Submersible Pumps Market by Type (Electric, Hydraulic, Air-Driven), Application (Open Pit, Borewell), Operation (Single-stage, Multi-stage), Power Rating (<1, 1-5, 5-15, >15 HP), Sector (Industrial, Agricultural, Domestic), Region - Global Forecasts to 2025

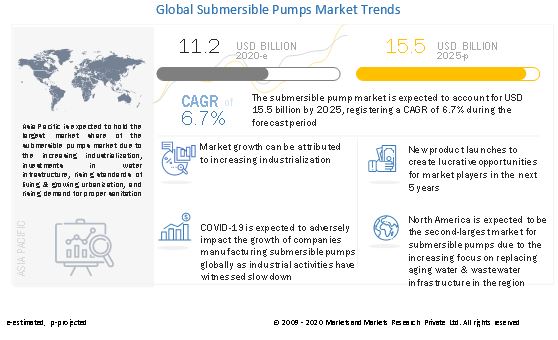

[211 Pages Report] The global Submersible Pumps Market in terms of revenue was estimated to be worth $11.2 billion in 2020 and is poised to reach $15.5 billion by 2025, growing at a CAGR of 6.7% from 2020 to 2025. Increasing investments in construction industry attributing to rapid urbanization, and high demand for submersible pumps in the agricultural sector are the key factors driving the growth of the submersible pumps market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the global submersible pumps market

The outbreak of the COVID-19 pandemic has slowed the growth of the submersible pump market. This slowdown is mainly due to economic contractions, resulted from a halt in investments from various end-use industries. For instance, in the mining industry, the ongoing impact of the COVID-19 pandemic remains uncertain; with every passing day, the crisis is adversely affecting the supply chains and demand for commodities. Significant price drops were observed across major commodities, while in some cases, prices remain to be passive. For example, demand for metallurgical coal and thermal coal has decreased, while demand for gold and iron ore has increased. With the rising COVID-19 cases worldwide, the market growth for mining has remained slow as mining companies do not have permission to operate their mines with full labor strength. The current market scenario projects that recovery of the mining industry would take approximately 2–3 years. With slowing mining activities worldwide, the demand for submersible pumps has declined as well.

Furthermore, the spread of COVID-19 is likely to adversely affect the business of companies manufacturing submersible pumps due to the global shutdown and supply chain disruptions. The order intake for the manufacturing companies has witnessed a decline in 2020 compared to the Q1 and Q2 of 2019. Also, the price for procuring raw materials is expected to increase due to the shortage of supply, which ultimately will lead to delay in order closures.

Submersible pumps market Dynamics

Driver: Increasing investments in construction industry attributed to rapid urbanization

Investments in the construction industry are playing a vital role in the growth of the global and regional economies. It is expected that spending on capital projects and infrastructure will grow significantly in the next decade. China, India, Indonesia, and other countries of Asia Pacific are highly investing in infrastructure development. For instance, in Indonesia, infrastructure spending is projected to reach USD 165 billion by 2025. Sufficient infrastructure investment is required for modernization and commercialization. In addition, increasing urbanization in emerging markets is expected to boost the investments in major sectors, such as water & wastewater treatment and power, which is consequently expected to drive the growth of the submersible pumps market.

Restraints: Motor failure and high troubleshooting cost

The motors of submersible pumps are extremely reliable when applied within their design limits of temperature, hydraulic loading, and power requirements. Typical agricultural, domestic, and municipal systems are excellent applications for these motors. Unfortunately, these motors are often used in applications that unknowingly exceed the design criteria of motors. As a result, failures occur, and the advantages of submersible motors are lost or quickly forgotten. Submersible motors are most commonly affected by high temperature, which includes pumping hot water, overloading of the motor by the pump, loss of cooling flow past in the motor, scale buildup, and frequent engine on and off. The troubleshooting cost of such failures is high, and it reduces the pump’s life because of repairs and re-installations. Thus, the failure of pump motors and the associated cost of troubleshooting act as a restraint for the growth of the submersible pumps market.

Opportunities: Upgradation of aging and construction of new water & wastewater treatment facilities

The water & wastewater treatment facilities in the developed countries are aging and are shifting toward the end of the operational lifecycle. High investments are required in reinstalling and upgrading the old infrastructure to overcome this situation. On the other hand, several emerging economies still do not have adequate access to drinking water and have just started building upgraded water infrastructure. Such initiatives to upgrade aging infrastructure is likely to create lucrative growth opportunities for the submersible pumps market.

Water & wastewater treatment systems have an operational life of about 70–80 years, and in many instances, the water & wastewater treatment plants have reached the end of their shelf life. This factor also demands high investments in repairing and upgrading the aging water infrastructure. The renovation or rebuilding of aging water plants will help in the supply of fresh water; however, lower installation and upgrading of new equipment and system to replace the old infrastructure are expected.

Challenges: High competition from local and regional players

Local and regional players offering submersible pumps pose a serious challenge to brand owners by providing cheap alternatives and maintenance services at a low cost. This unorganized sector can overpower market giants with its price competitiveness and local supply network. In developing countries such as India and China, cost is a major parameter during procurement, which provides opportunities for local players to offer substitutes and similar products at a comparatively lower cost. Also, due to their proximity, local players are more capable of responding to customer requirements early, which acts as an additional add-on during purchases. This restricts the entry of global players in the local market and presents a challenge in the submersible pumps market.

To know about the assumptions considered for the study, download the pdf brochure

By type, the electric segment is the largest contributor in the submersible pumps market in 2019.

The electrical submersible segment held a largest market size as these pumps can handle both solids & liquids and are used across numerous sectors to boost production. Electrical submersible pumps, commonly known as ESPs, are typically used to pump liquid. ESPs are centrifugal pumps with vertical shafts that depend on rotating impellers to pressurize the fluid. They use an electric motor to drive the pump, which helps in increasing the fluid’s kinetic energy. ESPs are used in different sectors, such as industrial, agricultural, and domestic. For instance, in the oil & gas industry, electrical submersible pumps are used to increase the flow of fluids from wells when a reservoir does not have enough energy to produce at economical rates naturally, and boost production to improve financial performance. The growth of this segment is due to its increasing demand attributed to high reliability and efficiency, and as it never has to be primed as it is already submerged in the fluid.

By application, open pit segment is expected to be the largest contributor during the forecast period.

Open pit submersible pump does not require a separate foundation or a pump house; it operates directly under submerged conditions. The pump is submerged in an underground reservoir or tank and is connected to the electrical supply for operation. The rotary energy of the impeller is converted into kinetic energy of water, which lifts the water to the desired levels. Open pit submersible pumps are expected witness the highest demand from industrial applications, particularly from the water supply and treatment sector, as well as the mining and construction industries, where they play an important role in dewatering open pits.

By operation, the single-stage segment is expected to be the largest contributor during the forecast period.

Single-stage submersible pump has only one impeller installed inside it and is designed as a relatively low head or low flow submersible pump. It is mostly used for sewage pumping, domestic, general industrial pumping, and slurry pumping. It is the most commonly used type of submersible pump and suitable for use when the total dynamic head (TDH) is low-to-moderate. The reliability and low maintenance costs of single-stage pumps in applications with moderate dynamic heads such as water pumping stations, which are some of the most common applications of submersible pumps, are expected to boost their demand for single-stage pumps across the globe.

By power rating, the 5–15 hp segment is expected to be the largest contributor during the forecast period.

5–15 hp submersible pumps market is expected to hold the largest share of the submersible pumps market during the forecast period. They are used for numerous applications in the industrial, agricultural, and domestic sectors. 5–15 hp submersible pumps have higher electrical and mechanical efficiency. It helps in reducing energy consumption significantly and efficiently address electric overload issues caused due to fluctuating power supply. The submersible pumps available in this range can be used for several applications, namely, industrial water supply, water treatment plants, agricultural, residential complexes, commercial buildings, and for several other industrial uses.

By sector, the industrial segment is expected to be the largest contributor during the forecast period.

The industrial sector includes industries such as water & wastewater, mining & construction, energy & power, and others. Others includes chemical & pharmaceutical, pulp & paper, and food & beverage industries. Submersible pumps are used for dewatering activities in construction sites, production activities in oilfields (artificial lift), and water and sewage treatment plants, as well as in the manufacturing plants and sand, sludge & slurry removal in mines. The submersible pumps market is expected to witness most of its demand from the industrial sector in the next 5 years, especially from Asia Pacific, which is quickly becoming the center of global economic growth in terms of production as well as consumption.

Asia Pacific is expected to account for the largest market size during the forecast period.

Asia Pacific region has been segmented, by country, into China, India, Australia, Indonesia, Japan, and Rest of Asia Pacific. Rest of Asia Pacific includes Malaysia, Thailand, Philippines, and South Korea. The region’s domination can be attributed to rapid economic expansion. The region is attracting investors to set up production facilities because of the availability of raw materials and labor at lower prices. Industrial activities are growing due to low manufacturing costs and the support of the local governments. Increasing investments in R&D is also one of the factors driving the submersible pumps market in Asia Pacific. According to the World Bank, Asia Pacific is the fastest-growing region in the world, experiencing continued economic growth. The International Monetary Fund (IMF) has deemed China and India to be two of the fastest-growing economies in the world. This is expected to increase industrial activities and population, which will, in turn, play a significant role in driving the demand for water & wastewater treatment plants and further boost the submersible pumps market in the region.

Key Market Players

Some of the key players are Xylem (US), Sulzer (Switzerland), KSB Group (Germany), Grundfos (Denmark), and Atlas Copco (Sweden). The leading players are adopting various strategies to increase their share in the submersible pumps market.

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, Application, Operation, Power Rating, Sector, and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

Xylem (US), Sulzer (Switzerland), KSB Group (Germany), Grundfos (Denmark), and Atlas Copco (Sweden), Tsurumi Manufacturing (Japan), Grindex (Sweden), Flowserve (US), Wilo (Germany), Vansan (Turkey), SAER Elettropompe (Italy), Pleuger (Germany), C.R.I. Pumps (India), PRORIL (Taiwan), HOMA (US), LEO (China), EBARA Corporation (Japan), BJM Pumps (US), Mody Pumps (US), SPT Pumpen (Germany), and HCP (Taiwan) |

This research report categorizes the submersible pumps market-based on type, application, operation, power rating, sector, and region

Based on Type, the submersible pumps market has been segmented as follows:

- Electrical

- Hydraulic

- Air-Driven

Based on application, the submersible pumps market has been segmented as follows:

- Open Pit

- Borewell

Based on operation, the submersible pumps market has been segmented as follows:

- Single-stage

- Multi-stage

Based on power rating, the submersible pumps market has been segmented as follows:

- Below 1 HP

- 1–5 HP

- 5–15 HP

- Above 15 HP

Based on sector, the submersible pumps market has been segmented as follows:

-

Industrial

- Water & Wastewater

- Mining & Construction

- Energy & Power

- Others

- Agricultural

- Domestic

Based on the region, the submersible pumps market has been segmented as follows:

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Recent Developments

- In November 2020, Sulzer was awarded a contract from Ringkøbing-Skjern Forsyning A/S (a Danish water utility) to provide pumps for a major flood defense project in Denmark. Two new pumping stations have been constructed to mitigate the impact of rising water levels during rain, drainage, and cloudburst water. Sulzer will supply one XFP baseload pump and three VUPX peak load pumps for the Ringkøbing pumping station, together with one XFP baseload pump and four VUPX peak load pumps for the adjacent Skælbækker station.

- In May 2020, Wilo expanded its presence with the establishment of a new headquarter and production facility in Cedarburg, Wisconsin, US. The new headquarters will bring the combined operations of Wilo USA, Weil Pump, Scot Pump, and Wilo Machine Co. to a single production site.

- In April 2020, Pleuger has expanded its presence in Singapore to strengthen its footprint in the Asian market.

- In July 2019, Xylem launched a new product, Flygt N3069 stainless steel submersible pump. It is specifically manufactured for industrial processes containing high chloride or extreme pH levels and helps in corrosion resistance.

- In January 2019, Atlas Copco introduced a wide range of high-quality electric submersible pumps designed specifically for drainage, sludge, and slurry pumping applications. The pumps help in preventing product failure, human errors, sudden loss of voltage, and overheating.

Frequently Asked Questions (FAQ):

What is the current size of the submersible pumps market?

The current market size of global submersible pumps market is billion 11.2 in 2020.

What is the major drivers for submersible pumps market?

Increasing investments in construction industry attributing to rapid urbanization and high demand for submersible pumps in agricultural sector are the key factors driving the growth of the submersible pumps market.

Which is the fastest growing region during the forecasted period in submersible pumps market?

Asia Pacific is the fastest growing region during the forecasted period owing to rapid economic expansion, availability of raw materials and labor at lower prices, and increasing investments in R&D across various industries in the region.

Which is the fastest growing segment, by type during the forecasted period in submersible pumps market?

The electrical segment, by type is the fastest growing segment during the forecasted period owing to its high reliability and efficiency, and as it never has to be primed as it is already submerged in the fluid. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.3.1 SUBMERSIBLE PUMPS MARKET, BY SECTOR: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION

1.4.2 REGIONAL SCOPE

1.5 YEARS CONSIDERED

1.6 CURRENCY

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 1 SUBMERSIBLE PUMPS MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Breakdown of primaries

FIGURE 3 PRIMARY BREAKDOWN

2.3 SCOPE

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4.3 IDEAL DEMAND SIDE ANALYSIS

2.4.3.1 Assumptions for demand side analysis

2.4.3.2 Demand side calculation

2.4.4 SUPPLY SIDE ANALYSIS

FIGURE 6 MAIN METRICS CONSIDERED IN ASSESSING SUPPLY FOR MARKET

2.4.4.1 Supply side calculation

2.4.4.2 Assumptions

FIGURE 7 MARKET RANKING & INDUSTRY CONCENTRATION, 2019

2.4.5 FORECAST

2.5 PRIMARY INSIGHTS

3 EXECUTIVE SUMMARY (Page No. - 44)

3.1 SCENARIO ANALYSIS

FIGURE 8 SCENARIO ANALYSIS: MARKET, 2018–2025

3.1.1 OPTIMISTIC SCENARIO

3.1.2 REALISTIC SCENARIO

3.1.3 PESSIMISTIC SCENARIO

TABLE 1 SUBMERSIBLE PUMPS MARKET SNAPSHOT

FIGURE 9 ASIA PACIFIC DOMINATED MARKET IN 2019

FIGURE 10 ELECTRICAL SEGMENT TO CONTINUE TO HOLD LARGEST SHARE OF MARKET, BY TYPE, DURING FORECAST PERIOD

FIGURE 11 OPEN PIT SEGMENT TO HOLD LARGEST SHARE OF MARKET, BY APPLICATION, DURING FORECAST PERIOD

FIGURE 12 SINGLE-STAGE SEGMENT TO ACCOUNT FOR LARGER SHARE OF MARKET, BY OPERATION, DURING FORECAST PERIOD

FIGURE 13 5–15 HP SEGMENT TO CONTINUE TO HOLD LARGER SHARE OF MARKET, BY POWER RATING, DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN SUBMERSIBLE PUMPS MARKET

FIGURE 14 INCREASING INVESTMENTS IN UPGRADATION OF AGEING INDUSTRIAL INFRASTRUCTURE AND RAPID URBANIZATION TO DRIVE GROWTH OF MARKET DURING 2020–2025

4.2 MARKET, BY REGION

FIGURE 15 MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET IN ASIA PACIFIC, BY SECTOR & COUNTRY

FIGURE 16 INDUSTRIAL SECTOR AND CHINA HELD LARGEST SHARES OF MARKET IN ASIA PACIFIC IN 2019

4.4 MARKET, BY TYPE

FIGURE 17 ELECTRICAL SEGMENT TO CONTINUE TO DOMINATE MARKET, BY TYPE, BY 2025

4.5 MARKET, BY APPLICATION

FIGURE 18 OPEN PIT SEGMENT TO DOMINATE MARKET,BY APPLICATION, BY 2025

4.6 MARKET, BY OPERATION

FIGURE 19 SINGLE-STAGE SEGMENT TO DOMINATE MARKET, BY OPERATION, BY 2025

4.7 MARKET, BY POWER RATING

FIGURE 20 5–15 HP SEGMENT TO HOLD LARGEST SHARE OF MARKET, BY POWER RATING, BY 2025

4.8 MARKET, BY SECTOR

FIGURE 21 INDUSTRIAL SEGMENT TO HOLD LARGEST SHARE OF MARKET, BY SECTOR, BY 2025

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 22 COVID-19 GLOBAL PROPAGATION

FIGURE 23 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 24 RECOVERY ROAD FOR 2020

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 25 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 26 SUBMERSIBLE PUMPS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Increasing investments in construction industry attributed to rapid urbanization

5.5.1.2 High demand for submersible pumps in agricultural sector

5.5.2 RESTRAINTS

5.5.2.1 Motor failure and high troubleshooting cost

FIGURE 27 PUMP LIFE CYCLE COST

5.5.3 OPPORTUNITIES

5.5.3.1 Adoption of solar-powered submersible pumps

5.5.3.2 Upgradation of aging and construction of new water & wastewater treatment facilities

5.5.4 CHALLENGES

5.5.4.1 High competition from local and regional players

5.5.4.2 Impact of COVID-19 on market

5.6 TARIFF AND REGULATORY LANDSCAPE

TABLE 2 CLEAN WATER ACT (CWA): REGULATORY PROGRAMS FOR WASTEWATER TREATMENT

5.7 YC SHIFT

5.7.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR SUBMERSIBLE PUMP MANUFACTURERS

FIGURE 28 REVENUE SHIFT FOR MARKET

5.8 MARKET MAP

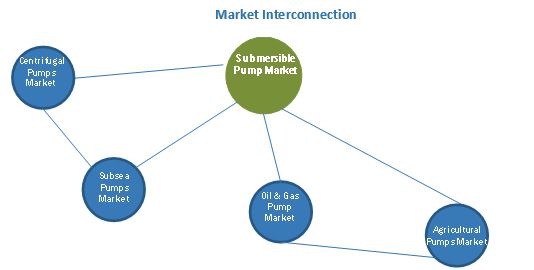

FIGURE 29 ADJACENT AND INTERCONNECTED MARKETS

5.9 SUPPLY CHAIN ANALYSIS

FIGURE 30 SUBMERSIBLE PUMPS MARKET SUPPLY CHAIN ANALYSIS

5.9.1 RAW MATERIAL SUPPLIERS

5.9.2 MANUFACTURING

5.9.3 END USERS

5.1 TECHNOLOGY ANALYSIS

5.11 TRADE ANALYSIS

5.11.1 EXPORT DATA ANALYSIS

TABLE 3 EXPORT DATA: CENTRIFUGAL PUMPS, BY VALUE, 2019

5.11.2 IMPORT DATA ANALYSIS

TABLE 4 IMPORT DATA: CENTRIFUGAL PUMPS, BY VALUE, 2019

5.12 AVERAGE SELLING PRICE TREND

TABLE 5 AVERAGE SELLING PRICE FOR SUBMERSIBLE PUMPS

5.13 CASE STUDY ANALYSIS

5.13.1 INSTALLATION OF SUBMERSIBLE PUMPS INCREASED PUMPING EFFICIENCY AT SEPON COPPER MINE

6 IMPACT OF COVID-19 ON MARKET, SCENARIO ANALYSIS, BY REGION (Page No. - 67)

6.1 INTRODUCTION

6.2 OPTIMISTIC SCENARIO

TABLE 6 OPTIMISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3 REALISTIC SCENARIO

TABLE 7 REALISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD MILLION)

6.4 PESSIMISTIC SCENARIO

TABLE 8 PESSIMISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD MILLION)

7 SUBMERSIBLE PUMPS MARKET, BY TYPE (Page No. - 70)

7.1 INTRODUCTION

FIGURE 31 ELECTRICAL SEGMENT DOMINATED MARKET IN 2019

TABLE 9 MARKET, BY TYPE, 2018–2025 (USD MILLION)

7.2 ELECTRICAL

7.2.1 HIGH EFFICIENCY AND ABILITY TO SAVE PUMP’S ENERGY IS FUELING DEMAND FOR ELECTRICAL SUBMERSIBLE PUMPS

TABLE 10 ELECTRICAL: MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 ELECTRICAL: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

7.3 HYDRAULIC

7.3.1 INCREASING DEMAND FOR UNATTENDED OPERATIONS TO BOOST DEMAND FOR HYDRAULIC SUBMERSIBLE PUMPS

TABLE 12 HYDRAULIC: MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 HYDRAULIC: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

7.4 AIR-DRIVEN

7.4.1 GROWING USE OF SUBMERSIBLE PUMPS IN HAZARDOUS & RESTRICTED AREAS

TABLE 14 AIR-DRIVEN: MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 15 AIR-DRIVEN: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

8 SUBMERSIBLE PUMPS MARKET, BY APPLICATION (Page No. - 75)

8.1 INTRODUCTION

FIGURE 32 OPEN PIT SEGMENT DOMINATED MARKET IN 2019

TABLE 16 MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

8.2 OPEN PIT

8.2.1 HIGH EFFICIENCY AND INCREASING INVESTMENTS IN SEVERAL SECTORS TO DRIVE GROWTH OF OPEN PIT SEGMENT

TABLE 17 OPEN PIT: MARKET, BY REGION,2018–2025 (USD MILLION)

TABLE 18 OPEN PIT: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 19 OPEN PIT: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

TABLE 20 OPEN PIT: MARKET, BY USAGE, 2018–2025 (USD MILLION

8.2.2 BY USAGE

8.2.2.1 Sewage

TABLE 21 SEWAGE: OPEN PIT MARKET, BY REGION, 2018–2025 (USD MILLION)

8.2.2.2 Dewatering

TABLE 22 DEWATERING: OPEN PIT MARKET, BY REGION, 2018–2025 (USD MILLION)

8.2.2.3 Transferring/pumping

TABLE 23 TRANSFERRING/PUMPING: OPEN PIT MARKET, BY REGION, 2018–2025 (USD MILLION)

8.3 BOREWELL

8.3.1 INCREASING DEMAND FOR ELECTRICAL SUBMERSIBLE PUMPS

TABLE 24 BOREWELL: MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 BOREWELL: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 26 BOREWELL: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

9 SUBMERSIBLE PUMPS MARKET, BY OPERATION (Page No. - 83)

9.1 INTRODUCTION

FIGURE 33 SINGLE-STAGE SEGMENT DOMINATED MARKET IN 2019

TABLE 27 MARKET, BY OPERATION, 2018–2025 (USD MILLION)

9.2 SINGLE-STAGE

9.2.1 INCREASING INVESTMENTS IN SEWAGE TREATMENT TO DRIVE GROWTH OF SEGMENT

TABLE 28 SINGLE-STAGE: MARKET, BY REGION, 2018–2025 (USD MILLION)

9.3 MULTI-STAGE

9.3.1 HIGH PRESSURE RANGES OF MULTI-STAGE PUMPS TO INCREASE THEIR DEMAND

TABLE 29 MULTI-STAGE: MARKET, BY REGION, 2018–2025 (USD MILLION)

10 SUBMERSIBLE PUMPS MARKET, BY POWER RATING (Page No. - 87)

10.1 INTRODUCTION

FIGURE 34 5–15 HP SUBMERSIBLE PUMP DOMINATED MARKET IN 2019

TABLE 30 MARKET, BY POWER RATING, 2018–2025 (USD MILLION)

10.2 BELOW 1 HP

10.2.1 RISE IN DEMAND IN DOMESTIC SECTOR TO EXTRACT UNDERGROUND WATER

TABLE 31 BELOW 1 HP: MARKET, BY REGION, 2018–2025 (USD MILLION)

10.3 1–5 HP

10.3.1 HIGH OPERATING EFFICIENCY TO FUEL DEMAND FOR 1–5 HP SUBMERSIBLE PUMPS

TABLE 32 1–15 HP: MARKET, BY REGION, 2018–2025 (USD MILLION)

10.4 5–15 HP

10.4.1 RESISTANCE TO HIGH VOLTAGE FLUCTUATIONS IS FUELING THEIR DEMAND

TABLE 33 5–15 HP: MARKET, BY REGION, 2018–2025 (USD MILLION)

10.5 ABOVE 15 HP

10.5.1 HIGH EFFICIENCY AND RESISTANT TO CORROSION

TABLE 34 ABOVE 15 HP: MARKET, BY REGION, 2018–2025 (USD MILLION)

11 SUBMERSIBLE PUMPS MARKET, BY SECTOR (Page No. - 92)

11.1 INTRODUCTION

FIGURE 35 INDUSTRIAL SECTOR DOMINATED MARKET IN 2019

TABLE 35 MARKET, BY SECTOR, 2018–2025 (USD MILLION)

11.2 INDUSTRIAL

11.2.1 INCREASING INVESTMENTS TO BOOST PRODUCTIVITY

TABLE 36 INDUSTRIAL: MARKET, BY REGION,2018–2025 (USD MILLION)

TABLE 37 INDUSTRIAL: MARKET, BY INDUSTRY, 2018–2025 (USD MILLION)

11.2.1.1 Water & wastewater

TABLE 38 WATER & WASTEWATER: MARKET, BY REGION, 2018–2025 (USD MILLION)

11.2.1.2 Mining & construction

TABLE 39 MINING & CONSTRUCTION: MARKET, BY REGION, 2018–2025 (USD MILLION)

11.2.1.3 Energy & Power

TABLE 40 ENERGY & POWER: MARKET, BY REGION, 2018–2025 (USD MILLION)

11.2.1.4 Others

TABLE 41 OTHER: MARKET, BY REGION, 2018–2025 (USD MILLION)

11.3 AGRICULTURAL

11.3.1 GROWTH IN AGRICULTURAL PRODUCTION TO BOOST DEMAND FOR SUBMERSIBLE PUMPS

TABLE 42 AGRICULTURE: MARKET, BY REGION, 2018–2025 (USD MILLION)

11.4 DOMESTIC

11.4.1 INCREASING DEMAND FOR GROUNDWATER EXTRACTION

TABLE 43 DOMESTIC: MARKET, BY REGION, 2018–2025 (USD MILLION)

12 SUBMERSIBLE PUMPS MARKET, BY REGION (Page No. - 99)

12.1 INTRODUCTION

FIGURE 36 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 37 ASIA PACIFIC DOMINATED MARKET IN 2019

TABLE 44 MARKET, BY REGION, 2018–2025 (USD MILLION)

12.2 ASIA PACIFIC

FIGURE 38 SNAPSHOT OF ASIA PACIFIC MARKET

12.2.1 BY TYPE

TABLE 45 ASIA PACIFIC: MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.2.1.1 Type, by application

TABLE 46 ASIA PACIFIC: ELECTRICAL MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 47 ASIA PACIFIC: HYDRAULIC MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 48 ASIA PACIFIC: AIR-DRIVEN MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

12.2.2 APPLICATION

TABLE 49 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

12.2.2.1 Application, by type

TABLE 50 ASIA PACIFIC: OPEN PIT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 51 ASIA PACIFIC: BOREWELL MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.2.2.2 Open pit, by usage

TABLE 52 ASIA PACIFIC: OPEN PIT MARKET, BY USAGE, 2018–2025 (USD MILLION)

12.2.2.3 Application, by sector

TABLE 53 ASIA PACIFIC: OPEN PIT MARKET, BY SECTOR, 2018–2025 (USD MILLION)

TABLE 54 ASIA PACIFIC: BOREWELL MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.2.3 BY SECTOR

TABLE 55 ASIA PACIFIC: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

TABLE 56 ASIA PACIFIC: MARKET, BY INDUSTRY, 2018–2025 (USD MILLION)

12.2.4 BY OPERATION

TABLE 57 ASIA PACIFIC: MARKET, BY OPERATION, 2018–2025 (USD MILLION)

12.2.5 BY POWER RATING

TABLE 58 ASIA PACIFIC: MARKET, BY POWER RATING, 2018–2025 (USD MILLION)

12.2.6 BY COUNTRY

TABLE 59 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

12.2.6.1 China

12.2.6.1.1 Investments to increase power generation capacities driving market

12.2.6.1.2 By sector

TABLE 60 CHINA: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.2.6.2 India

12.2.6.2.1 Growth in industrialization along with government support policies to drive demand

12.2.6.2.2 By sector

TABLE 61 INDIA: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.2.6.3 Japan

12.2.6.3.1 Adoption of modern technologies to boost productivity likely to drive market demand

12.2.6.3.2 By sector

TABLE 62 JAPAN: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.2.6.4 Australia

12.2.6.4.1 Growth in water & wastewater treatment plants and agricultural productivity contributes toward market growth

12.2.6.4.2 By sector

TABLE 63 AUSTRALIA: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.2.6.5 Indonesia

12.2.6.5.1 Growth in water & wastewater treatment plants and agricultural productivity contributes toward market growth

12.2.6.5.2 By sector

TABLE 64 INDONESIA: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.2.6.6 Rest of Asia Pacific

12.2.6.6.1 By sector

TABLE 65 REST OF ASIA PACIFIC: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.3 NORTH AMERICA

FIGURE 39 SNAPSHOT OF NORTH AMERICA MARKET

12.3.1 BY TYPE

TABLE 66 NORTH AMERICA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.3.1.1 Type, by application

TABLE 67 NORTH AMERICA: ELECTRICAL MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 68 NORTH AMERICA: HYDRAULIC MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 69 NORTH AMERICA: AIR-DRIVEN MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

12.3.2 BY APPLICATION

TABLE 70 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

12.3.2.1 Application, by type

TABLE 71 NORTH AMERICA: OPEN PIT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 72 NORTH AMERICA: BOREWELL MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.3.2.2 Open pit, by usage

TABLE 73 NORTH AMERICA: OPEN PIT MARKET, BY USAGE, 2018–2025 (USD MILLION)

12.3.2.3 Application, by sector

TABLE 74 NORTH AMERICA: OPEN PIT MARKET, BY SECTOR, 2018–2025 (USD MILLION)

TABLE 75 NORTH AMERICA: BOREWELL MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.3.3 BY SECTOR

TABLE 76 NORTH AMERICA: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY INDUSTRY,2018–2025 (USD MILLION)

12.3.4 BY OPERATION

TABLE 78 NORTH AMERICA: MARKET, BY OPERATION, 2018–2025 (USD MILLION)

12.3.5 BY POWER RATING

TABLE 79 NORTH AMERICA: MARKET, BY POWER RATING, 2018–2025 (USD MILLION)

12.3.6 BY COUNTRY

TABLE 80 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

12.3.6.1 US

12.3.6.1.1 Modernization of aging industrial infrastructure to fuel demand for submersible pumps

12.3.6.1.2 By sector

TABLE 81 US: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.3.6.2 Canada

12.3.6.2.1 Strong presence of water & wastewater treatment facilities and mining industry drives demand

12.3.6.2.2 By sector

TABLE 82 CANADA: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.3.6.3 Mexico

12.3.6.3.1 Growing industrialization boosting market

12.3.6.3.2 By sector

TABLE 83 MEXICO: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.4 EUROPE

12.4.1 BY TYPE

TABLE 84 EUROPE: MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.4.1.1 Type, by application

TABLE 85 EUROPE: ELECTRICAL MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 86 EUROPE: HYDRAULIC MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 87 EUROPE: AIR-DRIVEN MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

12.4.2 BY APPLICATION

TABLE 88 EUROPE: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

12.4.2.1 Application, by type

TABLE 89 EUROPE: OPEN PIT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 90 EUROPE: BOREWELL MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.4.2.2 Open pit, by usage

TABLE 91 EUROPE: OPEN PIT MARKET, BY USAGE, 2018–2025 (USD MILLION)

12.4.2.3 Application, by sector

TABLE 92 EUROPE: OPEN PIT MARKET, BY SECTOR, 2018–2025 (USD MILLION)

TABLE 93 EUROPE: BOREWELL MARKET, BY SECTOR,2018–2025 (USD MILLION)

12.4.3 BY SECTOR

TABLE 94 EUROPE: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

TABLE 95 EUROPE: MARKET, BY INDUSTRY, 2018–2025 (USD MILLION)

12.4.4 BY OPERATION

TABLE 96 EUROPE: MARKET, BY OPERATION, 2018–2025 (USD MILLION)

12.4.5 BY POWER RATING

TABLE 97 EUROPE: MARKET, BY POWER RATING, 2018–2025 (USD MILLION)

12.4.6 BY COUNTRY

TABLE 98 EUROPE: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

12.4.6.1 UK

12.4.6.1.1 Rising adoption of submersible pumps in industrial sector boost market growth

12.4.6.1.2 By sector

TABLE 99 UK: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.4.6.2 Germany

12.4.6.2.1 Growth in industrial sector due to strong R&D to drive market

12.4.6.2.2 By sector

TABLE 100 GERMANY: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.4.6.3 France

12.4.6.3.1 Increasing adoption of advanced technologies to boost productivity drives market demand

12.4.6.3.2 By sector

TABLE 101 FRANCE: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.4.6.4 Italy

12.4.6.4.1 Focus on innovative technologies primarily in water & wastewater treatment plants to drive demand

12.4.6.4.2 By sector

TABLE 102 ITALY: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.4.6.5 Netherlands

12.4.6.5.1 Infrastructural development for water & wastewater treatment facility to drive demand

12.4.6.5.2 By sector

TABLE 103 NETHERLANDS: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.4.6.6 Spain

12.4.6.6.1 Most territories experience dry climate, driving demand for submersible pumps

12.4.6.6.2 By sector

TABLE 104 SPAIN: MARKET, BY SECTOR,2018–2025 (USD MILLION)

12.4.6.7 Rest of Europe

12.4.6.7.1 By sector

TABLE 105 REST OF EUROPE: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.5 MIDDLE EAST & AFRICA

12.5.1 BY TYPE

TABLE 106 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.5.1.1 Type, by application

TABLE 107 MIDDLE EAST & AFRICA: ELECTRICAL MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 108 MIDDLE EAST & AFRICA: HYDRAULIC MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 109 MIDDLE EAST & AFRICA: AIR-DRIVEN MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

12.5.2 BY APPLICATION

TABLE 110 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

12.5.2.1 Application, by type

TABLE 111 MIDDLE EAST & AFRICA: OPEN PIT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 112 MIDDLE EAST & AFRICA: BOREWELL MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.5.2.2 Open pit, by usage

TABLE 113 MIDDLE EAST & AFRICA: OPEN PIT MARKET, BY USAGE, 2018–2025 (USD MILLION)

12.5.2.3 Application, by sector

TABLE 114 MIDDLE EAST & AFRICA: OPEN PIT MARKET, BY SECTOR, 2018–2025 (USD MILLION)

TABLE 115 MIDDLE EAST & AFRICA: BOREWELL MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.5.3 BY SECTOR

TABLE 116 MIDDLE EAST & AFRICA: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

TABLE 117 MIDDLE EAST & AFRICA: MARKET, BY INDUSTRY, 2018–2025 (USD MILLION)

12.5.4 BY OPERATION

TABLE 118 MIDDLE EAST & AFRICA: MARKET, BY OPERATION, 2018–2025 (USD MILLION)

12.5.5 BY POWER RATING

TABLE 119 MIDDLE EAST & AFRICA: MARKET, BY POWER RATING, 2018–2025 (USD MILLION)

12.5.6 BY COUNTRY

TABLE 120 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

12.5.6.1 Angola

12.5.6.1.1 Rise in exploration & activities to propel demand

12.5.6.1.2 By sector

TABLE 121 ANGOLA: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.5.6.2 Saudi Arabia

12.5.6.2.1 Government initiatives to meet rising power demand driving market

12.5.6.2.2 By sector

TABLE 122 SAUDI ARABIA: MARKET, BY SECTOR,2018–2025 (USD MILLION)

12.5.6.3 South Africa

12.5.6.3.1 Rapid industrialization and increasing power generation capacity drives market demand

12.5.6.3.2 By sector

TABLE 123 SOUTH AFRICA: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.5.6.4 UAE

12.5.6.4.1 Increasing investments in construction & water & wastewater industry to drive market

12.5.6.4.2 By sector

TABLE 124 UAE: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.5.6.5 Kuwait

12.5.6.5.1 Increasing investments in water & wastewater industry and oil & gas production to drive market

12.5.6.5.2 By sector

TABLE 125 KUWAIT: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.5.6.6 Qatar

12.5.6.6.1 Increasing investments in power sector to meet rising demand

12.5.6.6.2 By sector

TABLE 126 QATAR: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.5.6.7 Rest of Middle East & Africa

12.5.6.7.1 By sector

TABLE 127 REST OF MIDDLE EAST & AFRICA: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.6 SOUTH AMERICA

12.6.1 BY TYPE

TABLE 128 SOUTH AMERICA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.6.1.1 Type, by application

TABLE 129 SOUTH AMERICA: ELECTRICAL MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 130 SOUTH AMERICA: HYDRAULIC MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 131 SOUTH AMERICA: AIR-DRIVEN MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

12.6.2 BY APPLICATION

TABLE 132 SOUTH AMERICA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

12.6.2.1 Application, by type

TABLE 133 SOUTH AMERICA: OPEN PIT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 134 SOUTH AMERICA: BOREWELL MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.6.2.2 Open pit, by usage

TABLE 135 SOUTH AMERICA: OPEN PIT MARKET, BY USAGE, 2018–2025 (USD MILLION)

12.6.2.3 Application, by sector

TABLE 136 SOUTH AMERICA: OPEN PIT MARKET, BY SECTOR, 2018–2025 (USD MILLION)

TABLE 137 SOUTH AMERICA: BOREWELL MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.6.3 BY SECTOR

TABLE 138 SOUTH AMERICA: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

TABLE 139 SOUTH AMERICA: MARKET, BY INDUSTRY,2018–2025 (USD MILLION)

12.6.4 BY OPERATION

TABLE 140 SOUTH AMERICA: MARKET, BY OPERATION, 2018–2025 (USD MILLION)

12.6.5 BY POWER RATING

TABLE 141 SOUTH AMERICA: MARKET, BY POWER RATING, 2018–2025 (USD MILLION)

12.6.6 BY COUNTRY

TABLE 142 SOUTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

12.6.6.1 Brazil

12.6.6.1.1 Technological advancements and strong economic growth promote market growth

12.6.6.1.2 By sector

TABLE 143 BRAZIL: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.6.6.2 Argentina

12.6.6.2.1 Increasing investments and rise in government support incentives to promote industrialization

12.6.6.2.2 By sector

TABLE 144 ARGENTINA: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.6.6.3 Venezuela

12.6.6.3.1 Growth in energy sector to propel demand

12.6.6.3.2 By sector

TABLE 145 VENEZUELA: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

12.6.6.4 Rest of South America

TABLE 146 REST OF SOUTH AMERICA: MARKET, BY SECTOR, 2018–2025 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 156)

13.1 OVERVIEW

FIGURE 40 KEY DEVELOPMENTS IN GLOBAL MARKET, 2016–NOVEMBER 2020

13.2 MARKET EVALUATION FRAMEWORK

FIGURE 41 MARKET EVALUATION FRAMEWORK: CONTRACTS & AGREEMENTS WERE MAJOR GROWTH STRATEGIES BY COMPANIES FROM 2017 TO 2020

13.3 COMPETITIVE SCENARIO

TABLE 147 DEVELOPMENTS OF KEY PLAYERS IN MARKET, 2016–2020

13.4 INDUSTRY CONCENTRATION, 2019

FIGURE 42 INDUSTRY CONCENTRATION, 2019

13.4.1 CONTRACTS & AGREEMENTS

13.4.2 INVESTMENTS & EXPANSION

13.4.3 NEW PRODUCT LAUNCHES

13.4.4 MERGERS & ACQUISITIONS

13.4.5 PARTNERSHIPS, COLLABORATIONS, JOINT VENTURE, AND INVESTMENTS & EXPANSIONS

13.5 COMPANY EVALUATION MATRIX TO DEFINITIONS AND METHODOLOGY

13.5.1 STAR

13.5.2 EMERGING LEADER

13.5.3 PERVASIVE

13.5.4 EMERGING COMPANY

13.6 COMPANY EVALUATION MATRIX, 2019

FIGURE 43 MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING (2019)

14 COMPANY PROFILES (Page No. - 164)

(Business and Financial Overview, Products Offered, Recent Developments, and MnM View (Key Strategies/Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats))*

14.1 XYLEM

FIGURE 44 XYLEM: COMPANY SNAPSHOT

14.2 SULZER

FIGURE 45 SULZER: COMPANY SNAPSHOT

14.3 KSB

FIGURE 46 KSB: COMPANY SNAPSHOT

14.4 GRUNDFOS

FIGURE 47 GRUNDFOS: COMPANY SNAPSHOT

14.5 ATLAS COPCO

FIGURE 48 ATLAS COPCO: COMPANY SNAPSHOT

14.6 FLOWSERVE

FIGURE 49 FLOWSERVE: COMPANY SNAPSHOT

14.7 WILO

FIGURE 50 WILO: COMPANY SNAPSHOT

14.8 TSURUMI MANUFACTURING

14.9 HOMA

14.10 LEO

14.11 VANSAN

14.12 SAER ELETTROPOMPE

14.13 PLEUGER

14.14 C.R.I. PUMPS

14.15 BJM PUMPS

14.16 MODY PUMPS

14.17 HCP PUMP

14.18 SPT PUMPEN

14.19 GRINDEX

14.20 PRORIL

14.21 EBARA CORPORATION

*Details on Business and Financial Overview, Products Offered, Recent Developments, and MnM View (Key Strategies/Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 202)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

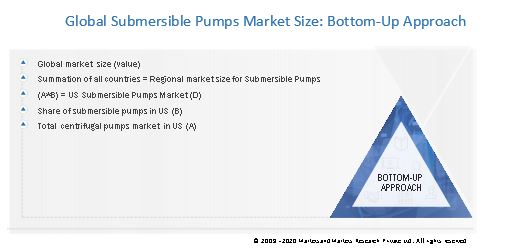

This study involved four major activities in estimating the current size of the submersibale pumps market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global submersible pumps market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

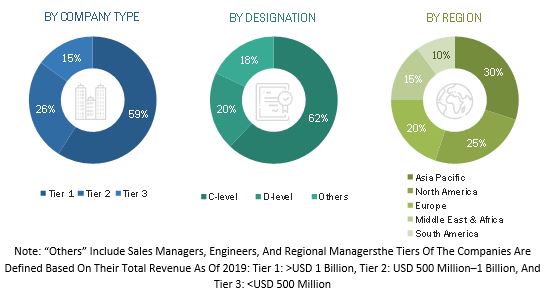

The submersible pumps market comprises several stakeholders, such as product manufacturers, service providers, distributors, and end-users in the supply chain. The demand-side of this market is characterized by its end-user, such as, various industries, the agricultural sector, and others. The supply-side is characterized by submersible pump OEMS, raw material providers, distributors, service providers, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global submersible pumps market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the submersible pumps market ecosystem.

Report Objectives

- To define and describe the submersible pumps market, based on type, application, operation, power rating, and sector

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market with respect to individual growth trends, prospects, and contributions of each segment to the market

- To analyze market opportunities for stakeholders and provide a detailed competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to five main regions (along with countries), namely, North America, South America, Europe, Asia Pacific, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments, such as new product developments, contracts & agreements, investments & expansion, and mergers & acquisitions, in the submersible pumps market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Growth opportunities and latent adjacency in Submersible Pumps Market