Web 3.0 Market by Technology Stack (Infrastructure Layer, Protocol Layer, Utility Layer (CDNs, DEXs, Cryptocurrency), Service Layer (NFTs, DECs), Application Layer (DApps, DeFi, Smart Contract, DAOs), Vertical and Region - Global Forecast to 2030

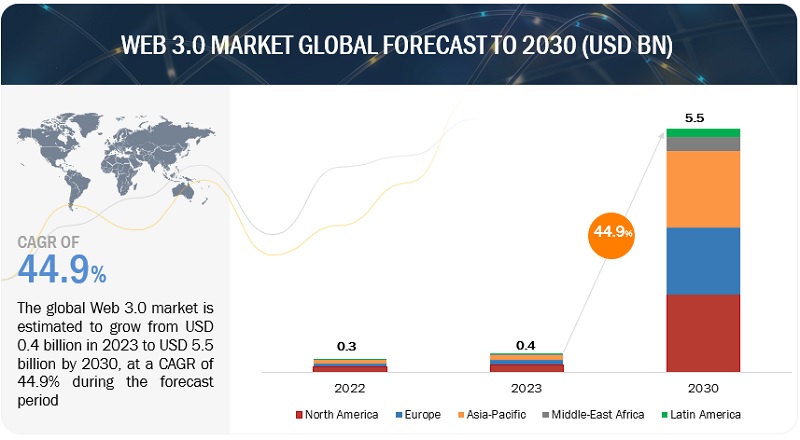

The global web 3.0 market size was estimated at USD 0.4 billion in 2023 and is projected to reach USD 5.5 billion by 2030, growing at a CAGR of 44.9% from 2023 to 2030. Web 3.0, the next phase of the internet, promises a more secure, private, and decentralized online experience compared to Web 2.0. This advancement, anchored in blockchain technology, prioritizes user data protection, granting individuals greater control over their information and reducing reliance on vulnerable central servers. Moreover, Web 3.0 signifies a shift in perspective, encouraging a forward-thinking outlook on the internet's potential, transcending its current capabilities, and fostering innovations that could reshape how we interact with digital content and services. While still emerging, Web 3.0 holds the potential to redefine the internet landscape and enhance user trust and autonomy in the digital realm.

Technology Roadmap of Web 3.0 till 2030

The Web 3.0 market report covers the technology roadmap till 2030, with insights into short-term, mid-term, and long-term developments.

Short-term roadmap (2023-2025)

- Growing interest in non-fungible tokens (NFTs) for digital collectibles and art.

- Enhanced AI-powered content recommendations and personalization in streaming services and e-commerce platforms.

- The development and adoption of Web 3.0 protocols allow users to control their own data and grant permissions to apps and services.

- Initial blockchain and cryptocurrency regulations aim to create legal structures emphasizing consumer protection and financial stability in the emerging technology space.

Mid-term roadmap (2025-2028)

- Decentralized Finance (DeFi) matures with more complex financial instruments, lending, and insurance services.

- Advanced AI-driven virtual assistants become capable of handling complex tasks, from scheduling appointments to content creation.

- Standardization of decentralized identity protocols enables secure and privacy-focused online identity management.

- Evolving regulations for decentralized technologies offer businesses and users a structured framework to navigate the legal landscape efficiently and with clarity.

Long-term roadmap (2029-2030)

- The vision of a fully decentralized internet starts to take shape, with a growing number of websites and applications hosted on blockchain-based infrastructure.

- Seamless integration of AI across web services, from content generation to virtual shopping assistants.

- Global adoption of open, secure, and interoperable Web 3.0 protocols establishes a new era of user-centric data control and digital rights management.

Global regulations for Web 3.0 harmonize legal requirements, enabling a unified digital economy operating within clear international boundaries.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Web 3.0 Market Dynamics

Driver: Rising need for decentralized technology and applications

The escalating demand for decentralized technology and applications serves as a driving force for the widespread adoption of the Web 3.0 market. Rooted in cryptographic principles and distributed ledger technologies, Web 3.0 offers robust solutions to pressing digital challenges. Decentralization, a foundational element of Web 3.0, fortifies security by dispersing data across a network of nodes, mitigating single points of failure and bolstering resilience against cyber threats. Web 3.0 places an unwavering focus on data privacy and ownership, granting users full sovereignty over their personal information. This aligns closely with the mounting concerns surrounding data breaches and privacy infringements. Furthermore, the architecture of decentralization facilitates censorship resistance, guaranteeing unimpeded dissemination of information and ideas. Trustless transactions, executed via smart contracts, eliminate the need for intermediaries, thereby enhancing operational efficiency while reducing associated costs. Interoperability across decentralized technologies fosters seamless data and asset transfer between heterogeneous platforms. The inclusion of community-driven governance models and token economies empowers users, incentivizing active participation and catalyzing innovation on a global scale. As the demand for these decentralized attributes intensifies, the Web 3.0 market gains substantial traction, precipitating a transformative shift across industries and redefining the digital landscape to establish a more secure, transparent, and user-centric Internet ecosystem.

Restraint: Extensive regulatory scrutiny and evolving regulatory perspectives

An overarching constraint within the Web 3.0 market is the profound regulatory scrutiny and the dynamic nature of regulatory viewpoints. Regulators worldwide are in the process of formulating frameworks to address the unique attributes of Web 3.0, seeking a delicate balance between mitigating potential risks and harnessing its innovative potential. Nevertheless, the current landscape remains marked by ambiguity and a lack of consistent, cross-border regulatory standards concerning the classification of digital assets, services, and governance models intrinsic to Web 3.0. For instance, the legal status of smart contracts, a fundamental component of Web 3.0, lacks universal enforceability. This legal uncertainty restricts the broader institutional adoption of Web 3.0, especially by heavily regulated entities. Furthermore, governance structures within the Web 3.0 ecosystem are still evolving, with the reliability and effectiveness of decentralized autonomous organizations (DAOs) varying widely and occasionally being vulnerable, as evidenced by recent incidents in the DeFi sector. These regulatory and governance uncertainties collectively serve as a restraint in the Web 3.0 market, influencing the pace of its adoption and overall growth.

Opportunity: Ability to offer increased transparency

The ability to provide heightened transparency is a fundamental opportunity within the Web 3.0 market. Web 3.0 technologies, prominently blockchain and decentralized systems, introduce an unprecedented level of transparency in the digital landscape. Blockchain's immutable ledger ensures that data, once recorded, remains unalterable and visible to all participants, offering an indisputable record of transactions, data origins, and asset ownership. Supply chains leverage this to bolster accountability and reduce fraudulent activities. Smart contracts, integral to Web 3.0, automate and make transparent the execution of agreements, reducing the reliance on intermediaries and potential conflicts. In finance, decentralized finance (DeFi) applications provide transparent, trustless, and auditable financial services, democratizing access and mitigating manipulation risks. Overall, enhanced transparency not only fosters trust but also empowers users with greater authority over their data, identities, and assets. Businesses operate with greater efficiency, diminish fraud, and cultivate trust among stakeholders, making transparency a compelling and transformative opportunity within the Web 3.0 market.

Challenge: Limited scalability of blockchain technology

The limited scalability of blockchain technology presents a significant challenge in the emerging Web 3.0 market. While blockchain promises decentralization, security, and trust, its current infrastructure struggles to handle the growing demands of a global decentralized ecosystem. Blockchains such as Bitcoin and Ethereum face issues such as slow transaction processing times and high fees, hindering their ability to scale effectively. This scalability challenge impacts various aspects of Web 3.0 applications, from decentralized finance (DeFi) to non-fungible tokens (NFTs) and beyond. Users experience delays and increased costs, limiting mass adoption. To thrive in the Web 3.0 era, addressing scalability is imperative. Layer-2 protocols and interoperability efforts are underway, aiming to enhance blockchain scalability. However, achieving seamless, high-speed, and cost-effective transactions on a global scale remains a pressing challenge for the blockchain community as it seeks to build the decentralized future of the internet.

Web 3.0Market Ecosystem

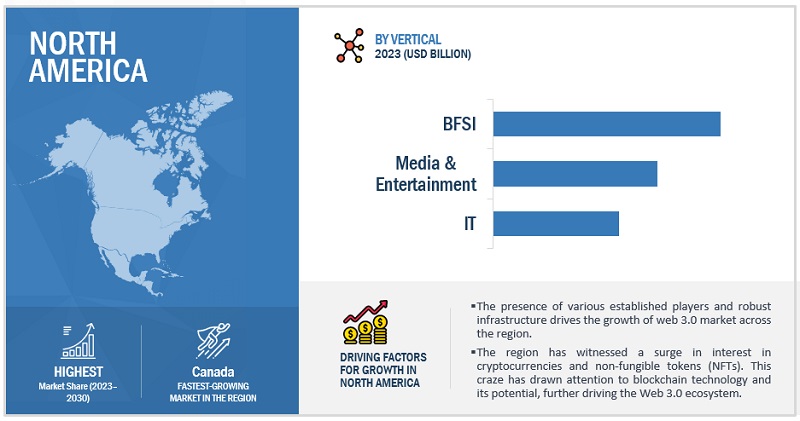

By vertical, BFSI accounts for the largest market size during the forecast period.

The BFSI sector is on the brink of a digital revolution as it embraces the principles of Web 3.0. This transformative shift capitalizes on blockchain, cryptocurrencies, and decentralized finance, ushering in an era of transparent, secure, and efficient financial services. However, this journey is not without challenges, from regulatory complexities to cybersecurity concerns, as it strives to reimagine traditional banking, financial services, and insurance within the Web 3.0 framework.

Based on the application layer, decentralized autonomous organizations hold the highest CAGR during the forecast period.

Decentralized Autonomous Organizations (DAOs) are self-governing entities run by code, enabling decentralized decision-making and management. DAOs utilize smart contracts on blockchain platforms to facilitate a wide range of activities, from governance and voting to investment and asset management, all while eliminating the need for intermediaries and fostering a trustless, global ecosystem.

By protocol layer, privacy & security protocols account for the largest market size during the forecast period.

Privacy & security protocols in Web 3.0's protocols layer employ advanced cryptographic techniques to ensure data confidentiality, integrity, and authenticity in a decentralized ecosystem. It enables secure user interactions and protects against data breaches and unauthorized access, crucial for safeguarding sensitive information and fostering trust in the decentralized web's applications and services.

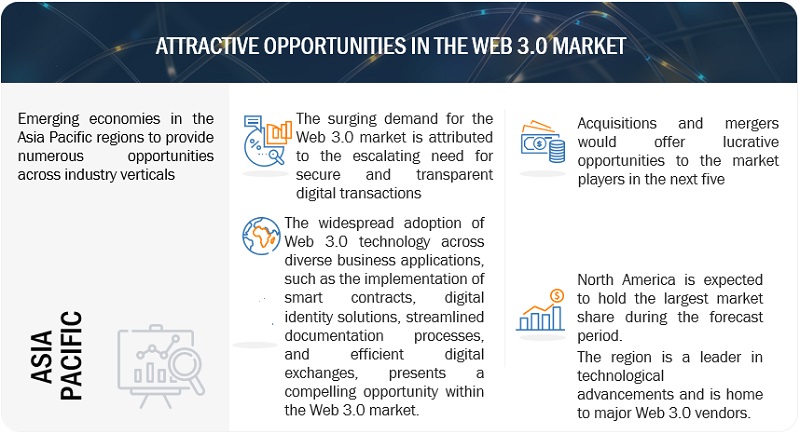

North America to account for the largest market size during the forecast period.

Web 3.0 adoption is surging across North America, driven by a robust embrace of decentralized technologies such as blockchain and smart contracts. This wave of transformation is particularly evident in the financial sector, where decentralized finance (DeFi) is gaining substantial ground, offering enhanced security, transparency, and trust that resonate with both businesses and investors. DeFi platforms, non-fungible tokens (NFTs), and blockchain-based applications are igniting innovation in various industries. Moreover, heightened concerns about data privacy and a growing desire for user empowerment are propelling the shift toward a more user-centric and decentralized digital landscape. Evolving regulatory frameworks further bolster this transition, making Web 3.0 adoption all the more appealing.

Key Market Players

The Web 3.0 vendors have implemented various types of organic and inorganic growth strategies, such as partnerships and agreements, new product launches, product upgrades, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global market for Web 3.0 includes IBM (US), AWS (US), Oracle (US), Coinbase (US), Fujitsu (Japan), Huawei Cloud (China), NTT DOCOMO (Japan), Chainanlysis (US), Ripple Labs (US), Consensys (US), Gemini (US), Binance (Malta), Ocean Protocol Foundation (Singapore), Helium Foundation (US), KUSAMA (Switzerland), Crypto.com (Singapore), Biconomy (Singapore), MakerDAO (US), Chainlink (Cayman Island), Web3 Foundation (Switzerland), HighStreet (US), PARFIN (UK), Ava Labs (US), Pinata (US), Covalent (Canada), Polygon Technology (Cayman Islands), Alchemy Insights (US), Decentraland (China), DAOstack (Israel), Kadena LLC (US), Sapien (US), Storj (US), and Brave (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2030 |

|

Forecast units |

USD Billion |

|

Segments Covered |

Technology Stack, Infrastructure Layer, Protocol Layer, Utility Layer, Service Layer, Application Layer, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), AWS (US), Oracle (US), Coinbase (US), Fujitsu (Japan), Huawei Cloud (China), NTT DOCOMO (Japan), Chainanlysis (US), Ripple Labs (US), Consensys (US), Gemini (US), Binance (Malta), Ocean Protocol Foundation (Singapore), Helium Foundation (US), KUSAMA (Switzerland), Crypto.com (Singapore), Biconomy (Singapore), MakerDAO (US), Chainlink (Cayman Island), Web3 Foundation (Switzerland), HighStreet (US), PARFIN (UK), Ava Labs (US), Pinata (US), Covalent (Canada), Polygon Technology (Cayman Islands), Alchemy Insights (US), Decentraland (China), DAOstack (Israel), Kadena LLC (US), Sapien (US), Storj (US), and Brave (US) |

This research report categorizes the Web 3.0 market based on Technology Stack, Infrastructure Layer, Protocol Layer, Utility Layer, Service Layer, Application Layer, Vertical, and Region.

By Technology Stack:

- Layer 0 – Infrastructure

- Layer 1 – Protocol

- Layer 2 – Utility

- Layer 3 – Service

- Layer 4 - Application

By Infrastructure Layer:

- Networking

- Virtualization

- Computing

- Data Storage & Processing

- Others

By Protocol Layer:

- Consensus Algorithm

- Blockchain Protocol

- Privacy & Security Protocols

- Messaging & Communication Protocols

- Others

By Utility Layer:

- Content Delivery Networks

- Cryptocurrency

- Decentralized Exchanges (DEXs)

- Others

By Service Layer:

- Non-Fungible Tokens (NFTs)

- Web 3.0 Browsers & Wallets

- Identity & Access Management Services

- Decentralized Messaging & Communication Services

- Distributed Edge Cloud Services (DCES)

- Others

By Application Layer:

- Decentralized Applications (DApps)

- Decentralized Finance (DeFi)

- Decentralized Social Media

- Decentralized Autonomous Organizations (DAOs)

- Smart Contracts

- Others

By Vertical:

- BFSI

- Retail & eCommerce

- Healthcare & Life Sciences

- IT

- Media & Entertainment

- Telecommunication

- Logistics

- Energy & Utilities

- Government

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Nordic

- Rest of Europe

-

Asia Pacific

- China

- India

- ANZ

- Japan

- ASEAN

- Rest of Asia Pacific

-

Middle East & Africa

- KSA

- UAE

- Israel

- Turkey

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- Coinbase partnered with Truflation to offer real-time inflation information to the Web3 and blockchain ecosystem. This partnership aims to establish transparency and standardization in the investment environment, enabling Coinbase to make well-informed investment decisions by accessing accurate economic data.

- Animoca Brands has partnered with AWS to boost Web3 product and service development. Animoca Brands is now an official AWS Activate Provider, offering its portfolio companies access to AWS tools, resources, content, and expert support, facilitating their development on the AWS platform.

- IBM and FYI are partnered to use secure and trustworthy generative AI to help creatives collaborate more effectively, manage their businesses, and protect their data and intellectual property. This partnership is a significant step forward in the development of AI for creatives in Web 3.0.

- SailGP partnered with Oracle and leveraged Oracle's customer experience (CX) technology to fuel its latest fan engagement platform, known as The Dock. This innovative platform, integrated with Web 3.0, offers a free fan loyalty program.

- Fujitsu and Mitsubishi Heavy Industries collaborate to develop and deploy blockchain solutions for the energy sector. The two companies would work together to develop blockchain-based solutions for several energy-related use cases, including green energy trading, demand response, distributed energy resources, and carbon emissions trading.

Frequently Asked Questions (FAQ):

What is Web 3.0?

Web 3.0 is a concept representing a more intelligent, decentralized, and interconnected internet that uses technologies like artificial intelligence, semantic web, and blockchain to provide enhanced user experiences, seamless data integration, and improved information retrieval. It aims to evolve the web beyond static web pages and user-generated content by enabling machines to understand, interpret, and generate data, thereby facilitating more advanced applications and services.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Nordic, Spain, and Italy in the European region.

Which are key verticals adopting Web 3.0?

Key verticals adopting Web 3.0 include BFSI, Retail & eCommerce, Logistics, Government, Healthcare and Life Sciences, Telecommunication, Energy and utilities, IT, Media and entertainment, and other verticals (agriculture, education, and real estate & construction).

Which are the key drivers supporting the market growth for Web 3.0?

The key drivers supporting the market growth for the Web 3.0 market include the rising adoption of blockchain technologies, the rising demand for secure and transparent digital transactions, rising need for decentralized technology and applications.

Who are the key vendors in the market for Web 3.0?

The key vendors in the global Web 3.0market include IBM (US), AWS (US), Oracle (US), Coinbase (US), Fujitsu (Japan), Huawei Cloud (China), NTT DOCOMO (Japan), Chainanlysis (US), Ripple Labs (US), Consensys (US), Gemini (US), Binance (Malta), Ocean Protocol Foundation (Singapore), Helium Foundation (US), KUSAMA (Switzerland), Crypto.com (Singapore), Biconomy (Singapore), MakerDAO (US), Chainlink (Cayman Island), Web3 Foundation (Switzerland), HighStreet (US), PARFIN (UK), Ava Labs (US), Pinata (US), Covalent (Canada), Polygon Technology (Cayman Islands), Alchemy Insights (US), Decentraland (China), DAOstack (Israel), Kadena LLC (US), Sapien (US), Storj (US), and Brave (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising adoption of blockchain technologies- Demand for secure and transparent digital transactions- Need for decentralized technology and applicationsRESTRAINTS- Extensive regulatory scrutiny and evolving regulatory perspectives- High demand for securityOPPORTUNITIES- Rising adoption of Web 3.0 technology across business applications- Ability to offer increased transparencyCHALLENGES- Lack of awareness- Limited scalability of blockchain technology

-

5.3 BRIEF HISTORY OF WEB 3.0 MARKETCOMPARISON OF WEB 1.0 VS WEB 2.0 VS WEB 3.0

-

5.4 WEB 3.0 MARKET ECOSYSTEM

-

5.5 CASE STUDY ANALYSISIT- OpenZeppelin leverages Infura to reduce the overhead of maintaining and managing nodesBFSI- Ripple Labs helped Novatti to make cross-border payments fast and secure- Alchemy helped Zerion improve reliability, scalability, and performance of its digital asset wallet and APITELECOMMUNICATION- Web3 Labs helps Vodafone eliminate identity management vulnerabilitiesMEDIA & ENTERTAINMENT- Alchemy enables Royal to enhance performance and scalability

- 5.6 SUPPLY/VALUE CHAIN ANALYSIS

-

5.7 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Blockchain- AI- Cloud computing- Big Data and analytics- AR/VRADJACENT TECHNOLOGIES- 5G- IoT- Digital twins

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 PRICING MODEL ANALYSISINDICATIVE PRICING ANALYSIS, BY PLATFORMAVERAGE SELLING PRICE TREND OF KEY PLAYERS

-

5.10 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEINNOVATION AND PATENT APPLICATIONS- Top applicants

- 5.11 KEY CONFERENCES & EVENTS, 2023–2024

-

5.12 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSNORTH AMERICA- US- CanadaEUROPE- General Data Protection Regulation (GDPR)ASIA PACIFIC- South Korea- China- IndiaMIDDLE EAST & AFRICA- UAE- IsraelLATIN AMERICA- Brazil- Mexico

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.14 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- 5.15 TECHNOLOGY ROADMAP OF WEB 3.0 MARKET

- 5.16 BUSINESS MODELS OF WEB 3.0 MARKET

- 5.17 INVESTMENT SCENARIO ANALYSIS

- 5.18 PERMISSIONLESS VS. PERMISSIONED BLOCKCHAINS

-

6.1 INTRODUCTIONTECHNOLOGY STACK: MARKET DRIVERS

-

6.2 LAYER 0 - INFRASTRUCTURESECURE AND TAMPER-RESISTANT DATA TRANSFER CAPABILITIES TO BOOST MARKET GROWTH

-

6.3 LAYER 1 - PROTOCOLSRISING DEMAND TO INTEGRATE IT SOLUTIONS WITHIN ENTERPRISE ECOSYSTEMS TO DRIVE MARKET

-

6.4 LAYER 2 - UTILITIESABILITY TO ENHANCE SCALABILITY BY OFFLOADING TRANSACTIONS AND DATA TO SUPPORT GROWTH

-

6.5 LAYER 3 - SERVICESNEED FOR ADVANCED CAPABILITIES TO FULFILL END-USER NEEDS TO DRIVE MARKET GROWTH

-

6.6 LAYER 4 - APPLICATIONSDEMAND FOR USER EMPOWERMENT AND IMPROVED SECURITY TO DRIVE MARKET

-

7.1 INTRODUCTIONINFRASTRUCTURE LAYER: WEB 3.0 MARKET DRIVERS

-

7.2 NETWORKINGDEMAND FOR INCREASED DECENTRALIZATION, SECURITY, AND TRUST TO SUPPORT GROWTHPEER-TO-PEER NETWORKINGBLOCK DELIVERY NETWORKINGNETWORK NODESNETWORK PERFORMANCE OPTIMIZATIONOTHER NETWORKING INFRASTRUCTURE

-

7.3 VIRTUALIZATIONVIRTUALIZATION EMPOWERING DECENTRALIZED COMPUTING IN WEB 3.0 INFRASTRUCTURECONTAINERIZATIONVIRTUAL MACHINESBLOCKCHAIN NODE VIRTUALIZATIONREAL-TIME DATA FLOW MONITORINGOTHER VIRTUALIZATION INFRASTRUCTURE

-

7.4 COMPUTINGRISING ADOPTION OF DECENTRALIZATION THROUGH BLOCKCHAIN SYSTEMS TO SUPPORT RELIANCE ON COMPUTINGBLOCKCHAIN COMPUTINGDISTRIBUTED COMPUTINGPEER-TO-PEER COMPUTINGFEDERATED COMPUTINGFEDERATED LEARNINGEDGE COMPUTINGOTHER COMPUTING INFRASTRUCTURE

-

7.5 DATA STORAGE & PROCESSINGTRANSFORMATIVE ADVANCES IN DATA STORAGE AND PROCESSING FOR WEB 3.0 INFRASTRUCTURE TO PROPEL MARKETDISTRIBUTED STORAGE SOLUTIONSREAL-TIME DATA PROCESSINGDATA GOVERNANCE & COMPLIANCEON-CHAIN DATA STORAGEOTHER DATA STORAGE & PROCESSING INFRASTRUCTURE

- 7.6 OTHER INFRASTRUCTURE LAYERS

-

8.1 INTRODUCTIONPROTOCOL LAYER: MARKET DRIVERS

-

8.2 CONSENSUS ALGORITHMSCRUCIAL CONSENSUS ALGORITHMS POWERING WEB 3.0 MARKETS AND DECENTRALIZATIONPROOF OF WORKPROOF OF STAKEPROOF OF HISTORYPROOF OF SPACE & TIMEOTHER CONSENSUS ALGORITHMS

-

8.3 BLOCKCHAIN PROTOCOLSFOCUS ON DECENTRALIZATION, INTEROPERABILITY, AND SUSTAINABILITY TO SUPPORT USAGEETHEREUMPOLKADOTCARDANOOCEAN PROTOCOLOTHER BLOCKCHAIN PROTOCOLS

-

8.4 PRIVACY & SECURITY PROTOCOLSFORTIFICATION OF PRIVACY & SECURITY PROTOCOLS TO DRIVE MARKETZERO-KNOWLEDGE PROOFSHOMOMORPHIC ENCRYPTIONCONFIDENTIAL TRANSACTIONSSECURE MULTI-PARTY COMPUTATIONDATA ANONYMIZATION TECHNIQUESOTHER PRIVACY & SECURITY PROTOCOLS

-

8.5 MESSAGING & COMMUNICATION PROTOCOLSNEED FOR PROTOCOLS TO ENABLE DECENTRALIZED AND SECURE DIGITAL INTERACTIONS TO DRIVE MARKETMATRIXWHISPERRAIDEN NETWORKOTHER MESSAGING & COMMUNICATION PROTOCOLS

- 8.6 OTHER PROTOCOL LAYERS

-

9.1 INTRODUCTIONUTILITY LAYER: MARKET DRIVERS

-

9.2 CONTENT DELIVERY NETWORKSNEED TO ENSURE EFFICIENT, SECURE, AND DECENTRALIZED CONTENT DELIVERY NETWORKS TO PROPEL USAGECONTENT DISTRIBUTION OPTIMIZATIONCACHING & LOAD BALANCINGDDOS MITIGATIONOTHER CONTENT DELIVERY NETWORK LAYERS

-

9.3 CRYPTOCURRENCYSIGNIFICANCE IN WEB 3.0 TO ENSURE SECURE TRANSACTIONS & DECENTRALIZED GOVERNANCEPRIVACY COINSCENTRAL BANK DIGITAL CURRENCIESUTILITIES TOKENSINTEROPERABILITY TOKENSGOVERNANCE TOKENSOTHER CRYPTOCURRENCY LAYERS

-

9.4 DECENTRALIZED EXCHANGESDECENTRALIZED EXCHANGES TO EMPOWER TRUSTLESS PEER-TO-PEER TRADING IN WEB 3.0UNISWAPSUSHISWAPBALANCER1INCHCURVE FINANCEOTHER DEX LAYERS

- 9.5 OTHER UTILITY LAYERS

-

10.1 INTRODUCTIONSERVICE LAYER: WEB 3.0 MARKET DRIVERS

-

10.2 NON-FUNGIBLE TOKENSNFTS TO FIND WIDE ADOPTION AMONG ARTISTS, CREATORS, ETC. FOR MONETIZATIONNFT STANDARDSNFT INSURANCEDYNAMIC NFTSMETAVERSE DEVELOPMENTOTHER NFT SERVICES

-

10.3 BROWSERS & WALLETSBETTER ASSET MANAGEMENT CAPABILITIES TO DRIVE ADOPTIONBROWSERSCRYPTO WALLETSIDENTITY WALLETS

-

10.4 IDENTITY & ACCESS MANAGEMENT SERVICESRISING IMPORTANCE OF IDENTITY AND ACCESS MANAGEMENT TO DRIVE MARKETDECENTRALIZED IDENTITY SERVICESIDENTITY VERIFICATION SERVICESBIOMETRIC AUTHENTICATION SERVICESTWO-FACTOR AUTHENTICATION SERVICESOTHER IDENTITY & ACCESS MANAGEMENT SERVICES

-

10.5 DECENTRALIZED MESSAGING & COMMUNICATION SERVICESDEMAND FOR BETTER, SAFER COMMUNICATION SERVICES TO BOOST MARKETSECURE EMAIL SERVICESVOICE & VIDEO COMMUNICATION PLATFORM SERVICESINTEROPERABLE MESSAGINGCONVERSATIONAL AICONTENT RECOMMENDATION CHATBOTSOTHER DECENTRALIZED MESSAGING & COMMUNICATION SERVICES

-

10.6 DISTRIBUTED EDGE CLOUD SERVICESMINIMIZED LATENCY AND ENHANCED EXPERIENCE TO DRIVE DEMANDDECENTRALIZED MARKETPLACESDECENTRALIZED SOCIAL MEDIA PLATFORMDECENTRALIZED GAMINGOTHER DISTRIBUTED EDGE CLOUD SERVICES

- 10.7 OTHER SERVICE LAYERS

-

11.1 INTRODUCTIONAPPLICATION LAYER: WEB 3.0 MARKET DRIVERS

-

11.2 DECENTRALIZED APPLICATIONSDEMAND FOR CONTROL & SECURITY TO BOOST ADOPTIONGOVERNANCEGAMINGAI-ENABLED PERSONALIZED RECOMMENDATIONSIDENTITY & AUTHENTICATION DAPPSOTHER DECENTRALIZED APPLICATIONS

-

11.3 DECENTRALIZED FINANCEDEFI TO TRANSFORM FINANCE IN WEB 3.0 THROUGH DECENTRALIZATION AND ACCESSIBILITYAUTOMATED PORTFOLIO MANAGEMENTASSET TOKENIZATIONCROSS-CHAIN DEFIOTHER DEFI APPLICATIONS

-

11.4 DECENTRALIZED SOCIAL MEDIADECENTRALIZED SOCIAL MEDIA TO EMPOWER USER CONTROL, PRIVACY, AND OWNERSHIPEND-TO-END ENCRYPTIONCONTENT MONETIZATIONDECENTRALIZED IDENTITYOTHER DECENTRALIZED SOCIAL MEDIA APPLICATIONS

-

11.5 DECENTRALIZED AUTONOMOUS ORGANIZATIONSSUPPORT FOR DECENTRALIZED DECISION-MAKING AND RESOURCE ALLOCATION TO BOOST ADOPTIONLIQUID DEMOCRACYGOVERNMENT DAOSCROSS-DAO STANDARDSOTHER DAO APPLICATIONS

-

11.6 SMART CONTRACTSSMART CONTRACTS TO ALLOW FOR DECENTRALIZED GOVERNANCE AND DECISION-MAKINGDEFI SMART CONTRACTSCROSS-CHAIN SMART CONTRACTSDAO GOVERNANCE CONTRACTSOTHER SMART CONTRACTS

- 11.7 OTHER APPLICATION LAYERS

-

12.1 INTRODUCTIONVERTICAL: WEB 3.0 MARKET DRIVERS

-

12.2 BFSIRISING DEMAND FOR DECENTRALIZED BANKING PLATFORMS TO DRIVE MARKETBFSI: USE CASES

-

12.3 MEDIA & ENTERTAINMENTTRACTION ACROSS DIGITAL ADVERTISING VERTICALS USING BLOCKCHAIN-BASED SMART CONTRACTSMEDIA & ENTERTAINMENT: USE CASES

-

12.4 RETAIL & ECOMMERCESUPPORT FOR TRANSACTIONAL IMPROVEMENTS AND PERSONALIZED SHOPPING TO DRIVE MARKETRETAIL & ECOMMERCE: USE CASES

-

12.5 HEALTHCARE & LIFE SCIENCESNEED TO SECURE CRITICAL PATIENT DATA ACROSS NODES TO BOOST SEGMENT GROWTHHEALTHCARE & LIFE SCIENCES: USE CASES

-

12.6 ITNEED TO SECURE CRITICAL PATIENT DATA ACROSS NODES TO BOOST SEGMENT GROWTHIT: USE CASES

-

12.7 TELECOMMUNICATIONSNEED TO SECURE CRITICAL PATIENT DATA ACROSS NODES TO BOOST SEGMENT GROWTHTELECOMMUNICATIONS: USE CASES

-

12.8 LOGISTICSINCREASED EFFICIENCY ACROSS MOVEMENT OF RAW MATERIAL AND INVENTORY MANAGEMENT USING MOBILITY SOLUTIONSLOGISTICS: USE CASES

-

12.9 ENERGY & UTILITIESPOWER GRID SUPPLY AND CRITICAL INFRASTRUCTURE MANAGEMENT TO GAIN TRACTION USING BLOCKCHAIN TECHNOLOGYENERGY & UTILITIES: USE CASES

-

12.10 GOVERNMENTGROWING CONCERNS ABOUT IDENTITY THEFT AND BUSINESS FRAUD TO DRIVE MARKETGOVERNMENT: USE CASES

- 12.11 OTHER VERTICALS

- 13.1 INTRODUCTION

-

13.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Need to comply with regulatory requirements to fuel demand for Web 3.0CANADA- Entrepreneurial leadership and innovation in tech ecosystem to support growth

-

13.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Strategic initiatives for Web 3.0 and DeFi taxation reform to support growthGERMANY- Germany’s emphasis on Web 3.0 and blockchain innovation to drive marketFRANCE- France to emerge as prominent hub for NFT innovation and digital ownershipITALY- Government support and initiatives to promote blockchain and digital technologiesSPAIN- Government backing and investment in Web 3.0 and metaverse tech innovation technologies to drive marketNORDIC- Robust inflow of venture capital funding into Nordic Web 3.0 startupsREST OF EUROPE

-

13.4 ASIA PACIFICASIA PACIFIC: MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Strong emphasis on developing and implementing blockchain technology to drive marketJAPAN- Japan’s commitment to creating a favorable environment for Web 3.0 innovationsINDIA- Rapidly growing talent pool in Web 3.0 to drive marketANZ- Increasing recognition of blockchain and Web 3.0 technologies to drive adoptionASEAN- Strong government support for digitization and technology adoption to favor market growthREST OF ASIA PACIFIC

-

13.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTKSA- Investment in digital transformation through Vision 2030 to support market growthUAE- Regulatory measures and substantial subsidies for Web 3.0 and AI enterprises to drive marketISRAEL- Strong culture of innovation and entrepreneurial spirit to propel Web 3.0 developmentTURKEY- Growing interest and investment in blockchain and Web 3.0 technologies to drive demandSOUTH AFRICA- Rising attention from venture capitalists to favor market growthREST OF MIDDLE EAST & AFRICA

-

13.6 LATIN AMERICALATIN AMERICA: WEB 3.0 MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Proactive adoption of Web 3.0 technologies, including blockchain and digital currencies, to support growthMEXICO- Growing demand for flexible and efficient digital payment solutionsARGENTINA- Rise of blockchain startups and innovative projects to drive Web 3.0 adoptionREST OF LATIN AMERICA

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.3 REVENUE ANALYSIS

- 14.4 MARKET SHARE ANALYSIS FOR KEY PUBLIC COMPANIES

- 14.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

-

14.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

14.7 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSSTARTUP/SME COMPETITIVE BENCHMARKING

-

14.8 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

- 14.9 VALUATION AND FINANCIAL METRICS OF KEY WEB 3.0 VENDORS

- 14.10 YTD PRICE TOTAL RETURN AND STOCK BETA OF KEY WEB 3.0 VENDORS

- 15.1 INTRODUCTION

-

15.2 KEY PLAYERSIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAWS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCOINBASE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFUJITSU- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHUAWEI CLOUD- Business overview- Products/Solutions/Services offered- Recent developmentsNTT DOCOMO- Business overview- Recent developmentsCHAINALYSIS- Business overview- Products/Solutions/Services offered- Recent developmentsRIPPLE LABS- Business overview- Products/Solutions/Services offered- Recent developmentsCONSENSYS- Business overview- Products/Solutions/Services offered- Recent developmentsGEMINI- Business overview- Products/Solutions/Services offered- Recent developmentsBINANCE- Business overview- Products/Solutions/Services offered- Recent developmentsOCEAN PROTOCOL FOUNDATIONHELIUM FOUNDATIONKUSAMA

-

15.3 OTHER KEY PLAYERSCRYPTO.COMBICONOMYMAKERDAOCHAINLINKWEB3 FOUNDATION

-

15.4 STARTUPS/SMESHIGHSTREETPARFINAVA LABSPINATACOVALENTPOLYGON TECHNOLOGYALCHEMY INSIGHTSDECENTRALANDDAOSTACKKADENA LLCSAPIENSTORJBRAVE

-

16.1 BLOCKCHAIN MARKET—GLOBAL FORECAST TO 2027MARKET DEFINITIONMARKET OVERVIEWBLOCKCHAIN MARKET, BY COMPONENTBLOCKCHAIN MARKET, BY PROVIDERBLOCKCHAIN MARKET, BY TYPEBLOCKCHAIN MARKET, BY ORGANIZATION SIZEBLOCKCHAIN MARKET, BY APPLICATIONBLOCKCHAIN MARKET, BY REGION

-

16.2 ARTIFICIAL INTELLIGENCE MARKET—GLOBAL FORECAST TO 2030MARKET DEFINITIONMARKET OVERVIEWARTIFICIAL INTELLIGENCE MARKET, BY OFFERINGARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGYARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTIONARTIFICIAL INTELLIGENCE MARKET, BY VERTICALARTIFICIAL INTELLIGENCE MARKET, BY REGION

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATE, 2020–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 MARKET ESTIMATION ASSUMPTIONS

- TABLE 4 GLOBAL WEB 3.0 MARKET AND GROWTH RATE, 2018–2022 (USD THOUSAND Y-O-Y%)

- TABLE 5 GLOBAL WEB 3.0 MARKET AND GROWTH RATE, 2023–2030 (USD THOUSAND, Y-O-Y%)

- TABLE 6 COMPARISON OF WEB GENERATIONS

- TABLE 7 WEB 3.0 MARKET: PLATFORM PROVIDERS

- TABLE 8 WEB 3.0 MARKET: SERVICE PROVIDERS

- TABLE 9 WEB 3.0 MARKET: CLOUD PROVIDERS

- TABLE 10 WEB 3.0 MARKET: END USERS

- TABLE 11 WEB 3.0 MARKET: REGULATORY BODIES

- TABLE 12 PORTER’S FIVE FORCES ANALYSIS

- TABLE 13 PRICING ANALYSIS

- TABLE 14 AVERAGE SELLING PRICE ANALYSIS OF WEB 3.0 PROVIDERS, BY TECHNOLOGY STACK

- TABLE 15 PATENTS FILED, 2013–2023

- TABLE 16 TOP 20 PATENT OWNERS, 2013–2023

- TABLE 17 LIST OF PATENTS IN WEB 3.0 MARKET, 2021–2023

- TABLE 18 DETAILED LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 24 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 25 TECHNOLOGY ROADMAP OF WEB 3.0 MARKET

- TABLE 26 INVESTMENTS BY TECH FIRMS IN WEB 3.0 MARKET

- TABLE 27 COMPARISON OF PERMISSIONED & PERMISSIONLESS BLOCKCHAINS

- TABLE 28 WEB 3.0 MARKET, BY TECHNOLOGY STACK, 2018–2022 (USD THOUSAND)

- TABLE 29 MARKET, BY TECHNOLOGY STACK, 2023–2030 (THOUSAND)

- TABLE 30 LAYER 0 – INFRASTRUCTURE: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 31 LAYER 0 – INFRASTRUCTURE: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 32 LAYER 1 – PROTOCOLS: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 33 LAYER 1 – PROTOCOLS: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 34 LAYER 2 – UTILITIES: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 35 LAYER 2 – UTILITIES: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 36 LAYER 3 – SERVICES: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 37 LAYER 3 – SERVICES: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 38 LAYER 4 – APPLICATIONS: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 39 LAYER 4 – APPLICATIONS: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 40 WEB 3.0 MARKET, BY INFRASTRUCTURE LAYER, 2018–2022 (USD THOUSAND)

- TABLE 41 MARKET, BY INFRASTRUCTURE LAYER, 2023–2030 (USD THOUSAND)

- TABLE 42 NETWORKING: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 43 NETWORKING: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 44 VIRTUALIZATION: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 45 VIRTUALIZATION: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 46 COMPUTING: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 47 COMPUTING: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 48 DATA STORAGE & PROCESSING: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 49 DATA STORAGE & PROCESSING: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 50 OTHER INFRASTRUCTURE LAYERS: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 51 OTHER INFRASTRUCTURE LAYERS: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 52 MARKET, BY PROTOCOL LAYER, 2018–2022 (USD THOUSAND)

- TABLE 53 WEB 3.0 MARKET, BY PROTOCOL LAYER, 2023–2030 (USD THOUSAND)

- TABLE 54 CONSENSUS ALGORITHMS: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 55 CONSENSUS ALGORITHMS: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 56 BLOCKCHAIN PROTOCOLS: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 57 BLOCKCHAIN PROTOCOLS: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 58 PRIVACY & SECURITY PROTOCOLS: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 59 PRIVACY & SECURITY PROTOCOLS: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 60 MESSAGING & COMMUNICATION PROTOCOLS: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 61 MESSAGING & COMMUNICATION PROTOCOLS: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 62 OTHER PROTOCOL LAYERS: WEB 3.0 MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 63 OTHER PROTOCOL LAYERS: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 64 MARKET, BY UTILITY LAYER, 2018–2022 (USD THOUSAND)

- TABLE 65 WEB 3.0 MARKET, BY UTILITY LAYER, 2023–2030 (USD THOUSAND)

- TABLE 66 CONTENT DELIVERY NETWORKS: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 67 CONTENT DELIVERY NETWORKS: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 68 CRYPTOCURRENCY: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 69 CRYPTOCURRENCY: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 70 DECENTRALIZED EXCHANGES: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 71 DECENTRALIZED EXCHANGES: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 72 OTHER UTILITY LAYERS: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 73 OTHER UTILITY LAYERS: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 74 WEB 3.0 MARKET, BY SERVICE LAYER, 2018–2022 (USD THOUSAND)

- TABLE 75 MARKET, BY SERVICE LAYER, 2023–2030 (USD THOUSAND)

- TABLE 76 NON-FUNGIBLE TOKENS: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 77 NON-FUNGIBLE TOKENS: WEB 3.0 INTELLIGENCE MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 78 BROWSERS & WALLETS: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 79 BROWSERS & WALLETS: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 80 IDENTITY & ACCESS MANAGEMENT SERVICES: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 81 IDENTITY & ACCESS MANAGEMENT SERVICES: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 82 DECENTRALIZED MESSAGING & COMMUNICATION SERVICES: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 83 DECENTRALIZED MESSAGING & COMMUNICATION SERVICES: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 84 DISTRIBUTED EDGE CLOUD SERVICES: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 85 DISTRIBUTED EDGE CLOUD SERVICES: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 86 OTHER SERVICE LAYERS: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 87 OTHER SERVICE LAYERS: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 88 WEB 3.0 MARKET, BY APPLICATION LAYER, 2018–2022 (USD THOUSAND)

- TABLE 89 MARKET, BY APPLICATION LAYER, 2023–2030 (USD THOUSAND)

- TABLE 90 DECENTRALIZED APPLICATIONS: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 91 DECENTRALIZED APPLICATIONS: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 92 DECENTRALIZED FINANCE: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 93 DECENTRALIZED FINANCE: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 94 DECENTRALIZED SOCIAL MEDIA: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 95 DECENTRALIZED SOCIAL MEDIA: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 96 DECENTRALIZED AUTONOMOUS ORGANIZATIONS: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 97 DECENTRALIZED AUTONOMOUS ORGANIZATIONS: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 98 SMART CONTRACTS: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 99 SMART CONTRACTS: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 100 OTHER APPLICATION LAYERS: MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 101 OTHER APPLICATION LAYERS: MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 102 WEB 3.0 MARKET, BY VERTICAL, 2018–2022 (USD THOUSAND)

- TABLE 103 WEB 3.0, BY VERTICAL, 2023–2030 (USD THOUSAND)

- TABLE 104 WEB 3.0 MARKET FOR BFSI, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 105 MARKET FOR BFSI, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 106 WEB 3.0 MARKET FOR MEDIA & ENTERTAINMENT, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 107 MARKET FOR MEDIA & ENTERTAINMENT, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 108 WEB 3.0 MARKET FOR RETAIL & ECOMMERCE, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 109 MARKET FOR RETAIL & ECOMMERCE, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 110 WEB 3.0 MARKET FOR HEALTHCARE & LIFE SCIENCES, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 111 MARKET FOR HEALTHCARE & LIFE SCIENCES, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 112 WEB 3.0 FOR IT, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 113 WEB 3.0 FOR IT, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 114 WEB 3.0 MARKET FOR TELECOMMUNICATIONS, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 115 MARKET FOR TELECOMMUNICATIONS, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 116 WEB 3.0 MARKET FOR LOGISTICS, BY REGION,2018–2022 (USD THOUSAND)

- TABLE 117 MARKET FOR LOGISTICS, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 118 WEB 3.0 MARKET FOR ENERGY & UTILITIES, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 119 MARKET FOR ENERGY & UTILITIES, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 120 WEB 3.0 MARKET FOR GOVERNMENT, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 121 MARKET FOR GOVERNMENT, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 122 WEB 3.0 MARKET FOR OTHER VERTICALS, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 123 MARKET FOR OTHER VERTICALS, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 124 WEB 3.0 MARKET, BY REGION, 2018–2022 (USD THOUSAND)

- TABLE 125 MARKET, BY REGION, 2023–2030 (USD THOUSAND)

- TABLE 126 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 127 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2030 (USD THOUSAND)

- TABLE 128 NORTH AMERICA: MARKET, BY TECHNOLOGY STACK, 2018–2022 (USD THOUSAND)

- TABLE 129 NORTH AMERICA: MARKET, BY TECHNOLOGY STACK, 2023–2030 (USD THOUSAND)

- TABLE 130 NORTH AMERICA: MARKET, BY INFRASTRUCTURE LAYER, 2018–2022 (USD THOUSAND)

- TABLE 131 NORTH AMERICA: MARKET, BY INFRASTRUCTURE LAYER, 2023–2030 (USD THOUSAND)

- TABLE 132 NORTH AMERICA: MARKET, BY PROTOCOL LAYER, 2018–2022 (USD THOUSAND)

- TABLE 133 NORTH AMERICA: WEB 3.0 MARKET, BY PROTOCOL LAYER, 2023–2030 (USD THOUSAND)

- TABLE 134 NORTH AMERICA: MARKET, BY UTILITY LAYER, 2018–2022 (USD THOUSAND)

- TABLE 135 NORTH AMERICA: MARKET, BY UTILITY LAYER, 2023–2030 (USD THOUSAND)

- TABLE 136 NORTH AMERICA: MARKET, BY SERVICE LAYER, 2018–2022 (USD THOUSAND)

- TABLE 137 NORTH AMERICA: MARKET, BY SERVICE LAYER, 2023–2030 (USD THOUSAND)

- TABLE 138 NORTH AMERICA: MARKET, BY APPLICATION LAYER, 2018–2022 (USD THOUSAND)

- TABLE 139 NORTH AMERICA: MARKET, BY APPLICATION LAYER, 2023–2030 (USD THOUSAND)

- TABLE 140 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2022 (USD THOUSAND)

- TABLE 141 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2030 (USD THOUSAND)

- TABLE 142 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 143 EUROPE: MARKET, BY COUNTRY, 2023–2030 (USD THOUSAND)

- TABLE 144 EUROPE: MARKET, BY TECHNOLOGY STACK, 2018–2022 (USD THOUSAND)

- TABLE 145 EUROPE: WEB 3.0 MARKET, BY TECHNOLOGY STACK, 2023–2030 (USD THOUSAND)

- TABLE 146 EUROPE: MARKET, BY INFRASTRUCTURE LAYER, 2018–2022 (USD THOUSAND)

- TABLE 147 EUROPE: MARKET, BY INFRASTRUCTURE LAYER, 2023–2030 (USD THOUSAND)

- TABLE 148 EUROPE: MARKET, BY PROTOCOL LAYER, 2018–2022 (USD THOUSAND)

- TABLE 149 EUROPE: MARKET, BY PROTOCOL LAYER, 2023–2030 (USD THOUSAND)

- TABLE 150 EUROPE: MARKET, BY UTILITY LAYER, 2018–2022 (USD THOUSAND)

- TABLE 151 EUROPE: MARKET, BY UTILITY LAYER, 2023–2030 (USD THOUSAND)

- TABLE 152 EUROPE: MARKET, BY SERVICE LAYER, 2018–2022 (USD THOUSAND)

- TABLE 153 EUROPE: MARKET, BY SERVICE LAYER, 2023–2030 (USD THOUSAND)

- TABLE 154 EUROPE: MARKET, BY APPLICATION LAYER, 2018–2022 (USD THOUSAND)

- TABLE 155 EUROPE: MARKET, BY APPLICATION LAYER, 2023–2030 (USD THOUSAND)

- TABLE 156 EUROPE: MARKET, BY VERTICAL, 2018–2022 (USD THOUSAND)

- TABLE 157 EUROPE: MARKET, BY VERTICAL, 2023–2030 (USD THOUSAND)

- TABLE 158 ASIA PACIFIC: WEB 3.0 MARKET, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 159 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2030 (USD THOUSAND)

- TABLE 160 ASIA PACIFIC: MARKET, BY TECHNOLOGY STACK, 2018–2022 (USD THOUSAND)

- TABLE 161 ASIA PACIFIC: MARKET, BY TECHNOLOGY STACK, 2023–2030 (USD THOUSAND)

- TABLE 162 ASIA PACIFIC: MARKET, BY INFRASTRUCTURE LAYER, 2018–2022 (USD THOUSAND)

- TABLE 163 ASIA PACIFIC: MARKET, BY INFRASTRUCTURE LAYER, 2023–2030 (USD THOUSAND)

- TABLE 164 ASIA PACIFIC: MARKET, BY PROTOCOL LAYER, 2018–2022 (USD THOUSAND)

- TABLE 165 ASIA PACIFIC: MARKET, BY PROTOCOL LAYER, 2023–2030 (USD THOUSAND)

- TABLE 166 ASIA PACIFIC: MARKET, BY UTILITY LAYER, 2018–2022 (USD THOUSAND)

- TABLE 167 ASIA PACIFIC: MARKET, BY UTILITY LAYER, 2023–2030 (USD THOUSAND)

- TABLE 168 ASIA PACIFIC: MARKET, BY SERVICE LAYER, 2018–2022 (USD THOUSAND)

- TABLE 169 ASIA PACIFIC: MARKET, BY SERVICE LAYER, 2023–2030 (USD THOUSAND)

- TABLE 170 ASIA PACIFIC: MARKET, BY APPLICATION LAYER, 2018–2022 (USD THOUSAND)

- TABLE 171 ASIA PACIFIC: MARKET, BY APPLICATION LAYER, 2023–2030 (USD THOUSAND)

- TABLE 172 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2022 (USD THOUSAND)

- TABLE 173 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2030 (USD THOUSAND)

- TABLE 174 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 175 MIDDLE EAST & AFRICA: WEB 3.0 MARKET, BY COUNTRY, 2023–2030 (USD THOUSAND)

- TABLE 176 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY STACK, 2018–2022 (USD THOUSAND)

- TABLE 177 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY STACK, 2023–2030 (USD THOUSAND)

- TABLE 178 MIDDLE EAST & AFRICA: MARKET, BY INFRASTRUCTURE LAYER, 2018–2022 (USD THOUSAND)

- TABLE 179 MIDDLE EAST & AFRICA: MARKET, BY INFRASTRUCTURE LAYER, 2023–2030 (USD THOUSAND)

- TABLE 180 MIDDLE EAST & AFRICA: MARKET, BY PROTOCOL LAYER, 2018–2022 (USD THOUSAND)

- TABLE 181 MIDDLE EAST & AFRICA: MARKET, BY PROTOCOL LAYER, 2023–2030 (USD THOUSAND)

- TABLE 182 MIDDLE EAST & AFRICA: MARKET, BY UTILITY LAYER, 2018–2022 (USD THOUSAND)

- TABLE 183 MIDDLE EAST & AFRICA: MARKET, BY UTILITY LAYER, 2023–2030 (USD THOUSAND)

- TABLE 184 MIDDLE EAST & AFRICA: MARKET, BY SERVICE LAYER, 2018–2022 (USD THOUSAND)

- TABLE 185 MIDDLE EAST & AFRICA: MARKET, BY SERVICE LAYER, 2023–2030 (USD THOUSAND)

- TABLE 186 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION LAYER, 2018–2022 (USD THOUSAND)

- TABLE 187 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION LAYER, 2023–2030 (USD THOUSAND)

- TABLE 188 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2022 (USD THOUSAND)

- TABLE 189 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2030 (USD THOUSAND)

- TABLE 190 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 191 LATIN AMERICA: WEB 3.0 MARKET, BY COUNTRY, 2023–2030 (USD THOUSAND)

- TABLE 192 LATIN AMERICA: MARKET, BY TECHNOLOGY STACK, 2018–2022 (USD THOUSAND)

- TABLE 193 LATIN AMERICA: MARKET, BY TECHNOLOGY STACK, 2023–2030 (USD THOUSAND)

- TABLE 194 LATIN AMERICA: MARKET, BY INFRASTRUCTURE LAYER, 2018–2022 (USD THOUSAND)

- TABLE 195 LATIN AMERICA: MARKET, BY INFRASTRUCTURE LAYER, 2023–2030 (USD THOUSAND)

- TABLE 196 LATIN AMERICA: MARKET, BY PROTOCOL LAYER, 2018–2022 (USD THOUSAND)

- TABLE 197 LATIN AMERICA: MARKET, BY PROTOCOL LAYER, 2023–2030 (USD THOUSAND)

- TABLE 198 LATIN AMERICA: MARKET, BY UTILITY LAYER, 2018–2022 (USD THOUSAND)

- TABLE 199 LATIN AMERICA: MARKET, BY UTILITY LAYER, 2023–2030 (USD THOUSAND)

- TABLE 200 LATIN AMERICA: MARKET, BY SERVICE LAYER, 2018–2022 (USD THOUSAND)

- TABLE 201 LATIN AMERICA: MARKET, BY SERVICE LAYER, 2023–2030 (USD THOUSAND)

- TABLE 202 LATIN AMERICA: MARKET, BY APPLICATION LAYER, 2018–2022 (USD THOUSAND)

- TABLE 203 LATIN AMERICA: MARKET, BY APPLICATION LAYER, 2023–2030 (USD THOUSAND)

- TABLE 204 LATIN AMERICA: MARKET, BY VERTICAL, 2018–2022 (USD THOUSAND)

- TABLE 205 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2030 (USD THOUSAND)

- TABLE 206 OVERVIEW OF STRATEGIES ADOPTED BY KEY WEB 3.0 PLAYERS

- TABLE 207 COMPANY FOOTPRINT

- TABLE 208 MARKET: DETAILED LIST OF KEY SMES/STARTUPS

- TABLE 209 WEB 3.0 MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 210 WEB 3.0 MARKET: PRODUCT LAUNCHES, 2020–2023

- TABLE 211 WEB 3.0 MARKET: DEALS, 2020–2023

- TABLE 212 WEB 3.0 MARKET: OTHERS, 2020–2022

- TABLE 213 IBM: BUSINESS OVERVIEW

- TABLE 214 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 216 IBM: DEALS

- TABLE 217 AWS: BUSINESS OVERVIEW

- TABLE 218 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 220 AWS: DEALS

- TABLE 221 ORACLE: BUSINESS OVERVIEW

- TABLE 222 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 224 ORACLE: DEALS

- TABLE 225 COINBASE: BUSINESS OVERVIEW

- TABLE 226 COINBASE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 COINBASE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 228 COINBASE: DEALS

- TABLE 229 FUJITSU: BUSINESS OVERVIEW

- TABLE 230 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 FUJITSU: PRODUCT LAUNCHES

- TABLE 232 FUJITSU: DEALS

- TABLE 233 HUAWEI CLOUD: BUSINESS OVERVIEW

- TABLE 234 HUAWEI CLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 HUAWEI CLOUD: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 236 HUAWEI CLOUD: DEALS

- TABLE 237 NTT DOCOMO: BUSINESS OVERVIEW

- TABLE 238 NTT DOCOMO: DEALS

- TABLE 239 NTT DOCOMO: OTHERS

- TABLE 240 CHAINALYSIS: BUSINESS OVERVIEW

- TABLE 241 CHAINALYSIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 CHAINALYSIS: PRODUCT LAUNCHES

- TABLE 243 CHAINALYSIS: DEALS

- TABLE 244 RIPPLE LABS: BUSINESS OVERVIEW

- TABLE 245 RIPPLE LABS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 RIPPLE LABS: DEALS

- TABLE 247 RIPPLE LABS: OTHERS

- TABLE 248 CONSENSYS: BUSINESS OVERVIEW

- TABLE 249 CONSENSYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 CONSENSYS: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 251 CONSENSYS: DEALS

- TABLE 252 CONSENSYS: OTHERS

- TABLE 253 GEMINI: BUSINESS OVERVIEW

- TABLE 254 GEMINI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 GEMINI: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 256 BINANCE: BUSINESS OVERVIEW

- TABLE 257 BINANCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 BINANCE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 259 BINANCE: DEALS

- TABLE 260 BINANCE: OTHERS

- TABLE 261 BLOCKCHAIN MARKET SIZE AND GROWTH, 2018–2021 (USD MILLION, Y-O-Y %)

- TABLE 262 BLOCKCHAIN MARKET SIZE AND GROWTH, 2022–2027 (USD MILLION, Y-O-Y %)

- TABLE 263 BLOCKCHAIN MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 264 BLOCKCHAIN MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 265 BLOCKCHAIN MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 266 BLOCKCHAIN MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 267 BLOCKCHAIN MARKET, BY PROVIDER, 2018–2021 (USD MILLION)

- TABLE 268 BLOCKCHAIN MARKET, BY PROVIDER, 2022–2027 (USD MILLION)

- TABLE 269 BLOCKCHAIN MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 270 BLOCKCHAIN MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 271 BLOCKCHAIN MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 272 BLOCKCHAIN MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 273 BLOCKCHAIN MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 274 BLOCKCHAIN MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 275 BLOCKCHAIN MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 276 BLOCKCHAIN MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 277 ARTIFICIAL INTELLIGENCE MARKET SIZE AND GROWTH RATE, 2017–2022 (USD MILLION, Y-O-Y GROWTH)

- TABLE 278 ARTIFICIAL INTELLIGENCE MARKET SIZE AND GROWTH RATE, 2023–2030 (USD BILLION, Y-O-Y GROWTH)

- TABLE 279 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 280 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2023–2030 (USD MILLION)

- TABLE 281 ARTIFICIAL INTELLIGENCE MARKET, BY HARDWARE, 2017–2022 (USD MILLION)

- TABLE 282 ARTIFICIAL INTELLIGENCE MARKET, BY HARDWARE, 2023–2030 (USD MILLION)

- TABLE 283 ARTIFICIAL INTELLIGENCE MARKET, BY PROCESSOR, 2017–2022 (USD MILLION)

- TABLE 284 ARTIFICIAL INTELLIGENCE MARKET, BY PROCESSOR, 2023–2030 (USD MILLION)

- TABLE 285 SOFTWARE: ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 286 SOFTWARE: ARTIFICIAL INTELLIGENCE MARKET, BY TYPE, 2023–2030 (USD MILLION)

- TABLE 287 SOFTWARE: ARTIFICIAL INTELLIGENCE MARKET, BY DEPLOYMENT, 2017–2022 (USD MILLION)

- TABLE 288 SOFTWARE: ARTIFICIAL INTELLIGENCE MARKET, BY DEPLOYMENT, 2023–2030 (USD MILLION)

- TABLE 289 ARTIFICIAL INTELLIGENCE MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 290 ARTIFICIAL INTELLIGENCE MARKET, BY SERVICE, 2023–2030 (USD MILLION)

- TABLE 291 ARTIFICIAL INTELLIGENCE MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 292 ARTIFICIAL INTELLIGENCE MARKET, BY PROFESSIONAL SERVICE, 2023–2030 (USD MILLION)

- TABLE 293 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2017–2022 (USD MILLION)

- TABLE 294 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION)

- TABLE 295 ARTIFICIAL INTELLIGENCE MARKET, BY MACHINE LEARNING, 2017–2022 (USD MILLION)

- TABLE 296 ARTIFICIAL INTELLIGENCE MARKET, BY MACHINE LEARNING, 2023–2030 (USD MILLION)

- TABLE 297 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2017–2022 (USD MILLION)

- TABLE 298 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2023–2030 (USD MILLION)

- TABLE 299 ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 300 ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL, 2023–2030 (USD MILLION)

- TABLE 301 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 302 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2023–2030 (USD MILLION)

- FIGURE 1 WEB 3.0 MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

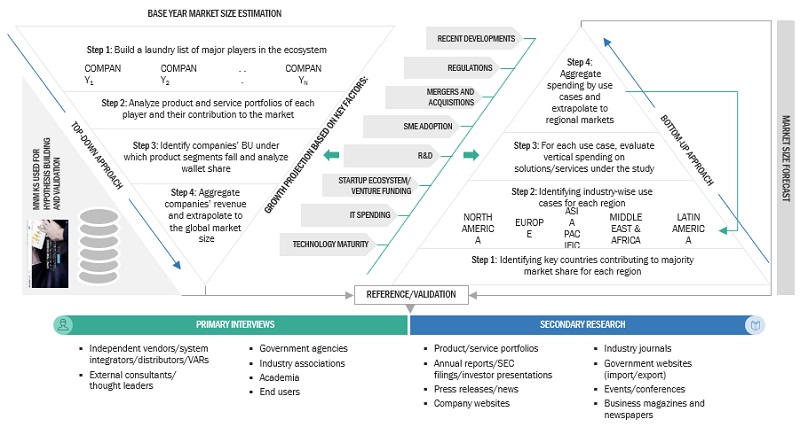

- FIGURE 3 WEB 3.0 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE), REVENUE FROM SOLUTIONS/SERVICES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2, BOTTOM-UP (SUPPLY-SIDE), COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3, BOTTOM-UP (SUPPLY-SIDE), COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF WEB 3.0

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4, BOTTOM-UP (DEMAND-SIDE), SHARE OF WEB 3.0 THROUGH OVERALL WEB 3.0 SPENDING

- FIGURE 8 LAYER 0 - INFRASTRUCTURE TO ACCOUNT FOR LARGEST MARKET SHARE (TECHNOLOGY STACK), 2023

- FIGURE 9 COMPUTING TO ACCOUNT FOR LARGEST MARKET SHARE, BY INFRASTRUCTURE LAYER, IN 2023

- FIGURE 10 PRIVACY & SECURITY PROTOCOLS TO DOMINATE MARKET, BY PROTOCOL LAYER, IN 2023

- FIGURE 11 CRYPTOCURRENCY ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE (UTILITY LAYER) IN 2023

- FIGURE 12 NON-FUNGIBLE TOKENS ESTIMATED TO DOMINATE SERVICE LAYER MARKET IN 2023

- FIGURE 13 DECENTRALIZED APPLICATIONS TO DOMINATE APPLICATION LAYER SEGMENT, 2023

- FIGURE 14 BFSI SEGMENT TO HOLD LARGEST SHARE OF MARKET, BY VERTICAL (2023)

- FIGURE 15 NORTH AMERICA AND EUROPE TO DOMINATE MARKET IN 2023

- FIGURE 16 RISING NEED FOR SECURE AND TRANSPARENT DIGITAL TRANSACTION TO BOOST DEMAND FOR WEB 3.0

- FIGURE 17 LAYER 0 – INFRASTRUCTURE ESTIMATED TO ACCOUNT FOR LARGEST MARKET

- FIGURE 18 LAYER 0 - INFRASTRUCTURE AND BFSI SEGMENTS ESTIMATED TO ACCOUNT FOR SIGNIFICANT MARKET SHARE

- FIGURE 19 NORTH AMERICA TO DOMINATE WEB 3.0 MARKET IN 2023

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: WEB 3.0 MARKET

- FIGURE 21 WEB 3.0 MARKET ECOSYSTEM ANALYSIS

- FIGURE 22 SUPPLY CHAIN ANALYSIS: WEB 3.0 MARKET

- FIGURE 23 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 24 TOTAL NUMBER OF PATENTS GRANTED, 2013–2023

- FIGURE 25 TOP COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2013–2023

- FIGURE 26 REGIONAL ANALYSIS OF PATENTS GRANTED, 2013–2023

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 29 WEB 3.0 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 30 LAYER 4 - APPLICATIONS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 VIRTUALIZATION SEGMENT TO GROW AT HIGHEST CAGR

- FIGURE 32 BLOCKCHAIN PROTOCOLS SEGMENT TO REGISTER HIGHEST GROWTH

- FIGURE 33 CRYPTOCURRENCY TO REGISTER HIGHEST CAGR

- FIGURE 34 NON-FUNGIBLE TOKENS TO HOLD LARGEST SHARE TILL 2030

- FIGURE 35 DECENTRALIZED APPLICATIONS TO DOMINATE MARKET TILL 2030

- FIGURE 36 HEALTHCARE & LIFE SCIENCES VERTICAL TO REGISTER HIGHEST CAGR

- FIGURE 37 INDIA TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 NORTH AMERICA AND EUROPE TO HOLD LARGEST MARKET SHARES

- FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 41 BUSINESS SEGMENT REVENUE ANALYSIS FOR KEY COMPANIES, 2020–2022 (USD MILLION)

- FIGURE 42 MARKET SHARE ANALYSIS FOR KEY PUBLIC COMPANIES, 2022

- FIGURE 43 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY PLATFORM

- FIGURE 44 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY PROJECT

- FIGURE 45 COMPANY EVALUATION MATRIX, 2023

- FIGURE 46 STARTUP/SME EVALUATION MATRIX, 2023

- FIGURE 47 VALUATION AND FINANCIAL METRICS OF KEY WEB 3.0 VENDORS

- FIGURE 48 YTD PRICE TOTAL RETURN AND STOCK BETA OF KEY WEB 3.0 VENDORS

- FIGURE 49 IBM: COMPANY SNAPSHOT

- FIGURE 50 AWS: COMPANY SNAPSHOT

- FIGURE 51 ORACLE: COMPANY SNAPSHOT

- FIGURE 52 COINBASE: COMPANY SNAPSHOT

- FIGURE 53 FUJITSU: COMPANY SNAPSHOT

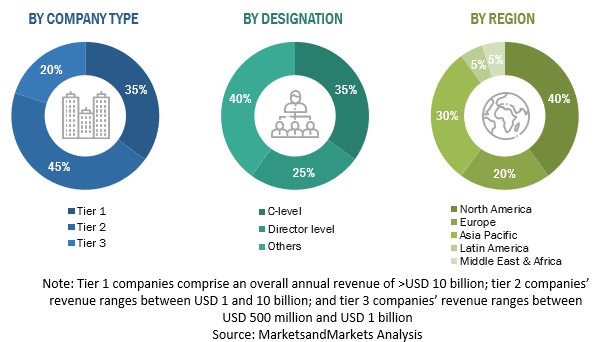

The research study for the Web 3.0 market involved the use of extensive secondary sources and directories, as well as various reputed open-source databases, to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including key opinion leaders, subject matter experts, high-level executives of multiple companies providing Web 3.0 offerings, and industry consultants to obtain and verify critical qualitative and quantitative information and assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as the Data Science Journal, Institute of Electrical and Electronics Engineers (IEEE) Journals and magazines, and other magazines. Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain to identify key players based on solutions, services, and market classification and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, applications, verticals, and region, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides of the Web 3.0 market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing Web 3.0 offerings; associated service providers; and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify and validate the segmentation types; industry trends; key players; the market's competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to record the critical information/insights throughout the report.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the Web 3.0 market and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global Web 3.0 market, using the revenue from the key companies and their offerings in the market. With data triangulation and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

The top-down approach prepared an exhaustive list of all the vendors offering Web 3.0. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on the breadth of solution and service offerings, cloud types, organization sizes, and verticals. The aggregate of all the companies' revenues was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

In the bottom-up approach, the adoption rate of Web 3.0 solutions, and services among different end-users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of Web 3.0 solutions, and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service’s website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency, USD, remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on Web 3.0 platforms and service based on some of the key use cases. These factors for the Web 3.0 tool industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Market Size Estimation: Top Down And Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to IBM, Web 3.0 is the collection of next gen web applications which use emerging technologies such as blockchain, AI, IoT, and augmented and virtual reality (AR/VR) as part of their core technology stack.

According to Binance, Web 3.0, often referred to as the "Semantic Web," signifies the next evolution of the internet, emphasizing a transition from an information-centric to a meaning-centric web. Its goal is to establish a smarter, more interconnected global web in which data is interconnected, machine-understandable, and readily accessible to humans.

Key Stakeholders

- Information Technology (IT) Professionals

- Government Agencies

- Investors and Venture Capitalists

- Managed and Professional Service Providers

- Web 3.0 Solution Vendors

- Infrastructure Providers

- Consultants/Consultancies/Advisory Firms

- System Integrators

- Third-Party Providers

- Value-added Resellers (VARs)

- Business Analysts

Report Objectives

- To define, describe, and predict the Web 3.0 market by technology stock, infrastructure layer, protocol layer, utility layer, service layer, application layer, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the market

- To analyze the impact of the recession on the Web 3.0 market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American market for Web 3.0

- Further breakup of the European market for Web 3.0

- Further breakup of the Asia Pacific market for Web 3.0

- Further breakup of the Latin American market for Web 3.0

- Further breakup of the Middle East & Africa market for Web 3.0

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Web 3.0 Market