Forage Seeds Market by Type (Alfalfa, Clover, Ryegrass, and Chicory), Livestock (Poultry, Cattle, and Swine), Species, Origin, Form, and Region - Global Forecast to 2022

[135 Pages Report] The forage seeds market was valued at USD 9.91 billion in 2016 and is projected to grow at a CAGR of 9.81%, to reach a value of USD 17.37 billion by 2022. The basic objective of the report is to define, segment, and project the global market size of the forage seeds market on the basis of type, livestock, species, origin, form, and region. It will also help to understand the structure of the forage seeds market by identifying its various segments. The other objectives include analyzing the opportunities in the market for the stakeholders, providing the competitive landscape of the market trends, and projecting the size of the forage seeds market and its submarkets, in terms of value (USD million) and volume (KT).

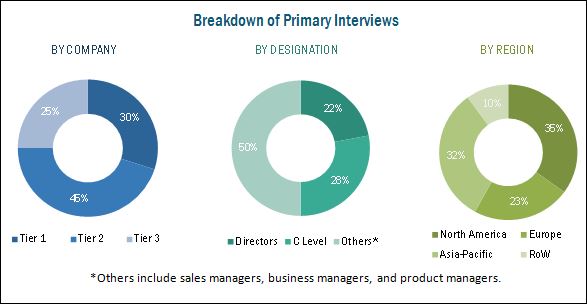

This research study involved the extensive use of secondary sources, which included directories and databasessuch as Hoovers, Forbes, Bloomberg Businessweek, and Factivato identify and collect information useful for a technical, market-oriented, and commercial study of the forage seeds market. The primary sources that have been involved include industry experts from the core and related industries and preferred suppliers, dealers, manufacturers, alliances, standards & certification organizations from companies; and organizations related to all the segments of this industrys value chain. In-depth interviews have been conducted with various primary respondents such as key industry participants, subject matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information as well as to assess future prospects. The following figure depicts the market research methodology applied in drafting this report on the forage seeds market.

To know about the assumptions considered for the study, download the pdf brochure

Key participants in the forage seeds market are the forage seeds manufacturers, suppliers, and regulatory bodies. The key players that are profiled in the report include the Monsanto Company (US), Land OLakes (US), Advanta Seeds Pty Ltd (India), Brettyoung (Canada), Barenburg Holdings B.V. (Netherlands), Allied Seed, LLC (US), AMPAC Seed Co. (US), Imperial Seed Ltd. (Canada).

This report is targeted at the existing players in the industry, which include the following:

- Seed manufacturers

- Regulatory bodies

- Intermediary suppliers

- End users

The study answers several questions for the stakeholders; primarily, which market segments to focus on in the next 2 to 5 years for prioritizing efforts and investments.

Scope of the Report

On the basis of Type, the forage seeds market has been segmented as follows:

- Alfalfa

- Clover

- Ryegrass

- Chicory

On the basis of Livestock, the forage seeds market has been segmented as follows:

- Poultry

- Cattle

- Swine

On the basis of Species, the forage seeds market has been segmented as follows:

- Legumes

- Grasses

On the basis of Origin, the forage seeds market has been segmented as follows:

- Organic

- Inorganic

On the basis of Form, the forage seeds market has been segmented as follows:

- Green

- Dry

On the basis of Region, the forage seeds market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW

Available Customizatio

With the given market data, MarketsandMarkets offers customizations according to a companys specific needs.

The following customization options are available for the report:

Segment Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Asia Pacific forage seeds market, by country

- Further breakdown of the Rest of Europe forage seeds market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The forage seeds market is estimated at USD 9,913.5 million in 2016 and is projected to reach USD 17,377.2 million by 2022, growing at a CAGR of 9.81% during the forecast period. Increase in demand for quality feed products and growth in livestock populations are resulting in the growth of forage seeds market. Forage seeds provide essential protein, fiber, and energy to the livestock, which results in increased yield and also helps save costs incurred on adding additional protein and supplement additives.

Based on type, the market has been segmented into alfalfa, clover, ryegrass, and chicory. The alfalfa segment dominated the market in terms of value in 2016. It is primarily used for feeding cattle, goats, horses, sheep, and dairy cows. Alfalfa improves the growth rate of the livestock by improving their digestibility and intestinal health. It also helps increase the yield of the livestock with an improved quality livestock production.

In terms of type of livestock, the cattle segment accounted for the largest share of the forage seeds market in 2016. The quality of milk and meat products depends on the quality of feed fed to the cattle. Forage seeds are added to the cattle feed by livestock producers to ensure optimum production and performance. They help to improve the milk quantity and enhance the immune system of cattle, leading to greater feed efficiency.

In the species segmentation, the legumes segment accounted for the larger share of the forage seeds market in 2016. Manufacturers have been using legumes to cultivate pastures and hayfields. Legumes have nitrogen-fixing nodules on their roots, which helps in fixing the atmospheric nitrogen. Forage legumes improve the health of animals, by providing essential nutrients such as proteins. Their production is a cost-effective method for enhancing the quality of livestock feeds. Legumes enhance soil fertility, thereby reducing the cost of crop production and livestock feed.

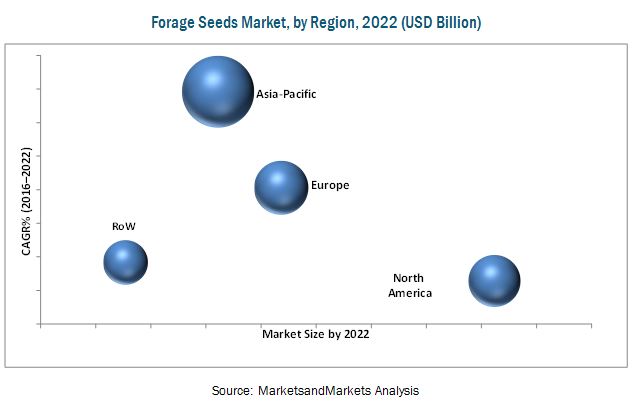

Asia Pacific is projected to be the fastest-growing market for forage seeds during the forecast period. The Asia Pacific market experiences the maximum consumption of forage seeds due to the rising demand for animal feed, reduction in the availability of grazing land, and increase in demand for dairy products. Key players in the forage seeds market focus on research & developments to develop innovative forage seeds that provide nutrients such proteins and vitamins to livestock through their feed.

The challenges faced by the forage seed manufactures include preference of feed quantity over feed quality, lack of seeds and planting materials in developing regions, and reduction in seed yields due to excess soil water, drought, and weeds. Such challenges hamper the forage seeds market.

Players such as DowDuPont (US), Monsanto (US), Land OLakes (US) and Advanta Seed Ltd. (India) have been actively strategizing their growth plans to expand in the forage seeds market. These companies have a strong presence in Asia Pacific and North America, and also have manufacturing facilities and a strong distribution network across these regions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Macroindicators

2.2.1 Increasing Population

2.2.2 Decline in Arable Land

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Forage Seeds Market

4.2 Market: Key Countries

4.3 Developed vs Developing Forage Seeds Markets

4.4 Market, By Category & Region

4.5 Life Cycle Analysis: Forage Seeds Market, By Region

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Species

5.2.2 By Livestock

5.2.3 By Product Segment

5.2.4 By Form

5.2.5 By Origin

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Livestock Population

5.3.1.2 Enhancement of Soil Health Resulting in Improved Yield

5.3.1.3 Forage Seeds Can Be Used for Soil & Water Conservation and Soil Fertility Improvement

5.3.2 Restraints

5.3.2.1 Reduction in Seed Yields Due to Excess Soil Water, Drought and Weeds

5.3.3 Opportunities

5.3.3.1 New Technologies & Improvements in Seed Genetics

5.3.4 Challenges

5.3.4.1 Lack of Improved Planting Material

5.4 Industry Analysis

5.4.1 Value Chain Analysis

5.4.2 Supply Chain Analysis

5.4.2.1 Prominent Companies

5.4.2.2 Small & Medium Enterprises

5.4.2.3 End Users

5.4.2.4 Key Influencers

5.4.3 Pricing Analysis

5.4.3.1 Seed-Price Relationships

5.4.4 Trade Analysis

6 Forage Seed Market, By Type (Page No. - 51)

6.1 Introduction

6.2 Alfalfa

6.3 Clover

6.4 Ryegrass

6.5 Chicory

6.6 Others

7 Forage Seeds Market, By Livestock (Page No. - 57)

7.1 Introduction7.2 Poultry

7.3 Cattle

7.4 Swine

7.5 Others

8 Forage Seeds Market, By Species (Page No. - 62)

8.1 Introduction8.2 Legumes

8.3 Grasses

8.4 Others

9 Forage Seeds Market, By Origin (Page No. - 66)

9.1 Introduction9.2 Organic

9.3 Inorganic

10 Forage Seeds Market, By Form (Page No. - 70)

10.1 Introduction10.2 Green

10.3 Dry

11 Forage Seeds Market, By Region (Page No. - 73)

11.1 Introduction11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Spain

11.3.2 U.K

11.3.3 Italy

11.3.4 France

11.3.5 Germany

11.3.6 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 Australia

11.4.5 Rest of Asia-Pacific

11.5 Rest of the World

11.5.1 Brazil

11.5.2 South Africa

11.5.3 Rest of RoW

12 Competitive Landscape (Page No. - 98)

12.1 Overview

12.2 Market Ranking Analysis

12.3 Competitive Situation & Trends

12.3.1 Agreements, Partnerships, Collaborations, and Mergers

12.3.2 Expansions

12.3.3 Mergers & Acquisitions

12.3.4 New Product Launches

13 Company Profiles (Page No. - 104)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

13.1 DOW Agrosciences LLC

13.2 E.I. Du Pont De Nemours and Company

13.3 Monsanto

13.4 Land O Lakes, Inc.

13.5 Advanta Seed Limited

13.6 Brettyoung

13.7 Barenbrug Holding B.V.

13.8 Allied Seed LLC

13.9 Ampac Seed Company

13.10 Imperial Seed Ltd.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 126)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (64 Tables)

Table 1 List of Import/Export Values for Selected Forage Products

Table 2 Forage Seeds Market Size, By Type, 20142022 (USD Million)

Table 3 Alfalfa: Market Size, By Region, 20142022 (USD Million)

Table 4 Clover: Market Size, By Region, 20142022 (USD Million)

Table 5 Ryegrass: Market Size, By Region, 20142022 (USD Million)

Table 6 Chicory: Market Size, By Region, 20142022 (USD Million)

Table 7 Others: Forage Seeds Market Size, By Region, 2015-2022 (USD Million)

Table 8 Market Size, By Livestock, 20142022 (USD Million)

Table 9 Poultry: Market Size, By Region, 20142022 (USD Million)

Table 10 Cattle: Market Size, By Region, 20142022 (USD Million)

Table 11 Swine: Market Size, By Region, 20142022 (USD Million)

Table 12 Others: Forage Seeds Market Size, By Region, 20142022 (USD Million)

Table 13 Market Size, By Species, 20142022 (USD Million)

Table 14 Legumes: Market Size, By Region, 20142022 (USD Million)

Table 15 Grasses: Market Size, By Region, 2014-2022 (USD Million)

Table 16 Others: Forage Seeds Market Size, By Region, 20142022 (USD Million)

Table 17 Market Size, By Origin, 20142022 (USD Million)

Table 18 Organic: Market Size, By Region, 20142022 (USD Million)

Table 19 Inorganic: Market Size, By Region, 20142022 (USD Million)

Table 20 Market Size, By Form, 20142022 (USD Million)

Table 21 Green: Market Size, By Region, 20142022 (USD Million)

Table 22 Dry: Market Size, By Region, 20142022 (USD Million)

Table 23 Market Size, By Region, 20142022 (USD Million)

Table 24 North America: Market Size, By Country, 20142022 (USD Million)

Table 25 North America: Market Size, By Type, 20142022 (USD Million)

Table 26 North America: Market Size, By Species, 20142022 (USD Million)

Table 27 North America: Market Size, By Livestock, 20142022 (USD Million)

Table 28 North America: Market Size, By Form, 20142022 (USD Million)

Table 29 U.S.: Market Size, By Type, 20142022 (USD Million)

Table 30 Canada: Market Size, By Type, 20142022 (USD Million)

Table 31 Mexico: Market Size, By Type, 20142022 (USD Million)

Table 32 Europe: Market Size, By Country, 20142022 (USD Million)

Table 33 Europe: Market Size, By Type, 20142022 (USD Million)

Table 34 Europe: Market Size, By Species, 20142022 (USD Million)

Table 35 Europe: Market Size, By Livestock, 20142022 (USD Million)

Table 36 Europe: Market Size, By Form, 20142022 (USD Million)

Table 37 Spain: Market Size, By Type, 20142022 (USD Million)

Table 38 U.K.: Market Size, By Type, 20142022 (USD Million)

Table 39 Italy: Market Size, By Type, 20142022 (USD Million)

Table 40 France: Market Size, By Type, 20142022 (USD Million)

Table 41 Germany: Market Size, By Type, 20142022 (USD Million)

Table 42 Rest of Europe: Market Size, By Type, 20142022 (USD Million)

Table 43 Asia-Pacific: Market Size, By Country, 20142022 (USD Million)

Table 44 Asia-Pacific: Market Size, By Type, 20142022 (USD Million)

Table 45 Asia-Pacific: Market Size, By Species, 20142022 (USD Million)

Table 46 Asia-Pacific: Market Size, By Livestock, 20142022 (USD Million)

Table 47 Asia-Pacific: Market Size, By Form, 20142022 (USD Million)

Table 48 China: Market Size, By Type, 20142022 (USD Million)

Table 49 Japan: Market Size, By Type, 20142022 (USD Million)

Table 50 India: Market Size, By Type, 20142022 (USD Million)

Table 51 Australia: Market Size, By Type, 20142022 (USD Million)

Table 52 Rest of Asia-Pacific: Market Size, By Type, 20142022 (USD Million)

Table 53 Rest of the World: Market Size, By Country, 20142022 (USD Million)

Table 54 Rest of the World: Market Size, By Type, 20142022 (USD Million)

Table 55 Rest of the World: Market Size, By Species, 20142022 (USD Million)

Table 56 Rest of the World: Market Size, By Livestock, 20142022 (USD Million)

Table 57 RoW: Market Size, By Form, 20142022 (USD Million)

Table 58 Brazil: Market Size, By Type, 20142022 (USD Million)

Table 59 South Africa: Market Size, By Type, 20142022 (USD Million)

Table 60 Rest of RoW: Market Size, By Type, 20142022 (USD Million)

Table 61 Agreements, Partnerships, Collaborations, and Joint Ventures, 20112016

Table 62 Investments & Expansions, 20112016

Table 63 Acquisitions, 20112016

Table 64 New Product Launches

List of Figures (53 Figures)

Figure 1 Forage Seeds Market Segmentation

Figure 2 Research Flow: Forage Seeds Market

Figure 3 Research Design: Forage Seeds Market

Figure 4 Breakdown of Primary Interviews, By Company Type, Designation, and Region

Figure 5 Global Population, 19552050 (Billion)

Figure 6 Arable Land, 19502020 (Hectares/Person)

Figure 7 Market Size Estimation Methodology: Bottom-Up Approach

Figure 8 Market Size Estimation Methodology: Top-Down Approach

Figure 9 Data Triangulation

Figure 10 Assumptions of the Study

Figure 11 Limitations of the Study

Figure 12 Alfalfa Segment to Dominate the Market, 20162022

Figure 13 Cattle to Account for the Largest Market, By Livestock, in 2016

Figure 14 Legumes Segment Expected to Dominate the Forage Seeds Market

Figure 15 Inorganic Forage Seeds to Lead the Market During the Period Under Consideration

Figure 16 North America Estimated to Lead the Forage Seeds Market in 2016

Figure 17 Asia-Pacific Region to Witness Highest Growth Rate By 2022

Figure 18 an Emerging Market With Promising Growth Potential, 2016 vs 2022

Figure 19 Japan to Be the Fastest-Growing Market for Forage Seed From 2016 to 2022

Figure 20 India Emerging to Be One of the Most Attractive Markets for Forage Seeds During the Forecast Period

Figure 21 North America Accounted for the Largest Share in Both Categories in 2016

Figure 22 Asia-Pacific Market is Experiencing High Growth

Figure 23 Market, By Species

Figure 24 Market, By Livestock

Figure 25 Market, By Type

Figure 26 Market, By Form

Figure 27 Market, By Origin

Figure 28 Forage Seeds: Market Dynamics

Figure 29 Global Livestock Production

Figure 30 Value Chain Analysis of Forage Seeds (2015): A Major Contribution From the R&D Phase

Figure 31 Supply Chain Analysis for the Forage Seeds Market

Figure 32 Seed-Price Relationships

Figure 33 Ryegrass Segment Projected to Be the Fastest-Growing Type of Forage Seed

Figure 34 Market Size, By Livestock, 2016 vs 2022

Figure 35 Grasses Segment Projected to Be the Fastest-Growing Species of Forage Seeds

Figure 36 Organic Segment is Projected to Grow at the Highest Rate

Figure 37 Market Size, By Form, 2016 vs 2022 (USD Million)

Figure 38 Japan is Projected to Grow at the Highest Rate During the Forecast Period

Figure 39 North America Market Snapshot

Figure 40 Asia Pacifc Market Snapshot

Figure 41 Agreements, Partnerships, Collaborations, and Joint Ventures Were Preferred By Companies in the Forage Seeds Market in the Last Five Years

Figure 42 Strengthening Market Presence Through Agreements, Partnership, Collaborations, and Joint Ventures, Between 2011 to 2016

Figure 43 Agreements, Partnerships, Collaborations, and Joint Ventures: the Key Strategy Adopted By the Companies, 20112016

Figure 44 DOW Agrosciences LLC: Company Snapshot

Figure 45 DOW Agrosciences: SWOT Analysis

Figure 46 E.I. Du Pont De Nemours and Company: Company Snapshot

Figure 47 E.I. Du Pont De Nemours and Company: SWOT Analysis

Figure 48 Monsanto: Company Snapshot

Figure 49 Monsanto: SWOT Analysis

Figure 50 Land O Lakes, Inc.: Company Snapshot

Figure 51 Land O Lakes, Inc.: SWOT Analysis

Figure 52 Advanta Seed Limited: Company Snapshot

Figure 53 Barenburg Holding B.V: Company Snapshot

Growth opportunities and latent adjacency in Forage Seeds Market