Automotive Plastics Market for Passenger Cars by Product Type (PP, PU, PVC, PA), Application (Interior, Exterior, Under Bonnet), Vehicle Type (Conventional Cars, Electric Cars), and Geography - Global Forecast to 2026

Updated on : September 03, 2025

Automotive Plastics Market

The global automotive plastics market was valued at USD 21.1 billion in 2021 and is projected to reach USD 30.8 billion by 2026, growing at 7.9% cagr from 2021 to 2026. Maximum mass reduction potential, significant emission reduction, and enhanced vehicle design and esthetics are some of the major factors contributing to the growth of the market for passenger cars.

Automotive Plastics Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Automotive Plastics Market for Passenger Cars

The COVID-19 outbreak has disrupted the whole automotive supply chain on a global scale. The initial supply and manufacturing sector is not the only one that has been disrupted. The entire automotive industry has been affected, thereby experiencing an uncertain recovery timeline due to lockdown implementation in various parts of the world. The automotive industry is currently facing four major challenges amid the COVID-19 pandemic — limited supply of vehicle parts, drop in new vehicle sales, shutdown of production facilities, and decline in working capital. In 2020, according to OICA, the global passenger car sales dropped by -15.9% from 63.7 million units in 2019 to 53.6 million units. As the automotive plastics market for passenger cars is dependent on passenger car sales, this market is expected to be significantly impacted due to this outbreak.

Automotive Plastics Market Dynamics

Driver: Adoption of lightweight materials due to stringent emission and fuel economy regulations

Several governments across the globe have introduced stringent emission and fuel economy regulations for vehicles. These regulations have compelled automotive OEMs to increase the use of lightweight materials such as plastics. Advanced plastics materials help increase the fuel economy of a vehicle while ensuring safety and performance. A 10% reduction in vehicle mass can improve fuel economy by 6 to 8%. The use of plastics reduces the consumption of fuel in a vehicle because less weight takes less energy at the time of acceleration. Carbon emission in passenger cars can be reduced by using greenhouse gas (GHG) reduction technologies, such as adjustment in valve timing, turbocharging, aerodynamic designing, and introduction of hybrid, plug-in hybrid, and fuel cell systems in automobiles. However, these technologies require modifications in engine design, powertrain systems, and power systems that involve high degree of complexities. Therefore, advanced plastic materials are being extensively used for the significant reduction of carbon emissions, which is comparatively reasonable than the above mentioned technologies.

Restraint: COVID-19 slowing down sales of passenger cars

The global automotive industry is facing a slowdown due to the lockdown in several countries amid the COVID- 19 outbreak. Operations of major automotive companies, including Nissan, Kia, BMW, Daimler, and Tesla, were affected by COVID-19. The pandemic and the consequent economic meltdown led to declining sales for the third year in China in 2020, the world’s biggest automobile market. This jeopardized multibillion-dollar expansion plans by EV makers. Further, due to COVID-19, passenger car sales in 2020 decline by 14% compared to 2019. The drop in global car sales in 2020 was significantly larger than the one observed during the global financial crisis of 2007-2009. South America and Europe were among the hardest-hit regions, with auto sales in these regions contracting by about one-fourth year-on-year. China was the largest automobile market based on sales with around 21 million units in 2019. However, monthly car sales in China were in free-fall in February 2020 due to the coronavirus outbreak in the country and fears over a looming recession. As a result of successful containment measures, the market started showing signs of recovery in April, providing a lifeline for major manufacturers.

Opportunity: Growing trend of vehicle electrification

The introduction of EVs has resulted in a technological revolution in the automotive industry. These vehicles have superior performance to their internal combustion counterparts. Factors such as increase in environmental awareness, government support and incentives, and investments by OEMs have paved the way for EVs. Leading automotive players such as Volkswagen, BMW, Tesla Motors, Ford, General Motors, and Toyota have ventured into the electric vehicle segment. EVs are more efficient, energy independent, and better than gas alternatives. Since EVs have low-power engines, they use lightweight materials that drive the engine’s pulling capacity. Therefore, the increasing demand for EVs provides an opportunity for the growth of the automotive plastics market.

Challenge: High cost of capital and infrastructure for re-engineering of plastics

One of the key challenges for the re-engineering of plastics is the relatively high cost of capital and infrastructure required. The obstacles include the lack of awareness among manufacturers for recycling these plastics and the lack of infrastructure. Moreover, from a component manufacturer's point of view, there is a knowledge gap about the recyclability of certain plastic types used in component designing. The recycling of plastics and composites from complex, durable products are limited due to technological and economic restraints. In addition, there is additional hindrance in the recycling of plastics such as lack of technology, infrastructure, and small market for recyclates. The recycling process of plastics requires state-of-the-art technology facilities. These facilities require heavy investments and plastic separation technologies such as magnetic separation, eddy current separators, float-sink tanks, and laser and infrared systems, which are used to differentiate and separate plastics based on color.

Therefore, lack of infrastructure, knowledge gap and the heterogeneous mixes of plastics make recycling challenging.

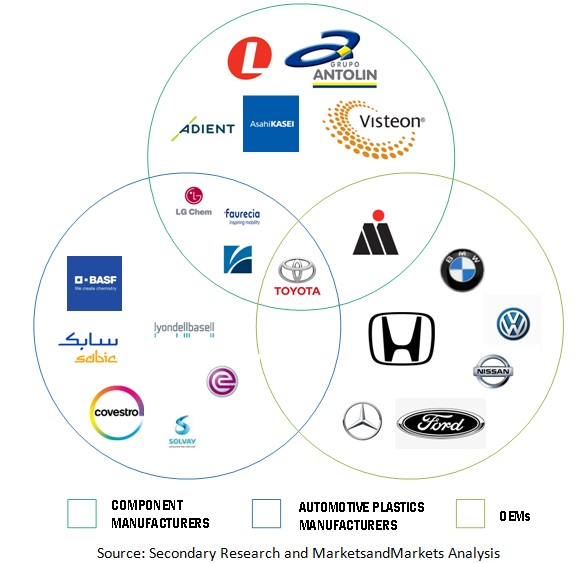

Automotive Plastics Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Low cost and extensive interior applications will drive demand for PP product type segment in the automotive plastics market for passenger cars

By product type, the PP segment accounted for the largest market share in 2020, in terms of volume. Polypropylene (PP) is also known as polypropene. As a thermoplastic polymer, polypropylene can easily be formed into almost any shape. Polypropylene is extensively used in passenger cars for various applications, such as interior, exterior, and under bonnet components. Polypropylene, being a commodity plastic, is cheaper than other engineered plastics and, hence, preferred over other plastics by design engineers. The low-cost vehicle design requirement for engineers is usually met using polypropylene. These factors are responsible for the large share of PP in the automotive plastics market for passenger cars.

Demand for comfort features to drive the interior application segment in the automotive plastics market for passenger cars

By application, the automotive interior segment accounted for the largest share of the automotive plastics market for passenger cars in 2020. Interior application leads the market as plastics are being increasingly used in these applications to provide impact resistance and dimensional stability. Use of plastics in interior applications provides high durability, color, and aesthetic appeal to automobiles. The interior segment includes components such as the interior lighting, interior door panels, inner door handles, window motor, door control module, door locks, interior trims, seats, seat belts, car upholstery, dashboard, infotainment systems, instrument cluster, steering wheel assembly and component, airbag, floor components and parts (carpet and other floor material), hood and trunk carpets, seals, frame, breaks and gears, cables, and connector & socket.

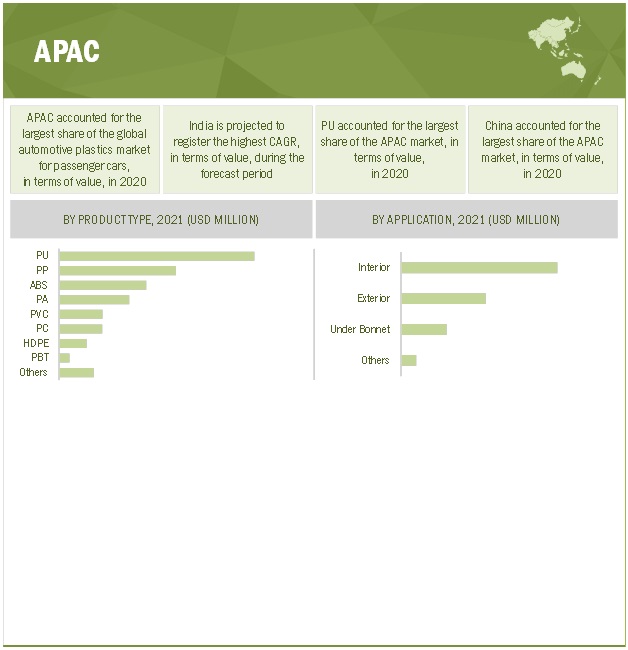

China is the largest consumer of automotive plastics in the Asia Pacific region

Asia Pacific (APAC) accounted for the largest share of the automotive plastics market for passenger cars in 2020. According to the World Bank, the two economic giants of APAC — China and Japan — are the world’s second-and third-largest economies, respectively, in 2021. The region is the hub for foreign investments and booming industrial sectors, mainly because of the low-cost labor, easy availability of raw materials, increase in adoption of modern technologies, innovations, and easy availability of inexpensive lands. China, Japan, India, and South Korea are the major countries in the region. China is the largest automotive plastics market for passenger cars in APAC, owing to the presence of major automobile companies. Growing middle-class population, industrialization, rising disposable income, and changing lifestyles are expected to drive the demand for passenger vehicles, providing various growth prospects to the automotive plastics market for passenger cars in China.

Automotive Plastics Market Players

BASF SE (Germany), SABIC (Saudi Arabia), LyondellBasell Industries Holdings BV (Netherlands), LG Chem (South Korea), DuPont (US), Covestro AG (Germany), Evonik Industries AG (Germany), Solvay (Belgium), Arkema SA (France), Borealis AG (Austria), among others are the key players operating in the automotive plastics market for passenger cars.

Read More: Automotive Plastics Companies

Automotive Plastics Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 21.1 Billion |

|

Revenue Forecast in 2026 |

USD 30.8 Billion |

|

CAGR |

7.9% |

|

Market Size Available for Years |

2019-2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021-2026 |

|

Forecast Units |

Value (USD million) and Volume (Kiloton) |

|

Segments Covered |

Product Type, Vehicle Type, Application, and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies Covered |

Some of the leading players operating in the automotive plastics market for passenger cars include BASF SE (Germany), SABIC (Saudi Arabia), LyondellBasell Industries Holdings BV (Netherlands), LG Chem (South Korea), DuPont (US), Covestro AG (Germany), Evonik Industries AG (Germany), Solvay (Belgium), Arkema SA (France), and Borealis AG (Austria) (Total 35 companies) |

This research report categorizes the automotive plastics market for passenger cars based on product type, vehicle type, application, and region.

Automotive Plastics Market for passenger cars, By Product Type

- Polypropylene (PP)

- Polyurethane (PU)

- Polyvinylchloride (PVC)

- Polyamide (PA)

- Acrylonitrile Butadiene Styrene (ABS)

- High Density Polyethylene (HDPE)

- Polycarbonate (PC)

- Polybutylene Terephthalate (PBT)

- Others (PMMA, PET, PVDF, PTFE, PFA, PAEK, PPS, PI, and ASA)

Automotive Plastics Market for passenger cars, By Application

- Interior

- Exterior

- Under Bonnet

- Others (Chassis, and Electrical Components)

Automotive Plastics Market for passenger cars, By Vehicle Type

- Conventional Cars

- Electric Cars

Automotive Plastics Market for passenger cars, By Region

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In May 2021, Covestro AG launched a new product, recycled Polyethylene Terephthalate (rPET). The recycled PET has been optimized for 3D pellet printing. This technology, also known as fused granulate fabrication (FGF), allows for fast and economically viable additive manufacturing of large-size parts. This has application in the automotive industry in the manufacturing of small interior parts.

- In March 2021, DuPont announced the acquisition of Laird Performance Materials (China) for USD 2.3 billion, which will be paid from existing cash balances. The transaction is expected to close in the third quarter of 2021, subject to regulatory approvals and other customary closing conditions. Laird Performance Materials is a world leader in high-performance electromagnetic shielding and thermal management with a comprehensive offering of performance components and solutions that manage heat and protect devices from electromagnetic interference for smart and autonomous vehicles.

- In March 2021, Celanese Corporation announced its intent to initiate a three-year plan to expand engineered materials compounding capacities at the company’s Asia facilities, including in Nanjing, China; Suzhou, China; and Silvassa, India, to support the significant business growth in engineered materials.

Frequently Asked Questions (FAQ):

What will be the demand for automobile plastics by 2026?

The global automotive plastics market size is projected to grow from USD 21.1 billion in 2021 and is projected to reach USD 30.8 billion by 2026, at a CAGR of 7.9%.

What are the types of plastics used in the manufacturing of passenger cars?

PP, PU, PVC, ABS, HDPE, PA, PC, PBT, among others are different types of plastics used in the manufacturing of passenger cars.

Which are the key countries expected to fuel the growth of automotive plastics market for passenger cars?

The automotive plastics market for passenger cars is expected to grow the fastest in India, China, and Indonesia.

What are the key driving factors for the automotive plastics market for passenger cars?

Adoption of lightweight materials due to stringent emission and fuel economy regulations, introduction of new safety features and luxury components, and OEMs’ inclination towards thermally stable plastics are expected to drive the automotive plastics market for passenger cars.

What are the new opportunities for the automotive plastics market for passenger cars?

Use of bioplastics, anti-microbial plastics/additives, PMMA, and composites in vehicle production, along with growing trend of vehicle electrification are expected to provide new growth opportunities for the automotive plastics market for passenger cars.

Who are the major manufacturers of automotive plastics?

BASF SE (Germany), SABIC (Saudi Arabia), LyondellBasell Industries Holdings BV (Netherlands), LG Chem (South Korea), DuPont (US), Covestro AG (Germany), Evonik Industries AG (Germany), Solvay (Belgium), Arkema SA (France), and Borealis AG (Austria) are the major manufacturers of automotive plastics. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 MARKET FOR PASSENGER CARS: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 \MARKET FOR PASSENGER CARS SEGMENTATION

FIGURE 2 AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS, BY REGION

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 3 AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.1.2.4 Primary participants

2.2 MARKET SIZE ESTIMATION

2.2.1 SUPPLY-SIDE APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) - MARKET (VOLUME)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) - MARKET FOR PASSENGER CARS (VOLUME)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): REVENUE OF AUTOMOTIVE PLASTICS MARKET PRODUCTS

2.2.2 DEMAND-SIDE APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM-UP (DEMAND SIDE)

2.3 DATA TRIANGULATION

FIGURE 8 AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS: DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.4.1 SUPPLY SIDE

FIGURE 9 HISTORICAL GROWTH RATE OF COMPANIES IN AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS

2.5 LIMITATIONS

2.6 ASSUMPTIONS

2.7 RISK ASSESSMENT

TABLE 2 LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 10 POLYURETHANE SEGMENT TO LEAD THE MARKET

FIGURE 11 INTERIOR TO BE LARGEST APPLICATION OF AUTOMOTIVE PLASTICS

FIGURE 12 CONVENTIONAL CARS TO ACCOUNT FOR LARGER SHARE IN OVERALL MARKET

FIGURE 13 APAC DOMINATED AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS IN 2020

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 SIGNIFICANT OPPORTUNITIES IN AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS

FIGURE 14 ADVANCEMENTS IN AUTOMOTIVE INDUSTRY TO DRIVE THE MARKET

4.2 APAC MARKET FOR PASSENGER CARS, BY PRODUCT TYPE, AND COUNTRY

FIGURE 15 CHINA LED THE APAC MARKET FOR PASSENGER CARS IN 2020

4.3 MARKET FOR PASSENGER CARS, BY APPLICATION

FIGURE 16 INTERIOR APPLICATION TO ACCOUNT FOR THE LARGEST MARKET SHARE

4.4 MARKET FOR PASSENGER CARS, BY REGION

FIGURE 17 APAC TO BE FASTEST-GROWING MARKET FOR PASSENGER CARS

4.5 MARKET FOR PASSENGER CARS ATTRACTIVENESS

FIGURE 18 INDIA TO BE FASTEST-GROWING MARKET FOR PASSENGER CARS

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS

5.2.1 DRIVERS

5.2.1.1 Adoption of lightweight materials due to stringent emission and fuel economy regulations

TABLE 3 GLOBAL EMISSION REGULATIONS, BY COUNTRY, 2014-2025

5.2.1.2 Introduction of new safety features and luxury components

5.2.1.3 OEMs’ inclination towards thermally stable plastics

5.2.2 RESTRAINTS

5.2.2.1 COVID-19 slowing down sales of passenger cars

5.2.3 OPPORTUNITIES

5.2.3.1 Use of bioplastics in vehicle production

5.2.3.2 Use of anti-microbial plastics/additives in vehicle car production

5.2.3.3 Use of composites and PMMA in vehicle car production

5.2.3.4 Growing trend of vehicle electrification

FIGURE 20 GLOBAL ELECTRIC VEHICLE SALES, 2018-2025 (THOUSAND UNITS)

5.2.4 CHALLENGES

5.2.4.1 Shifting demands of OEMs for advanced materials to adhere to carbon emission targets

5.2.4.2 High cost of capital and infrastructure for re-engineering of plastics

5.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 PORTERS 5 FORCES IMPACT ON MARKET FOR PASSENGER CARS

FIGURE 21 MARKET FOR PASSENGER CARS: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF SUBSTITUTES

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 IMPACT OF COVID-19 ON AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS

5.4.1 COVID-19

5.4.2 COVID-19 HEALTH ASSESSMENT

FIGURE 22 COUNTRY-WISE SPREAD OF COVID-19

FIGURE 23 IMPACT OF COVID-19 ON DIFFERENT COUNTRIES IN 2020 (Q4)

FIGURE 24 THREE SCENARIO-BASED ANALYSIS OF COVID-19 IMPACT ON GLOBAL ECONOMY

5.4.3 IMPACT ON AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS

5.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 25 YC-YCC SHIFT: AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS

5.6 ECOSYSTEM/MARKET MAP OF AUTOMOTIVE PLASTICS FOR PASSENGER CARS

FIGURE 26 ECOSYSTEM/MARKET MAP OF AUTOMOTIVE PLASTICS FOR PASSENGER CARS

TABLE 5 AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS: ECOSYSTEM

5.7 PATENT ANALYSIS

5.7.1 INTRODUCTION

FIGURE 27 PUBLICATION TRENDS (2010-2020)

5.7.2 INSIGHTS

FIGURE 28 AUTOMOTIVE PLASTIC PATENTS, TREND ANALYSIS

5.7.3 TOP PATENT HOLDERS

5.8 REGULATORY LANDSCAPE

5.8.1 US

5.8.2 EUROPE

5.8.3 JAPAN

5.8.4 INDIA

TABLE 6 SCENARIOS FOR FUTURE OF VEHICULAR EMISSIONS IN INDIA

5.9 CASE STUDY ANALYSIS

5.9.1 SUPPORTING PLASTICS PROCESS QUALITY CONTROL FOR AUTOMOTIVE DASHBOARD MATERIALS

5.9.2 METAL TO PLASTIC CONVERSION

5.9.3 WORLD'S FIRST PLASTIC ENGINE SUPPORT IN THE NEW MERCEDES GL CLASS MADE BY BASF SE

5.10 PRICING ANALYSIS

FIGURE 29 AVERAGE SELLING PRICE OF AUTOMOTIVE PLASTICS FOR PASSENGER CARS, BY REGION (2020)

TABLE 7 AVERAGE SELLING PRICE OF AUTOMOTIVE PLASTICS FOR PASSENGER CARS, BY REGION IN 2020 (USD/TON)

FIGURE 30 AVERAGE SELLING PRICE OF AUTOMOTIVE PLASTICS FOR PASSENGER CARS, BY PRODUCT TYPE, FROM 2019 TO 2026

TABLE 8 AVERAGE SELLING PRICE OF AUTOMOTIVE PLASTICS FOR PASSENGER CARS, BY PRODUCT TYPE, FROM 2019 TO 2026 (USD/TON)

5.11 TECHNOLOGY ANALYSIS

5.11.1 OVERVIEW

5.11.2 INJECTION MOLDING

5.11.3 BLOW MOLDING

5.11.4 COMPRESSION MOLDING

5.11.5 EXTRUSION

5.11.6 3D PRINTING

5.12 SUPPLY CHAIN ANALYSIS

FIGURE 31 SUPPLY CHAIN ANALYSIS FOR AUTOMOTIVE PLASTICS FOR PASSENGER CARS

6 AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS, BY PRODUCT TYPE (Page No. - 81)

6.1 INTRODUCTION

FIGURE 32 POLYAMIDE SEGMENT TO REGISTER THE HIGHEST CAGR IN THE AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS

TABLE 9 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 10 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

6.2 PP

6.2.1 LOW COST AND EXTENSIVE INTERIOR APPLICATIONS WILL DRIVE DEMAND

TABLE 11 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN PP TYPE, BY REGION, 2019–2026 (KILOTON)

TABLE 12 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN PP TYPE, BY REGION, 2019–2026 (USD MILLION)

6.3 PU

6.3.1 DURABILITY AND EASY MOLDING ABILITIES LIKELY TO BOOST DEMAND

TABLE 13 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN PU TYPE, BY REGION, 2019–2026 (KILOTON)

TABLE 14 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN PU TYPE, BY REGION, 2019–2026 (USD MILLION)

6.4 PVC

6.4.1 HIGH QUALITY AND DURABILITY WILL DRIVE DEMAND

6.4.2 RIGID PVC

6.4.3 FLEXIBLE PVC

TABLE 15 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN PVC TYPE, BY REGION, 2019–2026 (KILOTON)

TABLE 16 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN PVC TYPE, BY REGION, 2019–2026 (USD MILLION)

6.5 ABS

6.5.1 LIGHTWEIGHT AND HIGH STRENGTH PROPERTIES WILL DRIVE ABS DEMAND

TABLE 17 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN ABS TYPE, BY REGION, 2019–2026 (KILOTON)

TABLE 18 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN ABS TYPE, BY REGION, 2019–2026 (USD MILLION)

6.6 PA

6.6.1 NEW GRADES OF POLYAMIDE 6 WILL DRIVE POLYAMIDE DEMAND IN ELECTRIC VEHICLES

TABLE 19 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN PA TYPE, BY REGION, 2019–2026 (KILOTON)

TABLE 20 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN PA TYPE, BY REGION, 2019–2026 (USD MILLION)

6.7 HDPE

6.7.1 LOW WEIGHT AND LONG SHELF LIFE ARE EXPECTED TO DRIVE DEMAND

TABLE 21 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN HDPE TYPE, BY REGION, 2019–2026 (KILOTON)

TABLE 22 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN HDPE TYPE, BY REGION, 2019–2026 (USD MILLION)

6.8 PC

6.8.1 DESIGN FLEXIBILITY AND SUPERIOR STRUCTURE LIKELY TO DRIVE DEMAND

TABLE 23 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN PC TYPE, BY REGION, 2019–2026 (KILOTON)

TABLE 24 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN PC TYPE, BY REGION, 2019–2026 (USD MILLION)

6.9 PBT

6.9.1 HIGHER TOLERANCE THAN POLYCARBONATE WILL DRIVE DEMAND

TABLE 25 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN PBT TYPE, BY REGION, 2019–2026 (KILOTON)

TABLE 26 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN PBT TYPE, BY REGION, 2019–2026 (USD MILLION)

6.10 OTHERS

TABLE 27 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN OTHERS TYPE, BY REGION, 2019–2026 (KILOTON)

TABLE 28 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN OTHERS TYPE, BY REGION, 2019–2026 (USD MILLION)

7 AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS, BY APPLICATION (Page No. - 96)

7.1 INTRODUCTION

FIGURE 33 AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

TABLE 29 AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 30 AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (USD MILLION)

7.2 INTERIOR

7.2.1 DEMAND FOR COMFORT FEATURES TO DRIVE THE MARKET

TABLE 31 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN INTERIOR APPLICATION, BY REGION, 2019–2026 (KILOTON)

TABLE 32 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN INTERIOR APPLICATION, BY REGION, 2019–2026 (USD MILLION)

7.3 EXTERIOR

7.3.1 INCREASED USE OF SAFETY FEATURES IN CARS TO DRIVE DEMAND

TABLE 33 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN EXTERIOR APPLICATION, BY REGION, 2019–2026 (KILOTON)

TABLE 34 MARKET SIZE FOR PASSENGER CARS IN EXTERIOR APPLICATION, BY REGION, 2019–2026 (USD MILLION)

7.4 UNDER BONNET

7.4.1 DEMAND FOR LIGHTWEIGHT BATTERY CASING WI LL DRIVE THE MARKET

TABLE 35 MARKET SIZE FOR PASSENGER CARS IN UNDER BONNET APPLICATION, BY REGION, 2019–2026 (KILOTON)

TABLE 36 MARKET SIZE FOR PASSENGER CARS IN UNDER BONNET APPLICATION, BY REGION, 2019–2026 (USD MILLION)

7.5 OTHERS

7.5.1 ADVANCED SAFETY FEATURES TO DRIVE DEMAND

TABLE 37 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN OTHER APPLICATIONS, BY REGION, 2019–2026 (KILOTON)

TABLE 38 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS IN OTHER APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

8 AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS, BY VEHICLE TYPE (Page No. - 104)

8.1 INTRODUCTION

8.1.1 ASSUMPTIONS/LIMITATIONS

8.1.2 INDUSTRY INSIGHTS

FIGURE 34 AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS, BY VEHICLE TYPE 2021 VS 2026 (USD BILLION)

TABLE 39 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY VEHICLE TYPE, 2019–2026 (KILOTON)

TABLE 40 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY VEHICLE TYPE, 2019–2026 (USD MILLION)

8.2 CONVENTIONAL CARS

8.3 ELECTRIC CARS

8.3.1 BEV (BATTERY ELECTRIC VEHICLE)

8.3.1.1 Increasing focus to reduce vehicle weight to drive the demand for plastics in BEV batteries

8.3.2 PHEV (PLUG-IN HYBRID ELECTRIC VEHICLE)

8.3.2.1 Increasing sales and developments in battery plastic materials for housings/casings to drive the demand

8.3.3 FCEV (FUEL CELL ELECTRIC VEHICLE)

8.3.3.1 Continuous developments in FCEV technology and launches of various models to drive the market

9 AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS, BY REGION (Page No. - 110)

9.1 INTRODUCTION

FIGURE 35 INDIA TO BE THE FASTEST-GROWING AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS

TABLE 41 AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY REGION, 2019–2026 (KILOTON)

TABLE 42 MARKET SIZE FOR PASSENGER CARS, BY REGION, 2019–2026 (USD MILLION)

9.2 APAC

FIGURE 36 APAC: AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS SNAPSHOT

TABLE 43 APAC: MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 44 APAC: MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 45 APAC: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 46 APAC: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 47 APAC: MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 48 APAC: MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.1 CHINA

9.2.1.1 Stringent emission norms to drive the automotive plastics market

TABLE 49 CHINA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 50 CHINA: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

9.2.2 JAPAN

9.2.2.1 Electric passenger cars are projected to drive the demand for automotive plastics

TABLE 51 JAPAN: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 52 JAPAN: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

9.2.3 INDIA

9.2.3.1 Strategic government initiatives to boost the passenger cars industry expected to drive the market

TABLE 53 INDIA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 54 INDIA: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

9.2.4 SOUTH KOREA

9.2.4.1 Recent government policies and investments to drive the demand

TABLE 55 SOUTH KOREA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 56 SOUTH KOREA: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

9.2.5 THAILAND

9.2.5.1 Increase in car production to drive the market

TABLE 57 THAILAND: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 58 THAILAND: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

9.2.6 INDONESIA

9.2.6.1 Expansion of global car manufacturers in the country to drive the market

TABLE 59 INDONESIA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 60 INDONESIA: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

9.2.7 REST OF APAC

TABLE 61 REST OF APAC: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, 2019-2026 (KILOTON)

TABLE 62 REST OF APAC: MARKET SIZE FOR PASSENGER CARS, 2019-2026 (USD MILLION)

9.3 NORTH AMERICA

FIGURE 37 NORTH AMERICA: AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS SNAPSHOT

TABLE 63 NORTH AMERICA: MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 64 NORTH AMERICA: MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 66 NORTH AMERICA: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 68 NORTH AMERICA: MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.1 US

9.3.1.1 Increase in demand for high-performance plastics to drive the market

TABLE 69 US: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 70 US: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

9.3.2 CANADA

9.3.2.1 Electric cars to drive the demand

TABLE 71 CANADA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 72 CANADA: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

9.3.3 MEXICO

9.3.3.1 Rising car production to drive the market

TABLE 73 MEXICO: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 74 MEXICO: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

9.4 EUROPE

FIGURE 38 EUROPE: AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS SNAPSHOT

TABLE 75 EUROPE: MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 76 EUROPE: MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 78 EUROPE: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 79 EUROPE: MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 80 EUROPE: MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.1 GERMANY

9.4.1.1 Presence of major players to drive the market

TABLE 81 GERMANY: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 82 GERMANY: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

9.4.2 SPAIN

9.4.2.1 Electric vehicle production will drive the passenger cars plastics market

TABLE 83 SPAIN: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 84 SPAIN: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

9.4.3 FRANCE

9.4.3.1 Increase in the production of commercial vehicles to drive the market

TABLE 85 FRANCE: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 86 FRANCE: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

9.4.4 UK

9.4.4.1 Government policies to promote sales of electric vehicles to drive the demand

TABLE 87 UK: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 88 UK: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

9.4.5 RUSSIA

9.4.5.1 Setting of manufacturing facilities and growth in investments are driving market growth

TABLE 89 RUSSIA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 90 RUSSIA: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

9.4.6 REST OF EUROPE

TABLE 91 REST OF EUROPE: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019-2026 (KILOTON)

TABLE 92 REST OF EUROPE: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019-2026 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

TABLE 93 MIDDLE EAST & AFRICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 94 MIDDLE EAST & AFRICA: MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 95 MIDDLE EAST & AFRICA: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 96 MIDDLE EAST & AFRICA: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 97 MIDDLE EAST & AFRICA: MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 98 MIDDLE EAST & AFRICA: MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.1 TURKEY

9.5.1.1 New manufacturing facilities contribute to market growth

TABLE 99 TURKEY: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 100 TURKEY: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

9.5.2 IRAN

9.5.2.1 Partnerships with global OEMs to produce efficient vehicles to drive the market

TABLE 101 IRAN: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 102 IRAN: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

9.5.3 REST OF MIDDLE EAST & AFRICA

TABLE 103 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 104 REST OF MIDDLE EAST & AFRICA: MARKET SIZE FOR PASSENGERS CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

9.6 SOUTH AMERICA

TABLE 105 SOUTH AMERICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 106 SOUTH AMERICA: MARKET SIZE FOR PASSENGER CARS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 107 SOUTH AMERICA: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 108 SOUTH AMERICA: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 109 SOUTH AMERICA: MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 110 SOUTH AMERICA: MARKET SIZE FOR PASSENGER CARS, BY APPLICATION, 2019–2026 (USD MILLION)

9.6.1 BRAZIL

9.6.1.1 Growing passenger cars production to drive the market

TABLE 111 BRAZIL: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 112 BRAZIL: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

9.6.2 ARGENTINA

9.6.2.1 Increasing demand for passenger cars to drive the market

TABLE 113 ARGENTINA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 114 ARGENTINA: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

9.6.3 REST OF SOUTH AMERICA

TABLE 115 REST OF SOUTH AMERICA: AUTOMOTIVE PLASTICS MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (KILOTON)

TABLE 116 REST OF SOUTH AMERICA: MARKET SIZE FOR PASSENGER CARS, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 162)

10.1 KEY PLAYERS STRATEGIES/RIGHT TO WIN

10.1.1 OVERVIEW OF STRATEGIES ADOPTED BY AUTOMOTIVE PLASTIC MANUFACTURERS FOR PASSENGER CARS

10.2 REVENUE ANALYSIS OF TOP FIVE COMPANIES

FIGURE 39 REVENUE ANALYSIS FOR TOP 5 COMPANIES OF LAST 5 YEARS

10.3 MARKET SHARE ANALYSIS, 2020

FIGURE 40 AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS: MARKET SHARE ANALYSIS

TABLE 117 MARKET FOR PASSENGER CARS: DEGREE OF COMPETITION

10.4 COMPANY EVALUATION QUADRANT

10.4.1 STAR

10.4.2 PERVASIVE

10.4.3 EMERGING LEADER

10.4.4 PARTICIPANT

FIGURE 41 AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS: COMPANY EVALUATION MATRIX, 2020

10.4.5 COMPETITIVE BENCHMARKING

FIGURE 42 COMPANY PRODUCT FOOTPRINT

TABLE 118 COMPANY OFFERING FOOTPRINT

TABLE 119 COMPANY APPLICATION FOOTPRINT

TABLE 120 COMPANY REGION FOOTPRINT

10.5 STARTUP/SME EVALUATION QUADRANT, 2020

10.5.1 PROGRESSIVE COMPANY

10.5.2 RESPONSIVE COMPANY

10.5.3 DYNAMIC COMPANY

10.5.4 STARTING BLOCK

FIGURE 43 AUTOMOTIVE PLASTICS MARKET FOR PASSENGER CARS: START-UP/SME EVALUATION QUADRANT, 2020

10.5.5 RECENT DEVELOPMENT

10.5.5.1 Product launch

10.5.5.2 Deals

10.5.5.3 Others

11 COMPANY PROFILES (Page No. - 186)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View)*

11.1.1 BASF SE

TABLE 121 BASF SE: COMPANY OVERVIEW

FIGURE 44 BASF SE: COMPANY SNAPSHOT

11.1.2 SABIC

TABLE 122 SABIC: COMPANY OVERVIEW

FIGURE 45 SABIC: COMPANY SNAPSHOT

11.1.3 LYONDELLBASELL INDUSTRIES HOLDINGS BV

TABLE 123 LYONDELLBASELL INDUSTRIES HOLDINGS BV: COMPANY OVERVIEW

FIGURE 46 LYONDELLBASELL INDUSTRIES HOLDINGS BV: COMPANY SNAPSHOT

11.1.4 LG CHEM

TABLE 124 LG CHEM: COMPANY OVERVIEW

FIGURE 47 LG CHEM: COMPANY SNAPSHOT

11.1.5 DUPONT

TABLE 125 DUPONT: COMPANY OVERVIEW

FIGURE 48 DUPONT: COMPANY SNAPSHOT

11.1.6 BOREALIS AG

TABLE 126 BOREALIS AG: COMPANY OVERVIEW

FIGURE 49 BOREALIS AG: COMPANY SNAPSHOT

11.1.7 COVESTRO AG

TABLE 127 COVESTRO AG: COMPANY OVERVIEW

FIGURE 50 COVESTRO AG: COMPANY SNAPSHOT

11.1.8 EVONIK INDUSTRIES AG

TABLE 128 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

FIGURE 51 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

11.1.9 ROYAL DSM

TABLE 129 ROYAL DSM: COMPANY OVERVIEW

FIGURE 52 DSM: COMPANY OVERVIEW

11.1.10 ARKEMA SA

TABLE 130 ARKEMA: COMPANY OVERVIEW

FIGURE 53 ARKEMA SA: COMPANY SNAPSHOT

11.1.11 SOLVAY

TABLE 131 SOLVAY: COMPANY OVERVIEW

FIGURE 54 SOLVAY: COMPANY SNAPSHOT

11.1.12 LANXESS

TABLE 132 LANXESS

FIGURE 55 LANXESS: COMPANY SNAPSHOT

11.1.13 CELANESE CORPORATION

TABLE 133 CELANESE CORPORATION: COMPANY OVERVIEW

FIGURE 56 CELANESE CORPORATION: COMPANY SNAPSHOT

11.1.14 TORAY INDUSTRIES INC.

TABLE 134 TORAY INDUSTRIES INC.: COMPANY OVERVIEW

FIGURE 57 TORAY INDUSTRIES INC.: COMPANY SNAPSHOT

11.1.15 MITSUI CHEMICALS

TABLE 135 MITSUI CHEMICALS: COMPANY OVERVIEW

FIGURE 58 MITSUI CHEMICALS: COMPANY SNAPSHOT

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

11.2 OTHER KEY MARKET PLAYERS

11.2.1 TOYOTA BOSHOKU CORPORATION

11.2.2 FAURECIA SA

11.2.3 TOYODA GOSEI CO., LTD.

11.2.4 INEOS

11.2.5 SUMITO CHEMICALS COMPANY LTD.

11.2.6 UBE INDUSTRIES

11.2.7 MITSUBISHI ENGINEERING PLASTICS CORPORATION

11.2.8 FORMOSA PLASTICS CORPORATION

11.2.9 EMS CHEMI HOLDINGS

11.2.10 MOMENTIVE PERFORMANCE MATERIALS

11.2.11 AGC CHEMICALS AMERICAS INC.

11.2.12 CHEVRON PHILLIPS CHEMICALS

11.2.13 BRASKEM

11.2.14 PTT GLOBAL CHEMICAL

11.2.15 HANWHA CHEMICAL

11.2.16 STRATASYS

11.2.17 APPL INDUSTRIES LTD.

11.2.18 KRAIBURG HOLDING GMBH & CO. KG

11.2.19 SAINT-GOBAIN GROUP

11.2.20 AG INDUSTRIES PVT. LTD.

12 APPENDIX (Page No. - 249)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

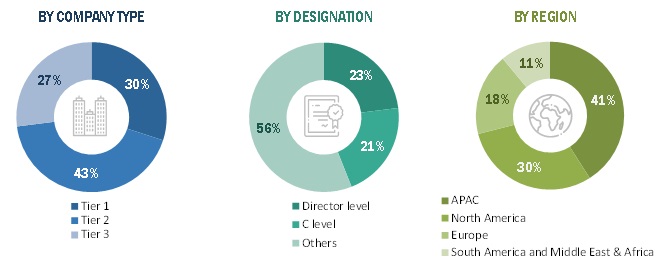

This study involved four major activities in estimating the current size of the automotive plastics market for passenger cars. Exhaustive secondary research was undertaken to collect information on the automotive plastics market for passenger cars, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the automotive plastics value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the market. After that, the market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the automotive plastics market for passenger cars.

Secondary Research

As a part of the secondary research process, various secondary sources such as Hoovers, Bloomberg, BusinessWeek, Reuters, and Factiva were referred for identifying and collecting information for this study on the automotive plastics market for passenger cars. Secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the monetary chain of the market, the total pool of players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments undertaken from both, market- and technology oriented perspectives.

Primary Research

As a part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the automotive plastics market for passenger cars. Primary sources from the supply side included industry experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the automotive plastics market for passenger cars. Primary sources from the demand side included directors, marketing heads, and purchase managers from the medical industry. Following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

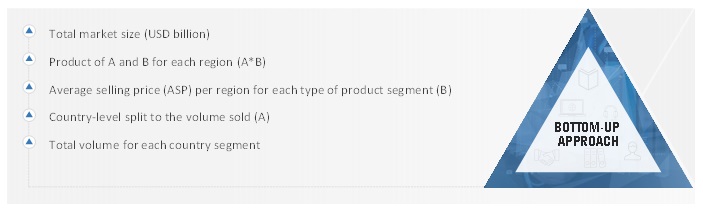

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the automotive plastics market for passenger cars. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The supply chain of the industry and the market size, in terms of value, and volume were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were used, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Objectives of the Report

- To define, describe, and forecast the market size of automotive plastics for passenger cars, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size by product type, vehicle type, application, and region

- To forecast the size of the market with respect to five main regions (along with key countries of each region), namely, North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To track and analyze recent developments, such as product launches, expansions, partnerships, joint ventures, and acquisitions, in the market

- To strategically profile the key market players and comprehensively analyze their core competencies2

Note: Core competencies of the companies are determined in terms of product offerings and business strategies adopted by them to sustain in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of companies with the given market data. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the automotive plastics market for passenger cars in Rest of APAC, Rest of Europe, Rest of South America, and Rest of Middle East & Africa

- Further breakdown of subsegments of the automotive plastics market for passenger cars across all regions

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Plastics Market

Market size on plastic market particularly for automotive industry

Specific information request on automotive nylon and nylon 6,6

Need information on automotive market wrt smart electronics, clean technology & Hybrid components and lighting components

General information require on butteroil, soybean oil, and Palm oil

Market estimation and forecast for plastic composites in automotive industry

Information on the Automotive plastic industry and major global producers of automotive plastic parts in India

Looking for long fiber composite marekt based on needle punched technology

Long fiber composites market

Historic data and estimate on automotive plastics by different types. Information on NEVs, will be better

Specific information request on automotive plastics used in Germany

Looking for updated version of report

Information on plastics consumption in the automotive industry by different grades/ types, key challenges and market drivers for a plastics producer to tap into automotive industry further in emerging markets.

Market overview of the automotive plastic injection molded parts by region & key players.

Looking for more information on 3D printing technology/Additive manufacturing

Interested in PP and HDPE plastics for European market

General information on PP and HDPE plastics for Europe market

Detail information on key market drivers and growth trends on plastics for automotive industry