Advanced Analytics Market

Advanced Analytics Market by Offering (Agentic (Copilots, Assistants, Autonomous Analytics Agents), Augmented (Insight Discovery, Automation, Orchestration), Predictive, Prescriptive), Delivery Mode (Cloud & Lakehouse, Edge) - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The advanced analytics market is expected to grow from USD 97.17 billion in 2026 to USD 193.23 billion by 2031, reflecting a 14.7% CAGR over the forecast period. This expansion mirrors broader use of data across enterprises and a steady rise in analytics-supported decision-making. Analytics is no longer treated only as a reporting layer. In many organizations, it has moved closer to operational teams. Pricing, risk, and supply chain decisions increasingly rely on analytics outputs. Cloud platforms and easier access to large datasets have made this shift more practical than in earlier years.

KEY TAKEAWAYS

-

BY REGIONBy region, North America is estimated to hold the largest market share of 38.73% in 2026.

-

BY SOLUTIONBy solution, the machine learning driven analytics segment is estimated to account for the largest market share of 44.33% in 2026

-

BY DELIVERY MODEBy delivery mode, the agent-based & autonomous delivery models segment is projected to exhibit the highest CAGR during the forecast period.

-

BY APPLICATIONBy application, the intelligent decision automation segment is set to record the highest growth rate of 17.5% during the forecast period.

-

BY VERTICALBy vertical, the energy & utilities segment is projected to witness the highest CAGR during the forecast period.

-

COMPETITIVE LANDSCAPE - Tier 1 companiesLeading market players like Google, IBM, and SAS Institute are pursuing both organic and inorganic strategies, including mergers, acquisitions, and ecosystem partnerships. Vendors are focusing on supporting decision-making across defense, infrastructure, and commercial applications

-

COMPETITIVE LANDSCAPE - Tier 2 & 3 companiesCompanies like Qilk, DataRobot, and Savant Labs, among others, have distinguished themselves among Tier 2 companies by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Earlier analytics deployments were largely focused on explaining past performance. That approach is gradually giving way to predictive and prescriptive use cases. Buyers are now paying closer attention to whether platforms can support recommendations, automation, or execution. At the same time, spending decisions have become more selective. Analytics investments are often reviewed alongside broader data and AI programs. Standalone tools are less common than they were a few years ago, particularly in large enterprises.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Commercial models in advanced analytics have changed over time. Subscription-based pricing and cloud delivery are now more common than traditional perpetual licenses. For many enterprises, analytics is consumed as a service rather than deployed as a fixed system. Usage patterns, too, have shifted. In many cases, insights now appear within operational tools instead of separate dashboards. Buyers are paying more attention to practical outcomes than to feature depth alone.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Alignment with AI spending cycles

-

Platform-centric enterprise architectures

Level

-

Data governance, security, and compliance overhead

-

Advanced analytics fails without data engineering spend

Level

-

Shift from descriptive to prescriptive & decision automation

-

Consumption-based pricing aligning analytics spend with value

Level

-

Difficulty attributing analytics ROI at enterprise scale

-

Fragmentation of analytics stack

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Alignment with AI spending cycles

Analytics investment is now assessed in the context of enterprise AI priorities. Platforms that support model deployment or operational decision-making tend to receive stronger internal support. Tools that operate outside these efforts are more likely to face delays.

Restraint: Data governance, security, and compliance overhead

Governance and compliance requirements remain a practical constraint. As analytics platforms handle larger volumes of sensitive data, managing access rights and audit requirements takes additional effort. These issues are more visible in regulated industries and across deployments spanning multiple regions.

Opportunity: Shift from descriptive to prescriptive & decision automation

Expectations around analytics use are changing. Insight generation alone is often not sufficient. Many organizations now expect analytics systems to guide or automate decisions. This has increased demand for platforms that combine analytics, AI models, and workflow integration.

Challenge: Difficulty attributing analytics ROI at enterprise scale

Despite wider adoption, linking analytics directly to financial outcomes remains difficult. Benefits are often spread across teams and processes. As a result, buyers tend to focus on operational impact and usage patterns rather than strict ROI calculations.

ADVANCED ANALYTICS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Zynex modernized its analytics workflows by adopting Savant Labs’ advanced analytics platform, replacing fragmented data systems and manual processes to enable faster insight generation and more efficient decision-making across the organization. | Approximately 60% reduction in analytics costs, improved analytics speed, enhanced decision quality, reduced manual effort, and increased overall business agility and responsiveness. |

|

Holcim partnered with C3 AI to deploy a real-time predictive maintenance solution for critical industrial assets, leveraging edge and cloud analytics to monitor equipment performance and predict failures across global operations. | Improved operational efficiency, reduced unplanned downtime, enhanced asset lifecycle management, and faster engineering response through real-time maintenance alerts and reliability insights. |

|

PepsiCo implemented Celonis’ process intelligence platform to analyze and optimize end-to-end business processes, identify inefficiencies across finance and operations, and automate critical workflows. | Delivered millions in working capital improvements, reduced rejected orders by 86%, saved over 1,000 labor hours annually, and improved productivity, process visibility, and operational efficiency. |

|

Roku adopted Anaplan’s Polaris-powered planning platform to support complex, multi-dimensional financial planning and scenario modeling, replacing legacy FP&A tools that lacked scalability and flexibility. | Gained deeper profitability insights, accelerated planning cycles, improved decision support, enhanced cross-functional collaboration, and higher precision in financial forecasting and scenario analysis. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The advanced analytics ecosystem includes both technology vendors and service providers that support analytics across the data-to-decision lifecycle. Solution providers offer platforms covering statistical analytics, machine learning–driven analytics, augmented analytics, and emerging agentic or autonomous capabilities. Service providers support deployment and day-to-day use. Together, these participants connect analytics tools with enterprise data infrastructure and business applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Advanced Analytics Market, by Offering

On the solution side, adoption of agentic and autonomous analytics is moving faster than most other categories. These tools are being explored in situations where decisions are frequent and time-sensitive. Early use cases are visible in operational analytics, risk management, and customer-facing processes. Compared with traditional advanced analytics tools, uptake in this area is progressing more quickly.

Advanced Analytics Market, by Delivery Mode

From a delivery perspective, cloud-native and lakehouse-based models account for a large share of current deployments. Enterprises are consolidating analytics workloads on shared data platforms to improve scalability and governance. These architectures are selected more often than on-premise or fragmented delivery approaches, particularly in larger organizations.

Advanced Analytics Market, by Application

Application demand is strongest around intelligent decision automation. Analytics is being embedded into pricing engines, fraud systems, and supply chain planning tools. In these settings, analytics is expected to influence action directly rather than support post-event analysis. Adoption has, therefore, advanced more rapidly than for insight-only applications.

Advanced Analytics Market, by Vertical

Across industries, BFSI is estimated to account for the largest share of analytics spending among verticals. Financial institutions rely heavily on analytics for fraud prevention, risk management, and compliance. High data volumes and real-time decision needs continue to support ongoing investment.

REGION

Asia Pacific to be fastest-growing region in global advanced analytics market during forecast period

From a regional standpoint, Asia Pacific is growing faster than other markets. Enterprises across the region are expanding analytics adoption as part of broader digital initiatives. Activity is visible across financial services, manufacturing, and technology sectors, with cloud-based deployments becoming more common.

ADVANCED ANALYTICS MARKET: COMPANY EVALUATION MATRIX

IBM maintains a strong presence in large enterprise deployments, particularly in environments with high operational complexity or stringent regulation. Its analytics offerings are often used alongside automation and hybrid cloud platforms. Adobe’s role has broadened over time. Its analytics and decisioning capabilities are closely linked to real-time data and customer-oriented use cases.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- IBM (US)

- Microsoft (US)

- Google (US)

- Palantir (US)

- Oracle (US)

- SAS Institute (US)

- SAP (Germany)

- Adobe (US)

- Zoho (India)

- Sisense (US)

- Workday (US)

- Infor (US)

- Epic Systems (US)

- Savant Labs (US)

- AWS (US)

- Mu Sigma (US)

- Splunk (US)

- Strategy (US)

- Teradata (US)

- Qlik (US)

- Pegasystems (US)

- Fractal Analytics (US)

- Salesforce (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 82.50 Billion |

| Market Forecast in 2031 (Value) | USD 193.23 Billion |

| CAGR | 14.70% |

| Years Considered | 2021–2031 |

| Base Year | 2025 |

| Forecast Period | 2026–2031 |

| Units Considered | USD Billion |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: ADVANCED ANALYTICS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Advanced Analytics Vendor |

|

|

| Leading Advanced Analytics Vendor |

|

|

RECENT DEVELOPMENTS

- January 2026 : Palantir expanded Gotham’s interoperability and analytics capabilities by aligning it with the broader 2026 platform release enhancements. This includes deeper integration with the Foundry analytics ecosystem, improved data connectivity, model development toolchain updates, ontology-driven analytics workflows, and unified governance features.

- January 2026 : Vertex AI Agent Engine introduced Memory Bank in preview, enabling agents to retain long-term conversational context, improving multi-step autonomous interactions with analytics systems.

- December 2025 : Savant Labs and Bulien, a data and analytics consultancy, formed a strategic partnership to deliver Savant’s agentic AI analytics platform together with Bulien’s implementation and integration expertise.

- December 2025 : Moody’s enhanced the Intelligent Risk Platform with expanded user management, unified authentication, and improved security and efficiency features supporting cloud-native, collaborative risk analytics across underwriting, portfolio monitoring, and compliance. These updates improve governance and real-time analytics performance.

- November 2025 : Microsoft expanded its partnership with OpenAI to deepen integration of advanced generative AI models into Azure services, strengthening AI-powered analytics, automation, and decision intelligence capabilities across enterprise applications.

Table of Contents

Methodology

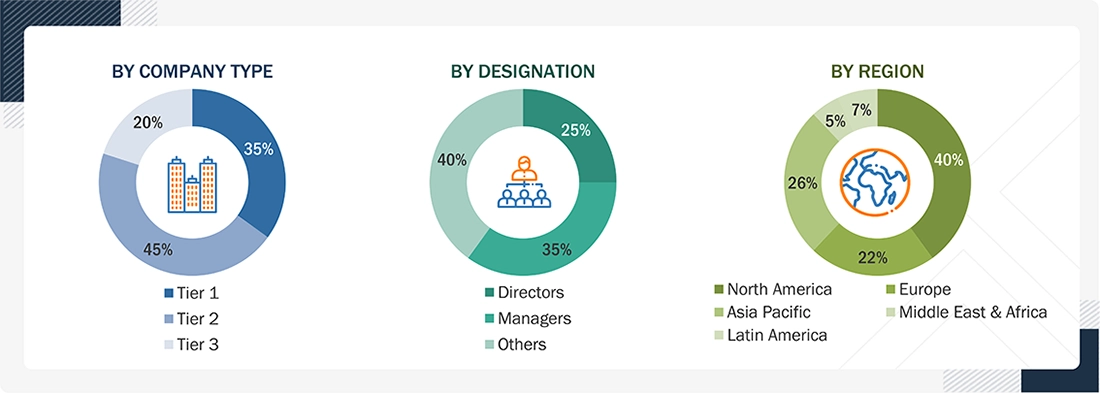

The research methodology for the advanced analytics market report involved the use of extensive secondary sources and directories, as well as various reputed open-source analytics databases, to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including analytics providers, analytics platform vendors, data providers, analytics consulting firms, data integration providers, database management vendors, big data suppliers, and agentic analytics providers; enterprise end users; high-level executives of multiple companies offering advanced analytics solutions, acquisition systems and services; and industry consultants to obtain and verify critical qualitative and quantitative information and assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications such as International Journal of Business and Data Analytics, Journal of Big Data Technology and Business Analytics, International Journal of Data Analytics (IJDA), and Journals - Business Intelligence & Data Analytics; and articles from recognized associations and government publishing sources. Additionally, the advanced analytics spending of various countries was extracted from respective sources. Secondary research was used to obtain key information about the industry’s value chain and supply chain to identify key players by solution, service, market classification, and segmentation according to the offerings of major players and industry trends related to solutions, delivery modes, applications, verticals, and regions, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including chief experience officers (CXOs); vice presidents (VPs); directors from business development, marketing, and advanced analytics expertise; related key executives from advanced analytics solution vendors, SIs, managed service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to delivery modes, applications, solutions, verticals, and regions. Stakeholders from the demand side, such as chief information officers (CIOs), chief technology officers (CTOs), chief strategy officers (CSOs), and end users using advanced analytics solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of analytics offerings, which would impact the overall advanced analytics market.

Note: Tier 1 companies account for annual revenue greater than USD 10 billion; tier 2 companies’ revenue ranges between USD 1 and 10 billion; and tier 3 companies’ revenue ranges between USD 500 million and USD 1 billion

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

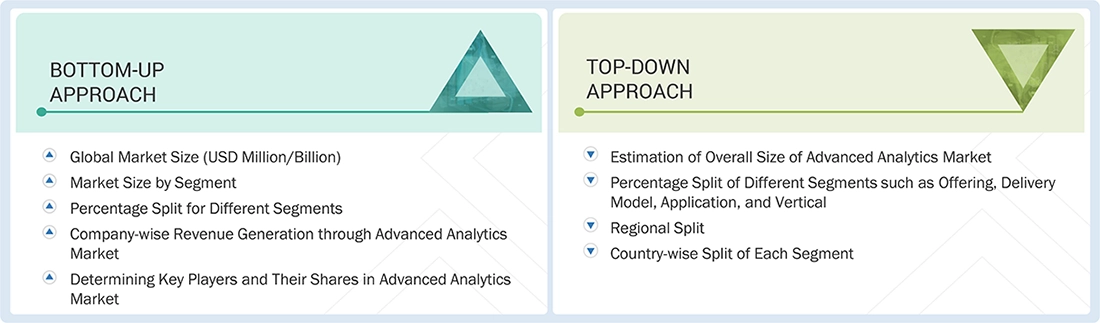

Market Size Estimation

The top-down and bottom-up approaches were employed to estimate and forecast the advanced analytics market, as well as its dependent submarkets. This multi-layered analysis was further reinforced through data triangulation, which incorporated primary and secondary research inputs. The market figures were also validated against the existing MarketsandMarkets repository for accuracy.

Market Size Estimation Methodology- Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the advanced analytics market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on the breadth of solutions according to solution type, service type, delivery mode, application, and vertical. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology - Bottom-up Approach

In the bottom-up approach, the adoption rate of advanced analytics solutions and services among different end users in key countries, with respect to their regions contributing the most to the market share, was identified. For cross-validation, the adoption of advanced analytics solutions among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the advanced analytics market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major analytics providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primary interviews, the exact values of the overall advanced analytics market size and the segments’ size were determined and confirmed using the study.

Advanced Analytics Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Advanced analytics refers to a set of sophisticated data analysis techniques and technologies used to examine large, complex, and diverse datasets to uncover hidden patterns, predict future outcomes, and generate actionable insights. It goes beyond traditional reporting and descriptive analytics by using methods such as machine learning, statistical modeling, data mining, and visualization to support deeper analysis. Advanced analytics enables organizations to process high data volumes, handle complexity, and move from understanding what happened to anticipating what will happen and determining the best actions to take. By combining computational power with advanced algorithms, it helps businesses improve decision-making, optimize operations, enhance customer experiences, and gain a sustainable competitive advantage.

Key Stakeholders

- Advanced analytics solution providers

- Advanced analytics service providers

- Cloud service providers

- Enterprise end-users

- Distributors and value-added resellers (VARs)

- Government agencies

- Independent software vendors (ISV)

- Managed service providers

- Support & maintenance service providers

- System integrators (SIs)/migration service providers

- Technology providers

- Academia & research institutions

- Investors & venture capital firms

- Market research and consulting firms

- Internet of Things (IoT) analytics vendors

Report Objectives

- To define, describe, and forecast the advanced analytics market, by offering, delivery mode, application, and vertical

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for the five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments, such as partnerships, product launches, and mergers & acquisitions, in the advanced analytics market

Customization Options

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic analysis

- Further breakup of additional European countries by offering, delivery mode, application, and vertical

- Further breakup of additional Asia Pacific countries by offering, delivery mode, application, and vertical

- Further breakup of additional Middle East & African countries by offering, delivery mode, application, and vertical

- Further breakup of additional Latin American countries by offering, delivery mode, application, and vertical

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Advanced Analytics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Advanced Analytics Market

Jhungha

Jun, 2014

Interested in data analytics for UK market.

Anand

Apr, 2015

Interested in data science and analytics..

Bill

Feb, 2014

Interested in IaaS for Advanced Analytics infrastructure integration solution market.