Mass Spectrometry Market Size, Growth, Share & Trends Analysis

Mass Spectrometry Market by Product (Instrument (Triple Quadrupole, Q-TOF, FTMS, Quadrupole, TOF), Software & Services), Sample (LC-MS, GC-MS), Application (Omics, Drug Discovery, Food, Environmental), End User (Pharma, Biotech) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

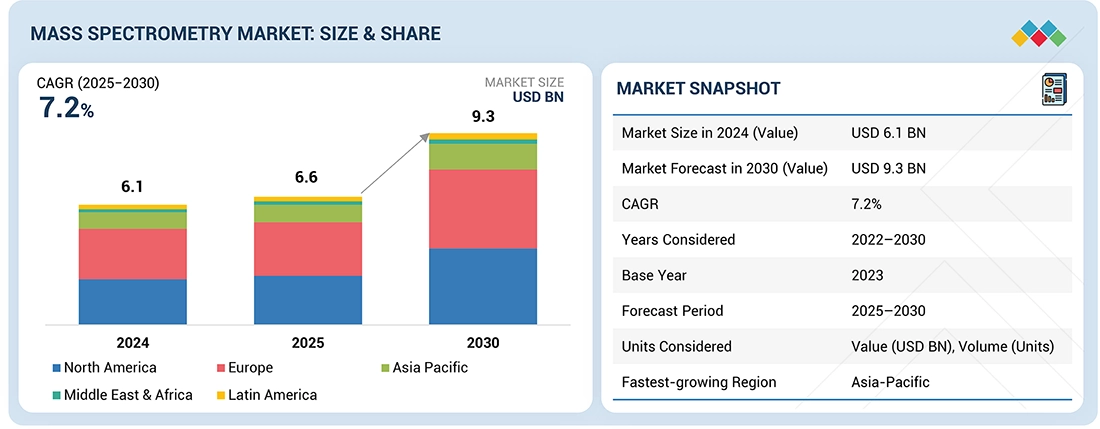

The global mass spectrometry market, valued at USD 6.1 billion in 2024, stood at USD 6.6 billion in 2025 and is projected to advance at a resilient CAGR of 7.2% from 2025 to 2030, culminating in a forecasted valuation of USD 9.3 billion by the end of the period. The global mass spectrometry systems market is witnessing strong growth, driven by rising adoption across pharmaceutical, biopharmaceutical, food safety, environmental testing, and clinical research applications. The technology has evolved from a niche analytical tool to a mainstream platform enabling high-precision molecular identification, quantitative proteomics, and advanced metabolomics. With the convergence of hybrid platforms (LC-MS, GC-MS, ICP-MS, MALDI-MS, and Orbitrap) and next-generation data analytics, the market is transitioning toward automation-enabled, software-driven workflows. The growing emphasis on regulatory-grade data, real-time monitoring, and multi-omics integration is reshaping purchasing decisions, making mass spectrometry a foundational element in analytical laboratories worldwide.

KEY TAKEAWAYS

-

BY INLET TYPE

- By Inlet Type, the market is categorized into GC-MS, LC-MS, ICP-MS, and others

- The LC-MS segment accounted for the largest share of the mass spectrometry market. There is a rising need for LC-MS in the pharmaceutical industry owing to expanding R&D pipeline, growing customer base, and greate regulatory compliance in APAC and other emerging countries.

-

BY PRODUCT

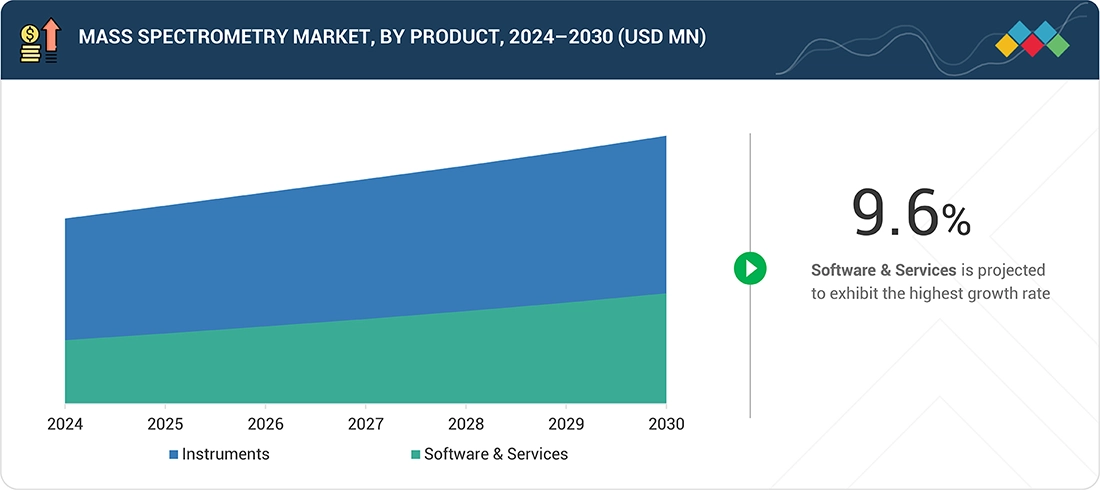

- By Product, the market covers key product types like the instruments and software & services

- The instruments acquired a major share of the market due to increased capital investments in pharma and biopharma, along with strict regulatory reforms for environmental testing

-

BY APPLICATION

- Key segments include OMICS research, drug discovery, environmental testing, food testing, pharma-biopharma manufacturing, clinical diagnostics, applied industries, and others

- The OMICS research segment is expected to witness significant growth during the forecast period. The biopharmaceutical and biotechnology industries have facilitated the advancement of diagnostics & biomarker identification applications in the R&D sector, leading to its significant growth and dominance in the industry in the upcoming years.

-

BY END USER

- Key end user segment include pharmaceutical companies, biotechnology companies, research labs & academic institutes, environmental testing labs, F&B industry, forensic labs, petrochemical industry, and other end users

- The pharmaceutical industry has facilitated the advancement of diagnostics & biomarker identification in the R&D sector, leading to its sizable growth and dominance in the industry in the upcoming years. Also, the anticipated revenue growth of this segment during the forecast period is attributed to the rapid expansion of the pharmaceutical industry worldwide and the technological advancements in the pharmaceutical sectors

-

BY REGIONThe mass spectrometry market covers Europe, North America, Asia Pacific, South America and Middle East and Africa. North America is the largest market for mass spectrometers.

-

COMPETITIVE LANDSCAPEThe key market players utilize both organic and inorganic strategies to strengthen their position in the market. The key players in the mass spectrometry market are Agilent Technologies, Inc. (US), Thermo Fisher Scientific, Inc. (US), Danaher Corporation (US), Waters Corporation (US), Bruker Corporation (US . These players have formed strategic partnerships and expanded capacity by establishing new manufacturing facilities to meet growing demand. Such activities will help them to maintain a dominant position in the market.

Several key shifts are redefining mass spectrometry industry. The migration from qualitative to quantitative workflows is fueling demand for high-resolution systems capable of low-limit detection and wide dynamic range. Miniaturization and benchtop MS systems are penetrating mid-tier labs, expanding the user base beyond high-end research centers. Integration of AI-driven data interpretation, cloud-based data management, and automation in sample preparation are improving throughput and reproducibility. Moreover, the democratization of proteomics and metabolomics research—spurred by lower cost per run and consumable innovations—is driving a strong aftermarket revenue stream for OEMs. The use of hybrid MS configurations, such as Q-TOF and Triple Quadrupole systems, is expanding in targeted quantitation and clinical validation workflows.

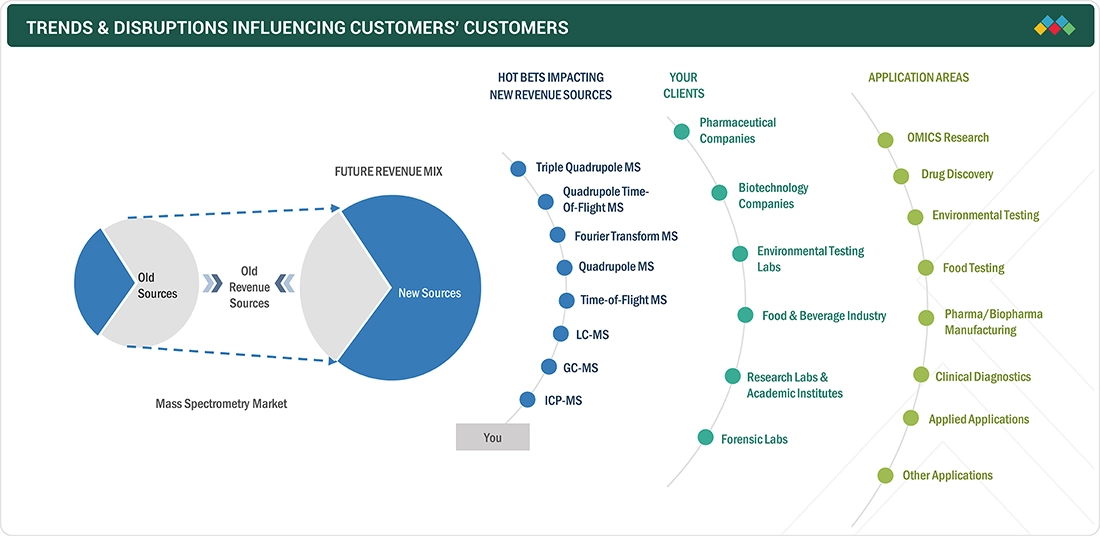

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Customer organizations—particularly pharma, biopharma, and applied research labs—are increasingly aligning analytical instrument investments with translational and diagnostic outcomes. Next-generation workflows emphasize integrated omics, trace contaminant monitoring, and accelerated drug validation. Trends such as advanced QqQ-MS for high-throughput biomarker quantitation, Orbitrap and TOF systems for complex proteomics, and coupling of MS with chromatography or ion mobility spectrometry are reshaping discovery-to-market timelines. For clients’ clients—such as clinical laboratories and regulatory agencies—these shifts translate into faster approvals, lower product recall risks, and enhanced data reliability. The shift in future revenue mix is tilting toward high-value solutions, automation-driven services, and subscription-based software analytics.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

1. Increasing regulatory emphasis and privatization of environmental testing services 2. Growing application of mass spectrometry in clinical and forensic settings 3. Rising focus on drug safety 4. Increasing Investments in pharmaceutical research & development

Level

-

1. Capital-intensive investments for high-end equipment 2. Time-consuming sample preparation steps

Level

-

1. Development of novel mass sensors and nanopore ion sources 2. Growth opportunities in emerging economies

Level

-

1. Inadequate infrastructure and shortage of skilled professionals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing regulatory emphasis and privatization of environmental testing services

Authorities in several countries have started enacting various policies and legislation for effective pollution monitoring and control. After 2022 - 2024, various government initiatives were implemented for pollution monitoring. ? In August 2024, the Drinking Water Inspectorate in the UK announced a regulation to monitor 48 PFAS with a cumulative limit of 100 nanograms per liter. ? In June 2023, G20 provided recommendations that include joint R&D, global data sharing, international organization collaboration, and LiFE mission integration to enhance air quality monitoring in G20 countries via Low-Cost Sensor-Satellite Synergy. ? The regulatory authorities are more aggressive toward the regulatory framework for environmental testing, specifically for water testing. The test volumes for the water test have significantly increased. LC-MS and GC-MS are among the widely used techniques in such applications. ? Privatization of environmental testing services is of great significance for international trade opportunities. Local governing bodies have typically provided environmental services such as testing for air, water, and sanitation; sewage & refuse disposal; and cleaning of lakes. However, the participation of private companies in the provision of these basic services has been increasing globally, driven by the need for cost reduction and private-sector capital. ? Third-party providers for services such as nitrosamines and PFAS testing use mass spectrometry-based instruments as part of the protocols, specifically instruments like GC-MS and LC-MS. Such a favorable scenario is expected to generate more demand for mass spectrometry instruments, which will help the market for mass spectrometry grow

Restraint: Capital-intensive investments for high-end equipment

Accurate and precise results require extensive sample preparation methods. Customized requirements need dedicated methods and SOPs. For PFAS and microplastics, dedicated methods such as EPA 1633, EPA 537.1, and ISO 21675:2019 are recommended by the Environmental Protection Agency (EPA). Such conditions require capital-intensive technologies such as Tandem MS and high-resolution mass spectrometry (HR-MS), LC-MS, and GC-MS. As these mass spectral techniques are precise and accurate, they are equally costly and have an increased per-sample operating cost. For instance, the cost of a new spectrometry instrument may vary from USD 75,000 to USD 500,000. The price of a single mass spectrometry system ranges from USD 400,000 to USD 350,000, while GC-MS may cost around USD 50,000 to USD 100,000, depending on the associated accessories. The cost of an HPLC system varies from USD 12,000 to USD 50,000. Such conditions make it difficult specifically for institutes with low CapEx limits to adopt such technologies, resulting in the shrinking of the total addressable market (TAM) for mass spectrometry

Opportunity: Development of novel mass sensors and nanopore ion sources

In September 2024, Brown University introduced a nanopore ion source, which has proven to eliminate the need for traditional electrospray ionization. The advancement can address the concern for sample loss in mass spectrometry. As the advancement improves the accuracy and sensitivity of mass spectrometry, it paves a path for advanced applications in proteomics, metabolomics, and other fields requiring high precision in small-scale analyses. Novel mass sensor-based diamond nanostructures named Diamond Molecular Balance (DMB) were developed in 2024. This system achieves extraordinary mass resolution and an extensive dynamic range at room temperature, making it ideal for high-resolution mass spectrometry. The technology detects low-abundance molecules and monitors real-time complex reactions. Such technical advancements will widen the application base for mass spectrometry, which will help grow the market for mass spectrometry

Challenge: Inadequate infrastructure and shortage of skilled professionals

There is a significant shortage of skilled personnel for method development, validation, operation, and troubleshooting activities. Apart from developing countries, established markets face a shortage of skilled workforce. To address such a scenario, the National Technical Development Centre (NTDC) outlines the challenges and runs technical development programs to provide training to professionals across various sectors. According to the NTDC, by 2030, the UK will require 700,000 technicians to support the economy. Hence, the shortage of skilled technical workforce poses a challenge to the growth of the mass spectrometry market. Mass spectrometry equipment and the use of consumables require expertise with relevant experience and knowledge of the technique. Moreover, selecting the right mass spectrometry technique and method specific to the requirement is crucial in gaining valuable results. Lack of knowledge regarding the right choice of technology affects the operation results and incurs several direct and indirect expenses for end users. All these factors have the potential to shrink the market for mass spectrometry

mass spectrometry market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of Orbitrap Exploris / Orbitrap Astral platforms for high-throughput biomarker discovery and verification in pharma and food safety — e.g., Nestlé’s wide-scope pesticide & natural toxin workflows developed on Orbitrap Exploris instruments. | Ultra-high resolution for confident compound ID, improved mass accuracy for non-target screening, and high throughput that accelerates R&D → faster biomarker discovery to clinical research translation |

|

Implementation of the 6495D Triple Quadrupole LC/MS in food, environmental and clinical testing labs for trace-level quantitation (PFAS, pesticides, clinical small molecule panels). Labs use the 6495D for ppq–ppt sensitivity workflows and high sample throughput. | Sub-ppt detection limits in difficult matrices, fast dwell times for large panels (higher sample throughput), and robustness for routine regulatory testing → reliable compliance testing and improved lab productivity. |

|

Clinical and regulated-testing labs deploying SCIEX Triple Quadrupole and TripleTOF platforms for routine clinical LC-MS/MS assays (therapeutic drug monitoring, endocrinology, toxicology) and targeted quantitation in biopharma QA/QC. SCIEX also provides implementation guides to support lab adoption. | High sensitivity and selectivity for clinical assays, validated workflows and implementation support reduce time-to-operational readiness, enabling labs to bring complex LC-MS tests into routine diagnostics. |

|

Use of Xevo MRT and UNIFI software for large-cohort metabolomics, lipidomics, and non-targeted environmental screens (including PFAS). Waters positions the Xevo MRT for studies requiring high mass resolution and sub-ppm accuracy across hundreds of injections. | High-resolution, stable mass accuracy for confident non-target identification, scalable throughput for cohort studies, and integrated software for pattern analysis → more reliable discovery datasets and faster time from data to decision. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The mass spectrometry ecosystem spans multiple interdependent layers—component suppliers (ion optics, vacuum pumps, detectors, electronics), OEM system manufacturers, chromatography partners, reagent and consumable suppliers, automation solution providers, and data analytics vendors. On the demand side, end users include pharmaceutical and biopharmaceutical companies, CROs, food and beverage testing labs, environmental monitoring agencies, and academic research institutions. Distributors and service integrators bridge the gap between OEMs and regional labs, while cloud-based LIMS and data processing firms increasingly anchor the digital layer of the ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Mass Spectrometry Market, By Product

The instruments segment dominates the market share, driven by recurring replacements and integration of hybrid and high-resolution systems. Software and services are gaining traction, primarily due to the increasing complexity of multi-omics datasets and compliance-driven reporting. Consumables such as columns, ion sources, and sample prep kits are witnessing consistent growth but remain secondary to system revenue.

Mass Spectrometry Market, By Inlet Type

LC-MS systems account for the largest share due to their versatility, high sensitivity, and compatibility with both small molecules and large biomolecules. LC-MS is the analytical backbone for pharmaceutical QA/QC, metabolite profiling, and proteomics workflows. ICP-MS follows, driven by its role in trace elemental analysis in environmental, semiconductor, and food applications. GC-MS maintains strong relevance in volatile compound analysis, while Orbitrap and TOF systems are rapidly growing in advanced life-science research due to superior resolution and mass accuracy.

Mass Spectrometry Market, By Application

The pharmaceutical and biopharmaceutical segment leads the market, leveraging MS for drug discovery, bioanalytical testing, and bioprocess monitoring. Increasing application in biomarker identification and structural elucidation of complex biologics fuels its dominance. Environmental testing and food safety form the next largest segments, supported by global regulatory emphasis on contaminant detection and trace quantification.

Mass Spectrometry Market, By End user

Pharmaceutical and biotechnology companies represent the largest end-user segment due to extensive use in R&D, process development, and QC. Academic and research institutions are growing rapidly with grant-funded proteomics and metabolomics projects, while clinical labs are emerging as a promising segment as MS transitions toward diagnostic use cases. CROs and CDMOs also contribute significantly through outsourced bioanalytical and validation studies.

REGION

Asia-Pacific to be the fastest-growing region in the mass spectrometry market during the forecast period

Asia-Pacific is the fastest-growing region, underpinned by expanding pharmaceutical manufacturing in China and India, growing academic research investments in Japan and South Korea, and government-backed initiatives supporting omics-based R&D. Increased localization of OEM production and affordable system variants are accelerating APAC penetration.

mass spectrometry market: COMPANY EVALUATION MATRIX

The competitive landscape is characterized by a few global leaders—such as Thermo Fisher Scientific, Agilent Technologies, SCIEX (Danaher), Bruker Corporation, Shimadzu Corporation, and Waters Corporation—alongside niche players offering specialized systems. Competition centers on analytical performance (resolution, mass accuracy, throughput), integration capability (AI-based analysis, automation), and service excellence. Continuous innovation in hybrid technology and digital platforms defines leadership, while smaller players differentiate through application-specific customization and cost optimization.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.1 billion |

| Market Forecast in 2030 (value) | USD 9.3 billion |

| Growth Rate | CAGR of 6.5% from 2025–2030 |

| Years Considered | 2022–2030 |

| Base Year | 2023 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

| Related Segment & Geographic Reports |

Pharma Mass Spectrometry Market Environmental Mass Spectrometry Market Drug Discovery Mass Spectrometry Market Clinical Mass Spectrometry Market Asia-Pacific Mass Spectrometry Market US Mass Spectrometry Market European Mass Spectrometry Market |

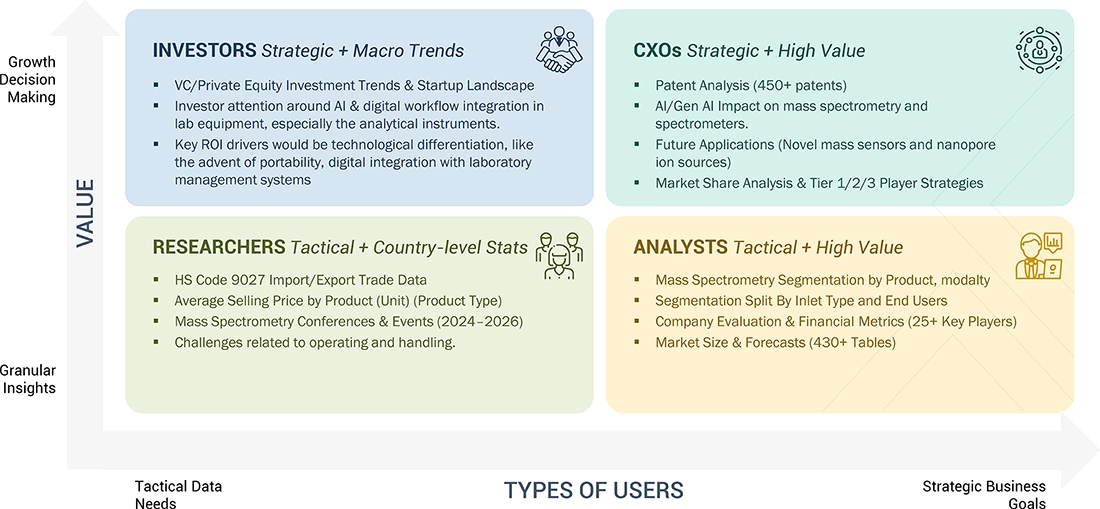

WHAT IS IN IT FOR YOU: mass spectrometry market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Key Maufacturer | Competitive Landscape for major players in the market. |

|

| Global MNC | Customer survey pertaining to major pain points and purchase workflow in 7 ASEAN countries |

|

RECENT DEVELOPMENTS

- June 2024 : Thermo Fisher Scientific, Inc (US) opened a new facility aiming to increase production capability for analytical services and clinical research, the facility has dedicated space for LC-MS.

- October 2024 : Danaher Corporation (US) entered into a partnership with IonOpticks (Australia) to co-market IonOptiks ‘s chromatography system with SCIEX’s Zeno TOF product line.

- August 2024 : Agilent Technologies, Inc. (US) entered into a partnership agreement with Newomics Inc. (US) that aims to develop an LC-MS platform, especially for identifying druggable targets for drug discovery.

Table of Contents

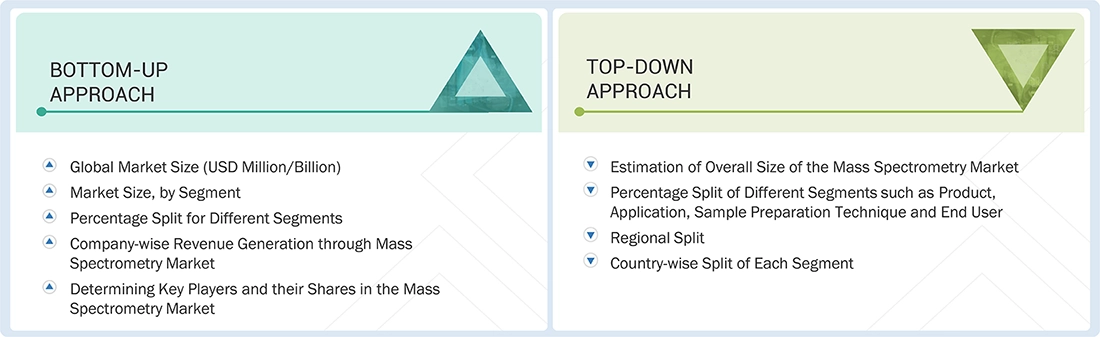

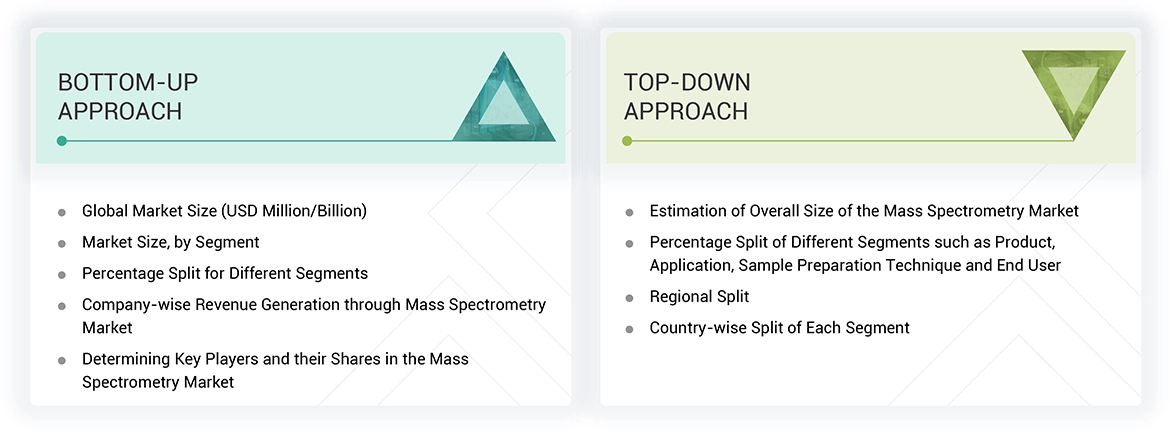

Methodology

To make a balance between primary and secondary research for the global Mass Spectrometry market, different market variables for small and medium-sized businesses and major businesses were analyzed as part of this study. The next step involved primary research with industry experts along the value chain to validate these findings, assumptions, and market sizing. Many different methodologies were used for estimating the overall market size, involving the top-down and bottom-up approaches. The study consists of significant market segments, evolving patterns, regulatory frameworks, and competitive environments. This study also considers leading market players and the strategies they deploy in this market. In conclusion, the total market size was estimated through top-down and bottom-up approaches along with data triangulation to reach the number for the final market size. Primary research was conducted throughout the study to validate and test each hypothesis.

Secondary Research

During the study, secondary research employed a variety of sources, including directories and databases such as Bloomberg Businessweek, D&B Hoovers, and Factiva. Additional materials included white papers, annual reports, SEC filings, and investor presentations. This research approach was used to collect and generate data that offers comprehensive, technical, and market-focused insights into the mass spectrometry market. The data provides insights into key players and market segmentation based on recent industry trends, as well as significant developments in the market. A database comprising leading industry figures was also created through this secondary research.

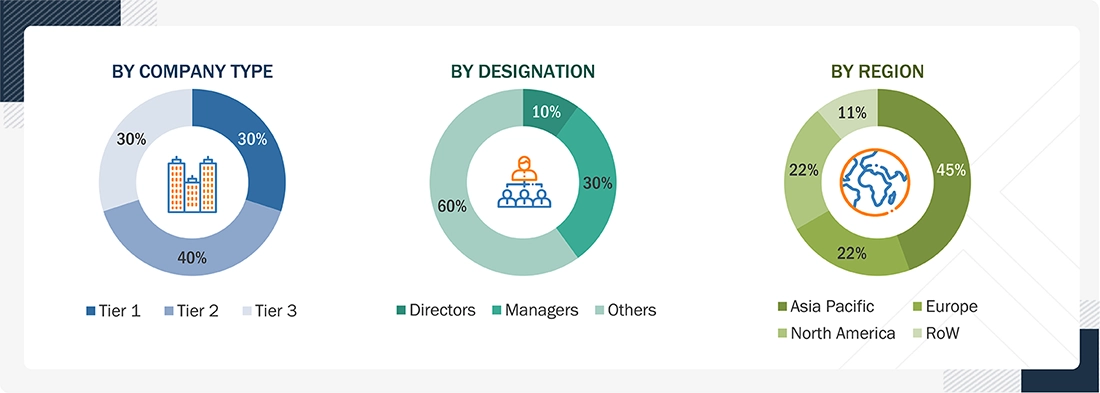

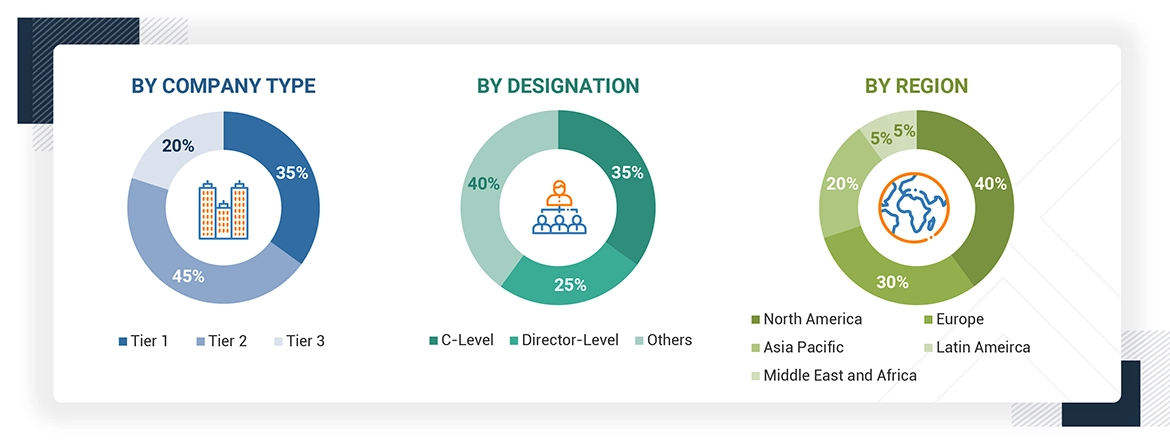

Primary Research

Primary research involved activities aimed at obtaining qualitative and quantitative data. A range of personalities from both supply and demand sides were questioned during this phase. For the supply side, folks from key designations like CEOs, vice presidents, directors of marketing and sales, directors of technology and innovation, and other important leaders were interviewed by key players. Among the demand-side primary sources were academic institutions, and research organizations. To validate market segmentation, identify prominent market participants, and gain insights into significant industry trends and market dynamics of the real-world primary study was carried out.

A breakdown of the primary respondents is provided below:

*Others include distributors, suppliers, product managers, business development managers, marketing managers and sales managers.

Note: Companies are categorized into tiers based on their total revenue. As of 2023, Tier 1 = >USD 1,000 million, Tier 2 = USD 500–1,000 million, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

As per the review of prominent companies and their revenue shares, market size of the global mass spectrometry market was calculated in this report. Key players with significant share in the market were identified as part of secondary research and their mass spectrometry business revenue was calculated, the same was validated by primaries. Analyzing the annual and financial reports of the leading market participants was one aspect of secondary research. On the other hand, in-depth interviews with important thought leaders, including directors, CEOs, and marketing executives, were a part of the primary study.

For calculation of global market value, segmental revenue was calculated in the basis of revenue mapping of service/product providers. Process involved below mentioned steps:

- List of key players that operate in the mass spectrometry market on regional or on country level.

- Formation of product mapping of manufacturers of mass spectrometry and related product lines at regional and country level

- Revenue mapping for listed players from mass spectrometry and related product and services.

- Revenue mapping of major players to cover at least ~70% of the global market share as of 2023. Revenue mapping for major players that cover nearly 70% of the global market share for year 2023.

- Revenue mapping extrapolation for players will drive the global market value for the respective segment.

- Summation for market value for all segments and subsegments to achieve the actual value of the global value of the mass spectrometry market.

Data Triangulation

After getting the overall market size from the market size estimation process mentioned above, the Mass spectrometry market was split into segments and subsegments. Data triangulation and market segmentation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying and analyzing various factors and trends from both the demand and supply sides. Additionally, the Mass spectrometry market was verified and validated using both top-down and bottom-up approaches.

Market Definition

Mass spectrometry is an analytical technique used to measure specific compounds and evaluate molecular structure & chemical properties. This technique ionizes chemical species and sorts the ions based on the mass-to-charge ratio. Mass spectroscopy has become a powerful analytical tool for testing in various industries due to its high sensitivity.

Stakeholders

- Pharmaceutical Industry

- Biotechnology Industry

- Manufacturers and suppliers of mass spectrometers.

- Product suppliers, distributors, and channel partners

- Food & beverage industry

- Academic & research institutes

- Regulatory authorities and industry associations

- Venture capitalists and investment firms

Report Objectives

- To define, describe, and forecast the global mass spectrometry market on the basis of product, sample preparation technique, application, end user, and region.

- To provide detailed information regarding the major factors influencing the growth potential of the global mass spectrometry market (drivers, restraints, opportunities, challenges, and trends).

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the global mass spectrometry market.

- To analyze key growth opportunities in the global mass spectrometry market for key stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, Australia, South Korea, ASEAN region and the RoAPAC), and rest of the world.

- To profile the key players in the global mass spectrometry market and comprehensively analyze their market shares and core competencies.

- To track and analyze the competitive developments undertaken in the global mass spectrometry market, such as product launches, agreements, expansions, and & acquisitions.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Mass Spectrometry Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Mass Spectrometry Market

Gayatri

Sep, 2021

Thanks You For the good information sharing with us..

George

Jun, 2022

Which geography will have the largest share of the global Mass Spectrometry Market?.

Federico

Oct, 2021

Thank you. This is, as usual, an authoritative survey of the field. A perspective for science historians would be tracing the evolution as backwards as your collected data and forecasts go. This is a totally virgin field that is worth investigation. I am looking for contact, since I am in your mailing list. Best regards.