Top 10 High Growth Paints & Coatings Market by Coating Type (Elastomeric, Polyurea, UV, Insulation, Ceramic, Automotive, Medical, Silicone, Fluoropolymer, and Epoxy Coatings) - Global Forecast to 2021

[198 Pages Report] The Top 10 High Growth Paints & Coatings Market was valued at USD 141.58 Billion in 2015 and is projected to reach USD 190.51 Billion by 2021, at a CAGR of 5.07% from 2016 to 2021. In this study, 2015 has been considered the base year to estimate the market size. The report provides the forecast from 2016 to 2021. This report aims to estimate the market size and future growth potential of the top 10 high growth paints & coatings market across different segments such as type, technology, property, application, and region. Factors influencing market growth such as drivers, restraints, opportunities, and industry-specific challenges have been studied in the report. The report analyzes the opportunities in the market for stakeholders and illustrates the competitive landscape of the market.

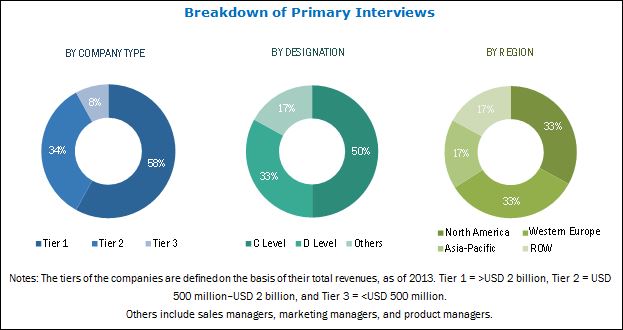

The top-down and bottom-up approaches have been used to estimate and validate the size of the global top 10 growing paints & coatings market and estimate the sizes of various other dependent submarkets. The research study involved the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government associations. Private and company websites have also been used to identify and collect information useful for a technical, market-oriented, and commercial study of the global top 10 growing paints & coatings market. After arriving at the total market size, the overall market has been split into several segments and subsegments. The figure given below provides a breakdown of the primaries conducted during the research study, based on company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

In the value chain analysis, maximum value is added during the raw material manufacturing stage. In the paints & coatings industry, the company has to manufacture final coating with raw materials such as resin, additive, pigment, extender, and water/solvent. The processing cost for the conversion of these raw materials into the final product is very high.

Key top ten growing paints & coatings manufacturers are AkzoNobel N.V. (Netherlands), PPG Industries, Inc. (U.S.), The Sherwin-Williams Company (U.S.), Axalta Coating Systems LLC (U.S.), BASF SE (Germany), Progressive Painting Inc., (U.S.), Jotun A/S (Norway), The Dow Chemical Company (U.S.), Nippon Paint (Japan), and Asian Paints Limited (India).

Key Target Audience:

- Manufacturers, Distributors, Traders, and Suppliers of Paints & Coatings and their Raw Materials

- End-use Industries such as Building & Construction, Automotive & Transportation, Industrial, Marine, and Others

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- Research & Development (R&D) Institutions

- Environment Support Agencies

- Raw Material Suppliers

Scope of the Report:

This research report categorizes the global top 10 growing paints & coating market based on resin type, application, and region.

Elastomeric Coatings

- Based on Type:

- Acrylic Elastomeric Coating

- polyurethane Elastomeric Coating

- Silicone Elastomeric Coating

- Butyl Elastomeric Coating

- Silicone

- Others

- Based on Application:

- Wall Coating

- Floor Coating

- Roof Coating

- Based on Technology:

- Water-borne Elastomeric Coating

- Solvent-borne Elastomeric Coating

- Based on Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Polyurea Coating

- Based on Application:

- Building & Construction

- Transportation

- Industrial application

- Landscape

- Based on Technology:

- Spraying

- Pouring

- Hand Mixing

- Based on Region:

- North America

- Europe

- Asia-Pacific

- Rest of the World

UV Coating

- Based on Application:

- Industrial Coatings

- Electronics

- Graphic Arts

- Based on Type:

- Wood Coatings

- UV Plastic Coatings

- UV over Print Varnish

- UV Display Coatings

- Hand Mixing

- UV Conformal Coatings

- UV Paper Coatings

- Based on Region:

- North America

- Europe

- Asia-Pacific

Insulation Coating

- Based on Application:

- Aerospace & Defense

- Automotive & Transportation

- Industrial Application

- Marine

- Building & Construction

- Others

- Based on Type:

- Acrylic

- Epoxy

- Polyurethane

- YTRIA Stabilized Zirconia

- Mullite

- Others (UV Cure)

- UV over Print Varnish

- UV Display Coatings

- Hand Mixing

- UV Conformal Coatings

- UV Paper Coatings

- Based on Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

Ceramic Coating

- Based on Resin Type:

- Polyurethane

- Acrylic

- Epoxy

- Others

- Based on Type:

- Oxide Coatings

- Carbide Coatings

- Nitride Coatings

- Others

- Based on Technology:

- Thermal Spray

- Physical Vapor Deposition (PVD)

- Chemical Vapor Deposition (CVD)

- Others

- Based on Region:

- Asia-Pacific

- Europe

- North America

- Rest of the World

Automotive Coating

- Based on Resin Type:

- Polyurethane

- Acrylic

- Epoxy

- Others

- Based on Technology:

- Solvent-borne

- Water-borne

- Powder Coating & Other

- Based on Coat Type:

- Clearcoat

- Basecoat

- Primer

- E-coat

- Based on Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Europe

- South America

Medical Coatings

- Based on Coating Type:

- Hydrophilic

- Hydrophobic

- Based on Substrates Type:

- Metals

- Ceramics

- Polymers

- Based on Chemistry Type:

- Silicones

- Fluoropolymers

- Parylene

- Based on Application:

- Medical Devices

- Implants

- Medical Equipment & Tools

- Others

- Based on Region:

- North America

- Western Europe

- Asia-Pacific

- Central & Eastern Europe

- Rest of the World

Silicone Coatings

- Based on Composition Type:

- Silicone Additives

- Silicone Polymers

- 100% Silicone

- Silicone Water Repellents

- Based on Technology:

- Solvent-based

- Solventless

- Water-based

- Powder-based

- Based on Application:

- Construction

- Consumer Goods

- Industrial

- Marine

- Automotive & Transportation

- Paper & Film Release

- Others

- Based on Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Rest of the World

Fluoropolymer Coatings

- Based on Type:

- PTFE Coating

- PVDF Coating

- FEP Coatings

- ETFE Coatings

- Others

- Based on Application:

- Food Processing

- Chemical Processing

- Electrical and Electronics

- Building & Construction

- Others

- Based on Region:

- North America

- Europe

- Asia-Pacific

- Rest of the World

Epoxy Coatings

- Based on Technology:

- Waterborne

- Solvent borne

- Powder based

- Based on Application:

- Construction

- Transportation

- General Industrial

- Others

- Based on Region:

- Asia-Pacific

- North America

- Europe

- RoW

The market is further analyzed for the key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of any of the top 10 high growth paints and coatings market by type, technology, and application

Company Information:

- Detailed analysis and profiles of additional market players

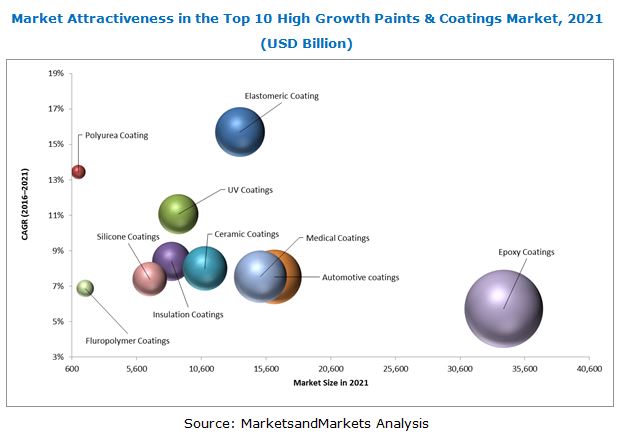

The global paints & coatings market was valued at USD 141.58 Billion in 2015 and is projected to reach USD 190.51 Billion by 2021, at a CAGR of 5.07% from 2016 to 2021. It is primarily driven by the increasing use of waterborne coatings for performance and environmental reasons. The global paints & coatings market is growing owing to the increasing demand from the building & construction industry. High demand for waterborne coatings has also been driving the architectural coatings market for the past few years. Additionally, growing manufacturing activities such as automotive, chemical, and other commercial industries in Asia-Pacific have been influencing the market for the past few years. The top 10 high growth paints & coatings markets considered for the study are elastomeric, polyurea, UV, insulation, ceramic, automotive, medical, silicone, fluoropolymer, and epoxy coatings.

The elastomeric coatings segment accounted for the largest share of paints & coatings market and is projected to register the highest CAGR of 15.19% between 2016 and 2021, to reach a market size of USD 13.51 Million by 2021. North America is the largest market for elastomeric coatings, whereas Asia-Pacific is the fastest-growing market for the same. There has been a steady growth in the Asia-Pacific market since the last 2-3 years because of increasing employment rate as well as improving economy and construction sector.

The global market size for polyurea coatings is estimated to be USD 5.34 Billion in 2016 and is projected to witness a CAGR of 10.57% to reach USD 8.93 Billion by 2021. The UV curable coatings market is witnessing high growth which is expected to continue in the near future. It is majorly driven by the highly growing manufacturing industry in Asia-Pacific and intense efforts at country level to promote environment-friendly products. Presently, Asia-Pacific and Europe are the major consumers of UV curable coatings.

The global market size for insulation coating is estimated to be USD 5.66 Billion in 2016 and is projected to witness a CAGR of 7.99% to reach USD 8.29 Billion by 2021. Energy cost saving and protection from corrosion under insulation are the main drivers for the insulation coatings market. Increased use in the building & construction industry, especially in the emerging markets, is one of the key drivers of the insulation coatings market.

The global market size for ceramic coatings is estimated to be USD 7.57 Billion in 2016 and is projected to witness a CAGR of 7.50% to reach USD 10.87 Billion by 2021. One of the biggest advantages of ceramic coatings is their ability to provide heat barrier potential, durability, and toughness to components in extreme environments. The growing automotive and automotive components market in China and India is one of the major drivers for high demand of ceramic coatings in the Asia-Pacific region. Due to various applications in the automotive sector and the requirement to create heat-resistant systems, ceramic coatings have gained high importance.

Though the paints & coatings market is gaining importance, factors such as the health and environmental concerns faced due to the release of VOC content in the environment are likely to hamper the growth of the solvent-borne paints & coatings segment, subsequently hindering the growth of paints & coatings market. Apart from strict regulations, substantial capital and time is invested in the testing phase of paints & coatings, which can act as a constraint for the newer players.

Companies such The Dow Chemical Company (U.S.), AkzoNobel N.V. (Netherlands), The Sherwin-Williams Company (U.S.), BASF SE (Germany), PPG Industries (U.S.), Jotun A/S (Norway), Nippon Paint (Japan), Axalta Coating Systems (U.S.), Asian Paints (India), Progressive Painting, Inc. (U.S.), and others are the key players in the global paints & coatings market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Scope

1.2.1 Years Considered for the Study

1.3 Currency

1.4 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Secondary Data

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 27)

4 Elastomeric Coatings (Page No. - 28)

4.1 Introduction

4.2 Market Segmentation

4.2.1 By Type

4.2.2 By Application

4.2.3 By Technology

4.2.4 By Region

4.3 Market Dynamics

4.4 Value Chain Analysis

4.5 Porter’s Five Forces Analysis

4.6 Elastomeric Coatings Market, By Type

4.6.1 Introduction

4.6.2 Acrylic Elastomeric Coatings

4.6.3 Pu Elastomeric Coatings

4.6.4 Silicone Elastomeric Coatings

4.6.5 Butyl Elastomeric Coating

4.6.6 Others

4.7 Elastomeric Coatings Market, By Technology

4.7.1 Introduction

4.7.2 Water-Borne Elastomeric Coating

4.7.3 Solvent-Borne Elastomeric Coatings

4.8 Elastomeric Coatings Market, By Application

4.8.1 Introduction

4.8.2 Wall Coating

4.8.3 Floor Coating

4.8.4 Roof Coating

4.8.4.1 Built Up Roofing

4.8.4.2 Concrete Roofing

4.8.4.3 Metal Roofing

4.8.4.4 Modified Bitumen Roofing

4.8.4.5 Pu Foam Roofing

4.8.4.6 Single Ply Roofing

4.8.5 Others

4.9 Elastomeric Coatings Market, By Region

4.9.1 Introduction

4.9.2 North America

4.9.3 Europe

4.9.4 Asia-Pacific

4.9.5 South America

4.9.6 Middle East & Africa

5 Polyurea Coatings (Page No. - 49)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Raw Material

5.2.2 By Polyurea Type

5.2.3 By Technology

5.2.4 By Application

5.2.5 By Region

5.3 Market Dynamics

5.4 Value-Chain Analysis

5.5 Porter’s Five Forces Analysis

5.6 Polyurea Coatings Market, By Technology

5.6.1 Introduction

5.6.2 Spraying

5.6.3 Pouring

5.6.4 Hand Mixing

5.7 Polyurea Coatings Market, By Application

5.7.1 Introduction

5.7.2 Building & Construction

5.7.3 Transportation

5.7.4 Industrial Application

5.7.5 Landscape

5.8 Polyurea Coatings Market, Regional Analysis

5.8.1 Introduction

5.8.2 North America

5.8.3 Europe

5.8.4 Asia-Pacific

5.8.5 Rest of the World (RoW)

6 UV Coatings (Page No. - 62)

6.1 Introduction

6.2 Market Dynamics

6.3 Value Chain Analysis

6.4 Porter’s Five Forces Analysis

6.5 UV Curable Coatings Composition Market, By Raw Material Type

6.6 UV Curable Coatings Market, By Type

6.6.1 Wood Coatings

6.6.2 UV Plastic Coatings

6.6.3 UV Over Print Varnish

6.6.4 UV Display Coatings

6.6.5 UV Conformal Coatings

6.6.6 UV Paper Coatings

6.7 UV Curable Coatings Market, By End-User Industry

6.7.1 Industrial Coatings

6.7.2 Electronics

6.7.3 Graphic Arts

6.8 UV Curable Coatings Market, By Region

7 Insulation Coatings (Page No. - 74)

7.1 Introduction

7.2 Market Segmentation

7.2.1 By Type

7.2.2 By End Use

7.2.3 By Region

7.3 Market Dynamics

7.4 Value Chain Analysis

7.5 Porter’s Five Forces Analysis

7.6 Insulation Coatings Market, By End Use

7.6.1 Introduction

7.6.2 Aerospace & Defense

7.6.3 Automotive & Transportation

7.6.4 Industrial Application

7.6.5 Marine

7.6.6 Building & Construction

7.6.7 Others

7.7 Insulation Coatings Market, By Type

7.7.1 Introduction

7.7.2 Acrylic

7.7.3 Epoxy

7.7.4 Pu

7.7.5 Ytria Stabilized Zirconia

7.7.6 Mullite

7.7.7 Others

7.8 Insulation Coatings Market, By Region

7.8.1 North America

7.8.2 Europe

7.8.3 Asia-Pacific

7.8.4 Middle East & Africa

7.8.5 South America

8 Ceramic Coatings (Page No. - 88)

8.1 Introduction

8.2 Market Segmentation

8.2.1 By Application

8.2.2 By Type

8.2.3 By Technology

8.3 Market Dynamics

8.4 Value-Chain Analysis

8.5 Porter’s Five Forces Analysis

8.6 Ceramic Coatings Market, By Type

8.6.1 Introduction

8.6.2 Oxide Coatings

8.6.3 Carbide Coatings

8.6.4 Nitride Coatings

8.6.5 Others

8.7 Ceramic Coatings Market, By Technology

8.7.1 Introduction

8.7.2 Thermal Spray

8.7.3 Physical Vapor Deposition (PVD)

8.7.4 Chemical Vapor Deposition (CVD)

8.7.5 Others

8.8 Ceramic Coatings Market, By Application

8.8.1 Introduction

8.8.2 Transportation & Automotive

8.8.3 Energy

8.8.4 Aerospace & Defense

8.8.5 Industrial Goods

8.8.6 Healthcare

8.8.7 Others

8.9 Ceramic Coatings Market, By Region

8.9.1 Asia-Pacific

8.9.2 Europe

8.9.3 North America

8.9.4 Rest of the World

9 Automotive Coating (Page No. - 105)

9.1 Introduction

9.2 Market Dynamics

9.3 Value Chain Analysis

9.4 Porter’s Five Forces Analysis

9.5 Automotive Coatings Market, By Resin Type

9.5.1 Introduction

9.5.2 PU

9.5.3 Epoxy

9.5.4 Acrylic

9.5.5 Others

9.5.5.1 Alkyd Resin

9.5.5.2 Melamine Resin

9.5.5.3 Saturated Polyester Resin

9.6 Automotive Coatings Market, By Technology

9.6.1 Introduction

9.6.2 Solvent-Borne

9.6.3 Water-Borne

9.6.4 Powder Coating and Others

9.7 Automotive Coatings Market, By Coat Type

9.7.1 Introduction

9.7.2 E-Coat

9.7.3 Primer

9.7.4 Basecoat

9.7.5 Clearcoat

9.8 Automotive Coatings Market, By Region

9.8.1 Asia-Pacific

9.8.2 North America

9.8.3 Europe

9.8.4 South America

9.8.5 Middle East & Africa

10 Medical Coatings (Page No. - 119)

10.1 Introduction

10.2 Market Segmentation

10.2.1 By Type

10.2.2 By Application

10.2.3 By Region

10.3 Market Dynamics

10.4 Value Chain Analysis

10.5 Porter’s Five Forces Analysis

10.6 Medical Coatings Market, By Type

10.6.1 Introduction

10.6.2 Medical Coatings, By Coating Type

10.6.2.1 Hydrophilic Coatings

10.6.2.2 Hydrophobic Coatings

10.7 Medical Coatings, By Substrate Type

10.7.1 Metals

10.7.1.1 Silver

10.7.1.2 Titanium

10.7.2 Ceramics

10.7.3 Polymers

10.8 Medical Coatings, By Chemistry Type

10.8.1 Silicones

10.8.2 Fluoropolymers

10.8.2.1 PTFE

10.8.2.2 PVDF

10.8.3 Parylene

10.9 Medical Coatings Market, By Application

10.9.1 Introduction

10.9.2 Medical Devices

10.9.3 Medical Implants

10.9.3.1 Orthopedic Implants

10.9.3.2 Dental Implants

10.9.3.3 Cardiovascular Implants

10.9.4 Medical Equipment & Tools

10.9.5 Others

10.10 Medical Coatings Market, By Region

10.10.1 North America

10.10.2 Western Europe

10.10.3 Asia-Pacific

10.10.4 Central & Eastern Europe

10.10.5 RoW

11 Silicone Coatings (Page No. - 139)

11.1 Introduction

11.2 Market Segmentation

11.2.1 By Composition Type

11.2.2 By Technology

11.2.3 By Application

11.2.4 By Region

11.3 Market Dynamics

11.4 Industry Trends

11.4.1 Value Chain Analysis

11.4.2 Porter’s Five Forces Analysis

11.5 Silicone Coatings Market, By Composition Type

11.5.1 Introduction

11.5.2 Silicone Additives

11.5.3 Silicone Polymers

11.5.3.1 Silicone Acrylic

11.5.3.2 Silicone Epoxy

11.5.3.3 Silicone Polyester

11.5.3.4 Silicone Pu

11.5.4 100% Silicone

11.5.4.1 Methyl Silicone

11.5.4.2 Phenyl Silicone

11.5.4.3 Others

11.5.5 Silicone Water Repellents

11.5.5.1 Silane

11.5.5.2 Silicone Emulsions

11.5.5.3 Others

11.6 Silicone Coatings Market, By Technology

11.6.1 Introduction

11.6.2 Solventless

11.6.3 Solvent-Based

11.6.4 Water-Based

11.6.5 Powder-Based

11.7 Silicone Coatings Market, By Application

11.7.1 Introduction

11.7.2 Construction

11.7.3 Automotive & Transportation

11.7.4 Consumer Goods

11.7.5 Marine

11.7.6 Industrial

11.7.7 Paper & Film Release

11.7.8 Others

11.8 Silicone Coatings Market, By Region

11.8.1 North America

11.8.2 Europe

11.8.3 Asia-Pacific

11.8.4 Middle East & Africa

11.8.5 RoW

12 Fluoropolymer Coatings (Page No. - 159)

12.1 Introduction

12.2 Market Segmentation

12.2.1 By Type

12.2.2 By End-User

12.3 Market Dynamics

12.4 Value Chain Analysis

12.5 Porter’s Five Forces Analysis

12.6 Fluoropolymer Coatings, By Type

12.6.1 PTFE Coating

12.6.2 PVDF Coating

12.6.3 FEP Coatings

12.6.4 ETFE Coatings

12.6.5 Others

12.7 Fluoropolymer Coatings, By End-User Industry

12.7.1 Food Processing

12.7.2 Chemical Processing

12.7.3 Electrical and Electronics

12.7.4 Building & Construction

12.7.5 Others

12.8 Fluoropolymer Coatings Market, By Region

12.8.1 North America

12.8.2 Europe

12.8.3 Asia-Pacific

12.8.4 RoW

13 Epoxy Coatings (Page No. - 180)

13.1 Introduction

13.1.1 Market Segmentation

13.2 Market Dynamics

13.3 Value-Chain Analysis

13.4 Porter’s Five Forces Analysis

13.5 Epoxy Coatings Market, By Technology

13.5.1 Introduction

13.5.2 Water-Borne

13.5.3 Solvent-Borne

13.5.4 Powder-Based

13.6 Epoxy Coatings Market, By Application

13.6.1 Introduction

13.6.2 Construction

13.6.3 Transportation

13.6.4 General Industrial

13.6.5 Others

13.7 Epoxy Coatings Market, By Region

13.7.1 Asia-Pacific

13.7.2 North America

13.7.3 Europe

13.7.4 RoW

14 Competitive Landscape (Page No. - 192)

14.1 Paints and Coatings Market Share Analysis

15 Company Profiles (Page No. - 193)

(Overview, Financial*, Products & Services, Strategy, and Developments)

15.1 Akzonobel N.V.

15.2 PPG Industries, Inc.

15.3 The Sherwin-Williams Company

15.4 Axalta Coating Systems LLC

15.5 BASF SE

15.6 Progressive Painting Inc.

15.7 Jotun A/S

15.8 The DOW Chemical Company

15.9 Nippon Paint

15.10 Asian Paints Limited

*Details Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 196)

16.1 Knowledge Store: Marketsandmarkets Subscription Portal

16.2 Author Details

List of Tables (106 Tables)

Table 1 High Growth Paints and Coatings Market

Table 2 Market Segmentation, By Type

Table 3 Market Segmentation, By Application

Table 4 Market Segmentation, By Technology

Table 5 Elastomeric Coatings Market Size, By Type, 2014–2021 (Kiloton)

Table 6 Elastomeric Coatings Market Size, By Type, 2014–2021 (USD Million)

Table 7 Elastomeric Coatings Market Size, By Technology, 2014–2021 (Kiloton)

Table 8 Elastomeric Coatings Market Size, By Technology, 2014–2021 (USD Million)

Table 9 Elastomeric Coatings Market Size, By Application, 2014–2021 (Kiloton)

Table 10 Elastomeric Coatings Market Size, By Application, 2014–2021 (USD Million)

Table 11 Elastomeric Coatings Market Size, By Region, 2014–2021 (Kiloton)

Table 12 Elastomeric Coatings Market Size, By Region, 2014–2021 (USD Million)

Table 13 Polyurea Coatings Market Size, By Technology, 2014-2021 (USD Million)

Table 14 Polyurea Coatings Market Size, By Technology, 2014-2021 (Thousand Liter)

Table 15 Polyurea Coatings Market Size, By Application, 2014-2021 (USD Million)

Table 16 Polyurea Coatings Market, By Application, 2014-2021 (Thousand Liter)

Table 17 Polyurea Coatings Market, By Region, 2014-2021 (USD Million)

Table 18 Polyurea Coatings Market, By Region, 2014-2021 (Thousand Liter)

Table 19 Global UV Curable Coatings Composition Market, By Raw Material Type, 2014-2021 (Tons)

Table 20 Global UV Wood Coatings Market Size (Tons) & (USD Million), 2014-2021

Table 21 Global UV Plastic Coatings Market Size (Tons) & (USD Million), 2014-2021

Table 22 Global UV Over Print Varnish Coatings Market Size (Tons) & (USD Million), 2014-2021

Table 23 Global UV Display Coatings Market Size (Tons) & (USD Million), 2014-2021

Table 24 Global UV Conformal Coatings Market Size (Tons) & (USD Million), 2014-2021

Table 25 Global UV Paper Coatings Market Size (Tons) & (USD Million), 2014-2021

Table 26 Global Industrial UV Curable Coatings Market Size in (Tons) & (USD Million), 2014-2021

Table 27 Global Electronics UV Curable Coatings Market Size in (Tons) & (USD Million), 2014-2021

Table 28 Global UV Graphic Arts Curable Coatings Market Size in (Tons) & (USD Million), 2014-2021

Table 29 UV Curable Coatings Market, By Region, 2014-2021 (Tons)

Table 30 UV Curable Coatings Market, By Region, 2014-2021 (USD Million)

Table 31 Insulation Coatings Market Size, By End-Use Industry, 2014–2021 (Kiloton)

Table 32 Insulation Coatings Market Size, By End-Use Industry, 2014–2021 (USD Million)

Table 33 Insulation Coatings Market Size, By Resin Type, 2014–2021 (Kiloton)

Table 34 Insulation Coatings Market Size, By Resin Type, 2014–2021 (USD Million)

Table 35 Insulation Coatings Market Size, By Region, 2014–2021 (Kiloton)

Table 36 Insulation Coatings Market Size, By Region, 2014–2021 (USD Million)

Table 37 Ceramic Coatings Market Size, By Type, 2014-2021 (USD Million)

Table 38 Ceramic Coatings Market Size, By Type, 2014-2021 (Kiloton)

Table 39 Ceramic Coatings Market Size, By Technology, 2014-2021 (USD Million)

Table 40 Ceramic Coatings Market Size, By Technology, 2014-2021 (Kiloton)

Table 41 Ceramic Coatings Market Size, By Application, 2014-2021 (USD Million)

Table 42 Ceramic Coatings Market Size, By Application, 2014-2021 (Kiloton)

Table 43 Ceramic Coatings Market Size, By Region, 2014-2021 (USD Million)

Table 44 Ceramic Coatings Market Size, By Region, 2014-2021 (Kiloton)

Table 45 List of Major Suppliers of Automotive Coating Component/ Technology

Table 46 Automotive Coatings Market Size, By Resin Type, 2014–2021 (Kiloton)

Table 47 Automotive Coatings Market Size, By Resin Type, 2014–2021 (USD Million)

Table 48 Automotive Coatings Market Size, By Technology, 2014–2021 (Kiloton)

Table 49 Automotive Coatings Market Size, By Technology, 2014–2021 (USD Million)

Table 50 Automotive Coatings Market Size, By Coat Type, 2014–2021 (Kiloton)

Table 51 Automotive Coatings Market Size, By Coat Type, 2014–2021 (USD Million)

Table 52 Automotive Coatings Market Size, By Region, 2014–2021 (Kiloton)

Table 53 Automotive Coatings Market Size, By Region, 2014–2021 (USD Million)

Table 54 Market Segmentation of Medical Coatings, By Type

Table 55 Market Segmentation of Medical Coatings, By Application

Table 56 Medical Coatings Market Size, By Coating Type, 2014–2021 (USD Million)

Table 57 Medical Coatings Market Size , By Coating Type, 2014–2021 (Kiloton)

Table 58 Global Medical Coatings Market, By Application, 2014–2021 (USD Million)

Table 59 Global Medical Coatings Market, By Application, 2014–2021 (Kiloton)

Table 60 Silicone Coatings Market Size, By Composition Type, 2014–2021 (USD Million)

Table 61 Silicone Coatings Market Size, By Composition Type, 2014–2021 (Kiloton)

Table 62 Thermal Stability of Organic Substitutes on Silicone

Table 63 Silicone Coatings Market Size, By Technology, 2016–2021 (USD Million)

Table 64 Silicone Coatings Market Size, By Technology, 2016–2021 (Kiloton)

Table 65 Silicone Coatings Market Size, By Application, 2014–2021 (USD Million)

Table 66 Silicone Coatings Market Size, By Application, 2014–2021 (Kiloton)

Table 67 Silicone Coatings Market Size, By Region, 2014–2021 (USD Million)

Table 68 Silicone Coatings Market Size, By Region, 2014–2021 (Kiloton)

Table 69 Fluoropolymer Coatings, By Company & Its Brand

Table 70 Global PTFE Coatings Market Size (Tons) & (USD Million), 2014-2021

Table 71 Global PVDF Coatings Market Size (Tons) & (USD Million), 2014-2021

Table 72 Global FEP Coatings Market Size (Tons) & (USD Million), 2014-2021

Table 73 Global ETFE Coatings Market Size (Tons) & (USD Million), 2014-2021

Table 74 Global Other Fluoropolymer Coatings Market Size (Tons) & (USD Million), 2014-2021

Table 75 Global Fluoropolymer Coatings Market Size in the Food Processing Industry (Tons) & (USD Million), 2014-2021

Table 76 Global Fluoropolymer Coatings Market Size in the Chemical Processing Industry (Tons) & (USD Million), 2014-2021

Table 77 Global Fluoropolymer Coatings Market Size, By End User, Electrical and Electronics (Tons) & (USD Million), 2014-2021

Table 78 Global Fluoropolymer Coatings Market Size in Building & Construction (Tons) & (USD Million), 2014-2021

Table 79 Global Fluoropolymer Coatings Market Size in Other End-User Industries (Tons) & (USD Million), 2014-2021

Table 80 Fluoropolymer Coatings Market Size, By Region, 2014-2021 (Tons)

Table 81 Fluoropolymer Coatings Market Size, By Region, 2014-2021 (USD Million)

Table 82 North America: Fluoropolymer Coatings Market Size, By Type, 2014-2021 (Tons)

Table 83 North America: Fluoropolymer Coatings Market Size , By Type, 2014-2021 (USD Million)

Table 84 North America: Fluoropolymer Coatings Market Size, By End User, 2014-2021 (Tons)

Table 85 North America: Fluoropolymer Coatings Market Size, By End User, 2014-2021 (USD Million)

Table 86 Europe: Fluoropolymer Coatings Market Size, By Type, 2014-2021 (Tons)

Table 87 Europe: Fluoropolymer Coatings Market Size , By Type, 2014-2021 (USD Million)

Table 88 Europe: Fluoropolymer Coatings Market Size, By End User, 2014-2021 (Tons)

Table 89 Europe: Fluoropolymer Coatings Market Size, By End User, 2014-2021 (USD Million)

Table 90 Asia Pacific: Fluoropolymer Coatings Market Size, By Type, 2014-2021 (Tons)

Table 91 Asia Pacific: Fluoropolymer Coatings Market Size, By Type, 2014-2021 (USD Million)

Table 92 Asia-Pacific: Fluoropolymer Coatings Market Size, By End User, 2014-2021 (Tons)

Table 93 Asia-Pacific: Fluoropolymer Coatings Market Size, By End User, 2014-2021 (USD Million)

Table 94 RoW: Fluoropolymer Coatings Market Size, By Type, 2014-2021 (Tons)

Table 95 RoW: Fluoropolymer Coatings Market Size, By Type, 2014-2021 (USD Million)

Table 96 RoW: Fluoropolymer Coatings Market Size, By End User, 2014-2021 (Tons)

Table 97 RoW: Fluoropolymer Coatings Market Size, By End User, 2014-2021 (USD Million)

Table 98 Market Segmentation, By Technology

Table 99 Epoxy Coatings Market Segmentation

Table 100 Epoxy Coatings Market Size, By Technology, 2014–2021 (Kiloton)

Table 101 Epoxy Coatings Market Size, By Technology, 2014–2021 (USD Million)

Table 102 Traditional Formulation Solvent Used for Each Resin Type

Table 103 Epoxy Coatings Market Size, By Application, 2014–2021 (Kiloton)

Table 104 Epoxy Coatings Market Size, By Application, 2014–2021 (USD Million)

Table 105 Epoxy Coatings Market Size, By Region, 2014–2021 (Kiloton)

Table 106 Epoxy Coatings Market Size, By Region, 2014–2021 (USD Million)

List of Figures (53 Figures)

Figure 1 Bottom-Up Approach

Figure 2 Top-Down Approach

Figure 3 Market Breakdown: Data Triangulation

Figure 4 Limitations of the Research Study

Figure 5 Acrylic-Based Paints and Coatings to Account for A Significant Share in the Global Paints and Coatings Market By 2021

Figure 6 Elastomeric Coatings Market, By Region

Figure 7 Drivers, Restraints, Opportunities, and Challenges for the Elastomeric Coatings Market

Figure 8 Value Chain Analysis

Figure 9 Porter’s Five Forces Analysis

Figure 10 Polyurea Coatings, By Region

Figure 11 Drivers, Restraints, Opportunities, and Challenges

Figure 12 Polyurea Coatings Value Chain Analysis

Figure 13 Porter’s Five Forces Analysis

Figure 14 Increasing Demand From Emerging Markets is Expected to Propel UV Curable Coatings Market Growth

Figure 15 Overview of UV Curable Coatings Value Chain

Figure 16 Porter’s Five Forces Analysis of the UV Curable Coatings Market

Figure 17 Mapping of UV Curable Coatings Type Under End-User Industries

Figure 18 Insulation Coatings Market: By Type

Figure 19 Insulation Coatings Market: By End Use

Figure 20 Insulation Coatings Market Segmentation, By Region

Figure 21 Value Chain Analysis: Insulation Coatings Market

Figure 22 Porter’s Five Forces Analysis of Insulation Coatings Market

Figure 23 Ceramic Coatings Market, By Application

Figure 24 Ceramic Coatings Market, By Type

Figure 25 Ceramic Coatings Market, By Technology

Figure 26 Ceramic Coatings: Market Dynamics

Figure 27 Value Chain: Ceramic Coatings Suppliers/ Distributors Act as A Bridge

Figure 28 Ceramic Coatings: Porter’s Five Forces Analysis

Figure 29 Ceramic Coatings Market, By Type

Figure 30 Drivers, Restraints, Opportunities, and Challenges for the Automotive Coatings Market

Figure 31 Value Chain: Automotive Coatings

Figure 32 Porter’s Five Forces Analysis

Figure 33 Other Resins and Their Properties

Figure 34 Automotive Coating Technologies

Figure 35 Powder Coating: Types

Figure 36 Market Segmentation of Medical Coatings, By Region

Figure 37 Growing Demand for Implantable Devices is Expected to Drive the Market

Figure 38 Value Chain Analysis: Direct Distribution is the Most Preferred Strategy

Figure 39 Porter’s Five Forces Analysis

Figure 40 Silicone Coatings Market, By Region

Figure 41 Drivers, Restraints, Opportunities, and Challenges

Figure 42 Silicone Coatings Value Chain Analysis

Figure 43 Porter’s Five Forces Analysis

Figure 44 Fluoropolymer Coatings Market Segmentation, By Type

Figure 45 Fluoropolymer Coatings Market, By End User

Figure 46 Increasing Demand From Emerging Markets Drives the Fluoropolymer Coatings Market Growth

Figure 47 Overview of the Fluoropolymer Coatings Value Chain

Figure 48 Porter’s Five Forces Analysis of the Fluoropolymer Coatings Market

Figure 49 Drivers, Restrains, Opportunities, and Challenges in the Epoxy Coatings Market

Figure 50 Overview of Value Chain of the Epoxy Coatings Market

Figure 51 Porter’s Five Forces Analysis of the Epoxy Coatings Market

Figure 52 Types of Water-Borne Coatings

Figure 53 Paints and Coatings Market Share, By Key Players, 2015

Growth opportunities and latent adjacency in Top 10 High Growth Paints & Coatings Market