Customer Journey Analytics Market by Component, Organization Size, Deployment Mode, Data Source, Application (Campaign Management & Product Management), Vertical (BFSI, Retail & eCommerce, & Telecommunications and IT), and Region - Global Forecast to 2026

The global Customer Journey Analytics Market size was valued at $8.3 billion in 2020 and it is projected to reach $25.1 billion by the end of 2026 at a CAGR of 20.3% during the forecast period.

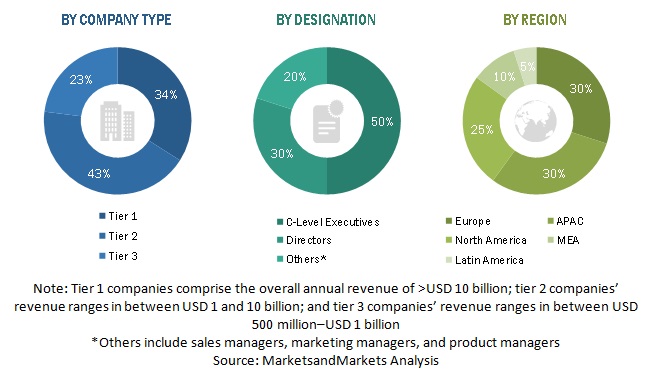

Various factors such as the growing need to provide seamless customer experience, a higher focus on better customer engagement strategies through omnichannel, and adoption of advanced analytics solutions to leverage the increasing customer data and reduce customer churn rate, are expected to drive the demand for customer journey analytics solutions and services.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The customer journey analytics market is projected to witness a slight slowdown in its growth in 2020 due to COVID-19 lockdowns imposed worldwide. These lockdowns have been impacting all the verticals, including retail and eCommerce, BFSI, healthcare and life sciences, media and entertainment, and government. The pandemic has led to a shift in customer behavior, with lockdown driving customers to opt for omnichannel for purchasing. The condition is expected to come under control by mid-2021. The demand for customer journey analytics solutions and services is expected to increase due to customers shifting toward online purchasing. Due to lockdown regulations, there was a surge in the number of online media and entertainment users, which has created the demand for customer journey analytics solutions and services for understanding customer needs.

Market Dynamics

Driver: Growing need to provide better customer experience to drive need for customer journey analytics

The recent technology and digital transformation boom have led to a customer revolution in terms of changes in buying behaviors, choices, and modes. Customers no longer base their loyalty on price or product. Instead, they stay loyal to companies due to the experience they receive. Customer experience encompasses every aspect of a company’s offering—the quality of customer care, of course, but also advertising, packaging, product and service features, ease of use, and reliability. Exceptional customer experience is the best competitive advantage a company can secure. Customer experience has risen in importance over the last decade and is now lauded as the primary competitive battleground for enterprises across industries. From financial services and telecommunications to healthcare and retail, it is now recognized that exceptional CX can significantly impact business outcomes, such as a share of wallet, retention, and customer lifetime value. Companies should have the ability to use both active and passive customer data to better gauge customer and their journey for creating the optimal CX. Companies must collect, analyze, understand — and most importantly use — customer data to learn how to make CX better.

Restraint: Difficulty in quantifying customer experience RoI

All organizations want to measure and manage their efforts with numbers. Quantifying the RoI of customer experience is the toughest challenge for CX leaders, but it is most important for brands to justify financial results. Organizations across industries struggle to connect customer behavior and journeys to business-critical KPIs, such as revenue, churn, and cost to serve. The organization faces an inability to measure the impact of CX on business outcomes, which makes it difficult to secure a CX budget. Organizations that are challenged to quantify the ROI of CX initiatives report stagnant budgets or small decreases. Without resources, CX leaders cannot invest in the technology necessary to effectively measure and improve customer experience. Investing in CX brings a strong return on investment. The key is using data to prove the RoI of CX. Investing in customer experience builds a powerful lifeline between customers and the company. A large amount of structured and unstructured databases require significant resources, such as money, time, and employees, to analyze. This creates issues that block the optimum RoI from customer journey analytics.

Opportunity: Rise in demand for real-time customer journey analytics for generating actionable insights

In today’s digital and big data era, data can be structured or unstructured, and most of it resides outside enterprises. Thus, it has become crucial to have a platform that can be used to integrate various customer information. Currently, enterprises need a comprehensive customer journey analytics platform that can collect a high volume of customer data in real time to provide meaningful insights. This can assimilate data, structure, refine, provide the exploratory capability, identify and evaluate various patterns, and help make insight-based decisions faster. The customer journey analytics offers layers that enable users to explore data in understanding customer needs and project trends, and draw valuable insights using known analysis methods, such as sales and marketing optimization, cost optimization, risk management, and social network analysis. The latest data and analytics tools are projected to provide growth opportunities to analyze data for the benefit of customers and the market. They help in making changes in internal processes and developing the product and service model.

Challenge: Data security and privacy concerns

Security threats are projected to grow even further in the future. In the past four years, the financial impact of cybercrimes has increased by nearly 78%, and the time it takes to resolve cyberattacks has doubled. The increase in data from various sources is cumbersome for several IT teams. The inefficiency of managing exabytes and petabytes of data has increased the chances of security breaches and data losses. In today’s competitive marketplace, the marketing team requires real-time and secure data to deliver an outstanding customer experience. The organizations are gathering data through multiple touchpoints and measuring it virtually. Such data, which is used in support and communications, may include a variety of data types, such as public information, big data, and small data collected from the customers. This data can include permissions, individual preferences, and updated contact information on products, services, and communication platforms. Thus, the vendors need to ensure high-level data security to maintain customer trust.

Among verticals, the retail and eCommerce segment to grow at a the highest CAGR during the forecast period

The customer journey analytics market is segmented on verticals into BFSI, government, healthcare and life sciences, retail and eCommerce, manufacturing, telecommunications and IT, transportation and logistics, media and entertainment, travel and hospitality, and other verticals (education, and energy and utilities). The BFSI vertical is expected to account for the largest market size during the forecast period. Moreover, the retail and eCommerce vertical is expected to grow at the highest CAGR during the forecast period. To meet the rapidly changing customer expectations, retail and eCommerce companies are inclining toward customer journey analytics solutions, which can monitor the customer’s journey in real time across different channels and guide them to meet their requirements.

The on-premises segments is expected to hold the larger market size during the forecast period

The customer journey analytics market by deployment mode has been segmented into on-premises and cloud. The cloud segment is expected to grow at a rapid pace during the forecast period. The high CAGR of the cloud segment can be attributed to the availability of easy deployment options and minimal requirements of capital and time. These factors are supporting the current lockdown scenario of COVID-19 as social distancing, and online purchasing of goods hit the industry and are expected to drive the adoption of cloud-based customer journey analytics solutions. Highly secure customer data encryption and complete data visibility and control feature are responsible for the higher adoption of on-premises-based customer journey analytics solutions.

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global customer journey analytics market, while Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. T The growing awareness for enhancing customer experience in key countries, such as China, India, and Japan, is expected to fuel the adoption of customer journey analytics solutions and services. The commercialization of the AI and ML technology, giving rise to increased customer data, and the need for further advancements to leverage its benefits to the maximum are expected to drive the adoption of customer journey analytics solutions in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The customer journey analytics vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global customer journey analytics market include Oracle (US), Adobe (US), Salesforce (US), NICE (US), SAP (Germany), Microsoft (US), Google (US), Genesys (US), Cisco (US), Teradata (US), Alterian (US), [24]7.ai (US), Pointillist (US), BryterCX (US), inQuba (South Africa), Kitewheel (US), Verint (US), Thunderhead (UK), Servion (India), CallMiner (US), NGDATA (Belgium), Acoustic (US), FirstHive (US), CaliberMind (US), Amperity (US), and Cerebri AI (US). The study includes an in-depth competitive analysis of these key players in the customer journey analytics market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value for 2020 |

US $8.3 billion |

|

Market size value for 2026 |

US $25.1 billion |

|

CAGR Growth Rate |

20.3% |

|

Largest Market |

North America |

|

Market size available for years |

2015–2026 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2026 |

|

Forecast units |

USD Billion |

|

Segments covered |

Component, organization size, deployment mode, data source, application, vertical, and region |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Oracle (US), Adobe (US), Salesforce (US), NICE (US), SAP (Germany), Google (US), Microsoft (US), Genesys (US), Cisco (US), Teradata (US), Alterian (US), [24]7.ai (US), Pointillist (US), BryterCX (US), inQuba (South Africa), Kitewheel (US), Verint (US), Thunderhead (UK), Servion (India), CallMiner (US), NGDATA (Belgium), Acoustic (US), FirstHive (US), CaliberMind (US), Amperity (US), and Cerebri AI (US) |

This research report categorizes the customer journey analytics market based on components, deployment mode, organization size, data source, application, vertical, and region.

By Component:

- Solutions

-

Services

- Managed Services

-

Professional Services

- Support and Maintenance

- Deployment and Integration

- Consulting

By organization size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By deployment mode:

- On-premises

- Cloud

By data source:

- Web

- Social Media

- Mobile

- Store

- Call Center

- Other Data Sources (Advertising, Loyalty Programs, Surveys, and Promotional Events)

By application:

- Customer Segmentation and Targeting

- Customer Experience Management

- Customer Behavioural Analysis

- Customer Churn and Retention Management

- Brand Management

- Campaign Management

- Product Management

- Other Applications (Compliance Management, Omnichannel Analysis and Customer Customer Lifetime Value Management)

By vertical:

- BFSI

- Government

- Healthcare and Life Sciences

- Retail and eCommerce

- Manufacturing

- Transportation and Logistics

- Media and Entertainment

- Telecommunications and IT

- Travel and Hospitality

- Other Verticals (Energy and Utilities, and Education)

By region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- KSA

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In January 2021, NICE launched the new integrated capabilities between NICE inContact CXone and Microsoft Teams, empowering real-time recording as well as compatibility with a range of related applications. This launch of new capabilities will enable customers to safeguard every interaction using global, carrier-grade voice services.

- In December 2020, Genesys launched Genesys Digital, a new business unit of Genesys. Genesys Digital will focus on enabling companies to keep pace with consumers’ evolving preferences for digital engagement across the customer journey, whether using webchat for an inquiry, scheduling an appointment via text, or receiving care from a chatbot.

- In November 2020, SAP completed the acquisition of Emarsys, an omnichannel customer engagement platform provider. The Emarsys products will be added to the SAP Customer Experience portfolio. The addition of Emarsys products in the SAP Customer Experience portfolio will enable SAP to engage customers and deliver hyper-personalized, omnichannel engagements in real time.

- In November 2020, NICE and NTT Data Germany formed a strategic partnership. The partnership aims to improve customer experience and drive cloud transformations with CXone. As a strategic partner in the EMEA region, NTT DATA will sell and support the entire NICE solution suite, including CXone, NICE Nexidia Analytics, and NICE Robotic Automation.

- In May 2020, Google Cloud and Splunk partnered to help customers gain deeper insights from data. This partnership aimed to help organizations drive actionable insights from their data and enable better, faster decisions with real-time visibility across the enterprise.

- In April 2020, Teradata announced the general availability of Teradata Vantage Customer Experience (CX) through the partnership with Celebrus. Vantage CX helps brands deliver relevant, personalized experiences in real time, across all customer interactions and touchpoints.

- In February 2020, Google acquired Looker, a provider of a unified platform for business intelligence, data applications, and embedded analytics. This acquisition would enable Google to extend its analytics offering by defining two capabilities that would define business metrics and provide an analytical platform to make business decisions.

- In January 2020, Adobe announced the availability of Adobe Experience Manager as a Cloud Service. Adobe Experience Manager as a Cloud Service brings together rich out-of-box capabilities and content customization options that marketers and developers demand.

- In November 2019, Salesforce launched Customer 360 Truth. This new set of data and identity services enables companies to build a single source of truth across all their customer relationships. This launch will enable companies to better cater to their customers and predict their needs, such as addressing a customer service problem, creating a personalized marketing journey, predicting the best sales opportunities, or surfacing product recommendations.

- In March 2019, Adobe announced the global availability of the Adobe Experience Platform. The platform claimed to be open and extensible that brings together data from across the enterprise, enabling real-time customer profiles leveraging Adobe Sensei AI and ML.

Frequently Asked Questions (FAQ):

How big is the customer journey analytics market?

What is growth rate of the customer journey analytics market?

What are the key applications end-users looking for customer journey analytics solutions?

Who are the key players in customer journey analytics market?

Who will be the leading hub for customer journey analytics market?

What is the customer journey analytics market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 49)

2.1 RESEARCH DATA

FIGURE 6 CUSTOMER JOURNEY ANALYTICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF THE CUSTOMER JOURNEY ANALYTICS MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF CUSTOMER JOURNEY ANALYTICS THROUGH OVERALL CUSTOMER JOURNEY ANALYTICS SPENDING

FIGURE 13 VENDOR ANALYSIS: ORACLE: COMPANY REVENUE ESTIMATION

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION QUADRANT METHODOLOGY

FIGURE 14 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION QUADRANT METHODOLOGY

FIGURE 15 STARTUP/SME EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

2.9 IMPLICATIONS OF COVID-19 ON THE CUSTOMER JOURNEY ANALYTICS MARKET

FIGURE 16 QUARTERLY IMPACT OF COVID-19 DURING 2020–2021

3 EXECUTIVE SUMMARY (Page No. - 66)

TABLE 4 GLOBAL CUSTOMER JOURNEY ANALYTICS MARKET SIZE AND GROWTH RATE, 2015–2019 (USD MILLION, Y-O-Y%)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2020–2026 (USD MILLION, Y-O-Y%)

FIGURE 17 SOLUTIONS SEGMENT TO HOLD A LARGER MARKET SIZE IN 2020

FIGURE 18 PROFESSIONAL SERVICES SEGMENT TO HOLD A HIGHER MARKET SHARE IN 2020

FIGURE 19 DEPLOYMENT AND INTEGRATION SEGMENT TO HOLD THE LARGEST MARKET SIZE IN 2020

FIGURE 20 LARGE ENTERPRISES SEGMENT TO HOLD A HIGHER MARKET SHARE IN 2020

FIGURE 21 ON-PREMISES SEGMENT TO HOLD A LARGER MARKET SIZE IN 2020

FIGURE 22 WEB SEGMENT TO HOLD THE HIGHEST MARKET SHARE IN 2020

FIGURE 23 CAMPAIGN MANAGEMENT SEGMENT TO HOLD THE LARGEST MARKET SIZE IN 2020

FIGURE 24 BANKING, INSURANCE, AND FINANCIAL SERVICES VERTICAL TO HOLD THE LARGEST MARKET SIZE IN 2020

FIGURE 25 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 73)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CUSTOMER JOURNEY ANALYTICS MARKET

FIGURE 26 GROWING NEED TO PROVIDE SEAMLESS CUSTOMER EXPERIENCE AND INCREASING ADOPTION OF OMNICHANNEL STRATEGIES TO REDUCE CUSTOMER CHURN TO DRIVE THE MARKET GROWTH

4.2 MARKET, TOP THREE APPLICATIONS

FIGURE 27 CAMPAIGN MANAGEMENT SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

4.3 MARKET, BY REGION

FIGURE 28 NORTH AMERICA TO ACCOUNT FOR THE HIGHEST MARKET SHARE IN THE MARKET IN 2020

4.4 NORTH AMERICAN MARKET, BY COMPONENT AND TOP THREE DATA SOURCES

FIGURE 29 SOLUTIONS AND WEB SEGMENTS TO ACCOUNT FOR HIGH MARKET SHARES IN 2020

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 76)

5.1 INTRODUCTION

5.2 CUSTOMER JOURNEY ANALYTICS: STAGES

FIGURE 30 STAGES OF THE CUSTOMER JOURNEY ANALYTICS MARKET

5.3 MARKET DYNAMICS

FIGURE 31 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARKET

5.3.1 DRIVERS

5.3.1.1 Growing need to provide better customer experience to drive the need for customer journey analytics

5.3.1.2 Rising need to plan better customer engagement strategies through omnichannel

5.3.1.3 Increasing data volume to drive the demand for advanced customer journey analytics solution to reduce customer churn rate

5.3.2 RESTRAINTS

5.3.2.1 Difficulties in quantifying customer experience RoI

5.3.2.2 Compliance with region-specific data privacy laws and regulations

5.3.3 OPPORTUNITIES

5.3.3.1 Rise in the demand for real-time customer journey analytics for generating actionable insights

FIGURE 32 REAL-TIME CUSTOMER ANALYTICS BUSINESS INVESTMENTS

5.3.3.2 COVID-19-led acceleration of organizations for new customer engagement through digital experiences

5.3.4 CHALLENGES

5.3.4.1 Data security and privacy concerns

5.3.4.2 Difficulty in data synchronization as customer data collected from multiple sources is stored in silos

5.3.4.3 Lack of understanding single view of the customer journey

FIGURE 33 PERCENTAGE OF RESPONDENTS TO DESCRIBE THE CURRENT STATE OF THEIR ORGANIZATIONS IN TERMS OF MANAGING AND ACTIONING CROSS-CHANNEL DATA

5.3.5 CUMULATIVE GROWTH ANALYSIS

5.4 CUSTOMER JOURNEY ANALYTICS MARKET: ECOSYSTEM

FIGURE 34 MARKET ECOSYSTEM

5.5 CASE STUDY ANALYSIS

5.5.1 METRO BANK REINVENTED CUSTOMER SERVICE WITH MICROSOFT DYNAMIC 365

5.5.2 SPAR SWITZERLAND, SUPPLIER OF MERCHANDISING AND MARKETING SERVICES, IMPLEMENTED SAP MARKETING CLOUD

5.5.3 SALESFORCE ENABLED INDIAN SCHOOL OF BUSINESS AND FINANCE TO GROW APPLICANTS YEAR BY YEAR

5.5.4 ABU DHABI DIGITAL AUTHORITY STRIVED TO LEAD DIGITAL FUTURE WITH MICROSOFT DYNAMIC 365

5.5.5 HEARST CORPORATION INCREASED CUSTOMER ENGAGEMENT WITH AWS

5.5.6 SPRINT BUILT SUPERIOR CUSTOMER EXPERIENCE WITH ADOBE MARKETING CLOUD

5.5.7 WESTERN UNION ADOPTED NICE CUSTOMER JOURNEY ANALYTICS TO MAXIMIZE RETENTION AND IMPROVE CUSTOMER EXPERIENCE

5.5.8 ENERGIE BADEN-WÜRTTEMBERG DELIVERED TRUE CUSTOMER WITH THUNDERHEAD ONE ENGAGEMENT HUB

5.5.9 NORTHWELL ADOPTED MICROSOFT DYNAMIC 365 TO OPTIMIZE PATIENT CARE

5.5.10 A LUXURY HOTEL AND RESORT COMPANY DISCOVERED UPSELL OPPORTUNITIES THROUGH POINTILLIST CUSTOMER JOURNEY ANALYTICS

5.5.11 SALESFORCE HELPED PHILIPS DEVELOP NEW WAYS TO CATER TO THE NEEDS OF CUSTOMERS

5.5.12 SALESFORCE ENABLED MAERSK TEAM TO CREATE PERSONALIZED CUSTOMER EXPERIENCE

5.6 CUSTOMER JOURNEY ANALYTICS MARKET: COVID-19 IMPACT

FIGURE 35 MARKET TO WITNESS MINIMAL SLOWDOWN IN GROWTH IN 2020

5.7 PATENT ANALYSIS

5.7.1 METHODOLOGY

5.7.2 DOCUMENT TYPE

TABLE 6 PATENTS FILED

5.7.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 36 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2010-2020

5.7.3.1 Top Applicants

FIGURE 37 TOP 11 COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2010-2020

TABLE 7 TOP 17 PATENT OWNERS (US) IN THE CUSTOMER JOURNEY ANALYTICS MARKET, 2010-2020

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 38 SUPPLY CHAIN ANALYSIS

5.9 TECHNOLOGY ANALYSIS

5.9.1 ARTIFICIAL INTELLIGENCE AND CUSTOMER JOURNEY ANALYTICS

5.9.2 BIG DATA AND CUSTOMER JOURNEY ANALYTICS

5.9.3 INTERNET OF THINGS AND CUSTOMER JOURNEY ANALYTICS

5.10 PRICING MODEL ANALYSIS

TABLE 8 PRICING: CUSTOMER JOURNEY ANALYTICS SOLUTIONS

5.11 PORTER’S FIVE FORCE ANALYSIS

FIGURE 39 PORTER’S FIVE FORCE ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 SCENARIO

TABLE 9 CRITICAL FACTORS TO IMPACT THE GROWTH OF THE CUSTOMER JOURNEY ANALYTICS MARKET

6 CUSTOMER JOURNEY ANALYTICS MARKET, BY COMPONENT (Page No. - 103)

6.1 INTRODUCTION

6.1.1 COMPONENTS: MARKET DRIVERS

6.1.2 COMPONENTS: COVID-19 IMPACT

FIGURE 40 SERVICES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 10 MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 11 MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

6.2 SOLUTIONS

TABLE 12 SOLUTIONS: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 13 SOLUTIONS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3 SERVICES

FIGURE 41 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 14 SERVICES: CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 15 SERVICES: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 16 SERVICES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 17 SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

FIGURE 42 SUPPORT AND MAINTENANCE SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 18 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 19 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 20 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 21 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.1.1 Consulting

TABLE 22 CONSULTING: CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 23 CONSULTING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.1.2 Support and maintenance

TABLE 24 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 25 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.1.3 Deployment and integration

TABLE 26 DEPLOYMENT AND INTEGRATION: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 27 DEPLOYMENT AND INTEGRATION: ENTERPRISE ARCHITECTURE TOOLS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.2 MANAGED SERVICES

TABLE 28 MANAGED SERVICES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 29 MANAGED SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7 CUSTOMER JOURNEY ANALYTICS MARKET, BY ORGANIZATION SIZE (Page No. - 116)

7.1 INTRODUCTION

7.1.1 ORGANIZATION SIZE: MARKET DRIVERS

7.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 43 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 30 MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 31 MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

7.2 LARGE ENTERPRISES

TABLE 32 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 33 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 34 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 35 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8 CUSTOMER JOURNEY ANALYTICS MARKET, BY DEPLOYMENT MODE (Page No. - 122)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODES: MARKET DRIVERS

8.1.2 DEPLOYMENT MODES: COVID-19 IMPACT

FIGURE 44 CLOUD SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 36 MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 37 MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

8.2 ON-PREMISES

TABLE 38 ON-PREMISES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 39 ON-PREMISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.3 CLOUD

TABLE 40 CLOUD: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 41 CLOUD: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9 CUSTOMER JOURNEY ANALYTICS MARKET, BY DATA SOURCE (Page No. - 128)

9.1 INTRODUCTION

9.1.1 DATA SOURCES: MARKET DRIVERS

9.1.2 DATA SOURCES: COVID-19 IMPACT

FIGURE 45 WEB SEGMENT TO RECORD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 42 MARKET SIZE, BY DATA SOURCE, 2015–2019 (USD MILLION)

TABLE 43 MARKET SIZE, BY DATA SOURCE, 2020–2026 (USD MILLION)

9.2 WEB

TABLE 44 WEB: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 45 WEB: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.3 SOCIAL MEDIA

TABLE 46 SOCIAL MEDIA: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 47 SOCIAL MEDIA: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.4 MOBILE

TABLE 48 MOBILE: CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 49 MOBILE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.5 EMAIL

TABLE 50 EMAIL: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 51 EMAIL: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.6 STORE

TABLE 52 STORE: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 53 STORE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.7 CALL CENTER

TABLE 54 CALL CENTER: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 55 CALL CENTER: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.8 OTHER DATA SOURCES

TABLE 56 OTHER DATA SOURCES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 57 OTHER DATA SOURCES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10 CUSTOMER JOURNEY ANALYTICS MARKET, BY APPLICATION (Page No. - 139)

10.1 INTRODUCTION

10.1.1 APPLICATIONS: MARKET DRIVERS

10.1.2 APPLICATIONS: COVID-19 IMPACT

FIGURE 46 CAMPAIGN MANAGEMENT SEGMENT TO RECORD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 58 MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 59 MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

10.2 CUSTOMER SEGMENTATION AND TARGETING

TABLE 60 CUSTOMER SEGMENTATION AND TARGETING: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 61 CUSTOMER SEGMENTATION AND TARGETING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.3 CUSTOMER EXPERIENCE MANAGEMENT

TABLE 62 CUSTOMER EXPERIENCE MANAGEMENT: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 63 CUSTOMER EXPERIENCE MANAGEMENT: CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.4 CUSTOMER BEHAVIORAL ANALYSIS

TABLE 64 CUSTOMER BEHAVIORAL ANALYSIS: CUSTOMER JOURNEY ANALYSIS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 65 CUSTOMER BEHAVIORAL ANALYSIS: CUSTOMER JOURNEY ANALYSIS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.5 CUSTOMER CHURN AND RETENTION MANAGEMENT

TABLE 66 CUSTOMER CHURN AND RETENTION MANAGEMENT: CUSTOMER JOURNEY ANALYSIS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 67 CUSTOMER CHURN AND RETENTION MANAGEMENT: CUSTOMER JOURNEY ANALYSIS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.6 BRAND MANAGEMENT

TABLE 68 BRAND MANAGEMENT: CUSTOMER JOURNEY ANALYSIS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 69 BRAND MANAGEMENT: CUSTOMER JOURNEY ANALYSIS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.7 CAMPAIGN MANAGEMENT

TABLE 70 CAMPAIGN MANAGEMENT: CUSTOMER JOURNEY ANALYSIS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 71 CAMPAIGN MANAGEMENT: CUSTOMER JOURNEY ANALYSIS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.8 PRODUCT MANAGEMENT

TABLE 72 PRODUCT MANAGEMENT: CUSTOMER JOURNEY ANALYSIS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 73 PRODUCT MANAGEMENT: CUSTOMER JOURNEY ANALYSIS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.9 OTHER APPLICATIONS

TABLE 74 OTHER APPLICATIONS: CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 75 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11 CUSTOMER JOURNEY ANALYTICS MARKET, BY VERTICAL (Page No. - 152)

11.1 INTRODUCTION

11.1.1 VERTICALS: MARKET DRIVERS

11.1.2 VERTICALS: COVID-19 IMPACT

FIGURE 47 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 76 MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 77 MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 78 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 79 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.3 GOVERNMENT

TABLE 80 GOVERNMENT: CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 81 GOVERNMENT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.4 HEALTHCARE AND LIFE SCIENCES

TABLE 82 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 83 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.5 RETAIL AND ECOMMERCE

TABLE 84 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 85 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.6 MANUFACTURING

TABLE 86 MANUFACTURING: CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 87 MANUFACTURING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.7 TELECOMMUNICATIONS AND INFORMATION TECHNOLOGY

TABLE 88 TELECOMMUNICATIONS AND INFORMATION TECHNOLOGY: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 89 TELECOMMUNICATIONS AND INFORMATION TECHNOLOGY: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.8 MEDIA AND ENTERTAINMENT

TABLE 90 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 91 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.9 TRANSPORTATION AND LOGISTICS

TABLE 92 TRANSPORTATION AND LOGISTICS: CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 93 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.10 TRAVEL AND HOSPITALITY

TABLE 94 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 95 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.11 OTHER VERTICALS

TABLE 96 OTHER VERTICALS: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 97 OTHER VERTICALS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12 CUSTOMER JOURNEY ANALYTICS MARKET, BY REGION (Page No. - 168)

12.1 INTRODUCTION

FIGURE 48 INDIA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 49 ASIA PACIFIC TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 98 MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 99 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: CUSTOMER JOURNEY ANALYTICS MARKET DRIVERS

12.2.2 NORTH AMERICA: COVID-19 IMPACT

12.2.3 NORTH AMERICA: REGULATIONS

12.2.3.1 Health Insurance Portability and Accountability Act of 1996

12.2.3.2 California Consumer Privacy Act

12.2.3.3 Gramm–Leach–Bliley Act

12.2.3.4 Health Information Technology for Economic and Clinical Health Act

12.2.3.5 Sarbanes Oxley Act

12.2.3.6 Federal Information Security Management Act

12.2.3.7 Payment Card Industry Data Security Standard

12.2.3.8 Federal Information Processing Standards

FIGURE 50 NORTH AMERICA: MARKET SNAPSHOT

TABLE 100 NORTH AMERICA: CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2015–2019 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 104 NORTH AMERICA: CUSTOMER JOURNEY ANALYTICS SIZE, BY PROFESSIONAL SERVICE, 2015–2019 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 109 NORTH AMERICA: CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET SIZE, BY DATA SOURCE, 2015–2019 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET SIZE, BY DATA SOURCE, 2020–2026 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 115 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

12.2.4 UNITED STATES

12.2.5 CANADA

12.3 EUROPE

12.3.1 EUROPE: CUSTOMER JOURNEY ANALYTICS MARKET DRIVERS

12.3.2 EUROPE: COVID-19 IMPACT

12.3.3 EUROPE: REGULATIONS

12.3.3.1 General Data Protection Regulation

12.3.3.2 European Committee for Standardization

12.3.3.3 European Technical Standards Institute

TABLE 118 EUROPE: MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY SERVICE, 2015–2019 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2019 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 125 EUROPE: CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY DATA SOURCE, 2015–2019 (USD MILLION)

TABLE 129 EUROPE: MARKET SIZE, BY DATA SOURCE, 2020–2026 (USD MILLION)

TABLE 130 EUROPE: MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 131 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 132 EUROPE: MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 133 EUROPE: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 134 EUROPE: MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 135 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

12.3.4 UNITED KINGDOM

12.3.5 GERMANY

12.3.6 FRANCE

12.3.7 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: CUSTOMER JOURNEY ANALYTICS MARKET DRIVERS

12.4.2 ASIA PACIFIC: COVID-19 IMPACT

12.4.3 ASIA PACIFIC: REGULATIONS

12.4.3.1 Privacy Commissioner for Personal Data

12.4.3.2 Act on the Protection of Personal Information

12.4.3.3 Critical Information Infrastructure

12.4.3.4 International Organization for Standardization 27001

12.4.3.5 Personal Data Protection Act

FIGURE 51 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 136 ASIA PACIFIC: CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2015–2019 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2019 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 146 ASIA PACIFIC: CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY DATA SOURCE, 2015–2019 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET SIZE, BY DATA SOURCE, 2020–2026 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

12.4.4 CHINA

12.4.5 JAPAN

12.4.6 INDIA

12.4.7 REST OF ASIA PACIFIC

12.5 MIDDLE EAST AND AFRICA

12.5.1 MIDDLE EAST AND AFRICA: CUSTOMER JOURNEY ANALYTICS MARKET DRIVERS

12.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

12.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

12.5.3.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

12.5.3.2 Cloud Computing Framework

12.5.3.3 GDPR Applicability in the Kingdom of Saudi Arabia (KSA)

12.5.3.4 Protection of Personal Information Act

TABLE 154 MIDDLE EAST AND AFRICA: CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 155 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 156 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2015–2019 (USD MILLION)

TABLE 157 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 158 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2019 (USD MILLION)

TABLE 159 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 160 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 161 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 162 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 163 MIDDLE EAST AND AFRICA: CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 164 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DATA SOURCE, 2015–2019 (USD MILLION)

TABLE 165 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DATA SOURCE, 2020–2025 (USD MILLION)

TABLE 166 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 169 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 170 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 171 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

12.5.4 KINGDOM OF SAUDI ARABIA

12.5.5 UNITED ARAB EMIRATES

12.5.6 SOUTH AFRICA

12.5.7 REST OF MIDDLE EAST AND AFRICA

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: CUSTOMER JOURNEY ANALYTICS MARKET DRIVERS

12.6.2 LATIN AMERICA: COVID-19 IMPACT

12.6.3 LATIN AMERICA: REGULATIONS

12.6.3.1 Brazil Data Protection Law

12.6.3.2 Argentina Personal Data Protection Law No. 25.326

TABLE 172 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 173 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 20120–2026 (USD MILLION)

TABLE 174 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2015–2019 (USD MILLION)

TABLE 175 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 176 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015-2019 (USD MILLION)

TABLE 177 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 178 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 179 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 180 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 181 LATIN AMERICA: CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 182 LATIN AMERICA: MARKET SIZE, BY DATA SOURCE, 2015–2019 (USD MILLION)

TABLE 183 LATIN AMERICA: MARKET SIZE, BY DATA SOURCE, 2020–2026 (USD MILLION)

TABLE 184 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 185 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 186 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 187 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 188 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 189 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

12.6.4 BRAZIL

12.6.5 MEXICO

12.6.6 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 229)

13.1 OVERVIEW

13.2 HISTORICAL REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 52 REVENUE ANALYSIS OF KEY MARKET PLAYERS

13.3 COMPANY EVALUATION QUADRANT

13.3.1 STAR

13.3.2 EMERGING LEADERS

13.3.3 PERVASIVE PLAYERS

13.3.4 PARTICIPANTS

FIGURE 53 CUSTOMER JOURNEY ANALYTICS MARKET (GLOBAL), COMPANY EVALUATION QUADRANT, 2020

13.3.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 54 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE MARKET

13.3.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 55 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE MARKET

13.3.7 RANKING OF KEY MARKET PLAYERS IN THE CUSTOMER JOURNEY ANALYTICS MARKET, 2020

FIGURE 56 RANKING OF KEY PLAYERS, 2020

13.3.8 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 190 COMPANY PRODUCT FOOTPRINT

FIGURE 57 COMPANY APPLICATION FOOTPRINT

FIGURE 58 COMPANY VERTICAL FOOTPRINT

TABLE 191 COMPANY REGION FOOTPRINT

13.4 COMPETITIVE SCENARIO

13.4.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 192 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2018–2021

13.4.2 BUSINESS EXPANSIONS

TABLE 193 BUSINESS EXPANSIONS, 2019-2020

13.4.3 MERGERS AND ACQUISITIONS

TABLE 194 MERGERS AND ACQUISITIONS, 2018–2020

13.4.4 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS

TABLE 195 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS, 2018–2021

13.5 STARTUP/SME EVALUATION QUADRANT, 2020

13.5.1 PROGRESSIVE COMPANIES

13.5.2 RESPONSIVE COMPANIES

13.5.3 DYNAMIC COMPANIES

13.5.4 STARTING BLOCKS

FIGURE 59 CUSTOMER JOURNEY ANALYTICS MARKET (GLOBAL), STARTUP/SME EVALUATION QUADRANT, 2020

13.5.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 60 PRODUCT PORTFOLIO ANALYSIS OF KEY STARTUPS IN THE MARKET

13.5.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 61 BUSINESS STRATEGY EXCELLENCE OF KEY STARTUPS IN THE MARKET

13.5.7 SME/STARTUP PRODUCT FOOTPRINT ANALYSIS

TABLE 196 SME/STARTUP PRODUCT FOOTPRINT

FIGURE 62 SME/STARTUP APPLICATION FOOTPRINT

FIGURE 63 SME/STARTUP VERTICAL FOOTPRINT

TABLE 197 SME/STARTUP REGION FOOTPRINT

14 COMPANY PROFILES (Page No. - 248)

14.1 INTRODUCTION

(Business Overview, Solutions and Services Offered, Recent Developments, MNM View, Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats)*

14.2 ORACLE

TABLE 198 ORACLE: BUSINESS OVERVIEW

FIGURE 64 ORACLE: COMPANY SNAPSHOT

14.3 ADOBE

TABLE 199 ADOBE: BUSINESS OVERVIEW

FIGURE 65 ADOBE: COMPANY SNAPSHOT

14.4 SALESFORCE

TABLE 200 SALESFORCE: BUSINESS OVERVIEW

FIGURE 66 SALESFORCE: COMPANY SNAPSHOT

14.5 NICE

TABLE 201 NICE: BUSINESS OVERVIEW

FIGURE 67 NICE: COMPANY SNAPSHOT

14.6 SAP

TABLE 202 SAP: BUSINESS OVERVIEW

FIGURE 68 SAP: COMPANY SNAPSHOT

14.7 MICROSOFT

TABLE 203 MICROSOFT: BUSINESS OVERVIEW

FIGURE 69 MICROSOFT: COMPANY SNAPSHOT

14.8 GOOGLE

TABLE 204 GOOGLE: BUSINESS OVERVIEW

FIGURE 70 GOOGLE: COMPANY SNAPSHOT

14.9 GENESYS

TABLE 205 GENESYS: BUSINESS OVERVIEW

14.10 CISCO

TABLE 206 CISCO: BUSINESS OVERVIEW

FIGURE 71 CISCO: COMPANY SNAPSHOT

14.11 TERADATA

TABLE 207 TERADATA: BUSINESS OVERVIEW

FIGURE 72 TERADATA: COMPANY SNAPSHOT

14.12 ALTERIAN

14.13 [24]7.AI

14.14 BRYTERCX

14.15 VERINT

14.16 THUNDERHEAD

14.17 SERVION

14.18 CALLMINER

14.19 STARTUP/SME PROFILES

14.19.1 ACOUSTIC

14.19.2 POINTILLIST

14.19.3 NGDATA

14.19.4 KITEWHEEL

14.19.5 INQUBA

14.19.6 FIRSTHIVE

14.19.7 CALIBERMIND

14.19.8 AMPERITY

14.19.9 CEREBRI AI

*Details on Business Overview, Solutions and Services Offered, Recent Developments, MNM View, Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS (Page No. - 310)

15.1 INTRODUCTION

15.2 CUSTOMER ANALYTICS MARKET - GLOBAL FORECAST TO 2025

15.2.1 MARKET DEFINITION

15.2.2 MARKET OVERVIEW

TABLE 208 GLOBAL CUSTOMER ANALYTICS MARKET SIZE AND GROWTH, 2016–2023 (USD MILLION, Y-O-Y %)

15.2.2.1 Customer analytics market, by component

TABLE 209 CUSTOMER ANALYTICS MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

15.2.2.2 Customer analytics market, by deployment mode

TABLE 210 CUSTOMER ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

15.2.2.3 Customer analytics market, by organization size

TABLE 211 CUSTOMER ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

15.2.2.4 Customer analytics market, by application

TABLE 212 CUSTOMER ANALYTICS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

15.2.2.5 Customer analytics market, by data source

TABLE 213 CUSTOMER ANALYTICS MARKET SIZE, BY DATA SOURCE, 2018–2025 (USD MILLION)

15.2.2.6 Customer analytics market, by industry vertical

TABLE 214 CUSTOMER ANALYTICS MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

15.2.2.7 Customer analytics market, by region

TABLE 215 CUSTOMER ANALYTICS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

15.3 RETAIL ANALYTICS MARKET - GLOBAL FORECAST TO 2025

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

TABLE 216 RETAIL ANALYTICS MARKET SIZE AND GROWTH RATE, 2016–2019 (USD MILLION, Y-O-Y %)

TABLE 217 RETAIL ANALYTICS MARKET SIZE AND GROWTH RATE, 2019–2025 (USD MILLION, Y-O-Y %)

15.3.2.1 Retail analytics market, by component

TABLE 218 RETAIL ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 219 RETAIL ANALYTICS MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

15.3.2.2 Retail analytics market, by business function

TABLE 220 RETAIL ANALYTICS MARKET SIZE, BY BUSINESS FUNCTION, 2016–2019 (USD MILLION)

TABLE 221 RETAIL ANALYTICS MARKET SIZE, BY BUSINESS FUNCTION, 2019–2025 (USD MILLION)

15.3.2.3 Retail analytics market, by application

TABLE 222 RETAIL ANALYTICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 223 RETAIL ANALYTICS MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

15.3.2.4 Retail analytics market, by organization size

TABLE 224 RETAIL ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 225 RETAIL ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

15.3.2.5 Retail analytics market, by end user

TABLE 226 RETAIL ANALYTICS MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 227 RETAIL ANALYTICS MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

15.3.2.6 Retail analytics market, by region

TABLE 228 RETAIL ANALYTICS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 229 RETAIL ANALYTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

16 APPENDIX (Page No. - 322)

16.1 INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

The study involved four major activities in estimating the current market size of customer journey analytics market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the customer journey analytics market.

Secondary Research

In the secondary research process, various secondary sources, such as Data Science Journal, Institute of Electrical and Electronics Engineers (IEEE) Journals and magazines, and Journal/forums for Machine Learning (ML), Analytics India magazine, Customer Experience magazine, and other magazines have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases & investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from customer journey analytics solution vendors, system integrators, professional service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the customer journey analytics market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the market. The bottom-up approach was used to arrive at the overall market size of the global market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentages, shares, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the customer journey analytics market by component (solutions and services), organization size, deployment mode, data source, application, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the customer journey analytics market

- To analyze the impact of the COVID-19 pandemic on the customer journey analytics market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American customer journey analytics market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Customer Journey Analytics Market