Food Glazing Agents Market by Ingredient Type (Stearic Acid, Beeswax, Carnauba Wax, Candelilla Wax, Shellac, Paraffin Wax), Ingredient Function, Application (Bakery, Confectionery, Fruits & Vegetables, Functional Foods), & by Region - Global Forecasts to 2021

The food glazing agents market was valued at USD 2.27 Billion in 2015, and is projected to reach USD 3.74 Billion by 2021, at a CAGR of 8.8% from 2016. The market has been segmented on the basis of ingredient type, ingredient function, application, and region.

The years considered for the study are as follows:

- Base year: 2015

- Estimated year: 2016

- Projected year: 2021

- Forecast period: 2016 to 2021

The objectives of the study include the following:

- To define, segment, and project the global market size for food glazing agents

- To understand the structure of the market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape of the market trends

Research Methodology

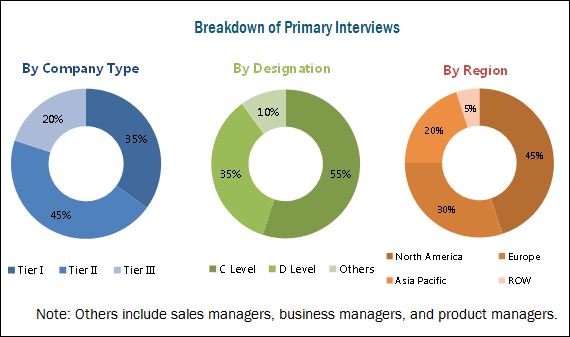

This report includes an estimation of market size in terms of value (USD million). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the food glazing agents market and various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research such as Hoovers, Forbes, and Bloomberg Businessweek; company websites; annual reports; and their market share in respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, download the pdf brochure

The key players involved in market include Mantrose-Haeuser (U.S.), Capol (Germany), Strahl & Pitsch (U.S.), and Masterol Foods (Australia).

Target Audience:

- Food glazing agents manufacturers

- Research institutions

- Raw material suppliers

- Government bodies

- Distributors

- End users (food industry)

Scope of the report

This research report categorizes the food glazing agents market based on ingredient type, ingredient function, application, and region.

Based on Ingredient Type, the market has been segmented as follows:

- Stearic acid

- Beeswax

- Carnauba wax

- Candelilla wax

- Shellac

- Paraffin wax

- Others (montan and lanolin wax)

Based on Ingredient Function, the market has been segmented as follows:

- Coating agents

- Surface finishing agents

- Firming agents

- Film agents

- Others (binding agents and stabilizing agents)

Based on Application, the market has been segmented as follows:

- Bakery

- Confectionery

- Processed meat, poultry & fish

- Fruits & vegetables

- Functional foods

- Others (dairy products & convenience foods

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW (South Africa and Brazil)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe food glazing agents market Greece, Spain, and the Netherlands

- Further breakdown of the Rest of Asia-Pacific food glazing agents market into South Korea, Indonesia, and Malaysia.

- Further breakdown of the RoW food glazing agents market into Chile, Argentina, and Middle Eastern countries.

Company Information

- Detailed analysis and profiling of additional market players (up to two)

The market for food glazing agents is projected to reach USD 3.74 Billion by 2021, at a CAGR of about 8.8% from 2016 to 2021. This market is fueled by the growing interest among consumers towards the appearance and texture of foods and the growth of end-use applications of glazing agents in the food industry. Globally, the growth of bakery and confectionery industry has led to a large-scale adoption of food glazing agents for various applications.

The global market is segmented on the basis of ingredient type into stearic acid, beeswax, carnauba wax, candelilla wax, shellac, paraffin wax, and others. The carnauba wax segment is projected to grow at the highest rate in terms of value and volume, during the forecast period. This is attributed to the increasing consumers’ demand for vegan and organic sources of food additives used in their food products.

On the basis of ingredient function, the market is segmented into coating agents, surface-finishing agents, firming agents, film-formers, and others. On the basis of application, it is segmented into bakery, confectionery, processed meat, poultry & fish, fruits & vegetables, functional foods, and others. On the basis of application, the functional foods segment is projected to grow at the highest rate due to its benefits in the overall development of human body and other health benefits associated with it. The confectionery segment dominated the food glazing agents market due to the growth of the confectionery industry, which in turn increases the demand for this market.

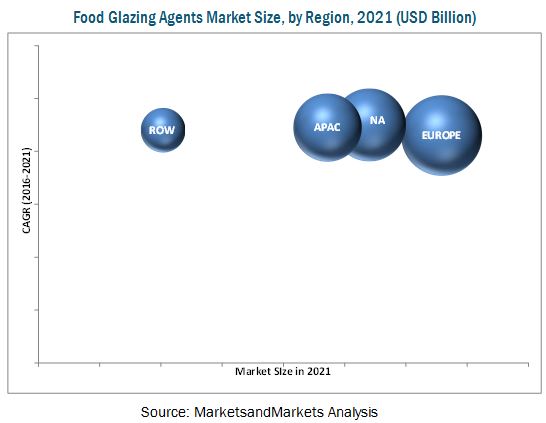

The market is also segmented on the basis of region into North America, Europe, Asia-Pacific, and the Rest of the World (RoW). In 2015, Europe dominated the global food glazing agents market, in terms of value, due to the developed food processing industry in the region. Asia-Pacific is projected to be the fastest-growing region in this market in terms of volume, due to continuous increase in demand for food glazing agents owing to the increased demand from different end-use applications.

The multi-functionality of food glazing agents, coupled with the growing demand from the food & beverage industry drives the market. However, the increasing costs of raw materials is restraining the market.

The global market is fragmented and competitive, with a large number of players operating at regional and local levels. The key players in the market adopted new product launches as their preferred growth strategy. Key players such as Mantrose-Haeuser Co., Inc. (U.S.), Capol GmbH (Germany), Strahl & Pitsch, Inc. (U.S.), and Masterol Foods (Australia) have been profiled in the report.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.4 Years Considered for the Study

1.5 Currency

1.6 Units

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Rising Population

2.2.2.1.1 Increase in Middle-Class Population, 2009–2030

2.2.2.2 Growth of Food & Beverage Industry

2.2.3 Supply-Side Analysis

2.2.3.1 Regulatory Bodies and Organizations in Different Countries

2.2.3.2 Economies of Scale

2.2.3.3 Changing and Improvised Technologies

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions of the Research Study

2.5.2 Limitations of the Research Study

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Food Glazing Agents Market

4.2 Coating Agents to Dominate the Ingredient Function

4.3 China to Dominate the Food Glazing Agents Market in Asia-Pacific in 2016

4.4 Europe to Dominate the Food Glazing Agents Market in 2016

4.5 Food Glazing Agents Market: Lifecycle Analysis, By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Ingredient Type

5.2.2 By Ingredient Function

5.2.3 By Application

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Demand for Glazing Agents in Bakery and Confectionery

5.3.1.2 Consumer Awareness Towards Appearance and Texture of Food Products

5.3.2 Restraints

5.3.2.1 Scarcity of Raw Material

5.3.3 Opportunities

5.3.3.1 Growing Applications of Food Glazing Agents

5.3.3.2 Growing Demand in Emerging Economies

5.3.4 Challenges

5.3.4.1 Price Volatility

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Supply Chain Analysis

6.2.1 Prominent Companies

6.2.2 Small & Medium Enterprises

6.2.3 End Users

6.3 Value Chain Analysis

6.4 Key Industry Insights

6.5 Porter’s Five Forces Analysis

6.5.1 Threat of New Entrants

6.5.2 Threat of Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of Buyers

6.5.5 Intensity of Competitive Rivalry

7 Market For Food Glazing Agents, By Ingredient Type (Page No. - 47)

7.1 Introduction

7.2 Stearic Acid

7.3 Beeswax

7.4 Carnauba Wax

7.5 Candelilla Wax

7.6 Shellac

7.7 Paraffin Wax

7.8 Others

8 Market For Food Glazing Agents, By Ingredient Function (Page No. - 57)

8.1 Introduction

8.2 Coating Agents

8.3 Surface-Finishing Agents

8.4 Firming Agents

8.5 Film Formers

8.6 Others

9 Market For Food Glazing Agents, By Application (Page No. - 65)

9.1 Introduction

9.2 Bakery

9.3 Confectionery

9.4 Processed Meat, Poultry & Fish

9.5 Fruits & Vegetables

9.6 Functional Foods

9.7 Others

10 Market For Food Glazing Agents, By Region (Page No. - 75)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 U.K.

10.3.2 Germany

10.3.3 France

10.3.4 Italy

10.3.5 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Australia & New Zealand

10.4.5 Rest of Asia-Pacific

10.5 Rest of the World (RoW)

10.5.1 Brazil

10.5.2 South Africa

10.5.3 Others in RoW

11 Market For Food Glazing Agents, By Brand (Page No. - 115)

11.1 Introduction

11.2 Capol Glazes for Chocolate-Coated Centers

11.3 Capol Glazes for Sugar Dragées

11.4 Beetex Series

11.5 Liquicote

11.6 Shellglaze Series

11.7 Speedigloss

11.8 Dllx10

12 Competitive Landscape (Page No. - 117)

12.1 Overview

12.2 Product Mapping

12.3 Competitive Situation and Trends

12.3.1 New Product Launches

12.3.2 Mergers & Acquisitions

13 Company Profiles (Page No. - 120)

13.1 Introduction

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.2 Capol GmbH

13.3 Mantrose-Haeuser Co., Inc.

13.4 Strahl & Pitsch

13.5 British Wax

13.6 Masterol Foods

13.7 Stéarinerie Dubois

13.8 Poth Hille

13.9 Koster Keunen

13.10 BJ International

13.11 Carnaúba Do Brasil LTDA

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 133)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

List of Tables (108 Tables)

Table 1 Food Glazing Agents Market Size, By Ingredient Type, 2014–2021 (USD Million)

Table 2 Food Glazing Agents Market Size, By Ingredient Type, 2014–2021 (KT)

Table 3 Stearic Acid Market Size, By Region, 2014–2021 (USD Million)

Table 4 Stearic Acid Market Size, By Region, 2014–2021 (KT)

Table 5 Beeswax Market Size, By Region, 2014–2021 (USD Million)

Table 6 Beeswax Market Size, By Region, 2014–2021 (KT)

Table 7 Carnauba Wax Market Size, By Region, 2014–2021 (USD Million)

Table 8 Carnauba Wax Market Size, By Region, 2014–2021 (KT)

Table 9 Candelilla Wax Market Size, By Region, 2014–2021 (USD Million)

Table 10 Candelilla Wax Market Size, By Region, 2014–2021 (KT)

Table 11 Shellac Market Size, By Region, 2014–2021 (USD Million)

Table 12 Shellac Market Size, By Region, 2014–2021 (KT)

Table 13 Paraffin Wax Market Size, By Region, 2014–2021 (USD Million)

Table 14 Paraffin Wax Market Size, By Region, 2014–2021 (KT)

Table 15 Other Ingredient Types Market Size, By Region, 2014–2021 (USD Million)

Table 16 Other Ingredient Types Market Size, By Region, 2014–2021 (KT)

Table 17 Food Glazing Agents Market Size, By Ingredient Function, 2014–2021 (USD Million)

Table 18 Food Glazing Agents Market Size, By Ingredient Function, 2014–2021 (KT)

Table 19 Coating Agents Market Size, By Region, 2014–2021 (USD Million)

Table 20 Coating Agents Market Size, By Region, 2014–2021 (KT)

Table 21 Surface-Finishing Agents Market Size, By Region, 2014–2021 (USD Million)

Table 22 Surface-Finishing Agents Market Size, By Region, 2014–2021 (KT)

Table 23 Firming Agents Market Size, By Region, 2014–2021 (USD Million)

Table 24 Firming Agents Market Size, By Region, 2014–2021 (KT)

Table 25 Film Formers Market Size, By Region, 2014–2021 (USD Million)

Table 26 Film Formers Market Size, By Region, 2014–2021 (KT)

Table 27 Other Ingredient Functions Market Size, By Region, 2014–2021 (USD Million)

Table 28 Others Ingredient Functions Market Size, By Region, 2014–2021 (Kilotons)

Table 29 Food Glazing Agents Market Size, By Application, 2014–2021 (USD Million)

Table 30 Food Glazing Agents Market Size, By Application, 2014–2021 (KT)

Table 31 Food Glazing Agents in Bakery Market Size, By Region, 2014–2021 (USD Million)

Table 32 Food Glazing Agents in Bakery Market Size, By Region, 2014–2021 (KT)

Table 33 Food Glazing Agents in Confectionery Market Size, By Region, 2014–2021 (USD Million)

Table 34 Food Glazing Agents in Confectionery Market Size, By Region, 2014–2021 (KT)

Table 35 Food Glazing Agents in Processed Meat, Poultry & Fish Market Size, By Region, 2014–2021 (USD Million)

Table 36 Food Glazing Agents in Processed Meat, Poultry & Fish Market Size, By Region, 2014–2021 (KT)

Table 37 Food Glazing Agents in Fruits & Vegetables Market Size, By Region, 2014–2021 (USD Million)

Table 38 Food Glazing Agents in Fruits & Vegetables Market Size, By Region, 2014–2021 (KT)

Table 39 Food Glazing Agents in Functional Foods Market Size, By Region, 2014–2021 (USD Million)

Table 40 Food Glazing Agents in Functional Foods Market Size, By Region, 2014–2021 (KT)

Table 41 Food Glazing Agents in Other Applications Market Size, By Region, 2014–2021 (USD Million)

Table 42 Food Glazing Agents in Other Applications Market Size, By Region, 2014–2021 (KT)

Table 43 Food Glazing Agents Market Size, By Region, 2014-2021 (USD Million)

Table 44 Food Glazing Agents Market Size, By Region, 2014-2021 (KT)

Table 45 North America: Food Glazing Agents Market Size, By Country, 2014-2021 (USD Million)

Table 46 North America: By Market Size, By Country, 2014-2021 (KT)

Table 47 North America: By Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 48 North America: By Market Size, By Ingredient Type, 2014-2021 (KT)

Table 49 North America: By Market Size, By Ingredient Function, 2014-2021 (USD Million)

Table 50 North America: Food Glazing Agents Market Size, By Ingredient Function, 2014-2021 (KT)

Table 51 North America: By Market Size, By Application, 2014-2021 (USD Million)

Table 52 North America: By Market Size, By Application, 2014-2021 (KT)

Table 53 U.S.: By Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 54 U.S.: By Market Size, By Ingredient Type, 2014-2021 (KT)

Table 55 Canada: By Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 56 Canada: By Market Size, By Ingredient Type, 2014-2021 (KT)

Table 57 Mexico: Food Glazing Agents Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 58 Mexico: By Market Size, By Ingredient Type, 2014-2021 (KT)

Table 59 Europe: By Market Size, By Country, 2014-2021 (USD Million)

Table 60 Europe: By Market Size, By Country, 2014-2021 (KT)

Table 61 Europe: By Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 62 Europe: By Market Size, By Ingredient Type, 2014-2021 (KT)

Table 63 Europe: Food Glazing Agents Market Size, By Ingredient Function, 2014-2021 (USD Million)

Table 64 Europe: By Market Size, By Ingredient Function, 2014-2021 (KT)

Table 65 Europe: By Market Size, By Application, 2014-2021 (USD Million)

Table 66 Europe: By Market Size, By Application, 2014-2021 (KT)

Table 67 U.K.: By Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 68 U.K.: By Market Size, By Ingredient Type, 2014-2021 (KT)

Table 69 Germany: By Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 70 Germany: By Market Size, By Ingredient Type, 2014-2021 (KT)

Table 71 France: By Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 72 France: By Market Size, By Ingredient Type, 2014-2021 (KT)

Table 73 Italy: Food Glazing Agents Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 74 Italy: By Market Size, By Ingredient Type, 2014-2021 (KT)

Table 75 Rest of Europe: By Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 76 Rest of Europe: By Market Size, By Ingredient Type, 2014-2021 (KT)

Table 77 Asia-Pacific: By Market Size, By Country, 2014-2021 (USD Million)

Table 78 Asia-Pacific: By Market Size, By Country, 2014-2021 (KT)

Table 79 Asia-Pacific: By Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 80 Asia-Pacific: By Market Size, By Ingredient Type, 2014-2021 (KT)

Table 81 Asia-Pacific: By Market Size, By Ingredient Function, 2014-2021 (USD Million)

Table 82 Asia-Pacific: By Market Size, By Ingredient Function, 2014-2021 (KT)

Table 83 Asia-Pacific: By Market Size, By Application, 2014-2021 (USD Million)

Table 84 Asia-Pacific: By Market Size, By Application, 2014-2021 (KT)

Table 85 China: By Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 86 China: By Size, By Ingredient Type, 2014-2021 (KT)

Table 87 Japan: By Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 88 Japan: By Market Size, By Ingredient Type, 2014-2021 (KT)

Table 89 India: By Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 90 India: By Market Size, By Ingredient Type, 2014-2021 (KT)

Table 91 Australia & New Zealand: By Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 92 Australia & New Zealand: By Market Size, By Ingredient Type, 2014-2021 (KT)

Table 93 Rest of Asia-Pacific: By Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 94 Rest of Asia-Pacific: Food Glazing Agents Market Size, By Ingredient Type, 2014-2021 (KT)

Table 95 RoW: By Market Size, By Country, 2014-2021 (USD Million)

Table 96 RoW: By Market Size, By Country, 2014-2021 (KT)

Table 97 RoW: Food Glazing Agents Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 98 RoW: By Market Size, By Ingredient Type, 2014-2021 (KT)

Table 99 RoW: By Market Size, By Ingredient Function, 2014-2021 (USD Million)

Table 100 RoW: By Market Size, By Ingredient Function, 2014-2021 (USD Million)

Table 101 RoW: Food Glazing Agents Market Size, By Application, 2014-2021 (USD Million)

Table 102 RoW: By Market Size, By Application, 2014-2021 (USD Million)

Table 103 Brazil: By Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 104 Brazil: By Market Size, By Ingredient Type, 2014-2021 (KT)

Table 105 South Africa: By Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 106 South Africa: By Market Size, By Ingredient Type, 2014-2021 (KT)

Table 107 Others in RoW: Food Glazing Agents Market Size, By Ingredient Type, 2014-2021 (USD Million)

Table 108 Others in RoW: By Market Size, By Ingredient Type, 2014-2021 (KT)

List of Figures (41 Figures)

Figure 1 Food Glazing Agents Market Segmentation

Figure 2 Food Glazing Agents Market: Research Design

Figure 3 Food Glazing Agents Market: Research Flow

Figure 4 Global Population is Projected to Reach ~9.5 Billion By 2050

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Food Glazing Agents Market Snapshot (2015 vs 2021): Confectionery Segment to Dominate the Market (KT)

Figure 9 Asia-Pacific to Be the Fastest-Growing Regional Market for Food Glazing Agents, 2016-2021

Figure 10 Carnauba Wax to Be the Fastest-Growing Ingredient Type, 2016 (KT)

Figure 11 Coating Agents Segment to Dominate the Food Glazing Agents Market, By Ingredient Function, 2016 (KT)

Figure 12 U.S. Dominated the Food Glazing Agents Market (Volume), 2015

Figure 13 Emerging Economies Offer Attractive Opportunities in the Food Glazing Agents Market, 2016 vs 2021

Figure 14 Film Forming Function of Food Glazing Agents Market to Grow at the Highest CAGR, in Terms of Value, From 2016 to 2021

Figure 15 Candelilla Wax Segment to Dominate the Asia-Pacific Food Glazing Agents Market, Followed By Carnauba Wax, in 2016

Figure 16 Confectionery is Projected to Be Largest Application for Food Glazing Agents From 2016 to 2021

Figure 17 Food Glazing Agents Market in Asia-Pacific to Enter an Exponential Growth Phase By 2021

Figure 18 Food Glazing Agents Market, By Ingredient Type

Figure 19 Food Glazing Agents Market, By Ingredient Function

Figure 20 Food Glazing Agents Market, By Application

Figure 21 Increasing Demand for Food Glazing Agents in Bakery and Confectionery Segments Drives the Food Glazing Agents Market

Figure 22 Supply Chain Integrity in the Food Glazing Agents Market

Figure 23 Value Chain Analysis

Figure 24 Porter’s Five Forces Analysis

Figure 25 Carnauba Wax to Be the Fastest-Growing Market, 2016-2020 (USD Million)

Figure 26 Stearic Acid to Dominate the Market, 2016-2021 (KT)

Figure 27 Asia-Pacific to Dominate the Carnauba Wax Segment of the Food Glazing Agents Market, 2016-2021 (KT)

Figure 28 Coating Agents to Dominate the Market, By Ingredient Function, 2016-2021 (KT)

Figure 29 Asia-Pacific to Dominate the Market for Coating Agents From 2016 to 2021 (KT)

Figure 30 Functional Foods Application to Be the Fastest Growing, in Terms of Value, 2016-2021

Figure 31 Confectionery Dominated the Market, in Terms of Value, in 2015

Figure 32 Asia-Pacific to Be the Fastest-Growing Market for the Confectionery Application of Food Glazing Agents, in Terms of Volume, 2016-2021

Figure 33 Europe to Dominate the Functional Foods Segment of the Market, in Terms of Value, 2016-2021

Figure 34 Geographic Snapshot (2016-2021): Rapidly Growing Markets Such as India and China are Emerging as New Hotspots

Figure 35 North American Food Glazing Agents Market: A Snapshot

Figure 36 European Food Glazing Agents Market: A Snapshot

Figure 37 Asia-Pacific Food Glazing Agents Market: A Snapshot

Figure 38 Growth Strategies Adopted By Leading Companies, 2013-2016

Figure 39 Product Mapping Snapshot for the Food Glazing Agents Market, 2016

Figure 40 Battle for Market Share: New Product Launches Accounted for the Key Strategy

Figure 41 Geographic Revenue Mix of Top Market Players, 2015

Growth opportunities and latent adjacency in Food Glazing Agents Market