Top 10 Sensors Market by Type (Pressure, Temperature, Image, Motion, Fingerprint, Level, Gas, Magnetic Field, Position, and Light), Technology, Application, End-User Industry, and Region (2021-2026)

Updated on : July 19 , 2023

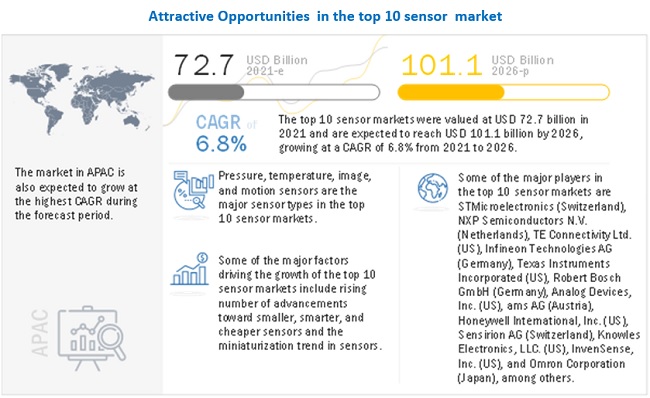

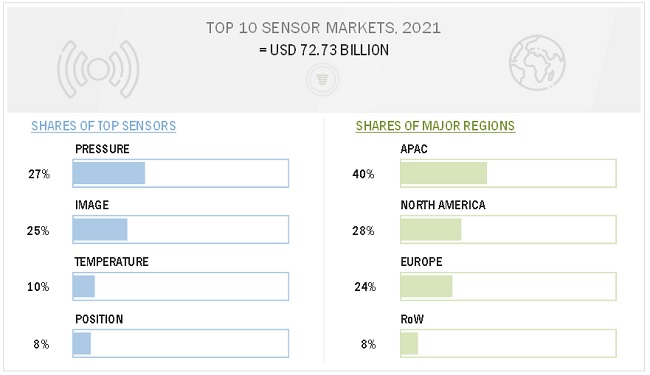

[373 Pages Report] The top 10 sensor markets were valued at USD 72.7 billion in 2021 and are expected to reach USD 101.1 billion by 2026, at a CAGR of 6.8% during the forecast period. Among the end-user industries, consumer electronics, automotive, and healthcare are the major markets. Some of the reasons are the increasing demand for smart devices in consumer electronics, growing importance of measuring and controlling devices in these industries, and increasing concern toward security and surveillance in these sectors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the top 10 sensor market

Automotive & transportation is a major end-use industry of the industrial sensors market. Many countries, including the US, China, Japan, and South Korea, have stopped the production of automobiles due to the COVID-19 pandemic. Ford (US) had earlier announced that it had suspended production at its facilities in the US for the first quarter of 2020. On March 26, 2020, it announced that a few of its facilities would be operational from April 14, 2020. Similarly, GM stopped all its North American operations on March 19, 2020, and announced that it would begin production based on a week-on-week analysis. Fiat Chrysler shut its entire production activities in North America on March 18, 2020. Kia Motors stopped its production in Georgia on March 24, 2020 and is expected to continue this for at least two weeks. Volvo suspended all the European production units on March 20, 2020; Aston Martin suspended its production units on March 24, 2020.

In the first quarter of 2020, the smartphone and consumer electronics sector was heavily impacted by the shutdown of production at facilities in China, which halted the manufacturing of phones and their key components and disrupted launch schedules for new phones. This segment saw major decline in global demand due to government lockdown mandates. Despite expected rebounds in some countries, the rest of the year is expected to be challenging for smartphone OEMs. The global smartphone shipments will decline to 1.20 billion units this year, down 13.1 % from 1.39 billion in 2019.

Market dynamics

DRIVERS: Advancements in MEMS technology-based sensors

Microelectromechanical system (MEM) is a technology used to develop micro-miniature electromechanical devices. sensors based on this technology can detect and measure external and respond mechanically (for instance, with the rotation of a motor) to compensate for the change. With significant advancements in the automotive and aviation industries, the demand for MEMS technology-based sensors is surging continuously. These sensors are used in biomedical applications, control systems, consumer products, and weather forecast systems to monitor environmental . Blood measuring systems using MEMS technology-based sensors when combined with analog-to-digital converters (ADC) have lower manufacturing costs than conventional blood monitoring systems. MEMS technology-based sensors are integrated with pills, known as smart pills, to monitor the flow rate of fluids in the stomach and intestines. Healthcare and automotive applications typically require compact, high-performance sensors that have fuel the adoption of MEMS technology-based sensors in these industries. These sensors have proven to be effective, as they can be easily installed behind panels and can transmit data to local or remote monitoring stations. Moreover, large-scale adoption of IoT platforms and remote connectivity is expected to result in a substantial rise in the demand for MEMS technology-based sensors, thereby contributing to the growth of the sensor market globally.

Stringent implementation of passenger safety regulations globally

Government regulations play a significant role in the growth of the market for sensors, used especially in automotive applications. The Transportation Recall Enhancement, Accountability, and Documentation (TREAD) Act implemented in the US has made the installation of tire monitoring systems (TPMS) mandatory in all vehicles. TPMS alerts drivers within 20 minutes of the detection of under-inflation tires in vehicles. The Government of the US also mandates all commercial vehicles to have airbags and side airbags for passengers. As sensors are deployed to regulate air in these bags, this fuels the growth of the sensor market. Similarly, the European Union regulations require all new passenger car models (M1) to be equipped with TPMS. Thus, intensifying concerns regarding the safety of onboard passengers, vehicles, and pedestrians are expected to fuel the demand for sensors used in automobiles. Additionally, the rising adoption of electric vehicles in the Americas, Europe, and APAC have increased growth prospects for the market for sensors used in automobiles.

RESTRAINTS

Intense pricing on manufacturers of sensors

While the widespread application of sensors in automated intelligent controls and wearable electronics leads to the increased shipment of these sensors, their sales growth is significantly restrained by price erosion. This is partially a result of the intense competition in the market owing to the rising number of manufacturers of sensors. Several companies are channeling their research and development activities toward providing cost-effective sensors based on existing technologies such as MEMS. Manufacturers are also required to decrease the prices of their sensors used in high-volume applications. This fall in prices not only hampers the revenue growth of companies operating in the highly competitive sensor market but also reduces the profit margins for suppliers.

The advancements in information and communication technologies (ICT) have led to the replacement of transducers with transmitters in most of the applications. Additionally, choosing transmitters over transducers has become highly attractive as the price premiums for transmitters are narrowing due to their high demand, leading to economies of scale, and this trend is expected to prevail in the coming years as well.

OPPORTUNITIES: Integration of IoT platforms and sensors

The advent of IoT has revolutionized the way the world connects. It has enabled the machines to make their own decisions by harnessing the capabilities of data analytics and cloud computing solutions. This is primarily achieved through advancements in semiconductor and electronic devices, high-speed wireless networks, and advanced analytics solutions. Several kinds of sensors are required to enable the exchange of data through several devices connected to IoT platforms.

sensors play a key role in the realization of benefits offered by IoT. The integration of these sensors with cloud computing is expected to help manufacturers offer comprehensive solutions for IoT applications. They measure physical parameters and convert them into values that can be read by users or their devices. sensors measure the of gas or liquid, along with variables such as speed and altitude.

CHALLENGE: High regulatory barriers

Legislation imposed by regulatory authorities have a key role in creating a positive macroeconomic environment for the growth of different markets. However, the economies that have been most successful in developing and maintaining healthy market spaces are those wherein governments have decreased their involvement at the microeconomic level and have allowed the market principles to operate. In the present era of globalization, when countries are increasing trading activities, the benefits in terms of an increase in exports are realized in an improved manner through free-trade policies. In such a scenario, excessively high tariffs act against the objective of globalization and hence, are required to be low. For instance, after the Brexit, there have been trading issues between the UK and the European Union (EU). Similarly, the ongoing trade war between the US and China is expected to further affect the overall sensor market as manufacturing plants of several sensor players are based in China. In case additional tariffs on China-made sensors are imposed in the US, it is expected to lead manufacturers of sensors to look for alternatives. Thus, high regulatory barriers act as a challenge for the growth of the sensor market.

Some of the well-known standards and regulations for sensors are as follows

- MIL-STD 202G Method 105C Barometric (9/12/63) that describes test procedures for barometric sensors used in high-altitude aircraft.

- Standards of the International Standards Organization (ISO) that fall under ISO/TC 30/SC 2— differential devices, ISO 21750: 2006, and road vehicles—safety enhancement in conjunction with the tire inflation monitoring.

- ISO 15500-2:2012 (en) road vehicles—compressed natural gas (CNG) fuel system components, which have two parts that specifically involve sensing. These are part 2: performance and general test methods and part 8: indicators.

- A certification program by NSF International specifying the safety and the quality requirements of automobiles for wheel tire monitoring sensors for the aftermarket parts industry.

- Standard specification for transducers, and differential, , electrical and fiber-optic, and active standard, ASTM F2070 issued by the American Society for Testing and Materials (ASTM) International that covers the requirements of and differential transducers for general applications.

Image sensor to dominate the market during the forecast period

Image sensors have recently found a major and evolving application in security & surveillance, automotive, and industrial sectors (especially in machine vision systems). These applications have recently started using cameras, creating a huge demand for image sensors. Earlier, only high-end cars had cameras installed, but now it is estimated that even low-end cars would have more than 10 cameras, which would assist the driver in safe driving. The developments and advancements in the technology of semiconductors have also helped in the development of complex image sensors that can take pictures without distorting the image quality.

“light sensor market to grow at a significant rate during the forecast period.”

The growing implementation of light sensor functions in smartphones and tablets is expected to support the growth of the light sensor market in the consumer electronics sector. Also, the demand from the automotive and home automation sectors is expected to drive the light sensor market. Functions such as gesture recognition, ambient light sensing (ALS), and proximity detection are expected to drive advancements in the automotive infotainment segment.

APAC is expected to highest CAGR during the forecast period

The top 10 sensor industry in this region is projected to grow at the highest CAGR during the forecast period as well. The increasing production of motor vehicles in countries such as India, China, Japan, and South Korea, is significantly contributing to the growth of the sensor market in APAC. Moreover, increased usage of sensors in various industries, such as automotive, healthcare, petrochemical, oil and gas, and consumer electronics, as well as process industries, is expected to fuel the growth of the market in APAC.

To know about the assumptions considered for the study, download the pdf brochure

In 2020, the Top 10 sensor companies such as Emerson Electric Co. (US), Honeywell (US), TDK Corporation (Japan), Texas Instruments (US), Apple (US), and Sony (Japan). A few strategies adopted by these players to compete in the top 10 sensor market include product launches and development, partnerships, and mergers and acquisition.

Top 10 sensor Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 72.7 billion in 2021 |

| Projected Market Size | USD 101.1 billion by 2026 |

| Growth Rate | At CAGR of 6.8% |

|

Market size available for years |

2016–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units |

Value (USD Billion/ Million), Volume ( Million Units) |

|

Segments covered |

Type, Application, technology , and end-use industry |

|

Region covered |

North America, Europe,APAC and RoW |

|

Companies covered |

Emerson Electric Co. (US), TDK Corporation(Japan), Endress+Hauser (Switzerland), Texas Instruments (US), ABB Ltd. (Switzerland), STMicroelctronics (Switzerland), NXP Semiconductors N.V. (Netherlands), Infineon technologies (Germany), Analog Devices (US), and Siemens AG (Germany), among others. |

This report categorizes the top 10 sensor market based on the methodology, gas analyzer, and region.

Market By Type

- Introduction

- sensor

- Temperature sensor

- Image Sensor

- Motion Sensor

- Gas sensor

- Fingerprint sensor

- Level Sensor

- Position Sensor

- Magnetic sensor

- Light sensor

- Market By Technology

- Market by Application

- Market by End use Industry

-

By Geography:

- Introduction

- North America

- Europe

- APAC

- RoW

Recent Market Developments

- In November 2020 STMicroelectronics collaborated with Qualcomm Technologies on unique sensor solutions for next-gen mobile phone, connected PC, IoT, and wearable applications.

- In July 2020 Texas Instruments launched the industry’s first zero-drift Hall-effect current sensors. The TMCS1100 and TMCS1101 enable the lowest drift and highest accuracy over time and temperature while providing reliable 3- kVrms isolation, which is especially important for AC or DC high-voltage systems such as industrial motor drives, solar inverters, energy storage equipment, and power supply.

- In June 2020 TDK and Arrow Electronics, Inc. extended their global distribution agreement to supply InvenSense products. Under the new agreement, Arrow extended its distribution of InvenSense’s complete portfolio of MEMS-based products to customers in the Americas, the Middle East, Africa, and Asia Pacific.

- In March 2020 TE Connectivity completed its public takeover offer of First Sensor AG. First Sensor is an expert in chip design and production, as well as microelectronic packaging and customer-specific sensor solutions in the fields of photonics, , and advanced electronics for applications within the industrial, medical, and transportation markets.

Frequently Asked Questions (FAQ):

What is the current size of the top 10 sensor market?

The top 10 sensor market was valued at USD 72.73 billion in 2021, growing at a CAGR of 6.8% during the forecast period.

Who are the winners in the global top 10 sensor market?

The major players operating in the top 10 sensor market are Emerson Electric Co. (US), Honeywell (US), Sony (Japan), STMicroelectronics(Swizterland), Apple (US), and Texas Instruments (US) few of the major strategies adopted by these players to compete in the top 10 sensor market include product launches and development, partnerships, and mergers and acquisitions.

What are the upcoming technological trends in the top 10 sensor market?

Printed electronics fabrication techniques combined with nano-catalysts used for gas sensing have led to the development of gas sensors with a thin chip-scale form factor. These sensors are inexpensive, having an ultralow-power package with high-performance capabilities. The presence of gases such as CO, alcohol, H2S, and zone can be detected with the help of these sensors.

What is the COVID-19 impact on top 10 sensor manufacturers?

In early 2020, COVID-19 hit the top 10 sensor market, resulting in a decline in magnetic sensor shipments and revenues generated from them. As a result, a dip was witnessed in the growth trend of the market during the first half of 2020. However, the latter half of the year is witnessed normalization in inventory levels and increased demand for magnetic sensors due to stabilization in the automotive, consumer electronics, and healthcare industries. The COVID-19 outbreak affected the production of top 10 sensors as manufacturing facilities across the world were temporarily shut down to curb the spread of the infection. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 45)

1.1 STUDY OBJECTIVES

1.2 STUDY SCOPE

1.2.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.2.2 YEARS CONSIDERED

1.3 CURRENCY

1.4 PACKAGE SIZE

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 49)

2.1 RESEARCH DATA

FIGURE 2 TOP 10 SENSOR MARKETS: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primaries

2.2 FACTOR ANALYSIS

2.2.1 DEMAND-SIDE ANALYSIS

2.2.1.1 Robust demand for consumer electronic products

2.2.1.2 Growth in wireless technology

2.2.2 SUPPLY-SIDE ANALYSIS

2.2.2.1 Growing need for real-time analysis

2.2.2.2 Technological advances in healthcare market

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Companies’ revenue contribution to top 10 sensor markets

2.3.1.2 Analysis of ASPs for different types of sensors

2.3.1.3 Shipment analysis for each type of sensor

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Estimating value and volume from secondary sources

2.3.2.2 Validating derived results with companies’ revenues and primaries

2.3.2.3 Mapping segment-I with remaining segments individually by “Waterfall Model”

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

FIGURE 4 RESEARCH FLOW

2.5 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 59)

FIGURE 5 FINGERPRINT SENSORS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 1 TOP 10 SENSOR MARKETS, BY TYPE, 2016–2019 (USD BILLION)

TABLE 2 TOP 10 SENSOR MARKETS, BY TYPE, 2020–2026 (USD BILLION)

FIGURE 6 IMAGE SENSOR TO HOLD MAJOR MARKET SHARE AND FINGERPRINT SENSOR LIKELY TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 65)

4.1 ATTRACTIVE OPPORTUNITIES IN TOP 10 SENSOR MARKETS

FIGURE 7 MARKET IN APAC TO GROW AT SIGNIFICANT CAGR FROM 2021 TO 2026

4.2 TOP 10 SENSOR MARKETS, BY TYPE (2016–2026)

FIGURE 8 PRESSURE SENSORS TO LEAD OVERALL TOP 10 SENSOR MARKETS DURING FORECAST PERIOD

4.3 TOP 10 SENSOR MARKETS, BY REGION (2021–2026)

FIGURE 9 APAC TO DOMINATE TOP 10 SENSOR MARKETS FROM 2021 TO 2026

4.4 TOP 10 SENSOR MARKETS, BY REGION AND TYPE

FIGURE 10 APAC TO HOLD LARGEST MARKET SHARE IN 2021

5 PRESSURE SENSOR MARKET (Page No. - 68)

5.1 MARKET DEFINITION

5.2 MARKET DYNAMICS

FIGURE 11 PRESSURE SENSOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Advancements in MEMS technology-based pressure sensors

5.2.1.2 Increased demand for pressure sensors from global automotive and medical industries

FIGURE 12 GLOBAL AUTOMOTIVE SALES, BY VEHICLE TYPE, 2012–2018 (MILLION UNITS)

5.2.1.3 Stringent implementation of passenger safety regulations globally

FIGURE 13 PRIVATELY CHARGED ELECTRIC CARS PLYING ON ROADS, BY COUNTRY, 2019 (%)

5.2.1.4 Increased use of pressure sensors in smartphones

FIGURE 14 GLOBAL MOBILE SUBSCRIPTIONS GROWTH FROM 2017 TO 2020

5.2.2 RESTRAINTS

5.2.2.1 Intense pricing pressure on manufacturers of pressure sensors

5.2.2.2 Fluctuating prices of raw materials

5.2.3 OPPORTUNITIES

5.2.3.1 Advancements in NEMS technology

5.2.3.2 Integration of IoT platforms and pressure sensors

FIGURE 15 SHARES OF REGIONS USING PRESSURE SENSORS AND IOT

5.2.4 CHALLENGES

5.2.4.1 High regulatory barriers

5.2.4.2 Mechanical shocks and vibration loads

5.3 COVID-19 IMPACT ANALYSIS

TABLE 3 PRE- AND POST-COVID-19 ANALYSIS OF PRESSURE SENSOR MARKET, 2016–2026 (USD MILLION)

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 PRESSURE SENSOR MARKET: PORTER’S FIVE FORCES ANALYSIS (2020)

5.4.1 INTENSITY OF COMPETITIVE RIVALRY

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF BUYERS

5.4.4 BARGAINING POWER OF SUPPLIERS

5.4.5 THREAT OF NEW ENTRANTS

5.5 PRESSURE SENSOR MARKET, BY TECHNOLOGY

FIGURE 17 PIEZORESISTIVE SEGMENT TO ACCOUNT FOR LARGEST SIZE OF PRESSURE SENSOR MARKET FROM 2021 TO 2026

TABLE 4 PRESSURE SENSOR MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 5 PRESSURE SENSOR MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

5.5.1 PIEZORESISTIVE PRESSURE SENSORS

5.5.1.1 Increasing use of piezoresistive pressure sensing technology to measure absolute, gauge, vacuum, and differential pressures

5.5.2 CAPACITIVE PRESSURE SENSORS

5.5.2.1 Growing adoption of capacitive pressure sensors for measuring liquid or gas pressure in car tires and jet engines

5.5.3 ELECTROMAGNETIC PRESSURE SENSORS

5.5.3.1 Rising demand for electromagnetic pressure sensors to measure very low pressures

5.5.4 RESONANT PRESSURE SENSORS

5.5.4.1 Increasig adoption of resonant pressure sensors in low differential pressure applications

5.5.5 OPTICAL PRESSURE SENSORS

5.5.5.1 Surging use of optical pressure sensors in high-temperature applications

5.5.6 OTHERS

5.5.6.1 Piezoelectric

5.5.6.1.1 Piezoelectric pressure sensors used for measuring dynamic pressure

5.5.6.2 Potentiometric

5.5.6.2.1 Potentiometric pressure sensors—low-cost sensors

5.5.6.3 Thermal

5.5.6.3.1 Thermal pressure sensors use thermal conductivity gauges

5.6 PRESSURE SENSOR MARKET, BY APPLICATION

TABLE 6 PRESSURE SENSOR MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 7 PRESSURE SENSOR MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

5.6.1 AUTOMOTIVE

5.6.1.1 Surging use of MEMS technology-based pressure sensors in new automotive applications

5.6.2 OIL AND GAS

5.6.2.1 Rising demand for gas pressure transducers in oil and gas plants for safe and efficient operations

5.6.3 CONSUMER ELECTRONICS

5.6.3.1 Increasing penetration of MEMS technology into pressure sensors for use in consumer electronics

5.6.4 MEDICAL

5.6.4.1 Blood pressure sensors

5.6.4.1.1 Rising use of pressure sensors for blood pressure monitoring

5.6.4.2 Cardiac catheters

5.6.4.2.1 Increasing adoption of pressure sensors in cardiac catheters for cardiac diagnosis

5.6.4.3 Neonatal catheters

5.6.4.3.1 Surging demand for intrauterine catheters equipped with pressure sensors for use in induced or complicated deliveries

5.6.4.4 Laparoscopic devices

5.6.4.4.1 Rising use of pressure sensors for measuring level of pressurized carbon dioxide

5.6.5 UTILITIES

5.6.5.1 Growing use of pressure sensors in power generation, water distribution, and related activities

5.6.6 INDUSTRIAL

5.6.6.1 Expanding deployment of pressure sensors for semiconductor processing, robotics, and test and measurement industrial applications

5.6.7 AVIATION

5.6.7.1 Rising demand for pressure sensors in aviation applications

5.6.8 MARINE

5.6.8.1 Surging use of Pressure sensors in submarines for measuring depth at which they operate

5.6.9 OTHERS

5.7 REGIONAL ANALYSIS

TABLE 8 PRESSURE SENSOR MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 9 PRESSURE SENSOR MARKET, BY REGION, 2020–2026 (USD MILLION)

5.7.1 NORTH AMERICA

5.7.2 EUROPE

5.7.3 APAC

5.7.4 ROW

5.8 COMPLETIVE LANDSCAPE

TABLE 10 TOP 5 PLAYERS IN PRESSURE SENSOR MARKET, 2020

TABLE 11 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS IN PRESSURE SENSOR MARKET, 2020

6 TEMPERATURE SENSOR MARKET (Page No. - 92)

6.1 MARKET DEFINITION

6.2 MARKET DYNAMICS

6.2.1 DRIVERS

6.2.1.1 Increasing penetration of temperature sensors in advanced and portable healthcare equipment

FIGURE 18 FORECAST FOR NUMBER OF PEOPLE ABOVE 60 YEARS OF AGE, FROM FY 2000 TO 2050 (MILLIONS)

6.2.1.2 Growing demand for temperature sensors in automotive sector

FIGURE 19 AUTOMOTIVE SALES, BY VEHICLE TYPE, 2012–2018 (MILLION UNIT)

6.2.1.3 Rising adoption of home and building automation systems

6.2.2 RESTRAINTS

6.2.2.1 Fluctuating raw material prices

6.2.3 OPPORTUNITIES

6.2.3.1 Increasing trend of wearable devices

FIGURE 20 GLOBAL WEARABLE DEVICES REGIONAL MARKET SHIPMENT FOR FY 2016, MILLION UNITS

6.2.3.2 Rising need for temperature control for food safety management

6.2.4 CHALLENGES

6.2.4.1 Stringent performance requirements for advanced applications

6.2.4.2 Continual price reductions and intense competition among manufacturers

6.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 TEMPERATURE SENSOR MARKET: PORTER’S FIVE FORCES ANALYSIS (2020)

6.3.1 THREAT OF NEW ENTRANTS

6.3.2 THREAT OF SUBSTITUTES

6.3.3 BARGAINING POWER OF SUPPLIERS

6.3.4 BARGAINING POWER OF BUYERS

6.3.5 INTENSITY OF COMPETITIVE RIVALRY

6.4 COVID-19 IMPACT ANALYSIS

TABLE 12 PRE- AND POST-COVID-19 ANALYSIS OF TEMPERATURE SENSOR MARKET, 2016–2025 (USD MILLION)

6.5 TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE

TABLE 13 MAJOR PRODUCT TYPE CHARACTERISTICS

FIGURE 22 THERMOCOUPLE-BASED TEMPERATURE SENSORS LIKELY TO LEAD TEMPERATURE SENSOR MARKET DURING FORECAST PERIOD

TABLE 14 TEMPERATURE SENSOR MARKET, BY CONTACT PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 15 TEMPERATURE SENSOR MARKET, BY CONTACT PRODUCT TYPE, 2020–2026 (USD MILLION)

TABLE 16 TEMPERATURE SENSOR MARKET, BY NON-CONTACT PRODUCT TYPE, 2016–2019 (MILLION)

TABLE 17 TEMPERATURE SENSOR MARKET, BY NON-CONTACT PRODUCT TYPE, 2020–2025 (MILLION)

TABLE 18 TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE, 2016–2019 (MILLION UNITS)

TABLE 19 TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE, 2020–2026 (MILLION UNITS)

6.5.1 BIMETALLIC TEMPERATURE SENSOR

6.5.1.1 Bimetallic temperature sensors used extensively to control water heating elements in boilers, furnaces, and hot water storage tanks

6.5.2 TEMPERATURE SENSOR IC

6.5.2.1 Market for temperature sensor ICs to grow at significant CAGR during forecast period

6.5.3 THERMISTOR

6.5.3.1 Low-cost NTC sensors used in applications where temperature ranges from -40°C to +300°C

6.5.4 RESISTIVE TEMPERATURE DETECTOR (RTD)

6.5.4.1 RTDs widely preferred for air conditioning, food processing, and textile production

6.5.5 THERMOCOUPLE

6.5.5.1 Thermocouples accounted for largest share of contact temperature sensor market

TABLE 20 COMMON TYPES OF THERMOCOUPLES

6.5.6 INFRARED TEMPERATURE SENSORS

6.5.6.1 Infrared temperature sensors have wide application in manufacturing processes for various end-user industries

6.5.7 FIBER OPTIC TEMPERATURE SENSORS

6.5.7.1 Market for fiber optic temperature sensors to grow at higher CAGR

6.5.8 OTHER TYPES OF TEMPERATURE SENSORS

6.6 TEMPERATURE SENSOR MARKET, BY OUTPUT

TABLE 21 TEMPERATURE SENSOR MARKET, BY OUTPUT, 2016–2019 (MILLION)

TABLE 22 TEMPERATURE SENSOR MARKET, BY OUTPUT, 2020–2025 (MILLION)

6.6.1 ANALOG

6.6.1.1 Analog temperature sensors cheaper than digital temperature sensors

6.6.2 DIGITAL

6.6.2.1 Market for digital temperature sensors to grow at higher CAGR during forecast period

6.6.2.2 Single-channel digital temperature sensors

6.6.2.2.1 Compactness and low power consumption—features of single-channel digital temperature sensors

6.6.2.3 Multichannel digital temperature sensors

6.6.2.3.1 Multichannel digital sensors can monitor multichannels, have flexible design, and offer higher accuracy

6.7 TEMPERATURE SENSOR MARKET, BY END-USER INDUSTRY

6.7.1 PROCESS INDUSTRY END USERS

TABLE 23 TEMPERATURE SENSOR MARKET, BY PROCESS INDUSTRY, 2016–2019 (USD MILLION)

TABLE 24 TEMPERATURE SENSOR MARKET, BY PROCESS INDUSTRY, 2020–2026 (USD MILLION)

6.7.2 CHEMICAL

6.7.2.1 Processes such as refining, heat tracing, and incineration require temperature sensors

6.7.3 OIL & GAS

6.7.3.1 oil & gas exploration involves critical measures such as preventing moisture, overheating, corrosion, and inefficient fuel usage

6.7.4 CONSUMER ELECTRONICS

6.7.4.1 Introduction of new technologies to surge market growth for electrical and electronic applications

6.7.5 UTILITIES

6.7.5.1 Increasing need for renewable energy generation to have positive impact on market growth

6.7.6 HEALTHCARE

6.7.6.1 Thermistors mostly used for disposable medical applications as these sensors provide most accurate and sensitive measurements

6.7.7 AUTOMOTIVE

6.7.7.1 Temperature sensors used in automotive HVAC systems owing to rising concerns about occupant comfort

6.7.8 METAL & MINING

6.7.8.1 Temperature sensors used for mineral extraction, refining, and engine monitoring

6.7.9 FOOD & BEVERAGES

6.7.9.1 Temperature monitoring and control required for quality assurance during production, storage, and transit of food and BEVERAGES

6.7.10 PULP & PAPER

6.7.10.1 Temperature monitoring and control through TEMPERATURE sensors involved in pulping and bleaching processes

6.7.11 ADVANCED FUELS

6.7.11.1 Increasing demand for temperature sensors from automobiles using different varieties of fuel

6.7.12 AEROSPACE & DEFENSE

6.7.12.1 Typical uses of temperature sensors include measurement of aircraft skin temperature, environmental temperature, and surrounding critical electronic components

6.7.13 GLASS

6.7.13.1 Temperature sensors required for measuring high temperatures during glass manufacturing

6.7.14 OTHERS

6.8 REGIONAL ANALYSIS

TABLE 25 TEMPERATURE SENSOR MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 TEMPERATURE SENSOR MARKET, BY REGION, 2020–2025 (USD MILLION)

6.8.1 NORTH AMERICA

6.8.2 EUROPE

6.8.3 APAC

6.8.4 ROW

6.9 COMPETITIVE LANDSCAPE

TABLE 27 TOP 5 PLAYERS IN TEMPERATURE SENSOR MARKET, 2020

7 IMAGE SENSOR MARKET (Page No. - 121)

7.1 MARKET DEFINITION

7.2 MARKET DYNAMICS

7.3 MARKET DYNAMICS

FIGURE 23 IMAGE SENSOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

7.3.1 DRIVERS

7.3.1.1 Increase in incorporation of high-resolution cameras equipped with image sensors in mobile devices

7.3.1.2 Growth in adoption of image cameras for automotive applications

7.3.1.3 Rise in use of image sensors in advanced medical imaging solutions

7.3.2 RESTRAINTS

7.3.2.1 High manufacturing costs of large chip image sensors

7.3.2.2 Easy availability of LiDAR solutions for autonomous vehicles

7.3.3 OPPORTUNITIES

7.3.3.1 Development of AI-based image sensors

7.3.4 CHALLENGES

7.3.4.1 Supply chain disruptions caused by COVID-19

7.4 REVENUE SHIFT AND NEW REVENUE POCKETS FOR IMAGE SENSOR MARKET

7.5 PORTER’S FIVE FORCES ANALYSIS

FIGURE 24 IMAGE SENSOR MARKET: PORTER’S FIVE FORCES ANALYSIS (2020)

7.5.1 INTENSITY OF COMPETITIVE RIVALRY

7.5.2 THREAT OF SUBSTITUTES

7.5.3 BARGAINING POWER OF BUYERS

7.5.4 BARGAINING POWER OF SUPPLIERS

7.5.5 THREAT OF NEW ENTRANTS

7.6 COVID-19 IMPACT ANALYSIS

FIGURE 25 PRE- AND POST-COVID-19 SCENARIOS OF IMAGE SENSOR MARKET, BY REGION

7.7 IMAGE SENSOR MARKET, BY TECHNOLOGY

TABLE 28 IMAGE SENSOR MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 29 IMAGE SENSOR MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

7.7.1 CMOS (COMPLEMENTARY METAL-OXIDE-SEMICONDUCTOR)

7.7.1.1 FSI Technology

7.7.1.1.1 FSI technology has limited end-use applications

7.7.1.2 BSI Technology

7.7.1.2.1 BSI technology enhances low light sensitivity, high image quality, and good color reproduction

7.7.1.3 3D stacking BSI

7.7.1.3.1 3D stacking in imaging chips helps in reducing size of chips

7.7.2 CCD (CHARGE-COUPLED DEVICE)

7.7.2.1 CCD image sensors use global shutter function to capture complete image at once

7.7.3 OTHERS

7.7.4 MARKET, BY PROCESSING TYPE

7.7.4.1 2D image sensor

7.7.4.2 3D image sensor

7.7.5 MARKET, BY SPECTRUM

7.7.5.1 Visible spectrum image sensors

7.7.5.1.1 Rising incorporation of visible spectrum image sensors in consumer electronics to propel demand

7.7.5.2 Non-visible spectrum image sensors

7.7.5.2.1 Infrared invisible spectrum image sensor

7.7.5.2.1.1 IR image sensors used in surveillance, automotive, and machine vision applications

7.7.5.2.2 X-ray light

7.7.5.2.2.1 X-ray crystallography, dental radiography, surgical radiography, analytical radiography, industrial CT & radiography—major application areas of X-ray light

TABLE 30 IMAGE SENSOR MARKET, BY SPECTRUM, 2016–2019 (USD MILLION)

TABLE 31 IMAGE SENSOR MARKET, BY SPECTRUM, 2020–2026 (USD MILLION)

7.7.6 IMAGE SENSOR MARKET, BY ARRAY TYPE

7.7.6.1 Linear image sensor

7.7.6.1.1 Linear image sensors facilitate fast scanning

7.7.6.2 Area image sensor

7.7.6.2.1 Area image sensor segment to lead market during forecast period

TABLE 32 IMAGE SENSOR MARKET, BY ARRAY TYPE, 2016–2019 (USD MILLION)

TABLE 33 IMAGE SENSOR MARKET, BY ARRAY TYPE, 2020–2026 (USD MILLION)

7.8 IMAGE SENSOR MARKET, BY APPLICATION

TABLE 34 IMAGE SENSOR MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 35 IMAGE SENSOR MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

7.8.1 AEROSPACE

7.8.1.1 CMOS image sensors extensively used for aerospace applications

7.8.2 AUTOMOTIVE

7.8.2.1 Increasing adoption of ADAS system fueling demand for image sensors in automotive applications

7.8.3 CONSUMER ELECTRONICS

7.8.3.1 Consumer electronics application to capture largest size of image sensor market during forecast period

7.8.3.2 Smartphones

7.8.3.2.1 High demand for camera-enabled smartphones fostering market for smartphone applications

7.8.3.3 Tablet PC

7.8.3.3.1 Demand for image sensors stemming from substantially growing shipments of tablet PCs

7.8.3.4 Camera

7.8.3.4.1 Digital cameras mainly use CMOS image sensors

7.8.3.5 Wearable electronics

7.8.3.5.1 Wearable electronics applications demand compact image sensors

7.8.4 HEALTHCARE

7.8.4.1 Image sensors increasingly being used in healthcare applications, such as endoscopy and X-ray imaging

7.8.4.2 X-ray Imaging

7.8.4.2.1 X-ray image sensors offer high-quality images

7.8.4.3 Endoscopy

7.8.4.3.1 Image sensor-equipped endoscopes used to examine different organs

7.8.5 INDUSTRIAL

7.8.5.1 CMOS image sensors preferred over CCD sensors for industrial applications

7.8.6 ENTERTAINMENT

7.8.6.1 Gaming services have boosted the demand for image sensors in the entertainment sector

7.8.7 SECURITY AND SURVEILLANCE

7.8.7.1 Demand for high-definition resolution in IP networking sped up development of image sensors for security and surveillance applications

7.8.8 OTHERS

7.9 REGIONAL ANALYSIS

TABLE 36 IMAGE SENSOR MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 37 IMAGE SENSOR MARKET, BY REGION, 2020–2026 (USD MILLION)

7.9.1 NORTH AMERICA

7.9.2 EUROPE

7.9.3 APAC

7.9.4 ROW

7.10 COMPETITIVE LANDSCAPE

TABLE 38 RANKING OF KEY PLAYERS IN IMAGE SENSOR MARKET, 2020

TABLE 39 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS IN IMAGE SENSOR MARKET

8 MOTION SENSOR MARKET (Page No. - 144)

8.1 MARKET DEFINITION

8.2 MARKET DYNAMICS

FIGURE 26 MOTION SENSOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

8.2.1 DRIVERS

8.2.1.1 Huge demand from consumer electronics industry

8.2.1.2 Emergence of efficient, economic, and compact MEMS technology

8.2.1.3 Growth in adoption of automation in industries and home

8.2.1.4 Rise in demand from emerging economies

8.2.1.5 Increase in defense expenditure worldwide

8.2.2 RESTRAINTS

8.2.2.1 Highly complex manufacturing process and demanding cycle time

8.2.2.2 Capital intensive applications

8.2.3 OPPORTUNITIES

8.2.3.1 Growth in demand for wearable electronics

8.2.3.2 Commercialization of IoT

FIGURE 27 IOT CONNECTIONS WORLDWIDE

8.2.3.3 Introduction of advanced consumer applications

8.2.3.4 Rise in demand for unmanned vehicles

8.2.3.5 Increase in fleet size in commercial aviation

8.2.4 CHALLENGES

8.2.4.1 Falling return on investment

8.2.4.2 Growing level of integration

8.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 28 MOTION SENSOR MARKET: PORTER’S FIVE FORCES ANALYSIS (2020)

8.3.1 INTENSITY OF COMPETITIVE RIVALRY

8.3.2 THREAT OF SUBSTITUTES

8.3.3 BARGAINING POWER OF BUYERS

8.3.4 BARGAINING POWER OF SUPPLIERS

8.3.5 THREAT OF NEW ENTRANTS

8.4 COVID-19 IMPACT ANALYSIS

TABLE 40 PRE- AND POST-COVID-19 ANALYSIS OF MOTION SENSOR MARKET, 2016–2026 (USD MILLION)

8.5 MOTION SENSOR MARKET, BY TECHNOLOGY

TABLE 41 MOTION SENSOR MARKET, BY MOTION TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 42 MOTION SENSOR MARKET, BY MOTION TECHNOLOGY, 2020–2026 (USD MILLION)

TABLE 43 MOTION SENSOR MARKET, BY MOTION TECHNOLOGY, 2016–2019 (MILLION UNITS)

TABLE 44 MOTION SENSOR MARKET, BY MOTION TECHNOLOGY, 2020–2026 (MILLION UNITS)

8.5.1 INFRARED MOTION SENSORS

8.5.1.1 Infrared motion technology sensors to dominate market

8.5.2 ULTRASONIC SENSORS

8.5.2.1 Growing adoption in home security system boosts demand

8.5.3 MICROWAVE SENSOR

8.5.3.1 Growing adoption in other applications boost demand

8.5.4 DUAL TECHNOLOGY SENSOR

8.5.4.1 Combination sensor preference to drive dual technology sensor demand

8.5.5 TOMOGRAPHIC SENSOR

8.5.5.1 Tomographic motion sensors widely used for consumer electronics and automotive applications

8.5.6 OTHER MOTION SENSOR TECHNOLOGIES

8.6 MOTION SENSOR MARKET, BY EMBEDDED SENSOR TYPE

TABLE 45 MOTION SENSOR MARKET, BY EMBEDDED SENSOR, 2016–2019 (USD MILLION)

TABLE 46 MOTION SENSOR MARKET, BY EMBEDDED SENSOR, 2020–2026 (USD MILLION)

8.6.1 MEMS ACCELEROMETER

8.6.2 MEMS GYROSCOPE

8.6.3 MEMS MAGNETOMETER

8.6.4 SENSOR COMBOS

8.7 MOTION SENSOR MARKET, BY APPLICATION

TABLE 47 MOTION SENSOR MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 48 MOTION SENSOR MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

8.7.1 CONSUMER ELECTRONICS

8.7.1.1 Consumer electronics applications to dominate market during forecast period

8.7.1.2 Smartphones & tablets

8.7.1.2.1 Growing advanced features in smartphones and tablets drive market growth

8.7.1.3 Gaming & entertainment

8.7.1.3.1 High adoption in next-generation gaming console boosting demand

8.7.1.4 Wearable devices

8.7.1.5 Others

8.7.2 AUTOMOTIVE APPLICATION

8.7.2.1 Automotive—fastest growing application for motion sensors

8.7.2.2 Airbag deployment system

8.7.2.2.1 Accelerometers and gyroscopes widely used in automotive applications

8.7.2.3 Advanced driver assistance system (ADAS)

8.7.2.3.1 Growing functional engagement with help of motion sensor integration drives market growth

8.7.3 INDUSTRIAL APPLICATION

8.7.3.1 Fire alarms & smoke detectors

8.7.3.1.1 Motion sensors preferred in home automation

8.7.3.2 Lighting controls (outdoor/indoor)

8.7.3.2.1 Low energy consumption ability drives demand

8.7.3.3 Service robotics

8.7.3.3.1 Sensors—important components of robotics

8.7.4 AEROSPACE & DEFENSE

8.7.4.1 Growing need for customized solutions within aerospace & defense boost demand

8.7.5 HEALTHCARE

8.7.5.1 Development of new technology and increase in demand for medical and healthcare devices drive market

8.8 REGIONAL ANALYSIS

TABLE 49 MOTION SENSOR MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 50 MOTION SENSOR MARKET, BY REGION, 2020–2026 (USD MILLION)

8.8.1 NORTH AMERICA

8.8.2 EUROPE

8.8.3 APAC

8.8.4 ROW

8.9 COMPETITIVE LANDSCAPE

TABLE 51 TOP 5 PLAYERS IN MOTION SENSOR MARKET, 2020

TABLE 52 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS IN MOTION SENSOR MARKET, 2020

9 FINGERPRINT SENSOR MARKET (Page No. - 168)

9.1 MARKET DEFINITION

9.2 MARKET DYNAMICS AND FACTOR ANALYSIS

FIGURE 29 FINGERPRINT SENSOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

9.2.1 DRIVERS

9.2.1.1 Increase in use of fingerprint sensing technology in consumer devices for biometric authentication

9.2.1.2 Emergence of biometric smartcards in BFSI applications

9.2.2 RESTRAINTS

9.2.2.1 Health concerns amid COVID-19

9.2.3 OPPORTUNITIES

9.2.3.1 Introduction of in-display fingerprint sensors in smartphones

9.2.3.2 Increase in demand for laptops and notebooks due to COVID-19

9.2.4 CHALLENGES

9.2.4.1 Government restrictions pertaining to COVID-19 lockdowns

9.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 30 FINGERPRINT SENSOR MARKET: PORTER’S FIVE FORCES ANALYSIS (2020)

9.3.1 BARGAINING POWER OF SUPPLIERS

9.3.2 BARGAINING POWER OF BUYERS

9.3.3 THREAT OF SUBSTITUTES

9.3.4 THREAT OF NEW ENTRANTS

9.3.5 INTENSITY OF COMPETITIVE RIVALRY

9.4 COVID-19 IMPACT ANALYSIS

TABLE 53 PRE- AND POST-COVID-19 ANALYSIS OF FINGERPRINT SENSOR MARKET, 2016–2026 (USD MILLION)

9.5 FINGERPRINT SENSOR MARKET, BY DEVICE TYPE

TABLE 54 FINGERPRINT SENSOR MARKET, BY DEVICE TYPE, 2016–2019 (MILLION)

TABLE 55 FINGERPRINT SENSOR MARKET, BY DEVICE TYPE, 2020–2026 (MILLION)

TABLE 56 FINGERPRINT SENSOR MARKET, BY DEVICE TYPE, 2016–2019 (MILLION UNITS)

TABLE 57 FINGERPRINT SENSOR MARKET, BY DEVICE TYPE, 2020–2026 (MILLION UNITS)

9.5.1 CONSUMER DEVICES

9.5.1.1 Smart devices and wearables

9.5.1.2 Access control systems

9.5.1.2.1 Biometric Systems

9.5.1.2.2 Digital Locks

9.5.1.3 Biometric smartcards

9.5.1.3.1 Financial cards

9.5.1.3.2 ID cards

9.5.1.4 Vehicles

9.5.1.5 Others

9.6 FINGERPRINT SENSOR MARKET, BY TECHNOLOGY

FIGURE 31 CAPACITIVE TECHNOLOGY TO DOMINATE FINGERPRINT SENSOR MARKET DURING FORECAST PERIOD

TABLE 58 FINGERPRINT SENSOR MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 59 FINGERPRINT SENSOR MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

9.6.1 CAPACITIVE SENSING TECHNOLOGY

9.6.2 OPTICAL SENSING TECHNOLOGY

9.6.3 OTHER TECHNOLOGIES

9.7 FINGERPRINT SENSOR MARKET, BY APPLICATION

FIGURE 32 CONSUMER DEVICES APPLICATION TO LEAD FINGERPRINT SENSOR MARKET DURING FORECAST PERIOD

TABLE 60 FINGERPRINT SENSOR MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 61 FINGERPRINT SENSOR MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

9.7.1 CONSUMER ELECTRONICS/MOBILE DEVICES

9.7.1.1 Smartphones

9.7.1.2 Laptops/notebooks/tablets

9.7.1.3 Wristbands and smartbands

9.7.1.4 USB flash drives

9.7.1.5 Other consumer electronics

9.7.2 TRAVEL & IMMIGRATION

9.7.3 GOVERNMENT & LAW ENFORCEMENT

9.7.4 MILITARY, DEFENSE, AND AEROSPACE

9.7.5 BANKING & FINANCE

9.7.6 COMMERCIAL SECURITY

9.7.7 HEALTHCARE

9.7.8 SMART HOMES

9.7.9 OTHERS

9.8 REGIONAL ANALYSIS

TABLE 62 FINGERPRINT SENSOR MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 63 FINGERPRINT SENSOR MARKET, BY REGION, 2020–2026 (USD MILLION)

9.8.1 NORTH AMERICA

9.8.2 EUROPE

9.8.3 APAC

9.8.4 ROW

9.9 COMPETITIVE LANDSCAPE

TABLE 64 TOP 5 PLAYERS IN FINGERPRINT SENSOR MARKET, 2020

TABLE 65 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS IN FINGERPRINT SENSOR MARKET, 2020

10 LEVEL SENSOR MARKET (Page No. - 190)

10.1 MARKET DEFINITION

10.2 MARKET DYNAMICS

FIGURE 33 LEVEL SENSOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

10.2.1 DRIVERS

10.2.1.1 Reducing size of sensors

10.2.1.2 Rising adoption of level sensors in process industries

10.2.1.3 Increasing use of IIoT solutions

10.2.1.4 Persisting vehicle production worldwide

FIGURE 34 GLOBAL VEHICLE PRODUCTION STATISTICS (2000–2020)

10.2.2 RESTRAINTS

10.2.2.1 Increasing competition among tier 1 players offering level sensors

10.2.3 OPPORTUNITIES

10.2.3.1 Rising adoption of Industry 4.0

10.2.3.2 Increasing use of level sensors in environmental applications

10.2.4 CHALLENGES

10.2.4.1 Maturity of critical end-user segments

10.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 35 LEVEL SENSOR MARKET: PORTER’S FIVE FORCES ANALYSIS (2020)

10.3.1 BARGAINING POWER OF SUPPLIERS

10.3.2 BARGAINING POWER OF BUYERS

10.3.3 THREAT OF NEW ENTRANTS

10.3.4 THREAT OF SUBSTITUTES

10.3.5 INTENSITY OF COMPETITIVE RIVALRY

10.4 COVID-19 IMPACT ANALYSIS

TABLE 66 PRE- AND POST-COVID-19 ANALYSIS OF LEVEL SENSOR MARKET, 2016–2026 (USD MILLION)

10.5 LEVEL SENSOR MARKET, BY TECHNOLOGY

TABLE 67 LEVEL SENSOR MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 68 LEVEL SENSOR MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 69 LEVEL SENSOR MARKET, SHIPMENT, 2016–2019 (MILLION UNITS)

TABLE 70 LEVEL SENSOR MARKET, SHIPMENT, 2020–2026 (MILLION UNITS)

10.5.1 CONTACT LEVEL SENSORS

10.5.1.1 Cost-effectiveness and straightforward applications to enhance adoption

TABLE 71 CONTACT LEVEL SENSOR MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 72 CONTACT LEVEL SENSOR MARKET, BY TYPE, 2020–2026 (USD MILLION)

10.5.1.2 Magnetostrictive

10.5.1.2.1 Features high accuracy, strong environmental adaptability, and convenient installation

10.5.1.3 Vibratory probe

10.5.1.3.1 Provide point level sensing for powders and bulk solids

10.5.1.4 Hydrostatic

10.5.1.4.1 Measure pressure generated by static head of liquid

10.5.1.5 Magnetic and mechanical float

10.5.1.5.1 Popular for their simplicity, dependability, and low cost

10.5.1.6 Pneumatic

10.5.1.6.1 Pneumatic level sensors used in hazardous environments

10.5.1.7 Guided wave

10.5.1.7.1 Leverages microwave pulses for level measurement

10.5.1.8 Other contact level sensors

10.5.2 NON-CONTACT LEVEL SENSORS

10.5.2.1 Versatility and contactless operation to enhance demand

FIGURE 36 MARKET FOR LASER NON-CONTACT LEVEL SENSORS TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 73 NON-CONTACT LEVEL SENSOR MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 74 NON-CONTACT LEVEL SENSOR MARKET, BY TYPE, 2020–2026 (USD MILLION)

10.5.2.2 Ultrasonic

10.5.2.2.1 Measures level based on travel time of ultrasonic pulses

10.5.2.3 Microwave/radar

10.5.2.3.1 Used in moist, vaporous, and dusty environments

10.5.2.4 Optical

10.5.2.4.1 Operation depends on light transmission, reflection, or refraction of medium

10.5.2.5 Laser

10.5.2.5.1 Leverage light waves for level measurement

10.5.2.6 Micro-electro-mechanical systems (MEMS)

10.5.2.7 Other non-contact level sensors

10.5.2.7.1 Capacitance

10.5.2.7.2 Conductive

10.5.2.7.3 Nucleonic

10.5.2.7.4 Air bubbler

10.5.2.7.5 Load cells

10.6 LEVEL SENSOR MARKET, BY END-USER INDUSTRY

FIGURE 37 LEVEL SENSOR MARKET, BY END-USER INDUSTRY

TABLE 75 LEVEL SENSOR MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 76 LEVEL SENSOR MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

10.6.1 CONSUMER GOODS

10.6.1.1 Penetration of MEMS and wireless technologies to boost use

10.6.2 INDUSTRIAL MANUFACTURING

10.6.2.1 Sensors to see increased use in manufacturing & process industries

10.6.3 CHEMICALS

10.6.3.1 Increasing need for accuracy expected to boost sensor demand

10.6.4 PHARMACEUTICAL

10.6.4.1 Non-contact sensors used to meet strict requirements for hygiene

10.6.5 WASTEWATER

10.6.5.1 Wastewater management regulations to spur sensor demand

10.6.6 OIL & GAS

10.6.6.1 Hydrostatic and ultrasonic level sensors to see increasing demand

10.6.7 UTILITIES

10.6.7.1 Ultrasonic, admittance, and pneumatic level sensors used in power generation

10.6.8 HEALTHCARE

10.6.8.1 Sensors used to monitor levels of reagent containers and waste tanks

10.6.9 OTHERS

10.6.9.1 Agricultural

10.6.9.2 Pulp & paper

10.6.9.3 Construction aggregates

10.7 LEVEL SENSOR MARKET, BY MONITORING TYPE

TABLE 77 LEVEL SENSOR MARKET, BY MONITORING TYPE, 2016–2019 (USD MILLION)

TABLE 78 LEVEL SENSOR MARKET, BY MONITORING TYPE, 2020–2026 (USD MILLION)

10.7.1 CONTINUOUS LEVEL MONITORING

10.7.1.1 Magnetostrictive

10.7.1.2 Resistive chain level

10.7.1.3 Magnetoresistive

10.7.1.4 Hydrostatic pressure level

10.7.1.5 Air bubbler

10.7.1.6 Gamma ray

10.7.2 POINT LEVEL MONITORING

10.7.2.1 Vibratory probe

10.7.2.2 Rotating paddle

10.7.2.3 Admittance type

10.7.2.4 Magnetic & mechanical float

10.7.2.5 Pneumatic

10.7.2.6 Conductive

10.8 REGIONAL ANALYSIS

TABLE 79 LEVEL SENSOR MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 80 LEVEL SENSOR MARKET, BY REGION, 2020–2026 (USD MILLION)

10.8.1 NORTH AMERICA

10.8.2 EUROPE

10.8.3 APAC

10.8.4 ROW

10.9 COMPETITIVE LANDSCAPE

TABLE 81 TOP 5 PLAYERS IN LEVEL SENSOR MARKET, 2020

TABLE 82 MARKET SHARE ANALYSIS OF TOP 3 MARKET PLAYERS IN LEVEL SENSOR MARKET, 2020

11 GAS SENSOR MARKET (Page No. - 218)

11.1 MARKET DEFINITION

11.2 MARKET DYNAMICS

11.3 MARKET DYNAMICS

FIGURE 38 GAS SENSOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

11.3.1 DRIVERS

11.3.1.1 Implementation of various health and safety regulations worldwide

FIGURE 39 MAJOR SOURCES OF AIR POLLUTION, 2018

TABLE 83 LIST OF GOVERNMENT REGULATIONS/ACTS FOR AIR QUALITY MONITORING

11.3.1.2 Increased adoption of gas sensors in HVAC systems and air quality monitors

11.3.1.3 Demand for gas sensors from critical industries

11.3.1.4 Increased air pollution and need for air quality monitoring in smart cities

TABLE 84 MOST POLLUTED CITIES

11.3.2 RESTRAINTS

11.3.2.1 Time-consuming development of new and innovative gas sensors

11.3.3 OPPORTUNITIES

11.3.3.1 Networking of gas sensors through IoT, cloud computing, and big data

11.3.3.2 Rising adoption of gas sensors in consumer electronic devices

11.3.3.3 Growing involvement of private and public organizations to create awareness about air quality monitoring

11.3.3.4 Increasing demand for miniaturized wireless gas sensors

11.3.4 CHALLENGES

11.3.4.1 Operational challenges for electrochemical sensors

11.4 INDUSTRY TRENDS

11.4.1 E-NOSES

11.4.2 PRINTED GAS SENSORS

11.4.3 CARBON NANOTUBES

11.4.4 ZEOLITES

11.5 PORTER’S FIVE FORCES ANALYSIS

FIGURE 40 GAS SENSOR MARKET: PORTER’S FIVE FORCES ANALYSIS (2020)

11.5.1 THREAT FROM NEW ENTRANTS

11.5.2 THREAT FROM SUBSTITUTES

11.5.3 BARGAINING POWER OF SUPPLIERS

11.5.4 BARGAINING POWER OF BUYERS

11.5.5 INTENSITY OF COMPETITIVE RIVALRY

11.6 COVID-19 IMPACT ANALYSIS

TABLE 85 PRE COVID/ POST COVID ANALYSIS, FOR GAS SENSOR MARKET, 2016–2026 (USD MILLION)

11.7 GAS SENSOR MARKET, BY TECHNOLOGY

TABLE 86 GAS SENSOR MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 87 GAS SENSOR MARKET, BY TECHNOLOGY, 2020–2026 (USD MILLION)

TABLE 88 GAS DETECTION TECHNOLOGIES

11.7.1 ELECTROCHEMICAL

11.7.1.1 Rising use of electrochemical technology due to its ability to be used in low-concentration ranges

11.7.2 PHOTOIONIZATION DETECTORS (PID)

11.7.2.1 Photoionization technology widely used in gas chromatography

11.7.3 SOLID STATE/METAL-OXIDE-SEMICONDUCTOR

11.7.3.1 Steady growth expected due to light weight, high sensitivity, and fast response time of gas sensors

11.7.4 CATALYTIC

11.7.4.1 Steady adoption of catalytic technology expected due to use in ammonia and methane gas sensors

11.7.5 INFRARED

11.7.5.1 Growth of infrared technology segment attributed to rising use in industrial, HVAC, and IQM applications

11.7.6 LASER

11.7.6.1 Significant growth of laser technology due to its ability of long-range detection of gases

11.7.7 ZIRCONIA

11.7.7.1 Steady adoption of zirconia technology expected in oxygen sensors

11.7.8 OTHERS

11.8 GAS SENSOR MARKET, BY GAS TYPE

FIGURE 41 VOC-BASED SENSORS TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 89 GAS SENSOR MARKET, BY GAS TYPE, 2016–2019 (USD MILLION)

TABLE 90 GAS SENSOR MARKET, BY GAS TYPE, 2020–2026 (USD MILLION)

11.8.1 OXYGEN

11.8.1.1 Oxygen sensors lead market due to their rising adoption in automotive, building automation, and medical applications

11.8.2 CARBON MONOXIDE (CO)

11.8.2.1 Serious impacts of CO on health and government regulations for monitoring of CO levels drive market growth

11.8.3 CARBON DIOXIDE (CO2)

11.8.3.1 Significant growth in CO2 gas sensors segment due to rising emission of greenhouse gases

11.8.4 AMMONIA

11.8.4.1 Rising usage of ammonia sensors in smart cities and industrial applications provides opportunities

11.8.5 CHLORINE (CL)

11.8.5.1 Growth in chlorine gas sensor segment driven by use in water and wastewater applications

11.8.6 HYDROGEN SULFIDE (H2S)

11.8.6.1 Major applications of H2S gas sensors include oil & gas, smart cities, and water & wastewater management

11.8.7 NITROGEN OXIDE

11.8.7.1 Significant growth in NOx gas sensor segment due to demand from smart cities and building automation applications

11.8.8 VOLATILE ORGANIC COMPOUND (VOC)

11.8.8.1 Rising pollution levels and need for air quality monitoring provide market growth opportunities

11.8.9 METHANE

11.8.9.1 Oil & gas, smart cities, and power stations major applications of methane gas sensors

TABLE 91 PERMISSIBLE/EXPOSURE LIMITS FOR METHANE

11.8.10 HYDROGEN

11.8.10.1 Hydrogen sensors mainly used in battery rooms, uninterruptible power supply areas, battery cabinet systems, and battery charging areas

TABLE 92 PERMISSIBLE/EXPOSURE LIMITS FOR HYDROGEN

11.8.11 HYDROCARBON (METHANE, PROPANE, BUTANE, AND OTHERS)

11.8.11.1 Hydrocarbons are majorly used as fuel in different industries and home cooking

11.9 GAS SENSOR MARKET, BY END-USE INDUSTRY

FIGURE 42 CONSUMER ELECTRONICS SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 93 GAS SENSOR MARKET, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 94 GAS SENSOR MARKET, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

11.9.1 WATER & WASTEWATER TREATMENT

11.9.1.1 Strict government regulations for monitoring of toxic gases in wastewater management provide opportunities

11.9.1.2 Water treatment

11.9.1.3 Wastewater treatment

11.9.2 MEDICAL

11.9.2.1 Increasing adoption of O2 and CO2 sensors in medical equipment provides growth opportunities

11.9.2.2 Measuring blood oxygen

11.9.2.3 Monitoring concentration of oxygen in anesthesia

11.9.2.4 Oxygen content of medical air cylinders

11.9.3 OIL & GAS

11.9.3.1 Need to monitor flammable and toxic gases such as CH4 and hydrocarbons in exploration and refining processes provides opportunities

11.9.3.2 Upstream

11.9.3.3 Downstream

11.9.4 ENVIRONMENTAL

11.9.4.1 Indoor and outdoor air quality monitoring

11.9.5 AUTOMOTIVE

11.9.5.1 O2 leading gas sensor segment in automotive applications

11.9.5.2 Vehicle cabin air quality control

11.9.5.3 Dynamometer test cells

11.9.6 FOOD & BEVERAGES

11.9.6.1 Food processing and storage require monitoring of Co2, VOC, and CH4, which drives market growth

11.9.7 METAL & CHEMICAL INDUSTRY

11.9.7.1 Rising adoption of ammonia, VOC, and oxygen gas sensors to provide significant opportunities

11.9.7.2 Coke ovens

11.9.7.3 Blast furnace

11.9.8 CONSUMER ELECTRONICS

11.9.8.1 Adoption of gas sensors in consumer devices such as smartphones and wearables to drive market growth

11.9.8.2 Smartphones & tablets

11.9.8.3 Wearable devices

11.9.9 TRANSPORT & LOGISTICS

11.9.9.1 Monitoring of hazardous gases in cargo freight

11.9.10 UTILITIES

11.9.10.1 Need for continuous monitoring of toxic and combustible gases in power plants drives market growth

11.9.10.2 Monitoring blast furnace gases

11.9.11 BUILDING AUTOMATION AND DOMESTIC APPLICATION

11.9.12 OTHERS (R&D LABS AND EDUCATIONAL INSTITUTIONS)

11.10 REGIONAL ANALYSIS

TABLE 95 GAS SENSOR MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 96 GAS SENSOR MARKET, BY REGION, 2020–2026 (USD MILLION)

11.10.1 NORTH AMERICA

11.10.2 EUROPE

11.10.3 APAC

11.10.4 ROW

11.11 COMPETITIVE LANDSCAPE

TABLE 97 TOP 5 PLAYERS IN GAS SENSOR MARKET, 2020

TABLE 98 GAS SENSOR MARKET SHARE ANALYSIS OF TOP 5 MARKET PLAYERS, 2020

12 MAGNETIC SENSOR MARKET (Page No. - 250)

12.1 MARKET DEFINITION

12.2 MARKET DYNAMICS

12.3 MARKET DYNAMICS

FIGURE 43 MAGNETIC SENSOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

12.3.1 DRIVERS

12.3.1.1 Intensifying focus of manufacturers on 3D magnetic sensors

12.3.1.2 Increasing investments in magnetic sensor ecosystem

12.3.1.3 Unceasing growth of consumer electronics industry

12.3.2 RESTRAINTS

12.3.3 OPPORTUNITIES

12.3.3.1 Increasing adoption of magnetic sensors in healthcare applications

12.3.3.2 Increasing manufacturing of hybrid and electric cars

FIGURE 44 PROJECTED INCREASE IN SALES FROM 2019 TO 2040

12.3.4 CHALLENGES

12.3.4.1 Growth of only few sensor types

12.3.5 COVID-19-DRIVEN CHALLENGES

12.3.5.1 Anticipated shortage of raw materials for manufacturing of sensors and supply chain disruptions

12.4 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MAGNETIC SENSOR MARKET

12.5 COVID-19 IMPACT ANALYSIS

TABLE 99 PRE- AND POST-COVID-19 ANALYSIS OF MAGNETIC SENSOR MARKET, 2016–2026 (USD MILLION)

12.6 PORTER’S FIVE FORCES ANALYSIS

FIGURE 45 MAGNETIC SENSOR MARKET: PORTER’S FIVE FORCES (2020)

12.6.1 INTENSITY OF COMPETITIVE RIVALRY

12.6.2 THREAT OF SUBSTITUTES

12.6.3 BARGAINING POWER OF BUYERS

12.6.4 BARGAINING POWER OF SUPPLIERS

12.6.5 THREAT OF NEW ENTRANTS

12.7 MAGNETIC SENSOR MARKET, BY TYPE

TABLE 100 MAGNETIC SENSOR MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 101 MAGNETIC SENSOR MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 102 MAGNETIC SENSOR MARKET, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 103 MAGNETIC SENSOR MARKET, BY TYPE, 2020–2026 (MILLION UNITS)

12.7.1 HALL EFFECT SENSORS

12.7.1.1 Hall ICs

12.7.1.2 Hall elements

FIGURE 46 HALL ICS TO HOLD LARGEST SIZE OF OVERALL HALL EFFECT MAGNETIC SENSOR MARKET FROM 2021 TO 2026

TABLE 104 HALL EFFECT MAGNETIC SENSOR MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 105 HALL EFFECT MAGNETIC SENSOR MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 106 HALL EFFECT MAGNETIC SENSOR MARKET, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 107 HALL EFFECT MAGNETIC SENSOR MARKET, BY TYPE, 2020–2026 (MILLION UNITS)

12.7.2 MAGNETORESISTIVE SENSORS

12.7.2.1 Anisotropic magnetoresistive (AMR) sensors

12.7.2.2 Giant Magnetoresistive (GMR) Sensors

12.7.2.3 Tunnel magnetoresistive (TMR) sensors

TABLE 108 MAGNETORESISTIVE MAGNETIC SENSOR MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 109 MAGNETORESISTIVE MAGNETIC SENSOR MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 110 MAGNETORESISTIVE MAGNETIC SENSOR MARKET, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 111 MAGNETORESISTIVE MAGNETIC SENSOR MARKET, BY TYPE, 2020–2026 (MILLION UNITS)

12.7.3 MEMS-BASED MAGNETIC FIELD SENSORS

12.7.4 SQUID SENSORS

12.7.4.1 High-temperature SQUID

12.7.4.2 Low-temperature SQUID

12.7.5 FLUXGATE SENSORS

12.7.6 OTHERS

12.7.6.1 Fiber optic

12.7.6.2 Optically pumped

12.7.6.3 Magnetodiode

12.7.6.4 Magneto-optical sensor

12.7.6.5 Search-coil

12.7.6.6 Magneto-inductive sensors

12.7.6.7 Nuclear procession

12.7.6.8 Reed switch

12.8 MAGNETIC SENSOR MARKET, BY APPLICATION

TABLE 112 MAGNETIC SENSOR MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 113 MAGNETIC SENSOR MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

12.8.1 POSITION SENSING

12.8.1.1 Rising demand for 3d position sensors from automotive and consumer electronics industries to propel market growth

12.8.2 SPEED SENSING

12.8.2.1 Rising demand for autonomous vehicles to fuel demand for magnetic speed sensors

12.8.3 NAVIGATION AND ELECTRONIC COMPASS

12.8.3.1 Increasing demand for magnetic sensors from consumer electronics industry to drive market growth

12.8.4 FLOW RATE SENSING

12.8.4.1 Industrial demand for high accuRAte flow sensing to drive market growth

12.8.5 PROXIMITY DETECTION/NON-DESTRUCTIVE TESTING

12.8.5.1 Need for quality inspection of aircraft, cars, and other automotive fuel market growth

12.8.6 OTHERS

12.9 MAGNETIC SENSOR MARKET, BY RANGE

TABLE 114 MAGNETIC SENSOR MARKET, BY RANGE, 2016–2019 (USD MILLION)

TABLE 115 MAGNETIC SENSOR MARKET, BY RANGE, 2020–2026 (USD MILLION)

TABLE 116 LANDSCAPE OF TECHNOLOGY, RANGE, AND DIFFERENT TYPES OF MAGNETIC FIELD SENSORS

FIGURE 47 VARIOUS MAGNETIC FIELD SENSORS AND THEIR DETECTABLE FIELD RANGE

12.9.1 <1 MICROGAUSS (LOW FIELD SENSORS)

12.9.1.1 Increasing adoption of low-field sensors for military surveillance and medical application to boost market growth

12.9.2 1 MICROGAUSS TO 10 GAUSS (EARTH FIELD SENSORS)

12.9.2.1 Earth field sensors held second-largest share of market in 2020

12.9.3 >10 GAUSS (BIAS MAGNETIC FIELD SENSORS)

12.9.3.1 Increase in driverless cars to spur magnetic sensor market growth

12.10 MAGNETIC SENSOR MARKET, BY END-USER INDUSTRY

FIGURE 48 TRANSPORTATION TO HOLD MAJOR MARKET SIZE OF MAGNETIC FIELD SENSORS DURING FORECAST PERIOD

TABLE 117 MAGNETIC SENSOR MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 118 MAGNETIC SENSOR MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

12.10.1 AUTOMOTIVE

12.10.1.1 Increase in deployment of navigation systems in vehicles to fuel market growth

12.10.2 CONSUMER ELECTRONICS

12.10.2.1 Widespread deployment of Hall effect and reed sensors in high-tech consumer appliances

12.10.3 HEALTHCARE

12.10.3.1 Use of magnetic sensors in healthcare industry helps detect anomalies accurately

12.10.4 AEROSPACE & DÉFENSE

12.10.4.1 Magnetic sensors used in multitude of electrical systems in aerospace & defense industry

12.10.5 INDUSTRIAL

12.10.5.1 Rise in industrial automation to fuel deployment of magnetic sensors

12.10.6 OTHERS

12.11 REGIONAL ANALYSIS

TABLE 119 MAGNETIC SENSOR MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 120 MAGNETIC SENSOR MARKET, BY REGION, 2020–2026 (USD MILLION)

12.11.1 NORTH AMERICA

12.11.2 EUROPE

12.11.3 APAC

12.11.4 ROW

12.12 COMPETITIVE LANDSCAPE

TABLE 121 RANKING OF TOP 5 PLAYERS IN MAGNETIC SENSOR MARKET, 2020

TABLE 122 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS IN FINGERPRINT SENSOR MARKET, 2020

13 POSITION SENSOR MARKET (Page No. - 282)

13.1 MARKET DEFINITION

13.2 MARKET DYNAMICS

13.3 MARKET DYNAMICS

FIGURE 49 POSITION SENSOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

13.3.1 DRIVERS

13.3.1.1 Increasing focus of manufacturing industry on accurate measurements and detailed inspection

13.3.1.2 Growing adoption of position sensors in aerospace industry

FIGURE 50 GLOBAL AIR PASSENGER TRAFFIC (2000–2017)

13.3.1.3 Rising demand for position sensors for modern automobiles

FIGURE 51 GLOBAL ELECTRIC CARS IN CIRCULATION (2013–2017)

13.3.2 RESTRAINTS

13.3.2.1 High cost of ownership

13.3.3 OPPORTUNITIES

13.3.3.1 Growing trend of industrial automation

13.3.3.2 High potential for industrial robotics applications

FIGURE 52 INDUSTRIAL ROBOTS ANNUAL SHIPMENT, BY REGION, 2012–2017

13.3.4 CHALLENGES

13.3.4.1 Lack of proper standards to measure performance indicators

13.4 COVID-19 IMPACT ANALYSIS

TABLE 123 PRE- AND POST-COVID-19 ANALYSIS OF POSITION SENSOR MARKET 2016–2026 (USD MILLION)

13.5 PORTER’S FIVE FORCES ANALYSIS

FIGURE 53 POSITION SENSOR MARKET: PORTER’S FIVE FORCES ANALYSIS (2020)

13.5.1 THREATS OF NEW ENTRANTS

13.5.2 THREATS OF SUBSTITUTES

13.5.3 BARGAINING POWER OF SUPPLIERS

13.5.4 BARGAINING POWER OF BUYERS

13.5.5 INTENSITY OF COMPETITIVE RIVALRY

13.6 POSITION SENSOR MARKET, BY TYPE

TABLE 124 POSITION SENSOR MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 125 POSITION SENSOR MARKET, BY TYPE, 2020–2026 (USD MILLION)

13.6.1 LINEAR POSITION SENSOR

13.6.1.1 Encoder

13.6.1.1.1 Optical encoder

13.6.1.1.2 Magnetic encoder

13.6.1.1.3 Inductive encoder

13.6.1.1.4 Capacitive encoder

13.6.1.2 Linear Variable Differential Transformer (LVDT)

13.6.1.3 Magnetostrictive Sensor

13.6.1.4 Potentiometer

13.6.1.5 Others

TABLE 126 LINEAR POSITION SENSOR MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 127 LINEAR POSITION SENSOR MARKET, BY TYPE, 2020–2026 (USD MILLION)

13.6.2 ROTARY POSITION SENSOR

13.6.2.1 Encoder

13.6.2.1.1 Optical rotary encoder

13.6.2.1.2 Magnetic rotary encoder

13.6.2.1.3 Mechanical rotary encoder

13.6.2.1.4 Capacitive rotary encoder

13.6.2.2 Potentiometer

13.6.2.3 Rotary Variable Differential Transformer (RVDT)

13.6.2.4 Resolver

FIGURE 54 RVDT TO LEAD ROTARY POSITION SENSOR MARKET IN 2021

TABLE 128 ROTARY POSITION SENSOR MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 129 ROTARY POSITION SENSOR MARKET, BY TYPE, 2020–2026 (USD MILLION)

13.7 POSITION SENSOR MARKET, BY SPECIFICATION

13.7.1 MARKET, BY CONTACT TYPE

TABLE 130 POSITION SENSOR MARKET, BY CONTACT TYPE, 2016–2019 (USD MILLION)

TABLE 131 POSITION SENSOR MARKET, BY CONTACT TYPE, 2020–2026 (USD MILLION)

13.7.1.1 Contact

13.7.1.1.1 Contact sensor—conventional sensing technology

13.7.1.2 Non-contact

13.7.1.2.1 Non-contact sensors gaining popularity over contact sensors

13.7.2 MARKET, BY OUTPUT

TABLE 132 POSITION SENSOR MARKET, BY OUTPUT, 2016–2019 (USD MILLION)

TABLE 133 POSITION SENSOR MARKET, BY OUTPUT, 2020–2026 (USD MILLION)

13.7.2.1 Analog

13.7.2.2 Digital

13.8 POSITION SENSOR MARKET, BY APPLICATION

FIGURE 55 MACHINE TOOLS APPLICATION TO LEAD POSITION SENSOR MARKET TILL 2026

TABLE 134 POSITION SENSOR MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 135 POSITION SENSOR MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

13.8.1 TEST EQUIPMENT

13.8.1.1 Automotive, aerospace, industrial, and medical sectors use position sensors in test equipment to achieve high accuracy and precision

13.8.2 MATERIAL HANDLING

13.8.2.1 Material handling applications require position sensors to ensure safe and controlled operations

13.8.3 MACHINE TOOLS

13.8.3.1 Use of position sensors in machine tools enables higher degree of automation and versatility along with improved safety and energy efficiency

13.8.4 MOTION SYSTEMS

13.8.4.1 Position sensors in motion systems used to measure absolute or incremental displacement

13.8.5 ROBOTICS

13.9 POSITION SENSOR MARKET, BY END-USER INDUSTRY

TABLE 136 POSITION SENSOR MARKET, BY END-USER INDUSTRY, 2016–2019 (USD MILLION)

TABLE 137 POSITION SENSOR MARKET, BY END-USER INDUSTRY, 2020–2026 (USD MILLION)

13.9.1 AUTOMOTIVE

13.9.1.1 On-vehicle application to account for largest share during forecast period

13.9.1.2 Body

13.9.1.3 Powertrain

13.9.1.4 Safety

13.9.2 AEROSPACE

13.9.2.1 Position sensors deployed in military aircraft due to their ability to withstand harsh environments

13.9.3 ELECTRONICS

13.9.3.1 Position sensors used in smartphones, gaming consoles, digital cameras, and home appliances drive growth

13.9.4 HEALTHCARE

13.9.4.1 Healthcare industry requires highly reliable position sensors that provide accurate information to ensure patient safety

13.9.5 MANUFACTURING

13.9.5.1 Manufacturing industry use position sensors owing to their ability to withstand harsher and corrosive environments

13.9.6 PACKAGING

13.9.6.1 Linear encoders, inductive position sensors, and proximity sensors used in packaging industry to enhance packaging machine performance

13.9.7 OTHERS

13.10 REGIONAL ANALYSIS

TABLE 138 POSITION SENSOR MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 139 POSITION SENSOR MARKET, BY REGION, 2020–2026 (USD MILLION)

13.10.1 NORTH AMERICA

13.10.2 EUROPE

13.10.3 APAC

13.10.4 ROW

13.11 COMPETITIVE LANDSCAPE

TABLE 140 RANKING OF TOP 5 PLAYERS IN POSITION SENSOR MARKET, 2020

TABLE 141 MARKET SHARE ANALYSIS OF POSITION SENSOR MARKET, 2020

14 LIGHT SENSOR MARKET (Page No. - 313)

14.1 MARKET DEFINITION

14.2 MARKET DYNAMICS

FIGURE 56 LIGHT SENSOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES

14.2.1 DRIVERS

14.2.1.1 Rise in implementation of light sensors in smartphones and PC tablets

14.2.1.2 Advancements in automotive sector

14.2.1.3 Adoption of smart home technology

14.2.1.4 Use of exterior building lighting and outdoor lighting

14.2.2 RESTRAINTS

14.2.2.1 Inflexible sensing ranges

14.2.2.2 Low-cost sensors increasing threat of substandard quality

14.2.3 OPPORTUNITIES

14.2.3.1 Benefits of light sensors to create demand in industrial sector

14.2.3.2 Automation in machine vision to create huge opportunities

14.2.4 CHALLENGES

14.2.4.1 Increasing demand for miniaturization of sensors

14.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 57 LIGHT SENSOR MARKET: PORTER’S FIVE FORCES (2020)

14.3.1 INTENSITY OF COMPETITIVE RIVALRY

14.3.2 THREAT OF SUBSTITUTES

14.3.3 BARGAINING POWER OF BUYERS

14.3.4 BARGAINING POWER OF SUPPLIERS

14.3.5 THREAT OF NEW ENTRANTS

14.4 COVID-19 IMPACT ANALYSIS

TABLE 142 PRE-& POST-COVID-19 ANALYSIS, FOR LIGHT SENSOR MARKET, 2016–2026 (USD MILLION)

14.5 LIGHT SENSOR MARKET, BY FUNCTION

FIGURE 58 AMBIENT LIGHT SENSING FUNCTION TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 143 LIGHT SENSOR MARKET, BY FUNCTION, 2016–2019 (USD MILLION)

TABLE 144 LIGHT SENSOR MARKET, BY FUNCTION, 2020–2026 (USD MILLION)

14.5.1 AMBIENT LIGHT SENSING

14.5.2 PROXIMITY DETECTION

14.5.3 RGB COLOR SENSING

14.5.4 GESTURE RECOGNITION

14.5.5 UV/INFRARED LIGHT (IR) DETECTION

14.6 LIGHT SENSOR MARKET, BY OUTPUT

TABLE 145 LIGHT SENSOR MARKET, BY OUTPUT, 2016–2019 (USD MILLION)

TABLE 146 LIGHT SENSOR MARKET, BY OUTPUT, 2020–2026 (USD MILLION)

14.6.1 ANALOG

14.6.2 DIGITAL

14.7 LIGHT SENSOR MARKET, BY INTEGRATION

TABLE 147 LIGHT SENSOR MARKET, BY INTEGRATION, 2016–2019 (USD MILLION)

TABLE 148 LIGHT SENSOR MARKET, BY INTEGRATION, 2020–2026 (USD MILLION)

14.7.1 DISCRETE

14.7.2 COMBINATION

14.8 LIGHT SENSOR MARKET, BY APPLICATION

TABLE 149 LIGHT SENSOR MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 150 LIGHT SENSOR MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

14.8.1 CONSUMER ELECTRONICS

14.8.1.1 Growing use of light sensor functions such as ambient light sensing, proximity detection, and RGB color sensing in handheld electronics is supporting the growth of the consumer electronics sector

14.8.2 AUTOMOTIVE

14.8.2.1 Light sensors are used in a variety of automotive applications including displays, dashboards, headlamps controls, and head-up displays

14.8.3 INDUSTRIAL

14.8.3.1 Growing use of ambient light sensors, and gesture recognition devices in the industrial application is driving the light sensor market

14.8.4 HOME AUTOMATION

14.8.4.1 Advancements in light sensor technology are expected to improve the ease of operation in the home automation sector.

14.8.5 HEALTHCARE

14.8.5.1 Healthcare is one of the fastest-growing industries for the light sensor market.

14.8.6 ENTERTAINMENT

14.8.6.1 Ambient light sensors are used to adjust the brightness of a television screen

14.8.7 SECURITY

14.8.7.1 Light sensors are used for indoor and outdoor security purposes

14.9 REGIONAL ANALYSIS

TABLE 151 LIGHT SENSOR MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 152 LIGHT SENSOR MARKET, BY REGION, 2020–2026 (USD MILLION)

14.9.1 NORTH AMERICA

14.9.2 EUROPE

14.9.3 APAC

14.9.4 ROW

14.10 COMPETITIVE LANDSCAPE

TABLE 153 TOP 5 PLAYERS IN LIGHT SENSOR MARKET, 2020

15 COMPANY PROFILES (Page No. - 330)

15.1 KEY PLAYERS

(Business overview, Products/solutions/services offered, Recent developments, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

15.1.1 TEXAS INSTRUMENTS

FIGURE 59 TEXAS INSTRUMENTS: COMPANY SNAPSHOT

15.1.2 TE CONNECTIVITY

FIGURE 60 TE CONNECTIVITY: COMPANY SNAPSHOT

15.1.3 BROADCOM (AVAGO)

FIGURE 61 BROADCOM: COMPANY SNAPSHOT

15.1.4 NXP SEMICONDUCTORS

FIGURE 62 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

15.1.5 STMICROELECTRONICS

FIGURE 63 STMICROELECTRONICS: COMPANY SNAPSHOT

15.1.6 BOSCH SENSORTEC

15.1.7 TDK (INVENSENSE)

FIGURE 64 TDK: COMPANY SNAPSHOT

15.1.8 INFINEON TECHNOLOGIES

FIGURE 65 INFINEON TECHNOLOGIES: COMPANY SNAPSHOT

15.1.9 ANALOG DEVICES

FIGURE 66 ANALOG DEVICES: COMPANY SNAPSHOT

15.1.10 OMRON

FIGURE 67 OMRON: COMPANY SNAPSHOT

15.1.11 AMS AG

FIGURE 68 AMS AG: COMPANY SNAPSHOT

15.2 OTHER KEY PLAYERS

15.2.1 SENSIRION

15.2.2 HONEYWELL

15.2.3 SIEMENS

15.2.4 KNOWLES ELECTRONICS

15.2.5 ABB

15.2.6 SENSATA TECHNOLOGIES

15.2.7 EMERSON ELECTRIC

15.2.8 ASAHI KASEI CORPORATION

15.2.9 OMEGA ENGINEERING

15.2.10 MICROCHIP

15.2.11 ENDRESS+HAUSER MANAGEMENT AG

15.2.12 TELEDYNE TECHNOLOGIES INCORPORATED

15.2.13 FIGARO ENGINEERING INC.

15.2.14 SAFRAN COLIBRYS SA

*Details on Business overview, Products/solutions/services offered, Recent developments, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 369)

16.1 INSIGHTS OF INDUSTRY EXPERTS

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the top 10 sensor market. Exhaustive secondary research has been done to collect information about the market, the peer markets, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals and certified publications, articles from recognized authors, and websites, directories, and databases. Secondary research has mainly been conducted to obtain key information about the industry’s supply chain, the market’s value chain, major players, market classification, and segmentation according to the industry trends to the bottommost level, regional markets, and key developments from both the market- and technology-oriented perspectives. Secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated by primary research.

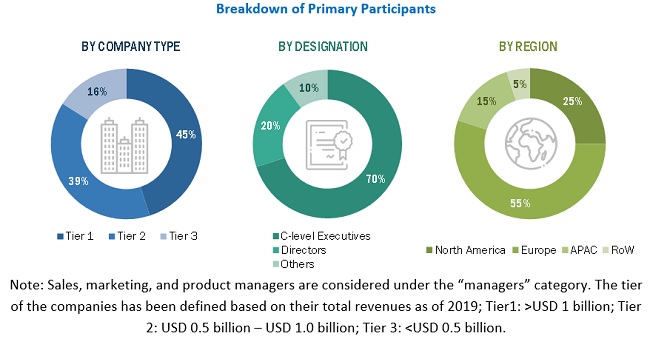

Primary Research

In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information pertaining to this report. Several primary interviews have been conducted with market experts from both demand (healthcare and consumer electronics companies) and supply sides (sensor manufacturers and distributors). This primary data has been collected through questionnaires, mails, and telephonic interviews. Primary sources include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related executives from various key companies and organizations operating in the top 10 sensor markets. Approximately 35% and 65% primary interviews have been conducted with parties from the demand side and supply side, respectively.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation