Antenna, Transducer, and Radome Market Size, Share, Trends & Growth Analysis by Product (Antenna & Transducer, Radome), Platform (Ground, Naval, Airborne), End User, Application, Technology (Radar, Communication, Sonar), Frequency, Region (2020-2025)

Updated on : Oct 22, 2024

The Antenna, Transducer, and Radome market is experiencing significant growth, driven by rising global demand across industries such as defense, aerospace, telecommunications, and maritime. Technological advancements, including innovations in materials, miniaturization, and enhanced signal processing, are improving the performance and efficiency of these systems. These advancements are particularly crucial for applications requiring high-speed data transmission, precise sensing, and durable protection from environmental conditions. Increasing investments in advanced radar systems, 5G networks, and satellite communications are also propelling market expansion, as industries seek cutting-edge solutions to meet the growing demand for robust and efficient communication and detection systems.

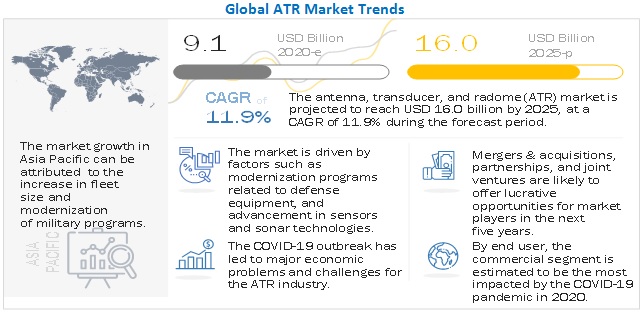

The Global Antenna, Transducer, and Radome Market size is projected to grow from USD 9.1 billion in 2020 to USD 16.0 billion by 2025, at a CAGR of 11.9% from 2020 to 2025. The growth of the market can be attributed to the growing trend of automation in flight control and increase in defense expenditure and R&D activities to develop ATR, capable of withstanding harsh conditions and providing long-range capabilities at low power consumption.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Antenna, Transducer, and Radome Market

The Antenna, Transducer, and Radome market includes major players Raytheon Technologies Corporation (US), Honeywell International Inc. (US), L3Harris Technologies Inc. (US), Lockheed Martin Corporation (US), and Cobham Plc (UK). These players have spread their business across various countries includes North America, Europe, Asia Pacific, Middle East, Africa, and South America. COVID-19 has impacted their businesses as well. Industry experts believe that COVID-19 could affect ATR production and services by 25-30% globally in 2020.

The rapid spread of COVID-19 in Europe, the US & Asia Pacific has led to a significant drop in demand for Antenna, Transducer, and Radome globally, with a corresponding reduction in revenues for various payload suppliers, service providers across all markets owing to late delivery, manufacturing shutdown, the limited staff at manufacturing facilities, and limited availability of equipment. As per industry experts, the global ATR demand is anticipated to recover by 2022 fully.

Antenna, Transducer, and Radome Market Dynamics

Driver: Demand for technologically advanced Antenna, Transducer, and Radome for next-generation aircraft

Manufacturers in the business jets industry are focusing on increasing operational efficiency, lowering carbon footprint, reducing operational costs, and upgrading avionics, cabin interiors, and aircraft systems. This has resulted in the introduction of new aircraft. For instance, Embraer launched the Praetor 500 and the Praetor 600 in 2018 and the Legacy 650E in 2016; Bombardier launched the Global 5500 and Global 6500 in 2018; Cessna launched the Citation Longitude in 2016; Honda launched the Honda Jet Elite in 2018, and Daher launched the TBM 910 in 2017 and the TBM 940 in 2019. These new-generation aircraft provide more efficiency, range, and performance, leading to an increase in replacement of existing aircraft as well as the number of first-time buyers. The demand for these aircraft has increased with the introduction of advanced avionics, interiors, more reliable connectivity solutions, and more efficient engines. The production of these aircraft drives the demand for technologically advanced antennas, boosting the market in the years to come

Restraint: Long duration of product certification

Antenna, Transducer, and Radome manufacturers are required to obtain product certification before launching a new product in the market. For manufacturers to reach the highest level of safety, multiple tests and iterations are required, leading to lengthy approval periods, which, in turn, leads to delays in the production process and losses. For instance, obtaining product approval from the Federal Aviation Administration (FAA), which provides certification in North America, can take as long as three years, as stated by primary respondents. Such delays in certification from regulatory authorities may restrain the growth of the ATR market.

Opportunity: New composites developed to improve radome properties

Countries such as India, China, and Russia have developed advanced missiles that are difficult to intercept. India, in collaboration with Russia, is developing hypersonic Brahmos missile, which can easily penetrate missile defense shields. These missiles encompass performance capabilities that make traditional radome design inadequate, thus requiring radomes made of materials having a high melting temperature and improved tensile strength.

Rayceram 8 developed by Raytheon, Nitroxyceram developed by Loral, Aeronutronic Reaction-Bonded Silicon Nitride (RBSN) developed by Boeing, and Hot-Pressed Silicon Nitride (HPSN) developed by GTE, Norton, and Ceradyne are composites that improve the overall properties of radomes. The improved characteristics of radomes have increased their use in various applications, thereby providing lucrative growth opportunities to developers of radomes.

Similarly, glass fiber composites are increasingly used over traditional materials to develop radomes. These moldable composites offer an economical solution to produce radomes and antenna substrates. The use of glass fiber composites results in the development of lightweight radome components, with varied designs at a relatively low cost, thereby contributing to the mass production of radomes. Glass fibers increase the dielectric constant of composites, enabling antenna size reduction when these composites are used as substrate materials.

Challenge: Maintenance of radomes

Radomes are constructed using materials that minimally attenuate the electromagnetic signal transmitted or received by antennas. The slightest change in their physical characteristics can affect the performance of radar and antenna systems and hamper the communication process. This makes timely maintenance of radomes important. The repairs of radomes should be performed in a way that their original properties, such as transmissivity and reflectivity, are restored. The maintenance of radomes requires technical expertise and the use of proper tools and simulation processes, which, in turn, acts as a challenge for radome developers.

The multi-band segment is projected to witness a higher CAGR during the forecast period

Multi-band signal processing is primarily conducted to improve signal resolution. A combination of different frequency bands is employed for a multi-band signal processing system. The growing demand for better signals is one of the major factors driving the adoption of multi-band frequency. Recent developments in photonic technologies have enabled the multiband surveillance radars to explore applications that require high-precision.

Widebody aircraft is expected to witness the largest market share during the forecast period

The demand for widebody aircraft is expected to increase globally due to its efficiency, rise in passenger traffic post-COVID-19 impact, and increasing connectivity across all geographical areas of developing regions and developed regions. With the growing manufacturing of a widebody aircraft platform, the demand for ATR is expected to surge across the forecast period.

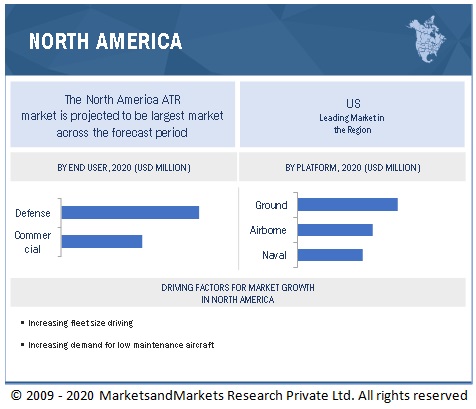

The North America market is projected to witness the highest market share from 2020 to 2025

North America leads the Antenna, Transducer, and Radome market due to the presence of several large Antenna, Transducer, and Radome manufacturers in the region. Prominent market players based in this region include Honeywell International Inc. (US), Collins Aerospace (US), L3Harris Technologies, Inc.(US). These major market players continuously invest in R&D to develop ATR with improved efficiency and reliability. They are also focused on developing ATR suitable for state-of-the-art technologies, such as longer range, small size and degital rather than using conventional technology.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The global Antenna, Transducer, and Radome Market is dominated by a few globally established players such as Raytheon Technologies Corporation (US), Honeywell International Inc. (US), L3Harris Technologies Inc. (US), Lockheed Martin Corporation (US), and Cobham Plc (UK), among others.

Scope of The Antenna, Transducer, and Radome Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 9.1 billion by 2020 |

|

Projected Market Size |

USD 16.0 billion by 2025 |

|

CAGR |

11.9% |

|

Market size available for years |

2016–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Antenna, Transducer, and Radome Market By Product Type, Platform, End User, Frequency, Application, Technology |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies covered |

Raytheon Technologies Corporation (US), Honeywell International Inc. (US), L3Harris Technologies Inc. (US), Lockheed Martin Corporation (US), and Cobham Plc (UK) and others. Total 25 Market Players |

The study categorizes the Antenna, Transducer, and Radome market based on Product Type, Platform, End User, Frequency, Application, Technology and region.

Antenna, Transducer, and Radome Market, By Product Type

- Antenna & Transducers

- Radome

Antenna, Transducer, and Radome Market, By Platform

- Airborne

- Ground

- Naval

A ntenna, Transducer, and RadomeMarket, By End User

- Commercial

- Defense

Antenna, Transducer, and Radome Market, By Frequency

- HF/VHF/UHF-band

- L-band

- S-band

- C-band

- X-band

- Ku-band

- Ka-band

- Multi-band

Antenna, Transducer, and Radome Market, By Application

- Communication

- Navigation & Surveillance

AUV Market, By Technology

- Communication

- Radar

- Sonar

Antenna, Transducer, and Radome Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In October 2020, Cobham plc, a unit of Cobham Advanced Electronic Solutions, has been awarded a contract worth USD 50 million from Lockheed Martin to provide antenna array panel assemblies to the US Navy’s SEWIP Block 2, which will improve the AN/SLQ-32 passive electronic support capability.

- In October 2020, Rohde & Schwarz signed a contract with Spanish shipbuilder Navantia to equip the Spanish Navy’s five new F-110 frigates with external communications systems, which consist of R&S M3SR software-defined radios (R&S Series4100 HF and R&S Series4400 VHF/UHF) and includes engineering services and Integrated Logistics Support (ILS). This contract will enable the company to attract new customers and increase its revenue generation.

- In July 2020, L3Harris Technologies, Inc. received an indefinite-delivery, indefinite-quantity (IDIQ) contract worth USD 380 million from the Canadian Commercial Corporation (CCC) for wescam mx-series products and support.

- In June 2020, Raytheon Technologies Corporation secured a contract worth USD 2.3 billion for missile radars from a missile defense agency in Saudi Arabia..

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Antenna, Transducer, and Radome market?

The Antenna, Transducer, and Radome market is expected to grow substantially owing to growing trend of modernizations of aerospace sector and the rising demand for UAVs, globally.

What are the key sustainability strategies adopted by leading players operating in the Antenna, Transducer, and Radome market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Antenna, Transducer, and Radome market. The major players include Raytheon Technologies Corporation (US), Honeywell International Inc. (US), L3Harris Technologies Inc. (US), Lockheed Martin Corporation (US), and Cobham Plc (UK), these players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market.

What are the new emerging technologies and use cases disrupting the Antenna, Transducer, and Radome market?

Some of the major emerging technologies and use cases disrupting the market include antenna for rotary wing aircraft with minimum interruption owing to vibration and noise cause by the wing. Also, Installation of Mechanically Phased Array Antennas for In-Flight Broadband Service.

Who are the key players and innovators in the ecosystem of the Antenna, Transducer, and Radome market?

The key players in the Antenna, Transducer, and Radome market include Raytheon Technologies Corporation (US), Honeywell International Inc. (US), L3Harris Technologies Inc. (US), Lockheed Martin Corporation (US), and Cobham Plc (UK).

Which region is expected to hold the highest market share in the Antenna, Transducer, and Radome market?

Antenna, Transducer, and Radome market in North America is projected to hold the highest market share during the forecast period due to the presence of several large ATR manufacturers in the region.

Which antenna type, such as aperture antennas, micro strip antennas, array antennas, wire antennas is expected to drive the growth of the market in the coming years?

For the Antenna, Transducer, and Radome market, microstrip antenna is projected to grow at the highest CAGR during the forecast period from 2020 to 2025 due to Significant advancements in antenna technology. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 Antenna, Transducer, and Radome MARKET: INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 ANTENNA TRANSDUCER AND RADOME (ATR) MARKET SEGMENTATION

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 2 USD EXCHANGE RATES

1.5 MARKET STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH PROCESS FLOW

FIGURE 3 Antenna, Transducer, and Radome MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH APPROACH

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND SIDE ANALYSIS

2.2.2.1 Increase in defense spending

TABLE 3 DEFENSE SPENDING OF MAJOR ECONOMIES

2.2.3 SUPPLY SIDE ANALYSIS

2.2.3.1 Naval forces incorporating sonar systems

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.3 MARKET PROJECTIONS

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.5.1 ASSUMPTIONS

2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 7 BY END USER, DEFENSE SEGMENT ESTIMATED TO ACCOUNT FOR LARGER SHARE OF Antenna, Transducer, and Radome MARKET IN 2020

FIGURE 8 BY TECHNOLOGY, RADAR SEGMENT ESTIMATED TO ACCOUNT FOR LARGER SHARE IN 2020

FIGURE 9 NORTH AMERICA ESTIMATED TO LEAD THE Antenna, Transducer & Radome MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE MARKET OPPORTUNITIES

FIGURE 10 ATTRACTIVE MARKET OPPORTUNITIES, 2020-2025

4.2 ANTENNA, TRANSDUCER, AND RADOME MARKET, BY PRODUCT

FIGURE 11 RADOME SEGMENT IS EXPECTED GROW AT A HIGHER CAGR DURING FORECAST PERIOD

4.3 ANTENNA, TRANSDUCER, AND RADOME MARKET, BY TECHNOLOGY

FIGURE 12 RADAR SEGMENT IS EXPECTED TO BE THE LARGEST SEGMENT FROM 2020 TO 2025

4.4 ANTENNA, TRANSDUCER, AND RADOME MARKET, BY COUNTRY

FIGURE 13 Antenna, Transducer & Radome MARKET IN INDIA EXPECTED TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 MARKET DYNAMICS OF ANTENNA, TRANSDUCER, AND RADOME (ATR) MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing aerospace modernization programs

5.2.1.2 Increasing demand for military UAVs

FIGURE 15 DEMAND FOR MILITARY UNMANNED AIR VEHICLES (2013-2021)

5.2.1.3 Demand for technologically advanced Antenna, Transducer, and Radome for next-generation aircraft

5.2.1.4 Significance of radomes in warfare

5.2.2 RESTRAINTS

5.2.2.1 Long duration of product certification

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of aircraft manufacturers in Asia Pacific and Latin America

5.2.3.2 Rising popularity of eVTOL aircraft

TABLE 4 ONGOING EVTOL PROGRAMS

5.2.3.3 New composites developed to improve radome properties

5.2.4 CHALLENGES

5.2.4.1 High manufacturing cost and designing constraints

5.2.4.2 Maintenance of radomes

5.2.4.3 Economic challenges due to COVID-19

TABLE 5 COVID-19 IMPACT ON PASSENGER NUMBER AND PASSENGER REVENUE

5.2.4.4 Reduced global demand for maintenance, repair, and overhaul (MRO) due to COVID-19

FIGURE 16 IN-SERVICE FLEET SIZE IN THOUSANDS, 2018-2022

5.3 AVERAGE SELLING PRICE

FIGURE 17 AVERAGE SELLING PRICE RANGE OF AIRCRAFT ANTENNAS, USD/UNIT

5.4 VALUE CHAIN ANALYSIS

FIGURE 18 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING ORIGINAL EQUIPMENT MANUFACTURING AND SYSTEM INTEGRATION PHASES

5.5 MARKET ECOSYSTEM MAP

5.5.1 PROMINENT COMPANIES

5.5.2 PRIVATE AND SMALL ENTERPRISES

5.5.3 END USERS

FIGURE 19 MARKET ECOSYSTEM MAP: ANTENNA, TRANSDUCER, AND RADOME (ATR) MARKET

5.6 DISRUPTIONS IMPACTING ATR CUSTOMERS’ BUSINESS

5.6.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR ATR MANUFACTURERS

FIGURE 20 REVENUE IMPACT FOR ANTENNA, TRANSDUCER, AND RADOME (ATR) MARKET

5.7 PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 INTENSITY OF COMPETITIVE RIVALRY IN ANTENNA TRANSDUCER AND RADOME MARKET IS MODERATE

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 DEGREE OF COMPETITION

5.8 TRADE DATA STATISTICS

5.8.1 EXPORT DATA STATISTICS

TABLE 6 EXPORT VALUE OF (PRODUCT HARMONIZED SYSTEM CODE: 852610) RADAR APPARATUS, RADIO NAVIGATIONAL AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS

5.8.2 IMPORT DATA STATISTICS

TABLE 7 IMPORT VALUE OF (PRODUCT HARMONIZED SYSTEM CODE: 8526) RADAR APPARATUS, RADIO NAVIGATIONAL AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS

5.9 TECHNOLOGY TRENDS IN Antenna, Transducer, and Radome MARKET

5.9.1 USE OF MULTI-PLATFORM ANTI-JAM GPS NAVIGATION ANTENNA (MAGNA)

5.9.2 RECONFIGURABLE LIQUID ANTENNAS FOR AIRCRAFT ADAPTABILITY

5.10 CASE STUDY

5.10.1 INSTALLATION OF MECHANICALLY PHASED ARRAY ANTENNAS FOR IN-FLIGHT BROADBAND SERVICE

5.11 RANGE/SCENARIOS

FIGURE 22 IMPACT OF COVID-19 ON ANTENNA, TRANSDUCER, AND RADOME (ATR) MARKET: GLOBAL SCENARIOS

6 INDUSTRY TRENDS (Page No. - 69)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 SYNTHETIC APERTURE RADAR

6.2.2 3D PRINTING

6.2.3 ADVANCED MATERIALS FOR UAV ANTENNAS

6.2.4 USE OF WIDE V-BAND FOR SATELLITE-AIRCRAFT COMMUNICATION

6.2.5 LIGHTWEIGHT ANTENNAS

6.2.6 PLASMA RADOME TECHNOLOGY FOR SPACE-BASED ANTENNAS

6.2.7 STEALTH RADOMES

6.2.8 DYNEEMA CRYSTAL TECHNOLOGY FOR RADOMES

6.2.9 RESIN TRANSFER MOLDING TECHNOLOGY

6.2.10 MULTI-BAND RADOMES

6.3 INNOVATIONS & PATENT REGISTRATIONS

TABLE 8 INNOVATIONS & PATENT REGISTRATIONS, 2011-2020

7 ANTENNA, TRANSDUCER, AND RADOME MARKET, BY PLATFORM (Page No. - 74)

7.1 INTRODUCTION

FIGURE 23 ANTENNA, TRANSDUCER & RADOME MARKET, BY PLATFORM, 2020-2025 (USD MILLION)

TABLE 9 Antenna, Transducer, and RadomeMARKET, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 10 Antenna, Transducer, and RadomeMARKET, BY PLATFORM, 2020–2025 (USD MILLION)

7.2 GROUND

TABLE 11 GROUND:

Antenna, Transducer, and Radome

MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 12 GROUND: ATR Antenna, Transducer, and Radome MARKET, BY TYPE, 2020–2025 (USD MILLION)

7.2.1 TELECOM TOWERS

7.2.2 GROUND VEHICLES

TABLE 13 GROUND VEHICLES: ATR MARKET, BY SUB-TYPE, 2016–2019 (USD MILLION)

TABLE 14 GROUND VEHICLES: ATR MARKET, BY SUB-TYPE, 2020–2025 (USD MILLION)

7.2.2.1 Command & control vehicles

7.2.2.2 Self-propelled artillery vehicles

7.2.2.3 Unmanned ground vehicles (UGV)

7.2.2.4 Commercial Vehicles

7.2.3 AIR TRAFFIC CONTROL

7.2.4 COMMAND CENTERS

7.3 NAVAL

TABLE 15 NAVAL: Antenna, Transducer, and Radome MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 16 NAVAL: ATR MARKET, BY TYPE, 2020–2025 (USD MILLION)

7.3.1 COMMERCIAL VESSELS

TABLE 17 NAVAL COMMERCIAL VESSELS: Antenna, Transducer, and Radome MARKET, BY SUB-TYPE, 2016–2019 (USD MILLION)

TABLE 18 NAVAL COMMERCIAL VESSELS: Antenna, Transducer & Radome MARKET, BY SUB-TYPE, 2020–2025 (USD MILLION)

7.3.1.1 Passenger vessels

7.3.1.2 Bulk carriers

7.3.1.3 Containers

7.3.1.4 Tankers

7.3.1.5 Dry cargo vessels

7.3.1.6 General cargo vessels

7.3.1.7 Others

7.3.2 MILITARY VESSELS

TABLE 19 NAVAL MILITARY VESSELS: Antenna, Transducer, and Radome MARKET, BY SUB-TYPE, 2016–2019 (USD MILLION)

TABLE 20 NAVAL MILITARY VESSELS: ATR MARKET, BY SUB-TYPE, 2020–2025 (USD MILLION)

7.3.2.1 Submarines

7.3.2.2 Destroyers

7.3.2.3 Frigates

7.3.2.4 Corvettes

7.3.2.5 Aircraft carriers

7.3.2.6 Offshore support vessels (OSVs)

TABLE 21 AIRBORNE: Antenna, Transducer, and Radome MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 22 AIRBORNE: ATR MARKET, BY TYPE, 2020–2025 (USD MILLION)

7.3.3 COMMERCIAL AIRCRAFT

TABLE 23 COMMERCIAL AIRCRAFT: ATR MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 24 OMMERCIAL AIRCRAFT: ATR MARKET, BY TYPE, 2020–2025 (USD MILLION)

7.3.3.1 Narrow-body aircraft (NBA)

7.3.3.2 Wide-body aircraft (WBA)

7.3.3.3 Extra wide body aircraft

7.3.3.4 Regional transport aircraft (RTA)

7.3.4 BUSINESS & GENERAL AVIATION

TABLE 25 BUSINESS & GENERAL AVIATION: ATR MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 26 BUSINESS AND GENERAL AVIATION: ATR MARKET, BY TYPE, 2020–2025 (USD MILLION)

7.3.4.1 Business jets

7.3.4.2 Light aircraft

7.3.4.3 Commercial helicopters

7.3.5 MILITARY AIRCRAFT

TABLE 27 MILITARY AVIATION: Antenna, Transducer, and Radome MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 28 MILITARY AVIATION: ATR MARKET, BY TYPE, 2020–2025 (USD MILLION)

7.3.5.1 Fighter jets

7.3.5.2 Special mission aircraft

7.3.5.3 Transport aircraft

7.3.5.4 Military helicopters

7.3.6 UNMANNED AERIAL VEHICLES (UAV)

7.3.6.1 Commercial UAV

7.3.6.2 Military UAV

TABLE 29 UAV: Antenna, Transducer, and Radome MARKET, BY TYPE, 2016-2019 (USD MILLION)

TABLE 30 UAV: ATR MARKET, BY TYPE, 2020–2025 (USD MILLION)

7.3.7 EVTOLS

TABLE 31 EVTOLS: ATR MARKET, BY TYPE, 2020–2025 (USD MILLION)

7.3.7.1 Air taxi

7.3.7.2 Personal air vehicle

7.3.7.3 Air ambulance

7.3.7.4 Air cargo vehicle

8 ANTENNA, TRANSDUCER, AND RADOME MARKET, BY PRODUCT TYPE (Page No. - 89)

8.1 INTRODUCTION

FIGURE 24 ANTENNA & TRANSDUCER SEGMENT IS EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 32 ATR MARKET, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 33 ATR MARKET, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

8.2 ANTENNA & TRANSDUCER

8.2.1 GROWING DISPUTES AMONG COUNTRIES DRIVE THE DEMAND FOR ANTENNA & TRANSDUCERS IN DEFENSE SECTOR

8.2.2 ANTENNA MARKET, BY STRUCTURE

TABLE 34 ANTENNA MARKET SIZE, BY STRUCTURE, 2016–2019 (USD MILLION)

TABLE 35 ANTENNA MARKET SIZE, BY STRUCTURE, 2020–2025 (USD MILLION)

8.2.3 PARABOLIC REFLECTOR ANTENNAS

8.2.4 FLAT PLANE ANTENNAS

8.2.5 OTHERS

8.2.6 ANTENNA MARKET, BY TYPE

TABLE 36 ANTENNA MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 37 ANTENNA MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

8.2.6.1 Aperture antennas

8.2.6.2 Microstrip antennas

8.2.6.3 Array antennas

8.2.6.4 Wire antennas

8.2.7 TRANSDUCER MARKET, BY TYPE

TABLE 38 TRANSDUCER MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 39 TRANSDUCER MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

8.2.7.1 Software-defined transducers

8.2.7.2 Conventional transducers

8.3 RADOME

TABLE 40 RADOME MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 41 RADOME MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

8.3.1 SANDWICH

8.3.2 SOLID LAMINATE

8.3.3 DIELECTRIC SPACE FRAME

8.3.4 METAL SPACE FRAME

9 ANTENNA, TRANSDUCER, AND RADOME MARKET, BY END USER (Page No. - 97)

9.1 INTRODUCTION

FIGURE 25 ANTENNA, TRANSDUCER, AND RADOME MARKET, BY END USER, 2020-2025 (USD MILLION)

TABLE 42 Antenna, Transducer & Radome MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 43 ATR MARKET, BY END USER, 2020–2025 (USD MILLION)

9.2 IMPACT OF COVID-19 ON COMMERCIAL AND DEFENSE ANTENNA, TRANSDUCER, AND RADOME

9.2.1 MOST IMPACTED END USER SEGMENT

9.2.1.1 COMMERCIAL

9.2.2 LEAST IMPACTED END USER SEGMENT

9.2.2.1 DEFENSE

9.3 COMMERCIAL

9.4 DEFENSE

10 ANTENNA, TRANSDUCER, AND RADOME MARKET, BY FREQUENCY (Page No. - 101)

10.1 INTRODUCTION

TABLE 44 FREQUENCY BANDS AND THEIR RANGES

FIGURE 26 MULTI-BAND SEGMENT PROJECTED TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

TABLE 45 Antenna, Transducer, and Radome MARKET SIZE, BY FREQUENCY, 2016–2019 (USD MILLION)

TABLE 46 ATR MARKET SIZE, BY FREQUENCY, 2020–2025 (USD MILLION)

10.2 HF/UHF/VHF-BAND

10.2.1 THESE FREQUENCY BANDS ARE PREFERRED FOR LONG-RANGE SURVEILLANCE AND TRACKING

10.3 L-BAND

10.3.1 L-BAND BAND RADARS ARE USED EXTENSIVELY FOR FLEET MANAGEMENT AND ASSET TRACKING

10.4 S-BAND

10.4.1 S-BAND RADARS ARE USED FOR MODERATE RANGE SURVEILLANCE

10.5 C-BAND

10.5.1 C-BAND RADARS ARE USED FOR LONG-RANGE MILITARY BATTLEFIELD AND GROUND SURVEILLANCE

10.6 X-BAND

10.6.1 X-BAND RADARS ARE USED FOR SITUATIONAL AWARENESS

10.7 KU-BAND

10.7.1 KA-BANDS PROVIDE WIDE BEAM COVERAGE AND HIGHER THROUGHPUT IN COMPARISON WITH LOWER BANDS

10.8 KA-BAND

10.8.1 KA-BAND TRANSMITS DATA AT A HIGHER RATE AS COMPARED TO KU-BAND

10.9 MULTI-BAND

10.9.1 MULTI-BAND RADARS ARE USED FOR COHERENT DETECTION AND TRACKING OF MOVING TARGET OBJECTS

11 ANTENNA, TRANSDUCER, AND RADOME MARKET, BY APPLICATION (Page No. - 108)

11.1 INTRODUCTION

FIGURE 27 ANTENNA, TRANSDUCER & RADOME MARKET, BY APPLICATION, 2020- 2025 (USD MILLION)

TABLE 47 ATR MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 48 ATR MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

11.2 COMMUNICATION

11.2.1 THE NEED FOR COMMUNICATION ONBOARD A PLATFORM AND COMMAND CENTER EXPECTED TO DRIVE THE MARKET

11.3 NAVIGATION & SURVEILLANCE

11.3.1 GROWING FOCUS ON AUTONOMOUS OPERATIONS OF PLATFORMS TO DRIVE THE MARKET GROWTH

12 ANTENNA, TRANSDUCER, AND RADOME MARKET, BY TECHNOLOGY (Page No. - 111)

12.1 INTRODUCTION

FIGURE 28 RADAR SEGMENT PROJECTED TO DOMINATE Antenna, Transducer, and Radome MARKET FROM 2020 TO 2025

TABLE 49 ATR MARKET SIZE, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 50 ATR MARKET SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

12.2 RADAR

12.2.1 NEED FOR SATELLITE-AIDED WARFARE, ISR, AND INFORMATION DISSEMINATION DRIVE THIS SEGMENT

12.3 COMMUNICATION

12.3.1 DEMAND FOR CUSTOMIZED COMMUNICATION SOLUTIONS TO INCREASE GROUND SUPPORT CONNECTIVITY EXPECTED TO DRIVE THE MARKET

12.4 SONAR

12.4.1 NEED FOR IMPROVING THE SEA WATER SURVEILLANCE DRIVES THE DEMAND FOR SONAR SYSTEM

TABLE 51 SONAR MARKET SIZE, BY INSTALLATION TYPE, 2016–2019 (USD MILLION)

TABLE 52 SONAR MARKET SIZE, BY INSTALLATION TYPE, 2020–2025 (USD MILLION)

12.4.2 AIRBORNE SONAR

12.4.3 SHIP SONAR

13 ANTENNA, TRANSDUCER, AND RADOME MARKET, REGIONAL ANALYSIS (Page No. - 115)

13.1 INTRODUCTION

13.2 COVID-19 IMPACT ON ANTENNA, TRANSDUCER & RADOME MARKET, BY REGION

FIGURE 29 COVID-19 IMPACT ON AVIATION REVENUE IN 2020, BY REGION

FIGURE 30 IMPACT OF COVID-19 ON ANTENNA, TRANSDUCER & RADOME MARKET

FIGURE 31 NORTH AMERICA ESTIMATED TO ACCOUNT FOR THE LARGEST SHARE OF Antenna, Transducer, and Radome MARKET IN 2020

TABLE 53 Antenna, Transducer & Radome MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 54 MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 55 MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 56 MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 57 MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 58 MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 59 MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 60 MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.3 NORTH AMERICA

13.3.1 NORTH AMERICA: ANTENNA AVERAGE SELLING PRICE TREND, PER UNIT 2020

FIGURE 32 NORTH AMERICA: ANTENNA AVERAGE SELLING PRICE TREND, PER UNIT

13.3.2 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 33 NORTH AMERICA: Antenna, Transducer, and Radome MARKET SNAPSHOT

TABLE 61 NORTH AMERICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

13.3.3 US

13.3.3.1 Presence of major manufacturers of aircraft, UAVs, commercial & military vehicles, and ships in the country drives the market

TABLE 69 US: Antenna, Transducer & Radome MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 70 US: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 71 US: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 72 US: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 73 US: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 74 US: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.3.4 CANADA

13.3.4.1 The availability of low-cost raw materials, such as aluminum, composites, and steel alloys is an opportunity for the market to grow in this country

TABLE 75 CANADA: Antenna, Transducer, and Radome MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 76 CANADA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 77 CANADA: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 78 CANADA: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 79 CANADA: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 80 CANADA: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.4 EUROPE

13.4.1 EUROPE: ANTENNA AVERAGE SELLING PRICE TREND, PER UNIT

FIGURE 34 EUROPE: ANTENNA AVERAGE SELLING PRICE TREND, PER UNIT 2020

13.4.2 PESTLE ANALYSIS: EUROPE

FIGURE 35 EUROPE: Antenna, Transducer, and Radome MARKET SNAPSHOT

TABLE 81 EUROPE: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 84 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 85 EUROPE: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 87 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 88 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

13.4.3 FRANCE

13.4.3.1 Presence of leading airborne platform manufacturers drives the Antenna, Transducer, and Radome market in France

TABLE 89 FRANCE: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 90 FRANCE: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 91 FRANCE: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 92 FRANCE: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 93 FRANCE: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 94 FRANCE: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.4.4 GERMANY

13.4.4.1 The market is expected to witness rapid growth during the forecast period, due to the growing equipment modernization programs

TABLE 95 GERMANY: Antenna, Transducer, and Radome MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 96 GERMANY: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 97 GERMANY: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 98 GERMANY: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 99 GERMANY: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 100 GERMANY: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.4.5 UK

13.4.5.1 Presence of military aircraft OEMs fuels demand for antennas in the UK

TABLE 101 UK: Antenna, Transducer, and Radome MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 102 UK: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 103 UK: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 104 UK: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 105 UK: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 106 UK: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.4.6 ITALY

13.4.6.1 Growing adoption of unmanned aircraft will drive the new demand for antennas, transducer, and radomes in Italy

TABLE 107 ITALY: Antenna, Transducer & Radome MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 108 ITALY: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 109 ITALY: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 110 ITALY: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 111 ITALY: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 112 ITALY: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.4.7 RUSSIA

13.4.7.1 Constant R&D focus on advanced aircraft drives market in Russia

TABLE 113 RUSSIA: Antenna, Transducer, and Radome MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 114 RUSSIA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 115 RUSSIA: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 116 RUSSIA: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 117 RUSSIA: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 118 RUSSIA: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.4.8 REST OF EUROPE

13.4.8.1 Growing focus on timely maintenance and replacement of aircraft parts fuels market in Rest of Europe

TABLE 119 REST OF EUROPE: Antenna, Transducer, and Radome MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 120 REST OF EUROPE: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 121 REST OF EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 122 REST OF EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 123 REST OF EUROPE: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 124 REST OF EUROPE: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.5 ASIA PACIFIC

13.5.1 ASIA PACIFIC: ANTENNA AVERAGE SELLING PRICE TREND, PER UNIT

FIGURE 36 ASIA PACIFIC: ANTENNA AVERAGE SELLING PRICE TREND, PER UNIT 2020

13.5.2 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 37 ASIA PACIFIC: Antenna, Transducer, and RadomeMARKET SNAPSHOT

TABLE 125 ASIA PACIFIC: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 132 ASIA PACIFIC: ATR MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

13.5.3 JAPAN

13.5.3.1 Market in Japan driven by increasing orders for new aircraft

TABLE 133 JAPAN: Antenna, Transducer, and Radome MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 134 JAPAN: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 135 JAPAN: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 136 JAPAN: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 137 JAPAN: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 138 JAPAN: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.5.4 CHINA

13.5.4.1 Heavy investments for advancements in avionics systems in China fuel the market

TABLE 139 CHINA: Antenna, Transducer & Radome MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 140 CHINA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 141 CHINA: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 142 CHINA: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 143 CHINA: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 144 CHINA: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.5.5 INDIA

13.5.5.1 Increased defense spending on different types of military aircraft is expected to drive the market

TABLE 145 INDIA: Antenna, Transducer, and Radome MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 146 INDIA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 147 INDIA: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 148 INDIA: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 149 INDIA: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 150 INDIA: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.5.6 AUSTRALIA

13.5.6.1 Increased air traffic and demand for aircraft components expected to propel the market

TABLE 151 AUSTRALIA: Antenna, Transducer & Radome MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 152 AUSTRALIA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 153 AUSTRALIA: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 154 AUSTRALIA: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 155 AUSTRALIA: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 156 AUSTRALIA: ATR MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.5.7 SOUTH KOREA

13.5.7.1 Leading communication component manufacturers are influencing the growth of the market in the country

TABLE 157 SOUTH KOREA: Antenna, Transducer, and Radome MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 158 SOUTH KOREA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 159 SOUTH KOREA: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 160 SOUTH KOREA: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 161 SOUTH KOREA: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 162 SOUTH KOREA: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.5.8 REST OF ASIA PACIFIC

13.5.8.1 Aging airborne platform fleets expected to drive demand for ATR in the Rest of Asia Pacific

TABLE 163 REST OF APAC: ATR MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 164 REST OF APAC: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 165 REST OF APAC: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 166 REST OF APAC: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 167 REST OF APAC: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 168 REST OF APAC: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.6 MIDDLE EAST & AFRICA

13.6.1 MIDDLE EAST & AFRICA: ANTENNA AVERAGE SELLING PRICE TREND, PER UNIT

FIGURE 38 MIDDLE EAST & AFRICA: ANTENNA AVERAGE SELLING PRICE TREND, PER UNIT 2020

13.6.2 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

TABLE 169 MIDDLE EAST & AFRICA: ATR MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 176 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

13.6.3 ISRAEL

13.6.3.1 Market growth attributed to increased spending on R&D of UAVs

TABLE 177 ISRAEL: Antenna, Transducer, and Radome MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 178 ISRAEL: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 179 ISRAEL: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 180 ISRAEL: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 181 ISRAEL: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 182 ISRAEL: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.6.4 UAE

13.6.4.1 High export of communication components such as antennas drive the market

TABLE 183 UAE: Antenna, Transducer, and Radome MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 184 UAE: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 185 UAE: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 186 UAE: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 187 UAE: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 188 UAE: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.6.5 SAUDI ARABIA

13.6.5.1 Significant growth of several airlines and increased demand for parts and repair stations in the country fuel the demand for Antenna, Transducer, and Radome

TABLE 189 SAUDI ARABIA: ATR MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 190 SAUDI ARABIA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 191 SAUDI ARABIA: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 192 SAUDI ARABIA: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 193 SAUDI ARABIA: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 194 SAUDI ARABIA: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.6.6 QATAR

13.6.6.1 Rise in political instability drives the demand for Antenna, Transducer, and Radome in the country

TABLE 195 QATAR: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 196 QATAR: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 197 QATAR: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 198 QATAR: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 199 QATAR: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 200 QATAR: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.6.7 SOUTH AFRICA

13.6.7.1 Demand for replacement of aircraft components fuels market in South Africa

TABLE 201 SOUTH AFRICA: Antenna, Transducer, and RadomeMARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 202 SOUTH AFRICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 203 SOUTH AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 204 SOUTH AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 205 SOUTH AFRICA: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 206 SOUTH AFRICA: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.7 LATIN AMERICA

13.7.1 LATIN AMERICA: ANTENNA AVERAGE SELLING PRICE TREND, PER UNIT

FIGURE 39 LATIN AMERICA: ANTENNA AVERAGE SELLING PRICE TREND, PER UNIT 2020

13.7.2 PESTLE ANALYSIS: LATIN AMERICA

TABLE 207 LATIN AMERICA: Antenna, Transducer, and Radome MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 213 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 214 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

13.7.3 BRAZIL

13.7.3.1 Presence of platform manufacturers offer opportunities for the market to grow in Brazil

TABLE 215 BRAZIL: Antenna, Transducer, and Radome MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 216 BRAZIL: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 217 BRAZIL: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 218 BRAZIL: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 219 BRAZIL: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 220 BRAZIL: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

13.7.4 MEXICO

13.7.4.1 The use of unmanned aircraft by the government for surveillance drives the market in Mexico

TABLE 221 MEXICO: Antenna, Transducer, and RadomeMARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 222 MEXICO: MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 223 MEXICO: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 224 MEXICO: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 225 MEXICO: MARKET SIZE, BY PLATFORM, 2016–2019 (USD MILLION)

TABLE 226 MEXICO: MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 176)

14.1 INTRODUCTION

TABLE 227 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE Antenna, Transducer, and Radome MARKET BETWEEN 2016 AND 2020

FIGURE 40 RANKING ANALYSIS OF TOP 5 PLAYERS IN ANTENNA, TRANSDUCER & RADOME MARKET, 2019

14.2 MARKET SHARE ANALYSIS, 2019

14.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2019

14.4 COMPETITIVE LEADERSHIP MAPPING

14.4.1 STAR

14.4.2 EMERGING LEADER

14.4.3 PERVASIVE

14.4.4 PARTICIPANT

FIGURE 41 COMPETITIVE LEADERSHIP MAPPING, 2019

14.4.5 Antenna, Transducer, and Radome MARKET COMPETITIVE LEADERSHIP MAPPING (STARTUPS/SME)

14.4.5.1 Progressive companies

14.4.5.2 Responsive companies

14.4.5.3 Dynamic companies

14.4.5.4 Starting blocks

FIGURE 42 ATR MARKET (STARTUPS/SME) COMPETITIVE LEADERSHIP MAPPING, 2019

14.5 COMPETITIVE SCENARIO

14.5.1 MARKET EVALUATION FRAMEWORK

FIGURE 43 MARKET EVALUATION FRAMEWORK: CONTRACTS WITNESSED TO BE LEADING STRATEGY AMONG TOP PLAYERS IN 2020

14.5.2 NEW PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 228 NEW PRODUCT LAUNCHES AND DEVELOPMENTS, 2017-2019

14.5.3 CONTRACTS

TABLE 229 CONTRACTS, 2017-2020

14.5.4 ACQUISITIONS/PARTNERSHIPS/JOINT VENTURES/AGREEMENTS

TABLE 230 ACQUISITIONS/PARTNERSHIPS/JOINT VENTURES/AGREEMENTS, 2017-2020

15 COMPANY PROFILE (Page No. - 192)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

15.1 MAJOR PLAYERS

15.1.1 L3HARRIS TECHNOLOGIES, INC.

FIGURE 44 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

15.1.2 COBHAM PLC

FIGURE 45 COBHAM PLC: COMPANY SNAPSHOT

15.1.3 RAYTHEON TECHNOLOGY CORPORATION

FIGURE 46 RAYTHEON TECHNOLOGY CORPORATION: COMPANY SNAPSHOT

15.1.4 LOCKHEED MARTIN CORPORATION

FIGURE 47 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

15.1.5 GENERAL DYNAMICS

FIGURE 48 GENERAL DYNAMICS: COMPANY SNAPSHOT

15.1.6 NORTHROP GRUMMAN CORPORATION

FIGURE 49 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

15.1.7 HONEYWELL INTERNATIONAL INC.

FIGURE 50 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

15.1.8 ASTRONICS

FIGURE 51 ASTRONICS: COMPANY SNAPSHOT

15.1.9 BAE SYSTEMS PLC.

FIGURE 52 BAE SYSTEMS PLC: COMPANY SNAPSHOT

15.1.10 THE BOEING COMPANY

FIGURE 53 THE BOEING COMPANY: COMPANY SNAPSHOT

15.1.11 JENOPTIK

FIGURE 54 JENOPTIK: COMPANY SNAPSHOT

15.1.12 ROYAL DSM

FIGURE 55 ROYAL DSM: COMPANY SNAPSHOT

15.1.13 SAINT-GOBAIN

FIGURE 56 SAINT-GOBAIN: COMPANY SNAPSHOT

15.1.14 NORDAM

15.1.15 COMMUNICATIONS & POWER INDUSTRIES LLC

15.1.16 HR SMITH GROUP OF COMPANIES

15.1.17 ANTCOM

15.1.18 THALES GROUP

FIGURE 57 THALES GROUP: COMPANY SNAPSHOT

15.1.19 ROHDE & SCHWARZ

15.1.20 FLIR SYSTEMS (RAYMARINE)

FIGURE 58 FLIR SYSTEMS: COMPANY SNAPSHOT

15.1.21 VERDANT TELEMETRY & ANTENNA SYSTEMS

15.1.22 KONGSBERG GRUPPEN

FIGURE 59 KONGSBERG GRUPPEN: COMPANY SNAPSHOT

15.1.23 RAMI

15.1.24 KELVIN HUGHES

15.1.25 STARWIN INDUSTRIES

15.1.26 TORAY ADVANCED COMPOSITES

15.1.27 ROYAL ENGINEERED COMPOSITES

15.1.28 KITSAP COMPOSITES

15.1.29 HARBIN TOPFRP COMPOSITE CO., LTD (HTC)

15.2 OTHER COMPANIES

15.2.1 DELTA G

15.2.2 COMTECH TELECOMMUNICATIONS

15.2.3 KAMAN COMPOSITES

15.2.4 FDS ITALY SRL

15.2.5 PACIFIC RADOMES INC.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 252)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATION

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

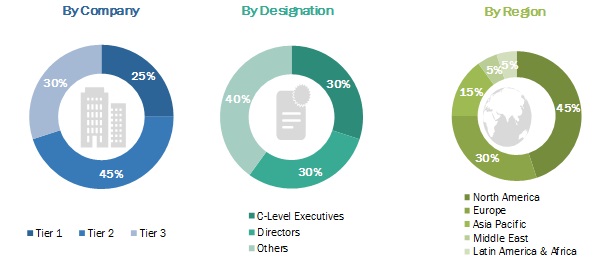

The study involved four major activities in estimating the current size of the ATR market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Statista, SIPRI report, World Bank, Global Firepower, Factiva, Bloomberg, BusinessWeek, SEC filings, annual reports, press releases & investor presentations of companies, certified publications, and articles by recognized authors were referred to for identifying and collecting information on the ATR market.

Primary Research

The ATR market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, service providers, and system integrators in its supply chain. The demand side of this market is characterized by various end-users such as commercial, and government & Defense organizations of different countries among others. The supply side is characterized by technologically advanced ATR components catering to applications such as communication and navigation & surveillance. The following is the breakdown of the primary respondents that were interviewed to obtain qualitative and quantitative information about the ATR market.

Market Size Estimation

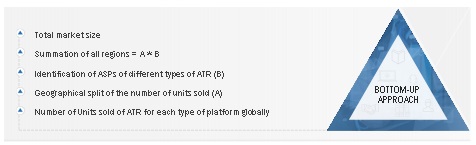

Both top-down and bottom-up approaches were used to estimate and validate the total size of the ATR market. These methods were also used extensively to estimate the size of various segments and subsegment of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global ATR MARKET Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the ATR market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the ATR market.

Report Objectives

- To define, describe, and forecast the antenna, transducer, and radome market based on end user, frequency, product type, technology, application, platform, and region

- To forecast the size of various segments of the antenna, transducer, and radome market based on five regions—North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, along with major countries in each region

- To provide in-depth market analysis regarding market dynamics and major factors that influence the growth in this market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions made towards the antenna, transducer, and radome market

- To analyze the opportunities in the market for stakeholders by identifying various key market trends

- To analyze macro and micro indicators influencing the antenna, transducer, and radome market

- To forecast the market size of segments with respect to five major regions, along with key countries

- To track and analyze competitive developments, such as joint ventures, mergers & acquisitions, new product launches, and research & development activities, in the antenna, transducer, and radome market

- To provide a detailed competitive landscape of this market, along with an analysis of growth strategies adopted by key players

- To strategically profile key players in this market and comprehensively analyze their market shares and core competencies2

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the ATR Market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the ATR Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Antenna, Transducer, and Radome Market