TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 STUDY OBJECTIVES

1.1.1 EXCLUSIONS

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MILITARY EMBEDDED SYSTEMS MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 INCLUSIONS & EXCLUSIONS

1.5 CURRENCY & PRICING

1.6 USD EXCHANGE RATES

1.7 LIMITATIONS

1.8 MARKET STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 2 MILITARY EMBEDDED SYSTEMS MARKET: RESEARCH FLOW

FIGURE 3 MILITARY EMBEDDED SYSTEMS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

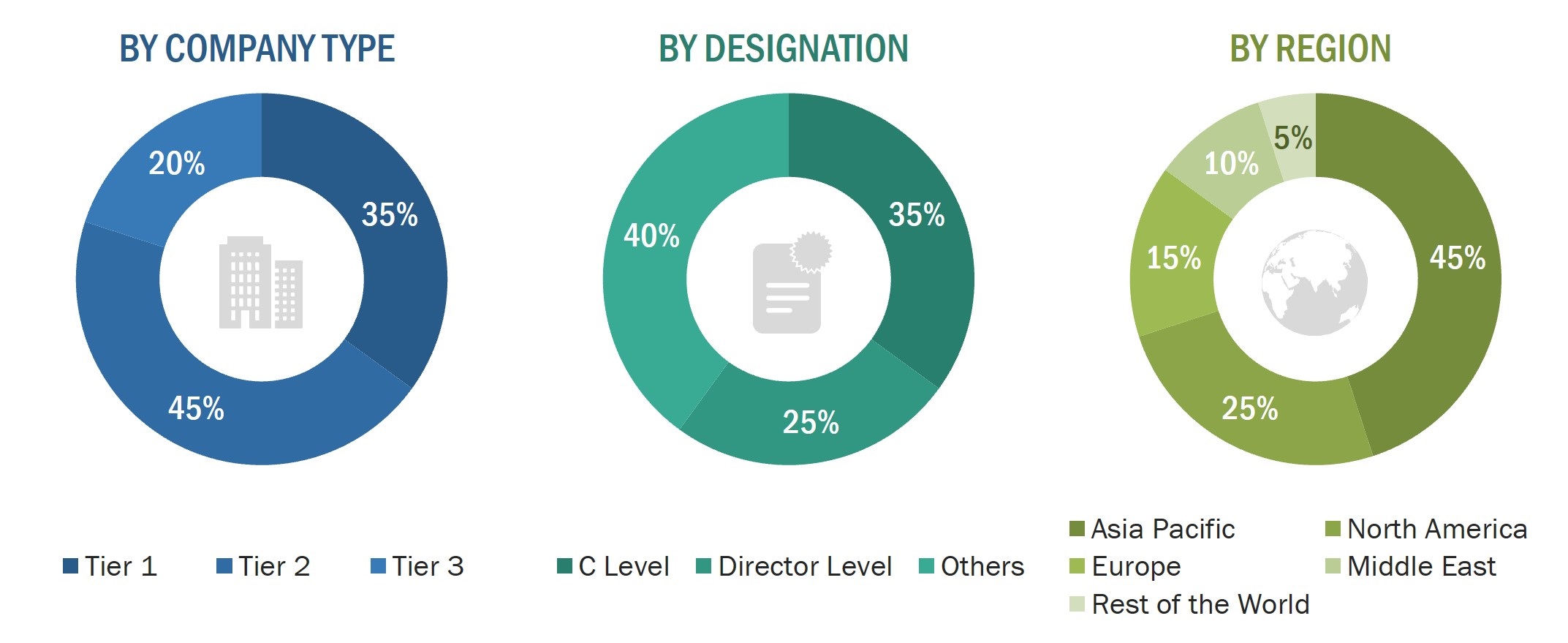

TABLE 1 KEY PRIMARY DETAILS

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 FACTOR ANALYSIS

2.2.1 DEMAND-SIDE ANALYSIS

2.2.2 SUPPLY-SIDE ANALYSIS

2.3 MARKET SCOPE

2.3.1 SEGMENTS AND SUB-SEGMENTS

2.4 RESEARCH APPROACH & METHODOLOGY

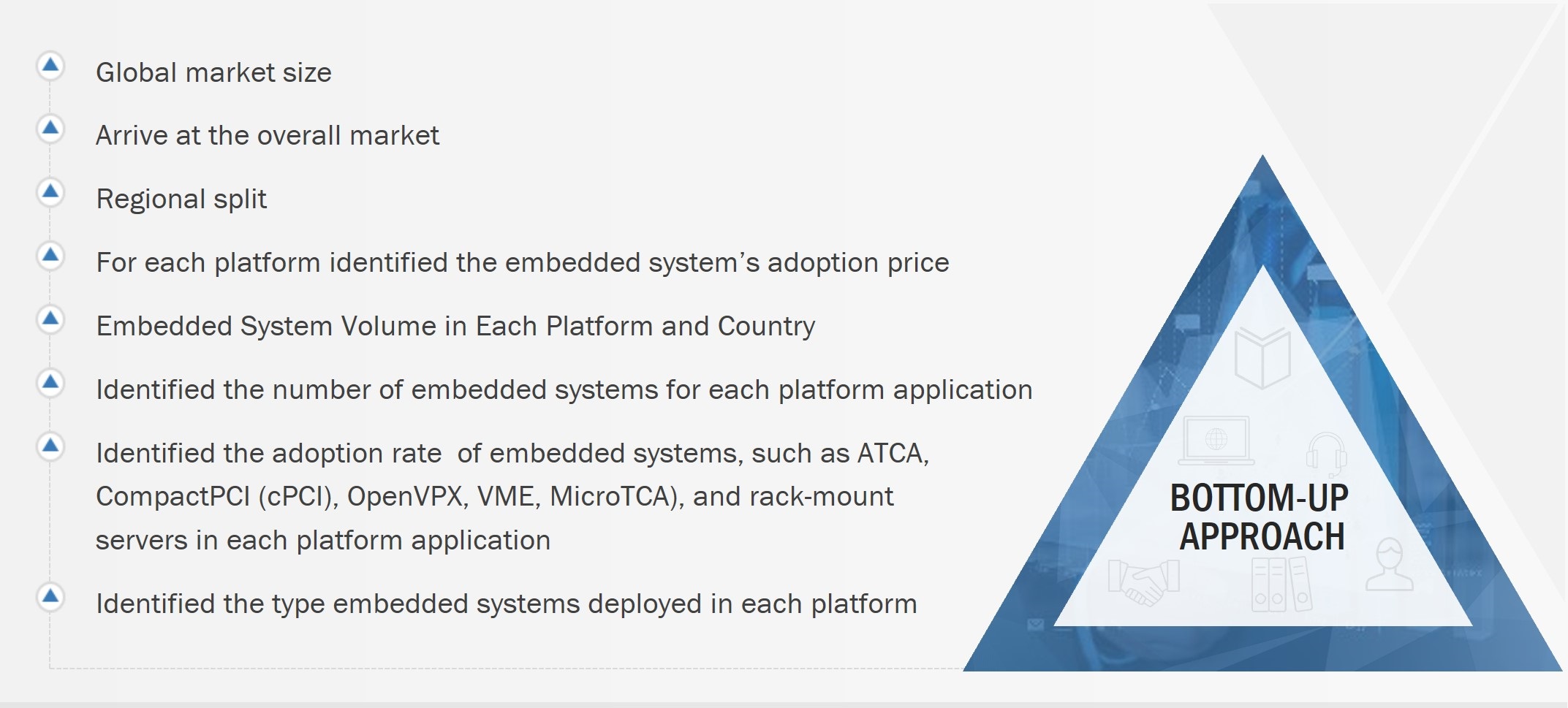

2.4.1 BOTTOM-UP APPROACH

TABLE 2 GLOBAL MARKET SUMMATION

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.5.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.6 GROWTH RATE ASSUMPTIONS

2.7 RESEARCH ASSUMPTIONS

FIGURE 8 RESEARCH ASSUMPTIONS

2.8 RISK ANALYSIS

2.9 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 56)

FIGURE 9 MILITARY EMBEDDED SYSTEMS MARKET, BY SERVER ARCHITECTURE, 2022–2027

FIGURE 10 MILITARY EMBEDDED SYSTEMS MARKET, BY PLATFORM, 2022–2027

FIGURE 11 MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027

FIGURE 12 MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027

FIGURE 13 MILITARY EMBEDDED SYSTEMS MARKET, BY REGION, 2022–2027

4 PREMIUM INSIGHTS (Page No. - 60)

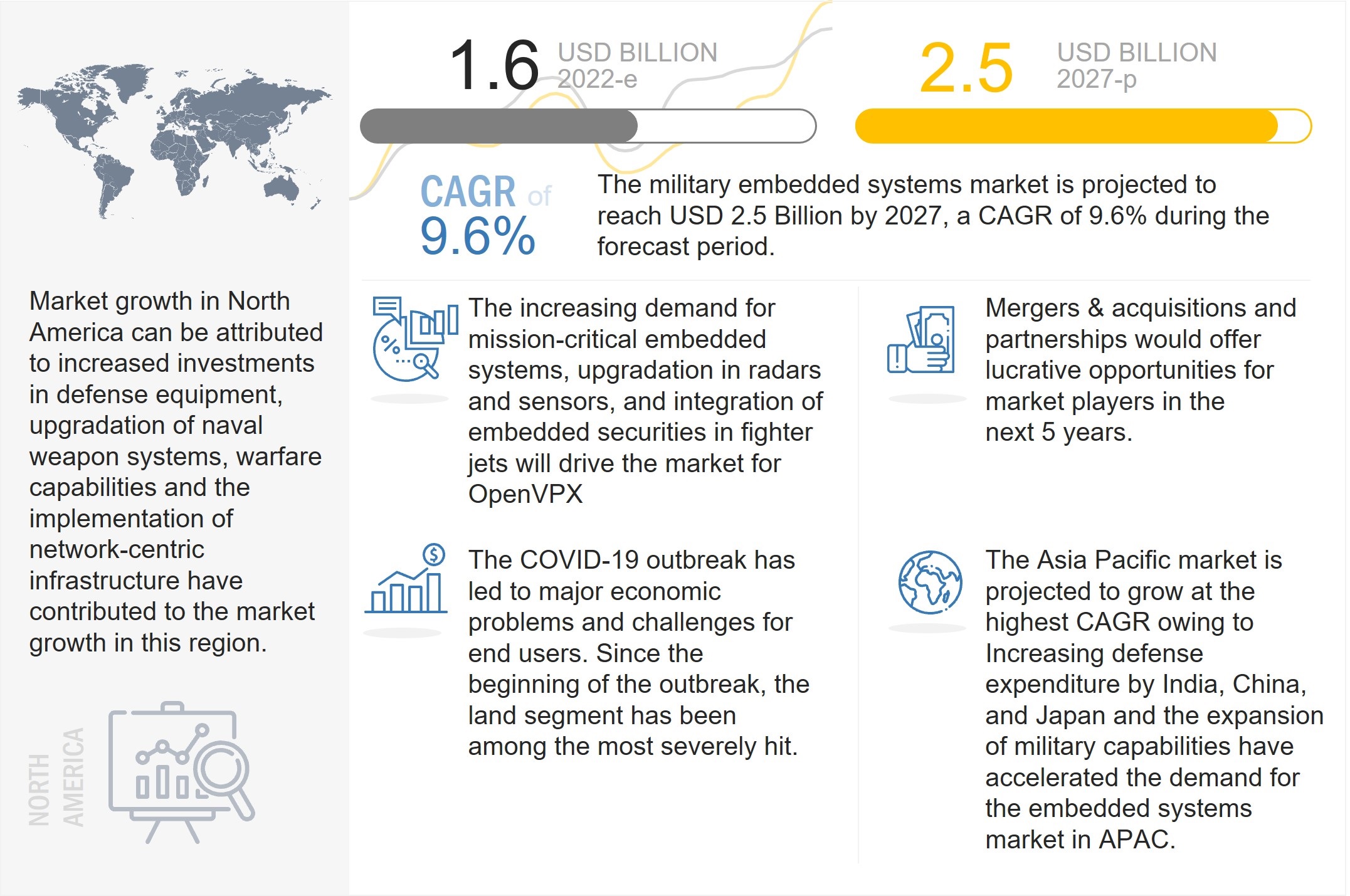

4.1 ATTRACTIVE OPPORTUNITIES IN MILITARY EMBEDDED SYSTEMS MARKET

FIGURE 14 EMERGENCE OF ELECTRONIC AND NETWORK-CENTRIC WARFARE TO DRIVE MILITARY EMBEDDED SYSTEMS MARKET DURING FORECAST PERIOD

4.2 MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION

FIGURE 15 ISR SEGMENT TO LEAD MILITARY EMBEDDED SYSTEMS MARKET

4.3 MILITARY EMBEDDED SYSTEMS MARKET, BY PLATFORM

FIGURE 16 SPACE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.4 MILITARY EMBEDDED SYSTEMS MARKET, BY SERVER ARCHITECTURE

FIGURE 17 BLADE SERVER TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

4.5 MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE

FIGURE 18 NEW INSTALLATION SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE

4.6 GLOBAL MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY

FIGURE 19 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 64)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 MILITARY EMBEDDED SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Technological advancements in network convergence

5.2.1.2 Use of multicore processor technology

5.2.1.3 Emergence of electronic and network-centric warfare

5.2.1.4 Increased focus on cloud computing and wireless technologies

5.2.1.5 Rising demand for new and advanced electronic combat systems

5.2.1.6 Increasing use of EW systems for geospatial intelligence gathering

5.2.2 RESTRAINTS

5.2.2.1 System design certification requirement for system upgrade

5.2.2.2 Complexities in embedded product development

5.2.3 OPPORTUNITIES

5.2.3.1 Scope for software innovation in military computers

5.2.3.2 Development of EW systems with enhanced capabilities

5.2.4 CHALLENGES

5.2.4.1 Increased barriers in designing military embedded systems

5.2.4.2 Critical security procedures in embedded devices

FIGURE 21 CYBERCRIME RATE, BY COUNTRY

5.3 MILITARY EMBEDDED SYSTEMS MARKET: ECOSYSTEM

5.3.1 PROMINENT COMPANIES

5.3.2 PRIVATE AND SMALL ENTERPRISES

5.3.3 END USERS

FIGURE 22 MILITARY EMBEDDED SYSTEMS MARKET: ECOSYSTEM MAP

5.4 AVERAGE SELLING PRICE OF MILITARY EMBEDDED SYSTEM COMPONENTS & SUB-COMPONENTS

TABLE 3 AVERAGE SELLING PRICE TRENDS FOR MILITARY EMBEDDED SYSTEM COMPONENTS

TABLE 4 AVERAGE SELLING PRICE TRENDS FOR SINGLE-BOARD COMPUTERS REQUIRED FOR MILITARY EMBEDDED SYSTEMS

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MILITARY EMBEDDED SYSTEM MANUFACTURERS

FIGURE 23 REVENUE SHIFT IN MILITARY EMBEDDED SYSTEMS MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 MILITARY EMBEDDED SYSTEMS MARKET: PORTER’S FIVE FORCE ANALYSIS

FIGURE 24 MILITARY EMBEDDED SYSTEMS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 DEGREE OF COMPETITION

5.7 TECHNOLOGY ANALYSIS

5.7.1 QUANTUM COMPUTING

5.7.2 AFFECTIVE COMPUTING ANALYSIS FOR MILITARY APPLICATIONS

5.8 USE CASES

5.8.1 RUGGED RACK-MOUNTED SERVER—MERCURY SYSTEMS, INC.

5.9 MILITARY EMBEDDED SYSTEMS MARKET: VALUE CHAIN ANALYSIS

FIGURE 25 MILITARY EMBEDDED SYSTEMS MARKET: VALUE CHAIN ANALYSIS

5.9.1 RESEARCH & DEVELOPMENT

5.9.2 RAW MATERIALS

5.9.3 COMPONENT/PRODUCT MANUFACTURERS (OEMS)

5.9.4 ASSEMBLERS & INTEGRATORS

5.9.5 END USERS

5.10 TARIFF & REGULATORY LANDSCAPE

5.10.1 NORTH AMERICA

TABLE 6 NORTH AMERICAN REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.10.2 EUROPE

TABLE 7 EUROPEAN REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.10.3 ASIA PACIFIC

TABLE 8 ASIA PACIFIC REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.10.4 MIDDLE EAST & AFRICA

TABLE 9 MIDDLE EASTERN & AFRICAN REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.10.5 LATIN AMERICA

TABLE 10 LATIN AMERICAN REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.11 TRADE ANALYSIS

TABLE 11 COUNTRY-WISE IMPORTS, NAVIGATIONAL INSTRUMENTS, AND APPARATUS, 2019–2021 (USD THOUSAND)

TABLE 12 COUNTRY-WISE EXPORTS, NAVIGATIONAL INSTRUMENTS, AND APPARATUS, 2019–2021 (USD THOUSAND)

6 INDUSTRY TRENDS (Page No. - 83)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 26 MILITARY EMBEDDED SYSTEMS MARKET: SUPPLY CHAIN ANALYSIS

6.2.1 MAJOR COMPANIES

6.2.2 SMALL AND MEDIUM-SIZED ENTERPRISES

6.2.3 END USERS/CUSTOMERS

6.3 TECHNOLOGY TRENDS

6.3.1 MULTICORE PROCESSORS

6.3.2 DEVELOPMENT OF HPEC (HIGH-PERFORMANCE EMBEDDED COMPUTING) FOR DEFENSE APPLICATIONS

6.3.3 MODERN MILITARY-GRADE ELECTRONIC PACKAGING TECHNOLOGY

6.3.4 AVAILABILITY OF COMMERCIAL OFF-THE-SHELF (COTS) PRODUCTS

6.3.5 SENSOR OPEN SYSTEMS ARCHITECTURE (SOSA)

6.3.6 SMALL FORM FACTOR IN MILITARY EMBEDDED SYSTEMS

6.3.7 USE OF ADVANCED MATERIALS IN EMBEDDED SYSTEMS

6.4 MEGATRENDS

6.4.1 ARTIFICIAL INTELLIGENCE IN MILITARY EMBEDDED SYSTEMS

6.4.2 INCREASING USE OF INTERNET OF THINGS (IOT)

6.5 INNOVATION & PATENT REGISTRATION

TABLE 13 INNOVATION & PATENT REGISTRATION, 2017–2022

7 MILITARY EMBEDDED SYSTEMS MARKET, BY SERVER ARCHITECTURE (Page No. - 88)

7.1 INTRODUCTION

FIGURE 27 BLADE SERVER SEGMENT TO DOMINATE MILITARY EMBEDDED SYSTEMS MARKET DURING FORECAST PERIOD

TABLE 14 MILITARY EMBEDDED SYSTEMS MARKET, BY SERVER ARCHITECTURE, 2018–2021 (USD MILLION)

TABLE 15 MILITARY EMBEDDED SYSTEMS MARKET, BY SERVER ARCHITECTURE, 2022–2027 (USD MILLION)

7.2 BLADE SERVER

FIGURE 28 OPENVPX TO DOMINATE MILITARY EMBEDDED SYSTEMS MARKET DURING FORECAST PERIOD

TABLE 16 MILITARY EMBEDDED SYSTEMS MARKET, BY BLADE SERVER, 2018–2021 (USD MILLION)

TABLE 17 MILITARY EMBEDDED SYSTEMS MARKET, BY BLADE SERVER, 2022–2027 (USD MILLION)

7.2.1 ADVANCEDTCA (ATCA)

7.2.1.1 Network intelligence applications to drive market for ATCA segment

7.2.2 COMPACTPCI (CPCI)

7.2.2.1 High demand for CompactPCI in Europe to drive market

TABLE 18 COMPACTPCI VS. COMPACTPCI SERIAL

7.2.3 OPENVPX

7.2.3.1 Need for upgrading existing military embedded systems to drive this segment

7.2.4 VME

7.2.4.1 Increasing demand in existing platform deployment to drive market for VME

7.2.5 MICROTCA

7.2.5.1 Increasing demand in combat land platform to drive market for MicroTCA

7.3 RACK-MOUNT SERVER

7.3.1 INCREASING DEMAND FOR NAVAL WEAPON SYSTEMS AND COMMAND & CONTROL CENTERS TO DRIVE MARKET FOR RACK-MOUNT SERVER

TABLE 19 MILITARY EMBEDDED SYSTEMS MARKET, BY RACK-MOUNT SERVER, 2018–2021 (USD MILLION)

TABLE 20 MILITARY EMBEDDED SYSTEMS MARKET, BY RACK-MOUNT SERVER, 2022–2027 (USD MILLION)

8 MILITARY EMBEDDED SYSTEMS MARKET, BY PLATFORM (Page No. - 96)

8.1 INTRODUCTION

FIGURE 29 NAVAL SEGMENT TO LEAD MILITARY EMBEDDED SYSTEMS MARKET FROM 2022 TO 2027

TABLE 21 MILITARY EMBEDDED SYSTEMS MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 22 MILITARY EMBEDDED SYSTEMS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

8.2 LAND

FIGURE 30 ARMORED VEHICLES SEGMENT TO LEAD MILITARY EMBEDDED SYSTEMS MARKET FROM 2022 TO 2027

TABLE 23 MILITARY EMBEDDED SYSTEMS MARKET FOR LAND PLATFORM, 2018–2021 (USD MILLION)

TABLE 24 MILITARY EMBEDDED SYSTEMS MARKET FOR LAND PLATFORM, 2022–2027 (USD MILLION)

8.2.1 ARMORED VEHICLES

TABLE 25 MILITARY EMBEDDED SYSTEMS MARKET, BY ARMORED VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 26 MILITARY EMBEDDED SYSTEMS MARKET, BY ARMORED VEHICLE TYPE, 2022–2027 (USD MILLION)

8.2.1.1 Combat vehicles

TABLE 27 MILITARY EMBEDDED SYSTEMS MARKET, BY COMBAT VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 28 MILITARY EMBEDDED SYSTEMS MARKET, BY COMBAT VEHICLE TYPE, 2022–2027 (USD MILLION)

8.2.1.1.1 Main battle tanks (MBTs)

8.2.1.1.1.1 New embedded product launches and procurements to fuel demand for military embedded systems

8.2.1.1.2 Infantry fighting vehicles (IFVs)

8.2.1.1.2.1 Demand for next-generation, advanced infantry vehicles to fuel market

8.2.1.1.3 Air defense vehicles

8.2.1.1.3.1 Technological advancements in air defense vehicles to support market growth

8.2.1.1.4 Self-propelled howitzers

8.2.1.1.4.1 Increasing use of in-built electronic suites in howitzers to boost demand for military embedded systems

8.2.1.1.5 Armored amphibious vehicles

8.2.1.1.5.1 Demand for amphibious armored vehicles to drive market

8.2.1.2 Combat support vehicles

8.2.1.2.1 Armored command and control vehicles

8.2.1.2.1.1 Integration of C2 systems in modern warfare vehicles to propel market

8.2.1.2.2 Armored supply trucks

8.2.1.2.2.1 Increased use of advanced protection systems in military transport to drive market

8.2.2 COMMAND CENTERS

8.2.2.1 Focus on modernization of command centers to boost market

8.2.3 SOLDIERS

8.2.3.1 Developments in rugged military wearable systems to contribute to market growth

8.2.4 WEAPON & MUNITION SYSTEMS

TABLE 29 MILITARY EMBEDDED SYSTEMS MARKET, BY WEAPON & MUNITION SYSTEM, 2018–2021 (USD MILLION)

TABLE 30 MILITARY EMBEDDED SYSTEMS MARKET, BY WEAPON & MUNITION SYSTEM, 2022–2027 (USD MILLION)

8.2.4.1 Launch systems

8.2.4.1.1 Embedded system manufacturers focus on modular embedded systems for weapon launching systems

8.2.4.2 Defense systems

8.2.4.2.1 Increasing demand for 360-degree day & night coverage, 3D sensors, and integrated command and control systems

8.3 AIRBORNE

FIGURE 31 FIGHTER JETS SEGMENT TO LEAD MILITARY EMBEDDED SYSTEMS MARKET FROM 2022 TO 2027

TABLE 31 AIRBORNE PLATFORM: MILITARY EMBEDDED SYSTEMS MARKET, BY AIRCRAFT TYPE, 2018–2021 (USD MILLION)

TABLE 32 AIRBORNE PLATFORM: MILITARY EMBEDDED SYSTEMS MARKET, BY AIRCRAFT TYPE, 2022–2027 (USD MILLION)

8.3.1 FIGHTER JETS

8.3.1.1 Development of advanced electronic systems and mission-critical embedded systems to drive market

8.3.2 SPECIAL MISSION AIRCRAFT

8.3.2.1 Increasing demand for open system avionics to drive special mission aircraft market

8.3.3 HELICOPTERS

8.3.3.1 Increased surveillance operations due to geographical instability to fuel demand for helicopters

8.3.4 AEROSTATS

8.3.4.1 Modernization of electronic systems in aerostats to drive market

8.3.4.1.1 Powered

8.3.4.1.2 Unpowered

8.4 NAVAL

FIGURE 32 DESTROYERS SEGMENT TO LEAD MILITARY EMBEDDED SYSTEMS MARKET IN NAVAL PLATFORM FROM 2022 TO 2027

TABLE 33 NAVAL PLATFORM: MILITARY EMBEDDED SYSTEMS MARKET, BY VESSEL TYPE, 2018–2021 (USD MILLION)

TABLE 34 NAVAL PLATFORM: MILITARY EMBEDDED SYSTEMS MARKET, BY VESSEL TYPE, 2022–2027 (USD MILLION)

8.4.1 DESTROYERS

8.4.1.1 Use of advanced electronics and high-tech embedded systems to propel market

8.4.2 FRIGATES

8.4.2.1 Demand for open-architecture scalable framework using non-developmental software to drive market

8.4.3 CORVETTES

8.4.3.1 Use of advanced radar systems, open-architecture systems, and several sensors and weapons systems to favor market growth

8.4.4 OFFSHORE PATROL VESSELS

8.4.4.1 Increasing investments in maritime security to support market growth

8.4.5 AIRCRAFT CARRIERS

8.4.5.1 Focus on optimizing construction of ships to drive market

8.4.6 SUBMARINES

8.4.6.1 Development of advanced submarines for maritime security to boost market

8.5 UNMANNED VEHICLES

FIGURE 33 UNMANNED MARITIME VESSELS TO LEAD MILITARY EMBEDDED SYSTEMS MARKET FROM 2022 TO 2027

TABLE 35 UNMANNED PLATFORM: MILITARY EMBEDDED SYSTEMS MARKET, BY UNMANNED VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 36 UNMANNED PLATFORM: MILITARY EMBEDDED SYSTEMS MARKET, BY UNMANNED VEHICLE TYPE, 2022–2027 (USD MILLION)

8.5.1 UNMANNED GROUND VEHICLES

8.5.1.1 Development of UGVs for human-inconvenient operations to fuel growth of unmanned armored vehicles

8.5.2 UNMANNED AERIAL VEHICLES (UAVS)

8.5.2.1 Use of advanced embedded components in UAV platforms to drive market

8.5.3 UNMANNED MARITIME VEHICLES (UMVS)

TABLE 37 UNMANNED MARITIME VESSEL: MILITARY EMBEDDED SYSTEMS MARKET, BY UNMANNED MARITIME VESSEL (UMV) TYPE, 2018–2021 (USD MILLION)

TABLE 38 UNMANNED MARITIME VESSEL: MILITARY EMBEDDED SYSTEMS MARKET, BY UNMANNED MARITIME VESSEL (UMV) TYPE, 2022–2027 (USD MILLION)

8.5.3.1 Unmanned underwater vehicles (UUVs)

8.5.3.1.1 Demand for intelligence support for underwater warfare systems to fuel market

8.5.3.2 Unmanned surface vessels (USVs)

8.5.3.2.1 Increasing use of military embedded systems in USVs to help market growth

8.5.3.3 Unmanned submarines

8.5.3.3.1 Increasing use of advanced communication & navigation systems in unmanned submarines to drive market

8.6 SPACE

FIGURE 34 SATELLITES SEGMENT TO LEAD MILITARY EMBEDDED SYSTEMS MARKET IN SPACE PLATFORM

TABLE 39 SPACE PLATFORM: MILITARY EMBEDDED SYSTEMS MARKET, BY SPACE PLATFORM TYPE, 2018–2021 (USD MILLION)

TABLE 40 SPACE PLATFORM: MILITARY EMBEDDED SYSTEMS MARKET, BY SPACE PLATFORM TYPE, 2022–2027 (USD MILLION)

8.6.1 CUBESATS

8.6.1.1 Development of onboard internet systems, electronic propulsion system, and 3D printed electronics to fuel growth of CubeSats

8.6.2 SATELLITES

TABLE 41 MILITARY EMBEDDED SYSTEMS MARKET, BY SATELLITE TYPE, 2018–2021 (USD MILLION)

TABLE 42 MILITARY EMBEDDED SYSTEMS MARKET, BY SATELLITE TYPE, 2022–2027 (USD MILLION)

8.6.2.1 Small satellites

8.6.2.1.1 Increasing use of commercial-off-the-shelf (COTS) technology in small satellites to be growth factor

8.6.2.2 Medium satellites

8.6.2.2.1 Growing use of innovative propulsion, attitude control, and communication & computation systems in medium satellites to propel market

8.6.2.3 Large satellites

8.6.2.3.1 Increased demand for space-based communication subsystems to drive market

8.6.3 LAUNCH VEHICLES

8.6.3.1 Advancements in launch vehicles and related electronic systems to support market growth

9 MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION (Page No. - 119)

9.1 INTRODUCTION

FIGURE 35 ISR SEGMENT TO LEAD MILITARY EMBEDDED SYSTEMS MARKET FROM 2022 TO 2027

TABLE 43 MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 44 MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 INTELLIGENCE, SURVEILLANCE, & RECONNAISSANCE (ISR)

9.2.1 INCREASED PROCUREMENT OF HIGH-TECH SURVEILLANCE & MONITORING SYSTEMS TO FUEL MARKET

9.3 ELECTRONIC WARFARE

9.3.1 GROWING FOCUS ON COGNITIVE ELECTRONIC WARFARE TECHNOLOGIES TO PROPEL MARKET

9.4 COMMAND & CONTROL

9.4.1 INVESTMENTS IN C2 SYSTEMS TO FUEL GROWTH OF MILITARY EMBEDDED SYSTEMS

9.5 COMMUNICATION & NAVIGATION

9.5.1 DEMAND FOR UNINTERRUPTED MILITARY COMMUNICATION AND NAVIGATION SYSTEMS TO BOOST MARKET

9.6 WEAPON & FIRE CONTROL

9.6.1 RISING DEMAND FOR HIGH-PRECISION AUTOMATIC WEAPON SYSTEMS TO DRIVE MARKET

9.7 WEARABLES

9.7.1 DEVELOPMENT OF ADVANCED EMBEDDED SYSTEMS TO ENHANCE CAPABILITIES OF WEARABLES FOR SOLDIERS

9.8 OTHERS

10 MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE (Page No. - 125)

10.1 INTRODUCTION

FIGURE 36 NEW INSTALLATION SEGMENT TO DOMINATE MILITARY EMBEDDED SYSTEMS MARKET DURING FORECAST PERIOD

TABLE 45 MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 46 MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

10.2 NEW INSTALLATION

10.2.1 GROWING DEFENSE BUDGET ALLOCATION FOR INSTALLATION OF ADVANCED MILITARY EMBEDDED SYSTEMS

10.3 UPGRADE

10.3.1 NEED TO UPGRADE EXISTING MILITARY EMBEDDED SYSTEMS

11 MILITARY EMBEDDED SYSTEMS MARKET, BY COMPONENT (Page No. - 128)

11.1 INTRODUCTION

11.2 HARDWARE

11.2.1 PROCESSOR

11.2.2 MEMORY

11.2.3 CONVERTER

11.2.4 GRAPHICAL PROCESSING UNIT (GPU)

11.2.5 OTHERS

11.3 SOFTWARE

12 MILITARY EMBEDDED SYSTEMS MARKET, BY SERVICE (Page No. - 133)

12.1 INTRODUCTION

12.2 DESIGN

12.2.1 TECHNOLOGICAL ENHANCEMENT IN ELECTRONIC HARDWARE

12.2.1.1 Development consulting

12.2.1.2 Engineering support

12.2.1.3 Deployment support

12.3 TEST & CERTIFICATION

12.3.1 INCREASING SAFEGUARDS TO AVOID AND COUNTERACT SECURITY RISKS RELATED TO EMBEDDED SOFTWARE

12.3.1.1 Accelerated life testing

12.3.1.2 International standards

12.3.1.3 Product safety

12.3.1.4 Others

12.4 DEPLOYMENT

12.4.1 FOCUS ON ENHANCEMENT OF PRODUCT LIFE CYCLE TO FUEL DEMAND FOR DEPLOYMENT SERVICES

12.5 RENEWAL

12.5.1 FOCUS ON ENHANCEMENT, PRODUCT UPGRADE, AND PROVISION OF SOFTWARE UPDATES TO DRIVE RENEWAL SERVICES MARKET

12.6 SEAMLESS LIFE CYCLE SUPPORT

12.6.1 FOCUS ON PROVIDING SEAMLESS SERVICE SUPPORT TO CUSTOMERS TO DRIVE MARKET

13 MILITARY EMBEDDED SYSTEMS MARKET, BY REGION (Page No. - 136)

13.1 INTRODUCTION

FIGURE 37 MILITARY EMBEDDED SYSTEMS MARKET IN ASIA PACIFIC TO WITNESS HIGHEST CAGR FROM 2022 TO 2027

TABLE 47 MILITARY EMBEDDED SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 MILITARY EMBEDDED SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

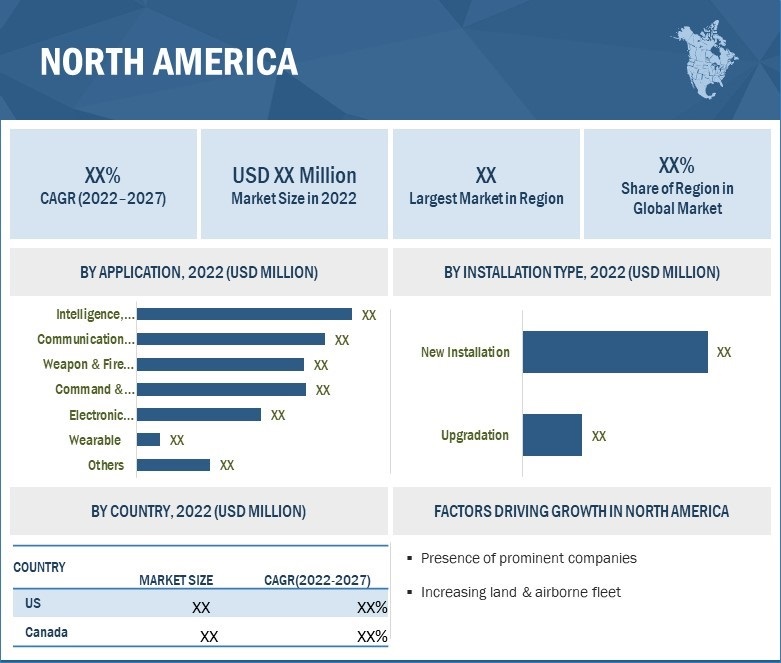

13.2 NORTH AMERICA

13.2.1 PESTLE ANALYSIS

FIGURE 38 NORTH AMERICA: MILITARY EMBEDDED SYSTEMS MARKET SNAPSHOT

TABLE 49 NORTH AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 50 NORTH AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 52 NORTH AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 53 NORTH AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 54 NORTH AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.2.2 US

13.2.2.1 Increase in adoption of AI and IoT

TABLE 55 US: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 56 US: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 57 US: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 58 US: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.2.3 CANADA

13.2.3.1 Rise in demand for high-tech equipment used in military aircraft

TABLE 59 CANADA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 60 CANADA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 61 CANADA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 62 CANADA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.3 EUROPE

13.3.1 PESTLE ANALYSIS

FIGURE 39 EUROPE: MILITARY EMBEDDED SYSTEMS MARKET SNAPSHOT

TABLE 63 EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 64 EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 65 EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 66 EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 67 EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 68 EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.3.2 UK

13.3.2.1 Advancements in military automation and increasing investments in R&D to provide lucrative opportunities

TABLE 69 UK: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 70 UK: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 71 UK: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 72 UK: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.3.3 RUSSIA

13.3.3.1 Rising investments in digitizing armored vehicle platforms to drive market

TABLE 73 RUSSIA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 74 RUSSIA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 75 RUSSIA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 76 RUSSIA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.3.4 GERMANY

13.3.4.1 Integration of AI and improved safety standards for armored vehicles equipped with smart robotics to drive market

TABLE 77 GERMANY: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 78 GERMANY: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 79 GERMANY: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 80 GERMANY: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.3.5 NORWAY

13.3.5.1 Presence of strong shipbuilding industry to drive market

TABLE 81 NORWAY: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 82 NORWAY: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 83 NORWAY: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 84 NORWAY: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.3.6 FRANCE

13.3.6.1 Demand for advanced avionics systems to fuel market

TABLE 85 FRANCE: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 86 FRANCE: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 87 FRANCE: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 88 FRANCE: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.3.7 REST OF EUROPE

TABLE 89 REST OF EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 90 REST OF EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 91 REST OF EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 92 REST OF EUROPE: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.4 ASIA PACIFIC

13.4.1 PESTLE ANALYSIS

FIGURE 40 ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET SNAPSHOT

TABLE 93 ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 94 ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 95 ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 96 ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 97 ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 98 ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2022–2027(USD MILLION)

13.4.2 CHINA

13.4.2.1 Increased investment to strengthen military capabilities due to cross-border conflicts to drive market

TABLE 99 CHINA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 100 CHINA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 101 CHINA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 102 CHINA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.4.3 INDIA

13.4.3.1 Focus on digitization of military applications to support market growth

TABLE 103 INDIA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 104 INDIA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 105 INDIA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 106 INDIA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.4.4 JAPAN

13.4.4.1 Investment by government and private sectors in AI, IoT, and robotics to drive market

TABLE 107 JAPAN: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 108 JAPAN: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 109 JAPAN: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 110 JAPAN: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.4.5 SOUTH KOREA

13.4.5.1 Introduction of Patriot air defense systems and radars with advanced embedded capabilities

TABLE 111 SOUTH KOREA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 112 SOUTH KOREA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 113 SOUTH KOREA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 114 SOUTH KOREA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.4.6 AUSTRALIA

13.4.6.1 Investment in development of advanced embedded systems for ground vehicles to drive market

TABLE 115 AUSTRALIA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 116 AUSTRALIA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 117 AUSTRALIA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 118 AUSTRALIA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.4.7 REST OF ASIA PACIFIC

TABLE 119 REST OF ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 120 REST OF ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 121 REST OF ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 122 REST OF ASIA PACIFIC: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.5 MIDDLE EAST & AFRICA

13.5.1 PESTLE ANALYSIS

FIGURE 41 MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET SNAPSHOT

TABLE 123 MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 124 MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 125 MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 126 MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 127 MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 128 MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.5.2 SAUDI ARABIA

13.5.2.1 Demand for combat vehicle segment to drive market

TABLE 129 SAUDI ARABIA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 130 SAUDI ARABIA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 131 SAUDI ARABIA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 132 SAUDI ARABIA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.5.3 ISRAEL

13.5.3.1 Rising imports of military electronic hardware and electronic systems to drive market

TABLE 133 ISRAEL: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 134 ISRAEL: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 135 ISRAEL: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 136 ISRAEL: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.5.4 UAE

13.5.4.1 Increasing use of military embedded systems for ISR and command & control applications to drive market

TABLE 137 UAE: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 138 UAE: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 139 UAE: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 140 UAE: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.5.5 TURKEY

13.5.5.1 Joint programs on advanced robotics and embedded systems to drive market

TABLE 141 TURKEY: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 142 TURKEY: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 143 TURKEY: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 144 TURKEY: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.5.6 SOUTH AFRICA

13.5.6.1 Developments in electronic warfare systems to support market growth

TABLE 145 SOUTH AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 146 SOUTH AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 147 SOUTH AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 148 SOUTH AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.5.7 REST OF MIDDLE EAST & AFRICA

TABLE 149 REST OF MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 150 REST OF MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 151 REST OF MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 152 REST OF MIDDLE EAST & AFRICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.6 LATIN AMERICA

13.6.1 PESTLE ANALYSIS

FIGURE 42 LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET SNAPSHOT

TABLE 153 LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 154 LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 155 LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 156 LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 157 LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 158 LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.6.2 BRAZIL

13.6.2.1 Military aircraft electronic system and radar surveillance system modernization programs to fuel market

TABLE 159 BRAZIL: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 160 BRAZIL: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 161 BRAZIL: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 162 BRAZIL: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.6.3 MEXICO

13.6.3.1 Program for electronics and high technology industry competitiveness (PCIEAT) to propel market

TABLE 163 MEXICO: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 164 MEXICO: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 165 MEXICO: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 166 MEXICO: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.6.4 REST OF LATIN AMERICA

TABLE 167 REST OF LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2018–2021 (USD MILLION)

TABLE 168 REST OF LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY INSTALLATION TYPE, 2022–2027 (USD MILLION)

TABLE 169 REST OF LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 170 REST OF LATIN AMERICA: MILITARY EMBEDDED SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 198)

14.1 INTRODUCTION

TABLE 171 COMPANIES ADOPTED CONTRACTS AS KEY GROWTH STRATEGY BETWEEN JANUARY 2019 AND OCTOBER 2022

14.2 COMPETITIVE LEADERSHIP MAPPING

14.2.1 STARS

14.2.2 EMERGING LEADERS

14.2.3 PERVASIVE PLAYERS

14.2.4 PARTICIPANTS

FIGURE 43 COMPETITIVE LEADERSHIP MAPPING, 2021

14.3 MARKET SHARE OF KEY PLAYERS, 2021

TABLE 172 DEGREE OF COMPETITION

FIGURE 44 MARKET SHARE ANALYSIS OF TOP PLAYERS IN MILITARY EMBEDDED SYSTEMS MARKET, 2021

14.4 REVENUE ANALYSIS OF KEY PLAYERS, 2021

FIGURE 45 REVENUE ANALYSIS OF MILITARY EMBEDDED SYSTEMS MARKET PLAYERS, 2019–2021

14.5 RANK ANALYSIS

FIGURE 46 REVENUE SHARE OF TOP 5 PLAYERS IN MILITARY EMBEDDED SYSTEMS MARKET IN 2021

TABLE 173 COMPANY REGION FOOTPRINT

TABLE 174 COMPANY APPLICATION FOOTPRINT

TABLE 175 COMPANY PLATFORM FOOTPRINT

14.6 COMPETITIVE SCENARIO

14.6.1 PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 176 MILITARY EMBEDDED SYSTEMS MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2019–2022

14.6.2 DEALS

TABLE 177 MILITARY EMBEDDED SYSTEMS MARKET: DEALS, 2019–2022

14.6.3 OTHERS

TABLE 178 MILITARY EMBEDDED SYSTEMS MARKET: OTHERS, 2019–2022

15 COMPANY PROFILES (Page No. - 215)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

15.1 INTRODUCTION

15.2 KEY PLAYERS

15.2.1 CURTISS-WRIGHT CORPORATION

TABLE 179 CURTISS-WRIGHT CORPORATION: COMPANY OVERVIEW

FIGURE 47 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

15.2.2 KONTRON (S&T AG)

TABLE 180 KONTRON (S&T AG): COMPANY OVERVIEW

FIGURE 48 KONTRON (S&T AG): COMPANY SNAPSHOT

15.2.3 MERCURY SYSTEMS, INC.

TABLE 181 MERCURY SYSTEMS, INC.: COMPANY OVERVIEW

FIGURE 49 MERCURY SYSTEMS, INC.: COMPANY SNAPSHOT

15.2.4 AMETEK

TABLE 182 AMETEK: COMPANY OVERVIEW

FIGURE 50 AMETEK: COMPANY SNAPSHOT

15.2.5 GENERAL DYNAMICS CORPORATION

TABLE 183 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

FIGURE 51 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

15.2.6 XILINX, INC.

TABLE 184 XILINX, INC: COMPANY OVERVIEW

FIGURE 52 XILINX, INC.: COMPANY SNAPSHOT

15.2.7 CONCURRENT TECHNOLOGIES

TABLE 185 CONCURRENT TECHNOLOGIES: COMPANY OVERVIEW

FIGURE 53 CONCURRENT TECHNOLOGIES: COMPANY SNAPSHOT

15.2.8 EUROTECH

TABLE 186 EUROTECH: COMPANY OVERVIEW

FIGURE 54 EUROTECH: COMPANY SNAPSHOT

15.2.9 DELL TECHNOLOGIES

TABLE 187 DELL TECHNOLOGIES: COMPANY OVERVIEW

FIGURE 55 DELL TECHNOLOGIES: COMPANY SNAPSHOT

15.2.10 AITECH DEFENSE SYSTEMS

TABLE 188 AITECH DEFENSE SYSTEMS: COMPANY OVERVIEW

15.2.11 AUTOTEC

TABLE 189 AUTOTEC: COMPANY OVERVIEW

15.2.12 GENERAL MICRO SYSTEMS, INC.

TABLE 190 GENERAL MICRO SYSTEMS: COMPANY OVERVIEW

15.2.13 ADVANTECH CO., LTD.

TABLE 191 ADVANTECH CO., LTD.: COMPANY OVERVIEW

FIGURE 56 ADVANTECH CO., LTD.: COMPANY SNAPSHOT

15.2.14 THALES GROUP

TABLE 192 THALES GROUP: COMPANY OVERVIEW

FIGURE 57 THALES GROUP: COMPANY SNAPSHOT

15.2.15 SMART EMBEDDED COMPUTING

TABLE 193 SMART EMBEDDED COMPUTING: COMPANY OVERVIEW

FIGURE 58 SMART EMBEDDED COMPUTING: COMPANY SNAPSHOT

15.2.16 NXP SEMICONDUCTORS

TABLE 194 NXP SEMICONDUCTORS: COMPANY OVERVIEW

FIGURE 59 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

15.2.17 ADVANCED MICRO PERIPHERALS

TABLE 195 ADVANCED MICRO PERIPHERALS: COMPANY OVERVIEW

15.2.18 ELMA ELECTRONIC

TABLE 196 ELMA ELECTRONIC: COMPANY OVERVIEW

FIGURE 60 ELMA ELECTRONIC: COMPANY SNAPSHOT

15.2.19 TEXAS INSTRUMENTS INCORPORATED

TABLE 197 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

FIGURE 61 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

15.2.20 INTEL CORPORATION

TABLE 198 INTEL CORPORATION: COMPANY OVERVIEW

FIGURE 62 INTEL CORPORATION: COMPANY SNAPSHOT

15.3 OTHER PLAYERS

15.3.1 RADISYS

TABLE 199 RADISYS: COMPANY OVERVIEW

15.3.2 CRYSTAL GROUP

TABLE 200 CRYSTAL GROUP: COMPANY OVERVIEW

15.3.3 VADATECH

TABLE 201 VADATECH: COMPANY OVERVIEW

15.3.4 AVDOR HELET

TABLE 202 AVDOR HELET: COMPANY OVERVIEW

15.3.5 NORTH ATLANTIC INDUSTRIES, INC.

TABLE 203 NORTH ATLANTIC INDUSTRIES, INC.: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 279)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Military Embedded Systems Market

Hello, I would like to know the number of units and revenue for switches and routers and the market share by each integrator.