on household pet healthcare, growing interest in rapid, accurate testing, and the general acceptance and use of state-of-the-art diagnostic technology. Novel technologies with market potential for companion animal diagnostics include image analysis using artificial intelligence, cloud-connected analyzers, liquid biopsy platforms, and wearable health monitors. Moreover, the growing interest in partnerships among industry stakeholders is fueling the development process.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact to the consumer businesses in the companion animal diagnostics market stems from an increasing need for pet healthcare, increased disease complexity, and the rapid development of diagnostic tools and technologies. Animal healthcare businesses, veterinary practices, and laboratories are highly dependent on sophisticated diagnostic equipment, in-office rapid testing solutions, and AI-based solutions to boost accuracy, improve work flows, and enable fast diagnostic decisions. The need to deliver data-driven, preventive, and precision-based pet healthcare practices, and transform their operational models to accommodate integrated diagnostic environments and cloud-based solutions, are highly contributing to these significance to the consumer businesses. The demand for fast, accurate, and comprehensive diagnostic solutions and practices creates an increased dependency on innovative diagnostic solution partners, thereby accelerating market growth. There is a shift in the companion animal diagnostics business from conventional and routine testing to modern and technology-driven diagnostic solutions, which are expected to be the catalyst for future business revenues. The current method of revenue generation mainly focuses on conventional and routine testing for hematology, clinical chemistry, immunodiagnostics, and routine urinalysis and fecal analysis, while the future method will focus on molecular diagnostics, AI-based analysis, integrated diagnostic solutions, and at-home/remote patient monitoring. At present, diagnostic labs, veterinary hospitals, clinics, and research organizations need faster, higher-speed, and more precise solutions to detect and diagnose diseases in companion animals. These new testing and diagnostic solutions are likely to be in high demand in the near future to deliver improved medical outcomes for better disease diagnosis and treatment. These new kinds of testing and diagnostic solutions will also be expected to take care of the quality of overall veterinary medical solutions and services.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in companion animal population

-

Rising demand for pet insurance and increased spending on animal healthcare

Level

-

High cost of diagnostic devices

-

Stringent regulations and lengthy approval processes for diagnostic products

Level

-

Growing demand for rapid tests and portable instruments for POC diagnostics

-

Integration of AI and ML for enhanced disease diagnosis

Level

-

Shortage of veterinary practitioners in emerging markets

-

Barriers to Adoption in Small Clinics

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in companion animal population

The increasing number of companion animals, especially in developed and emerging regions, is a key enabler of the companion animal diagnostics market growth. As people increasingly own companion animals, especially the younger population, the need for their healthcare, including diagnostics, is increasing substantially. With companion animals increasingly being accepted within families and treated as an integral part of them, their owners tend to spend on their healthcare checks and preventive care. These companion animals lead to an increased number of diagnostic procedures being performed, thereby driving the market for diagnostics in the veterinary segment.

Restraint: High cost of diagnostic devices

One of the key restraints for the adoption of advanced diagnostic solutions across the companion animal segment is the high investment required for the use of these diagnostic solutions. Solutions ranging from advanced molecular diagnostics tools to advanced point-of-care instruments also pose high investment costs to the users. This proves to be an area of concern for the smaller veterinary setups, mainly the ones existing in developing regions with less access to investment and monetary budgets. Despite the potential offered through advanced diagnostic solutions regarding accuracy and time efficiency, the cost component remains an area of hindrance to the adoption of these solutions across the companion animal segment.

Opportunity: Growing demand for rapid tests and portable instruments for POC diagnostics

The growing demand for quick diagnostic solutions and portable point-of-care (POC) diagnostic instruments is a significant opportunity available in the companion animal diagnostic segment. This is because the instruments have the capability of providing fast and accurate results within veterinary settings. Additionally, the growing home veterinary care services trend and the adoption of telemedicine creates a new and unmet need for working POC diagnostic instruments within this segment. This is especially the case given the increased interest in and focus on preventive healthcare and early disease detection.

Challenge: Shortage of veterinary practitioners in emerging markets

A major factor challenging the market's growth is a lack of qualified veterinary practitioners in most emerging markets. In most regions, because only a few professionals are trained to handle advanced diagnostic technologies, this hampers the effective utilization of these tools. For instance, there exists an imbalance in various regions of the world between rural and urban areas, with the former possessing skilled professionals and better diagnostic facilities, while the latter most often lacks sufficient veterinary professionals or diagnostic facilities. This leads to slow adoption and integration of newer diagnostic technologies, becoming a bottleneck to growth and resulting in restricted access to modern veterinary diagnostics in many underprivileged regions.

COMPANION ANIMAL DIAGNOSTIC MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides in-clinic and reference laboratory diagnostic products for companion animals, including clinical chemistry, hematology, immunoassays, urinalysis systems, and rapid diagnostic tests | Enables fast and accurate diagnosis | Supports preventive care | Improves clinical decision-making in veterinary practices |

|

Offers point-of-care diagnostic analyzers and rapid tests for companion animals, covering clinical chemistry, hematology, and immunodiagnostic testing | Improves diagnostic efficiency | Supports earlier disease detection and treatment decisions |

|

Produces and distributes companion animal diagnostic testing kits and laboratory analyzers used for clinical pathology and specialty diagnostics | Provides access to advanced diagnostic assays and consistent test performance across high-throughput laboratory environments |

|

Supplies microbiology and immunodiagnostic instruments and reagents used for detecting infectious diseases in companion animals | Improves pathogen detection accuracy | Supports reliable, reproducible laboratory diagnostics |

|

Markets rapid diagnostic test kits and immunodiagnostic products for companion animals alongside its therapeutic portfolio | Supports early diagnosis | Improves treatment selection through quick, easy-to-use tests |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the companion animal diagnostics market includes a broad range of stakeholders, each with an important role in the development, distribution, and end-use of diagnostic solutions. At the forefront are the companies engaged in manufacturing and supplying diagnostic products, catering to the need for in-house testing, molecular, and immunodiagnostic solutions in animal healthcare. These are supported and supplemented by the reference laboratories, which provide advanced testing solutions and also assist in managing complex or large-scale diagnostic needs. Also, veterinary practitioners, hospitals, and institutions are important end users that seek advanced diagnostic solutions to inform and support their treatment decisions and patient outcomes. Emerging supportive members of the ecosystem are also technology companies engaged in AI, ML, and cloud-based solutions, entering the mainstream to support improvements in diagnostic accuracy, data interpretation, and integrated workflow solutions. Corresponding to these are also the regulatory organizations that guarantee support and compliance with quality and safety regulations to ensure an important role for the ecosystem to contribute to and facilitate expansion to the companion animal diagnostics market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Companion Animal Diagnostics Market, By Product

As of 2025, consumables held the largest share of the companion animal diagnostics market because they are required for all diagnostic procedures performed in veterinary clinics and laboratories. Consumables have to be replaced from time to time, adding to their high and consistent demand in the market. The growing adoption of in-house analyzers, the rising use of POCT, and the strong focus on routine screenings and preventive measures will drive demand for consumables. The increasing use of diagnostic procedures for pets for infectious disease testing, wellness, and monitoring for chronic diseases will, thus, ensure the largest market share of consumables.

Companion Animal Diagnostics Market, By Technology

In 2025, clinical biochemistry dominated the companion animal diagnostics market because it is one of the main components in general animal practice, and it helps determine the organ function, metabolism, electrolyte balance, and general health status of domestic animals. These parameters are critical in the detection and treatment of common illnesses such as kidney disease, liver disease, diabetes, and endocrine system imbalances, which are increasingly common among an aging companion animal population. Animal hospitals generate large volumes of biochemistry analyses in animals undergoing general health checks, pre-operative checks, and chronic disease monitoring.

Companion Animal Diagnostics Market, By Application

In 2025, clinical pathology held the largest share of the companion animal diagnostics market due to the inclusion of routine tests, such as hematology, urinalysis, and clinical chemistry, which are essential for diagnosing common ailments in companion animals. These tests are used on a large scale for the diagnosis of infections, metabolic and chronic ailments, and are further required for routine health checks. In-house analysis has made the diagnosis of these tests more convenient, thereby increasing the overall market share. Increasing cases of age-related ailments in animals are also adding to the market demand for these tests.

Companion Animal Diagnostics Market, By Animal Type

The dogs segment is expected to dominate the companion animal market due to the prevalence of dog ownership over other pet animals, thereby driving the demand for diagnostic services. Since dogs are more prone to various health issues, such as infectious diseases, genetic disorders, and chronic conditions like arthritis and cancer, which increases the need among dog owners to subject their pets to diagnostic procedures. Furthermore, the growing interest in dog-specific health conditions, the expanding scope of diagnostic procedures for canines, and the increasing number of dog owners with access to quality medical treatment are key factors contributing to the dominant share among dogs.

Companion Animal Diagnostics Market, By End User

The diagnostic laboratories segment of the companion animal diagnostics market is expected to lead due to the specialized testing services, the majority of which may not be available in the clinics themselves. From this standpoint, advanced diagnostics, as well as molecular diagnostics and screening tests, are generally aided by the diagnostic laboratories and hence highly required when it comes to the diagnosis of intricate diseases and illnesses involving companion animals. This works well in the sense that, due to the demand for accurate and reliable results, the clinics themselves are opting more for reference laboratories.

REGION

Asia Pacific to be fastest-growing companion animal diagnostics market during forecast period

The Asia Pacific region is likely to experience the fastest growth rate in the companion animal diagnostics market, driven by rising pet ownership, higher disposable incomes, and increased awareness of veterinary care in countries such as China, India, and Japan. As pet owners become increasingly aware of the need for modern diagnostic techniques in companion animals to prevent diseases, the demand for molecular diagnostics, point-of-care technologies, and in-vitro diagnostics has been increasing. Moreover, the infrastructure of companion animal healthcare, the availability of novel diagnostic techniques, and government support are driving the market's growth. The vast market opportunities in Asia Pacific, along with the entry of emerging companies offering companion animal diagnostics, have accelerated the adoption of novel diagnostics, which will soon put Asia Pacific at the forefront of companion animal care.

COMPANION ANIMAL DIAGNOSTIC MARKET: COMPANY EVALUATION MATRIX

In the companion animal diagnostics market matrix, IDEXX Laboratories, Inc. (Star) occupies a leading position, driven by its strong market presence, fueled by its broad diagnostic product portfolio and extensive knowledge and expertise in in-clinic and lab-based analysis for the diagnosis and detection of diseases in companion animals. Neogen Corporation’s (Emerging Leader) growing market presence is related to its broad diagnostic product portfolio, which includes immunoanalytical and rapid tests for companion animals, thereby improving the efficiency of disease screening and preventive testing among such animals. While other existing players continue to expand their product portfolios, IDEXX’s scale and Neogen’s targeted diagnostic focus position them prominently in the growing companion animal diagnostics market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- IDEXX Laboratories, Inc. (US)

- Zoetis Services LLC (US)

- Mars, Incorporated (US)

- bioMérieux (France)

- FUJIFILM Corporation (Japan)

- Thermo Fisher Scientific Inc. (US)

- Neogen Corporation (US)

- Virbac (France)

- INDICAL BIOSCIENCE GmbH (Germany)

- Innovative Diagnostics (France)

- Randox Laboratories Ltd. (UK)

- Shenzhen Mindray Animal Medical Technology Co., LTD. (China)

- BIONOTE (South Korea)

- Boule (Sweden)

- URIT MEDICAL ELECTRONIC CO., LTD. (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 3.29 BN |

| Market Forecast in 2031 (Value) | USD 5.40 BN |

| Growth Rate | CAGR of 8.7% from 2026-2031 |

| Years Considered | 2024-2031 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Related Segment & Geographic Reports | Europe Companion Animal Diagnostics Market |

WHAT IS IN IT FOR YOU: COMPANION ANIMAL DIAGNOSTIC MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparison of key companion animal diagnostic products and technologies including immunodiagnostics and molecular diagnostics. Highlighted technology adoption trends, test menu expansion, and product differentiation across leading manufacturers | Enabled identification of technology trends, pricing and adoption drivers, and unmet diagnostic needs; supported strategic decisions on product positioning, portfolio expansion, and innovation focus |

| Company Information |

|

Delivered clarity on competitive intensity, differentiation strategies, and partnership opportunities shaping the companion animal diagnostics landscape |

| Geographic Analysis | Provided detailed regional analysis of companion animal diagnostics demand across Rest of Asia Pacific, focusing on pet ownership trends, veterinary infrastructure, and diagnostic adoption rates | Supported regional strategy planning by identifying high-growth markets, localization opportunities, and expansion priorities for diagnostic product manufacturers |

RECENT DEVELOPMENTS

- March 2025 : IDEXX Laboratories introduced IDEXX Cancer Dx, a new diagnostic panel designed to enable early detection of lymphoma in dogs, particularly targeting the millions of dogs in North America that are at heightened risk for cancer.

- January 2025 : Antech Diagnostics, Inc. unveiled truRapid FOUR, a new proprietary lateral flow test that screens for important canine vector-borne disease. This test reacts to Anaplasma spp. antibodies, Ehrlichia spp. antibodies, Lyme C6, as well as heartworm antigen in whole blood, serum, or plasma.

- December 2024 : Zoetis Services LLC launched Vetscan OptiCell, a screenless, cartridge-based, artificial intelligence-enhanced point-of-care hematology analyzer designed to rapidly analyze complete blood counts with high accuracy in just minutes.

Table of Contents

Methodology

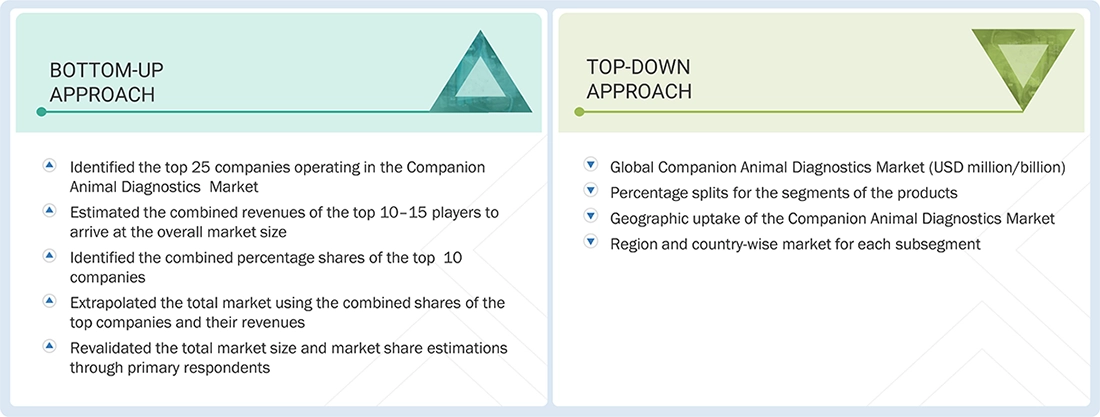

This research study extensively utilized both primary and secondary sources. It involved analyzing various factors influencing the industry to identify segmentation types, industry trends, key players, the competitive landscape, key market dynamics, and strategies employed by key players.

Secondary Research

This research study utilized a variety of comprehensive secondary sources, including directories, databases such as Bloomberg Business, Factiva, and Dun & Bradstreet, white papers, annual reports, company house documents, investor presentations, and SEC filings from various companies. Secondary research was employed to gather information crucial for an in-depth, technical, market-oriented, and commercial analysis of the companion animal diagnostics market. This approach also helped identify key players in the industry and allowed for classification and segmentation based on emerging trends at the most detailed level. Furthermore, significant developments pertaining to both market and technological perspectives were documented. A database of primary industry leaders was created as part of this secondary research.

Primary Research

In the primary research process, we interviewed a range of sources from both the supply and demand sides to gather qualitative and quantitative information for this report. Primary sources from the supply side include project/sales/marketing/business development managers, presidents, CEOs, vice presidents, chairpersons, chief operating officers, chief strategy officers, directors, chief information officers, and chief medical information officers related to the companion animal diagnostics market. Primary sources from the demand side include R&D product development teams in animal health companies, veterinary clinicians, diagnostic laboratory managers, and procurement heads at veterinary reference laboratories.

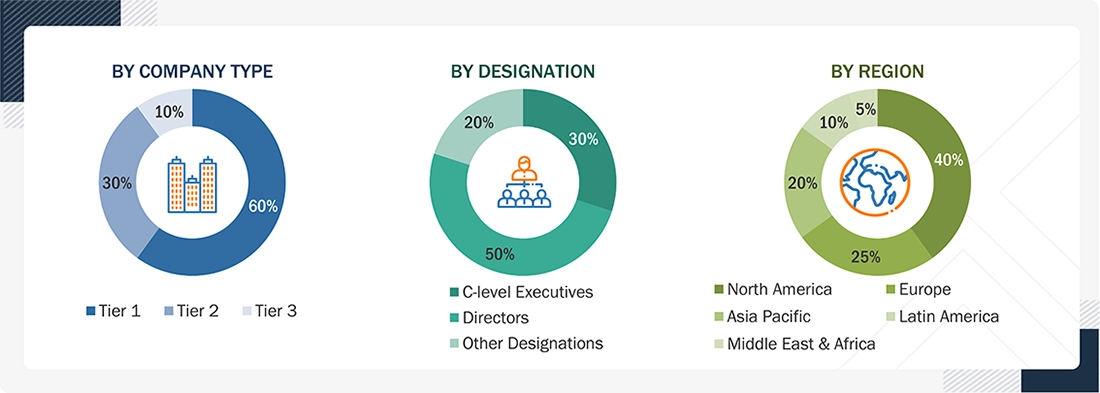

A breakdown of the primary respondents is provided below:

BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE PARTICIPANTS, BY COMPANY TYPE, DESIGNATION, AND REGION

Note: C-level executives include CEOs, COOs, CTOs, and VPs. Other designations include sales, marketing, and product managers.

Tiers are defined based on a company’s total revenue. As of 2025: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the companion animal diagnostics market was determined through data triangulation across three approaches, as described below. After each approach, the weighted average of the three was calculated based on the level of assumptions used in each.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed as applicable to complete the overall market engineering process and obtain exact statistics for all segments and subsegments.

Market Definition

Companion animal diagnostics use plasma, serum, blood, urine, feces, and tissue samples to detect, monitor, and manage diseases and health conditions in dogs, cats, horses, and other household pets. The companion animal diagnostics market includes diagnostic instruments, test kits, reagents, and consumables used in veterinary clinics and laboratories, covering technologies such as clinical chemistry analyzers, hematology analyzers, immunodiagnostics and ELISA test kits, urinalysis systems, molecular diagnostic assays, glucose monitoring systems, and blood gas–electrolyte analyzers. These products support routine wellness screening, disease diagnosis, treatment monitoring, and preventive healthcare in companion animals

Key Stakeholders

- Companion animal diagnostic manufacturers

- Companion animal diagnostic distributors and suppliers

- Companion animal R&D companies

- Veterinary reference laboratories

- Veterinary hospitals and clinics

- Veterinary universities and research institutes

- Government associations

- Market research and consulting firms

- Venture capitalists and investors

- Distributors, channel partners, and third-party suppliers

Report Objectives

- To define, describe, segment, and forecast the companion animal diagnostics market by product, technology, application, animal type, end user, and region

- To provide detailed information about the factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall companion animal diagnostics market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the companion animal diagnostics market in five main regions (along with their respective key countries): North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the companion animal diagnostics market and comprehensively analyze their core competencies and market shares

- To analyze competitive developments such as acquisitions, product launches, expansions, collaborations, agreements, and partnerships

Available customizations:

Based on the given market data, MarketsandMarkets offers customization to meet your company’s specific needs. The following customization options are available for the report:- Company Information

Detailed analysis and profiling of additional market players (up to 5)

- Geographic Analysis

Further breakdown of the Rest of European companion animal diagnostics market into Austria, Finland, Switzerland, and other countries

Further breakdown of the Rest of Latin American companion animal diagnostics market into Colombia, Chile, and other countries

- Competitive Landscape Assessment

Market share analysis for North America and Europe, which provides market shares of the top 3–5 key players in the companion animal diagnostics market

Competitive leadership mapping for established players in the US

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Companion Animal Diagnostic Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Companion Animal Diagnostic Market