Enterprise Content Collaboration Market by Component (Software, Services– Professional, Managed), Deployment Type (Cloud, On-Premises), User Type (SME, Large Enterprise), Industry Vertical and Region - Global Forecast to 2020

[153 Pages Report] The enterprise content collaboration market is estimated to grow from USD 3.65 Billion in 2015 to USD 8.26 Billion by 2020, at a Compound Annual Growth Rate (CAGR) of 17.7% from 2015 to 2020. This report considered 2014 as base year and the forecast period from 2015 to 2020. This market aims at collaborating critical documents in a secured and channelized manner to provide a unified point of reference. The report aims at estimating the market size and future growth opportunities of market across different segments, such as components, deployment types, user types, industry verticals, and regions. The growing demand for improved organizational productivity and improved access and pooling of knowledge base are the major driving forces of the market.

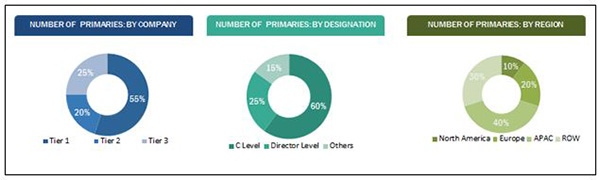

Major players in the enterprise content collaboration ecosystem were identified across various regions and their offerings, distribution channel; regional presence is understood through in-depth discussions. Also, the average revenue generated by these companies segmented, by region was employed to arrive at the overall enterprise content collaboration market size. This overall market size is used in the top-down procedure to estimate the sizes of other individual markets (component) via percentage splits from secondary and primary research. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews of industry leaders, such as CEOs, VPs, directors, and marketing executives for key insights.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

The breakdown of profiles of primary is depicted in the below figure:

The enterprise content collaboration ecosystem comprises content providers, such as IBM, Oracle, Xerox, HP Autonomy, and AirWatch; personal cloud providers such as Box, and Drobox; and open source content collaboration providers such as OpenCMS, and Drupal. Other stakeholders of the enterprise content collaboration market include content vendors, government authorities, and distributors.

Target audience:

- Enterprise Content Collaboration Providers

- End Users

- System Integrators

- Cloud Service Providers

- Third-Party Vendors

- Managed Service Providers

- Personal Cloud Providers

Among the enterprise content collaboration market components, the software segment is expected to gain more momentum in terms of market size. The banking, financial services and insurance industry vertical is expected to show increased demand for content collaboration solutions than other verticals such as education, manufacturing, and energy.

Scope of the Report

The research report segments the global market into following submarkets:

By Component:

- Software

- Services

- Professional

- Managed

By Deployment Type:

- Cloud

- On-Premise

By User Type:

- SME

- Large Enterprise

By Industry Vertical:

- Education

- Government

- BFSI

- Consumer Goods and Retail

- Healthcare

- IT and Telecom

- Manufacturing

- Energy

- Others (Media and Entertainment and Construction)

By Region:

- North America

- Europe

- Asia-Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America market

- Further breakdown of the Europe market

Company Information

- Detailed analysis and profiling of additional market players

The global market is expected to grow from USD 3.65 Billion in 2015 to USD 8.26 Billion by 2020, at a CAGR of 17.7%. Factors such as increasing need for improved organizational productivity, improved access and pooling of knowledge base, and accelerating need for diligence and risk mitigation are expected to encourage the growth of this market.

In the enterprise content collaboration market, managed service is the fastest-growing segment for the small and medium enterprises. This segment is expected to grow as the businesses need cost-efficient real-time content collaboration tools for their geographically scattered employee base. However, organizations encounter difficulties in sharing documents externally with ensured security. The solution vendors are expected to help organizations overcome this problem by offering robust security equipped content collaboration solutions.

Presently, this market is growing progressively with consistent technological advancements. The banking, financial services and insurance sector is increasingly using enterprise content collaboration solutions to enhance its operational efficiency and reduced paper management cost and is the largest revenue contributor to the market. Other high growth industry verticals comprise consumer goods and retail and healthcare.

Enterprise content collaboration platform providers, such as Microsoft and eXO platform, also play a vital role in this market as they allow integration of other organizational systems such as Customer Relationship Management (CRM). This enterprise content collaboration ecosystem consists of various stakeholders, including enterprise content collaboration providers, system integrators, third-party vendors, cloud service providers, network operators, managed service providers, personal cloud providers, and collaborative application developers. These stakeholders play an important role in the significant growth of the enterprise content collaboration market by providing the needed technologies, networks, and applications.

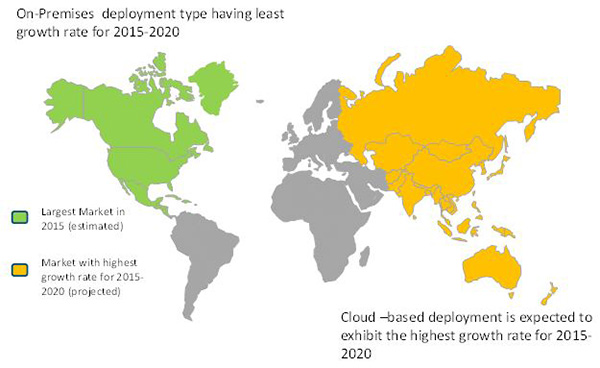

Among regions, North America is projected to hold the largest market share and is expected to dominate the enterprise content collaboration market from 2015 to 2020. The factors supplementing the growth of this market are the large-scale investments in the implementation of enterprise content collaboration solutions due to growth in e-commerce applications and need for better control and visibility mechanisms. The market in APAC is expected to showcase a significant growth potential in the years to come. This extensive growth is owing to the rising need for implementing security and accessibility controls along with enhanced decision making. The major vendors in this market include AirWatch by VMware, IBM, Oracle, Microsoft, HP Autonomy, Hyland Software, Box, and others. Partnerships, new product launches, and acquisitions are the key strategies adopted by these players to expand their global footprints.

In the years to come, it is expected that themarket will grow substantially with the integration of contextual and digital collaboration, along with the advancements in Web 2.0. However, the lack of proper alignment of content collaboration strategy with the business strategy and prevailing apprehensions about breach of privacy and data security are likely to inhibit the growth of this market.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunities in the Enterprise Content Collaboration Market

4.2 Top Three Industry Verticals

4.3 Global Market, By Region and Industry Vertical

4.4 Market Potential

4.5 Enterprise Content Collaboration User Type Market (2020)

4.6 Global Market, By Industry Vertical (2015–2020)

4.7 Enterprise Content Collaboration Regional Market

4.8 Industry Vertical Growth Matrix

4.9 Lifecycle Analysis, By Region, 2015

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Evolution

5.3 Enterprise Content Collaboration Market Segmentation

5.3.1 By Component

5.3.2 By Service

5.3.3 By Deployment Type

5.3.4 By User Type

5.3.5 By Industry Vertical

5.3.6 By Region

5.4 Enterprise Content Collaboration Market Dynamics

5.4.1 Drivers

5.4.1.1 Growing Need for Improved Organizational Productivity

5.4.1.2 Improved Access and Pooling of Knowledge Base

5.4.1.3 Escalating Need for Diligence and Risk Mitigation

5.4.2 Restraints

5.4.2.1 Difficulty in External Sharing of Documents

5.4.2.2 Integration of Content Collaboration is Time-Consuming

5.4.3 Opportunities

5.4.3.1 Ability to Unify and Collaborate Content Among Organizations

5.4.3.2 Emerging Potential Markets

5.4.3.3 Demand for Dynamic Documents is Growing

5.4.3.4 Integration of Content Model and Framework

5.4.4 Challenges

5.4.4.1 Securing the Perimeter and Organization

5.4.4.2 Increased Use of File Sharing Within the Organization

5.4.5 Burning Issues

5.4.5.1 Proper Alignment of Content Collaboration Strategy Along With the Business Strategy

6 Industry Trends (Page No. - 53)

6.1 Introduction

6.2 Enterprise Content Collaboration Architecture

6.3 Value Chain Analysis

6.4 Porter’s Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

6.5 Industry Standards and Regulations

6.5.1 Introduction

6.5.2 Health Insurance Portability and Accountability Act (HIPAA)

6.5.3 Sarbanes Oxley Act (SOX)

6.6 Innovation Spotlight

7 Enterprise Content Collaboration Market Analysis, By Component (Page No. - 60)

7.1 Introduction

7.2 Software

7.3 Services

7.3.1 Professional Services

7.3.2 Managed Services

8 Enterprise Content Collaboration Market Analysis, By Deployment Type (Page No. - 67)

8.1 Introduction

8.2 Cloud

8.3 On-Premises

9 Enterprise Content Collaboration Market Analysis, By User Type (Page No. - 72)

9.1 Introduction

9.2 Small and Medium Enterprises (SMES)

9.3 Large Enterprises

10 Enterprise Content Collaboration Market Analysis, By Industry Vertical (Page No. - 77)

10.1 Introduction

10.2 Education

10.3 Government

10.4 Banking, Financial Services, and Insurance (BFSI)

10.5 Consumer Goods and Retail

10.6 Healthcare

10.7 IT and Telecom

10.8 Manufacturing

10.9 Energy

10.10 Others

11 Geographic Analysis (Page No. - 88)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia-Pacific

11.5 Middle East and Africa (MEA)

11.6 Latin America

12 Competitive Landscape (Page No. - 108)

12.1 Overview

12.2 Competitive Situation and Trends

12.2.1 New Product Launches

12.2.2 Partnerships

12.2.3 Mergers and Acquisitions

13 Company Profiles (Page No. - 115)

(Overview, Products & Services, Strategies & Insights, Developments and MnM View)*

13.1 Introduction

13.2 Airwatch (Vmware)

13.3 Oracle Corporation

13.4 HP Autonomy

13.5 IBM Corporation

13.6 Microsoft Corporation

13.7 Xerox Corporation

13.8 Opentext Corporation

13.9 Box, Inc.

13.10 Hyland Software, Inc.

13.11 Alfresco Software

*Details on Overview, Products & Services, Strategies & Insights, Developments and MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 146)

14.1 Industry Excerpts

14.2 Discussion Guide

14.3 Introducing RT: Real Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

List of Tables (55 Tables)

Table 1 Global Market Size and Growth Rate, 2013–2020 (USD Billion, Y-O-Y %)

Table 2 Drivers: Impact Analysis

Table 3 Restraints: Impact Analysis

Table 4 Opportunities: Impact Analysis

Table 5 Challenges: Impact Analysis

Table 6 Enterprise Content Collaboration Market Size, By Component, 2013-2020 (USD Million)

Table 7 Software: Market Size, By Region, 2013-2020 (USD Million)

Table 8 Services: Market Size, By Region, 2013-2020 (USD Million)

Table 9 Professional Services: Market Size, By Region, 2013-2020 (USD Million)

Table 10 Managed Services: Market Size, By Region, 2013-2020 (USD Million)

Table 11 Enterprise Content Collaboration Market Size, By Deployment Type, 2013-2020 (USD Million)

Table 12 Cloud: Market Size, By Region, 2013-2020 (USD Million)

Table 13 On-Premises: Market Size, By Region, 2013-2020 (USD Million)

Table 14 Market Size, By User Type, 2013-2020 (USD Million)

Table 15 SME: Market Size, By Region, 2013-2020 (USD Million)

Table 16 Large Enterprise: Market Size, By Region, 2013-2020 (USD Million)

Table 17 Enterprise Content Collaboration Market Size, By Industry Vertical, 2013-2020 (USD Million)

Table 18 Education: Market Size, By Region, 2013-2020 (USD Million)

Table 19 Government: Market Size, By Region, 2013-2020 (USD Million)

Table 20 BFSI: Market Size, By Region, 2013-2020 (USD Million)

Table 21 Consumer Goods and Retail: Market Size, By Region, 2013-2020 (USD Million)

Table 22 Healthcare: Market Size, By Region, 2013-2020 (USD Million)

Table 23 IT and Telecom: Market Size, By Region, 2013-2020 (USD Million)

Table 24 Manufacturing: Market Size, By Region, 2013-2020 (USD Million)

Table 25 Energy: Market Size, By Region, 2013-2020 (USD Million)

Table 26 Others: Market Size, By Region, 2013-2020 (USD Million)

Table 27 Enterprise Content Collaboration Market Size, By Region, 2013-2020 (USD Million)

Table 28 North America: Enterprise Content Collaboration Market Size, By Component, 2013-2020 (USD Million)

Table 29 North America: Market Size, By Service, 2013-2020 (USD Million)

Table 30 North America: Market Size, By Deployment Type, 2013-2020 (USD Million)

Table 31 North America: Market Size, By User Type, 2013-2020 (USD Million)

Table 32 North America: Market Size, By Industry Vertical, 2013-2020 (USD Million)

Table 33 Europe: Enterprise Content Collaboration Market Size, By Component, 2013-2020 (USD Million)

Table 34 Europe: Market Size, By Service, 2013-2020 (USD Million)

Table 35 Europe: Market Size, By Deployment Type, 2013-2020 (USD Million)

Table 36 Europe: Market Size, By User Type, 2013-2020 (USD Million)

Table 37 Europe: Market Size, By Industry Vertical, 2013-2020 (USD Million)

Table 38 Asia-Pacific: Enterprise Content Collaboration Market Size, By Component, 2013-2020 (USD Million)

Table 39 Asia-Pacific: Market Size, By Service, 2013-2020 (USD Million)

Table 40 Asia-Pacific: Market Size, By Deployment Type, 2013-2020 (USD Million)

Table 41 Asia-Pacific: Market Size, By User Type, 2013-2020 (USD Million)

Table 42 Asia-Pacific: Market Size, By Industry Vertical, 2013-2020 (USD Million)

Table 43 Middle East and Africa: Enterprise Content Collaboration Market Size, By Component, 2013-2020 (USD Million)

Table 44 Middle East and Africa: Market Size, By Service, 2013-2020 (USD Million)

Table 45 Middle East and Africa: Market Size, By Deployment Type, 2013-2020 (USD Million)

Table 46 Middle East and Africa: Market Size, By User Type, 2013-2020 (USD Million)

Table 47 Middle East and Africa: Market Size, By Industry Vertical, 2013-2020 (USD Million)

Table 48 Latin America: Enterprise Content Collaboration Market Size, By Component, 2013-2020 (USD Million)

Table 49 Latin America: Market Size, By Service, 2013-2020 (USD Million)

Table 50 Latin America: Market Size, By Deployment Type, 2013-2020 (USD Million)

Table 51 Latin America: Market Size, By User Type, 2013-2020 (USD Million)

Table 52 Latin America: Enterprise Content Collaboration Market Size, By Industry Vertical, 2013-2020 (USD Million)

Table 53 New Product Launches, 2013–2015

Table 54 Partnerships, 2013–2015

Table 55 Mergers and Acquisitions, 2013-2015

List of Figures (68 Figures)

Figure 1 Markets Covered

Figure 2 Enterprise Content Collaboration: Research Design

Figure 3 Breakdown of Primaries: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Component Snapshot (2015-2020): Market for Services is Expected to Grow at the Highest CAGR

Figure 8 Deployment Type Snapshot (2015-2020): On-Premises is Expected to Dominate the Enterprise Content Collaboration Market

Figure 9 User Type Snapshot (2015-2020): Large Enterprises Segment is Expected to Dominate the Market

Figure 10 North America is Estimated to Hold the Largest Market Share in 2015

Figure 11 Improved Access and Pooling of Knowledge Base is Driving this Market

Figure 12 Healthcare Industry Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 13 North America is Expected to Hold the Largest Market Share Among All Regions in this Market

Figure 14 Asia-Pacific is Expected to Have the Highest Market Growth Potential Till 2020

Figure 15 Large Enterprise User Sgement is Expected to Dominate the Market in 2020

Figure 16 Top Two Industries are Estimated to Account for More Than One-Fourth of the Enterprise Content Collaboration Market During the Forecast Period

Figure 17 Enterprise Content Collaboration Market in Asia-Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 18 Market Growth Matrix, By Industry Vertical

Figure 19 Regional Lifecycle: Asia-Pacific is Expected to Be in the Growth Phase in 2015

Figure 20 Contextual Collaboration and Mobility is Expected to Play A Crucial Role in the Market

Figure 21 Enterprise Content Collaboration Market Segmentation

Figure 22 Market Segmentation: By Component

Figure 23 Market Segmentation: By Service

Figure 24 Market Segmentation: By Deployment Type

Figure 25 Market Segmentation: By User Type

Figure 26 Market Segmentation: By Industry Vertical

Figure 27 Market Segmentation: By Region

Figure 28 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 29 Enterprise Content Collaboration Architecture

Figure 30 Value Chain Analysis: Enterprise Content Collaboration Market

Figure 31 Porter’s Five Forces Analysis (2015): Availability of Substitute Vendors has Increased the Value of Enterprise Content Collaboration Products

Figure 32 Software Estimated to Lead in the Component Segment During the Forecast Period

Figure 33 Software Expected to Grow at the Highest CAGR in Asia-Pacific

Figure 34 Services Expected to Grow at the Highest CAGR in Asia-Pacific

Figure 35 Asia-Pacific is Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 36 Asia-Pacific is Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 37 On-Premises is Expected to Be the Highest Contributor in Terms of Market Size for the Deployment Type Segment

Figure 38 Cloud Deployment is Expected to Grow at the Highest CAGR in Asia-Pacific

Figure 39 On-Premises Deployment is Expected to Grow at the Highest CAGR in Asia-Pacific

Figure 40 SME User Segment is Expected to Exhibit the Highest Growth Rate During the Forecast Period

Figure 41 SME Segment is Expected to Grow at the Highest CAGR in Asia-Pacific

Figure 42 On-Premises is Expected to Experience A High Growth Rate in the Asia-Pacific Region

Figure 43 Consumer Goods and Retail is Expected to Experience A High Growth Rate in the Industry Verticals Segment

Figure 44 BFSI Industry Vertical is Expected to Grow at the Highest CAGR in Asia-Pacific

Figure 45 Healthcare Industry Vertical is Expected to Grow at the Highest CAGR in Asia-Pacific

Figure 46 Manufacturing Industry Vertical is Expected to Grow at the Highest CAGR in Asia-Pacific

Figure 47 Geographic Snapshot – Asia-Pacific Emerging as A New Hotspot

Figure 48 Asia-Pacific: an Attractive Destination for Industry Verticals

Figure 49 Geographic Snapshot (2015-2020): Asia-Pacific and Latin America are Attractive Destinations for the Enterprise Content Collaboration Market

Figure 50 North America Market Snapshot

Figure 51 Asia-Pacific Market Snapshot

Figure 52 Asia-Pacific is Expected to Grow at the Highest CAGR in the Market

Figure 53 Companies Adopted New Product Launch as the Key Growth Strategy Between 2013 and 2015

Figure 54 Market Evaluation Framework

Figure 55 Battle for Market Share: New Product Launches and Partnerships Were the Key Strategies

Figure 56 Geographic Revenue Mix of Top 4 Market Players

Figure 57 Airwatch: SWOT Analysis

Figure 58 Oracle Corporation: Company Snapshot

Figure 59 Oracle Corporation: SWOT Analysis

Figure 60 HP Corporation: Company Snapshot

Figure 61 HP Autonomy: SWOT Analysis

Figure 62 IBM Corporation: Company Snapshot

Figure 63 IBM: SWOT Analysis

Figure 64 Microsoft Corporation: Company Snapshot

Figure 65 Microsoft: SWOT Analysis

Figure 66 Xerox Corporation: Company Snapshot

Figure 67 Opentext Corporation: Company Snapshot

Figure 68 Box, Inc.: Company Snapshot

Growth opportunities and latent adjacency in Enterprise Content Collaboration Market