Temperature Sensor Market Size, Share & Trends, 2025 To 2030

Temperature Sensor Market by Connectivity (Wired, Wireless), Contact Type (Thermocouple, Thermistor), Non-Contact Type (Infrared Temperature, Fiber Optic), Output (Digital, Analog), End Use Industry and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

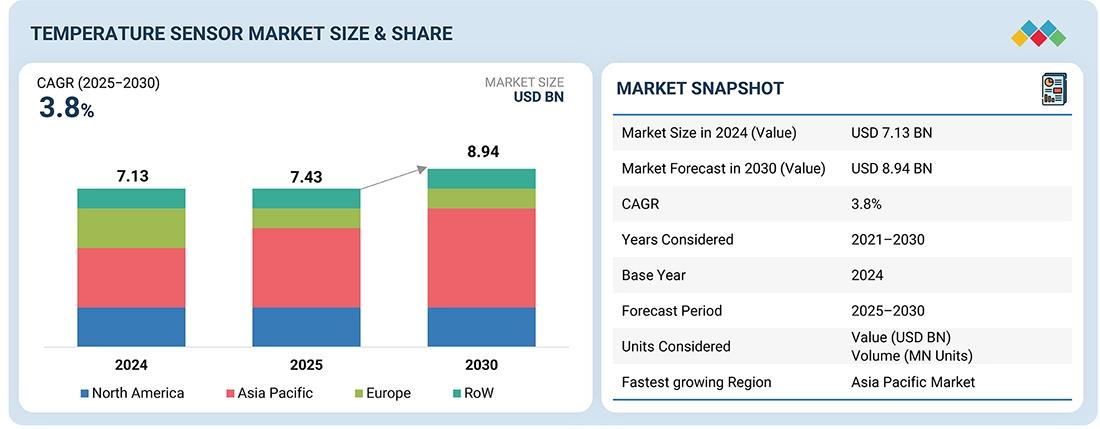

The global temperatuire sensor market is projected to grow from USD 7.13 billion in 2024 to USD 8.94 billion by 2030, registering a CAGR of 3.8%. Wearable devices track several biometric parameters, such as heartbeat and body temperature. The adoption of wearable devices is increasing rapidly, with many end users seeking such technologies to improve their fitness and overall health. Today, it is estimated 1 in 6 people own and use a wearable device, and this adoption trend is expected to continue to grow in the upcoming years. The thermometer sensor market is experiencing growth related to the rise of advanced and portable equipment in healthcare.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is estimated to dominate the temperature sensor market with a share of 48.2% in 2025.

-

BY PRODUCT TYPEBy product type, the contact temperature sensor accounted for the largest market size in 2024.

-

BY OUTPUTBy output, the digital segment accounted for a share of 66.7% in terms of value in 2024.

-

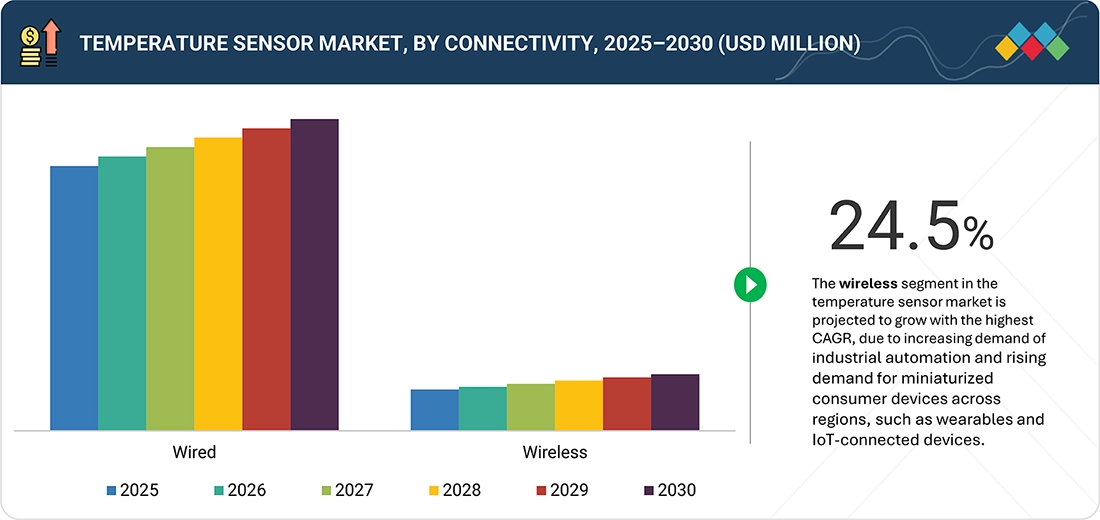

BY CONNECTIVITYBy connectivity, the wireless segment is projected to grow at a CAGR of 6.5% during the forecast period.

-

BY END-USER INDUSTRYBy end-user industry, consumer electronics is expected to hold a share of 16.4% of the temperature sensor market in 2025.

-

COMPETITIVE LANDSCAPEMajor players including TE Connectivity (Switzerland), Texas Instruments Incorporated (US), NXP Semiconductors (Netherlands), and STMicroelectronics (Switzerland) were identified as Star players in the temperature sensor market, given their broad industry coverage and strong operational & financial strength. FLIR Systems, Inc. and IFM ELectronics GmBH have distinguished themselves among startups and SMEs due to their well-developed marketing channels and extensive funding to build their product portfolios.

The advance of technology including the impact of/or on the advanced patient monitoring systems and health monitoring systems that can be used portable also contributes to the trend. The growing geriatric population affects health hardware and modifies lifestyles, it also adds to the demand for portable device, portable device use. Viral infection growth also supports the trend and there will be your device.

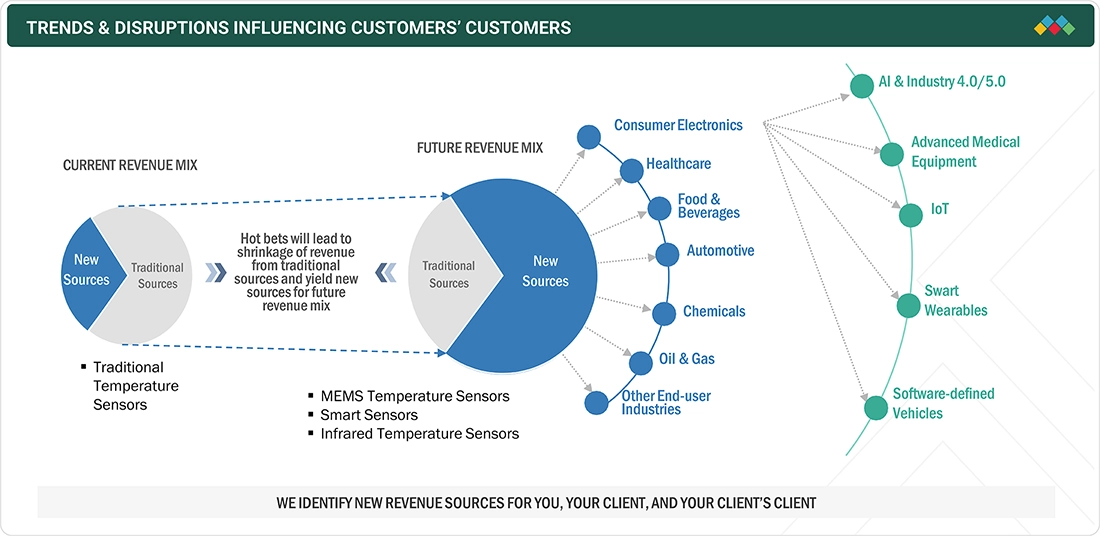

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The temperature sensor market is undergoing a transformative shift driven by a growing demand for advanced, multi-functional systems. Key innovation hotspots, such as industrial automation, healthcare automation, and smart wearables, are reshaping the future revenue mix. These advancements directly influence industries, including consumer electronics, healthcare, and others, ultimately leading to measurable shifts in client revenues.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Escalating adoption of Industry 4.0 and IoT technologies

-

Increasing need for sensors to control spacecraft remotely

Level

-

Fluctuations in raw material costs

Level

-

Surging investments in IoT research projects

-

Rising preference for wearable devices

Level

-

Stringent performance requirements for advanced applications

-

Intense price competition among manufacturers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing need for sensors to control spacecraft remotely

Sensors for spacecraft must distinguish between payload sensors and sensors that control the function of the satellite platform and payload. Remote sensing payloads use electromagnetic techniques for information acquisition. Different types of sensors operate in different ranges of the electromagnetic spectrum.

Restraint: Fluctuations in raw material costs

Fluctuations in these raw material prices are attributed to continuing global economic growth in emerging economies, trade tariffs, increases in global demand, natural disasters, wars, and other political events, and the volatility in foreign currency exchange rates.

Opportunity: Mounting investment in IoT research projects

Governments worldwide are supporting and funding IoT-related innovations, as the government sector is likely to be one of the largest potential customers of IoT. Governments are also funding new IoT research projects to develop smart cities. This support is expected to play a crucial role in the growth of the IoT in the next few years.

Challenge: Stringent performance requirements for advanced applications

Since temperature measurement is vital in almost every process, sensors have achieved deep market penetration. However, volume discounting in the case of low-priced sensors is a challenge. To sustain market demand, high precision, ease of integration, and competency are prerequisites.

Temperature Sensor Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Honeywell’s temperature sensors are deployed across aerospace, automotive, and industrial automation sectors for precise thermal monitoring, HVAC control, and energy management. | Enhances operational reliability, reduces maintenance downtime, and optimizes energy efficiency through advanced thermal control and diagnostics. |

|

Texas Instruments Incorporated analog and digital temperature sensing ICs are used in data centers, EV battery management, and consumer electronics for compact, energy-efficient thermal monitoring. | Enables high-accuracy thermal control, improved device safety, and faster product design cycles through scalable sensor integration.. |

|

TE Connectivity Ltd. temperature sensors support automotive, industrial, and medical applications, including EV charging systems, HVAC, and patient monitoring devices. | Improves system performance and product safety, ensuring temperature stability and compliance with automotive and medical-grade standards. |

|

Endress+Hauser’s industrial-grade temperature sensors and transmitters are used in process automation for oil & gas, chemical, and food & beverage sectors. | Enhances process efficiency, ensures product quality, and minimizes operational risks through precise and real-time temperature monitoring. |

|

Siemens integrates temperature sensors into its automation and building management systems for predictive maintenance and energy optimization. | Enables smart infrastructure and efficient energy utilization through IoT-enabled monitoring and predictive analytics. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The temperature sensor ecosystem highlights the categories, products, and new emerging technologies that would boost the demand for temperature sensors. Under component and solution provider, key players, such as Honeywell International Inc (US), TE Connectivity (Switzerland), Texas Instruments Incorporated (US), and others enhance the upstream landscape. On the distributors' front, Digi-key Electronics, Inc. (US) and Mouser Electronics (US) represent critical channels for component availability and product reach. Finally, end-use can be broadened to include major temperature sensor adopters such as Johnson & Johnson Services, Inc. (US) and Reynolds Group Ltd. (New Zealand), ensuring a more complete, industry-representative ecosystem view.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Temperature Sensor Market, By Product Type

By product type, the contact type segment accounted for the largest share in the temperature sensors market in 2024, and the segment is expected to continue to dominate the market during the forecast period. Because of their low cost, wide temperature ranges, and high accuracy, contact temperature sensors are widely used in industries such as chemicals, consumer electronics, oil & gas, energy & power, and automotive. Some prominent companies offering contact temperature sensors are Honeywell International Inc. (US), TE Connectivity (Switzerland), Dwyer Instruments, LLC. (US), and Texas Instruments Incorporated (US).

Temperature Sensor Market, By Connectivity

By connectivity, the wireless segment accounted for the largest share in 2024 due to increasing demand of industrial automation and rising demand for miniaturized consumer devices across regions, such as wearables and IoT-connected devices. Additionally, the increasing development of temperature sensors by various manufacturers is creating an opportunity for the market. For instance, in 2023, Disruptive Technologies (Norway), a provider of wireless sensor technology, is set to launch a new wireless temperature sensor for the cold chain market.

Temperature Sensor Market, By End-user Industry

By end-user industry, the consumer electronics segment is expected to grow at the highest CAGR during the forecast period. The increasing use of temperature sensors in smartphones, PCs, laptops, tablets, and other smart home appliances, including smart refrigerators, is expected to contribute to the market growth. This growth in the consumer electronics industry presents a huge opportunity for innovative and power-efficient temperature sensors. The market for temperature sensors in electrical and electronic applications is expected to grow with the introduction of new and innovative technologies.

REGION

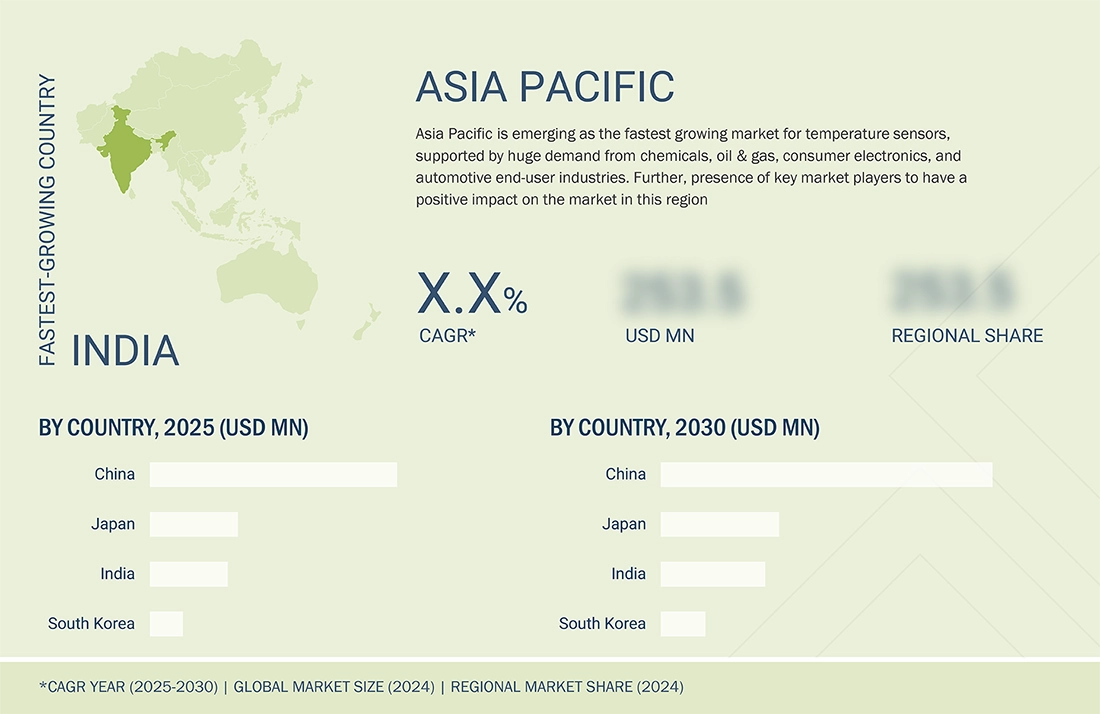

Asia Pacific to be fastest-growing region in global collaborative robot market during forecast period

The Asia Pacific market for temperature sensors is propelled by accelerating industrialization and growing automation efforts in major economies such as China, Japan, South Korea, and India. The region has been ahead of others in adopting temperature sensor products and solutions. Continuous demand for cost-effective and highly efficient temperature sensors from chemicals, oil & gas, consumer electronics, energy & power, healthcare, automotive, and metals & mining industries is expected to drive the temperature sensor market. The region's automotive sector accounts for over 50% of the world's passenger car production. Moreover, China is going through unprecedented economic growth. The development of fast cycling technologies is making possible the development of many consumer electronics, medical equipment, telecom and communication devices and vehicles.

The Asia Pacific temperature sensor market is projected to grow from USD 3.58 billion in 2025 to USD 4.51 billion by 2030, registering a CAGR of 4.7%. Continuous demand for cost-effective and highly efficient temperature sensors from chemicals, oil & gas, consumer electronics, energy & power, healthcare, automotive, and metals & mining industries is expected to drive the temperature sensor market. Moreover, China is witnessing rapid economic development. Emerging technologies in China have facilitated the development of numerous consumer electronics, medical equipment, telecom and communication devices, and automobiles. With the launch of 5G services in the country, the demand for smartphones has been increasing. The increasing trend of advanced technologies drives the semiconductor market, thereby increasing the need for temperature sensors in the region.

The North America temperature sensor market is projected to grow from USD 1.84 billion in 2024 to USD 2.11 billion by 2030, registering a CAGR of 2.3%. Strong demand from automotive, aerospace, energy, and semiconductor industries, where precise thermal control is critical. Growth in healthcare and medical device manufacturing, driven by rising diagnostic and continuous monitoring needs, further boosts the deployment of advanced contact and non-contact temperature sensing technologies. The region’s increasing focus on building automation, HVAC efficiency, and regulatory compliance around workplace and equipment safety strengthens demand for integrated temperature sensing solutions.

The Europe temperature sensor market is projected to grow from USD 1.16 billion in 2024 to USD 1.42 billion by 2030, registering a CAGR of 3.3%. Strong demand from the automotive, aerospace, energy, and semiconductor industries, where precise thermal control is critical, supports this growth. Growth in healthcare and medical device manufacturing, driven by rising diagnostic and continuous monitoring needs, further boosts deployment of advanced contact and non-contact temperature sensing technologies. The region’s increasing focus on building automation, HVAC efficiency, and regulatory compliance around workplace and equipment safety strengthens demand for integrated temperature sensing solutions.

Temperature Sensor Market: COMPANY EVALUATION MATRIX

In the temperature sensor market matrix, Texas Instruments Incorporated (Star) leads with a strong global presence and a comprehensive temperature sensor portfolio. Analog Devices, Inc. (Emerging Leader) is rapidly expanding its footprint through strong adoption in various sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 7.13 Billion |

| Market Forecast in 2030 (Value) | USD 8.94 Billion |

| Growth Rate | CAGR of 3.8% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe & RoW |

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automotive OEM |

|

|

| Healthcare Device Manufacturer |

|

|

RECENT DEVELOPMENTS

- January 2025 : Emerson Electric Co. launched its new AVENTICS™ DS1 dew point sensor, the only industrial sensor to monitor dew point, temperature, humidity levels and quality of compressed air and other non-corrosive gases in real time from one device.

- September 2024 : Siemens and Merck establish a strategic partnership on digital transformation technology through strategic projects across Merck's three business sectors. The MoU designates Siemens a preferred global supplier and strategic partner for Smartfacturing technologies, opening the door to transformation projects across Merck's three business sectors.

- June 2024 : Honeywell has completed its acquisition of Carrier Global Corporation's Global Access Solutions business for $4.95 billion. By acquiring Carrier's Global Access Solutions business, Honeywell is positioning itself as a security solutions provider for the digital age while allowing for opportunities for advanced innovation in the fast-growing, cloud-based services and solutions solutions space.

- May 2024 : Amphenol Corporation completed the acquisition of the acquisition of the Carlisle Interconnect Technologies (CIT) business from Carlisle Companies Incorporated. The acquisition of CIT enhances Amphenol’s product offerings for highly engineered harsh environment interconnect solutions and will enable to deliver offering for customers in the commercial air, defense and industrial markets..

- October 2023 : Endress+Hauser Group Services AG and SICK aim for a strategic partnership for SICK’s process automation business segment and have signed a joint memorandum of understanding. The goal of the partnership is to expand the Endress+Hauser product portfolio with process analysis and gas flow measurement engineering from SICK.

Table of Contents

Methodology

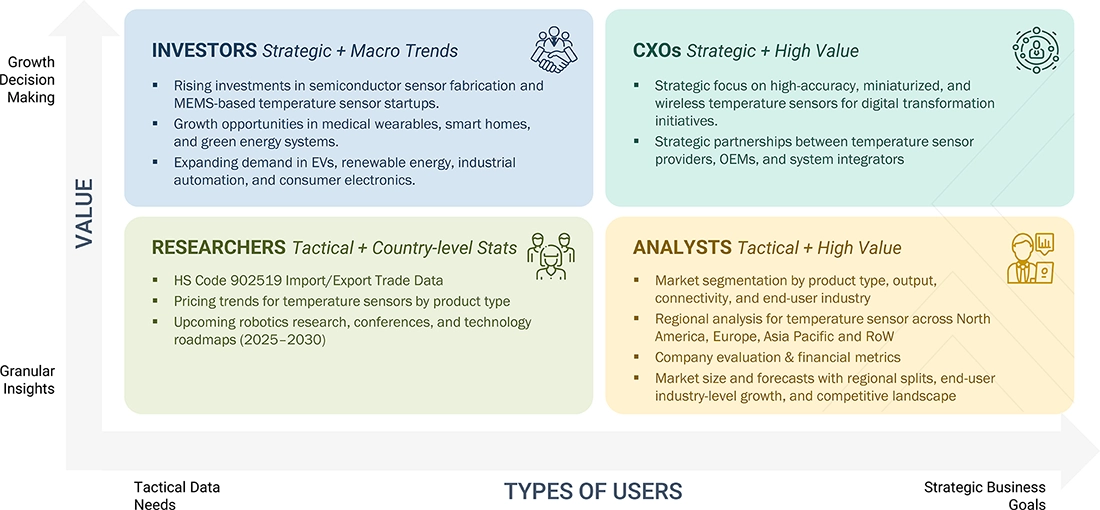

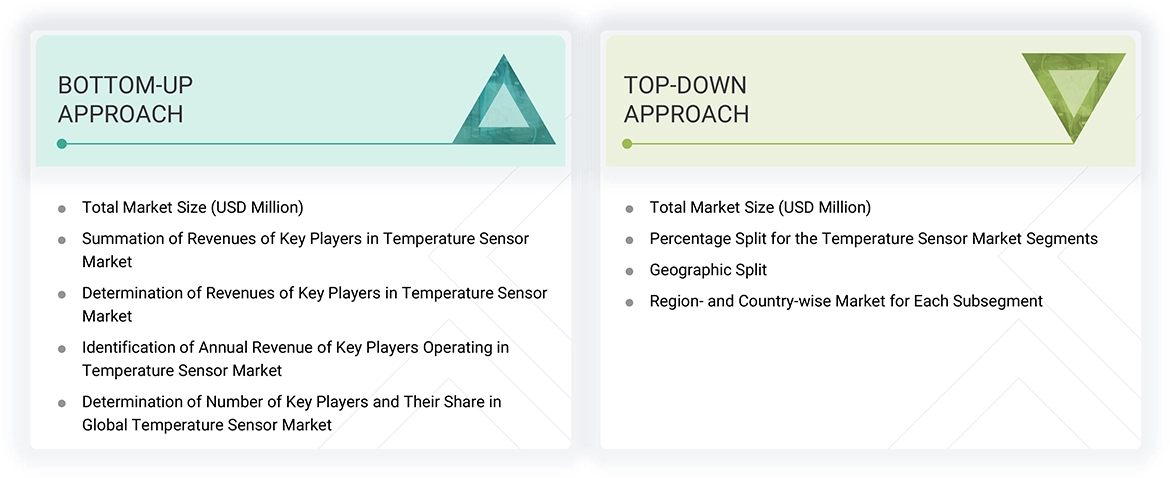

The study involved major activities in estimating the current size of the temperature sensor market. Exhaustive secondary research was done to collect information on temperature sensors. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the temperature sensor.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information relevant to this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research was mainly carried out to obtain critical information about the industry’s supply chain, value chain, the total pool of key players, and market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives. Secondary sources included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; IoT technologies journals and certified publications; articles by recognized authors; gold- and silver-standard websites; directories; and databases. Data was also collected from secondary sources, such as the Semiconductor Industry Association, Global Semiconductor Alliance, and Taiwan Semiconductor Industry Association.

Secondary research was mainly used to obtain critical information about the industry's supply chain and value chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments from both the market and technology-oriented perspectives. Secondary data has been gathered and analyzed to determine the overall market size, which has also been validated by primary research.

Primary Research

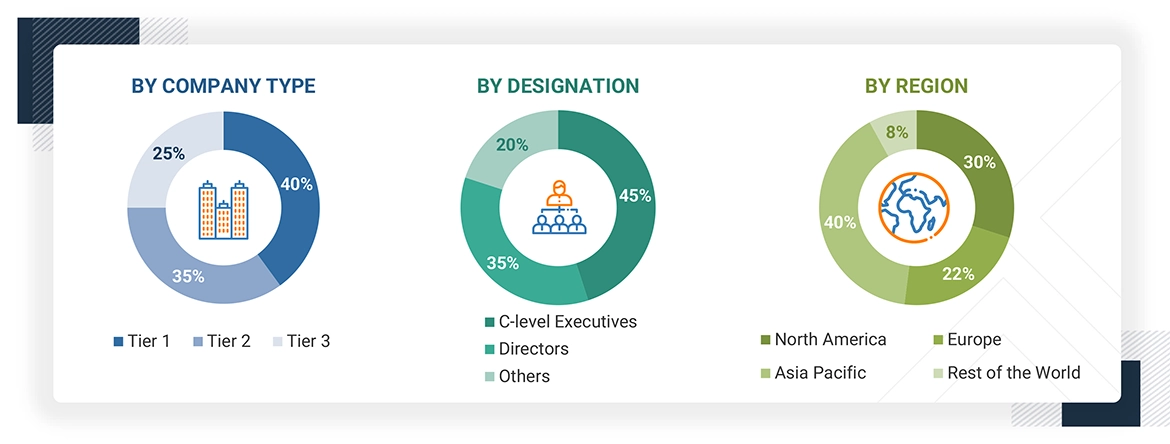

Extensive primary research was conducted after understanding and analyzing the current scenario of the temperature sensor market through secondary research. A number of primary interviews were held with demand and supply side key opinion leaders in four key regions: North America, Europe, Asia Pacific, and Rest of the World. Nearly 25% of the primary interviews were held with the demand side and 75% with the supply side. The primary data was gathered primarily through telephonic interviews, which were 80% of the total primary interviews. Surveys and e-mails were also utilized to gather data.

Note: Three tiers of companies are defined based on their total revenue as of 2024; tier 1: revenue more than or equal to USD 500 million, tier 2: revenue between USD 100 million and USD 500 million, and tier 3: revenue less than or equal to USD 100 million. Other designations include sales and marketing executives and researchers, as well as members of various temperature sensor organizations.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

This report implements both the top-down and bottom-up approaches to estimate and validate the size of the temperature sensor market and various other dependent submarkets. Key players in this market are identified through secondary research, and their market shares in the respective regions are determined through primary and secondary research.

This entire research methodology included the study of annual and financial reports of top companies, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative). All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the market covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The figures given below show the overall market size estimation process employed for this study.

Bottom-Up Approach

- Key players in the temperature sensor market were identified through secondary research, and their global market share was determined through primary and secondary research.

- The research methodology included a study of annual and quarterly financial reports, regulatory filings of major market players (public), and interviews with industry experts for detailed market insights.

- All temperature penetration rates, percentage shares, splits, and breakdowns for the temperature sensor market were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain validated and verified quantitative and qualitative data.

- The gathered market data was consolidated, enhanced with detailed inputs, analyzed, and presented in this report.

Top-Down Approach

- Focusing initially on the top-line investments and expenditures made in the temperature sensor ecosystem, splitting the key market areas into product type, output, connectivity, end-user industry, and region, and listing key developments

- Identifying all leading players and end users in the temperature sensor market based on product type, output, and connectivity through secondary research and fully verifying them through a brief discussion with industry experts

- Analyzing revenues, product mix, geographic presence, and key applications served by all identified players to estimate and arrive at percentage splits for all key segments

- Discussing splits with the industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Temperature Sensor Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the temperature sensor market from the estimation process explained above, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed (wherever applicable) to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The size of the temperature sensor market was validated using both top-down and bottom-up approaches.

Market Definition

A temperature sensor is a device that is used to measure the degree or level of heat in a substance or its surroundings. Temperature sensors can typically be classified into two types: contact and non-contact sensors.

Contact sensors: These temperature sensors need to make physical contact with the object being sensed. In contact sensors, temperature sensing occurs through conduction. Contact sensors are capable of measuring the temperature of solids, liquids, or gases over a wide range. A few examples of common contact sensors include thermocouples, temperature sensor ICs, thermistors, and RTDs. Non-contact sensors operate on the principles of convection and radiation to detect temperature changes. Non-contact sensors detect the thermal radiation that is emitted from an object and are equipped with infrared radiation sensors. The major types of non-contact sensors are optical and infrared sensors.

Key Stakeholders

- Semiconductor Industry Association

- Global Semiconductor Alliance

- European Semiconductor Industry Association

- Taiwan Semiconductor Industry Association

- SemiconPortal

- AMA Association for Sensor Technology

- OMICS International

- IEEE

- MEMS & Sensors Industry Group

- Educational Institutions Research/White Papers (Published by Communication Organizations)

- Investor Presentations and Annual Reports of Key Market Players

Report Objectives

- To define, describe, and forecast the temperature sensor market, by product type, output, connectivity, end-user industry, and region, in terms of value

- To define, describe, and forecast the global temperature sensor market, in terms of volume

-

To forecast the sizes of various segments with respect to the four major regions—

North America, Europe, Asia Pacific, and Rest of the World (RoW) - To provide a detailed analysis of the temperature sensors supply chain

- To analyze the impact of the recession on the temperature sensor market

- To strategically analyze the micromarkets with respect to individual growth trends and prospects, and their contributions to the total market

- To analyze competitive developments, such as expansions, agreements, partnerships, acquisitions, product developments, and research & development (R&D), in the temperature sensor market

- To analyze the opportunities for market players and provide details of the competitive landscape of the market.

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of business strategy excellence and strength of product portfolios

- To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with a detailed competitive landscape of the market

- To analyze the supply chain, market/ecosystem map, trend/disruptions impacting customer business, technology analysis, Porter’s five force analysis, trade analysis, patent analysis, key conferences & events, and regulations related to the temperature sensor market

Available customizations:

With the market data given, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Key Questions Addressed by the Report

What are the major driving factors and opportunities for the players in the temperature sensor market?

The major factors driving the temperature sensor market include surging demand for portable health monitoring systems, rising popularity of autonomous vehicles, escalating adoption of Industry 4.0 and IoT technologies, and increasing need for sensors to control spacecraft remotely. Key opportunities lie in the rising preference for wearable devices, increasing consumption of packaged foods, and mounting investment in IoT research projects.

Which region is expected to hold the largest share of the temperature sensor market in 2025?

Asia Pacific is projected to capture the largest market share in 2025 due to the huge demand from chemicals, oil & gas, consumer electronics, and automotive end-user industries and presence of key market players to have a positive impact on the market in this region.

Who are the leading players in the global temperature sensor market?

Leading players operating in the global temperature sensor market include Honeywell International Inc. (US), TE Connectivity (Switzerland), Texas Instruments Incorporated (US), Endress+Hauser Group Services AG (Switzerland), and Siemens (Switzerland).

Which advanced technologies are expected to drive the temperature sensor market?

Integration of IoT with temperature sensors and MEMS temperature sensors is expected to drive the market.

What will be the size of the global temperature sensor market in 2025 and 2030?

The global temperature sensor market is projected to grow from USD 7.43 billion in 2025 to USD 8.94 billion by 2030, at a CAGR of 3.8%.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Temperature Sensor Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Temperature Sensor Market

Scott

Sep, 2015

I am particularly interested in wireless temperature monitoring in pharmaceuticals and biologicals applications..

Tris-Shaunna

Mar, 2015

Need to understand the scope of temperature sensors market..

Wong

Apr, 2019

Our research group is currently conducting studies on contact thermometry and we need better understandings on the temperature sensor market..

Ulf

Nov, 2014

We are looking in to new products developments and the information related to market segmentation for temperature sensor..

桑运明

Nov, 2017

I am solution provider and interested in integrated temperature sensors, and I really want to know about the scope and research methodology of the market. .

Carlos

Jul, 2017

I am a researcher in luminescent molecular thermometers and in our group we frequently cite your organization as a realizable source in terms of sensor market. In order to keep us updated we kindly request a version of the report "Temperature Sensors Market by Product Type". .

Daniel

Jan, 2017

I am trying to compile a report which outlines the most popular manufacturers of certain electrical components, (see below) over the last 20 years, segmented by global regions and industry. I understand your reports are highly valued as they give future forecasts. I wondered if it would be possible to negotiate a price for the data you have on file (2000-2017) ? List of components: Temperature sensors; pressure sensors; flow meters; level sensors; PLCs; DCSs; valves, actuators and positioners; variable speed drives, agitator controls and electric trace heating. .

Natasha

Mar, 2019

I am interesting in purchasing this report, however I am unable to purchase it without being able to sense check a number against our own data, to check that the data is accurate and reliable. Would it be possible to gain access to one figure (e.g. China or APAC temperature market size) in order to check this prior to purchasing? I am looking forward to hear from you. .

sai

Oct, 2019

Could you please share the sample pages as I found the content of the report suitable for our internal operations..

ildong

Jul, 2017

Interested in the depth analysis for the Asian temperature sensors market. .

Brianna

Apr, 2017

We are a small company working on SBIR proposal that require some market information. We do not have the resources to meet your price point but were wondering if you ever worked with small companies like us to provide some segments information of market research at a much lower price point? Thank you so much for your help!.

D

Jan, 2019

At what extent, downfall in automotive sales will affect temperature sensor demand?.