C4ISR Market by Application (Command and Control, Communications, Computers, ISR, Electronic Warfare), Platform (Airborne, Land, Naval, Space), Solution (Hardware, Application Software, Services), End User, Installation and Region - Global Forecast to 2028

Updated on : Nov 25, 2024

C4ISR Market Size & Share

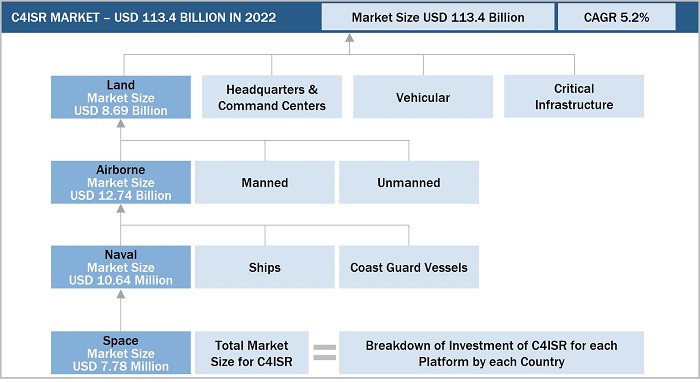

The C4ISR Market is projected to grow from USD 113.4 billion in 2022 to USD 154.0 billion by 2028, at a CAGR of 5.2%. Over the world, the C4ISR market is expanding significantly, and during the forecast period, a similar trend is anticipated. The extensive use of small, efficient, and advanced C4ISR systems has raised demand for them all around the world. On the other side, concerns like escalating terrorism, hostile threats, and rising territorial disputes globally are pushing military to improve their ability to share data on the battlefield. Throughout the projected period, the C4ISR industry growth is anticipated to increase due to the rising need for asymmetric warfare and new technologies like network-centric battle management and unmanned vehicles. To improve the effectiveness and situational awareness of military troops, there is an increasing emphasis on increasing expenditures in integrating cutting-edge technology like machine learning and artificial intelligence into C4ISR solutions. In the upcoming years, this is also anticipated to fuel market expansion.

C4ISR Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

C4ISR Market Trends

Driver: Need for enhanced integrated situational awareness to support decision making

In any mission, decision-making and directing of forces that command and control require the support of effective computer and communication systems for situational awareness. Situational awareness (SA) refers to the ability of decision-makers to identify, process, and analyze critical information from various sources. Thus, it plays a key role in air, naval, and military operations. Advanced ISR technologies integrated with C4 capabilities provide air, ground, and maritime solutions with real-time SA information for strategic decision-making. High-bandwidth sensor processing, video management systems, secure network routers, and switches play a crucial role in effective decision-making in a mission.

The US government is currently planning to invest in the development of small satellite constellations into the low Earth orbit (LEO) to obtain enhanced space-based SA capabilities. These investments are targeted at overcoming the shortcomings of traditional large satellites and airborne sensors that cannot provide continuous surveillance. On this note, in January 2023, Raytheon Intelligence & Space (RI&S), a business unit of Raytheon Technologies Corporation (US), was awarded a prime contract to develop a prototype Missile Track Custody (MTC) system for the US Space Force. MTC is the US Space Force's first medium earth orbit missile tracking system.

Several other manufacturers are also upgrading their product offerings and conducting R&D to develop new technologies to address the evolving needs of their clientele. For instance, in August 2021, Lockheed Martin Corporation (US) invented the Wide Angle ESA Fed Reflector (WAEFR) antenna, a hybrid of a phased array electronically steerable antenna (ESA) and a parabolic dish that increases coverage area by 190% compared to traditional phased array antennas at a much lower cost. Such developments are anticipated to drive the adoption of C4ISR systems by armed forces across the globe, thereby boosting the growth of the market in focus during the forecast period.

Restraints: High development and maintenance costs of C4 systems

C4 is essential in modern warfare; however, the high R&D and implementation cost of these systems must be borne by the defense arms of countries. C4 means the integration of various air defense, communication, computer, command, and control systems and intelligence, surveillance, and reconnaissance systems on a functional multidomain platform. These systems are expensive to develop, install, and maintain. Therefore, the cost and time required to develop and implement these systems are important factors that limit the development of these systems.

Opportunities: Increasing need for interoperability between military devices/technologies

The legacy devices traditionally used by defense forces were typically incompatible with one another and required significant effort for the assimilation and management of data for analysis. This resulted in the advent of control systems designed to effectively perform the task. New generation control systems are integrated into a single system that increases the situational awareness of defense forces. Data from all sensors combine to provide an overall picture of any situation. In military systems, data fusion from air defense radar systems and electro-optical, acoustic, and infrared systems increases surveillance capabilities and provides mission planning capabilities. For example, the global command and control system (GCCS) provides information-sharing capabilities for US armed forces. This enables armed forces to undertake data analysis and leverage mission planning capabilities.

The large volume of data generated has also necessitated the development of a centralized battle management system that can assist users of AI capabilities for effective decision-making considering the influence and impact of several parameters, both macro and micro, within a short span. Hence, companies are developing advanced battle management systems that can assimilate data from multiple devices and platforms. For instance, in December 2022, RI&S (US) was selected to develop a common tactical edge network (CTEN) in support of the US Air Force's Advanced Battle Management System. RI&S is one of nine companies selected to demonstrate portions of the network. CTEN would provide edge networking to help operators enable distributable battle management command and control in highly contested environments to support joint all-domain command and control (JADC2).

Challenges: Inability of existing electronic warfare systems to address diverse threats

The utilization of the electromagnetic spectrum is expanding, which makes it feasible for various electronic equipment to operate at different frequencies, making it challenging to identify some. The electronic warfare domain is therefore crucial for defensive forces. The military of different nations use tactical indicators to identify danger categories, transmission frequencies, signal characteristics, detection signals, and other relevant data. They also concentrate on gathering threat intelligence through frequency hopping detection. Threats can be detected by interrupting, searching, identifying, and locating hostile electromagnetic radiation sources, which will make it easier to deploy security troops. Existing EW systems must be technically improved nevertheless in order to implement these functions properly. In contemporary EW Systems, the threat of asymmetric warfare is a real issue. The difficulties experienced by standard EW systems on the battlefield have also been made worse by the availability of many delivery vehicles for stealth weapons, such as airplanes and frigates.

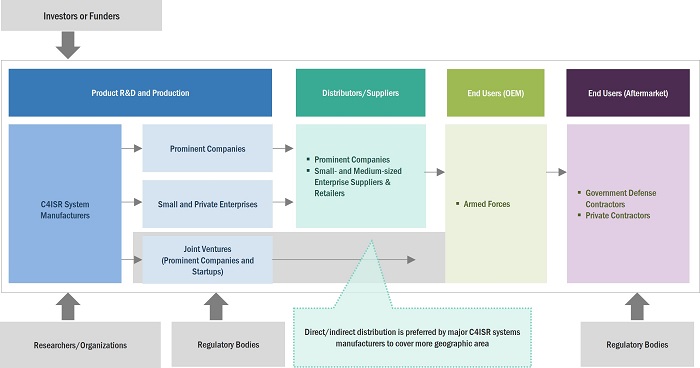

C4isr Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of C4ISR systems and platforms. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Northrop Grumman Corporation (US), BAE Systems plc (UK), Lockheed Martin Corporation (US), Raytheon Technologies Corporation (US), and General Dynamics Corporation (US).

C4ISR Market Segmentation

Based on Solution, hardware segment is estimated to account for the largest market share of the C4ISR market

Based on solution, the hardware market is estimated to account for the largest market share. The demand for wired communication devices for underwater and subsurface military applications, the need for 5G networks for faster wireless data transfer, the need for sensors in next-generation airborne intelligence, surveillance, and reconnaissance systems, the demand for tactical navigation systems for unmanned platforms, the demand for potable, rugged devices for dismounted soldiers, as well as the growing need for intelligence gathering, will all contribute to the market growth.

Based on application, The intelligence, surveillance, and reconnaissance segment are anticipated to dominate the market

Based on application, the market is segmented into the intelligence, surveillance and reconnaissance, communications, command and control, computers and electronic warfare. ISR offers situational awareness and access to mission-critical data without blocking tactical communication networks. High-volume data obtained from surveillance and reconnaissance platforms are analyzed and shared with operational groups. In June 2021, Northrop Grumman Corporation (US) received a newly expanded role as a system integrator for C5ISR and control systems on the US Coast Guard Offshore Patrol Cutter (OPC) by Eastern Shipbuilding Group (ESG), the prime contractor for the OPC program.

Naval segment of the C4ISR market by platform is projected to witness the highest CAGR during the forecast period.

Based on platform, the naval segment estimated to account for the highest growth rate. With an increase in the number of sensors on ships and advancements in radar technology, naval C4ISR systems have been upgraded with data analytics solutions such as artificial intelligence and cloud computing. Companies such as Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), THALES (France), Lockheed Martin Corporation (US), and BAE Systems plc (UK) are involved in the development and production of advanced signal processing and naval warfare systems. These systems include various types of shipboard radars, track management systems, communication systems, and electronic warfare systems to counter sea-based threats. Thus, Enhanced systems for tactical information management and improved efficiency to drive the market growth.

Defense and space segment of the C4ISR market by end user is projected to witness the highest market share of the C4ISR market.

The Defense and space segment Is to hold the highest market share. This can be linked to improvements in C4ISR capabilities for improved combat situational awareness. The C4ISR improves the capability of armed forces across the world. By situational awareness, understanding of the enemy and environment, and reducing the lag between sensing and reacting, advanced C4ISR capabilities give an advantage. Thus the department of defense worldwide are adopting the C4ISR Systems to enhance their capabilities.

New Installations segment of the C4ISR market by installations is projected to dominate the market.

The growing emphasis on the deployment of advanced C4ISR capabilities across commercial and military sectors is driving the growth of the market for new installations. Militaries across the world are focusing on integrating newer generation platforms, including airborne, naval, and land vehicles and equipment, which, in turn, is driving the need for state-of-the-art C4ISR technologies to enhance interoperability and situational awareness in modern warfare.

C4ISR Market Regional Analysis

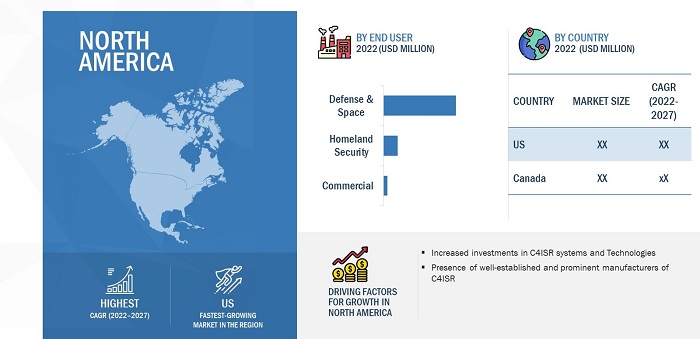

The North American market is projected to contribute the largest share for the C4ISR market.

North America is expected to lead the C4ISR market in 2022. The US is the largest market for C4ISR in North America. Due to the United States' significant investment in military systems, the North American market is predicted to be considerable. Comparing defense budgets amongst nations reveals that between 30 and 40% of all military gear purchased globally is purchased by the United States. Cyber warfare has changed the military battlefield, necessitating significant expenditures from both civilian and military institutions in data processing and secure communication infrastructure. As a result, a key component of the U.S. military's war strategy is the development of creative C4ISR solutions. For the United States government, developing new and enhanced land, air, and sea platforms with cutting-edge situational awareness and communication technologies is a major priority.

C4ISR Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top C4ISR Companies - Key Market Players

The C4ISR companies are dominated by a few globally established players such as Northrop Grumman (US), Lockheed Martin Corporation (US), BAE Systems (UK), Raytheon Technologies Corporation (US) and General Dynamics Corporation (US), among others, are the key manufacturers that secured C4ISR contracts in the last few years. Major focus was given to the contracts and new product development due to the changing requirements of commercial, homeland security and defense & space users across the world.

C4ISR Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 113.4 billion in 2022 |

|

Projected Market Size |

USD 154.0 billion by 2028 |

|

Growth Rate (CAGR) |

5.2% |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

By Solution, By Application, By Platform, By End User, By Installation |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Companies covered |

Lockheed Martin Corporation (US), Raytheon Technologies Corporation (US), BAE Systems Inc. (UK), General Dynamics Corporation (US), and Northrop Grumman (US). |

C4ISR Market Highlights

The study categorizes the C4ISR market based on Application, End User, Installation, Platform, Solution and Region.

|

Segment |

Subsegment |

|

By Application |

|

|

By End User |

|

|

By Installation |

|

|

By Platform |

|

|

By Solution |

|

|

By Region |

|

Recent Developments

- In June 2021, Northrop Grumman Corporation received a contract to install more life-saving Large Aircraft Infrared Countermeasure (LAIRCM) systems on the US and international fixed-wing and rotary-wing aircraft under a USD 146 million order from the US Air Force.

- In June 2021, Raytheon Intelligence & Space (RI&S) signed a contract to offer logistics and repair services for all US Marine Corps (USMC) ground equipment.

- In March 2021, Raytheon Technologies signed a contract worth USD 178 Million to support the US Air Force intel-sharing system transition, the service’s primary intelligence-sharing system.

- In February 2021, The French defense procurement agency (DGA) awarded Thales and Airbus a contract for the new joint tactical signals intelligence (SIGINT) system to upgrade the French forces' critical signal monitoring, direction finding, and spectrum analysis capabilities.

Frequently Asked Questions (FAQ):

Which are the major companies in the C4ISR market? What are their major strategies to strengthen their market presence?

Some of the key players in the C4ISR market are Northrop Grumman (US), Lockheed Martin Corporation (US), BAE Systems (UK), Raytheon Technologies Corporation (US), and General Dynamics Corporation (US), among others, are the key manufacturers that secured C4ISR contracts in the last few years. Contracts was the key strategies adopted by these companies to strengthen their C4ISR market presence.

What are the drivers and opportunities for the C4ISR market?

The need for C4ISR has increased significantly around the world, but particularly in Asia Pacific, where the development of new technologies and the purchase of new aircraft in countries like China, India, and South Korea will present several prospects for companies in the C4ISR industry. Rising R&D efforts to create C4ISR solutions are anticipated to accelerate market expansion globally.

Which region is expected to hold the highest market share?

The market in North America will dominate the market share in 2022, showcasing strong demand from C4ISR in the region. Defense forces of countries in the North American region are involved in the development of technologically advanced C4ISR systems. Well-established and prominent manufacturers in this region include Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), L3Harris Technologies, Inc. (US), and Raytheon Technologies Corporation (US).

Which are the key technology trends prevailing in the C4ISR market?

The two main technologies dominating the C4ISR industry are autonomous mission management systems for UGVs and weapon integrated C4ISR systems. Also, it is anticipated that the advent of C4ISR businesses that create and provide clients with strategic cloud solutions would result in a revision of the economic model for the battlefield/combat sector.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

|

USD 26.1 billion by 2028 |

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Need for enhanced integrated situational awareness to support decision-making- Modernization of defense capabilities to address asymmetric warfare threats- Rising military focus on wireless connectivity and technologiesRESTRAINTS- High development and maintenance costs of C4 systems- Vulnerability to cyberattacks- Regulatory obstacles related to technology transferOPPORTUNITIES- Increasing need for interoperability between military devices/technologies- Integration of satellite-based geospatial analytical tools with C4 systems- Increasing use of AI to assist in effective decision-making- Cloud computing and data storage solutions for C4ISRCHALLENGES- Inability of existing EW systems to address diverse threats

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR C4ISR SYSTEM MANUFACTURERS

- 5.4 TRADE STATISTICS

- 5.5 PRICING ANALYSIS

-

5.6 MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.7 VALUE CHAIN ANALYSIS

-

5.8 TECHNOLOGY ANALYSISRADIOFREQUENCYADDITIVE MANUFACTURING

-

5.9 PORTER'S FIVE FORCES MODELTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.10 RECESSION IMPACT ANALYSIS

-

5.11 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.12 KEY CONFERENCES & EVENTS IN 2023 & 2024

- 5.13 TARIFF REGULATORY LANDSCAPE FOR AEROSPACE & DEFENSE INDUSTRY

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

-

6.3 TECHNOLOGY TRENDSAUTONOMOUS MISSION MANAGEMENT SYSTEM FOR UGVSOPEN ARCHITECTURE C4 SYSTEMSSTRATEGIC CLOUD APPLICATIONS

-

6.4 USE CASE ANALYSISUSE CASE: C5ISRUSE CASE: C6ISR

-

6.5 IMPACT OF MEGATRENDSAI & COGNITIVE APPLICATIONSMACHINE LEARNINGDEEP LEARNINGBIG DATA

-

6.6 C4ISR MARKET: PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 HARDWARESENSOR SYSTEMS- Help in collection and transmission of data to C2 systemsCOMMUNICATION & NETWORK TECHNOLOGIES- Wireless communication devices- Wired communication devices- Navigation systems- Data linksDISPLAYS & PERIPHERALS- Used by armed forces to track operations in real timeELECTRONIC WARFARE- Signals intelligence (SIGINT)- Human intelligence (HUMINT)

-

7.3 APPLICATION SOFTWARECOMMAND & CONTROL SOFTWARE- Facilitates secure information sharing over military networksCYBERSECURITY SOFTWARE- Uses encryption and decryption technologies to ensure secure data transmission and receptionCOMPUTING SOFTWARE- Helps prevent unauthorized access to networksSITUATIONAL AWARENESS SOFTWARE- Leads to most effective decisions in intelligence and securityOTHERS

-

7.4 SERVICESSYSTEM INTEGRATION & ENGINEERING- Enhance operational efficiency of armed forcesSIMULATION & TRAINING- Help enhance operational excellence of military commandersMANAGED SERVICES- Help improve operations and cut down expensesSUPPORT SERVICES- Used to support life extension programs of C4ISR systems

- 8.1 INTRODUCTION

-

8.2 COMMAND & CONTROLPROVIDES ADVANCED INTEGRATED SITUATIONAL AWARENESS TO SUPPORT DECISION-MAKING

-

8.3 COMMUNICATIONSENABLE DATA TRANSMISSION IN C4ISR SYSTEMS THROUGH SECURE DATALINKS

-

8.4 COMPUTERSUSED BY C4ISR SYSTEMS TO PROVIDE INFORMATION ABOUT SITUATIONAL AWARENESS

-

8.5 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCEOFFERS ACCESS TO MISSION-CRITICAL DATA WITHOUT BLOCKING TACTICAL COMMUNICATION NETWORKS

-

8.6 ELECTRONIC WARFAREOFFER ELECTRONIC SUPPORT ESM, SIGINT, AND COMINT

- 9.1 INTRODUCTION

-

9.2 LANDHEADQUARTERS & COMMAND CENTERS- Help improve situational awareness and battlefield managementVEHICLES- Used to receive relevant, high-quality information on battlefields

-

9.3 NAVALSHIPS- Enhance tactical information management and provide decision-making supportCOAST GUARD VESSELS- Improve vessel systems to enable efficient maritime operations

-

9.4 AIRBORNEMANNED- Used in manned aircraft for surveillance activitiesUNMANNED- Used by various armed forces to manage mission parameters of UAVs

-

9.5 SPACESATELLITES- Used for fast and secure data transferGROUND STATIONS- Earth observation satellites used for remote site monitoring, asset tracking, and real-time battlefield surveys

- 10.1 INTRODUCTION

-

10.2 DEFENSE & SPACEDEPARTMENTS OF DEFENSE- Use C4ISR capabilities to achieve better situational awarenessCOUNTER-TERRORISM AGENCIES- Use C4ISR systems to combat or prevent terrorismINTELLIGENCE ORGANIZATIONS- Use C4ISR systems to obtain real-time critical military intelligence for faster decision-makingSPACE FORCES- Emerging as field of strategic interest for military activities

-

10.3 HOMELAND SECURITYDISASTER MANAGEMENT & FIRST RESPONDERS- Use C4ISR to minimize effects of disasters and conflictsLAW ENFORCEMENT PROFESSIONALS- Use ISR to gain information about enemy strategySEARCH & RESCUE AGENCIES- C4ISR capabilities used to detect movement in disaster-affected areas

-

10.4 COMMERCIALCRITICAL INFRASTRUCTURE- C4 systems used for data management, monitoring, and security managementINDUSTRIAL- Deployment on the rise due to proliferation of manufacturing hubs in remote locationsNEW SPACE- Rise in satellite data usage to promote satellite launches

- 11.1 INTRODUCTION

-

11.2 NEW INSTALLATIONSDEPLOYMENT ACROSS MILITARY AND COMMERCIAL APPLICATIONS TO DRIVE SEGMENT

-

11.3 UPGRADESCONSTANT UPDATES TO KEEP SYSTEMS THREAT-RESILIENT TO BOOST SEGMENT GROWTH

- 12.1 INTRODUCTION

- 12.2 RECESSION IMPACT ANALYSIS

-

12.3 NORTH AMERICARECESSION IMPACT ANALYSIS: NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Increased investments to modernize C4 systemsCANADA- Government support for enhancement of C4ISR

-

12.4 EUROPERECESSION IMPACT ANALYSIS: EUROPEPESTLE ANALYSIS: EUROPERUSSIA- Increasing investments in AI to improve C2 and decision-makingUK- High investments in next-gen tactical communication and information systemsFRANCE- Focus on internal security and interoperability of defense forcesGERMANY- Increasing spending on R&D for advanced military capabilitiesITALY- Focus on battlefield readiness technologies that employ C4ISRREST OF EUROPE- Geopolitical rifts to encourage adoption of C4ISR platforms

-

12.5 ASIA PACIFICRECESSION IMPACT ANALYSIS: ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Increasing R&D expenditure on C4 and electronic warfareINDIA- Modernization of defense forces underwayJAPAN- Development of modern technologies and procurement of new aircraftSOUTH KOREA- Focus on acquiring various ISR assetsAUSTRALIA- Demand for modern digital technologies in military equipmentREST OF ASIA PACIFIC- Increased military expenditure for aerial C4ISR platforms

-

12.6 MIDDLE EAST & AFRICARECESSION IMPACT ANALYSIS: MIDDLE EAST & AFRICAPESTLE ANALYSIS: MIDDLE EAST & AFRICASAUDI ARABIA- Growing need for cyber defenseISRAEL- Military modernization programs and development of defense capabilities in focusUAE- Modernization initiatives for adoption of C4ISR systemsSOUTH AFRICA- Need for C4ISR systems to protect resourcesREST OF MIDDLE EAST & AFRICA

-

12.7 LATIN AMERICARECESSION IMPACT ANALYSIS: LATIN AMERICAPESTLE ANALYSIS: LATIN AMERICABRAZIL- Focus on strengthening border monitoring capabilitiesMEXICO- Focus on monitoring cross-border trafficking and drug cartels

- 13.1 INTRODUCTION

- 13.2 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

- 13.3 MARKET RANKING ANALYSIS OF TOP FIVE PLAYERS, 2021

- 13.4 COMPETITIVE BENCHMARKING

-

13.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.6 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

13.7 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKDEALS

- 14.1 INTRODUCTION

-

14.2 KEY PLAYERSNORTHROP GRUMMAN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBAE SYSTEMS PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLOCKHEED MARTIN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGENERAL DYNAMICS CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewL3HARRIS TECHNOLOGIES INC.- Business overview- Products/Solutions/Services offered- Recent developmentsTHALES- Business overview- Products/Solutions/Services offered- Recent developmentsRHEINMETALL AG- Business overview- Products/Solutions/Services offered- Recent developmentsSAAB AB- Business overview- Products/Solutions/Services offered- Recent developmentsLEONARDO S.P.A.- Business overview- Products/Solutions/Services offered- Recent developmentsIAI GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsSYSTEMATIC A/S- Business overview- Products/Solutions/Services offered- Recent developmentsAIRBUS- Business overview- Products/Solutions/Services offered- Recent developmentsINDRA SISTEMAS, S.A.- Business overview- Products/Solutions/Services offered- Recent developmentsCURTISS-WRIGHT CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsBOOZ ALLEN HAMILTON INC.- Business overview- Products/Solutions/Services offeredCUBIC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsELBIT SYSTEMS LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsKRATOS DEFENSE & SECURITY SOLUTIONS, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsRAFAEL ADVANCED DEFENSE SYSTEMS LTD.- Business overview- Products/Solutions/Services offered- Recent developments

-

14.3 OTHER PLAYERSSERCO INC.- Business overview- Products/Solutions/Services offeredMAG AEROSPACE- Business overview- Products/Solutions/Services offeredTRAKKA SYSTEMS- Business overview- Products/Solutions/Services offeredOCTOPUS ISR SYSTEMS- Business overview- Products/Solutions/Services offeredUKRSPECSYSTEMS- Business overview- Products/Solutions/Services offered

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 IMPORTED VALUE OF ARMORED VEHICLES, USD MILLION (2015–2020)

- TABLE 2 AVERAGE SELLING PRICE RANGE: C4ISR MARKET (BY TECHNOLOGY)

- TABLE 3 MARKET ECOSYSTEM

- TABLE 4 C4ISR MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF C4ISR TECHNOLOGIES (%)

- TABLE 6 KEY BUYING CRITERIA FOR C4ISR TECHNOLOGIES

- TABLE 7 C4ISR MARKET: CONFERENCES & EVENTS IN 2023 & 2024

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 KEY PATENTS, 2018–2022

- TABLE 14 MARKET, BY SOLUTION, 2018–2021 (USD BILLION)

- TABLE 15 C4ISR MARKET, BY SOLUTION, 2022–2028 (USD BILLION)

- TABLE 16 HARDWARE: MARKET, BY TYPE, 2018–2021 (USD BILLION)

- TABLE 17 HARDWARE: C4ISR MARKET, BY TYPE, 2022–2028 (USD BILLION)

- TABLE 18 COMMUNICATION & NETWORK TECHNOLOGY: C4ISR HARDWARE MARKET, BY TYPE, 2018–2021 (USD BILLION)

- TABLE 19 COMMUNICATION & NETWORK TECHNOLOGY: C4ISR HARDWARE MARKET, BY TYPE, 2022–2028 (USD BILLION)

- TABLE 20 ELECTRONIC WARFARE: C4ISR HARDWARE MARKET, BY TYPE, 2018–2021 (USD BILLION)

- TABLE 21 ELECTRONIC WARFARE: C4ISR HARDWARE MARKET, BY TYPE, 2022–2028 (USD BILLION)

- TABLE 22 C4ISR HARDWARE MARKET, BY SIGINT TYPE, 2018–2021 (USD BILLION)

- TABLE 23 C4ISR HARDWARE MARKET, BY SIGINT TYPE, 2022–2028 (USD BILLION)

- TABLE 24 APPLICATION SOFTWARE: C4ISR MARKET, BY TYPE, 2018–2021 (USD BILLION)

- TABLE 25 APPLICATION SOFTWARE: MARKET, BY TYPE, 2022–2028 (USD BILLION)

- TABLE 26 SERVICES: C4ISR MARKET, BY TYPE, 2018–2021 (USD BILLION)

- TABLE 27 SERVICES: MARKET, BY TYPE, 2022–2028 (USD BILLION)

- TABLE 28 MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

- TABLE 29 MARKET, BY APPLICATION, 2022–2028 (USD BILLION)

- TABLE 30 MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 31 C4ISR MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 32 LAND: MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 33 LAND: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 34 NAVAL: MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 35 NAVAL: C4ISR MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 36 AIRBORNE: MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 37 AIRBORNE: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 38 SPACE: C4ISR MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 39 SPACE: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 40 MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 41 MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 42 DEFENSE & SPACE: C4ISR MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 43 DEFENSE & SPACE: MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 44 HOMELAND SECURITY: MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 45 HOMELAND SECURITY: C4ISR MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 46 C4ISR MARKET, BY INSTALLATION, 2018–2021 (USD BILLION)

- TABLE 47 MARKET, BY INSTALLATION, 2022–2028 (USD BILLION)

- TABLE 48 RECESSION IMPACT ANALYSIS

- TABLE 49 C4ISR MARKET, BY REGION, 2018–2021 (USD BILLION)

- TABLE 50 MARKET, BY REGION, 2022–2028 (USD BILLION)

- TABLE 51 NORTH AMERICA: C4ISR MARKET, BY SOLUTION, 2018–2021 (USD BILLION)

- TABLE 52 NORTH AMERICA: MARKET, BY SOLUTION, 2022–2028 (USD BILLION)

- TABLE 53 NORTH AMERICA: MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 54 NORTH AMERICA: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 55 NORTH AMERICA: C4ISR MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 56 NORTH AMERICA: MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 57 NORTH AMERICA: C4ISR MARKET, BY INSTALLATION, 2018–2021 (USD BILLION)

- TABLE 58 NORTH AMERICA: MARKET, BY INSTALLATION, 2022–2028 (USD BILLION)

- TABLE 59 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

- TABLE 60 NORTH AMERICA: C4ISR MARKET, BY COUNTRY, 2022–2028 (USD BILLION)

- TABLE 61 US: C4ISR MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 62 US: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 63 US: MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 64 US: MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 65 CANADA: C4ISR MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 66 CANADA: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 67 CANADA: MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 68 CANADA: MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 69 EUROPE: C4ISR MARKET, BY SOLUTION, 2018–2021 (USD BILLION)

- TABLE 70 EUROPE: MARKET, BY SOLUTION, 2022–2028 (USD BILLION)

- TABLE 71 EUROPE: C4ISR MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 72 EUROPE: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 73 EUROPE: C4ISR MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 74 EUROPE: MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 75 EUROPE: MARKET, BY INSTALLATION, 2018–2021 (USD BILLION)

- TABLE 76 EUROPE: C4ISR MARKET, BY INSTALLATION, 2022–2028 (USD BILLION)

- TABLE 77 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

- TABLE 78 EUROPE: MARKET, BY COUNTRY, 2022–2028 (USD BILLION)

- TABLE 79 RUSSIA: C4ISR MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 80 RUSSIA: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 81 RUSSIA: MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 82 RUSSIA: C4ISR MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 83 UK: MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 84 UK: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 85 UK: MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 86 UK: MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 87 FRANCE: MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 88 FRANCE: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 89 FRANCE: C4ISR MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 90 FRANCE: MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 91 GERMANY: C4ISR MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 92 GERMANY: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 93 GERMANY: C4ISR MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 94 GERMANY: MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 95 ITALY: C4ISR MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 96 ITALY: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 97 ITALY: MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 98 ITALY: C4ISR MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 99 REST OF EUROPE: MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 100 REST OF EUROPE: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 101 REST OF EUROPE: C4ISR MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 102 REST OF EUROPE: MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 103 ASIA PACIFIC: MARKET, BY SOLUTION, 2018–2021 (USD BILLION)

- TABLE 104 ASIA PACIFIC: MARKET, BY SOLUTION, 2022–2028 (USD BILLION)

- TABLE 105 ASIA PACIFIC: MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 106 ASIA PACIFIC: C4ISR MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 107 ASIA PACIFIC: MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 108 ASIA PACIFIC: C4ISR MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 109 ASIA PACIFIC: MARKET, BY INSTALLATION, 2018–2021 (USD BILLION)

- TABLE 110 ASIA PACIFIC: MARKET, BY INSTALLATION, 2022–2028 (USD BILLION)

- TABLE 111 ASIA PACIFIC: C4ISR MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

- TABLE 112 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2028 (USD BILLION)

- TABLE 113 CHINA: C4ISR MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 114 CHINA: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 115 CHINA: C4ISR MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 116 CHINA: MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 117 INDIA: C4ISR MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 118 INDIA: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 119 INDIA: C4ISR MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 120 INDIA: MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 121 JAPAN: C4ISR MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 122 JAPAN: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 123 JAPAN: MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 124 JAPAN: MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 125 SOUTH KOREA: C4ISR MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 126 SOUTH KOREA: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 127 SOUTH KOREA: MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 128 SOUTH KOREA: C4ISR MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 129 AUSTRALIA: MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 130 AUSTRALIA: C4ISR MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 131 AUSTRALIA: MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 132 AUSTRALIA: MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 133 REST OF ASIA PACIFIC: C4ISR MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 134 REST OF ASIA PACIFIC: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 135 REST OF ASIA PACIFIC: MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 136 REST OF ASIA PACIFIC: C4ISR MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 137 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2018–2021 (USD BILLION)

- TABLE 138 MIDDLE EAST & AFRICA: C4ISR MARKET, BY SOLUTION, 2022–2028 (USD BILLION)

- TABLE 139 MIDDLE EAST & AFRICA: MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 140 MIDDLE EAST & AFRICA: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 141 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 142 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 143 MIDDLE EAST & AFRICA: MARKET, BY INSTALLATION, 2018–2021 (USD BILLION)

- TABLE 144 MIDDLE EAST & AFRICA: MARKET, BY INSTALLATION, 2022–2028 (USD BILLION)

- TABLE 145 MIDDLE EAST & AFRICA: C4ISR MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

- TABLE 146 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2028 (USD BILLION)

- TABLE 147 SAUDI ARABIA: C4ISR MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 148 SAUDI ARABIA: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 149 SAUDI ARABIA: MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 150 SAUDI ARABIA: MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 151 ISRAEL: C4ISR MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 152 ISRAEL: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 153 ISRAEL: MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 154 ISRAEL: C4ISR MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 155 UAE: MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 156 UAE: C4ISR MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 157 UAE: MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 158 UAE: C4ISR MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 159 SOUTH AFRICA: MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 160 SOUTH AFRICA: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 161 SOUTH AFRICA: MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 162 SOUTH AFRICA: C4ISR MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 163 REST OF MIDDLE EAST & AFRICA: C4ISR MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 164 REST OF MIDDLE EAST & AFRICA: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 165 REST OF MIDDLE EAST & AFRICA: C4ISR MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 166 REST OF MIDDLE EAST & AFRICA: MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 167 LATIN AMERICA: MARKET, BY SOLUTION, 2018–2021 (USD BILLION)

- TABLE 168 LATIN AMERICA: MARKET, BY SOLUTION, 2022–2028 (USD BILLION)

- TABLE 169 LATIN AMERICA: C4ISR MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 170 LATIN AMERICA: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 171 LATIN AMERICA: C4ISR MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 172 LATIN AMERICA: MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 173 LATIN AMERICA: C4ISR MARKET, BY INSTALLATION, 2018–2021 (USD BILLION)

- TABLE 174 LATIN AMERICA: MARKET, BY INSTALLATION, 2022–2028 (USD BILLION)

- TABLE 175 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

- TABLE 176 LATIN AMERICA: C4ISR MARKET, BY COUNTRY, 2022–2028 (USD BILLION)

- TABLE 177 BRAZIL: MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 178 BRAZIL: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 179 BRAZIL: C4ISR MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 180 BRAZIL: MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 181 MEXICO: MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 182 MEXICO: MARKET, BY PLATFORM, 2022–2028 (USD BILLION)

- TABLE 183 MEXICO: MARKET, BY END USER, 2018–2021 (USD BILLION)

- TABLE 184 MEXICO: MARKET, BY END USER, 2022–2028 (USD BILLION)

- TABLE 185 C4ISR MARKET: DEGREE OF COMPETITION

- TABLE 186 KEY DEVELOPMENTS BY LEADING PLAYERS IN C4ISR MARKET, 2019–2022

- TABLE 187 COMPANY PRODUCT FOOTPRINT

- TABLE 188 COMPANY SOLUTION FOOTPRINT

- TABLE 189 COMPANY REGION FOOTPRINT

- TABLE 190 C4ISR MARKET: KEY START-UPS/SMES

- TABLE 191 MARKET, DEALS, FEBRUARY 2022–JANUARY 2023

- TABLE 192 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

- TABLE 193 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 194 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 195 BAE SYSTEMS PLC: BUSINESS OVERVIEW

- TABLE 196 BAE SYSTEMS PLC: PRODUCT LAUNCHES

- TABLE 197 BAE SYSTEMS PLC: DEALS

- TABLE 198 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

- TABLE 199 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES

- TABLE 200 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 201 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- TABLE 202 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 203 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

- TABLE 204 GENERAL DYNAMICS CORPORATION: PRODUCT LAUNCHES

- TABLE 205 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 206 L3HARRIS TECHNOLOGIES INC.: BUSINESS OVERVIEW

- TABLE 207 L3HARRIS TECHNOLOGIES INC.: PRODUCT LAUNCHES

- TABLE 208 L3HARRIS TECHNOLOGIES INC.: DEALS

- TABLE 209 THALES: BUSINESS OVERVIEW

- TABLE 210 THALES: PRODUCT LAUNCHES

- TABLE 211 THALES: DEALS

- TABLE 212 RHEINMETALL AG: BUSINESS OVERVIEW

- TABLE 213 RHEINMETALL AG: PRODUCT LAUNCHES

- TABLE 214 RHEINMETALL AG: DEALS

- TABLE 215 SAAB AB: BUSINESS OVERVIEW

- TABLE 216 SAAB AB: PRODUCT LAUNCHES

- TABLE 217 SAAB AB: DEALS

- TABLE 218 LEONARDO S.P.A.: BUSINESS OVERVIEW

- TABLE 219 LEONARDO S.P.A.: PRODUCT LAUNCHES

- TABLE 220 LEONARDO S.P.A.: DEALS

- TABLE 221 IAI GROUP: BUSINESS OVERVIEW

- TABLE 222 IAI GROUP: PRODUCT LAUNCHES

- TABLE 223 IAI GROUP: DEALS

- TABLE 224 SYSTEMATIC A/S: BUSINESS OVERVIEW

- TABLE 225 SYSTEMATIC A/S: PRODUCT LAUNCHES

- TABLE 226 SYSTEMATIC A/S: DEALS

- TABLE 227 AIRBUS: BUSINESS OVERVIEW

- TABLE 228 AIRBUS: PRODUCT LAUNCHES

- TABLE 229 AIRBUS: DEALS

- TABLE 230 INDRA SISTEMAS, S.A.: BUSINESS OVERVIEW

- TABLE 231 INDRA SISTEMAS, S.A.: PRODUCT LAUNCHES

- TABLE 232 INDRA SISTEMAS, S.A.: DEALS

- TABLE 233 CURTISS-WRIGHT CORPORATION: BUSINESS OVERVIEW

- TABLE 234 CURTISS-WRIGHT CORPORATION: PRODUCT LAUNCHES

- TABLE 235 CURTISS-WRIGHT CORPORATION: DEALS

- TABLE 236 BOOZ ALLEN HAMILTON INC.: BUSINESS OVERVIEW

- TABLE 237 BOOZ ALLEN HAMILTON INC.: DEALS

- TABLE 238 CUBIC CORPORATION: BUSINESS OVERVIEW

- TABLE 239 CUBIC CORPORATION: DEALS

- TABLE 240 ELBIT SYSTEMS LTD.: BUSINESS OVERVIEW

- TABLE 241 ELBIT SYSTEMS LTD.: PRODUCT LAUNCHES

- TABLE 242 ELBIT SYSTEMS LTD.: DEALS

- TABLE 243 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: BUSINESS OVERVIEW

- TABLE 244 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: DEALS

- TABLE 245 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: BUSINESS OVERVIEW

- TABLE 246 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: DEALS

- TABLE 247 SERCO INC.: BUSINESS OVERVIEW

- TABLE 248 MAG AEROSPACE: BUSINESS OVERVIEW

- TABLE 249 TRAKKA SYSTEMS: BUSINESS OVERVIEW

- TABLE 250 OCTOPUS ISR SYSTEMS: BUSINESS OVERVIEW

- TABLE 251 UKRSPECSYSTEMS: BUSINESS OVERVIEW

- FIGURE 1 C4ISR MARKET SEGMENTATION

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 C4ISR MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 RECESSION IMPACT ON REVENUE OF KEY PLAYERS

- FIGURE 9 ASSUMPTIONS FOR STUDY ON C4ISR MARKET

- FIGURE 10 NAVAL PLATFORMS TO EXHIBIT HIGHEST CAGR IN C4ISR MARKET DURING FORECAST PERIOD

- FIGURE 11 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE TO LEAD APPLICATION SEGMENT DURING FORECAST PERIOD

- FIGURE 12 COMMUNICATION & NETWORKING IN C4ISR MARKET, 2022–2028

- FIGURE 13 HARDWARE SEGMENT PROJECTED TO DOMINATE C4ISR MARKET DURING FORECAST PERIOD

- FIGURE 14 NORTH AMERICA TO BE DOMINANT C4ISR MARKET FROM 2022 TO 2028

- FIGURE 15 NEED TO ENHANCE DEFENSE AND SURVEILLANCE CAPABILITIES OF ARMED FORCES AND LAW ENFORCEMENT TO DRIVE C4ISR MARKET

- FIGURE 16 WIRELESS COMMUNICATION DEVICES TO LEAD HARDWARE SOLUTIONS SEGMENT

- FIGURE 17 SIGINT TO DOMINATE IN COMMUNICATION & NETWORKING

- FIGURE 18 DEPARTMENTS OF DEFENSE - LARGEST END USER IN MARKET

- FIGURE 19 LAW ENFORCEMENT PROFESSIONALS TO HOLD MAJOR SHARE

- FIGURE 20 C4ISR MARKET IN INDIA PROJECTED TO GROW AT HIGHEST CAGR

- FIGURE 21 C4ISR MARKET DYNAMICS

- FIGURE 22 NUMBER OF CASUALTIES DUE TO TERRORIST ATTACKS WORLDWIDE, 2010–2019

- FIGURE 23 REVENUE SHIFT IN C4ISR MARKET

- FIGURE 24 MARKET ECOSYSTEM MAP: C4ISR SYSTEMS

- FIGURE 25 VALUE CHAIN ANALYSIS: C4ISR MARKET

- FIGURE 26 PORTER'S FIVE FORCES: C4ISR MARKET

- FIGURE 27 UNCERTAINTY ANALYSIS

- FIGURE 28 FACTORS IMPACTING C4ISR MARKET, 2022–2023

- FIGURE 29 PROBABLE SCENARIO IMPACT OF C4ISR MARKET

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF C4ISR TECHNOLOGIES

- FIGURE 31 KEY BUYING CRITERIA FOR C4ISR TECHNOLOGIES

- FIGURE 32 SUPPLY CHAIN ANALYSIS OF C4ISR MARKET

- FIGURE 33 APPLICATION SOFTWARE SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE TO DOMINATE DURING FORECAST PERIOD

- FIGURE 35 NAVAL SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 DEFENSE & SPACE SEGMENT TO LEAD C4ISR MARKET DURING FORECAST PERIOD

- FIGURE 37 NEW INSTALLATIONS SEGMENT PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 38 NORTH AMERICA TO DOMINATE C4ISR MARKET FROM 2022 TO 2028

- FIGURE 39 C4ISR MARKET: NORTH AMERICA SNAPSHOT

- FIGURE 40 MARKET: EUROPE SNAPSHOT

- FIGURE 41 MARKET: ASIA PACIFIC SNAPSHOT

- FIGURE 42 MARKET: MIDDLE EAST & AFRICA SNAPSHOT

- FIGURE 43 C4ISR MARKET: LATIN AMERICA SNAPSHOT

- FIGURE 44 SHARE OF TOP PLAYERS IN C4ISR MARKET, 2021

- FIGURE 45 RANKING OF LEADING PLAYERS IN C4ISR MARKET, 2021

- FIGURE 46 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2021

- FIGURE 47 C4ISR MARKET: COMPANY EVALUATION MATRIX, 2021

- FIGURE 48 C4ISR MARKET: START-UP/SME EVALUATION MATRIX, 2021

- FIGURE 49 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- FIGURE 51 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 L3HARRIS TECHNOLOGIES INC.: COMPANY SNAPSHOT

- FIGURE 55 THALES: COMPANY SNAPSHOT

- FIGURE 56 RHEINMETALL AG: COMPANY SNAPSHOT

- FIGURE 57 SAAB AB: COMPANY SNAPSHOT

- FIGURE 58 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 59 IAI GROUP: COMPANY SNAPSHOT

- FIGURE 60 SYSTEMATIC A/S: COMPANY SNAPSHOT

- FIGURE 61 AIRBUS: COMPANY SNAPSHOT

- FIGURE 62 INDRA SISTEMAS, S.A.: COMPANY SNAPSHOT

- FIGURE 63 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 BOOZ ALLEN HAMILTON INC.: COMPANY SNAPSHOT

- FIGURE 65 CUBIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 66 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 67 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: COMPANY SNAPSHOT

- FIGURE 68 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: COMPANY SNAPSHOT

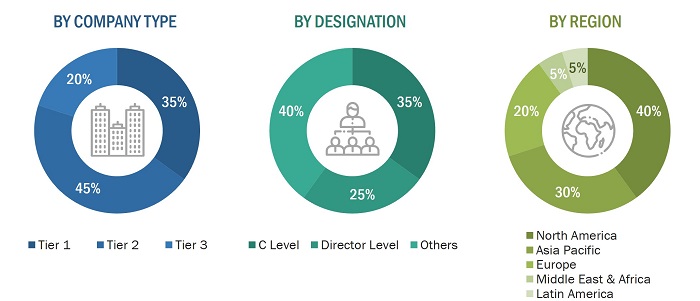

The study involved four major activities in estimating the current size of the C4ISR market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering C4ISR and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the C4ISR market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the C4ISR market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from C4ISR vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using C4ISR were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of C4ISR and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Command and Control Technology |

Individual Industry Expert |

|

The Homeland Security Consulting Group, LLC |

Director |

|

Mirion Technologies, Inc |

Project Manager |

|

Ansys, Inc. |

Director |

Market Size Estimation

The research methodology used to estimate the size of the C4ISR market includes the following details.

The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in the land, airborne, naval, and space platforms at a regional level. Such procurements provide information on the demand aspects of C4ISR systems, software, and services in each platform. For each platform, all possible application areas where C4ISR is integrated or installed were mapped.

Global C4ISR Market Size: Botton Up Approach

Global C4ISR Market Size: Top Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the C4ISR market based on Solution, Application, Platform, End User, Installation and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Latin America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the C4ISR market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the C4ISR market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the C4ISR Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in C4ISR Market