The study involved four major activities in estimating the current size of the Electronic Warfare Market. Exhaustive secondary research was done to collect information on the electronic warfare market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. After that, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the Electronic Warfare Market.

Secondary Research

The market ranking of electronic warfare companies was determined using secondary data made available through paid and unpaid sources and by analyzing the product portfolios of major companies. These companies perform on the basis of the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred to for this research study included financial statements of companies offering Electronic warfare systems and components and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the Electronic Warfare market, which was validated by primary respondents.

Primary Research

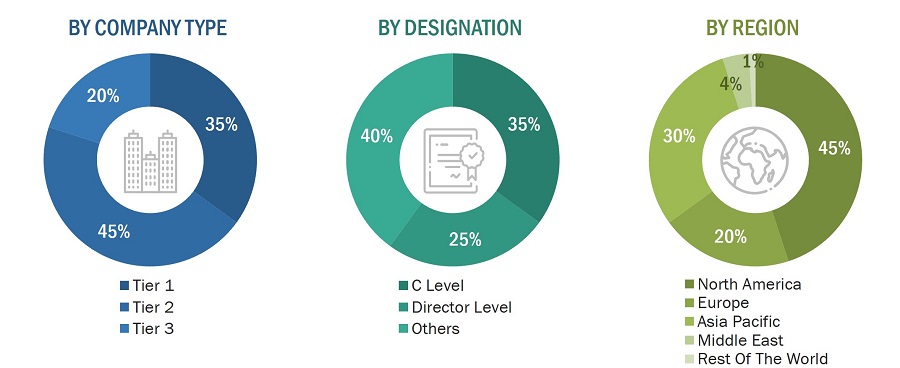

Extensive primary research was conducted after acquiring information regarding the Electronic Warfare Market market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East and ROW which includes Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

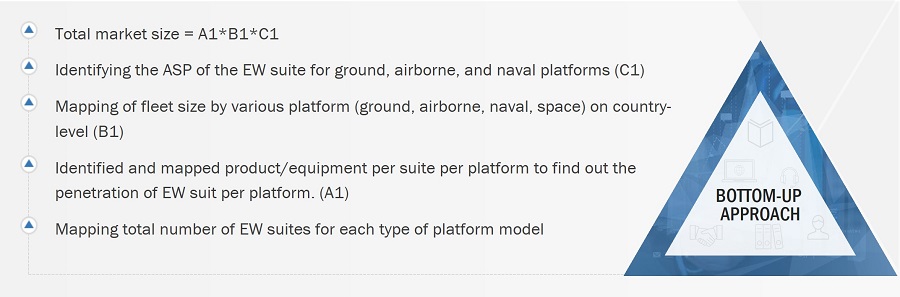

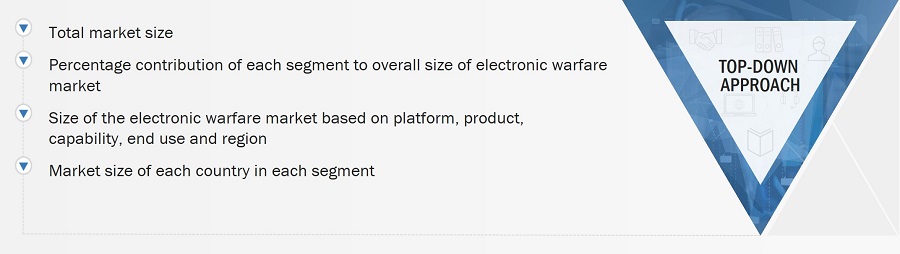

The top-down and bottom-up approaches were used to estimate and validate the size of the electronic warfare market. The figure in the section below is a representation of the overall market size estimation process employed for the purpose of this study.

The research methodology used to estimate the market size includes the following details.

-

Key players in the industry and markets were identified through secondary research, and their market share was determined through primary and secondary research. This included an extensive study of annual and financial reports of top market players and interviews with CEOs, directors, and marketing executives.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Note: An analysis of technological, military funding, year-on-year launches, and operational costs was carried out to arrive at the CAGR and understand the market dynamics of all countries in the report. The market share for all vertical, end-use, service, deployment and region was based on the recent and upcoming launches of Electronic Warfare in every country from 2023 to 2028.

Electronic Warfare Market Size: Bottom-up Approach

Electronic Warfare Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size of the market, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both, the demand and supply sides. Along with this, the market size was validated using both, the top-down and bottom-up approaches.

Country-wise deliveries of vehicles in different platforms from 2023 to 2028 were considered for base data. Data was taken from the OEM manufacturers and various governing bodies of each country.

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process used to develop this report.

Market Definition

Electronic Warfare (EW), defined by the Department of Defense (DOD), encompasses military activities utilizing electromagnetic energy to manipulate and control the electromagnetic spectrum. The spectrum represents a range of frequencies for electromagnetic energy. EW plays a pivotal role in supporting command and control (C2) by granting military commanders access to the spectrum for communication while thwarting potential adversaries from doing the same. Key capabilities within EW comprise electronic attack, electronic protection, and electronic support. Electronic protection involves safeguarding through both passive and active measures to shield personnel, equipment, and facilities from an enemy's electromagnetic attacks. Meanwhile, electronic support focuses on identifying, intercepting, and locating electromagnetic energy for immediate threat recognition and related planning.

Market Stakeholders

-

Armed Forces

-

Electronic Warfare Manufacturers

-

Component Manufacturers

-

Distributors and Suppliers

-

Research Organizations, Forums, Alliances, and Associations

-

Ministries of Defense

-

Original Equipment Manufacturers (OEMs)

-

Regulatory Bodies

-

R&D Companies

-

Aerospace and Defense Industries

-

Electronic Warfare System Integrators

-

Electronic Warfare Technology Support Providers

-

Software/Hardware/Service and Solution Providers

Report Objectives

-

To define, describe, and forecast the size of the electronic warfare market based on platform,, capability, product, end-use, and region from 2023 to 2028.

-

To forecast the size of various segments of the market with respect to major regions, namely, North America, Europe, Asia Pacific, Middle East and the Rest of the World (RoW), which comprises Latin America and Africa

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of electronic warfare market across the globe.

-

To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the electronic warfare market.

-

To analyze opportunities for stakeholders in the market by identifying key market trends

-

To analyze competitive developments such as contracts, acquisitions and expansions, agreements, joint ventures and partnerships, new product launches, and Research & Development (R&D) activities in the electronic warfare market.

-

To provide a detailed competitive landscape of the -market, in addition to an analysis of business and corporate strategies adopted by leading market players.

-

To strategically profile key market players and comprehensively analyze their core competencies2.

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

-

Additional country-level analysis of the Electroic Warfare Market

-

Profiling of other market players (up to 10)

Product Analysis

-

Product matrix, which provides a detailed comparison of the product portfolio of each company in the Electronic Warfare Market.

Zaliny

Aug, 2019

The need to identify suitable EW products and solutions to achieve the goals of the local law enforcement (market).The goals are counter-terrorist and asymmetry warfare in an ever-shrinking budget requirement..