Pipeline Monitoring System Market by Pipe Type (Metallic, Non-Metallic), Technology (Ultrasonic, PIGs, Smart Ball, Magnetic Flux Leakage, Fiber Optic Technology), Solution, End-use Industry, and Region - Global Forecast to 2026

Updated on : September 02, 2025

Pipeline Monitoring System Market

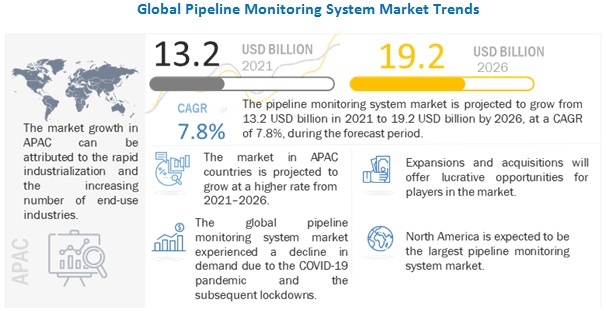

The global pipeline monitoring system market was valued at USD 13.2 billion in 2021 and is projected to reach USD 19.2 billion by 2026, growing at 7.8% cagr from 2021 to 2026. The market is expected to witness significant growth in the coming years due to its increased demand across the crude & refined petroleum and water & wastewater industries.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global pipeline monitoring system market

With the surge of COVID-19 cases, emergency protocols have been implemented, as well as the suspension of numerous operations and facilities in 2020. The COVID-19 outbreak in Wuhan, China, has spread throughout key APAC, European, and North American countries, disrupting the pipeline monitoring system market because most global corporations have headquarters in these regions. The impact of COVID-19 has triggered supply chain disruptions, which has hampered market growth due to a lack of raw materials and workforce availability.

The COVID-19 pandemic had a minimal influence on the pipeline monitoring system market in 2020, with a minor reduction in CAGR. Reduced raw material output, supply problems, and hindered trade movements have all impacted the market in 2020. The pandemic had an impact on end-use sectors like as crude and refined petroleum, as well as water and wastewater.

Pipeline Monitoring System Market Dynamics

Driver: Sustainable use of resources

Developing pipeline infrastructure requires a significant initial investment. Oil and gas reserves are depleting due to rising global energy demand. To address this challenge, businesses are developing highly efficient facilities to increase production technologies and lower operational expenses. Oil and gas businesses are now forced to install monitoring systems throughout their infrastructure. Due to the heightened terrorist threats and cyber-attacks on oil and gas infrastructure systems, oil and gas operators around the world have boosted their spending on infrastructure and network monitoring. Multiple attacks against gas facilities and refineries have occurred in Europe and the Middle East. Information and communication technologies like as Supervisory Control and Data Acquisition (SCADA), Intelligent Video Surveillance (IVS), Human Machine Interface (HMI), and Programmable Logic Controller are heavily used in modern pipeline facilities (PLCs). These technologies create a digital pipeline infrastructure for oil and gas companies who want to manage and operate their operations remotely. As a result, corporations have increased their investment on network monitoring and are implementing comprehensive monitoring solutions to prevent making systems vulnerable to cyber-attacks and safeguard networks.

Restraint: Lack of apprehensions about monitoring system implementation by operators

Pipeline firms have long been wary of employing cyber and network security solutions due to a lack of exposure and understanding. Furthermore, IT organisations' network security solutions were not comprehensive, and most solutions were only offered in silos. This makes it difficult for pipeline operators to select specific pipeline network monitoring systems. IT security firms also have a hard time convincing operators of the value of both physical and network monitoring systems. The lack of awareness and apprehension regarding the adoption of monitoring systems among operators is a major roadblock for monitoring solution providers in the oil and gas industry.

Opportunity: Augmented demand of pipeline monitoring due to increase in pipeline infrastructure

Due to the increased demand for oil and gas in most major countries, pipeline infrastructure has increased significantly. Pipelines for the transportation and distribution of oil and gas products are being installed across various geographies across thousands of miles. The demand for pipeline monitoring systems has been fueled by such enormous networks of pipelines. Pipeline firms are using sophisticated monitoring technology and sensors to detect leaks in pipeline infrastructure. To protect pipelines from terrorist attacks and sabotage, companies are also focusing on deploying physical security solutions such as aerial and ground surveillance and video surveillance. In the coming years, pipeline infrastructure growth will present a lucrative market for monitoring system vendors.

Challenge: Lack of funds hampering the development of aging infrastructure

Poor metering, leakages, and non-management of vital pipeline infrastructures such as pipelines, valves, and hydrants are the result of a lack of funds impeding the development of ageing infrastructure. For numerous sectors, such as water, oil, gas, and chemical pipelines, ageing has become an issue. The scarcity of finances for the pipeline monitoring system is primarily due to federal agencies' unwillingness to support R&D. These solutions come with high initial costs, which many small and medium-sized utilities are unwilling to pay. In addition, pipeline infrastructure evolves at a glacial pace. Once installed, infrastructure components such as pipeline pipes, valves, and meters survive for decades. As a result, utilities are hesitant to replace pipeline systems because the older solutions are costly and long-lasting. Sustainable resource management can address good integration with advanced infrastructure. Furthermore, involving stakeholders would minimise fragmented and uncoordinated approaches to pipeline safety issues, resulting in a smarter pipeline management approach.

Metallic pipes are widely used in pipeline monitoring system.

Based on pipe type, the metallic pipes segment is projected to be the largest segment in the pipeline monitoring system market. Ductile iron pipes, stainless steel pipes, aluminum pipes, and other types, such as cast-iron pipes, corrugated pipes, and copper pipes, are considered under metallic pipes. When treated with highly oxygenated water steam, iron-based pipes can become corrosive; as a result, end-user industries prefer steel-based pipes. Metallic pipes are also less corrosion-resistant than non-metallic pipes and are more receptive to heat.

Significant increase in the demand for pipeline monitoring system in crude & refined petroleum industry

By end-use industry, crude & refined petroleum sector is projected to be the largest segment in the pipeline monitoring system market. Crude oil is an unrefined type of petroleum that occurs naturally. It is a primary source of energy for the energy & power industries. Crude oil is refined into petroleum, gasoline, diesel, and petrochemicals once it has been processed. It is a non-renewable resource that is also known as fossil fuel. It is divided into three segments: oil, natural gas, and biofuels, all of which are delivered by pipelines, resulting in a large market potential for pipeline monitoring systems, which offer end-to-end monitoring and security solutions. Because oil and gas pipelines provide a cost-effective, efficient, dependable, and safe route of transportation across large distances around the world, pipeline monitoring systems are in high demand in the crude and refined petroleum segment.

North America region to lead the global pipeline monitoring system market by 2026.

North America accounted for the largest market share of about 34.4%, in terms of value in 2020. North America has long been one of the key markets for pipeline monitoring systems. It has been a global leader in product innovation, both in terms of quality and applicability. The growing oil and gas exploration and production activities are driving up demand for pipeline monitoring systems. Because of the rise of pipelines across North American countries such as US, Canada, and Mexico, oil and gas corporations, government bodies, and environmental organisations are working on preventing oil spills, gas leaks, and other mishaps.

To know about the assumptions considered for the study, download the pdf brochure

Pipeline Monitoring System Market Players

Key manufacturers in the pipeline monitoring system market are Siemens AG (US), Honeywell International Inc. (US), Huawei Technologies Co. Ltd. (China), BAE Systems (UK), and TransCanada PipeLines Limited (Canada), amongst others.

Pipeline Monitoring System Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2019-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Pipe Type, Solution, Technology, End-Use Industry And Region |

|

Geographies covered |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies covered |

Siemens AG (US), Honeywell International Inc. (US), Huawei Technologies Co. Ltd. (China), BAE Systems (UK), and TransCanada PipeLines Limited (Canada), among others. |

This research report categorizes the pipeline monitoring system market based on pipe type, solution, technology, end-use industry and region.

Based on Pipe Type:

- Metallic

- Non-Metallic

- Others

Based on Solution:

- Leak Detection

- Pipeline Break Detection

- Operating Condition

- Others

Based on Technology:

- Ultrasonic

- PIGs

- Smart Ball

- Magnetic Flux Leakage

- Fiber Optic Technology

- Others

Based on End-use Industry:

- Crude & Refined Petroleum

- Water & Wastewater

- Others

Based on region:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

Recent Developments in Pipeline Monitoring System Market

- In May 2021, Huawei and SINO-PIPELINE International entered into a strategic cooperation agreement in Shenzhen. SINO-PIPELINE International is expected to offer sophisticated business capabilities and resources, while Huawei is expected to provide leading ICT technology and professional personnel. The ultimate objective of the agreement is to establish a long-term strategic relationship. Together, the businesses are expected to utilize digital transformation to foster collaboration on projects such as intelligent pipeline networks, assisting SINO-PIPELINE International in its goal of becoming a world-class global corporation by 2030.

- In March 2021, TC Energy Corporation (TC Energy) and TC PipeLines, LP (TCP) completed the merger pursuant to an agreement and plan of merger dated December 14, 2020. As a result of this merger, TC Energy is expected to acquire all of the outstanding publicly held common units of TCP and become an indirect, wholly-owned subsidiary of TC Energy.

- In June 2019, PERMA-PIPE International Holdings announced the establishment of a new subsidiary, Perma-Pipe Egypt and is in the process of establishing a new production facility in Beni Suef, south of Cairo. This expansion was undertaken to meet the rising demand for the company’s containment piping and leak detection systems in Egypt.

- In March 2019, Siemens equipped 29 gas turbines with remote diagnostic services for Gail India Limited across the Hazira-Vijaipur-Jagdishpur (HVJ) pipeline and the Vijaipur C2/C3 Plant.

- In March 2018, Honeywell undertook technology-oriented acquisitions with Ortloff Engineers, Ltd., which develops highly proprietary technology that enables maximum separation of gas and gas liquids. The company continues to seek acquisition opportunities but is expected to maintain the valuation discipline.

Frequently Asked Questions (FAQ):

What is the current size of the global pipeline monitoring system market?

The global pipeline monitoring system market size is projected to grow from USD 13.2 billion in 2021 to USD 19.2 billion by 2026, at a CAGR of 7.8% from 2021 to 2026.

Who are the key players in the global pipeline monitoring system market?

Key manufacturers in the pipeline monitoring system market are Siemens AG (US), Honeywell International Inc. (US), Huawei Technologies Co. Ltd. (China), BAE Systems (UK), and TransCanada PipeLines Limited (Canada), amongst others.

What are the factors driving the growth of the pipeline monitoring system market?

The growth of the pipeline monitoring system market is attributed to the increase in demand for pipeline monitoring system in end-use industries, particularly for crude & refined petroleum industry. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 PIPELINE MONITORING SYSTEM MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.3.2 REGIONAL SCOPE

FIGURE 2 PIPELINE MONITORING SYSTEM MARKET, BY REGION

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 3 PIPELINE MONITORING SYSTEM MARKET: RESEARCH DESIGN

2.2 DATA TRIANGULATION

2.2.1 SECONDARY DATA

2.2.2 PRIMARY DATA

FIGURE 4 DATA TRIANGULATION

FIGURE 5 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.3 MARKET SIZE ESTIMATION

FIGURE 6 APPROACH 1: BASED ON SUPPLY-SIDE ANALYSIS

2.3.1 APPROACH – 2

FIGURE 7 PIPELINE MONITORING SYSTEM MARKET: TOP DOWN APPROACH

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

FIGURE 8 LIMITATIONS

2.4.2 RISK ASSESSMENT

TABLE 1 LIMITATIONS & ASSOCIATED RISKS

TABLE 2 RISKS

3 EXECUTIVE SUMMARY (Page No. - 36)

FIGURE 9 METALLIC PIPE TYPE TO HAVE LARGER MARKET SHARE DURING FORECAST PERIOD

FIGURE 10 LEAK DETECTION TO BE FASTEST-GROWING SOLUTION SEGMENT

FIGURE 11 APAC TO BE FASTEST-GROWING PIPELINE MONITORING SYSTEM MARKET FROM 2021–2026

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 APAC TO EXHIBIT HIGHER GROWTH RATE DUE TO RAPID INDUSTRIALIZATION AND INCREASING END-USE INDUSTRIES

FIGURE 12 INCREASING DEMAND FROM CRUDE & REFINED PETROLEUM INDUSTRY WILL DRIVE DEMAND FOR PIPELINE MONITORING SYSTEM

4.2 PIPELINE MONITORING SYSTEM MARKET, BY TECHNOLOGY

FIGURE 13 PIPELINE INSPECTION GAUGES (PIGS) TO BE FASTEST-GROWING SEGMENT

4.3 PIPELINE MONITORING SYSTEM MARKET, BY END-USE INDUSTRY

FIGURE 14 CRUDE & REFINED PETROLEUM SEGMENT TO LEAD PIPELINE MONITORING SYSTEM MARKET

4.4 PIPELINE MONITORING SYSTEM MARKET, BY REGION AND END-USE INDUSTRY

FIGURE 15 CRUDE & REFINED PETROLEUM AND NORTH AMERICA SEGMENTS LED PIPELINE MONITORING SYSTEM MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 PIPELINE MONITORING SYSTEM HAS EVOLVED SIGNIFICANTLY SINCE EARLY 1900S

5.2.1 EVOLUTION OF PIPELINE MONITORING SYSTEM MARKET

5.3 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE PIPELINE MONITORING SYSTEM MARKET

5.3.1 DRIVERS

5.3.1.1 Sustainable use of resources

5.3.1.2 Increased spending by a majority of oil & gas companies for pipeline infrastructure, network monitoring, and leak detection

5.3.1.3 Increase in the number of oil & gas leakage incidences/ accidents

5.3.1.4 Increasing maintenance and government regulations for pipeline safety and monitoring

5.3.2 RESTRAINTS

5.3.2.1 Lack of apprehensions about monitoring system implementation by operators

5.3.2.2 Cost of monitoring systems for oil & gas pipelines varies with technology

5.3.3 OPPORTUNITIES

5.3.3.1 Internet of things (IoT) proving to be attractive in pipeline leak detection

5.3.3.2 Augmented demand of pipeline monitoring due to increase in pipeline infrastructure

5.3.3.3 Rising oil & gas demand in developing countries

5.3.4 CHALLENGES

5.3.4.1 Lack of funds hampering the development of aging infrastructure

5.3.4.2 Multi-site facilities pose a challenge for implementing a comprehensive monitoring system

5.4 RANGE SCENARIO ANALYSIS

FIGURE 17 RANGE SCENARIO FOR THE PIPELINE MONITORING SYSTEM

5.4.1 OPTIMISTIC SCENARIO

5.4.2 PESSIMISTIC SCENARIO

5.4.3 REALISTIC SCENARIO

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 18 PIPELINE MONITORING SYSTEM: SUPPLY CHAIN

5.6 YC-YCC DRIVERS

FIGURE 19 YC-YCC DRIVERS

6 INDUSTRY TRENDS (Page No. - 50)

6.1 PORTER'S FIVE FORCES ANALYSIS

FIGURE 20 PIPELINE MONITORING SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

6.1.1 THREAT OF SUBSTITUTES

6.1.2 BARGAINING POWER OF SUPPLIERS

6.1.3 BARGAINING POWER OF BUYERS

6.1.4 THREAT OF NEW ENTRANTS

6.1.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 3 ELECTRIC VEHICLE FLUIDS MARKET: PORTER'S FIVE FORCES ANALYSIS

6.2 IMPACT OF COVID-19

TABLE 4 INTERIM ECONOMIC OUTLOOK FORECAST, 2019–2021 (PERCENTAGE)

6.2.1 IMPACT OF COVID-19 ON PIPELINE MONITORING SYSTEM MARKET

7 PIPELINE MONITORING SYSTEM MARKET, BY PIPE TYPE (Page No. - 55)

7.1 INTRODUCTION

FIGURE 21 PIPELINE MONITORING SYSTEM MARKET SIZE, BY PIPE TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 5 PIPELINE MONITORING SYSTEM MARKET SIZE, BY PIPE TYPE, 2019–2026 (USD MILLION)

7.2 METALLIC PIPES

7.2.1 DEMAND FOR METALLIC PIPES DUE TO SUPERIOR PROPERTIES

7.2.1.1 Ductile iron pipes

7.2.1.2 Stainless steel pipes

7.2.1.3 Aluminum pipes

7.2.1.4 Other metal pipes

7.3 NON-METALLIC PIPES

7.3.1 LOW COST AND HIGH CORROSION RESISTANCE OF NON-METALLIC PIPES TO DRIVE SEGMENT

7.3.1.1 Plastic pipes

7.3.1.2 Glass pipes

7.4 OTHERS

8 PIPELINE MONITORING SYSTEM MARKET, BY TECHNOLOGY (Page No. - 59)

8.1 INTRODUCTION

FIGURE 22 PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2021 VS. 2026 (USD MILLION)

TABLE 6 PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

8.2 ULTRASONIC

8.2.1 ULTRASONIC SEGMENT TO DOMINATE PIPELINE MONITORING SYSTEM MARKET

8.3 PIGS

8.3.1 PIGS TECHNOLOGY TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

8.4 SMART BALL

8.4.1 VARIOUS APPLICATIONS OF SMART BALL TECHNOLOGY IN PETROLEUM PRODUCTS AND WATER & WASTEWATER PIPELINES

8.5 MAGNETIC FLUX LEAKAGE

8.5.1 INCREASING APPLICATIONS OF TECHNOLOGY TO DRIVE SEGMENT

8.6 FIBER OPTIC TECHNOLOGY

8.6.1 RISING DEMAND FROM OIL & GAS INDUSTRY DRIVING SEGMENT

8.7 OTHERS

8.7.1 LOWEST GROWTH FOR PIPELINE MONITORING SYSTEMS FOR OTHER TECHNOLOGIES

9 PIPELINE MONITORING SYSTEM MARKET, BY SOLUTION (Page No. - 63)

9.1 INTRODUCTION

FIGURE 23 PIPELINE MONITORING SYSTEM MARKET SIZE, BY SOLUTION, 2021 VS. 2026 (USD MILLION)

TABLE 7 PIPELINE MONITORING SYSTEM MARKET SIZE, BY SOLUTION, 2019–2026 (USD MILLION)

9.2 LEAK DETECTION

9.2.1 QUICK DETECTION FACILITATING LEAK DETECTION SEGMENT TO GROW

9.2.1.1 Flow

9.2.1.2 Pressure

9.2.1.3 Temperature

9.2.1.4 Density

9.3 OPERATING CONDITION

9.3.1 INTEGRATED BACK-END IT SYSTEMS FOR PIPELINES AND OTHER RELATED TOOLS TO DRIVE OPERATING CONDITION SEGMENT

9.4 PIPELINE BREAK DETECTION

9.4.1 PIPELINE BREAK DETECTION SEGMENT TO ACCOUNT FOR SECOND-LARGEST SHARE IN FORECASTED PERIOD

9.5 OTHERS

10 PIPELINE MONITORING SYSTEM MARKET, BY END-USE INDUSTRY (Page No. - 67)

10.1 INTRODUCTION

FIGURE 24 PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021 VS. 2026 (USD MILLION)

TABLE 8 PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

10.2 CRUDE & REFINED PETROLEUM

10.2.1 NATURAL OCCURRENCE OF CRUDE OIL TO SUPPORT GROWTH OF CRUDE & PETROLEUM SEGMENT

TABLE 9 PIPELINE MONITORING SYSTEM MARKET SIZE, BY CRUDE & REFINED PETROLEUM, 2019–2026 (USD MILLION)

10.2.1.1 Oil

10.2.1.2 Natural gas

10.2.1.3 Biofuel

10.3 WATER & WASTEWATER

10.3.1 TRANSPORTATION OF WATER FOR DRINKING AND IRRIGATION PURPOSES DRIVING SEGMENT

10.4 OTHERS

11 PIPELINE MONITORING SYSTEM MARKET, BY REGION (Page No. - 71)

11.1 INTRODUCTION

FIGURE 25 APAC TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

TABLE 10 PIPELINE MONITORING SYSTEM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

11.2 APAC

FIGURE 26 APAC: PIPELINE MONITORING SYSTEM MARKET SNAPSHOT

TABLE 11 APAC: PIPELINE MONITORING SYSTEM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 12 APAC: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 13 APAC: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE, 2019–2026 (USD MILLION)

11.2.1 CHINA

11.2.1.1 Inclination toward natural gas as major fuel for energy attracting imports through pipelines

TABLE 14 CHINA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 15 CHINA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

11.2.2 JAPAN

11.2.2.1 Single largest LNG importer to drive market

TABLE 16 JAPAN: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 17 JAPAN: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

11.2.3 INDIA

11.2.3.1 Huge production rates of oil & gas and natural gas to drive market

TABLE 18 INDIA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 19 INDIA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

11.2.4 AUSTRALIA

11.2.4.1 Growing industries and commercial construction projects to support market

TABLE 20 AUSTRALIA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 21 AUSTRALIA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

11.2.5 REST OF APAC

TABLE 22 REST OF APAC: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 23 REST OF APAC: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

11.3 NORTH AMERICA

11.3.1 IMPACT OF COVID-19 IN NORTH AMERICA

FIGURE 27 NORTH AMERICA: PIPELINE MONITORING SYSTEM MARKET SNAPSHOT

TABLE 24 NORTH AMERICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 25 NORTH AMERICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 26 NORTH AMERICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.3.2 US

11.3.2.1 Largest pipeline monitoring system market in North America

TABLE 27 US: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 28 US: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.3.3 CANADA

11.3.3.1 Government regulations to provide guidance for best management practices related to leak detection in pipelines

TABLE 29 CANADA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 30 CANADA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.3.4 MEXICO

11.3.4.1 Ongoing development of pipeline monitoring infrastructures to drive market growth

TABLE 31 MEXICO: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 32 MEXICO: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.4 EUROPE

11.4.1 IMPACT OF COVID-19 IN EUROPE

FIGURE 28 EUROPE: PIPELINE MONITORING SYSTEM MARKET SNAPSHOT

TABLE 33 EUROPE: PIPELINE MONITORING SYSTEM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 34 EUROPE: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 35 EUROPE: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.4.2 GERMANY

11.4.2.1 Import of petroleum and other liquids through several pipelines and seaports

TABLE 36 GERMANY: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 37 GERMANY: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.4.3 UK

11.4.3.1 Launching of new oil & gas projects to fuel demand for pipeline monitoring system

TABLE 38 UK: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 39 UK: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.4.4 RUSSIA

11.4.4.1 Surging requirement of pipeline monitoring systems in Russia

TABLE 40 RUSSIA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 41 RUSSIA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.4.5 FRANCE

11.4.5.1 Stringent government regulations pertaining to deployment of leak detection systems

TABLE 42 FRANCE: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 43 FRANCE: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.4.6 ITALY

11.4.6.1 Italy Emerging as major transit country for crude oil

TABLE 44 ITALY: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 45 ITALY: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.4.7 REST OF EUROPE

TABLE 46 REST OF EUROPE: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 47 REST OF EUROPE: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.5 MIDDLE EAST & AFRICA

TABLE 48 MIDDLE EAST & AFRICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE, 2019–2026 (USD MILLION)

11.5.1 UAE

11.5.1.1 Established economic and natural gas reserves to drive market

TABLE 51 UAE: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 52 UAE: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.5.2 SAUDI ARABIA

11.5.2.1 World’s largest crude oil exporter

TABLE 53 SAUDI ARABIA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 54 SAUDI ARABIA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.5.3 IRAN

11.5.3.1 Developments across oil and gas pipeline infrastructures to drive market

TABLE 55 IRAN: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 56 IRAN: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.5.4 SOUTH AFRICA

11.5.4.1 Increasing import of to support market growth

TABLE 57 SOUTH AFRICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 58 SOUTH AFRICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.5.5 OMAN

11.5.5.1 Global strategic importance and oil & gas expotrs to drive market

TABLE 59 OMAN: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 60 OMAN: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.5.6 REST OF MIDDLE EAST & AFRICA

TABLE 61 REST OF MIDDLE EAST & AFRICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 62 REST OF MIDDLE EAST & AFRICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.6 SOUTH AMERICA

TABLE 63 SOUTH AMERICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 64 SOUTH AMERICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 65 SOUTH AMERICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE, 2019–2026 (USD MILLION)

11.6.1 BRAZIL

11.6.1.1 Competitive oil production and active offshore to drive market in South America

TABLE 66 BRAZIL: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 67 BRAZIL: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.6.2 ARGENTINA

11.6.2.1 Dry gas production to drive market

TABLE 68 ARGENTINA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 69 ARGENTINA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.6.3 CHILE

11.6.3.1 Economic freedom to drive market

TABLE 70 CHILE: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 71 CHILE: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.6.4 PERU

11.6.4.1 Economic investments in the oil & gas industry to drive market

TABLE 72 PERU: PIPELINE MONITORING SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 73 PERU: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

11.6.5 REST OF SOUTH AMERICA

TABLE 74 REST OF SOUTH AMERICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 75 REST OF SOUTH AMERICA: PIPELINE MONITORING SYSTEM MARKET SIZE, BY END-USE INDUSTRY Y, 2019–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 108)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 29 COMPANIES ADOPTED EXPANSIONS AS THE KEY GROWTH STRATEGY DURING 2016–202O

12.3 MARKET RANKING

FIGURE 30 MARKET RANKING OF KEY PLAYERS, 2020

12.3.1 SIEMENS AG

12.3.2 HONEYWELL INTERNATIONAL INC.

12.3.3 HUAWEI TECHNOLOGIES CO. LTD.

12.3.4 BAE SYSTEMS

12.3.5 TRANSCANADA PIPELINES LIMITED

12.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 31 REVENUE ANALYSIS FOR KEY COMPANIES IN THE PIPELINE MONITORING SYSTEM MARKET

12.5 MARKET SHARE ANALYSIS

TABLE 76 PIPELINE MONITORING SYSTEM MARKET: SHARES OF KEY PLAYERS

FIGURE 32 SHARE OF LEADING COMPANIES IN THE PIPELINE MONITORING SYSTEM MARKET

12.6 COMPANY EVALUATION QUADRANT

12.6.1 STAR

12.6.2 PERVASIVE

12.6.3 EMERGING LEADER

12.6.4 PARTICIPANT

FIGURE 33 COMPETITIVE LEADERSHIP MAPPING: PIPELINE MONITORING SYSTEM MARKET, 2020

12.7 COMPETITIVE BENCHMARKING

12.7.1 STRENGTH OF PRODUCT PORTFOLIO

12.7.2 BUSINESS STRATEGY EXCELLENCE

TABLE 77 COMPANY TYPE FOOTPRINT

TABLE 78 COMPANY TECHNOLOGY FOOTPRINT

TABLE 79 COMPANY PROCESS FOOTPRINT

TABLE 80 COMPANY END-USE FOOTPRINT

TABLE 81 COMPANY REGION FOOTPRINT

12.8 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES)

12.8.1 PROGRESSIVE COMPANIES

12.8.2 RESPONSIVE COMPANIES

12.8.3 STARTING BLOCKS

12.8.4 DYNAMIC COMPANIES

FIGURE 34 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES), 2020

12.9 COMPETITIVE SCENARIO AND TRENDS

12.9.1 DEALS

TABLE 82 PIPELINE MONITORING SYSTEM MARKET: DEALS, JANUARY 2016–NOVEMBER 2020

12.9.2 OTHERS

TABLE 83 PIPELINE MONITORING SYSTEM MARKET: OTHERS, JANUARY 2017–AUGUST 2021

13 COMPANY PROFILES (Page No. - 122)

13.1 MAJOR PLAYERS

(Business and financial overview, Products/solutions/services offered, Recent developments, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

13.1.1 ORBCOMM INC.

TABLE 84 ORBCOMM INC.: BUSINESS OVERVIEW

FIGURE 35 ORBCOMM INC.: COMPANY SNAPSHOT

TABLE 85 ORBCOMM INC.: NEW PRODUCT LAUNCHES

13.1.2 TRANSCANADA PIPELINES LIMITED

TABLE 86 TRANSCANADA PIPELINES LIMITED: BUSINESS OVERVIEW

FIGURE 36 TRANSCANADA PIPELINES LIMITED: COMPANY SNAPSHOT

13.1.3 HONEYWELL INTERNATIONAL INC.

TABLE 87 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 37 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

13.1.4 PSI SOFTWARE AG

TABLE 88 PSI SOFTWARE AG: BUSINESS OVERVIEW

FIGURE 38 PSI SOFTWARE AG: COMPANY SNAPSHOT

13.1.5 SIEMENS AG

TABLE 89 SIEMENS AG: BUSINESS OVERVIEW

FIGURE 39 SIEMENS AG: COMPANY SNAPSHOT

13.1.6 HUAWEI TECHNOLOGIES CO. LTD.

TABLE 90 HUAWEI TECHNOLOGIES CO. LTD.: BUSINESS OVERVIEW

FIGURE 40 HUAWEI TECHNOLOGIES CO. LTD.: COMPANY SNAPSHOT

TABLE 91 HUAWEI TECHNOLOGIES CO. LTD.: NEW PRODUCT LAUNCHES

13.1.7 BAE SYSTEMS

TABLE 92 BAE SYSTEMS: BUSINESS OVERVIEW

FIGURE 41 BAE SYSTEMS.: COMPANY SNAPSHOT

TABLE 93 BAE SYSTEMS: NEW PRODUCT LAUNCHES

13.1.8 PURE TECHNOLOGIES

TABLE 94 PURE TECHNOLOGIES: BUSINESS OVERVIEW

13.1.9 C-FER TECHNOLOGIES

TABLE 95 C-FER TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 96 C-FER TECHNOLOGIES: NEW PRODUCT LAUNCHES

13.1.10 PERMA-PIPE

TABLE 97 PERMA-PIPE: BUSINESS OVERVIEW

FIGURE 42 PERMA-PIPE: COMPANY SNAPSHOT

13.2 ADDITIONAL PLAYERS

13.2.1 THALES GROUP

13.2.2 ABB GROUP

13.2.3 KROHNE GROUP

13.2.4 ATMOS INTERNATIONAL

13.2.5 CLAMPON AS

13.2.6 FUTURE FIBRE TECHNOLOGIES

13.2.7 SENSTAR CORPORATION

13.2.8 SYRINIX

13.2.9 POLUS-ST

13.2.10 TTK

*Details on Business and financial overview, Products/solutions/services offered, Recent developments, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 163)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

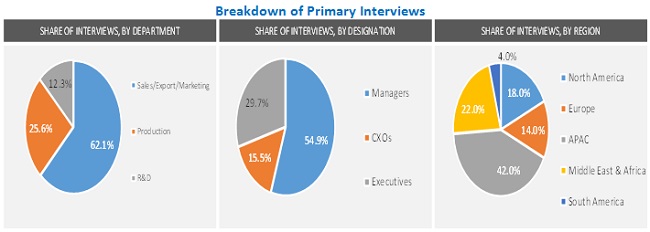

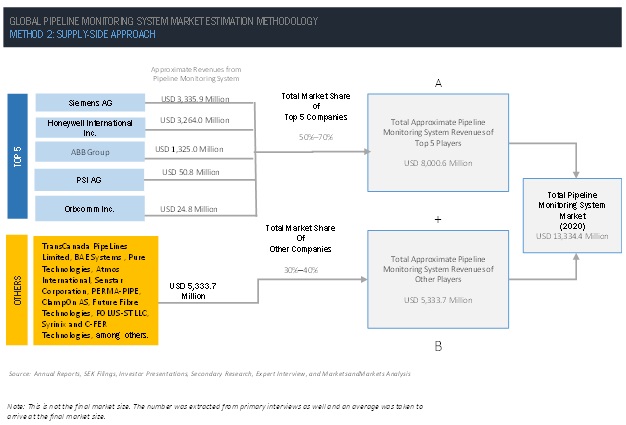

The study involved four major activities for estimating the current global size of the pipeline monitoring system market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of pipeline monitoring system through primary research. The top-down approach was employed to estimate the overall size of the pipeline monitoring system market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Pipeline Monitoring System Market Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the pipeline monitoring system market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Pipeline Monitoring System Market Primary Research

Various primary sources from both the supply and demand sides of the pipeline monitoring system market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the pipeline monitoring system industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Pipeline Monitoring System Market Size Estimation

To know about the assumptions considered for the study, Request for Free Sample Report

The above approach was used to estimate and validate the global size of the pipeline monitoring system market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Pipeline Monitoring System Market Report Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the pipeline monitoring system market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Pipeline Monitoring System Market Report Objectives

- To define, analyze, and project the size of the pipeline monitoring system market in terms of value based on pipe type, solution, technology, end-use industry and region

- To project the size of the market and its segments in terms of value, with respect to the five main regions, namely, North America, Europe, APAC, Middle East & Africa, and South America.

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Pipeline Monitoring System Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the pipeline monitoring system report:

Pipeline Monitoring System Market Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies.

Pipeline Monitoring System Market Regional Analysis

- Further analysis of the pipeline monitoring system market for additional countries

Pipeline Monitoring System Market Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Pipeline Monitoring System Market