Pipeline Safety Market by Component (Solutions (Pipeline Monitoring System, Secure Communication, Perimeter Intrusion Detection, SCADA for Pipelines, and ICS Security) and Services), Application, Vertical, and Region - Global Forecast to 2025

Pipeline Safety Market Statistics & Size

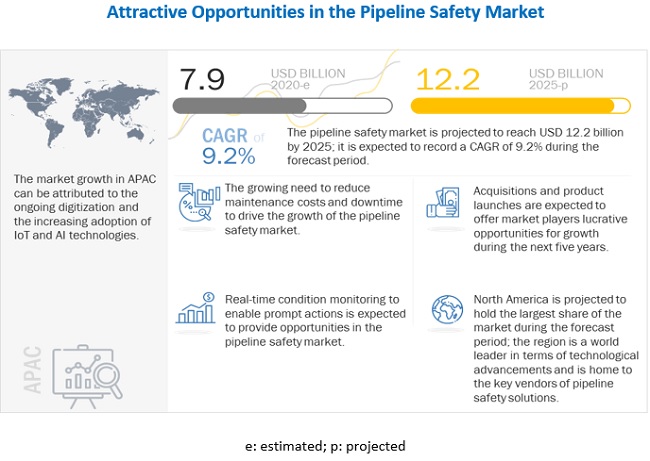

The global Pipeline Safety Market was valued at $7.9 billion in 2020, and is projected to reach $12.2 billion by 2025, growing at a CAGR of 9.2% from 2020 to 2025. Improved spending by most oil and gas companies for pipeline infrastructure, network monitoring, leak detection, and the rise in the number of oil and gas leakage incidence/accidents is also expected to drive market growth. However, the lack of apprehensions related to monitoring system implementation by operators.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global Pipeline safety market

COVID-19 would have an impact on all the elements of the technology sector. The global ICT spending is estimated to decline by 4%–5% by the end of 2020. The hardware business is predicted to have the most impact on the IT industry. Due to the slowdown of hardware supply and reduced manufacturing capacity, the IT infrastructure growth has slowed down. Businesses providing solutions and services are also expected to slow down for a short span of time. However, the adoption of collaborative applications, analytics, security solutions, and AI is set to increase in the remaining part of the year.

In a short time, the COVID-19 outbreak has affected markets and customers' behavior and has a substantial impact on economies and societies. With offices, educational institutions, and manufacturing facilities shutting down for an indefinite period, major sports and events being postponed, and work-from-home and social distancing policies in effect, businesses are increasingly looking for technologies to assist them through these difficult times. Analytics professionals, business intelligence professionals, and professionals providing expertise in more advanced analytics, such as AI and ML, have been called for their expertise to help executives make business decisions on how to respond to the new business challenges caused by the COVID-19 outbreak.

The oil and gas pipeline sector has been impacted due to a weak demand and low oil and gas prices as a result of COVID-19. While worsening financial situation results in a delay of upcoming pipeline projects, measures to curb the spread of pandemic have impacted operations of existing pipelines. While pipeline and piping systems remain in operation throughout the current COVID-19 pandemic, understandably, some repair and maintenance scopes have been delayed. When normal operations resume, it will be even more important to plan effectively with early engagement from the supply chain and ensure the use of the safest and most efficient tools on the market.

Pipeline Safety Market Dynamics

Driver: Improved spending by the majority of oil and gas companies for pipeline infrastructure, network monitoring, and leak detection

The need to monitor oil, gas, and refined products have increased as pipeline infrastructures are easily exposed to sabotaging, illegal tapping, militant and terrorist actions, combined with the detection of leaks, and in-line equipment failure. There has been a significant increase in pipeline infrastructure due to the rise in demand for oil and gas in most major countries. Pipelines are laid over different regions over thousands of miles to transport and distribute oil and gas products. These large networks of pipelines have increased the demand for pipeline safety, monitoring, and leakage detection. Pipeline companies are implementing sensors and sophisticated monitoring technologies for detecting leakages to monitor the pipeline infrastructure. Companies are also focusing on implementing physical security solutions, such as aerial and ground surveillance, and video surveillance, to protect and monitor pipelines from terrorist attacks and sabotage. This growth in pipeline infrastructure will provide a lucrative market for monitoring system vendors in the coming years.

Restraint: Cost of monitoring systems for oil and gas pipelines varies with technology

The cost of implementation of pipeline safety and leak detection system for oil and gas varies with technology. The monitoring and leak detection system's cost with installed software-based volume balance and pressure analysis systems is worth about USD 300,000, and the ultrasonic systems are more expensive than other systems, which cost nearly USD 60,000 per each flowmeter. The monitoring leak detection system with real-time transient model technology is worth USD 300,000 based on the pipeline configuration. However, a major Canadian company named SkyX reduced the cost of pipeline safety systems to USD 37 billion using a more effective, less expensive automated drone-based alternative than the current practices. The company claimed to reduce the traditional monitoring costs by nearly 90% and use their proprietary technology to provide more comprehensive information faster and employ AI to recognize issues and recommend interventions. The prices mentioned above exhibit that the costs of monitoring and leak detection systems are high. These charges are excluding the implementation and maintenance and majorly depend on the technological changes and advancement in the industry. As a result, the cost factor of monitoring and leak detection systems for oil and gas is one of the key restraining factors.

Opportunity: COVID-19 pandemic increases the need for remote monitoring and management of assets and business processes

The COVID-19 pandemic has had a remarkable effect on the world; with more than half of the world’s population forced into lockdown and countries struggling with the fast-evolving health crisis, the economic implications of the pandemic have started emerging in the form of muted growth projections and unemployment levels unheard due to companies’ slowdown in revenue generation. Social distancing and self-quarantines created cabin fever, and reduced spending combination provides significant potential demand. Those with well-maintained and reliable equipment will be positioned to respond to this new level of demand.

COVID-19, in the initial stage of lockdown, has slowed the market growth and affected the global industries; however, post the second and third quarters of the pandemic, with business moving toward a new normal, technology demand would boom immensely and the increase in the adoption of technologies such as AI, IoT, and ML would drive the business revenue growth; some factors contributing to this include training and knowledge transfer, infrastructure, and new software accreditation in the next financial year. Since the lockdowns have enforced remote working trends, this would extend to functions that were earlier considered too sensitive.

The adoption of pipeline safety solutions and services would provide a tremendous opportunity for various industries to control and monitor their remote working process. Remote monitoring and diagnosis will be key to enabling pipeline safety service during the time of social distancing, which will likely stretch on for months. The surge in need for remote monitoring could further the adoption of smart sensing technologies. The increase in the use of Geospatial Information System (GIS) and related technologies during this slowdown will accelerate the use of IoT, connected equipment, and emerging technologies that will enable functions, such as pipeline safety, and optimize field technicians' use.

Challenge: Severe climatic conditions and lack of funds hampering the development of aging infrastructure

Owing to the rising oil demand, E&P companies are exploring for oilfields located in remote and harsh environments. According to the US Geological Survey, the offshore arctic holds 25% of the world’s untapped reserves. Most of these reserves are located under the sea ice, which creates additional challenges for the design, construction, installation, and operation of offshore pipelines.

Offshore arctic and sub-arctic areas, such as the Barents Sea, the Russian Arctic, Alaskan Chukchi Sea, Beaufort Sea, have created interest among the upstream companies for the development of these reserves. The developments of these reserves pose a challenge not only for the upstream E&P operations but also to the offshore pipeline EPC companies as these pipelines have to withstand severe climatic challenges, such as low temperature, ice gouging, and material issues. These pipelines are exposed to challenging loading conditions, such as permafrost, fault crossings, and ice scouring, which impose high strain on pipelines. Hence, the load and the low temperature need to be considered when the material and weld procedures are determined for strain-based design purposes, increasing the cost incurred for designing, construction/installing, and commissioning offshore pipelines.

Offshore construction of pipeline faces several challenges specific to ultra-deep-water regions and high-pressure conditions. These pipelines require robust and end-to-end pipeline safety solutions that provide visibility of equipment, machinery, and interconnectors' performance. The designing and the accurate laying down of pipelines with its interconnections increase the cost of construction. The offshore construction cost is approximately 50% more than the onshore one. This is majorly owed to the day rate cost incurred for operating the pipelaying vessels. Developments in the artic and ultra-deep-water regions are expected to pose a technical challenge to companies operating offshore.

Aging infrastructure is one of the main reasons for poor metering, leakages, and non-management of critical pipeline infrastructures, such as pipelines, valves, and hydrants. Aging has become a problem for several industries, such as water, oil, gas, and chemical pipelines. Federal agencies' resistance to supporting R&D is one of the main reasons for the lack of funds for pipeline safety systems. These solutions are associated with large upfront costs, which various small/medium utilities are reluctant to pay for. The pipeline infrastructure changes at a slow pace. Infrastructure elements, such as pipes, valves, and meters, once deployed, last for decades. Hence, utilities are not keen on replacing pipeline systems as the earlier deployed solutions are expensive and last longing. With advanced infrastructure, sustainable resource management can address proper integration. The stakeholder involvement would prevent fragmented and uncoordinated approaches to pipeline safety issues, leading to a smarter pipeline management method.

The offshore segment to account for a larger CAGR during the forecast period

Offshore pipelines are critical elements of the subsea transportation system for the transportation and delivery of carbon products from the resource sites to end-users and markets. The design, construction, and operation of offshore pipelines require risk management elements to mitigate potential adverse effects from the perspective of technical, business, environmental, and societal factors. The need, scope, requirements, and the complexity of risk management have evolved in concert with the pipeline industry meeting the challenges for extending application into deep water environments and ice regimes, and capabilities to achieve more extreme operating conditions (internal pressure, temperature, and aggressive fluids) and envelopes (transient cool down and restart conditions.

Asia Pacific is the leading pipeline safety market, globally, by volume in 2020

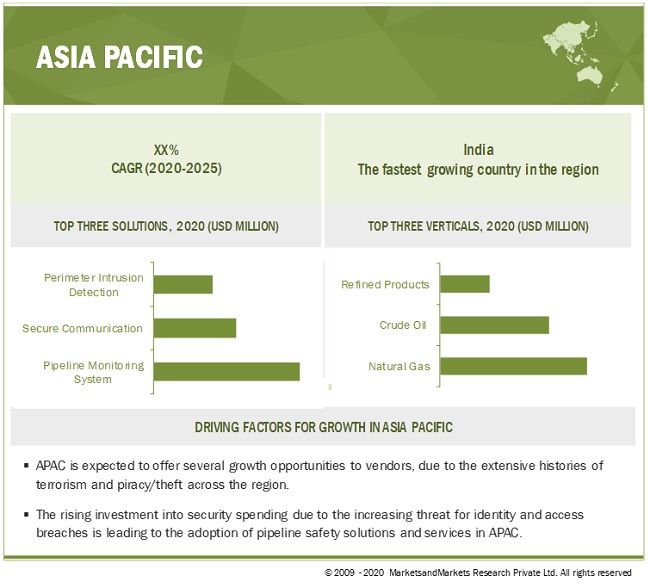

Asia Pacific is expected to have the highest market growth rate during the forecast period. With the rising awareness about the increase in business productivity, supplemented with competently designed pipeline safety platforms offered by vendors present in this region, Asia Pacific is becoming a highly potential market. The region comprises emerging economies, such as India, China, and Japan. With the significant rise in pipelines' construction across China, Pakistan, and India, the need to deploy comprehensive security measures has increased considerably. Security concerns over pipeline attacks and damage due to natural disasters and piracy are key areas of concern at the country level. China, India, and Japan have the potential market for pipeline transport implementation across the manufacturing, transportation, and energy industry. In September 2020, Malaysian energy firm PETRONAS launched it's Virtual Pipeline System (VPS) solution via the Regasification Terminal (RGT) in Pengerang, Johor. In recent years, APAC has undergone tremendous economic and political changes. This has eventually resulted in an increasing number of enterprises and industries in APAC.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The pipeline safety platform vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors offering Pipeline safety solutions are ABB (Switzerland), Siemens AG (Germany), Schneider Electric (France), Baker Hughes (US), Honeywell (US), Huawei Technologies (China), AVEVA (UK), PSI AG (Germany), BAE Systems (UK), TransCanada (Canada), Atmos International (UK), Clampon AS (Norway), FFT (Australia), Perma-Pipe (US), Senstar (Canada), Syrinix (UK), RADIOBARRIER (Russia), Pure Technologies (Canada), C-Fer Technologies (Canada), Total Safety (US), Krohne Group (Germany), PLM CAT (US), Leater (Ukraine), and TTK (France).

Scope of the report

|

Report Metric |

Details |

|

Market Size Available for years |

2016-2025 |

|

Base year considered |

2019 |

|

Forecast Period |

2020-2025 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Component, By Application, By Vertical and By Region |

|

Geographies covered |

North America, APAC, Europe, MEA and Latin America |

|

Companies covered |

The major market players include ABB (Switzerland), Siemens AG (Germany), Schneider Electric (France), Baker Hughes (US), Honeywell (US), Huawei Technologies (China), AVEVA (UK), PSI AG (Germany), BAE Systems (UK), TransCanada (Canada), Atmos International (UK), Clampon AS (Norway), FFT (Australia), Perma-Pipe (US), Senstar (Canada), Syrinix (UK), RADIOBARRIER (Russia), Pure Technologies (Canada), C-Fer Technologies (Canada), Total Safety (US), Krohne Group (Germany), PLM CAT (US), Leater (Ukraine), and TTK (France) (Total 30 companies) |

The study categorizes the Pipeline safety market based on component, application, vertical at the regional and global levels.

By Component

- Solutions

-

Services

- Pipeline Integrity Management

-

Professional Services

- Risk Management

- Engineering and Consulting

By Solution

- Perimeter Intrusion Detection

-

Secure Communication

- Satellite Monitoring

- Video Surveillance

- SCADA for Pipelines

-

Pipeline Monitoring System

- Leakage Detection

- External Threat Detection

- Pig Tracking

- Integrated Fiber Optic Monitoring

- Industrial Control System (ICS) Security

By Application

- Onshore

- Offshore

By Vertical

- Natural Gas

- Crude Oil

- Refined Products

- Other Verticals (water and wastewater, drugs, and beverages)

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Recent Developments:

- In April 2020, ABB was chosen by IOC’s Barauni refinery. IOC’s Barauni refinery chose ABB to ensure reliable grid connection and expand its crude oil processing capacity at the plant by 50% to 9 million tons per annum in the next three years. This order from IOCL will allow ABB to play a more active role in meeting future energy demand with its pioneering technology solutions.

- In July 2020, Siemen launched digital solutions for post-COVID-19 workplaces. The solution aims to ensure social distancing and other safety measures. It includes IoT solutions, which support adherence to social distancing and contact tracing guidelines, body temperature detection integrated with access control, indoor air quality optimization, and secured remote monitoring of a building's systems.

- In February 2020, Schneider Electric enhanced its latest version of its software, EcoStruxure Power SCADA Operation 2020. The platform is designed to provide real-time vision and control for a timely response. The new enhancement to the EcoStruxure Power edge control portfolio keeps demanding operations running with new cybersecurity and graphics customization levels.

- In February 2020, Baker Hughes and C3.ai launched AI software to optimize oil and gas production to allow well operators to view real-time production data and predict future production more accurately. The software will help the energy industry improve productivity and efficiency with enterprise-scale AI applications.

- In August 2020, Honeywell UOP will provide PetroChina, a petrochemical company, with various solutions and technologies. Honeywell would offer technology licenses, engineering design, key equipment, operator training sessions, and technical services for startup and efficient operation

Frequently Asked Questions (FAQ):

What is the projected market value of Pipeline Safety Market?

What is the estimated growth rate (CAGR) of the global Pipeline Safety Market?

What is Pipeline Safety?

Which are Leading Companies in Pipeline Safety Market?

What are the applications in Pipeline Safety Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 FACTORS IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 6 PIPELINE SAFETY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 PIPELINE SAFETY MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 2 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3—BOTTOM-UP (DEMAND SIDE): SHARE OF PIPELINE SAFETY THROUGH OVERALL PIPELINE SAFETY SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 12 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS OF THE STUDY

2.8 IMPLICATIONS OF COVID-19 ON PIPELINE SAFETY MARKET

FIGURE 13 QUARTERLY IMPACT OF COVID-19 DURING 2020–2021

3 EXECUTIVE SUMMARY (Page No. - 48)

TABLE 4 PIPELINE SAFETY MARKET SIZE AND GROWTH RATE, 2016–2019 (USD MILLION, Y-O-Y %)

TABLE 5 MARKET SIZE AND GROWTH RATE, 2019–2025 (USD MILLION, Y-O-Y %)

FIGURE 14 MARKET SNAPSHOT, BY COMPONENT

FIGURE 15 MARKET SNAPSHOT, BY SOLUTION

FIGURE 16 MARKET SNAPSHOT, BY SERVICE

FIGURE 17 MARKET SNAPSHOT, BY APPLICATION

FIGURE 18 MARKET SNAPSHOT, BY VERTICAL

FIGURE 19 MARKET SNAPSHOT, BY REGION

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES IN PIPELINE SAFETY MARKET

FIGURE 20 REAL-TIME CONDITIONING MONITORING FOR TAKING PROMPT ACTIONS TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

4.2 MARKET: TOP THREE SOLUTIONS

FIGURE 21 SCADA FOR PIPELINES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY REGION

FIGURE 22 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2020

4.4 MARKET, BY APPLICATION AND TOP TWO VERTICALS

FIGURE 23 NATURAL GAS VERTICAL AND ONSHORE APPLICATION TO ACCOUNT FOR LARGE SHARES OF PIPELINE SAFETY MARKET IN 2020

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 55)

5.1 INTRODUCTION

5.2 PIPELINE SAFETY: EVOLUTION

FIGURE 24 EVOLUTION OF TECHNOLOGY IN PIPELINE SAFETY

5.3 ECOSYSTEM

FIGURE 25 PIPELINE SAFETY: ECOSYSTEM

5.4 MARKET DYNAMICS

FIGURE 26 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: PIPELINE SAFETY MARKET

5.4.1 DRIVERS

5.4.1.1 Improved spending by majority of oil and gas companies for pipeline infrastructure, network monitoring, and leak detection

5.4.1.2 Rise in number of oil and gas leakage incidences/accidents

TABLE 6 OIL AND GAS/NATURAL GAS LEAK ACCIDENTS

5.4.2 RESTRAINTS

5.4.2.1 Lack of apprehensions related to monitoring system implementation by operators

5.4.2.2 Cost of monitoring systems for oil and gas pipelines varies with technology

5.4.3 OPPORTUNITIES

5.4.3.1 COVID-19 pandemic increases need for remote monitoring and management of assets and business processes

5.4.4 CHALLENGES

5.4.4.1 Severe climatic conditions and lack of funds hampering the development of aging infrastructure

5.4.4.2 Multi-site facilities pose a challenge for implementing a comprehensive monitoring system

5.4.5 CUMULATIVE GROWTH ANALYSIS

5.5 PIPELINE SAFETY MARKET: COVID-19 IMPACT

FIGURE 27 MARKET TO WITNESS DECLINE IN GROWTH IN 2020

5.6 CASE STUDY ANALYSIS

5.6.1 CENTRAL ASIA–CHINA GAS PIPELINE USED HUAWEI SOLUTION FOR SUPERVISING WORLD’S LONGEST SMART PIPELINE

5.6.2 HUAWEI SELECTED HONEYWELL FOR SHORTENING DELIVERY TIME OF CENTRAL ASIA GAS PIPELINE PROJECT

5.6.3 GLOBAL 500 ENERGY & UTILITIES COMPANY USED AVEVA LEAK DETECTION SOLUTIONS TO IMPROVE REGULATORY COMPLIANCE

5.6.4 AN ENERGY AND UTILITIES COMPANY USED AVEVA SIMSUITE PIPELINE OPERATOR TRAINER SIMULATOR TO IMPROVE SAFETY AND REDUCE RISK

5.6.5 OCP ECUADOR S.A. USED SCHNEIDER ELECTRIC SOLUTION TO IMPROVE PIPELINE EFFICIENCY AND SAFETY

5.6.6 INCREASE RELIABILITY OF PIPELINE NETWORKS AND IMPROVE COST-EFFICIENCY USING SYRINIX PIPEMINDER SOLUTIONS

5.6.7 NYSEARCH USED FFT SECURE PIPE SYSTEM FOR RELIABLE AND ACCURATE PIPELINE LOCATION DATA TO REDUCE THIRD-PARTY DAMAGE

5.6.8 SENSTAR’S FIBERPATROL FIBER OPTIC INTRUSION DETECTION SENSOR WAS USED TO SECURE A SITE FROM INTRUSION

5.7 PATENT ANALYSIS

5.7.1 PATENTS FILED: PIPELINE SAFETY, BY SOLUTION AND APPLICATION, 2017–2020

5.8 VALUE CHAIN ANALYSIS

FIGURE 28 VALUE CHAIN ANALYSIS

5.9 TECHNOLOGY ANALYSIS

5.9.1 GIS AND PLANNING PIPELINE ROUTES

5.9.2 ACOUSTIC DETECTION

5.9.3 INFRARED THERMAL DETECTION

5.9.4 ORFEUS TECHNOLOGY

5.9.5 SPAR 300 TECHNOLOGY

5.9.6 MAGNETIC FLUX LEAKAGE

5.9.7 EDDY CURRENT TESTING

5.9.8 ULTRASONIC TESTING

5.9.9 IN-LINE INSPECTION OF PIPELINES

5.10 PIPELINE SAFETY, RESEARCH AREAS FOR TECHNOLOGY IMPLEMENTATION

FIGURE 29 MARKET: TECHNOLOGIES CATEGORIES AND RESEARCH AREAS

6 PIPELINE SAFETY MARKET, BY COMPONENT (Page No. - 73)

6.1 INTRODUCTION

6.1.1 COMPONENTS: COVID-19 IMPACT

6.1.2 COMPONENTS: MARKET DRIVERS

FIGURE 30 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 7 MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 8 MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

6.2 SOLUTIONS

FIGURE 31 SCADA FOR PIPELINES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 9 MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 10 MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

6.2.1 PERIMETER INTRUSION DETECTION

TABLE 11 PERIMETER INTRUSION DETECTION: PIPELINE SAFETY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 12 PERIMETER INTRUSION DETECTION: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.2.2 SECURE COMMUNICATION

TABLE 13 SECURE COMMUNICATION: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 14 SECURE COMMUNICATION: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.2.2.1 Video surveillance

6.2.2.2 Satellite monitoring

6.2.3 SCADA FOR PIPELINES

TABLE 15 SCADA FOR PIPELINES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 SCADA FOR PIPELINES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.2.4 PIPELINE MONITORING SYSTEM

TABLE 17 PIPELINE MONITORING SYSTEM: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 18 PIPELINE MONITORING SYSTEM: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.2.4.1 Leakage detection

6.2.4.2 External Threat detection

6.2.4.3 Pig tracking

6.2.4.4 Integrated fiber optics monitoring

6.2.5 INDUSTRIAL CONTROL SYSTEM SECURITY

TABLE 19 INDUSTRIAL CONTROL SYSTEM SECURITY: PIPELINE SAFETY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 INDUSTRIAL CONTROL SYSTEM SECURITY: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3 SERVICES

FIGURE 32 PROFESSIONAL SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 21 MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 22 MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

TABLE 23 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3.1.1 Risk management

6.3.1.2 Engineering and consulting

6.3.2 PIPELINE INTEGRITY MANAGEMENT

TABLE 25 PIPELINE INTEGRITY MANAGEMENT: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 PIPELINE INTEGRITY MANAGEMENT: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7 PIPELINE SAFETY MARKET, BY APPLICATION (Page No. - 89)

7.1 INTRODUCTION

7.1.1 APPLICATIONS: COVID-19 IMPACT

7.1.2 APPLICATIONS: MARKET DRIVERS

FIGURE 33 OFFSHORE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 27 MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 28 MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

7.2 ONSHORE

TABLE 29 ONSHORE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 ONSHORE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3 OFFSHORE

TABLE 31 OFFSHORE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 32 OFFSHORE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8 PIPELINE SAFETY MARKET, BY VERTICAL (Page No. - 94)

8.1 INTRODUCTION

8.1.1 VERTICALS: COVID-19 IMPACT

8.1.2 VERTICALS: MARKET DRIVERS

FIGURE 34 REFINED PRODUCTS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 33 MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 34 MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

8.2 NATURAL GAS

TABLE 35 NATURAL GAS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 36 NATURAL GAS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3 CRUDE OIL

TABLE 37 CRUDE OIL: PIPELINE SAFETY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 38 CRUDE OIL: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.4 REFINED PRODUCTS

TABLE 39 REFINED PRODUCTS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 40 REFINED PRODUCTS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.5 OTHER VERTICALS

TABLE 41 OTHER VERTICALS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 OTHER VERTICALS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9 PIPELINE SAFETY MARKET, BY REGION (Page No. - 102)

9.1 INTRODUCTION

FIGURE 35 INDIA TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 36 ASIA PACIFIC TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

TABLE 43 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 44 MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA: PIPELINE SAFETY MARKET DRIVERS

9.2.2 NORTH AMERICA: COVID-19 IMPACT

9.2.3 NORTH AMERICA: REGULATIONS

9.2.3.1 Canada Energy Regulator Act of 1959

9.2.3.2 Federal Energy Regulatory Commission

9.2.3.3 United States Department of Transportation

9.2.3.4 Pipeline Safety Act

FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

TABLE 45 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 51 NORTH AMERICA: PIPELINE SAFETY MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.2.4 UNITED STATES

9.2.5 CANADA

9.3 EUROPE

9.3.1 EUROPE: PIPELINE SAFETY MARKET DRIVERS

9.3.2 EUROPE: COVID-19 IMPACT

9.3.3 EUROPE: REGULATIONS

9.3.3.1 Gas Coordination Group

9.3.3.2 Standards policy and strategy committee

9.3.3.3 Pipeline safety regulations 1996

9.3.3.4 Safety of offshore and oil and gas operations directive

9.3.3.5 Petroleum safety authority

TABLE 57 EUROPE: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 58 EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 59 EUROPE: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 60 EUROPE: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 61 EUROPE: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 62 EUROPE: PIPELINE SAFETY MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 63 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 64 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 65 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 66 EUROPE: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 67 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 68 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.3.4 RUSSIA

9.3.5 NORWAY

9.3.6 UNITED KINGDOM

9.3.7 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC: PIPELINE SAFETY MARKET DRIVERS

9.4.2 ASIA PACIFIC: COVID-19 IMPACT

9.4.3 ASIA PACIFIC: REGULATIONS

9.4.3.1 Oil and Gas Pipeline Protection Law, 2010

9.4.3.2 Petroleum and Natural Gas Regulatory Board Act, 2006

9.4.3.3 National Offshore Petroleum Safety and Environmental Management Authority

FIGURE 38 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 69 ASIA PACIFIC: PIPELINE SAFETY MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 70 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 71 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 72 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 73 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 74 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 75 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 76 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 77 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 78 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 79 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 80 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.4.4 CHINA

9.4.5 JAPAN

9.4.6 INDIA

9.4.7 REST OF ASIA PACIFIC

9.5 MIDDLE EAST AND AFRICA

9.5.1 MIDDLE EAST AND AFRICA: PIPELINE SAFETY MARKET DRIVERS

9.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

9.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

9.5.3.1 Petroleum Pipelines Act

9.5.3.2 Gas Act 48 of 2001

TABLE 81 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 87 MIDDLE EAST AND AFRICA: PIPELINE SAFETY MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 88 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 89 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 90 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 91 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 92 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.5.4 MIDDLE EAST

9.5.5 AFRICA

9.5.6 REST OF MIDDLE EAST AND AFRICA

9.6 LATIN AMERICA

9.6.1 LATIN AMERICA: PIPELINE SAFETY MARKET DRIVERS

9.6.2 LATIN AMERICA: COVID-19 IMPACT

9.6.3 LATIN AMERICA: REGULATIONS

9.6.3.1 Protecting Our Infrastructure of Pipelines and Enhancing Safety (PIPES) Act of 2016

9.6.3.2 Official Mexican Standard NOM-007-ASEA-2016

TABLE 93 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 94 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 95 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 96 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 97 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 98 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2025 (USD MILLION)

TABLE 99 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 100 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 101 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 102 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2020–2025 (USD MILLION)

TABLE 103 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 104 LATIN AMERICA: PIPELINE SAFETY MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.6.4 BRAZIL

9.6.5 MEXICO

9.6.6 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 140)

10.1 OVERVIEW

10.2 MARKET EVALUATION FRAMEWORK

FIGURE 39 MARKET EVALUATION FRAMEWORK

10.3 MARKET SHARE, 2020

FIGURE 40 ABB LED PIPELINE SAFETY MARKET IN 2020

10.4 HISTORIC REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 41 REVENUE ANALYSIS OF KEY MARKET PLAYERS

10.5 KEY MARKET DEVELOPMENTS

10.5.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 105 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2019–2020

10.5.2 BUSINESS EXPANSIONS

TABLE 106 BUSINESS EXPANSIONS, 2018–2020

10.5.3 MERGERS AND ACQUISITIONS

TABLE 107 MERGERS AND ACQUISITIONS, 2018–2020

10.5.4 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS

TABLE 108 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS, 2019–2020

10.6 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

10.6.1 MARKET RANKING ANALYSIS, BY COMPANY

FIGURE 42 RANKING OF KEY PLAYERS, 2020

10.7 COMPANY EVALUATION MATRIX, 2020

10.7.1 STAR

10.7.2 EMERGING LEADER

10.7.3 PERVASIVE

10.7.4 PARTICIPANT

FIGURE 43 PIPELINE SAFETY MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

10.8 STARTUP/SME EVALUATION MATRIX, 2020

10.8.1 PROGRESSIVE COMPANIES

10.8.2 RESPONSIVE COMPANIES

10.8.3 DYNAMIC COMPANIES

10.8.4 STARTING BLOCKS

FIGURE 44 PIPELINE SAFETY MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX, 2020

11 COMPANY PROFILES (Page No. - 152)

11.1 INTRODUCTION

(Business Overview, Products, Solutions & Services, Key Insights, Recent Developments, MnM View)*

11.2 ABB

FIGURE 45 ABB: COMPANY SNAPSHOT

11.3 SIEMENS AG

FIGURE 46 SIEMENS AG: COMPANY SNAPSHOT

11.4 SCHNEIDER ELECTRIC

FIGURE 47 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

11.5 BAKER HUGHES

FIGURE 48 BAKER HUGHES: COMPANY SNAPSHOT

11.6 HONEYWELL

FIGURE 49 HONEYWELL: COMPANY SNAPSHOT

11.7 HUAWEI

FIGURE 50 HUAWEI: COMPANY SNAPSHOT

11.8 AVEVA

FIGURE 51 AVEVA: COMPANY SNAPSHOT

11.9 PSI AG

FIGURE 52 PSI AG: COMPANY SNAPSHOT

11.10 BAE SYSTEMS

FIGURE 53 BAE SYSTEMS: COMPANY SNAPSHOT

11.11 TRANSCANADA

FIGURE 54 TRANSCANADA: COMPANY SNAPSHOT

11.12 ATMOS INTERNATIONAL

11.13 CLAMPON AS

11.14 FUTURE FIBRE TECHNOLOGIES

11.15 PERMA-PIPE

FIGURE 55 PERMA-PIPE: COMPANY SNAPSHOT

11.16 SENSTAR

11.17 SYRINIX

11.18 RADIOBARRIER

11.19 PURE TECHNOLOGIES

11.20 C-FER TECHNOLOGIES

11.21 TOTAL SAFETY

11.22 KROHNE GROUP

11.23 PLM CAT

11.24 LEATER

11.25 TTK

*Details on Business Overview, Products, Solutions & Services, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

11.26 STARTUP/SME PROFILES

11.26.1 NOVOSOUND

11.26.2 LIVEEO

11.26.3 DETECT TECHNOLOGIES

11.26.4 MIQROTECH

11.26.5 DASHBOARD LIMITED

11.26.6 PLANYS TECHNOLOGIES

12 APPENDIX (Page No. - 215)

12.1 ADJACENT AND RELATED MARKETS

12.1.1 INTRODUCTION

12.1.2 PIPELINE MONITORING SYSTEMS MARKET– GLOBAL FORECAST TO 2024

12.1.2.1 Market definition

12.1.2.2 Pipeline Monitoring System Market, By Pipe Type

TABLE 109 PIPELINE MONITORING SYSTEM MARKET SIZE, BY PIPE TYPE, 2017–2024 (USD MILLION)

12.1.2.3 Pipeline Monitoring System Market, By Technology

TABLE 110 PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2017–2024 (USD MILLION)

12.1.2.4 Pipeline Monitoring System Market, by Solution

TABLE 111 PIPELINE MONITORING SYSTEM MARKET SIZE, BY SOLUTION, 2017–2024 (USD MILLION)

12.1.2.5 Pipeline Monitoring System Market, by End-use Industry

TABLE 112 PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD MILLION)

12.1.2.5.1 Crude and refined petroleum

TABLE 113 CRUDE AND REFINED PETROLEUM PIPELINE MONITORING SYSTEM MARKET SIZE, BY PRODUCT TYPE, 2017–2024 (USD MILLION)

12.1.2.6 Pipeline Monitoring System Market, by Region

12.1.2.6.1 North America

TABLE 114 PIPELINE MONITORING SYSTEM MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 115 NORTH AMERICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 116 NORTH AMERICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD MILLION)

TABLE 117 NORTH AMERICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2017–2024 (USD MILLION)

12.1.2.6.2 Europe

TABLE 118 EUROPE: PIPELINE MONITORING SYSTEM MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 119 EUROPE: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD MILLION)

TABLE 120 EUROPE: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2017–2024 (USD MILLION)

12.1.2.6.3 Asia Pacific

TABLE 121 ASIA PACIFIC: PIPELINE MONITORING SYSTEM MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 122 ASIA PACIFIC: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2024 (USD MILLION)

TABLE 123 ASIA PACIFIC: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2017–2024 (USD MILLION)

12.1.2.6.4 Middle East and Africa

TABLE 124 MIDDLE EAST AND AFRICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 125 MIDDLE EAST AND AFRICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USER INDUSTRY, 2017–2024 (USD MILLION)

TABLE 126 MIDDLE EAST AND AFRICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2017–2024 (USD MILLION)

12.1.2.6.5 South America

TABLE 127 SOUTH AMERICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 128 SOUTH AMERICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USER INDUSTRY, 2017–2024 (USD MILLION)

TABLE 129 SOUTH AMERICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2017–2024 (USD MILLION)

12.1.3 PIPELINE AND PROCESS SERVICES MARKET– GLOBAL FORECAST TO 2024

12.1.3.1 Market definition

12.1.3.2 Market overview

12.1.3.3 Pipeline and Process Market, By Asset Type

TABLE 130 PIPELINE AND PROCESS SERVICES MARKET SIZE, BY ASSET TYPE, USD MILLION, 2017–2024 (USD MILLION)

TABLE 131 PIPELINE SERVICES MARKET SIZE, BY ASSET TYPE, USD MILLION, 2017–2024 (USD MILLION)

TABLE 132 PROCESS SERVICES MARKET SIZE, BY ASSET TYPE, USD MILLION, 2017–2024

12.1.3.4 Pipeline and Process Market, By Operation

TABLE 133 PIPELINE AND PROCESS SERVICES MARKET SIZE, BY OPERATION, USD MILLION, 2017–2024

12.1.3.4.1 Pre-commissioning and commissioning market size, by service, USD million,2017–2024

TABLE 134 PRE-COMMISSIONING AND COMMISSIONING MARKET SIZE, BY SERVICE, USD MILLION, 2017–2024

12.1.3.4.2 Maintenance market size, by service, USD million, 2017–2024

TABLE 135 MAINTENANCE MARKET SIZE, BY SERVICE, USD MILLION, 2017–2024

12.1.3.4.3 Decommissioning market size, by service, USD million, 2017–2024

TABLE 136 DECOMMISSIONING MARKET SIZE, BY SERVICE, USD MILLION, 2017–2024

12.1.3.5 Pipeline and Process Market, By Region

TABLE 137 GLOBAL: PIPELINE AND PROCESS SERVICES MARKET, BY REGION, USD MILLION (2017–2024)

12.1.3.5.1 North America

TABLE 138 NORTH AMERICA: PIPELINE AND PROCESS SERVICES MARKET, BY OPERATION, USD MILLION (2017–2024)

TABLE 139 NORTH AMERICA: PIPELINE AND PROCESS SERVICES MARKET, BY ASSET TYPE, USD MILLION (2017–2024)

TABLE 140 NORTH AMERICA: PIPELINE AND PROCESS SERVICES MARKET RANKING, BY OPERATION, IN 2018

TABLE 141 NORTH AMERICA: PIPELINE SERVICES MARKET, BY OPERATION, USD MILLION (2017–2024)

TABLE 142 NORTH AMERICA: PIPELINE SERVICES MARKET, BY ASSET TYPE, USD MILLION (2017–2024)

TABLE 143 NORTH AMERICA: PROCESS SERVICES MARKET, BY OPERATION, USD MILLION (2017–2024)

TABLE 144 NORTH AMERICA: PROCESS SERVICES MARKET, BY ASSET TYPE, USD MILLION (2017–2024)

12.1.3.5.2 Latin America

TABLE 145 LATIN AMERICA: PIPELINE AND PROCESS SERVICES MARKET, BY OPERATION, USD MILLION (2017–2024)

TABLE 146 LATIN AMERICA: PIPELINE AND PROCESS SERVICES MARKET, BY ASSET TYPE, USD MILLION (2017–2024)

TABLE 147 LATIN AMERICA: PIPELINE AND PROCESS SERVICES MARKET RANKING, BY OPERATION, IN 2018

TABLE 148 LATIN AMERICA: PIPELINE SERVICES MARKET, BY OPERATION, USD MILLION (2017–2024)

TABLE 149 LATIN AMERICA: PIPELINE SERVICES MARKET, BY ASSET TYPE, USD MILLION (2017–2024)

TABLE 150 LATIN AMERICA: PROCESS SERVICES MARKET, BY OPERATION, USD MILLION (2017–2024)

TABLE 151 LATIN AMERICA: PROCESS SERVICES MARKET, BY ASSET TYPE, USD MILLION (2017–2024)

12.1.3.5.3 Middle East and North Africa

TABLE 152 MIDDLE EAST AND NORTH AFRICA: PIPELINE AND PROCESS SERVICES MARKET, BY OPERATION, USD MILLION (2017–2024)

TABLE 153 MIDDLE EAST AND NORTH AFRICA: PIPELINE AND PROCESS SERVICES MARKET, BY ASSET TYPE, USD MILLION (2017–2024)

TABLE 154 MIDDLE EAST AND NORTH AFRICA: PIPELINE AND PROCESS SERVICES MARKET RANKING, BY OPERATION, IN 2018

TABLE 155 MIDDLE EAST AND NORTH AFRICA: PIPELINE SERVICES MARKET, BY OPERATION, USD MILLION (2017–2024)

TABLE 156 MIDDLE EAST AND NORTH AFRICA: PIPELINE SERVICES MARKET, BY ASSET TYPE, USD MILLION (2017–2024)

TABLE 157 MIDDLE EAST AND NORTH AFRICA: PROCESS SERVICES MARKET, BY OPERATION, USD MILLION (2017–2024)

TABLE 158 MIDDLE EAST AND NORTH AFRICA: PROCESS SERVICES MARKET, BY ASSET TYPE, USD MILLION (2017–2024)

12.1.3.5.4 Eurasia

TABLE 159 EURASIA: PIPELINE AND PROCESS SERVICES MARKET, BY OPERATION, USD MILLION (2017–2024)

TABLE 160 EURASIA: PIPELINE AND PROCESS SERVICES MARKET, BY ASSET TYPE, USD MILLION (2017–2024)

TABLE 161 EURASIA: PIPELINE AND PROCESS SERVICES MARKET RANKING, BY OPERATION, IN 2018

TABLE 162 EURASIA: PIPELINE SERVICES MARKET, BY OPERATION, USD MILLION (2017–2024)

TABLE 163 EURASIA: PIPELINE SERVICES MARKET, BY ASSET TYPE, USD MILLION (2017–2024)

TABLE 164 EURASIA: PROCESS SERVICES MARKET, BY OPERATION, USD MILLION (2017–2024)

TABLE 165 EURASIA: PROCESS SERVICES MARKET, BY ASSET TYPE, USD MILLION (2017–2024)

12.1.3.5.5 Asia Pacific

TABLE 166 ASIA PACIFIC: PIPELINE AND PROCESS SERVICES MARKET, BY OPERATION, USD MILLION (2017–2024)

TABLE 167 ASIA PACIFIC: PIPELINE AND PROCESS SERVICES MARKET, BY ASSET TYPE, USD MILLION (2017–2024)

12.2 INDUSTRY EXPERTS

12.3 DISCUSSION GUIDE

12.4 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.5 AVAILABLE CUSTOMIZATIONS

12.6 RELATED REPORTS

12.7 AUTHOR DETAILS

The study involved four major activities in estimating the current market size of the pipeline safety market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the size of the pipeline safety market segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Security of Gas Pipelines – SpingerLink Risk-based underground pipeline safety management, and Safety Risk Analysis for Gas Pipeline Construction, and related magazines, have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases & investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

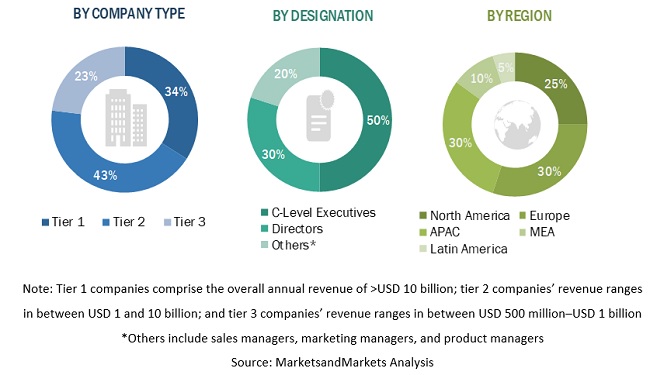

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from Pipeline safety solution vendors, system integrators, professional service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the Pipeline safety market's total size. The top-down approach was used to derive top vendors' revenue contribution and their offerings in the market. The bottom-up approach was used to arrive at the global pipeline safety market's overall market size using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentages, shares, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate other individual markets' size via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the pipeline safety market by component (solutions and services), application, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments in the pipeline safety market, such as partnerships, new product launches, and mergers and acquisitions

- To analyze the impact of the COVID-19 pandemic on the pipeline safety market.

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American Pipeline safety market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Pipeline Safety Market