Middle East and Africa (MEA) Wi-Fi as a Service (WaaS) Market by Solution (Access Points and WLAN Controllers), Service (Professional and Managed Services), Location Type (Indoor and Outdoor), Organization Size, End User, and Country - Forecast to 2025

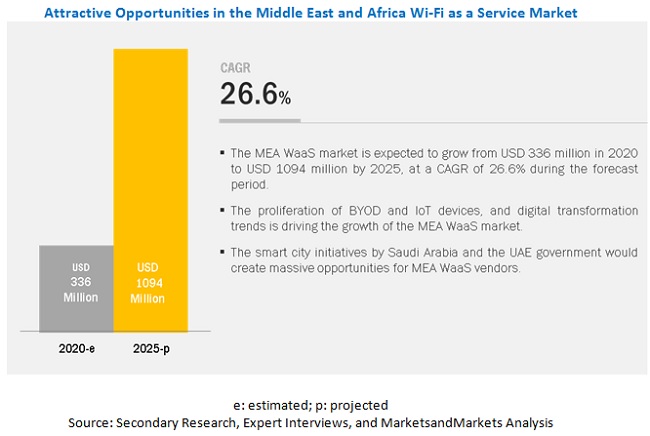

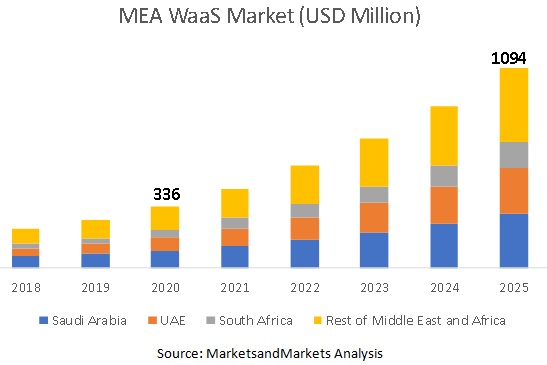

The Middle East and Africa (MEA) Wi-Fi as a Service (WaaS) market size is projected to grow from USD 336 million in 2020 to USD 1,094 million by 2025, at a Compound Annual Growth Rate (CAGR) of 26.6% during the forecast period. The major factors driving the growth of the MEA Wi-Fi as a service market include Capital Expenditure (CAPEX) and Operational Expenditure (OPEX) savings using as service models and growing Internet of Things (IoT) connection across enterprises.

Wireless local area network controllers segment to grow at a higher CAGR during the forecast period

Based on solutions, the Wireless Local Area Network (WLAN) controllers segment is projected to grow at a higher CAGR during the forecast period. WLAN controllers help network operation teams to configure, manage, and control Access Points (APs) located across different locations. It is important for enterprises to choose the right set of controllers that match the requirement of Wi-Fi networks. Generally, the selection of controllers depends on the number that are expected to use and access the Wi-Fi network. For instance, large enterprises cater to more number of Wi-Fi users as compared to Small and Medium-sized Enterprises (SMEs).

Indoor segment to hold a higher market share during the forecast period

Based on the location type, the indoor segment is projected to lead the MEA Wi-Fi as a service market during the forecast period. The use of business applications, such as Unified Communication (UC), cloud, enterprise mobility, and collaboration tools across all the sectors; penetration of Bring Your Won Device (BYOD) devices in enterprises; and increasing mobile traffic in indoor environments are the key driving factors for the large-scale adoption of indoor Wi-Fi services.

Saudi Arabia to record the highest market share in 2020

Saudi Arabia is among the world’s 25 largest economies and the largest free-market economy in the MEA. The country accounts for about 25% of the total Arab Gross Domestic Product (GDP) with per capita income expected to reach USD 33,500 by 2020. The domestic market is growing by about 3.5% per annum, which ensures a young consumer population with good purchasing power. The country has approximately 50% of youth under 25 years of age. The young and tech-savvy population has helped the Information and Communications Technology (ICT) sector boost its GDP contribution to four percent, with Saudi Arabia rising 16 places in the World Economic Forum’s Global Competitive Index “ICT adoption” category.

Key Market Players

Key market players profiled in this report include Cisco (US), CommScope (US), HPE (US), Huawei (China), Ubiquiti(US), Extreme Networks (US), Cambium (US), Juniper (US), Fortinet (US), Arista (US), ADTRAN (US), ALE (France), stc (Saudi Arabia), Linksys (US), Cradlepoint (US), TP-Link (China), EnGenius (Singapore), Etisalat (UAE), EZELINK (UAE), NETGEAR (US), WAFAINET (Saudi Arabia), Creative Solutions (Saudi Arabia), Ctelecoms (Saudi Arabia), ExterNetworks (US), du (UAE), AllCAD Solutions (India), Airangel WiFi (UK), and D-Link (Taiwan). These players have adopted various growth strategies, such as partnerships and new service launches, to expand their presence further in the MEA Wi-Fi as a service market and broaden their customer base.

Cisco is a California-based networking company that was founded in 1984. It specializes in Internet Protocol (IP)-based products and services, which specifically cater to the ICT industry. The company offers end-to-end Wi-Fi products, such as APs, controllers, and management solutions, to Small and Medium-sized Enterprises (SMEs) and large enterprises. Recently, the company rolled-out new Wi-Fi 6 offerings with Catalyst 9100 series APs. With the acquisition of Meraki, Cisco offers cloud-managed Wi-Fi solutions that include all sets of elements wherein customers do not need to buy anything. Cisco Meraki’s cloud-managed Wi-Fi solution provides a wide range of features, including centralized management, location analytics, application visibility, Radio Frequency (RF) optimization, and dedicated security. The company offers cloud-based Wi-Fi controllers that eliminate the need for on-site controllers, which in turn, reduces costs.

Scope of Report

|

Report Metrics |

Details |

|

Market size available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Solution, Service, Location Type, Organization Size, End User, and Country |

|

Country covered |

Saudi Arabia, UAE, South Africa, and Rest of MEA |

|

Companies covered |

Cisco (US), CommScope (US), HPE (US), Huawei (China), Ubiquiti(US), Extreme Networks (US), Cambium (US), Juniper (US), Fortinet (US), Arista (US), ADTRAN (US), ALE (France), stc (Saudi Arabia), Linksys (US), Cradlepoint (US), TP-Link (China), EnGenius (Singapore), Etisalat (UAE), EZELINK (UAE), NETGEAR (US), WAFAINET (Saudi Arabia), Creative Solutions (Saudi Arabia), Ctelecoms (Saudi Arabia), ExterNetworks (US), du (UAE), AllCAD Solutions (India), Airangel WiFi (UK), and D-Link (Taiwan). |

This research report categorizes the MEA Wi-Fi as a service market to forecast revenue and analyze trends in each of the following submarkets:

Based on solutions:

- Access Points (APs)

- Wireless Local Area Network (WLAN) controllers

Based on Services:

- Professional Services

- Advisory and implementation

- Support and Maintenance

- Training

- Managed Services

Based on location types:

- Indoor

- Outdoor

Based on organization size:

- Large enterprises

- Small and Medium-sized Enterprises (SMEs)

Based on end users:

- Education

- Retail

- Travel and hospitality

- Healthcare

- Banking, Financial Services and Insurance (BFSI)

- Manufacturing

- Government

- Service provider

- Oil and gas

- Others (media and entertainment, and IT and ITES)

Based on countries:

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

Recent Developments

- In April 2019, Cisco entered into the new emerging Wi-Fi 6 technology with the introduction of Wi-Fi 6 APs. Cisco rolled-out several products, including Wi-Fi AP 6 (Catalyst and Meraki), switches (Catalyst 9600), and DevNet Wireless Dev Center.

- In June 2019, CommScope (Ruckus) introduced two products: R750 Wi-Fi 6 AP and ICX 7150-C10ZP switch, in its portfolio. The new product announcement would complement Ruckus’ existing networking portfolio. These APs support dual band frequency (2.5GHz and 5GHz) and the WPA3 Wi-Fi security standard.

- In June 2019, HPE (Aruba) launched the Aruba Instant On solution. The new Aruba Instant On solution would address the needs of SMEs. The solution includes indoor and outdoor APs with the Wi-Fi management capability to deliver superior Wi-Fi experience to clients and employees.

- In April 2019, Huawei introduced a new product in the Wi-Fi 6 segment. Huawei announced its Wi-Fi 6 offering with the brand name AirEngine. Wi-Fi 6- enabled APs would complement the data-hungry applications, such as Augmented Reality (AR), Virtual Reality (VR), and 4K/8K videos.

- In October 2019, Extreme Networks unveiled ExtremeCloud IQ, a network management solution. ExtremeCloud IQ, a microservice-based application that leverages the capabilities of Artificial Intelligence (AI), Machine Learning (ML), and automation techniques to provide in-depth insights on entire network infrastructure.

Key questions addressed by the report

- What are the growth opportunities in the MEA Wi-Fi as a service market?

- What is the competitive landscape scenario in the market?

- What are the regulations that are expected to have an impact on the market?

- How have WaaS model evolved from traditional technologies?

- What are the market dynamics of the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primaries

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.4 MARKET FORECAST

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTIONS FOR THE STUDY

2.5.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 32)

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

4.2 MEA WI-FI AS A SERVICE MARKET, BY ORGANIZATION SIZE

4.3 MARKET IN SAUDI ARABIA, BY ORGANIZATION SIZE AND LOCATION TYPE

4.4 MARKET IN UNITED ARAB EMIRATES, BY ORGANIZATION SIZE AND LOCATION TYPE

4.5 MARKET IN SOUTH AFRICA, BY ORGANIZATION SIZE AND LOCATION TYPE

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 As a service model saves 20-25% CAPEX and 80-90% OPEX

5.2.1.2 Education, retail, smart cities, manufacturing, and healthcare sectors driving IoT connections

5.2.1.3 Proliferation of smartphones and bring your own device users in businesses

5.2.1.4 Increasing trend of digital transformation in GCC countries

5.2.2 RESTRAINTS

5.2.2.1 Limited pre-existing bandwidth in many remote places in the MEA region

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing number of smart city projects in the UAE and Saudi Arabia to boost growth of the Wi-Fi as a service market in government and public sector

5.2.3.2 Emergence of Wi-Fi 6 to boost growth of as a service model in oil and gas industry

5.2.4 CHALLENGES

5.2.4.1 Data security and privacy concerns

5.3 REGULATORY LANDSCAPE

5.3.1 UNITED ARAB EMIRATES

5.3.1.1 UAE Civil Code Number 5 of 1985 on the Civil Transactions Law

5.3.1.2 UAE Federal Law Number 2 on the Prevention of IT Crimes

5.3.1.3 Federal Law Number 1 of 2006 Concerning Electronic Transactions and eCommerce

5.3.1.4 Dubai International Financial Centre Law Number 5 of 2012

5.3.1.5 Electronic Transactions Law, Dubai International Financial Centre Law Number 2 of 2017

5.3.2 SAUDI ARABIA

5.3.2.1 Law Number 20 of 2014 Pertaining to Electronic Transactions

5.3.2.2 Anti-Cyber Crime Law

5.3.2.3 Saudi Arabia Telecommunications Act

5.3.2.4 Shariah Principles

5.3.3 QATAR

5.3.3.1 Penal Code: Law 11 of 2004

5.3.3.2 Electronic Commerce and Transactions Law

5.3.3.3 Telecommunications Law

5.3.3.4 Banking Law: Law 33 of 2006

5.3.3.5 Qatar Computer Emergency Response Team

5.3.3.6 Data Protection Law

5.4 USE CASES

6 MEA WI-FI AS A SERVICE MARKET, BY SOLUTION (Page No. - 66)

6.1 INTRODUCTION

6.2 ACCESS POINTS

6.2.1 ACCESS POINTS: MARKET DRIVERS

6.2.2 ACCESS POINTS: MEA WI-FI AS A SERVICE VENDOR INITIATIVES AND DEVELOPMENTS

6.3 WLAN CONTROLLERS

6.3.1 WLAN CONTROLLERS: MARKET DRIVERS

6.3.2 WLAN CONTROLLERS: MEA WI-FI AS A SERVICE VENDOR INITIATIVES AND DEVELOPMENTS

7 MEA WI-FI AS A SERVICE MARKET, BY SERVICE (Page No. - 74)

7.1 INTRODUCTION

7.2 PROFESSIONAL SERVICES

7.2.1 ADVISORY AND IMPLEMENTATION

7.2.1.1 Advisory and Implementation: Market Drivers

7.2.2 SUPPORT AND MAINTENANCE

7.2.2.1 Support and Maintenance: Market Drivers

7.2.3 TRAINING

7.2.3.1 Training: Market Drivers

7.3 MANAGED SERVICES

7.3.1 MANAGED SERVICES: MARKET DRIVERS

8 MEA WI-FI AS A SERVICE MARKET, BY ORGANIZATION SIZE (Page No. - 83)

8.1 INTRODUCTION

8.2 LARGE ENTERPRISES

8.2.1 LARGE ENTERPRISES: MARKET DRIVERS

8.2.2 LARGE ENTERPRISES: MEA WI-FI AS A SERVICE VENDOR INITIATIVES AND DEVELOPMENTS

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

8.3.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

8.3.2 SMALL AND MEDIUM-SIZED ENTERPRISES: MEA WI-FI AS A SERVICE VENDOR INITIATIVES AND DEVELOPMENTS

9 MEA WI-FI AS A SERVICE MARKET, BY LOCATION TYPE (Page No. - 89)

9.1 INTRODUCTION

9.2 INDOOR

9.2.1 INDOOR: MARKET DRIVERS

9.2.2 INDOOR: MEA WI-FI AS A SERVICE VENDOR INITIATIVES AND DEVELOPMENTS

9.3 OUTDOOR

9.3.1 OUTDOOR: MARKET DRIVERS

9.3.2 OUTDOOR: MEA WI-FI AS A SERVICE VENDOR INITIATIVES AND DEVELOPMENTS

10 MEA WI-FI AS A SERVICE MARKET, BY END USER (Page No. - 95)

10.1 INTRODUCTION

10.2 EDUCATION

10.2.1 EDUCATION: MARKET DRIVERS

10.3 RETAIL

10.3.1 RETAIL: MARKET DRIVERS

10.4 TRAVEL AND HOSPITALITY

10.4.1 TRAVEL AND HOSPITALITY: MARKET DRIVERS

10.5 HEALTHCARE

10.5.1 HEALTHCARE: MARKET DRIVERS

10.6 MANUFACTURING

10.6.1 MANUFACTURING: MARKET DRIVERS

10.7 BANKING, FINANCIAL SERVICES, AND INSURANCE

10.7.1 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET DRIVERS

10.8 SERVICE PROVIDERS

10.8.1 SERVICE PROVIDERS: MARKET DRIVERS

10.9 GOVERNMENT

10.9.1 GOVERNMENT: MARKET DRIVERS

10.10 OIL AND GAS

10.10.1 OIL AND GAS: MARKET DRIVERS

10.11 OTHERS

11 MEA WI-FI AS A SERVICE MARKET, BY COUNTRY (Page No. - 120)

11.1 MIDDLE EAST AND AFRICA

11.1.1 SAUDI ARABIA

11.1.1.1 Saudi Arabia: Market Drivers

11.1.2 UNITED ARAB EMIRATES

11.1.2.1 United Arab Emirates: Market Drivers

11.1.3 SOUTH AFRICA

11.1.3.1 South Africa: Market Drivers

11.1.4 REST OF MIDDLE EAST AND AFRICA

12 COMPETITIVE LANDSCAPE (Page No. - 146)

12.1 OVERVIEW

12.2 COMPETITIVE SCENARIO

12.2.1 PARTNERSHIPS

12.2.2 NEW PRODUCT LAUNCHES

12.2.3 ACQUISITIONS

12.2.4 BUSINESS EXPANSIONS

13 COMPANY PROFILES (Page No. - 151)

13.1 INTRODUCTION

(Business Overview, Solutions & Services, Key Insights, Recent Developments, SWOT Analysis, Right-to-win)*

13.2 CISCO

13.3 COMMSCOPE

13.4 HPE

13.5 HUAWEI

13.6 UBIQUITI

13.7 EXTREME NETWORKS

13.8 CAMBIUM

13.9 JUNIPER

13.10 FORTINET

13.11 ARISTA

13.12 ALCATEL LUCENT ENTERPRISE

13.13 ADTRAN

13.14 STC

13.15 LINKSYS

13.16 CRADLEPOINT

13.17 TP-LINK

13.18 ENGENIUS

13.19 ETISALAT

13.20 EZELINK

13.21 NETGEAR

13.22 WAFAINET

13.23 CREATIVE SOLUTIONS

13.24 CTELECOMS

13.25 EXTERNETWORKS

13.26 DU

13.27 ALLCAD SOLUTIONS

13.28 AIRANGEL WIFI

13.29 D-LINK

*Details on Business Overview, Solutions & Services, Key Insights, Recent Developments, SWOT Analysis, Right-to-Win might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 215)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

LIST OF TABLES (75 Tables)

TABLE 1 FACTOR ANALYSIS

TABLE 2 WI-FI AS A SERVICE VS WI-FI BUSINESS MODEL

TABLE 3 INTERNET OF THINGS: EMERGING USE CASES TO DRIVE IOT CONNECTIONS GROWTH

TABLE 4 MIDDLE EAST AND AFRICA: INTERNET PENETRATION BY COUNTRY

TABLE 5 WI-FI 6: USE CASES

TABLE 6 USE CASE 1: CTELECOMS

TABLE 7 USE CASE 2: EZELINK

TABLE 8 USE CASE 3: EZELINK

TABLE 9 USE CASE 4: TP-LINK

TABLE 10 USE CASE 5: TP-LINK

TABLE 11 MEA WI-FI AS A SERVICE MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 12 ACCESS POINTS SHIPMENT: MARKET, 2018–2025 (UNIT ‘000)

TABLE 13 ACCESS POINTS: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 14 INTERNET PENETRATION BY REGION

TABLE 15 MOBILE SUBSCRIBERS PENETRATION BY REGION

TABLE 16 WLAN CONTROLLERS: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 17 MEA WI-FI AS A SERVICE MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 18 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 19 PROFESSIONAL SERVICES: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 20 ADVISORY AND IMPLEMENTATION MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 21 SUPPORT AND MAINTENANCE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 22 TRAINING MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 23 MANAGED SERVICES: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 24 NUMBER OF EMPLOYEES BY ORGANIZATION SIZE

TABLE 25 MEA WI-FI AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 26 LARGE ENTERPRISES: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 27 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 28 MARKET SIZE, BY LOCATION TYPE, 2018–2025 (USD MILLION)

TABLE 29 INDOOR: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 30 MIDDLE EAST AND NORTH AFRICA: INTERNET USERS BY USER LOCATION

TABLE 31 OUTDOOR: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 32 MEA WI-FI AS A SERVICE MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 33 KINGDOM OF SAUDI ARABIA: NUMBER OF SCHOOLS BY SCHOOL AFFILIATION AND TYPE

TABLE 34 EDUCATION: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 35 RETAIL: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 36 TRAVEL AND HOSPITALITY: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 37 HEALTHCARE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 38 SAUDI ARABIA: OPERATING INDUSTRIAL UNITS BY NUMBER, TOTAL FINANCES, AND EMPLOYEES, 1974 – 2018

TABLE 39 MANUFACTURING: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 40 SUB-SAHARAN AFRICA: BANKING OUTLOOK

TABLE 41 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 42 SERVICE PROVIDERS: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 43 GOVERNMENT: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 44 OIL AND GAS: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 45 OTHERS: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 46 MEA WI-FI AS A SERVICE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 47 SAUDI ARABIA: NUMBER OF SCHOOLS BY SCHOOL AFFILIATION AND TYPE

TABLE 48 SAUDI ARABIA: MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 49 SAUDI ARABIA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 50 SAUDI ARABIA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 51 SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 52 SAUDI ARABIA: MARKET SIZE, BY LOCATION TYPE, 2018–2025 (USD MILLION)

TABLE 53 SAUDI ARABIA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 54 UNITED ARAB EMIRATES: MEA WI-FI AS A SERVICE MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 55 UNITED ARAB EMIRATES: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 56 UNITED ARAB EMIRATES: MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 57 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 58 UNITED ARAB EMIRATES: MARKET SIZE, BY LOCATION TYPE, 2018–2025 (USD MILLION)

TABLE 59 UNITED ARAB EMIRATES: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 60 SOUTH AFRICA: MEA WI-FI AS A SERVICE MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 61 SOUTH AFRICA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 62 SOUTH AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 63 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 64 SOUTH AFRICA: MARKET SIZE, BY LOCATION TYPE, 2018–2025 (USD MILLION)

TABLE 65 SOUTH AFRICA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 66 REST OF MIDDLE EAST AND AFRICA: MEA WI-FI AS A SERVICE MARKET SIZE, BY SOLUTION, 2018–2025 (USD MILLION)

TABLE 67 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 68 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2018–2025 (USD MILLION)

TABLE 69 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

TABLE 70 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY LOCATION TYPE, 2018–2025 (USD MILLION)

TABLE 71 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 72 PARTNERSHIPS, 2018–2019

TABLE 73 NEW PRODUCT LAUNCHES, 2019

TABLE 74 ACQUISITIONS, 2019

TABLE 75 BUSINESS EXPANSIONS, 2018-2020

LIST OF FIGURES (83 Figures)

FIGURE 1 MEA WI-FI AS A SERVICE MARKET: RESEARCH DESIGN

FIGURE 2 DATA TRIANGULATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS AND SERVICES OF THE MEA WI-FI AS A SERVICE MARKET

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS AND SERVICES OF THE MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 TOP-DOWN (DEMAND SIDE): MEA WI-FI AS A SERVICE MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE): MARKET

FIGURE 7 MEA WI-FI AS A SERVICE MARKET HOLISTIC VIEW

FIGURE 8 MARKET GROWTH TREND

FIGURE 9 UNITED ARAB EMIRATES TO GROW AT THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

FIGURE 10 ADOPTION OF DIGITAL TRANSFORMATION STRATEGY BY ENTERPRISES TO DRIVE MEA WI-FI AS A SERVICE MARKET GROWTH DURING THE FORECAST PERIOD

FIGURE 11 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO HOLD A HIGHER MARKET SHARE IN 2020

FIGURE 12 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT AND INDOOR SEGMENT TO ACCOUNT FOR HIGHER MARKET SHARES IN SAUDI ARABIA IN 2020

FIGURE 13 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT AND INDOOR SEGMENT TO ACCOUNT FOR HIGHER MARKET SHARES IN UNITED ARAB EMIRATES IN 2020

FIGURE 14 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT AND INDOOR SEGMENT TO ACCOUNT FOR HIGHER MARKET SHARES IN SOUTH AFRICA IN 2020

FIGURE 15 MEA WI-FI AS A SERVICE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 16 MIDDLE EAST AND NORTH AFRICA: CONSUMER AND INDUSTRIAL INTERNET OF THINGS CONNECTIONS

FIGURE 17 RISE OF BRING YOUR OWN DEVICES IN ORGANIZATIONS

FIGURE 18 MIDDLE EAST AND NORTH AFRICA: UNIQUE MOBILE SUBSCRIBERS

FIGURE 19 BENEFITS OF REMOTE WORKING

FIGURE 20 DIGITAL TRANSFORMATION OUTCOMES

FIGURE 21 IMPACT OF DIGITAL TRANSFORMATION ACROSS DIFFERENT INDUSTRIES, 2016-2025 (USD BILLION)

FIGURE 22 SAUDI ARABIA: KEY FOCUS AREAS OF DIGITAL TRANSFORMATION TECHNIQUES

FIGURE 23 MIDDLE EAST AND NORTH AFRICA: MOBILE CONNECTIVITY INDEX (MILLION)

FIGURE 24 SUB-SAHARAN AFRICA: MOBILE CONNECTIVITY INDEX (MILLION)

FIGURE 25 GULF COOPERATION COUNCIL: SMART CITY INITIATIVES

FIGURE 26 SMART CITY: WI-FI APPLICATION AREAS

FIGURE 27 WI-FI 6: USE CASES

FIGURE 28 MIDDLE EAST VS GLOBAL SCENARIO: INSIDER LEAKS BY SECTOR

FIGURE 29 PERCEIVED THREATS IN ENTERPRISES

FIGURE 30 MIDDLE EAST VS GLOBAL SCENARIO: DATA LEAK SCENARIO

FIGURE 31 WLAN CONTROLLERS SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 32 MEA WI-FI AS A SERVICE MARKET: ACCESS POINT SHIPMENTS

FIGURE 33 SUB-SAHARAN AFRICA: UNIQUE MOBILE SUBSCRIBERS AND PENETRATION RATE

FIGURE 34 MIDDLE EAST AND NORTH AFRICA: UNIQUE MOBILE SUBSCRIBERS AND PENETRATION RATE

FIGURE 35 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 36 SUPPORT AND MAINTENANCE SERVICES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 37 DECISION-MAKING CRITERIA FOR SELECTING EXTERNAL SERVICE PROVIDERS IN UNITED ARAB EMIRATES AND SAUDI ARABIA

FIGURE 38 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 39 OUTDOOR SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 40 MIDDLE EAST AND AFRICA: INTERNET PROTOCOL TRAFFIC BY TYPE

FIGURE 41 SERVICE PROVIDERS SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 42 MIDDLE EAST AND AFRICA: INTERNET USAGE

FIGURE 43 INTERNATIONAL TOURIST ARRIVALS, 2018 (MILLION)

FIGURE 44 UNITED ARAB EMIRATES: NUMBER OF HOSPITALS BY PROVINCE

FIGURE 45 SAUDI ARABIA: NUMBER OF HOSPITALS

FIGURE 46 SOUTH AFRICA: MANUFACTURING INDUSTRY CONTRIBUTION

FIGURE 47 MIDDLE EAST AND AFRICA: GULF COOPERATION COUNCIL LEADS INTERNET PENETRATION

FIGURE 48 MIDDLE EAST AND NORTH AFRICA: MAIN GOALS OF DIGITAL GOVERNMENT STRATEGIES

FIGURE 49 MIDDLE EAST AND NORTH AFRICA: ICT-ENABLED MECHANISMS FOR PUBLIC ENGAGEMENT AND PARTICIPATION

FIGURE 50 MIDDLE EAST AND AFRICA: MARKET SNAPSHOT

FIGURE 51 SAUDI ARABIA: INTERNET USERS

FIGURE 52 SAUDI ARABIA: EXPENDITURE BY SECTOR

FIGURE 53 SAUDI ARABIA: MARKET SHARE OF DEVICES

FIGURE 54 SAUDI ARABIA: NUMBER OF HOSPITALS BY TYPE

FIGURE 55 UNITED ARAB EMIRATES: INTERNET USERS

FIGURE 56 UNITED ARAB EMIRATES: INTERNET TRAFFIC ACROSS DEVICES

FIGURE 57 DUBAI: HOTEL GUESTS BY REGION

FIGURE 58 GULF COOPERATION COUNCIL: EDUCATION EXPENDITURE AS % OF GROSS DOMESTIC PRODUCT

FIGURE 59 SOUTH AFRICA: INTERNET USERS

FIGURE 60 SOUTH AFRICA: DEVICE USED BY POPULATION

FIGURE 61 SOUTH AFRICA: SMARTPHONE PENETRATION

FIGURE 62 SOUTH AFRICA: MOBILE DATA TRAFFIC (TERABYTES)

FIGURE 63 SOUTH AFRICA: INTERNET CONNECTIVITY TO THE NUMBER OF SCHOOLS

FIGURE 64 SOUTH AFRICA: MACHINE TO MACHINE MOBILE-NETWORK SUBSCRIPTIONS

FIGURE 65 SOUTH AFRICA: INTERNET USAGE BY YOUNG GENERATION

FIGURE 66 SOUTH AFRICA: MOBILE PHONE PENETRATION BY DEVICE

FIGURE 67 KEY DEVELOPMENTS BY THE LEADING PLAYERS IN THE MEA WI-FI AS A SERVICE MARKET, 2018–2019

FIGURE 68 MARKET EVALUATION FRAMEWORK, 2017–2019

FIGURE 69 CISCO: COMPANY SNAPSHOT

FIGURE 70 CISCO: SWOT ANALYSIS

FIGURE 71 COMMSCOPE: COMPANY SNAPSHOT

FIGURE 72 COMMSCOPE: SWOT ANALYSIS

FIGURE 73 HPE: COMPANY SNAPSHOT

FIGURE 74 HPE: SWOT ANALYSIS

FIGURE 75 HUAWEI: COMPANY SNAPSHOT

FIGURE 76 HUAWEI: SWOT ANALYSIS

FIGURE 77 UBIQUITI: COMPANY SNAPSHOT

FIGURE 78 UBIQUITI: SWOT ANALYSIS

FIGURE 79 EXTREME NETWORKS: COMPANY SNAPSHOT

FIGURE 80 CAMBIUM NETWORKS: COMPANY SNAPSHOT

FIGURE 81 JUNIPER: COMPANY SNAPSHOT

FIGURE 82 FORTINET: COMPANY SNAPSHOT

FIGURE 83 ARISTA: COMPANY SNAPSHOT

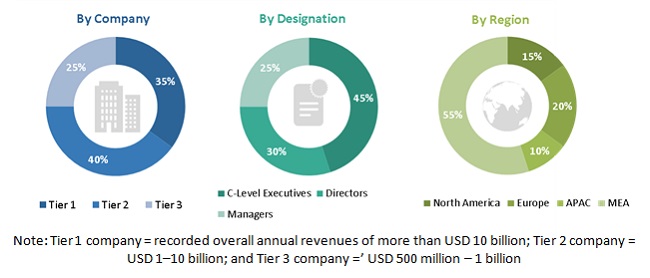

The study involved four major activities in estimating the current market size for the Middle East and Africa (MEA) Wi-Fi as a Service (WaaS) market. An exhaustive secondary research was done to collect information on the MEA Wi-Fi as a service market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the MEA Wi-Fi as a service market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications (Institute of Electrical and Electronics Engineers [IEEE]), and articles by recognized authors; gold standard and silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The MEA Wi-Fi as a service market comprises several stakeholders, such as Wi-Fi vendors, Wi-Fi service providers, venture capitalists, government organizations, regulatory authorities, policymakers, and financial organizations, consulting firms, research organizations, academic institutions, resellers and distributors and training providers. The demand side of the Wi-Fi market consists of all the firms operating in several industry verticals. The supply side includes WaaS providers, offering Wi-Fi solution and services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakup of the primary respondents:

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the MEA Wi-Fi as a service market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors who offer solutions and services in the Wi-Fi market was prepared while using the top-down approach. The market share for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its components (hardware, software, and services). The aggregate of all companies’ revenues was extrapolated to reach the overall market size.

Further, each subsegment was studied and analyzed for its regional market size and country level penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and managers.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast MEA Wi-Fi as a service market by solution, service, location type, organization size, end user, and country during the forecast period, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to four countries: Saudi Arabia, United Arab Emirates (UAE), South Africa, and Rest of MEA

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the MEA Wi-Fi as a service market

- To analyze each submarket with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile key market players; provide a comparative analysis based on business overview, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Middle East and Africa (MEA) Wi-Fi as a Service (WaaS) Market