This comprehensive study of the powder coatings market involves extensive research utilising various secondary sources such as Hoovers, Bloomberg, Factiva, ICIS, and OneSource. Primary sources include industry experts from core and related sectors, preferred suppliers, manufacturers, distributors, service providers, and organisations across all segments of the industry's value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of major market players, and industry consultants. These interviews aimed to gather and validate essential qualitative and quantitative data and evaluate the market's growth prospects.

Secondary Research

During the secondary research phase, a wide array of secondary sources including annual reports, press releases, investor presentations, white papers, regulatory bodies' documents, trade directories, certified publications, articles by reputable authors, credible websites, and databases were utilized to gather information for this study. The focus of the secondary research was primarily on extracting essential insights regarding the industry's value chain, identifying all significant market players, and delineating market classification and segmentation down to the most granular level, including regional markets. This approach was adopted to capture key market-oriented developments.

Primary Research

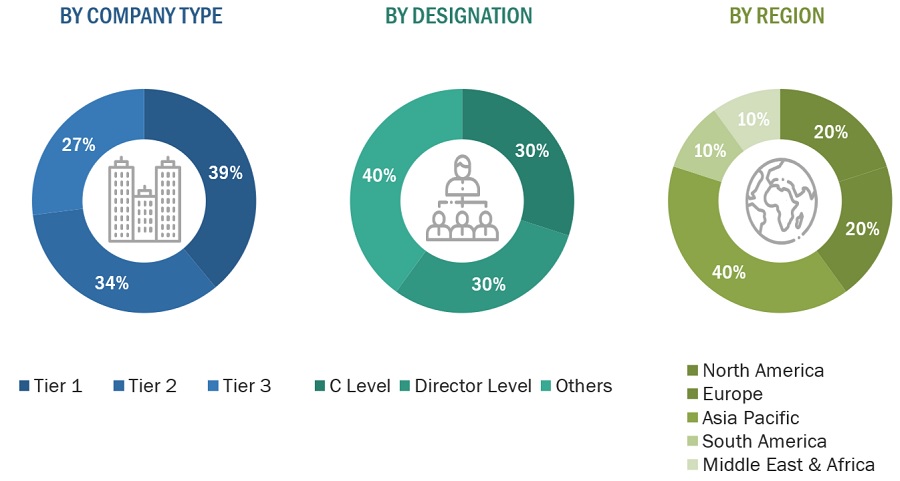

Extensive primary research was carried out after gathering information about powder coating market through secondary research. During the primary research phase, interviews were conducted with experts representing both the supply and demand sides to gather qualitative and quantitative data, ensuring the accuracy and validity of the report's findings. On the supply side, primary sources included industry leaders such as CEOs, vice presidents, marketing directors, technology and innovation directors, and other relevant executives from prominent companies and organizations within the powder coatings market. The primary objective of this research was to identify segmentation types and industry trends.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Key Primary Interview Participants

|

KEY PRIMARY |

RESPONDENTS |

|

AkzoNobel N.V.

|

RPM International Inc.

|

|

PPG Industries, Inc.

|

Asian Paints limited

|

|

The Sherwin-Williams Company

|

Jotun Group

|

|

Jotun A/S

|

Nippon Paint Holdings Co., Ltd.

|

Market Size Estimation

The following information is part of the research methodology used to estimate the size of the powder coating market. The market sizings of the powder coating market was undertaken from the demand side. The market size was estimated based on market size for powder coating in various sectors. Extensive qualitative and quantitative date were analyzed to list key information throughout the report.

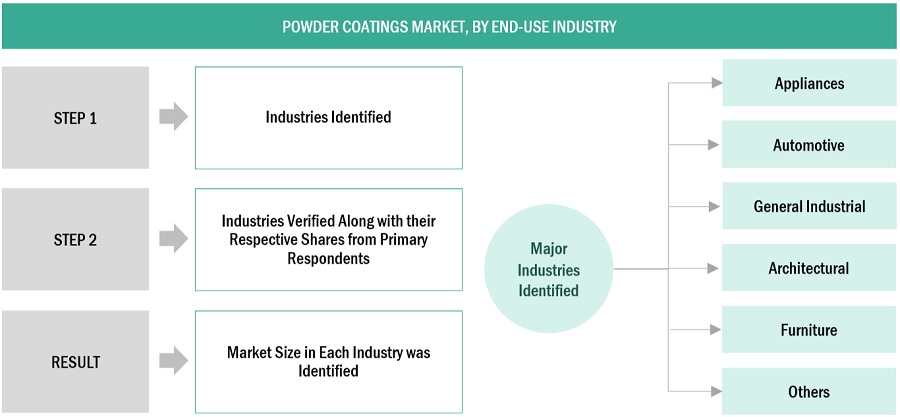

Powder Coating Market Size Estimation: Bottom Up Approach, By End-Use Industry

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation: Top-Down Approach

Data Triangulation

Upon determining the total market size, it was segmented into several distinct categories. To ensure accuracy, data triangulation and market breakdown methodologies were utilized, completing the comprehensive market engineering process and yielding precise statistics for all relevant segments. Triangulation involved incorporating diverse factors and trends from both the demand and supply perspectives. Additionally, the market validation process employed both top-down and bottom-up approaches to affirm the accuracy and reliability of the findings.

Market Definition

Powder coating is a dry powder applied in a free-flowing manner, eliminating the need for solvents to maintain the binder and filler components in a liquid state. Typically administered electrostatically, the coating is then cured under heat to form a durable layer. The powder consists of either thermoplastic or thermoset polymers and is favored for its ability to produce a robust finish surpassing traditional paint.

Primarily employed for coating metals, powder coating finds extensive applications in household appliances, aluminum extrusions, drum hardware, as well as automobile and bicycle components.

Key Stakeholders

-

End-Use Industries such as Appliances, Automotive, General Industrial, Architectural

-

Powder Coating Manufacturers

-

Raw Material Suppliers

-

Formulators and Applicators

-

Industry Associations

-

Investment Banks, Venture Capitalists

-

Government and Regional Agencies

Report Objectives

-

To analyze and forecast the size of powder coating market in terms of value and volume

-

To provide detailed information regarding the key factors (drivers, restraints, opportunities, challenges) influencing the growth of the market

-

To anaylze and forecast the powder coatings market by resin type, coating method, end-use industry, and region

-

To forecast the size of the market and its submarkets with respect to five regions (along with the major countries), namely, Asia Pacific, Europe, North America, Middle East & Africa, and South America

-

To analyze the opportunities in the market for stakeholders by identifying high-growth segments and provide a competitive landscape for market leaders

-

To track and analyze competitive developments such as expansions, new product launches, partnerships & collaborations, and joint ventures in the market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

-

Additional country-level analysis of the powder coating market

-

Profiling of additional market players (up to 5)

Product Analysis

-

Product matrix, which provides a detailed comparison of the product portfolio of each company in the Powder Coating Market

Growth opportunities and latent adjacency in Powder Coatings Market