Port Equipment Market by Type (Diesel, Electric, Hybrid), Solutions (Equipment, Software & Solutions), Investment (New Ports, Existing Ports), Operation (Conventional, Autonomous), Application and Region - Global Forecast to 2027

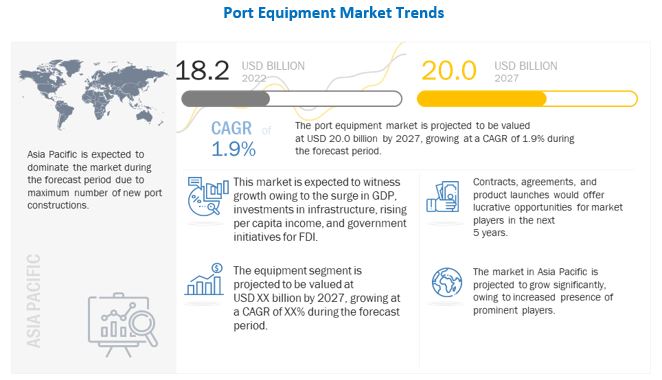

The Port Equipment Market is projected to grow from USD 18.2 billion in 2022 to USD 20.0 billion by 2027, at a CAGR of 1.9%.

Port equipment are used primarily to handle 40 or 20 foot equivalent unit (TEU) in port warehouses and terminals. Equipment such as cargo—forklifts, conveyor systems, ship-to-shore cranes, automated guided vehicles, straddle carriers, reach stackers, empty cargo handlers, Rail Mounted Gantry (RMG) cranes, Rubber Tire Gantry (RTG) cranes, mobile harbor cranes, and terminal tractors are considered in this market study. This equipment usually handles containerized or non-containerized cargo, which can weigh up to approximately 400 tons depending on the usage.

The use of cargo ships for goods transportation or containers has grown tremendously in recent years. According to the United Nations Conference on Trade and Development (UNCTAD), the global cargo transportation market has increased from 758 million TEUs in 2020 to 849 million TEUs in 2021 (increase of 12% from 2020-2021). Hence, port terminals have become busier. This growth in the global cargo trade is anticipated to fuel the demand for Port Equipment Industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Port equipment Market Dynamics

Driver: Electric equipment to lead to zero emissions ports

The maritime sector is at a major crossroads in terms of its future. The electrification and automation of ports are receiving significant attention globally, with the majority of the largest ports in the world preparing or already implementing such programs. Manufacturers and ports must accelerate the introduction of new technologies to realize global net-zero targets and achieve carbon neutrality. Many leading port equipment manufacturers and ports are actively buying electric equipment despite its higher price than diesel equipment.

Shanghai Zhenhua Heavy Industries (China) is one of the largest port machinery manufacturers in the world. It has a strong track record, successfully building the largest single automatic wharf in the world and China’s first fully automatic wharf. One such product in the company portfolio is electrified straddle carriers, which are already in operation at the Port of Barcelona in Spain and Durban Port in South Africa. Shanghai Zhenhua Heavy Industries (China) received assistance from the Editron division of Danfoss (Denmark) for developing electric straddle carriers using hybrid systems.

Restrains: High capital and maintenance costs

Port equipment requires a huge investment in terms of installing different sets of equipment for different applications. Innovations and advances have played a key role in providing a new aspect to the container and bulk cargo handling industry. However, these technologies have increased the complexity of these machines while operating or maintaining installed systems by the operator. Continuous R&D efforts have resulted in highly advanced products capable of handling multiple tasks by equipment operators. All steps involved in the designing, production, and distribution of this equipment require huge investments, which is reflected in the cost of the machinery made available to customers. The rising focus on cabin comfort and the constantly changing emission norms require equipment manufacturers to regularly upgrade their products, which further increases the cost of the overall system.

For instance, equipment such as forklifts requires a medium to high range of capital investments. Additionally, the propulsion type of forklift also affects the cost of the equipment. For example, the battery-operated manufacturing and installation costs and hydrogen fuel cell forklift are high compared with the similarly powered ICE forklifts. The high installation and maintenance costs are one of the major factors preventing manufacturers from entering key markets such as Asia Pacific.

Opportunities: Upcoming port development projects

Since the start of 2021, over 80 important port construction projects have been completed. According to World Bank, the net investments in these projects amount to over USD 39 billion. The new investments came when the global ocean freight shipping industry was reeling under the impact of a pandemic, labor shortage, container shortage, and lack of capacity. The 10 most expensive port projects totaled nearly USD 22 billion. The port equipment manufacturers receive several orders from these port development authorities.

For instance, India is creating a new port over an area of 890 ha worth USD 1.4 billion at Ramayapatnam, Andhra Pradesh, to facilitate the commercial transaction of all commodities. The project includes the construction of distribution centers, new access roads, storage facilities, load/unloading facilities, and the creation of a high-end security system. The Andhra Pradesh Maritime Board will oversee the development of this port. The construction of the port is scheduled to be completed by 2023.

The Al Faw Port in Iraq is set to become the largest port in the Middle East. In 2021, Daewoo Engineering and Construction (South Korea) won a USD 2.7 billion contract to build this port. This project entails the creation of one of the longest subsea tunnels in the world that will connect it to the Umm Qasr Port. New roads will be constructed to ensure better connectivity with Basra. Even though its capacity will not compare to the mega port of Asia like Singapore or Shanghai, the Al Faw will be greater than Jebel Ali Port (Dubai) in terms of the number of berths. The project involves the creation of a container terminal for handling 99 million tonnes per year.

Challenges: Synchronization issues

The automation of port equipment is a key trend at the global level, which requires the installation of various systems and technologies to handle the increased cargo flow at terminals. For instance, the control system of automated stacking cranes has been integrated with control systems of other equipment such as ship-to-shore cranes, straddle carriers, and mobile harbor cranes. However, these control systems communicate through different interfaces and protocols. The lack of integration of the communication interfaces and protocols between different equipment complicates the process and affects the overall performance while reducing the productivity at port terminals.

Software architects and system developers face issues while accessing real-time data related to equipment location to assign job orders. The absence of critical information due to a lack of standardization and interoperability metrics between the equipment installed by different manufacturers may delay the information flow, resulting in delayed decision making. However, a few major manufacturers are working to develop a system that works on the same platform to achieve high efficiency and enable a faster and more reliable exchange of key information. Hence, the synchronization of several technologies, communication interfaces, protocols, and platforms for better data transmission is a key concern that needs to be overcome during the forecast period.

The importance of automated stacking cranes (ASC) for container handling is driving the Application segment

The automated stacking cranes (ASC) are updated versions of RMG cranes used for handling yard containers at the port terminals. Automated stacking cranes are electric and offer a high automation level with a maximum lifting capacity of 40-70 tons for container handling applications. There is high demand for 35-45 tons, and the trend is expected to continue in the near future. Kalmar and Konecranes Abp are the leading suppliers of automated stacking cranes in the global market.

With the rising demand for automation levels at the port terminals to increase the container throughput, the ASC has become an important piece of equipment for container handling applications. Europe, Middle East & Africa has the highest demand for automated stacking cranes. European countries, in particular, have a high demand owing to the high adoption rate of automated technologies. Thus, the rising demand for automation that provides automatic pick, drop, and stacking of containers and offers reliable operation would drive the demand for automated stacking cranes in the coming years.

Growing stringency of emission regulations and operational efficiency to drive the type segment

RMG cranes, Automated Stacking Cranes (ASCs), and ship-to-shore cranes are offered in fully-electric variants for application in cargo and bulk cargo handling, among others. RTG cranes and straddled carriers are available in the electric version. The emission regulations for industrial equipment have seen constant upgrades at the regional level. As per the emission regulations of the European Union, NOx and PM levels have been reduced by nearly 95.7% and 97.2%, respectively, from Stage I to Stage V. Similarly, as per the US EPA norms, NOx and PM levels have seen a decline of around 95.6% and 96.2%, respectively, from Tier 1 to Tier 4. China, Japan, and India are expected to follow norms in line with the European Union and North American standards.

Leading equipment manufacturers, such as Konecranes Abp, Kalmar, and Hyster-Yale Materials Handling, Inc. (US), have an adequate mix of product offerings for electric equipment ranging from RMG cranes to straddle carriers. These manufacturers are undertaking R&D activities to develop electric engines for reach stackers and terminal tractors. In 2018, Hyster-Yale Materials Handling, Inc. initiated the development of an electric truck at its facility in Weeze, Germany. This truck is powered by a lithium-ion battery, with a lifting capacity of 48 tons. Hence, with the growing stringency of emission regulations and the desire for operational efficiency, the demand for electric port equipment is expected to grow steadily in the coming years.

Based on equipment, RMG crane segment is estimated to be the largest growing market

Rail mounted gantry crane, or RMG crane is commonly used for the quick, safe, and automated handling of containers. The crane provides high performance, reliability, low operating costs, and low energy consumption, playing a key role in facilitating the operations of yard stacking. The gantry crane can be designed with a wide range of capacities and sizes to accommodate different container capacities. The span of the crane is designed according to the rows of containers that need to be crossed.

The growth of this market can be attributed to the increasingly stringent regulations related to emissions, especially in Europe and North America, at the regional level to reduce particulate matter (PM) and nitrogen oxide (NOx) levels. Environmental benefits coupled with other advantages over rubber tired gantry cranes, such as higher flexibility and larger area coverage within the terminals, make RMG cranes a suitable choice for container handling.

In January 2022, Liebherr Container Cranes Ltd. (Switzerland) handed over 3 fully automated rail mounted gantry cranes to the CSX Carolina Connector Intermodal Terminal (CCX) in Rocky Mount, North Carolina, US. The cabinless RMGs have been supplied with Liebherr Remote operator Stations (ROS) for supervised moves and exception handling.

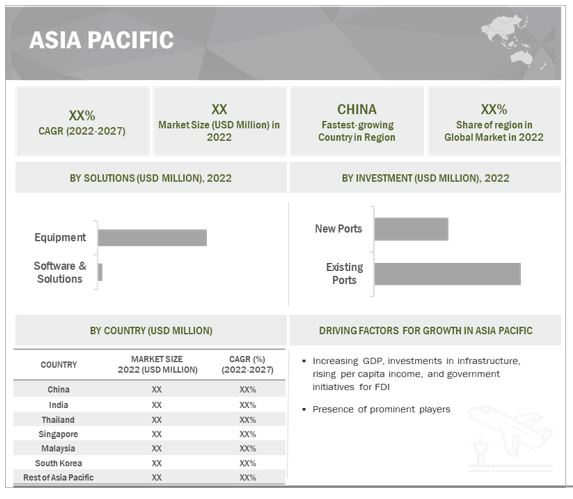

Asia Pacific likely to emerge as the largest Port equipment market

The Asia Pacific market has always been the largest for Port equipment. Asia Pacific is considered a technology and innovation leader due to the presence of countries like Japan, China, India, South Korea, and Singapore. It has the fastest-growing technology companies based on annual percentage revenue growth. Investors expect to be rewarded for their faith in pioneering startups by driving new products to the market

China to lead Asia Pacific Port equipment market

China is expected to be the largest economy by 2023 and one of the largest markets for trading in the world. Trade has become an increasingly important part of China’s overall economy and has been a significant tool used for economic modernization. Most of its imports consist of machinery and apparatus (including semiconductors, computers, and office machines), chemicals, and fuels.

The main import sources are Japan, Taiwan, South Korea, Australia, EU, and US. Regionally, almost half of the imports of China come from East and Southeast Asia, and one fourth of its exports go to the same countries. China is not handling the major share of shipbuilding and holds the top share in port equipment manufacturing. In 2022, DeloPorts (Russia) signed an agreement with Shanghai Zhenhua Heavy Industries Co., Ltd. (ZPMC) for the manufacture and delivery of a new ship to shore crane with a total contract value over USD 11.8 million.

To know about the assumptions considered for the study, download the pdf brochure

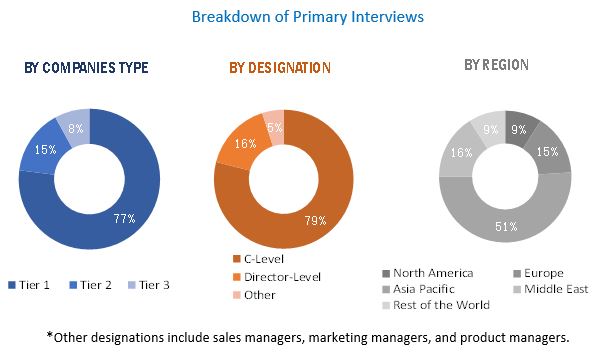

The break-up of the profile of primary participants in the Port equipment market::

- By Company Type: Tier 1 – 77%, Tier 2 – 15%, and Tier 3 – 8%

- By Designation: C Level – 79%, Director Level – 16%, and Others – 5%

- By Region: North America – 9%, Europe – 15%, Asia Pacific – 51%, Middle East– 16%, Rest of the World – 9%.

Key Market Players

The Port Equipment Companies are dominated by a few globally established players such as Kalmar (Finland), Liebherr Group (Switzerland), Konecranes Abp (Finland), Sany Heavy Industry Co., Ltd. (China), and Shanghai Zhenhua Heavy Industries (ZPMC) (China) among others.

Scope of the Report

|

Report Metric |

Details |

|

Growth Rate

|

1.9 %

|

| Estimated Market Size in 2022 |

USD 18.2 Billion |

| Projected Market Size in 2027 |

USD 20.0 Billion |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments covered |

By Solutions, By Application, By Investment, By Type, By Operation |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East, and Rest of the World |

|

Companies covered |

Kalmar (Finland), Liebherr Group (Switzerland), Konecranes Abp (Finland), Sany Heavy Industry Co., Ltd. (China), and Shanghai Zhenhua Heavy Industries (ZPMC) (China) are some of the major players of Port equipment market. (25 Companies) |

The study categorizes the Port equipment market based on solutions, application, investment, type, operation and region.

By Solutions

-

Equipment

- Tugboats

- Cranes

- Ship loaders

- Reach Stackers

- Mooring Systems

- Automatic Guided Vehicles (AGV)

- Forklift Trucks

- Container Lift Trucks

- Terminal Tractors

- Straddle Carriers

- Others (Hoppers, Passenger Boarding Bridges, Conveyors, Linkspan)

- Software & Solutions

By Application

- Container Handling

- Bulk Handling

- Scrap Handling

- Stacking

- General Cargo

- Others (Heavy Lift)

By Investment

- New Ports

- Existing Ports

By Type

- Diesel

- Electric

- Hybrid

By Operation

- Conventional

- Autonomous

By Region

- North America

- Asia Pacific

- Europe

- Middle East

- Rest of the World

Recent Developments

- In July 2022, Shanghai Zhenhua Heavy Industries delivered the last 2 equipment of the 56 automated rail crane contract signed by the PSA Tuas Terminal in Singapore.

- In March 2022, Port Gdansk Eksploatacja S.A., one of the leading port operators in Poland, has signed a contract with Liebherr Group for a new LHM 550 mobile harbor crane. The machine is primarily used for bulk handling.

- In January 2022, Liebherr Group handed over 3 fully automated rail mounted gantry cranes to the CSX Carolina Connector Intermodal Terminal (CCX) in Rocky Mount, North Carolina. The cabinless RMGs have been supplied with Liebherr Remote operator Stations (ROS) for supervised moves and exception handling.

- In November 2021, Kalmar has signed a 3 year Kalmar Care service agreement with Holmen Iggesund, part of the Holmen Group. The contract covers the provision of maintenance services for all wheeled loading equipment at Iggesund Mill, Sweden.

- In July, Sany Heavy Industry Co., Ltd. delivered 3 units of SANY SDCY90K6H4 empty container handler to Tokyo Harbor, marking its initial entrance into Japan, with the goal of including all Japanese harbors on its business map within the next 3 years.

Frequently Asked Questions (FAQ):

Which are the major companies in the Port equipment market? What are their major strategies to strengthen their market presence?

The Port equipment market is dominated by a few globally established players such as Kalmar (Finland), Liebherr Group (Switzerland), Konecranes Abp (Finland), Sany Heavy Industry Co., Ltd. (China), and Shanghai Zhenhua Heavy Industries (ZPMC) (China) among others.

Contracts were the main strategy adopted by leading players to sustain their position in the Port equipment market, followed by new product developments with advanced technologies. Many companies also collaborated to set up special centers for the research & development of advanced Port equipment.

What are the drivers and opportunities for the Port equipment market?

The market for Port equipment has grown substantially across the globe, and especially in Asia Pacific, where increase in developing new technologies and development of new port equipment in countries such as China, India, and Singapore, will offer several opportunities for Port equipment industry. The rising R&D activities to develop Port equipment are also expected to boost the growth of the market around the world.

Which region is expected to grow at the highest rate in the next five years?

The market in Asia Pacific is projected to grow at the highest CAGR of from 2022 to 2027, showcasing strong demand for use of Port equipment system in the region.

Which type of Port equipment segment is expected to significantly lead in the coming years?

Equipment segment of the Port equipment market is projected to witness the highest CAGR. The growth of the Port equipment market can be attributed to the increased demand in new ports and the development of existing ports.

What are some of the technological advancements in the market?

Various research activities have been conducted by manufacturers across the globe to enhance Port equipment. Technologies such as artificial intelligence and deep learning, internet of things (IoT), Internet of Vehicles (IoV), Hydrotreated Vegetable Oils (HVO) will bring in huge advancements in the port equipment market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED

1.4 INCLUSIONS AND EXCLUSIONS

1.5 CURRENCY

TABLE 1 USD EXCHANGE RATES

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH PROCESS FLOW

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

FIGURE 3 KEY DATA FROM SECONDARY SOURCES

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

FIGURE 4 KEY DATA FROM PRIMARY SOURCES

2.1.2.2 Breakdown of primaries

2.2 FACTOR ANALYSIS

2.2.1 DEMAND-SIDE INDICATORS

2.2.2 SUPPLY-SIDE ANALYSIS

2.3 MARKET SIZE ESTIMATION

2.4 RESEARCH APPROACH AND METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

TABLE 2 PORT EQUIPMENT: MARKET ESTIMATION PROCEDURE

2.4.1.1 Regional port equipment market

2.4.1.2 Market size estimation of port equipment market, by application

2.4.1.3 Market size estimation of port equipment market, by investment

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.5.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.6 GROWTH RATE ASSUMPTIONS

2.7 ASSUMPTIONS FOR RESEARCH STUDY

2.8 RISKS

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 8 SHIPLOADERS SEGMENT PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 9 ELECTRIC SEGMENT PROJECTED TO ACQUIRE HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 10 CONTAINER HANDLING APPLICATION SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

FIGURE 11 ASIA PACIFIC ESTIMATED TO HOLD LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN PORT EQUIPMENT MARKET, 2022–2027

FIGURE 12 INCREASED DEMAND FOR ELECTRIC PORT EQUIPMENT AND AUTOMATED OPERATIONS TO DRIVE MARKET GROWTH

4.2 PORT EQUIPMENT MARKET, BY SOLUTIONS

FIGURE 13 EQUIPMENT SEGMENT TO LEAD PORT EQUIPMENT MARKET DURING FORECAST PERIOD

4.3 PORT EQUIPMENT MARKET, BY INVESTMENT

FIGURE 14 NEW PORTS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.4 PORT EQUIPMENT MARKET, BY OPERATION

FIGURE 15 CONVENTIONAL SEGMENT TO HAVE HIGHEST SHARE IN PORT EQUIPMENT MARKET DURING FORECAST PERIOD

4.5 PORT EQUIPMENT MARKET, BY COUNTRY

FIGURE 16 INDIA AND CHINA PROJECTED TO WITNESS HIGHEST CAGR (2022–2027)

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 MARKET DYNAMICS OF PORT EQUIPMENT MARKET

5.2.1 DRIVERS

5.2.1.1 Electric equipment to lead to zero emission ports

5.2.1.2 Global increase in seaborne trade

5.2.1.3 Automation of ports

TABLE 3 AUTOMATED CONTAINER TERMINALS GLOBALLY

5.2.2 RESTRAINTS

5.2.2.1 High capital and maintenance costs

5.2.3 OPPORTUNITIES

5.2.3.1 Upcoming port development projects

5.2.3.2 Smart factories for manufacturing port equipment

5.2.4 CHALLENGES

5.2.4.1 Synchronization issues

5.2.4.2 Risk of accidents

5.3 VALUE CHAIN ANALYSIS

FIGURE 18 VALUE CHAIN ANALYSIS: PORT EQUIPMENT MARKET

5.4 OPERATIONAL DATA

TABLE 4 OPERATIONAL DATA: DELIVERIES OF PORT EQUIPMENT

5.5 TECHNOLOGY ANALYSIS

5.5.1 INCREASED USE OF SENSORS IN SHIPS AND PORTS

5.5.2 INTRODUCTION OF SIMULATION-BASED TRAINING FOR OPERATING PORT EQUIPMENT

5.6 PORT EQUIPMENT MARKET ECOSYSTEM

TABLE 5 PORT EQUIPMENT MARKET ECOSYSTEM

5.7 DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.7.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN PORT EQUIPMENT MARKET

FIGURE 19 REVENUE SHIFT IN PORT EQUIPMENT MARKET

5.8 PRICING ANALYSIS

5.8.1 AVERAGE SELLING PRICE

TABLE 6 AVERAGE SELLING PRICE: PORT EQUIPMENT (USD MILLION)

5.8.2 AVERAGE SELLING PRICES OF KEY PLAYERS, BY EQUIPMENT

TABLE 7 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP 3 EQUIPMENT (USD MILLION)

FIGURE 20 AVERAGE SELLING PRICE OF PORT EQUIPMENT, BY EQUIPMENT (USD MILLION)

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 PORT EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 PORT EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.1 TARIFF AND REGULATORY LANDSCAPE

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.2 INTERNATIONAL REGULATIONS

5.11 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 13 PORT EQUIPMENT MARKET: CONFERENCES AND EVENTS

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 EQUIPMENT

TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 EQUIPMENT (%)

5.12.2 BUYING CRITERIA

FIGURE 23 KEY BUYING CRITERIA FOR TOP 3 EQUIPMENT

TABLE 15 KEY BUYING CRITERIA FOR TOP 3 EQUIPMENT

6 INDUSTRY TRENDS (Page No. - 78)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 ARTIFICIAL INTELLIGENCE AND DEEP LEARNING

6.2.2 INTERNET OF THINGS (IOT)

6.2.3 INTERNET OF VEHICLES (IOV)

6.2.4 AUTOMATION

FIGURE 24 NUMBER OF FULLY AUTOMATED OR SEMI-AUTOMATED TERMINALS

6.2.5 HYDROTREATED VEGETABLE OILS (HVO)

6.2.6 ADVANCED MATERIALS IN MANUFACTURING PORT EQUIPMENT

6.2.7 INTRODUCTION OF NEW ENGINES WITH REDUCED EMISSIONS

6.3 USE CASES: PORT EQUIPMENT

6.3.1 USE CASE: FULLY AUTOMATED RMG CRANES

TABLE 16 USE CASE: FULLY AUTOMATED RMG CRANES

6.3.2 USE CASE: FIRST AUTOMATED CONTAINER TERMINAL OF AFRICA

TABLE 17 USE CASE: FIRST AUTOMATED CONTAINER TERMINAL OF AFRICA

6.4 PATENT ANALYSIS

TABLE 18 PATENTS RELATED TO PORT EQUIPMENT MARKET GRANTED BETWEEN 2019 AND 2022

6.5 IMPACT OF MEGATRENDS

6.5.1 EVOLVING GLOBAL TRADE

6.5.2 LOGISTICS PATTERNS AND DIGITAL TRANSFORMATION

7 PORT EQUIPMENT MARKET, BY SOLUTIONS (Page No. - 85)

7.1 INTRODUCTION

FIGURE 25 EQUIPMENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 19 MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 20 MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

7.2 EQUIPMENT

FIGURE 26 CRANE SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 21 MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 22 MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

7.2.1 TUGBOATS

7.2.1.1 Assists bigger vessels in berthing and unberthing

7.2.2 CRANES

7.2.2.1 Rubber Tired Gantry (RTG) Cranes

7.2.2.1.1 Capable of stacking 50–55 tons

7.2.2.2 Rail Mounted Gantry (RMG) Cranes

7.2.2.2.1 Increased productivity vs. alternative designs

7.2.2.3 Fixed Cargo Cranes (FCC)/Jib Cranes

7.2.2.3.1 Space-saving crane solutions for harbors, quaysides, and dockyards

7.2.2.4 Automated Stacking Cranes (ASC)

7.2.2.4.1 Considered important for container handling

7.2.2.5 Ship to Shore Cranes

7.2.2.5.1 Lifts containers ranging from 40–100 tons

7.2.2.6 Others

7.2.2.6.1 Used to move extremely heavy loads through overhead space

7.2.3 SHIPLOADERS

7.2.3.1 Stationary Shiploaders

7.2.3.1.1 Increased demand due to unloading of bulk cargo

7.2.3.2 Traveling Shiploaders

7.2.3.2.1 Reduces operating costs

7.2.4 REACH STACKERS

7.2.4.1 Driven by rising container volume at port terminals

7.2.5 MOORING SYSTEMS

7.2.5.1 Increases quayside efficiency

7.2.6 AUTOMATED GUIDED VEHICLES (AGVS)

7.2.6.1 Aids increased seaborne trade

7.2.7 FORKLIFT TRUCKS

7.2.7.1 More usage at small and medium port terminals

7.2.8 CONTAINER LIFT TRUCKS

7.2.8.1 Empty Container Lift Trucks

7.2.8.1.1 Enables quick transportation for loading

7.2.8.2 Laden Container Lift Trucks

7.2.8.2.1 Capable of lifting containers up to 50 tons

7.2.9 TERMINAL TRACTORS

7.2.9.1 Provides better port efficiency

7.2.10 STRADDLE CARRIERS

7.2.10.1 Enhances operational efficiency

7.2.11 OTHERS

7.3 SOFTWARE & SOLUTIONS

7.3.1 LOAD COLLISION PREVENTION SYSTEM (LCPS)

7.3.1.1 Reduces risk of collisions

7.3.2 TRUCK POSITIONING SYSTEM (TPS)

7.3.2.1 Ensures higher safety

7.3.3 CONTAINER NUMBER RECOGNITION SYSTEM (CNRS)

7.3.3.1 Fast and efficient container identification

7.3.4 REMOTE CONTROL OPERATION SYSTEM (RCOS)

7.3.4.1 Optimum crane performance

7.3.5 CRANE MANAGEMENT SYSTEM (CMS)

7.3.5.1 Monitors crane for fast diagnosis

7.3.6 OTHERS

8 MARKET, BY APPLICATION (Page No. - 97)

8.1 INTRODUCTION

FIGURE 27 CONTAINER HANDLING SEGMENT TO DOMINATE MARKET

TABLE 23 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 24 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 CONTAINER HANDLING

8.2.1 LED BY INCREASED ACTIVITIES AT MARINE PORTS

8.3 BULK HANDLING

8.3.1 HIGH DEMAND DUE TO INDUSTRIALIZATION

8.4 SCRAP HANDLING

8.4.1 INCREASED CONSUMPTION OF STEEL SCRAPS

8.5 STACKING

8.5.1 REDUCED CONTAINER RESHUFFLES

8.6 GENERAL CARGO

8.6.1 INCREASE IN NON-CONTAINERIZED DRY CARGO VOLUMES TO DRIVE DEMAND

8.7 OTHERS

9 MARKET, BY TYPE (Page No. - 101)

9.1 INTRODUCTION

FIGURE 28 ELECTRIC SEGMENT TO GROW AT HIGHEST CAGR DURING FROM 2022–2027

TABLE 25 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 26 MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.2 DIESEL

9.2.1 COMPANIES UPGRADING TO FUEL-EFFICIENT AND ENVIRONMENT-FRIENDLY MODELS

9.3 ELECTRIC

9.3.1 GROWING STRINGENCY OF EMISSION REGULATIONS AND OPERATIONAL EFFICIENCY

9.4 HYBRID

9.4.1 HIGH DEMAND DUE TO REDUCTION IN FUEL CONSUMPTION AND EMISSION

10 MARKET, BY INVESTMENT (Page No. - 105)

10.1 INTRODUCTION

FIGURE 29 NEW PORTS EXPECTED TO DRIVE MARKET DURING FORECAST PERIOD

TABLE 27 MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 28 MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

10.2 NEW PORTS

10.2.1 DRIVEN BY UPCOMING PORT PROJECTS

10.3 EXISTING PORTS

10.3.1 INCREASE IN AUTOMATION

11 MARKET, BY OPERATION (Page No. - 108)

11.1 INTRODUCTION

FIGURE 30 AUTONOMOUS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 29 MARKET, BY OPERATION, 2018–2021 (USD MILLION)

TABLE 30 MARKET, BY OPERATION, 2022–2027 (USD MILLION)

11.2 CONVENTIONAL

11.2.1 USE OF CONVENTIONAL PORT EQUIPMENT AT EXISTING PORTS

11.3 AUTONOMOUS

11.3.1 INCREASING NUMBER OF SMART PORTS

12 MARKET, BY REGION (Page No. - 111)

12.1 INTRODUCTION

TABLE 31 PORT EQUIPMENT SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

12.2.1 PESTLE ANALYSIS: NORTH AMERICA

12.2.2 NORTH AMERICA: CONTAINER PORT TRAFFIC (MILLION TEU)

FIGURE 32 NORTH AMERICA: CONTAINER PORT TRAFFIC (MILLION TEU)

TABLE 33 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.2.3 US

12.2.3.1 Port infrastructure development grant program

FIGURE 33 US PORT INFRASTRUCTURE INVESTMENT FROM 2021–2025

TABLE 41 US: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 42 US: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 43 US: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 44 US: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 45 US: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 46 US: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.2.4 CANADA

12.2.4.1 Upgrading indigenous marine industry

TABLE 47 CANADA: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 48 CANADA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 49 CANADA: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 50 CANADA: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 51 CANADA: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 52 CANADA: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.3 EUROPE

12.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 34 EUROPE: MARKET SNAPSHOT

12.3.2 EUROPE: CONTAINER PORT TRAFFIC (MILLION TEU)

FIGURE 35 EUROPE: CONTAINER PORT TRAFFIC (MILLION TEU)

TABLE 53 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 54 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 55 EUROPE: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 56 EUROPE: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 57 EUROPE: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 58 EUROPE: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 59 EUROPE: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 60 EUROPE: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.3.3 UK

12.3.3.1 Increased investments in port development programs

TABLE 61 UK: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 62 UK: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 63 UK: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 64 UK: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 65 UK: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 66 UK: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.3.4 GERMANY

12.3.4.1 Ports aim to emit zero CO2 emissions by 2030

TABLE 67 GERMANY: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 68 GERMANY: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 69 GERMANY: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 70 GERMANY: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 71 GERMANY: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 72 GERMANY: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.3.5 NETHERLANDS

12.3.5.1 Modernized ports to boost demand for automated port equipment

TABLE 73 NETHERLANDS: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 74 NETHERLANDS: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 75 NETHERLANDS: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 76 NETHERLANDS: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 77 NETHERLANDS: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 78 NETHERLANDS: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.3.6 ITALY

12.3.6.1 Heavy government investment in port modernization

TABLE 79 ITALY: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 80 ITALY: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 81 ITALY: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 82 ITALY: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 83 ITALY: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 84 ITALY: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.3.7 SPAIN

12.3.7.1 Digital revolution and growing demand for automation

TABLE 85 SPAIN: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 86 SPAIN: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 87 SPAIN: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 88 SPAIN: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 89 SPAIN: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 90 SPAIN: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.3.8 NORWAY

12.3.8.1 Regional connectivity to port to drive market

TABLE 91 NORWAY: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 92 NORWAY: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 93 NORWAY: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 94 NORWAY: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 95 NORWAY: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 96 NORWAY: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.3.9 REST OF EUROPE

TABLE 97 REST OF EUROPE: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 98 REST OF EUROPE: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 99 REST OF EUROPE: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 100 REST OF EUROPE: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 101 REST OF EUROPE: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 102 REST OF EUROPE: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

12.4.2 ASIA PACIFIC: CONTAINER PORT TRAFFIC (MILLION TEU)

FIGURE 37 ASIA PACIFIC: CONTAINER PORT TRAFFIC (MILLION TEU)

TABLE 103 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.4.3 CHINA

12.4.3.1 Presence of leading equipment manufacturers

TABLE 111 CHINA: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 112 CHINA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 113 CHINA: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 114 CHINA: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 115 CHINA: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 116 CHINA: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.4.4 INDIA

12.4.4.1 Led by port development program Sagarmala

TABLE 117 INDIA: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 118 INDIA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 119 INDIA: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 120 INDIA: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 121 INDIA: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 122 INDIA: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.4.5 THAILAND

12.4.5.1 Construction of new ports to support growth of international sea freight

TABLE 123 THAILAND: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 124 THAILAND: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 125 THAILAND: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 126 THAILAND: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 127 THAILAND: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 128 THAILAND: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.4.6 SINGAPORE

12.4.6.1 Development of Tuas megaport

TABLE 129 SINGAPORE: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 130 SINGAPORE: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 131 SINGAPORE: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 132 SINGAPORE: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 133 SINGAPORE: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 134 SINGAPORE: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.4.7 MALAYSIA

12.4.7.1 Houses large port facilities

TABLE 135 MALAYSIA: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 136 MALAYSIA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 137 MALAYSIA: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 138 MALAYSIA: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 139 MALAYSIA: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 140 MALAYSIA: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.4.8 SOUTH KOREA

12.4.8.1 Increasing international trade

TABLE 141 SOUTH KOREA: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 142 SOUTH KOREA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 143 SOUTH KOREA: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 144 SOUTH KOREA: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 145 SOUTH KOREA: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 146 SOUTH KOREA: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.4.9 REST OF ASIA PACIFIC

TABLE 147 REST OF ASIA PACIFIC: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 148 REST OF ASIA PACIFIC: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 149 REST OF ASIA PACIFIC: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 150 REST OF ASIA PACIFIC: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 151 REST OF ASIA PACIFIC: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 152 REST OF ASIA PACIFIC: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.5 MIDDLE EAST

FIGURE 38 MIDDLE EAST: TOTAL NUMBER OF PORT CONSTRUCTION PROJECTS (2000–2019)

FIGURE 39 MIDDLE EAST: PORT CONSTRUCTION INVESTMENT, IN USD MILLION, 2009–2019

12.5.1 PESTLE ANALYSIS: MIDDLE EAST

12.5.2 MIDDLE EAST: CONTAINER PORT TRAFFIC (MILLION TEU)

FIGURE 40 MIDDLE EAST: CONTAINER PORT TRAFFIC (MILLION TEU)

TABLE 153 MIDDLE EAST: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 154 MIDDLE EAST: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 155 MIDDLE EAST: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 156 MIDDLE EAST: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 157 MIDDLE EAST: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 158 MIDDLE EAST: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 159 MIDDLE EAST: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 160 MIDDLE EAST: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.5.3 SAUDI ARABIA

12.5.3.1 Increase in maritime development

TABLE 161 SAUDI ARABIA: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 162 SAUDI ARABIA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 163 SAUDI ARABIA: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 164 SAUDI ARABIA: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 165 SAUDI ARABIA: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 166 SAUDI ARABIA: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.5.4 UAE

12.5.4.1 Logistics and marine center

TABLE 167 UAE: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 168 UAE: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 169 UAE: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 170 UAE: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 171 UAE: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 172 UAE: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.5.5 EGYPT

12.5.5.1 Plans to establish 6 dry ports

TABLE 173 EGYPT: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 174 EGYPT: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 175 EGYPT: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 176 EGYPT: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 177 EGYPT: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 178 EGYPT: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.5.6 TURKEY

12.5.6.1 Large recycling capabilities

TABLE 179 TURKEY: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 180 TURKEY: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 181 TURKEY: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 182 TURKEY: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 183 TURKEY: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 184 TURKEY: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.5.7 REST OF MIDDLE EAST

TABLE 185 REST OF MIDDLE EAST: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 186 REST OF MIDDLE EAST: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 187 REST OF MIDDLE EAST: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 188 REST OF MIDDLE EAST: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 189 REST OF MIDDLE EAST: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 190 REST OF MIDDLE EAST: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.6 REST OF THE WORLD

12.6.1 PESTLE ANALYSIS: REST OF THE WORLD

12.6.2 REST OF THE WORLD: CONTAINER PORT TRAFFIC (MILLION TEU)

FIGURE 41 REST OF THE WORLD: CONTAINER PORT TRAFFIC (MILLION TEU)

TABLE 191 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 192 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 193 REST OF THE WORLD: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 194 REST OF THE WORLD: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 195 REST OF THE WORLD: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 196 REST OF THE WORLD: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 197 REST OF THE WORLD: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 198 REST OF THE WORLD: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.6.3 SOUTH AFRICA

12.6.3.1 Strategic position in sea commerce route

TABLE 199 SOUTH AFRICA: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 200 SOUTH AFRICA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 201 SOUTH AFRICA: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 202 SOUTH AFRICA: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 203 SOUTH AFRICA: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 204 SOUTH AFRICA: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.6.4 TANZANIA

12.6.4.1 Indian Ocean port project with China

TABLE 205 TANZANIA: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 206 TANZANIA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 207 TANZANIA: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 208 TANZANIA: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 209 TANZANIA: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 210 TANZANIA: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.6.5 KENYA

12.6.5.1 Expansion and renovation of ports

TABLE 211 KENYA: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 212 KENYA: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 213 KENYA: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 214 KENYA: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 215 KENYA: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 216 KENYA: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

12.6.6 BRAZIL

12.6.6.1 Thriving and dominant port trade

TABLE 217 BRAZIL: MARKET, BY SOLUTIONS, 2018–2021 (USD MILLION)

TABLE 218 BRAZIL: MARKET, BY SOLUTIONS, 2022–2027 (USD MILLION)

TABLE 219 BRAZIL: MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

TABLE 220 BRAZIL: MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

TABLE 221 BRAZIL: MARKET, BY INVESTMENT, 2018–2021 (USD MILLION)

TABLE 222 BRAZIL: MARKET, BY INVESTMENT, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 194)

13.1 INTRODUCTION

13.2 KEY PLAYER STRATEGIES

TABLE 223 KEY DEVELOPMENTS OF LEADING PLAYERS IN MARKET, 2018–2021

13.3 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2021

FIGURE 42 RANKING ANALYSIS OF TOP FIVE PLAYERS IN MARKET, 2021

13.4 REVENUE ANALYSIS, 2019–2021

FIGURE 43 REVENUE ANALYSIS OF KEY COMPANIES

13.5 MARKET SHARE ANALYSIS, 2021

FIGURE 44 MARKET SHARE ANALYSIS OF KEY COMPANIES

TABLE 224 MARKET: DEGREE OF COMPETITION

13.6 COMPANY EVALUATION QUADRANT

13.6.1 STARS

13.6.2 EMERGING LEADERS

13.6.3 PERVASIVE PLAYERS

13.6.4 PARTICIPANTS

FIGURE 45 MARKET COMPETITIVE LEADERSHIP MAPPING, 2022

13.6.5 COMPETITIVE BENCHMARKING

TABLE 225: COMPETITIVE BENCHMARKING

TABLE 226 PORT EQUIPMENT: DETAILED LIST OF KEY STARTUPS/SMES

13.7 STARTUP/SME EVALUATION QUADRANT

13.7.1 PROGRESSIVE COMPANIES

13.7.2 RESPONSIVE COMPANIES

13.7.3 STARTING BLOCKS

13.7.4 DYNAMIC COMPANIES

FIGURE 46 (STARTUP/SME) COMPETITIVE LEADERSHIP MAPPING, 2022

13.8 COMPETITIVE SCENARIO

13.8.1 NEW PRODUCT LAUNCHES

TABLE 227 NEW PRODUCT LAUNCHES

13.8.2 CONTRACTS, PARTNERSHIPS, AND AGREEMENTS

TABLE 228 CONTRACTS, PARTNERSHIPS, AND AGREEMENTS, APRIL 2019–MAY 2022

14 COMPANY PROFILES (Page No. - 205)

14.1 INTRODUCTION

14.2 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.2.1 KALMAR

TABLE 229 KALMAR: BUSINESS OVERVIEW

TABLE 230 KALMAR: PRODUCTS

TABLE 231 KALMAR: DEALS

14.2.2 KONECRANES ABP

TABLE 232 KONECRANES ABP: BUSINESS OVERVIEW

FIGURE 47 KONECRANES ABP: COMPANY SNAPSHOT

TABLE 233 KONECRANES ABP: PRODUCTS

TABLE 234 KONECRANES ABP: DEALS

14.2.3 LIEBHERR GROUP

TABLE 235 LIEBHERR GROUP: BUSINESS OVERVIEW

FIGURE 48 LIEBHERR GROUP: COMPANY SNAPSHOT

TABLE 236 LIEBHERR GROUP: PRODUCTS

TABLE 237 LIEBHERR GROUP: PRODUCT LAUNCHES

TABLE 238 LIEBHERR GROUP: DEALS

14.2.4 SANY HEAVY INDUSTRY CO., LTD.

TABLE 239 SANY HEAVY INDUSTRY CO., LTD.: BUSINESS OVERVIEW

FIGURE 49 SANY HEAVY INDUSTRY CO., LTD.: COMPANY SNAPSHOT

TABLE 240 SANY HEAVY INDUSTRY CO., LTD.: PRODUCTS

TABLE 241 SANY HEAVY INDUSTRY CO., LTD.: DEALS

14.2.5 SHANGHAI ZHENHUA HEAVY INDUSTRIES (ZPMC)

TABLE 242 SHANGHAI ZHENHUA HEAVY INDUSTRIES (ZPMC): BUSINESS OVERVIEW

TABLE 243 SHANGHAI ZHENHUA HEAVY INDUSTRIES (ZPMC): PRODUCTS

TABLE 244 SHANGHAI ZHENHUA HEAVY INDUSTRIES (ZPMC): DEALS

14.2.6 CAVOTEC SA

TABLE 245 CAVOTEC SA: BUSINESS OVERVIEW

FIGURE 50 CAVOTEC SA: COMPANY SNAPSHOT

TABLE 246 CAVOTEC SA: PRODUCTS

TABLE 247 CAVOTEC SA: DEALS

14.2.7 HYSTER-YALE MATERIALS HANDLING, INC.

TABLE 248 HYSTER-YALE MATERIALS HANDLING, INC.: BUSINESS OVERVIEW

FIGURE 51 HYSTER-YALE MATERIALS HANDLING, INC.: COMPANY SNAPSHOT

TABLE 249 HYSTER-YALE MATERIALS HANDLING, INC.: PRODUCTS

14.2.8 CVS FERRARI

TABLE 250 CVS FERRARI: BUSINESS OVERVIEW

TABLE 251 CVS FERRARI: PRODUCTS

TABLE 252 CVS FERRARI: DEALS

14.2.9 LONKING HOLDINGS LIMITED

TABLE 253 LONKING HOLDINGS LIMITED: BUSINESS OVERVIEW

TABLE 254 LONKING HOLDINGS LIMITED: PRODUCTS

14.2.10 AMERICAN CRANE & EQUIPMENT

TABLE 255 AMERICAN CRANE & EQUIPMENT: BUSINESS OVERVIEW

TABLE 256 AMERICAN CRANE & EQUIPMENT: PRODUCTS

14.2.11 ABB

TABLE 257 ABB: BUSINESS OVERVIEW

FIGURE 52 ABB: COMPANY SNAPSHOT

TABLE 258 ABB: PRODUCTS

TABLE 259 ABB: DEALS

14.2.12 SIEMENS AG

TABLE 260 SIEMENS AG: BUSINESS OVERVIEW

FIGURE 53 SIEMENS AG: COMPANY SNAPSHOT

TABLE 261 SIEMENS AG: PRODUCTS

14.2.13 TMEIC CORPORATION

TABLE 262 TMEIC CORPORATION: BUSINESS OVERVIEW

TABLE 263 TMEIC CORPORATION: PRODUCTS

TABLE 264 TMEIC CORPORATION: DEALS

14.2.14 ANHUI HELI CO., LTD.

TABLE 265 ANHUI HELI CO., LTD.: BUSINESS OVERVIEW

FIGURE 54 ANHUI HELI CO., LTD.: COMPANY SNAPSHOT

TABLE 266 ANHUI HELI CO., LTD.: PRODUCTS

TABLE 267 ANHUI HELI CO., LTD.: DEALS

14.2.15 THYSSENKRUPP INDUSTRIES

TABLE 268 THYSSENKRUPP INDUSTRIES: BUSINESS OVERVIEW

FIGURE 55 THYSSENKRUPP INDUSTRIES: COMPANY SNAPSHOT

TABLE 269 THYSSENKRUPP INDUSTRIES: PRODUCTS

TABLE 270 THYSSENKRUPP INDUSTRIES: DEALS

14.3 OTHER PLAYERS

14.3.1 PROSERTEK GROUP S.L

TABLE 271 PROSERTEK GROUP S.L: COMPANY OVERVIEW

14.3.2 TIMARS SVETS & SMIDE AB

TABLE 272 TIMARS SVETS & SMIDE AB: COMPANY OVERVIEW

14.3.3 DAMEN SHIPYARDS GROUP

TABLE 273 DAMEN SHIPYARDS GROUP: COMPANY OVERVIEW

14.3.4 HOIST MATERIAL HANDLING, INC.

TABLE 274 HOIST MATERIAL HANDLING, INC.: COMPANY OVERVIEW

14.3.5 YARDEYE GMBH

TABLE 275 YARDEYE GMBH: COMPANY OVERVIEW

14.3.6 BEDESCHI S.P.A.

TABLE 276 BEDESCHI S.P.A.: COMPANY OVERVIEW

14.3.7 BRUKS SIWERTELL GROUP

TABLE 277 BRUKS SIWERTELL GROUP: COMPANY OVERVIEW

14.3.8 KOOIMAN MARINE GROUP

TABLE 278 KOOIMAN MARINE GROUP: COMPANY OVERVIEW

14.3.9 NAVIS

TABLE 279 NAVIS: COMPANY OVERVIEW

14.3.10 BALTKRAN

TABLE 280 BALTKRAN: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 249)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved various activities in estimating the current size of the Port equipment market. Exhaustive secondary research was done to collect information on the Port equipment market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the Port equipment market.

Secondary Research

The market ranking of companies was determined using the secondary data made available through paid and unpaid sources and by analyzing the service portfolios of major companies. These companies were rated on the basis of performance and quality of their services. These data points were further validated by primary sources.

Secondary sources referred to, for this research study include financial statements of companies offering Port equipment systems, services and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the Port equipment market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information regarding the Port equipment market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, Middle East, AND Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

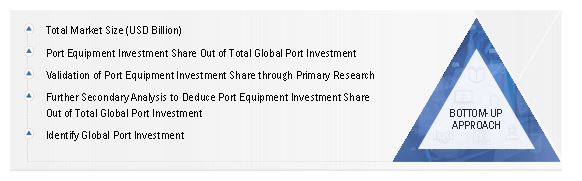

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the Port equipment market. The research methodology used to estimate the size of the market includes the following details:

The key players in the Port equipment market were identified through secondary research, and their market shares were determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews with leaders such as CEOs, directors, and marketing executives of leading companies operating in the Port equipment market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the Port equipment market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Port equipment Market Size: Bottom-Up Approach:

Data Triangulation

After arriving at the overall size of the Port equipment market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various segments and subsegments of the market. The data was triangulated by studying various factors and trends from both, the demand and supply sides. The market size was validated using both, the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the Port equipment market based on solutions, application, investment, type, operation and region

- To analyze the degree of competition in the market by identifying various parameters, including key market players

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the Port equipment market

- To analyze the macro and micro indicators of the market and provide a factor analysis

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Middle East, and Rest of the World, along with the major countries in each region

- To strategically profile key market players and comprehensively analyze their market rankings and core competencies

- To track and analyze competitive developments, such as joint ventures, mergers & acquisitions, and new product launches & developments of key players in the Port equipment market

- To identify detailed financial positions, key products, and key developments of leading companies in the Port equipment market

- To identify industry trends, market trends, and technology trends currently prevailing in the Port equipment market

- To strategically analyze micro markets with respect to individual technological trends and prospects of the Port equipment market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Port equipment market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Port equipment market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Port Equipment Market