Glucose, Dextrose, and Maltodextrin Market by Product (Glucose, Dextrose, and Maltodextrin), Application (Food & Beverages (Confectionery, Bakery, Dairy), Pharmaceuticals, Personal Care Products, Paper & Pulp), and Region - Global Forecast to 2024

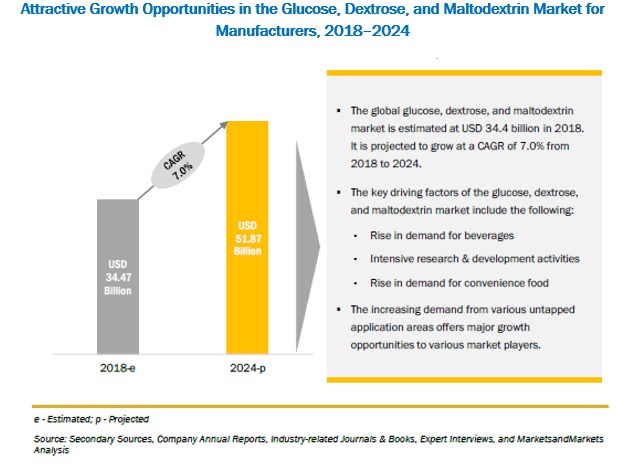

[206 Pages Report] The glucose, dextrose, and maltodextrin market is projected to reach USD 51.87 billion by 2024, at a CAGR of 7.0% from 2018, in terms of value. The market for glucose, dextrose, and maltodextrin is driven by the increase in demand from the beverage industry, intense research & development activities, and increase in demand for convenience foods. The demand for glucose, dextrose, and maltodextrin in the food & beverages segment, is expected to witness significant growth in the near future, as major food & beverage companies are expected to increase the application of glucose, dextrose, and maltodextrin due to their multiple benefits, including their role as sweeteners, binders, emulsifiers, and thickening agents. However, growth in demand for gums as an alternative to glucose, dextrose, and maltodextrin restrains market growth.

The confectionery products segment is projected to dominate the glucose market for food & beverages through the forecasted period.

Glucose syrup is widely used in the confectionery industry. As it is a doctoring agent, it prevents crystallization, imparting uniformity to the product; in some confectionery applications, it can be used as a necessary ingredient up to the extent of around 40%. It is generally used in the production of homogenous confectionery products such as chewing gums and chocolates. Liquid glucose also has good preservative qualities, imparts a smooth texture to the end product, and enhances the shelf life of the end product. This has led to increased demand for glucose in the confectionery products segment.

The food & beverages segment is projected to dominate the dextrose market through the forecast period.

Dextrose is used as a sweetener and nutritional supplement in the production of various food products such as in candy & gums, creams, bakery products, jarred & canned foods, frozen dairy products, and cured meats. It can also be used in beverages, jelly, jam, and honey for improved taste and quality and extended shelf life. Thus, changes in food habits and inclination toward snacks and desserts, where dextrose is used as an effective sweetening agent, drive the usage of dextrose in the food & beverages segment.

The personal care products segment is projected to be the fastest-growing, in terms of value and volume, in the maltodextrin market from 2018 to 2024.

Maltodextrin is used as an emulsifier to improve the texture of products such as toothpaste. It is important in the cosmetics industry because it helps bind other compounds and helps in stabilizing the formula during the production stage. The personal care products industry is large in developing as well as developed regions such as North America, Europe, Asia Pacific, and the Middle East, which provides scope for maltodextrins to be used in the personal care products industry.

The glucose segment is expected to dominate the glucose, dextrose, and maltodextrin market through 2024.

In 2017, the glucose segment accounted for a larger share, by product, in the glucose, dextrose, and maltodextrin market, in terms of value. Glucose, in the form of syrup and solids, has a high water binding capacity, is fermentable, and prevents sugar crystallization. It is used as a texturant, volume enhancing agent, and flavorant, and also helps in the prevention of crystallization of sugar molecules in beverages. The growth of the food & beverage industry, especially in the confectionery products sector, increases the demand for glucose. Further, increasing demand for aerated and non-aerated beverages drives the demand for glucose syrup, as it is widely used as a sweetener in these beverages

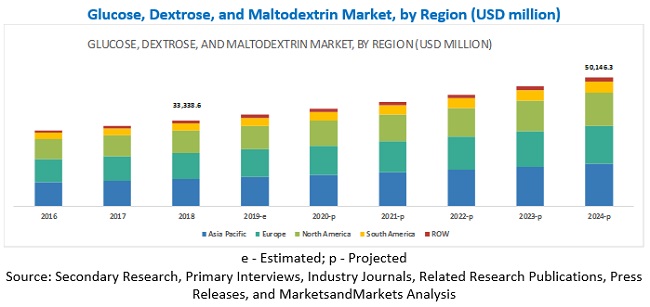

Asia Pacific is projected to be the fastest-growing in the maltodextrin market for food & beverages from 2018 to 2024

The Asia Pacific region projected to be the fastest-growing in the maltodextrin market for food & beverages, owing to the rising demand for low-caloric food in this region and the large-scale availability and affordability of maltodextrins. Furthermore, the rapidly growing convenience food and personal care industries in the Asia Pacific region have led to an increase in the consumption of glucose, dextrose, and maltodextrin products

Market Dynamics

Rise in demand for beverages is a major driver for the market

Glucose and maltodextrin are widely used as sweeteners. The demand for cereal sweeteners is backed by the development of the soft drinks industry. The demand for soft drinks is rapidly increasing in the developing markets of Asia Pacific and South America. Although juices and aerated drinks can be sweetened by using saccharose sugar or low-calorie syrups, fructose and glucose syrups are generally preferred. This is due to the price effectiveness of glucose syrups and dextrose and technical properties such as enhancement of viscosity and visual appearance of the food items. Furthermore, the demand for maltodextrin is expected to increase over the next six years as it is used as a thickening and filling agent in beverages and is one of the key elements in sports drinks.

Growth in demand for gums as an alternative to glucose, dextrose, and maltodextrin is a major restraint

Rise in preference for gums such as gum Arabic, guar gum, xanthan gum and locust bean gum over starch-derived products is emerging as a restraint for the market. It has been analyzed that food & beverages stabilized with sources of gums attain better stability than those with modified starches. Gums are posing a threat to starch derivatives such as glucose, dextrose, and maltodextrin in various food & beverage segments, where they are utilized to prevent sugar crystallization as well. The increase in preference for gums may restrain the usage of starch derivatives in the foods segment. Along with taste, texture, and stability, gums also provide functional benefits to food & beverage products.

Break-up of Primaries:

- By Company Type: Tier 1 - 45%, Tier 2 - 35%, and Tier 3 - 20%

- By Designation: C-level - 45%, Director-level - 30%, and Manager-level - 25%

- By Region: North America - 20%, Europe - 35%, Asia Pacific - 40%, and South America - 5%

The leading players in the glucose, dextrose, and maltodextrin market ADM (US), Ingredion (US), AGRANA (Austria), Tate & Lyle (UK), Cargill (US), ROQUETTE (France), Grain Processing Corporation (US), Avebe Group (Netherlands), Tereos (France), Global Sweeteners Holdings (Hong Kong), Gulshan Polyols (India), and Fooding Group Limited (China).

Scope of the Report

The glucose, dextrose, and maltodextrin market is segmented as follows:

On the basis of Application:

- Food & beverages

- Confectionery products

- Bakery products

- Dairy products

- Beverages

- Soups, sauces, and dressings

- Others (meat & seafood, snacks, and noodles)

- Pharmaceuticals

- Personal care products

- Paper & pulp

- Others (agriculture, leather processing, and other industrial applications)

On the basis of Product:

- Glucose

- Dextrose

- Maltodextrin

On the basis of Region:

- North America

- Europe

- Asia Pacific

- South America

- RoW (South Africa, the Middle East, and other African countries)

Recent Developments

|

DATE |

COMPANY |

DEVELOPMENT |

|

March 2018 |

Tate & Lyle (UK) |

Tate & Lyle expanded its food application laboratory in Shanghai, to meet the growing consumer demand for healthier food & beverage products. |

|

October 2017 |

Tate & Lyle (UK) |

Tate & Lyle plans to expand its production capacity in Boleraz, Slovakia, to enhance the production of maltodextrin. This expansion is expected to be completed in 2019. |

|

October 2017 |

Ingredion (US) |

Ingredion launched a new line of low-sugar glucose syrupsVERSASWEETin the US and Canada. |

|

August 2017 |

Tate & Lyle (UK) |

Tate & Lyle expanded its CLARIA product line by launching two new instant starch products. |

|

|

ADM (US) |

ADM completed its acquisition of Chamtor SA (France) to expand its global footprint in the sweetener and starch segments. |

|

|

ADM (US) |

ADM acquired the production plant in Morocco from Tate & Lyle PLC (UK); it produces glucose and starch. This acquisition will help the company reach its customers globally, as well as regionally. |

|

|

Tate & Lyle (UK) |

Tate & Lyle re-aligned its joint venture with ADM Company (US) for its corn business. This helped the company to expand its business with key players in the starch business. |

|

|

Tereos (France) |

Tereos and Fιculerie Coopιrative Agricole de Vic sur Aisne (FCAVA) entered into a joint venture agreement to strengthen the cooperative branch of the French starch potato sector in the European market. |

Source: Company Websites, Company Publications, and Press Releases

Research Coverage:

The glucose, dextrose, and maltodextrin market is segmented on the basis of applications, products, and key regions. On the basis of application, the market is segmented into food & beverages, pharmaceuticals, personal care products, paper & pulp, and others (agriculture, leather processing, and other industrial applications). The food & beverages segment is further subsegmented into confectionery products, bakery products, dairy products, beverages, soups, sauces, and dressings, and others (meat & seafood, snacks, and noodles). The product market is segmented into glucose, dextrose, and maltodextrin. On the basis of region, the market is segmented into North America, Europe, Asia Pacific, South America, and Rest of the World (RoW). The report also includes an in-depth competitive analysis of the key players in the market along with their company profiles, competitive landscape, company ranking analysis, recent developments, and key market strategies.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of The Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Unit Considered

1.7 Stakeholders

2 Research Methodology

2.1 Research Data

2.2 Market Split Estimation

2.2.1 Secondary Data

2.2.1.1 Key Data from Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Data from Primary Sources

2.2.2.2 Key Industry Insights

2.2.2.3 Breakdown of Primaries

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

3 Executive Summary

4 Premium Insights

4.1 Market Opportunities for Glucose, Dextrose, and Maltodextrin Manufacturers

4.2 Glucose, Dextrose, and Maltodextrin Market, By Product

4.3 Asia Pacific: Fastest-Growing Glucose, Dextrose, and Maltodextrin Market

4.4 Glucose, Dextrose, and Maltodextrin Market, By Application

4.5 Glucose, Dextrose, and Maltodextrin Market, By Food & Beverages Sub-Application

4.6 Glucose, Dextrose, and Maltodextrin Market Size, 20162024 (Usd Billion)

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rise in Demand for Beverages

5.2.1.2 Intensive Research & Development Activities

5.2.1.3 Rise in Demand for Convenience Food

5.2.2 Restraints

5.2.2.1 Growth in Demand for Gums as An Alternative to Glucose, Dextrose, And Maltodextrin

5.2.3 Opportunities

5.2.3.1 Wide Range of Untapped Applications

5.2.4 Challenges

5.2.4.1 Fluctuating Costs of Raw Materials

5.3 Glucose, Dextrose, and Maltodextrin Market: Value Chain Analysis

5.4 Supply Chain Analysis

5.5 Regulatory Framework

5.5.1 North America

5.5.2 Europe

5.5.3 Asia Pacific

5.5.4 South America

6 Glucose, Dextrose, and Maltodextrin Market, By Product

6.1 Introduction

Table 3 Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 4 Market Size, By Product, 20162024 (KT)

6.2 Glucose

Table 5 Glucose Market Size, By Region, 20162024 (USD Million)

Table 6 Glucose Market Size, By Region, 20162024 (KT)

6.3 Dextrose

Table 7 Dextrose Market Size, By Region, 20162024 (USD Million)

Table 8 Dextrose Market Size, By Region, 20162024 (KT)

6.4 Maltodextrin

Table 9 Maltodextrin Market Size, By Region, 20162024 (USD Million)

Table 10 Maltodextrin Market Size, By Region, 20162024 (KT)

7 Glucose, Dextrose, and Maltodextrin Market, By Application

7.1 Introduction

7.2 Glucose

Table 11 Glucose Market Size, By Application, 20162024 (USD Million)

Table 12 Glucose Market Size, By Application, 20162024 (KT)

7.2.1 Food & Beverages

Table 13 Glucose Market Size for Food & Beverages, By Region, 20162024 (USD Million)

Table 14 Glucose Market Size for Food & Beverages, By Region, 20162024 (KT)

Table 15 Glucose Market Size, By Food & Beverage Sub-Application, 20162024 (USD Million)

Table 16 Glucose Market Size, By Food & Beverage Sub-Application, 20162024 (KT)

7.2.1.1 Confectionery Products

Table 17 Glucose Market Size for Confectionery Products, By Region, 20162024 (USD Million)

Table 18 Glucose Market Size for Confectionery, By Region, 20162024 (KT)

7.2.1.2 Bakery Products

Table 19 Glucose Market Size for Bakery Products, By Region, 20162024 (USD Million)

Table 20 Glucose Market Size for Bakery, By Region, 20162024 (KT)

7.2.1.3 Dairy Products

Table 21 Glucose Market Size for Dairy Products, By Region, 20162024 (USD Million)

Table 22 Glucose Market Size for Dairy Products, By Region, 20162024 (KT)

7.2.1.4 Beverages

Table 23 Glucose Market Size for Beverages, By Region, 20162024 (USD Million)

Table 24 Glucose Market Size for Beverages, By Region, 20162024 (KT)

7.2.1.5 Soups, Sauces, And Dressings

Table 25 Glucose Market Size for Soups, Sauces, And Dressings, By Region, 20162024 (USD Million)

Table 26 Glucose Market Size for Soups, Sauces, And Dressings, By Region, 20162024 (KT)

7.2.1.6 Others

Table 27 Glucose Market Size for Other Food & Beverages, By Region, 20162024 (USD Million)

Table 28 Glucose Market Size for Other Food & Beverages, By Region, 20162024 (KT)

7.2.2 Pharmaceuticals

Table 29 Glucose Market Size for Pharmaceuticals, By Region, 20162024 (USD Million)

Table 30 Glucose Market Size for Pharmaceuticals, By Region, 20162024 (KT)

7.2.3 Personal Care Products

Table 31 Glucose Market Size for Personal Care Products, By Region, 20162024 (USD Million)

Table 32 Glucose Market Size for Personal Care Products, By Region, 20162024 (KT)

7.2.4 Paper & Pulp

Table 33 Glucose Market Size for Paper & Pulp, By Region, 20162024 (USD Million)

Table 34 Glucose Market Size for Paper & Pulp, By Region, 20162024 (KT)

7.2.5 Others

Table 35 Glucose Market Size for Other Applications, By Region, 20162024 (USD Million)

Table 36 Glucose Market Size for Other Applications, By Region, 20162024 (KT)

7.3 Dextrose

Table 37 Dextrose Market Size, By Application, 20162024 (USD Million)

Table 38 Dextrose Market Size, By Application, 20162024 (KT)

Table 39 Dextrose Market Size for Food & Beverages, By Region, 20162024 (USD Million)

Table 40 Dextrose Market Size for Food & Beverages, By Region, 20162024 (KT)

7.3.1 Food & Beverages

Table 41 Dextrose Market Size, By Food & Beverage Sub-Application, 20162024 (USD Million)

Table 42 Dextrose Market Size, By Food & Beverage Sub-Application, 20162024 (KT)

7.3.1.1 Confectionery Products

Table 43 Dextrose Market Size for Confectionery Products, By Region, 20162024 (USD Million)

Table 44 Dextrose Market Size for Confectionery Products, By Region, 20162024 (KT)

7.3.1.2 Bakery Products

Table 45 Dextrose Market Size for Bakery Products, By Region, 20162024 (USD Million)

Table 46 Dextrose Market Size for Bakery Products, By Region, 20162024 (KT)

7.3.1.3 Dairy Products

Table 47 Dextrose Market Size for Dairy Products, By Region, 20162024 (USD Million)

Table 48 Dextrose Market Size for Dairy Products, By Region, 20162024 (KT)

7.3.1.4 Beverages

Table 49 Dextrose Market Size for Beverages, By Region, 20162024 (USD Million)

Table 50 Dextrose Market Size for Beverages, By Region, 20162024 (KT)

7.3.1.5 Soups, Sauces, And Dressings

Table 51 Dextrose Market Size for Soups, Sauces, And Dressings, By Region, 20162024 (USD Million)

Table 52 Dextrose Market Size for Soups, Sauces, And Dressings, By Region, 20162024 (KT)

7.3.1.6 Others

Table 53 Dextrose Market Size for Other Food & Beverages, By Region, 20162024 (USD Million)

Table 54 Dextrose Market Size for Other Food & Beverages, By Region, 20162024 (KT)

7.3.2 Pharmaceuticals

Table 55 Dextrose Market Size for Pharmaceuticals, By Region, 20162024 (USD Million)

Table 56 Dextrose Market Size for Pharmaceuticals, By Region, 20162024 (KT)

7.3.3 Personal Care Products

Table 57 Dextrose Market Size for Personal Care Products, By Region, 20162024 (USD Million)

Table 58 Dextrose Market Size for Personal Care Products, By Region, 20162024 (KT)

7.3.4 Paper & Pulp

Table 59 Dextrose Market Size for Paper & Pulp, By Region, 20162024 (USD Million)

Table 60 Dextrose Market Size for Paper Making, By Region, 20162024 (KT)

7.3.5 Others

Table 61 Dextrose Market Size for Other Applications, By Region, 20162024 (USD Million)

Table 62 Dextrose Market Size for Other Applications, By Region, 20162024 (KT)

7.4 Maltodextrin

Table 63 Maltodextrin Market Size, By Application, 20162024 (USD Million)

Table 64 Maltodextrin Market Size, By Application, 20162024 (KT)

7.4.1 Food & Beverages

Table 65 Maltodextrin Market Size for Food & Beverages, By Region, 20162024 (USD Million)

Table 66 Maltodextrin Market Size for Food & Beverages, By Region, 20162024 (KT)

Table 67 Maltodextrin Market Size, By Food & Beverage Sub-Application, 20162024 (USD Million)

Table 68 Maltodextrin Market Size, By Food & Beverage Sub-Application, 20162024 (KT)

7.4.1.1 Confectionery Products

Table 69 Maltodextrin Market Size for Confectionery Products, By Region, 20162024 (USD Million)

Table 70 Maltodextrin Market Size for Confectionery Products, By Region, 20162024 (KT)

7.4.1.2 Bakery Products

Table 71 Maltodextrin Market Size for Bakery Products, By Region, 20162024 (USD Million)

Table 72 Maltodextrin Market Size for Bakery Products, By Region, 20162024 (KT)

7.4.1.3 Dairy Products

Table 73 Maltodextrin Market Size for Dairy Products, By Region, 20162024 (USD Million)

Table 74 Maltodextrin Market Size for Dairy Products, By Region, 20162024 (KT)

7.4.1.4 Beverages

Table 75 Maltodextrin Market Size for Beverages, By Region, 20162024 (USD Million)

Table 76 Maltodextrin Market Size for Beverages, By Region, 20162024 (KT)

7.4.1.5 Soups, Sauces, And Dressings

Table 77 Maltodextrin Market Size for Soups, Sauces, And Dressings, By Region, 20162024 (USD Million)

Table 78 Maltodextrin Market Size for Soups, Sauces, And Dressings, By Region, 20162024 (KT)

7.4.1.6 Others

Table 79 Maltodextrin Market Size for Other Food & Beverages, By Region, 20162024 (USD Million)

Table 80 Maltodextrin Market Size for Other Food & Beverages, By Region, 20162024 (KT)

7.4.2 Pharmaceuticals

Table 81 Maltodextrin Market Size for Pharmaceuticals, By Region, 20162024 (USD Million)

Table 82 Maltodextrin Market Size for Pharmaceuticals, By Region, 20162024 (KT)

7.4.3 Personal Care Products

Table 83 Maltodextrin Market Size for Personal Care Products, By Region, 20162024 (USD Million)

Table 84 Maltodextrin Market Size for Personal Care Products, By Region, 20162024 (KT)

7.4.4 Paper & Pulp

Table 85 Maltodextrin Market Size for Paper & Pulp, By Region, 20162024 (USD Million)

Table 86 Maltodextrin Market Size for Paper & Pulp, By Region, 20162024 (KT)

7.4.5 Others

Table 87 Maltodextrin Market Size for Other Applications, By Region, 20162024 (USD Million)

Table 88 Maltodextrin Market Size for Other Applications, By Region, 20162024 (KT)

8 Glucose, Dextrose, and Maltodextrin Market, By Form

8.1 Introduction

8.2 Syrup

8.3 Solid

9 Glucose, Dextrose, and Maltodextrin Market, By Region

9.1 Introduction

Table 89 Glucose, Dextrose, and Maltodextrin Market Size, By Region, 20162024 (USD Million)

Table 90 Market Size, By Region, 20162024 (KT)

9.2 North America

Table 91 North America: Glucose, Dextrose, and Maltodextrin Market Size, By Country, 20162024 (USD Million)

Table 92 North America: Market Size, By Country, 20162024 (KT)

Table 93 North America: Market Size, By Product, 20162024 (USD Million)

Table 94 North America: Market Size, By Product, 20162024 (KT)

Table 95 North America: Glucose Market Size, By Application, 20162024 (USD Million)

Table 96 North America: Glucose Market Size, By Application, 20162024 (KT)

Table 97 North America: Dextrose Market Size, By Application, 20162024 (USD Million)

Table 98 North America: Dextrose Market Size, By Application, 20162024 (KT)

Table 99 North America: Maltodextrin Market Size, By Application, 20162024 (USD Million)

Table 100 North America: Maltodextrin Market Size, By Application, 20162024 (KT)

9.2.1 US

Table 101 Us: Market Size for Glucose, Dextrose, And Maltodextrin, By Product, 20162024 (USD Million)

Table 102 Us: Market Size, By Product, 20162024 (KT)

9.2.2 Canada

Table 103 Canada: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 104 Canada: Market Size, By Product, 20162024 (KT)

9.2.3 Mexico

Table 105 Mexico: Market Size for Glucose, Dextrose, And Maltodextrin, By Product, 20162024 (USD Million)

Table 106 Mexico: Market Size, By Product, 20162024 (KT)

9.3 Europe

Table 107 Europe: Glucose, Dextrose, and Maltodextrin Market Size, By Country, 2016-2024 (USD Million)

Table 108 Europe: Market Size, By Country, 2016-2024 (KT)

Table 109 Europe: Market Size, By Product, 2016-2024 (USD Million)

Table 110 Europe: Market Size, By Product, 2016-2024 (KT)

Table 111 Europe: Glucose Market Size, By Application, 2016-2024 (USD Million)

Table 112 Europe: Glucose Market Size, By Application, 2016-2024 (KT)

Table 113 Europe: Dextrose Market Size, By Application, 2016-2024 (USD Million)

Table 114 Europe: Dextrose Market Size, By Application, 2016-2024 (KT)

Table 115 Europe: Maltodextrin Market Size, By Application, 2016-2024 (USD Million)

Table 116 Europe: Maltodextrin Market Size, By Application, 2016-2024 (KT)

9.3.1 Germany

Table 117 Germany: Market Size for Glucose, Dextrose, And Maltodextrin, By Product, 2016-2024 (USD Million)

Table 118 Germany: Market Size, By Product, 2016-2024 (KT)

9.3.2 Uk

Table 119 Uk: Market Size for Glucose, Dextrose, And Maltodextrin, By Product, 2016-2024 (USD Million)

Table 120 Uk: Market Size, By Product, 2016-2024 (KT)

9.3.3 France

Table 121 France: Market Size for Glucose, Dextrose, And Maltodextrin, By Product, 2016-2024 (USD Million)

Table 122 France: Market Size, By Product, 2016-2024 (KT)

9.3.4 Spain

Table 123 Spain: Market Size for Glucose, Dextrose, And Maltodextrin, By Product, 2016-2024 (USD Million)

Table 124 Spain: Market Size, By Product, 2016-2024 (KT)

9.3.5 Russia

Table 125 Russia: Market Size for Glucose, Dextrose, And Maltodextrin, By Product, 2016-2024 (USD Million)

Table 126 Russia: Market Size, By Product, 2016-2024 (KT)

9.3.6 Rest of Europe

Table 127 Rest of Europe: Market Size for Glucose, Dextrose, And Maltodextrin, By Product, 2016-2024 (USD Million)

Table 128 Rest of Europe: Market Size, By Product, 2016-2024 (KT)

9.4 Asia Pacific

Table 129 Asia Pacific: Glucose, Dextrose, and Maltodextrin Market Size, By Country, 20162024 (USD Million)

Table 130 Asia Pacific: Market Size, By Country, 20162024 (KT)

Table 131 Asia Pacific: Market Size, By Product, 20162024 (USD Million)

Table 132 Asia Pacific: Market Size, By Product, 20162024 (KT)

Table 133 Asia Pacific: Glucose Market Size, By Application, 20162024 (USD Million)

Table 134 Asia Pacific: Glucose Market Size, By Application, 20162024 (KT)

Table 135 Asia Pacific: Dextrose Market Size, By Application, 20162024 (USD Million)

Table 136 Asia Pacific: Dextrose Market Size, By Application, 20162024 (KT)

Table 137 Asia Pacific: Maltodextrin Market Size, By Application, 20162024 (USD Million)

Table 138 Asia Pacific: Maltodextrin Market Size, By Application, 20162024 (KT)

9.4.1 China

Table 139 China: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 140 China: Market Size, By Product, 20162024 (KT)

9.4.2 India

Table 141 India: Market Size for Glucose, Dextrose, And Maltodextrin, By Product, 20162024 (USD Million)

Table 142 India: Market Size, By Product, 20162024 (KT)

9.4.3 Indonesia

Table 143 Indonesia: Market Size for Glucose, Dextrose, And Maltodextrin, By Product, 20162024 (USD Million)

Table 144 Indonesia: Market Size, By Product, 20162024 (KT)

9.4.4 Vietnam

Table 145 Vietnam: Market Size for Glucose, Dextrose, And Maltodextrin, By Product, 20162024 (USD Million)

Table 146 Vietnam: Market Size, By Product, 20162024 (KT)

9.4.5 Thailand

Table 147 Thailand: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 148 Thailand: Market Size, By Product, 20162024 (KT)

9.4.6 Rest of Asia Pacific

Table 149 Rest of Asia Pacific: Market Size for Glucose, Dextrose, And Maltodextrin, By Product, 2016 2024 (USD Million)

Table 150 Rest of Asia Pacific: Market Size, By Product, 20162024 (KT)

9.5 South America

Table 151 South America: Glucose, Dextrose, and Maltodextrin Market Size, By Country, 20162024 (USD Million)

Table 152 South America: Market Size, By Country, 20162024 (KT)

Table 153 South America: Market Size, By Product, 20162024 (USD Million)

Table 154 South America: Market Size, By Product, 20162024 (KT)

Table 155 South America: Glucose Market Size, By Application, 20162024 (USD Million)

Table 156 South America: Glucose Market Size, By Application, 20162024 (KT)

Table 157 South America: Dextrose Market Size, By Application, 20162024 (USD Million)

Table 158 South America: Dextrose Market Size, By Application, 20162024 (KT)

Table 159 South America: Maltodextrin Market Size, By Application, 20162024 (USD Million)

Table 160 South America: Maltodextrin Market Size, By Application, 20162024 (KT)

9.5.1 Brazil

Table 161 Brazil: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 162 Brazil: Market Size, By Product, 20162024 (KT)

9.5.2 Argentina

Table 163 Argentina: Market Size for Glucose, Dextrose, And Maltodextrin, By Product, 20162024 (USD Million)

Table 164 Argentina: Market Size, By Product, 20162024 (KT)

9.5.3 Rest of South America

Table 165 Rest of South America: Market Size for Glucose, Dextrose, And Maltodextrin, By Product, 20162024 (USD Million)

Table 166 Rest of South America: Market Size, By Product, 20162024 (KT)

9.6 Rest of The World (Row)

Table 167 Row: Glucose, Dextrose, and Maltodextrin Market Size, By Country, 2016-2024 (USD Million)

Table 168 Row: Market Size, By Country, 2016-2024 (KT)

Table 169 Row: Market Size, By Product, 2016-2024 (USD Million)

Table 170 Row: Market Size, By Product, 2016-2024 (KT)

Table 171 Row: Glucose Market Size, By Application, 2016-2024 (USD Million)

Table 172 Row: Glucose Market Size, By Application, 2016-2024 (KT)

Table 173 Row: Dextrose Market Size, By Application, 2016-2024 (USD Million)

Table 174 Row: Dextrose Market Size, By Application, 2016-2024 (KT)

Table 175 Row: Maltodextrin Market Size, By Application, 2016-2024 (USD Million)

Table 176 Row: Maltodextrin Market Size, By Application, 2016-2024 (KT)

9.6.1 South Africa

Table 177 South Africa: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (USD Million)

Table 178 South Africa: Market Size, By Product, 2016-2024 (KT)

9.6.2 Others in Row

Table 179 Others in Row: Market Size for Glucose, Dextrose, And Maltodextrin, By Product, 2016-2024 (USD Million)

Table 180 Others in Row: Market Size, By Product, 2016-2024 (KT)

10 Competitive Landscape

10.1 Overview

10.2 Market Ranking Analysis

10.3 Competitive Scenario

10.3.1 Expansions & Investments

10.3.2 New Product Launches

10.3.3 Acquisitions

10.3.4 Joint Ventures, Partnerships, And Agreements

11 Company Profiles

(Business Overview, Products Offered, Recent Developments, Swot Analysis, Mnm View) *

11.1 ADM

11.1.1 Business Overview

11.1.2 Product Offered

11.1.3 Recent Developments

11.1.4 SWOT Analysis

11.1.5 MnM View

11.2 Ingredion

11.2.1 Business Overview

11.2.2 Product Offered

11.2.3 Recent Developments

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 Agrana

11.3.1 Business Overview

11.3.2 Product Offered

11.3.3 Recent Developments

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 Tate & Lyle

11.4.1 Business Overview

11.4.2 Product Offered

11.4.3 Recent Developments

11.4.4 SWOT Analysis

11.4.5 MnM View

11.5 Cargill

11.5.1 Business Overview

11.5.2 Product Offered

11.5.3 Recent Developments

11.5.4 SWOT Analysis

11.5.5 MnM View

11.6 Roquette

11.7 Grain Processing Corporation

11.8 Avebe Group

11.9 Tereos

11.10 Global Sweeteners Holdings

11.11 Gulshan Polyols

11.12 Fooding Group Limited

*Details on Business Overview, Products Offered, Recent Developments, Swot Analysis, Mnm View Might Not Be Captured In Case Of Unlisted Companies.

12 Appendix

12.1 Discussion Guide

12.2 Knowledge Store: MarketsandMarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables

Table 1 Us Dollar Exchange Rate, 20122017

Table 2 Corn Starch Pricing (USD/MT)

Table 3 Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 4 Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (KT)

Table 5 Glucose Market Size, By Region, 20162024 (USD Million)

Table 6 Glucose Market Size, By Region, 20162024 (KT)

Table 7 Dextrose Market Size, By Region, 20162024 (USD Million)

Table 8 Dextrose Market Size, By Region, 20162024 (KT)

Table 9 Maltodextrin Market Size, By Region, 20162024 (USD Million)

Table 10 Maltodextrin Market Size, By Region, 20162024 (KT)

Table 11 Glucose Market Size, By Application, 20162024 (USD Million)

Table 12 Glucose Market Size, By Application, 20162024 (KT)

Table 13 Glucose Market Size for Food & Beverages, By Region, 20162024 (USD Million)

Table 14 Glucose Market Size for Food & Beverages, By Region, 20162024 (KT)

Table 15 Glucose Market Size, By Food & Beverage Sub-Application, 20162024 (USD Million)

Table 16 Glucose Market Size, By Food & Beverage Sub-Application, 20162024 (KT)

Table 17 Glucose Market Size for Confectionery Products, By Region, 20162024 (USD Million)

Table 18 Glucose Market Size for Confectionery, By Region, 20162024 (KT)

Table 19 Glucose Market Size for Bakery Products, By Region, 20162024 (USD Million)

Table 20 Glucose Market Size for Bakery, By Region, 20162024 (KT)

Table 21 Glucose Market Size for Dairy Products, By Region, 20162024 (USD Million)

Table 22 Glucose Market Size for Dairy Products, By Region, 20162024 (KT)

Table 23 Glucose Market Size for Beverages, By Region, 20162024 (USD Million)

Table 24 Glucose Market Size for Beverages, By Region, 20162024 (KT)

Table 25 Glucose Market Size for Soups, Sauces, And Dressings, By Region, 20162024 (USD Million)

Table 26 Glucose Market Size for Soups, Sauces, And Dressings, By Region, 20162024 (KT)

Table 27 Glucose Market Size for Other Food & Beverages, By Region, 20162024 (USD Million)

Table 28 Glucose Market Size for Other Food & Beverages, By Region, 20162024 (KT)

Table 29 Glucose Market Size for Pharmaceuticals, By Region, 20162024 (USD Million)

Table 30 Glucose Market Size for Pharmaceuticals, By Region, 20162024 (KT)

Table 31 Glucose Market Size for Personal Care Products, By Region, 20162024 (USD Million)

Table 32 Glucose Market Size for Personal Care Products, By Region, 20162024 (KT)

Table 33 Glucose Market Size for Paper & Pulp, By Region, 20162024 (USD Million)

Table 34 Glucose Market Size for Paper & Pulp, By Region, 20162024 (KT)

Table 35 Glucose Market Size for Other Applications, By Region, 20162024 (USD Million)

Table 36 Glucose Market Size for Other Applications, By Region, 20162024 (KT)

Table 37 Dextrose Market Size, By Application, 20162024 (USD Million)

Table 38 Dextrose Market Size, By Application, 20162024 (KT)

Table 39 Dextrose Market Size for Food & Beverages, By Region, 20162024 (USD Million)

Table 40 Dextrose Market Size for Food & Beverages, By Region, 20162024 (KT)

Table 41 Dextrose Market Size, By Food & Beverage Sub-Application, 20162024 (USD Million)

Table 42 Dextrose Market Size, By Food & Beverage Sub-Application, 20162024 (KT)

Table 43 Dextrose Market Size for Confectionery Products, By Region, 20162024 (USD Million)

Table 44 Dextrose Market Size for Confectionery Products, By Region, 20162024 (KT)

Table 45 Dextrose Market Size for Bakery Products, By Region, 20162024 (USD Million)

Table 46 Dextrose Market Size for Bakery Products, By Region, 20162024 (KT)

Table 47 Dextrose Market Size for Dairy Products, By Region, 20162024 (USD Million)

Table 48 Dextrose Market Size for Dairy Products, By Region, 20162024 (KT)

Table 49 Dextrose Market Size for Beverages, By Region, 20162024 (USD Million)

Table 50 Dextrose Market Size for Beverages, By Region, 20162024 (KT)

Table 51 Dextrose Market Size for Soups, Sauces, And Dressings, By Region, 20162024 (USD Million)

Table 52 Dextrose Market Size for Soups, Sauces, And Dressings, By Region, 20162024 (KT)

Table 53 Dextrose Market Size for Other Food & Beverages, By Region, 20162024 (USD Million)

Table 54 Dextrose Market Size for Other Food & Beverages, By Region, 20162024 (KT)

Table 55 Dextrose Market Size for Pharmaceuticals, By Region, 20162024 (USD Million)

Table 56 Dextrose Market Size for Pharmaceuticals, By Region, 20162024 (KT)

Table 57 Dextrose Market Size for Personal Care Products, By Region, 20162024 (USD Million)

Table 58 Dextrose Market Size for Personal Care Products, By Region, 20162024 (KT)

Table 59 Dextrose Market Size for Paper & Pulp, By Region, 20162024 (USD Million)

Table 60 Dextrose Market Size for Paper Making, By Region, 20162024 (KT)

Table 61 Dextrose Market Size for Other Applications, By Region, 20162024 (USD Million)

Table 62 Dextrose Market Size for Other Applications, By Region, 20162024 (KT)

Table 63 Maltodextrin Market Size, By Application, 20162024 (USD Million)

Table 64 Maltodextrin Market Size, By Application, 20162024 (KT)

Table 65 Maltodextrin Market Size for Food & Beverages, By Region, 20162024 (USD Million)

Table 66 Maltodextrin Market Size for Food & Beverages, By Region, 20162024 (KT)

Table 67 Maltodextrin Market Size, By Food & Beverage Sub-Application, 20162024 (USD Million)

Table 68 Maltodextrin Market Size, By Food & Beverage Sub-Application, 20162024 (KT)

Table 69 Maltodextrin Market Size for Confectionery Products, By Region, 20162024 (USD Million)

Table 70 Maltodextrin Market Size for Confectionery Products, By Region, 20162024 (KT)

Table 71 Maltodextrin Market Size for Bakery Products, By Region, 20162024 (USD Million)

Table 72 Maltodextrin Market Size for Bakery Products, By Region, 20162024 (KT)

Table 73 Maltodextrin Market Size for Dairy Products, By Region, 20162024 (USD Million)

Table 74 Maltodextrin Market Size for Dairy Products, By Region, 20162024 (KT)

Table 75 Maltodextrin Market Size for Beverages, By Region, 20162024 (USD Million)

Table 76 Maltodextrin Market Size for Beverages, By Region, 20162024 (KT)

Table 77 Maltodextrin Market Size for Soups, Sauces, And Dressings, By Region, 20162024 (USD Million)

Table 78 Maltodextrin Market Size for Soups, Sauces, And Dressings, By Region, 20162024 (KT)

Table 79 Maltodextrin Market Size for Other Food & Beverages, By Region, 20162024 (USD Million)

Table 80 Maltodextrin Market Size for Other Food & Beverages, By Region, 20162024 (KT)

Table 81 Maltodextrin Market Size for Pharmaceuticals, By Region, 20162024 (USD Million)

Table 82 Maltodextrin Market Size for Pharmaceuticals, By Region, 20162024 (KT)

Table 83 Maltodextrin Market Size for Personal Care Products, By Region, 20162024 (USD Million)

Table 84 Maltodextrin Market Size for Personal Care Products, By Region, 20162024 (KT)

Table 85 Maltodextrin Market Size for Paper & Pulp, By Region, 20162024 (USD Million)

Table 86 Maltodextrin Market Size for Paper & Pulp, By Region, 20162024 (KT)

Table 87 Maltodextrin Market Size for Other Applications, By Region, 20162024 (USD Million)

Table 88 Maltodextrin Market Size for Other Applications, By Region, 20162024 (KT)

Table 89 Glucose, Dextrose, and Maltodextrin Market Size, By Region, 20162024 (USD Million)

Table 90 Glucose, Dextrose, and Maltodextrin Market Size, By Region, 20162024 (KT)

Table 91 North America: Glucose, Dextrose, and Maltodextrin Market Size, By Country, 20162024 (USD Million)

Table 92 North America: Glucose, Dextrose, and Maltodextrin Market Size, By Country, 20162024 (KT)

Table 93 North America: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 94 North America Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (KT)

Table 95 North America: Glucose Market Size, By Application, 20162024 (USD Million)

Table 96 North America: Glucose Market Size, By Application, 20162024 (KT)

Table 97 North America: Dextrose Market Size, By Application, 20162024 (USD Million)

Table 98 North America: Dextrose Market Size, By Application, 20162024 (KT)

Table 99 North America: Maltodextrin Market Size, By Application, 20162024 (USD Million)

Table 100 North America: Maltodextrin Market Size, By Application, 20162024 (KT)

Table 101 Us: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 102 Us: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (KT)

Table 103 Canada: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 104 Canada: Glucose, Dextrose, And Maltodextrin Size, By Product, 20162024 (KT)

Table 105 Mexico: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 106 Mexico: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (KT)

Table 107 Europe: Glucose, Dextrose, and Maltodextrin Market Size, By Country, 2016-2024 (USD Million)

Table 108 Europe: Glucose, Dextrose, and Maltodextrin Market Size, By Country, 2016-2024 (KT)

Table 109 Europe: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (USD Million)

Table 110 Europe: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (KT)

Table 111 Europe: Glucose Market Size, By Application, 2016-2024 (USD Million)

Table 112 Europe: Glucose Market Size, By Application, 2016-2024 (KT)

Table 113 Europe: Dextrose Market Size, By Application, 2016-2024 (USD Million)

Table 114 Europe: Dextrose Market Size, By Application, 2016-2024 (KT)

Table 115 Europe: Maltodextrin Market Size, By Application, 2016-2024 (USD Million)

Table 116 Europe: Maltodextrin Market Size, By Application, 2016-2024 (KT)

Table 117 Germany: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (USD Million)

Table 118 Germany: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (KT)

Table 119 UK: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (USD Million)

Table 120 UK: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (KT)

Table 121 France: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (USD Million)

Table 122 France: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (KT)

Table 123 Spain: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (USD Million)

Table 124 Spain: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (KT)

Table 125 Russia: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (USD Million)

Table 126 Russia: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (KT)

Table 127 Rest of Europe: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (USD Million)

Table 128 Rest of Europe: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (KT)

Table 129 Asia Pacific: Glucose, Dextrose, and Maltodextrin Market Size, By Country, 20162024 (USD Million)

Table 130 Asia Pacific: Glucose, Dextrose, and Maltodextrin Market Size, By Country, 20162024 (KT)

Table 131 Asia Pacific: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 132 Asia Pacific: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (KT)

Table 133 Asia Pacific: Glucose Market Size, By Application, 20162024 (USD Million)

Table 134 Asia Pacific: Glucose Market Size, By Application, 20162024 (KT)

Table 135 Asia Pacific: Dextrose Market Size, By Application, 20162024 (USD Million)

Table 136 Asia Pacific: Dextrose Market Size, By Application, 20162024 (KT)

Table 137 Asia Pacific: Maltodextrin Market Size, By Application, 20162024 (USD Million)

Table 138 Asia Pacific: Maltodextrin Market Size, By Application, 20162024 (KT)

Table 139 China: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 140 China: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (KT)

Table 141 India: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 142 India: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (KT)

Table 143 Indonesia: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 144 Indonesia: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (KT)

Table 145 Vietnam: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 146 Vietnam: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (KT)

Table 147 Thailand: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 148 Thailand: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (KT)

Table 149 Rest of Asia Pacific: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 150 Rest of Asia Pacific: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (KT)

Table 151 South America: Glucose, Dextrose, and Maltodextrin Market Size, By Country, 20162024 (USD Million)

Table 152 South America: Glucose, Dextrose, and Maltodextrin Market Size, By Country, 20162024 (KT)

Table 153 South America: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 154 South America: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (KT)

Table 155 South America: Glucose Market Size, By Application, 20162024 (USD Million)

Table 156 South America: Glucose Market Size, By Application, 20162024 (KT)

Table 157 South America: Dextrose Market Size, By Application, 20162024 (USD Million)

Table 158 South America: Dextrose Market Size, By Application, 20162024 (KT)

Table 159 South America: Maltodextrin Market Size, By Application, 20162024 (USD Million)

Table 160 South America: Maltodextrin Market Size, By Application, 20162024 (KT)

Table 161 Brazil: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 162 Brazil: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (KT)

Table 163 Argentina: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 164 Argentina: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (KT)

Table 165 Rest of South America: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (USD Million)

Table 166 Rest of South America: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 20162024 (KT)

Table 167 Row: Glucose, Dextrose, and Maltodextrin Market Size, By Country, 2016-2024 (USD Million)

Table 168 Row: Glucose, Dextrose, and Maltodextrin Market Size, By Country, 2016-2024 (KT)

Table 169 Row: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (USD Million)

Table 170 Row: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (KT)

Table 171 Row: Glucose Market Size, By Application, 2016-2024 (USD Million)

Table 172 Row: Glucose Market Size, By Application, 2016-2024 (KT)

Table 173 Row: Dextrose Market Size, By Application, 2016-2024 (USD Million)

Table 174 Row: Dextrose Market Size, By Application, 2016-2024 (KT)

Table 175 Row: Maltodextrin Market Size, By Application, 2016-2024 (USD Million)

Table 176 Row: Maltodextrin Market Size, By Application, 2016-2024 (KT)

Table 177 South Africa: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (USD Million)

Table 178 South Africa: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (KT)

Table 179 Others in Row: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (USD Million)

Table 180 Others in Row: Glucose, Dextrose, and Maltodextrin Market Size, By Product, 2016-2024 (KT)

Table 181 Expansions & Investments, 20132018

Table 182 New Product Launches, 20132018

Table 183 Acquisitions, 20132018

Table 184 Joint Ventures, Partnerships, And Agreements, 20132018

List of Figures

Figure 1 Glucose, Dextrose, and Maltodextrin Market Segmentation

Figure 2 Regional Scope

Figure 3 Glucose, Dextrose, and Maltodextrin Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, And Region

Figure 5 Market Size Estimation: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market Breakdown & Data Triangulation

Figure 8 Research Assumptions

Figure 9 Research Limitations

Figure 10 Dextrose to Register the Highest CAGR In Terms of Value Between 2018 & 2024

Figure 11 Food & Beverages Segment to Dominate the Glucose Application, In Terms of Value, From 2018 To 2024

Figure 12 Personal Care Products to Grow at The Highest CAGR In the Dextrose Segment, From 2018 To 2024

Figure 13 Personal Care Products Segment to Grow at The Highest CAGR For Maltodextrin, Between 2018 And 2024

Figure 14 Glucose, Dextrose, and Maltodextrin Market, By Form

Figure 15 Thailand To Have the Highest CAGR As A Country-Level Market, In Terms of Value (20182024)

Figure 16 Attractive Growth Opportunities in The Glucose, Dextrose, and Maltodextrin Market for Manufacturers, 20182024

Figure 17 Dextrose Segment Is Projected to Grow at The Highest CAGR From 2018 To 2024, In Terms of Value

Figure 18 Dextrose Segment Is Projected to Grow at The Highest Rate From 2018 To 2024, In Terms of Volume

Figure 19 China Accounted for The Largest Share of The Asia Pacific Glucose, Dextrose, and Maltodextrin Market, 2017

Figure 20 Food & Beverages Segment Dominated the Glucose, Dextrose, And Maltodextrin Market In 2017

Figure 21 Glucose, Dextrose, and Maltodextrin Market Share, By Food & Beverages Sub-Application

Figure 22 Glucose, Dextrose, and Maltodextrin Market: Asia Pacific Is Projected to Dominate the Market Through 2024

Figure 23 Glucose, Dextrose, and Maltodextrin Market Dynamics: Drivers, Restraints, Opportunities, And Challenges

Figure 24 Glucose, Dextrose, and Maltodextrin Market: Value Chain

Figure 25 Glucose, Dextrose, and Maltodextrin Market: Supply Chain

Figure 26 Glucose Is Projected to Dominate the Glucose, Dextrose, And Maltodextrin Market Through 2024

Figure 27 Asia Pacific Dominated the Glucose Market In 2017

Figure 28 Asia Pacific To Witness the Highest Growth in The Dextrose Market Between 2018 And 2024

Figure 29 Food & Beverages Segment to Dominate the Glucose Market By 2024

Figure 30 Food & Beverages Segment to Lead the Dextrose Market Between 2018 & 2024

Figure 31 Food & Beverages Segment to Lead the Maltodextrin Market Between 2018 & 2024

Figure 32 Asia Pacific Is Projected to Dominate the Global Glucose, Dextrose, and Maltodextrin Market By 2024

Figure 33 North America: Market Snapshot

Figure 34 Us to Lead the North American Glucose, Dextrose, and Maltodextrin Market Through 2024 (USD Million)

Figure 35 Rest of Europe To Dominate the Market for Glucose, Dextrose, And Maltodextrin in Europe by 2024 (USD Million)

Figure 36 Asia Pacific: Market Snapshot

Figure 37 China Is Projected to Dominate the Asia Pacific Glucose, Dextrose, And Maltodextrin Market Through 2024

Figure 38 Brazil Is Expected to Dominate the Glucose, Dextrose, and Maltodextrin Market in South America by 2024

Figure 39 South Africa Is Expected to Lead the Row Glucose, Dextrose, And Maltodextrin Market From 2018 To 2024

Figure 40 Key Developments by Leading Players in The Glucose, Dextrose, And Maltodextrin Market, 20132018

Figure 41 Ranking of Key Players in The Glucose, Dextrose, And Maltodextrin Market

Figure 42 Number of Developments, 20152018

Figure 43 ADM: Company Snapshot

Figure 44 ADM: SWOT Analysis

Figure 45 Ingredion: Company Snapshot

Figure 46 Ingredion: SWOT Analysis

Figure 47 AGRANA: Company Snapshot

Figure 48 AGRANA: SWOT Analysis

Figure 49 Tate & Lyle: Company Snapshot

Figure 50 Tate & Lyle: SWOT Analysis

Figure 51 Cargill: Company Snapshot

Figure 52 Cargill: SWOT Analysis

Figure 53 AVEBE Group: Company Snapshot

Figure 54 Tereos: Company Snapshot

Figure 55 Global Sweeteners Holdings: Company Snapshot

Figure 56 Gulshan Polyols: Company Snapshot

Growth opportunities and latent adjacency in Glucose, Dextrose, and Maltodextrin Market