Wastewater Treatment Services Market

Wastewater Treatment Services Market by Service Type (Design & Engineering Consulting, Building & Installation, Operation & Process Control, Maintenance & Repair, and Other Service Types), End-Use Industry (Municipal, Industrial (Chemical & Pharma, Oil & Gas, Food, Pulp & Paper, Metal & Mining, Power Generation)), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

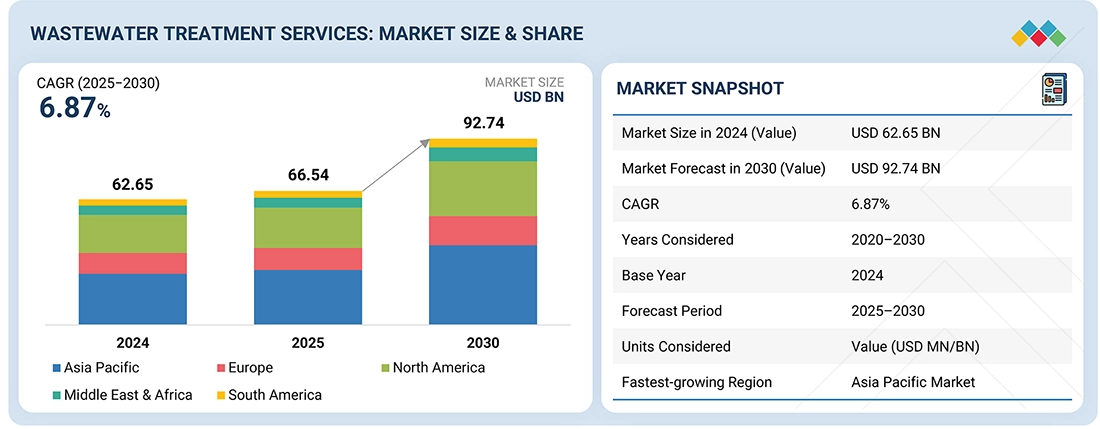

The wastewater treatment services market is projected to grow from USD 62.65 billion in 2024 to USD 92.74 billion by 2030, at a CAGR of 6.87% from 2025 to 2030. The treatment process used to remove impurities and toxins from sewage or industrial water is referred to as wastewater treatment. The treated water can be safely discharged back into the environment. Wastewater is contaminated with a range of pollutants, including bacteria, chemicals, and other toxins that are detrimental to the environment. Its treatment aims to reduce contaminants to acceptable levels, making the water safe for discharge back into the environment.

KEY TAKEAWAYS

-

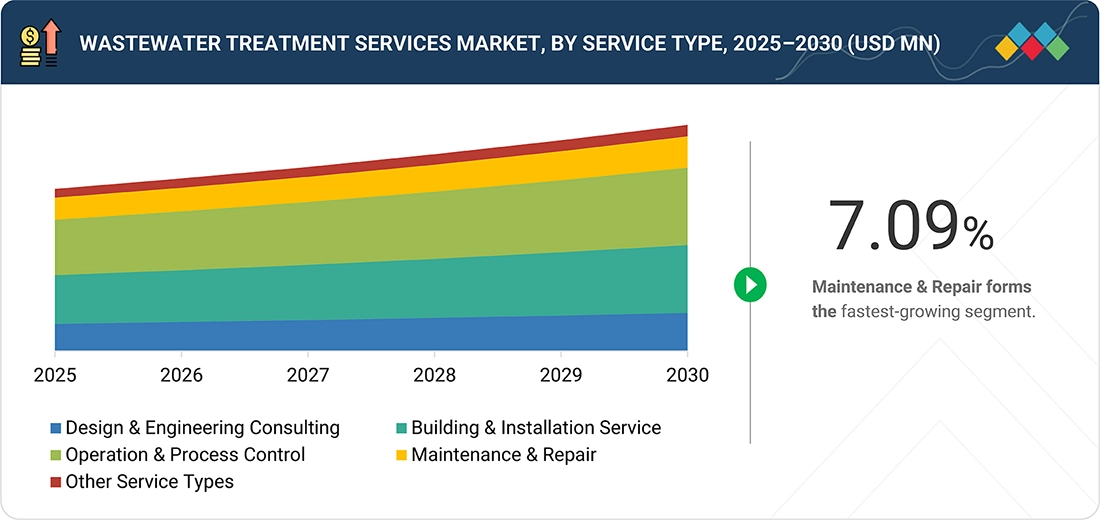

BY SERVICE TYPEThe Maintenance & Repair sub-segment of the wastewater treatment services market has posted the highest CAGR over the forecast period due to the stringent operational continuity, efficiency, and regulatory compliance requirements of wastewater treatment facilities. With aging treatment facilities and increasing facility complexity due to new technology deployments, regular maintenance and prompt repair service have become a necessity to avoid system failure, environmental contamination, and costly downtime. Additionally, greater regulatory scrutiny and stricter discharge requirements compel facility operators to maintain optimal facility performance and operational continuity. Both industrial and municipal sectors are shifting toward preventive maintenance practices, often aided by digital monitoring and predictive maintenance technologies. The trend is further supported by a growing emphasis on sustainability, wherein the maximum prolongation of in-place facilities through routine maintenance is becoming more cost-efficient and environmentally benign than occasional replacement.

-

BY END-USE INDUSTRYThe industrial segment of the wastewater treatment services industry is expected to achieve the highest CAGR during the forecast period, driven by increasing industrialization and stringent environmental policies worldwide. The pharmaceutical, chemical, food & beverages, power generation, and oil & gas industries produce enormous amounts of complex wastewater containing toxic pollutants that require advanced treatment. Governments in developed and emerging economies have set more stringent discharge standards, which have led industries to invest heavily in wastewater treatment services to avoid penalties, meet regulatory standards, and comply with sustainability mandates.

-

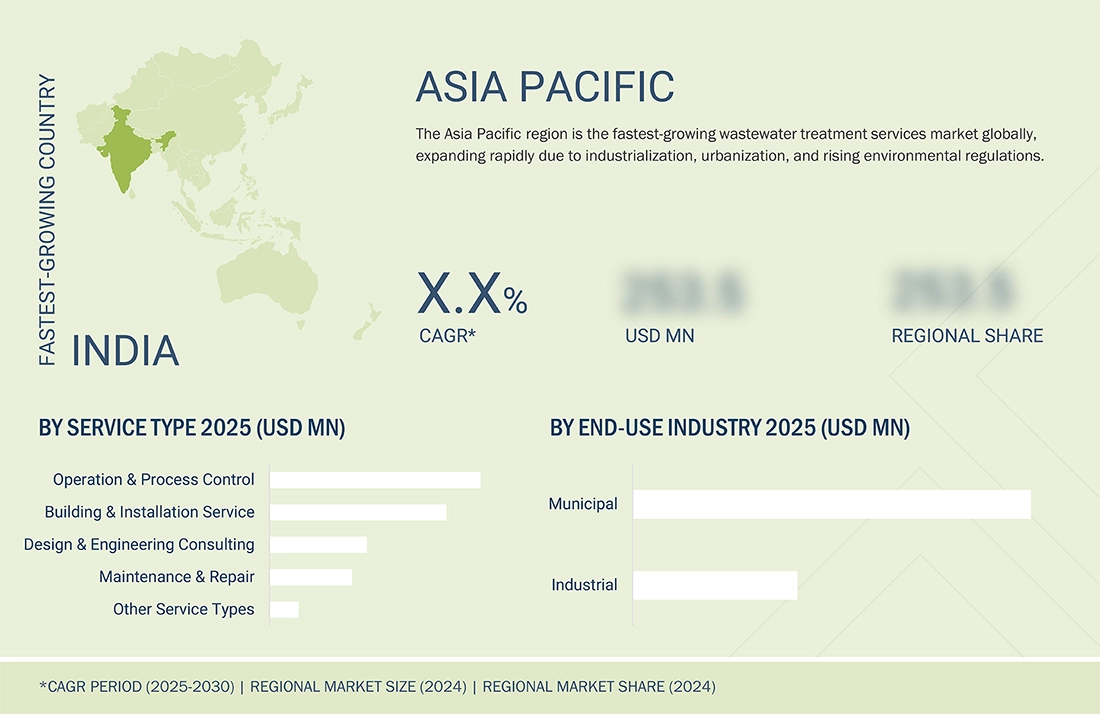

BY REGIONThe Asia Pacific is likely to achieve the highest CAGR among the wastewater treatment services market in the forecast period, owing to the growth in industrialization, population growth, and urbanization in major economies such as China, India, and those of Southeast Asia. Water resource pressure in the region is also creating enormous demand for effective wastewater treatment mechanisms. Government incentives and environmental regulations are also mounting pressure on the industrial segment and municipalities to implement sophisticated wastewater handling systems. Additionally, the growth of infrastructure investment and smart city projects is promoting the adoption of smart wastewater technologies. Multinationals also make significant investments in emerging economies, thereby fueling innovation and market growth.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including expansion, collaborations, partnerships, acquisitions, and investments. For instance, Veolia acquired SUEZ’s wastewater and waste management operations, creating a global leader in ecological solutions.

The wastewater treatment services market has experienced significant growth. It is expected to continue this trend in the coming years, driven by the rising demand for water in various industries, including chemicals and pharmaceuticals, food, pulp & paper, oil & gas, and power generation. The process of purifying wastewater so that it can be reintroduced into the water cycle is known as wastewater treatment. Chemical treatment, settling, evaporation, filtration, and other procedures are all part of the treatment process. Water used in various activities across the mining, oil and gas, food, pulp and paper, chemical, pharmaceutical, and power sectors is referred to as industrial wastewater. Because different industries have distinct needs and challenges, the type of service depends on the end-user.

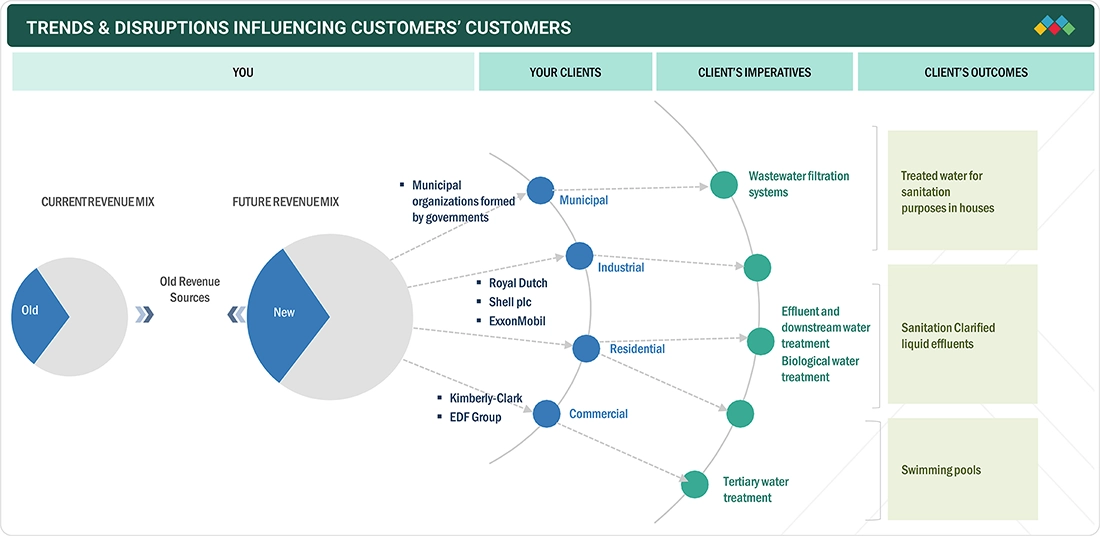

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Automation is one of the major trends in almost all end-use industries, including chemical & pharma, food & beverage, power generation, metal & mining, textiles, and paper & pulp. These industries are among the predominant users of wastewater treatment services, including design & engineering consulting, building & installation, operations & process control services, and maintenance & repair services. The growing demand for automation is driving the need for automating wastewater processes. There is a shift towards automating industrial wastewater treatment in various sectors of the chemical process industries (CPI), including food (especially grain processing, sugars, sweeteners, and edible oils), beverages (mainly soft drink bottlers and breweries), and hydrocarbon and chemical processing (particularly petroleum and petrochemical plants).

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Stringent environmental regulations

-

Initiatives for zero liquid discharge

Level

-

Volatile prices of plastic foams

-

High cost of wastewater treatment technologies

Level

-

Sustainable approach through reduce-recycle-reuse

-

Curbing risks of environmental noncompliance

Level

-

Lack of techno-commercial awareness

-

Competition from alternative water sources

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Stringent environmental regulations

Countries have imposed strict laws prohibiting the unlawful dumping of wastewater and the contamination of naturally existing water basins. Special regulations have been implemented to mitigate the adverse effects of wastewater discharge in countries like China, which are already severely impacted by air pollution. At the same time, affluent countries like the US have severe regulations for wastewater, drinking water, and potable water, demonstrating that wastewater treatment is taken very seriously. Countries have established stringent restrictions to combat global warming and preserve biodiversity due to the high standards upheld at the international level. Therefore, the strictest penalties are applied for improper wastewater effluent release, which may cause factories to become noncompliant. Efforts to maintain compliance will support the greater adoption of treatment services and directly contribute to market growth.

Restraint: High cost of wastewater treatment technologies

Primary, secondary, and tertiary treatment are the three steps of systematic wastewater treatment. These treatment processes are highly capital-intensive and need specific skills and expertise. For example, the Development Bank of Latin America (CAF) projected that, globally, wastewater treatment would cost USD 33 billion and sewerage infrastructure would cost USD 80 billion between 2010 and 2030. Water quality, the necessary level of purity, building materials, and effluent flow rates are some factors that raise the cost of wastewater treatment. Cheaper flow rates result in cheaper capital expenditures for water treatment plants. Although most systems follow this guideline, depending on the size of the operations, there may be notable variations. After accounting for the basic costs of engineering, control panels, and cleaning systems, the cost differences between large and small microfiltration (MF) units are comparatively scalable based on flow. Large-capacity ion exchange (IX) systems may be a little more expensive. For instance, a 50% increase in flow can result in a 20% increase in cost.

Opportunity: Sustainable approach through reduce-recycle-reuse

The three Rs of sustainability are reduction, recycling, and reuse. These practices help prevent waste and conserve natural resources. A great example of responsible corporate behavior is adopting green practices, such as the three Rs, at the facility or company level. Reusing treated wastewater for beneficial purposes, such as industrial processes, toilet flushing, landscape and agricultural irrigation, and groundwater recharge, is known as water recycling. Recycling water saves money and resources. Wastewater treatment can be adapted to meet the water quality standards required for different reuse applications. Water is essential for any business, but strict regulations limit the available supply for municipal and industrial use. Therefore, reusing wastewater is crucial, and any industry can become more sustainable by following these three Rs.

Challenge: Competition from alternative water sources

The wastewater treatment industry faces ongoing threats from the increasing use of alternative water sources, such as rainwater harvesting and desalination, which reduce reliance on treated wastewater. In water-scarce regions of the Middle East, for example, desalination capacity reached 40 million cubic meters daily in 2023, providing drinking water for industry, agriculture, and municipalities. This large-scale shift diverts attention from wastewater reuse, which UN-Water reports as accounting for only 11% of the global water supply, despite advances in treatment technology. Desalination is favored because it offers safe, high-quality water, whereas public perception issues continue to hinder the reuse of wastewater. Rainwater collection, promoted in countries such as Australia and India, is gaining popularity as a low-cost, decentralized alternative for non-potable applications. India's Jal Shakti Ministry reported a 15% increase in harvesting systems from 2020 to 2023, resulting in a decrease in the use of treated wastewater for irrigation.

Wastewater Treatment Services Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Treats process water and effluents from beverage production facilities to meet discharge norms and enable reuse | Conserves water, ensures regulatory compliance, supports sustainability goals, lowers costs, and strengthens brand reputation in global markets |

|

Uses wastewater treatment in manufacturing plants to recycle process water and minimize environmental footprint | Reduces water dependency, lowers disposal costs, improves eco-compliance, enhances corporate image, and contributes to long-term sustainability |

|

Treats cooling water, process effluents, and chemical discharges at steel plants for reuse in production cycles | Saves freshwater, reduces pollution, lowers operational costs, ensures compliance, and supports sustainable steelmaking operations |

|

Employs advanced wastewater treatment for chemical plant discharges to recover usable water and treat hazardous effluents | Improves resource efficiency, reduces hazardous discharge, ensures regulatory compliance, enhances process safety, and supports circular water economy initiatives |

|

Implements wastewater treatment at food processing plants to recycle water and reduce organic pollutant loads | Improves water availability, reduces environmental impact, ensures compliance, enhances production sustainability, and lowers long-term operational expenses |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The wastewater treatment service market system comprises a chain of government agencies, industrial users, municipal governments, service companies, technology developers, and equipment companies. The participants in the system are involved in addressing increasing water pollution, meeting compliance requirements, and achieving sustainability goals. The system comprises processes like primary treatment, biological treatment, sludge handling, and advanced filtration. Technological advancements, compliance requirements, and the circular economy paradigm are the dominant drivers of the dynamic system, providing safe discharge and reuse of treated water by industries and society.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Wastewater Treatment Services Market, By Service Type

The maintenance and repair segment, by service type, of the wastewater treatment services market has witnessed the highest value growth during the forecast period, due to the rising complexity and age of treatment infrastructure. With treatment plants equipped with the most advanced technologies, such as membrane bioreactors and artificial intelligence-based systems, regular maintenance is crucial to ensure maximum operational performance and compliance with stringent regulations, including the EU's Urban Wastewater Treatment Directive. The growing demand from industrial and municipal customers, combined with the need to minimize downtime and extend the operational life of equipment, drives investments in predictive maintenance and repair services, thereby driving growth in this segment.

Wastewater Treatmet Services Market, By End-use Industry

The municipal segment held the largest market share in value in 2024. The primary factors driving this demand are global urbanization and rising water demands from densely populated cities worldwide. Strict regulations requiring advanced water treatment to safeguard public health and water bodies also significantly contribute to the municipal segment's market dominance. Governments worldwide are prioritizing investments in wastewater treatment facilities to combat water scarcity. The adoption of innovative technologies such as smart water systems and efficient treatment processes has reinforced the dominance of the municipal segment, ensuring effective wastewater management and environmental protection.

REGION

Asia Pacific region is projected to be the largest region in the wastewater treatement services market

Due to rapid urbanization, population growth, and industrialization in countries such as China, India, and those in Southeast Asia, the Asia Pacific region became the largest market for wastewater treatment services in 2024. The region, which is home to more than half of the world's population, is under tremendous pressure to manage water resources responsibly. To combat pollution and safeguard diminishing water supplies, governments are taking action and implementing stronger wastewater discharge regulations. Industrial output, particularly in manufacturing and textiles, is driven by economic growth and generates complex effluents that necessitate advanced treatment. The need for strong infrastructure is further increased by growing awareness of environmental degradation and waterborne illnesses. With the help of public-private partnerships, technologies such as membrane bioreactors and zero-liquid discharge systems are gaining popularity.

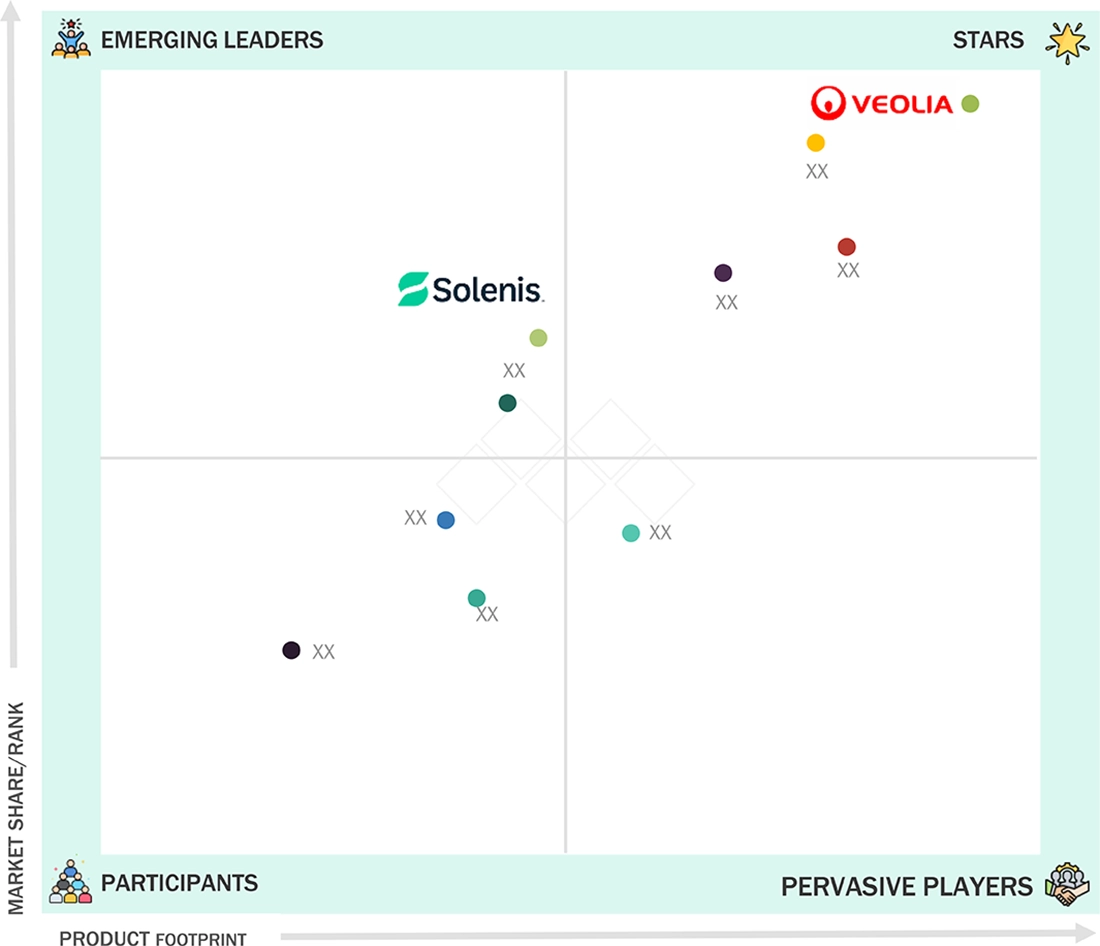

Wastewater Treatment Services Market: COMPANY EVALUATION MATRIX

In the wastewater treatment services market matrix, Veolia (Star) leads with a strong market presence and a wide range of services, driving large-scale adoption across various industries. Solenis (Emerging Leader) is gaining traction due to its diversified services portfolio and continuous investment in R&D. While Veolia dominates with scale, Solenis shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 62.65 Billion |

| Market Forecast in 2030 (Value) | USD 92.74 Billion |

| Growth Rate | CAGR of 6.87% from 2025-2030 |

| Years Considered | 2020−2030 |

| Base Year | 2024 |

| Forecast Period | 2025−2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific, North America, Europe, South America, and Middle East & Africa |

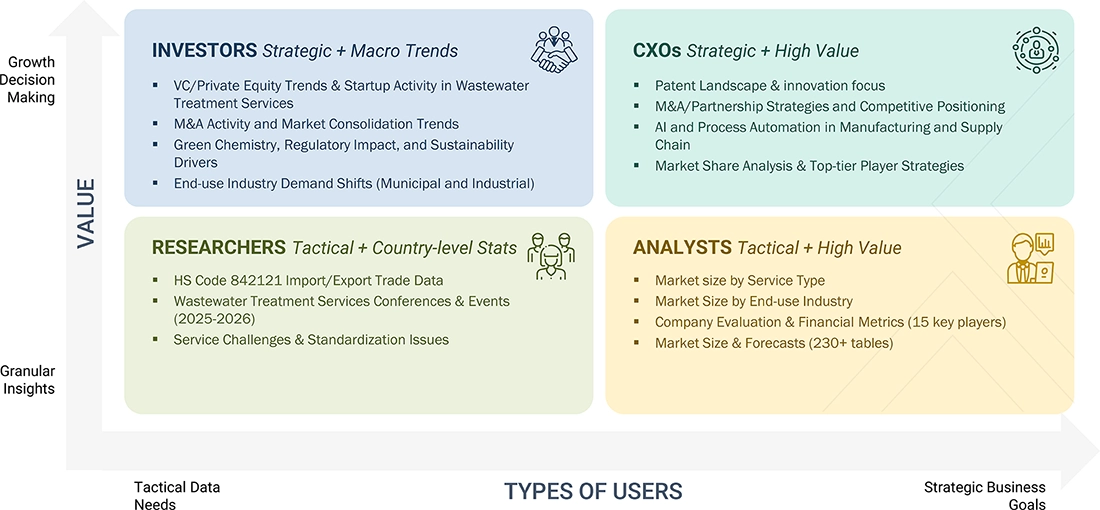

WHAT IS IN IT FOR YOU: Wastewater Treatment Services Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe -based Wastewater Treatment Services Provider |

|

|

| Asia Pacific-based wastewater treatment services provider |

|

|

RECENT DEVELOPMENTS

- November 2024 : Ecolab acquired Barclay Water Management, enhancing its water safety and digital monitoring solutions. Barclay’s iChlor system enhances water quality, extends asset longevity, and maintains continuous water chemistry control for industrial and institutional clients.

- September 2024 : Veolia’s GreenUp 24-27 program launches Water Technologies & New Solutions, delivering innovative, sustainable water services focused on reuse, resource recovery, and decarbonization, backed by leading technology, patents, and USD 2.2 billion investment.

- April 2024 : Thermax opened a new state-of-the-art manufacturing facility in Pune for water and wastewater solutions, expanding its capabilities in RO, STP, ERS, ZLD, and advanced technologies like CDI and digital monitoring.

- October 2023 : Solenis acquired CedarChem, a wastewater treatment company, thereby strengthening its portfolio and enhancing customer value through expanded solutions in water treatment services across both industrial and municipal markets.

Table of Contents

Methodology

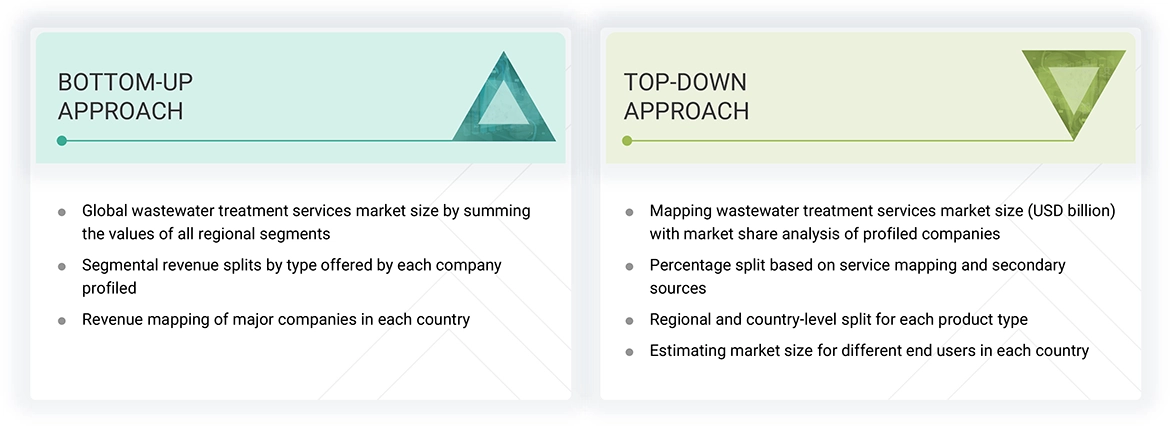

The study involved four major activities in estimating the market size for the wastewater treatment services market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

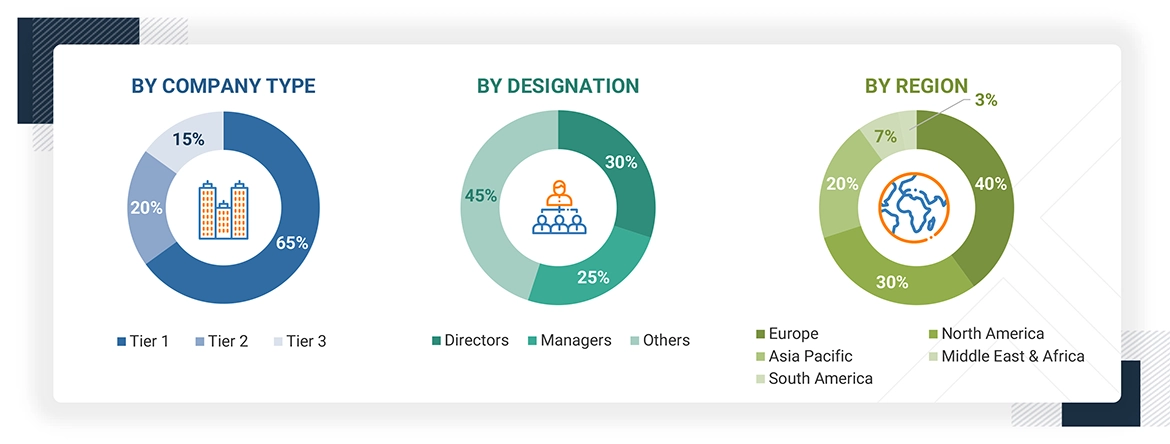

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

Extensive primary research was carried out after gathering information about wastewater treatment services market through secondary research. During the primary research phase, interviews were conducted with experts representing both the supply and demand sides to gather qualitative and quantitative data, ensuring the accuracy and validity of the report's findings. On the supply side, primary sources included industry leaders such as CEOs, vice presidents, marketing directors, technology and innovation directors, and other relevant executives from prominent companies and organizations within the wastewater treatment services market. The primary objective of this research was to identify segmentation types and industry trends.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023/2024, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| BASF SE | Senior Manager | |

| Chemtex Ltd. | Innovation Manager | |

| Alkema Solutions | Vice-President | |

| H2O Innovation Inc. | Production Supervisor | |

| Golder Associates | Sales Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the wastewater treatment service market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the wastewater treatment services industry.

Market Definition

The treatment process used to remove impurities and toxins from sewage or industrial water is referred to as wastewater treatment. The treated water can be safely discharged back into the environment. Wastewater is full of contaminants, including bacteria, chemicals, and other toxins that are harmful to the environment. Its treatment aims at reducing contaminants to acceptable levels to make the water safe for discharge back into the environment.

Stakeholders

- Companies related to wastewater treatment services industry

- Consulting companies in the wastewater treatment and sustainability sector

- Government and research organizations

- Power generation utilities

- Smart water metering organizations

- State and national utility authorities

- Textile, oil and gas and chemical & pharmaceutical companies

- Venture capital firm

Report Objectives

- To analyze and forecast the size of the wastewater treatment services market in terms of value

- To analyze the drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and forecast the market based on service type, end-use industry, and region

- To provide a comprehensive understanding of the market, the report includes detailed insights on service type, end-use industry and the market size of different regions: Asia Pacific, Europe, North America, the Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets1 concerning individual growth trends, growth prospects, and their contribution to the total market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To strategically profile key players and comprehensively analyze their core competencies

- To track and analyze research & development (R&D) and competitive developments, such as product launches, investments, partnerships, and collaborations, in the wastewater treatment services market

Key Questions Addressed by the Report

What is wastewater treatment?

Wastewater treatment is the organized removal of pollutants from used or contaminated water—derived from domestic, industrial, or commercial operations—so that it can be returned to the environment or reused safely. The main goals are to protect human health, the environment, and recover resources. The process involves physical, chemical, and biological methods like screening, sedimentation, biological treatment, pH adjustment, and disinfection. It includes both municipal and industrial treatment approaches.

What are the different service types of wastewater treatment?

Design & Engineering Consulting, Building & Installation Service, Operations & Process Control, Maintenance & Repair, Other Service Types.

Which key companies operate in the wastewater treatment services market?

Veolia (France), Xylem Inc. (US), Ecolab Inc. (US), Thermax Limited (India).

Which key strategies do the market players adopt to sustain their position?

Companies focus on new service launches, acquisitions, partnerships, and expansions to increase geographical reach and revenue.

What will be the CAGR for the wastewater treatment services market from 2025 to 2030?

The market is expected to record a CAGR of 6.87% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Wastewater Treatment Services Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Wastewater Treatment Services Market

Adeeb

Nov, 2017

Detailed information on Wastewater Treatment Services Market.

Tomas

Jan, 2019

I would like to determine the market size in the US in terms of value and numbers. Specifically, to identify how many sewer rehabilitation service providers are in the US..

Tyler

May, 2018

Market estimation of wastewater treatment services for all types in the US .

Peter

Jul, 2019

General information on business opportunities in influent water & effluent wastewater treatment market of Asia Pacific .

Kelvin

Sep, 2019

Africa water treatment market.

Mahdi

Aug, 2019

Specific information on constraints of chemicals used in cooling tower .

Mohammed

Aug, 2019

Share proposal for the treatment of paper mill wastewater market including Flow rate 120 m≥/h TSS 560 ppm COD 2300 ppm BOD 1600 ppm Ph 6.7.

Milind

Jul, 2019

Market information on Wastewater treatment services.

santosh

May, 2019

Global market potential of environment tech and share of India in overall market.

Kathleen

Apr, 2019

General information on Wastewater Treatment Services for business financing.