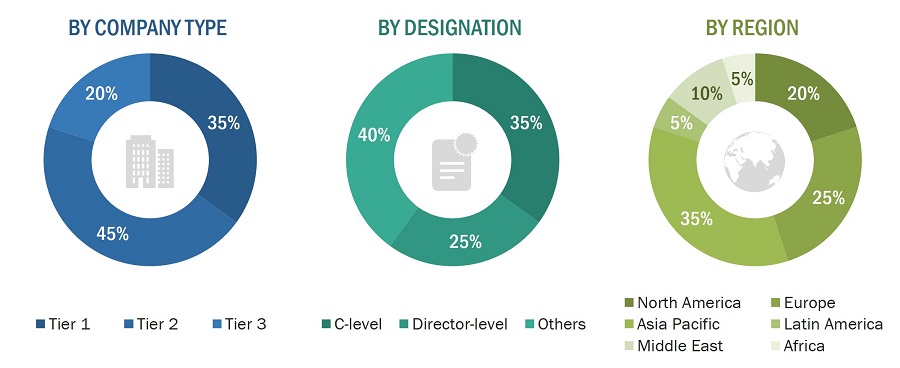

This research study on the aircraft seating market involved the extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. Primary sources included industry experts, service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of this industry's value chain. In-depth interviews with primary respondents, including key industry participants, subject matter experts, industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information about the aircraft seating market and assess the market's growth prospects.

Secondary Research

The market share of companies in the aircraft seating market was determined using the secondary data acquired through paid and unpaid sources and analyzing the product portfolios of major companies operating in the market. These companies were rated based on the performance and quality of their products. Primary sources further validated these data points.

Secondary sources referred to for this research study on the aircraft seating market included government sources, such as GAMA (General Aviation Manufacturer Association), International Air Transport Association (IATA), Boeing Outlook 2023, Airbus Outlook 2023, and federal and state governments of various countries; corporate filings, such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations; among others. Secondary data was collected and analyzed to determine the overall size of the aircraft seating market, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information regarding the aircraft seating market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, Africa and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

-

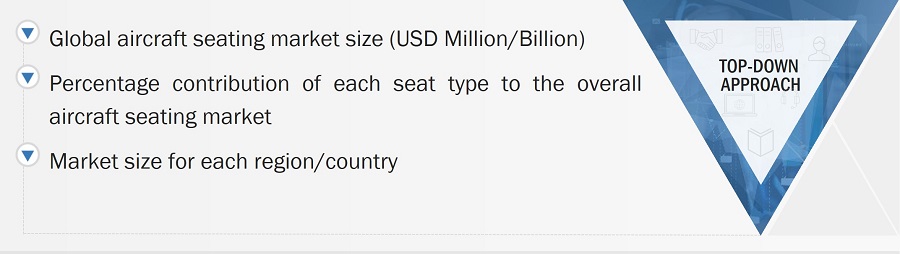

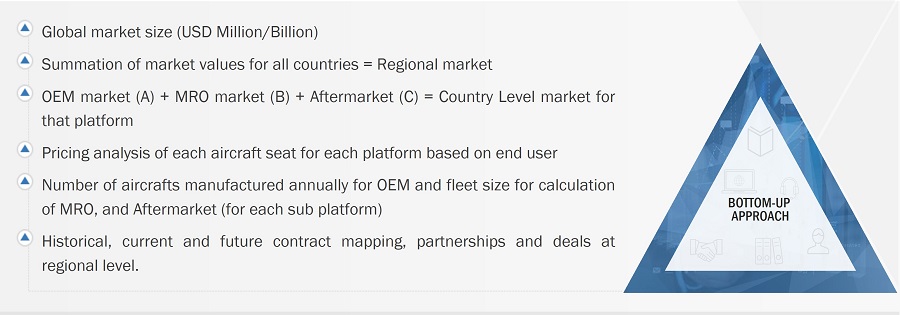

Both top-down and bottom-up approaches were used to estimate and validate the size of the aircraft seating market.

-

Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market Size Estimation Methodology: Bottom-up Approach

Market Size Estimation Methodology: Top-Down Approach

Data triangulation

After arriving at the overall size of the aircraft seating market from the market size estimation process explained above, the total market was split into several segments and subsegments. Wherever applicable, data triangulation and market breakdown procedures explained below were implemented to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up approaches.

Market Definition

Aircraft seats are specialized passenger and pilot & crew seating solutions designed for use within the interior of an aircraft. These seats are engineered for safety, comfort, ergonomics, and efficient space utilization, aligning with aviation standards and regulatory requirements. Manufacturers focus on incorporating lightweight materials, advanced technology for personalization, and features that enhance passenger experience, including adjustable recline, personal entertainment systems, and connectivity options. Aircraft seats include components such as structure, foam, actuators, electrical fittings, and others. The design and configuration of aircraft seats are critical for airlines to optimize cabin space, differentiate service offerings, improve passenger satisfaction, and pilot & crew safety, ultimately influencing airline branding and revenue generation.

The market is driven by the constant evolution of technology, leading to the development of advanced seating solutions that contribute to fuel efficiency, increased comfort, and enhanced safety. Growing demand for modernized aircraft, increased air travel, and the imperative for regulatory compliance further propel the aircraft seating market.

Stakeholders

Various stakeholders of the market are listed below:

-

Manufacturers of Aircraft Seats

-

Suppliers of Aircraft Seating Parts

-

Manufacturers of Subcomponents

-

Retailers, Distributors, and Wholesalers of Aircraft Seating

-

Airline Associations

-

Private and Public Aircraft Seating Companies

-

Regulators

-

Technology Support Providers

Report Objectives

-

To define, describe, segment, and forecast the size of the aircraft seating market based on platform, end-user, seat type, standard, seat material, and region.

-

To forecast the market size of various segments of the aircraft seating market with respect to major regions, namely, North America, Europe, Asia Pacific, Middle East, Latin America, and Africa along with major countries in each region

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the aircraft seating market

-

To identify industry trends, market trends, and technology trends currently prevailing in the market

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

-

To analyze competitive developments such as contracts, partnerships, agreements, collaborations, acquisitions, funding, and new product launches & developments of key players in the market

-

To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the aircraft seating market

-

To strategically profile key market players and comprehensively analyze their market ranking and core competencies2

1 Micromarkets are referred to as the segments and subsegments of the Aircraft Seating market considered in the scope of the report.

2 Core competencies of companies were captured in terms of their key developments and key strategies adopted to sustain their positions in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company.

Regional Analysis

-

Further breakdown of the market segments at the country level

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Nick

Jul, 2019

I'd like to know the market size and growth of 9G seats compared to 16G seats, the market data for the last 20 years, and an estimate in future growth and size for these 2 segments..

MICHAEL

Apr, 2019

Hi. I'm investigating an investment in an aircraft seating company and was just keen to know the relative size, the players, the split of the market in to First/Business/Premium Economy/Economy, and the split into OEM, Aftermarket, MRO. If there's any snippets you could provide that would be much appreciated. Thanks, Michael..

Peter

Oct, 2019

We are manufacturing and developing polymer material products which are used in the production of aircraft seats. As a wider business we have 8 manufacturing sites around Europe producing different polymer sheet products for many diverse markets..