Pine-Derived Chemicals Market by Type (TOFA, TOR, Gum Turpentine, Gum Rosin, Pitch, and Sterols), Application (Paints & Coatings, Adhesives & Sealants, Surfactants, and Printing Inks), Source, Process and Region - Global Forecast to 2027

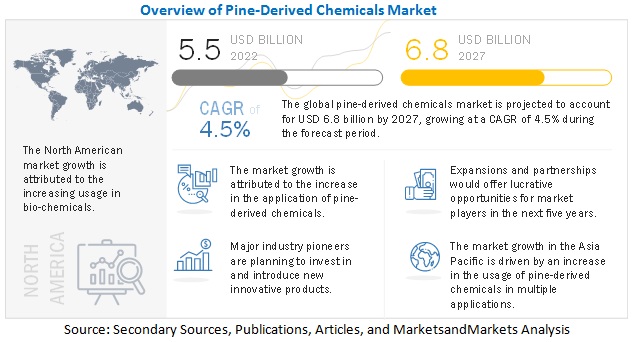

The global pine-derived chemicals market is estimated to reach $6.8 billion by 2027, growing at a 4.5% compound annual growth rate (CAGR). The global market size was valued $5.5 billion in 2022. Pine-derived chemicals is a major commercial product of pine trees. Pine-derived chemicals are used in the manufacturing of paints & coatings, adhesives & sealants, surfactants, and printing inks. Additionally, it finds its application in cosmetics, vitamin intermediates, pine oil disinfectants & insect repellents, fragrances & perfumes, and food & drink flavors.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Increasing demand for bio-friendly products

The demand for these products is exponentially increasing because consumers are inclined more toward environment-friendly products. These chemicals use natural and renewable products as raw materials to develop basic as well as necessary items and serve as a mechanism to lower the carbon footprint. The pine-derived chemicals are obtained from living trees, pine stumps, and logs for which the industry depends on raw materials from the forestry sector. Crude Tall Oil (CTO) is a very prominent example of pine chemistry which has varied applications. American Chemistry Council (ACC) presented that the global availability of CTO will increase to 2.26 million tonnes per year by 2030, owing to the growth of pine-derived chemicals over their chemical substitutes.

Restraints: Stringent regulations imposed by government

The major government agencies such as the Environment Protection Agency (EPA), Food and Drugs Association (FDA), The American Chemistry Council, and the Pine Chemicals Association regulate pine-derived chemicals. These organizations are responsible for registering the products and regulating their safety, usage, and residue levels permitted in food and other applications. Increasing strictness in the rules and regulations of pine-derived chemicals is mainly due to environmental degradation. These regulations primarily affect the already existing pine-derived chemical products while resulting in the delayed introduction of new products.

Opportunities: Opportunities in developing countries

There are huge growth opportunities in the world's developing countries where the agriculture sector is growing rapidly. The high population growth and growing industrialization result in increased food demand. More than 90% of total industries’ wood products manufactured in developing countries will be utilized domestically. The FAO projects that the trend will continue to be the same for the next two decades. The high population growth and growing industrialization result in increased food demand. This will boost the pine-derived chemicals market. There have been quite a few investments by means of mergers, acquisitions, and partnerships by key players in developing regions. These developments in the pine-derived chemicals industry will drive the need for raw materials obtained from pine trees and increase its demand and application into the end-consumer segment. It would also provide employment and generate income opportunities in developing countries.

Challenges: Rising labor costs

In emerging economies where labor costs are low, laborers work for themselves in communally owned forests, accepting lower wages due to low bargaining power, working in difficult terrain with limited or no mechanization or modern safety equipment. Additionally, the gum resin farmers are leaving the forest for better-paying jobs in the cities, which causes labor and production shortage, leading to a rise in wages and increasing the cost of production. Outdated forestry management practices restrain the pine chemical output.

By type, the Tall Oil Fatty Acid (TOFA) segment is projected to account for the second-largest market share in the market during the forecast period

The Tall oil fatty acid segment is expected to account for the second-largest market share in the market. TOFA is used in the manufacturing of soaps, detergents, mining, paints, coating, metalworking fluid, corrosion inhibitors, fuel additives, construction chemicals, rubber, tires, and metallic stabilizers. TOFA is obtained from a natural source and it is not chemically modified, these factors are projected to drive the segment in the global market during the study period.

By source, the by-products of sulfate pulping account for the largest market share in the market

Based on the source, the by-products of the sulfate pulping segment is the largest segment in the overall pine-derived chemicals market. Sulfate processing is used to produce pine wood pulp which consists of pure cellulose fiber. The entire process is called as kraft process, which is a primary technique to extract pine chemicals. The two main by-products obtained from this process are CTO and CST, which has wide application in the end-user industry.

By application, adhesives & sealant segment is projected to account for the second-largest market share during the forecast period

By application, the adhesives & coating segment is projected to account for the second-largest market. Adhesives & sealants are versatile products that are obtained from pine trees. The automotive and construction industries are the two key sectors that use adhesives and sealants extensively. The natural stickiness of rosin makes it an ideal adhesion enhancer when added to adhesives and sealants.

By process, the tapping process segment is projected to account for the largest share in the market during the forecast period

Pine oleoresin or gum is obtained from living pine trees through tapping. Tapping is a repeated wounding process of the tree trunk, which removes the bark and tissues beneath it, followed (or not) by a chemical stimulant application. Crude oleoresin is collected from the wounded trees and evaporated with steam distillation to obtain turpentine. Molten rosin remains at the bottom after turpentine, which is used to manufacture adhesives & sealants and, paints & coatings on a large scale.

To know about the assumptions considered for the study, download the pdf brochure

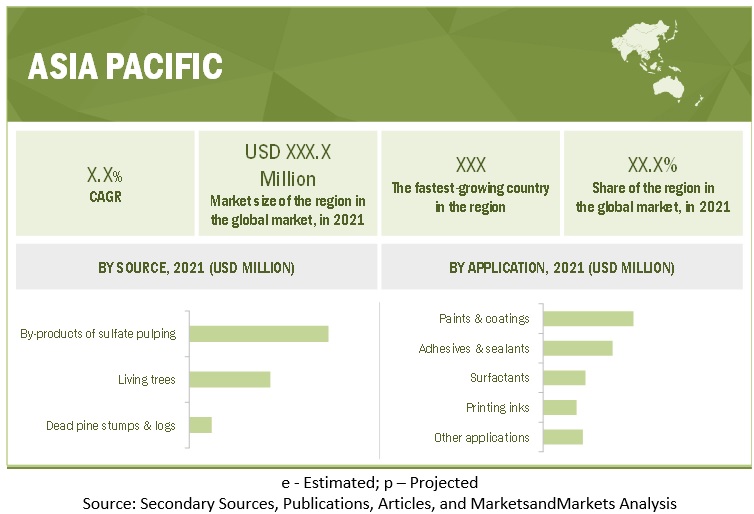

Asia Pacific’s growth is attributed by many new ventures, acquisitions, and collaborations occur between global players, which are expected to change the dynamics of the Asia Pacific pine-derived chemicals market. Due to low labor costs and the execution of new processing methods, most of the production of pine chemicals, especially gum rosin, is carried out in the Asia Pacific, affecting the overall market conditions. In short, the Asia Pacific region is rapidly emerging in the pine chemicals manufacturing segment, supported by strong forestry management, leading to sustainability.

Key Market Players:

Key players in this market include Foreverest Resources Ltd, (China), Harima Chemical Company (Japan), Takasgo International Corporation (Japan), Chemiplas Australia Pvt Ltd (Australia), Mentha and Allied Products Ltd., (India).

Scope of the report

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 5.5 billion |

|

Revenue forecast in 2027 |

USD 6.8 billion |

|

Growth rate |

CAGR of 4.5% |

|

Base year for estimation |

2021 |

|

Forecast period |

2022-2027 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report Coverage & Deliverables |

Revenue forecast, company ranking, driving factors, Competitive benchmarking, and analysis |

|

Segments covered |

Application, Region, Type |

|

Regional Insight |

Europe, North America, South America, Asia Pacific |

|

Key companies profiled |

Foreverest Resources Ltd, (China), Harima Chemical Company (Japan), Takasgo International Corporation (Japan), Chemiplas Australia Pvt Ltd (Australia), Mentha and Allied Products Ltd., (India) |

|

Major Drivers |

|

Target Audience:

- Commercial Research and Development (R&D) Institutions and Financial Institutions

- Adhesives & Sealants, Paints & Coating, Surfactant, Printing Inks Manufacturers

- Government and Non-Government Research Institutes and Institutional Laboratories

- Companies (Manufacturer/Supplier) Involved in the Use of Pine-Derived Chemicals as Main Ingredients

- Pine Chemicals Manufacturers

- Retailers, suppliers, and distributors

Report Scope:

This research report categorizes pine-derived chemicals market based on source, type, application, process, and region.

|

By Source |

By Type |

By Application |

By Process |

By Region |

|

|

|

|

|

Recent Developments

- In February 2022, DCL Corporation (Canada), a color pigment and dispersion manufacturing company, announced a partnership with Chemiplas Australia Pty Ltd (Australia), this partnership will enable Chemiplas to become the sole distributor of DCL Corporation for Australia and New Zealand markets.

- In 2020, Harima Chemical Company (Japan) entered into a strategic partnership agreement with Takasago International Corporation (Japan), and with this partnership Lawter (US) a subsidiary of Harima will provide turpentine derivatives to Takasago to be used in their aroma, flavors, fragrance, and fine chemical business.

- In 2018, DRT (France) announced a new partnership with Mangalam Organics Limited (India), through this partnership DRT will become a worldwide distributor of Managalam’s terpene phenolic resins.

Frequently Asked Questions (FAQ):

How big is the pine-derived chemicals market?

With a 4.5% compound annual growth rate (CAGR), the pine-derived chemicals market is expected to reach $6.8 billion globally by 2027. $5.5 billion was the estimated market size worldwide in 2022.

Which players are involved in the manufacturing of pine-derived chemicals market?

Foreverest Resources Ltd, (China), Harima Chemical Company (Japan), Takasgo International Corporation (Japan), Chemiplas Australia Pvt Ltd (Australia), Mentha and Allied Products Ltd., (India)

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for pine-derived chemicals market?

On request, We will provide details on market size, key players, growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

What is the future growth potential of pine-derived chemicals market?

The pine-derived chemicals market exhibits significant growth potential poised for expansion in the coming years. Fueled by increasing emphasis on sustainability, these chemicals offer a renewable and eco-friendly alternative to traditional petrochemicals, resonating with environmentally conscious consumers and industries alike. Their versatility across multiple sectors, including adhesives, construction, flavors and fragrances, cosmetics, and pharmaceuticals, ensures a consistent demand trajectory. Furthermore, ongoing research and development endeavors are continually broadening the scope of applications, paving the way for innovation-driven growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2021

1.5 VOLUME UNITS CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 44)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key primary insights

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH ONE – BOTTOM-UP (BASED ON TYPE, BY REGION)

2.2.2 APPROACH TWO – TOP-DOWN (BASED ON GLOBAL MARKET)

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR STUDY

2.5 LIMITATIONS AND RISK ASSESSMENT OF STUDY

2.6 MARKET SCENARIOS CONSIDERED FOR COVID-19 IMPACT

2.6.1 OPTIMISTIC SCENARIO

2.6.2 REALISTIC AND PESSIMISTIC SCENARIOS

2.6.3 SCENARIO-BASED MODELING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 4 COVID-19: GLOBAL PROPAGATION

FIGURE 5 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 6 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 7 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 8 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 59)

TABLE 2 MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 9 COVID-19 IMPACT ON PINE-DERIVED CHEMICALS MARKET, BY SCENARIO, 2020 VS. 2021 (USD MILLION)

FIGURE 10 MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET FOR PINE-DERIVED CHEMICALS, BY SOURCE, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 64)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 14 INCREASING DEMAND FOR BIO-FRIENDLY PRODUCTS TO PROPEL MARKET GROWTH FOR PINE-DERIVED CHEMICALS

4.2 NORTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE AND COUNTRY

FIGURE 15 US AND GUM ROSIN TO ACCOUNT FOR LARGEST SHARES IN 2021

4.3 MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE

FIGURE 16 GUM ROSIN SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.4 MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION

FIGURE 17 PAINTS & COATINGS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.5 MARKET FOR PINE-DERIVED CHEMICALS, BY SOURCE AND REGION

FIGURE 18 NORTH AMERICA AND BY-PRODUCTS OF SULFATE PULPING SEGMENTS TO DOMINATE MARKET DURING FORECAST PERIOD

4.6 MARKET FOR PINE-DERIVED CHEMICALS, BY PROCESS

FIGURE 19 TAPPING PROCESS TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 20 COVID-19 IMPACT ON PINE-DERIVED CHEMICALS MARKET: COMPARISON OF PRE AND POST-COVID-19 SCENARIOS

5 MARKET OVERVIEW (Page No. - 68)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 DRIVERS, RESTRAINERS, OPPORTUNITIES, AND CHALLENGES: MARKET FOR PINE-DERIVED CHEMICALS

5.2.1 DRIVERS

5.2.1.1 Increasing demand for bio-friendly products

5.2.1.2 Increasing demand for Asia Pacific construction industry

5.2.1.3 Growing importance of kraft process and increase in application of pine-derived chemicals

5.2.1.4 Scientific advances in pine-derived chemicals industry for economic and sustainable growth

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulations imposed by governments

5.2.3 OPPORTUNITIES

5.2.3.1 Opportunities in developing countries

5.2.4 CHALLENGES

5.2.4.1 Rising labor costs

5.3 COVID-19 IMPACT ON MARKET FOR PINE-DERIVED CHEMICALS

6 INDUSTRY TRENDS (Page No. - 73)

6.1 INTRODUCTION

6.2 VALUE CHAIN

6.2.1 RESEARCH & DEVELOPMENT

6.2.2 RAW MATERIAL SOURCING

6.2.3 PRODUCTION AND PROCESSING

6.2.4 END-USE INDUSTRY

FIGURE 22 VALUE CHAIN ANALYSIS OF PINE-DERIVED CHEMICALS MARKET: RESEARCH & DEVELOPMENT AND RAW MATERIAL SOURCING

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 23 MARKET FOR PINE-DERIVED CHEMICALS: SUPPLY CHAIN

6.4 TECHNOLOGY ANALYSIS

6.5 PRICING ANALYSIS: MARKET FOR PINE-DERIVED CHEMICALS

TABLE 3 GLOBAL PINE-DERIVED CHEMICALS AVERAGE SELLING PRICE (ASP), BY TYPE, 2020–2022 (USD/TONS)

TABLE 4 GLOBAL PINE-DERIVED CHEMICALS AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TONS)

6.6 MARKET MAPPING AND ECOSYSTEM OF PINE-DERIVED CHEMICALS

6.6.1 DEMAND-SIDE

6.6.2 SUPPLY-SIDE

FIGURE 24 PINE-DERIVED CHEMICALS: MARKET MAP

FIGURE 25 PINE-DERIVED CHEMICALS: ECOSYSTEM MAPPING

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 26 REVENUE SHIFT FOR MARKET FOR PINE-DERIVED CHEMICALS

6.8 MARKET FOR PINE-DERIVED CHEMICALS: PATENT ANALYSIS

FIGURE 27 NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2021

FIGURE 28 TOP 10 INVESTORS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

FIGURE 29 TOP 10 APPLICANTS WITH HIGHEST NO. OF PATENT DOCUMENTS

TABLE 5 PATENTS PERTAINING TO PINE-DERIVED CHEMICALS, 2019–2021

6.9 TRADE DATA: MARKET FOR PINE-DERIVED CHEMICALS

6.9.1 2019: TALL OIL

TABLE 6 TOP 10 IMPORTERS AND EXPORTERS OF TALL OIL, 2019 (KG)

6.9.2 2020: TALL OIL

TABLE 7 TOP 10 IMPORTERS AND EXPORTERS OF TALL OIL, 2020 (KG)

6.9.3 2021: TALL OIL

TABLE 8 TOP 10 IMPORTERS AND EXPORTERS OF TALL OIL, 2021 (KG)

6.10 CASE STUDIES

6.10.1 KRATON CORPORATION: TAKING MEASURES TO SAVE ENVIRONMENT

6.11 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 9 KEY CONFERENCES & EVENTS IN MARKET

6.12 TARIFF & REGULATORY LANDSCAPE

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA-PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.12.1 UNITED STATES (US)

6.12.2 CANADA

6.12.3 EUROPEAN UNION (EU)

6.12.4 INDIA

6.12.5 AUSTRALIA

6.12.6 CHINA

6.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 13 MARKET FOR PINE-DERIVED CHEMICALS: PORTER’S FIVE FORCES ANALYSIS

6.13.1 DEGREE OF COMPETITION

6.13.2 BARGAINING POWER OF SUPPLIERS

6.13.3 BARGAINING POWER OF BUYERS

6.13.4 THREAT OF SUBSTITUTES

6.13.5 THREAT OF NEW ENTRANTS

6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 30 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 14 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

6.14.2 BUYING CRITERIA

TABLE 15 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

7 PINE-DERIVED CHEMICALS MARKET, BY TYPE (Page No. - 94)

7.1 INTRODUCTION

FIGURE 31 MARKET SIZE (VALUE), BY TYPE, 2022 VS. 2027

TABLE 16 MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 17 MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 18 MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2019–2021 (KT)

TABLE 19 MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (KT)

7.2 COVID-19 IMPACT ON PINE DERIVED CHEMICALS MARKET, BY TYPE

7.2.1 OPTIMISTIC SCENARIO

TABLE 20 OPTIMISTIC SCENARIO: IMPACT OF COVID–19 ON PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2020–2023 (USD MILLION)

7.2.2 REALISTIC SCENARIO

TABLE 21 REALISTIC SCENARIO: IMPACT OF COVID–19 ON THIS MARKET, BY TYPE, 2020–2023 (USD MILLION)

7.2.3 PESSIMISTIC SCENARIO

TABLE 22 PESSIMISTIC SCENARIO: IMPACT OF COVID–19 ON THIS MARKET, BY TYPE, 2020–2023 (USD MILLION)

7.3 TALL OIL FATTY ACID

7.3.1 INCREASING AWARENESS FOR CLEAN LABEL PRODUCTS TO DRIVE GROWTH FOR TALL OIL FATTY ACID

TABLE 23 TALL OIL FATTY ACID: PINE-DERIVED CHEMICALS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 24 TALL OIL FATTY ACID: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

TABLE 25 TALL OIL FATTY ACID: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2019–2021 (KT)

TABLE 26 TALL OIL FATTY ACID: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (KT)

7.4 TALL OIL ROSIN

7.4.1 STRONG MARKET DEMAND DUE TO WIDE APPLICATIONS IN VARIOUS END-USE INDUSTRIES TO PROPEL GROWTH FOR TALL OIL ROSIN

TABLE 27 TALL OIL ROSIN: PINE-DERIVED CHEMICALS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 28 TALL OIL ROSIN: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

TABLE 29 TALL OIL ROSIN: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2019–2021 (KT)

TABLE 30 TALL OIL ROSIN: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (KT)

7.5 GUM TURPENTINE

7.5.1 INCREASING DEMAND FROM PAINTS, PERFUME, AND PERSONAL CARE INDUSTRIES TO DRIVE GROWTH FOR GUM TURPENTINE

TABLE 31 GUM TURPENTINE: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2019–2021 (USD MILLION)

TABLE 32 GUM TURPENTINE: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

TABLE 33 GUM TURPENTINE: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2019–2021 (KT)

TABLE 34 GUM TURPENTINE: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (KT)

7.6 GUM ROSIN

7.6.1 INCREASING DEMAND FOR GUM ROSIN IN RUBBER AND INK INDUSTRIES TO PROPEL ITS GROWTH

TABLE 35 GUM ROSIN: PINE-DERIVED CHEMICALS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 36 GUM ROSIN: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

TABLE 37 GUM ROSIN: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2019–2021 (KT)

TABLE 38 GUM ROSIN: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (KT)

7.7 STEROLS

7.7.1 RISING AWARENESS ABOUT HEALTH CONSCIOUSNESS AND CHOLESTEROL PRODUCTS TO DRIVE GROWTH FOR STEROLS

TABLE 39 STEROLS: PINE-DERIVED CHEMICALS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 40 STEROLS: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

TABLE 41 STEROLS: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2019–2021 (KT)

TABLE 42 STEROLS: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (KT)

7.8 PITCH

7.8.1 RISING POPULARITY OF PINE PITCH AS A PREMIUM ADHESIVE ALONG WITH RISING DEMAND TO DRIVE ITS GROWTH

TABLE 43 PITCH: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2019–2021 (USD MILLION)

TABLE 44 PITCH: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

TABLE 45 PITCH: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2019–2021 (KT)

TABLE 46 PITCH: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (KT)

7.9 OTHER TYPES

7.10 ALPHA-PINENE

7.11 BETA-PINENE

TABLE 47 OTHER TYPES: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2019–2021 (USD MILLION)

TABLE 48 OTHER TYPES: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

TABLE 49 OTHER TYPES: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2019–2021 (KT)

TABLE 50 OTHER TYPES: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (KT)

8 PINE-DERIVED CHEMICALS MARKET, BY APPLICATION (Page No. - 112)

8.1 INTRODUCTION

FIGURE 32 MARKET SIZE (VALUE), BY APPLICATION, 2022 VS. 2027

TABLE 51 MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 52 MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 COVID-19 IMPACT ON PINE-DERIVED CHEMICALS MARKET, BY APPLICATION

8.2.1 OPTIMISTIC SCENARIO

TABLE 53 TABLE 3: OPTIMISTIC SCENARIO: IMPACT OF COVID–19 ON PINE-DERIVED CHEMICALS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

8.2.2 REALISTIC SCENARIO

TABLE 54 TABLE 4: REALISTIC SCENARIO: IMPACT OF COVID–19 ON PINE-DERIVED CHEMICALS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

8.2.3 PESSIMISTIC SCENARIO

TABLE 55 TABLE 5: PESSIMISTIC SCENARIO: IMPACT OF COVID–19 ON PINE-DERIVED CHEMICALS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

8.3 ADHESIVES & SEALANTS

8.3.1 RISING DEMAND FOR HIGH-PERFORMANCE ADHESIVES FROM AUTOMOTIVE AND CONSTRUCTION INDUSTRIES TO DRIVE GROWTH

TABLE 56 ADHESIVES AND SEALANTS: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2019–2021 (USD MILLION)

TABLE 57 ADHESIVES AND SEALANTS: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

8.4 PAINTS & COATINGS

8.4.1 RISING DEMAND ACROSS BORDERS AND NEW PRODUCT LAUNCHES TO DRIVE GROWTH OF PAINTS & COATINGS

TABLE 58 PAINTS & COATINGS: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2019–2021 (USD MILLION)

TABLE 59 PAINTS & COATINGS: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

8.5 SURFACTANTS

8.5.1 RISING APPLICATIONS FROM VARIOUS NICHE AND VALUE-BASED PRODUCTS MARKET TO DRIVE GROWTH OF SURFACTANTS

TABLE 60 SURFACTANTS: PINE-DERIVED CHEMICALS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 61 SURFACTANTS: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

8.6 PRINTING INKS

8.6.1 RISING DEMAND AND EXPANSION OF PRODUCT PORTFOLIOS BY COMPANIES TO DRIVE PRINTING INKS GROWTH

TABLE 62 PRINTING INKS: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2019–2021 (USD MILLION)

TABLE 63 PRINTING INKS: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

8.7 OTHER APPLICATIONS

TABLE 64 OTHER APPLICATIONS: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2019–2021 (USD MILLION)

TABLE 65 OTHER APPLICATIONS: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

9 PINE-DERIVED CHEMICALS MARKET, BY SOURCE (Page No. - 123)

9.1 INTRODUCTION

FIGURE 33 MARKET SIZE (VALUE), BY SOURCE, 2022 VS. 2027

TABLE 66 MARKET FOR PINE-DERIVED CHEMICALS, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 67 MARKET FOR PINE-DERIVED CHEMICALS, BY SOURCE, 2022–2027 (USD MILLION)

9.2 COVID-19 IMPACT ON PINE-DERIVED CHEMICALS MARKET, BY SOURCE

9.2.1 OPTIMISTIC SCENARIO

TABLE 68 OPTIMISTIC SCENARIO: IMPACT OF COVID–19 ON PINE-DERIVED CHEMICALS MARKET, BY SOURCE, 2020–2023 (USD MILLION)

9.2.2 REALISTIC SCENARIO

TABLE 69 REALISTIC SCENARIO: IMPACT OF COVID–19 ON PINE-DERIVED CHEMICALS MARKET, BY SOURCE, 2020–2023 (USD MILLION)

9.2.3 PESSIMISTIC SCENARIO

TABLE 70 PESSIMISTIC SCENARIO: IMPACT OF COVID–19 ON PINE-DERIVED CHEMICALS MARKET, BY SOURCE, 2020–2023 (USD MILLION)

9.3 LIVING TREES

9.3.1 INCREASING DEMAND FROM END-USE INDUSTRIES AND USAGE BY KEY PLAYERS TO DRIVE MARKET GROWTH

TABLE 71 LIVING TREES: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2019–2021 (USD MILLION)

TABLE 72 LIVING TREES: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

9.4 DEAD PINE STUMPS & LOGS

9.4.1 INCREASED FOCUS ON R&D AND DEMAND FROM END-USE INDUSTRIES TO PROPEL MARKET GROWTH

TABLE 73 DEAD PINE STUMPS & LOGS: PINE-DERIVED CHEMICALS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 74 DEAD PINE STUMPS & LOGS: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

9.5 BY-PRODUCTS OF SULFATE PUMPING (KRAFT PROCESS)

9.5.1 RISING DEMAND ACROSS BORDERS AND INCREASED FOCUS ON R&D TO IMPROVE TECHNIQUES OF EXTRACTION TO DRIVE GROWTH

TABLE 75 BY-PRODUCTS OF SULFATE PUMPING: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2019–2021 (USD MILLION)

TABLE 76 BY-PRODUCTS OF SULFATE PUMPING: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

10 PINE-DERIVED CHEMICALS MARKET, BY PROCESS (Page No. - 130)

10.1 INTRODUCTION

FIGURE 34 MARKET SIZE (VALUE), BY PROCESS, 2022 VS. 2027

TABLE 77 MARKET FOR PINE-DERIVED CHEMICALS, BY PROCESS, 2019–2021 (USD MILLION)

TABLE 78 MARKET FOR PINE-DERIVED CHEMICALS, BY PROCESS, 2022–2027 (USD MILLION)

10.2 COVID-19 IMPACT ON PINE-DERIVED CHEMICALS MARKET, BY PROCESS

10.2.1 OPTIMISTIC SCENARIO

TABLE 79 TABLE 3: OPTIMISTIC SCENARIO: IMPACT OF COVID–19 ON PINE-DERIVED CHEMICALS MARKET, BY PROCESS, 2020–2023 (USD MILLION)

10.2.2 REALISTIC SCENARIO

TABLE 80 REALISTIC SCENARIO: IMPACT OF COVID–19 ON PINE-DERIVED CHEMICALS MARKET, BY PROCESS, 2020–2023 (USD MILLION)

10.2.3 PESSIMISTIC SCENARIO

TABLE 81 PESSIMISTIC SCENARIO: IMPACT OF COVID–19 ON PINE-DERIVED CHEMICALS MARKET, BY PROCESS, 2020–2023 (USD MILLION)

10.3 KRAFT PROCESS

10.3.1 COMPANIES WORLDWIDE SHIFTING THEIR FOCUS TOWARD KRAFT PROCESS TO INCREASE ITS USAGE

TABLE 82 KRAFT PROCESS: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2019–2021 (USD MILLION)

TABLE 83 KRAFT PROCESS: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

10.4 TAPPING PROCESS

10.4.1 INCREASING DEMAND FROM END-USE INDUSTRIES AND RISING TAPPERS’ NUMBERS TO BOOST TAPPING PROCESS DEMAND

TABLE 84 TAPPING PROCESS: PINE-DERIVED CHEMICALS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 85 TAPPING PROCESS: MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

11 PINE-DERIVED CHEMICALS MARKET, BY REGION (Page No. - 136)

11.1 INTRODUCTION

FIGURE 35 CHINA TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 86 PINE-DERIVED CHEMICALS MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 87 MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (USD MILLION)

TABLE 88 MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2019–2021 (KT)

TABLE 89 MARKET FOR PINE-DERIVED CHEMICALS, BY REGION, 2022–2027 (KT)

11.2 COVID-19 IMPACT ON PINE-DERIVED CHEMICALS MARKET, BY REGION

11.2.1 OPTIMISTIC SCENARIOS

TABLE 90 OPTIMISTIC SCENARIO: IMPACT OF COVID–19 ON PINE-DERIVED CHEMICALS MARKET, BY REGION, 2020–2023 (USD MILLION)

11.2.2 REALISTIC SCENARIO

TABLE 91 REALISTIC SCENARIO: IMPACT OF COVID–19 ON PINE-DERIVED CHEMICALS MARKET, BY REGION, 2020–2023 (USD MILLION)

11.2.3 PESSIMISTIC SCENARIO

TABLE 92 PESSIMISTIC SCENARIO: IMPACT OF COVID–19 ON PINE-DERIVED CHEMICALS MARKET, BY REGION, 2020–2023 (USD MILLION)

11.3 NORTH AMERICA

FIGURE 36 NORTH AMERICA: PINE-DERIVED CHEMICALS MARKET SNAPSHOT

TABLE 93 NORTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2019–2021 (KT)

TABLE 98 NORTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (KT)

TABLE 99 NORTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY PROCESS, 2019–2021 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY PROCESS, 2022–2027 (USD MILLION)

11.3.1 US

11.3.1.1 Rising awareness of safe and healthy consumer products to drive demand for pine-derived chemicals

TABLE 105 US: PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 106 US: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 107 US: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 108 US: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.2 CANADA

11.3.2.1 Increasing focus on newer applications of pine-derived chemicals to present growth opportunities

TABLE 109 CANADA: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 110 CANADA: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 111 CANADA: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 112 CANADA: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.3 MEXICO

11.3.3.1 Personal care products market and rising focus on innovation to create significant business opportunities

TABLE 113 MEXICO: PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 114 MEXICO: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 115 MEXICO: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 116 MEXICO: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

11.4 EUROPE

TABLE 117 EUROPE: PINE-DERIVED CHEMICALS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 118 EUROPE: MARKET FOR PINE-DERIVED CHEMICALS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 119 EUROPE: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 120 EUROPE: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 121 EUROPE: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2019–2021 (KT)

TABLE 122 EUROPE: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (KT)

TABLE 123 EUROPE: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 124 EUROPE: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 125 EUROPE: MARKET FOR PINE-DERIVED CHEMICALS, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 126 EUROPE: MARKET FOR PINE-DERIVED CHEMICALS, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 127 EUROPE: MARKET FOR PINE-DERIVED CHEMICALS, BY PROCESS, 2019–2021 (USD MILLION)

TABLE 128 EUROPE: MARKET FOR PINE-DERIVED CHEMICALS, BY PROCESS, 2022–2027 (USD MILLION)

11.4.1 GERMANY

11.4.1.1 Rising demand for environment-friendly products and companies’ excellent expertise to boost pine-derived chemicals industry

TABLE 129 GERMANY: PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 130 GERMANY: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 131 GERMANY: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 132 GERMANY: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.2 UK

11.4.2.1 Increasing demand for personal care products, paints, and coating sectors to fuel demand for pine-derived chemicals

TABLE 133 UK: PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 134 UK: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 135 UK: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 136 UK: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.3 RUSSIA

11.4.3.1 Fastest-growing segment because of increased demand for raw materials, such as gum and wood

TABLE 137 RUSSIA: PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 138 RUSSIA: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 139 RUSSIA: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 140 RUSSIA: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.4 ITALY

11.4.4.1 Increased demand for bio-based pine-derived chemicals due to major rise in construction activities

TABLE 141 ITALY: PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 142 ITALY: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 143 ITALY: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 144 ITALY: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.5 SPAIN

11.4.5.1 Increased dependence on renewable resources to provide opportunity for pine chemicals in Spain

TABLE 145 SPAIN: PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 146 SPAIN: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 147 SPAIN: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 148 SPAIN: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.6 FRANCE

11.4.6.1 Need for renewable and sustainable products to flourish pine-derived chemicals segment

TABLE 149 FRANCE: PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 150 FRANCE: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 151 FRANCE: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 152 FRANCE: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.7 REST OF EUROPE

TABLE 153 REST OF EUROPE: PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 154 REST OF EUROPE: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 155 REST OF EUROPE: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 156 REST OF EUROPE: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

11.5 ASIA PACIFIC

FIGURE 37 ASIA PACIFIC: PINE-DERIVED CHEMICALS MARKET SNAPSHOT

TABLE 157 ASIA PACIFIC: MARKET FOR PINE-DERIVED CHEMICALS, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET FOR PINE-DERIVED CHEMICALS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2019–2021 (KT)

TABLE 162 ASIA PACIFIC: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (KT)

TABLE 163 ASIA PACIFIC: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 164 ASIA PACIFIC: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 165 ASIA PACIFIC: MARKET FOR PINE-DERIVED CHEMICALS, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 166 ASIA PACIFIC: MARKET FOR PINE-DERIVED CHEMICALS, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 167 ASIA PACIFIC: MARKET FOR PINE-DERIVED CHEMICALS, BY PROCESS, 2019–2021 (USD MILLION)

TABLE 168 ASIA PACIFIC: MARKET FOR PINE-DERIVED CHEMICALS, BY PROCESS, 2022–2027 (USD MILLION)

11.5.1 CHINA

11.5.1.1 Mature adhesives, paints, and coatings industries to drive demand for pine derived chemicals products

TABLE 169 CHINA: PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 170 CHINA: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 171 CHINA: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 172 CHINA: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

11.5.2 JAPAN

11.5.2.1 Attractive cosmetics market and partnerships with end-use industries to present growth opportunities

TABLE 173 JAPAN: PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 174 JAPAN: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 175 JAPAN: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 176 JAPAN: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

11.5.3 INDIA

11.5.3.1 Partnerships and large markets for paints and adhesives to drive growth of pine-derived chemical companies

TABLE 177 INDIA: PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 178 INDIA: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 179 INDIA: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 180 INDIA: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

11.5.4 AUSTRALIA & NEW ZEALAND

11.5.4.1 Rising demand and partnerships with international players to present significant business opportunities

TABLE 181 AUSTRALIA & NEW ZEALAND: PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 182 AUSTRALIA & NEW ZEALAND: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 183 AUSTRALIA & NEW ZEALAND: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 184 AUSTRALIA & NEW ZEALAND: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

11.5.5 REST OF ASIA PACIFIC

TABLE 185 REST OF ASIA PACIFIC: PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 186 REST OF ASIA PACIFIC: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 187 REST OF ASIA PACIFIC: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 188 REST OF ASIA PACIFIC: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

11.6 SOUTH AMERICA

TABLE 189 SOUTH AMERICA: PINE-DERIVED CHEMICALS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 190 SOUTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 191 SOUTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 192 SOUTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 193 SOUTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2019–2021 (KT)

TABLE 194 SOUTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (KT)

TABLE 195 SOUTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 196 SOUTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 197 SOUTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 198 SOUTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 199 SOUTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY PROCESS, 2019–2021 (USD MILLION)

TABLE 200 SOUTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY PROCESS, 2022–2027 (USD MILLION)

11.6.1 BRAZIL

11.6.1.1 Growing economy and availability of low-cost labor to drive demand for pine-derived chemicals

TABLE 201 BRAZIL: PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 202 BRAZIL: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 203 BRAZIL: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 204 BRAZIL: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

11.6.2 ARGENTINA

11.6.2.1 Rising demand for end-consumer products to increase demand for pine-derived chemicals market in Argentina

TABLE 205 ARGENTINA: PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 206 ARGENTINA: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 207 ARGENTINA: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 208 ARGENTINA: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

11.6.3 REST OF SOUTH AMERICA

TABLE 209 REST OF SOUTH AMERICA: PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 210 REST OF SOUTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 211 REST OF SOUTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 212 REST OF SOUTH AMERICA: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

11.7 REST OF THE WORLD

TABLE 213 REST OF THE WORLD: PINE-DERIVED CHEMICALS MARKET, BY SUB-REGION, 2019–2021 (USD MILLION)

TABLE 214 REST OF THE WORLD: MARKET FOR PINE-DERIVED CHEMICALS, BY SUB-REGION, 2022–2027 (USD MILLION)

TABLE 215 REST OF THE WORLD: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 216 REST OF THE WORLD: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 217 REST OF THE WORLD: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2019–2021 (KT)

TABLE 218 REST OF THE WORLD: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (KT)

TABLE 219 REST OF THE WORLD: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 220 REST OF THE WORLD: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 221 REST OF THE WORLD: MARKET FOR PINE-DERIVED CHEMICALS, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 222 REST OF THE WORLD: MARKET FOR PINE-DERIVED CHEMICALS, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 223 REST OF THE WORLD: MARKET FOR PINE-DERIVED CHEMICALS, BY PROCESS, 2019–2021 (USD MILLION)

TABLE 224 REST OF THE WORLD: MARKET FOR PINE-DERIVED CHEMICALS, BY PROCESS, 2022–2027 (USD MILLION)

11.7.1 AFRICA

11.7.1.1 Huge pine reserves and limited pine processing industries to boost business opportunities

TABLE 225 AFRICA: PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 226 AFRICA: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 227 AFRICA: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 228 AFRICA: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

11.7.2 MIDDLE EAST

11.7.2.1 Rising awareness and demand for bio-based fuels to present newer business opportunities for pine-derived chemicals

TABLE 229 MIDDLE EAST: PINE-DERIVED CHEMICALS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 230 MIDDLE EAST: MARKET FOR PINE-DERIVED CHEMICALS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 231 MIDDLE EAST: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 232 MIDDLE EAST: MARKET FOR PINE-DERIVED CHEMICALS, BY APPLICATION, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 198)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS, 2021

TABLE 233 PINE-DERIVED CHEMICALS MARKET SHARE ANALYSIS, 2021

12.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 38 REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2018–2020 (USD BILLION)

12.4 COVID-19-SPECIFIC COMPANY RESPONSE

12.4.1 EASTMAN CHEMICAL COMPANY (US)

12.4.2 HARIMA CHEMICALS GROUP (JAPAN)

12.4.3 INGEVITY CORPORATION (US)

12.4.4 KRATON CORPORATION (US)

12.4.5 MENTHA AND ALLIED PRODUCTS PVT. LTD. (INDIA)

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.5.1 STARS

12.5.2 PERVASIVE PLAYERS

12.5.3 EMERGING LEADERS

12.5.4 PARTICIPANTS

FIGURE 39 PINE-DERIVED CHEMICALS MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

12.5.5 PINE-DERIVED CHEMICALS PRODUCT FOOTPRINT (KEY PLAYERS)

TABLE 234 COMPANY FOOTPRINT, BY TYPE (KEY PLAYERS)

TABLE 235 COMPANY FOOTPRINT, BY APPLICATION (KEY PLAYERS)

TABLE 236 COMPANY FOOTPRINT, BY SOURCE (KEY PLAYERS)

TABLE 237 COMPANY FOOTPRINT, BY REGION (KEY PLAYERS)

TABLE 238 OVERALL COMPANY FOOTPRINT (KEY PLAYERS)

12.6 PINE-DERIVED CHEMICALS MARKET, OTHER PLAYERS EVALUATION QUADRANT, 2021

12.6.1 PROGRESSIVE COMPANIES

12.6.2 STARTING BLOCKS

12.6.3 RESPONSIVE COMPANIES

12.6.4 DYNAMIC COMPANIES

FIGURE 40 PINE-DERIVED CHEMICALS MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

TABLE 239 PINE-DERIVED CHEMICALS: COMPETITIVE BENCHMARKING OF OTHER PLAYERS

12.7 COMPETITIVE SCENARIO

12.7.1 NEW PRODUCT LAUNCHES

TABLE 240 PINE-DERIVED CHEMICALS MARKET: NEW PRODUCT LAUNCHES, 2018-2019

12.7.2 DEALS

TABLE 241 MARKET FOR PINE-DERIVED CHEMICALS: OTHERS, 2018-2022

TABLE 242 MARKET FOR PINE-DERIVED CHEMICALS: DEALS, 2018-2020

13 COMPANY PROFILES (Page No. - 212)

13.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View)*

13.1.1 EASTMAN CHEMICAL COMPANY

TABLE 243 EASTMAN CHEMICAL COMPANY: BUSINESS OVERVIEW

FIGURE 41 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

TABLE 244 EASTMAN CHEMICAL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 245 EASTMAN CHEMICAL COMPANY: OTHERS

13.1.2 HARIMA CHEMICALS GROUP

TABLE 246 HARIMA CHEMICALS GROUP: BUSINESS OVERVIEW

FIGURE 42 HARIMA CHEMICALS GROUP: COMPANY SNAPSHOT

TABLE 247 HARIMA CHEMICALS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 248 HARIMA CHEMICALS GROUP: DEALS

13.1.3 INGEVITY CORPORATION

TABLE 249 INGEVITY CORPORATION: BUSINESS OVERVIEW

FIGURE 43 INGEVITY CORPORATION: COMPANY SNAPSHOT

TABLE 250 INGEVITY CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 251 INGEVITY CORPORATION: DEALS

13.1.4 KRATON CORPORATION

TABLE 252 KRATON CORPORATION: BUSINESS OVERVIEW

FIGURE 44 KRATON CORPORATION: COMPANY SNAPSHOT

TABLE 253 KRATON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.5 MENTHA AND ALLIED PRODUCTS PVT LTD.

TABLE 254 MENTHA AND ALLIED PRODUCTS PVT LTD.

TABLE 255 MENTHA AND ALLIED PRODUCTS PVT LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.6 MAHENDRA ROSIN AND TURPENTINE PVT LTD.

TABLE 256 MAHENDRA ROSIN AND TURPENTINE PVT LTD: BUSINESS OVERVIEW

TABLE 257 MAHENDRA ROSIN AND TURPENTINE PVT LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.7 ARAKAWA CHEMICAL INDUSTRIES, LTD.

TABLE 258 ARAKAWA CHEMICAL INDUSTRIES, LTD.: BUSINESS OVERVIEW

FIGURE 45 ARAKAWA CHEMICAL INDUSTRIES, LTD.: COMPANY SNAPSHOT

TABLE 259 ARAKAWA CHEMICAL INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.8 GEORGE-PACIFIC CHEMICALS

TABLE 260 GEORGE-PACIFIC CHEMICALS: BUSINESS OVERVIEW

TABLE 261 GEORGE-PACIFIC CHEMICALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 262 GEORGE-PACIFIC CHEMICALS: OTHERS

13.1.9 FORCHEM OYJ

TABLE 263 FORCHEM OYJ: BUSINESS OVERVIEW

TABLE 264 FORCHEM OYJ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 265 FORCHEM OYJ: NEW PRODUCT LAUNCHES

13.1.10 FLORACHEM CORPORATION

TABLE 266 FLORACHEM CORPORATION: BUSINESS OVERVIEW

TABLE 267 FLORACHEM CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 268 FLORACHEM CORPORATION: OTHERS

13.2 OTHER PLAYERS

13.2.1 DRT (DÉRIVÉS RÉSINIQUES ET TERPÉNIQUES)

TABLE 269 DRT (DÉRIVÉS RÉSINIQUES ET TERPÉNIQUES): BUSINESS OVERVIEW

TABLE 270 DRT (DÉRIVÉS RÉSINIQUES ET TERPÉNIQUES): PRODUCTS/SOLUTIONS/ SERVICES OFFERED

TABLE 271 DRT (DÉRIVÉS RÉSINIQUES ET TERPÉNIQUES: DEALS

TABLE 272 DRT (DÉRIVÉS RÉSINIQUES ET TERPÉNIQUES): OTHERS

13.2.2 FOREVEREST RESOURCES LTD.

TABLE 273 FOREVEREST RESOURCES LTD: BUSINESS OVERVIEW

TABLE 274 FOREVEREST RESOURCES LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 275 FOREVEREST RESOURCES LTD: NEW PRODUCT LAUNCHES

13.2.3 WUZHOU SUNSHINE FORESTRY & CHEMICALS CO. LTD.

TABLE 276 WUZHOU SUN SHINE FORESTRY & CHEMICALS CO. LTD.: BUSINESS OVERVIEW

TABLE 277 WUZHOU SUNSHINE FORESTRY & CHEMICALS CO. LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

13.2.4 GUILIN SONGQUAN FOREST CHEMICAL CO. LTD.

TABLE 278 GUILIN SONGQUAN FOREST CHEMICAL CO. LTD.: BUSINESS OVERVIEW

TABLE 279 GUILIN SONGQUAN FOREST CHEMICAL CO. LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

13.2.5 MIDHILLS ROSIN & TURPENES

TABLE 280 MIDHILLS ROSIN & TURPENES: BUSINESS OVERVIEW

TABLE 281 MIDHILLS ROSIN & TURPENES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.6 RESINAS ALFONSO CRIADO MARTÍN

13.2.7 FLORPINUS CHEMICAL INDUSTRIES

13.2.8 PINECHEMICAL GROUP OY

13.2.9 PUNJAB ROSIN & CHEMICAL WORKS

13.2.10 KEICHEM INDONESIA

Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 256)

14.1 INTRODUCTION

TABLE 282 ADJACENT MARKETS TO PINE-DERIVED CHEMICALS MARKET

14.2 LIMITATIONS

14.3 RENEWABLE CHEMICAL MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

TABLE 283 RENEWABLE CHEMICAL MARKET, BY TYPE, 2013–2020 (USD MILLION)

14.4 CONSTRUCTION CHEMICAL MARKET

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

TABLE 284 CONSTRUCTION CHEMICAL MARKET, BY TYPE, 2013–2020 (USD MILLION)

15 APPENDIX (Page No. - 259)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

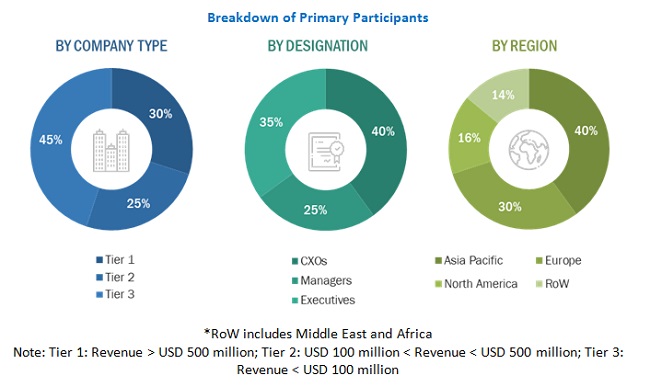

The study involved four major activities in estimating pine-derived chemicals market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders in the supply chain, including pine chemical manufacturers, adhesives & sealants manufacturers, paints & coating manufacturers, distributors & suppliers, trading bodies, research centers, laboratories, and scientific institutes. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side include pine chemical manufacturers, exporters, and importers. The primary sources from the demand-side include paints & adhesives manufacturers, printing ink manufacturers, adhesives & sealants manufacturers, food & beverages manufacturers, and other end-use sectors.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—the top-down approach, the bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- To describe and forecast pine-derived chemicals market, in terms of source, type, application, process, and region.

- To describe and forecast pine-derived chemicals market, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of pine-derived chemicals market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as expansions & investments, product launches & approvals, and agreements & partnerships in market

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of the Asia Pacific pine-derived chemicals market, by key country

- Further breakdown of the Rest of the European pine-derived market, by key country

- Further breakdown of the Rest of South America includes Chile, Colombia, Peru, Uruguay, and other South American countries

- Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Pine-Derived Chemicals Market