Glycomics Market / Glycobiology Market by Product (Enzymes (Glycosidases, Transferases), Instruments (Mass Spectrometry, Chromatography, Arrays), Kits, Carbohydrates, Reagents), Application (Drug Discovery, Diagnostics), End User - Global Forecast to 2027

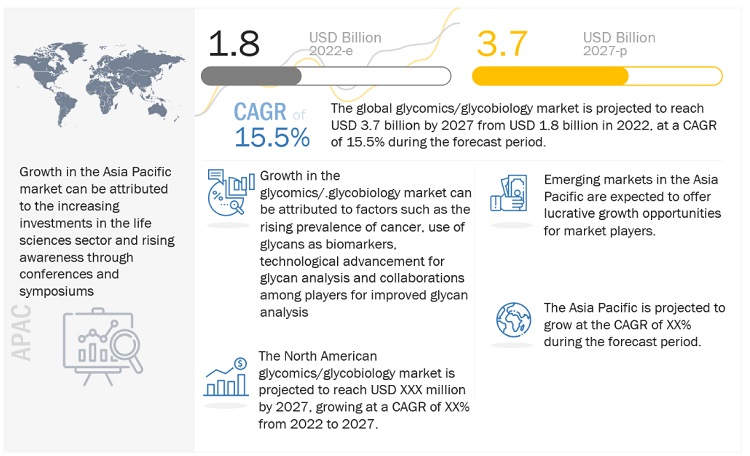

The global glycomics market in terms of revenue was estimated to be worth $1.8 Billion in 2022 and is poised to reach $3.7 billion by 2027, growing at a CAGR of 15.5% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Growth in the glycobiology market can be attributed to factors such as the use of glycans as biomarkers, and increasing number of collaboration and partnership among players for improving glycomics research.

Growth Opportunities in the Glycomics Market

To know about the assumptions considered for the study, Request for Free Sample Report

Global Glycobiology Market Size, Share, Trends and Dynamics

Driver: Emergence of glycans as biomarkers

Glycans play a vital role in biology; alterations in glycans can lead to dangerous consequences, such as congenital disorders, heart diseases, growth defects, and epilepsy. Research has shown that mutation in glycosyltransferases or related enzymes modifies/alters the glycome and can cause over 100 types of human congenital disorders of glycosylation.

Restraint: Extravagant cost of glycobiology products and tools

The high cost of glycobiology products and instruments like reagents, carbohydrates, mass spectrometers, glycan analysis kits, and enzymes pose an obstacle to their adoption. Developing glycobiology tools requires significant investment; stringent rules and regulations make them even more expensive.

Opportunity: Glycomics applications in precision medicine

Precision medicine has grown rapidly in the last few years. Many pharma and biotech companies are investing heavily to develop targeted drugs that can be used for a specific group of patients. Sugars present on the surface of the cells and complex biomolecules are involved in various processes, including cell recognition and communication. These are crucial processes in inflammation, autoimmune disease, and viral & bacterial infections.

Challenge: Lack of skilled workforce

One of the biggest challenges is the lack of skilled workforce engaged in glycobiology research and conduct the process. This is very time consuming, cost ineffective and risky process. Even the staff who handles the glycobiology products are present in scarce. This factor is a biggest obstacle in the market.

The enzyme segment of the glycomics industry is projected to hold the dominant position during the forecast period:

On the bases on product, the global glycomics market is segmented into enzymes, instruments, kits, carbohydrates, and reagents and chemicals. The enzyme segment is expected to remain dominant by 2027 owing to consumable nature of enzymes and increasing use of enzymes in glycan analysis.

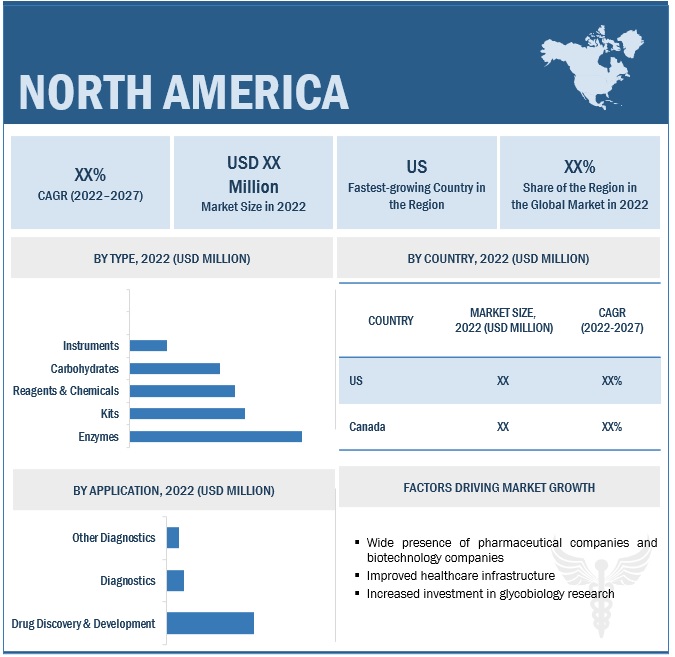

North America was the largest regional market for glycomics industry in 2021.

The glycomics market is segmented into five major regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2021, North America accounted for the largest share of the market, and this trend is expected to continue during the forecast period. The increasing investments by companies in glycomics research and development and the presence of prominent market players in the US.

To know about the assumptions considered for the study, download the pdf brochure

Key players in the market include Thermo Fisher Scientific (US), New England Biolabs (US), Merck KGaA (Germany), Promega Corporation (US), Waters Corporation (US), Takara Bio Inc, (Japan), Bio-Techne (US), Agilent Technologies (US), Sumitomo Bakelite Co. Ltd. (Japan), Bruker Corporation (US), Shimadzu Corporation (Japan), Danaher Corporation (US), AMS Bio (UK), Ludger Ltd (UK), Z Biotech, LLC (US), Chemily Glycoscience (US), CD BioGlyco (US), GlycoDiag (France), Kode Biotech Limited (New Zealand), Glyxera GmBH (Germany), Lectenz Bio (US), Glycomix Ltd (UK), IEC Group (Italy), Asparia Glycomics (Spain) and Ray Biotech Life Inc. (US).

Scope of the Glycobiology Market Report

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product, Application and End User |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Companies covered |

Thermo Fisher Scientific (US), New England Biolabs (US), Merck KGaA (Germany), Promega Corporation (US), Waters Corporation (US), Takara Bio Inc, (Japan), Bio-Techne (US), Agilent Technologies (US), Sumitomo Bakelite Co. Ltd. (Japan), Bruker Corporation (US), Shimadzu Corporation (Japan), Danaher Corporation (US), AMS Bio (UK), Ludger Ltd (UK), Z Biotech, LLC (US), Chemily Glycoscience (US), CD BioGlyco (US), GlycoDiag (France), Kode Biotech Limited (New Zealand), Glyxera GmBH (Germany), Lectenz Bio (US), Glycomix Ltd (UK), IEC Group (Italy), Asparia Glycomics (Spain), and Ray Biotech Life Inc. (US). |

This report categorizes the glycomics market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Enzymes

- Glycosidases

- Transferases

- Other Enzymes

-

Instruments

- Mass Spectrometry Instruments

- Chromatography Instruments

- Arrays

- Other Instruments

-

Kits

- Glycan Releasing Kits

- Glycan Purification Kits

- Glycan Labeling Kits

- Other Kits

-

Carbohydrates

- Oligosaccharides

- Polysaccharides

- Other Carbohydrates

- Reagents & Chemicals

By Application

- Drug Discovery & Development

- Diagnostics

- Cancer Diagnostics

- Other Diagnostics

- Other Applications

By End User

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Clinical Laboratories

- Contract Research Organizations (CROs)

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia

- India

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of Glycobiology Industry

- In April 2022, Bruker Corporation (US) acquired the IonSense (US) for expansion of the use of DART Mass spectrometers.

- In April 2021, GlycoNet (Canada) and BridgeBio Pharma Inc, (US) entered into partnership for developing medicines for treating genetic diseases through glycobiology research.

Frequently Asked Questions (FAQ):

Who are the key players in the glycomics market?

Key players in the Market include Thermo Fisher Scientific (US), New England Biolabs (US), Merck KGaA (Germany), Promega Corporation (US), Waters Corporation (US), Takara Bio Inc, (Japan), Bio-Techne (US), Agilent Technologies (US), Sumitomo Bakelite Co. Ltd. (Japan), and Bruker Corporation (US).

Which product segment dominates the glycomics market?

The enzyme segment accounted for the largest share of the market in 2021, owing to their increasing use in glycan analysis and glycobiology research.

Which application segment dominates the glycomics market?

The drug discovery & development segment accounted for the largest share of the market in 2021, as research & development investments are being increased by pharmaceutical & biotechnology companies, especially for developing targeted or precision medicine.

Which end user segment dominates the glycomics market?

The academic research institutes segment accounted for the largest share of the glycomics/glycobiology market, by end user, in 2021 owing to increased research activities on drug discovery and funding on glycomics research.

What is the market size for the glycomics market?

The glycomics market is projected to reach USD 3.7 billion by 2027 from USD 1.8 billion in 2022, at a CAGR of 15.5% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH APPROACH

FIGURE 1 RESEARCH DESIGN

2.1.1 PRIMARY RESEARCH

FIGURE 2 GLYCOMICS MARKET: PRIMARY RESPONDENTS

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 3 GLYCOMICS MARKET SIZE ESTIMATION (SUPPLY-SIDE ANALYSIS), 2021

FIGURE 4 MARKET SIZE ESTIMATION: APPROACH 1 (COMPANY REVENUE ANALYSIS-BASED ESTIMATION), 2021

2.2.1 INSIGHTS FROM PRIMARY EXPERTS

FIGURE 5 MARKET SIZE VALIDATION FROM PRIMARY SOURCES

2.3 MARKET GROWTH RATE PROJECTIONS

FIGURE 6 GLYCOBIOLOGY MARKET (DEMAND SIDE): GROWTH ANALYSIS OF DEMAND-SIDE FACTORS

2.4 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.5 RESEARCH ASSUMPTIONS

2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 8 GLYCOMICS MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 9 GLYCOMICS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 10 GLYCOBIOLOGY MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 11 GEOGRAPHICAL SNAPSHOT OF GLYCOMICS MARKET

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 GLYCOMICS MARKET OVERVIEW

FIGURE 12 RISING PREVALENCE OF INFECTIOUS DISEASES TO DRIVE MARKET

4.2 NORTH AMERICA: GLYCOBIOLOGY MARKET, BY PRODUCT

FIGURE 13 ENZYMES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4.3 GLYCOMICS MARKET SHARE, BY PRODUCT, 2022 VS. 2027

FIGURE 14 ENZYMES SEGMENT TO DOMINATE MARKET IN 2027

4.4 GLYCOBIOLOGY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 15 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 GLYCOMICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

TABLE 1 GLYCOMICS MARKET: IMPACT ANALYSIS

5.2.1 DRIVERS

5.2.1.1 Emergence of glycans as biomarkers

5.2.1.2 Technological advancements in glycan analysis

5.2.1.3 Increasing R&D expenditure and funding

FIGURE 17 R&D EXPENDITURE BY PHRMA MEMBER COMPANIES, 2001–2021 (USD BILLION)

TABLE 2 FUNDING FOR NIH INNOVATION PROJECTS UNDER 21ST CENTURY CURES ACT, 2017–2026

5.2.1.4 Collaborations and partnerships

5.2.1.5 Increasing number of cancer cases worldwide

FIGURE 18 NUMBER OF NEW CASES WORLDWIDE, 2020

5.2.2 RESTRAINTS

5.2.2.1 High cost of glycobiology products and tools

5.2.3 OPPORTUNITIES

5.2.3.1 Glycomics applications in precision medicine

5.2.4 CHALLENGES

5.2.4.1 Lack of skilled workforce

5.3 RANGES/SCENARIOS

FIGURE 19 SPECTRUM OF SCENARIOS BASED ON IMPACT OF UNCERTAINTIES ON GROWTH OF GLYCOBIOLOGY MARKET

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 20 REVENUE SHIFT AND NEW REVENUE POCKETS

5.5 PRICING ANALYSIS

TABLE 3 AVERAGE SELLING PRICES OF PRODUCTS OFFERED BY KEY PLAYERS

5.6 TECHNOLOGY ANALYSIS

5.6.1 CELL-FREE SYNTHETIC GLYCOBIOLOGY

5.6.2 GLYCAN MICROARRAY PLATFORMS

5.6.3 MASS SPECTROMETRY FOR GLYCOSAMINOGLYCANS

5.7 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS OF GLYCOBIOLOGY MARKET

5.8 ECOSYSTEM ANALYSIS

FIGURE 22 ECOSYSTEM ANALYSIS: GLYCOMICS MARKET

TABLE 4 SUPPLY CHAIN ECOSYSTEM

5.9 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 5 GLYCOBIOLOGY MARKET: LIST OF CONFERENCES AND EVENTS

5.10 REGULATORY ANALYSIS

5.10.1 NORTH AMERICA

5.10.2 EUROPE

5.10.3 EMERGING MARKETS

5.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 GLYCOMICS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF BUYERS

5.11.4 BARGAINING POWER OF SUPPLIERS

5.11.5 DEGREE OF COMPETITION

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

FIGURE 23 INFLUENCE OF STAKEHOLDERS ON PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES IN BUYING PROCESS OF GLYCOMICS/GLYCOBIOLOGY PRODUCTS

FIGURE 24 BUYING CRITERIA FOR GLYCOMICS/GLYCOBIOLOGY PRODUCTS

6 GLYCOMICS MARKET, BY PRODUCT (Page No. - 75)

6.1 INTRODUCTION

TABLE 7 GLYCOBIOLOGY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

6.2 ENZYMES

TABLE 8 ENZYMES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 9 NORTH AMERICA: ENZYMES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 10 EUROPE: ENZYMES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 11 ASIA PACIFIC: ENZYMES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 12 LATIN AMERICA: ENZYMES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 13 ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.2.1 GLYCOSIDASES

6.2.1.1 Glycosidases to hold largest share of enzymes market

TABLE 14 GLYCOSIDASES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 15 NORTH AMERICA: GLYCOSIDASES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 16 EUROPE: GLYCOSIDASES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 17 ASIA PACIFIC: GLYCOSIDASES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 18 LATIN AMERICA: GLYCOSIDASES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2 TRANSFERASES

6.2.2.1 Transferase catalyzes transfer of specific functional groups

TABLE 19 TRANSFERASES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 20 NORTH AMERICA: TRANSFERASES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 21 EUROPE: TRANSFERASES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 22 ASIA PACIFIC: TRANSFERASES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 23 LATIN AMERICA: TRANSFERASES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.3 OTHER ENZYMES

TABLE 24 OTHER ENZYMES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 25 NORTH AMERICA: OTHER ENZYMES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 26 EUROPE: OTHER ENZYMES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 27 ASIA PACIFIC: OTHER ENZYMES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 28 LATIN AMERICA: OTHER ENZYMES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3 KITS

TABLE 29 KITS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 30 NORTH AMERICA: KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 31 EUROPE: KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 32 ASIA PACIFIC: KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 33 LATIN AMERICA: KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 34 KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.3.1 GLYCAN RELEASING KITS

6.3.1.1 Separation of glycans from glycoproteins is the foremost step in glycomics

TABLE 35 GLYCAN RELEASING KITS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 36 NORTH AMERICA: GLYCAN RELEASING KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 37 EUROPE: GLYCAN RELEASING KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 38 ASIA PACIFIC: GLYCAN RELEASING KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 39 LATIN AMERICA: GLYCAN RELEASING KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.2 GLYCAN LABELING KITS

6.3.2.1 Advancements in labeling kits to drive market growth

TABLE 40 GLYCAN LABELING KITS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 41 NORTH AMERICA: GLYCAN LABELING KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 42 EUROPE: GLYCAN LABELING KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 43 ASIA PACIFIC: GLYCAN LABELING KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 44 LATIN AMERICA: GLYCAN LABELING KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.3 GLYCAN PURIFICATION KITS

6.3.3.1 Need to separate unwanted material from samples for better characterization to drive use of purification kits

TABLE 45 GLYCAN PURIFICATION KITS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 46 NORTH AMERICA: GLYCAN PURIFICATION KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 47 EUROPE: GLYCAN PURIFICATION KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 48 ASIA PACIFIC: GLYCAN PURIFICATION KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 49 LATIN AMERICA: GLYCAN PURIFICATION KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.4 OTHER KITS

TABLE 50 OTHER KITS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: OTHER KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 52 EUROPE: OTHER KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 53 ASIA PACIFIC: OTHER KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 54 LATIN AMERICA: OTHER KITS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.4 REAGENTS & CHEMICALS

6.4.1 GROWING DEMAND FOR REAGENTS & CHEMICALS TO DRIVE MARKET GROWTH

TABLE 55 REAGENTS & CHEMICALS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: REAGENTS & CHEMICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 57 EUROPE: REAGENTS & CHEMICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 58 ASIA PACIFIC: REAGENTS & CHEMICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 59 LATIN AMERICA: REAGENTS & CHEMICALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.5 CARBOHYDRATES

TABLE 60 CARBOHYDRATES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 61 NORTH AMERICA: CARBOHYDRATES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 62 EUROPE: CARBOHYDRATES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 63 ASIA PACIFIC: CARBOHYDRATES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 64 LATIN AMERICA: CARBOHYDRATES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 65 CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.5.1 OLIGOSACCHARIDES

6.5.1.1 Oligosaccharides to dominate carbohydrates segment

TABLE 66 OLIGOSACCHARIDES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 67 NORTH AMERICA: OLIGOSACCHARIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 68 EUROPE: OLIGOSACCHARIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 69 ASIA PACIFIC: OLIGOSACCHARIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 70 LATIN AMERICA: OLIGOSACCHARIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.5.2 MONOSACCHARIDES

6.5.2.1 Growing use in solution/buffer preparation to drive market

TABLE 71 MONOSACCHARIDES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: MONOSACCHARIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 73 EUROPE: MONOSACCHARIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 74 ASIA PACIFIC: MONOSACCHARIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 75 LATIN AMERICA: MONOSACCHARIDES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.5.3 OTHER CARBOHYDRATES

TABLE 76 OTHER CARBOHYDRATES MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: OTHER CARBOHYDRATES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 78 EUROPE: OTHER CARBOHYDRATES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 79 ASIA PACIFIC: OTHER CARBOHYDRATES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 80 LATIN AMERICA: OTHER CARBOHYDRATES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.6 INSTRUMENTS

TABLE 81 INSTRUMENTS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 82 NORTH AMERICA: INSTRUMENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 83 EUROPE: INSTRUMENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 84 ASIA PACIFIC: INSTRUMENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 85 LATIN AMERICA: INSTRUMENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 86 INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.6.1 MASS SPECTROMETRY INSTRUMENTS

6.6.1.1 Wide use of mass spectrometry in glycan analysis to support segment growth

TABLE 87 MASS SPECTROMETRY INSTRUMENTS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: MASS SPECTROMETRY INSTRUMENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 89 EUROPE: MASS SPECTROMETRY INSTRUMENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 90 ASIA PACIFIC: MASS SPECTROMETRY INSTRUMENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 91 LATIN AMERICA: MASS SPECTROMETRY INSTRUMENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.6.2 CHROMATOGRAPHY INSTRUMENTS

6.6.2.1 Need to separate unwanted material during glycan analysis to drive demand for chromatography instruments

TABLE 92 CHROMATOGRAPHY INSTRUMENTS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 93 NORTH AMERICA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 94 EUROPE: CHROMATOGRAPHY INSTRUMENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 95 ASIA PACIFIC: CHROMATOGRAPHY INSTRUMENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 96 LATIN AMERICA: CHROMATOGRAPHY INSTRUMENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.6.3 ARRAYS

6.6.3.1 Increasing demand for glycan, lectin, and antibody arrays to drive market growth

TABLE 97 ARRAYS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: ARRAYS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 99 EUROPE: ARRAYS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 100 ASIA PACIFIC: ARRAYS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 101 LATIN AMERICA: ARRAYS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.6.4 OTHER INSTRUMENTS

TABLE 102 OTHER INSTRUMENTS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 103 NORTH AMERICA: OTHER INSTRUMENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 104 EUROPE: OTHER INSTRUMENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 105 ASIA PACIFIC: OTHER INSTRUMENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 106 LATIN AMERICA: OTHER INSTRUMENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7 GLYCOMICS MARKET, BY APPLICATION (Page No. - 127)

7.1 INTRODUCTION

TABLE 107 GLYCOMICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

7.2 DRUG DISCOVERY & DEVELOPMENT

7.2.1 INCREASING IMPORTANCE OF GLYCAN ANALYSIS IN DRUG DEVELOPMENT TO DRIVE GROWTH

TABLE 108 GLYCOBIOLOGY MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY REGION, 2020–2027 (USD MILLION)

TABLE 109 NORTH AMERICA: GLYCOMICS MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 110 EUROPE: GLYCOBIOLOGY MARKET FOR DRUG DISCOVERY AND DEVELOPMENT, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 111 ASIA PACIFIC: GLYCOMICS MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 112 LATIN AMERICA: GLYCOBIOLOGY MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 DIAGNOSTICS

TABLE 113 GLYCOMICS MARKET FOR DIAGNOSTICS, BY REGION, 2020–2027 (USD MILLION)

TABLE 114 NORTH AMERICA: GLYCOBIOLOGY MARKET FOR DIAGNOSTICS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 115 EUROPE: GLYCOBIOLOGY MARKET FOR DIAGNOSTICS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 116 ASIA PACIFIC: GLYCOMICS MARKET FOR DIAGNOSTICS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 117 LATIN AMERICA: GLYCOBIOLOGY MARKET FOR DIAGNOSTICS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 118 GLYCOMICS MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

7.3.1 CANCER DIAGNOSTICS

7.3.1.1 Rising importance of glycomics in cancer diagnostics to support market growth

TABLE 119 GLYCOBIOLOGY MARKET FOR CANCER DIAGNOSTICS, BY REGION, 2020–2027 (USD MILLION)

TABLE 120 NORTH AMERICA: GLYCOMICS/ MARKET FOR CANCER DIAGNOSTICS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 121 EUROPE: GLYCOBIOLOGY MARKET FOR CANCER DIAGNOSTICS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 122 ASIA PACIFIC: GLYCOMICS MARKET FOR CANCER DIAGNOSTICS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 123 LATIN AMERICA GLYCOBIOLOGY MARKET FOR CANCER DIAGNOSTICS, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.2 OTHER DIAGNOSTIC APPLICATIONS

TABLE 124 GLYCOMICS MARKET FOR OTHER DIAGNOSTIC APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 125 NORTH AMERICA: GLYCOBIOLOGY MARKET FOR OTHER DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 126 EUROPE: GLYCOBIOLOGY MARKET FOR OTHER DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 127 ASIA PACIFIC: GLYCOMICS MARKET FOR OTHER DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 128 LATIN AMERICA: GLYCOBIOLOGY MARKET FOR OTHER DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

7.4 OTHER APPLICATIONS

TABLE 129 GLYCOMICS MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 130 NORTH AMERICA: GLYCOBIOLOGY MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 131 EUROPE: GLYCOMICS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 132 ASIA PACIFIC: GLYCOBIOLOGY MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 133 LATIN AMERICA: GLYCOMICS/ MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8 GLYCOMICS MARKET, BY END USER (Page No. - 143)

8.1 INTRODUCTION

TABLE 134 GLYCOBIOLOGY MARKET, BY END USER, 2020–2027 (USD MILLION)

8.2 ACADEMIC & RESEARCH INSTITUTES

8.2.1 ACADEMIC & RESEARCH INSTITUTES TO ACCOUNT FOR LARGEST MARKET SHARE

TABLE 135 GLYCOMICS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2020–2027 (USD MILLION)

TABLE 136 NORTH AMERICA: GLYCOBIOLOGY MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 137 EUROPE: GLYCOMICS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 138 ASIA PACIFIC: GLYCOBIOLOGY MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 139 LATIN AMERICA: GLYCOMICS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

8.3.1 INCREASING INTEREST IN DEVELOPING CARBOHYDRATE-BASED THERAPEUTICS TO DRIVE SEGMENT GROWTH

TABLE 140 GLYCOBIOLOGY MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2020–2027 (USD MILLION)

TABLE 141 NORTH AMERICA: GLYCOMICS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 142 EUROPE: GLYCOBIOLOGY MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 143 ASIA PACIFIC: GLYCOMICS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 144 LATIN AMERICA: GLYCOBIOLOGY MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 CLINICAL LABORATORIES

8.4.1 RISING BURDEN OF INFECTIOUS DISEASE AND CANCER TO DRIVE MARKET GROWTH

TABLE 145 GLYCOMICS MARKET FOR CLINICAL LABORATORIES, BY REGION, 2020–2027 (USD MILLION)

TABLE 146 NORTH AMERICA: GLYCOBIOLOGY MARKET FOR CLINICAL LABORATORIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 147 EUROPE: GLYCOMICS MARKET FOR CLINICAL LABORATORIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 148 ASIA PACIFIC: GLYCOBIOLOGY MARKET FOR CLINICAL LABORATORIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 149 LATIN AMERICA: GLYCOMICS MARKET FOR CLINICAL LABORATORIES, BY COUNTRY, 2020–2027 (USD MILLION)

8.5 CONTRACT RESEARCH ORGANIZATIONS

8.5.1 RISING PREFERENCE FOR OUTSOURCING TO DRIVE MARKET GROWTH

TABLE 150 GLYCOBIOLOGY MARKET FOR CROS, BY REGION, 2020–2027 (USD MILLION)

TABLE 151 NORTH AMERICA: GLYCOMICS MARKET FOR CROS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 152 EUROPE: GLYCOBIOLOGY MARKET FOR CROS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 153 ASIA PACIFIC: GLYCOMICS MARKET FOR CROS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 154 LATIN AMERICA: GLYCOBIOLOGY MARKET FOR CROS, BY COUNTRY, 2020–2027 (USD MILLION)

9 GLYCOMICS MARKET, BY REGION (Page No. - 155)

9.1 INTRODUCTION

TABLE 155 GLYCOMICS MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 25 NORTH AMERICA: GLYCOBIOLOGY MARKET SNAPSHOT

TABLE 156 NORTH AMERICA: GLYCOMICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 157 NORTH AMERICA: GLYCOBIOLOGY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 158 NORTH AMERICA: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 159 NORTH AMERICA: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 160 NORTH AMERICA: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 161 NORTH AMERICA: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 162 NORTH AMERICA: GLYCOMICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 163 NORTH AMERICA: GLYCOBIOLOGY MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 164 NORTH AMERICA: GLYCOMICS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.1 US

9.2.1.1 US to hold largest share of glycobiology market

TABLE 165 US: GLYCOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 166 US: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 167 US: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 168 US: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 169 US: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 170 US: GLYCOBIOLOGY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 171 US: GLYCOMICS MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 172 US: GLYCOBIOLOGY MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Increasing government funding and strong infrastructure to drive growth

TABLE 173 CANADA: GLYCOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 174 CANADA: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 175 CANADA: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 176 CANADA: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 177 CANADA: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 178 CANADA: GLYCOBIOLOGY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 179 CANADA: GLYCOMICS MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 180 CANADA: GLYCOBIOLOGY MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3 EUROPE

TABLE 181 EUROPE: GLYCOMICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 182 EUROPE: GLYCOBIOLOGY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 183 EUROPE: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 184 EUROPE: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 185 EUROPE: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 186 EUROPE: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 187 EUROPE: GLYCOMICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 188 EUROPE: GLYCOBIOLOGY MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 189 EUROPE: GLYCOMICS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Germany to dominate European glycobiology market

TABLE 190 GERMANY: GLYCOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 191 GERMANY: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 192 GERMANY: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 193 GERMANY: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 194 GERMANY: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 195 GERMANY: GLYCOBIOLOGY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 196 GERMANY: GLYCOMICS MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 197 GERMANY: GLYCOBIOLOGY MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.2 UK

9.3.2.1 Rising investments in pharmaceutical R&D to boost market growth

TABLE 198 UK: GLYCOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 199 UK: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 200 UK: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 201 UK: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 202 UK: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 203 UK: GLYCOBIOLOGY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 204 UK: GLYCOMICS MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 205 UK: GLYCOBIOLOGY MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Well-established life sciences industry to support market growth

TABLE 206 FRANCE: GLYCOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 207 FRANCE: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 208 FRANCE: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 209 FRANCE: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 210 FRANCE: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 211 FRANCE: GLYCOBIOLOGY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 212 FRANCE: GLYCOMICS MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 213 FRANCE: GLYCOBIOLOGY MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Increased funding and strong research base to drive market

TABLE 214 ITALY: GLYCOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 215 ITALY: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 216 ITALY: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 217 ITALY: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 218 ITALY: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 219 ITALY: GLYCOBIOLOGY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 220 ITALY: GLYCOMICS MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 221 ITALY: GLYCOBIOLOGY MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Government initiatives to expand pharma & biotech sector to support market growth

TABLE 222 SPAIN: GLYCOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 223 SPAIN: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 224 SPAIN: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 225 SPAIN: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 226 SPAIN: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 227 SPAIN: GLYCOBIOLOGY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 228 SPAIN: GLYCOMICS MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 229 SPAIN: GLYCOBIOLOGY MARKET, BY END USER, 2020–2027 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 230 ROE: GLYCOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 231 ROE: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 232 ROE: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 233 ROE: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 234 ROE: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 235 ROE: GLYCOBIOLOGY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 236 ROE: GLYCOMICS MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 237 ROE: GLYCOBIOLOGY MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 26 ASIA PACIFIC: GLYCOMICS MARKET SNAPSHOT

TABLE 238 ASIA PACIFIC: GLYCOBIOLOGY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 239 ASIA PACIFIC: GLYCOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 240 ASIA PACIFIC: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 241 ASIA PACIFIC: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 242 ASIA PACIFIC: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 243 ASIA PACIFIC: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 244 ASIA PACIFIC: GLYCOBIOLOGY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 245 ASIA PACIFIC: GLYCOMICS MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 246 ASIA PACIFIC: GLYCOBIOLOGY MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 China to hold largest share of APAC market

TABLE 247 CHINA: GLYCOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 248 CHINA: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 249 CHINA: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 250 CHINA: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 251 CHINA: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 252 CHINA: GLYCOBIOLOGY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 253 CHINA: GLYCOMICS MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 254 CHINA: GLYCOBIOLOGY MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Research initiatives for precision medicine to boost market

TABLE 255 JAPAN: GLYCOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 256 JAPAN: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 257 JAPAN: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 258 JAPAN: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 259 JAPAN: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 260 JAPAN: GLYCOBIOLOGY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 261 JAPAN: GLYCOMICS MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 262 JAPAN: GLYCOBIOLOGY MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Increased R&D activities to drive market growth

TABLE 263 INDIA: GLYCOMICS/ MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 264 INDIA: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 265 INDIA: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 266 INDIA: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 267 INDIA: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 268 INDIA: GLYCOBIOLOGY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 269 INDIA: GLYCOMICS/ MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 270 INDIA: GLYCOBIOLOGY MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.4 AUSTRALIA

9.4.4.1 Rising funding for research to support market growth

TABLE 271 AUSTRALIA: GLYCOMICS/ MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 272 AUSTRALIA: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 273 AUSTRALIA: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 274 AUSTRALIA: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 275 AUSTRALIA: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 276 AUSTRALIA: GLYCOBIOLOGY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 277 AUSTRALIA: GLYCOMICS/ MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 278 AUSTRALIA: GLYCOBIOLOGY MARKET, BY END USER, 2020–2027 (USD MILLION)

9.4.5 REST OF ASIA PACIFIC

TABLE 279 ROAPAC: GLYCOMICS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 280 ROAPAC: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 281 ROAPAC: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 282 ROAPAC: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 283 ROAPAC: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 284 ROAPAC: GLYCOBIOLOGY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 285 ROAPAC: GLYCOMICS MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 286 ROAPAC: GLYCOBIOLOGY MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5 LATIN AMERICA

TABLE 287 LATIN AMERICA: GLYCOMICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 288 LATIN AMERICA: GLYCOBIOLOGY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 289 LATIN AMERICA: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 290 LATIN AMERICA: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 291 LATIN AMERICA: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 292 LATIN AMERICA: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 293 LATIN AMERICA: GLYCOMICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 294 LATIN AMERICA: GLYCOBIOLOGY MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 295 LATIN AMERICA: GLYCOMICS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 Brazil to hold largest share of Latin American market

TABLE 296 BRAZIL: GLYCOBIOLOGY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 297 BRAZIL: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 298 BRAZIL: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 299 BRAZIL: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 300 BRAZIL: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 301 BRAZIL: GLYCOMICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 302 BRAZIL: GLYCOBIOLOGY MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 303 BRAZIL: GLYCOMICS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5.2 MEXICO

9.5.2.1 Well-built pharmaceutical industry to support market growth

TABLE 304 MEXICO: CANCER CASES, BY CANCER TYPE, 2020

TABLE 305 MEXICO: GLYCOBIOLOGY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 306 MEXICO: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 307 MEXICO: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 308 MEXICO: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 309 MEXICO: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 310 MEXICO: GLYCOMICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 311 MEXICO: GLYCOBIOLOGY MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 312 MEXICO: GLYCOMICS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.5.3 REST OF LATIN AMERICA

TABLE 313 ROLATAM: GLYCOBIOLOGY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 314 ROLATAM: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 315 ROLATAM: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 316 ROLATAM: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 317 ROLATAM: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 318 ROLATAM: GLYCOMICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 319 ROLATAM: GLYCOBIOLOGY MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 320 ROLATAM: GLYCOMICS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 INCREASED FOCUS ON PRECISION MEDICINE AND TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET GROWTH

TABLE 321 MEA: GLYCOBIOLOGY MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 322 MEA: ENZYMES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 323 MEA: KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 324 MEA: CARBOHYDRATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 325 MEA: INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 326 MEA: GLYCOMICS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 327 MEA: GLYCOBIOLOGY MARKET FOR DIAGNOSTICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 328 MEA: GLYCOMICS MARKET, BY END USER, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 242)

10.1 INTRODUCTION

10.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

FIGURE 27 GLYCOBIOLOGY MARKET: STRATEGIES ADOPTED

10.3 MARKET SHARE ANALYSIS

FIGURE 28 GLYCOMICS MARKET: MARKET SHARE ANALYSIS, BY KEY PLAYER (2021)

TABLE 329 GLYCOBIOLOGY MARKET: DEGREE OF COMPETITION

10.4 REVENUE ANALYSIS

FIGURE 29 REVENUE ANALYSIS FOR KEY COMPANIES (2019–2021)

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 30 GLYCOMICS MARKET: COMPANY EVALUATION MATRIX, 2022

10.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES

10.6.1 PROGRESSIVE COMPANIES

10.6.2 STARTING BLOCKS

10.6.3 RESPONSIVE COMPANIES

10.6.4 DYNAMIC COMPANIES

FIGURE 31 GLYCOBIOLOGY MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2021

10.7 COMPETITIVE BENCHMARKING OF TOP 25 PLAYERS

10.7.1 OVERALL COMPANY FOOTPRINT (25 COMPANIES)

TABLE 330 PRODUCT AND REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS

10.7.2 COMPANY PRODUCT FOOTPRINT (25 COMPANIES)

TABLE 331 PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS

10.7.3 COMPANY REGIONAL FOOTPRINT (25 COMPANIES)

TABLE 332 REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS

10.7.4 COMPETITIVE BENCHMARKING OF START-UPS/SMES

TABLE 333 GLYCOMICS MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 334 GLYCOBIOLOGY MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (START-UPS/SMES)

10.8 COMPETITIVE SCENARIO AND TRENDS

10.8.1 PRODUCT LAUNCHES

TABLE 335 GLYCOMICS MARKET: PRODUCT LAUNCHES, JANUARY 2019–SEPTEMBER 2022

10.8.2 DEALS

TABLE 336 GLYCOBIOLOGY MARKET: DEALS, JANUARY 2019–SEPTEMBER 2022

10.8.3 OTHER DEVELOPMENTS

TABLE 337 GLYCOMICS MARKET: OTHER DEVELOPMENTS, JANUARY 2019– SEPTEMBER 2022

11 COMPANY PROFILES (Page No. - 256)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1.1 MERCK KGAA

TABLE 338 MERCK KGAA: BUSINESS OVERVIEW

FIGURE 32 MERCK KGAA: COMPANY SNAPSHOT

TABLE 339 MERCK KGAA: PRODUCT OFFERINGS

11.1.2 THERMO FISHER SCIENTIFIC

TABLE 340 THERMO FISHER SCIENTIFIC: BUSINESS OVERVIEW

FIGURE 33 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT (2021)

TABLE 341 THERMO FISHER SCIENTIFIC: PRODUCT OFFERINGS

11.1.3 AGILENT TECHNOLOGIES

TABLE 342 AGILENT TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 34 AGILENT TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 343 AGILENT TECHNOLOGIES: PRODUCT OFFERINGS

11.1.4 WATERS CORPORATION

TABLE 344 WATERS CORPORATION: BUSINESS OVERVIEW

FIGURE 35 WATERS CORPORATION: COMPANY SNAPSHOT

TABLE 345 WATERS CORPORATION: PRODUCT OFFERINGS

11.1.5 NEW ENGLAND BIOLABS

TABLE 346 NEW ENGLAND BIOLABS: BUSINESS OVERVIEW

11.1.6 TAKARA BIO

TABLE 347 TAKARA BIO: BUSINESS OVERVIEW

FIGURE 36 TAKARA BIO: COMPANY SNAPSHOT

TABLE 348 TAKARA BIO: PRODUCT OFFERINGS

11.1.7 SHIMADZU CORPORATION

TABLE 349 SHIMADZU CORPORATION: BUSINESS OVERVIEW

FIGURE 37 SHIMADZU CORPORATION: COMPANY SNAPSHOT

TABLE 350 SHIMADZU CORPORATION: PRODUCT OFFERINGS

11.1.8 DANAHER CORPORATION

TABLE 351 DANAHER CORPORATION: BUSINESS OVERVIEW

FIGURE 38 DANAHER CORPORATION: COMPANY SNAPSHOT

TABLE 352 DANAHER CORPORATION: PRODUCT OFFERINGS

11.1.9 BIO-TECHNE

TABLE 353 BIO-TECHNE: BUSINESS OVERVIEW

FIGURE 39 BIO-TECHNE: COMPANY SNAPSHOT

TABLE 354 BIO-TECHNE: PRODUCT OFFERINGS

11.1.10 SUMITOMO BAKELITE

TABLE 355 SUMITOMO BAKELITE: BUSINESS OVERVIEW

FIGURE 40 SUMITOMO BAKELITE: COMPANY SNAPSHOT

TABLE 356 SUMITOMO BAKELITE: PRODUCT OFFERINGS

11.1.11 BRUKER CORPORATION

TABLE 357 BRUKER CORPORATION: BUSINESS OVERVIEW

FIGURE 41 BRUKER CORPORATION: COMPANY SNAPSHOT

TABLE 358 BRUKER CORPORATION: PRODUCT OFFERINGS

11.1.12 LUDGER

TABLE 359 LUDGER: BUSINESS OVERVIEW

TABLE 360 LUDGER: PRODUCT OFFERINGS

11.1.13 PROMEGA CORPORATION

TABLE 361 PROMEGA CORPORATION: BUSINESS OVERVIEW

TABLE 362 PROMEGA CORPORATION: PRODUCT OFFERINGS

11.1.14 AMSBIO

TABLE 363 AMSBIO: BUSINESS OVERVIEW

TABLE 364 AMSBIO: PRODUCT OFFERINGS

11.1.15 CD BIOGLYCO

TABLE 365 CD BIOGLYCO: BUSINESS OVERVIEW

TABLE 366 CD BIOGLYCO: PRODUCT OFFERINGS

11.1.16 ICE S.P.A.

TABLE 367 ICE S.P.A.: BUSINESS OVERVIEW

TABLE 368 ICE S.P.A.: PRODUCT OFFERINGS

11.1.17 ASPARIA GLYCOMICS

TABLE 369 ASPARIA GLYCOMICS: BUSINESS OVERVIEW

TABLE 370 ASPARIA GLYCOMICS: PRODUCT OFFERINGS

11.1.18 LECTENZ BIO

TABLE 371 LECTENZ BIO: BUSINESS OVERVIEW

TABLE 372 LECTENZ BIO: PRODUCT OFFERINGS

11.1.19 Z BIOTECH, LLC

TABLE 373 Z BIOTECH, LLC: BUSINESS OVERVIEW

TABLE 374 Z BIOTECH, LLC: PRODUCT OFFERINGS

11.1.20 CHEMILY GLYCOSCIENCE

TABLE 375 CHEMILY GLYCOSCIENCE: BUSINESS OVERVIEWs

TABLE 376 CHEMILY GLYCOSCIENCE: PRODUCT OFFERINGS

11.2 OTHER COMPANIES

11.2.1 GLYCOMIX

11.2.2 GLYCODIAG

11.2.3 KODE BIOTECH LIMITED

11.2.4 GLYXERA GMBH

11.2.5 RAYBIOTECH LIFE

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 313)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

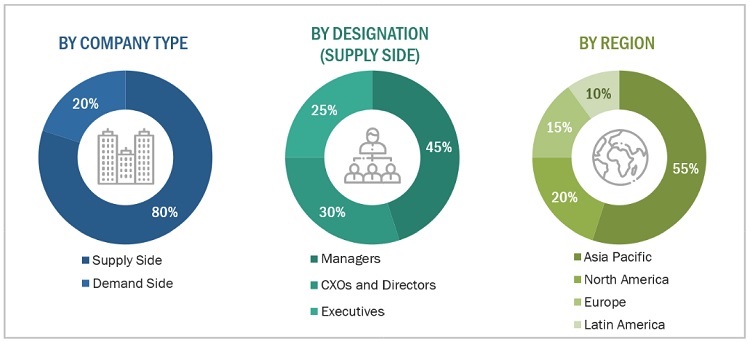

This study involved four major activities in estimating the current size of the glycomics/glycobiology market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive technical, market-oriented, and commercial study of the glycomics/glycobiology market. The secondary sources used for this study include Press Releases, Annual Reports, White Papers, Certified Publications, Articles form authorized authors, Gold Standard and Silver Standard Websites, Directories and Databases, SEC Filings, Investor Presentations, Expert Interviews, and MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue. As of 2021, Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the glycomics/glycobiology market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the glycomics/glycobiology and related products business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global glycomics/glycobiology market based on the product, application, end user, and region.

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, and opportunities).

- To strategically analyse micromarkets with respect to individual growth trends, future prospects, and contributions to the overall glycomics/glycobiology market.

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies.

- To track and analyze competitive developments such as product launches, expansions, acquisitions, agreements, collaborations, and partnerships in the glycomics/glycobiology market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

- An additional five company profiles

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Glycomics Market