Camera Modules Market Size, Share & Industry Trends Analysis Report by Component (Image Sensor, Lens Module, Voice Coil Motor, Filters), Interface (Serial, Parallel), Pixel (>7 MP,8-13 MP, <13 MP), Focus (Autofocus, Fixed), Interface (Serial, Parallel), Process and Region - Global Forecast to 2028

Updated on : Oct 22, 2024

Camera Modules Market Size & Share

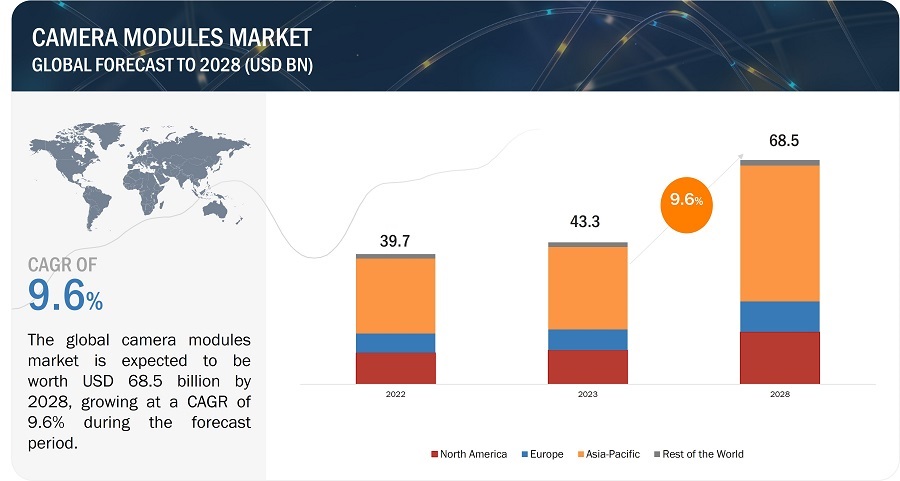

The global camera modules market size was valued at USD 43.3 billion in 2023 and is estimated to reach USD 68.5 billion by 2028, growing at a CAGR of 9.6% during the forecast period from 2023 to 2028

The increasing demand for consumer electronics applications due to heavy adoption and advancements in smartphones, tablets, and wearables, as well as growing automotive applications due to ADAS and vehicle automation, is driving the growth of the camera modules market. Furthermore, the rising adoption of IoT-based security systems and growing demand for industrial automation and digitalization are also expected to drive the market for camera modules.

Camera Modules Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Camera Modules Market Trends

Driver: Increasing demand for consumer electronics application

End users’ demand for consumer electronics has increased in recent years. The shorter replacement cycles, falling prices of electronic items, easy availability through e-commerce websites, and new technologies such as wearables, virtual and augmented reality, 4K televisions, smart homes, 3D printers, autonomous vehicles, drones, and communication robots encourage frequent purchases of the same.

Camera modules are becoming more common in electronic devices all around usThe demand for camera modules in consumer electronics has surged due to the proliferation of smartphones, where flagship models from companies like Apple, Samsung, Google, and Huawei continuously enhance camera capabilities. Tablets, laptops, and desktop computers also integrate cameras for video conferencing and content creation, while action cameras like GoPro cater to outdoor enthusiasts. Gaming consoles, drones, smart home devices, wearable tech, AR/VR headsets, and automotive applications all incorporate camera modules for various purposes, from gaming enhancements to safety features.

This trend is driven by the pursuit of better image quality, innovative features, and the integration of cameras into daily life, shaping the future of consumer electronics.. Smartphones are increasingly featuring two, three, and even four camera systems on a single device, allowing users to access features previously only available through high-end photographic equipment. LG Innotek, OFILM Group Co., Ltd., Sunny Optical Technology (Group) Co., Ltd., and other companies have been offering their products and adopting different strategies to cater to the consumer electronics industry. For instance, in September 2021, LG Innotek developed the ECO Magnet in collaboration with Sung Lim Group Industry (SGI) Co. (South Korea)–a magnet company. The ECO Magnet helps provide more explicit photos and videos by increasing the driving force of the actuator when applied to a high-pixel smartphone camera.

Restraint: Interoperability and workforce skills

Interoperability is paramount in the camera modules market, ensuring seamless integration with diverse consumer electronics. Camera modules must work harmoniously across various platforms, emphasizing compatibility between hardware, software, and operating systems. Simultaneously, a skilled and adaptable workforce is essential for innovation and addressing evolving consumer demands. Workforce expertise spans electrical engineering, optical technology, software development, quality assurance, and manufacturing processes, with continuous training and education required to stay abreast of rapid technological advancements. These interconnected aspects drive the camera modules industry, enabling versatile and cutting-edge solutions to meet a wide range of consumer needs, from smartphones to automotive applications and beyond..

Opportunity: Expansion of e-commerce and logistics industry

The continuous innovations and advancements in image sensor technology are fueling a growing demand for camera modules across diverse applications. These developments encompass higher-resolution sensors for sharper imaging, improved low-light performance crucial for night photography and security, HDR and WDR technologies enabling balanced images in varying lighting conditions, miniaturization for smaller form factors in devices like smartphones and wearables, depth-sensing capabilities for facial recognition and augmented reality, integration with AI and machine learning for object recognition and intelligent processing, and the emergence of specialized sensors for applications like agriculture and environmental monitoring. Additionally, higher frame rates, reduced power consumption, customization options, and seamless integration further drive the role of camera modules in capturing the full potential of evolving image sensor technologies across industries ranging from consumer electronics to healthcare and industrial automation.

Challenge: Complex manufacturing and supply chain process.

The primary camera module industry challenge is the complex manufacturing and competitive supply chain. Camera modules have many different components, each of which must be manufactured to high standards. The supply chain for camera modules is also complex, with many other companies producing and distributing the components. This complexity can lead to delays and disruptions in the supply of camera modules, which can impact the market.

The camera modules market is a very competitive market, with many different companies competing for market share. This can lead to price wars and other challenges for manufacturers. Despite these challenges, the camera modules market is expected to grow in the coming years. This growth is driven by the increasing demand for camera modules in various applications, such as smartphones, tablets, and security cameras.

CMOS Camera Module Market Analysis

Camera Modules Market Ecosystem

The Camera modules market is competitive, with major companies such as LG Innotek, OFILM Group Co., Ltd., Sunny Optical Technology (Group), Hon Hai Precision Inc. Co., Ltd. (Foxconn), Chicony Electronics, Sony, Intel, and Samsung Electro-Mechanics are the significant manufacturers of camera modules, and numerous small- and medium-sized enterprises. Many players offer both camera modules and their components, while many players and components offer integration services. These integration services are widely required in automotive, electronics, and industrial applications, among others.

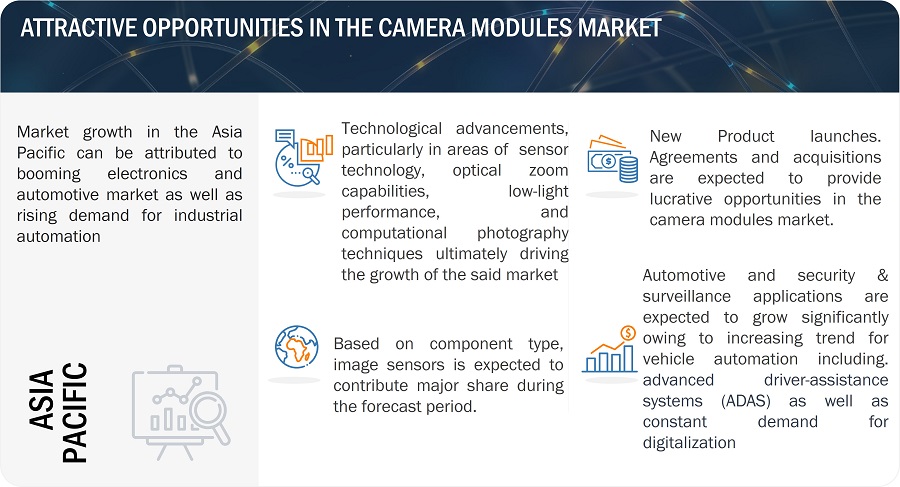

Based on components, the image sensor segment is expected to account for the largest market share during the forecast period.

The image sensors segment is projected to account for a significant market share during the forecast period. Image sensors are critical components in camera modules, and their advancement directly impacts the quality and capabilities of cameras in various devices, including smartphones, digital cameras, automotive cameras, and more. Image sensors have catalyzed rapid growth in the camera modules market, driven by rising demand for higher-resolution images and enhanced low-light performance.

They have enabled advanced features like HDR imaging and seamlessly supported multi-lens configurations in devices like smartphones to provide improved zoom and wide-angle capabilities. The integration of AI algorithms further boosted camera performance, while their application in the automotive sector, particularly in advanced driver-assistance systems (ADAS) and autonomous vehicles, fueled substantial demand. Manufacturing advancements have yielded smaller, more cost-effective sensors, making them accessible across various devices and emerging markets like IoT, drones, and robotics.

Based on Pixel, the above 13 MP segment is projected to grow with the highest CAGR during the forecast period

The above 13 MP pixel type is expected to grow the fastest in the camera modules market because of the increasing demand for better image quality from end users. This is especially true in the smartphone market, where consumers demand higher-resolution cameras for taking photos and videos.

Machine vision systems are used in various applications, such as quality control, robotics, and medical imaging. These systems require high-resolution camera modules to capture detailed images of objects. The increasing shift to high-resolution camera modules, especially in machine vision systems, is also driving the growth of this market segment. In addition, the declining prices of camera components and modules are making them more affordable for a broader range of applications.

Based on region, Asia Pacific is projected to grow fastest for the camera modules market

The scope of the camera modules market in Asia Pacific includes China, Japan, South Korea, India, and the Rest of Asia Pacific. The region is experiencing the fastest growth due to the increasing adoption of industrial automation and the growing industries such as automotive and electronics applications.

As Asia Pacific is a significant automobile manufacturing hub, the adoption of cameras is high in the region. Companies such as Toyota, Hyundai, Suzuki, Yamaha, and Nissan exist in Japan, China, and South Korea. The region is home to the world's largest and fastest-growing smartphone market. This is driving the demand for smartphone camera modules, as consumers demand higher-resolution cameras for taking photos and videos.

Camera Modules Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Camera Modules Companies - Key market players

The camera modules companies is dominated by a few globally established players such as

- LG Innotek ,

- OFILM Group Co., Ltd.,

- Sunny Optical Technology (Group),

- Hon Hai Precision Inc. Co., Ltd.,

- Chicony Electronics,

- Samsung Electro-Mechanics and so on.

Camera Modules Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 43.3 billion in 2023 |

| Projected Market Size | USD 68.5 billion by 2028 |

| Camera Module Market Growth Rate | CAGR of 9.6% |

|

Camera Module Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Component, Pixel, Focus Type , Interface , Application and Region. |

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the world |

|

Companies Covered |

LG Innotek, OFILM Group Co., Ltd., Sunny Optical Technology (Group), Hon Hai Precision Inc. Co., Ltd. (Foxconn), Chicony Electronics, Sony, Intel, Samsung Electro-Mechanics, etc. |

Camera Modules Market Highlights

This research report categorizes the camera modules market based on type, pitch, and application, and region

|

Segment |

Subsegment |

|

Based on component: |

|

|

Based on Focus Type: |

|

|

Based on Interface |

|

|

Based on Pixel |

|

|

Based on Application |

|

|

Based on Region: |

|

Recent Developments in Camera Modules Industry

- In September 2023, MCNEX, in partnership with Corephotonics, a firm acquired by Samsung Electronics with crucial multi-camera patents, has created the 8MP DUAL SCANNING CAMERA, an advanced driver assistance system (ADAS) aimed at improving blind spot detection in autonomous vehicles

- In December 2022, LG Innotek unveiled its inaugural Optical Telephoto Zoom Camera Module at CES. The module features pristine and vibrant image clarity with seamless filming across magnifications ranging from 4 to 9 times. The image quality has been elevated through the culmination of optical advancements, eliminating the need for a protruding 'Camera Bump.

- In August 2021, Hon Hai Precision Inc. Co., Ltd. (Foxconn) expanded its applications from just fitting completed units in iPhone to assembling iPhone camera components. This expansion aimed to strengthen Foxconn’s position in the market.

- In March 2021, Samsung Electro-Mechanics developed an optical 10x zoom folded camera module and initiated its mass production.

Frequently Asked Questions (FAQs):

Which are the major companies in the camera modules market? What are their significant strategies to strengthen their market presence?

The major companies in the camera modules market are –LG Innotek, OFILM Group Co., Ltd., Sunny Optical Technology (Group), Hon Hai Precision Inc. Co., Ltd. (Foxconn), Chicony Electronics, Sony, Intel, and Samsung Electro-Mechanics The significant strategies adopted by these players are product launches and developments, collaborations, acquisitions, and expansions.

What is the potential market for camera modules in the region?

The Asia Pacific region is expected to dominate the camera modules market due to the presence of leading players from the camera modules market, such as Sony, Chicony Electronics, etc.

What are the opportunities for new market entrants?

Opportunities in the camera modules market arise from the growth of augmented reality (AR) and virtual reality (VR), increasing demand for camera modules in industrial applications, and so on.

What are the drivers and opportunities for the camera modules market?

Factors such as increasing demand for consumer electronics and automotive applications fuel the need to grow the camera modules market.

Who are the major end users of the camera modules expected to drive the market’s growth in the next 5 years??

The significant consumers for the camera modules are consumer electronics, industrial, and automotive industries. They are expected to have a substantial share in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for consumer electronics- Growing deployment of surveillance cameras to ensure public safety and security- Rising focus on integrating ADAS and AI-powered systems to enhance vehicle and passenger safety- Rapid advancements in camera technologyRESTRAINTS- Design complexities due to miniaturization of devicesOPPORTUNITIES- Growing use of image sensors in electronic devices- Emerging applications of AR and VR devices- Growing demand for industrial automation technologies and systemsCHALLENGES- Complexities associated with manufacturing processes and supply chain

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE OF CAMERA MODULES OFFERED BY KEY PLAYERSAVERAGE SELLING PRICE TRENDS

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.8 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.9 CASE STUDY ANALYSIS

-

5.10 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- CMOS technology- CCD technology- ToF technology- OIS technology- IR technologyADJACENT TECHNOLOGIES- Quantum dot technology

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 PATENT ANALYSIS, 2018–2022

-

5.13 TARIFFS AND REGULATIONSTARIFFSREGULATORY COMPLIANCE- Regulations

-

5.14 STANDARDS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS- Common safety standards related to camera modules market

- 5.15 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.1 INTRODUCTION

- 6.2 SINGLE CAMERA MODULES

- 6.3 DUAL CAMERA MODULES

- 6.4 MULTI-CAMERA MODULES

- 6.5 3D CAMERA MODULES

- 7.1 INTRODUCTION

-

7.2 FLIP-CHIP CAMERA MODULESGROWING DEMAND FOR COMPACT AND SLIM DEVICES WITH MULTIPLE CAMERA CONFIGURATIONS TO FUEL SEGMENTAL GROWTH

-

7.3 CHIP-ON-BOARD CAMERA MODULESINCREASING USE IN AUTOMATION AND PRODUCT STANDARDIZATION TO CONTRIBUTE TO MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 IMAGE SENSORSINCREASING DEPLOYMENT IN DIGITAL CAMERAS AND SMARTPHONES FOR HIGH-QUALITY IMAGES TO CONTRIBUTE TO SEGMENTAL GROWTHCMOS IMAGE SENSORS- Frontside illumination technology- Backside illumination technologyCCD IMAGE SENSORSOTHER IMAGE SENSORS- NMOS image sensors- InGaAs image sensors- Flat-panel X-ray sensors- sCMOS image sensors

-

8.3 LENS MODULESUTILIZATION FOR SAFETY AND NAVIGATION AND IN SLIM AND PORTABLE PRODUCTS TO DRIVE SEGMENT

-

8.4 VOICE COIL MOTORSREQUIREMENT OF ADVANCED CAMERA FUNCTIONALITIES WITH ENHANCED IMAGE OUTPUT FROM VARIOUS APPLICATIONS TO PROPEL DEMAND

- 8.5 OTHER COMPONENTS

- 9.1 INTRODUCTION

-

9.2 AUTOFOCUSWIDE DEPLOYMENT IN MODERN CAMERAS TO GENERATE SHARP IMAGES IRRESPECTIVE OF DISTANCE OF OBJECTS TO DRIVE SEGMENTAL GROWTH

-

9.3 FIXED FOCUSUTILIZATION IN CAMERAS REQUIRING INEXPENSIVE AND EASY-TO-USE FEATURES TO PROPEL MARKET

- 10.1 INTRODUCTION

-

10.2 SERIAL INTERFACEGROWING UTILIZATION FOR HIGH-SPEED DATA TRANSFER AND IMPROVED IMAGE QUALITY IN MODERN IMAGING AND VISION SYSTEMS TO PROPEL SEGMENT

-

10.3 PARALLEL INTERFACEADVANTAGES IN TERMS OF COMPACTNESS, SCALABILITY, AND POWER EFFICIENCY TO BOOST DEMAND

- 11.1 INTRODUCTION

-

11.2 UP TO 7 MPGREATER DEPLOYMENT IN AUTOMOBILES TO SUPPORT SEGMENTAL GROWTH

-

11.3 8 TO 13 MPFREQUENT USE IN SMARTPHONES WITH DUAL OR TRIPLE CAMERA SETTINGS TO DRIVE MARKET

-

11.4 ABOVE 13 MPRISING FOCUS ON HIGH-RESOLUTION SMARTPHONE CAMERAS AND HIGH-PERFORMANCE CAMERA MODULES FOR VARIOUS APPLICATIONS TO PROPEL SEGMENTAL GROWTH

- 12.1 INTRODUCTION

-

12.2 CONSUMER ELECTRONICSDEPLOYMENT OF MULTIPLE CAMERAS AND BETTER-QUALITY CAMERA MODULES IN SMARTPHONES TO ENHANCE CONSUMER EXPERIENCE TO DRIVE MARKETSMARTPHONESTABLET PCSCAMERASWEARABLESOTHER CONSUMER ELECTRONICS

-

12.3 AUTOMOTIVEINCREASING DEMAND FOR SAFETY FEATURES IN VEHICLES AND GOVERNMENT MANDATES TO PUSH MARKET GROWTHBY FUNCTION- ADAS- Viewing & OthersBY VIEW TYPE- Rear view- Front view and othersBY VEHICLE TYPE- Passenger- Commercial

-

12.4 INDUSTRIALUSEFULNESS IN PRODUCTION MONITORING, MEASUREMENT TASKS, AND QUALITY CONTROL TO FUEL SEGMENTAL GROWTHMACHINE VISIONROBOTIC VISION

-

12.5 SECURITY & SURVEILLANCEAVAILABILITY OF SPECIALIZED SURVEILLANCE CAMERAS WITH AI-BASED OBJECT DETECTION AND HIGH-RESOLUTION SENSORS TO CONTRIBUTE TO RISING DEMANDPUBLIC PLACES AND INFRASTRUCTURESCOMMERCIAL & RESIDENTIAL

-

12.6 OTHER APPLICATIONSHEALTHCARE- Endoscopy- Ophthalmology- Other healthcare applicationsAEROSPACE & DEFENSE- Aerial and marine surveillance- Border surveillance & military operations

- 13.1 INTRODUCTION

-

13.2 NORTH AMERICAIMPACT OF RECESSION ON CAMERA MODULES MARKET IN NORTH AMERICAUS- Rising focus on automobile safety and technologically advanced consumer electronics to create market growth opportunitiesCANADA- Government mandates to increase safety of vehicles to drive marketMEXICO- Increasing foreign direct investments to provide growth opportunities

-

13.3 EUROPEIMPACT OF RECESSION ON CAMERA MODULES MARKET IN EUROPEGERMANY- Focus on premium automotive manufacturing to provide opportunities for market growthFRANCE- Increasing demand and popularity of autonomous vehicles to support market expansionUK- Presence of premium vehicle companies to fuel market growthITALY- Growing adoption of digital technologies to drive marketREST OF EUROPE

-

13.4 ASIA PACIFICIMPACT OF RECESSION ON CAMERA MODULES MARKET IN ASIA PACIFICCHINA- Elevated demand for automotive and consumer electronics products to boost marketJAPAN- Market dominance in automobiles, robotics, & biotechnology to propel adoption of camera modulesSOUTH KOREA- Presence of leading smartphone and automotive players to drive demand for camera modulesREST OF ASIA PACIFIC

-

13.5 ROWIMPACT OF RECESSION ON CAMERA MODULES MARKET IN ROWSOUTH AMERICA- Rising use of cameras in vehicles for 360° view and ADAS to support market growthMIDDLE EAST & AFRICA- Strict security & surveillance regulations to propel adoption of cameras

- 14.1 OVERVIEW

- 14.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 14.3 REVENUE ANALYSIS, 2018–2022

- 14.4 MARKET SHARE ANALYSIS, 2022

-

14.5 KEY COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

14.6 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 14.7 COMPANY FOOTPRINT

- 14.8 COMPETITIVE BENCHMARKING

- 14.9 COMPETITIVE SCENARIOS AND TRENDS

-

15.1 KEY PLAYERSLG INNOTEK- Business overview- Product/Solution/Service offered- Recent developments- MnM viewOFILM- Business overview- Product/Solution/Service offered- MnM viewSUNNY OPTICAL TECHNOLOGY (GROUP) COMPANY LIMITED- Business overview- Product/Solution/Service offered- MnM viewHON HAI PRECISION INDUSTRY CO., LTD.- Business overview- Product/Solution/Service offered- Recent developments- MnM viewSAMSUNG ELECTRO-MECHANICS- Business overview- Product/Solution/Service offered- Recent developments- MnM viewCHICONY ELECTRONICS CO., LTD- Business overview- Product/Solution/Service offeredQ TECHNOLOGY (GROUP) COMPANY LIMITED- Business overview- Product/Solution/Service offeredAMS-OSRAM AG- Business overview- Product/Solution/Service offered- Recent developmentsMCNEX CO., LTD- Business overview- Product/Solution/Service offered- Recent developmentsTRULY INTERNATIONAL HOLDINGS LIMITED- Business overview- Product/Solution/Service offered

-

15.2 OTHER PLAYERSCAMMSYS. CORPINTEL CORPORATIONPRIMAX ELECTRONICS LTD.SONY CORPORATIONSHENZHEN CHUANGMU TECHNOLOGY CO., LTDJENOPTIKLEOPARD IMAGING INC.LUXVISIONS-INNOHAESUNG OPTICSCOWELLPARTRONOMNIVISIONKYOCERA CORPORATIONE-CON SYSTEMSSYNTEC OPTICSNAMUGAAAC TECHNOLOGIES

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 TOTAL NUMBER OF CCTV CAMERAS INSTALLED IN TOP COUNTRIES (MILLION UNITS)

- TABLE 2 ROLE OF PARTICIPANTS IN ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICE OF CAMERA MODULES OFFERED BY KEY PLAYERS (USD)

- TABLE 4 INDICATIVE SELLING PRICE OF CAMERA MODULES, BY REGION

- TABLE 5 CAMERA MODULES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 8 E-CON SYSTEMS CAMERA MODULES MET SECURITY & SURVEILLANCE APPLICATION REQUIREMENTS FOR OEM

- TABLE 9 E-CON SYSTEMS PROVIDED CAMERA SYSTEM FOR IMPROVED AUDIO AND VIDEO EXPERIENCES OUTSIDE CLASSROOMS OF EDUCATIONAL CENTERS

- TABLE 10 PATENTS RELATED TO CAMERA MODULES

- TABLE 11 TOP 20 PATENT OWNERS IN US, 2012–2022

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 CAMERA MODULES MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 17 CAMERA MODULES MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 18 CAMERA MODULES MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 19 IMAGE SENSORS: CAMERA MODULES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 20 IMAGE SENSORS: CAMERA MODULES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 21 LENS MODULES: CAMERA MODULES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 22 LENS MODULES: CAMERA MODULES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 23 VOICE COIL MOTORS: CAMERA MODULES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 24 VOICE COIL MOTORS: CAMERA MODULES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 25 OTHER COMPONENTS: CAMERA MODULES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 26 OTHER COMPONENTS: CAMERA MODULES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 27 CAMERA MODULES MARKET, BY FOCUS TYPE, 2019–2022 (USD MILLION)

- TABLE 28 CAMERA MODULES MARKET, BY FOCUS TYPE, 2023–2028 (USD MILLION)

- TABLE 29 AUTOFOCUS: CAMERA MODULES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 30 AUTOFOCUS: CAMERA MODULES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 31 FIXED FOCUS: CAMERA MODULES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 32 FIXED FOCUS: CAMERA MODULES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 33 CAMERA MODULES MARKET, BY INTERFACE, 2019–2022 (USD MILLION)

- TABLE 34 CAMERA MODULES MARKET, BY INTERFACE, 2023–2028 (USD MILLION)

- TABLE 35 CAMERA MODULES MARKET, BY PIXEL, 2019–2022 (USD MILLION)

- TABLE 36 CAMERA MODULES MARKET, BY PIXEL, 2023–2028 (USD MILLION)

- TABLE 37 UP TO 7 MP: CAMERA MODULES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 38 UP TO 7 MP: CAMERA MODULES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 39 8 TO 13 MP: CAMERA MODULES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 40 8 TO 13 MP: CAMERA MODULES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 41 ABOVE 13 MP: CAMERA MODULES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 42 ABOVE 13 MP: CAMERA MODULES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 43 CAMERA MODULES MARKET SHIPMENT, BY APPLICATION, 2019–2022 (MILLION UNITS)

- TABLE 44 CAMERA MODULES MARKET SHIPMENT, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 45 CAMERA MODULES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 46 CAMERA MODULES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 47 CONSUMER ELECTRONICS: CAMERA MODULES MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 48 CONSUMER ELECTRONICS: CAMERA MODULES MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 49 CONSUMER ELECTRONICS: CAMERA MODULES MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 50 CONSUMER ELECTRONICS: CAMERA MODULES MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 51 CONSUMER ELECTRONICS: CAMERA MODULES MARKET, BY FOCUS TYPE, 2019–2022 (USD MILLION)

- TABLE 52 CONSUMER ELECTRONICS: CAMERA MODULES MARKET, BY FOCUS TYPE, 2023–2028 (USD MILLION)

- TABLE 53 CONSUMER ELECTRONICS: CAMERA MODULES MARKET, BY PIXEL, 2019–2022 (USD MILLION)

- TABLE 54 CONSUMER ELECTRONICS: CAMERA MODULES MARKET, BY PIXEL, 2023–2028 (USD MILLION)

- TABLE 55 CONSUMER ELECTRONICS: CAMERA MODULES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 CONSUMER ELECTRONICS: CAMERA MODULES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 AUTOMOTIVE: CAMERA MODULES MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 58 AUTOMOTIVE: CAMERA MODULES MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 59 AUTOMOTIVE: CAMERA MODULES MARKET, BY FOCUS TYPE, 2019–2022 (USD MILLION)

- TABLE 60 AUTOMOTIVE: CAMERA MODULES MARKET, BY FOCUS TYPE, 2023–2028 (USD MILLION)

- TABLE 61 AUTOMOTIVE: CAMERA MODULES MARKET, BY PIXEL, 2019–2022 (USD MILLION)

- TABLE 62 AUTOMOTIVE: CAMERA MODULES MARKET, BY PIXEL, 2023–2028 (USD MILLION)

- TABLE 63 AUTOMOTIVE: CAMERA MODULES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 64 AUTOMOTIVE: CAMERA MODULES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 AUTOMOTIVE: CAMERA MODULES MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 66 AUTOMOTIVE: CAMERA MODULES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 67 AUTOMOTIVE: CAMERA MODULES MARKET, BY VIEW TYPE, 2019–2022 (USD MILLION)

- TABLE 68 AUTOMOTIVE: CAMERA MODULES MARKET, BY VIEW TYPE, 2023–2028 (USD MILLION)

- TABLE 69 AUTOMOTIVE: CAMERA MODULES MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 70 AUTOMOTIVE: CAMERA MODULES MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 71 INDUSTRIAL: CAMERA MODULES MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 72 INDUSTRIAL: CAMERA MODULES MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 73 INDUSTRIAL: CAMERA MODULES MARKET, BY FOCUS TYPE, 2019–2022 (USD MILLION)

- TABLE 74 INDUSTRIAL: CAMERA MODULES MARKET, BY FOCUS TYPE, 2023–2028 (USD MILLION)

- TABLE 75 INDUSTRIAL: CAMERA MODULES MARKET, BY PIXEL, 2019–2022 (USD MILLION)

- TABLE 76 INDUSTRIAL: CAMERA MODULES MARKET, BY PIXEL, 2023–2028 (USD MILLION)

- TABLE 77 INDUSTRIAL: CAMERA MODULES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 78 INDUSTRIAL: CAMERA MODULES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 SECURITY & SURVEILLANCE: CAMERA MODULES MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 80 SECURITY & SURVEILLANCE: CAMERA MODULES MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 81 SECURITY & SURVEILLANCE: CAMERA MODULES MARKET, BY FOCUS TYPE, 2019–2022 (USD MILLION)

- TABLE 82 SECURITY & SURVEILLANCE: CAMERA MODULES MARKET, BY FOCUS TYPE, 2023–2028 (USD MILLION)

- TABLE 83 SECURITY & SURVEILLANCE: CAMERA MODULES MARKET, BY PIXEL, 2019–2022 (USD MILLION)

- TABLE 84 SECURITY & SURVEILLANCE: CAMERA MODULES MARKET, BY PIXEL, 2023–2028 (USD MILLION)

- TABLE 85 SECURITY & SURVEILLANCE: CAMERA MODULES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 86 SECURITY & SURVEILLANCE: CAMERA MODULES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 OTHER APPLICATIONS: CAMERA MODULES MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 88 OTHER APPLICATIONS: CAMERA MODULES MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 89 OTHER APPLICATIONS: CAMERA MODULES MARKET, BY FOCUS TYPE, 2019–2022 (USD MILLION)

- TABLE 90 OTHER APPLICATIONS: CAMERA MODULES MARKET, BY FOCUS TYPE, 2023–2028 (USD MILLION)

- TABLE 91 OTHER APPLICATIONS: CAMERA MODULES MARKET, BY PIXEL, 2019–2022 (USD MILLION)

- TABLE 92 OTHER APPLICATIONS: CAMERA MODULES MARKET, BY PIXEL, 2023–2028 (USD MILLION)

- TABLE 93 OTHER APPLICATIONS: CAMERA MODULES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 94 OTHER APPLICATIONS: CAMERA MODULES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 CAMERA MODULES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 96 CAMERA MODULES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: CAMERA MODULES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: CAMERA MODULES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: CAMERA MODULES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 100 NORTH AMERICA: CAMERA MODULES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 101 EUROPE: CAMERA MODULES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 102 EUROPE: CAMERA MODULES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 103 EUROPE: CAMERA MODULES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 104 EUROPE: CAMERA MODULES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: CAMERA MODULES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 106 ASIA PACIFIC: CAMERA MODULES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: CAMERA MODULES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 108 ASIA PACIFIC: CAMERA MODULES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 109 ROW: CAMERA MODULES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 110 ROW: CAMERA MODULES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 111 ROW: CAMERA MODULES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 112 ROW: CAMERA MODULES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 113 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN CAMERA MODULES MARKET

- TABLE 114 CAMERA MODULES MARKET: MARKET SHARE ANALYSIS

- TABLE 115 OVERALL COMPANY FOOTPRINT

- TABLE 116 COMPANY FOOTPRINT, BY COMPONENT

- TABLE 117 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 118 COMPANY FOOTPRINT, BY REGION

- TABLE 119 CAMERA MODULES MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 120 CAMERA MODULES MARKET: PRODUCT LAUNCHES, 2021−2023

- TABLE 121 CAMERA MODULES MARKET: DEALS, 2021–2023

- TABLE 122 CAMERA MODULES MARKET: OTHERS, 2021–2023

- TABLE 123 LG INNOTEK: COMPANY OVERVIEW

- TABLE 124 LG INNOTEK: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 125 LG INNOTEK: PRODUCT LAUNCHES

- TABLE 126 LG INNOTEK: DEALS

- TABLE 127 OFILM: COMPANY OVERVIEW

- TABLE 128 OFILM: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 129 SUNNY OPTICAL TECHNOLOGY (GROUP) COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 130 SUNNY OPTICAL TECHNOLOGY (GROUP) COMPANY LIMITED: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 131 HON HAI PRECISION INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 132 HON HAI PRECISION INDUSTRY CO., LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 133 HON HAI PRECISION INDUSTRY CO., LTD.: DEALS

- TABLE 134 SAMSUNG ELECTRO-MECHANICS: COMPANY OVERVIEW

- TABLE 135 SAMSUNG ELECTRO-MECHANICS: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 136 SAMSUNG ELECTRO-MECHANICS: PRODUCT LAUNCHES

- TABLE 137 CHICONY ELECTRONICS CO., LTD: COMPANY OVERVIEW

- TABLE 138 CHICONY ELECTRONICS CO., LTD: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 139 Q TECHNOLOGY (GROUP) COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 140 Q TECHNOLOGY (GROUP) COMPANY LIMITED: PRODUCT/SOLUTION/ SERVICE OFFERINGS

- TABLE 141 AMS-OSRAM AG: COMPANY OVERVIEW

- TABLE 142 AMS-OSRAM AG: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 143 AMS-OSRAM AG: PRODUCT LAUNCHES

- TABLE 144 MCNEX CO., LTD: COMPANY OVERVIEW

- TABLE 145 MCNEX CO., LTD: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 146 MCNEX CO., LTD: PRODUCT LAUNCHES

- TABLE 147 TRULY INTERNATIONAL HOLDINGS LIMITED: COMPANY OVERVIEW

- TABLE 148 TRULY INTERNATIONAL HOLDINGS LIMITED: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 149 CAMMSYS. CORP: COMPANY OVERVIEW

- TABLE 150 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 151 PRIMAX ELECTRONICS LTD.: COMPANY OVERVIEW

- TABLE 152 SONY CORPORATION: COMPANY OVERVIEW

- TABLE 153 SHENZHEN CM TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 154 JENOPTIK: COMPANY OVERVIEW

- TABLE 155 LEOPARD IMAGING INC.: COMPANY OVERVIEW

- TABLE 156 LUXVISIONS-INNO: COMPANY OVERVIEW

- TABLE 157 HAESUNG OPTICS: COMPANY OVERVIEW

- TABLE 158 COWELL: COMPANY OVERVIEW

- TABLE 159 PARTRON: COMPANY OVERVIEW

- TABLE 160 OMNIVISION: COMPANY OVERVIEW

- TABLE 161 KYOCERA CORPORATION: COMPANY OVERVIEW

- TABLE 162 E-CON SYSTEMS: COMPANY OVERVIEW

- TABLE 163 SYNTEC OPTICS: COMPANY OVERVIEW

- TABLE 164 NAMUGA: COMPANY OVERVIEW

- TABLE 165 AAC TECHNOLOGIES: COMPANY OVERVIEW

- FIGURE 1 CAMERA MODULES MARKET: SEGMENTATION

- FIGURE 2 CAMERA MODULES MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1—TOP DOWN (SUPPLY SIDE)—REVENUES GENERATED BY COMPANIES FROM SALES OF CAMERA MODULES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 IMAGE SENSORS SEGMENT TO DOMINATE CAMERA MODULES MARKET IN 2028

- FIGURE 8 FIXED FOCUS CAMERA MODULES HELD LARGER SHARE OF CAMERA MODULES MARKET IN 2022

- FIGURE 9 CONSUMER ELECTRONICS APPLICATION REGISTERED LARGEST MARKET SIZE IN 2028

- FIGURE 10 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF CAMERA MODULES MARKET IN 2022

- FIGURE 11 GROWING DEMAND FOR CONSUMER ELECTRONICS AND FOCUS ON AUTOMOTIVE APPLICATIONS TO FUEL MARKET GROWTH FROM 2023 TO 2028

- FIGURE 12 SERIAL INTERFACE TYPE CAMERA MODULES TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 13 8 TO 13 MP SEGMENT TO ACCOUNT FOR LARGEST SHARE OF CAMERA MODULES MARKET IN 2028

- FIGURE 14 AUTOMOTIVE APPLICATIONS TO EXHIBIT HIGHEST CAGR IN CAMERA MODULES MARKET DURING FORECAST PERIOD

- FIGURE 15 INDIA TO REGISTER HIGHEST CAGR IN CAMERA MODULES MARKET DURING FORECAST PERIOD

- FIGURE 16 CAMERA MODULES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 COMPARISON OF YEARLY PRODUCTION OF PASSENGER CARS, 2017–2022 (MILLION UNITS)

- FIGURE 18 CAMERA MODULES MARKET DRIVERS AND THEIR IMPACT

- FIGURE 19 CAMERA MODULES MARKET RESTRAINTS AND THEIR IMPACT

- FIGURE 20 CAMERA MODULES MARKET OPPORTUNITIES AND THEIR IMPACT

- FIGURE 21 CAMERA MODULES MARKET CHALLENGES AND THEIR IMPACT

- FIGURE 22 CAMERA MODULES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 ECOSYSTEM ANALYSIS

- FIGURE 24 AVERAGE SELLING PRICE OF CAMERA MODULES OFFERED BY KEY PLAYERS

- FIGURE 25 REVENUE SHIFTS AND NEW REVENUE POCKETS IN CAMERA MODULES MARKET

- FIGURE 26 CAMERA MODULES MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- FIGURE 29 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 30 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 31 NUMBER OF PATENTS GRANTED WORLDWIDE, 2012–2022

- FIGURE 32 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2012–2022

- FIGURE 33 CAMERA MODULES MARKET, BY MODULE TYPE

- FIGURE 34 CAMERA MODULES MARKET, BY PROCESS

- FIGURE 35 CAMERA MODULES MARKET, BY COMPONENT

- FIGURE 36 IMAGE SENSORS SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 CONSUMER ELECTRONICS APPLICATIONS TO HOLD LARGEST SHARE OF CAMERA MODULES MARKET FOR IMAGE SENSORS IN 2028

- FIGURE 38 CAMERA MODULES MARKET, BY FOCUS TYPE

- FIGURE 39 AUTOFOCUS SEGMENT TO EXHIBIT HIGHER CAGR FROM 2023 TO 2028

- FIGURE 40 CAMERA MODULES MARKET, BY INTERFACE

- FIGURE 41 SERIAL INTERFACE SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 42 CAMERA MODULES MARKET, BY PIXEL

- FIGURE 43 ABOVE 13 MP SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 CAMERA MODULES MARKET, BY APPLICATION

- FIGURE 45 CONSUMER ELECTRONICS APPLICATIONS TO LEAD CAMERA MODULES MARKET IN 2028

- FIGURE 46 ASIA PACIFIC TO DOMINATE CAMERA MODULES MARKET FOR CONSUMER ELECTRONICS IN 2028

- FIGURE 47 AUTOMOTIVE MARKET IN EUROPE TO LEAD CAMERA MODULES MARKET IN 2028

- FIGURE 48 CAMERA MODULES MARKET, BY REGION

- FIGURE 49 NORTH AMERICA: CAMERA MODULES MARKET SNAPSHOT

- FIGURE 50 EUROPE: CAMERA MODULES MARKET SNAPSHOT

- FIGURE 51 ASIA PACIFIC: CAMERA MODULES MARKET SNAPSHOT

- FIGURE 52 FIVE-YEAR REVENUE ANALYSIS OF TOP THREE PLAYERS IN CAMERA MODULES MARKET

- FIGURE 53 MARKET SHARE OF KEY PLAYERS, 2022

- FIGURE 54 CAMERA MODULES MARKET (GLOBAL): KEY COMPANY EVALUATION MATRIX, 2022

- FIGURE 55 CAMERA MODULES MARKET (GLOBAL): STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 56 LG INNOTEK: COMPANY SNAPSHOT

- FIGURE 57 SUNNY OPTICAL TECHNOLOGY (GROUP) COMPANY LIMITED: COMPANY SNAPSHOT

- FIGURE 58 HON HAI PRECISION INDUSTRY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 59 SAMSUNG ELECTRO-MECHANICS: COMPANY SNAPSHOT

- FIGURE 60 CHICONY ELECTRONICS CO., LTD: COMPANY SNAPSHOT

- FIGURE 61 AMS-OSRAM AG: COMPANY SNAPSHOT

- FIGURE 62 MCNEX CO., LTD: COMPANY SNAPSHOT

- FIGURE 63 TRULY INTERNATIONAL HOLDINGS LIMITED: COMPANY SNAPSHOT

To estimate the size of the camera modules market, the study utilized four major activities. Exhaustive secondary research was conducted to gather information on the market, as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the camera modules market. Secondary sources for this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of key secondary sources

|

SOURCE NAME |

WEBLINK |

|

Association for Advancing Automation |

https://www.automate.org/ |

|

European Machine Vision Association |

https://www.emva.org/ |

|

Organisation Internationale des Constructeurs d'Automobiles (France) |

https://www.oica.net/ |

|

Camera and Imaging Products Association (Japan) |

https://www.cipa.jp/e/index.html |

|

World Trade Organization (WTO) |

https://www.wto.org/ |

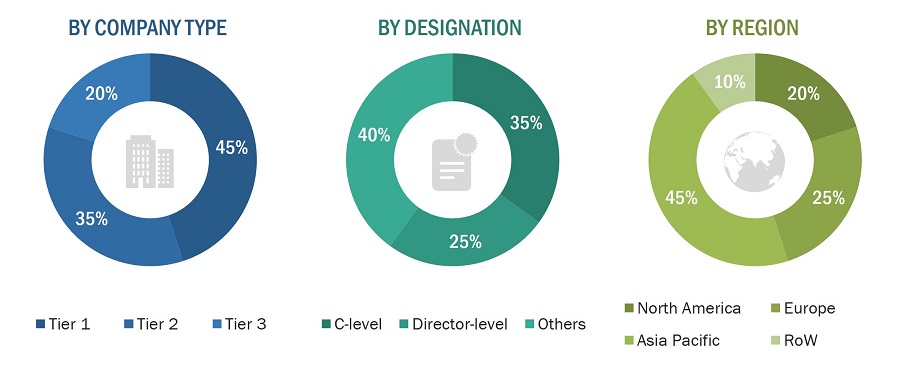

Primary Research

To gather insights on market statistics, revenue data, market breakdowns, size estimations, and forecasting, primary interviews were conducted. Additionally, primary research was used to comprehend the various technology, application, vertical, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end-user installation teams using camera modules, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of camera modules, which will impact the overall market. Several primary interviews were conducted across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To estimate and validate the size of the camera modules market and its submarkets, both top-down and bottom-up approaches were utilized. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The entire process involved studying the annual and financial reports of top players and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were then verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

Global Camera modules Market Size: Botton Up Approach

- Identifying various camera module manufacturers

- Analyzing the penetration of each component through secondary and primary research

- Analyzing integration of camera modules in different applications through secondary and primary research

- Conducting multiple discussions with key opinion leaders to understand the detailed working of camera modules and their implementation in multiple industries; this helped analyze the break-up of the scope of work carried out by each major company

- Verifying and cross-checking the estimates at every level with key opinion leaders, including CEOs, directors, operation managers, and finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Global Camera modules Market Size: Top Down Approach

The top-down approach has been used to estimate and validate the total size of the camera modules market.

- Focusing initially on the R&D investments and expenditures being made in the ecosystem of the camera modules market; further splitting the market on the basis of component, interface, focus type, pixel, application, and region and listing the key developments

- Identifying leading players in the camera modules market through secondary research and verifying them through brief discussions with industry experts

- Analyzing revenue, product mix, geographic presence, and key applications for which products are served by all identified players to estimate and arrive at percentage splits for all key segments

- Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

Once the overall size of the camera modules market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both top-down and bottom-up approaches.

Market Definition

A camera module is used for capturing photographic or video-type images. A camera module includes an image sensor, a lens, and an aperture and may include an IR filter and other additional components (voice coil motors and control electronics). Camera modules can be easily integrated into several embedded platforms that are ideal for imaging applications including computer vision, automation, medical imaging, industrial, artificial intelligence (AI), drone, stereo vision, license plate recognition, smart cities, and others. The increasing importance of high-megapixel cameras in smartphones to improve image quality and the growing adoption of ADAS systems in vehicles drive the growth of the market.

Key Stakeholders

- Suppliers of raw materials

- Technology investors

- Original equipment manufacturers (OEMs)

- Third-party service providers

- Government labs

- In-house testing labs

- System integrators

- Distributors, resellers, and traders

- Research institutions and organizations

- Camera modules forums, alliances, consortiums, and associations

- Market research and consulting firms

- End users

Report Objectives

- To define, describe, and forecast the camera modules market based on component, pixel, focus type , interface , application and region.

- To forecast the shipment data of camera modules market based on offerings.

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the market.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies.

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market.

- To analyze competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, product developments, and research & development (R&D) in the market

- To analyze the impact of the recession on the camera modules market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the camera modules market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the camera modules market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Camera Modules Market