Protective Coatings Market by Resin Type (Epoxy, Polyurethane, Acrylic, Alkyd, Zinc), Technology (Solvent-based, Water-based, Powder Coatings), Application, End-Use Industry, and Region - Global Forecast to 2026

Updated on : September 03, 2025

Protective Coatings Market

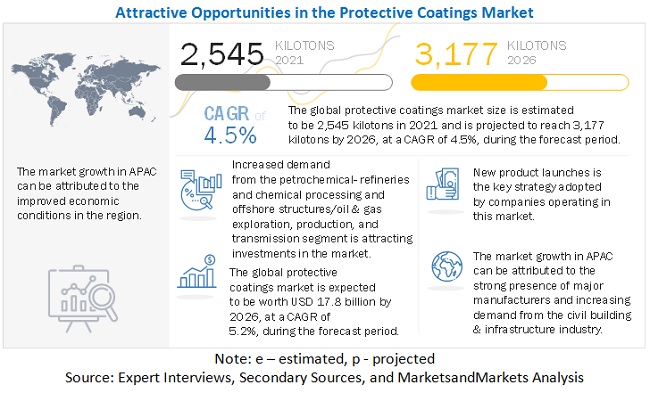

The global protective coatings market was valued at USD 13.8 billion in 2021 and is projected to reach USD 17.8 billion by 2026, growing at 5.2% cagr from 2021 to 2026. The civil building and infrastructure, by end use industry in APAC region is expecting a boom in the forecasted period and will lead to an increase in the demand for Protective Coatings.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Protective Coatings Market

According to recent updates by the IMF (International Monetary Fund), there will be a recession as bad as the global economic crisis of 2008 or worse in 2020. The IMF has warned of a total output loss of USD 9 trillion of the world economy between 2020 and 2021. The extent of the economic damage still depends on how the virus spreads in Europe, the US, and other major economies.

- According to economists, the Chinese economy is likely to be hit further by reduced global demand for its products due to the effect of the outbreak on economies around the world. As the pandemic escalates, the growth rate will fall sharply against the backdrop of volatile markets and growing credit stress.

- Initial data from China suggests that its economy has been hit far harder than projected, although a tentative stabilization has begun. In Europe and the US, increasing restrictions on travel & transportation and prolonged lockdown will lead to a demand collapse that is expected to recover a little in the second quarter before significant recovery begins later in the year.

- Central banks have swung into action and are undertaking some combinations of sharply reduced policy rates, resumed assets purchase, and liquidity injections. Fiscal authorities have generally lagged but begun to loosen their purse strings. It is expected that larger and more targeted spending to the most affected groups is forthcoming.

- Restrictions on movement in Europe and the US are putting a severe dent on economic activity. India and Southeast Asian countries are also facing major disruption in their economies.

Protective Coatings Market Dynamics

Drivers: Increasing demand from Civil Building and Infrastructure industry

Protective coatings are used in the civil building & infrastructure industry for flooring, wood finishes, interior & exterior walls, bridges, swimming pools, doors, and ceilings. Protective coatings form a thin layer on the surfaces on which they are applied and are used for increasing the longevity and stability of the structures. Bridges, highways, and infrastructure projects are essentially in the need of long-time stability and the ability to withstand harsh weather conditions, for instance, acid rains.

Restraints: High prices of raw materials and energy

Protective coatings are very costly, and their cost of manufacturing is also growing with the increase in the price of energy. Fluctuating crude oil prices and changing foreign currency fluctuations have resulted in higher raw material prices. Raw materials for protective coatings vary significantly in terms of prices that range from USD 2.5/kg to USD 10/kg. Acrylics are the least expensive among them and cost about USD 2.5/kg. Polyurethane and alkyd protective coatings are available in the price range of USD 3/kg to USD 4/kg. Epoxies are the costliest type of protective coatings and cost about USD 4.5/kg–USD 10/kg. In addition to the raw material prices, manufacturers are also burdened with the additional cost incurred due to the increased taxes on energy, which results in higher operating costs and lower profit margins.

Opportunities: Increasing demand for maintenance for existing substrates

Protective coatings are used in maintaining the existing substrates to extend their lifespans. Many industries have systems that run on continuous operations. Several of them are exposed to environmental changes or involve the use of harsh materials. This results in the deterioration in the structure of the equipment or decline in the efficiency of the process, which causes shutdown of the plant or stoppage in the overall operations. Protective coatings help in preventing these issues, thereby saving on the cost of shutdown and replacement of equipment. The marine industry is prone to damages in vessels, ships, and docks due to the corrosive action of seawater. Coatings, such as waterproofing coats and joints & crack filling coats are widely used for maintenance in the marine industry.

Challenges: Development of cost effective products under stringent environmental regulations

Increasingly stringent regulations governing the use of protective coatings have compelled manufacturers to develop products with low volatile organic compounds (VOCs), high solid content, and less harmful biocides. Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH), Green Seal, Solvent Emissions Directive (SED), and Biocidal Products Directive (BPD) are stringent environmental regulations limiting the emission of VOCs (volatile organic compounds) and HAPs (hazardous air pollutants). This has resulted in technical difficulties in the use of solvent-based coatings. These regulations also make the industries shift toward the use of environmentally-friendly coatings. However, the challenge exists in the development of new products that conform to these stringent regulations and make it economically efficient for industries.

Civil Building and Infrastructure accounted for the fastest-growing segment of the Protective Coatings market between 2021 and 2026.

The civil building and infrastructure industry is the fastest-growing end-use industry for protective coatings. The primary purpose of protective coatings is to protect structures from solvents, dust, fungi, corrosion, humidity, and other threat that may affect the stability and functionality of the structures. Protective coatings also provide waterproofing solutions, thereby preventing water leakages. Protective coatings act as a protective barrier that enables structures such as buildings, dams, wells, bridges, floors, wood finishes, and exterior & interior walls to function in demanding environments and situations.

To know about the assumptions considered for the study, download the pdf brochure

APAC is the fastest-growing Protective Coatings market.

APAC is projected to be the fastest-growing market during the forecast period. The region comprises countries with different levels of economic development. The growth in the region is mainly attributed to the use of Protective Coatings in various end-use industries such as Civil Building & Infrastructure and Marine.

Protective Coatings Market Players

PPG Industries (US), AkzoNobel N.V. (Netherlands), Sherwin-Williams (US), Hempel (Denmark) and Jotun (Norway) are the major players in the Protective Coatings market.

Jotun is a leading supplier of protective coatings (steel and concrete protection) to companies in the offshore, energy, infrastructure, and hydrocarbon processing industries. In 2020, Jotun has experienced a high demand for protective coatings from the Brazil power generation industry for 216 wind towers and secured a record-breaking 256 contracts for wind towers scheduled for delivery in 2021. Jotun benefitted from increased activity in the oil & gas industry, which created a demand for Jotun products in both, the Offshore and Hydrocarbon Processing Industry (HPI) concepts.

Protective Coatings Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 13.8 billion |

|

Revenue Forecast in 2026 |

USD 17.8 billion |

|

CAGR |

5.2% |

|

Years Considered for the study |

2017-2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Technology |

|

Regions covered |

APAC, Europe, North America, Middle East & Africa, South America |

|

Companies profiled |

PPG (US), AkzoNobel N.V. (Netherlands), Sherwin-Williams (US), Hempel (Denmark) and Jotun (Norway). A total of 25 players have been covered. |

This research report categorizes the Protective Coatings market based on Technology, Resin Type, Application, End-use Industry, and Region.

Protective Coatings Market by Technology:

- Solvent based

- Water based

- Powder coatings and others

Protective Coatings Market by Resin type:

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Zinc

- Others

Protective Coatings Market by End-use Industry:

- Offshore structures/oil&gas – Exploration, Production & Transmission

- Petrochemical – Refineries & chemical processing

- Marine

- Cargo containers

- Power generation

- Water & wastewater treatment

- Civil building & Infrastructure

- Food & beverages

- Others

Protective Coatings Market by Application:

- Abrasion Resistance

- Chemical Resistance

- Fire Protection

- Heat Resistance

- Corrosion Resistance

- Pipe Coatings

- Tank Linings

- Others

Protective Coatings Market by Region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments in Protective Coatings Market

- In December 2019, Jotun has made a joint venture with the shipment leading company of Hong Kong i.e., COSCO shipping. This venture delivers the mutual value to both the parties. The company marries the innovative, high-performance coatings technology of Jotun with the infrastructure, industry, and expertise whereas Jotun will enjoy the COSCO valued reputation in the key market, China.

- In December 2018, Jotun and Kansai have signed an agreement forming the SeaStar Alliance 2002, they had already worked together for many years, and the alliance was a development. The partnership has led to the development of anti-fouling brands such as SeaQuantum, which is now the world leader in antifouling based on Silyl technology. The alliance between both the companies enables the widest coverage of the global market and the plans are to work towards more exciting innovations, solutions, and services together.

Upcoming Changes

- In this edition of the report, the main market is segmented by resin type, technology, application, end-use industry, and region.

- It includes the value chain analysis, ecosystem, technology analysis, average selling price (ASP) analysis for different protective coatings, and patents analysis.

- It includes the company evaluation quadrant for 25 major market players.

- It includes the startup/SME (Small and Medium-sized Enterprise) evaluation quadrant for six key startups/SMEs in the protective coatings market.

- It provides detailed use cases from different verticals.

- It comprises the operational drivers for every segment in the market.

- It provides the market ranking analysis of the top five players in the market.

- It consists of the historical revenue analysis of the top five players in the market.

- It consists of the market share analysis of the top five players in the market.

- This edition provides updated financial information in the context of the protective coatings market for 2020 for each listed company in a graphical representation.

- This edition includes market developments from 2016 to 2021.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of Protective Coatings?

The global Protective Coatings market is driven by the marine end-use industry and civil building & infrastructure market.

What are the major end-use industries for Protective Coatings?

The major end-use industries of Protective Coatings are offshore structures/oil&gas – Exploration, Production and Transmission, Petrochemical – Refineries & chemical processing, Marine, Cargo Containers, Power generation, Water and wastewater treatment, Civil Building & Infrastructure, Food & beverages, and others.

Who are the major manufacturers?

AkzoNobel N.V. (Netherlands), PPG (US), Sherwin-Williams (US), Hempel (Denmark), and Jotun (Norway) are some of the leading players operating in the global Protective Coatings market.

Why Protective Coatings are gaining market share?

The growth of this market is attributed to the growing demand in APAC and the increasing usage of Protective Coatings in the Civil building & infrastructure industry and marine industry. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET INCLUSIONS

1.2.2 MARKET EXCLUSIONS

1.3 MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 1 PROTECTIVE COATINGS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.2.3 Primary data sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION: PROTECTIVE COATINGS MARKET

2.4 ASSUMPTIONS

2.5 LIMITATIONS

2.6 RISK ANALYSIS ASSESSMENT

2.7 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 46)

TABLE 1 PROTECTIVE COATINGS MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 6 EPOXY RESIN ACCOUNTED FOR THE LARGEST SHARE

FIGURE 7 MARINE END-USE INDUSTRY LED THE PROTECTIVE COATINGS MARKET IN 2020

FIGURE 8 APAC TO WITNESS HIGHEST CAGR BETWEEN 2021 AND 2026

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE PROTECTIVE COATINGS MARKET

FIGURE 9 INCREASING DEMAND FROM END-USE INDUSTRIES ATTRACTING INVESTMENTS

4.2 PROTECTIVE COATINGS MARKET, BY RESIN TYPE

FIGURE 10 EPOXY RESIN TYPE TO LEAD PROTECTIVE COATINGS MARKET

4.3 PROTECTIVE COATINGS MARKET, BY END-USE INDUSTRY

FIGURE 11 CIVIL BUILDING AND INFRASTRUCTURE TO BE FASTEST-GROWING END-USE INDUSTRY IN THE MARKET

4.4 PROTECTIVE COATINGS MARKET, DEVELOPED VS. EMERGING COUNTRIES

FIGURE 12 CHINA TO BE THE LARGEST PROTECTIVE COATINGS MARKET

4.5 APAC: PROTECTIVE COATINGS MARKET, BY RESIN TYPE AND END-USE INDUSTRY

FIGURE 13 MARINE END-USE INDUSTRY ACCOUNTED FOR THE LARGEST SHARE

4.6 PROTECTIVE COATINGS MARKET, BY COUNTRY

FIGURE 14 MARKET IN INDIA TO GROW AT THE HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 53)

5.1 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES IN THE PROTECTIVE COATINGS MARKET

5.1.1 DRIVERS

5.1.1.1 Growing demand from civil building & infrastructure industry

5.1.1.2 Increasing need for efficient processes and longer life of equipment and devices

5.1.2 RESTRAINTS

5.1.2.1 High prices of raw materials and energy

5.1.3 OPPORTUNITIES

5.1.3.1 Increasing demand for maintenance of existing substrates

5.1.3.2 New products increasing use of protective coatings

5.1.4 CHALLENGES

5.1.4.1 Development of cost-effective products under stringent environmental regulations

5.2 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 PROTECTIVE COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 PROTECTIVE COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.2.1 BARGAINING POWER OF SUPPLIERS

5.2.2 THREAT OF NEW ENTRANTS

5.2.3 THREAT OF SUBSTITUTES

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF COMPETITIVE RIVALRY

5.3 MACROECONOMIC INDICATORS

5.3.1 INTRODUCTION

5.3.2 TRENDS AND FORECAST OF GDP

TABLE 3 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE

5.3.3 TRENDS AND FORECASTS FOR THE GLOBAL CONSTRUCTION INDUSTRY

FIGURE 17 GLOBAL SPENDING IN THE CONSTRUCTION INDUSTRY, 2014–2035

5.3.4 TRENDS IN THE OIL & GAS INDUSTRY

FIGURE 18 TOP TEN OIL PRODUCERS AS OF JUNE 2020

FIGURE 19 OIL PRODUCTION BY REGION, 2017-2019

5.3.5 TRENDS IN THE POWER GENERATION INDUSTRY

FIGURE 20 ELECTRICITY GENERATION, BY REGION

5.4 IMPACT OF COVID-19

5.5 COVID-19 ECONOMIC ASSESSMENT

FIGURE 21 ECONOMIC OUTLOOK FOR MAJOR COUNTRIES

5.5.1 COVID-19 ECONOMIC IMPACT: SCENARIO ASSESSMENT

FIGURE 22 FACTORS THAT IMPACTED ECONOMY OF SELECT G20 COUNTRIES IN 2020

5.6 IMPACT OF COVID-19 ON END-USE INDUSTRIES

FIGURE 23 PRE-COVID-19 IMPACT AND POST-COVID-19 IMPACT MARKET SCENARIOS: PROTECTIVE COATINGS MARKET

5.6.1 IMPACT ON CONSTRUCTION INDUSTRY

5.7 IMPACT OF COVID-19 ON REGIONS

5.7.1 IMPACT OF COVID-19 ON APAC

5.7.2 IMPACT OF COVID-19 ON NORTH AMERICA

5.7.3 IMPACT OF COVID-19 ON EUROPE

5.7.4 IMPACT OF COVID-19 ON MIDDLE EAST & AFRICA

5.7.5 IMPACT OF COVID-19 ON SOUTH AMERICA

5.8 VALUE CHAIN ANALYSIS

FIGURE 24 PROTECTIVE COATINGS MARKET: VALUE CHAIN ANALYSIS

5.9 PRICING ANALYSIS

FIGURE 25 AVERAGE PRICE COMPETITIVENESS IN PROTECTIVE COATINGS MARKET, BY REGION

5.10 PAINTS & COATINGS ECOSYSTEM AND INTERCONNECTED MARKET

TABLE 4 PROTECTIVE COATINGS MARKET: SUPPLY CHAIN

FIGURE 26 PAINTS & COATINGS: ECOSYSTEM

5.11 YC AND YCC SHIFT

5.12 EXPORT-IMPORT TRADE STATISTICS

TABLE 5 COUNTRY-WISE EXPORT DATA, PAINTS, AND VARNISHES BASED ON SYNTHETIC OR CHEMICALLY-MODIFIED POLYMERS DISPERSED AND DISSOLVED IN AQUEOUS MEDIUM, 2020

TABLE 6 COUNTRY-WISE EXPORT DATA, PAINTS, AND VARNISHES BASED ON SYNTHETIC OR CHEMICALLY-MODIFIED POLYMERS DISPERSED AND DISSOLVED IN NON-AQUEOUS MEDIUM, 2020

TABLE 7 COUNTRY-WISE IMPORT DATA, PAINTS, AND VARNISHES BASED ON SYNTHETIC OR CHEMICALLY-MODIFIED POLYMERS DISPERSED AND DISSOLVED IN AQUEOUS MEDIUM, 2020

TABLE 8 COUNTRY-WISE IMPORT DATA, PAINTS AND VARNISHES BASED ON SYNTHETIC OR CHEMICALLY-MODIFIED POLYMERS DISPERSED AND DISSOLVED IN NON-AQUEOUS MEDIUM, 2020

5.13 REGULATIONS

5.13.1 COATINGS STANDARD

TABLE 9 BASIC COATING SYSTEM REQUIREMENTS FOR DEDICATED SEAWATER BALLAST TANKS OF ALL TYPE OF SHIPS AND DOUBLE-SIDE SKIN SPACES OF BULK CARRIERS OF 150 M AND UPWARD:

5.14 PATENT ANALYSIS

5.14.1 METHODOLOGY

5.14.2 PUBLICATION TRENDS

FIGURE 27 NUMBER OF PATENTS PUBLISHED, 2015-2021

5.14.3 TOP JURISDICTION

FIGURE 28 PATENTS PUBLISHED BY JURISDICTION, 2015-2020

5.14.4 TOP APPLICANTS

FIGURE 29 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2015-2021

TABLE 10 RECENT PATENTS BY OWNERS

5.15 CASE STUDY ANALYSIS

5.16 TECHNOLOGY ANALYSIS

6 PROTECTIVE COATINGS MARKET, BY TECHNOLOGY (Page No. - 88)

6.1 INTRODUCTION

FIGURE 30 SOLVENT-BASED COATINGS TO BE LARGEST TECHNOLOGY SEGMENT DURING THE FORECAST PERIOD

TABLE 11 PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 12 PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 13 PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (KILOTONS)

TABLE 14 PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2021–2026 (KILOTONS)

6.2 SOLVENT-BASED PROTECTIVE COATINGS

TABLE 15 TRADITIONAL FORMULATION SOLVENTS USED FOR EACH RESIN TYPE

6.2.1 ADVANTAGES AND DISADVANTAGES OF SOLVENT-BASED PROTECTIVE COATINGS

TABLE 16 SOLVENT-BASED PROTECTIVE COATINGS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 17 SOLVENT-BASED PROTECTIVE COATINGS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 18 SOLVENT-BASED PROTECTIVE COATINGS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTONS)

TABLE 19 SOLVENT-BASED PROTECTIVE COATINGS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTONS)

6.3 WATER-BASED PROTECTIVE COATINGS

6.3.1 TYPE

FIGURE 31 TYPES OF WATER-BASED COATINGS

6.3.2 RESIN TYPES USED IN FORMULATIONS OF WATER-BASED PROTECTIVE COATINGS

6.3.3 APPLICATIONS OF WATER-BASED PROTECTIVE COATINGS

6.3.4 ADVANTAGES AND DISADVANTAGES OF WATER-BASED PROTECTIVE COATINGS

FIGURE 32 DRIVERS AND RESTRAINTS IN THE WATER-BASED PROTECTIVE COATINGS MARKET

TABLE 20 WATER-BASED PROTECTIVE COATINGS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 WATER-BASED PROTECTIVE COATINGS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 22 WATER-BASED PROTECTIVE COATINGS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTONS)

TABLE 23 WATER-BASED PROTECTIVE COATINGS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTONS)

6.4 POWDER COATINGS

6.4.1 TYPE

FIGURE 33 TYPES OF POWDER COATINGS

FIGURE 34 DRIVERS AND RESTRAINTS IN THE POWDER COATINGS MARKET

TABLE 24 POWDER COATINGS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 POWDER COATINGS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 26 POWDER COATINGS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTONS)

TABLE 27 POWDER COATINGS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTONS)

6.5 OTHERS

6.5.1 HIGH-SOLID COATINGS

6.5.1.1 Type

FIGURE 35 TYPES OF HIGH-SOLIDS COATINGS

6.5.1.2 Advantages and disadvantages

FIGURE 36 DRIVERS AND RESTRAINTS IN THE HIGH-SOLID COATINGS MARKET

6.5.2 RADIATION-CURABLE COATINGS

6.5.2.1 Type

FIGURE 37 TYPES OF RADIATION-CURABLE COATINGS

6.5.2.2 Resin systems

6.5.2.3 Applications

6.5.2.4 Advantages

6.5.2.5 Disadvantages

FIGURE 38 DRIVERS AND RESTRAINTS IN THE RADIATION-CURABLE COATINGS MARKET

TABLE 28 OTHER TECHNOLOGIES: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 OTHER TECHNOLOGIES: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 30 OTHER TECHNOLOGIES: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTONS)

TABLE 31 OTHER TECHNOLOGIES: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTONS)

7 PROTECTIVE COATINGS MARKET, BY RESIN TYPE (Page No. - 106)

7.1 INTRODUCTION

FIGURE 39 EPOXY-BASED COATINGS TO LEAD THE PROTECTIVE COATINGS MARKET

TABLE 32 PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 33 PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 34 PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 35 PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

7.2 EPOXY

7.2.1 LARGEST CATEGORY OF PROTECTIVE COATINGS USED FOR DIFFERENT APPLICATIONS

TABLE 36 PROPERTIES AND APPLICATIONS OF EPOXY PROTECTIVE COATINGS

TABLE 37 EPOXY PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 EPOXY PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 39 EPOXY PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 40 EPOXY PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

7.3 POLYURETHANE

7.3.1 FAST CURE TIME INCREASES THE UTILIZATION OF POLYURETHANE PROTECTIVE COATINGS

TABLE 41 PROPERTIES AND APPLICATIONS OF POLYURETHANE PROTECTIVE COATINGS

TABLE 42 POLYURETHANE PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 POLYURETHANE PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 44 POLYURETHANE PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 45 POLYURETHANE PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

7.4 ACRYLIC

7.4.1 EXCELLENT WEATHERING AND OXIDATION-RESISTANT PROPERTIES TO BOOST GROWTH OF THIS SEGMENT

TABLE 46 PROPERTIES AND APPLICATIONS OF ACRYLIC PROTECTIVE COATINGS

TABLE 47 ACRYLIC PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 ACRYLIC PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 49 ACRYLIC PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 50 ACRYLIC PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

7.5 ALKYD

7.5.1 COMBINATIONS MADE BY ADDING DIFFERENT BINDERS, ADDITIVES, AND MODIFIERS TO AMPLIFY THE MARKET OF ALKYD

TABLE 51 PROPERTIES AND APPLICATIONS OF ALKYD PROTECTIVE COATINGS

TABLE 52 ALKYD PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 ALKYD PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 54 ALKYD PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 55 ALKYD PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

7.6 ZINC

7.6.1 EXCELLENT CORROSION RESISTANCE IN MOST ENVIRONMENTS LEADS TO ITS INCREASING USE

TABLE 56 PROPERTIES AND APPLICATIONS OF ZINC PROTECTIVE COATINGS

TABLE 57 ZINC PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 58 ZINC PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 59 ZINC PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 60 ZINC PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

7.7 OTHERS

TABLE 61 OTHER PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 62 OTHER PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 63 OTHER PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 64 OTHER PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

8 PROTECTIVE COATINGS MARKET, BY APPLICATION (Page No. - 122)

8.1 INTRODUCTION

8.2 ABRASION RESISTANCE

8.3 CHEMICAL RESISTANCE

8.4 FIRE PROTECTION

8.5 HEAT RESISTANCE

8.6 CORROSION PROTECTION

8.7 PIPE COATINGS

8.8 TANK LININGS

9 PROTECTIVE COATINGS MARKET, BY END-USE INDUSTRY TYPE (Page No. - 125)

9.1 INTRODUCTION

FIGURE 40 MARINE IS LARGEST END-USE INDUSTRY OF PROTECTIVE COATINGS

TABLE 65 PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY TYPE, 2017–2020 (USD MILLION)

TABLE 66 PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY TYPE, 2021–2026 (USD MILLION)

TABLE 67 PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY TYPE, 2017–2020 (KILOTONS)

TABLE 68 PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY TYPE, 2021–2026 (KILOTONS)

9.2 OFFSHORE STRUCTURES/OIL & GAS EXPLORATION, PRODUCTION, AND TRANSMISSION

9.2.1 THERMAL RESISTANCE AND FIRE PROTECTION COATINGS TO DRIVE THE MARKET IN THE OFFSHORE AND OIL & GAS END-USE INDUSTRY

TABLE 69 OFFSHORE STRUCTURES/OIL & GAS EXPLORATION, PRODUCTION, AND TRANSMISSION: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 70 OFFSHORE STRUCTURES/OIL & GAS EXPLORATION, PRODUCTION, AND TRANSMISSION: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 71 OFFSHORE STRUCTURES/OIL & GAS EXPLORATION, PRODUCTION, AND TRANSMISSION: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTONS)

TABLE 72 OFFSHORE STRUCTURES/OIL & GAS EXPLORATION, PRODUCTION, AND TRANSMISSION: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTONS)

9.3 PETROCHEMICAL - REFINERIES AND CHEMICAL PROCESSING

9.3.1 TANK LININGS AND SAFETY COATINGS APPLICATION INCREASE THE DEMAND FOR PROTECTIVE COATINGS

TABLE 73 PETROCHEMICAL – REFINERIES AND CHEMICAL PROCESSING: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 74 PETROCHEMICAL – REFINERIES AND CHEMICAL PROCESSING: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 75 PETROCHEMICAL – REFINERIES AND CHEMICAL PROCESSING: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTONS)

TABLE 76 PETROCHEMICAL – REFINERIES AND CHEMICAL PROCESSING: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTONS)

9.4 MARINE

9.4.1 SHIPPING STANDARDS EXPECTED TO INCREASE THE SALES OF PROTECTIVE COATINGS IN THE MARINE END-USE INDUSTRY MARKET

TABLE 77 MARINE: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 78 MARINE: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 79 MARINE: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTONS)

TABLE 80 MARINE: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTONS)

9.5 CARGO CONTAINERS

9.5.1 ROUGH AND TOUGH ENVIRONMENTAL CONDITIONS MAKE PROTECTIVE COATINGS A NECESSITY FOR CARGO CONTAINERS

TABLE 81 CARGO CONTAINERS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 82 CARGO CONTAINERS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 83 CARGO CONTAINERS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTONS)

TABLE 84 CARGO CONTAINERS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTONS)

9.6 POWER GENERATION

9.6.1 MAINTENANCE SYSTEMS AND STRUCTURES PROTECTED DUE TO PROTECTIVE COATINGS

TABLE 85 POWER GENERATION: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 86 POWER GENERATION: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 87 POWER GENERATION: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTONS)

TABLE 88 POWER GENERATION: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTONS)

9.7 WATER AND WASTE TREATMENT

9.7.1 ABRASION AND CHEMICAL RESISTANCE PROPERTIES TO BOOST THE DEMAND FOR PROTECTIVE COATINGS

TABLE 89 WATER AND WASTE TREATMENT: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 90 WATER AND WASTE TREATMENT: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 91 WATER AND WASTE TREATMENT: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTONS)

TABLE 92 WATER AND WASTE TREATMENT: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTONS)

9.8 CIVIL BUILDING AND INFRASTRUCTURE

9.8.1 MULTIPURPOSE PROPERTIES LEAD TO THE EXPANSION OF THE PROTECTIVE COATINGS MARKET IN CIVIL BUILDINGS AND INFRASTRUCTURE

TABLE 93 CIVIL BUILDINGS AND INFRASTRUCTURE: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 94 CIVIL BUILDINGS AND INFRASTRUCTURE: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 95 CIVIL BUILDINGS AND INFRASTRUCTURE: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTONS)

TABLE 96 CIVIL BUILDINGS AND INFRASTRUCTURE: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTONS)

9.9 FOOD AND BEVERAGES

9.9.1 HEAVY EQUIPMENT & FOOD PROCESSING UNITS REQUIRE PROTECTION AND DRIVE THE DEMAND FOR PROTECTIVE COATINGS

TABLE 97 FOOD AND BEVERAGES: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 98 FOOD AND BEVERAGES: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 99 FOOD AND BEVERAGES: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTONS)

TABLE 100 FOOD AND BEVERAGES: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTONS)

9.10 OTHERS

TABLE 101 OTHERS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 102 OTHERS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 103 OTHERS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTONS)

TABLE 104 OTHERS: PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTONS)

10 PROTECTIVE COATINGS MARKET, BY REGION (Page No. - 145)

10.1 INTRODUCTION

FIGURE 41 PROTECTIVE COATINGS MARKET IN APAC TO GROW AT THE HIGHEST CAGR BETWEEN 2021 AND 2026

TABLE 105 PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 106 PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 107 PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTONS)

TABLE 108 PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTONS)

10.2 APAC

FIGURE 42 APAC: PROTECTIVE COATINGS MARKET SNAPSHOT

TABLE 109 APAC: PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 110 APAC: PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 111 APAC: PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTONS)

TABLE 112 APAC: PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTONS)

TABLE 113 APAC: PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 114 APAC: PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 115 APAC: PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (KILOTONS)

TABLE 116 APAC: PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2021–2026 (KILOTONS)

TABLE 117 APAC: PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 118 APAC: PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 119 APAC: PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTONS)

TABLE 120 APAC: PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTONS)

TABLE 121 APAC: PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 122 APAC: PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 123 APAC: PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTONS)

TABLE 124 APAC: PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTONS)

10.2.1 CHINA

10.2.1.1 Rising demand from housing industry corroborated by increasing population

10.2.2 INDIA

10.2.2.1 Increased FDI investments and shifting of manufacturing facilities to drive the market

10.2.3 JAPAN

10.2.3.1 Investments in civil engineering to boost the protective coatings market

10.2.4 SOUTH KOREA

10.2.4.1 Rising demand from the infrastructure & construction and marine industries

10.2.5 REST OF APAC

10.3 EUROPE

FIGURE 43 EUROPE: PROTECTIVE COATINGS MARKET SNAPSHOT

TABLE 125 EUROPE: PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 126 EUROPE: PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 127 EUROPE: PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTONS)

TABLE 128 EUROPE: PROTECTIVE COATINGS MARKET, BY COUNTRY, 2021–2026 (KILOTONS)

TABLE 129 EUROPE: PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 130 EUROPE: PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 131 EUROPE: PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (KILOTONS)

TABLE 132 EUROPE: PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2021–2026 (KILOTONS)

TABLE 133 EUROPE: PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 134 EUROPE: PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 135 EUROPE: PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTONS)

TABLE 136 EUROPE: PROTECTIVE COATINGS MARKET, BY RESIN TYPE, 2021–2026 (KILOTONS)

TABLE 137 EUROPE: PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 138 EUROPE: PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 139 EUROPE: PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTONS)

TABLE 140 EUROPE: PROTECTIVE COATINGS MARKET, BY END-USE INDUSTRY, 2021–2026 (KILOTONS)

10.3.1 GERMANY

10.3.1.1 Increasing demand from the power generation and marine industries

10.3.2 FRANCE

10.3.2.1 Large-scale investments in energy, transport infrastructure, and commercial and industrial projects

10.3.3 ITALY

10.3.3.1 Construction industry is expected to boost demand for protective coatings

10.3.4 UK

10.3.4.1 Growing construction industry to boost demand for protective coatings

10.3.5 SPAIN

10.3.5.1 Oil & gas industry to accelerate market growth in the country

10.3.6 RUSSIA

10.3.6.1 Significant demand from the marine and shipbuilding industry

10.3.7 REST OF EUROPE

10.4 NORTH AMERICA

FIGURE 44 NORTH AMERICA: PROTECTIVE COATINGS MARKET SNAPSHOT

TABLE 141 NORTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 142 NORTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 143 NORTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTONS)

TABLE 144 NORTH AMERICA: PROTECTIVE COATINGS MARKET, BY COUNTRY, 2021–2026 (KILOTONS)

TABLE 145 NORTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 146 NORTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 147 NORTH AMERICA PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (KILOTONS)

TABLE 148 NORTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2021–2026 (KILOTONS)

TABLE 149 NORTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 150 NORTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 151 NORTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTONS)

TABLE 152 NORTH AMERICA: PROTECTIVE COATINGS MARKET, BY RESIN TYPE, 2021–2026 (KILOTONS)

TABLE 153 NORTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 154 NORTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 155 NORTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTONS)

TABLE 156 NORTH AMERICA: PROTECTIVE COATINGS MARKET, BY END-USE INDUSTRY, 2021–2026 (KILOTONS)

10.4.1 US

10.4.1.1 Innovation in developing technologies to lead the market

10.4.2 CANADA

10.4.2.1 Oil & gas industries to lead to the growth of the market

10.4.3 MEXICO

10.4.3.1 Power generation sector and shipping containers industry expected to show robust growth

10.5 MIDDLE EAST & AFRICA

TABLE 157 MIDDLE EAST & AFRICA: PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 158 MIDDLE EAST & AFRICA: PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 159 MIDDLE EAST & AFRICA: PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTONS)

TABLE 160 MIDDLE EAST & AFRICA: PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTONS)

TABLE 161 MIDDLE EAST & AFRICA: PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 162 MIDDLE EAST & AFRICA: PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 163 MIDDLE EAST & AFRICA: PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (KILOTONS)

TABLE 164 MIDDLE EAST & AFRICA: PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2021–2026 (KILOTONS)

TABLE 165 MIDDLE EAST & AFRICA: PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 166 MIDDLE EAST & AFRICA: PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 167 MIDDLE EAST & AFRICA: PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTONS)

TABLE 168 MIDDLE EAST & AFRICA: PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTONS)

TABLE 169 MIDDLE EAST & AFRICA: PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTONS)

TABLE 172 MIDDLE EAST & AFRICA: PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTONS)

10.5.1 SAUDI ARABIA

10.5.1.1 Demand from the oil & gas industry and mega construction projects to boost demand for protective coatings

10.5.2 UAE

10.5.2.1 Multiple developing sectors to increase demand for protective coatings

10.5.3 REST OF MIDDLE EAST & AFRICA

10.6 SOUTH AMERICA

TABLE 173 SOUTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 174 SOUTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 175 SOUTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTONS)

TABLE 176 SOUTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTONS)

TABLE 177 SOUTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 178 SOUTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 179 SOUTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2017–2020 (KILOTONS)

TABLE 180 SOUTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY TECHNOLOGY, 2021–2026 (KILOTONS)

TABLE 181 SOUTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 182 SOUTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 183 SOUTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTONS)

TABLE 184 SOUTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTONS)

TABLE 185 SOUTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 186 SOUTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 187 SOUTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTONS)

TABLE 188 SOUTH AMERICA: PROTECTIVE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTONS)

10.6.1 BRAZIL

10.6.1.1 New infrastructural projects to boost consumption of protective coatings

10.6.2 ARGENTINA

10.6.2.1 Increase in population and improved economic conditions to be major market drivers

10.6.3 REST OF SOUTH AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 196)

11.1 OVERVIEW

11.1.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PROTECTIVE COATINGS PLAYERS

11.2 COMPETITIVE SCENARIO

11.2.1 MARKET EVALUATION MATRIX

TABLE 189 COMPANY FOOTPRINT

TABLE 190 COMPANY INDUSTRY FOOTPRINT

TABLE 191 COMPANY REGION FOOTPRINT

TABLE 192 STRATEGIC DEVELOPMENTS, BY COMPANY

TABLE 193 STRATEGIES ADOPTED, 2016-2021

TABLE 194 GROWTH STRATEGIES ADOPTED, BY KEY COMPANIES – 2016-2021

11.3 COMPANY EVALUATION QUADRANT

11.3.1 STARS

11.3.2 EMERGING LEADERS

11.3.3 PERVASIVE

11.3.4 EMERGING COMPANIES

FIGURE 45 PROTECTIVE COATINGS MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2020

11.4 PRODUCT FOOTPRINT

FIGURE 46 PRODUCT FOOTPRINT ANALYSIS OF TOP PLAYERS IN PROTECTIVE COATINGS MARKET

11.5 SME MATRIX, 2020

11.5.1 RESPONSIVE COMPANIES

11.5.2 PROGRESSIVE COMPANIES

11.5.3 STARTING BLOCKS

11.5.4 DYNAMIC COMPANIES

FIGURE 47 PROTECTIVE COATINGS MARKET: EMERGING COMPANIES COMPETITIVE LEADERSHIP MAPPING, 2020

11.6 PROTECTIVE COATINGS MARKET RANKING ANALYSIS: COMPETITIVE MARKET

11.7 PROTECTIVE COATINGS MARKET SHARE

FIGURE 48 MARKET SHARE OF PROTECTIVE COATINGS (2020)

11.8 COMPANY REVENUE ANALYSIS

FIGURE 49 COMPANY REVENUE ANALYSIS, 2016-2020

11.8.1 AKZONOBEL N.V.

11.8.2 PPG INDUSTRIES

11.8.3 JOTUN A/S

11.8.4 THE SHERWIN-WILLIAMS COMPANY

11.8.5 HEMPEL A/S

11.9 COMPETITIVE SITUATIONS AND TRENDS

TABLE 195 PROTECTIVE COATINGS MARKET: PRODUCT LAUNCHES, 2016-2021

TABLE 196 PROTECTIVE COATINGS MARKET: DEALS, 2016-2021

12 COMPANY PROFILES (Page No. - 224)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 MAJOR PLAYERS

12.1.1 AKZONOBEL N.V. (AKZONOBEL)

TABLE 197 AKZONOBEL N.V.: COMPANY OVERVIEW

FIGURE 50 AKZONOBEL N.V.: COMPANY SNAPSHOT

TABLE 198 AKZONOBEL N.V.: PRODUCT LAUNCHES

TABLE 199 AKZONOBEL N.V.: DEALS

12.1.2 PPG INDUSTRIES

TABLE 200 PPG INDUSTRIES: COMPANY OVERVIEW

FIGURE 51 PPG INDUSTRIES: COMPANY SNAPSHOT

TABLE 201 PPG INDUSTRIES: PRODUCT LAUNCHES

TABLE 202 PPG INDUSTRIES: DEALS

12.1.3 THE SHERWIN-WILLIAMS COMPANY

TABLE 203 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

FIGURE 52 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

TABLE 204 THE SHERWIN-WILLIAMS COMPANY: PRODUCT LAUNCHES

12.1.4 JOTUN A/S

TABLE 205 JOTUN A/S: COMPANY OVERVIEW

FIGURE 53 JOTUN A/S: COMPANY SNAPSHOT

TABLE 206 JOTUN A/S: PRODUCT LAUNCHES

TABLE 207 JOTUN A/S: DEALS

12.1.5 HEMPEL A/S

TABLE 208 HEMPEL A/S: COMPANY OVERVIEW

FIGURE 54 HEMPEL A/S: COMPANY SNAPSHOT

TABLE 209 HEMPEL A/S: PRODUCT LAUNCHES

TABLE 210 HEMPEL A/S: DEALS

12.1.6 CHUGOKU MARINE PAINTS LTD.

TABLE 211 CHUGOKU MARINE PAINTS LTD.: COMPANY OVERVIEW

FIGURE 55 CHUGOKU MARINE PAINTS LTD.: COMPANY SNAPSHOT

TABLE 212 CHUGOKU MARINE PAINTS LTD.: DEALS

12.1.7 NIPPON PAINT HOLDINGS CO. LTD.

TABLE 213 NIPPON PAINT HOLDINGS CO. LTD.: COMPANY OVERVIEW

FIGURE 56 NIPPON HOLDINGS CO. LTD.: COMPANY SNAPSHOT

12.1.8 SIKA AG

TABLE 214 SIKA AG: COMPANY OVERVIEW

FIGURE 57 SIKA AG: COMPANY SNAPSHOT

12.1.9 KANSAI PAINTS CO. LTD.

TABLE 215 KANSAI PAINTS CO. LTD.: COMPANY OVERVIEW

FIGURE 58 KANSAI PAINTS CO. LTD.: COMPANY SNAPSHOT

TABLE 216 KANSAI PAINTS CO. LTD.: DEALS

12.1.10 RPM INTERNATIONAL INC.

TABLE 217 RPM INTERNATIONAL INC.: COMPANY OVERVIEW

FIGURE 59 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 218 RPM INTERNATIONAL INC.: DEALS

12.2 OTHER COMPANIES

12.2.1 AXALTA COATING SYSTEMS, LLC

TABLE 219 AXALTA COATING SYSTEMS, LLC: COMPANY OVERVIEW

TABLE 220 AXALTA COATING SYSTEMS, LLC: NEW PRODUCT LAUNCHES

TABLE 221 AXALTA COATING SYSTEMS, LLC: DEALS

12.2.2 DOW CHEMICAL COMPANY: COMPANY OVERVIEW

12.2.3 TEKNOS GROUP

TABLE 222 TEKNOS GROUP: COMPANY OVERVIEW

TABLE 223 TEKNOS GROUP: NEW PRODUCT LAUNCHES

12.2.4 PARKER HANNIFIN CORP

TABLE 224 PARKER HANNIFIN CORP: COMPANY OVERVIEW

12.2.5 CLOVERDALE PAINT INC.

TABLE 225 CLOVERDALE PAINT INC.: COMPANY OVERVIEW

TABLE 226 CLOVERDALE PAINT INC.: DEALS

12.2.6 BERGER PAINTS INDIA LTD.

TABLE 227 BERGER PAINTS INDIA LTD.: COMPANY OVERVIEW

TABLE 228 BERGER PAINTS INDIA LTD.: DEALS

12.2.7 TNEMEC COMPANY, INC.

TABLE 229 TNEMEC COMPANY, INC.: COMPANY OVERVIEW

TABLE 230 TNEMEC COMPANY, INC.: DEALS

12.2.8 BASF SE

TABLE 231 BASF SE: COMPANY OVERVIEW

12.2.9 BENJAMIN MOORE & CO.

TABLE 232 BENJAMIN MOORE & CO.: COMPANY OVERVIEW

TABLE 233 BENJAMIN MOORE & CO.: DEALS

12.2.10 NOROO PAINT & COATINGS CO. LTD.

TABLE 234 NOROO PAINT & COATINGS CO. LTD.: COMPANY OVERVIEW

12.2.11 DULUXGROUP

TABLE 235 DULUXGROUP: COMPANY OVERVIEW

12.2.12 SHAWCOR

TABLE 236 SHAWCOR: COMPANY OVERVIEW

12.2.13 FOSROC, INC.

TABLE 237 FOSROC, INC.: COMPANY OVERVIEW

12.2.14 PREMIUM COATINGS AND CHEMICALS PVT. LTD.

TABLE 238 PREMIUM COATINGS AND CHEMICALS PVT. LTD.: COMPANY OVERVIEW

12.2.15 WEILBURGER COATINGS GMBH

TABLE 239 WEILBURGER COATINGS GMBH: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 302)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involves five major activities in estimating the current market size of Protective Coatings. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to for identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The Protective Coatings market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in end-use industries, such as Offshore Structures/ oil&gas, Petrochemical – Refineries & Chemical processing, Marine, Cargo Containers, Power generation, Civil Building & Infrastructure, Water & wastewater, Food & beverages, and others. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

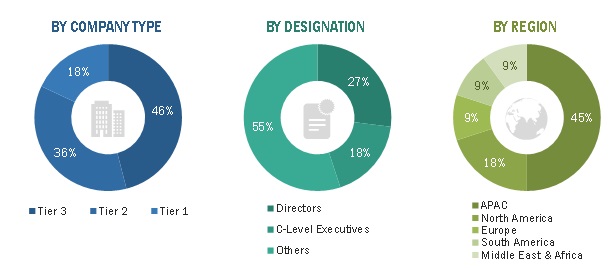

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Protective Coatings market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Protective Coatings Market Size: Top-down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global protective coatings market in terms of value and volume.

- To analyze and forecast the protective coatings market by resin type, technology, application, and end-use industry.

- To forecast the protective coatings market size with respect to five main regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market.

- To analyze competitive developments in the market, such as merger & acquisition, new product launch, investment, and expansion

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2.

Note: 1. Micromarkets are defined as the sub-segments of the Protective Coatings market included in the report.

Note 2: Core competencies of the companies are captured in terms of their key developments and key strategies adopted to sustain their position in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Protective Coatings market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Protective Coatings Market