VRF System Market by Component (Outdoor Units, Indoor Units, and Control Systems and Accessories), System Type (Heat Pump, Heat Recovery), Capacity, Application (Commercial, Residential, and Others), and Geography - Global Forecast to 2025

The global VRF system market was valued at approximately USD 14.5 billion in 2024 and is projected to reach around USD 24.7 billion by 2030, with a CAGR of 9.6% during the forecast period. This growth is driven by advancements in HVAC technology, increasing demand for energy-efficient solutions in various industries, and the need for flexible and efficient climate control systems.

The VRF system market is poised for significant growth over the forecast period, driven by technological advancements and the increasing need for efficient and customizable climate control solutions across various industries. Despite challenges such as high initial costs and integration complexities, improved energy efficiency, reduced operational costs, and enhanced comfort make VRF systems a valuable investment for enterprises and residential sectors aiming to modernize their climate control infrastructure.

Market Overview:

VRF systems are advanced HVAC solutions that offer precise temperature control by regulating refrigerant flow to multiple indoor units. These systems enhance energy efficiency and provide optimal comfort in commercial buildings, healthcare, retail, and residential applications. VRF systems allow for individualized temperature control in different zones, making them ideal for buildings with varying heating and cooling needs.

-

Type

- Heat Pump System: Provide either heating or cooling to all indoor units simultaneously.

- Heat Recovery System: Simultaneously provide heating and cooling to different indoor units, allowing for more energy-efficient operations

-

Application

- Residential: Multi-family buildings and high-end homes for energy-efficient heating and cooling.

- Commercial: Offices, retail spaces, and hospitality sectors for precise climate control.

- Industrial: Factories and warehouses for maintaining optimal working conditions.

- Healthcare: Hospitals and clinics for maintaining strict temperature and humidity levels.

- Education: Schools and universities for comfortable learning environments

-

Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Market Dynamics:

Driver: Energy Efficiency Drives Market Adoption

Energy efficiency is a significant driver for the VRF system market as these systems offer substantial energy savings compared to traditional HVAC systems. By adjusting the refrigerant flow to match the specific cooling or heating needs of different zones, VRF systems minimize energy wastage. For instance, commercial buildings and hotels increasingly adopt VRF systems to reduce operational costs and meet sustainability goals. Additionally, government incentives and regulations promoting energy-efficient technologies encourage investments in VRF systems, further driving market growth.

Restraint: High Initial Costs Limit Adoption

Despite their benefits, the high initial costs of VRF systems restrain market growth. These systems require a significant upfront investment, which can deter small and medium-sized enterprises and residential users. For example, the installation and setup costs for a VRF system can be considerably higher than those for conventional HVAC systems, making them less accessible for budget-conscious consumers. Overcoming this barrier requires increased awareness of long-term cost savings and potential financing options.

Opportunity: Rising Demand in Emerging Markets

The growing urbanization and industrialization in emerging markets present a significant opportunity for the VRF system market. Countries in Asia-Pacific, such as India and China, are experiencing rapid infrastructure development, increasing the demand for advanced HVAC solutions. Investments in commercial real estate, hospitality, and retail sectors create new opportunities for VRF system installations. Companies expanding in these regions can tap into a burgeoning market with substantial growth potential.

Challenge: Technical Complexity and Skilled Labor Shortage

The technical complexity of VRF systems poses a challenge for their widespread adoption. Proper installation and maintenance require specialized skills and knowledge, which are not always readily available. For instance, ensuring the system's optimal performance involves precise calculations and a thorough understanding of VRF technology. This challenge is exacerbated in regions with a shortage of trained HVAC professionals. Addressing this issue necessitates investment in training programs and partnerships with educational institutions to build a skilled workforce.

Competitive Landscape:

The VRF system market is highly competitive, with several key players such as Daikin Industries, Mitsubishi Electric, and Fujitsu General leading. These companies continuously invest in research and development to innovate and enhance their product offerings, focusing on energy efficiency and advanced control technologies. Some of the key players include:

- Daikin

- Mitsubishi Electric

- Toshiba

- LG Electronics

- Samsung

- Johnson Controls

- Panasonic

- Fujitsu

- Carrier

- Trane Technologies

- Midea Group

- Hitachi

- Gree Electric

- Ingersoll Rand

- Blue Star

Regional Analysis:

- North America: The North American market is driven by the early adoption of advanced HVAC technologies, substantial investments in commercial infrastructure, and a growing emphasis on energy efficiency and sustainability in building practices.

- Europe: Europe's market growth is propelled by stringent energy regulations, a strong focus on green building initiatives, and significant investments in modernizing existing HVAC systems to meet higher efficiency standards.

- Asia Pacific: The Asia Pacific region is anticipated to witness the highest growth rate due to rapid urbanization, increasing construction activities, and rising investments in advanced HVAC solutions for the growing commercial and residential sectors.

- Latin America: The VRF system market in Latin America is expanding, driven by rising awareness of energy-efficient technologies, government incentives for sustainable building practices, and increasing demand for modern HVAC systems in commercial buildings.

- Middle East & Africa: Growth in the Middle East and Africa is supported by large-scale infrastructure projects, a growing tourism and hospitality sector, and the need for efficient cooling solutions in the region's hot climate.

Recent Developments:

- In November 2024, Toshiba Carrier launched a new heat recovery VRF system to provide simultaneous heating and cooling, improving energy efficiency in large commercial buildings such as hotels and office complexes.

- In October 2024, LG Electronics partnered with a leading building management system (BMS) provider to integrate their VRF systems with advanced BMS solutions, enhancing building automation and energy efficiency.

- Daikin launched its new VRV 5 system in September 2024, featuring enhanced energy efficiency and reduced environmental impact using R-32 refrigerant. This system is designed for flexible installation in commercial buildings.

- In August 2024, Fujitsu General unveiled a compact VRF system for small—to medium-sized commercial spaces. The system offers high energy efficiency and easy installation, catering to the growing demand in urban areas.

- In July 2024, Mitsubishi Electric introduced advanced control solutions for its VRF systems, integrating IoT and AI technologies to optimize real-time performance and energy management.

Future Trends:

Integration with IoT for Smarter HVAC Solutions: The future of VRF systems lies in their integration with IoT and smart building technologies, transforming traditional HVAC systems into intelligent, connected solutions. This integration will enable real-time monitoring and control, optimizing energy usage and improving user comfort. Smart VRF systems can predict maintenance needs, reducing downtime and operational costs. As buildings become smarter, the demand for such advanced HVAC systems will grow, driving market expansion and attracting investments from tech-savvy consumers and businesses focused on sustainability and efficiency.

Eco-friendly Refrigerants for Sustainable HVAC Solutions: As environmental regulations become stricter and consumer awareness of sustainability grows, adopting eco-friendly refrigerants in VRF systems will become a key market trend. These refrigerants, such as R-32, have lower global warming potential (GWP) and contribute to reduced carbon footprints. VRF systems using eco-friendly refrigerants will appeal to environmentally conscious businesses and regulatory bodies, creating a competitive edge for manufacturers. Emphasizing sustainability and compliance with international standards will drive the adoption of these advanced systems in various markets.

Innovations Enhancing VRF System Performance: Technological advancements in VRF systems, such as improvements in inverter compressors, heat recovery systems, and control algorithms, will drive future market growth. These innovations will enhance system performance, efficiency, and reliability, making VRF systems more attractive to a broader range of consumers. Continuous research and development in VRF technology will lead to new features and capabilities, positioning these systems as the preferred choice for modern HVAC solutions. Companies that invest in cutting-edge technology and focus on innovation will capture a larger market share and set new industry standards.

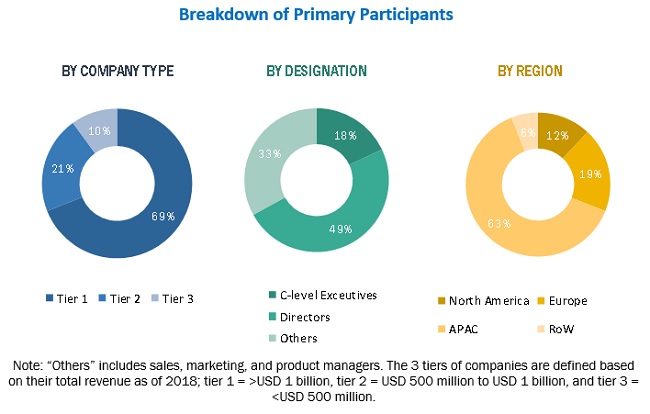

4 major activities were conducted to estimate the size of the global VRF system market. Exhaustive secondary research has been conducted to collect information on the market. The findings, assumptions, and sizing have been validated with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall market size. After that, market breakdown and data triangulation techniques have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers and VRF system-related journals and certified publications; articles of recognized authors; gold- and silver-standard websites; directories; and databases have been used to identify and collect information for an extensive technical and commercial study of the VRF system market.

Primary Research

In the primary research process, primary sources from both the supply and demand sides have been interviewed to obtain qualitative and quantitative information relevant to this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information as well as assess prospects. Key players in the VRF system market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research included studying annual reports of top market players and interviewing key opinion leaders such as CEOs, directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the VRF system market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the VRF system market, by component, system, capacity, application, and geography

- To describe and forecast the market size for various segments with regard to 4 main regions—North America, Europe, APAC, and RoW

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the VRF system market

- To strategically analyze micro markets with respect to growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying high-growth segments within the VRF system market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the VRF system ecosystem

- To analyze competitive developments such as product developments, expansions, partnerships, collaborations, agreements, and acquisitions in the VRF system market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the VRF system market report.

Company information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in VRF System Market

How do you rank various VRF suppliers in terms of energy efficiency, working efficiency in hot climate, product life, and after sales services?

I am a working professional in VRF industry and I would like to procure your reports to be well-informed about current trends and new development taking place in this market.

I am in search of heat recovery systems technology penetration rate in Western European countries. How you gather market data?. Can you share sample for research methodology which you follow for forecasting market data.

I am looking for VRF product analysis for certain company in specific country and region. I have to preseent these information to my senior management. Would you be able to provide these kind of information and what will be estimated time for this information ?

I am looking for data related to installation and and maintainace cost for VRF systems in US, Canada and South American Market. What information is available in your report with respect to my requirement.

I do believe that globally and perhaps in recent US history 2 pipes is much more prevalent. However, we are hearing from our reps in three regions of the US that the “Simultaneous Heating and Cooling” is the primary value proposition and that is becoming a requirement in many US commercial buildings where opening windows as a form of climate control is often prohibited. On the VRF report can you tell me 2 pipe vs 3 pipe installations trend and to what granularity do you have that information, country/state?.

Specifically I am looking for; -VRF Installations by country, especially for Asia region -who installs these, contractors? Individuals? -How are these systems specified in a commercial building -Sales channel description and value chain analysis -what are the failure rates, Frequency of systems maintainane or replacement, who (contractors or OEM) does take the account of maintenance and repairing process.

I am a graduate student at Auburn University in Alabama. As a part of my curriculum, I am writing a research paper on Use of VRF Systems in the South-Eastern United States. While doing a literature review, I came across this report and found it to be very helpful. However, obtaining this report is very expensive and beyond my reach as a student. I was wondering if you could share some information pertinent to my research. I am looking for only the following parts of this report... - Section 10.2 (page 105 onwards) - VRF Systems Market, By Geographic Analysis (North America) - Tables 17, 18, 47, and 48 - Figures 61 and 62 I would like to assure you that this information is required purely for academic purposes. Thank you!

Hi, I am conducting an informative paper on VRF system market adoption trends and penetration rate in different regions and need information on the this topic. Can you please provide me with some pages of this report? Some graphs and table data would be great. Thanks

Id like to receive VRF systems global forecast numbers and analysis data to understand better industry growth trend and regional data. What are the expectations for the VRF system. Thank you.