Bank Kiosk Market Size, Share & Industry Growth Analysis Report by Type (Single-function Kiosk, Multi-function Kiosk, Virtual/Video Teller Machine), Location (Indoor, Outdoor), Offering, Distribution, and Geography - Global Growth Driver and Industry Forecast to 2026

Updated on : Oct 23, 2024

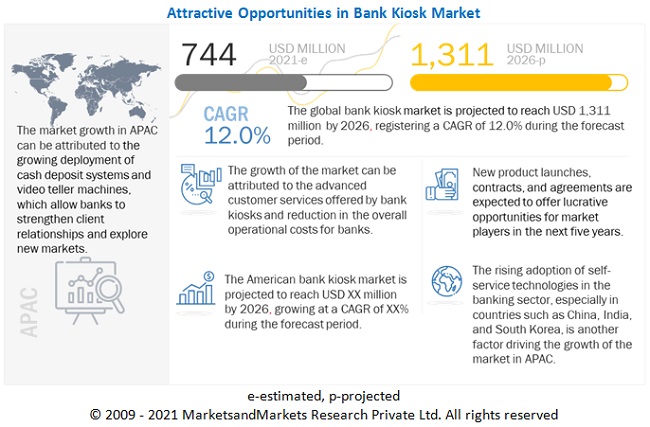

The global bank kiosk market size is expected to reach USD 1,311 million by 2026; it is anticipated to grow at a compound annual growth rate (CAGR) of 12.0% during the forecast period.

The factors such as rising demand for self-service in banking and financial services applications, enhanced customer services offered by banking kiosks, and reduction in overall operational costs—are the key factors driving the bank kiosk industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Bank Kiosk Market

The world is battling an economic crisis caused by the COVID-19 pandemic. The pandemic has affected various industries, such as automotive, semiconductor, and energy. The manufacturing units are highly affected due to the worldwide lockdowns and limited availability of labor and raw materials.

The bank kiosk market witnessed a significant decline in its growth in 2020 owing to the spread of COVID-19. The outbreak has adversely impacted the supply chain of the market, as some of the prominent players are based in China, which is the epicenter of the pandemic. Currently, the key market players are focusing on maintaining and generating operating revenue, due to which there were limited developments in the market in 2020.

The enhancement in customer services offered by banking kiosks is driving their demand. Traditional automatic teller machines (ATMs) have basic features such as cash and check deposits and cash withdrawals. However, they cannot provide other banking services and experiences. Bank kiosks enable customers to perform all the banking operations, such as account opening and closure, bills and loans payment, financial statement inquiries, and cash deposits and withdrawals using a passbook, all in a user-friendly environment.

Restraint: Increasing incidents of cyber crime

Bank kiosks are prone to theft and security issues if not maintained or if they do not abide by the regulations. An authenticated identity proof of the person is used to access kiosk payments, as there is a possibility of the information being misused by a third party.

The misuse of bank kiosks and cards is a major cybercrime being observed. Public kiosks are subject to hacking, which keeps the customers away from adopting such online services. Malware attacks have become an increasingly common threat to many organizations and can damage their infrastructure if they do not have proper protection against them.

Opportunity: Introduction of NFC-based contactless payments in banking sector in APAC region

Many banks, such as ICICI Bank Limited (India) and State Bank of India (India), along with some banking kiosk service providers such as Tech Mahindra Limited (India) and Aditya Birla Minacs (India), have introduced NFC-based contactless payments in the banking and financial services sector.

Mobile phones with NFC enable users to make payments through their mobile devices. NFC technology in a banking kiosk would allow people to withdraw cash even when they are not carrying their debit cards with them. To reduce such frauds, companies try to upgrade banking kiosks to ensure high security, cost-savings, and deployment of new services.

Challenge: Controlling cybersecurity threats

The adoption of business and technology innovations by financial service companies increases the potential threats related to cyberattacks.

The continued adoption of alternative channels such as kiosks, Internet, mobile, cloud, and social media technologies by financial service companies increases the opportunities for cybercriminals. Cybercriminals can target online financial and banking systems such as payment systems and POS terminals, and use mobile exploitation for nefarious activities.

Global Bank Kiosk Market Segment Overview

Multi-function kiosks to account for the largest share of bank kiosk market in 2020

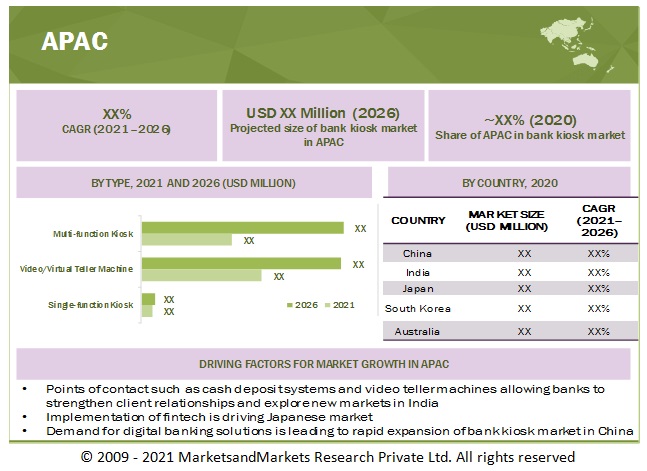

Based on the type, the bank kiosk market has been divided into single-function kiosk, multi-function kiosk, and virtual/video teller machine. Multi-function Kiosk held the highest share in 2020.

Factors such as less capital expenditure in application development, equipment purchases, installation, and maintenance are pushing the banks to adopt multi-function kiosks over single-function kiosks thereby, driving the growth of market.

Indoor segment to account for the largest bank kiosk market share during the forecast period

On the basis of location, the bank kiosk market is categorized into indoor and outdoor. Indoor bank kiosks are used in places with limited space and can help attract customers if placed in a crowded place.

The growing interest in automation and self-service technologies in the banking and financial service sector is contributing to the larger share of indoor kiosks.

APAC is leading the market for bank kiosk in 2020

APAC held the largest share in the bank kiosk market in 2020. The key reason behind the growth of the market in APAC is the rapidly expanding banking and financial services sector in countries such as India and China.

For instance, in India, various initiatives and schemes by the Reserve Bank of India (RBI) and the Government of India have been launched to expand the footprint of banking and financial services in areas with lesser or no penetration.

To know about the assumptions considered for the study, download the pdf brochure

Top Power Bank Companies - Key Market Players

Major bank kiosk companies are NCR Corporation (US), Diebold Nixdorf (US), GLORY LIMITED (Japan), GRGBanking (China), KAL ATM Software GmbH (Germany), Auriga SpA (Italy), Hitachi-Omron Terminal Solutions (Japan), and Cisco Systems, Inc. (US), and so on.

Power Bank Market Report Scope

|

Report Metric |

Details |

| Estimated Value | USD 744 million |

| Projected Value | USD 1,311 million |

| Growth Rate | CAGR of 12.0% |

|

Market size available for years |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Offering, Distribution, Type, Region, and Location |

|

Geographies covered |

Americas, Europe, APAC, and RoW |

|

Power Bank Companies covered |

NCR Corporation (US), Diebold Nixdorf (US), GLORY LIMITED (Japan), GRGBanking (China), Hyosung TNS Inc. (Japan), KAL ATM Software (Germany), Auriga SpA (Italy), Hitachi-Omron Terminal Solutions (Japan), Cisco Systems, Inc. (US), Aurionpro Solution Limited (India),and so on. |

In this research report, the bank kiosk market Reports has been segmented on the basis of offering, distribution, type, region, and location.

Bank Kiosk Market, by Offering

- Hardware

- Software

- Services

Bank Kiosk Market, by Distribution

- Rural

- Semi-urban

- Urban

- Metropolitan

Bank Kiosk Market, by Type

- Single-function kiosk

- Multi-function kiosk

- Virtual/Video Teller Machine (VTM)

Bank Kiosk Market Analysis, by Region

- Americas

- Europe

- APAC

- RoW

Bank Kiosk Market, by Location

- Indoor

- Outdoor

Recent Developments in Power Bank Industry

- In October 2020, NCR Corporation introduced its next-generation ATM software platform called NCR Activate Enterprise NextGen. This platform makes it easier and faster to offer new digital services through the ATM by integrating physical and digital for a consistent customer experience. The software platform is hardware-independent and enables banks to deploy new customer experiences such as video teller collaboration and contactless technology in a simple-to-deploy ATM application.

- In February 2021, Diebold Nixdorf partnered with America First Credit Union (US) to implement its Vynamic Payments software to transform its terminal driving and transaction switching capabilities. As part of its fleet upgrade initiative, America First Credit Union would also install DN Series ATMs to offer new member-centric experiences and more secure banking interactions to its members.

- In February 2020, GLORY LIMITED acquired 53% of shares in Cash Payment Solutions GmbH (CPS), which develops and provides online cash settlement platforms under the brands Barzahlen and via cash.

Frequently Asked Questions (FAQ):

What is the current size of the global bank kiosk market?

The bank kiosk market is expected to grow from USD 744 million in 2021 to USD 1,311 million by 2026, at a CAGR of 12.0%.

Who are the winners in the global bank kiosk market?

Some of the key companies operating in the bank kiosk market are NCR Corporation (US), Diebold Nixdorf (US), GLORY LIMITED (Japan), GRGBanking (China), KAL ATM Software GmbH (Germany), and so on. These players have adopted various growth strategies such as product launches/developments, partnerships/contracts/ collaborations/acquisitions to expand their global presence and increase their share in the global bank kiosk market.

What are the major drivers for the bank kiosk market?

The factors such as rising demand for self-service in banking and financial services applications, enhanced customer services offered by banking kiosks, and reduction in overall operational costs have proved to be the major driving forces for bank reality market.

Which is the highest growing kiosk by type in the bank kiosk market?

Multi-function Kiosk held the highest share in 2020. Factors such as less capital expenditure in application development, equipment purchases, installation, and maintenance are pushing the banks to adopt multi-function kiosks over single-function kiosks.

What are the impact of COVID-19 on the global bank kiosk market?

The COVID-19 outbreak has adversely impacted the supply chain of the bank kiosk market, as some of the prominent players are based in China, which is the epicenter of the pandemic. Currently, the key market players are focusing on maintaining and generating operating revenue, due to which there were limited developments in the market in 2020. However, the impact of COVID-19 is expected to reduce during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKET COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Secondary sources

2.1.2.2 List of key secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary sources

2.1.3.2 Key industry insights

2.1.3.3 Primary interviews with experts

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION—APPROACH 1 (SUPPLY SIDE): CALCULATION OF MARKET SIZE THROUGH REVENUE OF KEY PLAYERS

FIGURE 3 MARKET SIZE ESTIMATION—APPROACH 2 (DEMAND SIDE): CALCULATION OF MARKET SIZE THROUGH DEMAND FOR DIFFERENT TYPES OF KIOSKS

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Estimating market size using bottom-up analysis (demand side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Estimating market size using top-down approach (supply side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 7 BANK KIOSK MARKET: OPTIMISTIC, REALISTIC, AND PESSIMISTIC SCENARIO ANALYSIS, 2017–2026

3.1 MARKET: REALISTIC SCENARIO (POST-COVID-19)

3.2 MARKET: OPTIMISTIC SCENARIO (POST-COVID-19)

3.3 MARKET: PESSIMISTIC SCENARIO (POST-COVID-19)

FIGURE 8 SOFTWARE OFFERING SEGMENT TO REGISTER HIGHEST CAGR IN BANK KIOSK MARKET DURING FORECAST PERIOD

FIGURE 9 MULTI-FUNCTION KIOSK SEGMENT EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 10 INDOOR LOCATION SEGMENT EXPECTED TO HOLD LARGER SHARE OF MARKET DURING FORECAST PERIOD

FIGURE 11 APAC HELD LARGEST SHARE OF MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 MAJOR OPPORTUNITIES IN BANK KIOSK MARKET

FIGURE 12 MARKET TO REGISTER HIGHEST CAGR IN APAC DURING FORECAST PERIOD

4.2 MARKET, BY TYPE

FIGURE 13 MULTI-FUNCTION KIOSK TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

4.3 MARKET, BY DISTRIBUTION

FIGURE 14 URBAN DISTRIBUTION SEGMENT IS EXPECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.4 BANK KIOSK MARKET IN APAC, BY TYPE AND COUNTRY

FIGURE 15 CHINA HELD LARGEST SHARE OF MARKET IN APAC IN 2020

4.5 MARKET, BY GEOGRAPHY

FIGURE 16 MARKET IN INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 RISING DEMAND FOR SELF-SERVICE WOULD DRIVE BANK KIOSK MARKET DURING FORECAST PERIOD

5.2.1 DRIVERS

5.2.1.1 Rising demand for self-service in banking and financial services

5.2.1.2 Enhanced customer services offered by bank kiosks

FIGURE 18 PREFERRED METHOD OF COMMUNICATION WITH BANKS BY VARIOUS AGE GROUPS IN US

5.2.1.3 Reduction in overall operational costs

FIGURE 19 IMPACT ANALYSIS: DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Increasing use of mobile devices for banking services

5.2.2.2 High installation costs and need for regular maintenance

5.2.2.3 Increasing incidents of cybercrimes

FIGURE 20 IMPACT ANALYSIS: RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Introduction of NFC-based contactless payments in banking sector in APAC region

5.2.3.2 Increasing investments by companies in Asia Pacific

FIGURE 21 IMPACT ANALYSIS: OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Controlling cybersecurity threats

5.2.4.2 Continuously growing demand for improved technology

FIGURE 22 IMPACT ANALYSIS: CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED IN ASSEMBLY & MANUFACTURING, SOFTWARE PROVIDERS, TECHNOLOGY PROVIDERS, AND SYSTEM INTEGRATORS PHASES

5.4 REGULATORY LANDSCAPE

5.5 PORTER’S FIVE FORCES ANALYSIS

FIGURE 24 BANK KIOSK MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 1 THREAT OF SUBSTITUTES LIKELY TO HAVE LOW IMPACT ON OVERALL MARKET

5.5.1 INTENSITY OF COMPETITIVE RIVALRY

5.5.2 THREAT OF SUBSTITUTES

5.5.3 BARGAINING POWER OF BUYERS

5.5.4 BARGAINING POWER OF SUPPLIERS

5.5.5 THREAT OF NEW ENTRANTS

5.6 ECOSYSTEM ANALYSIS

TABLE 2 BANK KIOSK MARKET: ECOSYSTEM

FIGURE 25 KEY MARKETS RELATED TO BANK KIOSK ECOSYSTEM

5.7 TECHNOLOGY ANALYSIS

5.7.1 FACIAL RECOGNITION

5.7.2 DIGITAL AVATARS

5.8 CASE STUDIES

5.8.1 BRANCH PROCESSES ARE TRANSFORMED THROUGH TELLER CASH RECYCLING

5.8.2 SKIMMING PROTECTION SOLUTION ELIMINATES CARD SKIMMING LOSSES

5.8.3 SAUDI INVESTMENT BANK IMPROVES ORIGINATION BY CREATING FUTURISTIC BRANCH

5.8.4 BANK ALFALAH DEPLOYS SELF-SERVICE CASH DEPOSIT SOLUTION

5.8.5 BANQUE POPULAIRE INSTALLED SMART SAFES IN ITS BRANCHES

FIGURE 26 TRENDS IMPACTING BUSINESSES OF CUSTOMERS

5.9 PATENTS ANALYSIS

TABLE 3 PATENTS RELATED TO BANK KIOSK MARKET

5.10 AVERAGE SELLING PRICE (ASP) TREND

TABLE 4 ASP OF DIFFERENT TYPES OF BANK KIOSKS, 2020

FIGURE 27 TREND OF AVERAGE SELLING PRICES FOR DIFFERENT TYPES OF BANK KIOSKS

5.11 TRADE ANALYSIS

FIGURE 28 IMPORTS DATA FOR PARTS OF AUTOMATIC GOODS-VENDING MACHINES, INCL. MONEY CHANGING MACHINES, N.E.S., BY COUNTRY, 2016–2020 (USD THOUSAND)

FIGURE 29 EXPORTS DATA FOR PARTS OF AUTOMATIC GOODS-VENDING MACHINES, INCL. MONEY CHANGING MACHINES, N.E.S., BY COUNTRY, 2016–2020 (USD THOUSAND)

6 BANK KIOSK MARKET, BY TYPE (Page No. - 73)

6.1 INTRODUCTION

FIGURE 30 BANK KIOSK MARKET: BY TYPE

FIGURE 31 MULTI-FUNCTION KIOSK SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 5 MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 6 MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 7 MARKET, BY TYPE, 2017–2020 (THOUSAND UNITS)

TABLE 8 MARKET, BY TYPE, 2021–2026 (THOUSAND UNITS)

6.2 SINGLE-FUNCTION KIOSK

FIGURE 32 CATEGORIES OF SINGLE-FUNCTION KIOSKS

TABLE 9 SINGLE-FUNCTION KIOSK MARKET, BY OFFERING, 2017–2020 (USD THOUSAND)

TABLE 10 SINGLE-FUNCTION KIOSK MARKET, BY OFFERING, 2021–2026 (USD THOUSAND)

TABLE 11 SINGLE-FUNCTION KIOSK MARKET, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 12 SINGLE-FUNCTION KIOSK MARKET, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 13 SINGLE-FUNCTION KIOSK MARKET IN AMERICAS, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 14 SINGLE-FUNCTION KIOSK MARKET IN AMERICAS, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 15 SINGLE-FUNCTION KIOSK MARKET IN EUROPE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 16 SINGLE-FUNCTION KIOSK MARKET IN EUROPE, BY REGION, 2021–2026 (USD THOUSAND)

6.2.1 BILL PAYMENT KIOSK

6.2.1.1 Bill payment kiosks allow on-demand business transactions

6.2.2 CHECK DEPOSIT KIOSK

6.2.2.1 Check deposit kiosks enable automatic check collection and receipt printing

6.2.3 CARD DISPENSER

6.2.3.1 Card dispensers are essential to card-based transactions in self-service kiosks

6.2.4 PASSBOOK PRINTER

6.2.4.1 Passbook printers are used to print account statement or passbooks

6.3 MULTI-FUNCTION KIOSK

6.3.1 INCREASING CONSUMER ACCEPTANCE AND GROWING USE ACROSS NUMEROUS APPLICATIONS IN BANKING SECTOR TO DRIVE DEMAND FOR MULTI-FUNCTION KIOSKS

TABLE 17 MULTI-FUNCTION KIOSK MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 18 MULTI-FUNCTION KIOSK MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 19 MULTI-FUNCTION KIOSK MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 20 MULTI-FUNCTION KIOSK MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 21 MULTI-FUNCTION KIOSK MARKET IN AMERICAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 22 MULTI-FUNCTION KIOSK MARKET IN AMERICAS, BY REGION, 2021–2026 (USD MILLION)

TABLE 23 MULTI-FUNCTION KIOSK MARKET IN EUROPE, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 MULTI-FUNCTION KIOSK MARKET IN EUROPE, BY REGION, 2021–2026 (USD MILLION)

6.4 VIRTUAL/VIDEO TELLER MACHINE

6.4.1 VIRTUAL/VIDEO TELLER MACHINES OFFER REMOTE ASSISTANCE FOR COMPLEX BANKING TRANSACTIONS

TABLE 25 VIRTUAL/VIDEO TELLER MACHINE MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 26 VIRTUAL/VIDEO TELLER MACHINE MARKET, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 27 VIRTUAL/VIDEO TELLER MACHINE MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 VIRTUAL/VIDEO TELLER MACHINE MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 29 VIRTUAL/VIDEO TELLER MACHINE MARKET IN AMERICAS, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 30 VIRTUAL/VIDEO TELLER MACHINE MARKET IN AMERICAS, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 31 VIRTUAL/VIDEO TELLER MACHINE MARKET IN EUROPE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 32 VIRTUAL/VIDEO TELLER MACHINE MARKET IN EUROPE, BY REGION, 2021–2026 (USD THOUSAND)

7 BANK KIOSK MARKET, BY OFFERING (Page No. - 85)

7.1 INTRODUCTION

FIGURE 33 BANK KIOSK MARKET: BY OFFERING

FIGURE 34 SOFTWARE SEGMENT TO GROW AT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 33 MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 34 MARKET, BY OFFERING, 2021–2026 (USD MILLION)

7.2 HARDWARE

TABLE 35 BANK KIOSK MARKET FOR HARDWARE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 36 MARKET FOR HARDWARE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 37 MARKET FOR HARDWARE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 38 MARKET FOR HARDWARE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 39 BANK KIOSK MARKET FOR HARDWARE, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 MARKET FOR HARDWARE, BY REGION, 2021–2026 (USD MILLION)

TABLE 41 MARKET FOR HARDWARE IN AMERICAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 MARKET FOR HARDWARE IN AMERICAS, BY REGION, 2021–2026 (USD MILLION)

7.2.1 CARD READERS

7.2.1.1 Card readers decode information in credit and debit card microchips

7.2.2 CARD DISPENSING MACHINES

7.2.2.1 Card dispensing machines are used for card vending applications in various self-service industries

7.2.3 PRINTERS

7.2.3.1 Printers are used to print account statement on passbooks

7.2.4 TOUCHSCREENS

7.2.4.1 Touchscreens play vital role in bank kiosks

7.2.5 KEYBOARDS

7.2.5.1 Keyboards are used for entering data pertaining to banking transactions

7.2.6 BARCODE READERS AND SCANNERS

7.2.6.1 Barcode readers and scanners scan encrypted code to get information

7.3 SOFTWARE

TABLE 43 BANK KIOSK MARKET FOR SOFTWARE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 44 MARKET FOR SOFTWARE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 45 MARKET FOR SOFTWARE, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 MARKET FOR SOFTWARE, BY REGION, 2021–2026 (USD MILLION)

TABLE 47 MARKET FOR SOFTWARE IN AMERICAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 MARKET FOR SOFTWARE IN AMERICAS, BY REGION, 2021–2026 (USD MILLION)

7.3.1 REMOTE DEVICE MANAGEMENT

7.3.1.1 Remote device management software enables remote changes in kiosk functions and operations

7.3.2 USAGE ANALYTICS SOFTWARE

7.3.2.1 Usage analytics software determine current usage rate and insights

7.3.3 CONTENT MANAGEMENT SOFTWARE

7.3.3.1 Content management software enable digital content management across an organization

7.3.4 APPLICATION DEVELOPMENT PLATFORM

7.3.4.1 Application development platform delivers licensable code modules for bill payment transaction requirements

7.3.5 MULTIVENDOR SOFTWARE

7.3.5.1 Multivendor software offers individual administration area for real-time information about business

7.4 SERVICES

7.4.1 SERVICES INCLUDE PLANNING, DEPLOYMENT, INSTALLATION, TRAINING, MAINTENANCE, UPGRADE, AND TECHNICAL SUPPORT

TABLE 49 BANK KIOSK MARKET FOR SERVICES, BY TYPE, 2017–2020 (USD MILLION)

TABLE 50 MARKET FOR SERVICES, BY TYPE, 2021–2026 (USD MILLION)

TABLE 51 MARKET FOR SERVICES, BY REGION, 2017–2020 (USD MILLION)

TABLE 52 MARKET FOR SERVICES, BY REGION, 2021–2026 (USD MILLION)

TABLE 53 MARKET FOR SERVICES IN AMERICAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 MARKET FOR SERVICES IN AMERICAS, BY REGION, 2021–2026 (USD MILLION)

8 BANK KIOSK MARKET, BY LOCATION (Page No. - 98)

8.1 INTRODUCTION

FIGURE 35 MARKET: BY LOCATION

FIGURE 36 INDOOR SEGMENT TO HOLD LARGER SHARE OF MARKET IN 2021

TABLE 55 MARKET, BY LOCATION, 2017–2020 (USD MILLION)

TABLE 56 MARKET, BY LOCATION, 2021–2026 (USD MILLION)

8.2 INDOOR

8.2.1 INDOOR KIOSKS OFFER VIABLE ALTERNATIVE IN CLOSED ENVIRONMENTS

8.3 OUTDOOR

8.3.1 OUTDOOR KIOSKS SHOULD PROVIDE DURABILITY TO SURVIVE AND FUNCTION IN VARYING ENVIRONMENTAL CONDITIONS

9 BANK KIOSK MARKET, BY DISTRIBUTION (Page No. - 101)

9.1 INTRODUCTION

FIGURE 37 MARKET: BY DISTRIBUTION

FIGURE 38 MARKET FOR URBAN DISTRIBUTION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 57 MARKET, BY DISTRIBUTION, 2017–2020 (USD MILLION)

TABLE 58 MARKET, BY DISTRIBUTION, 2021–2026 (USD MILLION)

9.2 RURAL

9.2.1 RURAL SEGMENT HAS POTENTIAL FOR FURTHER PENETRATION OF BANK KIOSKS

TABLE 59 BANK KIOSK MARKET FOR RURAL DISTRIBUTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 60 MARKET FOR RURAL DISTRIBUTION, BY REGION, 2021–2026 (USD MILLION)

TABLE 61 MARKET FOR RURAL DISTRIBUTION IN AMERICAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 62 MARKET FOR RURAL DISTRIBUTION IN AMERICAS, BY REGION, 2021–2026 (USD MILLION)

9.3 SEMI-URBAN

9.3.1 GOVERNMENT INITIATIVES GOING TO BOOST DIGITAL PAYMENTS AND INCREASE ACCESS TO FINANCIAL SERVICES DRIVE WOULD DEMAND IN SEMI-URBAN AREAS

TABLE 63 MARKET FOR SEMI-URBAN DISTRIBUTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 64 MARKET FOR SEMI-URBAN DISTRIBUTION, BY REGION, 2021–2026 (USD MILLION)

TABLE 65 MARKET FOR SEMI-URBAN DISTRIBUTION IN AMERICAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 66 MARKET FOR SEMI-URBAN DISTRIBUTION IN AMERICAS, BY REGION, 2021–2026 (USD MILLION)

9.4 URBAN

9.4.1 URBAN DISTRIBUTION TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 67 BANK KIOSK MARKET FOR URBAN DISTRIBUTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 68 MARKET FOR URBAN DISTRIBUTION, BY REGION, 2021–2026 (USD MILLION)

TABLE 69 MARKET FOR URBAN DISTRIBUTION IN AMERICAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 70 MARKET FOR URBAN DISTRIBUTION IN AMERICAS, BY REGION, 2021–2026 (USD MILLION)

9.5 METROPOLITAN

9.5.1 METROPOLITAN DISTRIBUTION TO HAVE HIGH ADOPTION OF BANK KIOSKS DUE TO MORE EDUCATED AND TECH-SAVVY DEMOGRAPHY

TABLE 71 MARKET FOR METROPOLITAN DISTRIBUTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 72 MARKET FOR METROPOLITAN DISTRIBUTION, BY REGION, 2021–2026 (USD MILLION)

TABLE 73 MARKET FOR METROPOLITAN DISTRIBUTION IN AMERICAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 74 MARKET FOR METROPOLITAN DISTRIBUTION IN AMERICAS, BY REGION, 2021–2026 (USD MILLION)

10 GEOGRAPHICAL ANALYSIS (Page No. - 110)

10.1 INTRODUCTION

FIGURE 39 BANK KIOSK MARKET: BY GEOGRAPHY

TABLE 75 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 76 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2 AMERICAS

FIGURE 40 SEGMENTATION OF BANK KIOSK IN AMERICAS

FIGURE 41 SNAPSHOT OF BANK KIOSK IN AMERICAS

TABLE 77 MARKET IN AMERICAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 78 MARKET IN AMERICAS, BY REGION, 2021–2026 (USD MILLION)

TABLE 79 BANK KIOSK MARKET IN AMERICAS, BY DISTRIBUTION, 2017–2020 (USD MILLION)

TABLE 80 MARKET IN AMERICAS, BY DISTRIBUTION, 2021–2026 (USD MILLION)

TABLE 81 MARKET IN AMERICAS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 82 MARKET IN AMERICAS, BY TYPE, 2021–2026 (USD MILLION)

10.2.1 IMPACT OF COVID-19 ON BANK KIOSK MARKET IN AMERICAS

FIGURE 42 MARKET IN AMERICAS: ANALYSIS OF PRE- AND POST-COVID-19 SCENARIOS

10.2.2 NORTH AMERICA

TABLE 83 BANK KIOSK MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 84 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 85 MARKET IN NORTH AMERICA, BY DISTRIBUTION, 2017–2020 (USD MILLION)

TABLE 86 MARKET IN NORTH AMERICA, BY DISTRIBUTION, 2021–2026 (USD MILLION)

TABLE 87 MARKET IN NORTH AMERICA, BY TYPE, 2017–2020 (USD THOUSAND)

TABLE 88 MARKET IN NORTH AMERICA, BY TYPE, 2021–2026 (USD THOUSAND)

10.2.2.1 US

10.2.2.1.1 Advancement in the bank kiosk technology widens application areas of interactive kiosk across various verticals

10.2.2.2 Canada

10.2.2.2.1 Adoption of EMV standards helps reduce card cloning frauds

10.2.2.3 Rest of North America

10.2.3 LATIN AMERICA

TABLE 89 BANK KIOSK MARKET IN LATIN AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 90 MARKET IN LATIN AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 91 MARKET IN LATIN AMERICA, BY DISTRIBUTION, 2017–2020 (USD MILLION)

TABLE 92 MARKET IN LATIN AMERICA, BY DISTRIBUTION, 2021–2026 (USD MILLION)

TABLE 93 MARKET IN LATIN AMERICA, BY TYPE, 2017–2020 (USD THOUSAND)

TABLE 94 MARKET IN LATIN AMERICA, BY TYPE, 2021–2026 (USD THOUSAND)

10.2.3.1 Brazil

10.2.3.1.1 Check payment transactions are considered to be more legal and secure across Brazil

10.2.3.2 Rest of Latin America

10.3 EUROPE

FIGURE 43 SEGMENTATION OF BANK KIOSK MARKET IN EUROPE

FIGURE 44 SNAPSHOT OF BANK KIOSK IN EUROPE

TABLE 95 MARKET IN EUROPE, BY REGION, 2017–2020 (USD MILLION)

TABLE 96 MARKET IN EUROPE, BY REGION, 2021–2026 (USD MILLION)

TABLE 97 MARKET IN EUROPE, BY DISTRIBUTION, 2017–2020 (USD MILLION)

TABLE 98 MARKET IN EUROPE, BY DISTRIBUTION, 2021–2026 (USD MILLION)

TABLE 99 MARKET IN EUROPE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 100 MARKET IN EUROPE, BY TYPE, 2021–2026 (USD MILLION)

10.3.1 IMPACT OF COVID-19 ON BANK KIOSK MARKET IN EUROPE

FIGURE 45 MARKET IN EUROPE: ANALYSIS OF PRE- AND POST-COVID-19 SCENARIOS

10.3.2 WESTERN EUROPE

TABLE 101 MARKET IN WESTERN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 102 MARKET IN WESTERN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 103 MARKET IN WESTERN EUROPE, BY TYPE, 2017–2020 (USD THOUSAND)

TABLE 104 MARKET IN WESTERN EUROPE, BY TYPE, 2021–2026 (USD THOUSAND)

10.3.2.1 Germany

10.3.2.1.1 Electronic banking offers an independent platform for banks

10.3.2.2 UK

10.3.2.2.1 Contactless payments are considered more reliable for transactions across UK

10.3.2.3 Italy

10.3.2.3.1 Standardization of global transactions business has improved banking infrastructure and ecosystem in Italy

10.3.2.4 France

10.3.2.4.1 Digital revolution in France has led to development of Paylib service

10.3.2.5 Rest of Western Europe

10.3.3 EASTERN EUROPE

TABLE 105 BANK KIOSK MARKET IN EASTERN EUROPE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 106 MARKET IN EASTERN EUROPE, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 107 MARKET IN EASTERN EUROPE, BY TYPE, 2017–2020 (USD THOUSAND)

TABLE 108 MARKET IN EASTERN EUROPE, BY TYPE, 2021–2026 (USD THOUSAND)

10.3.3.1 Russia

10.3.3.1.1 Implementation of cash change function allows customers to pay for specific services

10.3.3.2 Rest of Eastern Europe

10.3.4 REST OF EUROPE

TABLE 109 MARKET IN REST OF EUROPE, BY TYPE, 2017–2020 (USD THOUSAND)

TABLE 110 MARKET IN REST OF EUROPE, BY TYPE, 2021–2026 (USD THOUSAND)

10.4 APAC

FIGURE 46 SEGMENTATION OF BANK KIOSK IN APAC

FIGURE 47 SNAPSHOT OF BANK KIOSK IN APAC

TABLE 111 BANK KIOSK MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 112 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 113 MARKET IN APAC, BY DISTRIBUTION, 2017–2020 (USD MILLION)

TABLE 114 MARKET IN APAC, BY DISTRIBUTION, 2021–2026 (USD MILLION)

TABLE 115 MARKET IN APAC, BY TYPE, 2017–2020 (USD MILLION)

TABLE 116 MARKET IN APAC, BY TYPE, 2021–2026 (USD MILLION)

10.4.1 IMPACT OF COVID-19 ON BANK KIOSK MARKET IN APAC

FIGURE 48 MARKET IN APAC: ANALYSIS OF PRE- AND POST-COVID-19 SCENARIOS

10.4.2 INDIA

10.4.2.1 Customer-centric touchpoints enable gains in operational efficiency of financial Institutions

10.4.3 CHINA

10.4.3.1 Demand for digital solutions in banking leads to rapid expansion of market

10.4.4 JAPAN

10.4.4.1 Implementation of fintech to revamp banking infrastructure is expected to boost demand for bank kiosks

10.4.5 SOUTH KOREA

10.4.5.1 Cost-effective banking services to reach unbanked population drive South Korean bank kiosk market

10.4.6 AUSTRALIA

10.4.6.1 Government supports financial innovation by adopting fintech

10.4.7 REST OF APAC

10.5 ROW

FIGURE 49 SEGMENTATION OF BANK KIOSK MARKET IN REST OF THE WORLD

TABLE 117 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 118 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 119 MARKET IN ROW, BY DISTRIBUTION, 2017–2020 (USD THOUSAND)

TABLE 120 MARKET IN ROW, BY DISTRIBUTION, 2021–2026 (USD THOUSAND)

TABLE 121 MARKET IN ROW, BY TYPE, 2017–2020 (USD THOUSAND)

TABLE 122 MARKET IN ROW, BY TYPE, 2021–2026 (USD THOUSAND)

10.5.1 IMPACT OF COVID-19 ON BANK KIOSK MARKET IN ROW

FIGURE 50 MARKET IN ROW: ANALYSIS OF PRE- AND POST-COVID-19 SCENARIOS

10.5.2 MIDDLE EAST

10.5.2.1 Launch of video teller technology in interactive kiosks helps provide additional banking services to customers across Middle East

10.5.3 AFRICA

10.5.3.1 Single-function kiosks are being adopted more than multi-function kiosks in Africa

11 COMPETITIVE LANDSCAPE (Page No. - 138)

11.1 INTRODUCTION

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MARKET

11.3 REVENUE ANALYSIS

FIGURE 51 5-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN MARKET, 2016–2020

11.4 MARKET SHARE ANALYSIS

FIGURE 52 MARKET SHARE ANALYSIS OF KEY PLAYERS IN MARKET IN 2020

TABLE 123 BANK KIOSK MARKET: DEGREE OF COMPETITION

TABLE 124 MARKET: RANKING ANALYSIS

11.5 COMPANY EVALUATION QUADRANT, 2020

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE

11.5.4 PARTICIPANT

FIGURE 53 BANK KIOSK MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2020

11.6 MARKET: COMPANY FOOTPRINT

11.6.1 COMPANY FOOTPRINT, BY OFFERING

11.6.2 COMPANY FOOTPRINT, BY REGION

11.6.3 COMPANY PRODUCT FOOTPRINT

11.7 STARTUP/SME EVALUATION QUADRANT, 2020

11.7.1 PROGRESSIVE COMPANY

11.7.2 RESPONSIVE COMPANY

11.7.3 DYNAMIC COMPANY

11.7.4 STARTING BLOCK

FIGURE 54 BANK KIOSK MARKET (GLOBAL) STARTUP/SME EVALUATION QUADRANT, 2020

11.8 COMPETITIVE SITUATIONS AND TRENDS

11.8.1 NEW PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 125 MARKET: NEW PRODUCT LAUNCHES/DEVELOPMENTS, 2019–2021

11.8.2 DEALS

TABLE 126 MARKET: DEALS, 2019–2021

12 COMPANY PROFILES (Page No. - 152)

(Business Overview, Products/solutions/services offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 INTRODUCTION

12.2 KEY PLAYERS

12.2.1 NCR CORPORATION

TABLE 127 NCR CORPORATION: BUSINESS OVERVIEW

FIGURE 55 NCR CORPORATION: COMPANY SNAPSHOT

TABLE 128 NCR CORPORATION: PRODUCT LAUNCHES

TABLE 129 NCR CORPORATION: DEALS

12.2.2 DIEBOLD NIXDORF

TABLE 130 DIEBOLD NIXDORF: BUSINESS OVERVIEW

FIGURE 56 DIEBOLD NIXDORF: COMPANY SNAPSHOT

TABLE 131 DIEBOLD NIXDORF: DEALS

12.2.3 GLORY LIMITED

TABLE 132 GLORY LIMITED: BUSINESS OVERVIEW

FIGURE 57 GLORY LIMITED: COMPANY SNAPSHOT

TABLE 133 GLORY LIMITED: DEALS

12.2.4 GRGBANKING

TABLE 134 GRGBANKING: BUSINESS OVERVIEW

FIGURE 58 GRGBANKING: COMPANY SNAPSHOT

TABLE 135 GRGBANKING: PRODUCT LAUNCHES

TABLE 136 GRGBANKING: DEALS

12.2.5 KAL ATM SOFTWARE GMBH

TABLE 137 KAL ATM SOFTWARE GMBH: BUSINESS OVERVIEW

TABLE 138 KAL ATM SOFTWARE GMBH: PRODUCT LAUNCHES

TABLE 139 KAL ATM SOFTWARE GMBH: DEALS

12.2.6 OKI ELECTRIC INDUSTRY CO., LTD.

TABLE 140 OKI ELECTRIC INDUSTRY CO., LTD.: BUSINESS OVERVIEW

FIGURE 59 OKI ELECTRIC INDUSTRY CO., LTD.: COMPANY SNAPSHOT

TABLE 141 OKI ELECTRIC INDUSTRY CO., LTD.: DEALS

12.2.7 AURIGA SPA

TABLE 142 AURIGA SPA: BUSINESS OVERVIEW

TABLE 143 AURIGA SPA: PRODUCT LAUNCHES

TABLE 144 AURIGA SPA: DEALS

12.2.8 HITACHI-OMRON TERMINAL SOLUTIONS, CORP.

TABLE 145 HITACHI-OMRON TERMINAL SOLUTIONS, CORP.: BUSINESS OVERVIEW

TABLE 146 HITACHI-OMRON TERMINAL SOLUTIONS, CORP.: DEALS

12.2.9 CISCO SYSTEMS, INC.

TABLE 147 CISCO SYSTEMS, INC.: BUSINESS OVERVIEW

FIGURE 60 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

TABLE 148 CISCO SYSTEMS, INC.: DEALS

12.2.10 STAR MICRONICS CO., LTD.

TABLE 149 STAR MICRONICS CO., LTD.: BUSINESS OVERVIEW

FIGURE 61 STAR MICRONICS CO., LTD.: COMPANY SNAPSHOT

TABLE 150 STAR MICRONICS CO., LTD.: PRODUCT LAUNCHES

12.3 OTHER PLAYERS

12.3.1 AURIONPRO SOLUTION LIMITED

12.3.2 SHENZHEN SUI-YI TOUCH COMPUTER CO., LTD.

12.3.3 OLICOM

12.3.4 IAGONA

12.3.5 HYOSUNG TNS INC.

12.3.6 GENMEGA INC.

12.3.7 AXIOMTEK CO., LTD.

12.3.8 EMERICO LIMITED

12.3.9 SHENZHEN YIHUA SMART EQUIPMENT TECHNOLOGY CO., LTD.

12.3.10 PHOENIX MICROSYSTEMS

12.3.11 WAVETEC

12.3.12 VERIPARK

12.3.13 PRINTEC GROUP

12.3.14 AGS TRANSACT TECHNOLOGIES LTD.

12.3.15 PARTTEAM & OEMKIOSKS

*Details on Business Overview, Products/solutions/services offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 198)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

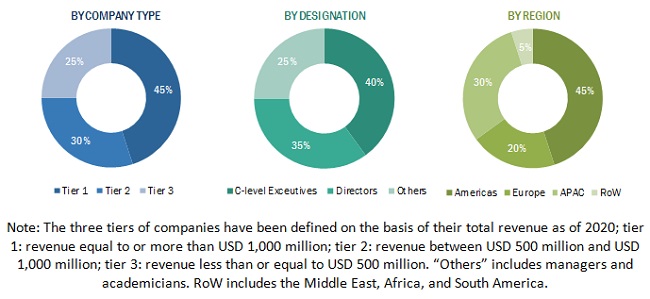

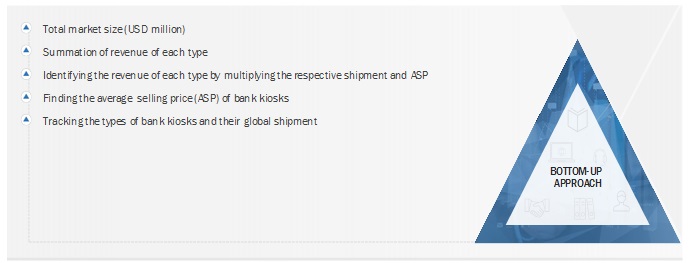

The study involved four major activities in estimating the size of the bank kiosk market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with power bank industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market’s size. After that, market breakdown and data triangulation were used to determine the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. Secondary sources include government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated by primary research.

Primary Research

Extensive primary research was conducted after understanding and analyzing the bank kiosk market scenario through secondary research. Several primary interviews were conducted with market experts from demand and supply side across 4 major regions—Americas, Europe, APAC, and RoW. Of the total primary interviews, 20% were conducted with demand-side vendors and 80% with supply-side respondents. Primary data was collected through questionnaires, e-mails, and telephonic interviews.

After interacting with power bank industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the bank kiosk market. These methods were also extensively used to estimate the sizes of various market sub-segments. The research methodology used to estimate the market sizes includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global Bank Kiosk Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define and forecast the bank kiosk market size, by offering, type, distribution, and location, in terms of value

- To describe and forecast the bank kiosk market size in 4 key regions: Americas, Europe, Asia Pacific (APAC), and Rest of the World (RoW), along with the key countries in each region

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the bank kiosk market

- To provide a detailed impact of COVID-19 on the bank kiosk market

- To provide the impact of COVID-19 on the market segments and the market players

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the bank kiosk ecosystem

- To strategically profile key players, comprehensively analyze their market position in terms of ranking and core competencies2, and provide details of the competitive landscape of the market

- To analyze strategic approaches such as product launches, acquisitions, agreements, and partnerships in the bank kiosk market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bank Kiosk Market