Hadoop Big Data Analytics Market by Component (Solutions and Service), Deployment Mode, Organization Size, Business Function, Vertical (BFSI, Healthcare and Life Sciences, Manufacturing), and Region - Global Forecast to 2025

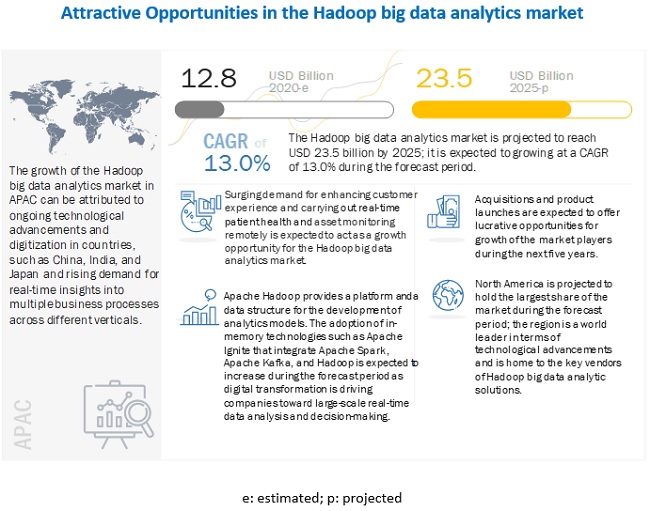

[318 Pages Report] The global Hadoop big data analytics market size to grow from USD 12.8 billion in 2020 to USD 23.5 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 13.0% during the forecast period. Various factors such as the rise in demand for analyzing large volumes of data , increasing investments in advanced analytics, surge in need for remote services and location data during COVID-19 , rise in development of smart payment technologies, and increasing use of social media applications for customer engagement are expected to drive the growth for Hadoop big data analytics market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on Global Hadoop Big Data Analytics Market

The COVID-19 has impacted all elements of the technology sector. It has slowed down the growth of IT infrastructure owing to disruptions in the hardware supply chain and reduced manufacturing activities. Businesses providing Hadoop big data analytics solutions and services are also expected to witness a decline in their growth for a short span of time. However, the adoption of collaborative applications, IoT, analytics, security solutions, and AI is set to increase in the remaining part of 2020. In a short time, the COVID-19 outbreak has affected all markets, as well as the behaviors of customers. It has a substantial impact on economies and societies. With offices, educational institutions, and manufacturing facilities being shut down for an indefinite period, major sports and events being postponed, and work-from-home and social distancing policies being implemented globally, businesses are increasingly making efforts to deploy technologies that assist them through this difficult time. Analytics professionals, BI professionals, and advanced analytics experts have been called to help executives make business decisions to respond to new challenges posed by the COVID-19 spread.

Market Dynamics

Driver: Rising adoption of smart payment technologies

Contactless and smart payments go together while contactless payments streamline the task of transferring money among multiple parties, IoT automates and interconnects different processes and tasks. Apart from contactless cards, devices such as key fobs and wearables, are also being increasingly used for contactless payments. Many digital firms are using ML for gathering insights from the field of commerce. Public transportation systems have also evolved, from cash and paper-based transactions to electronic modes of payments. Digital banking is one of the emerging industries that has been successful in creating meaningful consumer value out of a record-setting economic freefall during the COVID-19. With the rise in innovative technologies, companies are already witnessing growth owing to the increasing adoption of digital payments to redefine the city transit payment systems. Platforms, such as PayPal, Visa, MasterCard, and American Express, have been serial investors in payment startups, especially over the past 2 years. With the COVID-19 situation that has led to social distancing, the adoption of smart payment technologies has increased. The surge in the COVID-19 cases has also pushed the adoption of contactless payments. Governments are advising their citizens to use digital and contactless modes of payment during this pandemic as the transfer of physical currency might lead to a further rise in the number of COVID-19 cases.

Restraint: Legal concerns and data privacy issues

The misuse of data, whether intentional or not, can have serious legal consequences for both organizations and customers. Businesses should clearly state clauses related to data usage, process, and retention in their project contracts to ensure that no data usage violates government laws. The risk of identity theft grows whenever entities collect profile data, especially if the information is not maintained securely. This information can get compromised by hackers, malware, disk damages, etc. If brands create strategies around this inaccurate data, it can lead to serious complications for all users involved. Hence, businesses should properly check all legal and privacy-related concerns before using data gathered from various applications.

Opportunity: Requirement for real-time information to track and monitor COVID-19 spread

Hadoop big data analytics is helping governments and public agencies involved in healthcare, law enforcement, and transport sectors in understanding the COVID-19 situation and its evolution for making appropriate decisions. The real-time COVID-19 trackers are playing a key role in collecting data from various sources across the world. This real-time data is helping healthcare workers, scientists, epidemiologists, and policymakers aggregate and synthesize incident data on a global basis. The GPS analyses of population movement based on region, city, and other means have been helping government agencies in understanding the compliance or lack of compliance by masses in terms of social distancing mandates. During the pandemic, the world has been relying on the information provided by the dashboards of WHO and Johns Hopkins University. Governments are analyzing the effect of their measures using dashboards and critical points of interest (POI) for understanding patterns of population mobility using spatial data. Governments worldwide are progressively shifting toward mobile phone location data for tracking and stopping the spread of the COVID-19. Decentralized contact tracing apps are predominantly being used. The Government of India has launched the Aarogya Setu mobile app, while Singapore has launched the TraceTogether app that uses cell phone locations and proximity data for contact tracing

Challenge: COVID-19 leading to increase in cybersecurity concerns

With the continuous evolution of technologies, the rate of data intrusions is also increasing. Hence, data privacy and security are essential while developing analytics solutions for varied vertical-specific applications. Cybersecurity involves device and data security, as well as protection of privacy of individuals. Once the big data is collected, it undergoes parallel processing. One of the methods used is MapReduce. When the data is split into numerous bulks, a mapper processes them and allocates them to different storage locations. At that time, if outsiders get access to codes of mappers, they can change the settings of the existing mappers or add alien ones. The data processing can effectively get ruined as cybercriminals can make mappers produce inadequate lists of key/value pairs. Hence, the results produced by the MapReduce process may become faulty. Besides, outsiders can get access to sensitive information as well. There are various data compliances, which require to be followed while analyzing this data. If these compliances are ignored, alteration of the data becomes easy, which ultimately questions the integrity of the results generated. For instance, the data generated from devices fitted in intensive care units (ICUs) or deployed at airports requires security and privacy. Hence, cybersecurity and privacy are expected to be key challenges for the growth of the Hadoop big data analytics market.

Among verticals, the healthcare and life sciences segment to grow at the highest CAGR during the forecast period

Hadoop big data analytics market is segmented based on verticals. The verticals include BFSI, transportation and logistics, retail and eCommerce, manufacturing, telecommunications and IT, healthcare and life sciences, government and public sector, media and entertainment, travel and hospitality, others (energy and utilities, education and research, and real estate). The healthcare and life sciences vertical is expected to witness the highest growth during the forecast period. During the COVID-19 pandemic, researchers and hospitals are dealing with enormous data, which has created a massive need for tailor-made analytics solutions such as pandemic analytics. Hadoop big data analytics finds multiple use cases in healthcare and life sciences vertical, such as remote diagnostics/monitoring of patient status, real-time alerting, emergency care, tracking inventory staff and patients, pharmacy management, and telemedicine.

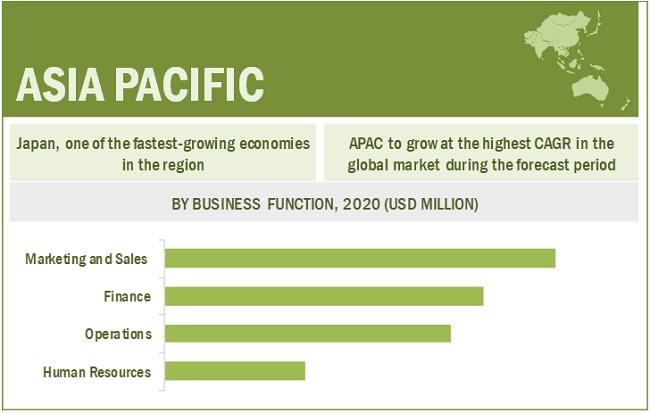

Operations business function to grow at the highest CAGR during the forecast period

Hadoop big data analytics market is segmented based on business function. The business functions include marketing and sales, operations, human resources, and finance. Many global operations teams have sufficient real-time shop-floor data and the capability to conduct such sophisticated statistical valuations. By leveraging Hadoop big data analytics, operational teams can see the inefficiencies that exist in their workflows, and accordingly, they can then change their processes to streamline operations.

Asia Pacific to grow at the highest CAGR during the forecast period

The Hadoop big data analytics market has been segmented into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. The Asia Pacific region is expected to be the fastest-growing region in the market. This growth can be attributed to the increasing demand for modernizing industries and infrastructure for data management across Asia Pacific countries, including China, Japan, and India. The rapid rise in data production from various industry verticals daily is increasing the demand for Hadoop big data analytics solutions in the region. The BFSI industry vertical is investing significantly in Hadoop big data analytics solutions to manage day-to-day transactions and operations. Industry players such as IBM, Google, and Microsoft have a prominent presence, and other players are expected to increase their investments and improve their presence.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Hadoop big data analytics vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors in the global Hadoop big data analytics market include Microsoft (US), AWS (US), Cloudera (US), HPE (US), IBM (US), Oracle (US), SAP (Germany), Google (US), SAS Institute (US), Salesforce (US), TIBCO Software (US), Alteryx (US), Micro Focus (UK), Hitachi Vantara (US), Qubole (US), Splunk (US), Dell Technologies (US), Huawei (China), Dremio (US), Imply (US), Starburst (US), Alluxio (US), TheMathCompany (US), Kyvos Insight (US), and Amlgo Labs (India). The study includes an in-depth competitive analysis of these key players in the Hadoop big data analytics market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2014–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

USD Million |

|

Segments covered |

Component, deployment mode, organization size, business function, vertical, and region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Microsoft (US), AWS (US), Cloudera (US), HPE (US), IBM (US), Oracle (US), SAP (Germany), Google (US), SAS Institute (US), Salesforce (US), TIBCO Software (US), Alteryx (US), Micro Focus (UK), Hitachi Vantara (US), Qubole (US), Splunk (US), Dell Technologies (US), Huawei (China), Dremio (US), Imply (US), Starburst (US), Alluxio (US), TheMathCompany (US), Kyvos Insight (US), and Amlgo Labs (India) |

This research report categorizes the Hadoop big data analytics market based on components, deployment modes, organization size, business functions, verticals, and regions.

By component:

- Solutions

-

Services

- Managed Services

-

Professional Services

- Deployment and Integration

- Support and Maintenance

- Consulting

By deployment mode:

- Cloud

- On-premises

By organization size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By business function:

- Marketing and Sales

- Operations

- Finance

- Human Resources

By vertical:

- BFSI

- Transportation and Logistics

- Retail and eCommerce

- Manufacturing

- Telecommunications and IT

- Healthcare and Life Sciences

- Government and Public Sector

- Media and Entertainment

- Travel and Hospitality

- Others (Energy and Utilities, Education and Research, and Real Estate)

By region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- KSA

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In July 2020, Google Cloud announced BigQuery Omni powered by Anthos for Multi-Cloud Analytics. BigQuery Omni provides enterprises with the flexibility they need to break down silos and create actionable business insights, without having to pay expensive egress fees for moving data from other cloud providers to Google Cloud. It will help customers securely and cost-effectively access, analyze, and find new insights empowering innovation in their business.

- In June 2020, HPE launched HPE Ezmeral, which is a new software portfolio and brand that will accelerate data-driven transformation across organizations. HPE Ezmeral provides a complete portfolio, including container orchestration and management, AI/ML and data analytics, cost control, IT automation and AI-driven operations, and security.

- In April 2020, IBM released novel AI-powered technologies to help the Health and Research Community in accelerating the discovery of medical insights and treatments for COVID-19.

- In September 2019, Cloudera acquired Arcadia Data to speed up data analytics’ time-to-insight. Post the acquisition, Cloudera and Arcadia Data integrated their technologies. These integrated technologies enabled companies to get insights required for business decisions.

- In August 2019, HPE acquired MapR business assets. This acquisition accelerated the intelligent data platform capabilities of HPE. It enabled HPE to offer a complete portfolio of products to drive AI and analytics applications. This helped HPE to strengthen its ability to manage data assets of customers from edge to cloud.

- In June 2019, Cloudera and IBM announced a partnership for bringing AI solutions and advanced data to organizations on the Apache Hadoop ecosystem. Due to this partnership, data-driven decisions will be accelerated.

Frequently Asked Questions (FAQ):

What is Hadoop big data analytics?

According to SAS Institute, Hadoop is an open-source software framework for storing data and running applications on clusters of commodity hardware. According to IBM, big data analytics is the use of advanced analytic techniques against very large, diverse data sets that include structured, semi-structured, and unstructured data from different sources and in different sizes, from terabytes to zettabytes. Apache Hadoop by itself does not do analytics but provides a platform and data structure upon which one can build analytics models. Collectively, Hadoop big data analytics is the use of advanced analytic techniques against the data stored on Hadoop.

Which countries are considered in the European region?

The report includes analysis of UK, Germany, and France in the European region.

Which are key verticals adopting Hadoop big data analytics solutions and services?

Key verticals adopting Hadoop big data analytics solutions and services include BFSI, transportation and logistics, retail and eCommerce, manufacturing, telecommunications and IT, healthcare and life sciences, government and public sector, media and entertainment, and travel and hospitality.

Which are the key drivers supporting the growth of Hadoop big data analytics market?

The key drivers supporting the growth of Hadoop big data market include increasing demand for digital transformation of organizations, growing investments in analytics, rising adoption of smart payment technologies, and increasing use of social media applications for customer engagement.

Who are the key vendors in the Hadoop big data analytics market?

The key vendors operating in the Hadoop big data analytics market include Cloudera, AWS, HPE, Microsoft, IBM, SAP, Salesforce, Dell Technologies, Huawei, Google, and Oracle. These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, product enhancements, partnerships, and mergers and acquisitions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 6 HADOOP BIG DATA ANALYTICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF HADOOP BIG DATA ANALYTICS MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 2 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3—BOTTOM-UP (DEMAND SIDE): SHARE OF HADOOP BIG DATA ANALYTICS THROUGH OVERALL HADOOP BIG DATA ANALYTICS SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 12 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 13 STARTUP/SME COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

2.9 IMPLICATIONS OF COVID-19 ON THE MARKET

FIGURE 14 QUARTERLY IMPACT OF COVID-19 DURING 2020–2021

3 EXECUTIVE SUMMARY (Page No. - 55)

TABLE 4 GLOBAL HADOOP BIG DATA ANALYTICS MARKET SIZE AND GROWTH RATE, 2014–2019 (USD MILLION, Y-O-Y%)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2019–2025 (USD MILLION, Y-O-Y%)

FIGURE 15 SOLUTIONS SEGMENT TO HOLD LARGE SHARE OF MARKET IN 2020

FIGURE 16 PROFESSIONAL SERVICES SEGMENT TO HOLD LARGE SHARE OF HADOOP BIG DATA ANALYTICS COMPONENT MARKET IN 2020

FIGURE 17 DEPLOYMENT AND INTEGRATION SERVICES SEGMENT TO HOLD LARGEST SIZE OF HADOOP BIG DATA ANALYTICS PROFESSIONAL SERVICES COMPONENT MARKET IN 2020

FIGURE 18 ON-PREMISES SEGMENT TO HOLD LARGE SHARE OF MARKET IN 2020

FIGURE 19 LARGE ENTERPRISES SEGMENT TO HOLD LARGE SHARE OF MARKET IN 2020

FIGURE 20 MARKETING AND SALES SEGMENT TO HOLD LARGEST SIZE OF MARKET IN 2020

FIGURE 21 BFSI SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2020

FIGURE 22 NORTH AMERICA TO HOLD LARGEST SHARE OF MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 62)

4.1 ATTRACTIVE OPPORTUNITIES IN HADOOP BIG DATA ANALYTICS MARKET

FIGURE 23 ONGOING GLOBAL DIGITAL TRANSFORMATION AND GROWING BUSINESS REQUIREMENTS TO LEVERAGE DATA COLLECTED FROM DIFFERENT SOURCES CONTRIBUTE TO MARKET GROWTH

4.2 MARKET, BY VERTICAL

FIGURE 24 BFSI SEGMENT TO HOLD LARGEST SIZE OF MARKET FROM 2020 TO 2025

4.3 MARKET, BY REGION

FIGURE 25 NORTH AMERICA TO HOLD LARGEST SHARE OF MARKET IN 2020

4.4 MARKET, BY BUSINESS FUNCTION AND VERTICAL

FIGURE 26 MARKETING AND SALES BUSINESS FUNCTION AND BFSI VERTICAL SEGMENTS TO HOLD LARGEST SHARES OF MARKET IN 2020

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 65)

5.1 INTRODUCTION

5.2 HADOOP: EVOLUTION

FIGURE 27 EVOLUTION OF HADOOP

5.3 HADOOP: ECOSYSTEM

FIGURE 28 HADOOP ECOSYSTEM

5.4 BIG DATA: TYPES

5.5 BIG DATA ANALYTICS: TYPES

5.6 MARKET DYNAMICS

FIGURE 29 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: HADOOP BIG DATA ANALYTICS MARKET

5.6.1 DRIVERS

5.6.1.1 Increasing demand for digital transformation of organizations

5.6.1.2 Growing investments in analytics

5.6.1.3 Rising adoption of smart payment technologies

5.6.1.4 Increasing use of social media applications for customer engagement

5.6.2 RESTRAINTS

5.6.2.1 Legal concerns and data privacy issues

5.6.3 OPPORTUNITIES

5.6.3.1 Requirement for real-time information to track and monitor COVID-19 spread

5.6.3.2 Surge in need for remote services and location data during COVID-19

5.6.3.3 Increase in demand for analyzing large volumes of data

5.6.4 CHALLENGES

5.6.4.1 Data accessibility and synchronization

5.6.4.2 Data management and Hadoop integration

5.6.4.3 Lack of proper application deployment and multiple data source support

5.6.4.4 COVID-19 leading to increase in cybersecurity concerns

5.6.4.5 Reduced industrial and manufacturing operations

5.6.4.6 Lack of big data analytics professionals

5.6.5 CUMULATIVE GROWTH ANALYSIS

5.7 HADOOP BIG DATA ANALYTICS MARKET: COVID-19 IMPACT

FIGURE 30 MARKET TO WITNESS DECLINE IN GROWTH IN 2020

5.7.1 COVID-19 RELATED ANALYTICS USE CASES

TABLE 6 COVID-19 RELATED ANALYTICS USE CASES

5.8 CASE STUDY ANALYSIS

5.8.1 BANKING, FINANCIAL SERVICES, AND INSURANCE

5.8.1.1 Case study 1: Risk assessment

5.8.1.2 Case study 2: Make real-time decisions and reduce operational costs

5.8.2 GOVERNMENT AND PUBLIC SECTOR

5.8.2.1 Case study 1: Monetize and harness real-time data for community benefit

5.8.2.2 Case study 2: Reduction in operational and management costs for defense sector

5.8.3 HEALTHCARE AND LIFE SCIENCES

5.8.3.1 Case study 1: Reckitt Benckiser empowered employees to make smart data-based decisions

5.8.3.2 Case study 2: Improvements in healthcare using smart data

5.8.4 MANUFACTURING

5.8.4.1 Case study 1: Improvements in commodity pricing forecasts

5.8.4.2 Case study 2: Dell built 360-degree customer view

5.8.5 RETAIL AND ECOMMERCE

5.8.5.1 Case study 1: Optimization of shopping experience of customers

5.8.5.2 Case study 2: Categorization of user behavior and improvement in campaign targeting

5.8.6 MEDIA AND ENTERTAINMENT

5.8.6.1 Case study 1: Visualization of clickstream insights in real-time

5.8.6.2 Case study 2: Boost subscriber engagement and data-driven decision-making

5.8.7 ENERGY AND UTILITIES

5.8.7.1 Case study 1: Easy access to exploration portfolio in oil and gas industry

5.8.7.2 Case study 2: Data centralization

5.8.8 TRANSPORTATION AND LOGISTICS

5.8.8.1 Case study 1: Analysis of travel patterns

5.8.8.2 Case study 2: Decisions related to route diversions based on live streaming traffic information

5.9 PATENT ANALYSIS

5.9.1 TOP PATENT APPLICANTS FOR PREDICTIVE ANALYTICS

FIGURE 31 TOP GEOGRAPHICAL AFFILIATIONS BY NUMBER OF SCIENTIFIC PUBLICATIONS FOR PREDICTIVE ANALYTICS

5.10 VALUE CHAIN ANALYSIS

FIGURE 32 VALUE CHAIN ANALYSIS

5.11 TECHNOLOGY ANALYSIS

5.11.1 AI AND HADOOP BIG DATA ANALYTICS

5.11.2 BLOCKCHAIN AND HADOOP BIG DATA ANALYTICS

5.11.3 IOT AND HADOOP BIG DATA ANALYTICS

5.11.4 SUSTAINABILITY HADOOP BIG DATA ANALYTICS

5.12 PRICING ANALYSIS

6 HADOOP BIG DATA ANALYTICS MARKET, BY COMPONENT (Page No. - 93)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

FIGURE 33 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 7 MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 8 MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

6.2 SOLUTIONS

TABLE 9 SOLUTIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 10 SOLUTIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3 SERVICES

FIGURE 34 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 11 MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 12 MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 13 SERVICES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 14 SERVICES: HADOOP BIG DATA ANALYTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3.1 MANAGED SERVICES

TABLE 15 MANAGED SERVICES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 16 MANAGED SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3.2 PROFESSIONAL SERVICES

FIGURE 35 CONSULTING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 17 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 18 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 19 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 20 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3.2.1 Consulting

TABLE 21 CONSULTING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 22 CONSULTING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3.2.2 Support and maintenance

TABLE 23 SUPPORT AND MAINTENANCE: HADOOP BIG DATA ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 24 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3.2.3 Deployment and integration

TABLE 25 DEPLOYMENT AND INTEGRATION: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 26 DEPLOYMENT AND INTEGRATION: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7 HADOOP BIG DATA ANALYTICS MARKET, BY DEPLOYMENT MODE (Page No. - 107)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT MODE: MARKET DRIVERS

7.1.2 DEPLOYMENT MODE: COVID-19 IMPACT

FIGURE 36 CLOUD SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 27 MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 28 MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

7.2 ON-PREMISES

TABLE 29 ON-PREMISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 30 ON-PREMISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3 CLOUD

TABLE 31 CLOUD: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 32 CLOUD: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8 HADOOP BIG DATA ANALYTICS MARKET, BY ORGANIZATION SIZE (Page No. - 113)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 37 SMALL- AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 33 MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 34 MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

8.2 LARGE ENTERPRISES

TABLE 35 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 36 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3 SMALL- AND MEDIUM-SIZED ENTERPRISES

TABLE 37 SMALL- AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 38 SMALL- AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9 HADOOP BIG DATA ANALYTICS MARKET, BY BUSINESS FUNCTION (Page No. - 119)

9.1 INTRODUCTION

9.1.1 BUSINESS FUNCTION: MARKET DRIVERS

9.1.2 BUSINESS FUNCTION: COVID-19 IMPACT

FIGURE 38 OPERATIONS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 39 MARKET SIZE, BY BUSINESS FUNCTION, 2014–2019 (USD MILLION)

TABLE 40 MARKET SIZE, BY BUSINESS FUNCTION, 2019–2025 (USD MILLION)

9.2 MARKETING AND SALES

TABLE 41 MARKETING AND SALES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 42 MARKETING AND SALES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.3 OPERATIONS

TABLE 43 OPERATIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 44 OPERATIONS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.4 FINANCE

TABLE 45 FINANCE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 46 FINANCE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.5 HUMAN RESOURCES

TABLE 47 HUMAN RESOURCES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 48 HUMAN RESOURCES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10 HADOOP BIG DATA ANALYTICS MARKET, BY VERTICAL (Page No. - 127)

10.1 INTRODUCTION

10.1.1 VERTICAL: MARKET DRIVERS

10.1.2 VERTICAL: COVID-19 IMPACT

10.2 HADOOP BIG DATA ANALYTICS: ENTERPRISE USE CASES

FIGURE 39 BFSI VERTICAL TO RECORD LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 49 MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 50 MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

10.3 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 51 BANKING, FINANCIAL SERVICES, AND INSURANCE: USE CASES

TABLE 52 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 53 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.4 TRANSPORTATION AND LOGISTICS

TABLE 54 TRANSPORTATION AND LOGISTICS: USE CASES

TABLE 55 TRANSPORTATION AND LOGISTICS: HADOOP BIG DATA ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 56 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.5 RETAIL AND ECOMMERCE

TABLE 57 RETAIL AND ECOMMERCE: USE CASES

TABLE 58 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 59 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.6 MANUFACTURING

TABLE 60 MANUFACTURING: USE CASES

TABLE 61 MANUFACTURING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 62 MANUFACTURING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.7 TELECOMMUNICATIONS AND INFORMATION TECHNOLOGY

TABLE 63 TELECOMMUNICATIONS AND INFORMATION TECHNOLOGY: USE CASES

TABLE 64 TELECOMMUNICATIONS AND INFORMATION TECHNOLOGY: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 65 TELECOMMUNICATIONS AND INFORMATION TECHNOLOGY: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.8 HEALTHCARE AND LIFE SCIENCES

TABLE 66 HEALTHCARE AND LIFE SCIENCES: USE CASES

TABLE 67 HEALTHCARE AND LIFE SCIENCES: HADOOP BIG DATA ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 68 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.9 GOVERNMENT AND PUBLIC SECTOR

TABLE 69 GOVERNMENT AND PUBLIC SECTOR: USE CASES

TABLE 70 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 71 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.10 MEDIA AND ENTERTAINMENT

TABLE 72 MEDIA AND ENTERTAINMENT: USE CASES

TABLE 73 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 74 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.11 TRAVEL AND HOSPITALITY

TABLE 75 TRAVEL AND HOSPITALITY: USE CASES

TABLE 76 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 77 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.12 OTHERS

TABLE 78 OTHER INDUSTRY VERTICALS: USE CASES

TABLE 79 OTHER VERTICALS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 80 OTHER VERTICALS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11 HADOOP BIG DATA ANALYTICS MARKET, BY REGION (Page No. - 149)

11.1 INTRODUCTION

FIGURE 40 JAPAN TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 41 APAC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 81 MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 82 MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

11.2.3 NORTH AMERICA: REGULATIONS

11.2.3.1 Health Insurance Portability and Accountability Act of 1996

11.2.3.2 California Consumer Privacy Act

11.2.3.3 Gramm–Leach–Bliley Act

11.2.3.4 Institute of Electrical and Electronics Engineers Standards Association

FIGURE 42 NORTH AMERICA: MARKET SNAPSHOT

TABLE 83 NORTH AMERICA: HADOOP BIG DATA ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2014–2019 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2019–2025 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.2.4 UNITED STATES

TABLE 99 UNITED STATES: HADOOP BIG DATA ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 100 UNITED STATES: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 101 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 102 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

11.2.5 CANADA

TABLE 103 CANADA: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 104 CANADA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 105 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 106 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: MARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT

11.3.3 EUROPE: REGULATIONS

11.3.3.1 General Data Protection Regulation

11.3.3.2 European Committee for Standardization

11.3.3.3 European Technical Standards Institute

TABLE 107 EUROPE: HADOOP BIG DATA ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 113 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY BUSINESS FUNCTION, 2014–2019 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY BUSINESS FUNCTION, 2019–2025 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.3.4 UK

TABLE 123 UK: HADOOP BIG DATA ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 124 UK: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 125 UK: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 126 UK: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

11.3.5 GERMANY

TABLE 127 GERMANY: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 128 GERMANY: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 129 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 130 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

11.3.6 FRANCE

TABLE 131 FRANCE: HADOOP BIG DATA ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 132 FRANCE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 133 FRANCE: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 134 FRANCE: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

11.3.7 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT

11.4.3 ASIA PACIFIC: REGULATIONS

11.4.3.1 International Organization for Standardization 27001

11.4.3.2 Personal Data Protection Act

FIGURE 43 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 135 APAC: HADOOP BIG DATA ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 136 APAC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 137 APAC: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 138 APAC: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 139 APAC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 140 APAC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 141 APAC: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 142 APAC: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 143 APAC: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 144 APAC: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 145 APAC: MARKET SIZE, BY BUSINESS FUNCTION, 2014–2019 (USD MILLION)

TABLE 146 APAC: MARKET SIZE, BY BUSINESS FUNCTION, 2019–2025 (USD MILLION)

TABLE 147 APAC: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 148 APAC: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 149 APAC: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 150 APAC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.4.4 CHINA

TABLE 151 CHINA: HADOOP BIG DATA ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 152 CHINA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 153 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 154 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

11.4.5 JAPAN

TABLE 155 JAPAN: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 156 JAPAN: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 157 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 158 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

11.4.6 INDIA

TABLE 159 INDIA: HADOOP BIG DATA ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 160 INDIA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 161 INDIA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 162 INDIA: MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

11.5 MIDDLE EAST & AFRICA

11.5.1 MIDDLE EAST & AFRICA: MARKET DRIVERS

11.5.2 MIDDLE EAST & AFRICA: COVID-19 EFFECT

11.5.3 MIDDLE EAST & AFRICA: REGULATIONS

11.5.3.1 ISRAELI Privacy Protection Regulations (Data Security), 5777-2017

11.5.3.2 Cloud Computing Framework

11.5.3.3 GDPR Applicability in KSA

11.5.3.4 Protection of Personal Information Act

11.5.3.5 TRA’s IoT Regulatory Policy

TABLE 163 MIDDLE EAST & AFRICA: HADOOP BIG DATA ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 164 MIDDLE EAST & AFRICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 165 MIDDLE EAST & AFRICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 166 MIDDLE EAST & AFRICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 167 MIDDLE EAST & AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 168 MIDDLE EAST & AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 169 MIDDLE EAST & AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: MARKET SIZE, BY BUSINESS FUNCTION, 2014–2019 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: MARKET SIZE, BY BUSINESS FUNCTION, 2020–2025 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 176 MIDDLE EAST & AFRICA: MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 177 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 178 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

11.5.4 KINGDOM OF SAUDI ARABIA

TABLE 179 KINGDOM OF SAUDI ARABIA: HADOOP BIG DATA ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 180 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 181 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 182 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

11.5.5 UNITED ARAB EMIRATES

TABLE 183 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 184 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 185 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 186 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

11.5.6 SOUTH AFRICA

TABLE 187 SOUTH AFRICA: HADOOP BIG DATA ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 188 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 189 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 190 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

11.5.7 REST OF MIDDLE EAST & AFRICA

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT

11.6.3 LATIN AMERICA: REGULATIONS

11.6.3.1 Brazil Data Protection Law

11.6.3.2 Argentina Personal Data Protection Law No. 25.326

TABLE 191 LATIN AMERICA: HADOOP BIG DATA ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2019 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2025 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2014–2019 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2020–2025 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 206 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

11.6.4 BRAZIL

TABLE 207 BRAZIL: HADOOP BIG DATA ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 208 BRAZIL: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 209 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 210 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

11.6.5 MEXICO

TABLE 211 MEXICO: MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 212 MEXICO: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 213 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 214 MEXICO: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2025 (USD MILLION)

11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 219)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 44 MARKET EVALUATION FRAMEWORK

12.3 MARKET SHARE, 2019

FIGURE 45 CLOUDERA LED HADOOP BIG DATA ANALYTICS MARKET IN 2020

12.4 HISTORIC REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 46 REVENUE ANALYSIS OF KEY MARKET PLAYERS

12.5 KEY MARKET DEVELOPMENTS

12.5.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 215 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2018–2020

12.5.2 BUSINESS EXPANSIONS

TABLE 216 BUSINESS EXPANSIONS, 2019–2020

12.5.3 MERGERS AND ACQUISITIONS

TABLE 217 MERGERS AND ACQUISITIONS, 2018–2020

12.5.4 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS

TABLE 218 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS, 2019–2020

13 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 227)

13.1 OVERVIEW

13.2 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

13.2.1 MARKET RANKING ANALYSIS, BY COMPANY

FIGURE 47 RANKING OF KEY PLAYERS, 2020

13.3 COMPANY EVALUATION MATRIX, 2020

13.3.1 STAR

13.3.2 EMERGING LEADER

13.3.3 PERVASIVE

13.3.4 PARTICIPANT

FIGURE 48 HADOOP BIG DATA ANALYTICS MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

13.4 COMPANY PROFILES

13.4.1 INTRODUCTION

(Business Overview, Solutions & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.4.2 MICROSOFT

FIGURE 49 MICROSOFT: COMPANY SNAPSHOT

13.4.3 AWS

FIGURE 50 AWS: COMPANY SNAPSHOT

13.4.4 CLOUDERA

FIGURE 51 CLOUDERA: COMPANY SNAPSHOT

13.4.5 HPE

FIGURE 52 HPE: COMPANY SNAPSHOT

13.4.6 IBM

FIGURE 53 IBM: COMPANY SNAPSHOT

13.4.7 ORACLE

FIGURE 54 ORACLE: COMPANY SNAPSHOT

13.4.8 SAP

FIGURE 55 SAP: COMPANY SNAPSHOT

13.4.9 GOOGLE

FIGURE 56 GOOGLE: COMPANY SNAPSHOT

13.4.10 SAS INSTITUTE

FIGURE 57 SAS INSTITUTE: COMPANY SNAPSHOT

13.4.11 SALESFORCE

FIGURE 58 SALESFORCE: COMPANY SNAPSHOT

13.4.12 DELL TECHNOLOGIES

13.4.13 TIBCO SOFTWARE

13.4.14 ALTERYX

13.4.15 MICRO FOCUS

13.4.16 HITACHI VANTARA

13.4.17 QUBOLE

13.4.18 SPLUNK

13.4.19 HUAWEI

*Details on Business Overview, Solutions & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

13.5 STARTUP/SME COMPANY EVALUATION MATRIX, 2020

13.5.1 PROGRESSIVE COMPANIES

13.5.2 RESPONSIVE COMPANIES

13.5.3 DYNAMIC COMPANIES

13.5.4 STARTING BLOCKS

FIGURE 59 HADOOP BIG DATA ANALYTICS MARKET (GLOBAL), STARTUP/SME COMPANY EVALUATION MATRIX, 2020

13.6 STARTUP/SME PROFILES

13.6.1 DREMIO

13.6.2 IMPLY

13.6.3 STARBURST

13.6.4 ALLUXIO

13.6.5 THEMATHCOMPANY

13.6.6 KYVOS INSIGHT

13.6.7 AMLGO LABS

14 APPENDIX (Page No. - 294)

14.1 ADJACENT AND RELATED MARKETS

14.1.1 INTRODUCTION

14.1.2 BIG DATA MARKET—GLOBAL FORECAST 2025

14.1.2.1 Market definition

14.1.2.2 Market overview

TABLE 219 GLOBAL BIG DATA MARKET SIZE AND GROWTH RATE, 2018–2025 (USD MILLION AND Y-O-Y %)

14.1.2.2.1 Big data market, by component

TABLE 220 BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

14.1.2.2.2 Big data market, by deployment mode

TABLE 221 BIG DATA MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

14.1.2.2.3 Big data market, by organization size

TABLE 222 BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

14.1.2.2.4 Big analytics market, by business function

TABLE 223 BIG DATA MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

14.1.2.2.5 Big data market, by industry

TABLE 224 BIG DATA MARKET SIZE, BY INDUSTRY, 2018–2025 (USD MILLION)

14.1.2.2.6 Big data market, by region

TABLE 225 BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

14.1.3 ANALYTICS AS A SERVICE MARKET– GLOBAL FORECAST TO 2024

14.1.3.1 Market definition

14.1.3.2 Market overview

TABLE 226 GLOBAL ANALYTICS AS A SERVICE MARKET SIZE AND GROWTH RATE, 2017–2024 (USD MILLION AND Y-O-Y %)

14.1.3.2.1 Analytics as a service market, by component

TABLE 227 ANALYTICS AS A SERVICE MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 228 ANALYTICS AS A SERVICE MARKET SIZE, BY SOLUTION, 2017–2024 (USD MILLION)

TABLE 229 ANALYTICS AS A SERVICE MARKET SIZE, BY SERVICE, 2017–2024 (USD MILLION)

TABLE 230 ANALYTICS AS A SERVICE MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2024 (USD MILLION)

14.1.3.2.2 Analytics as a service market, by deployment mode

TABLE 231 ANALYTICS AS A SERVICE MARKET SIZE, BY DEPLOYMENT MODE, 2017–2024 (USD MILLION)

14.1.3.2.3 Analytics as a service market, by organization size

TABLE 232 ANALYTICS AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

14.1.3.2.4 Analytics as a service market, by industry vertical

TABLE 233 ANALYTICS AS A SERVICE MARKET SIZE, BY INDUSTRY VERTICAL, 2017–2024 (USD MILLION)

14.1.3.2.5 Analytics as a service market, by region

TABLE 234 ANALYTICS AS A SERVICE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14.1.4 CUSTOMER JOURNEY ANALYTICS MARKET– GLOBAL FORECAST TO 2022

14.1.4.1 Market definition

14.1.4.2 Market overview

TABLE 235 GLOBAL CUSTOMER JOURNEY ANALYTICS MARKET SIZE AND GROWTH RATE, 2017–2022 (USD MILLION AND Y-O-Y %)

14.1.4.2.1 Customer journey analytics market, by component

TABLE 236 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY COMPONENT, 2017–2022 (USD MILLION)

TABLE 237 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY SERVICE, 2017–2022 (USD MILLION)

TABLE 238 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

14.1.4.2.2 Customer journey analytics market, by deployment mode

TABLE 239 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

14.1.4.2.3 Customer journey analytics market, by organization size

TABLE 240 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

14.1.4.2.4 Customer journey analytics market, by vertical

TABLE 241 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY VERTICAL, 2017–2022 (USD MILLION)

14.1.4.2.5 Customer journey analytics market, by application

TABLE 242 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY APPLICATION, 2017–2022 (USD MILLION)

14.1.4.2.6 Customer journey analytics market, by region

TABLE 243 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY REGION, 2017–2022 (USD MILLION)

14.2 INDUSTRY EXPERTS

14.3 DISCUSSION GUIDE

14.4 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.5 AVAILABLE CUSTOMIZATIONS

14.6 RELATED REPORTS

14.7 AUTHOR DETAILS

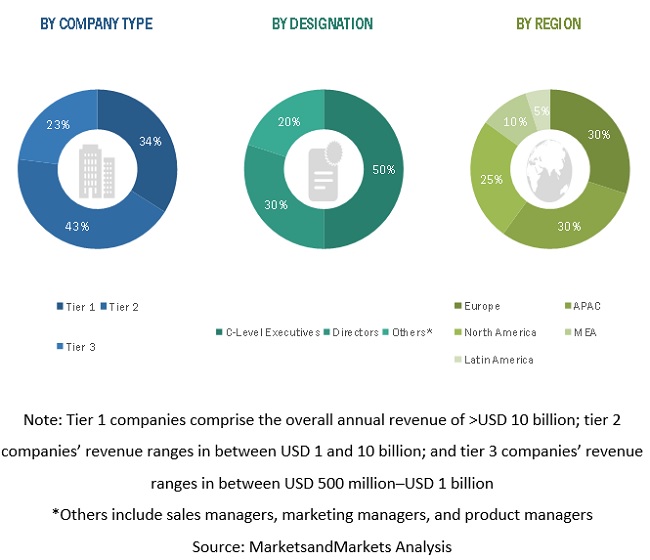

The study involved four major activities in estimating the current market size of the Hadoop big data analytics market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Hadoop big data analytics market.

Secondary Research

In the secondary research process, various secondary sources, such as Analytics Insight, Data Science and Artificial Intelligence for Communications, and related magazines, have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases & investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from Hadoop big data analytics solution vendors, system integrators, professional service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Hadoop big data analytics market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the market. The bottom-up approach was used to arrive at the overall market size of the global Hadoop big data analytics market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentages, shares, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the Hadoop big data analytics market by component (solutions and services), deployment mode, organization size, business function, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the Hadoop big data analytics market

- To analyze the impact of the COVID-19 pandemic on the Hadoop big data analytics market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American Hadoop big data analytics market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Hadoop Big Data Analytics Market

Understand the market opportunity for hadoop and analyze the competitive landscape

Interested in market insights on Consulting Services for Big Data, Telecom, and Financial Services

Understand the TAM for Big Data infrastructure in different verticals and regions

Gather insights on market breakdown by type and region within the US

Understand he Big Data/ Data&Analytics market size for consulting services, growth rates and market issues/trends/opportunities

Understand the Big Data Platform market size that supports Stream Processing, Interactive analysis and Batch Processing