Personal Cloud Market by Type (Online, NAS Device, Server Device), User Type (Enterprise, Consumer), Hosting Type (Provider, User/Self-hosting), Revenue Type (Direct, Indirect), Vertical (IT & ITeS, BFSI, Telecommunications) and Region - Global Forecast to 2028

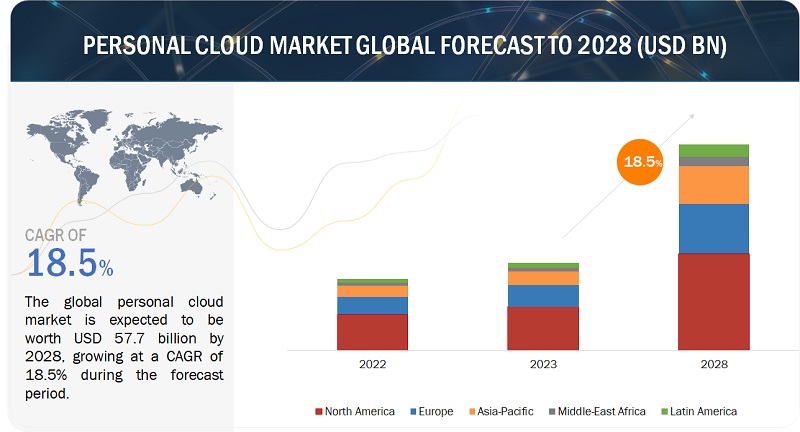

[330 Pages Report] The personal cloud market size to grow from USD 24.7 billion in 2023 to USD 57.7 billion by 2028 at a compound annual growth rate (CAGR) of 18.5% during the forecast period.

The personal cloud market is a dynamic sector within the broader cloud computing landscape that caters to individuals seeking secure and accessible solutions for storing and managing their digital data. Unlike traditional cloud services designed for businesses, personal cloud services focus on the needs of individual users, offering a platform to store, access, and sync personal files such as documents, photos, and videos across various devices. The market is witnessing significant growth due to the increasing reliance on digital content, the proliferation of connected devices, and the rising importance of data privacy.

In the personal cloud market, several business models have emerged to address diverse user preferences and needs. The freemium model is one of the most common approaches, allowing users to access a basic set of personal cloud services for free while offering premium features or additional storage space at a subscription cost. This model attracts a wide user base with essential functionalities and encourages users to upgrade for an enhanced experience or expanded storage options. Prominent personal cloud services such as Dropbox and Google Drive have successfully implemented the freemium model, providing users with scalable and customizable solutions.

Furthermore, subscription-based models are another prevalent business approach in the personal cloud market. Users pay a recurring fee for a subscription plan that offers a comprehensive set of features, increased storage capacity, and sometimes enhanced security options. Microsoft's OneDrive, for instance, adopts a subscription-based model that can be integrated with the broader Microsoft 365 suite, providing users with a unified experience for both personal and professional use. This model brings a steady revenue stream for service providers while delivering an array of valuable features to subscribers.

In summary, the personal cloud market revolves around providing individuals with secure and flexible solutions for managing their digital data. The freemium model and subscription-based models are two predominant business approaches, each offering users a different set of benefits and options. As the market continues to evolve, personal cloud solutions providers strive to strike a balance between offering free access to basic services and providing premium features through subscription plans to meet the diverse needs of their user base.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Personal Cloud Market Dynamics

Driver: Increase demand for data storage

The personal cloud market is experiencing a significant boost due to the rising demand for data storage. As individuals and businesses generate an ever-expanding volume of digital data, there is a growing need for secure, accessible, and scalable storage solutions. This surge is propelled by the widespread adoption of smart devices, which generate substantial amounts of personal and professional data. The proliferation of high-resolution media content, the increasing use of applications, and the trend toward remote work further contribute to the escalating demand for storage space. Consequently, consumers are turning to personal cloud services as a reliable means to store and manage their expanding digital footprints, allowing them to seamlessly access and share data across various devices.

Moreover, the rise in awareness regarding data security and privacy concerns is driving individuals to opt for personal cloud solutions that offer robust encryption and stringent security measures. As cyber threats become more sophisticated, users are prioritizing platforms that can safeguard their sensitive information. The personal cloud market is responding to this demand by integrating advanced security features, ensuring data integrity and confidentiality. This confluence of factors not only propels the market forward but also fosters innovation in personal cloud services, with providers continually enhancing their offerings to meet the evolving storage needs and security expectations of a digitally connected user base.

Restraint: Internet and connectivity issues

A significant restraint for the personal cloud market revolves around challenges related to internet and connectivity issues. The seamless functionality of personal cloud services heavily relies on robust and consistent internet connections. Users may encounter disruptions, slow network speeds, or even complete outages, impeding their ability to access, upload, or download data from the cloud. In regions with limited internet infrastructure, the effectiveness of personal cloud services can be compromised, affecting user experience and hindering the real-time collaboration and synchronization features that are integral to these platforms.

Furthermore, concerns about data security often deter users from using public or unsecured Wi-Fi networks, restricting their ability to access personal cloud services in various locations. The reliance on high-speed internet connectivity also impacts the efficiency of data backups and synchronization processes, potentially resulting in delays and frustration for users. The personal cloud market must contend with these connectivity challenges, prompting service providers to develop strategies for offline access, implement data compression techniques, and enhance caching mechanisms to mitigate the impact of internet-related constraints. Addressing these issues is critical for ensuring the broad accessibility and reliability of personal cloud services, particularly in areas where internet infrastructure remains a limiting factor.

Opportunity: Growing partnerships within market players

The personal cloud market is experiencing promising opportunities through the growing trend of partnerships among market players. Collaboration between personal cloud service providers and other tech companies has become increasingly prevalent, fostering innovation and expanding the scope of services offered. An illustrative example of this trend is the partnership between Microsoft and Dropbox. In a move that synergizes their strengths, Microsoft integrated Dropbox into its Office Suite, enabling users to seamlessly access and edit their Dropbox files directly from Microsoft Office applications. This partnership not only enhances user convenience but also showcases the potential for collaboration between established players in the personal cloud and productivity software domains. By combining the storage capabilities of Dropbox with the productivity tools of Microsoft Office, the partnership delivers a more integrated and efficient user experience, addressing the multifaceted needs of individuals and businesses.

Furthermore, collaborations within the personal cloud market extend beyond technological integration to encompass strategic alliances that drive mutual growth. For instance, partnerships between personal cloud service providers and telecommunications companies can enhance accessibility. Google's partnership with telecom giant Airtel in India exemplifies this trend, where Airtel offers Google One subscriptions to its mobile customers. This collaboration not only expands the reach of Google's personal cloud services but also leverages Airtel's extensive network infrastructure to provide seamless access to cloud storage for a broader user base. Such partnerships tap into existing user ecosystems, making personal cloud services more accessible to diverse demographics. As the personal cloud market continues to evolve, these partnerships not only amplify the value proposition for users but also contribute to the overall competitiveness and innovation within the industry.

Challenge: Integration with third-party applications

A significant challenge for the personal cloud market revolves around the integration with third-party applications. While personal cloud services aim to offer users a comprehensive and centralized solution for data management, seamless integration with a myriad of third-party applications poses a substantial hurdle. The diversity of applications used by individuals and businesses demands compatibility and interoperability with personal cloud platforms. Achieving this level of integration requires collaboration and standardization efforts across a wide array of software providers. Additionally, variations in application programming interfaces (APIs), data formats, and security protocols present hurdles for personal cloud providers seeking to create a cohesive ecosystem that caters to diverse user needs.

Concerns about data security and privacy further complicate the integration landscape. Personal cloud providers must ensure that the integration with third-party applications does not compromise the security of user data. Striking a balance between openness to integration and maintaining robust security measures becomes crucial, as vulnerabilities in third-party applications could potentially expose sensitive information stored in the personal cloud. Addressing these challenges necessitates ongoing efforts in establishing industry standards, fostering collaboration among software developers, and implementing robust security measures to create a seamless and secure environment for users across the personal cloud ecosystem.

Personal Cloud Market Ecosystem

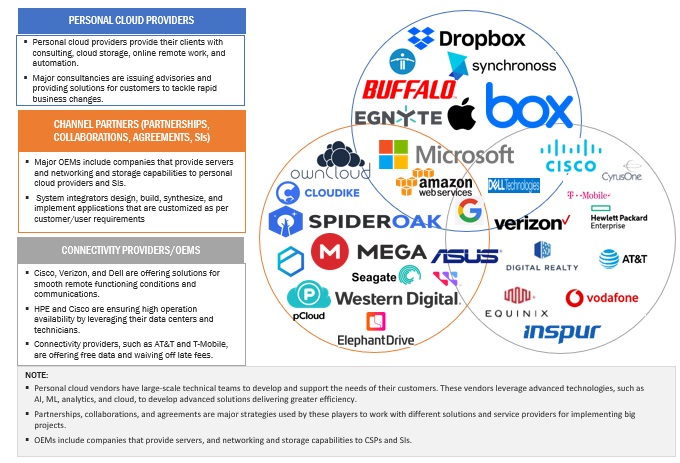

The ecosystem of the personal cloud market includes system integrators (SIs), personal cloud solution providers, and associated service providers. SIs design, build, synthesize, and implement customized applications as per customer/user requirements. SI players test and authenticate personal cloud solutions to determine suitability before integration. They own integration capabilities for software, platforms, services, or other related devices to develop a comprehensive personal cloud system. SI vendors have a strong client base and supply personal cloud solutions through direct channels and partner networks.

Personal cloud solution vendors have the large-scale technical expertise to develop and support personal cloud solutions. These vendors leverage advanced technologies, such as AI, ML, analytics, and cloud, to develop advanced solutions that deliver greater efficiency. These players offer their software to end users, such as colocation data centers, enterprise data centers, managed data centers, and cloud data centers or third-party integrators.

Partnerships, collaborations, and agreements are major strategies these players use to work with personal cloud software and service providers for implementing big personal cloud projects. Some players also provide integrated solutions in the personal cloud market.

The following figure shows the ecosystem of the personal cloud market:

Based on verticals, BFSI vertical is expteceted to dominate the market during the forecast period

Based on the verticals, the personal cloud market is segmented into BFSI, IT & ITeS, telecommunications, energy & utilities, healthcare & life sciences, manufacturing, retail & e-commerce, government & public sector, media & entertainment, and other verticals. Among the verticals, the BFSI vertical is expected to hold the largest market share during the forecast period. BFSI is witnessing a transformative shift with the widespread adoption of personal cloud solutions. As a sector inherently reliant on data-driven operations and stringent regulatory frameworks, organizations in the BFSI industry are adopting personal cloud technology to manage, access, and secure their critical information. The adoption of personal cloud solutions in BFSI is driven by a growing need for enhanced data accessibility, collaboration, and flexibility while navigating the complex landscape of regulatory compliance and cybersecurity. This innovative approach empowers financial institutions to streamline workflows, foster greater mobility, and meet the ever-evolving expectations of tech-savvy customers. As the industry embraces the benefits of personal cloud adoption, it stands on the cusp of a digital revolution, where the fusion of finance and technology reshapes the landscape of banking, insurance, and financial services. The BFSI sector can leverage personal cloud solutions to enhance efficiency, security, and customer experiences..

Based on the revenue type, the indirect revenue segment is expected to have the highest growth rate during the forecast period

Based on the revenue type, the personal cloud market is segmented into direct revenue and indirect revenue. As per the revenue type, indirect revenue segment is expected to hold the highest CAGR during the forecast period. The indirect revenue segment in the personal cloud market involves generating income through avenues other than direct user subscriptions, often through partnerships, collaborations, or value-added services. This revenue type is instrumental in diversifying income streams for personal cloud service providers, allowing them to explore innovative business models and partnerships beyond traditional subscription fees. Indirect revenue may be derived from collaborations with device manufacturers, software integrations, or other strategic alliances that enhance the overall value proposition for users.

A compelling example of the indirect revenue segment is Microsoft's approach with OneDrive. While Microsoft offers direct revenue through premium subscriptions, a significant portion of their revenue is also generated indirectly through the integration of OneDrive into the broader Microsoft 365 suite. Microsoft incentivizes users to adopt Microsoft 365 for its productivity tools, including Word, Excel, and Teams, which seamlessly integrate with OneDrive for file storage and collaboration. The indirect revenue is thus derived from the overall ecosystem adoption rather than direct subscription fees for OneDrive alone.

The role of the indirect revenue segment is multifaceted, contributing not only to financial sustainability but also to the strategic positioning of personal cloud providers in the market. By forming partnerships and integrations, providers can expand their user base and enhance the attractiveness of their services, indirectly driving revenue growth. This model allows personal cloud providers to explore innovative collaborations that align with evolving user needs and industry trends, fostering a dynamic ecosystem where indirect revenue complements and reinforces the core offerings of personal cloud services.

A major part of the indirect revenue is expected to come from North America as the sale of electronic devices is higher compared to other regions. Regions such as Asia Pacific and Latin America are expected to witness growth as organizations here demand indirect revenue services, such as advertisement and business tie-ups. However, the demand for electronic devices where personal cloud is useful will grow at a moderately slower pace. This will further affect revenue from these regions.

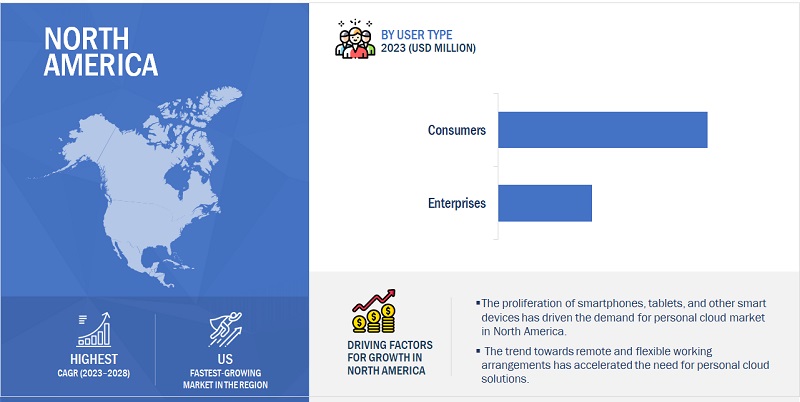

The US market is projected to contribute the largest share of the personal cloud market in North America.

North America is expected to lead the personal cloud market in 2023. The US is estimated to account for the largest market share in North America in 2023 in the personal cloud market, and the trend is expected to continue until 2028. The personal cloud market in the US is playing an increasingly crucial role in addressing the growing demand for secure and accessible storage solutions for personal data. The region's large and tech-savvy population, coupled with its widespread adoption of digital devices and online services, has fueled the need for personal cloud solutions that offer seamless access to files, photos, and other essential data from anywhere in the world.

Several factors are driving the growth of the US personal cloud market. One key factor is the pervasiveness of smartphones and other mobile devices, which generate a significant amount of data that can be challenging to store and manage locally. Personal cloud solutions provide a convenient way to store and back up this data, ensuring its accessibility whenever needed. Another driving force is the rise of remote work arrangements and BYOD (bring your own device) policies. With more individuals working from home or using their personal devices for work purposes, there's a growing need for secure personal cloud solutions that can effectively store and share work-related data. As more people recognize the benefits of personal cloud solutions, demand is expected to surge in the coming years. Additionally, advancements in technologies such as AI and ML are poised to further enhance the capabilities of personal cloud solutions, solidifying their role in the US market.

Key Market Players

The personal cloud market is dominated by a few globally established players such Google (US), Microsoft (US), Apple (US), Dropbox (US), AWS (US), Box (US), Seagate Technology (US), Western Digital (US), Synchronoss (US), and Egnyte (US), among others, are the key vendors that secured personal cloud contracts in last few years. Local participants only have local experience; while these vendors can add global processes and execution expertise. Customers are more likely to try new things in the personal cloud market because of their higher discretionary budgets, ease of access to information, and quick adoption of technical items..

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

Type, User Type, Hosting Type, Revenue Type, Vertical, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies Covered |

Some of the significant personal cloud market vendors are Google (US), Microsoft (US), Apple (US), Dropbox (US), AWS (US), Box (US), Seagate Technology (US), Western Digital (US), Synchronoss (US), Egnyte (US), BUFFALO Technology (Japan), Funambol (US), SugarSync (US), ElephantDrive (US), Cloudike (US), SpiderOak (US), ASUS Cloud (Taiwan), IDrive (US), AT&T (US), and OpenDrive (US). |

This research report categorizes the personal cloud market based on type, user type, hosting type, revenue type, vertical, and region.

Based on the Type:

- Online Cloud

- NAS Device Cloud

- Server Device Cloud

- Home-Made Cloud

Based on the User Type:

-

Enterprises

- Large Enterprises

- SMEs

- Consumers

Based on the Hosting Type:

- User/Self-Hosting

- Provider Hosting

Based on the Revenue Type:

- Direct Revenue

- Indirect Revenue

Based on the Vertical:

- BFSI

- IT & ITeS

- Telecommunications

- Retail & e-Commerce

- Government & Public Sector

- Manufacturing

- Energy & Utilities

- Healthcare & Life Sciences

- Media & Entertainment

- Other Verticals

Based on the Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Sweden

- Netherlands

- Norway

- Denmark

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia & New Zealand

- Singapore

- Malayasia

- Thailand

- Indonesia

- South Korea

- Rest of Asia Pacific

-

Middle East & Africa

-

Gulf Cooperation Councils (GCC)

- Kingdom of Saudi Arabia

- United Arab Emirates

- Rest of GCC Countries

- South Africa

- Rest of the Middle East & Africa

-

Gulf Cooperation Councils (GCC)

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In July 2023, Dynamics 365 Copilot, the world's first AI copilot integrated into cloud-based CRM and ERP apps, was unveiled by Microsoft recently. Its goals are to improve processes, provide insights, pinpoint the optimal course of action, and cut down on time spent on administrative duties.

- In October 2022, to help Lyve Mobile customers expedite mass data transfers from edge or core to the cloud destination of their choice, such as Amazon S3, Google Cloud Platform, Microsoft Azure, and Lyve Cloud, Seagate Technology announced the release of a new data transfer feature called cloud import. This secure, quick, and easy method of data ingest.

- In December 2022, as part of its continuous endeavour to give customers even more robust options for data protection, Apple unveiled three cutting-edge security capabilities aimed at thwarting threats to user data in the cloud. Users may confirm that they are speaking solely with the people they desire to speak with by using iMessage Contact Key Verification. Users can choose to need a physical security key in order to access their Apple ID accounts with Security Keys for Apple ID. Users can choose to further secure critical iCloud data, such as iCloud Backup, Photos, Notes, and more, with Advanced Data Protection for iCloud, which employs end-to-end encryption to offer Apple's highest level of cloud data protection.

Frequently Asked Questions (FAQ):

What is personal cloud?

According to Google, a personal cloud storage service allows users to store photos, documents, files, and videos securely. It allows users to access their data from any device, collaborate in real time, and keep their digital life organized.

According to pCloud, a personal cloud refers to a cloud computing environment that is designed for the individual user, allowing them to store, manage, and access their digital content, data, and applications across multiple devices through the internet. Unlike traditional cloud services that are often geared towards businesses and enterprises, personal clouds cater specifically to the needs of individuals, providing a secure and convenient way to store and retrieve personal files.

Which country is an early adopter of personal cloud market?

The US is an early adopter of personal cloud market.

Who are vital clients adopting personal cloud market?

Key clients adopting the personal cloud market include: -

- Government Agencies

- Resellers and Distributors

- Research Organizations

- Corporates

- Administrators

- End Users

Which are the key vendors exploring personal cloud market?

Some of the significant personal cloud vendors are Google (US), Microsoft (US), Apple (US), Dropbox (US), AWS (US), Box (US), Seagate Technology (US), Western Digital (US), Synchronoss (US), and Egnyte (US).

What is the total CAGR expected to be recorded for the personal cloud market during 2023-2028?

The market is expected to record a CAGR of 18.5% from 2023-2028 .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

5.1 INTRODUCTIONKEY FEATURES AND FUNCTIONALITIES- File storage and syncing- Cross-platform accessibility- File sharing and collaboration- Automatic backup- Security and encryption- Application integration

-

5.2 MARKET DYNAMICSDRIVERS- Increased demand for data storage- High demand for cloud accessibility across devices- Limited storage capacity of secondary storage devices and accidental data loss- Increasing volume of digital content- Growing BYOD and mobile workforce trendsRESTRAINTS- Internet and connectivity issues- Data security and privacy concernsOPPORTUNITIES- Growing partnerships among market players- Increasing use of smart devices and cloud-based services- Growing trends of big data and analytics- Increasing business tie-ups with device manufacturersCHALLENGES- Issues with geographical data storage- Integration with third-party applications- Lack of interoperability due to vendor lock-in

-

5.3 CASE STUDY ANALYSISCASE STUDY 1: BEN & JERRY’S ACHIEVES ORGANIZED STORAGE OF FILES USING DROPBOXCASE STUDY 2: DEKA IMMOBILIEN SCALES UP IN THE CONTENT CLOUDCASE STUDY 3: MUNHUWA BROADCASTING COMPANY (MBC) USES CLOUDIKE TO MANAGE MASSIVE DATA TRANSFERSCASE STUDY 4: TRESORIT’S ALL-IN-ONE PACKAGE HELPS DTG VERPACKUNGSLOGISTIK GMBH ENHANCE CYBERSECURITYCASE STUDY 5: TERRAVION USES AWS TO HELP FARMERS IMPROVE CROP YIELD THROUGH HIGH-RESOLUTION AERIAL IMAGES

-

5.4 ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOLUTIONAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY ENTERPRISE

-

5.7 PATENT ANALYSIS

-

5.8 TECHNOLOGY ANALYSISKEY TECHNOLOGY- Cloud Storage- Security and Encryption- User Interface and User Experience- Collaboration ToolsCOMPLEMENTARY TECHNOLOGY- Artificial Intelligence and Machine Learning- Internet of Things- BlockchainADJACENT TECHNOLOGY- 5G Technology- Edge Computing

-

5.9 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS, BY REGION- North America- Europe- Asia Pacific- Middle East & South Africa- Latin AmericaREGULATORY IMPLICATIONS AND INDUSTRY STANDARDS- General Data Protection Regulation- SEC Rule 17a-4- ISO/IEC 27001- System and organization controls 2 type II compliance- Financial Industry Regulatory Authority- Freedom of Information Act- Health Insurance Portability and Accountability Act

-

5.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.11 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14 BUYING CRITERIA

-

5.15 BUSINESS MODEL ANALYSISCUSTOM PRICING AGREEMENT- Freemium model- Free users vs. Paid users- Profitability apprehensionsSUBSCRIPTION MODELPAY-AS-YOU GO MODELPRICING MODELS FOR FUTURE

-

6.1 INTRODUCTIONTYPE: PERSONAL CLOUD MARKET DRIVERS

-

6.2 ONLINE CLOUDCONVENIENCE OF DATA ACCESS BOOSTS SEGMENT GROWTH

-

6.3 NAS DEVICE CLOUDCOMPLETE CONTROL AND SECURITY OF DATA FUELS GROWTH

-

6.4 SERVER DEVICE CLOUDENHANCED RELIABILITY AND MINIMIZED DOWNTIME DRIVE DEMAND

-

6.5 HOME-MADE CLOUDCOST-EFFECTIVENESS OFFERED BY HOME-MADE CLOUD DRIVES ADOPTION

-

7.1 INTRODUCTIONUSER TYPE: PERSONAL CLOUD MARKET DRIVERS

-

7.2 CONSUMERSAFETY AND SECURITY OF DATA DRIVE DEMAND AMONG CONSUMERS

-

7.3 ENTERPRISEABILITY TO ACCESS BUSINESS APPLICATIONS FROM ANY DEVICE ANYWHERE BOOSTS GROWTHSMESLARGE ENTERPRISES

-

8.1 INTRODUCTIONHOSTING TYPE: PERSONAL CLOUD MARKET DRIVERS

-

8.2 PROVIDER HOSTINGOFFERS CONVENIENT AND RELIABLE WAY TO ACCESS AND SHARE FILES

-

8.3 USER/SELF-HOSTINGGREATER CONTROL, SECURITY, AND CUSTOMIZATION – KEY APPEAL FOR USERS

-

9.1 INTRODUCTIONREVENUE TYPE: PERSONAL CLOUD MARKET DRIVERS

-

9.2 DIRECT REVENUEINCLUDES REVENUE GENERATED FROM SUBSCRIPTIONS OFFERED TO CONSUMERS AND ENTERPRISES

-

9.3 INDIRECT REVENUEREVENUE GENERATED THROUGH INTEGRATION AND VALUE- ADDED SERVICES

-

10.1 INTRODUCTIONVERTICAL: PERSONAL CLOUD MARKET DRIVERS

-

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)EFFICIENT DATA COLLECTION AND PREPARATION FOR REGULATORY REPORTING PURPOSES DRIVE SEGMENTFINANCIAL DOCUMENT MANAGEMENTRISK & COMPLIANCE MANAGEMENT

-

10.3 ENERGY & UTILITIESISSUES RELATED TO CRUDE OIL, STORAGE, AND TRANSPORTATION ADDRESSEDDISTRIBUTED ENERGY RESOURCE MANAGEMENTGRID DATA ANALYTICSCOMPLIANCE AND REGULATORY DOCUMENTATIONREMOTE MONITORING OF INFRASTRUCTURE

-

10.4 GOVERNMENT & PUBLIC SECTORNEED FOR FASTER DATA ANALYSIS IN GOVERNMENT AGENCIES TO DRIVE MARKETPUBLIC RECORDS ARCHIVINGGEOSPATIAL DATA MANAGEMENTSECURE DOCUMENT SHARING & COLLABORATION

-

10.5 TELECOMMUNICATIONSABILITY TO STORE AND MANAGE LOCATION-BASED DATA FOR TELECOM SUBSCRIBERS BOOSTS GROWTHVOIP CALL HISTORY AND RECORDINGNETWORK PERFORMANCE MONITORINGVALUE-ADDED SERVICES FOR IOT DEVICESMOBILE DEVICE BACKUP AND RESTORE

-

10.6 IT & ITESSEGMENT DRIVEN BY ENHANCED COLLABORATION AND COMPLIANCEREMOTE WORK COLLABORATIONFREELANCER AND CONTRACTOR COLLABORATIONPROJECT MANAGEMENT AND DOCUMENTATION

-

10.7 RETAIL & E-COMMERCEENHANCED OPERATIONAL EFFICIENCY AND IMPROVED CUSTOMER EXPERIENCE DRIVE DEMANDOMNICHANNEL INVENTORY MANAGEMENTCLIENTELING FOR IN-STORE ASSOCIATESCLICK-AND-COLLECT OPTIMIZATIONPERSONALIZED MARKETING CAMPAIGNS

-

10.8 MANUFACTURINGNEED FOR FLEXIBILITY AND SCALABILITY DRIVES SEGMENTWORKFLOW AUTOMATION AND DOCUMENTATIONINVENTORY AND MATERIAL MANAGEMENTEQUIPMENT MAINTENANCE RECORDSSUPPLY CHAIN COLLABORATIONREMOTE ACCESS TO MANUFACTURING DATA

-

10.9 MEDIA & ENTERTAINMENTNEED TO ARCHIVE AND ORGANIZE LARGE VOLUMES OF MEDIA CONTENT, COMPLETE WITH METADATA FUELS GROWTHMEDIA LIBRARY MANAGEMENTMEDIA DISTRIBUTION AND SHARINGCONTENT CREATION AND COLLABORATION

-

10.10 HEALTHCARE & LIFE SCIENCESINCREASED FOCUS ON PATIENT RECORD MANAGEMENT TO BOOST SEGMENTELECTRONIC HEALTH RECORDS STORAGEHEALTH INFORMATION EXCHANGETELEMEDICINE & REMOTE PATIENT MANAGEMENT SUPPORT

- 10.11 OTHER VERTICALS

-

11.1 INTRODUCTIONNORTH AMERICANORTH AMERICA: PERSONAL CLOUD MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Rise of remote work arrangements and BYOD policiesCANADA- Increased R&D and focus on long-term infrastructure plan for personal cloud

-

11.2 EUROPEEUROPE: PERSONAL CLOUD MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Rapid surge in mobile devices and mobile contentGERMANY- High demand for personal cloud among startupsFRANCE- Focus on equipping public sector operations with personal cloud solutionsITALY- Professional services within personal cloud market play crucial roleSWEDEN- Growing adoption of AI, IoT, and digital contentNETHERLANDS- Digitalization and integration of advanced technologiesNORWAY- Need to switch traditional infrastructure to legacy infrastructure with skilled cloud expertiseDENMARK- High demand for remote access, collaboration, and data synchronizationREST OF EUROPE

-

11.3 ASIA PACIFICASIA PACIFIC: PERSONAL CLOUD MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Strong government initiatives for technology advancementJAPAN- Increased R&D investments and skilled IT professionalsINDIA- Reduced personal cloud cost and improved operational efficiencyAUSTRALIA & NEW ZEALAND- High demand due to advanced personal cloud infrastructureSINGAPORE- Growing investments in new technologies for connectivityMALAYSIA- Continuous upgrades to companies’ IT infrastructure and applicationsTHAILAND- High demand for IT services in countryINDONESIA- Need to solve slow network connectivity issueSOUTH KOREA- Increasing number of vendors and attractive kick-start packagesREST OF ASIA PACIFIC

-

11.4 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: PERSONAL CLOUD MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTGULF COOPERATION COUNCIL- Agility and competitiveness among businesses in GCC countries- Kingdom Of Saudi Arabia- United Arab Emirates- Other Gulf Cooperation Council CountriesSOUTH AFRICA- High adoption of cloud services by startups due to low costsREST OF MIDDLE EAST & AFRICA

-

11.5 LATIN AMERICALATIN AMERICA: PERSONAL CLOUD MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Significant market for key IT playersMEXICO- Accelerated digital transformation and enhanced IT capabilitiesREST OF LATIN AMERICA

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS

- 12.4 PERSONAL CLOUD MARKET: VENDOR PRODUCTS/ BRANDS COMPARISON

- 12.5 REVENUE ANALYSIS

-

12.6 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSOVERALL COMPANY FOOTPRINT OF KEY PLAYERS

-

12.7 EVALUATION MATRIX FOR STARTUPS/SMES, 2022RESPONSIVE COMPANIESPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 12.8 COMPANY FINANCIAL METRICS

- 12.9 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

12.10 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHES AND PRODUCT ENHANCEMENTSDEALS

- 13.1 INTRODUCTION

-

13.2 MAJOR PLAYERSGOOGLE- Business overview- Products/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Services offered- Recent developments- MnM viewAPPLE- Business overview- Product/Services offered- Recent developments- MnM ViewDROPBOX- Business overview- Products/Services offered- Recent developments- MnM viewAWS- Business overview- Products/Services offered- Recent developments- MnM viewBOX- Business overview- Products/Services offered- Recent developmentsSEAGATE TECHNOLOGY- Business overview- Products/Services offered- Recent developmentsWESTERN DIGITAL- Business overview- Products/Services offered- Recent developmentsSYNCHRONOSS- Business overview- Products/Services offered- Recent developmentsEGNYTE- Business overview- Products/Services offered- Recent developments

-

13.3 OTHER PLAYERSBUFFALO TECHNOLOGYFUNAMBOLSUGARSYNCELEPHANTDRIVEOWNCLOUDCLOUDIKESPIDEROAKASUS CLOUDIDRIVEAT&TOPENDRIVE

-

13.4 STARTUPS/SMESMEGAPCLOUDTRESORITINTERNXTICEDRIVESYNC.COMMIMEDIADRACOONJUSTCLOUD.COMFILECLOUD

-

14.1 INTRODUCTIONRELATED MARKETSLIMITATIONS

- 14.2 CLOUD COMPUTING MARKET

- 14.3 CLOUD STORAGE MARKET

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 INDICATIVE PRICING ANALYSIS OF PERSONAL CLOUD MARKET, BY SOLUTION

- TABLE 4 INDICATIVE PRICING ANALYSIS OF PERSONAL CLOUD MARKET, BY ENTERPRISE

- TABLE 5 PERSONAL CLOUD MARKET: PATENTS

- TABLE 6 TOP PATENT OWNERS

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 PERSONAL CLOUD MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 12 PERSONAL CLOUD MARKET: KEY CONFERENCES AND EVENTS IN 2023–2024

- TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP USER TYPES

- TABLE 14 KEY BUYING CRITERIA FOR TOP USER TYPES

- TABLE 15 PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 16 PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 17 CONSUMER: PERSONAL CLOUD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 18 CONSUMER: PERSONAL CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 ENTERPRISE: PERSONAL CLOUD MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 20 ENTERPRISE: PERSONAL CLOUD MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 21 ENTERPRISE: PERSONAL CLOUD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 22 ENTERPRISE: PERSONAL CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 SMES: PERSONAL CLOUD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 24 SMES: PERSONAL CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 LARGE ENTERPRISES: PERSONAL CLOUD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 LARGE ENTERPRISES: PERSONAL CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 28 PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 29 DIRECT REVENUE: PERSONAL CLOUD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 DIRECT REVENUE: PERSONAL CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 INDIRECT REVENUE: PERSONAL CLOUD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 32 INDIRECT REVENUE: PERSONAL CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 PERSONAL CLOUD MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 34 PERSONAL CLOUD MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 35 BFSI: PERSONAL CLOUD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 BFSI: PERSONAL CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 ENERGY & UTILITIES: PERSONAL CLOUD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 ENERGY & UTILITIES: PERSONAL CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 GOVERNMENT & PUBLIC SECTOR: PERSONAL CLOUD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 GOVERNMENT & PUBLIC SECTOR: PERSONAL CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 TELECOMMUNICATIONS: PERSONAL CLOUD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 TELECOMMUNICATIONS: PERSONAL CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 IT & ITES: PERSONAL CLOUD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 44 IT & ITES: PERSONAL CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 RETAIL & ECOMMERCE: PERSONAL CLOUD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 RETAIL & ECOMMERCE: PERSONAL CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 MANUFACTURING: PERSONAL CLOUD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 MANUFACTURING: PERSONAL CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 MEDIA & ENTERTAINMENT: PERSONAL CLOUD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 MEDIA & ENTERTAINMENT: PERSONAL CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 HEALTHCARE & LIFE SCIENCES: PERSONAL CLOUD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 HEALTHCARE & LIFE SCIENCES: PERSONAL CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 OTHER VERTICALS: PERSONAL CLOUD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 OTHER VERTICALS: PERSONAL CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 PERSONAL CLOUD MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 56 PERSONAL CLOUD MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 58 NORTH AMERICA: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: PERSONAL CLOUD MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: PERSONAL CLOUD MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: PERSONAL CLOUD MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: PERSONAL CLOUD MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 67 US: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 68 US: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 69 US: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 70 US: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 71 US: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 72 US: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 73 CANADA: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 74 CANADA: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 75 CANADA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 76 CANADA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 77 CANADA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 78 CANADA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 79 EUROPE: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 80 EUROPE: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 81 EUROPE: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 82 EUROPE: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 83 EUROPE: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 84 EUROPE: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 85 EUROPE: PERSONAL CLOUD MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 86 EUROPE: PERSONAL CLOUD MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 87 EUROPE: PERSONAL CLOUD MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 88 EUROPE: PERSONAL CLOUD MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 89 UK: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 90 UK: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 91 UK: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 92 UK: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 93 UK: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 94 UK: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 95 GERMANY: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 96 GERMANY: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 97 GERMANY: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 98 GERMANY: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 99 GERMANY: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 100 GERMANY: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 101 FRANCE: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 102 FRANCE: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 103 FRANCE: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 104 FRANCE: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 105 FRANCE: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 106 FRANCE: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 107 ITALY: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 108 ITALY: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 109 ITALY: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 110 ITALY: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 111 ITALY: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 112 ITALY: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 113 SWEDEN: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 114 SWEDEN: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 115 SWEDEN: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 116 SWEDEN: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 117 SWEDEN: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 118 SWEDEN: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 119 NETHERLANDS: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 120 NETHERLANDS: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 121 NETHERLANDS: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 122 NETHERLANDS: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 123 NETHERLANDS: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 124 NETHERLANDS: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 125 NORWAY: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 126 NORWAY: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 127 NORWAY: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 128 NORWAY: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 129 NORWAY: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 130 NORWAY: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 131 DENMARK: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 132 DENMARK: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 133 DENMARK: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 134 DENMARK: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 135 DENMARK: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 136 DENMARK: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 137 REST OF EUROPE: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 138 REST OF EUROPE: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 139 REST OF EUROPE: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 140 REST OF EUROPE: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 141 REST OF EUROPE: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 142 REST OF EUROPE: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 143 ASIA PACIFIC: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 144 ASIA PACIFIC: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 146 ASIA PACIFIC: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 147 ASIA PACIFIC: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 148 ASIA PACIFIC: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 149 ASIA PACIFIC: PERSONAL CLOUD MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 150 ASIA PACIFIC: PERSONAL CLOUD MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 151 ASIA PACIFIC: PERSONAL CLOUD MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 152 ASIA PACIFIC: PERSONAL CLOUD MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 153 CHINA: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 154 CHINA: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 155 CHINA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 156 CHINA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 157 CHINA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 158 CHINA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 159 JAPAN: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 160 JAPAN: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 161 JAPAN: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 162 JAPAN: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 163 JAPAN: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 164 JAPAN: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 165 INDIA: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 166 INDIA: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 167 INDIA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 168 INDIA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 169 INDIA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 170 INDIA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 171 AUSTRALIA & NEW ZEALAND: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 172 AUSTRALIA & NEW ZEALAND: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 173 AUSTRALIA & NEW ZEALAND: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 174 AUSTRALIA & NEW ZEALAND: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 175 AUSTRALIA & NEW ZEALAND: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 176 AUSTRALIA & NEW ZEALAND: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 177 SINGAPORE: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 178 SINGAPORE: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 179 SINGAPORE: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 180 SINGAPORE: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 181 SINGAPORE: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 182 SINGAPORE: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 183 MALAYSIA: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 184 MALAYSIA: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 185 MALAYSIA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 186 MALAYSIA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 187 MALAYSIA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 188 MALAYSIA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 189 THAILAND: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 190 THAILAND: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 191 THAILAND: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 192 THAILAND: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 193 THAILAND: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 194 THAILAND: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 195 INDONESIA: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 196 INDONESIA: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 197 INDONESIA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 198 INDONESIA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 199 INDONESIA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 200 INDONESIA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 201 SOUTH KOREA: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 202 SOUTH KOREA: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 203 SOUTH KOREA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 204 SOUTH KOREA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 205 SOUTH KOREA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 206 SOUTH KOREA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 207 REST OF ASIA PACIFIC: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 208 REST OF ASIA PACIFIC: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 209 REST OF ASIA PACIFIC: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 210 REST OF ASIA PACIFIC: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 211 REST OF ASIA PACIFIC: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: PERSONAL CLOUD MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: PERSONAL CLOUD MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: PERSONAL CLOUD MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: PERSONAL CLOUD MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 223 GULF COOPERATION COUNCIL: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 224 GULF COOPERATION COUNCIL: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 225 GULF COOPERATION COUNCIL: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 226 GULF COOPERATION COUNCIL: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 227 GULF COOPERATION COUNCIL: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 228 GULF COOPERATION COUNCIL: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 229 GULF COOPERATION COUNCIL: PERSONAL CLOUD MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 230 GULF COOPERATION COUNCIL: PERSONAL CLOUD MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 231 KSA: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 232 KSA: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 233 KSA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 234 KSA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 235 KSA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 236 KSA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 237 UAE: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 238 UAE: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 239 UAE: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 240 UAE: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 241 UAE: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 242 UAE: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 243 SOUTH AFRICA: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 244 SOUTH AFRICA: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 245 SOUTH AFRICA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 246 SOUTH AFRICA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 247 SOUTH AFRICA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 248 SOUTH AFRICA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 249 REST OF MIDDLE EAST & AFRICA: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 250 REST OF MIDDLE EAST & AFRICA: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 251 REST OF MIDDLE EAST & AFRICA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 252 REST OF MIDDLE EAST & AFRICA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 253 REST OF MIDDLE EAST & AFRICA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 254 REST OF MIDDLE EAST & AFRICA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 255 LATIN AMERICA: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 256 LATIN AMERICA: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 257 LATIN AMERICA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 258 LATIN AMERICA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 259 LATIN AMERICA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 260 LATIN AMERICA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 261 LATIN AMERICA: PERSONAL CLOUD MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 262 LATIN AMERICA: PERSONAL CLOUD MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 263 LATIN AMERICA: PERSONAL CLOUD MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 264 LATIN AMERICA: PERSONAL CLOUD MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 265 BRAZIL: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 266 BRAZIL: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 267 BRAZIL: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 268 BRAZIL: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 269 BRAZIL: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 270 BRAZIL: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 271 MEXICO: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 272 MEXICO: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 273 MEXICO: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 274 MEXICO: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 275 MEXICO: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 276 MEXICO: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 277 REST OF LATIN AMERICA: PERSONAL CLOUD MARKET, BY USER TYPE, 2018–2022 (USD MILLION)

- TABLE 278 REST OF LATIN AMERICA: PERSONAL CLOUD MARKET, BY USER TYPE, 2023–2028 (USD MILLION)

- TABLE 279 REST OF LATIN AMERICA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 280 REST OF LATIN AMERICA: PERSONAL CLOUD MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 281 REST OF LATIN AMERICA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2018–2022 (USD MILLION)

- TABLE 282 REST OF LATIN AMERICA: PERSONAL CLOUD MARKET, BY REVENUE TYPE, 2023–2028 (USD MILLION)

- TABLE 283 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS

- TABLE 284 MARKET SHARE OF KEY VENDORS IN 2022

- TABLE 285 VENDOR PRODUCTS/BRANDS COMPARISON

- TABLE 286 OVERALL COMPANY FOOTPRINT

- TABLE 287 OVERALL COMPANY FOOTPRINT FOR STARTUPS/SMES

- TABLE 288 KEY STARTUPS/SMES

- TABLE 289 PERSONAL CLOUD MARKET: PRODUCT LAUNCHES AND ENHANCEMENT, 2020–2023

- TABLE 290 PERSONAL CLOUD MARKET: DEALS, 2020–2023

- TABLE 291 GOOGLE: BUSINESS OVERVIEW

- TABLE 292 GOOGLE: PRODUCTS/SERVICES OFFERED

- TABLE 293 GOOGLE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 294 GOOGLE: DEALS

- TABLE 295 MICROSOFT: BUSINESS OVERVIEW

- TABLE 296 MICROSOFT: PRODUCTS/SERVICES OFFERED

- TABLE 297 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 298 MICROSOFT: DEALS

- TABLE 299 APPLE: BUSINESS OVERVIEW

- TABLE 300 APPLE: PRODUCT/SERVICES OFFERED

- TABLE 301 APPLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 302 APPLE: DEALS

- TABLE 303 DROPBOX: BUSINESS OVERVIEW

- TABLE 304 DROPBOX: PRODUCTS/SERVICES OFFERED

- TABLE 305 DROPBOX: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 306 DROPBOX: DEALS

- TABLE 307 AWS: BUSINESS OVERVIEW

- TABLE 308 AWS: PRODUCTS/SERVICES OFFERED

- TABLE 309 AWS: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 310 AWS: DEALS

- TABLE 311 BOX: BUSINESS OVERVIEW

- TABLE 312 BOX: PRODUCTS/SERVICES OFFERED

- TABLE 313 BOX: PRODUCT LAUNCHES & ENHANCEMENT

- TABLE 314 BOX: DEALS

- TABLE 315 SEAGATE TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 316 SEAGATE TECHNOLOGY: PRODUCTS/SERVICES OFFERED

- TABLE 317 SEAGATE TECHNOLOGY: PRODUCT LAUNCHES & ENHANCEMENT

- TABLE 318 SEAGATE TECHNOLOGY: DEALS

- TABLE 319 WESTERN DIGITAL: BUSINESS OVERVIEW

- TABLE 320 WESTERN DIGITAL: PRODUCTS/SERVICES OFFERED

- TABLE 321 WESTERN DIGITAL: PRODUCT LAUNCHES & ENHANCEMENT

- TABLE 322 WESTERN DIGITAL: DEALS

- TABLE 323 SYNCHRONOSS: BUSINESS OVERVIEW

- TABLE 324 SYNCHRONOSS: PRODUCTS/SERVICES OFFERED

- TABLE 325 SYNCHRONOSS: PRODUCT LAUNCHES & ENHANCEMENT

- TABLE 326 SYNCHRONOSS: DEALS

- TABLE 327 EGNYTE: BUSINESS OVERVIEW

- TABLE 328 EGNYTE: PRODUCTS/SERVICES OFFERED

- TABLE 329 EGNYTE: PRODUCT LAUNCHES & ENHANCEMENT

- TABLE 330 EGNYTE: DEALS

- TABLE 331 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2018–2022 (USD BILLION)

- TABLE 332 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2023–2028 (USD BILLION)

- TABLE 333 PUBLIC CLOUD: CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 334 PUBLIC CLOUD: CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 335 PRIVATE CLOUD: CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 336 PRIVATE CLOUD: CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 337 HYBRID CLOUD: CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 338 HYBRID CLOUD: CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 339 CLOUD STORAGE MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 340 CLOUD STORAGE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 341 SMALL AND MEDIUM-SIZED ENTERPRISES: CLOUD STORAGE MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 342 SMALL AND MEDIUM-SIZED ENTERPRISES: CLOUD STORAGE MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 343 LARGE ENTERPRISES: CLOUD STORAGE MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 344 LARGE ENTERPRISES: CLOUD STORAGE MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 PERSONAL CLOUD MARKET: RESEARCH DESIGN

- FIGURE 2 PERSONAL CLOUD MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 3 PERSONAL CLOUD MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 PERSONAL CLOUD MARKET: RESEARCH FLOW

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): VENDOR REVENUE ESTIMATION

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH FROM SUPPLY SIDE - COLLECTIVE REVENUE OF VENDORS

- FIGURE 10 DEMAND-SIDE APPROACH: PERSONAL CLOUD MARKET

- FIGURE 11 PERSONAL CLOUD MARKET SNAPSHOT, 2020–2028

- FIGURE 12 TOP MARKET SEGMENTS IN TERMS OF GROWTH RATE

- FIGURE 13 CONSUMER SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 14 LARGE ENTERPRISES SEGMENT TO LEAD MARKET BY 2028

- FIGURE 15 DIRECT REVENUE SEGMENT TO HOLD MAJOR SHARE BY 2028

- FIGURE 16 BFSI TO BE LARGEST VERTICAL SEGMENT BY 2028

- FIGURE 17 NORTH AMERICA TO HOLD LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 18 GROWING AWARENESS ABOUT DATA SECURITY AND PRIVACY CONCERNS TO INCREASE DEMAND FOR SECURE STORAGE

- FIGURE 19 CONSUMER SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 20 LARGE ENTERPRISES SEGMENT TO HOLD MAJOR SHARE IN 2023

- FIGURE 21 DIRECT REVENUE SEGMENT TO DOMINATE IN 2023

- FIGURE 22 BFSI – LARGEST VERTICAL OF MARKET IN 2023

- FIGURE 23 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: PERSONAL CLOUD MARKET

- FIGURE 25 GROWTH OF SMARTPHONE USERS

- FIGURE 26 PERSONAL CLOUD MARKET ECOSYSTEM

- FIGURE 27 PERSONAL CLOUD MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 NUMBER OF PATENTS PUBLISHED, 2012–2022

- FIGURE 29 TOP 10 PATENT APPLICANTS (GLOBAL) IN 2022

- FIGURE 30 PERSONAL CLOUD MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 31 PERSONAL CLOUD MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP USER TYPES

- FIGURE 33 KEY BUYING CRITERIA FOR TOP USER TYPES

- FIGURE 34 ENTERPRISE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 35 LARGE ENTERPRISES TO DOMINATE DURING FORECAST PERIOD

- FIGURE 36 INDIRECT REVENUE SEGMENT TO GROW FASTER DURING FORECAST PERIOD

- FIGURE 37 BFSI VERTICAL TO DOMINATE PERSONAL CLOUD MARKET IN 2023

- FIGURE 38 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: REGIONAL SNAPSHOT

- FIGURE 41 PERSONAL CLOUD MARKET SHARE ANALYSIS

- FIGURE 42 HISTORICAL REVENUE ANALYSIS, 2018–2022 (USD MILLION)

- FIGURE 43 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 44 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- FIGURE 45 EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 46 EVALUATION MATRIX FOR STARTUPS/SMES

- FIGURE 47 COMPANY FINANCIAL METRICS, 2022

- FIGURE 48 PERSONAL CLOUD MARKET: GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS, 2022

- FIGURE 49 GOOGLE: COMPANY SNAPSHOT

- FIGURE 50 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 51 APPLE: COMPANY SNAPSHOT

- FIGURE 52 DROPBOX: COMPANY SNAPSHOT

- FIGURE 53 AWS: COMPANY SNAPSHOT

- FIGURE 54 BOX: COMPANY SNAPSHOT

- FIGURE 55 SEAGATE TECHNOLOGY COMPANY SNAPSHOT

- FIGURE 56 WESTERN DIGITAL: COMPANY SNAPSHOT

- FIGURE 57 SYNCHRONOSS: COMPANY SNAPSHOT

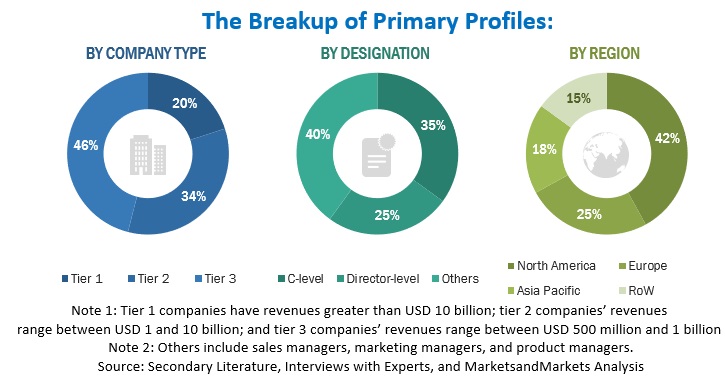

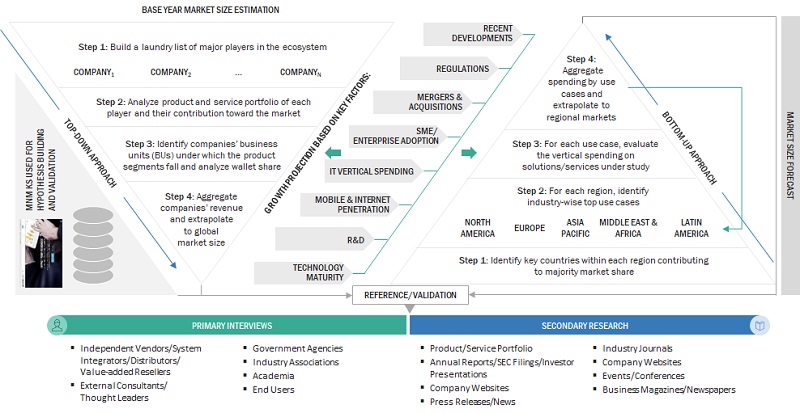

This research study involved extensive secondary sources, directories, and paid databases, to identify and collect information useful for this technical, market-oriented, and commercial study of the personal cloud market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market prospects. The following figure highlights the market research methodology in developing this report on the personal cloud market.

Secondary Research

The market size of companies offering personal cloud services was determined based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles by recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, the spending of various countries on personal cloud was extracted from the respective sources. Secondary research was mainly used to obtain the key information related to the industry’s value chain and supply chain to identify the key players based on solutions, services, market classification, and segmentation according to offerings of the major players, industry trends related to service models, verticals, and regions, and the key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the personal cloud market.

After the complete market engineering (including calculations for market statistics, market breakups, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify the segmentation types, industry trends, the competitive landscape of the personal cloud market players, and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

The Breakup of Primary Profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

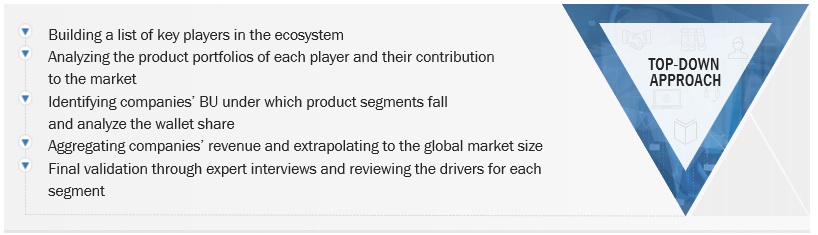

Both top-down and bottom-up approaches were used to estimate and forecast the personal cloud market and other dependent submarkets. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of the key companies in the market. With data triangulation methods and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments..

Top Down and Bottom Up Approach of personal cloud market

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down and bottom-up approaches were used to estimate and validate the size of the personal cloud market and various other dependent subsegments. The research methodology used to estimate the market size included the following:

Key players in the market were identified through secondary research, and their revenue contributions in respective countries were determined through primary and secondary research.

This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

All percentage splits, and breakups were determined using secondary sources and verified through primary sources.

Top Down Approach of personal cloud market

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from government agencies’ demand and supply sides.

Market Definition

A personal cloud helps users to access their digital content seamlessly across devices and computing environments. It is designed for storing, synchronizing, and sharing photos, videos, music, documents, and other digital content over various platforms and screens giving the user the same experience across devices and platforms.

Key Stakeholders

- Cloud Service Providers

- Networking Companies

- Personal Cloud Solution Vendors

- System Integrators

- Information Technology Developers

- Third-party Vendors

- Governments of Different Countries

- Consulting Companies

- Investors and Venture Capitalists

- Technology Providers

- Suppliers, Distributors, And Contractors

- End Users

Report Objectives

- To define, describe, and forecast the personal cloud market based on revenue type, user type, type, hosting type, vertical, and region

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contribution to the total market

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To comprehensively analyze the core competencies of key players

- To track and analyze the ecession impact and competitive developments, such as mergers & acquisitions, new product developments, and partnerships and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the personal cloud market

Company Information

- Detailed analysis and profiling of five additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Personal Cloud Market