AI in Supply Chain Market Size, Share Analysis

AI in Supply Chain Market by Offering (Software, Services), Deployment (Cloud, On-premises, Hybrid), Application (Demand Planning & Forecasting, Warehouse & Transportation Management, Supply Chain Risk Management) - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The AI in supply chain market is projected to reach USD 50.41 billion by 2032 from USD 13.93 billion in 2025, at a CAGR of 20.1%. The market is experiencing strong growth driven by increasing supply chain complexity, rising demand volatility, and the need for real-time decision-making. Enterprises are adopting AI-powered software and cloud-based platforms to improve demand forecasting, inventory optimization, logistics efficiency, and risk management. Growing digital transformation initiatives and the focus on supply chain resilience further accelerate market expansion.

KEY TAKEAWAYS

-

BY REGIONNorth America is estimated to dominate the AI in supply chain market with a 36.7% share in 2025.

-

BY OFFERINGBy offering, the software segment held the largest share in the AI in supply chain market in 2024.

-

BY DEPLOYMENTCloud deployment is projected to grow at a high CAGR of 21.8% in the AI in supply chain market from 2025 to 2032.

-

BY ORGANIZATION SIZEBy organization size, the small & medium organizations segment is estimated to grow at a high CAGR during the forecast period.

-

BY APPLICATIONBy application, warehouse and transport management is set to grow at the highest CAGR of 22.9% during the forecast period.

-

BY END-USE INDUSTRYBy end-use industry, the retail segment to dominate the AI in supply chain market in 2024.

-

Competitive Landscape - KEY PLAYERSSAP SE, Oracle, Blue Yonder Group, Inc., and Manhattan Associates were identified as some of the star players in the AI in supply chain market, given their strong market share and product footprint.

-

Competitive Landscape - STARTUPS/SMESAltana, o9 Solutions, and Project44, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The AI in supply chain market is witnessing robust growth due to rising supply chain complexity, increasing demand volatility, and the growing need for predictive and data-driven decision-making. Organizations are increasingly adopting AI-powered software and cloud-based platforms to enhance demand planning, inventory management, logistics optimization, and risk mitigation. Additionally, expanding e-commerce activities, digital transformation initiatives, and the focus on building resilient and agile supply chains are further accelerating market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The AI in supply chain market is undergoing significant disruption as enterprises move from rule-based planning and reactive operations toward intelligent, data-driven supply chain orchestration. Emerging trends such as predictive and prescriptive analytics, generative AI-enabled decision intelligence, autonomous planning systems, and real-time supply chain visibility are reshaping customer business models. Increased integration of AI with cloud platforms, IoT, and digital twins is enabling faster decision-making, improved resilience, and enhanced customer experience across retail, manufacturing, logistics, and distribution networks.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing implementation of big data and AI technologies

-

Need for enhanced visibility in supply chain processes

Level

-

Shortage of skilled workforce

-

Security and data privacy concerns

Level

-

Surge in demand for intelligent business processes and automation

-

Improved operational efficiency with AI

Level

-

Difficulties in seamless data integration

-

Inconsistent data quality and availability

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing implementation of big data and AI technologies

The increasing availability of large volumes of structured and unstructured supply chain data is driving the adoption of AI-powered solutions. Enterprises are leveraging big data analytics and machine learning to improve demand forecasting, inventory optimization, and logistics efficiency. This shift toward data-driven operations is accelerating AI deployment across end-to-end supply chain processes.

Restraint: Shortage of skilled workforce

The adoption of AI in supply chain operations is constrained by a shortage of skilled professionals capable of managing AI models and advanced analytics platforms. Many organizations face challenges in recruiting and retaining talent with expertise in data science, AI engineering, and supply chain domain knowledge. This skills gap slows implementation timelines and limits the effective utilization of AI technologies.

Opportunity: Surge in demand for intelligent business processes and automation

Rising pressure to improve operational efficiency and responsiveness is creating strong demand for intelligent and automated supply chain processes. AI-driven automation enables real-time decision-making, predictive planning, and autonomous execution across procurement, production, and logistics. This trend presents significant growth opportunities for AI solution providers targeting scalable and industry-specific supply chain applications.

Challenge: Difficulties in seamless data integration

Integrating data from multiple sources, such as ERP, WMS, TMS, and external partners, remains a major challenge for AI-driven supply chains. Data silos, inconsistent data formats, and poor data quality limit the accuracy and effectiveness of AI models. Overcoming these integration challenges is critical to realizing the full value of AI across complex supply chain networks.

AI IN SUPPLY CHAIN MARKET SIZE, SHARE ANALYSIS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

AI-enabled field service management using SAP Field Service Management to analyze and summarize historical equipment activity data, including spare parts usage, service durations, and checklist results, supporting faster issue diagnosis and efficient technician dispatching | Up to 65% improvement in field service productivity | 5% increase in first-time fix rates | Faster issue resolution | Smarter technician assignment | Improved service planning efficiency |

|

Cloud-based, AI-driven category management and assortment optimization deployed on Microsoft Azure to localize assortments, optimize shelf space, and automate replenishment | Improved on-shelf availability | Reduced out-of-stocks and obsolete inventory | Increased profitability | Localized assortment optimization | Rapid ROI through scalable cloud deployment |

|

Migration of warehouse management system to an AI-driven, cloud-based platform with real-time inventory tracking, analytics, and mobile voice integration across 19 distribution centers | 35% increase in warehouse productivity | Improved accuracy and visibility | Lower operational costs | Enhanced scalability | Faster response to demand fluctuations |

|

Blockchain-based platform to secure the pharmaceutical supply chain by enabling end-to-end traceability and verification of drugs to prevent counterfeiting and fraud | Enhanced drug traceability | Reduced counterfeit risks | Improved regulatory compliance | Greater supply chain transparency | Strengthened drug safety and security |

|

Deployment of Microsoft Copilot for Microsoft 365 to enhance collaboration, automate workflows, and optimize internal processes across complex energy operations | Improved operational efficiency | Enhanced collaboration | Streamlined workflows | Better data utilization | Increased productivity across energy operations |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AI in supply chain market ecosystem comprises hardware manufacturers, AI software and solution providers, system integrators, and distribution partners working together to enable end-to-end adoption. Hardware providers support high-performance data processing, while AI software vendors deliver advanced analytics, forecasting, and optimization capabilities. System integrators play a critical role in deployment, customization, and integration with existing enterprise systems. Distributors support market reach, scalability, and regional adoption, collectively strengthening the overall ecosystem and accelerating AI-driven supply chain transformation.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI in Supply Chain Market, By Offering

The software segment held the largest market share in 2024, driven by strong adoption of AI-powered planning, forecasting, and analytics tools. Enterprises are increasingly investing in AI software to improve visibility, decision-making, and operational efficiency across supply chains. Continuous advancements in predictive and prescriptive analytics further strengthen software-led revenue growth.

AI in Supply Chain Market, By Deployment

Cloud deployment is expected to dominate the market and grow at the highest CAGR during the forecast period due to its scalability and cost efficiency. Organizations prefer cloud-based AI solutions for faster deployment and real-time data processing. The ability to integrate seamlessly with existing enterprise systems further accelerates cloud adoption.

AI in Supply Chain Market, By Organization Size

Small and medium organizations are projected to grow at the highest CAGR as cloud-based AI solutions lower implementation barriers. SMEs are adopting AI to enhance demand planning, inventory management, and logistics optimization. Flexible pricing models and faster return on investment are encouraging wider adoption among these organizations.

AI in Supply Chain Market, By Application

Demand planning and forecasting dominated the AI in supply chain market in 2024 due to the critical need for accurate demand insights. AI enables organizations to reduce forecast errors and respond quickly to market fluctuations. Improved planning accuracy directly supports better inventory and service-level performance.

AI in Supply Chain Market, By End-use Industry

Retail is estimated to account for the largest market share in 2025, supported by omnichannel operations and high demand variability. Retailers are increasingly using AI to optimize inventory, enhance demand sensing, and improve fulfillment efficiency. The focus on customer experience and cost optimization continues to drive adoption.

REGION

Asia Pacific to be fastest-growing region in global AI in supply chain market during forecast period

Asia Pacific is estimated to grow at the highest CAGR due to rapid industrialization, expanding manufacturing bases, and strong adoption of digital supply chain technologies. Countries across the region are increasingly investing in AI to improve demand forecasting, production planning, and logistics efficiency. The growth of e-commerce, cross-border trade, and smart logistics infrastructure is further driving adoption. In addition, supportive government initiatives promoting AI, automation, and smart manufacturing are strengthening long-term market growth across the region.

AI IN SUPPLY CHAIN MARKET SIZE, SHARE ANALYSIS: COMPANY EVALUATION MATRIX

In the AI in supply chain market matrix, SAP SE and Oracle emerge as star players, supported by their strong market presence and broad, integrated product portfolios. SAP leads with its end-to-end, AI-enabled supply chain capabilities tightly embedded within its ERP ecosystem, enabling large enterprises to achieve real-time visibility, predictive planning, and intelligent execution across complex global networks. Oracle follows closely, leveraging its cloud-native SCM suite and embedded AI to deliver scalable, data-driven supply chain planning, logistics optimization, and automated decision-making.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- SAP SE (Germany)

- Oracle (US)

- Blue Yonder Group, Inc. (US)

- Manhattan Associates (US)

- Kinaxis Inc. (Canada)

- IBM (US)

- Microsoft (US)

- Amazon Web Services, Inc. (US)

- Anaplan, Inc. (US)

- Logility Supply Chain Solutions, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 9.43 Billion |

| Market Forecast, 2032 (Value) | USD 50.41 Billion |

| Growth Rate | CAGR of 20.2% |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Rest of the World |

WHAT IS IN IT FOR YOU: AI IN SUPPLY CHAIN MARKET SIZE, SHARE ANALYSIS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Comprehensive Ecosystem Mapping of AI in Supply Chain | Conducted detailed mapping of the AI supply chain ecosystem covering AI software platforms, analytics engines, data providers, cloud infrastructure, system integrators, and logistics technology stakeholders across key industries | Delivers holistic clarity on ecosystem structure, interdependencies, and emerging growth areas, supporting informed market entry and expansion strategies |

| Competitive Benchmarking of AI Supply Chain Solution Providers | Evaluated leading AI vendors based on solution breadth, AI capabilities, deployment models, scalability, industry focus, regional presence, and customer adoption | Enhances competitive intelligence, enables objective vendor comparison, and supports strategic partnership, investment, and acquisition decisions |

| Application-Level and Industry-Specific Opportunity Assessment | Analyzed AI adoption and high-impact use cases across demand planning, inventory management, procurement, logistics, and risk management for retail, manufacturing, logistics, and e-commerce sectors | Identifies revenue-generating opportunities, prioritizes high-growth applications and industries, and sharpens go-to-market focus |

| Technology Roadmap and Adoption Maturity Analysis | Assessed the maturity of AI technologies, including machine learning, predictive analytics, generative AI, digital twins, and autonomous planning across supply chain functions | Supports technology investment planning and helps align AI strategies with long-term digital transformation and resilience goals |

| Cost Structure, Pricing, and Deployment Barrier Analysis | Examined solution pricing models, implementation costs, data integration challenges, cloud versus on-premises trade-offs, and workforce skill constraints impacting AI adoption | Enables optimized pricing strategies, smoother deployment planning, and proactive risk mitigation for AI-driven supply chain initiatives |

RECENT DEVELOPMENTS

- December 2025 : Anaplan, Inc. introduced a new suite of role-based AI agents, anchored by the Anaplan CoModeler, designed to embed predictive, generative, and agentic intelligence across enterprise planning workflows. CoModeler converted natural language into structured planning models, enabling rapid model creation, scenario testing, and governance, significantly accelerating decision-making and improving resilience across business functions.

- November 2025 : SAP SE and HCL Technologies Limited collaborated to advance Physical AI by integrating intelligent, AI-driven capabilities into real-world industrial operations. The collaboration focused on next-generation use cases in warehouse automation, fleet optimization through multi-agent AI modeling, and embodied-AI-enabled 3D reality capture.

- November 2025 : SAP SE and Microsoft partnered to develop SAP Business Data Cloud (BDC) Connect for Microsoft Fabric, a new integration that would enable bi-directional, zero-copy data sharing between SAP BDC and Microsoft Fabric. The partnership simplified access to semantically rich SAP data products, allowing enterprises to rapidly unlock trusted, AI-ready insights without data replication.

- November 2025 : Pacsun partnered with Manhattan Associates to deploy Manhattan Active Point of Sale across 300+ stores, unifying commerce and accelerating checkout through mobile capabilities and RFID-powered inventory visibility. The rollout improved fulfillment efficiency across digital channels, reduced logistics costs by 25%, and enhanced in-store customer experience with streamlined returns and endless aisle capabilities.

Table of Contents

Methodology

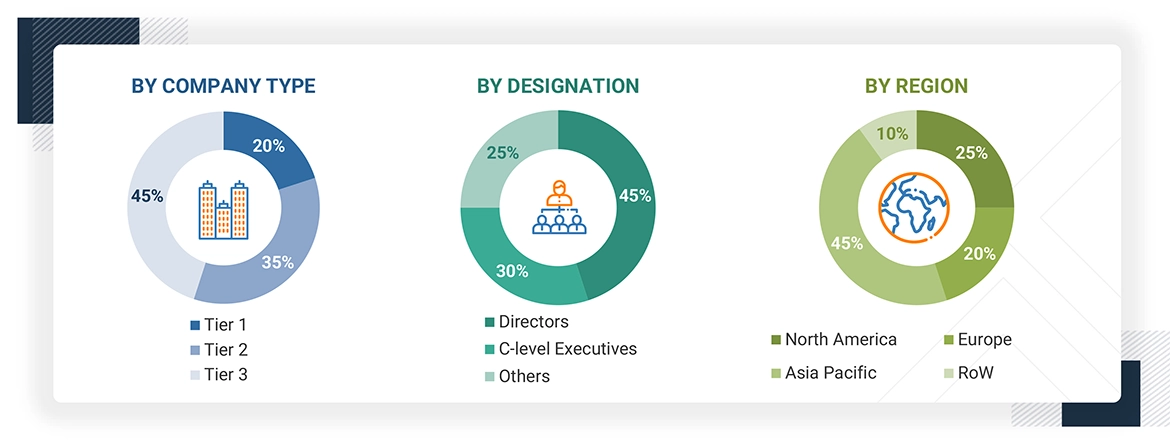

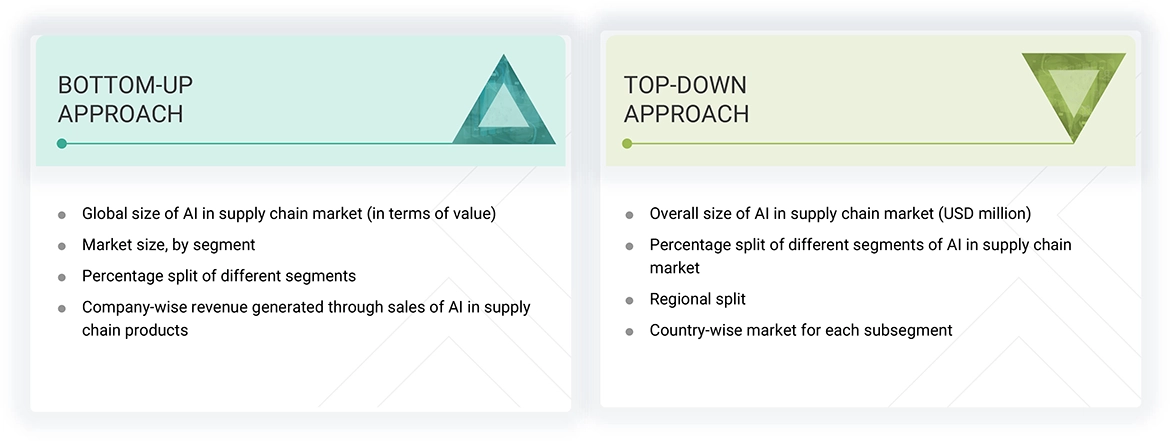

The study utilized four major activities to estimate the AI in supply chain market size. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information on the AI in supply chain market for this study. Secondary sources for this research study include corporate filings (annual reports, investor presentations, and financial statements), trade, business, and professional associations, white papers, certified publications, articles by recognized authors, directories, and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

Primary Research

Primary interviews were conducted to gather insights on market statistics, revenue data, market breakdowns, size estimations, and forecasting. Additionally, primary research was used to comprehend the various technology, type, end use, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end user installation teams using AI in supply chain market offerings and processes, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of AI in supply chain market, which will impact the overall market. Several primary interviews were conducted across major countries in North America, Europe, Asia Pacific, and RoW.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study's overall market size estimation process.

Al in Supply Chain Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall size of the AI in supply chain market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. Various factors and trends from the demand and supply sides were studied to triangulate the data. The market was validated using both top-down and bottom-up approaches.

Market Definition

AI in supply chain refers to the integration of artificial intelligence to optimize and automate various processes involved in managing the flow of goods, services, and information. AI enhances supply chain operations by improving demand forecasting, inventory management, logistics, and production planning. It leverages machine learning (ML), predictive analytics, and automation to analyze real-time data, enabling accurate decision-making, identification of potential disruptions, and streamlined operations. AI helps companies increase efficiency, reduce costs, and improve flexibility in response to market demands and changes.

Key Stakeholders

- Semiconductor companies

- Technology providers

- Universities and research organizations

- System integrators

- AI-based supply chain solution providers

- AI platform providers

- Cloud service providers

- Technology providers

- AI system providers

Report Objectives

- To describe and forecast the AI in supply chain market size, by offering, deployment, organization size, application, end-use industry, and region, in terms of value

- To describe and forecast the market for various segments across four main regions, namely North America, Europe, Asia Pacific, and RoW, in terms of value

- To describe and forecast the market volume in terms of offering

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the markets

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing market growth

- To analyze opportunities for stakeholders by identifying high-growth segments in the market

- To provide a detailed overview of the AI in supply chain market value chain

- To strategically analyze key technologies, average selling price trends, trends impacting customer business, ecosystem, regulatory landscape, patent landscape, Porter's five forces, import and export scenarios, trade landscape, key stakeholders and buying criteria, and case studies pertaining to the market under study

- To strategically profile key players in the AI in supply chain market and comprehensively analyze their market share and core competencies

- To analyze competitive developments, such as partnerships, acquisitions, expansions, collaborations, product launches, and research & development (R&D), in the AI in supply chain market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the AI in supply chain market

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company in the AI in supply chain market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI in Supply Chain Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI in Supply Chain Market