Electronic Grade Sulfuric Acid Market by Grade (PPT, PPB), Application (Semiconductors, PCB Panels, Pharmaceutical) and Region (North America, Europe, APAC, Middle East & Africa, South America) - Global Forecast to 2024

Updated on : March 25, 2023

Electronic Grade Sulfuric Acid Market

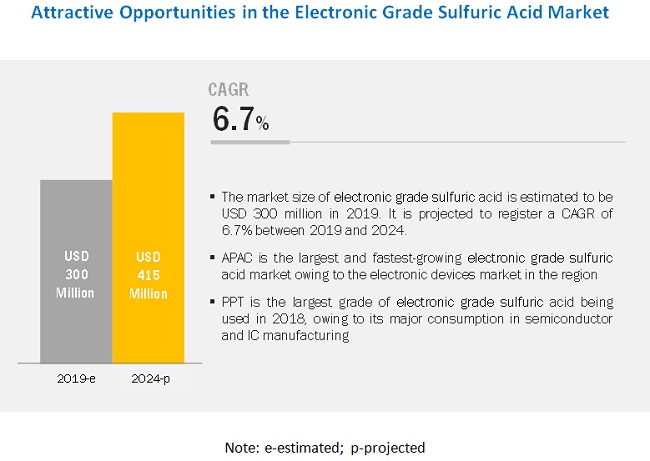

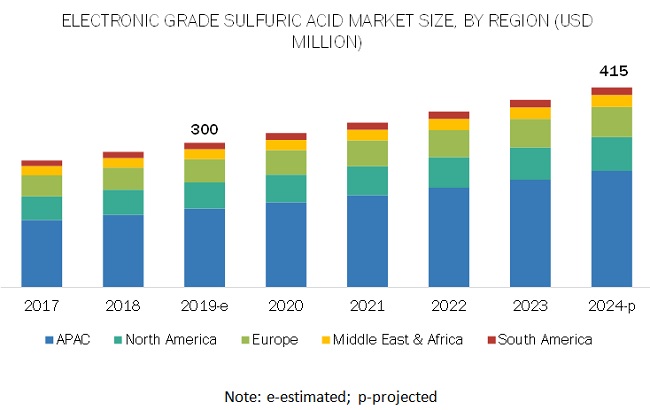

The global electronic grade sulfuric acid market was valued at USD 300 million in 2019 and is projected to reach USD 415 million by 2024, growing at a cagr 6.7% from 2019 to 2024. The market is driven majorly by its huge consumption in semiconductor, PCB panel, and IC manufacturing.

The PPT segment is estimated to lead the electronic grade sulfuric acid market during the forecast period.

PPT grade leads the market. The removal of ionic contaminants from silicon wafers is of utmost importance during the manufacturing of semiconductors and ICs. PPT is the purest grade of electronic grade sulfuric acid and is used in cleaning and etching of silicon wafers in the semiconductor industry.

The semiconductors segment is estimated to be the largest application of electronic grade sulfuric acid.

Electronic grade sulfuric acid majorly find applications in cleaning and etching of semiconductors and PCBs. It is the most common and widely used specialty wet chemical used in specific and customized electronic applications in the semiconductor industry. The increasing demand for electronic devices globally is expected to boost the market for electronic grade sulfuric acid during the forecast period.

APAC is projected to be the largest electronic grade sulfuric acid market.

APAC is estimated to be the largest electronic grade sulfuric acid market during the forecast period. China, Japan, India, South Korea, and Taiwan are the major markets in the APAC region, with China being the largest APAC market. The growth of the electronic grade sulfuric acid market in China can be attributed to the increase in the production of electronic products such as smartphones and LED and LCD televisions where PCB panels are majorly consumed.

Electronic Grade Sulfuric Acid Market Players

BASF SE (Germany), INEOS Group Holdings S.A. (UK), Chemtrade Logistics (Canada), KMG Chemicals (US), Kanto Chemical Co., Inc. (Japan), Trident Group (India), The Linde Group (Ireland), PVS Chemicals (US), Reagent Chemicals (UK), and Moses Lake Industries (US) are the key players operating in the electronic grade sulfuric acid market.

These companies have adopted several growth strategies to strengthen their position in the market. Expansion and merger & acquisition are the key growth strategies adopted by these leading players to enhance their product offering and regional presence and meet the growing demand for electronic grade sulfuric acid in emerging economies.

Electronic Grade Sulfuric Acid Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year |

2018 |

|

Forecast period |

2019–2024 |

|

Units considered |

Value (USD), Volume (Kilotons) |

|

Segments |

Grade, Application, and Region |

|

Regions covered |

APAC, Europe, North America, Middle East & Africa, and South America |

|

Companies profiled |

BASF SE (Germany), INEOS Group Holdings S.A. (UK), Chemtrade Logistics (Canada), KMG Chemicals (US), Kanto Chemical Co., Inc. (Japan), Trident Group (India), The Linde Group (Ireland), PVS Chemicals (US), Reagent Chemicals (UK), and Moses Lake Industries (US) Total 25 major electronic grade sulfuric acid market players are covered. |

This research report categorizes the electronic grade sulfuric acid market based on grade, application, and region.

By Grade:

- Parts per trillion (ppt)

- Parts per billion (ppb)

By Application:

- Semiconductors

- PCB Panels

- Pharmaceuticals

By Region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Critical questions the report answers:

- What are the upcoming hot bets for the electronic grade sulfuric acid market?

- What are the market dynamics for the different grades of electronic grade sulfuric acid?

- What are the market dynamics for different applications of electronic grade sulfuric acid?

- Who are the major manufacturers of electronic grade sulfuric acid?

- What are the significant factors which will impact the market growth during the forecast period?

Frequently Asked Questions (FAQ):

What are the factors Influencing the growth of electronic grade sulfuric acid market?

What are the grades for electronic grade sulfuric acid?

Who are the major manufacturers?

BASF SE (Germany), INEOS Group Holdings S.A. (UK), Chemtrade Logistics (Canada), KMG Chemicals (US), Kanto Chemical Co., Inc. (Japan), Trident Group (India), The Linde Group (Ireland), PVS Chemicals (US), Reagent Chemicals (UK), and Moses Lake Industries (US) are the most active players in the market.

What is the biggest Restraint for electronic grade sulfuric acid market??

What is the leading application for electronic grade sulfuric acid market?

How is the electronic grade sulfuric acid market aligned?

What are the key countries in the electronic grade sulfuric acid market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Electronic Grade Sulfuric Acid Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Base Number Calculation

2.2.1 Supply Side Approach

2.2.2 Demand Side Approach

2.3 Market Size Estimation

2.3.1 Secondary Data

2.3.1.1 Key Data From Secondary Sources

2.3.2 Primary Data

2.3.2.1 Key Data From Primary Sources

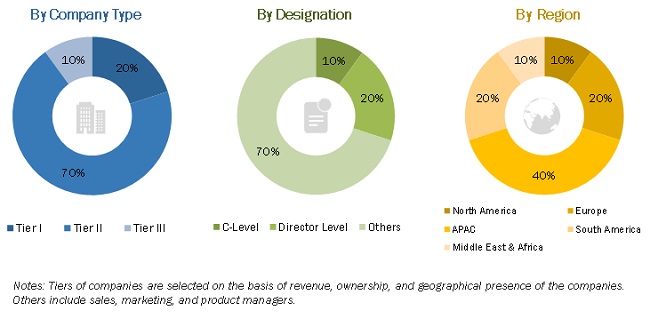

2.3.2.2 Breakdown of Primary Interviews

2.4 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Attractive Opportunities in the Electronic Grade Sulfuric Acid Market

4.2 Electronic Grade Sulfuric Acid Market in APAC, By Grade and Country, 2018

4.3 Electronic Grade Sulfuric Acid Market, By Application, 2018

4.4 Electronic Grade Sulfuric Acid Market, By Region

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Electronic Devices in APAC

5.2.2 Restraints

5.2.2.1 High Energy Consumption and Cost of Production

5.2.3 Opportunities

5.2.3.1 Growing Technological Advancements in North America

5.2.4 Challenges

5.2.4.1 Recycling of Sulfuric Acid Used in the Semiconductor Industry

5.3 Porter’s Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Threat of New Entrants

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

5.5 Distribution of Global Semiconductor Sales, By Product Segment, 2018

5.6 Snapshot of Share of Global Exports of Electronic Integrated Circuits

6 Electronic Grade Sulfuric Acid Market, By Grade (Page No. - 34)

6.1 Introduction

6.2 PPT (Parts Per Trillion)

6.2.1 Huge Consumption of PPT Grade Sulfuric Acid in Semiconductors Application is Expected to Drive the Demand During the Forecast Period

6.3 PPB (Parts Per Billion)

6.3.1 The Cost-Effectiveness of PPB Grade Sulfuric Acid as Compared to PPT is Likely to Boost the Demand

7 Electronic Grade Sulfuric Acid Market, By Application (Page No. - 38)

7.1 Introduction

7.2 Semiconductors

7.2.1 Increasing Industrial Automation is Expected to Drive the Demand for Electronic Grade Sulfuric Acid

7.3 PCB Panels

7.3.1 The Booming Electronic Device Market is Likely to Boost the Demand in This Segment

7.4 Pharmaceuticals

7.4.1 Electronic Grade Sulfuric Acid is Used for Manufacturing Chemotherapy Drugs

8 Electronic Grade Sulfuric Acid Market, By Region (Page No. - 43)

8.1 Introduction

8.2 APAC

8.2.1 China

8.2.1.1 Industrialization and the Growing Production of Electronics are Favorable for the Market in the Country

8.2.2 Japan

8.2.2.1 The Demand for Electronic Grade Sulfuric Acid in Japan is Driven By PCB Panels Application

8.2.3 India

8.2.3.1 There is an Increasing Demand for Wet Chemicals in the Country’s Semiconductor Industry

8.2.4 South Korea

8.2.4.1 Apart From Electronics, the Automobile and Shipbuilding Industries are Impacting the Market in the Country Positively

8.2.5 Taiwan

8.2.5.1 The Country has A Stable Financial Sector and Electronics Industry

8.2.6 Rest of APAC

8.3 North America

8.3.1 US

8.3.1.1 The Maturity of the Electronics Market is Affecting the Demand for Electronic Grade Sulfuric Acid Negatively in the Country

8.3.2 Canada

8.3.2.1 The Growing Manufacturing Sector in Canada is Boosting the Electronic Grade Sulfuric Acid Market

8.3.3 Mexico

8.3.3.1 The Country’s Electronics Market is Growing With the Use of New and Advanced Technologies

8.4 Europe

8.4.1 Germany

8.4.1.1 The Country has A Good Position in the Regional, as Well as Global Electronic Chemicals Market

8.4.2 France

8.4.2.1 The Presence of A Strong Industrial Sector is Promising for the Market in the Country

8.4.3 UK

8.4.3.1 The Country’s Electronics Industry is Innovation-Driven

8.4.4 Italy

8.4.4.1 Italy is A Prominent Market in the Region

8.4.5 Rest of Europe

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.1.1 The Economy is Shifting From the Dependency on the Oil Sector

8.5.2 South Africa

8.5.2.1 The Country is an Emerging Market for Semiconductors and Electronics

8.5.3 UAE

8.5.3.1 Electronic Grade Sulfuric Acid is Used for Manufacturing PCB Panels in the Country

8.5.4 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.1.1 Improving Economic Conditions are Expected to Influence Electronics and PCB Panel Manufacturing in the Country

8.6.2 Argentina

8.6.2.1 There is A Considerable Demand for Electronic Grade Sulfuric Acid for Displays Application

8.6.3 Rest of South America

9 Competitive Landscape (Page No. - 74)

9.1 Introduction

9.2 Market Ranking of Electronic Grade Sulfuric Acid Manufacturers

9.3 Competitive Situation & Trends

9.3.1 Expansion

9.3.2 Merger & Acquisition

10 Company Profiles (Page No. - 77)

10.1 BASF SE

(Business Overview, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Ineos Group Holdings’s Right to Win, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

10.2 Ineos Group Holdings S.A.

10.3 Chemtrade Logistics Income Fund

10.4 KMG Chemicals

10.5 Kanto Chemical Co., Inc.

10.6 Trident Group

10.7 Linde PLC

10.8 PVS Chemicals Inc.

10.9 Reagent Chemicals

10.10 Moses Lake Industries

(Business Overview, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Ineos Group Holdings’s Right to Win, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

10.11 Additional Companies

10.11.1 The Dharamsi Morarji Chemical Company Limited

10.11.2 Spectrum Chemicals Mfg. Corp.

10.11.3 Columbus Chemical Industries

10.11.4 Asia Union Electronic Chemical Corporation (AUECC)

10.11.5 Chung HWA Chemicals Industrial Works, LTD.

10.11.6 Jiangyin Jianghuamicro Electronics Material Co., LTD.

10.11.7 Aurubis

10.11.8 CSBP

10.11.9 Sigma-Aldrich Co. LLC

10.11.10 Nouryon

10.11.11 Seastar Chemicals

10.11.12 Supraveni Chemicals Pvt. LTD.

10.11.13 National Company for Sulphur Products (NCSP)

10.11.14 Airedale Chemical

11 Appendix (Page No. - 104)

11.1 Discussion Guide

11.2 Available Customizations

11.3 Related Reports

11.4 Author Details

List of Tables (70 Tables)

Table 1 Trends and Forecast of Global Semiconductor Sales, By Product Segment, 2018 (USD Billion)

Table 2 Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 3 PPT Grade: Electronic Grade Sulfuric Acid Market Size, By Region, 2017–2024 (USD Million)

Table 4 PPB Grade: Electronic Grade Sulfuric Acid Market Size, By Region, 2017–2024 (USD Million)

Table 5 Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 6 Electronic Grade Sulfuric Acid Market Size in Semiconductors Application, By Region, 2017–2024 (USD Million)

Table 7 Electronic Grade Sulfuric Acid Market Size in PCB Panels Application, By Region, 2017–2024 (USD Million)

Table 8 Electronic Grade Sulfuric Acid Market Size in Pharmaceuticals Application, By Region, 2017–2024 (USD Million)

Table 9 Electronic Grade Sulfuric Acid Market Size, By Region, 2017–2024 (USD Million)

Table 10 Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 11 Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 12 APAC: Electronic Grade Sulfuric Acid Market Size, By Country, 2017–2024 (USD Million)

Table 13 APAC: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 14 APAC: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 15 China: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 16 China: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 17 Japan: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 18 Japan: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 19 India: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 20 India: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 21 South Korea: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 22 South Korea: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 23 Taiwan: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 24 Taiwan: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 25 Rest of APAC: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 26 Rest of APAC: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 27 North America: Electronic Grade Sulfuric Acid Market Size, By Country, 2017–2024 (USD Million)

Table 28 North America: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 29 North America: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 30 US: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 31 US: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 32 Canada: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 33 Canada: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 34 Mexico: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 35 Mexico: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 36 Europe: Electronic Grade Sulfuric Acid Market Size, By Country, 2017–2024 (USD Million)

Table 37 Europe: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 38 Europe: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 39 Germany: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 40 Germany: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 41 France: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 42 France: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 43 UK: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 44 UK: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 45 Italy: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 46 Italy: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 47 Rest of Europe: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 48 Rest of Europe: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 49 Middle East & Africa: Electronic Grade Sulfuric Acid Market Size, By Country, 2017–2024 (USD Million)

Table 50 Middle East & Africa: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 51 Middle East & Africa: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 52 Saudi Arabia: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 53 Saudi Arabia: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 54 South Africa: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 55 South Africa: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 56 UAE: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 57 UAE: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 58 Rest of Middle East & Africa: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 59 Rest of Middle East & Africa: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 60 South America: Electronic Grade Sulfuric Acid Market Size, By Country, 2017–2024 (USD Million)

Table 61 South America: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 62 South America: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 63 Brazil: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 64 Brazil: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 65 Argentina: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 66 Argentina: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 67 Rest of South America: Electronic Grade Sulfuric Acid Market Size, By Grade, 2017–2024 (USD Million)

Table 68 Rest of South America: Electronic Grade Sulfuric Acid Market Size, By Application, 2017–2024 (USD Million)

Table 69 Expansion, 2014–2019

Table 70 Merger & Acquisition, 2014–2019

List of Figures (33 Figures)

Figure 1 Market Size Estimation Methodology: Bottom-Up Approach

Figure 2 Market Size Estimation Methodology: Top-Down Approach

Figure 3 PPT to Be the Larger Grade of Electronic Grade Sulfuric Acid

Figure 4 Semiconductors to Be the Largest Application of Electronic Grade Sulfuric Acid

Figure 5 APAC to Be the Fastest-Growing Electronic Grade Sulfuric Acid Market

Figure 6 Growing Electronic Device Market to Drive the Demand Between 2019 and 2024

Figure 7 China and PPT Segment Accounted for the Largest Shares

Figure 8 PCB Panels to Register the Fastest Growth

Figure 9 Electronic Grade Sulfuric Acid Market to Register the Highest Growth in APAC

Figure 10 Drivers, Restraints, Opportunities, and Challenges in the Electronic Grade Sulfuric Acid Market

Figure 11 Electronic Grade Sulfuric Acid Market: Porter’s Five Forces Analysis

Figure 12 PPT to Be the Larger Segment of the Electronic Grade Sulfuric Acid Market

Figure 13 APAC to Be the Largest Market in the PPT Grade Segment

Figure 14 Semiconductors Application to Dominate the Electronic Grade Sulfuric Acid Market

Figure 15 APAC to Be the Largest Market in the Semiconductors Segment

Figure 16 APAC to Grow at the Highest Rate

Figure 17 APAC: Electronic Grade Sulfuric Acid Market Snapshot

Figure 18 North America: Electronic Grade Sulfuric Acid Market Snapshot

Figure 19 Europe: Electronic Grade Sulfuric Acid Market Snapshot

Figure 20 Middle East & Africa: Electronic Grade Sulfuric Acid Market Snapshot

Figure 21 South America: Electronic Grade Sulfuric Acid Market Snapshot

Figure 22 Market Ranking of Key Players in 2018

Figure 23 BASF: Company Snapshot

Figure 24 BASF: SWOT Analysis

Figure 25 Ineos Group Holdings: Company Snapshot

Figure 26 Ineos Group Holdings: SWOT Analysis

Figure 27 Chemtrade Logistics Income Fund: Company Snapshot

Figure 28 Chemtrade Logistics Income Fund: SWOT Analysis

Figure 29 KMG Chemicals: Company Snapshot

Figure 30 KMG Chemicals: SWOT Analysis

Figure 31 Kanto Chemical: SWOT Analysis

Figure 32 Trident Group: Company Snapshot

Figure 33 Linde PLC: Company Snapshot

The study involved four major activities in estimating the current market size for electronic grade sulfuric acid. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

The electronic grade sulfuric acid market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the developments in the semiconductor & electronics industry, as well as the pharmaceutical industry. The supply side is characterized by market consolidation activities undertaken by raw material suppliers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the electronic grade sulfuric acid market. These methods were also used extensively to estimate the size of the various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study:

- To define, describe, and forecast the global electronic grade sulfuric acid market, in terms of value

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth

- To analyze and forecast the market based on grade and application

- To analyze and forecast the market size, based on five key regions, namely, Asia Pacific (APAC), Europe, North America, the Middle East & Africa, and South America along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansion and merger & acquisition, in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Available Customizations:

MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data.

The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the electronic grade sulfuric acid market

Company Information:

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Electronic Grade Sulfuric Acid Market

Electronic grade sulfuric acid report

ULTRAPURE SULPHURIC acid market insights

General information on Ultra Pure Sulfuric Acid

Need analysis on cost/ price and supply demand in South Korea and China for Semiconductor-grade Sulfuric Acid.

New product development in usage of sulphuric acid in an economically viable production route.

I am sourcing sulfuric acid manufacturers, providing Sulfuric Acid Electronic Grade 89 . Can you provide details ?

Information on sulfuric acid and other high purity chemicals

Information on suppliers of UP H2SO4