TABLE OF CONTENTS

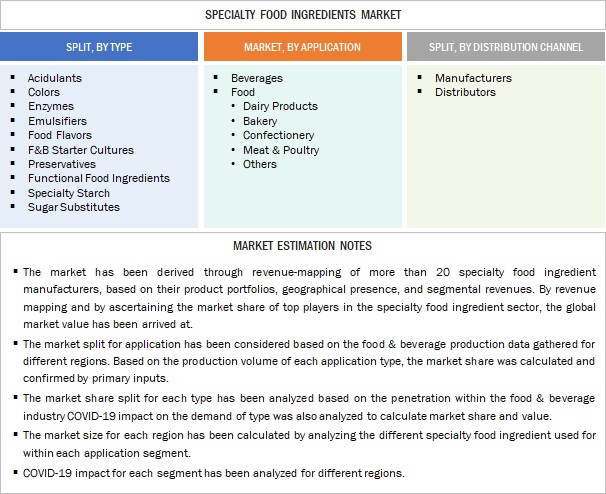

1 INTRODUCTION (Page No. - 35)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SEGMENTATION

1.3.1 INCLUSIONS & EXCLUSIONS

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 UNITS CONSIDERED

1.6.1 VALUE/CURRENCY UNIT

1.6.2 VOLUME UNIT

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

1.8.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY (Page No. - 42)

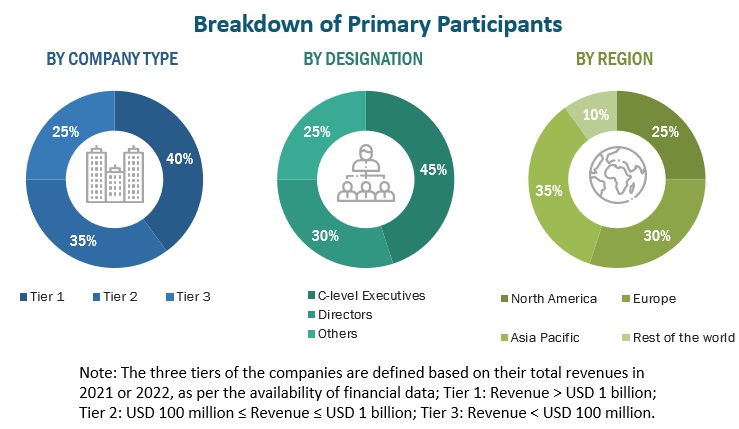

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

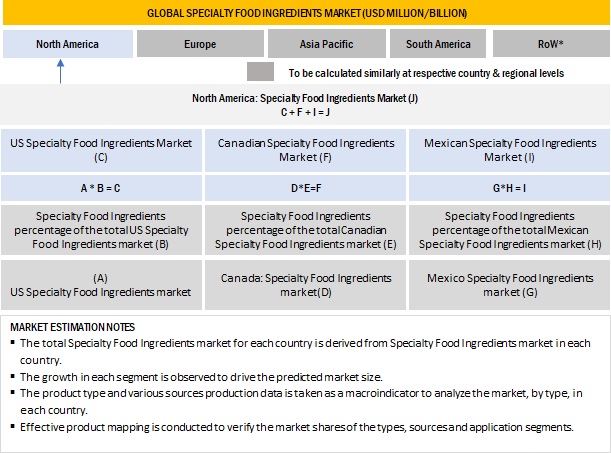

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

2.6 RECESSION IMPACT ANALYSIS

2.6.1 MACRO INDICATORS OF RECESSION

3 EXECUTIVE SUMMARY (Page No. - 55)

4 PREMIUM INSIGHTS (Page No. - 59)

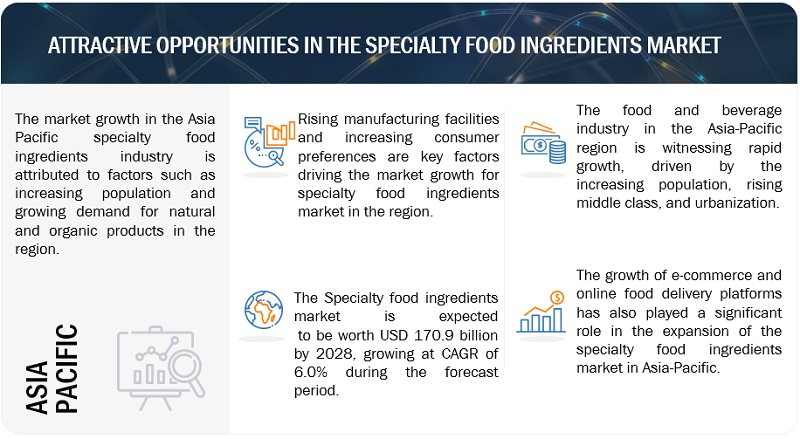

4.1 ATTRACTIVE OPPORTUNITIES FOR SPECIALTY FOOD INGREDIENTS MARKET PLAYERS

4.2 SPECIALTY FOOD INGREDIENTS MARKET: MAJOR REGIONAL SUBMARKETS FOR DISTRIBUTORS

4.3 SPECIALTY FOOD INGREDIENTS MARKET, BY TYPE

4.4 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE

4.5 SUGAR SUBSTITUTES MARKET, BY TYPE

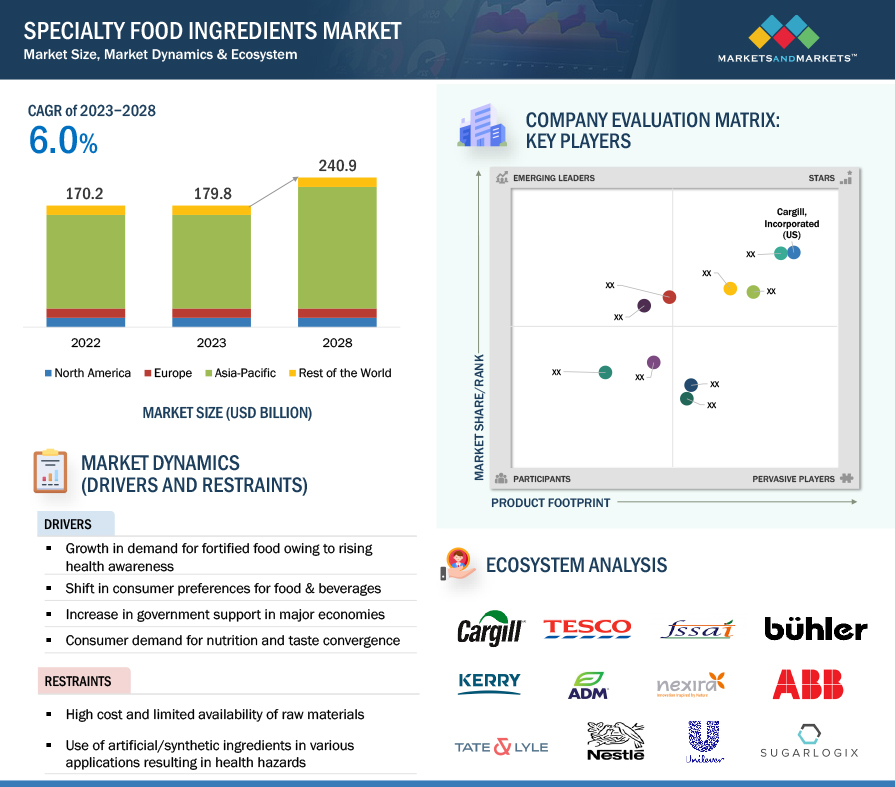

5 MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growth in demand for fortified food owing to rising health awareness

5.2.1.1.1 Demand for functional food ingredients due to increase in instances and economic burden of chronic diseases

5.2.1.1.2 Consumer awareness of micronutrient deficiencies

5.2.1.1.3 Malnutrition across regions

5.2.1.1.4 Partnerships between key players to address nutritional deficiencies

5.2.1.2 Shift in consumer preferences for food & beverages

5.2.1.2.1 Shift toward plant-based ingredients and proteins

5.2.1.2.2 Demand for natural, organic, and clean-label products

5.2.1.2.3 Increase in inclination toward premium and branded products

5.2.1.3 Increase in government support in major economies

5.2.1.3.1 Mandates on food fortification by government organizations

5.2.1.4 Consumer demand for nutrition and taste convergence

5.2.1.5 Rise in demand for convenience, ready-to-eat, and packaged foods

5.2.2 RESTRAINTS

5.2.2.1 High cost and limited availability of raw materials

5.2.2.1.1 Limited raw material availability due to seasonal changes

5.2.2.2 Use of artificial/synthetic ingredients in various applications resulting in health hazards

5.2.2.3 Increase in instances of allergies and intolerances related to few ingredients

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in number of end-use applications

5.2.3.1.1 Synergy between ingredients owing to multifunctional attributes

5.2.3.1.2 Increase in consumption of processed food

5.2.3.1.3 Rapidly growing beverage and functional drinks sales

5.2.3.2 Product-based and technological innovations in ingredient industry

5.2.3.2.1 Use of encapsulation technology

5.2.3.3 Emerging economies present high-growth opportunities due to rise in food processing investments

5.2.4 CHALLENGES

5.2.4.1 Lack of consistency in regulations about various ingredients

5.2.4.2 Increase in competition due to presence of low-cost ingredients

5.2.4.3 Growth in pressure on global resources and need to tap new raw materials

6 INDUSTRY TRENDS (Page No. - 80)

6.1 INTRODUCTION

6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

6.3 VALUE CHAIN ANALYSIS

6.3.1 RESEARCH & DEVELOPMENT

6.3.2 SOURCING OF RAW MATERIALS

6.3.3 PRODUCTION & PROCESSING

6.3.4 DISTRIBUTION, MARKETING, AND SALES

6.4 TECHNOLOGY ANALYSIS

6.4.1 PROTECTION OF SPECIALTY FOOD INGREDIENTS USING ENCAPSULATION

6.5 MARKET MAPPING

6.5.1 SUPPLY SIDE

6.6 TRADE ANALYSIS

6.7 PATENT ANALYSIS

6.8 PORTER’S FIVE FORCES ANALYSIS

6.8.1 INTENSITY OF COMPETITIVE RIVALRY

6.8.2 BARGAINING POWER OF SUPPLIERS

6.8.3 BARGAINING POWER OF BUYERS

6.8.4 THREAT FROM NEW ENTRANTS

6.8.5 THREAT FROM SUBSTITUTES

6.9 CASE STUDY ANALYSIS

6.9.1 MIND RIGHT’S PLANT-BASED BARS WAS FORMULAED TO FOCUS ON MENTAL HEALTH ISSUES

6.1 PRICING ANALYSIS

6.10.1 SPECIALTY FOOD INGREDIENTS MARKET, BY TYPE

6.11 REGULATORY FRAMEWORK

6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.12 NORTH AMERICA: REGULATIONS

6.12.1 REGULATIONS FOR ENZYMES

6.12.2 REGULATIONS FOR SUGAR SUBSTITUTES

6.12.2.1 US

6.12.2.2 Canada

6.12.3 REGULATIONS FOR MEAT SUBSTITUTES

6.12.3.1 US

6.12.3.1.1 Wheat protein

6.12.3.1.2 Soy protein

6.12.3.2 Canada

6.12.3.2.1 Soy protein

6.12.4 REGULATIONS FOR FOOD COLORS

6.12.5 REGULATIONS FOR FLAVORS

6.13 EUROPE: REGULATIONS

6.13.1 REGULATIONS FOR ENZYMES

6.13.1.1 EU legislation relevant to food enzymes

6.13.2 REGULATIONS FOR FOOD ADDITIVES

6.13.2.1 Hydrocolloids

6.13.2.2 Carotenoids

6.13.2.3 UK

6.13.3 REGULATIONS FOR MEAT SUBSTITUTES

6.13.3.1 Wheat protein

6.13.3.2 Soy protein

6.13.4 REGULATIONS FOR FOOD FLAVORS

6.14 ASIA AND AUSTRALIA & NEW ZEALAND: REGULATIONS

6.14.1 REGULATIONS FOR ENZYMES

6.14.2 REGULATIONS FOR FOOD ADDITIVES

6.14.3 REGULATIONS FOR SUGAR SUBSTITUTES

6.14.3.1 Hong Kong

6.14.4 REGULATIONS FOR MEAT SUBSTITUTES

6.14.4.1 India

6.14.4.1.1 Wheat protein usage level recommendation of Food Safety and Standards Authority of India (FSSAI)

6.15 CODEX ALIMENTARIUS

6.15.1 REGULATIONS FOR FOOD ADDITIVES

6.15.2 REGULATIONS FOR SUGAR SUBSTITUTES

6.15.3 REGULATIONS FOR DIETARY FIBERS

6.15.3.1 Prosky method

6.15.3.2 McCleary method

6.15.3.3 Rapid integrated total dietary fiber

6.16 KEY STAKEHOLDERS AND BUYING CRITERIA

6.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

6.16.2 BUYING CRITERIA

6.17 KEY CONFERENCES & EVENTS

7 RECESSION IMPACT ANALYSIS, BY REGION (Page No. - 119)

7.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

7.2 EUROPE: RECESSION IMPACT ANALYSIS

7.3 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

7.4 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

7.5 ROW: RECESSION IMPACT

8 ACIDULANTS MARKET (Page No. - 124)

8.1 INTRODUCTION

8.2 ACIDULANTS MARKET, BY APPLICATION

8.2.1 INCREASE IN DEMAND FOR CARBONATED BEVERAGES & SOFT DRINKS

8.2.1.1 Beverages

8.2.1.1.1 Citric acid: Widely used food additive owing to acidifying and flavor-enhancing qualities

8.2.1.2 Food

8.2.1.2.1 Increase in demand for convenience foods

8.2.1.2.2 Sauces, dressings, and condiments

8.2.1.2.2.1 High demand for acidulants in Asian cuisines

8.2.1.2.3 Processed foods

8.2.1.2.3.1 Increase in investments in food ingredients

8.2.1.2.4 Meat, poultry, and seafood

8.2.1.2.4.1 Need to inhibit microbial growth on meat

8.2.1.2.5 Bakery & confectionery

8.2.1.2.5.1 Demand for extended shelf life of bakery products

8.2.1.2.6 Other food applications

8.3 ACIDULANTS MARKET, BY REGION

8.3.1 INCREASE IN END-USER APPLICATIONS ACROSS REGIONS DUE TO MULTIFUNCTIONAL ATTRIBUTES OF ACIDULANTS

8.3.1.1 North America

8.3.1.2 Europe

8.3.1.3 Asia Pacific

8.3.1.4 South America

8.3.1.5 RoW

9 COLORS MARKET (Page No. - 140)

9.1 INTRODUCTION

9.2 COLORS MARKET, BY ORIGIN

9.2.1 RISE IN DEMAND FOR CLEAN-LABEL NATURAL INGREDIENTS

9.2.2 NATURAL

9.2.2.1 Increase in demand for natural safe-to-use food colors

9.2.3 SYNTHETIC

9.2.3.1 Demand for visually appealing colors in food products

9.2.4 NATURE-IDENTICAL

9.2.4.1 Low costs of nature-identical colors

9.3 COLORS MARKET, BY APPLICATION

9.3.1 GROWTH IN DEMAND FOR JUICES & FUNCTIONAL BEVERAGES

9.3.2 BEVERAGES

9.3.2.1 Availability of new, refreshing, and healthier juices and beverages

9.3.3 FOOD

9.3.3.1 Growth in preference for healthy natural ingredients

9.3.3.2 Processed food

9.3.3.2.1 Increase in demand for clean-label ingredients in processed food products

9.3.3.3 Bakery & confectionery

9.3.3.3.1 Nature-identical food colors such as carmine and lycopene used in cakes and bread

9.3.3.4 Meat, poultry, and seafood

9.3.3.4.1 Natural food coloring such as curing to provide stable red muscle pigment

9.3.3.5 Oils & fats

9.3.3.5.1 Colors in cooking oil enhance visual appeal of product

9.3.3.6 Dairy products

9.3.3.6.1 Natural food colors work well in sugar-free applications

9.3.3.7 Other food applications

9.4 COLORS MARKET, BY REGION

9.4.1 RISE IN PROCESSED FOOD CONSUMPTION ACROSS REGIONS

9.4.2 NORTH AMERICA

9.4.3 EUROPE

9.4.4 ASIA PACIFIC

9.4.5 SOUTH AMERICA

9.4.6 ROW

10 FOOD FLAVORS MARKET (Page No. - 161)

10.1 INTRODUCTION

10.2 FOOD FLAVORS MARKET, BY ORIGIN

10.2.1 INCREASE IN POPULARITY OF ORGANIC FOODS TO DRIVE NATURAL FLAVORS MARKET

10.2.2 NATURAL

10.2.2.1 Fruit & nut flavors, chocolate flavors, and vanilla—popular natural flavors

10.2.3 SYNTHETIC

10.2.3.1 Increase in demand for synthetic food flavors due to their cost-effectiveness and affordability.

10.2.4 NATURE-IDENTICAL

10.2.4.1 Demand for nature-identical food flavors fueled by evolving consumer preferences

10.3 FOOD FLAVORS MARKET, BY FORM

10.3.1 SEVERAL CLASSES OF ORGANIC COMPOUNDS USED AS AROMAS

10.3.2 LIQUID & GEL

10.3.2.1 Increase in production of alcoholic and non-alcoholic beverages

10.3.3 DRY

10.3.3.1 Surge in popularity of baked and confectionery foods using dry flavors

10.4 FOOD FLAVORS MARKET, BY TYPE

10.4.1 GROWTH IN DEMAND FOR SPICES, HERBS, OR CONDIMENTS

10.4.2 CHOCOLATE & BROWN

10.4.2.1 Dark chocolate

10.4.2.2 Milk chocolate

10.4.2.3 White chocolate

10.4.2.4 Caramel

10.4.3 VANILLA

10.4.3.1 Bourbon-Madagascar vanilla

10.4.3.2 Mexican vanilla

10.4.3.3 Tahitian vanilla

10.4.4 FRUITS

10.4.4.1 Citrus

10.4.4.2 Tree fruits

10.4.4.3 Tropical & exotic fruits

10.4.4.4 Berries

10.4.4.5 Other fruits

10.4.5 DAIRY

10.4.5.1 Milk

10.4.5.2 Butter

10.4.5.3 Cream

10.4.5.4 Yogurt

10.4.5.5 Cheese

10.4.5.6 Other dairy flavors

10.4.6 SPICES & SAVORY

10.4.6.1 Essential oils & oleoresins

10.4.6.2 Vegetable flavors

10.4.6.3 Meat flavors

10.4.6.4 Other spices & savory

10.4.7 MINT

10.4.8 OTHER FLAVORS

10.5 FOOD FLAVORS MARKET, BY APPLICATION

10.5.1 INTRODUCTION OF VARIETY AND STABILITY OF FLAVOR ADDITIVES

10.5.2 FOOD

10.5.2.1 Increase in awareness among consumers about health benefits

10.5.2.2 Confectionery products

10.5.2.2.1 Shift toward healthier snacking

10.5.2.3 Bakery products

10.5.2.3.1 Increase in market potential for fusion flavors

10.5.2.4 Dairy products

10.5.2.4.1 Popularity of plant-based food culture to urge dairy industries to introduce experimental flavors

10.5.2.5 Meat & products

10.5.2.5.1 Proliferation in flavor and aroma of meat & seafood

10.5.2.6 Other food applications

10.5.3 BEVERAGES

10.5.3.1 High demand for variety in bottled water

10.6 FOOD FLAVORS MARKET, BY REGION

10.6.1 INCREASE IN R&D ACTIVITIES FOR DIFFERENT FUNCTIONAL FOODS IN DEVELOPED REGIONS

10.6.2 NORTH AMERICA

10.6.3 EUROPE

10.6.4 ASIA PACIFIC

10.6.5 SOUTH AMERICA

10.6.6 ROW

11.1 INTRODUCTION

11.2 ENZYMES MARKET, BY APPLICATION

11.2.1 INDUSTRIAL USAGE OF ENZYMES FOR FOOD & BEVERAGE APPLICATIONS

11.2.2 FOOD

11.2.2.1 Growth of dairy and bakery products segments due to extensive range of enzymes and broader applications

11.2.2.1.1 Bakery & confectionery products

11.2.2.1.2 Dairy products

11.2.2.1.3 Meat processing products

11.2.2.1.4 Nutraceuticals

11.2.2.1.5 Other food applications

11.2.3 BEVERAGES

11.2.3.1 Use of pectin in beverages to help improve yield and quality

11.3 ENZYMES MARKET, BY REGION

11.3.1 ENZYMES AID IN INCREASING SHELF LIFE OF FOOD PRODUCTS, MITIGATING FOOD WASTAGE ACROSS REGIONS

11.3.1.1 North America

11.3.1.2 Europe

11.3.1.3 Asia Pacific

11.3.1.4 South America

11.3.1.5 RoW

12 EMULSIFIERS MARKET (Page No. - 208)

12.1 INTRODUCTION

12.2 EMULSIFIERS MARKET, BY TYPE

12.2.1 DIVERSE FUNCTIONALITIES OF EMULSIFIERS FIND APPLICATIONS IN FOOD AND OTHER SEGMENTS

12.2.1.1 Mono- & di-glycerides and their derivatives

12.2.1.1.1 Wide range of functionalities to boost applications

12.2.1.2 Lecithin (oiled & de-oiled)

12.2.1.2.1 Increase in demand for vegan products to drive growth for plant-sourced lecithin

12.2.1.3 Sorbitan esters

12.2.1.3.1 Aeration property of sorbitan esters to widen their scope of application

12.2.1.4 Stearoyl lactylates

12.2.1.4.1 Dough strengthening and foaming properties to widen usage of stearoyl lactylates

12.2.1.5 Polyglycerol esters

12.2.1.5.1 Cost-efficiency is associated with usage of polyglycerol esters

12.2.1.6 Other types

12.3 EMULSIFIERS MARKET, BY APPLICATION

12.3.1 EMULSIFIERS PROVIDE RICH TEXTURE AND SMOOTH FINISH TO FOOD PRODUCTS

12.3.2 BAKERY PRODUCTS

12.3.2.1 Popularity of yeast-raised bakery products

12.3.3 CONFECTIONERY PRODUCTS

12.3.3.1 Emulsifiers to aid in processing and storage

12.3.4 CONVENIENCE FOOD

12.3.4.1 Increase in demand for healthier convenience foods

12.3.5 DAIRY & FROZEN DESSERTS

12.3.5.1 Variety of products using emulsifiers

12.3.6 MEAT PRODUCTS

12.3.6.1 Cost-efficiency due to addition of emulsifiers

12.3.6.2 Hot processed meat emulsion

12.3.6.3 Cold processed meat emulsion

12.3.7 OTHER APPLICATIONS

12.4 EMULSIFIERS MARKET, BY REGION

12.4.1 INCREASE IN POPULARITY OF CLEAN-LABEL, INERT, AND BACTERIA-RESISTANT FOOD

12.4.1.1 North America

12.4.1.2 Europe

12.4.1.3 Asia Pacific

12.4.1.4 South America

12.4.1.5 RoW

13 F&B STARTER CULTURES MARKET (Page No. - 227)

13.1 INTRODUCTION

13.2 F&B STARTER CULTURES MARKET, BY APPLICATION

13.2.1 RISE IN POPULARITY OF PROBIOTICS

13.2.2 DAIRY & DAIRY PRODUCTS

13.2.2.1 Cheese to be largest application of starter cultures

13.2.2.2 Cheese

13.2.2.3 Yogurt

13.2.2.4 Butter & creams

13.2.2.5 Other dairy products

13.2.3 MEAT & SEAFOOD

13.2.3.1 Starter cultures help in effective preservation of fermented meat

13.2.4 OTHER APPLICATIONS

13.3 F&B STARTER CULTURES MARKET, BY REGION

13.3.1 DAIRY INDUSTRY TO DRIVE GLOBAL F&B STARTER CULTURES MARKET

13.3.2 NORTH AMERICA

13.3.3 EUROPE

13.3.4 ASIA PACIFIC

13.3.5 SOUTH AMERICA

13.3.6 ROW

14 PRESERVATIVES MARKET (Page No. - 243)

14.1 INTRODUCTION

14.2 PRESERVATIVES MARKET, BY TYPE

14.2.1 NATURAL PRESERVATIVES TO BECOME POPULAR WITH AWARENESS REGARDING ORGANIC SOURCES

14.2.2 NATURAL PRESERVATIVES

14.2.2.1 High consumer awareness and preference for natural food ingredients

14.2.3 SYNTHETIC PRESERVATIVES

14.2.3.1 Cost-effectiveness and easy availability

14.2.3.2 Sorbates

14.2.3.3 Benzoates

14.2.3.4 Propionates

14.2.3.5 Other synthetic preservatives

14.3 PRESERVATIVES MARKET, BY APPLICATION

14.3.1 BUSY LIFESTYLES FUEL DEMAND FOR PRESERVATIVE-INDUCED FOOD & BEVERAGES

14.3.2 FOOD

14.3.2.1 Use of preservatives in food products to enhance shelf life and food safety

14.3.2.2 Oils & fats

14.3.2.2.1 High demand for natural antioxidants in vegetable oil preservation

14.3.2.3 Bakery products

14.3.2.3.1 Increase in adoption of calcium & sodium propionates in baking goods

14.3.2.4 Dairy & frozen products

14.3.2.4.1 Rise in consumption of dairy products

14.3.2.5 Snacks

14.3.2.5.1 Greater preference for convenient and ultra-processed food products

14.3.2.6 Meat, poultry, and seafood

14.3.2.6.1 Rise in consumption of meat and seafood worldwide

14.3.2.7 Confectionery products

14.3.2.7.1 Higher demand for preserving food aesthetics

14.3.2.8 Other food applications

14.3.3 BEVERAGES

14.3.3.1 Rise in preference for naturally flavored health drinks to increase adoption of benzoates and sorbates

14.4 PRESERVATIVES MARKET, BY REGION

14.4.1 INCREASE IN CONSUMPTION OF CANNED FOODS

14.4.2 NORTH AMERICA

14.4.3 EUROPE

14.4.4 ASIA PACIFIC

14.4.5 SOUTH AMERICA

14.4.6 ROW

15 FUNCTIONAL FOOD INGREDIENTS MARKET (Page No. - 269)

15.1 INTRODUCTION

15.2 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE

15.2.1 RISE IN CHRONIC DISEASES

15.2.2 PROBIOTICS

15.2.2.1 High consumer demand for scientifically proven health food and supplements, particularly in developed economies

15.2.3 PROTEINS & AMINO ACIDS

15.2.3.1 Rise in awareness about health benefits of amino acids

15.2.4 PHYTOCHEMICAL & PLANT EXTRACTS

15.2.4.1 Side effects of chemical ingredients in nutraceuticals

15.2.5 PREBIOTICS

15.2.5.1 Benefits in weight management and infant health improvement

15.2.6 FIBERS & SPECIALTY CARBOHYDRATES

15.2.6.1 Need to promote health and reduce risk of chronic diseases

15.2.7 OMEGA-3 FATTY ACIDS

15.2.7.1 Need to reduce consequences of several chronic mental and physical diseases

15.2.8 CAROTENOIDS

15.2.8.1 Potential of lutein and zeaxanthin in reducing risk of eye diseases

15.2.9 VITAMINS

15.2.9.1 Awareness, wide acceptance, and easy availability of different types of vitamins

15.2.10 MINERALS

15.2.10.1 Several health benefits of macro and microminerals

15.2.10.2 Macrominerals

15.2.10.3 Microminerals

15.3 FUNCTIONAL FOOD INGREDIENTS MARKET, BY APPLICATION

15.3.1 DEMAND FOR VERSATILE HEALTH BENEFITS AND ADDED SENSORY BENEFITS

15.3.2 FOOD

15.3.2.1 Cost-effective food products with high nutritional benefits

15.3.2.2 Baby food

15.3.2.2.1 New product development with various value-added products

15.3.2.3 Dairy products

15.3.2.3.1 Rise in demand for new and improved functional dairy products

15.3.2.4 Bakery products

15.3.2.4.1 High consumption of bakery products to increase functional food ingredient use

15.3.2.5 Confectionery products

15.3.2.5.1 Increase in confectionery products offered with nutritional value

15.3.2.6 Snacks

15.3.2.6.1 Changing lifestyles of consumers

15.3.2.7 Meat & meat products

15.3.2.7.1 Enhancement of nutritional value by imparting functional food ingredients into meat products

15.3.2.8 Elderly nutrition & breakfast cereals

15.3.2.8.1 Rise in purchasing power of consumers

15.3.3 BEVERAGES

15.3.3.1 Rise in demand for health beverages

15.4 FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION

15.4.1 INCREASE IN POPULARITY OF CLEAN-LABEL AND FORTIFIED FOOD

15.4.2 NORTH AMERICA

15.4.3 EUROPE

15.4.4 ASIA PACIFIC

15.4.5 SOUTH AMERICA

15.4.6 ROW

16 SPECIALTY STARCH MARKET (Page No. - 293)

16.1 INTRODUCTION

16.2 SPECIALTY STARCH MARKET, BY TYPE

16.2.1 VERSATILE NATURE OF STARCH TO ENABLE MODIFICATION OF VARIOUS CHEMICAL FORMS

16.2.2 ETHERIFIED STARCH

16.2.2.1 Preference for soft and creamy texture of dairy products

16.2.3 ESTERIFIED STARCH

16.2.3.1 Increase in demand for frozen foods

16.2.4 RESISTANT STARCH

16.2.4.1 Nutritional benefits of resistant starch in humans

16.2.5 PREGELATINIZED

16.2.5.1 Pregelatinized starches to retain functional properties and viscosity of food & beverage products

16.3 SPECIALTY STARCH MARKET, BY APPLICATION

16.3.1 INCREASE IN DEMAND FOR PLANT-BASED ALTERNATIVES FOR EMULSIFIERS AND STABILIZERS

16.3.2 FOOD

16.3.2.1 Versatility and applications of specialty starches in food products

16.3.2.2 Bakery & confectionery products

16.3.2.2.1 Demand for specialty starches to improve texture and quality of confectionery products

16.3.2.3 Processed foods

16.3.2.3.1 Preference for modified starch’s freeze-thaw ability in processed foods

16.3.2.4 Meat, poultry, and seafood

16.3.2.4.1 Increase in use to enhance shelf life of meat products

16.3.2.5 Other food applications

16.3.3 BEVERAGES

16.3.3.1 Variegated functional properties of specialty starches

16.4 SPECIALTY STARCH MARKET, BY REGION

16.4.1 RISE IN DEMAND FOR CLEAN-LABEL PRESERVATIVES AND STABILIZERS

16.4.2 NORTH AMERICA

16.4.3 EUROPE

16.4.4 ASIA PACIFIC

16.4.5 SOUTH AMERICA

16.4.6 ROW

17 SUGAR SUBSTITUTES MARKET (Page No. - 311)

17.1 INTRODUCTION

17.2 SUGAR SUBSTITUTES MARKET, BY TYPE

17.2.1 HIGH-INTENSITY SWEETENERS (HIS) USED IN MOST COMPLEX PRODUCTS TO PRODUCE NATURAL FLAVORS

17.2.1.1 High-fructose syrup

17.2.1.1.1 Increase in demand for candies and soft drinks

17.2.1.2 High-intensity sweeteners

17.2.1.2.1 Rise in adoption of zero-calorie and sugar-free food & beverages

17.2.1.3 Low-intensity sweeteners

17.2.1.3.1 Increase in instances of metabolic diseases

17.3 SUGAR SUBSTITUTES MARKET, BY APPLICATION

17.3.1 SHIFT TOWARD CONSUMPTION OF NO-SUGAR AND LOW-CALORIE FOODS

17.3.1.1 Food

17.3.1.1.1 Extensive use of sugar substitutes in food

17.3.1.2 Beverages

17.3.1.2.1 Growth in demand for low-calorie beverages

17.3.1.3 Health & wellness

17.3.1.3.1 Demand for natural sweeteners to make pharmaceutical products healthier

17.4 SUGAR SUBSTITUTES MARKET, BY REGION

17.4.1 RISE IN DEMAND FOR PRODUCTS WITH LOW CALORIES

17.4.1.1 North America

17.4.1.2 Europe

17.4.1.3 Asia Pacific

17.4.1.4 South America

17.4.1.5 RoW

18 SPECIALTY FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL (Page No. - 328)

18.1 INTRODUCTION

18.2 DISTRIBUTORS

18.2.1 GROWTH IN GDP TO DRIVE DEMAND FOR DISTRIBUTION

18.3 MANUFACTURERS

18.3.1 INCREASE IN RESEARCH & DEVELOPMENT ACTIVITIES

19 COMPETITIVE LANDSCAPE (Page No. - 335)

19.1 OVERVIEW

19.2 MARKET SHARE ANALYSIS

19.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

19.4 KEY PLAYERS’ ANNUAL REVENUE VS GROWTH

19.5 KEY PLAYERS’ EBITDA

19.6 KEY PLAYER STRATEGIES

19.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

19.8 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

19.8.1 STARS

19.8.2 EMERGING LEADERS

19.8.3 PERVASIVE PLAYERS

19.8.4 PARTICIPANTS

19.9 COMPANY EVALUATION QUADRANT (STARTUPS/SMES)

19.9.1 PROGRESSIVE COMPANIES

19.9.2 STARTING BLOCKS

19.9.3 RESPONSIVE COMPANIES

19.9.4 DYNAMIC COMPANIES

19.9.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

19.1 COMPETITIVE SCENARIO

19.10.1 PRODUCT LAUNCHES

19.10.2 DEALS

19.10.3 OTHERS

20 COMPANY PROFILES (Page No. - 367)

20.1 KEY PLAYERS

20.1.1 ADM

20.1.1.1 Business overview

20.1.1.2 Products/Services/Solutions offered

20.1.1.3 Recent developments

20.1.1.4 MnM view

20.1.1.4.1 Right to win

20.1.1.4.2 Strategic choices

20.1.1.4.3 Weaknesses and competitive threats

20.1.2 DSM

20.1.2.1 Business overview

20.1.2.2 Products/Services/Solutions offered

20.1.2.3 Recent developments

20.1.2.4 MnM view

20.1.2.4.1 Right to win

20.1.2.4.2 Strategic choices

20.1.2.4.3 Weaknesses and competitive threats

20.1.3 INTERNATIONAL FLAVORS & FRAGRANCES INC.

20.1.3.1 Business overview

20.1.3.2 Products/Services/Solutions offered

20.1.3.3 Recent developments

20.1.3.4 MnM view

20.1.3.4.1 Right to win

20.1.3.4.2 Strategic choices

20.1.3.4.3 Weaknesses and competitive threats

20.1.4 KERRY GROUP PLC

20.1.4.1 Business overview

20.1.4.2 Products/Services/Solutions offered

20.1.4.3 Recent developments

20.1.4.4 MnM view

20.1.4.4.1 Right to win

20.1.4.4.2 Strategic choices

20.1.4.4.3 Weaknesses and competitive threats

20.1.5 GIVAUDAN

20.1.5.1 Business overview

20.1.5.2 Products/Services/Solutions offered

20.1.5.3 Recent developments

20.1.5.4 MnM view

20.1.6 CARGILL, INCORPORATED

20.1.6.1 Business overview

20.1.6.2 Products/Services/Solutions offered

20.1.6.3 Recent developments

20.1.6.4 MnM view

20.1.6.4.1 Right to win

20.1.6.4.2 Strategic choices

20.1.6.4.3 Weaknesses and competitive threats

20.1.7 SENSIENT TECHNOLOGIES CORPORATION

20.1.7.1 Business overview

20.1.7.2 Products/Services/Solutions offered

20.1.7.3 Recent developments

20.1.7.4 MnM view

20.1.8 INGREDION

20.1.8.1 Business overview

20.1.8.2 Products/Services/Solutions offered

20.1.8.3 Recent developments

20.1.8.4 MnM view

20.1.8.4.1 Right to win

20.1.8.4.2 Strategic choices

20.1.8.4.3 Weaknesses and competitive threats

20.1.9 CHR. HANSEN HOLDING A/S

20.1.9.1 Business overview

20.1.9.2 Products/Services/Solutions offered

20.1.9.3 Recent developments

20.1.9.4 MnM view

20.1.10 TATE & LYLE

20.1.10.1 Business overview

20.1.10.2 Products/Services/Solutions offered

20.1.10.3 Recent developments

20.1.10.4 MnM view

20.1.11 AMANO ENZYME INC.

20.1.11.1 Business overview

20.1.11.2 Products/Services/Solutions offered

20.1.11.3 Recent developments

20.1.11.4 MnM view

20.1.12 BIOCATALYSTS

20.1.12.1 Business overview

20.1.12.2 Products/Services/Solutions offered

20.1.12.3 Recent developments

20.1.12.4 MnM view

20.1.13 ENZYME SUPPLIES

20.1.13.1 Business overview

20.1.13.2 Products/Services/Solutions offered

20.1.13.3 Recent developments

20.1.13.4 MnM view

20.1.14 ROQUETTE FRÈRES

20.1.14.1 Business overview

20.1.14.2 Products/Services/Solutions offered

20.1.14.3 Recent developments

20.1.14.4 MnM view

20.1.15 ACE INGREDIENTS CO., LTD.

20.1.15.1 Business overview

20.1.15.2 Products/Services/Solutions offered

20.1.15.3 Recent developments

20.1.15.4 MnM view

20.2 STARTUPS/SMES

20.2.1 AXIOM FOOD, INC.

20.2.2 AMCO PROTEINS

20.2.3 FDL LTD

20.2.4 CRESPEL & DEITERS GROUP

20.2.5 AMINOLA

21 ADJACENT & RELATED MARKETS (Page No. - 449)

21.1 INTRODUCTION

21.2 LIMITATIONS

21.3 FOOD COLORS MARKET

21.3.1 MARKET DEFINITION

21.3.2 MARKET OVERVIEW

21.4 FOOD EMULSIFIERS MARKET

21.4.1 MARKET DEFINITION

21.4.2 MARKET OVERVIEW

21.5 FOOD PRESERVATIVES MARKET

21.5.1 MARKET DEFINITION

21.5.2 MARKET OVERVIEW

21.6 SUGAR SUBSTITUTES MARKET

21.6.1 MARKET DEFINITION

21.6.2 MARKET OVERVIEW

21.7 ENZYMES MARKET

21.7.1 MARKET DEFINITION

21.7.2 MARKET OVERVIEW

21.8 STARTER CULTURES MARKET

21.8.1 MARKET DEFINITION

21.8.2 MARKET OVERVIEW

21.9 FUNCTIONAL FOOD INGREDIENTS MARKET

21.9.1 MARKET DEFINITION

21.9.2 MARKET OVERVIEW

22 APPENDIX (Page No. - 463)

22.1 DISCUSSION GUIDE

22.2 CUSTOMIZATION OPTIONS

22.3 RELATED REPORTS

22.4 AUTHOR DETAILS

LIST OF TABLES (327 Tables)

TABLE 1 INCLUSIONS AND EXCLUSIONS

TABLE 2 US DOLLAR EXCHANGE RATES CONSIDERED, 2020–2022

TABLE 3 SPECIALTY FOOD INGREDIENTS MARKET SNAPSHOT, 2023 VS. 2028

TABLE 4 RECENT NEW PRODUCT LAUNCHES, BY KEY PLAYERS, 2020

TABLE 5 SPECIALTY FOOD INGREDIENTS MARKET: ECOSYSTEM

TABLE 6 TOP 10 EXPORTERS AND IMPORTERS OF ENZYMES, 2022 (USD THOUSAND)

TABLE 7 TOP 10 EXPORTERS AND IMPORTERS OF ENZYMES, 2022 (TON)

TABLE 8 TOP 10 EXPORTERS AND IMPORTERS OF VITAMINS AND PROVITAMINS, 2022 (USD THOUSAND)

TABLE 9 TOP 10 EXPORTERS AND IMPORTERS OF VITAMINS AND PROVITAMINS, 2022 (TON)

TABLE 10 TOP 10 EXPORTERS AND IMPORTERS OF DEXTRINS AND MODIFIED STARCHES, 2022 (USD THOUSAND)

TABLE 11 TOP 10 EXPORTERS AND IMPORTERS OF DEXTRINS AND MODIFIED STARCHES, 2022 (TON)

TABLE 12 KEY PATENTS ABOUT SPECIALTY FOOD INGREDIENTS MARKET, 2021–2023

TABLE 13 SPECIALTY FOOD INGREDIENTS MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 14 SPECIALTY FOOD INGREDIENTS MARKET: AVERAGE SELLING PRICE, BY TYPE, 2018-2023 (USD/KG)

TABLE 15 SPECIALTY FOOD INGREDIENTS MARKET: AVERAGE SELLING PRICE, BY REGION, 2018-2023 (USD/KG)

TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 ENZYME PREPARATION APPROVED-FOOD ADDITIVES LISTED IN 21 CFR 173

TABLE 20 ENZYME PREPARATION SPECIFIED IN FOOD STANDARDS

TABLE 21 ENZYME PREPARATIONS AFFIRMED AS GRAS LISTED IN 21 CFR 184

TABLE 22 COMMON COLOR ADDITIVES EXEMPTED FROM CERTIFICATION

TABLE 23 EUROPE: LIST OF PERMITTED ENZYMES

TABLE 24 LIST OF HYDROCOLLOIDS USED IN FOOD INDUSTRY

TABLE 25 LIST OF NON-NUTRITIVE SWEETENERS: MAXIMUM USAGE LEVEL

TABLE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FUNCTIONAL FOOD INGREDIENT TYPES

TABLE 27 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS OF FUNCTIONAL FOOD INGREDIENTS

TABLE 28 SPECIALTY FOOD INGREDIENTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2023–2024

TABLE 29 APPLICATIONS OF ACIDULANTS

TABLE 30 ACIDULANTS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

TABLE 31 ACIDULANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 32 ACIDULANTS MARKET, BY FOOD APPLICATION, 2018–2022 (USD MILLION)

TABLE 33 ACIDULANTS MARKET, BY FOOD APPLICATION, 2023–2028 (USD MILLION)

TABLE 34 ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 35 ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 36 ACIDULANTS MARKET, BY REGION, 2018–2022 (KT)

TABLE 37 ACIDULANTS MARKET, BY REGION, 2023–2028 (KT)

TABLE 38 NORTH AMERICA: ACIDULANTS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 39 NORTH AMERICA: ACIDULANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 40 EUROPE: ACIDULANTS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 41 EUROPE: ACIDULANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 42 ASIA PACIFIC: ACIDULANTS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 43 ASIA PACIFIC: ACIDULANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 44 SOUTH AMERICA: ACIDULANTS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 45 SOUTH AMERICA: ACIDULANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 46 ROW: ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 47 ROW: ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 48 COLORS MARKET, BY ORIGIN, 2018–2022 (USD MILLION)

TABLE 49 COLORS MARKET, BY ORIGIN, 2023–2028 (USD MILLION)

TABLE 50 COLORS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

TABLE 51 COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 52 COLORS MARKET, BY FOOD APPLICATION, 2018–2022 (USD MILLION)

TABLE 53 COLORS MARKET, BY FOOD APPLICATION, 2023–2028 (USD MILLION)

TABLE 54 COLORS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 55 COLORS MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 56 COLORS MARKET, BY REGION, 2018–2022 (KT)

TABLE 57 COLORS MARKET, BY REGION, 2023–2028 (KT)

TABLE 58 NORTH AMERICA: COLORS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 59 NORTH AMERICA: COLORS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 60 EUROPE: COLORS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 61 EUROPE: COLORS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 62 ASIA PACIFIC: COLORS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 63 ASIA PACIFIC: COLORS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 64 SOUTH AMERICA: COLORS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 65 SOUTH AMERICA: COLORS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 66 ROW: COLORS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 67 ROW: COLORS MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 68 FOOD FLAVORS MARKET, BY ORIGIN, 2018–2022 (USD MILLION)

TABLE 69 FOOD FLAVORS MARKET, BY ORIGIN, 2023–2028 (USD MILLION)

TABLE 70 FOOD FLAVORS MARKET, BY FORM, 2018–2022 (USD MILLION)

TABLE 71 FOOD FLAVORS MARKET, BY FORM, 2023–2028 (USD MILLION)

TABLE 72 FOOD FLAVORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 73 FOOD FLAVORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 74 FOOD FLAVORS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

TABLE 75 FOOD FLAVORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 76 FOOD FLAVORS MARKET, BY FOOD APPLICATION, 2018–2022 (USD MILLION)

TABLE 77 FOOD FLAVORS MARKET, BY FOOD APPLICATION, 2023–2028 (USD MILLION)

TABLE 78 FOOD FLAVORS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 79 FOOD FLAVORS MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 80 FOOD FLAVORS MARKET, BY REGION, 2018–2022 (KT)

TABLE 81 FOOD FLAVORS MARKET, BY REGION, 2023–2028 (KT)

TABLE 82 NORTH AMERICA: FOOD FLAVORS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 83 NORTH AMERICA: FOOD FLAVORS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 84 EUROPE: FOOD FLAVORS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 85 EUROPE: FOOD FLAVORS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 86 ASIA PACIFIC: FOOD FLAVORS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 87 ASIA PACIFIC: FOOD FLAVORS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 88 SOUTH AMERICA: FOOD FLAVORS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 89 SOUTH AMERICA: FOOD FLAVORS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 90 ROW: FOOD FLAVORS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 91 ROW: FOOD FLAVORS MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 92 ENZYMES & THEIR APPLICATIONS

TABLE 93 ENZYMES MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

TABLE 94 ENZYMES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 95 ENZYMES MARKET, BY FOOD APPLICATION, 2018–2022 (USD MILLION)

TABLE 96 ENZYMES MARKET, BY FOOD APPLICATION, 2023–2028 (USD MILLION)

TABLE 97 ENZYMES USED IN BEVERAGE APPLICATIONS

TABLE 98 ENZYMES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 99 ENZYMES MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 100 ENZYMES MARKET, BY REGION, 2018–2022 (KT)

TABLE 101 ENZYMES MARKET, BY REGION, 2023–2028 (KT)

TABLE 102 NORTH AMERICA: ENZYMES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 103 NORTH AMERICA: ENZYMES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 104 EUROPE: ENZYMES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 105 EUROPE: ENZYMES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 106 ASIA PACIFIC: ENZYMES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 107 ASIA PACIFIC: ENZYMES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 108 SOUTH AMERICA: ENZYMES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 109 SOUTH AMERICA: ENZYMES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 110 ROW: ENZYMES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 111 ROW: ENZYMES MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 112 EMULSIFIERS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 113 EMULSIFIERS MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 114 EMULSIFIERS MARKET, BY FOOD & BEVERAGE APPLICATION, 2018–2022 (USD MILLION)

TABLE 115 EMULSIFIERS MARKET, BY FOOD & BEVERAGE APPLICATION, 2023–2028 (USD MILLION)

TABLE 116 EMULSIFIERS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 117 EMULSIFIERS MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 118 EMULSIFIERS MARKET, BY REGION, 2018–2022 (KT)

TABLE 119 EMULSIFIERS MARKET, BY REGION, 2023–2028 (KT)

TABLE 120 NORTH AMERICA: EMULSIFIERS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 121 NORTH AMERICA: EMULSIFIERS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 122 EUROPE: EMULSIFIERS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 123 EUROPE: EMULSIFIERS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 124 ASIA PACIFIC: EMULSIFIERS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 125 ASIA PACIFIC: EMULSIFIERS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 126 SOUTH AMERICA: EMULSIFIERS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 127 SOUTH AMERICA: EMULSIFIERS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 128 ROW: EMULSIFIERS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 129 ROW: EMULSIFIERS MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 130 F&B STARTER CULTURES MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

TABLE 131 F&B STARTER CULTURES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 132 F&B STARTER CULTURES MARKET, BY DAIRY & DAIRY PRODUCTS, 2018–2022 (USD MILLION)

TABLE 133 F&B STARTER CULTURES MARKET, BY DAIRY & DAIRY PRODUCTS, 2023–2028 (USD MILLION)

TABLE 134 F&B STARTER CULTURES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 135 F&B STARTER CULTURES MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 136 F&B STARTER CULTURES MARKET, BY REGION, 2018–2022 (KT)

TABLE 137 F&B STARTER CULTURES MARKET, BY REGION, 2023–2028 (KT)

TABLE 138 NORTH AMERICA: F&B STARTER CULTURES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 139 NORTH AMERICA: F&B STARTER CULTURES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 140 EUROPE: F&B STARTER CULTURES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 141 EUROPE: F&B STARTER CULTURES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 142 ASIA PACIFIC: F&B STARTER CULTURES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 143 ASIA PACIFIC: F&B STARTER CULTURES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 144 SOUTH AMERICA: F&B STARTER CULTURES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 145 SOUTH AMERICA: F&B STARTER CULTURES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 146 ROW: F&B STARTER CULTURES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 147 ROW: F&B STARTER CULTURES MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 148 PRESERVATIVES MARKET: FUNCTIONS AND PERMISSIBLE LIMITS IN FOOD PRODUCTS

TABLE 149 PRESERVATIVES MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 150 PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 151 SYNTHETIC FOOD PRESERVATIVE APPLICATIONS AND ASSOCIATED HEALTH RISKS

TABLE 152 PRESERVATIVES MARKET, BY SYNTHETIC TYPE, 2018–2022 (USD MILLION)

TABLE 153 PRESERVATIVES MARKET, BY SYNTHETIC TYPE, 2023–2028 (USD MILLION)

TABLE 154 PRESERVATIVES MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

TABLE 155 PRESERVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 156 PRESERVATIVES MARKET, BY FOOD APPLICATION, 2018–2022 (USD MILLION)

TABLE 157 PRESERVATIVES MARKET, BY FOOD APPLICATION, 2023–2028 (USD MILLION)

TABLE 158 PRESERVATIVES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 159 PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 160 PRESERVATIVES MARKET, BY REGION, 2018–2022 (KT)

TABLE 161 PRESERVATIVES MARKET, BY REGION, 2023–2028 (KT)

TABLE 162 NORTH AMERICA: PRESERVATIVES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 163 NORTH AMERICA: PRESERVATIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 164 EUROPE: PRESERVATIVES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 165 EUROPE: PRESERVATIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 166 ASIA PACIFIC: PRESERVATIVES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 167 ASIA PACIFIC: PRESERVATIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 168 SOUTH AMERICA: PRESERVATIVES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 169 SOUTH AMERICA: PRESERVATIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 170 ROW: PRESERVATIVES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 171 ROW: PRESERVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 172 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 173 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 174 PROBIOTIC COMPONENTS AND THEIR BENEFITS

TABLE 175 PREBIOTIC COMPONENTS AND THEIR BENEFITS

TABLE 176 FUNCTIONAL FOOD INGREDIENTS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

TABLE 177 FUNCTIONAL FOOD INGREDIENTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 178 FUNCTIONAL FOOD INGREDIENTS MARKET, BY FOOD APPLICATION, 2018–2022 (USD MILLION)

TABLE 179 FUNCTIONAL FOOD INGREDIENTS MARKET, BY FOOD APPLICATION, 2023–2028 (USD MILLION)

TABLE 180 FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 181 FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 182 FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION, 2018–2022 (KT)

TABLE 183 FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (KT)

TABLE 184 NORTH AMERICA: FUNCTIONAL FOOD INGREDIENTS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 185 NORTH AMERICA: FUNCTIONAL FOOD INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 186 EUROPE: FUNCTIONAL FOOD INGREDIENTS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 187 EUROPE: FUNCTIONAL FOOD INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 188 ASIA PACIFIC: FUNCTIONAL FOOD INGREDIENTS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 189 ASIA PACIFIC: FUNCTIONAL FOOD INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 190 SOUTH AMERICA: FUNCTIONAL FOOD INGREDIENTS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 191 SOUTH AMERICA: FUNCTIONAL FOOD INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 192 ROW: FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 193 ROW: FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 194 ETHERIFIED STARCH IN FOOD APPLICATIONS

TABLE 195 FUNCTIONS, BENEFITS, AND APPLICATIONS OF MODIFIED RESISTANT STARCH IN FOOD & BEVERAGE INDUSTRY

TABLE 196 FUNCTIONS OF PREGELATINIZED SPECIALTY STARCH IN FOOD & BEVERAGE APPLICATIONS

TABLE 197 SPECIALTY STARCHES MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

TABLE 198 SPECIALTY STARCHES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 199 SPECIALTY STARCHES MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

TABLE 200 SPECIALTY STARCHES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 201 SPECIALTY STARCHES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 202 SPECIALTY STARCHES MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 203 SPECIALTY STARCHES MARKET, BY REGION, 2018–2022 (KT)

TABLE 204 SPECIALTY STARCHES MARKET, BY REGION, 2023–2028 (KT)

TABLE 205 NORTH AMERICA: SPECIALTY STARCHES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 206 NORTH AMERICA: SPECIALTY STARCHES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 207 EUROPE: SPECIALTY STARCHES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 208 EUROPE: SPECIALTY STARCHES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 209 ASIA PACIFIC: SPECIALTY STARCHES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 210 ASIA PACIFIC: SPECIALTY STARCHES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 211 SOUTH AMERICA: SPECIALTY STARCHES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 212 SOUTH AMERICA: SPECIALTY STARCHES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 213 ROW: SPECIALTY STARCHES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 214 ROW: SPECIALTY STARCHES MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 215 SUGAR SUBSTITUTES MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 216 SUGAR SUBSTITUTES MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 217 SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

TABLE 218 SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 219 SUGAR SUBSTITUTES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 220 SUGAR SUBSTITUTES MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 221 SUGAR SUBSTITUTES MARKET, BY REGION, 2018–2022 (KT)

TABLE 222 SUGAR SUBSTITUTES MARKET, BY REGION, 2023–2028 (KT)

TABLE 223 NORTH AMERICA: SUGAR SUBSTITUTES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 224 NORTH AMERICA: SUGAR SUBSTITUTES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 225 EUROPE: SUGAR SUBSTITUTES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 226 EUROPE: SUGAR SUBSTITUTES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 227 ASIA PACIFIC: SUGAR SUBSTITUTES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 228 ASIA PACIFIC: SUGAR SUBSTITUTES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 229 SOUTH AMERICA: SUGAR SUBSTITUTES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 230 SOUTH AMERICA: SUGAR SUBSTITUTES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

TABLE 231 ROW: SUGAR SUBSTITUTES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 232 ROW: SUGAR SUBSTITUTES MARKET, BY REGION, 2023–2028 (USD MILLION)

TABLE 233 SPECIALTY FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2018–2022 (USD MILLION)

TABLE 234 SPECIALTY FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2023–2028 (USD MILLION)

TABLE 235 SPECIALTY FOOD INGREDIENTS MARKET FOR DISTRIBUTORS, BY REGION, 2018–2022 (USD MILLION)

TABLE 236 SPECIALTY FOOD INGREDIENTS MARKET FOR DISTRIBUTORS, BY REGION, 2023–2028 (USD MILLION)

TABLE 237 SPECIALTY FOOD INGREDIENTS MARKET FOR DISTRIBUTORS, BY TYPE, 2018–2022 (USD MILLION)

TABLE 238 SPECIALTY FOOD INGREDIENTS MARKET FOR DISTRIBUTORS, BY TYPE, 2023–2028 (USD MILLION)

TABLE 239 SPECIALTY FOOD INGREDIENTS MARKET FOR MANUFACTURERS, BY REGION, 2018–2022 (USD MILLION)

TABLE 240 SPECIALTY FOOD INGREDIENTS MARKET FOR MANUFACTURERS, BY REGION, 2023–2028 (USD MILLION)

TABLE 241 SPECIALTY FOOD INGREDIENTS MARKET FOR MANUFACTURERS, BY TYPE, 2018–2022 (USD MILLION)

TABLE 242 SPECIALTY FOOD INGREDIENTS MARKET FOR MANUFACTURERS, BY TYPE, 2023–2028 (USD MILLION)

TABLE 243 DEGREE OF COMPETITION (CONSOLIDATED), 2022

TABLE 244 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 245 SPECIALTY FOOD INGREDIENTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 246 SPECIALTY FOOD INGREDIENTS MARKET: PRODUCT LAUNCHES, MARCH 2019–APRIL 2023

TABLE 247 SPECIALTY FOOD INGREDIENTS MARKET: DEALS, JANUARY 2019–JULY 2023

TABLE 248 SPECIALTY FOOD INGREDIENTS MARKET: OTHERS, JUNE 2018–APRIL 2023

TABLE 249 ADM: BUSINESS OVERVIEW

TABLE 250 ADM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 251 ADM: PRODUCT LAUNCHES

TABLE 252 ADM: DEALS

TABLE 253 ADM: OTHERS

TABLE 254 DSM: BUSINESS OVERVIEW

TABLE 255 DSM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 256 DSM: PRODUCT LAUNCHES

TABLE 257 DSM: DEALS

TABLE 258 INTERNATIONAL FLAVORS & FRAGRANCES INC.: BUSINESS OVERVIEW

TABLE 259 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 260 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCT LAUNCHES

TABLE 261 INTERNATIONAL FLAVORS & FRAGRANCES INC.: DEALS

TABLE 262 INTERNATIONAL FLAVORS & FRAGRANCES INC.: OTHERS

TABLE 263 KERRY GROUP PLC: BUSINESS OVERVIEW

TABLE 264 KERRY GROUP PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 265 KERRY GROUP PLC: PRODUCT LAUNCHES

TABLE 266 KERRY GROUP PLC: DEALS

TABLE 267 KERRY GROUP PLC: OTHERS

TABLE 268 GIVAUDAN: BUSINESS OVERVIEW

TABLE 269 GIVAUDAN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 270 GIVAUDAN: PRODUCT LAUNCHES

TABLE 271 GIVAUDAN: DEALS

TABLE 272 GIVAUDAN: OTHERS

TABLE 273 CARGILL, INCORPORATED: BUSINESS OVERVIEW

TABLE 274 CARGILL, INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 275 CARGILL, INCORPORATED: PRODUCT LAUNCHES

TABLE 276 CARGILL, INCORPORATED: DEALS

TABLE 277 CARGILL, INCORPORATED: OTHERS

TABLE 278 SENSIENT TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

TABLE 279 SENSIENT TECHNOLOGIES CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 280 INGREDION: BUSINESS OVERVIEW

TABLE 281 INGREDION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 282 INGREDION: PRODUCT LAUNCHES

TABLE 283 INGREDION: DEALS

TABLE 284 INGREDION: OTHERS

TABLE 285 CHR. HANSEN HOLDING A/S: BUSINESS OVERVIEW

TABLE 286 CHR. HANSEN HOLDING A/S: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 287 CHR. HANSEN HOLDING A/S: DEALS

TABLE 288 CHR. HANSEN HOLDING A/S: OTHERS

TABLE 289 TATE & LYLE: BUSINESS OVERVIEW

TABLE 290 TATE & LYLE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 291 TATE & LYLE: PRODUCT LAUNCHES

TABLE 292 TATE & LYLE: DEALS

TABLE 293 AMANO ENZYME INC.: BUSINESS OVERVIEW

TABLE 294 AMANO ENZYME INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 295 AMANO ENZYME INC.: PRODUCT LAUNCHES

TABLE 296 AMANO ENZYME INC.: OTHERS

TABLE 297 BIOCATALYSTS: BUSINESS OVERVIEW

TABLE 298 BIOCATALYSTS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 299 BIOCATALYSTS: PRODUCT LAUNCHES

TABLE 300 BIOCATALYSTS: OTHERS

TABLE 301 ENZYME SUPPLIES: BUSINESS OVERVIEW

TABLE 302 ENZYME SUPPLIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 303 ROQUETTE FRÈRES: BUSINESS OVERVIEW

TABLE 304 ROQUETTE FRÈRES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 305 ROQUETTE FRÈRES: DEALS

TABLE 306 ACE INGREDIENTS CO., LTD.: BUSINESS OVERVIEW

TABLE 307 ACE INGREDIENTS CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 308 FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

TABLE 309 FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 310 FOOD COLORS MARKET, BY TYPE, 2019–2022 (KT)

TABLE 311 FOOD COLORS MARKET, BY TYPE, 2023–2028 (KT)

TABLE 312 FOOD EMULSIFIERS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

TABLE 313 FOOD EMULSIFIERS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 314 FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

TABLE 315 FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 316 FOOD PRESERVATIVES MARKET, BY TYPE, 2019–2022 (KT)

TABLE 317 FOOD PRESERVATIVES MARKET, BY TYPE, 2023–2028 (KT)

TABLE 318 SUGAR SUBSTITUTES MARKET, BY TYPE, 2019–2022 (USD MILLION)

TABLE 319 SUGAR SUBSTITUTES MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 320 SUGAR SUBSTITUTES MARKET, BY TYPE, 2019–2022 (KT)

TABLE 321 SUGAR SUBSTITUTES MARKET, BY TYPE, 2023–2028 (KT)

TABLE 322 ENZYMES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 323 ENZYMES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 324 STARTER CULTURES MARKET, BY MICROORGANISM, 2017–2021 (USD MILLION)

TABLE 325 STARTER CULTURES MARKET, BY MICROORGANISM, 2022–2027 (USD MILLION)

TABLE 326 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 327 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE, 2021–2026 (USD MILLION)

LIST OF FIGURES (69 Figures)

FIGURE 1 SPECIALTY FOOD INGREDIENTS MARKET SEGMENTATION

FIGURE 2 SPECIALTY FOOD INGREDIENTS MARKET: RESEARCH DESIGN

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 4 SPECIALTY FOOD INGREDIENTS MARKET: BOTTOM-UP APPROACH

FIGURE 5 SPECIALTY FOOD INGREDIENTS MARKET: TOP-DOWN APPROACH

FIGURE 6 DATA TRIANGULATION

FIGURE 7 INDICATORS OF RECESSION

FIGURE 8 GLOBAL INFLATION RATE, 2012–2022

FIGURE 9 GLOBAL GROSS DOMESTIC PRODUCT, 2012–2022 (USD TRILLION)

FIGURE 10 RECESSION INDICATORS AND THEIR IMPACT ON SPECIALTY FOOD INGREDIENTS MARKET

FIGURE 11 SPECIALTY FOOD INGREDIENTS MARKET: CURRENT FORECAST VS. RECESSION FORECAST

FIGURE 12 SPECIALTY FOOD INGREDIENTS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

FIGURE 13 SPECIALTY FOOD INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2023 VS. 2028 (USD MILLION)

FIGURE 14 SPECIALTY FOOD INGREDIENTS MARKET SHARE (VALUE), BY REGION, 2022

FIGURE 15 RISE IN DEMAND FOR CLEAN-LABEL PRODUCTS TO DRIVE GROWTH OF SPECIALTY FOOD INGREDIENTS MARKET

FIGURE 16 ASIA PACIFIC WAS PROMINENT MARKET GLOBALLY FOR SPECIALTY FOOD INGREDIENT DISTRIBUTORS IN 2022

FIGURE 17 FUNCTIONAL FOOD INGREDIENTS TO DOMINATE MARKET BY 2028

FIGURE 18 PROBIOTICS TO ACCOUNT FOR LARGEST FUNCTIONAL FOOD INGREDIENTS MARKET SHARE BY 2028

FIGURE 19 HIGH-INTENSITY SWEETENERS TO LEAD SUGAR SUBSTITUTES MARKET THROUGH 2028

FIGURE 20 SPECIALTY FOOD INGREDIENTS: MARKET DYNAMICS

FIGURE 21 AUSTRALIA: RETAIL SALES OF FUNCTIONAL AND FORTIFIED FOOD PRODUCTS, 2018–2022 (USD MILLION)

FIGURE 22 CHRONIC DISEASES WERE AMONG TOP 10 CAUSES OF DEATH WORLDWIDE ACROSS ALL AGES, 2019

FIGURE 23 PREVALENCE OF MALNUTRITION IN CHILDREN ACROSS ALL MAJOR ECONOMIES, 2022

FIGURE 24 US: CONSUMER CHECKS FOR LABEL AND NUTRITIONAL INFORMATION PANEL (NIP) OF FOOD PRODUCTS, 2019

FIGURE 25 US: PLANT-BASED FOODS AND SALES GROWTH, BY CATEGORY, 2022 (USD BILLION)

FIGURE 26 CONTRIBUTION OF FOODS IN DIETS, 2019

FIGURE 27 CHINA: SALES OF VARIOUS TYPES OF BEVERAGES, 2021

FIGURE 28 US: IMPORT OF BEVERAGE PRODUCTS, 2015–2022 (USD MILLION)

FIGURE 29 ANNUAL GDP GROWTH OF EMERGING ECONOMIES, 2012–2022

FIGURE 30 REVENUE SHIFT FOR SPECIALTY FOOD INGREDIENTS MARKET

FIGURE 31 SPECIALTY FOOD INGREDIENTS MARKET: VALUE CHAIN ANALYSIS

FIGURE 32 ECOSYSTEM MAP

FIGURE 33 SPECIALTY FOOD INGREDIENTS MARKET MAP

FIGURE 34 PRODUCT DEVELOPMENT AND MANUFACTURING PLAY VITAL ROLE IN SPECIALTY FOOD INGREDIENTS SUPPLY CHAIN

FIGURE 35 PATENTS GRANTED FOR SPECIALTY FOOD INGREDIENTS MARKET, 2013–2022

FIGURE 36 HIGH INTENSITY OF COMPETITIVE RIVALRY OWING TO STRONG FOCUS ON NEW PRODUCT INNOVATIONS BY KEY PLAYERS

FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FUNCTIONAL FOOD INGREDIENT TYPES

FIGURE 38 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

FIGURE 39 NORTH AMERICA: SPECIALTY FOOD INGREDIENTS MARKET, RECESSION IMPACT ANALYSIS

FIGURE 40 EUROPE: SPECIALTY FOOD INGREDIENTS MARKET, RECESSION IMPACT ANALYSIS

FIGURE 41 ASIA PACIFIC: SPECIALTY FOOD INGREDIENTS MARKET SNAPSHOT

FIGURE 42 SOUTH AMERICA: SPECIALTY FOOD INGREDIENTS MARKET, RECESSION IMPACT ANALYSIS

FIGURE 43 ROW: SPECIALTY FOOD INGREDIENTS MARKET, RECESSION IMPACT ANALYSIS

FIGURE 44 CHINA AND GERMANY TO GROW AT HIGHEST RATES DURING FORECAST PERIOD IN ACIDULANTS MARKET

FIGURE 45 COLORS MARKET: REGIONAL AND COUNTRY-LEVEL GROWTH RATES, 2023–2028

FIGURE 46 BRAZIL TO GROW AT HIGHEST CAGR IN FOOD FLAVORS MARKET DURING FORECAST PERIOD

FIGURE 47 INDIA TO GROW AT HIGHEST RATE IN ENZYMES MARKET DURING FORECAST PERIOD

FIGURE 48 EMULSIFIERS MARKET: REGIONAL & COUNTRY-LEVEL GROWTH RATES, 2023–2028

FIGURE 49 F&B STARTER CULTURES MARKET: REGIONAL AND COUNTRY-LEVEL GROWTH RATES

FIGURE 50 PRESERVATIVES MARKET: REGIONAL & COUNTRY-LEVEL GROWTH RATES, 2023–2028

FIGURE 51 FUNCTIONAL FOOD INGREDIENTS MARKET: REGIONAL & COUNTRY-LEVEL GROWTH RATES, 2023–2028

FIGURE 52 SPECIALTY STARCH INGREDIENTS MARKET: REGIONAL & COUNTRY-LEVEL GROWTH RATES, 2023–2028

FIGURE 53 SUGAR SUBSTITUTES MARKET: REGIONAL & COUNTRY-LEVEL GROWTH RATES, 2023–2028

FIGURE 54 SEGMENTAL REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2020–2022 (USD BILLION)

FIGURE 55 ANNUAL REVENUE, 2022 (USD BILLION) VS REVENUE GROWTH, 2020–2022

FIGURE 56 EBITDA, 2022 (USD BILLION)

FIGURE 57 SPECIALTY FOOD INGREDIENTS: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

FIGURE 58 SPECIALTY FOOD INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

FIGURE 59 SPECIALTY FOOD INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

FIGURE 60 ADM: COMPANY SNAPSHOT

FIGURE 61 DSM: COMPANY SNAPSHOT

FIGURE 62 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

FIGURE 63 KERRY GROUP PLC: COMPANY SNAPSHOT

FIGURE 64 GIVAUDAN: COMPANY SNAPSHOT

FIGURE 65 CARGILL, INCORPORATED: COMPANY SNAPSHOT

FIGURE 66 SENSIENT TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

FIGURE 67 INGREDION: COMPANY SNAPSHOT

FIGURE 68 CHR. HANSEN HOLDING A/S: COMPANY SNAPSHOT

FIGURE 69 TATE & LYLE: COMPANY SNAPSHOT

Growth opportunities and latent adjacency in Specialty Food Ingredients Market