Predictive Analytics Market by Solution (Financial Analytics, Risk Analytics, Marketing Analytics, Web & Social Media Analytics), Service, Deployment Mode, Organization Size, Vertical, and Region - Global Forecast to 2026

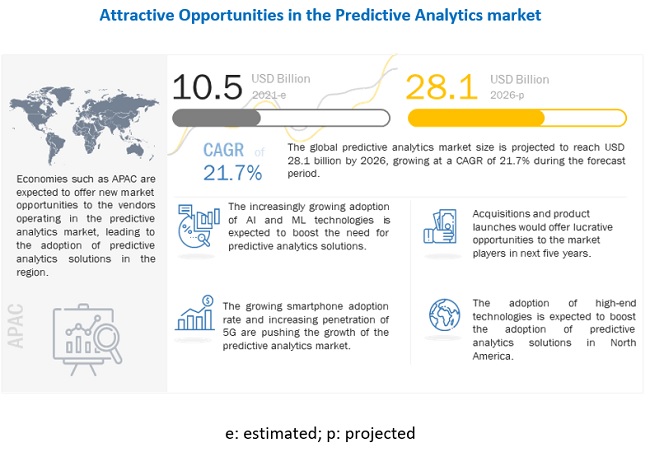

The global Predictive Analytics Market size was valued at $10.5 billion in 2021 and it is projected to reach $28.1 billion by the end of 2026, growing a CAGR of 21.7% during the forecast period. Various factors such as increasing use of AI and ML and acquisitions and product launches in this market are expected to drive the adoption of Predictive Analytics software and services.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The spread of COVID-19 has been disrupting the world, businesses, and economies and has impacted the way of living of the masses and approaches adopted by enterprises for their business management. The ability of enterprises to sustain this pandemic has become new normal for them as they shift their focus from growth opportunities and concentrate on implementing measures to mitigate the impact of COVID-19. The upcoming analytics projects are kept on hold owing to the pandemic. Several companies are competing with each other to gain a single project. Businesses have already started their efforts to return to normal and are facing multiple challenges in terms of the impact of the pandemic on their customer base and operations. Meeting customer expectations in terms of optimization of processes and increased security concerns due to the presence of various connected networks, rise in connectivity issues, and decline in industrial and manufacturing operations are the key challenges faced by businesses. New practices such as work from home and social distancing are creating the requirement of the remote health monitoring of infected patients, smart payment technologies, and the development of digital infrastructures for large-scale technology deployments. With an increased focus on health, there has been a rise in the demand for health-related wearable devices. For instance, in August 2020, Fitbit announced ~34% growth in its smartwatch sales in the second quarter of 2020.

Market Dynamics

Driver: Rising adoption of big data and other related technologies

The use of advanced technologies, such as cloud, IoT, big data and analytics, mobility, and social media, has led to innovation and transformation, thereby stimulating growth in the business ecosystem. Digital technologies have transformed the legacy approach to business into a modern approach. For example, online services are now firmly established in the banking and financial sector, resulting in the proliferation of online activities and websites. According to a blog published by Usabilla (Netherlands) in June 2020, the top 100 organizations are 50% more likely to address customer empowerment as a key parameter for business growth. The blog also stated that 92% of leaders had employed advanced digital transformation strategies to enhance their customers’ experience.

Restraint: Changing regional data regulations leading to a time-consuming restructuring of predictive models

Predictive analytics delivers a decisive data interpretation and provides a larger picture to decision-makers to boost overall business performance. The modification of predictive models permits integration with both software and services, depending on the level and nature of the analysis. Professional services are necessary for customizing existing analytics solutions, which cater to particular data sets. As the predictive analytics concept is still in the nascent phase, the availability of skilled labor is also limited. This is another important factor restraining market growth.

Opportunity: Rising internet proliferation and growing usage of connected and integrated technologies

The proliferation of the internet and the availability of various means to access the internet have led to a massive increase in data volumes generated. This would help in the advancement and expansion of high-speed internet services. Globalization and economic growth are also playing major roles in driving greater data generation worldwide. With the rise in touchpoints and the need for collecting data to understand consumer behavior, every touch by a consumer has become an important data point that can be processed to reveal user behavior. With the exponential rise in individual and organizational data, businesses are now deploying data scientists and analysts for processing collected data. Another factor accelerating adoption is the revenue-generating potential of predictive analytics. This is compelling firms to invest in predictive analytics.

Challenge: Integration of data from data silos

Extracting value from data has become a key requirement for companies to successfully mitigate risks, target valuable customers, and evaluate business performance. In addition, monetizing these data assets require the availability of a sufficient amount of data. However, data consolidation from distinct data sources into meaningful information can incite various new challenges for organizations, especially centralized business enterprises. Data exchange and data ecosystem deliver tools to analyze the collected data at a centralized location and help extract and cross-check business-critical components. The development of data exchanges and data ecosystems varies based on the assumptions made in the value of the data for each customer segment. Many predictive analytics providers offer unified data aggregation and data analytics platforms to help users successfully aggregate and analyze data from disparate data sources.

The services segment to hold higher CAGR during the forecast period

The services segment is further divided into professional services and managed services. These services are an integral step in deploying Predictive Analytics solution and are taken care of by solution and service providers. The demand for professional services is expected to rise due to a rise in tailored demands from customers. Customers are coming up with customization requirements in already installed predictive analytics solutions for enhancing overall performance. The customization requirements include enhanced real-time insights for precise alert systems, enhanced security measures, improved digital Customer Experience (CX), and the capability to extract the maximum potential from the rising enterprise data. The growing adoption of Predictive Analytics solutions is expected to boost the adoption of professional and managed services.

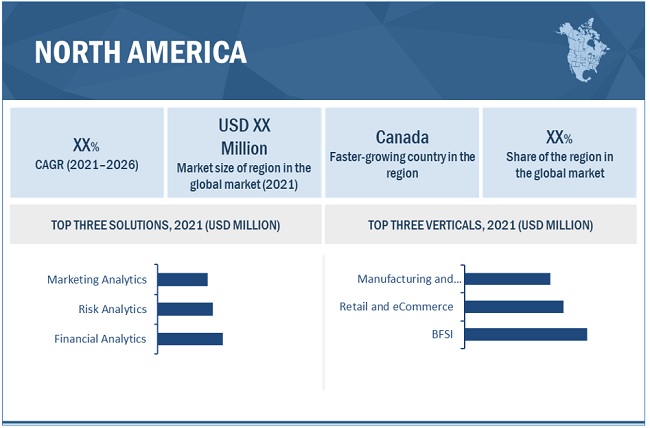

North America to account for largest market size during the forecast period

North America is expected to have the largest market share in the Predictive Analytics market. The adoption of predictive analytics solutions is expected to be the highest in North America, as compared to the other regions. This is mainly because of the presence of various developed economies, such as Canada and the US, and due to the focus on innovations obtained from R&D and various technologies. North America, a hub of data generation in large quantities, is the largest market for predictive analytics solutions.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Predictive Analytics vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global Predictive Analytics market IBM (US), Microsoft (US), Oracle (US), SAP (Germany), SAS Institute (US), Google (US), Salesforce (US), AWS (US), HPE (US), Teradata (US), Alteryx (US), FICO (US), Altair (US), Domo (US), Cloudera (US), Board International (Switzerland), TIBCO Software (US), Hitachi Vantara (US), Qlik (US), Happiest Minds (India), Dataiku (US), RapidMiner (US), Biofourmis (US), In-med Prognostics (India), Aito.Ai (Finland), Symend (US), Onward Health (India), Unioncrate (US), CyberLabs (Brazil), Actify Data Labs (India), Amlgo Labs (India), and Verimos (US). The study includes an in-depth competitive analysis of these key players in the Predictive Analytics market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2022 |

USD 10.5 Billion |

|

Market size value in 2027 |

USD 28.1 Billion |

|

Growth rate |

CAGR of 21.7% |

|

Segments covered |

Component, Deployment Mode, Organization Size, Vertical, And Region |

|

Geographies covered |

North America, Europe, APAC, Latin America and MEA |

|

Companies covered |

IBM (US), Microsoft (US), Oracle (US), SAP (Germany), SAS Institute (US), Google (US), Salesforce (US), AWS (US), HPE (US), Teradata (US), Alteryx (US), FICO (US), Altair (US), Domo (US), Cloudera (US) and many more. |

This research report categorizes the Predictive Analytics market based on Component, Deployment Mode, Organization Size, Vertical, And Region.

By Component:

-

Solutions

- Financial Analytics

- Risk Analytics

- Marketing Analytics

- Sales Analytics

- Customer Analytics

- Web and Social Media Analytics

- Supply chain Analytics

- Network Analytics

-

Services

-

Professional Services

- Consulting

- Deployment and Integration

- Support and Maintenance

- Managed Services

-

Professional Services

By Deployment Mode

- Cloud

- On-premises

By Organization Size:

- Large enterprises

- Small and medium-sized enterprises (SMEs)

By Vertical:

- BFSI

- Manufacturing

- Retail and eCommerce

- Government and Defense

- Healthcare and Life Sciences

- Energy and Utilities

- Telecommunications and IT

- Transportation and Logistics

- Media and Entertainment

- Travel and Hospitality

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- ANZ

- Rest of APAC

-

MEA

- UAE

- South Africa

- Rest of Middle East

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In September 2021, Teradata stated that Tesco PLC is expanding its cooperation with Teradata by incorporating Vantage into its data platform. Tesco may use Vantage to eliminate silos and query all their data in real time, regardless of whether it is in the cloud, multiple clouds, on-premises, or any mix thereof, to gain a comprehensive view of their business.

- In August 2021, Altair announced the acquisition of S-FRAME Software, a structural analysis software platform used by engineers worldwide to evaluate a structure’s ability to endure external loads (such as wind, water, and snow) and meet design code requirements.

- In January 2021, TIBCO Software announced the successful completion of its acquisition of Information Builders, Inc. (ibi), which it announced in October. ibi’s data management and analytics capabilities will be added to the superior TIBCO Connected Intelligence platform as a result of the acquisition. Following the completion of the acquisition, TIBCO software will concentrate on business alignment and resource mapping to ensure the continued health and support of its increased client base and global partner network.

- In August 2020, SAP partnered with HPE to deliver SAP HANA Enterprise Cloud with HPE GreenLake Cloud Services. This partnership will enable customers to keep their SAP software landscape and data on-premises.

- In June 2019, Cloudera and IBM announced a partnership for bringing AI solutions and advanced data to organizations on the Apache Hadoop ecosystem. Due to this partnership, data-driven decisions will be accelerated.

- In March 2018, Cloudera announced the expansion of Budapest, Hungary, headquarters. Cloudera expanded the R&D team of Budapest to increase the Hungarian employee base supported by Hungarian Investment Promotion Agency (HIPA).

Frequently Asked Questions (FAQ):

What is the projected market value of the global predictive analytics market?

The global market for predictive analytics is projected to reach USD 28.1 billion.

What is the estimated growth rate (CAGR) of the global predictive analytics market for the next five years?

The global predictive analytics market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.7% from 2021 to 2026.

What are the major revenue pockets in the predictive analytics market currently?

North America is expected to have the largest market share in the predictive analytics market. The adoption of predictive analytics solutions is expected to be the highest in North America, as compared to the other regions. This is mainly because of the presence of various developed economies, such as Canada and the US, and due to the focus on innovations obtained from R&D and various technologies. North America, a hub of data generation in large quantities, is the largest market for predictive analytics solutions.

Who are the key vendors in the predictive analytics market?

The key vendors operating in the predictive analytics market IBM (US), Microsoft (US), Oracle (US), SAP (Germany), SAS Institute (US), Google (US), Salesforce (US), AWS (US), HPE (US), Teradata (US), Alteryx (US), FICO (US), Altair (US), Domo (US), Cloudera (US), Board International (Switzerland), TIBCO Software (US), Hitachi Vantara (US), Qlik (US), Happiest Minds (India), Dataiku (US), RapidMiner (US), Biofourmis (US), In-med Prognostics (India), Aito.Ai (Finland), Symend (US), Onward Health (India), Unioncrate (US), CyberLabs (Brazil), Actify Data Labs (India), Amlgo Labs (India), and Verimos (US). These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, product enhancements, partnerships, and mergers and acquisitions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 41)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 51)

2.1 RESEARCH DATA

FIGURE 6 PREDICTIVE ANALYTICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 PREDICTIVE ANALYTICS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY -APPROACH 2 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE/SERVICES OF THE MARKET

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM-UP (DEMAND SIDE): SHARE OF PREDICTIVE ANALYTICS THROUGH OVERALL PREDICTIVE ANALYTICS SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

TABLE 4 IMPACT OF COVID-19

2.5 COMPANY EVALUATION MATRIX

FIGURE 13 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 START-UP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 14 START-UP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 65)

TABLE 5 PREDICTIVE ANALYTICS MARKET SIZE AND GROWTH RATE, 2015–2020 (USD MILLION, Y-O-Y%)

TABLE 6 MARKET SIZE AND GROWTH RATE, 2021–2026 (USD MILLION, Y-O-Y%)

FIGURE 15 SOLUTIONS SEGMENT, BY COMPONENT, EXPECTED TO ACHIEVE A LARGER MARKET SIZE IN 2021

FIGURE 16 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE IN 2021

FIGURE 17 FINANCIAL ANALYTICS SOLUTIONS TO DOMINATE THE MARKET IN 2021

FIGURE 18 ON-PREMISE DEPLOYMENT TO LEAD THE MARKET IN 2021

FIGURE 19 LARGE ENTERPRISES SEGMENT EXPECTED TO ACCOUNT FOR A LARGER MARKET SHARE IN 2021

FIGURE 20 BFSI VERTICAL TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2021

FIGURE 21 NORTH AMERICA TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 72)

4.1 ATTRACTIVE OPPORTUNITIES IN THE PREDICTIVE ANALYTICS MARKET

FIGURE 22 INCREASING ADOPTION OF AI AND ML TECHNOLOGIES TO BOOST THE MARKET GROWTH

4.2 MARKET, BY VERTICAL

FIGURE 23 BFSI SEGMENT EXPECTED TO LEAD THE MARKET BY 2026

4.3 MARKET, BY REGION

FIGURE 24 NORTH AMERICA ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2020

4.4 MARKET, BY SOLUTIONS AND VERTICAL

FIGURE 25 CUSTOMER ANALYTICS AND TELECOM AND IT TO ACCOUNT FOR THE LARGEST RESPECTIVE MARKET SHARES IN 2021

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 74)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 26 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: PREDICTIVE ANALYTICS MARKET

5.2.1 DRIVERS

5.2.1.1 Rising adoption of big data and other related technologies

5.2.1.2 Advent of machine learning and artificial intelligence

5.2.1.3 Cost benefits of cloud-based predictive analytics solutions

5.2.2 RESTRAINTS

5.2.2.1 Changing regional data regulations leading to a time-consuming restructuring of predictive models

5.2.2.2 Data security concerns

5.2.3 OPPORTUNITIES

5.2.3.1 Rising internet proliferation and growing usage of connected and integrated technologies

5.2.3.2 Increasing demand for real-time analytical solutions to track and monitor COVID-19 spread

5.2.3.3 Growing role of predictive analytics in achieving manufacturing excellence

5.2.4 CHALLENGES

5.2.4.1 Integration of data from data silos

5.2.4.2 Ownership and privacy of collected data

5.3 PREDICTIVE ANALYTICS MARKET: COVID-19 IMPACT

5.4 PREDICTIVE ANALYTICS: EVOLUTION

FIGURE 27 EVOLUTION OF PREDICTIVE ANALYTICS

5.5 PREDICTIVE ANALYTICS: ECOSYSTEM

FIGURE 28 PREDICTIVE ANALYTICS: ECOSYSTEM

5.6 CASE STUDY ANALYSIS

TABLE 7 USE CASES: PROMINENT INDUSTRY-WISE INSTANCES

5.6.1 BANKING, FINANCIAL SERVICES, AND INSURANCE

5.6.1.1 Case study 1: Streamlining the mortgage appraisal process

5.6.2 TELECOMMUNICATION AND IT

5.6.2.1 Case study 1: Customer segmentation

5.6.3 RETAIL AND ECOMMERCE

5.6.3.1 Case study 1: Using weather data to predict sales

5.6.4 HEALTHCARE AND LIFE SCIENCES

5.6.4.1 Case study 1: Improve healthcare operations through data analysis

5.6.5 MANUFACTURING

5.6.5.1 Case study 1: Improving customer support in electronic manufacturing

5.6.5.2 Case study 2: Improvements in products, services, and customer satisfaction through advanced analytics and AI

5.6.6 ENERGY AND UTILITIES

5.6.6.1 Case study 1: Increase debt collection

5.6.7 TRANSPORTATION AND LOGISTICS

5.6.7.1 Case study 1: Visualize and predict the status of the fleet

5.6.8 MEDIA AND ENTERTAINMENT

5.6.8.1 Case study 1: Scaling a small data team using machine learning

5.6.9 GOVERNMENT AND DEFENCE

5.6.9.1 Case study 1: HAN University to equip students thrive in a digital future

5.6.10 TRAVEL AND HOSPITALITY

5.6.10.1 Case study 1: Optimizing customer experience with Teradata Vantage

5.7 PATENT ANALYSIS

5.7.1 METHODOLOGY

5.7.2 DOCUMENT TYPE

TABLE 8 PATENTS FILED, 2018–2021

5.7.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 29 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2018–2021

5.7.3.1 Top applicants

FIGURE 30 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2018–2021

TABLE 9 TOP TEN PATENT OWNERS (US) IN THE PREDICTIVE ANALYTICS MARKET, 2018–2021

5.8 SUPPLY/VALUE CHAIN ANALYSIS

FIGURE 31 SUPPLY/VALUE CHAIN ANALYSIS

TABLE 10 MARKET: VALUE/SUPPLY CHAIN

5.9 PRICING MODEL ANALYSIS

5.10 PORTER’S FIVE FORCES ANALYSIS

FIGURE 32 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 11 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS IN THE PREDICTIVE ANALYTICS MARKET

FIGURE 33 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.12 TECHNOLOGY ANALYSIS

5.12.1 AI AND PREDICTIVE ANALYTICS

5.12.2 BLOCKCHAIN AND PREDICTIVE ANALYTICS

5.12.3 ML AND PREDICTIVE ANALYTICS

5.12.4 IOT AND PREDICTIVE ANALYTICS

5.12.5 5G AND PREDICTIVE ANALYTICS

5.13 REGULATORY IMPLICATIONS

5.13.1 INTRODUCTION

5.13.2 SARBANES-OXLEY ACT OF 2002

5.13.3 GENERAL DATA PROTECTION REGULATION

5.13.4 BASEL

5.14 PREDICTIVE ANALYTICS MODELS

5.14.1 CLASSIFICATION MODEL

5.14.2 CLUSTERING MODEL

5.14.3 FORECAST MODEL

5.14.4 TIME SERIES MODEL

5.14.5 OUTLIERS MODEL

6 PREDICTIVE ANALYTICS MARKET, BY COMPONENT (Page No. - 101)

6.1 INTRODUCTION

6.1.1 COMPONENTS: COVID-19 IMPACT

FIGURE 34 SERVICES SEGMENT EXPECTED TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 12 MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 13 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 SOLUTIONS

FIGURE 35 SALES ANALYTICS SEGMENT EXPECTED TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 14 MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 15 PREDICTIVE ANALYTICS MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

6.2.1 FINANCIAL ANALYTICS

TABLE 16 FINANCIAL ANALYTICS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 17 FINANCIAL ANALYTICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 18 FINANCIAL ANALYTICS MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 19 FINANCIAL ANALYTICS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

6.2.1.1 Fraud detection

6.2.1.2 Profitability management

6.2.1.3 Governance, risk, and compliance management

6.2.1.4 Other financial analytics applications

6.2.2 RISK ANALYTICS

TABLE 20 RISK ANALYTICS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 21 RISK ANALYTICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 22 RISK ANALYTICS MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 23 RISK ANALYTICS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

6.2.2.1 Cyber risk management

6.2.2.2 Operational risk management

6.2.2.3 Credit and market risk management

6.2.2.4 Other risk analytics applications

6.2.3 MARKETING ANALYTICS

TABLE 24 MARKETING ANALYTICS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 25 MARKETING ANALYTICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 26 MARKETING ANALYTICS MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 27 MARKETING ANALYTICS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

6.2.3.1 Predictive modeling

6.2.3.2 Yield management

6.2.3.3 Product and service development strategies

6.2.3.4 Other marketing analytics applications

6.2.4 SALES ANALYTICS

TABLE 28 SALES ANALYTICS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 29 SALES ANALYTICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 30 SALES ANALYTICS MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 31 SALES ANALYTICS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

6.2.4.1 Sales life cycle management

6.2.4.2 Sales rep efficiency management

6.2.4.3 Other sales analytics applications

6.2.5 CUSTOMER ANALYTICS

TABLE 32 CUSTOMER ANALYTICS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 33 CUSTOMER ANALYTICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 34 CUSTOMER ANALYTICS MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 35 CUSTOMER ANALYTICS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

6.2.5.1 Customer segmentation and clustering

6.2.5.2 Customer behavior analysis

6.2.5.3 Monitoring customer loyalty and satisfaction

6.2.5.4 Other customer analytics applications

6.2.6 WEB AND SOCIAL MEDIA ANALYTICS

TABLE 36 WEB AND SOCIAL MEDIA ANALYTICS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 37 WEB AND SOCIAL MEDIA ANALYTICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 38 WEB AND SOCIAL MEDIA ANALYTICS MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 39 WEB AND SOCIAL MEDIA ANALYTICS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

6.2.6.1 Social media management

6.2.6.2 Search engine optimization

6.2.6.3 Performance monitoring

6.2.6.4 Competitor benchmarking

6.2.7 SUPPLY CHAIN ANALYTICS

TABLE 40 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 41 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 42 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 43 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

6.2.7.1 Distribution and logistics optimization

6.2.7.2 Inventory management

6.2.7.3 Manufacturing analysis

6.2.7.4 Other supply chain analytics applications

6.2.8 NETWORK ANALYTICS

TABLE 44 NETWORK ANALYTICS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 45 NETWORK ANALYTICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 46 NETWORK ANALYTICS MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 47 NETWORK ANALYTICS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

6.2.8.1 Intelligent network optimization

6.2.8.2 Traffic management

6.2.8.3 Other Network Analytics Applications

6.2.9 OTHER PREDICTIVE ANALYTICS SOLUTIONS

TABLE 48 OTHER SOLUTIONS: PREDICTIVE ANALYTICS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 49 OTHER SOLUTIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 SERVICES

FIGURE 36 MANAGED SERVICES SEGMENT EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 50 MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 51 MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

6.3.1 MANAGED SERVICES

TABLE 52 MANAGED SERVICES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 53 MANAGED SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.2 PROFESSIONAL SERVICES

FIGURE 37 DEPLOYMENT AND INTEGRATION SEGMENT EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 54 PROFESSIONAL SERVICES: PREDICTIVE ANALYTICS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 55 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 56 PROFESSIONAL SERVICE: MARKET SIZE, BY TYPE, 2015–2020 (USD MILLION)

TABLE 57 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

6.3.2.1 Support and Maintenance

TABLE 58 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 59 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.2.2 Consulting

TABLE 60 CONSULTING MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 61 CONSULTING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.2.3 Deployment and integration

TABLE 62 DEPLOYMENT AND INTEGRATION: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 63 DEPLOYMENT AND INTEGRATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 PREDICTIVE ANALYTICS MARKET, BY DEPLOYMENT MODE (Page No. - 133)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT MODES: COVID-19 IMPACT

FIGURE 38 CLOUD SEGMENT TO ACCOUNT FOR A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 64 MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 65 MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

7.2 CLOUD

7.2.1 REDUCED OPERATIONAL COST AND HIGHER SCALABILITY TO ENABLE GROWTH IN CLOUD-BASED DEPLOYMENTS

TABLE 66 CLOUD: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 67 CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 ON-PREMISES

7.3.1 WITH THE GROWING THREAT OF DATA THEFTS, SOME ORGANIZATIONS PREFER PREDICTIVE ANALYTICS SOLUTIONS TO REMAIN ON-PREMISES

TABLE 68 ON-PREMISES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 69 ON-PREMISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 PREDICTIVE ANALYTICS MARKET, BY ORGANIZATION SIZE (Page No. - 138)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 39 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 70 MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 71 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

8.2 LARGE ENTERPRISES

8.2.1 EVER-INCREASING ADOPTION OF THE CLOUD AND LATEST TECHNOLOGIES TO DRIVE PREDICTIVE ANALYTICS ACROSS LARGE ENTERPRISES

TABLE 72 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 73 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

8.3.1 ROBUST CLOUD-BASED DEPLOYMENTS TO LEAD SMALL AND MEDIUM-SIZED ENTERPRISES, RECORDING A HIGHER GROWTH RATE

TABLE 74 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 75 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 PREDICTIVE ANALYTICS MARKET, BY VERTICAL (Page No. - 143)

9.1 INTRODUCTION

9.1.1 VERTICALS: COVID-19 IMPACT

FIGURE 40 HEALTHCARE AND LIFE SCIENCES VERTICAL TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 76 MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 77 MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

9.2.1 PREDICTIVE ANALYTICS SOLUTIONS IMPROVE BUSINESS PERFORMANCE, REDUCE COST, AND CHURNING

TABLE 78 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 79 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 RETAIL AND ECOMMERCE

9.3.1 ADOPTION OF PREDICTIVE ANALYTICS SOLUTIONS BOOSTS BUSINESS DECISION PERFORMANCE AND PROFIT MARGINS

TABLE 80 RETAIL AND ECOMMERCE: PREDICTIVE ANALYTICS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 81 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 TELECOM AND IT

9.4.1 USAGE OF SMARTPHONES, COMPLEXITY IN THE TELECOM INDUSTRY, AND GROWTH IN SERVICE PROVIDERS RAPIDLY DRIVE THE MARKET

TABLE 82 TELECOM AND IT: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 83 TELECOM AND IT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.5 TRANSPORTATION AND LOGISTICS

9.5.1 BUSINESS TRANSFORMATION AND REDUCED COSTS DRIVE GROWTH OF PREDICTIVE ANALYTICS

TABLE 84 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 85 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.6 MEDIA AND ENTERTAINMENT

9.6.1 RISING CONTENT CONSUMPTION AND DIGITAL ENTERTAINMENT ADOPTION TO GENERATE DEMAND FOR PREDICTIVE ANALYTICS

TABLE 86 MEDIA AND ENTERTAINMENT: PREDICTIVE ANALYTICS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 87 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.7 MANUFACTURING

9.7.1 ADOPTION OF PREDICTIVE ANALYTICS BOOSTS PERFORMANCE AND IMPROVES DECISION-MAKING

TABLE 88 MANUFACTURING: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 89 MANUFACTURING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.8 HEALTHCARE AND LIFE SCIENCES

9.8.1 REAL-TIME DECISION-MAKING TO PROVIDE NEW INNOVATIVE SOLUTIONS AND DELIVER PROPER INSIGHTS FOR PATIENTS

TABLE 90 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 91 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.9 TRAVEL AND HOSPITALITY

9.9.1 NEED TO DETERMINE NEW PROSPECTS AND OFFER STANDARD SERVICES FOR BETTER CUSTOMER ENGAGEMENT TO DRIVE PREDICTIVE ANALYTICS SOLUTIONS

TABLE 92 TRAVEL AND HOSPITALITY: PREDICTIVE ANALYTICS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 93 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.10 ENERGY AND UTILITIES

9.10.1 DEMAND FOR INTELLIGENT PRODUCTION, DISTRIBUTION, AND CONSUMPTION OF ENERGY AND UTILITIES DRIVE PREDICTIVE ANALYTICS SOLUTIONS

TABLE 94 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 95 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.11 GOVERNMENT AND DEFENSE

9.11.1 DEEP ANALYSIS AND FORECASTING OF TRENDS LEAD TO THE GROWTH OF PREDICTIVE ANALYTICS SOLUTIONS

TABLE 96 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 97 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.12 OTHER VERTICALS

TABLE 98 OTHER VERTICALS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 99 OTHER VERTICALS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 PREDICTIVE ANALYTICS MARKET, BY REGION (Page No. - 161)

10.1 INTRODUCTION

FIGURE 41 JAPAN AND AUSTRALIA & NEW ZEALAND TO ACCOUNT FOR HIGHEST CAGRS DURING FORECAST PERIOD

FIGURE 42 ASIA PACIFIC TO ACCOUNT FOR THE HIGHEST CAGR DURING FORECAST PERIOD

TABLE 100 ALYTICS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 101 PREDICTIVE ANALYTICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: COVID-19 IMPACT

TABLE 102 NORTH AMERICA: PROMINENT PLAYERS

10.2.2 NORTH AMERICA: REGULATIONS

10.2.2.1 Personal Information Protection and Electronic Documents Act (PIPEDA)

10.2.2.2 Gramm-Leach-Bliley (GLB) Act

10.2.2.3 Health Insurance Portability and Accountability Act (HIPAA) of 1996

10.2.2.4 Federal Information Security Management Act (FISMA)

10.2.2.5 Federal Information Processing Standards (FIPS)

10.2.2.6 California Consumer Privacy Act (CSPA)

FIGURE 43 NORTH AMERICA: MARKET SNAPSHOT

TABLE 103 NORTH AMERICA: PREDICTIVE ANALYTICS MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2020 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 112 NORTH AMERICA: PREDICTIVE ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 115 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 118 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.2.3 UNITED STATES

10.2.3.1 Rapid adoption of digitally innovative solutions and presence of tech giants to drive market growth

10.2.4 CANADA

10.2.4.1 Startup ecosystem and transformation into data-driven organizations to drive the growth of predictive analytics in Canada

10.3 EUROPE

10.3.1 EUROPE: COVID-19 IMPACT

TABLE 119 EUROPE: PROMINENT PLAYERS

10.3.2 EUROPE: REGULATIONS

10.3.2.1 General Data Protection Regulation (GDPR)

10.3.2.2 European Committee for Standardization (CEN)

10.3.2.3 EU’s General Court

TABLE 120 EUROPE: PREDICTIVE ANALYTICS MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2020 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 129 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 130 EUROPE: PREDICTIVE ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 131 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 132 EUROPE: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 133 EUROPE: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 134 EUROPE: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 135 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.3 UNITED KINGDOM

10.3.3.1 Advanced IT infrastructure, technologies, and continued transition toward online services to drive growth in the UK

10.3.4 GERMANY

10.3.4.1 Government initiatives for technological developments in manufacturing to drive the growth of these solutions in Germany

10.3.5 FRANCE

10.3.5.1 Heavy R&D investments; digitalization; and strong hold of retail, aerospace and defense, and manufacturing verticals to drive the growth in France

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: COVID-19 IMPACT

TABLE 136 ASIA PACIFIC: PROMINENT PLAYERS

10.4.2 ASIA PACIFIC: REGULATIONS

10.4.2.1 Personal Data Protection Act (PDPA)

10.4.2.2 International Organization for Standardization (ISO) 27001

FIGURE 44 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 137 ASIA PACIFIC: PREDICTIVE ANALYTICS MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2020 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 147 ASIA PACIFIC: PREDICTIVE ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2015–2020 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

10.4.3 CHINA

10.4.3.1 The use of predictive analytics services for driving policy support and technological investments to fuel its adoption in China

10.4.4 JAPAN

10.4.4.1 Rise of innovative technologies and collaboration between governments and businesses for digital transformation in Japan

10.4.5 INDIA

10.4.5.1 Local entrepreneurs with a shift in technologies to provide support to Indian companies in the predictive analytics market

10.4.6 AUSTRALIA & NEW ZEALAND

10.4.6.1 Adoption of advanced technologies and increase in young startups to increase the demand for predictive analytics

10.4.7 REST OF ASIA PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 153 MIDDLE EAST AND AFRICA: PROMINENT PLAYERS

10.5.2 MIDDLE EAST AND AFRICA: REGULATIONS

10.5.2.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

10.5.2.2 GDPR Applicability in KSA

10.5.2.3 Protection of Personal Information Act (POPIA)

TABLE 154 MIDDLE EAST AND AFRICA: PREDICTIVE ANALYTICS MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 155 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 156 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 157 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 158 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 159 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 160 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2020 (USD MILLION)

TABLE 161 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 162 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 163 MIDDLE EAST AND AFRICA: PREDICTIVE ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 164 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 165 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 166 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 169 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.5.3 UAE

10.5.3.1 New investments, strategies, and products to drive the adoption of predictive analytics solutions in the region

10.5.4 SOUTH AFRICA

10.5.4.1 Growing digitalization to offer opportunities for deploying predictive analytics solutions in South Africa

10.5.5 REST OF THE MIDDLE EAST AND AFRICA

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: COVID-19 IMPACT

TABLE 170 LATIN AMERICA:PROMINENT PLAYERS

10.6.2 LATIN AMERICA: REGULATIONS

10.6.2.1 Brazil Data Protection Law

10.6.2.2 Argentina Personal Data Protection Law No. 25.326

TABLE 171 LATIN AMERICA: PREDICTIVE ANALYTICS MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 172 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 173 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 174 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 175 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 176 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 177 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2020 (USD MILLION)

TABLE 178 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 179 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 180 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 181 LATIN AMERICA: PREDICTIVE ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 182 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 183 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 184 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 185 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 186 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.6.3 BRAZIL

10.6.3.1 Increased use of the internet, technologies, and government organizations to increase the demand in Brazil

10.6.4 MEXICO

10.6.4.1 Growth in trade, customer base, and government initiatives to fuel the growth of predictive analytics

10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 212)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES

TABLE 187 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN THE PREDICTIVE ANALYTICS MARKET

11.3 REVENUE ANALYSIS

FIGURE 45 REVENUE ANALYSIS FOR KEY COMPANIES IN THE PAST FIVE YEARS

11.4 MARKET SHARE ANALYSIS

FIGURE 46 MARKET SHARE ANALYSIS

TABLE 188 MARKET: DEGREE OF COMPETITION

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 47 KEY PREDICTIVE ANALYTICS MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2021

11.6 COMPETITIVE BENCHMARKING

TABLE 189 COMPANY SOLUTION FOOTPRINT (TOP 3)

TABLE 190 COMPANY REGION FOOTPRINT

11.7 STARTUP/SME EVALUATION QUADRANT

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 48 STARTUP/SME PREDICTIVE ANALYTICS MARKET EVALUATION MATRIX, 2021

11.8 COMPETITIVE SCENARIO

11.8.1 PRODUCT LAUNCHES

TABLE 191 PRODUCT LAUNCHES, JANUARY 2018–MAY 2021

11.8.2 DEALS

TABLE 192 DEALS, JANUARY 2018–MAY 2021

11.8.3 OTHERS

TABLE 193 OTHERS, 2018–2021

12 COMPANY PROFILES (Page No. - 224)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business and financial overview, Solutions offered, Recent developments, MNM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

12.2.1 MICROSOFT

TABLE 194 MICROSOFT: BUSINESS OVERVIEW

FIGURE 49 MICROSOFT: COMPANY SNAPSHOT

TABLE 195 MICROSOFT: SOLUTIONS OFFERED

TABLE 196 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 197 MICROSOFT: DEALS

12.2.2 IBM

TABLE 198 IBM: BUSINESS OVERVIEW

FIGURE 50 IBM: COMPANY SNAPSHOT

TABLE 199 IBM: SOLUTIONS OFFERED

TABLE 200 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 201 IBM: DEALS

TABLE 202 IBM: OTHERS

12.2.3 SAP

TABLE 203 SAP: BUSINESS OVERVIEW

FIGURE 51 SAP: COMPANY SNAPSHOT

TABLE 204 SAP: SOLUTIONS OFFERED

TABLE 205 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 206 SAP: DEALS

TABLE 207 SAP: OTHERS

12.2.4 ORACLE

TABLE 208 ORACLE: BUSINESS OVERVIEW

FIGURE 52 ORACLE: COMPANY SNAPSHOT

TABLE 209 ORACLE: SOLUTIONS OFFERED

TABLE 210 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 211 ORACLE: DEALS

TABLE 212 ORACLE: OTHERS

12.2.5 SAS INSTITUTE

TABLE 213 SAS INSTITUTE: BUSINESS OVERVIEW

FIGURE 53 SAS INSTITUTE: COMPANY SNAPSHOT

TABLE 214 SAS INSTITUTE: SOLUTIONS OFFERED

TABLE 215 SAS INSTITUTE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 216 SAS INSTITUTE: DEALS

TABLE 217 SAS INSTITUTE: OTHERS

12.2.6 GOOGLE

TABLE 218 GOOGLE: BUSINESS OVERVIEW

FIGURE 54 GOOGLE: COMPANY SNAPSHOT

TABLE 219 GOOGLE: SOLUTIONS OFFERED

TABLE 220 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 221 GOOGLE: DEALS

12.2.7 SALESFORCE

TABLE 222 SALESFORCE: BUSINESS OVERVIEW

FIGURE 55 SALESFORCE: COMPANY SNAPSHOT

TABLE 223 SALESFORCE: SOLUTIONS OFFERED

TABLE 224 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 225 SALESFORCE: DEALS

TABLE 226 SALESFORCE: OTHERS

12.2.8 AWS

TABLE 227 AWS: BUSINESS OVERVIEW

FIGURE 56 AWS: COMPANY SNAPSHOT

TABLE 228 AWS: SOLUTIONS OFFERED

TABLE 229 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 230 AWS: DEALS

TABLE 231 AWS: OTHERS

12.2.9 HPE

TABLE 232 HPE: BUSINESS OVERVIEW

FIGURE 57 HPE: COMPANY SNAPSHOT

TABLE 233 HPE: SOLUTIONS OFFERED

TABLE 234 HPE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 235 HPE: DEALS

TABLE 236 HPE: OTHERS

12.2.10 TERADATA

TABLE 237 TERADATA: BUSINESS OVERVIEW

FIGURE 58 TERADATA: COMPANY SNAPSHOT

TABLE 238 TERADATA: SOLUTIONS OFFERED

TABLE 239 TERADATA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 240 TERADATA: DEALS

12.2.11 ALTERYX

TABLE 241 ALTERYX: BUSINESS OVERVIEW

FIGURE 59 ALTERYX: COMPANY SNAPSHOT

TABLE 242 ALTERYX: SOLUTIONS OFFERED

TABLE 243 ALTERYX: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 244 ALTERYX: DEALS

TABLE 245 ALTERYX: OTHERS

12.2.12 FICO

TABLE 246 FICO: BUSINESS OVERVIEW

FIGURE 60 FICO: COMPANY SNAPSHOT

TABLE 247 FICO: SOLUTIONS OFFERED

TABLE 248 FICO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 249 FICO: DEALS

12.2.13 ALTAIR

TABLE 250 ALTAIR: BUSINESS OVERVIEW

FIGURE 61 ALTAIR: COMPANY SNAPSHOT

TABLE 251 ALTAIR: SOLUTIONS OFFERED

TABLE 252 ALTAIR: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 253 ALTAIR: DEALS

12.2.14 DOMO

TABLE 254 DOMO: BUSINESS OVERVIEW

FIGURE 62 DOMO: COMPANY SNAPSHOT

TABLE 255 DOMO: SOLUTIONS OFFERED

TABLE 256 DOMO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 257 DOMO: DEALS

12.2.15 CLOUDERA

TABLE 258 CLOUDERA: BUSINESS OVERVIEW

TABLE 259 CLOUDERA: SOLUTIONS OFFERED

TABLE 260 CLOUDERA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 261 CLOUDERA: DEALS

TABLE 262 CLOUDERA: OTHERS

12.2.16 BOARD INTERNATIONAL

TABLE 263 BOARD INTERNATIONAL: BUSINESS OVERVIEW

TABLE 264 BOARD INTERNATIONAL: SOLUTIONS OFFERED

TABLE 265 BOARD INTERNATIONAL: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 266 BOARD INTERNATIONAL: DEALS

12.2.17 TIBCO SOFTWARE

TABLE 267 TIBCO SOFTWARE: BUSINESS OVERVIEW

TABLE 268 TIBCO SOFTWARE: SOLUTIONS OFFERED

TABLE 269 TIBCO SOFTWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 270 TIBCO SOFTWARE: DEALS

12.2.18 HITACHI VANTARA

12.2.19 HAPPIEST MINDS

12.2.20 DATAIKU

12.2.21 RAPIDMINER

12.2.22 QLIK

12.3 STARTUPS/SMES

12.3.1 BIOFOURMIS

12.3.2 IN-MED PROGNOSTICS

12.3.3 AITO.AI

12.3.4 SYMEND

12.3.5 ONWARD HEALTH

12.3.6 UNIONCRATE

12.3.7 CYBERLABS

12.3.8 ACTIFY DATA LABS

12.3.9 AMLGO LABS

12.3.10 VERIMOS

*Details on Business and financial overview, Solutions offered, Recent developments, MNM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 296)

13.1 ADJACENT AND RELATED MARKETS

13.1.1 INTRODUCTION

13.1.2 CUSTOMER JOURNEY ANALYTICS MARKET—GLOBAL FORECAST TO 2026

13.1.2.1 Market definition

13.1.2.2 Market overview

13.1.2.2.1 Customer journey analytics market, by component

TABLE 271 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 272 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

13.1.2.2.2 Customer journey analytics market, by application

TABLE 273 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 274 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

13.1.2.2.3 Customer journey analytics market, by deployment mode

TABLE 275 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 276 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

13.1.2.2.4 Customer journey analytics market, by organization size

TABLE 277 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 278 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

13.1.2.2.5 Customer journey analytics market, by industry vertical

TABLE 279 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 280 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

13.1.2.2.6 Customer journey analytics market, by region

TABLE 281 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 282 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

13.1.3 BIG DATA MARKET - GLOBAL FORECAST TO 2025

13.1.3.1 Market definition

13.1.3.2 Market overview

13.1.3.2.1 Big data market, by component

TABLE 283 BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 284 SOLUTIONS: BIG DATA MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 285 BIG DATA MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 286 PROFESSIONAL SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

13.1.3.2.2 Big data market, by deployment mode

TABLE 287 BIG DATA MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 288 CLOUD: BIG DATA MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

13.1.3.2.3 Big data market, by organization size

TABLE 289 BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

13.1.3.2.4 Big data market, by business function

TABLE 290 BIG DATA MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

13.1.3.2.5 Big data market, by industry vertical

TABLE 291 BIG DATA MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

13.1.3.2.6 Big data market, by region

TABLE 292 BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

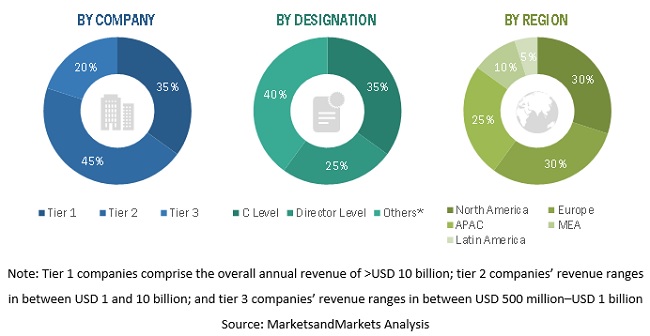

The study involved four major activities in estimating the current market size of the Predictive Analytics market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Predictive Analytics market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies; white papers; journals; and certified publications and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from Predictive Analytics solution vendors, system integrators, professional service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Predictive Analytics market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the market. The bottom-up approach was used to arrive at the overall market size of the global market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentages, shares, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the Predictive Analytics market by component (solutions and services), mode, organization size, deployment mode, end user, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the Predictive Analytics market

- To analyze the impact of the COVID-19 pandemic on the Predictive Analytics market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American Predictive Analytics market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Predictive Analytics Market